Key Statutory Provisions

Issues in relation to issuance and adjudication of SCN

Emerging disputes and controversies

Drafting of reply to SCN – Key considerations

Key Statutory Provisions

Issues in relation to issuance and adjudication of SCN

Emerging disputes and controversies

Drafting of reply to SCN – Key considerations

• GST is a self assessment tax regime

• Where the proper officer is of the opinion that – the person has failed to correctly assess and deposit the tax to be paid or where input tax credit has been wrongly availed or utilised or tax has been erroneously refunded etc.

he may proceed to determine the tax, interest and penalty payable by such person. In order to do so,

the proper officer is required to issue a Show Cause Notice

Show Cause Notice U/s 73 (Bonafide cases)

• Bonafide cases – Where tax is not paid or short paid or erroneously refunded or ITC wrongly availed or utilised due to genuine mistakes

• Implications –

It can cover only normal period of limitation

No penalty which is meant to be invoked under malafide cases can be invoked under section 73

Notices

Show Cause Notice U/s 74 (Malafide cases)

• Malafide cases – Where tax is not paid or short paid or erroneously refunded or ITC wrongly availed or utilised due to a reason of ‘Fraud’, ‘Wilful misstatement’ or ‘Suppression of facts

• Notable aspects -

Intention to evade tax

Burden of proof on revenue

• Implications –

It can cover both normal and extended period of limitation

It provides for penalty leviable in case of malafide defaults

Procedure for issuance of SCN (Common for Section 73 and 74)

Pre SCN stage

•Pre SCN consultation: Part A of Form DRC-01A. Optional effective 15-10-2020

•Demand accepted: Payment of tax via DRC 03

•Intimation: Acknowledgement of payment to be issued in DRC 04

•Closure of proceedings: No SCN

SCN stage

•Issue of SCN under Section 73/74

•Service of SCN to the assessee

Post SCN stage

•Basic checks:

•SCN is issued within time

•SCN is issued by proper officer

•SCN is served via valid modes

•Objections: to be filed in Part B of form DRC 01A

•Opportunity: When sought or negative order is contemplated

•Order: to be passed after considering the submissions made

Show Cause Notice U/s 129 (Movement of goods)

• The CGST Act provides that where it appears to the proper officer that any person: transports any goods, or stores any goods while they are in transit in contravention to the provision of the said Act – all such goods and conveyance used as a means of transport for carrying such goods and documents related thereto shall be detained and seized

Synopsis of SCN issued under different sections

SCN – Sec 73

•Basis of issue – Genuine or Bonafide mistakes

SCN – Sec 74

•Basis of issue – Malafide mistakes (Fraud, misrepresentation or suppression of facts)

SCN – Sec 129

•Time limit for issue of SCN – 2 years and 9 months from due date of filing annual return

•Time limit for issuance of order – 3 years from due date of filing of annual return

•Time limit for issue of SCN – 4 years and 6 months from due date of filing annual return

•Time limit for issuance of order – 5 years from due date of filing of annual return

•Basis of issue – Non compliance of provisions during movement or storage of goods

•Time limit for issue of SCN – 7 days of detention of goods or conveyance

•Time limit for issuance of order – 7 days of issuance of SCN

•Penalty – Higher of 10% of tax or Rs. 10000/-

•Penalty– Higher of 100% of tax or Rs. 10000/-

For optimal distribution of work relating to the issuance of show cause notices and orders under Sections 73 and Section 74, monetary limits for different levels of officers of central tax has been prescribed by the CBIC vide Circular No. 31/05/2018-GST, Dated 09-02-2018

Sl.

Hand delivery to the assessee or his authorised representative holding a valid PoA

Section 169(1)

Registered post or Speed post or Courier at the last known place of business or residence

Section 169(2)

Section 169 (4)

Section 169 (3)

E-mail address as provided at the time of registration or as amended from time to time

Uploading at the common portal

• M/s ABC Ltd was issued an SCN by the Superintendent of Central GST for wrong availment of ITC as under:

• CGST – Rs. 12,00,000/-

• SGST – Rs. 12,00,000/-

• Is the SCN valid?

