AFFORDABLE HOUSING MAGAZINE TEXAS

We have extensive experience in affordable housing development. We represent for-profit developers, non-profit developers and public housing authorities utilizing a variety of financing techniques, including low income housing tax credits, CDBG Disaster Recover y Funding, private activity bonds, historic tax credits, HUD programs (including RAD and CNI), investment syndications and conventional financing.

Our attorneys routinely structure complex transactions providing comprehensive solutions that utilize all aspects of financing in the affordable housing arena.

We are focused on the development of affordable housing and inner city revitalization.

Beyond providing financial solutions, BOK Financial’s team of community development professionals and financial services experts are committed to positively impacting the communities we serve.

With more than 30 years of experience, our community development team understands the unique needs and challenges of affordable housing – and we know it’s worth it.

HOW WE CAN HELP

Construction, permanent and bridge financing

Small business financing

Tax credit investments

Not-for-profit lending

Title VI lending

Our ‘Outstanding’ CRA rating for Community Reinvestment Act activities reflects one of our company’s core values: to advance the communities we serve.

Let’s partner together to achieve one common goal: making our community a better place.

Connect with our Community Development team

Delivering on our commitment to preserve affordability for more than 1,500 households in Texas... and counting.

Extending rent restrictions for another 30+ years.

Alexander Beaumariage alexander_s_beaumariage@keybank.com 214-540-9129

Rob Likes robert_l_likes@keybank.com 801-297-5811 Jeff Rodman jeffrey_s_rodman@keybank.com 214-414-2573

24

12 24 16 34 18 42 20 68 50 58 70

Building Sustainable Communities & Breaking the Cycle of Poverty with Mixed Income Affordable Housing

ELAINE ACKER, FOR TAAHP

It's a Race We're Losing: The Case for Protecting Existing Affordable Housing While Expanding New Supply

ELAINE ACKER, FOR TAAHP

Navigating Headwinds: Exploring Solutions to Address Texas' Affordable Housing Crisis

ZACHARY CAVENDER, PENNROSE

Affordable Housing Dealbreaker: The Imminent Threat of Rising Insurance Costs

ELAINE ACKER, FOR TAAHP

The Essential Role of Property Tax Exemptions: One of Only a Few Tools Available in Texas to Develop Affordable Housing

President's Message

NATHAN KELLEY, TAAHP PRESIDENT

Contributors

ARTICLES & ADVERTISERS

A Message from TAAHP

ROGER ARRIAGA, EXECUTIVE DIRECTOR

TAAHP Leadership

BOARD OF DIRECTORS

A Message from Leadership

MEGHAN CANO, TAAHP GOVERNMENT AFFAIRS

COMMITTEE CHAIR / TAAHP PRESIDENT-ELECT

50 70 58 89

Texas' 89th Legislative Session: Where the Dust Settled

WHITNEY PARRA-GUTI É RREZ, TAAHP POLICY & REGULATORY MANAGER

Affordable Housing Success Stories SPOTLIGHT ON AFFORDABLE HOUSING COMMUNITIES

ICON Builders has been an industry leader for over 30 years in occupied affordable housing renovation, having renovated over 25,000 units under the leadership of Founder and CEO, Kelly Sands. Our expertise in navigating the complexities of HUD, ADA, and other government regulations sets us apart, enabling us to deliver exceptional results on time and within budget.

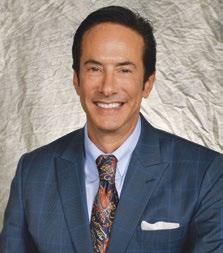

Serving as the TAAHP’s 20242025 President has been an incredible honor. As my tenure comes to a close, I want to take this opportunity to reflect on the past year and express my deepest gratitude to all who have been there to support the organization and its efforts. I am profoundly proud of all that we have accomplished together as a community of professionals united by a shared mission: ensuring access to quality, affordable housing for Texans.

This year has been marked by both challenges and significant progress. We’ve continued to navigate an ever-changing economic and regulatory landscape, yet through it all, the resilience and dedication of our membership has never wavered. I have been consistently inspired by your commitment to creating and preserving affordable housing across the state—work that is both essential and life-changing for countless families.

TAAHP 2024-2025 President

One of our most important achievements this year was the continued strengthening of TAAHP’s advocacy efforts. Together, we successfully engaged with state legislators and key stakeholders to protect and improve programs vital to the affordable housing industry. Our coordinated advocacy played a critical role during the 89th legislative session, and your participation, whether through testimony, meetings, or grassroots support, was instrumental in ensuring our voice was heard. I can’t thank the members of our Government Affairs Committee led by Meghan Cano, our lobby teams including Leticia Van de Putte, Jim Keffer, Colette Vallot, Carl Richie and Buffy Crownover as well as our partners at the Texas Association of Local Housing Finance Agencies (TALHFA), Rural Rental Housing Association (RRHA), Texas Association of Builders (TAB), Texas Apartment Association (TAA) and the Texas Chapter of National Association of Housing and Redevelopment Officials (TXNAHRO) enough for their work and partnership these last few months. Equally impactful was the work of the Qualified Allocation Plan (QAP) Committee. The QAP remains one of the most influential tools shaping the allocation of housing tax credits in Texas, and the Committee’s thoughtful, strategic engagement with the Texas Department of Housing and Community Affairs (TDHCA) has had

a real and lasting effect. Through extensive collaboration, data-driven feedback, and countless hours of discussion and drafting, the QAP Committee played a vital role in ensuring that the policy framework guiding affordable housing development in Texas remains responsive to the needs of communities across our state. I want to extend my heartfelt thanks to the QAP Committee leadership, Kathryn Saar and Karsten Lowe, and all its members for their tireless work and exceptional expertise. TAAHP continued to expand our educational initiatives, offering new webinars topics, our first ever legislative town hall, and has worked to grow the impact of our annual conference, all of which helped keep our members informed, connected, and better equipped to meet the evolving needs of our industry. The quality of these programs speaks to the expertise and professionalism that define our organization. I want to thank Darren Smith, Blair Henderson and the members of the Education Committee as well as Ellie Fanning and Nick Walsh and the members of the Conference Committee and all who contributed to these efforts for going above and beyond in providing meaningful content that adds real value to our membership.

Our members are doing truly remarkable work in communities, large and small, throughout Texas. From rural developments in underserved areas to urban revitalization projects, our members have demonstrated innovation, integrity, and impact. Whether you are a developer, lender, investor, attorney, consultant, or service provider, your work has created more than just buildings; it has created homes, opportunities, and hope.

I also want to extend a special thank you to our Executive Director and TAAHP staff. Their tireless behind-the-scenes efforts have ensured our association runs smoothly and continues to grow in influence and effectiveness. Their professionalism and passion are key to everything we do. As I transition out of this role, I do so with immense confidence in the future of TAAHP. Our organization is strong, our mission is clear, and our members are among the most dedicated and capable professionals I have ever known. Thank you for the opportunity to serve and for the work you do every day.

For more than 40 years, we’ve worked toward one mission: to make home and community places of pride, power and belonging.

Reagan Maechling

Vice President, Acquisitions

Enterprise Housing Credit Investments rmaechling@enterprisecommunity.com 213.787.8238

Philip Porter

Senior Vice President and Head of Acquisitions Enterprise Housing Credit Investments pporter@enterprisecommunity.com 410.772.2594

Scott Greenfield

Sr. Director, Originations Enterprise Real Estate Equity sgreenfield@enterprisecommunity.com 503.553.5641

Lauren Byrne

Sr. Director, Originations Enterprise Real Estate Equity lbyrne@enterprisecommunity.com 212.284.7111

Jon Clarke

Vice President, Chief Lending Officer Enterprise Community Loan Fund jclarke@enterprisecommunity.org 206.223.4516

Ryan Fleming Senior Loan Officer Enterprise Community Loan Fund rfleming@enterprisecommunity.org 404.698.4614

Kevin Bowen

Executive Vice President BWE kevin.bowen@bwe.com 469.729.7681

Bob Morton Director of RHS Programs BWE bob.morton@bwe.com 219.380.5956

Cindy Hannon

Senior Vice President BWE cindy.hannon@bwe.com 678.892.3178

enterprisecommunity.org | bwe.com

Michael Furrow

Senior Vice President, Affordable Housing Investment Sales BWE michael.furrow@bwe.com 979.330.5944

John Roberts Vice President BWE john.roberts@bwe.com 469.729.7687

Dwayne George

Executive Vice President BWE dwayne.george@bwe.com 410.934.3608

Jim Gillespie

Executive Vice President BWE jim.gillespie@bwe.com 646.829.1157

Elaine Acker

MIXED INCOME AFFORDABLE HOUSING

IT'S A RACE WE'RE LOSING: THE CASE FOR PROTECTING EXISTING AFFORDABLE HOUSING WHILE EXPANDING NEW SUPPLY

AFFORDABLE HOUSING DEALBREAKER: THE IMMINENT THREAT OF RISING INSURANCE COSTS

Whitney Parra-Gutiérrez: 89TH LEGISLATIVE

SESSION: WHERE THE DUST SETTLED

Summer Greathouse & Levi Stoneking

THE ESSENTIAL ROLE OF PROPERTY TAX EXEMPTIONS

Zachary Cavendar: EXPLORING SOLUTIONS TO ADDRESS TEXAS' AFFORDABLE HOUSING CRISIS

AMTEX, Boston Financial, DMA Companies, Fort Worth Housing Solutions, Hunt Companies, NRP Group, O-SDA Industries, Overland Property Group, Palladium USA, Whitestone Construction

