BUILD YOUR FOOD-TO-GO OFFER Reimagining Food-To-Go APR/MAY 2024 c-store.com.au

BUILD YOUR FOOD OFFER

SKYROCKET YOUR SALES WITH BEST SELLING FRIED FOODS!

Perfect Fry

Deep Fryers just

Small footprint

No hoods or vents

Fully enclosed

Safe & easy to use

Easy to clean

Offer a complete menu with just one piece of equipment!

Chips Chicken & Chips

Chicken tenders

Chicken nuggets

Potato cakes

Dim Sims

Jam donuts

Chicken schnitzels

Whether you want to fry, toast, bake or display, Meris Food Equipment offers a wide range of food-to-go solutions. Making Better Food, Easier LEARN MORE Ready to build your food-to-go offer? Contact Meris today! 1800 265 771 meris.com.au

In this issue Apr/May 2024 www.c-store.com.au Regulars 08 Face Time Jason Joukhador, General Manager of Merchandise and Dealer Channel, Ampol 12 Store Review White’s IGA Forest Glen Features 16 Confectionery Novelty and tradition collide in this category 20 Flavoured Milk A thriving category with opportunities aplenty 24 On-The-Go Hot Food Convenience is king in this popular category New Products 30 Product Ranging We bring you all of the latest new product launches Industry Experts 40 Opinion Jason Joukhador, Ampol; Jade Burnett, Consult Group Latest News 44 Industry updates UCB Conference; Drakes; 7-Eleven; Nestlé; Suntory Oceania 52 Petrol News Viva Energy; Hydrogen Hub; Fuel Discrepancies ON THE COVER Want to build a successful food-to-go-offer but not sure where to start? Contact Meris today on 1800 265 771 or visit meris.com.au 12 16 44 4 April/May 2024 CONTENTS

Welcome to the latest issue of Convenience & Impulse Retailing magazine, your trusted source of insights and trends in the fuel and convenience retail sector.

First up, we meet Jason Joukhador, General Manager of Merchandise and Dealer Channel at Ampol, where we find out what makes him tick and delve in to his passion for making a difference. We then head to White’s IGA Forest Glen to discover see what makes this store so beloved by its community.

Convenience stores have long been the go-to destination for those in need of a quick pick-me-up or a sweet treat on the run. From classic favourites to innovative new offerings, the confectionery aisle continues to entice customers with its array of chocolates, candies, and snacks. In this issue, we explore the latest trends and developments in the confectionery category.

We then turn our attention to flavoured milk, a category that has seen positive growth in recent years.

Whether it's the nostalgic taste of childhood or a bold new flavour sensation, flavoured milk options are captivating taste buds and driving sales across Australia.

No convenience store experience would be complete without a selection of hot, ready-to-eat meals and snacks for those on the move. In this issue, we take a closer look at the burgeoning market for on-the-go hot food, exploring the innovative products and strategies that are transforming convenience store kitchens into culinary hotspots.

We then take you to UCB’s 2024 National Member Conference which was held at the Royal Pines Resort on the Gold Coast, featuring a great few days of learning, networking, and fun.

As always, we are grateful for our columnist Jason Joukhador, GM Merchandise and Dealer Channel at Ampol, as well as a special opinion piece from Jade Burnett, from the sales team at Consult Group.

I hope you enjoy the issue!

Cheers, Thomas Oakley-Newell

www.c-store.com.au 5 DISCLAIMER This publication is published by C&I Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division

of Part V of the Trade Practices

1974 and any

contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication. Copyright © 2024 - C&I Media Pty Ltd. THE FINE PRINT The Intermedia Group takes its Corporate and Social Responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities. As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody. PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests. PROUD MEMBERS OF: INFORMATION PARTNERS: CONTACT DETAILS Published by C&I Media Pty Ltd (A division of The Intermedia Group) 41 Bridge Road (PO Box 55) Glebe NSW 2037 Tel: 02 8586 6292 Fax: 02 9660 4419 E: magazine@c-store.com.au Group Publisher C&I Media Pty Ltd Safa de Valois Commercial Director Safa de Valois safa@c-store.com.au Editorial Director James Wells james@intermedia.com.au Managing Editor Thomas Oakley-Newell tom@c-store.com.au Art Director Alyssa Coundouris alyssac@intermedia.com.au Production Manager Jacqui Cooper jacqui@intermedia.com.au Production Assistant Tazlin Cantrill magazine.material@intermedia.com.au Prepress Tony Willson Safa de Valois

Oakley-Newell

A tank full of knowledge

2

Act

statutory modification or reenactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in

Alyssa Coundouris Thomas

Wells MEET THE TEAM Join us for more Scan the code to explore the website and get social. EDITORIAL

James

Refreshing Coca-Cola Zero Sugar Lime

Coca-Cola Zero Sugar Lime – your favourite drink just got even more refreshing with a zesty twist of lime flavour.

Coca-Cola Zero Sugar Lime is the newest addition to Coca-Cola’s portfolio of innovative flavours. Coca-Cola is always evolving its product portfolio to provide more of what people love! Coca-Cola Zero Sugar lime features a 3.5 star health rating.

Add a little zest to your glass, available to order now! 132653 | www.cocacolaep.com/au

Stronger for longer

Ice Break has the real coffee solution for a sustained energy recharge. New Ice Break Strong Espresso 500mL is made from Aussie milk and features three shots of roasted robusta coffee and 25g protein per serve.

Leveraging the real coffee credentials of Ice Break, this exciting NPD has been designed to satisfy consumer appetite for more intense caffeine options while providing the satiety benefits of protein. The launch will be supported by screens activity, outdoor advertising, digital media, and in-store point of sale, to drive awareness and attract new drinkers.

Ice Break Strong Espresso will be available in grocery and convenience stores nationally from late April.

facebook.com/IceBreak

Introducing ice block with a sour twist

Get ready to tantalise taste buds with Sour Popz, the latest creation from Golden North.

These ice blocks pack a punch with Sour Grape and Sour Lemon flavours, perfect for kids and teenagers who crave the zing of sour lollies in a refreshing icy format.

Ideal for convenient stores and impulse channels, Sour Popz are set to be the coolest treat of the season.

Don't miss out on this refreshing and tangy delight that will leave your customers begging for more! Now available.

goldennorth.com.au/ice-block

Reimagined Polly Waffle returns for Aussies

Sweet-treat lovers across the country are set to rejoice this April, with Polly Waffle making its debut back on supermarket shelves for the first time in over a decade.

Menz acquired the rights to Polly Waffle from Nestlé in 2019, responding to the passionate demands of Aussies, desperate for the chocolate-aisle favourite to remain on-shelves. Menz has spent the last few years researching and developing the nostalgic Polly Waffle taste profile to re-introduce the product to Australians with a modern twist: Polly Waffle Bites.

Crunchy wafer pieces scattered through a coating of delicious milk chocolate, surround the soft marshmallow centre that Polly Waffle is best-known and loved for, with the new Bites providing a 125g bag of bite-sized Polly Waffle morsels.

Available at The Distributors.

1800 989 022 | www.the-distributors.com.au

6 April/May 2024 PRIME TIME

“I’m sublime with Lime.’’

NEW

© 2023 The Coca-Cola

Company

A positive impact

With a strong commitment to retail, Jason Joukhador, General Manager of Merchandise and Dealer Channel at Ampol, has a passion for making a difference in both his professional and personal life. This is his story…

I WAS BORN, grew up and still call home the vibrant heart of the inner west of Sydney, a place where a blend of wonderful cultures thrive.

Born into a traditional Lebanese household, my early life was shaped by the presence of four pivotal figures: my father, mother and two older brothers.

My father instilled in me the values of hard honest work, discipline and patience, whilst my mother was my beacon of compassion and care.

Growing up alongside two brothers, I was never short of companionship, competition, or adventure. They were both my fiercest competitors and my staunchest allies. Only years apart, we together, navigated the trials and tribulations of childhood and adolescence.

Each member of my family played a distinctive role in shaping the person I have become, both personally and professionally. Their influence is a thread that runs through the tapestry of who I am today, a constant reminder of where I come from and the values that drive me forward.

My upbringing was a blend of traditional values, deeply rooted in the migrant journey of my parents / grandparents. Their courageous move to Australia with nothing, driven by a desire for a better future for their family, was underpinned by strong Christian values that guided us through the challenges and opportunities alike.

From a young age, the emphasis was on education and personal development, seen as keys to unlocking opportunities. Surrounded by a close-knit circle of family and friends, I was instilled with a sense of community and the understanding that success is not just personal achievement but also the support network you have around you and the ability to contribute positively. This foundation laid the groundwork for my career, driving me to pursue excellence while staying true to the values of relationships, service and integrity.

My career journey commenced behind the cash registers at my local Big W, a role that spanned parts of my high school and university years. As I navigated various roles within the store, I gained a versatile understanding of retail operations, further enriching my professional toolkit and laying the groundwork for my professional path. This position, far from being just a job, was where I caught the retail bug and the best catch, my wife Rita, who since then has been my best friend and now mother to my three beautiful kids.

Throughout my career, the opportunity to travel overseas has been a privilege that has enriched my professional and personal outlook in countless ways. Each destination has been a chapter in an ongoing journey of learning and discovery, providing me with a broader understanding of the world and its diverse tapestry of cultures, ideas and ways of life.

These journeys have been instrumental in shaping my approach to my career, inspiring innovation and fostering a sense of empathy and adaptability that has been crucial in navigating the complexities of the modern workplace. The lessons learned from these experiences have transcended geographical boundaries, influencing my professional ethos and encouraging a continuous quest for knowledge and understanding.

8 April/May 2024 FACE TIME

Joukhador has been involved in various not-for-profits

“My desire to learn, grow, and be the best at what I’m passionate about meant I have jumped into many roles across a number of retail organisations, including sitting on three not for profit boards.”

If I were to pick my top three destinations it would be the breathtaking natural beauty of Jasper Canada, the unexpected diverse experience that Turkey offers and spending time on the beautiful beaches at our doorstep here in Australia.

Currently, I am General Manager of Merchandise and Dealer Channel at Ampol, where I lead our merchandise team for the over 600 company owned and operated Foodary branded stores and independent fuel dealer channel.

Since catching the retail bug, I have never ventured away from retail. I can confidently say I have covered most functions in retail – in field, central operations, IT, merchandise, strategy, improvement, finance. all sizes – large, medium, small. Key operating models –company, franchise and buying group. Various company structures – public, private and not for profit retail.

