BEACONTHE

Lookinsideforphotosfromoursummer events, informative articles, registration details about our upcoming Expos and more!

Lookinsideforphotosfromoursummer events, informative articles, registration details about our upcoming Expos and more!

Valerie Lykins, Executive Director

Angela Marsh, Marketing and Events Manager

Christina Killian, Office Administrator

PO Box 6838, Columbia, MD 21045

Office Line: 410-348-1534 Membership Line: 410-505-8746

Office Email: contact@caimdches.org

Membership Email: membership@caimdches.org

www.caimdches.org

This publication attempts to provide CAI’s membership with information on community association issues. Authors are responsible for developing the logic of their expressed opinions and for the authenticity of all presented facts in articles. CAI does not necessarily endorse or approve statements of fact or opinion made in these pages and assumes no responsibility for those statements. This publication is issued with the understanding that the publisher is not engaged in rendering legal, accounting or other professional services. If legal advice or other expert assistance is required, the services of a competent professional should be sought. Permission to reprint articles in Beacon may be granted only after receiving prior written approval from the CED of CRC/CAI.

President Rebecca Clemson-Petrik, CMCA, AMS, PCAM

President-Elect

Vice-President

FirstService Residential

James Anderson, PE

Becht Engineering BT, Inc

Gail Windisch, CMCA, AMS, PCAM, Tidewater Property Management, Inc. AAMC

Secretary Noni Roan, CMCA, Pinnacle Financial Partners

Treasurer Vicki Eaton, CMCA, AMS, LSM, PCAM

Community Association Services, Inc., AAMC

Hillary Collins, Esq, Rees Broome, PC

Cynthia McKoin, Potomac Ridge Condominium, Inc.

B.K. Swartwood, CMCA, AMS, PCAM, Montego Bay Civic Association

Gary Saylor, Atlantic Maintenance Group

Social Dani Bressler, Chair

Toepfer Construction Co., Inc.

Carrie Ehart, Vice-Chair

Raine & Son, LLC

DelMarva Chad Toms, Chair

WHITEFORD

Lisa Meck, CMCA, AMS, Vice-Chair

Carl M. Freeman Companies

Education

Christa Brady, AMS, PCAM, Chair

USI Insurance Services

Michelle Jones, CMCA, AMS, PCAM, Vice-Chair

General Manager, Lake Linganore Association

EXPO Ellen Throop, Chair

Davis, Agnor, Rapaport & Skalny, LLC

Joanne Frallicciardi, CMCA, AMS, Vice-Chair

Tidewater Property Management, Inc. AAMC

Golf

Chase Hudson, Chair

Sahouri Insurance

T.J. Socks, Vice-Chair

Becht Engineering BT

Legislative

Cynthia Hitt Kent, Chair, Chair

Law Office of Cynthia Hitt Kent, LLC

Karen Fooks, CMCA, AMS, Vice-Chair

Community Management Corporation/Associa

Membership

Jennifer Melson, CMCA, AMS, Chair

Premier Property Management

Beth Bencivenni, Vice-Chair

SecureCore

Magazine

Michelle Baldry, Chair

Reserve Advisors

Don Plank, PCAM, Vice-Chair

National Cooperative Bank

Communication

Alicia Menefee, CMCA, AMS, Chair

FirstService Residential

Vince Scarfo, CMCA, Vice-Chair

Clear: Restoration and PreDisaster Consulting

I’m not sure how it happened, but suddenly school buses are back on the roads and pumpkin spice lattes are available in every coffee shop. Our Chapter had an amazing summer, starting off with our first JointChapter Social Event. This event SOLD OUT! Thank you to all sponsors and attendees for making this event a success; and to our Joint-Chapter Social Committee for all of their work to create this new event with the Washington Metro Chapter. Our Annual Crab Feast was also a success, held in its new picturesque location right on the beach of Sandy Point State Park. Concluding the summer, the Golf Committee hosted our Annual Golf Outing in record time. Although hot, the golfers enjoyed their day on the course networking with the sponsors.