SPOTLIGHT: AFFORDABLE HOUSING COMMUNITY SUCCESS STORIES

SPECIAL THANKS TO

Thom Amdur, Thomas Dunbar, Megan Lasch, Nathan Kelley, Jeff Spicer, Erika Rich, Cody Campbell, Tim Leonhard

Published By

TEXAS AFFILIATION OF AFFORDABLE HOUSING PROVIDERS

2401 E 6th Street, Ste 3037, PMB 153 Austin, TX 78702 (512) 476-9901; www.taahp.org

Advertising, Sponsorship Sales

KRISTI SUTTERFIELD, CONFERENCE DIRECTOR kristi@taahp.org

Contributing Editors

Publisher ROGER ARRIAGA, EXECUTIVE DIRECTOR roger@taahp.org

Art Director / Design / Editor

NAOMI BLUDWORTH, DEPUTY EXECUTIVE DIRECTOR naomi@taahp.org

WHITNEY PARRA-GUTIERREZ, POLICY & REGULATORY MANAGER, whitney@taahp.org

AMANDA DOYLE-NICHOLLS, OPERATIONS MANAGER , amandadn@taahp.org

THERESA CLAIBORNE, EVENTS & EDUCATION MANAGER , theresa@taahp.org

EMILY LOE, DIGITAL MARKETING COORDINATOR , emily@taahp.org

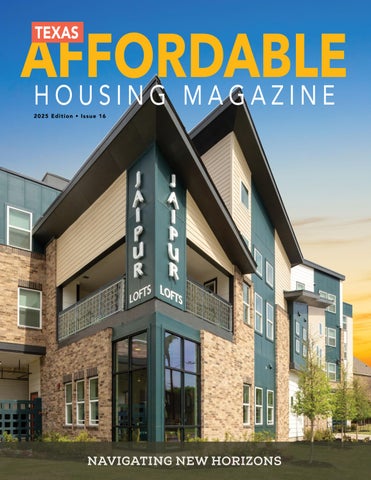

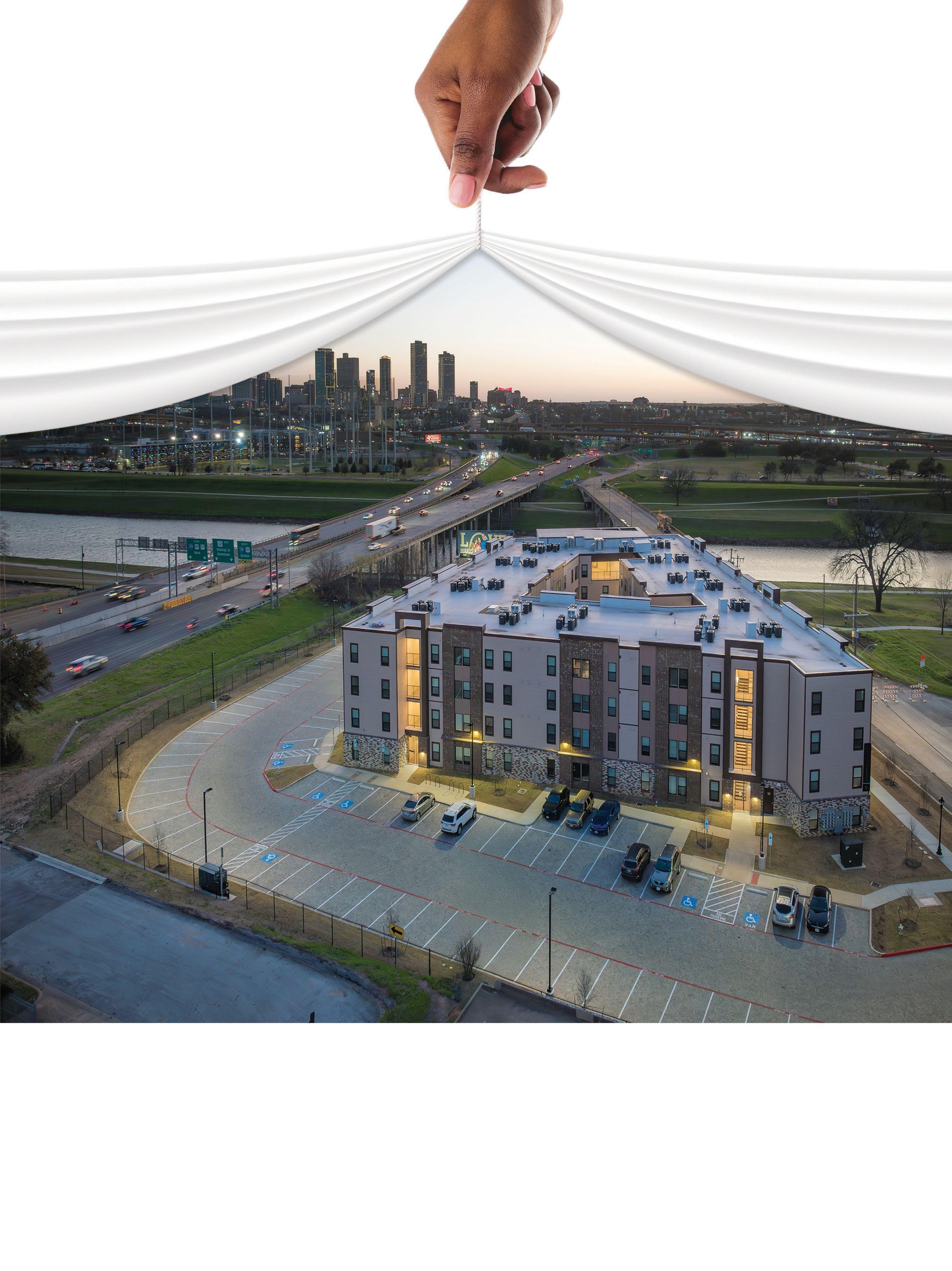

On the Cover: Jaipur Lofts — Photo Credit: Chad Davis

Although every attempt is made to be as comprehensive and accurate as possible, the Texas Affiliation of Affordable Housing Providers (TAAHP) and its affiliates are not responsible for any misprints, errors, omissions, deletions, or the accuracy of the information in the publication. TAAHP and its affiliates do not accept responsibility for any loss, injury or inconvenience sustained by anyone using this publication. Information may have changed since print date.

Copyright© 2025 by the Texas Affiliation of Affordable Housing Providers. All rights reserved. No part of this publication may be reproduced or transmitted in any form, by any means, electronic, mechanical, photocopying or otherwise without the written permission of the Publisher. The Texas Housing Conference™ is a protected trademark.

RBC COMMUNITY INVESTMENTS is a leading syndicator of Low Income Housing Tax Credits, Workforce Housing Investments, Renewable Energy Tax Credits, Historic Tax Credits, and State Tax Credits. By creating well-structured investments, our team of experienced professionals craft equity solutions that help drive the successful development of affordable multifamily communities and renewable energy projects nationwide.

NATIONAL FOOTPRINT

$20.4B Equity Raised Nationally $2.3B in Texas

Originations and Syndications

■ Affordable Housing (LIHTC)

■ Workforce Housing

■ Renewable Energy (RETC)

■ State Tax Credits

■ Historic Tax Credits

■ New Markets Tax Credits

125 Tax Credit Funds Nationally 1,546 Properties Nationally 135 in Texas

RBC Community Investments raised more than $20.4 billion in tax credit equity across the nation since inception. RBC Municipal Finance team senior managed over $7.3 billion in single family and multifamily housing bonds in 2024.1 As one of the nation’s largest syndicators and bond underwriters, we are proud to support TAAHP and are grateful for their partnership in advocating for affordable housing throughout the State of Texas.

Dan Kierce

Managing Director

RBC Community Investments daniel.kierce@rbccm.com

139,919 Affordable Homes Nationally 19,092 in Texas

49 States, Washington D.C. & Puerto Rico

Helen Feinberg

Managing Director

Housing Finance Group – Bond Underwriting helen.feinberg@rbccm.com

Brent Hanlin Director

Housing Finance Group – Bond Underwriting brent.hanlin@rbccm.com

rbccm.com/communityinvestments.com | rbccm.com/housingfinancegroup

1. Bloomberg to 1/1/24 - 12/31/24. This advertisement

You mean a lot to us. Really. Every member, whether you’ve just joined or you’ve been with us a while, helps us make the argument for a growing industry and the growing demand for safe, quality, affordable housing in Texas. And as our membership increases, we are also growing our capacity to represent you.