My desire to learn, grow and be the best at what I’m passionate about meant I have jumped into many roles across a number of retail organisations including sitting on three not for profit boards.

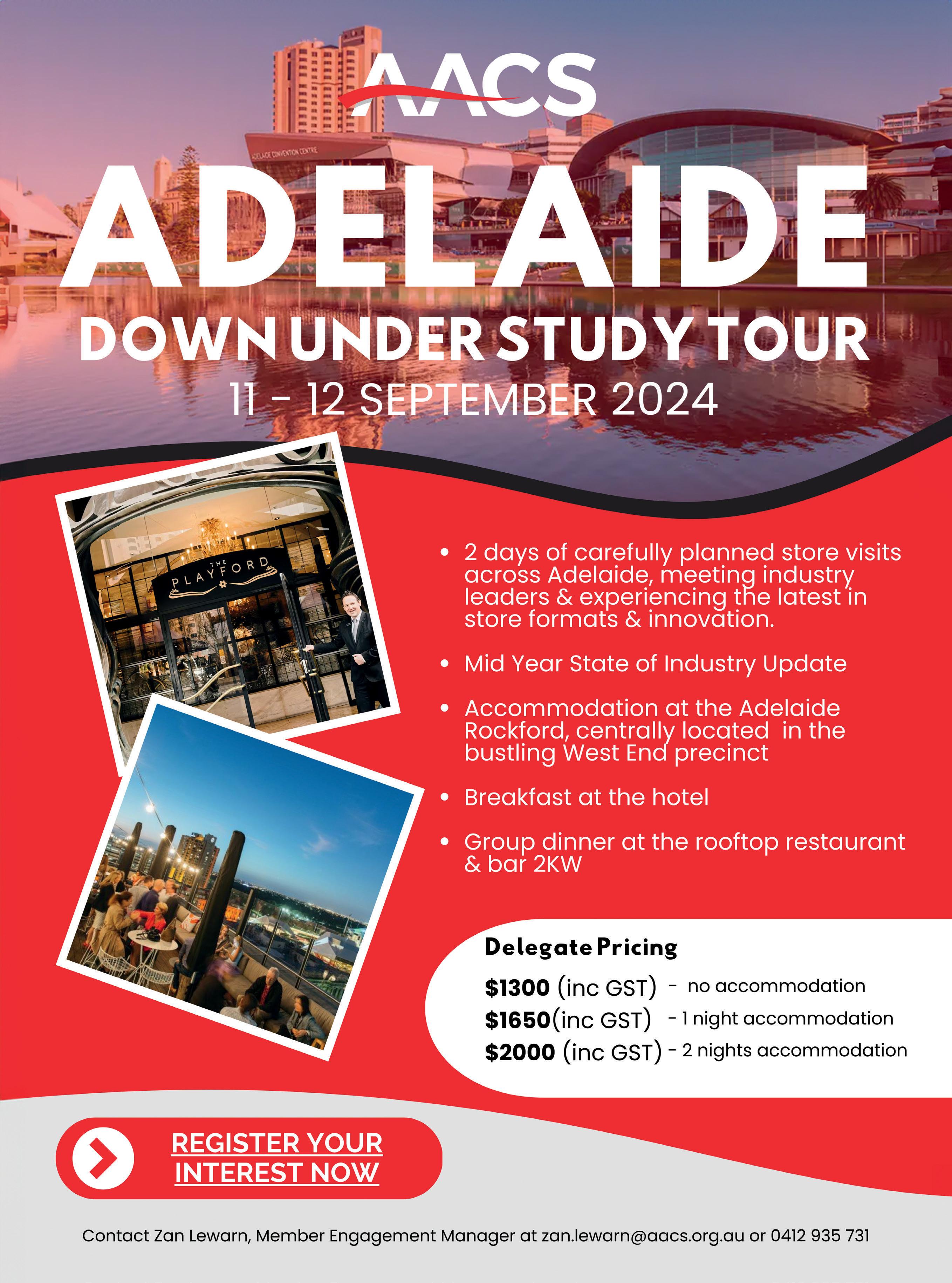

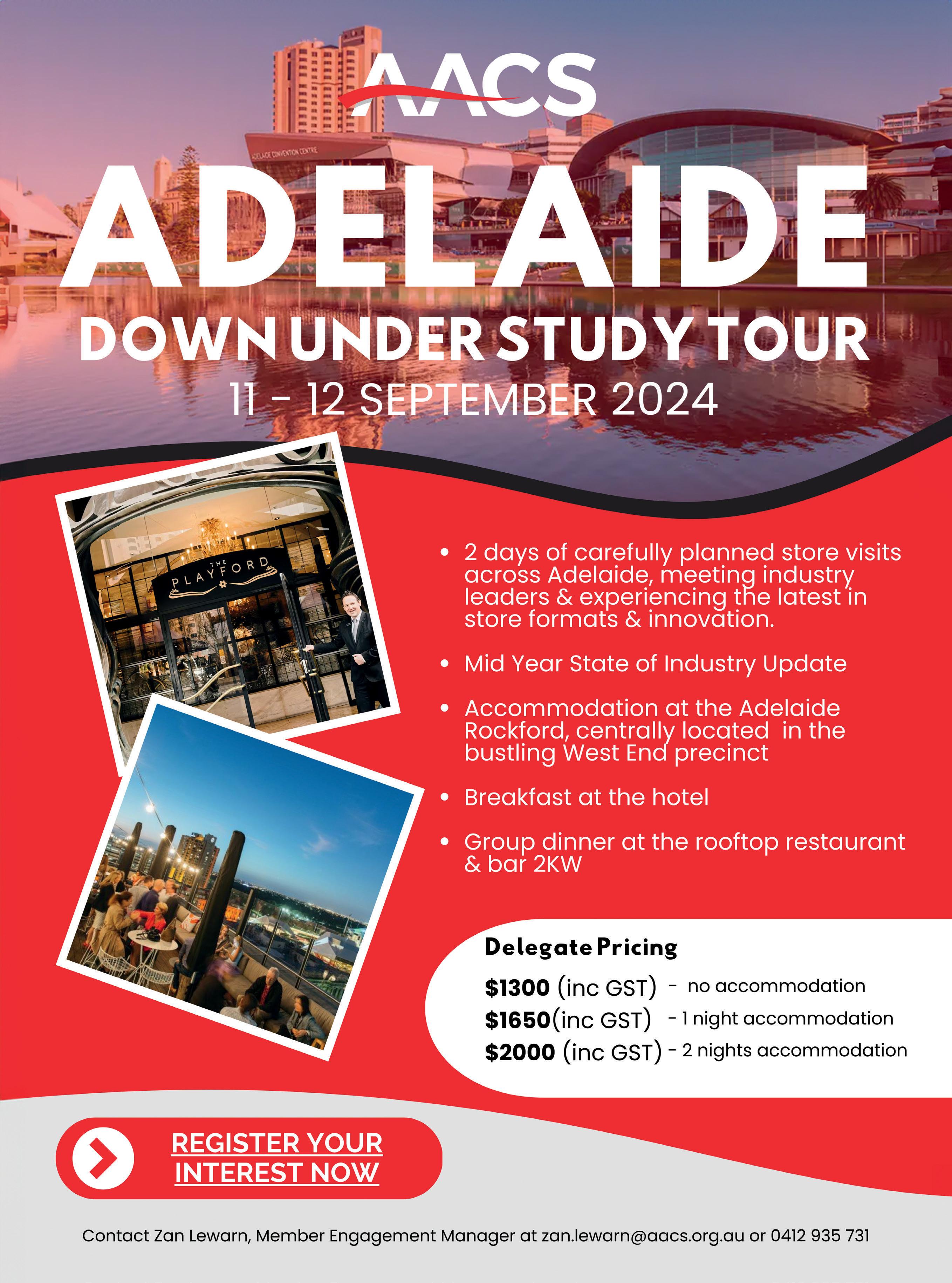

These boards are Save Our Sons – The peak body for Duchenne Muscular Dystrophy in Australia – a charity very close to my heart who look to cure Duchenne and Becker muscular dystrophy. The St Vincent de Paul Society NSW – a member and volunteer-based organisation who assist people experiencing disadvantage and hardship and the Australian Association of Convenience Stores (AACS) – representing the interests of all businesses within the convenience channel here in Australia.

I often get asked what drives me and how did you define your pathway to where you are today. The time I spend needs meaning and purpose. This meaning and purpose has either been determined by making a difference in the work that I do, making a difference to those who need a helping hand and making a difference for my family.

My advice to retailers would be that retail has never been a walk in the park. Understanding the market, your customer, and not being afraid to evolve and disrupt based on the insights is crucial. For suppliers, collaborate with your retailers. Retail is a value chain and most effective when there is no chink in the chain.

My family/my world is made up of my gorgeous and always positive wife, my super son and two shining lights, my daughters. We do have a few chickens to keep up with the demands of a good healthy daily breakfast.

Having three young children, my weeknights and weekends are filled in investing in their development, commitments and other family events.

I was lucky enough to grow up with parents who sacrificed and invested in me. If I appreciate this and do the same for my children that’s the best thanks I can give.

I often get asked where I want to be in five years.

My typical response doesn’t explain an explicit destination. Life is a journey and you never know what is around the path. For me good health and doing what I love with my family and friends around me is all I wish for. ■

Joukhador and his wife

Joukhador's three young children

www.c-store.com.au 9 FACE TIME

Speaking at the 2023 Ampol Supplier Forum

The ultimate destination for convenience retailers

29-30 October 2024

MCEC, Melbourne

Visitor registration is open for the 21st Convenience & Impulse Retailing Expo!

We’ve teamed up with Accommodation Link to secure exclusive discounted room rates at a variety of hotels close to the venue. Register early and book your stay now to avoid inflated prices or missing out (Coldplay will be in town and demand is high).

Visit the Accommodation page at candiexpo.com.au to get started. Australia’s leading Petrol & Convenience expo has so much to see and taste. Discover new products for your store, and network with retailers and suppliers from across Asia Pacific.