As we look toward the fall, we will not be slowing down. With several educational seminars, TWO Expos, a Broadway themed social and our Annual Meeting there is still so much to do before the end of the year. We hope you are able to join us for one or both Expos. Both have new exciting opportunities for Board Members, Business Partners, and Managers, so keep an eye out for the details of those events and register soon.

Last but far from least, I’m beyond excited to announce that we’ve already achieved our membership goal for this year!!! Thank you to everyone who has participated, joined and been a part of making this Chapter who we are today, 1300 strong.

Yours truly,

Rebecca Clemson-Petrik CMCA, AMS, PCAM Chesapeake Region Chapter President Regional Director, FirstService Residential

“Coming together is a beginning; keeping together is progress; working together is success.”

~Henry Ford, Founder of Ford MotorMr. Joe Adamczyk

Independence HOA

Jordan Andrews

Tidewater Property Management

Mr. Barry Andrews

Tilghman on Chesapeake Community Association

Ms. Carol Aversa

Villages at Herring Creek

Ms. Mary Jo Baker Brookshire I Condominium Association

Ms. Jade Banks

Tilghman on Chesapeake Community Association

Mr. Philip Berkheimer

Worman’s Mill Community Conservancy

Mr. Lawrence Bernard

The Willoughyby of Chevy Chase Condo

Ms. Jolie Best

Brookshire I Condominium Association

Mr. John Bickford

Waverly Woods West HOA

Ms. Carla Bray

The Mallard Lake Community Association Inc

Ms. Cheryl Butler Moore

East Hampton Estates Community Association

Ms. Jessica Calder

Bulle Rock Community Association

Ms. Linda Cherney

Independence HOA

Mr. David Churchill

The Willoughyby of Chevy Chase Condo

Mrs. Monica Cofiell

Montego Bay Civic Association

Mr. William Conrad

Villages at Herring Creek

Mr. Michael Cooperman

The Willoughyby of Chevy Chase Condo

Mr. Tom Cornwell

Tilghman on Chesapeake Community Association

Loury Davis Burncourt Condominiums

Mr. Steven Dicker Cooper Roofing

Mr. Christopher (Chris) Fish Lake Source LLC

Shie Fleek VN Management, Inc.

Mr. John Funderburk Worman’s Mill Community Conservancy

Mr. Tommy Gamble Tilghman on Chesapeake Community Association

Ms. Lauren Griggs-Moore Capital Court Homeowners Association

Time Hall

East Hampton Estates Community Association

Ms. Dawn Heacock Legum & Norman

Mr. Gerry Holtz

Independence HOA

Ms. Fran Houston Brookshire I Condominium Association

Ms. Maritza Ibrahim

APC Hospitality, LLC

Ms. Janet Jenkins Worman’s Mill Community Conservancy

Mr. Harvey Johnson

Independence HOA

Mr. Noah Johnston Penthouse Condominium

Mr. Joseph Kaub

The Mallard Lake Community Association Inc

Mr. Mchael Knowles

The Mallard Lake Community Association Inc

Mr. John Kumpulainen

Brookshire I Condominium Association

Ms. Veronica Lansey

East Hampton Estates Community Association

Ms. Fran Lazerow

The Mallard Lake Community Association Inc

Mr. Brian Leposki

Villages at Herring Creek

Ying Li

Stoneridge Condominium

Ms. Maureen Lorenzetti

The Willoughyby of Chevy Chase Condo

Styves Manigat

East Hampton Estates Community Association

Mr. Benjamin Mariano

The Manor Association

Mr. Robert Marlowe

The Mallard Lake Community Association Inc

Mr. Sean Mcarthur

Bulle Rock Community Association

Andrew Mcconnell

Legum & Norman

Ms. Ashley McNair

Villages at Herring Creek

Gabrielle Monroe

VN Management, Inc.

Mr. David Morris

The Mallard Lake Community Association Inc

Mr. Kyle Narsavage GreenSweep LLC

Mr. Daniel Nelson

The Mallard Lake Community Association Inc

Ms. Susan Pantuliano

Villages at Herring Creek

Mr. David Perin

Snowden Overlook Community Association

Mr. Robert Petrow

Independence HOA

Mr. Sam Piccarreta

Bay Forest Community Association

Mr. Matt Piersall

Windsor Knolls Homeowners Association, Inc.