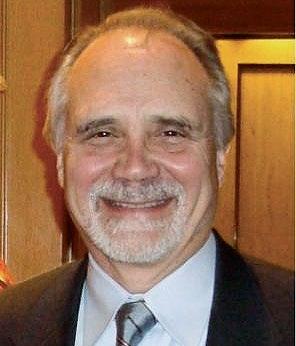

Whether we’re working to promote legislation at the Texas Capitol, speaking to city councils or county commissioners, educating members of Congress, or being interviewed by various media outlets, representing a growing membership base gets attention. Our policy makers have hundreds of special interest groups demanding their attention and time. So how do they decide what to advocate for? It’s in the numbers. We received some attention when I started with TAAHP four legislative sessions ago in 2019. Today, TAAHP is just shy of 800 members, and we received much more recognition and attention for our policy issues during the recently ended 89th Legislature.

Executive Director

One of the biggest ways for TAAHP to spread the message for affordable housing is by serving as a resource for statewide media. This year, we’ve engaged with a public relations firm to open channels of interest with the biggest media outlets in Texas. We’ve had numerous interviews and housing education sessions with the likes of the Texas Tribune, the Dallas Morning News, Ft. Worth Star-Telegram, the Houston Chronicle, Spectrum News, and ABC News Houston, among others.

Breaking News! Keep an eye out for TAAHP on the national stage too. This summer, TAAHP is partnering with PBS Television to produce a brief education segment on affordable housing that will be broadcasted nationally.

We are also excited to witness the remarkable growth of the Texas Housing Conference. With attendance now surpassing 2,000 participants, it has become the largest of its kind in the region, and rivals some of the most well-known national conferences in the industry.

As TAAHP continues to grow its presence in Washington and in Austin, our Local and Municipal Affairs (LAMA) Groups are coming together for education, advocacy, and some fun. We often hear from many of you about how great the conference is but would also like other opportunities to connect with your TAAHP family. Our LAMA groups in Austin, San Antonio, Houston, and Dallas/Ft. Worth are working to provide new opportunities to connect, learn, and extend TAAHP’s reach to impact local housing policy across the state. If you’re not already connected with your local LAMA group, take some time to get involved and make a difference with your local TAAHP members and represent the best of affordable housing providers in the cities where you live, work, and play!

To enhance our services and events, the TAAHP team is expanding to better support your needs. Please join me in welcoming our newest team members—Events Manager Theresa Claiborne and Digital Marketing Coordinator Emily Lowe. If you haven’t yet had the chance to meet our newest staff or our Deputy Executive Director Naomi Bludworth, Policy and Regulatory Manager Whitney Parra, and our Operations Manager, Amanda Doyle-Nicholls, I encourage you to connect with them. Their dedication and hard work have significantly contributed to our organization, our industry, and most importantly, to serving you.

TAAHP's continued growth reflects our unwavering commitment to advancing the affordable housing industry in Texas. With a thriving membership, expanding influence at state and national levels, and an increasingly active presence in local communities, we are better positioned than ever to advocate for the needs of our members and the communities they serve. Our expanding team, growing opportunities for engagement, and media efforts all serve to strengthen our collective voice. Together, we are making a meaningful difference—growing the tent and increasing our impact for the future of affordable housing across Texas.

Top Row, Left to Right: Nathan Kelley, President; Valerie Williams, Immediate Past President; Meghan Cano, President-Elect

Second Row, Left to Right: Quinn Gormley, First VP; Darren Smith, Second VP; Kathryn Saar, Secretary; Hector Zuniga, Treasurer

Bottom,

By Elaine Acker for the Texas Affiliation of Affordable Housing Providers

Texas has seen its share of booms—oil, tech, housing, and population—but the future depends on how we build communities where everyone can thrive. A strong economy needs more than just opportunity. It needs a place for everyone to call home. That’s where mixed-income developments step in, helping communities grow and prosper by offering housing that welcomes families across a wide range of incomes.

"The vast majority of the affordable housing communities that are built today are, by design, mixed income," explains TAAHP Executive Director Roger Arriaga. "They have a certain number of units that are for 30 to 80 percent of area median income (AMI), and now, we’re even seeing units reserved for families up to 120 percent AMI."

The reality is that many of the teachers, first responders, grocery store clerks, and small business employees who make communities work earn incomes in this range of AMI’s and are eligible for affordable housing programs. This isn’t because they’re failing, but because the cost of living keeps climbing. As Arriaga notes, “More people are now seen as program eligible simply because everything costs more.”

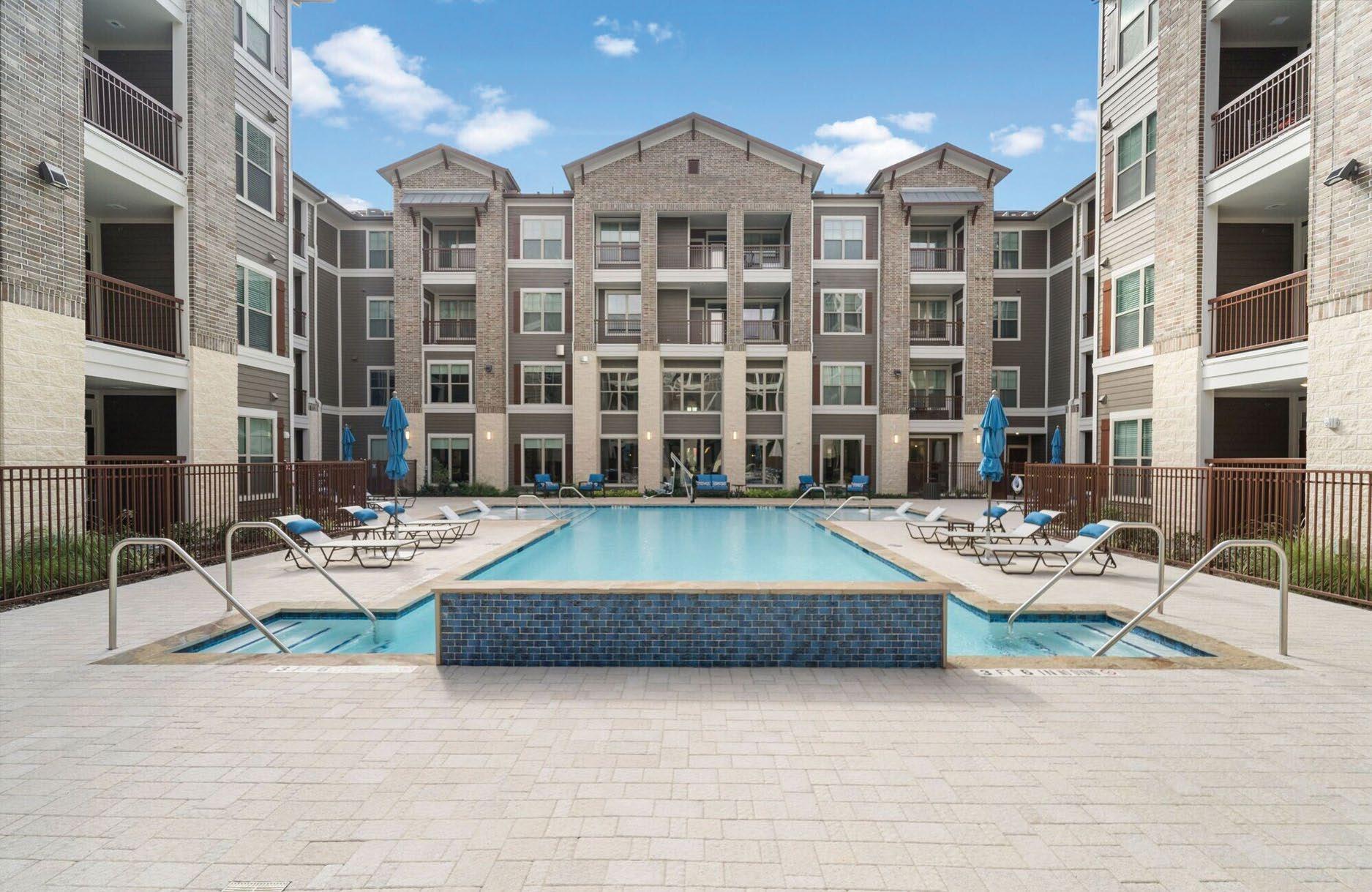

When people hear the term "affordable housing," old stereotypes often creep in: dilapidated buildings, crime-ridden properties, and absentee landlords. But that’s not the story of today’s mixed-income developments, especially with housing that has been awarded housing tax credits.

“These are high-quality developments,” says Arriaga. "They often have swimming pools, workout facilities, spaces for after-school care, and amenities you’d find in any other desirable community. It’s not just a place to live—it’s a place to live and thrive." And by design, they are built and maintained to serve the community while retaining a high market value for decades.

Developer Megan Lasch, founder of O-SDA Industries, echoes Arriaga. "People assume affordable means cheap in terms of quality, and it doesn’t," she says. "Our job is to integrate communities into neighborhoods where you wouldn’t even know you’re looking at affordable housing."

