The Superyacht Report

This edition marks the culmination of my time as editor at The Superyacht Group. Over the past five years, I've witnessed first-hand the evolution of an industry in flux. Beneath the surface of record-breaking deliveries lies a landscape shaped by shifting public perception, technological revolutions and changing regulatory forces. These are pivotal times as the superyacht sector defines its future.

Despite all the fascinating events that have unfolded over the past five years, the parting message that I feel is the most prescient is the value of onboard knowledge and the people who hold it. When I sat at sea approaching my 30s, I felt that I had missed my chance to succeed in a ‘normal’ career. In a world where corporate titles dazzle and impenetrable hierarchies loom large, it’s hard to see a way in.

While my friends on land were being promoted to positions with titles like ‘Executive Vice President of Regional Business Development’ or some similar business-speak word salad, they seemed to be both very important and entrenched in impenetrable corporate structures. All the while, I was pushing a chamois and trying to stop the boss’ kids from crashing jet skis into each other.

BY JACK HOGAN

BY JACK HOGAN

I felt siloed in the golden prison, looking out on a bucolic sunset wondering if my chance to succeed in another life was disappearing with it. If you are reading this wondering the same, let me stress that you are far more valuable than you realise. Equally, if you are an employer shoreside, I implore you to look to this under-utilised reservoir of skill and knowledge.

There are thousands of smart and motivated yacht crew out there who are either looking to get out or have already left a life at sea, and the tragic truth is that the vast majority of their knowledge and insights are lost with them.

The sum total of my self-analysed

abilities, I thought, were to – at most –try my hand at being a junior charter broker or yacht manager. The narrowness of my focus, I am sure, was due to these being the shoreside people I had the most exposure to. Trust me when I say that project management in a corporate setting pales in comparison to a well-executed charter guest BBQ on a tidal beach at sunset, and managing the expectations of people with power and influence is a skill you already have in spades.

This is a fantastic and frustrating industry to work in. Operational experience is foundational to almost all aspects of the shoreside sector. Some of the simplest insights I have passed on have had the biggest impact on my team and the direction of our projects. Piecing together how this experience translates into tangible outcomes for a company will require more creative approaches from employers.

The industry will need to bridge the gap between shoreside machinations and on-board reality if it is to continue to thrive. With rotation rates on the rise, there is even more chance for more engagement shoreside. Officers, engineers and interior crew who are looking to transition shoreside have up to six months a year available. So, use them!

Martin Redmayne and The Superyacht Group gave me the chance to discover what I could do, and I am sincerely grateful to the team for taking a risk on a fresh-off-the-boat officer who didn’t know that an ‘account manager’ didn’t, in fact, work in the finance department. This role gave me the chance to bridge the gap for myself and, hopefully, connect and communicate some diverse and intriguing idiosyncrasies that make this industry so endlessly fascinating. In doing so I know that I brought value to the wider industry and, more importantly, to myself. JH

Cracking the code

The REG Large Yacht Code forms the foundation of safe construction in the new-build sector. Here, we take a detailed look at how the 2024 revisions will affect the industry.

80

Gross tonnage (gt) is arguably the most misunderstood but commonly used term in the yachting industry. The definition bears repetition. Gross tonnage is a measurement used in the maritime industry to indicate the overall internal volume of a ship. It’s a standardised measure that includes the entire enclosed space within a vessel, including cargo holds, engine rooms, crew quarters and any other enclosed spaces.

Arksen makes its marque

Baglietto: A benchmark and beyond

Gross tonnage is calculated in accordance with international regulations set by the International Maritime Organ-ization (IMO). The formula for calculating gross tonnage considers the volume of the ship’s enclosed spaces and is used for various purposes, including determining registration fees, port dues

59m and 1,277gt. This will be surpassed in 2024 by a 58-metre RMX Marine project that comes in at a colossal 1,365gt.

It’s important to note that gross tonnage is distinct from a ship’s displacement, which refers to the weight of water displaced by the ship’s hull and is a measure of the ship’s actual physical

While not directly representative of the ship’s mass, it does give a great yardstick as to design trends and the amount of usable space for an owner, and crucially, yachts above a certain gross tonnage threshold may be subject to stricter regulatory requirements for

62 Technical director Jim Mair and build captain Ben Bowley give the rundown on the latest Arksen as the rugged explorer yacht awaits its maiden journey to the Mediterranean.

Evolution of the new-build brokers

The 80-100m scatter plot displays the same trend around the 3,000gt mark, although less pronounced due to the lower number of yachts in this fleet. The grouping of yachts at 2,999gt is obvious, and the variance in gross tonnage is equally large. The outliers of note here are the Corsair Yachts’ modern classic Nero at 90 metres and 1,413gt and the 2019 Silver Yachts’ Bold at 85metres and 1,504gt at the other end of the scale.

Outside these ranges, there are some other noticeable trends in the percentage shifts in gross tonnage since 2000. The

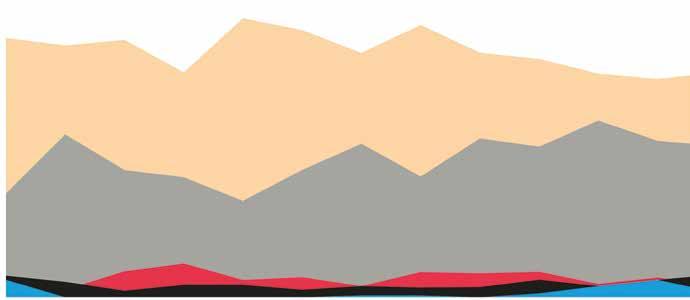

graphic below shows the significant increase in gross tonnage for smaller yachts between 2021-2024 (plus orderbook) in comparison to 2000-2020, most drastically in the 30-35-metre bracket (13.7 per cent) and the 35-40-metre bracket (10.8 per cent), suggesting a trend towards more volume from these smaller yachts. There is a notable decline in gross tonnage for vessels ranging between 50 -55 metres (12.5 per cent), 80-85 (7.9 per cent) and 85-90 metres (14.3 per cent). These declines correspond closely to the scatter plots of gross tonnage vs LOA and the concentration of yachts that are engineered to keep their gross tonnage below the 500gt and 3,000gt regulatory thresholds respectively.

86

Baglietto CEO Diego Michele Deprati on the yard’s latest product lines, its investment in infrastructure and his views on how the market will respond given current world geopolitics.

Percentage shift in vessel GT from 2000-2020 to 2021-2024 plus the order book

To encompass the important 500gt and 3,000gt thresholds, this analysis uses slightly different size brackets, 4560 metres to capture the 500gt mark and 80-100 metres to capture the 3,000gt. There is an inbuilt flexibility in these Gross tonnage calculations, with some designers and shipyards using the full range of the regulations to keep a vessel below a certain regulatory threshold. When the fleet’s gross tonnage is plotted on a scatter plot, it’s fairly obvious where these demarcations occur. This is starkest in the 45-60-metre-plus sector. The logjam of vessels at 499gt is clear to see.

Understandably, there are very few yachts between 500gt and 600gt. A sim-plistic way to view this is that in the design process, if a yacht is going

Today’s brokers have to do much more than just bring cash to the table and then sign off, with clients now considered to be long-term assets rather than merely a one-time source of income.

74

Market insights

We analyse the latest developments, trends and forecasts in deliveries, engine manufacturers and the GT effect, as well as detailing the increasing influence and future growth prospects of SYBAss in the new-build sector.

95

For more than 30 years The Superyacht Report has prided itself on being the superyacht market’s most reliable source of data, information, analysis and expert commentary. Our team of analysts, journalists and external contributors remains unrivalled and we firmly believe that we are the only legitimate source of objective and honest reportage. As the industry continues to grow and evolve, we are forthright in our determination to continue being the market’s most profound business-critical source of information.