Mr. Dick Plambeck

Independence HOA

Mr. James Power

Michele Rempe

Baymont Farms Service Corporation

Mr. Christopher Reutersham

The Mallard Lake Community Association Inc

Ms. Ellen Sartin

Adobe

Ms. Barry Schwartz Bay Bridge Cove Community Association, Inc.

Mr. Stacey Selby

The Mallard Lake Community Association Inc

Ms. Lee Shorter Independence HOA

Mr. Gary Smith

Independence HOA

Mr. Walt Smith

Independence HOA

Mr. Williams Strohm Tilghman on Chesapeake Community Association

John Szczur

Mr. William Tabilio Bay Bridge Cove Community Association, Inc.

Mr. George Tenckhoff Penthouse Condominium

Mr. Donald Torres

Mr. Harry Towner Independence HOA

Ms. Gail Turner Tilghman on Chesapeake Community Association

Mr. Richard Turner

Snowden Overlook Community Association

Ms. Joyce Valdivia

The Mallard Lake Community Association Inc

Ms. Brenda Viehe-Naess

The Willoughyby of Chevy Chase Condo

Ms. Anita Volpe

Independence HOA

Miss Jeanne Walsh

Independence HOA

Matthew Weitzman

Villages at Herring Creek

Mr. Darryll Williams

Brookshire I Condominium Association

We had a great first Joint Chapter Block Party Happy Hour Event with the Washington Metro Chapter at Lone Oak Farm Brewing Company on Thursday, June 15th! Thank you to our committee for putting this event together and thank you to everyone who attended!

Atlantic Maintenance Group

BrightView Landscapes

Capitol Boiler Works

Cleat Design + Build

Community Risk Advisors

EJF Real Estate Services, Inc.

Exterior Medics

FirstService Residential

Kolb Electric

Mid Atlantic Asphalt Inc

National Cooperative Bank Points North Strategies LLC

Pothole Repair.com.

PTG Enterprises, Inc.

RAINE & SON, LLC

RESCON Restoration & Construction

RoofPRO LLC

Toepfer Construction Co., Inc.

TRC Engineering

Electric vehicles (“EV”) represent a key technology in the world’s efforts to electrify the transportation system and reduce the reliance on combustion engines. Laws have been passed in the U.S. whereby no gas vehicles will be produced past 2030. It is predicted by the International Energy Agency Global, that the electric vehicle stock will increase to 130M by 2030. The increased number of EV vehicles will need to be supported by a robust vehicle charging infrastructure (V.C.I.) for this to be a viable goal. Owning an electric vehicle requires access to both public and personal (home) charging infrastructures. Without access to a charging station, the drivers risk the chance of their travel being curtailed or becoming stranded. As reported in an article by Sarah LaMonaca and Lisa Ryan (“The State of Play in Electric Vehicle Charging Services –A Review of Infrastructure Provision, Players and

Things to consider include:

Seek Board approval

Planning (Including logistical) and permitting considerations including American Disabilities Act (“ADA”) considerations

Regulatory/legal considerations

Contracting and procurement – vet the contractor (secure Certificate of Insurance, “COI”) product completed operations coverage

Upfront costs (Including owning versus leasing costs)

Effect on insurability; how will carrier view EV station

Identify any available incentive programs (grants, rebates, etc.)

Secure surety bond (charging station performance bond); for large projects ≥ $500K

Secure builder’s risk coverage (prior to installation)

Policies”), 75%-80% of the US population prefer to charge their EV at home. Furthermore, a recent survey conducted by AAA found that more than 24% of public charging stations are out of order.

As a property management association, how prepared are you in addressing the needs of your community’s charging stations? What would be the impact on the community you are serving? While the topic is vast and requires a multi-disciplinary approach (legal, financial, contracting), a few major elements need to be considered: before, during and post-installation

Knowing that the need for access to a charging station will only increase, it is important for property managers to consider and prepare for the installation of an EV charging station.