From architectural details to on-site services, today’s developments are thoughtfully planned. Residents benefit from community centers, green spaces, playgrounds, and programs designed to strengthen families and connect neighbors.

Mixed-income housing is built to serve a broad spectrum of residents, from diverse backgrounds and educational levels and who earn a broad range of household incomes. In places like Austin, 60 percent AMI is close to $70,000 a year. “That’s a lot of money,” says Arriaga. “And yet people don’t think of those earners as needing housing support—but they do.”

continued on next page...

One of the biggest misconceptions about affordable housing is that these developments are all exempt from property taxes. “I often hear arguments against affordable housing based on the idea that the community needs properties that contribute to the tax base,” says Lasch. “Yet, they’re looking at a development that would be generating tax revenue based on operating income. We could be paying a million dollars over the course of 10 or 15 years when we develop a raw piece of property that had been generating only $1,200 a year in taxes.”

In Grand Prairie, a formerly vacant property that generated less than $5,000 a year in taxes has been transformed into a vibrant senior living community. Thanks to smart partnerships and thoughtful planning, that same property will now contribute thousands of dollars in property taxes every year. “It made complete sense,” says Lasch. “Instead of sitting empty, that land now provides homes. And during construction, the development generated revenues from building permits, boosted local businesses, and strengthened the city's economy.” And once residnets move in, support the community through the buying of goods and services.

Meanwhile, in many rural communities, service workers now commute from over 50 miles away

because housing isn’t available, or affordable, where they work. For example, in Fredericksburg, the tourism boom and the popularity of the area’s wineries and breweries has inspired landlords (who once provided rental housing for local staff) to turn their properties into short-term rentals for visitors. The longer commutes for staff mean that local businesses who have trouble keeping good staff are now paying significantly higher wages just to attract employees.

This is a prime opportunity to explore mixed-income developments that create housing options that serve the people who power communities like Fredericksburg. “In a situation like this, you inevitably need some sort of government intervention,” says Arriaga. “Because that’s the only way to stop the cycle and give the local community a chance to build inventory of available housing to serve their own workforce.”

A big part of the shift happening in Texas is about changing the narrative. Poverty isn’t just about income—it’s about access and opportunity. Mixed-income communities place families next to neighbors with different life experiences, jobs, and resources. That kind of everyday exposure can help broaden what residents, especially children, believe is possible for their own futures. Viable affordable housing has less to do with providing basic housing options few would choose

When people grow up around peers who have more opportunities, they start to believe that those opportunities are possible for them, too.

and more to do with ensuring that families are not spending every dime on having a safe, high quality, desirable place to live.

Mixed-income real estate developers are providing more than housing and the idea of new opportunities. And there’s far more expected of them than most people realize. They are supporting many of the complex social services required to break that old cycle of "limited possibilities." These can include initiatives for childcare, after-school programs, services for seniors, and more. Even though this is outside the scope of most market-rate developers, there are expectations from lenders and policymakers that affordable housing developers will create environments where change can happen. They aren't just about housing—they are about changing lives.

Mixed-income developments don’t just benefit families. They elevate entire communities:

• Better Workforce Stability: Teachers, first responders, restaurant workers, and small business employees can live near where they work.

• Stronger Local Economies: Mixed-income housing strengthens the local tax base. Developments bring in new property taxes, boost local spending, and create jobs.

• More Resilient Communities: Affordable, high-quality housing reduces long commutes, lowers traffic congestion, and supports local businesses and schools.

continued on page 28...

Understanding Area Median Income (AMI) levels isn’t just a policy exercise. It’s important to stop and acknowledge the real humans served by affordable and mixed-income housing. This snapshot helps illustrate what AMI means in real life by connecting each income bracket to the jobs that keep our communities running.

2025 Texas Area Median Income (AMI) for a 2-person household: $79,200

30% AMI Up to $23,750 Rail Transportation Workers, Home Health and Personal Care Aides, Shampoo Assistants

50% AMI Up to $39,550 Fast Food Workers, Hairdressers, Child Care Workers, Dry Cleaning Workers, Tutors, Housekeepers, Ambulance Drivers, Pharmacy Aides

60% AMI Up to $47,460 Teachers, Exercise Trainers, Dental Assistants, School Bus Drivers, Marriage & Family Therapists,

80% AMI Up to $63,250 Auto Mechanics, Preschool & Daycare Administrators, Real Estate Agents, Electricians, Plumbers

100% AMI Up to $79,100 Librarians, Educational & Career Counselors, Police Officers

120% AMI Up to $94,920 Chiropractors, Registered Nurses, Dental Hygentists, Psychologists

It’s easy to look at percentages and income charts without fully seeing the faces behind the numbers. But these aren’t just figures. This data represents essential workers, service providers, and professionals who need safe, stable housing in the communities they support. Whether we’re talking about a barista, a child care worker, teacher or police officer, the challenge is the same: wages often fall far short of housing costs. Mixed-income developments are one way to help bridge that gap while addressing the wider concern as it relates to affordable housing: decentralizing poverty.

Texas continues to attract businesses and new residents, but without housing solutions that match the needs of the full workforce, growth can stall. Communities that embrace affordable housing, which includes availability for mixed-income families are better equipped to meet today’s challenges—and tomorrow’s opportunities. “Affordable housing developments are supporting local infrastructure, and bringing real economic benefit,” says Lasch. “They’re not a drain—they’re a community investment.”

The need for mixed-income affordable housing communities will only grow. Texas is projected to become the most populous state in the nation by 2045, with an increase from today’s 31 million to an anticipated 42 million or more. Housing developments built today will serve those residents, and housing affordability will remain one of the top challenges facing our cities and towns.

Without accessible housing options, the cost of living rises, essential workers leave, and businesses struggle to recruit and retain employees. That’s what’s called the doom loop cycle and it’s something no community can afford.

Sources: HUD's 2025 income limits for Texas.. U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics continued on page 30...

Training that supports your professional goals and your community’s needs.

Grow your skills, earn certification, and create real impact.

Grow America is proud to sponsor the 2025 Texas Housing Conference.

With

•

Without accessible housing options, the cost of living rises, essential workers leave, and businesses struggle to recruit and retain employees.

Mixed-income developments offer a practical and sustainable path forward for Texas. They are not solely about assisting individual residents but are fundamentally about building communities that work for everyone. By promoting inclusivity, these communities help ensure that growth remains balanced, equitable, and prepared for the future. When housing options cater to every stage of life and income level, the benefits extend beyond individual families—they strengthen the entire community and keep the Texas dream attainable for all.

Texas isn’t just a place where businesses can thrive—it should be a place where families succeed and thrive. Building mixed-income communities is not an added burden; instead, they become a catalyst for opportunity, resilience, and shared prosperity. These neighborhoods help foster social cohesion by encouraging interactions

among residents from diverse backgrounds, which in turn creates a more understanding and unified community. Additionally, mixed-income developments support local economies by bolstering small businesses and maintaining a broad range of services and retail options that all residents can enjoy. This diversity helps develop dynamic, vibrant neighborhoods that reflect the true fabric of Texas—varied and inclusive. As Arriaga notes, "Mixed-income communities are microcosms of healthy cities—they strengthen our society by making sure everyone—regardless of their job title or background—has a chance to contribute and succeed." Overall, these communities promote economic stability and long-term resilience, ensuring that all residents have the opportunity to participate in and benefit from the state’s ongoing growth and development. By investing in mixed-income housing, Texas can build a future where success is accessible to all, and communities are stronger and more vibrant than ever before.

By Elaine Acker for the Texas Affiliation of Affordable Housing Providers

In Texas, we talk a lot about the need for more affordable housing — and for good reason. But what if, even as we build new developments, we’re quietly losing more units accountable to stringent affordable housing restrictions than we’re adding? And what if some policies meant to help actually slow down the addition of overall supply?

When it comes to affordable housing, keeping our current stock of safe, high quality, affordable housing through preservation isn't a secondary issue. It’s a cornerstone of making sure we keep up with the demand from families moving to Texas and those Texans seeking housing where job opportunities are available. And right now, without changes, we’re caught in a frustrating one-step-forward, two-steps-back dance that’s costing families the homes they need.

The developers, nonprofit leaders, policymakers working hardest to solve this know this all too well. “We’re losing ground faster than we’re gaining it,” says Roger Arriaga, TAAHP executive director. “For every unit we create, we fall behind because of increased demand, insufficient resources and some obsolete regulatory barriers. While some of that loss is by design, most of it is because of lack of resources for rehab investment.” Additional units are lost once these long-standing developments have met their affordability requirement terms.

It’s time we tackle the real obstacles standing in the way and rethink the policies that are holding Texas back.