INTELLIGENCE

Head of Intelligence

Charlotte Gipson charlotteg@thesuperyachtgroup.com

Research Analyst

Isla Painter isla@thesuperyachtgroup.com

Senior Research Analyst

Amanda Rogers amanda@thesuperyachtgroup.com

Data Analyst

Miles Warden miles@thesuperyachtgroup.com

Production Editor

Felicity Salmon

SuperyachtNews

Spanning every sector of the superyacht sphere, our news portal is the industry’s only source of independent, thoroughly researched journalism. Our team of globally respected editors and analysts engage with key decision-makers in every sector to ensure our readers get the most reliable and accurate business-critical news and market analysis.

Superyachtnews.com

The Superyacht Report

The Superyacht Report is published four times a year, providing decision-makers and influencers with the most relevant, insightful and respected journalism and market analysis available in our industry today.

Superyachtnews.com/reports/thesuperyachtreport

The Superyacht Forum Live

Over the past 30 years, we have delivered the most important conferences and meetings in the superyacht calendar, resulting in a global network of ‘Events Worth Attending’. Our flagship event, The Superyacht Forum Live, has proved to be the largest and most respected meeting of industry decision-makers.

Superyachtnews.com/thesuperyachtforum

The Superyacht Agency

Drawing on the unparalleled depth of knowledge and experience within The Superyacht Group, The Superyacht Agency’s team of brilliant creatives, analysts, event planners, digital experts and marketing consultants combine four cornerstones – Intelligence, Strategy, Creative and Events – to deliver the most effective insights, campaigns and strategies for our clients.

Superyachtnews.com/intel/

Follow The Superyacht Report and Intelligence content

@SuperyachtNews

SuperyachtNews

Join The Superyacht Group Community

By investing in and joining our inclusive community, we can work together to transform and improve our industry. Included in our Essential Membership is a subscription to The Superyacht Report, access to SuperyachtIntel and access to high-impact journalism on SuperyachtNews.

Explore our membership options here: www.superyachtnews.com/shop/p/MH

by Charles Boyle

by Charles Boyle

‘We must be proactive on crew welfare’

Charles Boyle, director of legal services at Nautilus International, says mere compliance with existing regulations

isn’t enough … and the industry must prioritise the well-being of its workforce.

There’s a distinction between the public perception of the glamorous lifestyle of working on superyachts and the actual reality, which rarely matches that perception. The importance of crew welfare is gaining increasing attention across the entire shipping industry, including that relating to yacht crew. While some regulatory frameworks are trying to address these concerns, it’s evident that more proactive measures are needed to truly enhance the quality of life for crewmembers.

Nautilus is doing much to assist its yacht members, with our legal and yacht teams being kept constantly busy on many issues such as dismissals, unpaid wages, discrimination, bullying and harassment as well as regulatory work with the Maritime and Coastguard Agency and Red Ensign Group.

This contributes to the improvement of crew welfare because working and living conditions on board yachts are vitally important. Therefore, the industry must prioritise the improvement of conditions on superyachts and in shipyards, ensuring they are more appropriate for crew. This is an area covered by the Maritime Labour Convention, 2006, and Flag-state implementation laws, measures and guidance.

The MLC contains extensive mandatory rules and guidelines for the provision of decent accommodation and recreational facilities for seafarers consistent with promoting their health and well-being. The MLC is a ‘living instrument’ and is amended by the International Labour Organization every few years.

The 2022 amendments will come into force in December this year, and most relevant for the superyacht industry will be the requirement for mandatory ‘social connectivity’ on board and, where practicable, owners and ports will have to provide internet access. There will also be a requirement for the mandatory provision of appropriately fitting personal protective equipment, for meals to be balanced and drinking water to be provided free of charge (as is already the case with meals).

The MLC also provides for flexibility in how it is implemented, particularly through the concept of ‘substantial equivalence’ as a means of implementation in cases where it’s impossible to adopt the exact letter of the Convention. The UK’s Tripartite Working Group (TWG) oversees the application of such flexibilities on UK and REG vessels.

Particularly important is Part A of the REG Yacht Code, Chapter 21B (applying to yachts more than 200gt), which sets out standards on headroom, ventilation, lighting, food, sleeping accommodation, mess rooms and recreational facilities. Regarding accommodation, the strict letter of the MLC provides that (except on passenger ships) an individual sleeping room shall be provided for each seafarer. However, in the case of ships of less than 3,000gt or special-purpose ships, the MLC allows exemptions from this requirement to be granted by the Flag state after consultation with the shipowners’ and seafarers’ organisations concerned.

The TWG used this flexibility, as set out in

MGN 517, to apply a general substantial equivalence to yachts from 3,000gt to less than 5,000gt, allowing the sharing of a twin cabin by non-officers, with a minimum floor area of at least 11 square metres. The quid pro quo was that each twin cabin must be provided with ensuite sanitary facilities including a WC, a basin and a shower or tub.

The TWG has also been consulted on new-build projects for an equivalence to be applied to yachts more than 5,000gt (which fall outside MGN 517). These applications are carefully scrutinised and approved only if there’s clear evidence the proposals benefit seafarers – for example, crew preferences following a survey of their views. So, in some cases, crew might prefer sharing a cabin in exchange for an en-suite bathroom rather than sharing a bathroom built for six seafarers.

However, mere compliance with regulations isn’t enough. The industry must prioritise the well-being of its workforce by going beyond minimum standards. The upcoming 2022 amendments to the MLC, including mandatory ‘social connectivity’ and improved access to the internet, are steps in the right direction. But more proactive measures are needed to truly enhance the quality of life for crew, both on board and in the yards.

Nautilus will continue to fight for the advancement of the welfare of crew, whether it be by tackling their employment problems or representing their interests with national, regional and global regulators. CB

by Toby Allies

by Toby Allies

Toby Allies, joint managing director at Pendennis Shipyard, shares his thoughts on why new construction still holds a special place in the hearts of everyone at the yard, and what the future holds for the company in this market sector.

Over the past 36 years, Pendennis has had the privilege to help design, build and craft some of the most iconic yachts that exist in today’s superyacht fleet. During this period, and as a truly bespoke custom builder, we’ve worked with most of the world’s leading naval architects and designers, helping to push both design and engineering boundaries –on projects such as the 42-metre racing icon Rebecca or the 44-metre catamaran Hemisphere

The team has witnessed many ups and downs in the market as well as trends and innovations. One thing that remains constant throughout though is the pure joy and sense of satisfaction that our in-house team of 550 craftspeople experiences on the completion of a new project. Taking an owner’s design and being entrusted to bring their vision to life over a two- to three-year period is an immense responsibility of both time and money for anyone – and something not to be taken lightly!

While for many in the industry, Pendennis might be more recently synonymous with a large-scale complex refit or conversion project, or the restoration of a classic yacht, new construction is still very much a core part of our business. In the early part of this summer, the team will be proud to hand over one of our custom-

build projects to its owner, with the official launch of the 35-metre explorer yacht Fox.

In today’s unstable economic and political climate, few yards would say that the new-build market is anywhere near as strong as it was directly after the pandemic but, as an industry, we feel we’re witnessing a levelling-out to a more stable position. Certainly, for Pendennis, we’re starting to see a consistent number of strong and diverse enquiries coming through our sales funnel, whether this be for an eco-conscious sailing yacht or a more commercial, rugged, off-the-beatentrack motoryacht.

The management team at Pendennis sees a future for our company in the 30-to 60-metre truly custom new-build market, but to survive and thrive in this sector, it’s our belief that we need to concentrate our efforts on two key areas –sustainability and innovation – without changing in any way our absolute commitment to building custom yachts of the very highest quality.

At Pendennis, as with many of our industry counterparts, we’ve implemented and embraced new construction methods that integrate a more sustainable approach to yacht-

building. Examples of this include innovations linked to whole vessel system design and optimisation reviews aimed at minimising emissions and a yacht’s carbon footprint, as well as seeking out alternative modern material selection.