• No, it is not valid

• The maximum threshold limit for a Superintendent to issue an SCN is INR 10 lakhs. In the present case, the SCN covers a total demand of INR. 24,00,000/- which is beyond the jurisdiction of the Superintendent. Therefore, the said SCN can be challenged before the High Court through a Writ Petition

• The Allahabad High Court in Mansoori Enterprises vs Union of India [2024] 160 taxmann.com 261 (All.) has allowed the writ petition challenging the jurisdiction of the Superintendent based on the monetary limits

• M/s ABC Ltd paid the tax after the due date of payment of tax

• The SGST officer issued the SCN in form DRC 01 demanding interest for delay in payment of tax

• Is the SCN valid?

• No, it is not valid

• For recovery of only interest, the proper officer is required to issue an SCN in form DRC 07

• Rajkamal Builder Infrastructure (P.) Ltd. vs Union of India [2021] 127 taxmann.com 150 (Guj.)

- The Gujarat High Court has held that interest cannot be demanded by sending out a notice using Form GST DRC-01, for raising the demand of interest , Form GST DRC-07 is required to be issued for raising the demand of interest

• Proper officer issued SCN u/s 73 for FY 2017-18, 2018-19 and 2019-20 as a single SCN

• Is the SCN valid?

• Yes, it is valid

• GST law does not restrict issuance of SCN for multiple years as one SCN

• Section 73(4) of the CGST Act – Where SCN has been issued for one year on some grounds, a statement can be issued on same grounds for other years

Titan Company Ltd v. Joint Commissioner of GST & Central Excise [2024]

159 taxmann.com 162 (Mad.)

- Bunching of SCN for multiple years under section 73 is invalid where it exceed the individual limitation period of each year

• Goods belonging to M/s ABC Ltd were transported in the truck belonging to M/s XYZ Transporters Pvt. Ltd

• Truck was intercepted while en-route to customer’s location

• Goods were detained due to faulty documents

• SCN issued and handed over to the driver of the Truck

• No reply was filed within the prescribed timelines

• Consequently order was passed as ex-parte

• Whether the order is valid?

• No, it is not valid

• Ranchi Carrying Corporation vs State of UP [2021] 124 taxmann.com 294 (All.)

- It was held that that where the notice is served to the driver of the truck, the same is not considered to be served in terms of provisions of the GST Law as it is not covered in any of the modes of communication. Hence, the Order passed in pursuance of such notice is considered as a failure to serve natural justice

• M/s ABC Ltd was issued an SCN by the Superintendent of Central GST for wrong availment of ITC

• Reply to the SCN was filed within time. However, while filing the reply, M/s ABC Ltd failed to request for personal hearing

• The Superintendent passed the negative basis the submissions filed by the company

• Whether the order is valid?

• No, it is not valid

• Section 75(4) provides that a reasonable opportunity is required to be provided to the person chargeable to tax in the below cases:

Specific request is received from the person chargeable with tax or penalty

Adverse decision is contemplated against such person

• B.L Pahariya Medical Store v. State of UP [2023] 153 taxmann.com 659 (All.)

- It was held that the Assessing Authority was bound to afford the opportunity of a personal hearing to the petitioner before he may have passed an adverse assessment order

Assigned Authority

• Central officer as proper officer

• SGST officer as proper officer

Proceedings initiated

• SGST officer: No proceedings shall be initiated by the CGST officer on the same subject matter and vice versa

Powers to issue orders

• CGST order + SGST order + IGST order [Section 6 of SGST and Section 4 of IGST Act]

• CGST order + SGST order + IGST order [Section 6 of CGST and Section 4 of IGST Act]

Rectification, Appeal or Revision

• Any rectification, appeal or revision against an order passed by CGST officer shall not lie before the officer appointed under the SGST Act

Criteria for division of taxpayer between Centre and State

• The GST Council vide Circular No 01/2017 (F. No 166/Cross Empowerment/GSTC/2017) has provided the guidelines for division of taxpayers between Centre and State to ensure single interface under GST:

• M/s ABC Ltd was assigned to State authority

• SGST officer issued a SCN for FY 2018-19 for wrong availment of ITC on certain items

• The proceedings before the SGST officer are underway

• Can CGST officer also issue an SCN for FY 2018-19 to deny ITC on restricted items

• No

• Since the proceedings are already initiated by the State GST authorities, Central GST authorities are not permitted to initiate in-parallel proceedings on the similar issue

• The Patna High Court has held that where the central tax authority had already initiated the proceedings, separate proceedings initiated by the State tax authority subsequently for the same assessment year should be kept in abeyance [Baibhaw Construction (P.) Ltd. vs Union of India [2023] 156 taxmann.com 378 (Patna)]