REGISTER NOW FOR FREE AND ACCESS OUR SELECTION OF DISCOUNTED ACCOMMODATION CLOSE TO THE VENUE Categories you can explore: - Accessories - Auto Products - Bakery - Beverages - Coffee - Confectionery - Cooking Equipment - Dairy - Digital Solutions - Display Fit Outs & Equipment - Frozen / Ready / On-The-Go Meals - Gifts - Hot & Cold Snacks - Merchandising Solutions - Payment Systems - Petrol Forecourt Technology & Equipment - Plant-Based F&B - QSR Opportunities - Refrigeration - Vending Machines WANT TO GET INVOLVED? To find out how to exhibit at C&I Expo, contact Safa de Valois em: safa@c-store.com.au or ph: +61 2 8586 6172 candiexpo.com.au C&I Industry Symposium Sponsor:

A cornerstone of the community

Words Thomas Oakley-Newell

An emphasis on personalisation and local produce makes White’s IGA Forest Glen a local favourite.

LOCATED IN THE picturesque Sunshine Coast of Queensland, White’s IGA Forest Glen offers a unique and exciting shopping experience designed to entice and captivate customers through intimate store design featuring handpicked, artisan and bespoke products ranged and sourced through its exclusive locavore program and a great mix of everyday products at competitive prices.

“We create a heartspace for our community to gather, socialise and feel connected. We are the only supermarket group in the world to facilitate the technology companion created by C’erge, to provide an inclusive, independent, and personalised service for our shoppers who identify with disability,” explained Roz White, owner of White’s IGA Group.

The mission at White’s IGA Forest Glen, and all White’s IGAs, is to help customers make better, conscious, and mindful selections to transform their shopping experience from a standardised experience to an enjoyable, empowered, personalised, connected, and fulfilling one.

“Our stores are uniquely designed in tune with their location to reflect local history and individuality and to capture the nuances that exist in each community, subtly interwoven and represented through design and layout. Every touchpoint within the store has been deeply considered and carefully selected to that which is unique to White’s IGA and the community to create a welcome feeling.”

Supporting local White’s IGA’s unique and exclusive locavore program supports local businesses by sourcing food and products that are grown, raised, or produced locally, usually within 200 kilometres from the store.

“White’s IGA’s distinctive locavore culture supports over 200 local suppliers and contractors with local, national, and international recognition. It was recently admired and highlighted through the global office of IGA Inc. based in the USA,” said White.

The store deepens the locavore messaging in-store through unique ticketing, locavore market days, taste testing, and food demonstrations, designed to connect customers to the creator and ignite a passion and love for local food.

Recently, White has seen an escalation in the wellness category and special dietary, displaying that living a healthy lifestyle is becoming increasingly important to shoppers.

“Health, energy or vitamin shots, sugar-free drinks and varying alternatives to traditional sodas are popular. Premium and sustainable non-plastic options by local providers such as OK Boocha and Heads of Noosa, provides broad shopping choice for the customer. White’s IGA places a huge emphasis on sourcing local products which means food is fresher and kinder to the planet by minimising transportation.

“Adapting range to pursue new opportunities for alternative products is essential to stay viable and

12 April/May 2024 STORE REVIEW

capture and combat market changes. Shoppers needs change all the time and so we must embrace new lines and make space for our modern shoppers needs.”

Stocking traditional grocery at everyday prices, mixed with hot specials, easy meal solutions, private label and a good representation of traditional brands proves popular with shoppers at White’s IGA.

Building relationships

As an independent supermarket operator, relationships are paramount for White. This independence enables them a wide scope to build meaningful and enduring relationships with customers, the industry, and community.

“It is imperative to build strong relationships with suppliers and your trading partners. Business is built on relationships. Immerse yourself in your industry, build networks and create friendships to gain insights and support. Being up to date and informed creates a great platform for new ideas.

“Three decades of partnerships feels more like old friends. There is a camaraderie that exists through longevity.”

One such partnership is the one that White’s IGA has formed with Queensland-based chicken brand Lenard’s.

“We have stocked Lenard’s products in our stores for as long as I can remember. I believe we gained greater access to the products when the brand moved away from the exclusive standalone franchise model. Offering our customers this value-add line at the time of availability brought some excitement to our delis and meat offer.”

Remaining relevant

“We continue to adapt our business model to remain relevant and market leading, which requires not just physical changes to layouts and design, but the management of margins and sales to remain viable.”

- Roz White, Owner, White’s IGA Group

The ever-changing nature of retail throws up many challenges, but also many opportunities. For White, she says that while retail keeps challenging them, is also inspires them to innovate and change to the needs of the modern shopper.

“We continue to adapt our business model to remain relevant and market leading, which requires not just physical changes to layouts and design, but the management of margins and sales to remain viable.

“My biggest epiphany over 30 years of grocery retailing is in the words of Bob Proctor ‘you don’t decide your purpose, you discover it’. When your passion and purpose come to life, you can craft your vision, and focus with clarity. When you understand these fundamentals, you just know what to do and then get on with it.”

Roz White has clearly discovered her purpose, having opened six IGA stores since purchasing their first IGA site in 2004.

“Wherever you might be in your retailing journey, always keep learning, adapt and change, refine and improve, reinvest to grow. Don’t stand still, otherwise you will easily slip behind and your competitors will take advantage of the opportunity you have left on the table.” ■

White’s IGA’s locavore program supports local businesses

Bespoke and artisan products are sold alongside everyday items

www.c-store.com.au 13 STORE REVIEW

White’s IGA Forest Glen aims to create a welcoming atmosphere

Hitting the sweet spot

Novelty and tradition continue to collide in the confectionery category, as consumers seek out novel and inventive offerings, while maintaining a steadfast demand for the classic sweet treats.

Words Lizzie Hunter

DESPITE INCREASING COST of living

pressures, consumers continue to be drawn to the petrol and convenience (P&C) channel when looking to satisfy cravings or find a sweet treat they can have on the go.

According to Joy Lu, Nestlé Australia’s Commercial Development Executive – Impulse and Convenience, while consumers are putting more time and effort into getting the most value for their money, they are not always reaching for the cheapest products, but instead for the most convenient ones.

“Maintaining a presence in this channel ensures Nestlé can capture these impulse purchases, reach a broad customer base, complement other retail channels and stay competitive in the market,” says Lu.

As stated in the AACS 2023 State of the Industry Report, confectionery accounts for 6.7 per cent of total channel sales, up from 6.1 per cent in the prior year, with $693 million in sales in 2023.

Shift towards healthy alternatives

Founder of Funday Natural Sweets, Daniel Kitay says there has been a continued rise in the health and wellness trend within the confectionery category over the last 12 months, despite economic pressures.

“This trend is reflected in the premium segment's resilience, where Funday Sweets operates with its high-quality, health-conscious offerings,” says Kitay.

“Consumer spending habits, as reported by industry analyses, show a willingness to pay a premium for products that align with personal health goals and ethical standards, even in tighter economic times. This shift indicates a broader consumer movement towards value-based purchasing, where the intrinsic value of a product's health and ethical credentials outweighs its cost.”

Kitay says the shift towards products with low sugar content, clean label ingredients and natural flavours are driven by a more informed consumer base that demands transparency and healthfulness in their snack choices.

“According to Food Standards Australia New Zealand, there's a growing demand for products that offer clear nutritional information and health benefits, reflecting changing consumer expectations towards healthier, more sustainable snacking options,” he says.

Rising demand for US confectionery

While a fascination with American culture is nothing new to the Australian market, GC Brands Brand Manager Guy Bennett, says there has been a steady rise in demand for US confectionery, cereal and snack foods.

“We’re seeing some big players take notice of the consumer demand for a trend that was initially confined to niche independent or specialty stores,” says Bennett.

“As a distributor with strong partnerships with US confectionery manufacturers including Ferrara and Jelly Belly, GC is working with a number of major retailers to realise the sales potential of this trend in the first half of 2024.”

CTC Australia Brand Manager Lisa Pushkin says when it comes to confectionery purchasing decisions, familiarity, tradition, and comfort remain top of mind for consumers, however more than one in three are now looking for new flavours.

“Today’s consumers are seeking flavours that are interesting or exotic and are also basing purchasing decisions on indulgence,” Pushkin says.

16 April/May 2024 FEATURE CONFECTIONERY

“Customers are also searching for a point of difference when shopping in P&C retailers. For example, buying products or brands that can only be found in P&C and aren’t available in the major supermarkets.”

Kitay says Funday’s nostalgic flavours like raspberry frogs, fruity snakes and strawberries and cream resonate with consumers seeking comfort in familiar tastes without compromising their health goals.

“These products align with a broader trend towards nostalgic consumption, where consumers gravitate towards brands and products that evoke a sense of nostalgia while adhering to modern health standards,” says Kitay.

“The success of these products in the P&C channel underscores a significant consumer shift towards health-conscious indulgence, where taste and health are not mutually exclusive.

“Industry reports indicate that products offering a combination of health benefits and indulgent experiences are seeing increased preference among consumers, particularly among millennials and Gen Z.”

Lu says introducing innovative products and flavours can attract customers and drive sales in the P&C market.

“Shopper studies showed that consumers within the P&C channel are particularly captivated by novel and inventive offerings,” says Lu.

“As customers perpetually seek indulgence and delightful treats, P&C confectionery retailers can seize the moment by pushing the boundaries of innovation, satisfying cravings and establish themselves as the ultimate destination for irresistible confectionery delights.

Embracing technology can also unlock opportunities for the P&C market, according to Lu.

“Implementing digital solutions, such as mobile apps, loyalty programs and personalized marketing can enhance customer engagement, streamline operations, and provide valuable insights for targeted promotions,” says Lu.

“Consumer spending habits, as reported by industry analyses, show a willingness to pay a premium for products that align with personal health goals and ethical standards, even in tighter economic times.”

- Daniel Kitay, Founder, Funday Natural Sweets

Pushkin echoes Lu, pointing to the fact that younger consumers favour social and digital media as key sources of food inspiration and information.

“TikTok will continue to set trends in novel use of products and ingredient, whereas older consumers are still more likely to turn to friends, family and oldschool recipe books,” says Pushkin.

“The challenge this poses for P&C retailers is meeting consumer needs via a strong digital media strategy, whilst ensuring the older consumers are still catered for.”

In 2024, GC Brands will be targeting growth in ‘Peg Bags’ with HI-CHEW, Nerds and Jelly Belly. Previously these brands had focused on impulse offerings.

“Our fastest growing products are Nerds Gummy Clusters and HI-CHEW Sticks,” says Bennett.