The need for innovation has become paramount for Pendennis. Utilising modern manufacturing methods and technologies is now an integral part of our business ethos. We’re investing in new state-of-the-art facilities and digital manufacturing that will complement and enhance some of the more traditional techniques we employ here at the yard.

Our new digital manufacturing centre will bring together a five-axis joinery mill, a suite of CNC machines and plate profiling and machining equipment into one location that focuses on adding value to our business. Ultimately, this will result in shorter build times.

At Pendennis, we’re confident in the knowledge that comes with our history and the breadth of our in-house skills base. We believe this strong foundation, plus our focus on making custom new construction both sustainable and innovative for clients, will help to keep this sector at the heart of our business for many years to come. TA

Business is flourishing for the industry’s top shipyards. As revealed in the new-build data later in this edition, the delivery numbers in 2023 for 30-metre-plus superyachts reached levels not seen since 2010. This trend is mirrored in the figures for 60-metre-plus custom yachts, with total deliveries reaching their highest point since 2011. However, with only a limited number of yards operating in this space, the lead times for these larger, and often fully custom, superyachts are stretching towards the next decade. The man-hour intensity of these projects extends well beyond the shipyards, and with supply-chain issues and labour shortages still prevalent, bringing these dream projects to fruition on time presents a significant challenge. Transforming a vision from pencil to slipway takes years.

The semi-custom approach is gaining traction, partly as a response to these challenges. Far from being perceived negatively, many designers and shipyards embrace this process as a means of delivering a high-end product while tackling some of the factors that contribute to extended lead times. The reality is that there isn’t always significant variance between the naval architecture of many large yachts, and designing around a defined and well-tested platform streamlines the process.

One of the most prominent forays into the semi-custom model is Oceanco’s Simply Custom initiative, where 15 design studios were invited to submit designs based on a set platform. With most of these submissions now showcased in the press, Jim Dixon, director of yachts & aviation at Winch Design, gave us his insight about the company’s striking concept Project Reverie.

Oceanco’s Simply Custom initiative collaborates with a notable array of renowned design studios, demonstrating a commitment to diversity in design and innovation. Among those mentioned are Bozca Limitless Design, Espen Øino International, H2 Yacht Design, Harrison Eidsgaard, Hot Lab, Lobanov Design, Nuvolari Lenard, Pascoli International, Sinot Yacht Architecture & Design, Sorgiovanni Designs, Taylor Design, Team For Design – Enrico Gobbi, The A Group, Touch Studio, Vallicelli Design and, of course, Winch Design.

According to Dixon, Winch Design’s strategy for innovation within the Simply Custom framework, and to stand out from this impressive gallery of design talent, focuses on deep market analysis and client needs, recognising the evolving ways clients utilise yacht spaces.

“The essence here is our commitment to a design philosophy that shuns a ‘house style’, opting

instead for a reflection of the client’s personality and desires,” says Dixon. “Each project, such as Project Reverie, is treated as a unique undertaking, showcasing Winch Design’s dedication to creativity and problem-solving in the face of unprecedented design challenges.”

Winch is well placed to take up this challenge, having worked extensively within a similar framework with another top Dutch shipyard, Damen Yachting. Dixon feels that Winch’s approach is illustrated in its diverse design contributions to the Amels semi-custom fleet, emphasising customisation and individuality.

Dixon explains, “If you look at the number of different interiors we have designed across the Amels semi-custom fleet, for example, you will see that each interior is completely unique to the individual client and covers a range of different interior styles. In the Amels 242 Limited Edition Series, we designed the interior for Synthesis, Avanti and M&Em, and we are currently working on hull number eight. We have also worked across a number of the Amels 60 Limited Edition Series.

“The way clients use space on a yacht is evolving, and our latest concept with Oceanco explores a unique layout that blurs exterior/interior spaces,

“The design introduces a novel three-deck beach and wellness concept, enhancing the connection to the sea and promoting sustainable living by integrating spaces that reduce reliance on air conditioning.”

offering more flexibility to suit the lifestyle of a dynamic owner.”

According to Oceanco, its Simply Custom technical foundation serves as a blank canvas, offering designers the flexibility to create an Oceanco yacht with distinctive character while adhering to a highly optimised and efficient hull design developed in collaboration with Lateral Naval Architects.

This foundation includes a future-proof allelectric propulsion and energy system, alongside a layout that accommodates the foundational features of a superyacht. The typical configuration provided by Oceanco’s Simply Custom platform, which adheres to the Red Ensign Group Large Yacht Code Part A Regulatory Compliance, includes an owner’s stateroom and six guest suites.

For Project Reverie, this is complemented by luxury amenities such as a forward helideck, a main deck aft pool, a beach club and a dedicated storage room for electric toys that could include items such as e-bikes, underwater scooters or electric surfboards.

With the other design submissions now publicly available, the natural next question is how Dixon sees it in comparison to the rest of the field.

“Project Reverie distinguishes itself through its inspiration from the beauty of daydreams and nature, achieving a harmonious blend of sleek lines and simplicity that exudes elegance,” says Dixon. “The design blurs the line between indoor and outdoor living, aligning with the dynamic lifestyle of today’s yacht owners. It introduces a novel threedeck beach and wellness concept, enhancing the connection to the sea and promoting sustainable living by integrating spaces that reduce reliance on air conditioning.

“The semi-enclosed main deck ‘pool lounge’

offers a unique space designed to bring daily family pleasure, breathing new life into a typically underutilised area. This design also fosters a more sustainable approach by allowing interior and exterior spaces to coexist, reducing the demand on air-conditioning systems.”

The shift towards semi-custom yacht builds, as exemplified by the Simply Custom range, offers a strategic response to the prolonged timelines inherent in fully custom projects. This approach not only addresses time constraints, but also empowers clients to commence their yacht journey from a pre-established platform, ripe for personalisation. By streamlining the initial stages with a verified foundation, this trend has the potential to redefine the premium-yacht-market landscape, emphasising efficiency while retaining the hallmark elements of luxury and customisation.

The conventional route of embarking on a fully custom-yacht build is undeniably laborious and time-intensive. In recognition of this, shipyards are increasingly introducing larger semi-custom models into the market. The Oceanco Simply Custom range serves as an illustration of this evolving approach, theoretically offering clients the best of both worlds – a framework for swift customisation without compromising on the bespoke elements that define luxury yachting.

“The unveiling of Project Reverie and its subsequent promotion have generated positive feedback from both clients and the industry, especially following the release of new exterior and interior visuals,” concludes Dixon. “The interest spurred by these discussions at events like the Dubai Boat Show underscores the market’s receptiveness to Oceanco’s innovative Simply Custom concept and Winch Design’s visionary execution.” JH

With increasing focus on the operational impacts of today’s superyacht fleet, are new-build shipyards doing enough to improve their in-house sustainability processes, with the clock ticking down to the looming deadline of 2030?

Shipyards sustainability report

mprovements in the design and operational impact of superyachts often attract attention and make headlines. However, everyone within the industry plays a role in enhancing sustainability, and shipyards are just one of these groups.

While designers’ choices affect the impact of the usage phase of a superyacht’s life cycle, shipyards are responsible for the ‘cradle-to-gate’ element of a superyacht. The impact of these steps depends heavily on the facilities, materials used and processes the shipyard employs.

Reducing these impacts will be a particular priority for many shipyards in the EU as the Corporate Sustainability Reporting Directive (CSRD) comes into effect over the coming years. This requires them to assess their impacts and implement plans and strategies to reduce them. Therefore, many new-build shipyards will need to catch up with other manufacturing industries such as luxury cars, aviation and even refit yards like Amico & Co and MB92 – all of which are regularly publishing sustainability reports.

As environmental, social and governance (ESG) requirements increase, shipyards will benefit from implementing strategies to reduce their impacts and demonstrate progress. Legislative and other mandates will drive actions covering various aspects of sustainability. As well as environmental impact reduction, it’s crucial to address all facets of sustainability. This necessitates incorporating sustainability into business operations through diverse approaches to achieve set targets.