Whether SGST officer a proper officer to pass IGST order

• M/s ABC Ltd was assigned to State authority

• A SCN for FY 2018-19 was issued for wrong availment of ITC on certain items and short payment of GST on inter-state transaction

• Hence the demand involves:

• CGST + SGST on wrong availment of ITC

• IGST on inter-state transaction

• Whether SGST officer can pass an order under the CGST Act and IGST Act for recovery of GST short paid or ITC wrongly availed

• Yes

• The designated SGST authority is empowered to pass an order under CGST and IGST Act

• Bright Road Logistics vs State of Haryana [2023] 153 taxmann.com 353 (Punj. & Har.)

• The Punjab and Haryana High Court has held that cross-empowerment means that State Authorities empowered under State GST Act can also enforce provisions of CGST Act or IGST Act.

• M/s ABC Ltd was assigned to State authority

• SGST officer issued a SCN for FY 2018-19 for wrong availment of ITC on certain items

• The proceedings before the SGST officer are underway

• Can CGST officer also issue an SCN for FY 2018-19 for illegal claim of refunds

• Yes

• Section 6 does not prohibit separate investigations on the different subject matter if initiated by different authorities

• The Bombay High Court has held that section 6(2)(b) of the MGST Act would not apply to bar CGST proceedings where the subject matter is different [Yash Alloys India vs Union of India [2023] 155 taxmann.com 594 (Bom.)

In- Parallel proceedings by SGST and CGST officers against different entities whether permissible

• Maharashtra CGST authorities initiated investigation proceedings against M/s ABC Ltd on denial of ITC on select items

• Patna SGST authorities initiated investigation proceedings against M/s XYZ Ltd on denial of ITC on same items

• Summons issued to Mr ‘A’ to appear as a witness on same issue

Whether summons issued to Mr A are valid or an argument can be taken that on same issue separate proceedings by CGST and SGST authorities cannot be initiated?

• Summons are valid

• Mr. A is required to appear before both the authorities

• Neeraj Jain vs Union of India [2023] 156 taxmann.com 328 (Patna)

• The Patna High Court has held that Section 6 does not prohibit separate investigations on the same subject matter if initiated by different authorities against two separate entities

Investigation proceedings by Central authority

• M/s ABC Ltd is assigned to State authority

• Central GST authority (DGGI) initiated investigation proceedings

• Is the DGGI proceedings valid?

• Yes, it is valid

• The CBIC vide letter no CBIC 20/10/07/2019-GST dated 22-06-2020 has clarified that section 6(1) of the CGST Act empowers officers appointed by Central Government as ‘proper officers’ under SGST Act subject to the prescribed conditions

• DOF No. CBEC/20/43/01/2017-GST dated 5-10-2018

- It is provided that though the taxable persons are bifurcated between Central and State authorities for administration purposes both the Central and State tax authorities are authorised to initiate intelligence based enforcement against the taxpayer

Appeal against the order passed by SGST officer

• M/s ABC Ltd is assigned to SGST authority

• SGST officer passed an order under the IGST Act

• M/s ABC Ltd filed an appeal against the IGST order before the Joint Commissioner (Appeals) central

• Is the appeal so filed is valid or not?

• No, it is not valid

• M/s ABC Ltd is required to file an appeal before the State GST authority

• Metacube Business Ventures Pvt. Ltd, In re [2020] 40 GSTL 375 (Rajasthan)

- The Commissioner Appeals of Rajasthan has held that an appeal filed before the Appellate Authority under the CGST Act against the order passed under the SGST Act is not maintainable

- Such appeal would lie before the jurisdictional appellate authority appointed under the Rajasthan GST Act

• M/s ABC Ltd is a SEZ unit

• State GST authority conducted search in SEZ area

• Is the search proceedings valid?

• Yes, it is valid

• RHC Global Exports (P.) Ltd. vs Union of India [2023] 151 taxmann.com 134 (Guj.)

• The Gujarat High Court has held that GST authorities are empowered to investigate and conduct search operation in SEZ unit without preapproval or intimation as they are authorized under both SEZ Act and CGST Act

Denial of ITC on account of cancellation of registration certificate of the supplier

• Check registration status of the supplier from the Government portal. In many cases it is found that dealer is active

• A Purchasing dealer is entitled by law to rely upon the certificate of registration of the selling dealer and to act upon it.

