Hobart breathes.

Connections between nature, history, culture, businesses and each other are the heart of our city.

We are brave and caring.

We resist mediocrity and sameness.

As we grow, we remember what makes this place special.

We walk in the fresh air between all the best things in life.

Our mission:

Working together to make Hobart a better place for the community.

We value:

People

We care about people – our community, customers and colleagues.

Teamwork

We collaborate both within the organisation and with external stakeholders drawing on skills and expertise for the benefit of our community.

Focus and Direction

We have clear goals and plans to achieve sustainable social, environmental and economic outcomes for the Hobart community.

Creativity and Innovation

We embrace new approaches and continuously improve to achieve better outcomes for our community.

Accountabilit y

We are transparent, work to high ethical and professional standards and are accountable for delivering outcomes for our community.

In recognition of the deep history and culture of our city, we acknowledge the Tasmanian Aboriginal people as the Traditional Custodians of this land. We acknowledge the determination and resilience of the Palawa people of Tasmania who have survived invasion and dispossession and continue to maintain their identity, culture and rights.

We recognise that we have much to learn from Aboriginal people today, who represent the world’s oldest continuing culture. We pay our sincere respects to Elders past and present and to all Aboriginal people living in and around Hobart.

On behalf of the Council, I am pleased to present the annual report for 2024-25.

The City of Hobart has implemented a number of forward-looking projects over the past year, including important strategic planning work to guide the growth of our city into the future. Infrastructure has also been installed which is transforming how we protect our environment and provide new facilities for residents.

The City has realigned its internal structure to deliver programs, services and infrastructure more efficiently. In addition, Council has also implemented a new committee structure which allows us to more effectively conduct our business.

While there can be a reluctance to embrace change, innovation needs to be at the forefront of how we operate today to ensure Hobart continues to thrive in a changing world.

The financial profile of the city remains healthy with a turn-over of $186.9 million

in 2024-25 and an underlying surplus of $14.4 million. We invested $2.0 million in new assets and $25.7 million in replacement of worn-out assets. There were no new borrowings taken out and $4.1 million in existing debt was repaid.

There is a significant pipeline of approved developments in the City of Hobart with 582 permits approved in 2024-25 with an estimated value of work of over $485 million. The value of development s approved is a significant increase on the 2023-24 figure of $330 million. The dwelling application approval rate for this year was 98.46 per cent, showing a Council which overwhelmingly approves development.

Major developments approved in this financial year include a $40 million 12-storey commercial development on the corner of Harrington and Liverpool streets, and a $74 million 9-storey mixed-use building with retail and office spaces, on the corner of Watchorn and Bathurst streets.

Council voted to adopt the North Hobart Neighbourhood Plan—a 20-year plan that will guide the future growth and sustainable development of the area to protect the character of North Hobart and encourage new development.

We also developed and released for public comment the Hobart Design Guidelines, Tasmania’s first ever city design guidelines. Council made an in-depth submission to the Tasmanian Planning Commission as part of the Macquarie Point Stadium Project of State Significance Process (POSS) and

provided briefings to members of the Tasmanian Parliament about the project. Following detailed consideration and analysis, the City concluded that it does not support this project being built at this location because the negative impacts outweigh the positives.

Council adopted the Hobart Transport Strategy to support the implementation of an integrated, sustainable and efficient transport system for Hobart. During this financial year, several projects from the strategy were implemented including the completion of a Parking and Kerbside Management Plan to help manage our transport network and street spaces. School Access Travel Plans were developed in partnership with Goulburn Street Primary School, New Town Primary School, and South Hobart Primary School to make the streets around these schools safer.

The City introduced an eBike Library to give people real-world experience to see if an e-bike suits their needs before committing to purchasing one.

The City continues to work with the Tasmanian Government on the expansion of the Derwent River Ferry Service. A terminal at Sandy Bay will improve transport options for commuters and students and help relieve peak hour usage of Sandy Bay Road. The Derwent Ferry expansion is a collaborative project with both the Federal and State Governments and made possible by the successful advocacy of the Greater Hobart mayors, securing $20 million in federal funding to construct the three terminals. Council also endorsed the West Hobart Local Area Mobility Plan, to improve safety for people walking, riding and driving through the suburb.

The City of Hobart will continue with pedestrian-only phase crossings (“scramble crossings”) at four CBD intersections following a successful 12-month trial, which demonstrated that they provide a safer and quicker way for pedestrians by separating them from car movements.

The two-year Transforming Collins Street trial began across a 700-metre section of the street between Molle and Murray Streets. The trial includes separated cycle lanes, a zebra crossing, street greenery, outdoor dining space, and a lower speed limit.

The trial aims to support local businesses and encourage people to spend more time on Collins Street—resulting in a more welcoming CBD and boosting economic activity. A large public meeting held in March 2025 passed a motion in support of the trial.

The Marlyn Road Fire Trail, fondly known as the “Bumpy Track”, was upgraded to make a safer and more accessible route.

Council approved a two-year trial to extend the Centrepoint Car Park’s weekday closing time from 6.15pm to 7.15pm and the Argyle Street car park’s daily opening time from 7am to 6.30am.

The new Parliament Reserve Slide—the biggest slide in Hobart—was opened and meets contemporary safety standards. The area has been landscaped with new gardens to make it more accessible.

Vacant land in South Hobart was transformed into a new playground with play towers, slides, swings, a picnic shelter, and native tree plantings, following requests from the local community.

Council adopted the Hobart Waste Management Strategy 2025 which maps out 64 actions that will be taken over the next five years to embrace a circular economy and close the McRobies Gully landfill site in 2030.

Hobart has a unique natural and built environment with over 60 per cent of the municipal area that we manage being native vegetation.

Council approved the Biodiversity Action Plan 2025–2030 which maps biodiversity values across all land types and guides our land management to protect the City’s flora and fauna. It commits to restoring and reconnecting key habitat corridors across Hobart, helping native wildlife adapt and thrive amid increasing urbanisation and climate pressures.

In addition to its own grants, the City of Hobart also delivers the Youth Climate Action Fund (YCAF) — a global initiative fully funded by Bloomberg Philanthropies.

The YCAF empowers young people aged 15 to 24 to lead climate action projects in their communities. The City has awarded more than $200,000 of Bloomberg funding to youth led projects, ranging from sustainability workshops and creative arts initiatives to urban greening and clean energy installations.

Council approved the installation of a new gross pollutant trap below the existing leachate pond at the McRobies Gully Waste Management Centre to significantly reduce rubbish and pollutants from entering the Hobart Rivulet, protecting the platypus population by improving water quality in their natural habitat.

The $2 million restoration of the New Town Rivulet estuary has been a major project to transform 300 metres of the Rivulet from a degraded concrete drain into a beautiful, natural estuarine environment.

A guide to the flammability of common garden plants in Greater Hobart was developed with researchers at the University of Tasmania’s FireLab.

The City made a submission to the Kunanyi/ Mount Wellington and Wellington Park Strategic Review A shared vision for Our Mountain’s Future highlighting that Council owns and maintains assets worth over $84 million within Wellington Park, including: fire trails, tracks, bridges, public conveniences, sheds and huts, roads and stormwater infrastructure.

During the financial year, 900 trees and 4,100 plants have been given away to residents to grow Hobart’s urban tree canopy cover to 40 per cent by 2046.

To mark the International Day of Peace, the Cit y planted in Hobart Peace Park a sapling descended from a ginkgo tree that survived the atomic bombing of Hiroshima and a Blue Gum was planted in Sandy Bay as a gift to Mary Donaldson on her accession as Queen of Denmark. These were two of the approximately 180 new trees planted in Hobart’s parks and streets this financial year

Council adopted the 2040 Climate Ready Hobart Strategy which includes a goal of zero emissions across Hobart by 2040, the first Tasmanian council to set this ambitious target. The strategy is the result of more than a year of research, collaboration and design with climate experts, leaders, and the wider community including Tasmania’s first citizens assembly on climate change.