“Gummy Clusters is a simple yet addictive evolution of the classic Nerds formula and one which we’re seeing adults embrace. The result is sales which exceed classic Nerds products in many retailers. Meanwhile HI-CHEW, a giant of Asia, is proving to be just as popular for Australian consumers with significant year on year growth marking this as a large brand for the future.”

GC Brands has also enjoyed significant growth of NOMO, a UK vegan chocolate brand that was launched into the market last year. →

www.c-store.com.au 17 FEATURE CONFECTIONERY

“NOMO has already carved out a strong presence across structured retail. While we very much view this as a product of scale in two to five years’ time, we have already seen significant growth in the range on the back of an incredible flavour profile.”

Nestlé Australia’s KitKat, Allen’s and MilkyBar continue to have a strong presence and consumer appeal in the channel, says Lu.

“The KitKat milk chocolate bar (45g) is the top selling medium chocolate bar in the market, while the KitKat Chunky Bar (50g) has moved up to the third ranking,” says Lu.

“Also delivering strong growth are the KitKat Share Bar and KitKat Chunky Share Bar, both sitting in the top five best-selling chocolate share bars. Additionally, MilkyBar, the top white chocolate brand in market, is leading the white chocolate segment, experiencing growth of 18 per cent.”

Nestlé is set to launch the KitKat Honeycomb Buzz Share Bar (65g) exclusively to the P&C channel in April this year.

“Offering a channel-exclusive product means Nestlé can create a sense of exclusivity and excitement among P&C customers, enticing them with a unique product tailored in the right format,” explains Lu.

“This aligns with Nestlé’s strategy to not only drive customer engagement and loyalty, but to also strengthen the P&C channel's position as a go-to destination for exclusive and innovative confectionery options.”

CTC will launch two new flavours into its range of Fini Confectionery in a cup this year.

“The Fini Confectionery in a cup is perfect for drink holders in the car,” says Pushkin.

“In addition to this, we have a proven offlocation system called Kandy Kingdom. This point-of-sale unit carries a range of exciting novelty

“Today’s consumers are seeking flavours that are interesting or exotic and are also basing purchasing decisions on indulgence.”

– Lisa Pushkin, Brand Manager, CTC Australia

confectionery products that are perfect to keep kids happy in the car. Other new novelty lines from CTC include Soda Cans, Mallow Burger and Minions Sherbet Dips.”

Market forecasts

Bennett notes the single biggest challenge for retailers over the 12-24 months will be consumer spending.

“While this will no doubt pinch many categories, the slowdown is likely to hit on premise consumption in particular as consumers switch to look for better value options.”

While Kitay echoes Bennett’s sentiments on consumer spending habits, he notes the confectionery sector, particularly the niche occupied by healthier options like Funday, presents an opportunity for growth.

“Historical data suggests that confectionery sales remain stable or even increase during economic downturns, as consumers seek indulgences or elements of joy in otherwise a dark economic environment,” he says.

Lu advises P&C retailers to offer seamless omnichannel experiences.

“Customers are increasingly looking for convenience in their shopping experiences, not only in physical stores but also through online platforms,” Lu says. “P&C retailers will need to adapt by offering seamless omnichannel experiences, providing convenient services like click-and-collect or home delivery, and ensuring a smooth transition between online and offline shopping.

“Navigating challenges and capitalising on opportunities will require strategic planning, adaptability, and a customer-centric approach.

P&C retailers that can anticipate and respond to these dynamics will be well-positioned for success in 2024 and beyond.” ■

18 April/May 2024 FEATURE CONFECTIONERY

PRICE POINT

ONE BAR OF LUSCIOUS CHERRIES AND COCONUT WITH BLACKCURRANT FLAVOUR IN OLD GOLD RICH DARK CHOCOLATE SPRINKLED WITH COCONUT

Milking the moment

The flavoured milk category continues to thrive as consumers increasingly seek handy, functional beverages that offer not only taste, but additional nutritional benefits.

Words Lizzie Hunter

FLAVOURED MILK CONTINUES to gain importance due to the growing health and wellness trend, with more consumers turning to flavoured milk for a tasty alternative to sugary beverages, that also delivers essential nutrients like calcium and protein*.

Flavoured milk consists of two key segments – iced coffee and ‘rainbow’ milk, which comprises all other flavoured milks.

In the recently released AACS 2023 State of Industry Report, total beverage sales reached $2.85 billion, an increase of 12.1 per cent from the prior year. Flavoured milk now makes up 19.2 per cent of total beverages.

Daryl Barry, Senior Category Manager of Beverages at Bega Dairy and Drink, says one of the key drivers for the growth of the flavoured milk market is the rising demand for functional beverages.

“Consumers are increasingly seeking functional beverages that offer not only taste but also additional health benefits,” says Barry.

“Flavoured milk is perceived as a healthier alternative to carbonated soft drinks and other sugary beverages as it contains essential nutrients such as calcium, protein, vitamins and minerals.”

Australians are recognised as big consumers of drinking milk, with Australia’s per capita consumption ranking among the highest in the world, according to a report released by Rabobank last year**, while the International Dairy Federation has found the average Australian consumes a large volume of drinking milk, ranking only behind Ireland, Finland and New Zealand.

Barry says the flavoured milk category is critical to the success of a P&C retailer’s overall beverage offer, because it drives foot traffic into stores, with one in five shoppers purchasing flavoured milk, mainly between the hours of 5:00am – 9:00am.

“The milk beverage shopper is very valuable because they have a very high propensity to cross shop and buy on impulse, therefore it is extremely important that their favourite brand is always available,” says Barry.

“Almost half of iced coffee shoppers and 60 per cent of flavoured milk shoppers buy into another category more than any other beverage category, therefore it is critical that stock is fully merchandised and replenished during the 5:00am – 9:00am window.

“Forty-four per cent of shoppers are likely to walk away altogether without a purchase if their preferred

20 April/May 2024 FEATURE FLAVOURED MILK

brand is unavailable. This highlights a great opportunity for retailers to merchandise milk beverages both in the main and front of store fridge to capitalise on the impulse nature of this category.”

Prime position

Despite the relative short shelf-life of flavoured milk, Marcus Morais, Category Manager at Lactalis Australia says with good stock management, P&C retailers can easily boost their total sales by allowing adequate space for flavoured milk.

“The biggest opportunity we see for retailers when it comes to the positioning and space of flavoured milk, is that the category is often very under-indexed in terms of space on shelf compared to share of the total fridge sales,” says Morais.

“Flavoured milk represents around 26 per cent of value share, the second largest in the beverages category, not far behind energy drinks which has 30 per cent. Despite that, it is not uncommon to see energy drinks with twice as much space as flavoured milk.

“When it comes to the key segments, iced coffee is a much more habitual planned purchase, while rainbow is more impulsive – therefore it is important to ensure rainbow milks are always featured at a prominent, eye level position on shelves so it can be seen and purchased by shoppers.”

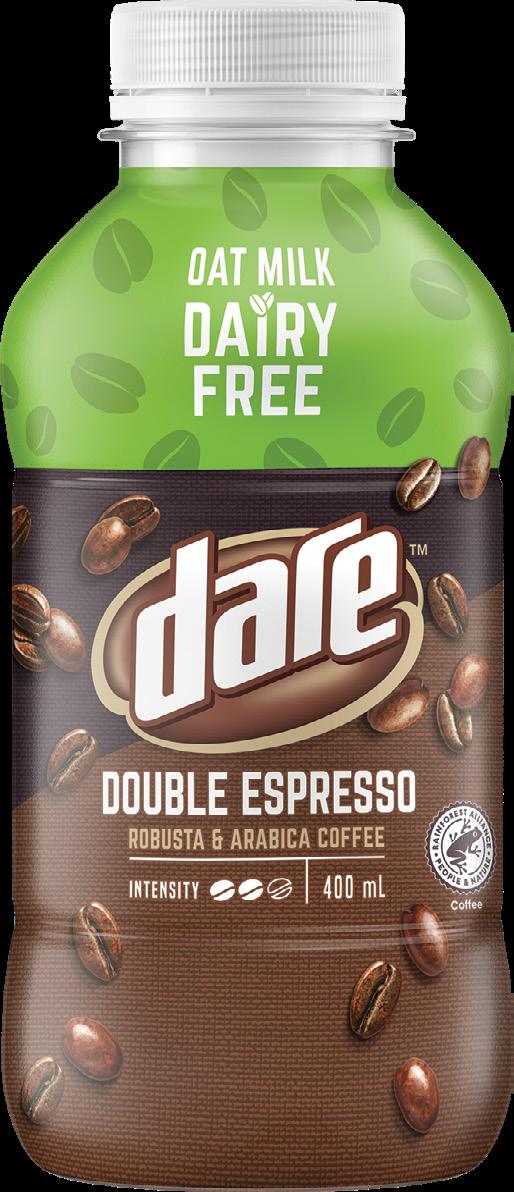

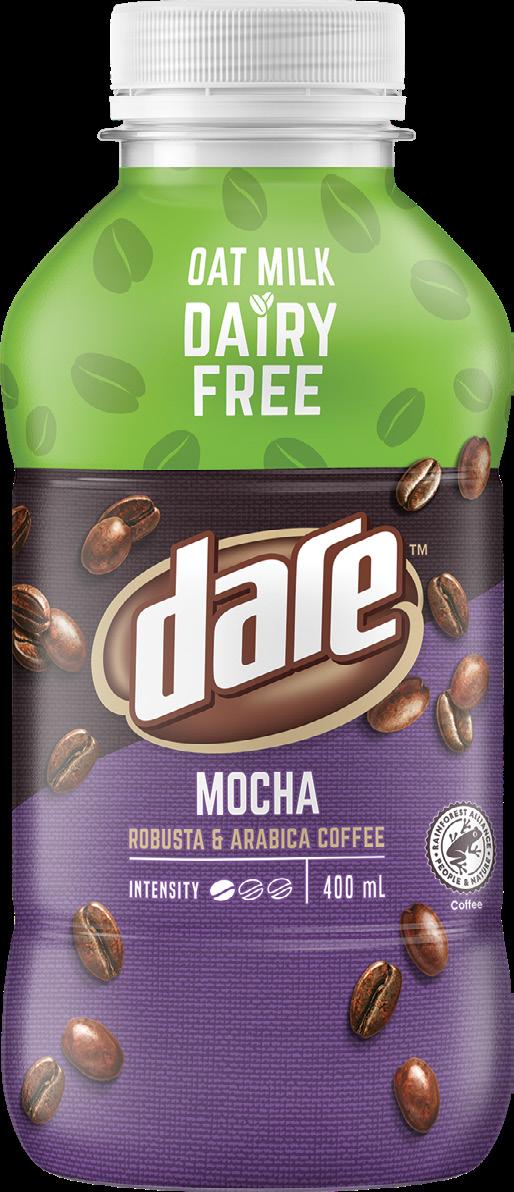

Ben Faulkhead, Category Manager at APCO, said most of the growth in the category is being driven from iced coffee, with stronger strength profiles being key to this and products like Dare Intense and Ice Break Extra Shot being strong performers for the APCO network.

