© All rights reserved

Price : ` 695

First Published : October 2025

Published by :

Taxmann Publications (P.) Ltd.

Sales & Marketing :

59/32, New Rohtak Road, New Delhi-110 005 India

Phone : +91-11-45562222

Website : www.taxmann.com

E-mail : sales@taxmann.com

Regd. Office : 21/35, West Punjabi Bagh, New Delhi-110 026 India

Printed at :

Tan Prints (India) Pvt. Ltd.

44 Km. Mile Stone, National Highway, Rohtak Road Village Rohad, Distt. Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. It is notified that neither the publisher nor the author or seller will be responsible for any damage or loss of action to any one, of any kind, in any manner, therefrom. No part of this book may be reproduced or copied in any form or by any means [graphic, electronic or mechanical, including photocopying, recording, taping, or information retrieval systems] or reproduced on any disc, tape, perforated media or other information storage device, etc., without the written permission of the publishers. Breach of this condition is liable for legal action.

For binding mistake, misprints or for missing pages, etc., the publisher’s liability is limited to replacement within seven days of purchase by similar edition. All expenses in this connection are to be borne by the purchaser. All disputes are subject to Delhi jurisdiction only.

MODULE 3 COST AUDITOR

CHAPTER 3.1

CHAPTER 3.2

COST AUDITOR’S ELIGIBILITY, QUALIFICATIONS, DISQUALIFICATIONS, APPOINTMENT, REGISTRATION, ROTATION, REMUNERATION, REMOVAL, RIGHTS AND DUTIES, LIABILITIES

CHAPTER 3.3

CHAPTER 3.4

DUTIES OF COST AUDITOR TO REPORT FRAUD – SECTION 143 OF COMPANIES ACT, 2013

CHAPTER 3.5 PUNISHMENT FOR FRAUD (SECTION 447 OF COMPANIES ACT, 2013) 3.14

CHAPTER 3.6

MODULE 7 COST AUDIT DOCUMENTATION, AUDIT PROCESS AND EXECUTION

CHAPTER 7.1

MODULE 8 PREPARATION AND FILING OF COST AUDIT REPORT

CHAPTER 8.1

CHAPTER

SECTION B MANAGEMENT AUDIT

MODULE 9 BASICS OF MANAGEMENT AUDIT

CHAPTER

CHAPTER

CHAPTER

CHAPTER

MODULE 10 MANAGEMENT REPORTING ISSUES AND ANALYSIS CHAPTER

MODULE 11 MANAGEMENT AUDIT IN DIFFERENT FUNCTIONS CHAPTER

MODULE 12 EVALUATION OF CORPORATE IMAGE

SECTION C

INTERNAL AUDIT, OPERATIONAL AUDIT & OTHER RELATED ISSUES

MODULE 14 INTERNAL CONTROL AND INTERNAL AUDIT

CHAPTER 14.1

MODULE 15

CHAPTER

CHAPTER

MODULE 16 AUDIT OF DIFFERENT SERVICE ORGANISATIONS

CHAPTER

CHAPTER

CHAPTER

COST AUDIT DOCUMENTATION, AUDIT PROCESS AND EXECUTION

A QUICK REVIEW

Audit documentation: Audit documentation means the material including working papers prepared by and for, or obtained and retained by the cost auditor in connection with the performance of the audit.

Audit file: Audit file means one or more folders or other storage media, in physical or electronic form, containing the records that comprise the audit documentation for a specific assignment or audit.

Audit working papers: Audit working papers are the documents which record all audit evidence obtained during audit. Such documents are used to support the audit work done in order to provide assurance that the audit was performed in accordance with the relevant Cost Audit and Assurance Standards.

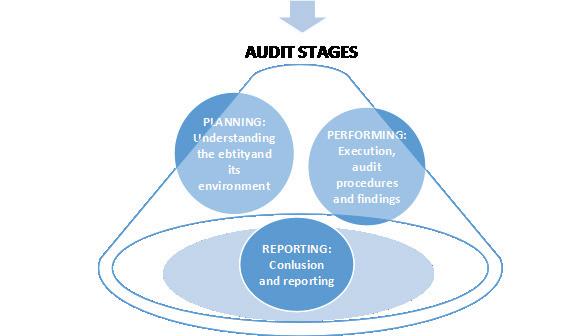

AUDIT STAGES:

Figure below gives a pictorial view of these three stages.

A QUICK REVIEW

The Processes of Cost Audit can be explained through the connection between Activity Purpose Documentation at the planning, performing and reporting phases.

PAST EXAMINATION QUESTION

THEORY QUESTION

Q. 1 What are the 3 stages of audit? Analyse the 3 stages of audit. [June 2023, 8 Marks]

Ans. :

AUDIT STAGES

Planning: The planning stage involves determining the audit strategy as well as identifying the nature and the timing of the procedures to be performed. This is done to optimize efficiency and effectiveness when conducting an audit. Efficiency refers to the amount of time spent gathering audit evidence. Effectiveness refers to the minimization of audit risk. A well-planned audit will ensure that sufficient appropriate evidence is gathered to minimize risk of material misstatement at the cost statement level. The planning stage involves:

Gaining an understanding of the client,

Identifying factors that may impact the risk of a material misstatement in the cost statements,

Performing a risk and materiality assessment, and Developing an audit strategy.