The Country, Culture, People 2025–2027 was drafted to improve opportunities to work with the Palawa community and promote Aboriginal culture to the Hobart community.

Council also endorsed establishing a secretariat and Steering Committee to endorse our status as a UNESCO City of Literature. The City supported the production of Voices of the Southern Ocean an anthology of writing inspired by the Southern Ocean by more than 50 writers and illustrators from Hobart.

The City continued its support of community run Christmas carol events with eight community groups supported to run events across five days, maximising the opportunity for Hobart residents to celebrate with their community.

The City’s support for the community also continued through its Grant program which allocated:

• $86,450 for Community Grants.

• $21,767 for Community Quick Response Grants.

• $144,783 for Creative Hobar t Medium Grants.

• $38,717 for Creative Hobart Small Grants

• $324,250 for Event Partnerships.

• $11,157 in Event Quick Response Grants.

• $55,000 in Urban Sustainability Grants.

The City Partnerships Program provided $122,739 in support to significant event s including ANZAC Day, the Sandy Bay and Royal Hobart Regattas, the Estia Greek Festival, and Festa Italia, and the Sponsorship Program also provided $313,500 in financial and $467,998 in in-kind support to major events including

the Taste of Summer, Australian Wooden Boat Festival, and the Dark MoFo Winterfeast.

The City’s Event grants round supported a wide variety of high-quality performances and community events, including through grants to the Hobart Jazz Club Inc for the Hot August Jazz Festival, to the South Hobart Sustainable Community for a South Hobart Resilience Fair and Film Night, and for the Tasmanian Fashion Festival.

The Hobart City Council endorsed the recommendations from a review of grants and sponsorships conducted with KPMG. As a result, the Council agreed to establish a centralised grants coordination team, update relevant policies, and an evaluation framework.

The City of Hobart’s 2024 Business Grant Program saw 27 local small businesses in the Hobart local government area receive financial support to improve their visual merchandising and overall retail marketing.

To support local businesses and assist shoppers in the lead-up to Christmas, council funded additional Derwent ferry services in December 2024.

Council formed the Safer Hobart Alliance, a strategic advisory committee to enhance community safety and also held a retail crime and safety forum, with over 10 0 retailers and community members, to discuss how strategies can be applied to make stores and Hobart safer. It also completed the CCTV network along Elizabeth Street, from North Hobart to the CBD, providing enhanced public safety and security for residents, visitors, and businesses as well as vital city planning data.

The City of Hobart agreed on its Advocacy Priorities 2024-25 focussing on key areas including Kunanyi/Mount Wellington, transport choices for Hobart, housing and urban development, the New Town Sports Precinct, a dedicated basketball facility at Rugby Park, and a new world-class STEM hub at the University of Tasmania’s Sandy Bay campus. These priorities aim to secure investment and support from other levels of government to better meet community needs.

The City’s ongoing advocacy on the redevelopment of Macquarie Wharf 6 was successful with funding allocated by the Federal Government to ensure Hobart continues to serve as Australia’s Antarctic gateway.

It is through the hard work of all City of Hobart employees that Hobart continues to be an exciting and vibrant place to live, and I thank our CEO, Michael Stretton, his Executive Leadership Team, and all staff for their efforts.

My elected member colleagues represent the diversity of views within our community and I thank them for their work on behalf of the people of Hobart.

I look forward to the year ahead where Hobart continues to be a welcoming, innovative, and globally connected city.

Cr Anna Reynolds Lord Mayor

It is with pleasure that I reflect on the achievements of this organisation for the 2024-25 financial year.

Throughout 2024-25, the City of Hobart continued to deliver a wide array of services to its community. This report summarises organisational performance and outlines major developments during the year.

When I commenced at the City of Hobart in February 2024, I spent time working out how the organisation ‘ticked’ by talking with senior leaders, staff and Elected Members. These observations resulted in the release of a Review and Organisational Alignment Project 2024 Report in July which articulated my vision for the organisation to be innovative and contemporary, to have a constructive culture that staff are proud to be a part of and to be widely respected as local government leaders. Following excellent engagement from staff, a number of changes to the organisation’s structure came into effect on 25 November 2024.

It is pleasing to have a full compliment of Executive Leadership Team (ELT) member s with the appointment of three new Directors to the team. The ELT is committed to

promoting a positive working environment with each team member leading by example and setting the tone. The ELT’s purpose statement articulates how Directors will build trust, create a positive culture, demonstrate integrity and strive to be leaders that others want to follow.

Leadership, staff and team development has also been at the forefront with the One Hobart Leadership Program being offered throughout the organisation. The Program is designed to consolidate and uplift the collective capability of our staff by equipping leaders to respond to complexity and continuous change, taking initiative, being accountable, thinking strategically, identifying opportunities for improvements, and feeling empowered to contribute to work together to achieve outcomes. A series of monthly “Leadership in Practice” sessions is held for graduates of the Program whilst “Where to from Here” workshops allow teams to set priorities, outcomes and accountabilities in terms of team behaviours and outcomes.

We placed a strong emphasis on the Work Health and Safety (WHS) of our employees by reviewing resourcing and our WHS committee structure.

These committees are an important part of our organisation as they facilitate effective consultation, cooperation and communication between staff and management with regards to safety matters across the organisation. Our One Safe Framework connects the efforts of WHS in eliminating psychosocial hazards and

consists of the following four key areas: Safe to be, Safe to learn, Safe to contribute, and Safe to constructively challenge. Support has been provided to all teams to enable them to develop skills to create a psychologically safe and constructive environment.

For new employees of the City of Hobart we launched a new Onboarding Program at an inaugural One Hobart Showcase. These Showcases consists of groups and teams within our work areas who provide information about programs and services and provides a great opportunity for new and not so new employees to learn about what we do. This event is an integral part of the new onboarding program which takes place three times a year. In addition, new staff are also able to participate in walking tours to all City of Hobart council office locations, and a fortnightly tour to all other locations.

We successfully negotiated a new Enterprise Agreement this year with a majority of staff supporting the Hobart City Council Enterprise Agreement 2024 (EA 2024). We have always been committed to consulting with our staff and their representatives about matters affecting them in the workplace. The EA 2024 provides for the ongoing establishment of a Consultative Committee whose role is to work cooperatively and practically to engage on workplace issues, policies and proposed changes in the workplace.

Our digital transformation continued with the roll-out of the City’s 2025-2030 Information Technology Strategy. The Strategy aims to improve our digital tools, make it easier for staff and the community

to access information and services, and keep information safe. The Strategy follows global goals for a better future and will help Hobart be ready for new technology. Our commitment to improving digital workflows and compliance with legislative requirements for information management has seen our teams enjoying benefits such as real-time document collaboration, improved information sharing, better version control, enhanced mobile access and stronger information governance. To help drive brand uniformity, accessibility and mobile phone readiness our IT and Digital Communications teams worked together to create an enterprise-wide email signature that provides organisational consistency for our staff.

Led by our fantastic finance team, the Council’s financial performance continues to be strong, recording an operational surplus of $20.4 million for the financial year.

Our focus will remain on the implementation of service reviews across the organisation to continue reducing our cost of service to the community over time.

In April, more than 100 people gathered in the Town Hall Ballroom for a retail crime and safety forum, to discuss how strategies can be applied to make shops and Hobart safer. The event was in collaboration with Tasmania Police and brought together community leaders and retailers to discuss ways to help make the community a safer place for all by ensuring reporting of a crime in a timely manner, things retailers can do to prevent crime such as installing CCTV and ensuring staff are properly trained in crime prevention.

The City has a team of volunteers operate at Salamanca Market, Hobart Airport, Tasmanian Travel and Information Centre and the MAC 02 Cruise Ship Terminal during cruise season. These amazing volunteers primarily greet visitors at the

above mentioned entry points to Tasmania and provide them with a warm welcome. They also help visitors in many other ways, such as wayfinding, what they can do whils t visiting Tasmania, and transport options for travelling around the state.