When multi-family developments are awarded housing tax credits, they come with a number of requirements to ensure not only that the communities are developed to the highest standards but also that rents are kept low and the families living there are served with a variety of services to assist them. One of the incentives for housing providers to participate in the tax credit program is that once developments are completed and placed into service, there is a long, but

limited, period of time that the development must remain affordable and subject to strict compliance guidelines. After that time is completed, the property owner may has the option to exit the program or to recapitalize the housing tax credits and extend the affordability requirements further. These decision points occur after the 15th year and again after the 30th year the community has been in the program.

Given that the tax credit program was initiated in 1986, the very first of these affordable developments reached the 30-year milestone in 2016. As each year progresses, these developments retain a high market value and more which reach this point are opting to leave the program after satisfying the agreed upon affordability periods.

Two-Mile Rule:

One of the biggest culprits? A powerful regulation called the Two-Mile Same Year Rule. Under current Texas law, no two affordable housing developments can be funded in the same year if they are located within two miles of each other, even if one of those developments is an existing property seeking funding for renovation.

Imagine you have an affordable housing community in downtown Austin that desperately needs rehab. They apply for 9-percent tax credits to preserve it. But then, a developer a mile away wants to build something new. Only one of those developments is eligible for a tax credit award that year. The other has to wait for another year.

In theory, the Two-Mile Rule was meant to prevent an overconcentration of poverty. In practice, it’s blocking exactly what we need most, both preserving what we already have and building new supply.

And in urban cities like Austin, Houston, Dallas, and San Antonio, two miles can cover enormous differences in neighborhood characteristics, business districts, and job opportunities. Those two miles in Austin

For every unit we create, we fall behind because of increased demand, insufficient resources and some obsolete regulatory barriers.

Roger Arriaga

TAAHP Excecutive Director

might take you from the Rainey historic district just east of downtown all the way over to Clarksville. And no one would argue those are the same neighborhood or that they have the same needs.

The impact is clear:

• Existing affordable communities deteriorate while waiting for preservation funds.

• New developments are delayed, slowing the creation of new homes.

• And the state keeps losing valuable housing stock faster than it can be replaced.

Put simply, the lack of affordable housing is directly related to limited funding. No high quality affordable housing can exist

without some level of subsidy from public sources. If there was sufficient funding, then preserving housing would not have to compete with creating new supply.

There’s a quiet ticking clock inside every affordable housing development: An expiration date.

“In Texas, the minimum affordability period under the tax credit program is 30 years, says Cody Campbell, director of multifamily programs at TDHCA. “But once a development reaches that point, it can transition to the private market unless we step in to preserve it.”

Preservation means recapturing, rehabbing, and extending affordability protec-

tions before they expire. “It’s far more efficient to preserve existing housing than it is to build new,” says Jeffrey Spicer, senior vice president and project partner at Dominium. “Once it’s built, you don't want to lose it.”

But the never-ending challenge? Resources.

Texas receives one “bucket” of 9-percent tax credits each year, and housing providers seeking to funding to make capital improvements to current properties and those seeking funding for new development must share the same pool.

“When you preserve a property,” says Campbell, “it necessarily takes resources away from doing a new deal. Balancing those priorities is tough when the need for both is so urgent.” And despite a 15 percent set-aside for properties at-risk of exiting the tax credit program, preserving aging developments often feels like a race against time and funding.

When older affordable properties aren’t preserved, the consequences ripple across communities:

• High-quality affordable units disappear, sometimes permanently.

• Families lose stable housing and have limited choices on where to live. They will revert to chasing rent specials every few months, which means uprooting children from schools and longer commutes to jobs.

• Cities lose diversity and workforce resilience, as middle-income workers are priced out.

“At the end of a property's affordability period, 30 or 40 years, developers have the right to transition it to market rate,” says Arriaga. “And after decades of keeping properties in good condition, some are located in newly gentrified areas where values have skyrocketed.” It’s a system designed to work that way, but it’s happening at a faster pace than many expected.

Due to economic conditions that limit the value of tax credits while having to absorb skyrocketing insurance rates and stubbornly high interest rates, new developments coming online today are often smaller than are needed. And every year we delay preservation efforts, the harder and more expensive it becomes to catch up. The long term risk is that working families will eventually be forced to live and work in other states where housing supply is more plentiful and costs are less expensive. Employers watch these trends and make growth decisions based on metrics such as the sufficient availability of affordable and workforce housing options.

The original intent behind the Two-Mile Rule was solid: prevent the concentrated pockets of poverty that plagued older models of affordable housing. This rule was put into state law in 2003. But the modern affordable housing landscape has changed dramatically since then.

"The public perception of affordable housing has shifted,” says Campbell. “The housing we’re building now is attractive, durable, and blends into the community. We're not concentrating poverty anymore."

continued on next page...

Today's affordable housing serves the people who keep our communities running: teachers, first responders, veterans, bus drivers, baristas, delivery drivers — everyday Texans who deserve a safe, affordable place to live. "Everyone wants their morning coffee or next-day deliveries," says Spicer. "But the people who make that possible need a place to live, too."

Despite these realities, the Two-Mile Rule continues to treat every development the same, ignoring the evolution in how, and for whom, affordable housing is built. Campbell notes that the rule technically only applies in counties with over one million people. But in urban areas, it still seems an imperfect fit.

Policies built decades ago for a different time can't keep pace with today's needs. If Texas truly wants to expand housing opportunities, we need smarter, more flexible rules that reflect what affordable housing really is — not what it used to be.

So how do we fix it? Here’s what industry leaders suggest:

Carve out an exemption for preservation developments from the Two-Mile Rule. Preservation shouldn't be penalized for proximity. And saving an existing community shouldn't block new supply.

Prioritize policies that promote BOTH preservation and new development. We need a true net gain, not trading one for the other.

Create additional funding streams for preservation. Right now, funding for preserving existing properites pulls from the same limited tax credit pool as new developments. Dedicated resources could ease the strain and save more properties. In the 88th Legislature, the first State Tax Credit program was authorized, but not sufficiently funded. This is one possible source of funding for these developments.

Reform local and state rules to reflect population density and urban context. For example, a two-mile

radius in downtown Austin spans areas on different sides of the city, each with distinct neighborhoods that could never be described as being in the same area and shouldn't be treated as such.

Continue reshaping public perception. Affordable housing isn’t what it used to be — and that’s something Texans can be proud of. “Affordable housing today is attractive, built to high standards, and essential,” says Campbell.

“We’re not just housing people. We’re strengthening communities.” Plus, those eligible for this housing go well beyond the lowest income households. Many certified and degreed professionals meet the income necessary to live in these high quality communities.

The good news is, awareness is growing, conversations are happening and TAAHP is working tirelessly to advocate for smarter policies.

The choice is clear: We can keep patching holes and fall further behind. Or embrace the idea that preservation and new development are not enemies and build momentum for the future.

Smith, Founder

Board Member 2022-Present

Based in the Dallas/Fort Worth Metroplex, Auxano Development specializes in creating "win-win" solutions that provide value-added services. With strong partnerships, Auxano has the capacity to develop across the U.S., focusing on connecting communities by collaborating with local stakeholders and providers. Our goal is to create sustainable, affordable, and workforce communities with the right mix of amenities and services. Learn more at auxanodevelopment.com

By Zachary Cavender, Regional Vice President at Pennrose

Affordable housing stands at a critical crossroads in Texas. While the state continues to attract new businesses and residents in droves with its economic opportunity, it simultaneously faces a staggering shortage of more than 650,000 affordable rental homes, according to the National Low Income Housing Coalition.

As developers, we’re increasingly caught in the perfect storm of rising property taxes, construction costs, and insurance premiums, combined with a complex regulatory framework – unfortunately hindering efforts to build the robust housing infrastructure essential for sustaining and capitalizing on Texas’s economic momentum.

While the challenges facing the real estate industry are significant, they are not insurmountable. Below, we explore key factors impeding affordable housing production and discuss solutions to help communities address the housing gap.

Texas maintains one of the nation's highest property tax rates, creating significant pressure on affordable housing development and operations. This high-tax environment directly impacts project feasibility, particularly for developers already managing complex capital stacks with extremely tight margins.

One solution to help reduce the property tax burden was the implementation of the Public Facility Corporation (PFC) structure, which granted multifamily developers a 100% property tax exemption in exchange for an affordability component in mixed-income developments.

Unfortunately, this widely used program became a hot button issue in 2023 due to concerns about misuse, ultimately resulting in major reforms. These reforms, enacted in the 88th Legislature through HB 2071, added stricter affordability and compliance requirements.

The program remains controversial with calls to curb abuses reaching a fever pitch. Most recently, Governor Abbott signed House Bill 21, which adds new constraints for “traveling” housing finance corporations that operate outside their local jurisdictions.

continued on next page...

A 2024 report by Novogradac found that Texas has the lowest LowIncome Housing Tax Credit (LIHTC) allocation per low-income home in the country.

It’s clear the PFC program needs improvement, reform, and clarification to safeguard its use. However, it’s important we don’t let political backlash and bad actors threaten one of the few mechanisms affordable developers have for delivering high-quality, mixed-income housing.

Private sector developers, state lawmakers, local municipalities, and housing advocates need to work collaboratively to advance statewide tax relief and incentive programs, while also refining and standardizing programs that have demonstrated success.