New-build shipyards represent a sector of the industry still in the nascent stages of its sustainability journey. This is evident from the lack of relevant reports and the cautious language used by yards in their responses, such as ‘investigating’ and ‘looking into’ when addressing future activities and choices.

While such language demonstrates intent from shipyards, there appears to be a disconnect between this intent and tangible actions with measurable impact reduction achievements or defined strategies. Vague, uncertain elements within sustainability efforts may not meet the increasingly stringent ESG-related requirements that will apply to these shipyards in the future.

We contacted multiple superyacht shipyards to find out what they are doing to reduce their impact. While there’s no single solution, learning from the steps taken by a diverse range of yards, manufacturing in equally diverse regions, paints an intriguing picture of how far the industry has come … and how far it still has to go.

Among the most referenced impact reductions from the yards we spoke to was that of energy usage within the facilities. As we all have undoubtedly seen over the past few years, many shipyards are installing solar-panel arrays. However, even a cursory look at the maths shows this can account only for nominal savings compared to the overall energy needs across an average newbuild process.

A far more significant lever is purchasing energy from renewable sources. Baltic Yachts sets an example with some

of the best energy sourcing available. Its location in Finland allows for all power used in its production facilities to be sourced locally from wind farms and hydropower facilities. This renewable energy will be the lowest impact type of energy available – commendable, but this is due to the progressive energy policies in Finland.

Not all production facilities will be able to attain this level of low-impact energy supply. One example of this is Southern Wind, in South Africa. As seen in the graphic below, South Africa’s energy consumption is sourced almost entirely from fossil fuels, whereas Finland’s is less than half from fossil fuels. This energy-supply issue contributed to a life-cycle assessment (LCA) carried out by Southern Wind into its new-build and existing fleet, which found that electricity was a significant contributor to the impact of its yachts.

The goal of achieving a majority or total renewable energy supply is a common element found in the reports of other similar industries that have progressed further in sustainability than the superyacht industry. For instance, Aston Martin, Learjet and Textron have successfully operated one or more of their production facilities on 100 per cent renewable energies. These sustainability reports from comparable industries offer valuable insights into the potential trajectory of the superyacht industry.

Another prevalent theme among shipyards, as well as other industries, is waste reduction. This involves two primary factors: firstly, reducing waste generated in the first place, which decreases the demand for raw materials, and, secondly, maximising waste that will be recycled or repurposed, thereby increasing the supply of recycled

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad

minim veniam, quis nostrud exercitation

eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad

minim veniam, quis nostrud exercitation

ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure

minim veniam, quis nostrud exercitation

ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure

dolor in reprehenderit in voluptate velit

esse cillum dolore eu fugiat nulla pariatur.

Teak, in particular, poses sustainability challenges due to high demand outpacing its replenishment rate. While technically renewable, the rate of consumption exceeds the pace of new growth.

materials and reducing reliance on landfill or incineration disposal methods.

Shipyards have prioritised waste reduction by enhancing manufacturing efficiency, yielding significant benefits for business operations. This approach not only reduces material costs, but also minimises expenses related to waste storage, processing and disposal.

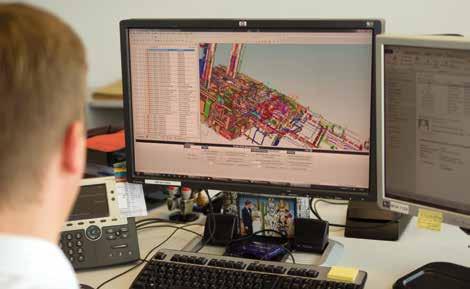

For example, Sylke auf dem Graben, marketing team leader for Lürssen, confirms Lürssen employs digitalisation in its piping workshop to streamline processes and cut waste, while Southern Wind optimises material use through IT and data systems. Feadship focuses on reducing packaging waste from the supply chain and using more easily recycled options, and Baltic Yachts has quantified its efforts, achieving more than a 10 per cent reduction in waste per labour hour.

Among the shipyards surveyed, Baltic Yachts stood out for achieving zero unsorted waste by utilising the Finland-specific KiMuRa-route scheme to recycle industrial composite waste. Feadship is also using additional recycling programmes for its range of waste materials, which includes a national

10%

REDUCTION IN WASTE PER LABOUR HOUR AT BALTIC YACHTS

OF WASTE REDUCTION IN 2022 AT LEARJET

95%

OF ASTON MARTIN’S SUPPLIERS HAVE ATTAINED ISO 14001 CERTIFICATION

2030

DATE FOR FEADSHIP’S GREENHOUSE - GAS - EMISSIONSREDUCTION TARGETS

scheme to repurpose wood waste, and facilities that utilise non-recyclable waste to generate heat/electricity.

As industry reports increasingly emphasise waste-reduction goals, such as those found in Damen Yachting’s and Fincantieri’s sustainability reports, we can anticipate more evaluation of such efforts in the superyacht sector. For instance, Learjet’s 2022 sustainability report showcased a notable achievement of over 800 metric tons of waste reduction across more than 90 projects, setting a benchmark for the industry.

Improvements in waste-disposal routes must be accompanied by shifts in the materials used in superyacht construction. Teak, in particular, poses sustainability challenges due to high demand outpacing its replenishment rate. While technically renewable, the rate of consumption exceeds the pace of new growth. Despite this, teak’s unique qualities for maritime use make it difficult to replace with more sustainable alternatives.

Consequently, considerable focus, research and development have been directed towards finding suitable substitutes. Lürssen collaborated with the

University of Göttingen to develop the patented Tesumo material, offering an alternative to teak. Similarly, Southern Wind employs maple decking as a sustainable option.

Recycling waste is one part of circularity, the other is utilising recycled materials. Examples of this from shipyards are Feadship using recycled metals or Southern Wind using recycled PET core materials in construction. Using recycled materials is better because it has reduced impact from both the disposal of materials and impact savings from cutting the amount of material production required.

Another approach is to obtain locally sourced materials to reduce associated transport emissions – a priority for Baltic Yachts. However, Pamela Honga, head of quality and sustainability at the company, explains, “Sometimes customer choices and the scarcity of specific items need to come from abroad.” In such cases, efforts are made to ship these items in bulk and organise common transport routes to minimise additional transport emissions.

This reflects a broader effort within the industry to advance sustainability. Umberta Bassino, marketing and communication manager at Southern Wind, emphasises the need for support from the supply chain, highlighting the importance of engaging with suppliers to drive improvements collaboratively.

Both Feadship and Southern Wind have expressed their commitment to prioritising preferred supplies, equipment and materials. This underscores the growing demand for environmentally friendly construction materials, with increasing pressure for external certification or scientific validation of their sustainability credentials.

An external example of this approach is Aston Martin’s requirement for suppliers to comply with ISO 14001, an environmental management system standard. Presently, 95 per cent of its suppliers have attained this certification. This underscores the potential benefits for suppliers to invest in the development of suitable alternatives for shipyards, exemplified by Lürssen’s co-creation of a teak alternative.

In addition to the activities mentioned above, there are also investments to be made directly in the shipyard facilities themselves into equipment that

Below: Photovoltaic installation at Feadship’s Aalsmeer facilities. Bottom: Lürssen’s digitalisation of piping to prevent waste.The key question revolves around whether clients are willing to absorb additional costs in the pursuit of life cycle and shipyard sustainability.

improves efficiency and other methods to reduce consumption or emissions associated with the running of the yard.

One example of this is Feadship’s goal of becoming carbon-neutral by 2030. Specifically, Feadship aims for 95 per cent reductions for Scope 1 and 2 greenhouse gas emissions and around 45 to 65 per cent for Scope 3 by 2030. This is planned to be achieved through extensive investments such as new machinery, installing smart systems, changing lighting systems, and optimising heating, cooling and ventilation systems. These measures will reduce consumption and emissions but the company is also looking to break away from fossil fuels which, while unspecific, can be assumed to be similar to other changes such as that made by refit yard Cantiere Rossini to replace diesel with HVO for on-site equipment.