“Sales have been growing in the area with double digit sales growth from iced coffee. Some of this has been driven by shelf price increases and

whilst we have had some unit growth, we did see this slow in the back half of the year.

Faulkhead said APCO has expanded its offering in the space slightly from where it was 12 months ago, although they have traditionally always given a lot of space to iced coffee and flavoured milk based on their customer’s preferences.

“I think brand and promotions are important in the area. We certainly see a big switch between on and off promotional windows. We also see that there is a strong preference for local flavoured milk where our customers have a local brand available.”

Morais says the P&C channel plays a vital role for the Lactalis Business, which manufactures brands including Oak (which is currently valued at more than $37 million in P&C) and Ice Break (valued at over $55 million).

“Flavoured milk is a highly impulsive category, with consumption occurring immediately, or shortly after purchase,” explains Morais. “Having our products in P&C stores allows us to reach shoppers while they are on the go in need of a treat, an energy boost, or simply to refresh themselves. It also allows us to diversify our business and reduce our reliance on the major grocers.”

Despite inflation and interest rate hikes appearing to have peaked, Morais notes the cost of living is still very high, impacting many consumers in a negative way.

“When things get tough, consumers turn to small, affordable luxuries, treats or experiences to escape reality, and help themselves feel better – the so called ‘lipstick effect’, now more broadly described as ‘fun-flation’. This phenomenon is great news for flavoured milk and the P&C channel – as the category itself is seen as a ‘treat’ with shoppers buying it because ‘they feel like it’.” →

“Flavoured milk is perceived as a healthier alternative to carbonated soft drinks and other sugary beverages as it contains essential nutrients such as calcium, protein, vitamins and minerals.”

- Daryl Barry, Senior Category Manager of Beverages, Bega Dairy and Drink

www.c-store.com.au 21 FEATURE FLAVOURED MILK

Market moo-ving with opportunities

New products contributed more than 88 per cent of the growth of milk beverage sales in 2023.

“New Product Development (NPD) and innovation is critical to the growth of the category and bringing new shoppers into your store,” says Barry.

“However careful consideration should be given to the core SKUs and space allocated that generate the majority of your sales and profitability.

“As sugar remains the main barrier to increased consumption of milk beverages, the ‘no sugar’ segment offers a great opportunity for retailers to expand into,” says Barry.

“‘No sugar’ continues to be one of the fastest growing segments across total beverages yet still remains significantly under-indexed in milk beverages vs energy and carbonated soft drink ‘no sugar’ added sales.

“Dairy free or plant-based milk also continue to gain momentum, although still a niche segment at this stage, as consumers look for plant based or animal free alternatives but still crave the great taste of traditional iced coffee and flavoured milk beverages.”

Faulkhead says that APCO hasn’t seen the growth in low or no added sugar type beverages that he would have expected 12 months ago.

“Lactose free has also been challenging as I think more education to customers is needed in the space. Outside of iced coffee, our core chocolate and strawberry flavours continue to perform strongest and have driven most of the unit growth in flavoured milk. I think moving forward there are a number of challenges facing the category in terms of shelf price, promotional price, margin.”

Morais adds that protein has been a mega trend in food for the last decade, with a multitude of brands and products not only being launched, but more importantly, succeeding.

“There is a clear opportunity for flavoured milk to take advantage of the protein trend and attract a new wave of shoppers into the category.”

- Marcus Morais, Category Manager, Lactalis Australia

“We’ve seen this trend playing out in a number of dairy categories such as yoghurt and cheese where brands are supporting consumers with their specific health needs. There is a clear opportunity for flavoured milk to take advantage of the protein trend and attract a new wave of shoppers into the category,” he says.

Smaller packs sizes, especially in the iced coffee space, will be a big opportunity in 2024.

“Flavoured milk really lacks attractive entry level options for new or light shoppers who can't drink the usual 500ml sizes widely available,” says Morais.

“Ice Break has entered this space with its 320ml range, which has been a hit with shoppers.

“Lactalis is also set to launch the Ice Break Strong Espresso 500ml featuring three shots of roasted robusta coffee and 25g protein per serve in April. This new product has been designed to satisfy consumer appetite for more intense caffeine options while providing the satiety benefits of protein,” explains Morais.

“Ice Break’s recently launched lactose-free dedicated iced coffee is also outselling its direct competitor and helping to attract new shoppers to the segment who look for easy-to-digest dairy options.”

Following its success partnering with Australian brands such as Golden Gaytime and Paddle Pop, Oak is also set to partner with Violet Crumble this year, bringing yet another iconic confectionery brand into the flavoured milk space. ■

*https://www.renub.com/flavoured-milk-market-p.php

**https://www.rabobank.com.au/media-releases/2023/230227drinking-milk-to-stay-key-category-for-australian-dairy-sector

22 April/May 2024 FEATURE FLAVOURED MILK

PRODUCT NAME PACK SIZE PRODUCT CODE EAN Ice Break Iced Coffee Strong Espresso (QLD only) 500mL 73063 9310036073062 Ice Break Iced Coffee Strong Espresso (all states ex QLD) 500mL 73079 9310036073079 Availablefrom 15TH APRIL FOR MORE INFORMATION PLEASE CONTACT YOUR LACTALIS AUSTRALIA PTY LTD REPRESENTATIVE Lactalis Australia Pty Ltd, Level 5, 35 Boundary Street, South Brisbane QLD 4101 PHONE: 1800 000 257 EMAIL: sales@au.lactalis.com

Hot opportunity

Foodservice is a key growth category for petrol and convenience retailers, with Food Savouries, including on-the-go options leading that charge.

Words Deb Jackson

DESPITE MEDIA REPORTS stating that national pie sales were down by around 40 per cent in 2023, this is not evident in the petrol and convenience channel (P&C), where Food Savouries, including meat pies, continue to be a key driver of sales growth within the wider Foodservice segment.

Theo Foukkare, CEO of the Australian Association of Convenience Stores (AACS), has highlighted that a strong Foodservice offering is of crucial importance to convenience retailers, with the channel adding $142 million in value growth over the last 12 months.

According to the AACS 2023 State of the Industry Report, the Foodservice channel saw a strong performance with total sales of $1.34 billion, up 12 per cent on the year prior, and marking six straight years of double-digit growth.

At the recent AACS Industry Awards 2023, the winner of the Food-on-the-Go category was Patties Food Group, which is a leading player within the P&C channel with its Four’N Twenty range.

Anand Surujpal, Chief Marketing and Growth Officer at Patties Food Group said P&C plays a key role in the Four’N Twenty broad distribution network.

“Our product range has something for everyone, from commuters needing a quick snack to travellers on a long road trip to anyone needing a midafternoon pick-me-up. P&C plays a vital role in helping us service our on-the-go customers,” he said.

“We constantly work with our P&C partners to connect with our customers, ensure we keep up with changing customer needs, and remain the on-the-go hot snack food of choice for Australians.”

Within the increasingly competitive convenience sector, Four'N Twenty is the market leader for hot, on-the-go, savoury options and outperforms its competitors across the channel. In fact, according to Circana data, Patties Food Group and Four'N Twenty manufacture six of the top seven selling SKUs in the hot, on-the-go, savoury category in P&C, with the classic Four’N Twenty King Size Sausage Roll 180g being the number one SKU*.

“We largely owe our success to our close working relationship with our retail partners, our development of innovative new flavours the public loves, and our use of engaging consumer promotions to drive sales,” says Surunjpal.

24 April/May 2024 FEATURE ON-THE-GO HOT FOOD

Michael Brick, General Manager at Meris Food Equipment, said the hot food on-the-go offer is a significant opportunity for P&C retailers, with sustained strong growth expected to continue for years to come.

“Sales of food-to-go continues to increase, it has been trending up for the last few years and continues to climb. In general, consumers are spending more on eating out of home, ready to eat foods. Factors of time poor, changing behaviours, more access, and options, changing demographics are all leading to increased spend on food. We are seeing the same impacts in P&C, with increasing sales in this category,” he said.

“We are also seeing more competition, so customers’ expectations and demands continue to increase with things like freshness, range etc. For us in P&C, we need to continually strive to provide increasingly good offers to keep up with these expectations.”

For almost 30 years, Meris Food Equipment has been helping retailers to power up their hot food offering and fuel business profits.

“We are fully aware of the demands and limitations business owners in the P&C sector experience. This is why we offer the most sophisticated food equipment that does all the work for you without the need for cooking skills or a commercial kitchen – just a countertop, power socket and a person to activate it,” said Brick.

“The P&C industry typically are wanting to maximise the exposure to food-to-go sales, but installing traditional kitchens and other impactful measures could challenge their existing business and infrastructure, so the ‘cooking outside of the kitchen’ solution is Meris Food Equipment’s ‘bread and butter’.”

“We constantly work with our P&C partners to connect with our customers, ensure we keep up with changing customer needs, and remain the on-the-go hot snack food of choice for Australians.”

- Anand Surujpal, Chief Marketing and Growth Officer, Patties Food Group

Make your Hot Box Great Kevin Azzopardi, Business Manager at UCB Stores, says that food is the shining light within the P&C channel with continued year-on-year growth. He highlights that fried foods have always been a staple within the channel, and as such, UCB Stores has launched a ‘Make your Hot Box Great Again’ campaign, to help lift quality and awareness across their network of stores.

“We want to bring focus back onto the Hot Box, improving awareness, display, and quality of product,” says Azzopardi.

“Fresh does not necessarily mean just healthy or salad. It’s more about good value and quality, presented and enjoyed like it has just been cooked. Snacking remains a strong food mission driver, so having delightful, hot snacks such as Wing Dings, Dim Sims and Potato Cake/Scallops is a mission solver and margin builder,” he explains.

Like in every retail environment, everyone's disposable dollar is more important than ever.