Today’s economic climate presents unprecedented challenges for residential real estate developers. At the macro level, high interest rates have dramatically increased borrowing costs and inflation continues to drive construction fees upwards. The volatile market is further compounded for the affordable housing industry with low pricing on tax credit equity requiring developers to increasingly rely on soft funding sources, which are limited and competitive.

At the micro level, insurance premiums in Texas have skyrocketed alongside the rise in climate-related natural disasters, rapidly outpacing rents. Projects also face significant risk as costs can escalate substantially between initial underwriting and construction completion, further complicating deal feasibility.

A 2024 report by Novogradac found that Texas has the lowest Low Income Housing Tax Credit (LIHTC) allocation per low-income home in the country. Expanding and implementing new gap financing tools across state and local levels is critical to getting deals across the finish line.

For example, as Texas rolls out its state LIHTC, we can follow the model from other successful states, such as Missouri, to ensure the program is effective and impactful. Additionally, exploring a state-backed collective for affordable housing insurance could help stabilize premiums, improve negotiating power, and mitigate risk.

Local developers face significant upfront costs navigating complex zoning processes. To even apply for

With more than a decade of affordable, multifamily, and mixed-use development experience, Zachary Cavender leads Pennrose’s development activities and oversees the continued growth of Pennrose’s development pipeline in the state of Texas.

tax-exempt bonds, developers must have the correct zoning in place – which can require heavy investment in architectural and engineering designs, site plans, traffic studies, fees, and more – all without any guarantee of approval.

This system makes affordable housing development risky, expensive, and inefficient, with more time and funds spent on consultants than on providing high-quality housing to our local communities.

It’s imperative we work hand-in-hand with local governments and finance agencies to identify a more streamlined approach. For example, Atlanta’s mayor recently announced the goal of building and preserving more than 20,000 affordable units over

the next several years. While lofty, this effort has been wildly successful so far because the local administration has taken significant steps to help expedite approval processes, reduce development timelines, and fast-track building permits.

One solution to consider is Senate Bill 840, which was recently sent to Governor Abbott. The bill would permit residential and mixed-income conversions on the sites of vacant office buildings, strip malls, and warehouses, while circumventing the lengthy and costly rezoning process.

Exploring thoughtful approaches to cutting some of the red tape can make a huge difference to ensure we aren’t losing meaningful development opportunities to bureaucracy.

The data is clear: Texas is growing. If we want to continue to reap the benefits as a business-friendly state with a high quality-of-life reputation, ensuring access to housing and reducing the rent burden for employees at all rungs of the income ladder is essential. The current shortage of affordable housing – both for low- and middle-income families – is not just a housing issue, it’s a social need and economic imperative.

Without addressing these challenges and the headwinds against developers, we risk stunting job growth and limiting economic prosperity across the state.

At the end of the day, there will always be factors impacting the housing landscape that are beyond our control. But what we can control is how we work collaboratively to implement innovative solutions. By addressing property tax burdens, identifying new financing tools, and reforming regulatory processes, we can make sure that thoughtful, streamlined housing solutions are possible within our communities.

About the Author As Regional Vice President of the region, Zach is responsible for the execution and continued growth of Pennrose’s development pipeline, including all aspects of the real estate development process from initial conception through construction, to lease-up and stabilized occupancy or sale.

By Elaine Acker for the Texas Affiliation of Affordable Housing Providers

"Today, outside of taxes, insurance is probably the number one pain point for affordable housing owners and developers."

Thomas Dunbar, Ross & Yerger Insurance

In Texas and across the nation, affordable housing developers and operators are facing a growing crisis, and it’s not just construction costs or workforce shortages. It’s insurance.

The cost of property and casualty insurance for affordable housing communities has climbed dramatically over the past five years, (over 300 percent in some cases, according to Yardi Matrix, a leading multifamily data provider) adding another layer of complexity to an already challenging mission. According to Thomas Dunbar, a shareholder at Ross & Yerger Insurance, it’s become one of the top threats to project viability:

“Ten or fifteen years ago, insurance was just another line item. Nobody lost sleep over it. Today, outside of taxes, insurance is probably the number one pain point for affordable housing owners and developers.”

Every Texan can relate, because we’re feeling it in expenses like home and auto coverage. These are things that once were a simple checkbox in the budget. Now, the costs are under the magnifying glass and causing plenty of sleepless nights.

When insurance costs spiral out of control, it threatens not just developments, but the sustainability of affordable housing programs statewide.

continued on next page...

The Perfect Storm: Why Costs Are Soaring

Why is insurance hitting so hard now? It's a perfect storm of challenges:

Natural Disasters

Texas has faced devastating freezes, hurricanes, hailstorms, and wildfires over the past few years.

Thom Amdur, Executive Director of Fairview Housing Partners and author of the paper: State and Local Policy Strategies to Address the Affordable Housing Insurance Crisis. “Texas is ground zero for many of these large disaster events. We’ve got floods, hail, tornadoes, and each one contributes to huge claims and pressures the entire insurance market.”

Skyrocketing Construction Costs

Building materials like lumber have become more expensive, driven by tariffs, supply chain disruptions, and labor shortages. “If it costs 50 percent more to rebuild a building than it did five years ago,” says Dunbar, “insurers are going to charge 50 percent more in premiums just to stay in line.”

Increased Litigation

Insurance carriers are also battling a rise in lawsuits, and that’s often amplified by third-party litigation

Source: Yardi Matrix, a leading multifamily data provider added an affordable housing component in 2024. Matrix tracks 26,000 fully affordable properties with 3.5 million units nationally.

funding, where outside investors fund plaintiff lawsuits in exchange for a share of settlements. These lawsuits drive up defense costs, raise settlement payouts, and push insurers to increase rates for everyone.

Today, even though there are thousands of property insurers nationwide, very few are willing to underwrite affordable housing projects, especially older or wood-framed properties.

“Most wood-framed affordable housing developments are seen as higher risk,” says Dunbar. And most affordable housing developments are wood framed. “Insurance carriers are being extremely selective, and they don’t have to fight for business right now."

Adding to the strain, some insurers are now declining to cover properties over 20 years old, regardless of their condition, making it even harder to secure insurance for long-standing affordable communities.

Rents in affordable properties are tied to local median incomes and program regulations. Developers are locked into rent caps designed to protect working families, and that’s a good thing. But it also means they have no real way to absorb these surging costs.

“Market-rate developers can offset an insurance increase by raising rents. Affordable housing owners can’t,” Dunbar explains. “They’re stuck absorbing the cost or cutting elsewhere.”

Worse still, insurance companies sometimes charge higher premiums simply because a property serves low-income tenants — a practice rooted in outdated assumptions about crime risk, despite today’s strong management standards and rigorous compliance standards for affordable communities.

The result? Maintenance budgets get slashed. Staff cuts follow. Services to residents — things like after-school programs, financial literacy classes, and mental health support — may have to be negotiated and reduced or eliminated.

And if insurance rates continue to spike, Amdur warns it could put properties into financial default, leading to foreclosure. “And when that happens,” he says, “affordability protections disappear. Entire communities lose critical affordable units.”

Once a property goes into foreclosure, affordability requirements tied to tax credits are stripped away. The property can be sold on the open market with no obligations to stay affordable, accelerating the loss of critical housing stock.

Imagine a small nonprofit that owns a 60-unit apartment complex for low-income seniors. When insurance costs rise by 50 percent, that nonprofit faces an impossible choice: skip roof repairs, raise resident fees (if allowed), or dip dangerously into reserves.

Multiply that scenario by hundreds of properties, and the stakes become painfully clear.

If this trend continues unchecked, here’s what affordable housing providers say we can expect:

New developments stall: Rising insurance premiums add millions in additional costs to new projects, making financing gaps harder to close.

Existing properties deteriorate: While most developments anticipate regular insurance increases, today’s cost increases are much higher — with no certainty increases will level out. Consequently, maintenance and vital repairs are often deferred, leading properties to fall into disrepair. This decline damages the perception of quality among developments in the tax credit program, making investors less willing to support future essential affordable housing supply.

Affordability protections vanish: Foreclosures and exits from affordability programs could eliminate thousands of units.

Communities feel the strain: Longer commutes for teachers, bus drivers, EMTs. Increased traffic, slower emergency response times, and lower quality of life.

continued on next page...

If you've got security cameras, locking doors, and good lighting, you shouldn't be at risk for a huge negligence suit.

Thomas Dunbar, Ross & Yerger Insurance

Affordable housing providers are further constrained by federal rules allowing only one rent adjustment per year, leaving them vulnerable when costs like insurance skyrocket midyear. Insurance isn’t just an expense line anymore. It’s a force that could reshape our communities if we aren’t proactive.

Strategies and Solutions

There’s no single solution, but affordable housing leaders and policy experts are rallying around several strategies:

Premises Liability Reform

One way to lower insurance costs is to reduce frivolous lawsuits. In 2023, Florida passed legislation limiting property owner liability if basic safety measures like security cameras, deadbolts, and lighting are in place.