We commenced a refresh of our City of Hobart website. The main focus areas of the project are around the site page structure and navigation (information architecture), page content and visual design.

The City’s Warm Hearts campaign was rolled out for the second year to highlight Hobart in its darkest months. The campaign aims to increase awareness of what the City delivers and contributes to the Hobart community as well as increase the sense of pride and connection for those who live, work, visit and study in Hobart.

We continue to engage regularly with our Elected Members through strategic planning days which focus on Annual Plan, Budget,

Long Term Financial Management Plan, the development of a four-year delivery plan, professional development, and future priorities. In April, the Elected Members and ELT participated in a capital projects site tour which included the redevelopment of the Queenborough Oval change rooms, Doone Kennedy Hobart Aquatic Centre, Queens Walk and the Glebe.

In closing, I wish to extend my thanks to the Lord Mayor and Elected Members, my Executive Leadership Team colleagues and all employees for their excellent efforts, commitment and dedication in making a valuable contribution to the City of Hobart.

Michael Stretton Chief Executive Officer

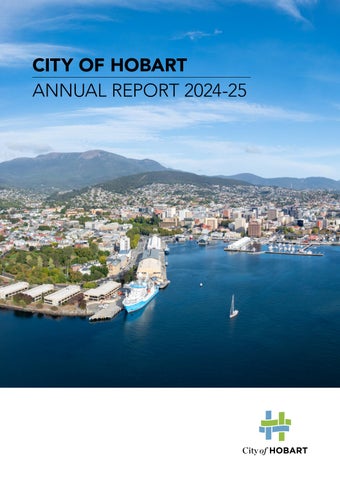

We are an island capital on the fringe of the Southern Hemisphere, a city defined by wild weather and its place as a gateway to Antarctica.

Hobart: A community vision for our island capital, identity statement 1

The 1850s saw the establishment of municipal administration in Tasmania in the form of general purpose locally elected institutions.

Municipal government was established by t he Hobart Town and Launceston Municipal Council Act 1852 and in 1852, the first elections for a seven-member Council were held. The new Council took office from the beginning of 1853, with William Carter as Mayor. In 1857 the Municipal Council was incorporated (Hobart Town Corporation Act 1857), and its constitution and powers redefined

Between 1853 and 1934 the Council was led by various mayors, elected annually. The title was raised to ‘Lord Mayor’ by Letters Patent issued by King George V in January 1934.

The Town Hall was opened in 1866 and in 2016 celebrated its 150th anniversary

Further details of the history of Hobart City Council, including its past elected members, can be sourced from the City of Hobart’s historical reference: Growing with Strength—a History of the Hobart City Council 1846–2000.

The Council is the ultimate policy making body of the organisation. It sets the strategic direction, monitors the performance of its functions, and is responsible for allocating finances and resources

The Council meets once a month on Mondays, commencing at 4pm in the Council Chamber at the Hobart Town Hall. Council meetings are open to the public who may sit in the public gallery.

The meetings are also streamed live and can be watched live through the City of Hobart’s You Tube channel.

There are 12 Elected Members who represent the residents and businesses of Hobart.

They have specific powers, responsibilities and duties as set out in the Local Government Act 1993.

Local government elections are held every four years with all seats contested. The positions of Lord Mayor and Deputy Lord Mayor are popularly elected.

During the 2024-25 year, a review of the Council’s governance model was undertaken resulting in a change to the meeting program format occurring in September 2024. The City moved away from a portfoliobased model and introduced a new Council Committee and five Special Committees of an advisory nature.

The Council continues to meet once a month and the Planning Authority Committee meets each fortnight.

A new Council Committee called the Hobart Workshop Committee was introduced that meets twice a month and deals with lowerorder policy and strategic matters such as (but not limited to):

• Leases

• Special Committee reports

• Executive reports

• Review of Council policies.

The agenda of the Hobart Workshop Committee also provides an opportunity for a workshop component (non-decision making) that enables Elected Members to consider and provide input on matters before they are presented to a Council meeting for full determination. As these meetings are open for public attendance, this new format for workshops introduced more transparency in the Council’s decision-making process.

Meetings of the Hobart Workshop Committee vary between the Town Hall and at off-site locations in the community.

The Council also has Special Committees to support the implementation of the Hobart Community Vision and the Capital City Strategic Plan 2023. The Special Committees are advisory bodies consisting of Elected Members and independent community members that have been appointed by the Council. The Committees are:

• City Economy Committee

• City Heritage Committee

• City Transport Committee

• Place and Wellbeing Committee

• Climate, Sustainability and Biodiversity Committee

Each Special Committee is chaired by an Elected Member or a member appointed by the Council. Minutes of the Special

Committees are provided to the Hobart Workshop Committee for receiving and noting.

Elected Members also participate and represent the City on external bodies to provide input on various issues that have an impact on the local government sector, our community and economy. Membership is listed against each Elected Member on pages 22 to 26.

The Risk and Audit Panel (the Panel) was established by the Council in 2015 in accordance with the Local Government Act 1993 and Local Government (Audit Panels) Order 2014. The Panel consists of an independent chairperson, two elected representatives and two independent members, who collectively have a broad range of skills and experience relevant to the operations of the Council.

The membership of the panel for 2024-25 included Mr Frank Barta as the independent Chairperson, and Mr Wayne Davy and Mr Paul McTaggart as the independent panel members, and Councillor Louise Elliot and Alderman Louise Bloomfield as the Council’s nominees.

The Panel’s objective is to provide assurance and advice to the Council about the assessment, management and review of risk across all City activities and services.

Lord Mayor

Councillor Anna Reynolds

BA, MM

Committee Membership

• Council (Chairperson)

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authorit y Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

• Heritage Account Special Committee

• City Heritage Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• Climate Futures Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• City Heritage Special Committee from 16 September 2024

• Climate, Sustainability and Biodiversity Special Committee (Co-Chairperson) from 16 September 2024

Representation on other committees, advisory groups and external bodies

• Council of Capital City Lord Mayors

• Global Covenant of Mayors for Climate and Energy

• Greater Hobart Homelessness Alliance

• Greater Hobart Strategic Alliance

• Hobart Emergency Management Committee (Chairperson) (ex-officio Lord Mayor)

• ICLEI – Local Governments for Sustainabilit y

• Local Government Association of Tasmania General Management Committee

• Mayors for Peace (ex-officio Lord Mayor)

• Premiers Local Government Council

• Sister Cities Australia (ex-officio Lord Mayor)

• Wellington Park Management Trust (Deputy Member)

Deputy Lord Mayor

Council lor

Dr Zelinda Sherlock

BA-LLB, MA-TESOL, PhD

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• Welcoming and Inclusive City Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

Representation on other committees, advisory groups and external bodies

• Local Government Association of Tasmania General Management Committee Proxy Voting delegate

Alder man

Marti Zucco

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Nominee member) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

Council lor

Bill Harvey

BA, GDipEd, GDipEnvMgt, GAICD

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

• Sustainability in Infrastructure Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• Climate, Sustainability and Biodiversity Special Committee (Co-Chairperson) from 16 September 2024

Representation on other committees, advisory groups and external bodies

• Southern Tasmanian Regional Waste Authority Local Government Forum

• Cycling South

Council lor

Mike Dutta

Committee Membership

• Council

• Planning Committee (Chairperson) from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Chairperson) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

• Housing and Homelessness Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

Representation on other committees, advisory groups and external bodies

• Housing with Dignity Reference Group

Council lor

John Kelly

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Nominee member) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

• Creative City Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

Representation on other committees, advisory groups and external bodies

• Wellington Park Management Trust

• Maritime Museum of Tasmania Management Committee

• Tasmanian Water and Sewerage Corporation –Owners Representative (proxy)