Shoppers are happy to spend but are demanding more in quality and value, so Azzopardi offers the following advice on how P&C retailers can improve their food strategy.

“Food is a hard category to win, it takes a lot of time, effort, and energy. We need to remove the mindset that food is just one more contributor to the bottom line, and instead treat it as its own profit centre,” he says. “We need to think that we are now café owners, and the food we sell is all we have to feed to our family.” →

www.c-store.com.au 25 FEATURE ON-THE-GO HOT FOOD

His advice is to keep your offer simple and uncomplicated, with high quality and fresh products tailored to your customer demographic.

“Give your customers the best food experience they can have, in a way that is operationally sensible for you. Look at your food display from your customers’ eyes and don’t be afraid to sample some of your food. Always ask yourself, if you wouldn’t eat it, what makes you think anyone else would?”

Always innovating

Four'N Twenty might already be the market leader in hot, on-the-go snacks in the P&C channel, but there are still plenty of opportunities for growth and innovation.

“Last year, we released the Four'N Twenty Traveller Hi-Protein pie in response to the ‘better for you’ products desired by convenience sector customers. This protein-packed pie boasts a four-health-star rating and delivers 25 per cent more protein than the traditional Four'N Twenty Traveller Meat Pie. It has proven extremely popular with the more healthconscious customers still looking for a delicious snack in the P&C channel,” says Surunjpal.

In terms of scaling presence within the P&C channel, Patties says that the most important thing a brand can do is to ensure its designated shelves are fully stocked with products that customers want at the time they want them.

“For Four'N Twenty, we work with retailers to ensure our pie warmers are continuously filled, and no shelf is left bare. We want customers to feel confident that they can walk in-store and consistently pick up the product they want.

“A major challenge across the industry is the costof-living pressure. Customers will increasingly be turning to the products they know and the brands, and retailers they trust for affordable snack and meal options. We strive to ensure our products remain the same delicious, quality our customers expect at a price point that doesn’t break the bank.”

“Food costs continue to increase, so the cost of food waste continues to be a concern for operators, better ways to manage this is important, without reducing what is on display because this will reduce your sales.”

- Michael Brick, General Manager, Meris Food Equipment

Brick agrees that the rising cost-of-living is having an impact on consumer behaviour, so he offers this advice to retailers.

“Food costs continue to increase, so the cost of food waste continues to be a concern for operators, better ways to manage this is important, without reducing what is on display because this will reduce your sales. Better display cases with proven technology for increasing shelf life, better packaging solutions, looking at how food is heated and cooked to increase shelf life, choice of food types themselves that lend to longer shelf life all will help build sales without compromising the offer to customers.

“Very often we think that expanded hot food is meeting customer demand for meals, but there will still be a large percentage of sales that are impulse generated. So, positioning the hot food next to the point of sale will go a long way to entice customers into purchasing a cheeky dim sim or chicken strip as a snack between meals.

“And finally, stack them high – a full hot food display goes a long way to building sales through setting increasing customer perception of the freshness and their confidence in your food. Manage your times, food types, planograms to minimise waste, but never compromise on the food on display.”

According to AACS’ Foukkare, providing a strong food and beverage offering needs to be front and centre of the minds of all P&C retailers.

“Convenience stores have been heavily focused on developing their food and beverage offers, providing a broader range of options beyond traditional snacks,” he says. “We are blessed in Australia with some exceptional retailers that continue to push the boundaries and deliver on their customers’ expectations.” ■

*Data sourced from Circana MarketEdge MAT 25/02/2024 based on data definitions provided by Patties Food Group.

Advice for retailers

Kevin Azzopardi from UCB Stores offers the following advice for retailers when deciding what hot food to range in-store:

• Think about quality over price when placing your order.

• Know your customer and understand what they would want to eat.

• Understand your daypart menu.

• Ensure your products are cooked at the right time to ensure that are at their best when eaten.

• Understand how to do all of this safely.

26 April/May 2024 FEATURE ON-THE-GO HOT FOOD

Connect

with our

plans, with

options from 7 to 365 days. Perfect for tablets and portable modems. Available as Starter Packs and Recharges.

Data that never runs out on Prepaid Plus with 28 day expiry.

First use all other data, then use infinite data at speeds up to 1.5Mbps. With 1.5Mbps you can check your socials, browse the web and stream music but its not suitable for HD videos. Data Rollover

Rollover up to 200GB of unused data each time you recharge before expiry on any Prepaid Plus plan. Heaps of Included Data Packed with heaps of included data you can use at Vodafone’s fastest available speeds.

for coverage.

Andorra Argentina Austria Bahrain Belgium Bermuda Bolivia Zone Zone Bangladesh Brazil Canada Chile China Vodafone Prepaid

Flexible Expiry With recharges from 7 days to 365 days.

Stay in touch with

friends

family with

included international minutes. See Zone 1 and Zone 2

at vodafone.com.au/prepaid-idd-rates

every recharge

$5

every recharge when you set your $35 , $45 & $55 Prepaid Plus on Auto Recharge. You can

to Automatic Recharge

saving your payment

activate your SIM

by texting ‘ATR’ to 1263

through My Vodafone.

Mobile Broadband

$12

$45 $55 $160 $250 Expiry 7 days 30 days 30 days 30 days 365 days 365 days Total Data 11GB 9GB + 2GB Bonus Data* 60GB 35GB + 25GB Bonus Data* 90GB 50GB + 40GB Bonus Data* 120GB 65GB + 55GB Bonus Data* 110GB 85GB + 25GB Bonus Data* 250GB 200GB + 50GB Bonus Data* Bonus Data (when you set to Auto Recharge) 1GB – – – 30GB 50GB Save $5 on every recharge When you opt-in to Automatic Recharge – $30 $40 $50 – –Data Rollover (Up to 50GB of unused data) Prepaid Pay and Go Pay and Go gives you great value rates for data and calling in Australia and to overseas. With recharges from $12 and expiry options from 60 to 365 days. $12 $35 $45 $55 Expiry Period 60 days 180 days 365 days 365 days Pay and Go Credit $12 $35 $45 $55 Calls 20¢/min Standard national calls. Message 20¢/TXT Standard national and international TXT (160 characters) Data 6¢/MB. Surf or stream. Rollover Credit Rollover unused credit if you recharge before your next expiry. Our great national rates on Pay and Go Our great international rates on Pay and Go Head to vodafone.com.au/prepaid-idd-rates for a full list of our international call rates. Prepaid Expiry Total Data (Includes Data for Save $5 when you Automatic Unlimited calls & Data Rollover International to 36 countries* International to 54 countries* *See vodafone.com.au/prepaid-idd-rates Vodafone Prepaid Data that never runs out on Prepaid Plus with 28 day expiry. First use all other data, then use infinite data at speeds up to 1.5Mbps. With 1.5Mbps you can check your socials, browse the web and stream music but its not suitable for HD videos. Data Rollover Rollover up to 200GB of unused data each time you recharge before expiry on any Prepaid Plus plan. Heaps of Included Data Packed with heaps of included data you can use at Vodafone’s fastest available speeds. Flexible Expiry With recharges from 7 days to 365 days. International Calling Stay in touch with your friends and family with your included international minutes. See Zone 1 and Zone 2 countries at vodafone.com.au/prepaid-idd-rates Save $5 on every recharge Get $5 off every recharge when you set your $35 , $45 & $55 Prepaid Plus on Auto Recharge. You can opt-in to Automatic Recharge when saving your payment details when you activate your SIM or by texting ‘ATR’ to 1263 or through My Vodafone. Prepaid Mobile Broadband Connect your world with our Prepaid Mobile Broadband plans, with flexible expiry options from 7 to 365 days. Perfect for tablets and portable modems. Available as Starter Packs and Recharges. $12 $35 $45 $55 $160 $250 Expiry 7 days 30 days 30 days 30 days 365 days 365 days Total Data 11GB 9GB + 2GB Bonus Data* 60GB 35GB + 25GB Bonus Data* 90GB 50GB + 40GB Bonus Data* 120GB 65GB + 55GB Bonus Data* 110GB 85GB + 25GB Bonus Data* 250GB 200GB + 50GB Bonus Data* Bonus Data (when you set to Auto Recharge) 1GB – – – 30GB 50GB Save $5 on every recharge When you opt-in to Automatic Recharge – $30 $40 $50 – –Data Rollover (Up to 50GB of unused data) Prepaid Pay and Go Pay and Go gives you great value rates for data and calling in Australia and to overseas. With recharges from $12 and expiry options from 60 to 365 $12 $35 $45 $55 Expiry Period 60 days 180 days 365 days 365 days Pay and Go Credit $12 $35 $45 $55 Calls 20¢/min Standard national calls. Message 20¢/TXT Standard national and international TXT (160 characters) Data 6¢/MB. Surf or stream. Rollover Credit Rollover unused credit if you recharge before your next expiry. Our great national rates on Pay and Go Our great international rates on Pay and Go Head to vodafone.com.au/prepaid-idd-rates for a full list of our international call rates. For use in Oz. *Prepaid Plus Bonus Data Offer available to new eligible Vodafone Prepaid Customers who purchase and activate a $2 SIM with a $12-$320 recharge bonus data for the first 6 eligible recharges within 180 days of Activation. Activation counts as 1st recharge. $160-$320 Prepaid Plus customers will Prepaid Customers who purchase and activate a $2 SIM with a $12-$250 recharge or $12-$250 Starter pack between 10/04/24 and 10/11/24. $12 days of Activation. Activation counts as 1st recharge. $160-$250 Mobile Broadband customers will receive bonus data on activation only. Bonus data Broadband. See website for details. Prepaid Plus Starter Pack: Must activate Vodafone SIM within 365 days of purchase. You will require a credit

in

areas of

cities. Check website

MV05629_A4 PL Vodafone Kaizen Cheat Sheet.indd 2 19/3/2024 12:04 pm Andorra Argentina Austria Bahrain Belgium Bermuda Bolivia Zone 1 – 36 Countries: Zone 2 – 54 Countries: Bangladesh Brazil Canada Chile China

Prepaid Data that never runs out on Prepaid Plus with 28 day expiry. First use all other data, then use infinite data at speeds up to 1.5Mbps. With 1.5Mbps you can check your socials, browse the web and stream music but its not suitable for HD videos.