Adopting similar reforms in Texas could help stabilize general liability premiums and make affordable housing more insurable. “If you’ve got security cameras, locking doors, and good lighting, you shouldn’t be at risk for a huge negligence suit,” says Dunbar.

Expand FAIR Plans FAIR (Fair Access to Insurance Requirements) plans are government-backed insurance programs for high-risk properties. Expanding these programs and raising their coverage limits to reflect today's construction costs could provide a much-needed backstop for affordable housing.

Colorado recently expanded their FAIR plan to allow up to $5 million in coverage for commercial properties, offering a model Texas could explore.

Promote Competition in the Insurance Market

Opening the door to more insurers willing to cover affordable housing is critical. The basic laws of supply and demand apply here. “We need more competition,” says Dunbar. “The fewer companies willing to write policies, the higher the costs.”

Offering incentives, lowering regulatory hurdles, and sharing risk through community-based catastrophe insurance programs could bring more carriers into the fold.

Invest in Resiliency Building stronger properties with better roofing, flood protection, and fire-resistant materials can reduce future claims. Government grants or tax credits could help developers afford these upgrades during construction or major renovations. "Investing in resilience today reduces the risk and the cost of claims tomorrow,” says Amdur. “It’s a win-win."

Push for Better Data There’s a massive gap in data around claims and losses specific to affordable housing. Without better data, policymakers are flying blind. States like New Jersey are starting to collect this information. Texas could do the same, giving leaders the facts they need to drive smart reforms.

At its core, affordable housing isn’t about units. It’s about Texans living in thriving communities. If rising insurance costs squeeze affordable housing out of the market, the impacts will ripple far beyond property developers. It will affect schools struggling to hire

teachers. Hospitals scrambling for nurses. Cities battling traffic congestion and labor shortages.

In Texas, where we pride ourselves on resilience, independence, and opportunity, we can’t afford to sit back and wait for things to change. “Protecting affordable housing is protecting the future of our communities,” says Amdur. “We have to be proactive. Not reactive.”

If you're a policymaker, business leader, or concerned citizen, now is the time to act:

• Support legislation that addresses premises liability, FAIR plan expansion, and insurance discrimination.

• Champion resilient building policies that reduce future risks.

• Partner with affordable housing developers to advocate for solutions that strengthen our communities.

The insurance crisis isn't merely a policy issue; it's a call to action. Now is the time to lead, take decisive action, and invest in Texas's future.

TAAHP offers various ways for members to stay informed and get involved. Members receive monthly e-mail newsletters with the latest industry news, policy updates, and events. TAAHP members interested in a more active role can join committees to help shape advocacy and industry initiatives. For more information, visit www.taahp.org

Tom Amdur, Senior Vice President, Policy & Impact,

#1 Total Originations

#1 Intermediary

#1 Originator for Banks

#1 Originator for Insurance Companies

#1 Originator for Debt Funds

#1 Originator for First Lien JLL Capital Markets 2024 MBA Rankings

#1 Originator for Seconds/Mezzanine/Preferred Equity

#1 Originator for Multifamily Total

#1 Originator for Multifamily Conventional

#1 Originator for Retail

#1 Originator for Industrial

$186B in global capital markets transactions during 2024

$2.1B

U.S. afforable housing volume in 2024

$46.4B

U.S. multi-housing volume in 2024

© 2025 Jones Lang Lasalle IP, Inc. All rights reserved.

• True Inverter experience that provides the ultimate in comfort for a

• 40% smaller, and 53% lighter than traditional cube style units.

• Environmentally friendly - Now available in R-32, using less refrigerant.

• Ultra quiet and best in class humidity control.

• Available in Air Conditioner, Heat Pump, and Dual Fuel (Hybrid) applications!

A custom utility allowance model can boost your property’s income and keep affordable housing costs fair. Plummer’s modeling process is simple. If there's no benefit, then there's no cost. That's our guarantee.

By Summer Greathouse and Levi Stoneking, Bracewell LLP

Texas stands at a pivotal juncture in its journey to address affordable housing. With rapid population growth, high construction costs and interest rates, stagnating or decreasing subsidy levels and evolving state and federal policies, stakeholders in the affordable housing industry face both unprecedented challenges and promising opportunity.

In this landscape, one policy tool has emerged as essential: the real estate tax exemption. Long viewed as a technical aspect of project finance, property tax exemptions have increasingly become the linchpin in making affordable housing transactions viable across the state.

As cities face mounting affordability pressures and housing providers seek new ways to make developments financially viable, understanding how real estate tax exemptions function—along with the benefits they provide, the people they serve, and the legislative framework behind them—is critical to the future of the industry.

In most major Texas markets, property taxes account for anywhere from 25 percent to 50 percent of a multifamily property’s operating expenses. For affordable housing developers, who are already restricted on the revenue side due to rent caps, tax burdens of this magnitude can easily make a project unviable.

The ability to eliminate or significantly reduce property taxes through exemption allows for:

• Lower rents without sacrificing financial feasibility or product quality/finishes

• Greater leverage and investor interest in low-income housing tax credit( LIHTC) and Public Facility Corporation (PFC)-backed deals

• Deeper income targeting, making communities accessible to lower-income households

• Longer affordability periods, since reduced operating costs improve long-term sustainability

For local governments and housing authorities, this trade-off—relinquishing property tax revenue in exchange for long-term affordable homes and ownership of a quality housing development by the local government at the end of the long-term lease—often represents good public policy, especially when paired with transparency and accountability measures.

Tax-exempt affordable housing helps stabilize vulnerable populations while fostering inclusive growth. The residents served by tax-exempt affordable housing transactions span a diverse range of Texans, including:

• Working families earning 30% to 80% of AMI: grocery clerks, school staff, warehouse workers, and home health aides—often priced out of the very cities where they work

• Seniors on fixed incomes who cannot keep up with rising rents in gentrifying areas

• Unhoused populations and people with disabilities or chronic health issues who benefit from supportive housing models

• Veterans and those at risk of homelessness who need permanent, service-enriched housing

The Legal Basis for Property Tax Exemptions in Texas

Texas law provides for various property tax exemptions that support the development and preservation of affordable housing. Chief among them are Texas Local Government Code Chapter 303 (public facility corporations (PFCs)), Chapter 394 (housing finance corporations (HFCs) and Chapter 392 (housing authorities (PHAs)).

Impactful in recent years, these statutes enable various local government entities to enter into public-private partnerships with housing providers, leveraging private sector capital and experience with public policy requirements. If structured correctly, the ownership of the property by the PFC, HFC or PHA makes the asset tax-exempt, as it is considered publicly owned for governmental purposes. In exchange, devel-

"In most major Texas markets, property taxes account for anywhere from 25 percent to 50 percent of a multifamily property’s operating expenses.

For affordable housing developers, who are already restricted on the revenue side due to rent caps, tax burdens of this magnitude can easily make a project unviable."

opers agree to rent and income restrictions—often ranging from 50% to 80% AMI—and other public benefits like increased accessibility, infrastructure improvements, fees payable to the public partner and design requirements.

Together, these legal mechanisms have formed the basis for a large percentage of the development and preservation of affordable housing units—the vast majority of which simply would not be feasible without the property tax relief provided by exemption.

The question of how tax exemptions are deployed—and who benefits from them—is deeply intertwined with broader issues of equity and public accountability. Critics have argued that some early PFC deals disproportionately benefitted developers without ensuring deep affordability or meaningful community input. Also, in recent years, there’s been special concern regarding so-called “traveling” HFCs and PFCs that have enabled exemptions for development far outside their sponsors’ jurisdictional boundaries. In response to these abuses, housing advocates and policymakers have pushed for more transparency, greater affordability and jurisdictional limitations, among other priorities, which has led to legislative and policy changes at both the state and local level.

While many Texas cities have developed their own frameworks for evaluating whether to approve transactions that would benefit from tax exemptions, the legislature has recently implemented statewide reforms that usurp local communities’ ability to determine an appropriate public benefit in exchange for the property tax exemption.

Effective as of June 18, 2023, introduced significant reforms to non-LIHTC PFC developments, aimed at increasing affordability and ensuring greater accountability and transparency:

• Enhanced Affordability Requirements for New Construction – at least 10 percent of units now must be affordable to households earning 60% AMI or less, in addition to 40 percent of units reserved for those earning up to 80% AMI.

• Rehabilitation and Acquisition Standards – for existing multifamily developments acquired by PFCs, a minimum of 15 percent of the property’s total acquisition cost must be invested in rehabilitation, provided that this requirement may be waived if 25 percent of units are set aside for households at or below 60% AMI, instead of the standard 10% at or below 60% AMI.

• Jurisdictional and Time Limitations – PFCs are now restricted to operating within the boundaries of their sponsoring entities and the length of the tax exemption is limited to 60 years on new construction and 30 years for acquisitions (each subject to extension).