Council lor

Louise Elliot

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Nominee member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• Risk and Audit Panel

Alder man

Louise Bloomfield

B.Com FNTAA FIPA

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Nominee member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• Risk and Audit Panel

• Heritage Account Special Committee

• City Economy Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• City Economy Special Committee (Chairperson) from 16 September 2024

Representation on other committees, advisory groups and external bodies

• Hobart City Council Access Advisory Committee (Chairperson)

• Southern Tasmanian Councils Authority (Chairperson) from 15 July 2024

• Safer Hobart Alliance (Chairperson) from 31 March 2025

Council lor Ryan Posselt

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• City Mobility Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• City Transport Special Committee (Chairperson) from 16 September 2024

Representation on other committees, advisory groups and external bodies

• Wellington Park Management Trust (Deputy Member)

• Hobart City Council Access Advisory Committee (Deputy Chairperson)

• Cycling South

Council lor

Ben Lohberger

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• City Water Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• Climate, Sustainability and Biodiversity Special Committee (Co-Chairperson) from 16 September 2024

Representation on other committees, advisory groups and external bodies

• Tasmanian Water and Sewerage Corporation Owners’ Representative

• Wellington Park Management Trust

• Housing with Dignity Reference Group Deputy (Co-Chairperson)

Council lor

Will Coats

BGS (Info Systems), Dip Financial Services

Committee Membership

• Council

• Planning Authority Committee (Nominee member) from 16 September 2024

• Hobart Workshop Committee (Nominee member) from 14 October 2024

• Healthy Hobart Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2025

• Place and Wellbeing Special Committee (Co-Chairperson) from 16 September 2024

Council lor

Gemma Kitsos

BMus BOccTHY (Hons)

Committee Membership

• Council

• Planning Committee from 1 July 2024 until 15 September 2024

• Planning Authority Committee (Appointed member) from 16 September 2024

• Hobart Workshop Committee (Appointed member) from 14 October 2024

• Future Hobart Portfolio Committee (Chairperson) from 1 July 2024 until 15 September 2024

• Place and Wellbeing Special Committee (Co-Chairperson) from 16 September 2024

The City’s organisational structure facilitates the delivery of projects, programs and services to the community.

Executive Leadership Team

As at 30 June 2025

Director Strategic and Regulatory Services Network

Karen Abey

Responsible for:

• City Compliance

• City Transport

• Development Appraisal

• Place Design, Sport and Recreation

• Strategic Land Use Planning

Head of Executive Services Network

Laura Eaton

Responsible for:

• Communications, Engagement and Marketing

• Climate Change

• International Relations

• Office of the CEO

• Office of the Lord Mayor

• Strategic Projects

Direc tor Infrastructure and Assets Network

David Reeve

Responsible for:

• City Assets

• City Infrastructure

• City Projects

• City Resilience

• Open Space

• Stormwater and Waterways

Director Corporate Services Network

Michael Reynolds

Responsible for:

• Workplace Relations

• Information and Technology Services

• Legal and Governance

• People and Culture

• Rates, Procurement and Risk

Direc tor Community and Economic Development Network

Ben Artup

Responsible for:

• City Welcome

• Community Programs

• Creative City

• Doone Kennedy Hobart Aquatic Centre

• Economic Development

• Environmental Health

Chief Financial Officer

Michelle Wickham

Responsible for:

• Budget and Finance

• Long Term Financial Management Plan

• Corporate Strategy, Finance and Performance

The City of Hobart aims to provide a workplace and work-life balance that suits individual needs, and offer a range of benefits to all employees. The City is committed to gender equality and is an equal opportunity employer.

Workforce profile at June 2025

72 Total em 6 ployees (headcount, includes casuals)

Number of employees by age and gender (headcount)

52 Perman 8 ent full-time equivalent (FTE) employees

4 Numb 60 er of

16 Number 6 of casual employees

The definition of volunteering is time willingly given for the common good and without financial gain. Being a volunteer can make a difference to the lives of others and be deeply satisfying for the people who volunteer with many health and wellbeing benefits and opportunities to learn and connect.

At the City of Hobart our volunteers are crucial to help deliver critical services for our community. We have over 1,000 active registered volunteers across six volunteer programs, offering their time and skills to make Hobart a better place for everyone.

Our volunteers support our ageing population in their gardens, serve them lunch at Mathers House, create safe spaces for youth to be creative, care for our bushland, welcome cruise ship arrivals, meet-and-greet visitors at the airport, and ensure the flow of Salamanca Market ever y Saturday morning.

The following programs regularly engage volunteers for various activities and events.

Youth Arts and Recreation Centre and Youth Advisory Squad

The dedicated volunteers at the Youth Arts and Recreation Centre (YARC) continue to be the backbone of its creative programs, workshops, events, and daily operations. YARC provides young people with a creative space to explore their talents, build essential skills, find social support, and engage meaningfully with the community.

The volunteers have been instrumental in bringing to life events like the Youth Week celebration ‘YARC Fest,’ Tas Pride events, and the monthly YARC Live performances.

YARC is home to the Youth Advisory Squad (YAS), a vital platform for young people aged 12 to 25 to connect and contribute to making our city more youth friendly. YAS members develop leadership, communication, and teamwork skills while gaining hands-on experience in creating and managing youth-centered community projects and events. Meeting eight to ten times a year, YAS members collaborate on upcoming initiatives and discuss ways to address the issues affecting Hobart’s young people.

The vibrant community of over 35 volunteers, ranging in age from 20 to 90, play a vital role in bringing the City of Hobart’s Positive Ageing program to life at Mathers House and Criterion House. These dedicated volunteers support our residents aged 50 and over by preparing and serving around 150 meals weekly and leading

activities that create strong social bonds and reduce isolation helping them live more enriched lives. From T’ai Chi and the Hobart Ukulele Group to quilting bees and digital literacy classes our volunteers are the heart of our programs, keeping our ageing community connected, active, and engaged.

The City of Hobart launched the International Student Ambassador Program in 2015, in collaboration with University of Tasmania, welcoming ambassadors from around the world. This program connects international students with the local community, fostering inclusion while helping them develop leadership, communication and presentation skills.

The program runs on a yearly basis and the students participate in various City of Hobart events, including Citizenship Ceremonies, and gain valuable insights from key community stakeholders. They also contribute to the Networking for

Harmony Advisory Group and spearhead projects supporting the Hobart Respects

All campaign, making a meaningful impact on the community.

The City of Hobart supports 14 active Bushcare and Landcare groups dedicated to enhancing wildlife habitat, protecting threatened vegetation communities and maintaining the health and resilience of Hobart’s bushland reserves.

With a legacy spanning over 30 years, the Bushcare Volunteer Program has built a strong community of thousands of volunteers. Each year, more than 700 active volunteers contribute over 3,000 hours to environmental restoration efforts.

These contributions are further strengthened by the leadership of dedicated volunteer coordinators, who play a vital role in guiding their groups, conducting site inspections, and collaborating with Bushcare staff on annual planning.

The core working bee program runs on Sundays from February to November. The program also engages the broader community through special events such as Clean Up Australia Day, National Tree Day, the South Hobart Resilience Fair, the Kunanyi Mountain Run, and various school and community group activities.

To honour the incredible efforts of our volunteers, we host an annual end-ofyear celebration featuring a community BBQ and the presentation of the Golden Secateurs Award. The program also shares

inspiring stories and updates through the City’s Hobart News and Bandicoot Times digital newsletters, as well as via Bushcare’s Facebook page.

The Trackcare Volunteering Program brings together mountain bikers, bushwalkers, trail runners, and rock climbers, connecting their passion for adventure with the care and maintenance of Hobart’s tracks and trails. Through regular “dig days,” volunteers lear n essential trackwork techniques, engage with fellow outdoor enthusiasts, and contribute to shaping the city’s beloved bushland trails. This program not only ensures the upkeep of these natural assets but also fosters a vibrant community dedicated to preserving the trails that make Hobart special.