Lürssen, too, is investing in energyconsumption changes at its facilities, utilising LED lights among wider plans to implement more energy-efficient options for facades and windows, alongside emission control and filter technology.

Baltic Yachts has implemented a dif-

Baltic Yachts’ Pink Gin Verde comes with a durable alternative cork deck material from Marinedeck exterior.

Baltic Yachts’ Pink Gin Verde comes with a durable alternative cork deck material from Marinedeck exterior.

Southern Wind is one of many shipyards installing solar panels within their facilities. The yard also uses recycled PET core materials in construction.

ferent approach to reduce emissions by consolidating all of its staff at one location – in Pietarsaari, Finland. This strategic move is expected to result in reduced energy consumption and emissions as the shipyard will run less equipment such as lights and heating.

Many shipyards are also enhancing their business operations. For example, Lürssen’s energy-efficient refurbishments not only reduce energy consumption but also lower energy costs.

Baltic Yachts achieved a 10 per cent economic saving by switching to renewable energy supply. Additionally, wastereduction efforts contribute to reduced material costs. However, some of these benefits may be offset by the higher costs of alternative materials or improved products used.

The key question revolves around whether clients are willing to absorb additional costs in the pursuit of lifecycle and shipyard sustainability. As reduced impact practices become more widespread, uncertainties remain as to the effect this will have on the operational efficiency of the yards. Will they be incorporated into overall cost increases, such as those driven by inflation or changes in material supply, or will there be pushback from clients despite the efforts of the shipyards?

Ideally, clients will align with the trend seen among consumers generally, who are increasingly willing to pay for sustainability. For instance, a 2021 Deloitte study found that 67 per cent of participants were willing to pay up to 41 per cent more for products if they were sustainable.1

One critical aspect in this early stage of shipyard sustainability evaluation is understanding the impact of current actions. Feadship has established 2022 as its footprint baseline, while Southern Wind conducted a Life Cycle Assessment (LCA) on one of its builds, SW105-05 Sørvind, and its existing fleet to assess the environmental impact of its vessels from cradle to grave.

Once the current impacts are understood, it can inform the next steps. Charlotte van de Kerk, programme manager sustainability at Feadship, highlights the importance of using emissions data to make informed decisions that consider environmental impact in short- and long-term investments.

Paul Dumbell, planning and control manager at Southern Wind, explains that the LCA has helped clarify areas of increased impact. “I expected freight to have a high impact and electricity to be negligible, but freight turned out to be less than expected and the electricity we use in manufacturing is quite significant,” he says. This quest for understanding is also reflected in the research many yards are undertaking into viable alternatives for use in manufacturing.

Measuring baseline impacts not only allows for quantifying savings but also provides valuable data to be communicated in the future, thereby enhancing sustainability-related credentials. This communication is likely to take the form of reports published by shipyards, currently uncommon among new-build yards, although a few reports have been published by refit yards.

Drawing on lessons from industries further along in their sustainability journeys can help our industry catch up and accelerate sustainability efforts more rapidly. Another aspect to learn from these industries is how they ensure progress in these areas, mainly by integrating sustainability progression into the overall success of the business. This will involve continued measurement of various impact aspects and linking them to key performance indicators (KPIs) of the business.

With only six years until 2030, the gap between the current state of the industry and the goals that need to be achieved seems considerable.

Baltic Yachts has consolidated all of its staff into one location in Pietarsaari, Finland, as a different approach to reducing emissions.

While we await further details on Lürssen’s KPIs when it publishes its CSRD-related documents, Baltic Yachts has shared that its current KPIs focus on the energy usage of its facilities and specific pollutants such as volatile organic compound gases from certain products, such as paint used within the facilities. Efforts are also underway to include CO2 scope 1, 2 and 3 emissions in future KPIs.

Setting goals within a business is one aspect of progressing sustainability, but it’s equally crucial to invest appropriate time, resources and manpower into these efforts to ensure their attainment. This requires the support and advocacy of senior figures within shipyards. Shipyards employ various methods to facilitate this, including having a dedicated sustainability team, as at Baltic Yachts, or through the efforts of employees appointed to specific positions to address targets.

Achieving these goals and sharing them through published reports will not only demonstrate proactive action towards sustainability, but also address the growing demand for transparency surrounding sustainability efforts. As expectations rise for company sustainability credentials, openness in sharing this information becomes increasingly important. Moreover, such transparency fosters collaboration, whether with

By incorporating sustainability into their operations, shipyards can achieve impact savings and reduce the environmental footprint associated with the entire life cycle of superyachts, from cradle to gate.

suppliers, initiatives such as Water Revolution Foundation or with other shipyards.

Working together on these efforts could accelerate progress in shipyard sustainability, leading to increased impact reductions or faster timelines. Collaboration is key to driving meaningful change in the industry. Indeed, many sustainability efforts within the industry are aligned with the deadline of 2030, such as the Paris Agreement’s target of achieving a 43 per cent reduction in greenhouse-gas emissions by that year, as well as Feadship’s greenhouse-gasemissions-reduction target.

Feadship’s plan to achieve carbon neutrality involves extensive investments in new machinery, installation of smart systems, upgrades to lighting systems as well as optimisation of heating, cooling and ventilation systems. While these activities will undoubtedly reduce consumption and emissions, the broader objective also includes transitioning away from fossil fuels, which will require significantly more investment (and published data) in order to be realised and verified.

However, with only six years until 2030, the gap between the current state of the industry and the goals that need to be achieved seems considerable. There’s currently no clear pathway from where the industry stands now to where it needs to be by 2030 if it is to meet these ambitious targets.

It’s evident that shipyards have various avenues to progress sustainability

by adopting a holistic approach that encompasses operations beyond just improving the impact of yachts. By incorporating sustainability into their operations, yards can achieve impact savings and reduce the environmental footprint associated with the entire life cycle of superyachts, from cradle to gate.

There may be questions about whether the goals of individual shipyards will be ambitious enough to drive significant improvements, especially if renewable energy use falls short of reaching 100 per cent, as seen in other industries. Additionally, even if ideal scenarios are achieved, some avoidable impacts may persist, necessitating offsetting measures where relevant. Challenges such as material consumption will also be harder to address.

Despite being in the early stages of the sustainability journey, shipyards are focusing on understanding and researching strategies and actions to achieve unspecified goals. We can anticipate an acceleration in the publishing of formalised efforts and relevant information in the near future.

Observing how shipyards and the wider industry work to improve the impact of the early life of a superyacht will be fascinating, and the imperative is on us, as clients and observers, to look beyond the press releases. MH

1. Monitor Deloitte, Sustainability as a value driver – How sustainability elevates product innovation and price differentiation. December 2021.

"Sète are going above and beyond to make our stay as simple as possible, and the facilities are exactly what we need this time of the year. Sète helped us accomplish more during our stay there than we did in the shipyard. The privacy and security and the surroundings are amazing!

What an amazing team, with a tireless work ethic and great personality. We really can't say enough about these guys. Kudos to your Sète team".

As the world’s largest sportfisher project hits the water, we discover what happens when a hyper-specific design brief meets a convention-busting shipyard.BY JACK HOGAN

As the editor of a superyacht magazine, in a space so perfectly positioned to marvel and excite, it’s with a heavy heart when I say it’s not that often that something comes across my desk that really does either. This can be especially true of mid-size motoryachts; there’s surprisingly little product variance in this size bracket.

This makes my job difficult at times. While the press releases may abound with superlatives, extolling virtues, as a writer with any conviction, it can be hard. Occasionally, however, something does appear that seems to be truly remarkable – a design that not only reimagines the form, but also the function of what defines a superyacht.

The term ‘superyacht’ itself is nebulous (see this issue’s Stern Words) – equally hard to define at the smaller end of the spectrum as it is becoming at the largest. The newest forays from luxury brands into the small ultra-high-end cruise market are blurring the lines, and the highly capable 24-30-metre yachts – one of which is covered in this edition –equally so.