• Transparency and Oversight – at least 30 days prior to approval, PFCs must notify local taxing authorities and post an underwriting assessment that evaluates the development’s affordability and financial feasibility. Additionally, if the PFC board is not comprised of a majority of elected officials, a development proposal must receive approval from the municipality or county where it’s located.

• Compliance Monitoring and Reporting – annual audits of PFC developments are now required to be submitted to the Texas Department of Housing and Community Affairs (TDHCA); failure to comply may result in a loss of property tax exemption.

• Taxes imposed by certain special districts such as municipal utility districts (MUDs) are no longer exempted for PFC multifamily projects.

The changes enacted by HB 2071 served to reform and increase public benefit to housing communities but does not completely halt the production of new

affordable housing, which has been viewed as a positive outcome in the industry by many.

Authored by Representative Gary Gates and signed into law by Governor Abbott on May 28, 2025, HB 21 took effect immediately and enacts significant changes to the operations of HFCs. Similar to HB 2071, it addresses jurisdictional limitations, audit requirements and heightened affordability standards. It also makes HFCs subject to open meetings and open

Critics of the recently passed House Bill 21 warned legislators that HB21's lack of grandfathering could have a chilling effect on production of affordable housing in the state and may adversely affect our state’s ability to sustain continued economic development and investment.

"Fannie Mae and Freddie Mac have already halted non-jurisdictional HFCs and paused lending on jurisdictional HFCs until more clarity emerges."

Tim Leonhard, Berkadia

records laws. By themselves, these changes would have curtailed the abuses of the HFC program that have been identified by the legislature and highlighted by the media.

However, HB 21 goes farther than HB 2071 by adding the requirement that developers of HFC-backed, non-LIHTC developments demonstrate rent reductions equal to at least 50 percent of tax savings, which is tested both prior to development approval and on an ongoing basis. The bill also requires payment of special district taxes (e.g., those correlating to MUDs and ESDs) in all future developments, including LIHTC. HB 21 also failed to fully grandfather existing HFC partnerships under the prior law, requiring existing developments to come into compliance with various provisions of the law, including deeper affordability and ongoing rent reduction tests to maintain the tax exemption. The specifics of these requirements are far more nuanced than can be explained here, but suffice it to say that HB 21 will drastically change the underwriting of many HFC

developments and keep developers and their advisers busy with a bevy of new compliance concerns. Critics of the bill warned legislators prior to its approval that HB 21, especially its lack of grandfathering, could have a chilling effect on production of affordable housing in the state and may adversely affect our state’s ability to sustain continued economic development and investment. HB 21 poses significant challenges for investors and lenders in Texas’ affordable housing industry by creating uncertainty around the true value of the HFC tax exemption, according to Tim Leonhard, senior managing director of affordable housing at Berkadia. “Fannie Mae and Freddie Mac have already halted all lending activities on non-jurisdictional HFCs and paused lending on jurisdictional HFCs under 394 until more clarity emerges,” says Leonhard. “Other lenders are following Fannie and Freddie’s lead. And while lending on new housing tax credit developments with jurisdictional HFC sponsorships continues for now, these developments won’t be able to generate the same loan proceeds as they

would have prior to HB21. This will cause even wider financing gaps for developers and will negatively impact the production and preservation of affordable housing in this state.” The full effects of this reform will become clearer as the industry attempts to navigate this and other myriad challenges of the post-pandemic economy.

As the affordable housing sector in Texas continues to evolve, real estate tax exemptions will remain a core component of financing strategy—but they must be wielded responsibly.

Key priorities for the road ahead include:

Educating Stakeholders and the Public Developers, elected officials, and community members all benefit from clear, accessible explanations of how exemptions work and the tradeoffs involved. Transparent storytelling can help build the consensus needed to sustain and expand these programs. Unfortunately, the narrative thus far has only included voices that focus on the shortcomings and not the benefits the majority of developments have produced for communities across the state

Maintaining Oversight Without Chilling Development

Policymakers must continue to strive to strike a balance between accountability and efficiency. Overly burdensome compliance could deter much-needed private sector participation, while lax standards and lack of good judgment around policy goals has and will continue to erode public trust.

Property tax exemptions have become a foundational element of how affordable housing gets built in Texas. When applied with care and oversight, they unlock critical public benefits: safe, stable homes for working families, seniors, and vulnerable Texans across the income spectrum.

"Policymakers

must find a balance between accountability and efficiency. Overly burdensome compliance could deter vital private sector participation, while lax standards risk eroding public trust."

Levi Stoneking, Associate Bracewell, LLP

As the state confronts a growing affordability crisis, expanding and refining the use of tax exemptions may well determine whether Texas can meet the housing needs of its rapidly changing population.

*Early-registraion pricing; recordings of live webinars are offered at standard pricing. Individual webinars and recordings can be purchased by members and non-members. Pricing is subject to change without notice.

Stifel is a global financial services firm providing investment banking, capital markets, and asset management services to corporations, financial sponsors, investors, instituitions, and governments. As a national leader in multifamily housing finance, we help our clients achieve strategic objectives through comprehensive investment banking services, in-depth housing sector knowledge, debt structuring, and trading expertise.

• Bonds secured by FHA-insured mortgages

• Essential function workforce housing

• Fannie Mae Tax-Exempt Bond Collateral (M.TEB) (forward and immediate delivery)

• Collateralized short-term multifamily housing bonds

• 501(c)(3) housing bonds

• S&P global ratings and Moody’s Investors Service unenhanced project finance-rated bonds

• USDA rural development pooled bond financings

• Agency and private label securitization

• Fannie Mae workforce housing taxable bonds

• Freddie Mac and Fannie Mae credit-enhanced bonds

Source: LSEG (Full to Book, Equal if Joint) negotiated Multi-Family Housing transactions ranked by number of issues. 2024 year-end numbers are as of January 24, 2025. National rankings are based on the number of negotiated transactions brought to market and closed from January 1 to December 31 for each respective year.

Dan Dill (425) 455-8122 dilld@stifel.com David Dill (425) 455-8122 daviddill@stifel.com

Mark Risch (303) 291-5370 rischm@stifel.com

Access to affordable housing remains one of Texas’ most urgent challenges. As the state’s population and employment opportunities grow rapidly, the need for affordable homes far exceeds current supply. TAAHP continues to lead as the voice for affordable housing in Texas, championing policies that empower our members to build safe, quality homes.

Over the last year, TAAHP’s Government Affairs and Legislative Advisory (GALA) Committee has continued to deepen engagement with policymakers and influential partners. These connections are critical to shaping the laws and regulations that influence our industry. Through property tours and community-based events, GALA offers lawmakers a meaningful, on-the-ground perspective of the positive impact affordable housing brings to communities across the state.

Government Affairs Committee Chair

these subcommittees with energy and purpose. Their efforts are shaping TAAHP’s priorities, which include potential reforms to the Housing Tax Credit program, property tax exemptions and appraisals, insurance affordability, and more.

In the coming months, TAAHP will continue to educate lawmakers and staff on the complexities of affordable housing. These interim engagements are critical for laying the groundwork for successful advocacy in 2027.

During the 89th Legislative Session, our priority was to increase efficiency by removing the obstacles hindering housing development. In response, GALA’s subcommittees have been actively engaged in creating strategic solutions and drafting robust legislative proposals aimed at overcoming these issues. Despite a very tough legislative landscape, TAAHP is pleased with many of this session’s outcomes. Whether it was the protections of the tax credit program in HB21, our success in passing SB2137/HB3753 on Education Quality, or our work in successfully reducing administrative burdens to development; TAAHP was an active participant in ensuring the production of quality affordable housing continues in Texas.

Special thanks to Kathryn Saar, Nick Walsh, Emily Abeln, Jason Arechiga and Alyssa Flores, and Avis Chaisson, who have led

TAAHP also deeply values its collaboration with key partner organizations: Texans for Reasonable Solutions (TRS), Texas Apartment Association (TAA), the Texas Association of Builders (TAB), Rural Rental Housing Association of Texas (RRHA), the Texas Association of Local Housing Finance Agencies (TALHFA), and the Texas chapter of the National Association of Housing and Redevelopment Officials (TXNAHRO). These partnerships enhance our collective impact and ensure our messages are aligned as we champion housing access together.

None of our work would be possible without the unwavering support of the TAAHP staff—Roger, Naomi, and Whitney—whose commitment and coordination keep our efforts running smoothly. We also extend sincere gratitude to our legislative consultants, Andrade-Van De Putte and Associates and Texas Lobby Strategies, for their guidance, strategy, and tireless work on behalf of affordable housing across the state.

As we approach this next legislative cycle, I am more confident than ever that TAAHP is positioned for meaningful progress. Thank you to our members for your ongoing engagement and passion. Together, we are creating a more affordable Texas for all.

Thank You to the GALA Committee Members

Emily Abeln, Brinshore Development, LLC

Christopher Akbari, ITEX Development, LLC

Dan Allgeier, Lakewood Property Management

Terri Anderson, Anderson Development & Construction, LLC

Bobby Bowling, Tropicana Building Corp.

Meghan Cano, CHR Partners

Zachary Cavender, Pennrose, LLC