The Still Gardening Program, funded annually as part of the Commonwealth Home Support Program, has been empowering seniors to stay active and connected through the joy of gardening since 2008. This initiative brings together a team of dedicated volunteers (Garden Mates) who work one-on-one with older community members in their gardens, helping them continue doing what they love—getting their hands dirty and enjoying the outdoors.

Still Gardening enhances the well-being of older Tasmanians by fostering social connections and providing valuable training and education for Garden Mate volunteers. This upskilling ensures that the program consistently improves the quality of aged care service standards and delivery, making a lasting impact on the lives of those it serves.

For over 25 years, the City Welcome Volunteers have been providing a warm and friendly welcome to travellers, visitors and locals at the Travel Centre, Salamanca Market, Hobart Airport, MAC02 Cruise Ship Terminal and at City of Hobart Community Events. Our City Welcome volunteers love to help other people and contribute over 3,500 hours support each year.

The City Welcome Program enhances the visitor experience in Hobart and beyond, with volunteers providing essential wayfinding assistance and travel recommendations.

Through various networks, advisory committees and reference groups, our volunteers play a pivotal role in shaping and implementing action plans that align with our commitments and goals. Through advocating for accessibility and inclusion, promoting multiculturism and action on homelessness, their contributions have been instrumental in driving forward our mission and creating a positive impact across all sectors.

Providing a platform for community organisations and stakeholders to discuss multicultural issues and contribute to the City’s projects and initiatives in the Multicultural Action, the Networking for Harmony members volunteer their time to monitor the implementation of the City’s “Hobart: A City for All Action Plan,” with a focus on Multicultural Programs. Working subgroups facilitate multicultural events such as Harmony Week, the Together Festival, and World Refugee Week.

Lesbian, Gay, Bisexual, Transgender, Queer, Intersex, Asexual, + Reference Group

Established in 2024, the Lesbian, Gay, Bisexual, Transgender, Queer, Intersex, Asexual, + (LGBTQIA+) Reference Group was created to offer guidance on implementing the City’s Community Commitment and identify potential future actions relevant to the LGBTQIA+ community. The group facilitates community engagement while providing insights and identifying opportunities related to issues such as discrimination and stigma, resilience and pride, and empowerment and voice.

Since 2019, the Housing with Dignity Reference Group (HWDRG) has helped provide a voice to individuals with lived experience of homelessness. The HWDRG assists the City in reviewing the Housing and Homelessness Commitment and serves as a critical reference point for consultation on decisions related to homelessness, including identifying priorities for advocating and lobbying the State and Federal Governments on behalf of homeless individuals.

The HWDRG have achieved several key outcomes such as the annual Street to Stage event, the I am Somebody campaign, promoting the Health with Dignity campaign, and the creation and distribution of the Hobart Help cards.

The Access Advisory Committee (AAC) are a group of people volunteering their time to improve accessibility in public spaces and events around Hobart. They advocate for the rights of people with disabilities, provide advice from lived experiences, and raise awareness through initiatives such as International Day of People with Disability.

By promoting best practices and engaging with the community, the AAC supports the development of inclusive policies and increased participation opportunities, ensuring better access to events, information and recreational programs.

Since 2008, the Hobart Older Persons Reference Group (HOPRG) has championed the interests of older people facilitating the delivery of the Hobart Positive Ageing Commitment, creating opportunities for community consultation, and leading initiatives that promote the positive contributions of an ageing population. HOPRG members volunteer their time to ensure that the voice of older people is heard, and that older people can be included and engaged in their communities.

The City of Hobart Integrated Planning and Reporting Framework aligns planning and reporting with performance evaluation and continuous improvement.

The Integrated Planning and Reporting Framework ensures that the Capital City Strategic Plan and Long-Term Financial Management Plan are put into action through the City’s Annual Plan and Annual Budget Program.

The City’s Community Vision outlines what people value about Hobart and what they aspire to for its future. The vision guides the City of Hobart’s work and calls on us to demonstrate long-term commitment to help create the Hobart our communities want.

The vision and its identity statements and pillars detail the values and special qualities that the community want to see reinforced, developed or improved and highlights the aspirations for the future of Hobart.

The vision is used to guide and direct the City’s strategies, plans and priorities. All strategic actions and programs are designed to deliver on the vision.

The City’s Integrated Planning and Reporting Framework incorporates the requirements of the Local Government Act 1993 and the principles in the Australian Business Excellence Framework as illustrated in the diagram below.

This section highlights strategic priorities, programs and projects delivered, community engagement, capital works projects, and progress on key actions and initiatives in the Annual Plan.

The strategies and outcomes in the Capital City Strategic Plan are implemented through a series of supporting strategic documents and action plans. The information in this section notes some of what has been delivered during the year.

2040 Climate Ready Hobart Strategy is a plan for what the City of Hobart and the community can do together to respond to the climate and biodiversity emergency as we move towards 2040.

It sets a clear direction for the City to lead by example across its core business and services and work with the community towards a zero emissions target and climate resilience.

Since endorsement of Climate Ready Hobart, the following has been achieved:

• Finalisation of the Hobart Climate Risk Assessment.

• The Hobart Climate Assembly was awarded the 2024 Tasmanian PIA Award for Planning Excellence.

• In partnership with Bloomberg Philanthropies over $200 000 was awarded through the Youth Climate Action Fund to help deliver youth led climate projects.

• Progressing the South Hobart Community Battery, funded by the Australian Government and TasNetworks.

• Funding secured through the Tasmanian Government Community Climate Change Action Grant led to the launch of the e-bike library.

• Progress has been made in reducing organisational emissions largely due to improved methane gas capture at McRobies Waste Facility. Overall emissions were calculated as 35,482 tonnes of carbon dioxide equivalent which is 19.8 per cent lower than last year.

The Hobart Transport Strategy supports an integrated, climate ready, efficient transpor t and land use strategy for Hobart, and aims to provide transport options that support and encourage behaviour change leading to a reduction in transport emissions.

To deliver these actions we will ensure our streets are accessible, healthy and safe for all people, and respond to emerging trends, technology and change.

Since endorsement of the Hobart Transport Strategy a number of actions have been progressed, these include:

• An audit of streets and pedestrian crossings in Central Hobart.

• A Parking and Kerbside Management Plan has been developed.

• Continued delivery of Local Area Mobility Plans to manage local trips safely and efficiently

• Support for children’s active travel to school through development of School Access Travel Plans.

• Development of an EV Charging Infrastructure Policy.

• Working with the Tasmanian Government on active transport connectivity to new ferry terminals.

The City Economy Strategy 2023-28 aims to grow the capacity and capability of Hobart’s competitive advantages while leveraging emerging and planned growth and development opportunities, positioning Hobart as a place that attracts responsible investment – a place people want to visit, live and do business.

Actions to support the Hobart economy include:

• The Business Grants Program that provided financial support for 27 local businesses

• Development of the Retail Safety and Crime Forum with Tasmania Police.

• Attendance at the 2025 Darwin Infusion to celebrate and promote the value of Sister Cities and international partnerships in strengthening economic, cultural and people-to-people links between Hobart, Darwin and international partners.

• Support for major events in Hobart through formal sponsorship and in-kind support eg, Dark Mofo, the Taste of Summer.

• Free parking at the Regatta Grounds and Cenotaph car park during the festive shopping period and for major events.

The Hobart Waste Management Strategy was endorsed by Council in June 2025 and replaced the 2015 strategies of which mos t actions were completed.

As a vital service and a significant contributor to CO2 emissions, the Hobart Waste Management Strategy 2025 underpins the behavioural change needed to meet our waste reduction objective of zero waste to landfill by 2030.

In 2024-25 we have:

• Reduced methane emissions from landfill due to increased efficiency in the landfill gas capture system.