One constant defining set of characteristics that does feel more immutable is that exhibited in the 50-70-metre size range: big enough to cross the world’s oceans and house a full-time crew of officers, interior crew and engineers, and at the same time dedicated exclusively to a family or small group of charterers.

These yachts are still inevitably designed around a similar operational profile. The ‘purpose’ of the majority of them is leisure and luxury, so it fits that they mostly come from a homogeneous design brief. It’s unrealistic and counterproductive to expect them not to. What is rare is to see real design considerations taken around something totally novel.

That's why it’s refreshing to see a yacht launched

that has a unique reason for being. While the owner’s team has kept relatively quiet about Project 406, shipyard Royal Huisman has said it is designed for an experienced owner who is passionate about fishing. This remarkable Alustar® aluminium motoryacht stakes its claim as the largest true sportfish yacht globally, boasting a towering profile spread across six decks and an impressive overall length of 52 metres.

Jan Timmerman, CEO of Royal Huisman, says, “Royal Huisman has built its reputation by fulfilling the most ambitious and challenging dreams of its clients. We create yachts of extraordinary individuality, with unrivalled levels of craftsmanship and reliability. It is a privilege to be selected by the owner’s team to realise this unique sportfish superyacht. We look forward to celebrating the launch of the finished product. Project 406 will be another masterpiece of creativity, innovation and expertise, uniquely embodying the essence of a Royal Huisman motoryacht.”

Dutch studio Vripack Yacht Design is responsible for the exterior and interior as well as the naval architecture of this ambitious project. The distinctive lines, with a long bow and high bulwarks sweeping through a clear sheer to a low and uncluttered cockpit aft, are akin to the sportfishing fleets of the US East Coast, sharing shape, if not scale, with the intrepid vessels traversing the wilds of the Central American Coast in search of sailfish and marlin.

The high tower, designed to give ultimate visibility and a separate conning station while stalking pelagic game fish, dominates the design profile, the same with the immense outriggers gracing the outboard aft on either side as well as the low-slung transom. The single game-fishing chair, the focal point of any serious sportfish vessel, sitting at the centre of the low-slung transom, is

Serious game-fishing requires equally serious design dedication, which is why Project 406 has been designed with the idiosyncrasies of game-fishing in mind. It needs to be because this tried and tested pastime requires integral operational considerations.

dwarfed by its surroundings, providing the clearest indicator that the scale of Project 406 is unlike anything on the water.

This is not to say blue-water game-fishing is unheard of on board superyachts. This usually casual, and sometimes not so casual, pastime for these yachts is a little spoken-about activity. However, many superyachts already try their hand at game-fishing, sometimes exclusively for the owner’s enjoyment.

The basics of deep-sea game-fishing are relatively simple, and on the surface, possible from a large motoryacht. I have trawled lures halfway round the world (with varying levels of success) on a range of 50-70-metre motor and sailing yachts. Fitting a rod holder and setting a small spread of lures behind a yacht travelling at 12 knots may be feasibly within the limits of game-fishing, but the reality of actually landing a fish is very different.

For starters, once hooked, the vessel needs to slow down quickly, ideally stop and, in some cases, even reverse to follow a large fish that is hell-bent on heading the other way. But that’s only the start of the problems. Lures may have to be trawled for hours before a hook-up happens. Sometimes a boat may have the luxury of keeping a deckhand permanently on watch, but even on a relatively chilled crossing, there’s still plenty of other work to be done.

The likelihood that anyone is watching the rods at the exact time that a fish is hooked is low. In the time it takes anyone to notice, let alone relay back to the bridge and start the slow slowdown process, the fish may have taken most, if not all, of the line from the reel. I remember many times returning to the aft deck to see an empty fishing reel, simmering suspiciously in its holder and stripped of its line, with a presumably perturbed

fish swimming away with a lure and 1,000 metres of nylon trailing from its mouth.

Serious game-fishing requires equally serious design dedication, which is why Project 406 has been designed with the idiosyncrasies of gamefishing in mind. It needs to be because this tried and tested pastime requires integral operational considerations.

Since its inception, the discerning owner of Project 406 has assembled a capable team to support Royal Huisman in bringing their vision to life. Expert advice from Bush & Noble on sportfishing and classic yacht forms, along with Hampshire Marine managing the day-to-day technical aspects at the shipyard, ensures a comprehensive approach to the project. Pascarelli Consulting acts as the owner’s representative, overseeing the project’s progress.

As Project 406 transitions from Royal Huisman’s Vollenhove facility to the vibrant heart of Amsterdam, it marks a pivotal moment in the unveiling of a vessel that reinterprets the essence of a luxury yacht. This 52-metre build is the culmination of high-end, purpose-driven design and engineering as well as a bold statement in the world of bespoke yachting. The yacht’s functional architecture, epitomised by its observation tower, is a design feat that melds the high demands of sportfishing with the elegance of superyacht living.

The tower’s strategic vantage point will offer more than just watching the spread of lures; it’s a special space from where owner and guests can survey the vastness of the ocean, a feature that underscores the dual-purpose nature of this unique project.

Project 406 stands as a testament to pushing the boundaries of custom-yacht creation, ready to sail as a pioneering vessel that will turn the heads of observers and game-fishers alike. JH

Leading provider of luxury outfitting for yachts, hotels, private aircrafts and homes.

We offer a complete customer experience with historical purchase information, billing and quotations. Enabling a simple reorder process and removing the need for multiple suppliers.

Reduce shipping costs by benefitting from our courier discounts. Pay lower prices utilising our bulk ordering buying power.

We can arrange storage and ship whenever it is convenient for you.

Our interior designers will help you with all aspects of a project. From reviewing the finer details to implementing a major refit.

Our graphic designers will assist with branding, logos and supporting artwork.

Backed by 20 years of experience in the yachting industry, we have the best brands, equipment and expertise available to deliver results for our clients.

Codecasa project manager Roberto Dalle Mura explains why they choose Jotun for their paintwork.

In the success of a company, investments play a key role and must always be accompanied by purposeful choices. When it comes to yachting and shipyards, the departments involved in the construction of a yacht are numerous, and for the success of the vessel, they need to be highly specialised. In this landscape, paint has gained importance, and today many companies have set their sights on high-end results.

Now, let us ask: why is paint so important? It is now generally agreed that the paint job on yachts is a crucial aspect of their beauty. Whether yachts are made of fibreglass, metal or any other construction type, a good paint job characterises their appearance, protects them from the marine environment and increases their value. Boats are constantly exposed to the elements and are subject to the corrosive action of salt spray, which can cause wear and tear over time. Careful painting can significantly extend the life of the boat, ensuring optimal conditions for many years and enabling the shipyard to meet the customer’s highest expectations for longevity.

We broached the subject with Roberto Dalle Mura, Codecasa project manager, to understand the choices of one of the world’s most renowned shipyards, which enters 2024 with nearly 200

years of history behind it. His opinion is that paint has taken on significant importance in boating and that executing it to perfection adds value to the boat.

During the launch, the beauty and brightness of the paint job are the first things that catch the eye, at a time when everyone’s expectations are high.

“This is why a good paint job has to turn out aesthetically and qualitatively perfect, and the effort and energy that go into this process are considerable.

During the staging phase, we optimise all processing procedures and follow up with the plasterers to ensure an optimal end result.”

Added to this is the importance of the

raw material: choosing the right supplier that ensures an excellent product is crucial, as is the know-how of the applicator who must be trained and thoroughly familiar with all the characteristics of the paints used. Among all the brands on the market, Codecasa has chosen Jotun products since 2020 thanks to the specific request of a shipowner who, after being fascinated by the colour of a yacht in the harbour, had decided he wanted it for his own as well.