Whatever, may be the effect of a retrospective cancellation upon the selling dealer, it can have no effect upon any person who has acted upon the strength of a registration certification when the registration was current – State of Maharashtra vs Suresh Trading Company [1998] taxmann.com 1747 (SC)

• ITC cannot be denied to a genuine buyer who with its due diligence has verified the genuineness and identify of the supplier as registered person from the Government portal. The buyer cannot be penalized if the supplier appears to be fake later on –LGW Industries Ltd vs Union of India [2022] 134 taxmann.com 42 (Cal.)

Denial of ITC due to mismatch between GSTR 3B and GSTR 2A

Period prior to October 09, 2019

• There was no requirement under the GST Law to avail ITC on the basis of GSTR 2A

• Bonafide purchaser cannot be put at jeopardy, when he has done all that the Law expects him to comply with. Since the said purchasing dealer has no means to ascertain and secure compliance provisions of the Law by the selling dealer. Thus, in such situations, it cannot be said that the Assessee has availed the ITC fraudulently – Karnataka High Court in Rajshree Impex S.T.R.P. NO.55 OF 2019, dated 28-6-2021

• CBIC Circular No 183/15/2022-GST: GSTR 2A should not be the basis for disallowance of ITC claimed by the taxpayer

Period effective October 09, 2019

• Circular No. 123/42/2019-GST : In order to determine the eligible ITC a registered person may refer to auto populated GSTR 2A as available on the due date of filing the Form GSTR 1. Use of the term ‘may’ suggests that it was still not made a mandatory requirement to take ITC only on the basis of the amounts appearing in the GSTR 2A

• GSTR2A is only a functionality and payment of tax in GSTR-3B is on self-assessment basis - Hon'ble Supreme Court in UOI vs. Bharti Airtel Ltd. [2021] 131 taxmann.com 319 (SC)

Detention of goods due to typographic error in E-way bill –Incorrect vehicle type. Rest details were correctly filled

• To invoke harsh penal consequences under section 129 and section 130 of the CGST Act, there must be a clear case of contravention of the provisions of this Act with the intention to evade payment of tax

• Presence of mens-rea is a perquisite to invoke provisions of section 129 and section 130 of the CGST Act

• Circular No 64/38/2018-GST: Para 5 of the Circular provide for token penalty in case of genuine mistakes. The circular specifically covers following aspects where proceedings under section 129 of the CGST Act cannot be initiated:

Where there are spelling mistakes in the name of the consignor or the consignee, but the GSTIN is correctly mentioned

Where there is error in the PIN code, however, the address of the consignor and the consignee mentioned is correct. Notably, the error in the PIN code should not have the effect of increasing the validity period of the e-way bill

Where there is error in the address of the consignee to the extent that the locality and other details of the consignee are correct

Where there is error in one or two digits of the document number mentioned in the e-way bill

Where there is Error in 4- or 6-digit level of HSN, however, the first 2 digits of HSN are correct and the rate of tax mentioned is correct

Where there is error in one or two digits/characters of the vehicle number

• Where E-Way Bill accompanied goods in transit and vehicle number was correctly mentioned therein, there could not be detention and seizure for mere wrong mentioning of vehicle type – Gujarat High Court in Dhabriya Polywood Ltd vs Union of India [2022] 141 taxmann.com 210 (Gujarat)

• The company recovers an amount by way of recovery of notice pay from such employees who leave the company without complying with the condition of the notice period as stipulated in the appointment letter

• SCN has been issued alleging that the Noticee being an employer has agreed to tolerate the situation of leaving the company by its employee, without complying with the condition of serving for notice period.

• Notice pay recovery is in relation to a service provided by the employee to the employer for which the employee gets a salary and such notice pay is recovered from the employee in terms of the employment contract

• Per Entry 1 of Schedule III, services by an employee during the course of employment are covered as one such activity which neither falls under the supply of goods nor supply of services for levy of GST

• Notice pay recovery can be linked to compensatory damages under Indian Contact Act 1872 (hereinafter ‘Contract Act’) as the recovery by the Noticee is in relation to non-performance of contractual obligation by employee

• No GST is leviable on any amount recovered/forfeited from employees on account of their leaving services without serving notice period/ resigning during probation period - Chhattisgarh Advance Ruling Authority (‘ARA’) in Re: Chhattisgarh Rajya Gramin Bank [2023] 149 taxmann.com 16 (AAR - CHHATTISGARH) , Maharashtra ARA in Re: Emcure Pharmaceuticals Ltd. [2022] 134 taxmann.com 74 (AAR - MAHARASHTRA), Madras High Court in GE T & D India

Limited vs. Dy. Commissioner of C.Ex. [2020] 115 taxmann.com 213 (Mad.)