• Supported the rollout of the Recycle Rewards program with reverse vending machines located at the South Hobart Tip Shop and Queens Walk Oval in New Town.

• $50 rebates (or 50 per cent of purchase price) for cloth nappies and reusable sanitary products.

• Provided drop off points for soft plastics at the McRobies Gully Waste Management Centre and the South Hobart Tip Shop.

Neighourhood Plans provide a guide for how a local area could develop over the next 20 years, and consider future population changes and community needs.

The Central Hobart Plan was endorsed by Council in 2023 and has seen the completion of a built form analysis for the area and the progression of Planning Scheme Amendments to enable implementation.

The North Hobart Neighbourhood Plan was endorsed by Council in May 2025. Work has started on identified Planning Scheme Amendments.

• Mowed 144 hectares of grass

• Planted 1,180 trees

• Gave away 900 trees and 4,100 plants to residents

• Maintained 170 hectares of fuel breaks over 200 sites

• Did hazard reduction burn off across 16 hectares

• Installed new equipment acros s 54 playgrounds

• Approved 347 residential planning permits

• Approved 181 commercial planning permits

• Value of approved planning permit s $485 million

• Issued 437 building approvals at a value of $108 million

• Issued 318 plumbing permits at a value of $131 million

• Social media reach 8.5 million

• 150,000 social media followers

• 977,000 visits to our website

• 2.6 million website page views

• Cleaned 16,500 toilets and 8,760 change rooms

• Removed 14,40 0 graf fiti tags

•

• Cleaned 16,500 BBQs Responded to 847 after hour phone calls

• 271 after hour call outs to assist residents

• Registered 4,724 dogs

• Invested $22.1 million on capital works

• Repaired 296 road defects and 269 footpaths

• Renewed 15,500 metres of road and 1,300 metres of footpaths

• Maintained 5,900 metres of gravel roads

• Replaced 108 street signs

• Installed 23 new stormwater connections

• Emptied over 1.5 million residential bins

• Collected 21,547 tonnes of waste

• Recycled 10,402 tonnes of waste

• Composted 9,139 tonnes of waste

• Supported or delivered 124 events

• Welcomed 352 new Australian Citizens

• Supported over 1,000 volunteers

• Served over 7,800 meals at Mathers House

• Provided services to 1,069,000 visitor s

• 447,600 people went to Salamanca Market

• 141,066 people visited the Tasmanian Tourism Information Centre

• Over 600,000 people attended Doone Kennedy Hobart Aquatic Centre

• 3,888 members at Doone Kennedy Hobart Aquatic Centre

Below is a selection of programs and projects that have been delivered during 2024-25

• A two-year trial to reimagine Collins Street as a vibrant, welcoming, and people-friendly place was launched. The project includes a new streetside dining deck, a zebra crossing, and separated bike lanes to connect the CBD to the Hobart Rivulet path.

• 4,000 plants were distributed to residents to support nature strip gardening across Hobart.

• In April, the City held an open day to highlight potential concepts for the future of the Halls Saddle site. Over 60 people came along to talk to City staff about the future of Halls Saddle and Kunanyi/Mount Wellington.

• Tasmania Police and the City of Hobart held the Retail Safety and Retail Crime Forum which brought together community leaders, police, retailers, and politicians to discuss safety in shopping precincts and stores.

• A Housing Forum was held to discuss how housing affordability and supply challenges can be addressed. The Forum brought together 80 experts from the housing sector, including government representatives, community organisations and developers.

• Hello Hobart held a Christmas window display competition with 40 entries. Local businesses showed off their creativity and spread the Christmas spirit in our shopping precincts.

• The New Town Rivulet estuary restoration project is underway, a $2 million joint venture between the City of Hobart and Glenorchy City Council to transform the degraded mouth of the New Town Rivulet into a natural estuarine environment.

The project involves major earthworks, landscaping, and planting of nearly 45,000 native trees, shrubs, water plants, and grasses.

• A project to eradicate crack willows, a highly invasive environmental weed, from Hobart’s rivulets is underway. The project is funded by the Australian Government Disaster Ready Fund and the City of Hobart, and will be delivered over three years.

During 2024-25, the successful completion of several high-profile capital projects, including:

• Collins Street Streetscape Improvement and Cycleway

• Pipeline Track Extension – City to Mountain

• Saunders Crescent Playground

• Good Water Project

• Soldiers Memorial Oval Drainage

• Parliament Street Slide Replacement

• Hobart Rivulet Gore Street Debris Irons Renewal

• Domain Slipway Stormwater Extension

• Marlyn Road Fire Trail

• 747–753 Sandy Bay Road Stormwater Connection

• Matilda Pontoon Floats Replacement

• South Hobart Oval Courts Upgrade

• Knocklofty to McRobies Gully Connector tracks – City to Mountain

Significant construction was progressed on the following key projects:

• New Town Netball Court Upgrade

• Queenborough Oval Changeroom Upgrade

• New Town Rivulet Outfall Remediation

• McRobies Gully Gross Pollutant Trap Installation

Four kilometres of new shared use and mountain bike track to link the eastern edge of Wellington Park to Knocklofty Reserve and West Hobart was completed. The new tracks improve recreational access for the community and means the public no longer need to use fire trails located on private land to walk or ride between the two places. These new tracks connect the city to the mountain and were identified as gaps in the network.

Hobart Rivulet Gore Street Debris Irons Renewal

Work to replace the debris irons in the Hobart Rivulet was successfully completed.

The original irons were installed decades ago to prevent large debris such as rocks and logs travelling under the CBD from the rivulet after periods of high rainfall which can cause damage and blockages in drainage and lead to flooding.

The structure was badly rusted in several areas and needed remedial attention. The work was undertaken in such a way as to not impact the health of the waterway and was finished with minimal impact on the surrounding environment

The City of Hobart believes the best, most sustainable decisions are made when the community is involved in the decisionmaking process. Best-practice community engagement helps achieve that.

Hobart has a diverse community. This includes people who live, study, work, and visit the city. We strive for access and inclusion to be at the forefront of how we approach engagement.

There are a range of ways we engage with our community. Some of these methods are determined by legislation, such as planning schemes and the Local Government Act 1993. But generally, engagement methods are selected based on what will best allow the community to have their say. These may include surveys, workshops, pop-up stalls or other public events.

With an ambitious goal to increase the City’s urban tree canopy to 40 per cent by 2046 we engaged with diverse community members of all ages. People came together to celebrate and reflect on their love of trees and provide their thoughts on how we can prioritise tree planting and care over the next decade.

The direction and actions in the draft Hobart Urban Tree Strategy have been guided by what we heard during the engagement period.

In 2024-25, the City engaged with the community on key projects, including:

• Draft Urban Tree Strategy

• North Hobart Neighbourhood Plan

• Dog Management Policy

• West Hobart Local Area Mobility Plan

• Southern Tasmania Regional Land Use Strategy

• Doone Kennedy Hobart Aquatic Centre Upgrades

• Hobart Transport Strategy 2024 –Transforming Collins Street

• Sandy Bay Ferry Terminal

• Hobart Housing Strategy

• Waste Management Strategy 2025-30

• Hobart Design Guidelines

• Community Budget 2024-25

People who participated received a tree to plant in their own garden so they could contribute to meeting the goal.

509 people responded to the Your Say survey, eleven pop-ups were held at various locations, and consultation with internal and external committees and organisations occurred.

This is an ongoing project that is designed to reimagine and develop a long-term vision for Collins Street that looks to enhance the connection between the CBD and Hobart Rivulet Track. The vision will be informed by temporary changes to the stretch of road on Collins Street between Molle and Murray Streets.

The changes include streetside dining, separated cycling lanes, additional accessible parking spaces, street plantings, lower speed limits and a new zebra crossing.