Rollover Rollover up to 200GB of unused data each time you recharge before expiry on any Prepaid Plus plan. Heaps of Included Data Packed with heaps of included data you can use at Vodafone’s fastest available speeds. Flexible Expiry With recharges from 7 days to 365 days. International Calling Stay in touch with your friends and family with your included international minutes. See Zone 1 and Zone 2 countries at vodafone.com.au/prepaid-idd-rates Save $5 on every recharge Get $5 off every recharge when you set your $35 , $45 & $55 Prepaid Plus on Auto Recharge. You can opt-in to Automatic Recharge when saving your payment details when you activate your SIM or by texting ‘ATR’ to 1263 or through My Vodafone. Prepaid Mobile Broadband Connect your world with our Prepaid Mobile Broadband plans, with flexible expiry options from 7 to 365 days. Perfect for tablets and portable modems. Available as Starter Packs and Recharges. $12 $35 $45 $55 $160 $250 Expiry 7 days 30 days 30 days 30 days 365 days 365 days Total Data 11GB 9GB + 2GB Bonus Data* 60GB 35GB + 25GB Bonus Data* 90GB 50GB + 40GB Bonus Data* 120GB 65GB + 55GB Bonus Data* 110GB 85GB + 25GB Bonus Data* 250GB 200GB + 50GB Bonus Data* Bonus Data (when you set to Auto Recharge) 1GB – – – 30GB 50GB Save $5 on every recharge When you opt-in to Automatic Recharge – $30 $40 $50 – –Data Rollover (Up to 50GB of unused data) Prepaid Pay and Go Pay and Go gives you great value rates for data and calling in Australia and to overseas. With recharges from $12 and expiry options from 60 to 365 days. $12 $35 $45 $55 Expiry Period 60 days 180 days 365 days 365 days Pay and Go Credit $12 $35 $45 $55 Calls 20¢/min Standard national calls. Message 20¢/TXT Standard national and international TXT (160 characters) Data 6¢/MB. Surf or stream. Rollover Credit Rollover unused credit if you recharge before your next expiry. Our great national rates on Pay and Go Our great international rates on Pay and Go Head to vodafone.com.au/prepaid-idd-rates for a full list of our international call rates. Prepaid Plus Expiry Total Data (Includes Included Data for first 6 eligible Save $5 on every when you opt-in Automatic Recharge Unlimited standard calls & text Data Rollover International Talk to 36 countries* International Talk to 54 countries* *See vodafone.com.au/prepaid-idd-rates

International Calling

your

and

your

countries

Save $5 on

Get

off

opt-in

when

details when you

or

or

Prepaid

your world

Prepaid Mobile Broadband

flexible expiry

$35

or available

selected

major

Vodafone

Data

*See vodafone.com.au/prepaid-idd-rates for countries.

vodafone.com.au/prepaid-idd-rates for countries.

Andorra Argentina Belgium Bermuda Brunei Cambodia Cayman Islands Costa Rica Cyprus Czech Republic Denmark Dominican Republic Egypt Faroe Islands France Gibraltar Greece Guadeloupe Guatemala Hungary Kazakhstan Laos Lebanon Luxembourg Macau Malta Mozambique Namibia Nepal Northern Mariana Isl Pakistan Panama Paraguay Philippines Poland Portugal Reunion Russia San Marino Saudi Arabia Slovakia South Africa Spain Canary Isl Sri Lanka Swaziland Turkey Zone 1 – 36 Countries: Zone 2 – 54 Countries: Bangladesh Colombia Germany Guam Hong Kong Iceland India Indonesia Ireland Israel Italy Japan Kuwait Malaysia Mongolia Mexico Netherlands New Zealand Norway Peru Puerto Rico Romania Singapore South Korea Spain Sweden Switzerland Taiwan Thailand UK USA Vatican Prepaid Plus Plans $12 $35 $45 $55 $160 $250 $320 7 days 28 days 28 days 28 days 185 days 365 days 365 Data (Includes Included Data plus Bonus for first 6 eligible recharges) 7GB 5GB + 2GB Bonus Data* 45GB 25GB + 20GB Bonus Data* 65GB 35GB + 30GB Bonus Data* 85GB 50GB + 35GB Bonus Data* 150GB 90GB + 60GB Bonus Data* 240GB 150GB + 90GB Bonus Data* 320GB 220GB Bonus $5 on every recharge you opt-in to Automatic Recharge – $30 $40 $50 – –Automatic Recharge Bonus Data 1GB 30GB 50GB 100GB Unlimited standard national & text

International Talk Zone 1 36 countries* – 500 mins Unlimited Unlimited – – 6000 International Talk Zone 2 54 countries* – – 100 mins 200 mins – – 1200 Turkmenistan UAE Uruguay Venezuela Vietnam

Rollover

Andorra Argentina Austria Bahrain Belgium Bermuda Bolivia Brunei Cambodia Cayman Islands Costa Rica Cyprus Czech Republic Denmark Dominican Republic Egypt Faroe Islands France Gibraltar Greece Guadeloupe Guatemala Hungary Kazakhstan Laos Lebanon Luxembourg Macau Malta Mozambique Namibia Nepal Northern Mariana Isl Pakistan Panama Paraguay Philippines Poland Portugal Reunion Russia San Marino Saudi Arabia Slovakia South Africa Spain Canary Isl Sri Lanka Swaziland Turkey Zone 1 – 36 Countries: Zone 2 – 54 Countries: Bangladesh Brazil Canada Chile China Colombia Germany Guam Hong Kong Iceland India Indonesia Ireland Israel Italy Japan Kuwait Malaysia Mongolia Mexico Netherlands New Zealand Norway Peru Puerto Rico Romania Singapore South Korea Spain Sweden Switzerland Taiwan Thailand UK USA Vatican City (Holy See) you your Zone texting $250 days 0GB Data* days. recharge or $12-$320 Starter pack between 10/04/24 and 10/11/24. $12 Prepaid Plus customers will receive bonus data for the first 6 eligible recharges within 90 days of activation. $35-$55 Prepaid Plus customers will receive will receive bonus data on activation only. Bonus data is applied within 72 hours following activation. See Starter Pack packaging for terms. *Prepaid Mobile Broadband Bonus Data Offer available to new eligible Vodafone Mobile Broadband customers will receive bonus data for the first 6 eligible recharges within 90 days of activation. $35-$55 Mobile Broadband customers will receive bonus data for the first 6 eligible recharges within 180 data is applied within 72 hours following activation. See Starter Pack packaging for terms. Data Rollover: Rollover up to 200GB of unused data each time you recharge before expiry on Prepaid Plus, or 50GB on Prepaid Mobile debit card to activate and/or opt-in to Auto Recharge online. Prescribed ID and user details must be provided. Recharge costs additional. Not transferrable or redeemable for cash. Vodafone 5G approved device required. 5G MV05629 04.24 Prepaid Plus Plans $12 $35 $45 $55 $160 $250 $320 Expiry 7 days 28 days 28 days 28 days 185 days 365 days 365 days Total Data (Includes Included Data plus Bonus Data for first 6 eligible recharges) 7GB 5GB + 2GB Bonus Data* 45GB 25GB + 20GB Bonus Data* 65GB 35GB + 30GB Bonus Data* 85GB 50GB + 35GB Bonus Data* 150GB 90GB + 60GB Bonus Data* 240GB 150GB + 90GB Bonus Data* 320GB 220GB + 100GB Bonus Data* Save $5 on every recharge when you opt-in to Automatic Recharge – $30 $40 $50 – – –Automatic Recharge Bonus Data 1GB 30GB 50GB 100GB Unlimited standard national calls & text Data Rollover International Talk Zone 1 to 36 countries* – 500 mins Unlimited Unlimited – – 6000 mins International Talk Zone 2 to 54 countries* – – 100 mins 200 mins – – 1200 mins Turkmenistan UAE Uruguay Venezuela Vietnam

Brunei Cambodia Cayman Islands Costa Rica Cyprus Czech Republic Denmark Dominican Republic Egypt Faroe Islands France Gibraltar Greece Guadeloupe Guatemala Hungary Kazakhstan Laos Lebanon Luxembourg Macau Malta Mozambique Namibia Nepal Northern Mariana Isl Pakistan Panama Paraguay Philippines Poland Portugal Reunion Russia San Marino Saudi Arabia Slovakia South Africa Spain Canary Isl Sri Lanka Swaziland Turkey Countries: Countries: Colombia Germany Guam Hong Kong Iceland India Indonesia Ireland Israel Italy Japan Kuwait Malaysia Mongolia Mexico Netherlands New Zealand Norway Peru Puerto Rico Romania Singapore South Korea Spain Sweden Switzerland Taiwan Thailand UK USA Vatican City (Holy See) Plus Plans $12 $35 $45 $55 $160 $250 $320 7 days 28 days 28 days 28 days 185 days 365 days 365 days Included Data plus Bonus eligible recharges) 7GB 5GB + 2GB Bonus Data* 45GB 25GB + 20GB Bonus Data* 65GB 35GB + 30GB Bonus Data* 85GB 50GB + 35GB Bonus Data* 150GB 90GB + 60GB Bonus Data* 240GB 150GB + 90GB Bonus Data* 320GB 220GB + 100GB Bonus Data* every recharge to Automatic Recharge – $30 $40 $50 – – –Recharge Bonus Data 1GB 30GB 50GB 100GB standard national Talk Zone 1 – 500 mins Unlimited Unlimited – – 6000 mins Talk Zone 2 – – 100 mins 200 mins – – 1200 mins Turkmenistan UAE Uruguay Venezuela Vietnam vodafone.com.au/prepaid-idd-rates for countries. For use in Oz. *Prepaid Plus Bonus Data Offer available to new eligible Vodafone Prepaid Customers who purchase and activate a $2 SIM with a $12-$320 recharge or $12-$320 Starter pack between 10/04/24 and 10/11/24. $12 Prepaid Plus customers will receive bonus data for the first 6 eligible recharges within 90 days of activation. $35-$55 Prepaid Plus customers will receive bonus data for the first 6 eligible recharges within 180 days of Activation. Activation counts as 1st recharge. $160-$320 Prepaid Plus customers will receive bonus data on activation only. Bonus data is applied within 72 hours following activation. See Starter Pack packaging for terms. *Prepaid Mobile Broadband Bonus Data Offer available to new eligible Vodafone Prepaid Customers who purchase and activate a $2 SIM with a $12-$250 recharge or $12-$250 Starter pack between 10/04/24 and 10/11/24. $12 Mobile Broadband customers will receive bonus data for the first 6 eligible recharges within 90 days of activation. $35-$55 Mobile Broadband customers will receive bonus data for the first 6 eligible recharges within 180 days of Activation. Activation counts as 1st recharge. $160-$250 Mobile Broadband customers will receive bonus data on activation only. Bonus data is applied within 72 hours following activation. See Starter Pack packaging for terms. Data Rollover: Rollover up to 200GB of unused data each time you recharge before expiry on Prepaid Plus, or 50GB on Prepaid Mobile Broadband. See website for details. Prepaid Plus Starter Pack: Must activate Vodafone SIM within 365 days of purchase. You will require a credit or debit card to activate and/or opt-in to Auto Recharge online. Prescribed ID and user details must be provided. Recharge costs additional. Not transferrable or redeemable for cash. Vodafone 5G approved device required. 5G available in selected areas of major cities. Check website for coverage. MV05629 04.24