“We initiated a lot of research and eventually discovered that the paint was Jotun’s Aquila White. We were impressed that the effect of the white was so beautiful that it looked like ceramic. From that moment, here at Codecasa Shipyard, we wanted to rely on the quality of Jotun products for all stages of painting: MegaCote, MegaFiller, MegaFiller Smooth, MegaPrimer, MegaPrimer Lite and MegaGloss AC.”

Choosing a paint product must take into consideration several variables: durability, colour, finish, application method and brand reputation. Dalle Mura emphasises that Codecasa’s choice was Jotun “also because of the customer service that employs skilled workers at the highest level. We have great confidence in them because their assistance is immediate. Their advisors are always available, and they come periodically to analyse the progress of the work. In a nutshell, I can say that Jotun has the best customer service.”

Jotun products will soon stand out on the new 24-metre Classic lines, the first unit of which was recently launched, and 34-metre Classic yacht. The other Codecasa vessels, already launched and painted with Jotun products, are 56-metre M/Y Framura and M/Y My Legacy, 58-metre M/Y Kathryn and the 43-metre M/Y Boji.

Is it time for a technological re-evaluation of mooring operations? The team at Rondal certainly thinks so. Here, we speak with managing director Harald Lubbinge and technical product specialist Ard Ritsema about their innovative captive mooring and self-contained mooring winch system.

BY JACK HOGANThe process of mooring is fundamental to maritime operations. It serves as the literal connection point with safe harbour, integral to peace of mind for operators and owners alike. It’s also one of the most dangerous hands-on operations on board.

As a large yacht is secured to a fixed dock, especially in high winds, deck crew are regularly handling large lines under enormous loads. Orders are barked across crowded radio channels, all with potentially dangerous consequences. Traditionally, this process is done using an array of deck capstans, elbow grease and thrusters. Once attached to the dock, these lines then need to be removed from the winch (capstan) that tensioned them and ‘bounced’ on to a bollard – mostly by hand.

Despite significant technological advancements across all aspects of onboard operations, mooring processes have remained a curiously analogue outlier. Checking the tension on lines is also primarily done visually. As tides and winds influence a yacht’s mooring, the safety of the vessel is gauged by eye and feel.

However, Rondal, a leading expert in custom captive winch design which has been producing captive winches for more than 30 years, is looking to modernise this aspect of deck operations by introducing a more advanced and safer mooring system for large motoryachts.

The company’s track record speaks volumes: Juliet, delivered in 1993, was the first yacht equipped with Rondal captive winches. Remarkably, the original winches are still on board, a testament to their enduring reliability. Juliet’s captain, Jonathan Allan, confirmed they have undergone minimal servicing over the years.

These winches have been installed on a large number of sailing superyachts from various shipyards since their

debut, and they have been continuously improved and developed over the years to become even better, ensuring unparalleled safety and efficiency in mooring operations.

“We had a motoryacht customer who saw our winches, which he had normally used for our sailing system, and he asked us if it could also be used for mooring,” says Rondal’s managing director Harald Lubbinge. “We were not specifically doing that at the time, but we had a meeting quite recently and have moved ahead to design a complete system.”

There is a regulatory catalyst for this development also. On 1 January, the International Maritime Organization (IMO) introduced revised SOLAS Regulation II-1/3-8 and associated guidelines aimed at enhancing safety and efficiency in towing and mooring operations. This update underscores the imperative for greater consideration of occupational safety and secure mooring when designing new vessels. As of 2024, mooring vessels more than 3,000gt will become a mandatory hands-off procedure, and for vessels of less than 3,000gt it’s strongly advised.

The amendments by the IMO Maritime Safety Committee emphasise key functional objectives for mooring systems, including minimising obstructed access, reducing manual handling and enhancing safety for personnel involved in mooring operations.

Rondal seeks to supply a complete mooring system that can integrate with yacht builders during the construction process. By focusing on the most efficient line running on board, whether electric or hydraulic winches, the system is designed to offer a more consolidated solution. When operating high loads entirely hands-free, it substantially reduces crew-safety risks and is cleaner and more precise. No cleating

“We had a motoryacht customer who saw our winches, which he had normally used for our sailing system, and he asked us if it could also be used for mooring. ”

is required, and when trimming the mooring line, no manual line-handling is needed, therefore ensuring safety.

Two crewmembers, each with a local control unit, can split responsibilities for faster adjustment if preferred. Loads on all the winch sheaves are monitored and integrated with the ship’s AMS system. The system’s load capacities meet established classification requirements.

By installing the winches below deck and controlling them remotely, the system minimises the risk to crewmembers and ensures a clean deck layout. Moreover, sensors on the winches continuously monitor tension levels, providing real-time alerts and ensuring optimal safety and efficiency during mooring operations.

Captive drum winches, as seen left, are staples of the large sailing-yacht fleet for managing rigging and are an alternative solution that can be applied to mooring operations. Rondal has pioneered a self-contained and selfflaking system for yachts in the past.

“Our winches have quite a long drum where we can store lines and also pull the lines as needed,” says Rondal technical product specialist Ard Ritsema. “Our current motoryacht

Photo: Tom van Oossanen

Top: Harald Lubbinge, Rondal managing director.

Below: Ard Ritsema, Rondal technical product specialist.

Photo: Bastiaan Musscher

Top: Harald Lubbinge, Rondal managing director.

Below: Ard Ritsema, Rondal technical product specialist.

Photo: Bastiaan Musscher

client wanted to have those winches operated remotely to avoid the tension getting off to the drum. They saw the benefit of having the system be safer and less interference between the line and the crew.”

The primary advantage of this is that it allows deck crew to stand at a safe distance controlling the lines. A crewmember theoretically only needs to handle the line if tension needs to be adjusted. This will be done by remote control, with no physical interaction during mooring. A sensor warns if the line is over-tensioned or if there is slack line, and a crewmember will then adjust the tension in the line by remote control but, otherwise, they can be at a safe distance. This will hopefully make life a lot easier for mooring purposes.

“We have sensors on the winches that measure tension on the line. If there’s too much tension, the system sends a signal to the yacht’s control system,” adds Ritsema. “The control system can then take action, such as adjusting the tension or alerting the crew if needed.”

To have such capability would be advantageous and a break from tradition. As any deck crew can attest, man-

One of the significant challenges encountered in mooring operations is dealing with overruns and ensuring quick tensioning, especially when retrieving slack lines.

handling heavy lines under tension is a stressful side of operations. Any system would need to have a lot of strength in the drum and its attachment point because it would be handling huge loads, which is why this system is fully integrated into the build process.

“The regulations have become stricter, especially for vessels above 3,000gt, where mooring systems are becoming mandatory,” says Lubbinge. “For vessels below 3,000gt, it’s highly advised to ensure safety and compliance with regulations. We want to continue to discuss further with classification societies how they see our system’s application over a wider range of the fleet.”

One of the significant challenges encountered in mooring operations is dealing with overruns and ensuring quick tensioning, especially when retrieving slack lines. However, Rondal’s system includes tensioners and sensors to detect slack lines and automatic tensioners to prevent such issues, thereby mitigating operational challenges. The tensioners avoid slack line on the drum of the winch but if there’s a slack line between the yacht and

the quay, the line can be tensioned by remote control.

Due to the wide range of available captive winches, the Rondal mooring system can benefit yachts of various sizes; larger motoryachts of 60 metresplus, with more space and heavier loads, stand to gain significantly from the added safety and automation. Additionally, compliance with stricter regulations, especially for vessels more than 3,000gt, further emphasises the importance of adopting innovative mooring solutions.

With encroaching regulations seeking to address a historically dangerous aspect of deck operations, a more technologically advanced and handsfree system presents an intriguing option for new builds. As the Rondal team, – as well as the regulations – lay out, this is likely to be employed by the 3,000gt-plus fleet initially, but with advancement in line technology, it may also be feasible for smaller yachts.