Community engagement in this two-year tactical trial is being implemented in five stages, with ongoing monitoring and reporting including community sentiment, usage data, and other key metrics being tracked throughout this period. To date there have been over 400 Your Say surveys completed, 66 face-to-face interviews, 4 drop-in sessions and over 10 0 conversations with businesses and residents about the project

The next stage of engagement is scheduled for late 2025.

The Sandy Bay Ferry Terminal community engagement project aimed to gather feedback on the location and design of a proposed terminal. The engagement was delivered over a three-week period, during March 2025, to hear from community members and stakeholders to help inform planning for the project.

We heard from 467 people via online and in-person surveys, written submissions, one-on-one conversations, pop-up events and focus groups.

In parallel, engagement was held with the Tasmania Aboriginal Community through Palawa consultants.

2 Vis 6 its t ,9 o the 00+ Your Say Hobart website

2 Con , tr 23 ibution 5 s were made via online tools

1 New ,1 reg 0 ist 0 rations to Your Say Hobart

The projects that attracted the most engagement were:

• North Hobart Neighbourhood Plan

• Sandy Bay Ferry Terminal

• Transforming Collins Street

• Hobart Design Guidelines

• Crowther Reinterpretation

9 Infor ,1 me 0 d p 0 arti + cipants (people who visited project pages on Your Say Hobart and/ or downloaded information)

The Annual Plan is based on the eight pillars in the Vision and the Capital City Strategic Plan 2023.

The Annual Plan sets out the major actions and initiatives for the year ahead and covers a wide range of operational responsibilities, programs and projects that are aligned with the community vision, the Capital City Strategic Plan, the Capital Works Program and other strategies.

Progress on the major actions and initiatives in the Annual Plan are reported quarterly to the Council.

A summary of progress at the end of 2024-25 is provided in the following pages:

28

Total number of actions and initiatives in the Annual Plan

8 of a 6% ll actions and initiatives completed or on track

7% on hold or carried forward to 2025-26 7% in progress but delayed

We are a city of unique beauty, environment, heritage and people, built on a shared sense of ownership, pride and wonder. This spirit of place has been shaped by Tasmanian Aboriginal people for tens of thousands of years and continues to be shaped by all who have called Hobart home. It is developed jointly by community, private enterprise and government, valuing and enhancing our Hobart identity.

1.1 Hobart keeps a strong sense of place and identity, even as the city changes.

1.2 Hobart’s cityscape reflects the heritage, culture and natural environment that make it special.

Actions and initiatives

Finalise the draft Elizabeth Street Vision Plan and action plan to guide the evolution of Elizabeth Street from the Waterfront to Burnett Street over the coming 15 years.

Finalise Urban Design Guidelines that will provide an innovative placed-based guide outlining urban design principles and strategies which will apply equally to the public realm and private development in the municipality.

Performance

Completed/on-track In progress – delayed On hold/carry forward

Performance

We are an island capital city that is socially inclusive and coherently connected, whose people are informed, safe, happy, healthy and resilient.

2.1 Hobart is a place that recognises and celebrates Tasmanian Aboriginal people, history and culture, working together towards shared goals.

2.2 Hobart is a place where diversity is celebrated and everyone can belong, and where people have opportunities to learn about one another and participate in city life.

2.3 Hobart communities are active, have good health and wellbeing and are engaged in lifelong learning.

2.4 Hobart communities are safe and resilient, ensuring people can support one another and flourish in times of hardship.

Actions and initiatives

Develop and implement the updated Aboriginal Commitment and Action Plan.

Implement the findings of the outgoing grants and sponsorship review.

Develop a Masterplan for the Tasmanian Hockey Centre which balances the future sporting needs of the site together with potential affordable housing options.

Initiate, in collaboration with other regional Councils, the development of a Regional Sports Facility Plan that reflects the needs of the Greater Hobart community over the next 20 years.

Update the Public Health Emergency Management Plan.

Performance

Completed/on-track In progress – delayed On hold/carry forward

Performance

Community panel’s vision statement

We are a city connected, embracing our diverse communities in cultural expression and creative and artistic participation; a city that enhances our homes, lifestyles and heritage; a city that bravely puts its people first.

3.1 Hobart is a creative and cultural capital where creativity is a way of life.

3.2 Creativity serves as a platform for raising awareness and promoting understanding of diverse cultures and issues understanding of diverse cultures and issues.

3.3 Everyone in Hobart can participate in a diverse and thriving creative community, as professionals and hobbyists.

3.4 Civic and heritage spaces support creativity, resulting in a vibrant public realm.

Actions and initiatives Performance

Develop a Creative City Strategy that provides an integrated approach to creative activities including arts and culture, events, and usage of facilities and spaces

Performance

Completed/on-track In progress – delayed On hold/carry forward

We are a city whose economies connect people, businesses, education and government to create a high-quality lifestyle in a thriving and diverse community. Our city is our workshop. We collaborate, embracing ideas, inventiveness and initiative.

4.1 Hobart’s economy reflects its unique environment, culture and identity

4.2 Diverse connections give people opportunities to participate in the economic life of the city and help the economy, businesses and workers thrive.

4.3 Hobart is a place where entrepreneurs and businesses can grow and flourish

4.4 Hobart’s economy is strong, diverse and resilient.

Actions and initiatives

Undertake promotional campaigns and activations to drive visitation and spend with local businesses.

Performance

Completed/on-track In progress – delayed On hold/carry forward

Performance

We are a city where everyone has effective, safe, healthy and environmentally-friendly ways to move and connect, with people, information and goods, and to and through spaces and the natural environment. We are able to maintain a pace of life that allows us to fulfil our needs, such as work, study, business, socialising, recreation, accessing services, shopping, entertainment and spending time with loved ones.

5.1 An accessible and connected city environment helps maintain Hobart’s pace of life.

5.2 Hobart has effective and environmentally sustainable transport systems.

5.3 Technology serves Hobart communities and visitors and enhances quality of life.

5.4 Data informs decision-making.

Actions and initiatives

Endorsement and delivery of actions from the Transport Strategy and the Parking and Kerbside Management Plan.

Engage with the community to develop Local Area Mobility Plans for West Hobart and Mount Nelson.

Work with neighbouring Councils and the Tasmanian Government to develop the infrastructure that is needed to support the expansion of the ferry service.

Completed/on-track

Performance

We are a city whose people see ourselves as part of a beautiful and unique natural environment, from the mountain to the river, which embrace us and shape our identity. We are proud custodians and advocates, ensuring resources are appreciated rather than wasted, supporting biodiverse ecosystems in honour of past, current and future generations.

6.1 The natural environment is part of the city and biodiversity is preserved, secure and flourishing

6.2 Education, participation, leadership and partnerships all contribute to Hobart’s strong environmental performance and healthy ecosystems.

6.3 Hobart is a city with renewable and ecologically sustainable energy, waste and water systems.

6.4 Hobart is responsive and resilient to climate change and natural disasters.

6.5 Hobart’s bushland, parks and reserves are places for sport, recreation and play.

Actions and initiatives

Finalise the Open Space Strategy.

Work with all relevant stakeholders including the Wellington Park Management Trust and State Government to review the governance and masterplanning for Kunanyi/Mount Wellington and develop an agreed future direction and sustainable funding model.

Develop a plan for the closure, rehabilitation and repurposing of the McRobies Waste Management Centre and the ongoing implementation of the zero waste to landfill goal.

Endorsement and delivery of actions from the Climate Action Plan.

Finalise review of Dog Management Strategy.

Performance

Completed/on-track In progress – delayed On hold/carry forward

Performance

We are a city that maintains our unique built and ecological character, where we all have a safe, secure and healthy place to live. We are a city where people and communities can access world-class services and infrastructure and provide for their social, cultural and economic wellbeing. We embrace change but not at the expense of our Hobart identity and character.