• While filing reply to SCN on this issue, following factors to be kept in mind:

Advance ruling orders are specific to dealer sought the ruling

There are contrary ruling providing levy of GST on notice pay recovery

Denial of ITC on expenses incurred towards CSR

• The company incur CSR expenses as part of their responsibility towards the Society

Relevant for period prior to March 31, 2023

• SCNs have been issued to deny ITC on expenses towards CSR activities on the pretext that these are in the nature of social contribution, the same cannot be considered as activities in the course or furtherance of business of the company

• Apart from the voluntary social contribution and economic development, CSR expenses are mandatory under section 135 of the Companies Act, 2013

• Reliance can be placed on following jurisprudence:

Inclusive definition of 'business' covers any activity whether incidental or ancillary to any trade, commerce or manufacture to fall within the purview of business

The Hon'ble Supreme Court in the case of Malayalam Plantation Ltd. [(1964) AIR (1722)] has held that the expression 'for the purpose of the business' may include not only the day to day running of a business but also the rationalization of its administration and modernization of its machinery

Expenditure made towards CSR under section 135 of the Companies Act, 2013, is an expenditure made in the furtherance of the business - Advance Ruling issued by the State of Telangana in Re. Bambino Pasta Food Industries (P.) Ltd. [2022] 144 taxmann.com 207 (AAR- TELANGANA)], Advance Ruling issued by the State of Uttar Pradesh Dwarikesh Sugar Industries Ltd., In re [2021] 125 taxmann.com 329 (AAR - UTTAR PRADESH)

• While filing reply to SCN on this issue, following factors to be kept in mind:

Advance ruling orders are specific to dealer sought the ruling

There are contrary ruling denying ITC on CSR expenses

Denial of ITC on Motor Vehicles used for DEMO purpose

• The company engaged in sale or purchase of Motor Vehicle often purchases Demo cars for providing first hand experience about the features and test drive of the car to the prospective customers

• SCNs have been issued to deny ITC on Demo Cars purchased by the company on the pretext that ITC on motor vehicles is restricted in terms of Section 17(5)(a) of the Central Goods and Services Tax (‘CGST’) Act

BASIS OF REPLY

• Section 17(5)(a)(A) restricts ITC in respect of motor vehicle except when they are used for further supply of such motor vehicles

• The intention of the law, as it appears from the expression 'for further supply of such vehicles' is to allow ITC in respect of taxpayers dealing with motor vehicles as they are engaged in further supply of such motor vehicles. The expression 'such' as used in section 17(5)(a)(A) bears a wide connotation which does not put any restriction in respect of supply of Demo Vehicles

• Reliance can be placed on following Advance Ruling wherein the authority has allowed ITC on demo cars:

Toplink Motorcar (P.) Ltd., In re [2022] 140 taxmann.com 161 (AAR - WEST BENGAL)

Chowgule Industries (P.) Ltd., In re [2020] 113 taxmann.com 365 (AAR - MAHARASHTRA)

• While filing reply to SCN on this issue, following factors to be kept in mind:

Advance ruling orders are specific to dealer sought the ruling

There are contrary ruling denying ITC on demo cars which authorities can rely

• Employees of foreign entity are seconded to Indian entity for limited duration or specific project

• Recently, the Hon’ble SC in C.C.,C.E. & S.T. Bangalore v. Northern Operating Systems (P.) Ltd. [2022] 138 taxmann.com 359 (SC) has held that secondment of employees is construed as import of service and liable to service tax under reverse charge mechanism

• Post this ruling, the authorities are issuing notices to companies demanding GST on salary reimbursements

• The CBIC has issued a instruction vide No 5/2023 which provides:

The ruling of SC in Northern Operating should be applied mechanically

The nature of activities and the facts should be critically examined while demanding GST

01

Document the complete facts

02

05 04

03

Address all the issues raised in the SCN point wise

Reply should be crisp and to the point

Quote the judgments which are relevant to the matter and preferably of higher forum