“Convention has dictated that we do it a certain way for centuries,” concludes Lubbinge. “But it may be time to bring this aspect of operations into the next generation.” JH

Monohulls still comprise the lion’s share of the fleet, but could large multihulls ever overcome current prejudices to become the new kings of the jungle?

Despite their allure with increased gross tonnage, greater fuel efficiency and enhanced stability, interest in large multi-hulls has been relatively slow, with most movement seen below 30 metres. Yes, there have been some famous launches in recent years and some seriously eyecatching support vessels joining the fleet, but multihull vessels are still rare gems, rarely seen in the superyacht sector.

So what factors have contributed to this cautious approach, what’s the potential of multihulls in the future of yachting, and what lessons can be learned from past launches in both the yachting and supportvessel sectors?

“There’s a slow uptake on the upper scale, which is ironic because you’d think the top shipbuilders would be more adventurous and cutting-edge,” says Jennifer Smith, director of business development at SHADOWCAT, a builder of large luxury multihull support vessels. “I think there are a few factors at play, with one of the bigger ones being operational resistance.

“While owners are excited enough to call us directly, once they involve their operational crew, enthusiasm tends to fade. This might be due to the inexperience of marine departments in handling large cats, which require different navigational approaches more common in the commercial sector.”

Multihulls aren’t a modern concept in the maritime industry by any means, and decades of research in commercial and naval marine sectors has been spent evaluating multihull platforms for various vessel types, sizes and speeds. James Roy, managing director of Lateral Naval Architects, explains that, as seasoned commercial catamaran designers, the firm first delivered a 38-metre catamaran superyacht in the early ’90s. “We thought that the then relatively infant superyacht industry would be in awe of this and many more would follow.”

However, the phone didn’t exactly ring off the hook, and big cats have never really gained any significant market share since. Roy adds that a few years after their 38-metre yacht’s delivery, the owner invited them on board. “While on the aft deck, he expressed his fondness for the yacht, but felt uneasy when berthed stern to alongside sleek monohulls with raked bows. The owner then pointed and said, ‘I want my yacht to look like that’. He was, of course, pointing to a monohull.”

We were surprised by this; from conversations at boat shows and in interviews, catamarans

had appeared to be rising in popularity – but the data says otherwise. According to Superyacht Intelligence, only 12 multihulls over 30 metres have been delivered since 2019, four of which are support vessels. The most recent deliveries of both yachts and support vessels have been Viaraggiobased Tecnomar’s 43-metre motoryacht This Is It and Australian shipyard Echo Yachts’ 56-metre Charley 2. Both are the largest catamarans built by their respective shipyards, with the latter being the biggest catamaran motoryacht ever built in Australia, representing a shift in construction methods towards multihulls, small though it may be.

Whether the slow uptake is down to a lack of operational or construction knowledge, infrastructure, education on their benefits or simply aesthetic hang-ups is unclear. What is clear, however, is that there’s a lot the superyacht industry can learn from the commercial and support-yacht sectors. Their adoption of multihull construction methods to increase useable space and stability on board, and boost fuel efficiency while reducing operational costs, are innovations to aspire to should the fleet wish to continue its evolution.

This is the key point to consider when discussing multihulls – their design enhances hydrodynamic efficiency in the water due to their slender hulls, meaning they require less engine power and fuel to achieve the same speed or range compared to traditional single-hull vessels. The same principles apply to trimarans, which consist of a long, slender central hull and two smaller outer hulls. This configuration acts as a stabilised monohull, with the outer hulls providing additional stability as well as enhanced hydrodynamic efficiency.

By dividing the displacement between two or more hulls, the length-to-displacement ratio is improved and, in turn, the wave-making component of the drag is substantially reduced. “Across much of the speed range of interest, the wave-making drag is the dominant component, and it is the length-to-displacement ratio which is the most influential variable,” explains Roy. “It is often cited that the benefit of the multihull is derived from the very slender hulls, as characterised by the visibly low waterline beam of each hull. However, this is a second order variable and it is length in relation to displacement which is the most influential.”

The disadvantage to dividing up the displacement, however, says Roy, is that it increases wetted surface area, leading to higher frictional drag. In

“I think there is a great coalescence between the faith of these new yacht owners and that product personality. They are sporty, they are active, they want to adventure. They want to embrace these things. And they’re a little bolder when it comes to taking risks and doing different things.”

M/Y Charley 1 – 50-metre composite catamaran yacht support/adventure yacht, from Echo Yachts.

M/Y Charley 1 – 50-metre composite catamaran yacht support/adventure yacht, from Echo Yachts.

A trimaran rolls around a single longitudinal centre point like a monohull, providing stability and efficiency similar to a catamaran with the aesthetic appeal and motion similar to a traditional monohull, combining the best of both worlds.

segments of speed-to-length ratio where wavemaking drag dominates (moderate to higher speeds), the multihull will therefore be at an advantage, while in areas where frictional drag is dominant (low and very high speed) multihulls have a higher drag than a monohull. Multihulls also dsiplay wave interference effects from the component hulls, varying in effects on drag. But these effects tend to only be pronounced at lower speeds and heavier displacements.

They are also typically constructed from lighter materials such as aluminium, which reduces submerged hull area, minimising wetted surface area, and further reducing hydrodynamic drag and fuel consumption. For instance, compare a 92-metre monohull to Echo Yachts’ 84-metre White Rabbit Despite having a similar gross tonnage, the monohull requires 7.2mW of power to achieve a top speed of 19 knots. In contrast, White Rabbit needs only 4.2mW to reach 18.7 knots – towards a 40 per cent reduction of installed engine powering requirement, according to Echo Yachts’ sales and marketing manager Chris Blackwell. When considering that the industry has spoken extensively about its aspirations to decarbonise and adopt more environmentally friendly practices, multihulls present a compelling option.

“If everyone in the industry genuinely wants to make a really big dent in CO2 emissions and make yachts more environmentally friendly, while simultaneously lowering your fuel costs, catamarans and, moreover, trimarans are the way to go,” says Blackwell.

“We’ve made these boats more efficient from existing technologies. If the industry were to then integrate emerging solutions like hydrogen fuel cells and diesel-electric propulsion systems into our platform, it could enhance efficiency even further, beyond the 40 per cent benchmark.”

The stability of catamarans is often cited as a core factor in their appeal. With a monohull, whether you’re powering along or at anchor, there’s a distinct roll characteristic from port to starboard.

It’s a longitudinal motion that rolls back and forth. “However, with a catamaran, the motion is different. It’s a slightly more noticeable motion, shifting weight from one hull to the other,” says Blackwell. “While this is less noticeable when the catamaran is moving, it can be slightly more pronounced when anchored.”

Here is where trimarans offer a distinct advantage. As a stabilised monohull, a trimaran rolls around a single longitudinal centre point like a monohull, providing stability and efficiency similar to a catamaran with the aesthetic appeal and motion similar to a traditional monohull, combining the best of both worlds.

Looking to execute its multihull expertise, Lateral Naval Architects has unveiled Spear, an ambitious 140-metre trimaran project that aims to combine comfort, expansive open spaces and enhanced hydrodynamic efficiency and stability. By design, the relatively small sponsons contribute to a platform that needs little support from active stabilisation. The stabilised monohull concept introduces more advantages by also offering a spacious platform, with a 40 per cent increase in highly sought-after external space while keeping the internal area similar to a 110-metre monohull.

This lesson in stability is one best learned from the support-yacht sector. With the industry evolving, Robert Smith, CEO of SHADOWCAT, says there has been a notable shift towards clients buying smaller vessels and purchasing a shadow yacht to carry its tenders, with owners less willing to invest in a 100-metre yacht with its hefty operational expenses.

He adds, “This trend mirrors what we’ve observed in the support-vessel sector, where we’ve been involved for over 15 years. Building a 70-metre vessel allows access to the best ports and offers flexibility in terms of operations. If you look at what we did with Hodor, that was all about launching and recovering large tenders and heavy weights.

“It is so stable and has a much higher metacentric height [GM] than a mono hull, so it can handle the