choice

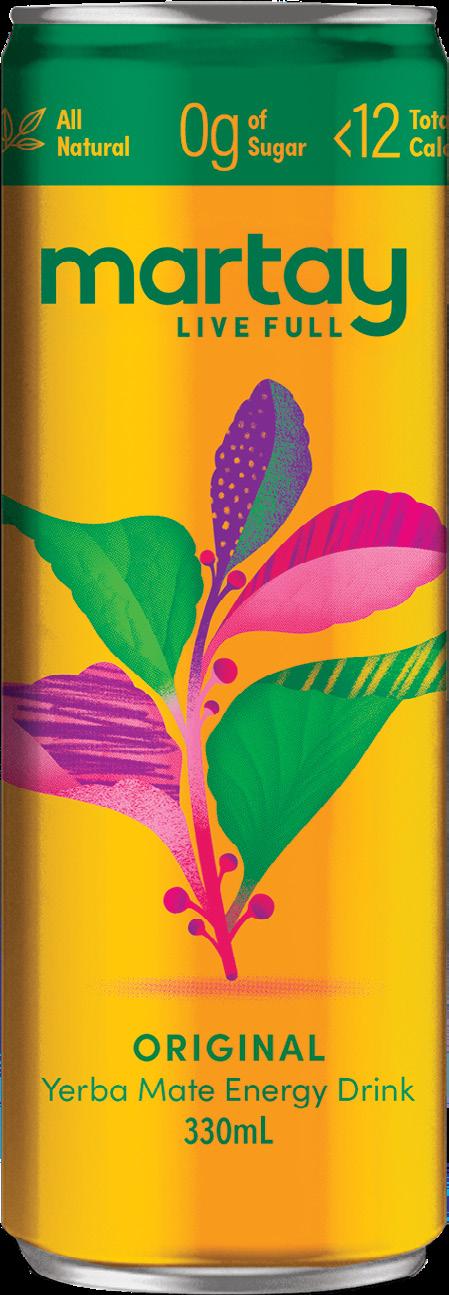

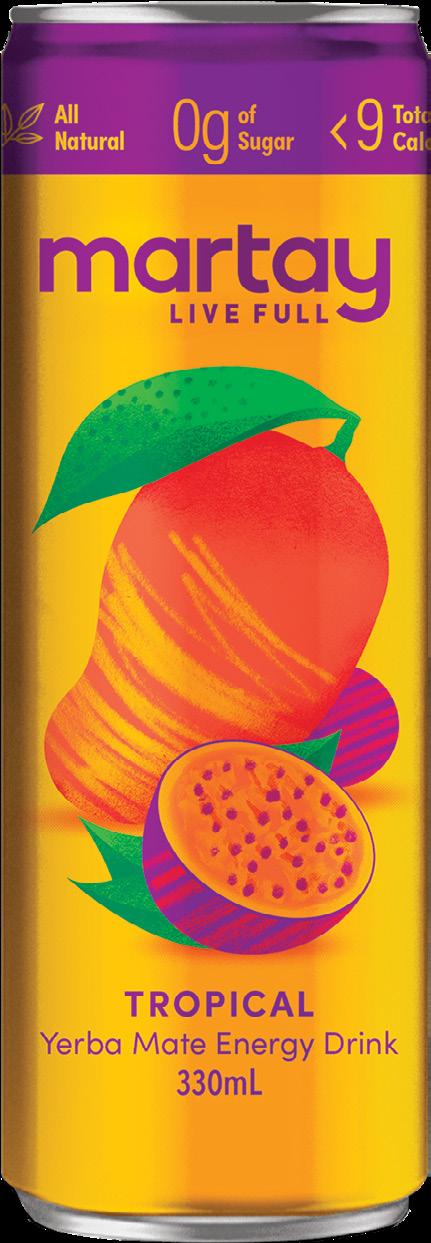

Martay – not just an energy drink

Introducing our C&I Choice for this issue – Martay, a carbonated beverage breaking into an untapped hybrid market; a healthy energy drink/functional beverage. Similar to a kombucha or a natural sparkling tea in flavour and ingredients, there is one crucial difference – Yerba Mate (pronounced Yer-ba Mar-tay).

Yerba Mate is a plant found in South America that provides a natural source of caffeine which gives consumers a longer-lasting lift in energy (without all the artificial stimulants) – not to mention numerous health benefits.

The Yerba Mate RTD beverage market has experienced significant growth in Europe and the United States. Its success stems from its convenience, ability to deliver sustained energy, and associated health benefits.

Martay was originally developed to give employees in a Tech company access to a healthy energy drink. The company felt that other ‘better for you’ drinks weren’t quite cutting it for mental focus and health benefits. Demand became so intense that it was decided to bring the product to market.

The goal is simple – give consumers a healthy energy boost in one convenient 330ml can!

Two mouth-watering flavours are available in Original – an earthy flavour with a floral zing, and Tropical – a refreshing flavour combo of Kensington mango and popping passionfruit.

To stock Martay, contact hello@yerbamartay.com.

A hole lot of fun with Thins Onion Rings

Thins Onion Rings are the new crispy, irresistible chips that are a must-have for your convenience snack shelf.

These delectable ring-shaped snacks are light and crispy with a whole lot of fun packed into every bite. They're also completely gluten-free, so everyone can enjoy them guilt-free.

With Thins Onion Rings, your customers will be spoiled for choice with a range of irresistible flavours.

Original Roast Onion: A timeless classic that'll have your customers coming back for more with its rich, roasted onion goodness.

Sour Cream and Chives: Creamy, tangy, and oh-so-satisfying, this flavour combo is sure to be a hit with snack enthusiasts everywhere.

Hot and Spicy: For those who like a little kick, the Hot and Spicy variety will ignite their taste buds and keep them coming back for another fiery fix.

Don't miss out on the opportunity to delight customers with Thins Onion Rings and let them experience flavour-packed, gluten-free goodness like never before. Get ready to snack happy with Thins.

Whether lounging at home, on the go, or need a quick snack fix, Thins Onion Rings are conveniently available nationwide. Find them across petrol and convenience outlets, independents, and Coles and Woolworths.

PRODUCT RANGING 30 April/May 2024

Maxibon brings back fan favourite flavour

After eight years off the shelf, Peters has brought back the muchloved cult flavour, Maxibon Peanut Jams with Butter.

A spinoff from the original flavour, Maxibon Peanut Jams with Butter features peanut butter with crushed peanuts, and peanut butter flavoured slab followed by raspberry jam syrup notes throughout, sandwiched between two chocolate biccies on one end and dipped in chocolate on the other with more crushed peanuts.

Setphanie Chosich, Brand Manager at Maxibon, said they’re really proud of Maxibon Peanut Jams with Butter, and there are a few people on the team who are already speculating whether this could be Maxibon’s most delicious creation yet.

“We are so excited about sharing our revamped creation with Maxibon fans across Australia. We’ve had more requests to bring this flavour back than any other, so at a time when sandwich delis and ice cream sandwiches are buzzing across Australia, the timing felt right.”

Peters said it’s no surprise that Maxibon fans have been messaging the brand demanding the re-release of this particular flavour.

Maxibon Peanut Jams with Butter is available in single serves and 4-packs now at independent grocery stores, petrol and convenience stores, Woolworths, and from 8 April, Coles.

Sweet teen convenience from Fini

Fini has a range of insanely delicious, sweet snacks! These colourful, one-of-a-kind snacks have teens all over Australia seeking them out to satisfy their hunger and sweet cravings.

The Jumbo Tornado Bar is a soft rainbow candy bar, that is sour on the outside and creamy on the inside. A Jumbo size for a Jumbo appetite!

The Fini Giant XXL Rainbow Twist is big enough to share... If you dare! Delicious, swirly twists of rainbow, colourful and so fun!

Fini's Crazy Roller is a super fun, super fizzy rolled-up belt in Rainbow flavour – enough to share with friends or keep them all for yourself!

All of these products are made from the highest quality ingredients from the number one candymaker in Spain, Fini!

It’s Fun, It’s Fini!

Available at The Distributors. 1800 989 022. www.the-distributors.com.au.

www.c-store.com.au 31 PRODUCT RANGING

Time to shake things up with Australia's #1 weight loss brand*

In 2014, NRL legend, Adam MacDougall, launched The Man Shake in response to Australia's obesity challenge, due to his friend's untimely and tragic death. This high-protein, low-sugar meal replacement shake is specifically formulated for men and has supported Aussie men's health for a decade.

From its success, The Lady Shake followed, offering busy women a convenient, nutritious solution for weight loss and improved health. More than just shakes, this movement is sparking daily health transformations. With over one million Australians on

board, the journey of innovation and health empowerment is just beginning. Join in this revolution and shake things up together!

Step up your health game with Australia’s number one choice in weight loss, now available in convenient grab and go formats of bars, sachets and RTDs. Over a million Aussies have transformed their lives, and now you can help more do the same.

*Source: CIRCANA – MAT 06/02/24, DIET SEGMENT, AU GROCERY/ PHARMACY SCAN. #1 WEIGHT LOSS BRAND = THE MAN SHAKE AND THE LADY SHAKE COMBINED RSV.

Violet Crumble reveals fresh new mint flavour

Violet Crumble has released a minty-fresh new take on the original, with the brand-new Violet Crumble Mint Cubes hitting the shelves.

The latest in a long line of innovative flavour reinventions from Violet Crumble, including Raspberry Twist, Dark Choc and Caramel, the Mint Cubes offer a deliciously cool, mouth-watering take on the honeycomb confectionery classic.