Do not use the words which are harsh. Prayer clause to be meticulously drafted. Clearly mention all prayers (like personal hearing)

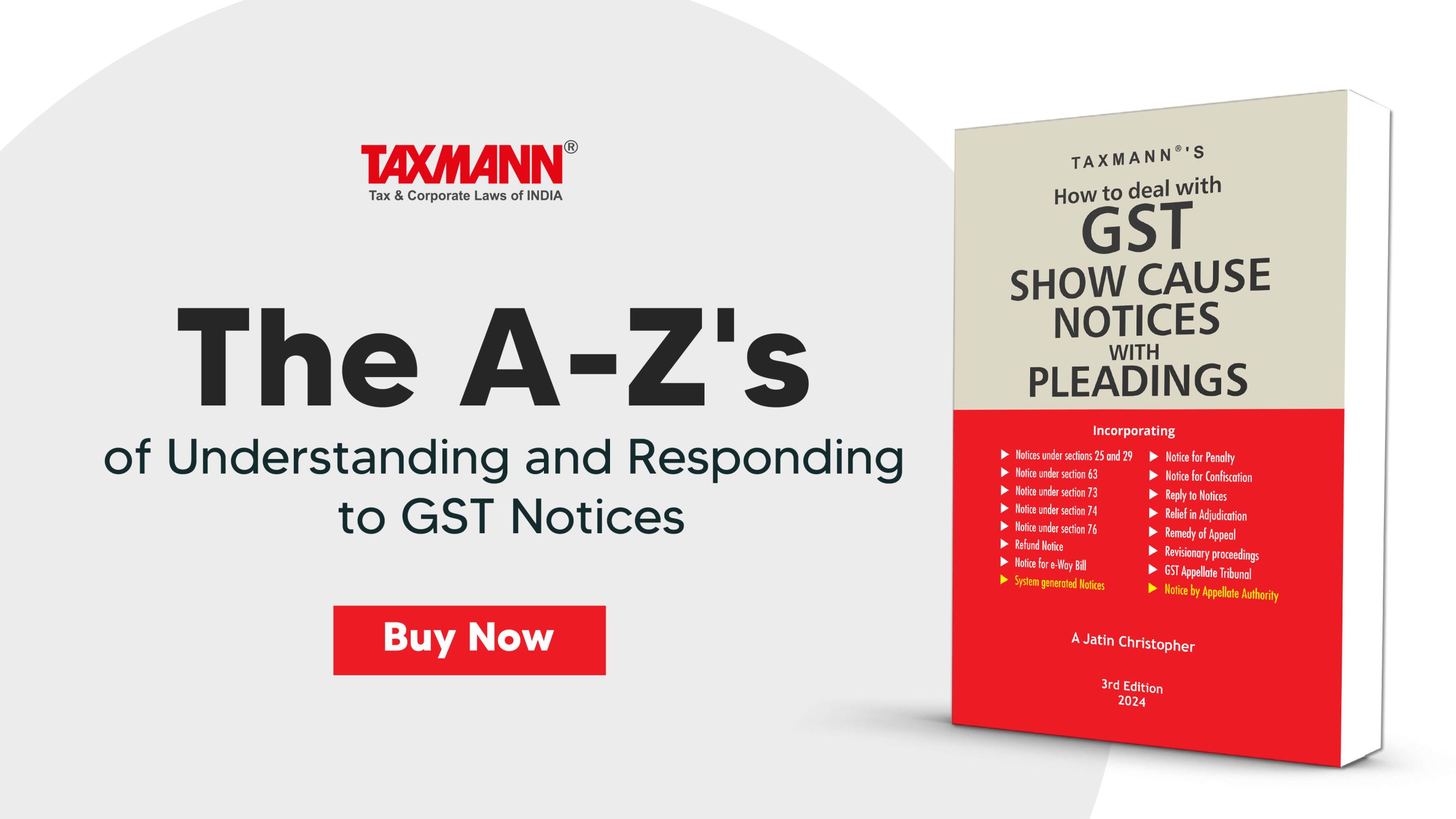

Sample Formats

Sample 1:

Denial of ITC on Raw Material when the Finished Goods are lost or Destroyed

Sample 2: Denial of ITC on Hiring of Buses used for transportation of employees

Sample 3: No need for separate GST registration in case of import and sale of goods are from two different States

Other formats

You can access to 100+ GST and Direct tax submissions formats by subscribing to our Taxmann Practice Module