Performing: The performance, or execution, stage of the audit involves detailed testing of internal controls, material consumptions, cost accumulation, allocation, apportionment, and absorption. If an auditor plans to rely on their client’s system of internal controls, they will conduct tests of controls. Cost auditor will conduct detailed substantive tests of audit procedures for the period and detailed substantive tests of consumptions and balances recorded at the period end. This detailed testing provides the evidence that the cost auditor requires to determine whether the cost statements have been fairly presented. The execution stage (or performing stage) of the audit involves the:

Performance of detailed testing of internal controls, and

Substantive testing of cost accounting policies & procedures.

Reporting: The final stage of the audit involves drawing conclusions based on the evidence gathered and arriving at an opinion regarding the fair presentation of cost statements. The cost auditor’s opinion is expressed in the cost audit report. At this stage of the audit, a cost auditor will draw on their understanding of the client, their detailed knowledge of the risks faced by the client, and the conclusions drawn when testing the entity’s controls, transactions, cost heads, item of cost and related disclosures.

The reporting stage involves evaluating the results of detailed testing in light of the cost auditor’s understanding of the entity and forming an opinion on the fair presentation of the entity’s cost statements as a whole.

7.3

PRACTICAL STEPS OF AUDIT PROCESS A QUICK REVIEW

Step-I: Objectives of Audit and Management Outlook

The cost auditor should understand whether the audit is meant only for meeting with the statutory requirements or the management does have any other expectations or outcomes in its mind from the cost audit, such as:

Cost optimization or cost reduction

Checking parameters of operational efficiency of a unit or any utility or any other function or department

Suggesting product diversification or changed product-mix

Identifying profit making or loss making products

Suggesting changed marketing strategies; market expansion; market diversification

Complete review of business strategies

Step-II: Pre-conditions

The cost auditor should fully understand the:

Objectives of cost audit

Area, nature and scope of audit

Number of cost auditors appointed

The applicable reporting framework

The reporting period

The statutory deadlines

The auditor should as certain whether the Management understands its scope of work and responsibilities for:

Maintenance of cost records & producing them to the cost auditor;

SECTION A : COST AUDIT

Preparation & presentation of cost statements & other details as per the applicable reporting framework, and in compliance with the cost accounting standards;

Selection and consistent application of appropriate cost accounting policies;

Allowing access to the auditor all information, including the books of account, vouchers, cost records, other records, documents, and other matters of the company, which are relevant to the preparation of the cost statements;

Providing additional information that the cost auditor may request from the management for the purpose of cost audit;

Allowing unrestricted access to persons within the company from whom the cost auditor determines and obtains cost audit evidence; and

Giving proper management representation.

The auditee and the cost auditor decides the audit fee and payment schedule; and finally, the cost auditor gets an engagement letter. All these are called pre-conditions of audit.

Step-III: Understanding the Company’s Business

The cost auditor is required to understand the company’s business, its corporate structure and various systems followed. The company related details and other general details include:

The company, its nature of activities, its size, product profile, unit locations, ownership structure, management structure, organizational structure, marketing set-up, accounting set-up, etc.

The nature of the industry or the sector in which client company operates

The applicable regulatory framework, financial reporting framework and cost reporting framework

The company’s production process, product details, joint or by-products, outsourcing, if any

Details of subsidiaries, associates and joint ventures

Key personnel in all departments including in Finance, Accounts, Costing, IT, Administration, Production, Purchase, Sales, etc.

Purchase policy, sales policy, pricing policy, export/import policy

Inventory receipt, storage, issue & pricing policies; physical verification system; inventory management system

Related parties and nature of transactions with them

Indirect tax structure, as applicable

Internal Control Systems followed by the company

Internal Audit System, its scope & adequacy of coverage as well as effectiveness

Accounting Systems & Policies followed by the company

Cost Accounting System & Policies followed by the company

Company’s MIS system, risk identification & management system

IT structure followed for financial accounting and for cost accounting, IT policy, control checks, authorization checks, IT data security policy

Previous auditor’s report

Step-IV: Planning the Audit

Planning the audit include:

Timing [dates] and duration [no. of days] of audit period including plan to visit the unit(s)

Level and number of audit personnel to be deployed including supervision and review of work done by the audit team

Audit partner to be deployed and his expected days & dates

Drawing up an overall audit plan and audit strategy – this will act as guide to the audit team

Deciding the materiality levels & sampling levels

Formulating appropriate audit procedures:

Management Representation

Management Assertion

Test of Controls

Test of Details

Substantive procedures

Analytical procedures

Formulating risk assessment strategies & procedures i.e. methodology to measure material misstatements

Planning for discussions with key personnel of the company, previous cost auditor, statutory financial auditor, and internal auditor

Key inputs for planning are:

Results of preliminary activities as specified above

Knowledge from previous audits and other engagements with the company

Knowledge of business

Nature and scope of the audit

Statutory deadlines and reporting format

Relevant factors determining the direction of the audit efforts

Nature, timing and extent of resources required for the audit

Documenting the Audit Plan and sharing it with the company

Ensuring adherence to the Guidance Manual for Audit Quality

Step-V: Execution of Audit

Performing the audit checks and procedures, as planned

Collecting all required audit evidence enabling the auditor to form his opinion