7.1 Hobart has a diverse supply of housing and affordable homes.

7.2 Development enhances Hobart’s unique identity, human scale and built heritage.

7.3 Infrastructure and services are planned, managed and maintained to provide for community wellbeing.

7.4 Community involvement and an understanding of future needs help guide changes to Hobart’s built environment.

Actions and initiatives

Implement homelessness actions under the Hobart: City for All Action Plan and progress housing initiatives outlined within the Central Hobart Plan including working with key stakeholders to prepare a development ready Masterplan for the Innovation Precinct.

Finalise the North Hobart Neighbourhood Plan.

Continue to develop the Mount Nelson and Sandy Bay Neighbourhood Plan.

Continue development of the Inner Northeast Neighbourhood Plan and contribute to the applicable planning processes concerning the development of the proposed stadium and surrounds at Macquarie Point Precinct.

Performance

Completed/on-track In progress – delayed On hold/carry forward

Performance

We are a city of ethics and integrity. We govern with transparency and accountability, encouraging and welcoming active civic involvement. We collaborate for the collective good, working together to create a successful Hobart.

8.1 Hobart is a city that is well governed that recognises the community as an active partner that informs decisions.

8.2 Hobart is a city that delivers public value and excellence by being a financially responsible, high performing and accountable organisation that it responsive to the needs of the community.

Actions and initiatives

Further to the local Government reform process, explore opportunities to enhance cooperation and collaboration with the Glenorchy City Council.

Lead regional collaboration through the Greater Hobart Strategic Partnership activities including the Hobart City Deal and Greater Hobart Committee and other bodies.

Identify priority projects and prepare a comprehensive advocacy strategy for the City for the next Federal Election.

Review the long-term Strategic Asset Management Plan and develop and implement Asset Management Policies, Strategies and Plans that fully integrate and are aligned with the City's strategic objectives, finances, and direction.

Consider options for the future of the Hobart Council Centre, Town Hall Annex and Civic Square Site.

Commence a review of our customer service approach to ensure customers are offered a contemporary and satisfactory customer experience.

Enhance Sustainable, Responsible and Social Procurement through the development of the procurement policy framework.

Performance

Performance

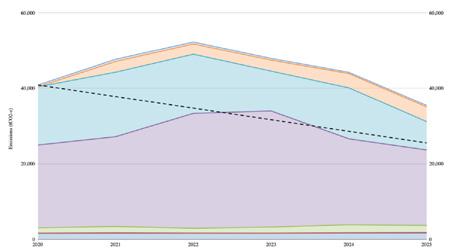

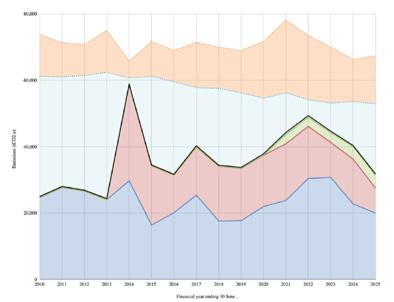

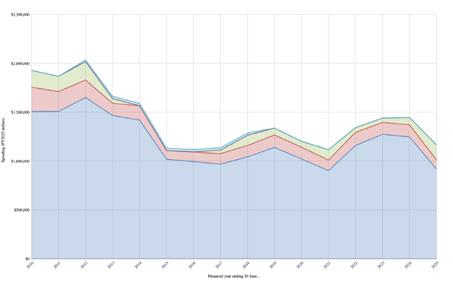

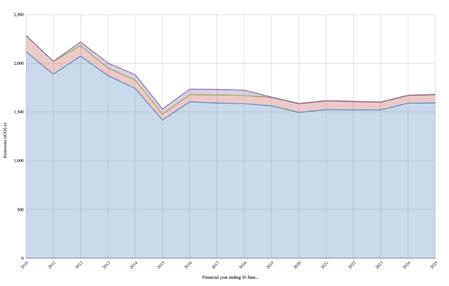

The 2040 Climate Ready Hobart Strategy provides a roadmap for a zero emissions and climate resilient future across our city. This report details the City of Hobart’s organisational greenhouse gas emissions inventory for 2024-25. Overall emissions were calculated to be 35,482 tonnes of carbon dioxide equivalent. This is 19.8 per cent lower than the previous year, and 13.2 per cent lower than 2019-20.

The greatest reductions in emissions were a result of the McRobies landfill gas capture system, with an increase in its efficiency and a reduction in the proportion of Australian Carbon Credit Units (ACCUs) generated. Reductions were achieved in waste, transport and plant, and electricity, while gas emissions increased. Use of diesel reduced significantly, resulting in a saving of $471,872 compared to 2023-24. The total spend on fossil fuels (petrol, diesel and gas) was $975,469.

Zero emissions City of Hobart: Reduce organisational emissions by 75% by 2030 (from 2020); and zero emissions by 2035.

Overall emissions were calculated to be 35,482 tonnes of carbon dioxide equivalent. Emissions were 13.2% lower than 2019-20 and trending downward. Good progress has been made however emissions are above the linear trajectory required to achieve the target.

Zero emissions waste: By 2030, divert 85% of waste from landfill and 95% of residential organics from general waste.

By 2035, aim to capture 100% of landfill gas, or as close as possible from landfill.

89.6% of the City’s emissions are generated from waste, namely methane from organic matter decomposing landfill sites at McRobies, Copping and Interlaken. While the amount of landfill at McRobies slightly increased this year, emissions dropped significantly This was due mainly to the rebounding of the efficiency of the landfill gas capture system. A secondary contributor was that a lower proportion of ACCUs were created from the landfill gas capture system.

Zero emissions targets

Status Why

Phase out fossil fuels by 2035. Spend on petrol, diesel and gas (fossil fuels) has decreased by $280,740 compared with 2023-24. The total spend is $1.2 million and largely due to decreases in costs of fuels in 2024-25.

Zero emissions vehicles: Transition fleet to 100% electric by 2030 for all passenger fleet vehicles. Transition medium and large vehicles to 100% zero emissions by 2035.

In 2025, a fleet transition plan was endorsed to achieve 100% electric by 2030 for the passenger fleet, and implementation of this plan is on track. The fleet will transition from hybrid/hybrid electric to fully electric.

Status: On-track Progress made

All electric City operations: City operations and buildings are electrified and powered by 100% renewable electricity by 2030.

Electricity use has decreased, largely due to a failure of Aquatic Centre heat pumps, and resulted in increased gas usage. While total solar generation remained stable, there were significant increases and reductions on a site-by-site basis.

6 Greenhouse emissions from electricity, emitted and avoided (stacked)

Status: On-track Progress made

Creating a Climate Ready Hobart go to: hobartcity.com.au/Community/Climate-Ready-Hobart.

For information on the Hobart Community Emissions: snapshotclimate.com.au/locality/municipality/australia/tasmania/hobart /.

Local Government Act 1993 Section 21

The City has not resolved to exercise any powers or undertake any activities in accordance with section 21 of the Local Government Act 1993.

Local Government Act 1993 Section 72(1)(BA) and (BB).

Eight Code of Conduct complaints were received against Elected Members of the Hobart City Council during 2024-25. Two of the complaints were upheld in part and one was wholly upheld.

The total cost* met by the City during the 2024-25 financial year in respect to code of conduct complaints was $12,208.

*Note: that some of the costs disclosed relate to complaints made in previous financial years. The costs for some of the complaints disclosed this year will be incurred and reported in future years.

Local Government Act 1993 Section 177

The City has not resolved to donate any lands in accordance with section 177 of the Local Government Act 1993

The City of Hobart’s procedures for dealing with matters under the Public Interest Disclosure Act 2002 can be viewed on the website hobartcity.com.au or by requesting a copy from the Chief Executive Officer, Michael Stretton on (03) 6238 2711 or ceo@hobartcity.com.au

Public Interest Disclosures 2024-25

The number and types of disclosures made to the City of Hobart during the year.

The number of those disclosures determined to be public interest disclosures.

The number of disclosures determined by the City of Hobart to be public interest disclosures that it investigated during the year.