Keep board and insurance agent informed

Ensure safety of worksite and the equipment

Add the new facility to your insurance policy and anticipate the impact on the premium

Install monitoring system to prevent theft of equipment, charge or misuse of the facility

Address the necessity of striping and signage

Establish rules and guidelines for usage of the charging station

Provide summary analysis of costs/savings to board

Manage risk (educate consumers and post signage)

Schedule ongoing maintenance

Increase liability coverage limit to protect association in case of fire or tripping

Implement guidelines set by association for use of charging station

Manage impact on the electric bill

Much thought and planning must go into the decision of adding EV charging station(s) to the association’s property. In order to successfully navigate this journey, it is critical to keep your Board informed at all times. You may need to amend your Governing Documents. Investigate fully the costs associated with such an endeavor, compare the benefits of owning versus leasing and determine who will pay for what (i.e., any costs passed on to the community and how that will happen). It may be advisable to hire a consultant to help the Board plan all phases of the project. Secure whatever permits are required and ensure that you are in compliance with all legal and regulatory guidelines. As you would with any vendor with whom you contract, properly vet the contractor to ensure they are properly licensed and bonded and that they provide you with a certificate of insurance, showing adequate coverage. Lastly, talk with your insurance agent to confirm you have the appropriate insurance in place prior to installation. If the project is over $500K, it may be advisable to procure a surety bond to ensure the project is properly covered.

Once the installation has begun, make sure the property, owners/tenants are kept safe. Secure the job site!

Continue to keep the Board informed and begin to prepare for post-installation by obtaining signage relating to safety; begin providing education to consumers as to how to safely use the charging station. Reach out to your insurance agent again to confirm proper insurance coverage is in place.

Upon completion of installation, risk management is a key to sustaining the integrity of the station. Keep your eyes open for any misuse or damage (hoses being dragged, copper being stolen). Stay current on any maintenance

and keep compliant of any regulatory guidelines. After three years, the Reserve Study needs to be updated. Provide your Board with a summary of all costs incurred as well as savings earned by the Association through the installation of the charging station(s). Follow-up with your insurance agent to ensure coverage is adjusted for the new value of the property and to counsel you on any adjustments that might be needed to the master policy. It is not an easy road to travel. You will no doubt be met with challenges, but there are benefits: potential income opportunities through incentive programs, addressing the demand allowing you to compete with other associations (staying relevant within the industry), increased property values, and successfully achieving environmental regulatory goals!

A number of managers surveyed expressed misgivings about the wisdom and application of this technology. This viewpoint stems from the stress that will be placed on the electric grid, the future cost of electricity (a property manager interviewed was recently informed that electricity is climbing to $0.13/kWh in May), the software versus hardware, and the recycling of the lithium batteries. These unknown factors can play a major role in the success or failure of this new mode of transportation.

Sources:

• The state of play in electric vehicle charging services – A review of infrastructure provision, players, and policiesScienceDirect

• Electric Vehicle Charging Stations 101 - SSR (ssr-inc.com)

• 17 Critical Considerations When Planning for EV Charging Stations - Charged Future

Level 1 charging uses a common 120-volt receptacle outlet and can be suitable for overnight or workplace charging. Every electric or plug-in hybrid vehicle can use Level 1 charging by plugging the charging equipment (typically a portable unit provided with the vehicle) into a standard three-prong wall outlet. Level 1 adds between three and five miles of range per hour and is the slowest way to charge, often referred to as “trickle-charging.” Level 1 charging can be easily provided at private residences and office buildings from 120V convenience receptacles located near designated parking spots

Level 2 charging stations require a dedicated electrical connection and are most suitable for providing a full charge in a few hours. Level 2 charging equipment is typically supplied with a dedicated circuit at 208V or 240V, with circuit breaker rating ranging from 40-100 amps. Level 2 can charge much faster than Level 1, adding between 12 and 80 miles of range per hour depending on the power output of the Level 2 charger and the vehicle’s maximum charge rate. Level 2 charging stations account for >80% of public EVSE ports in the United States, and are often installed at private residences, office buildings, and in public locations like shopping centers, parking garages, and other destinations with expected dwell times of a few hours.

Written by: Sami Satouri, RHU®, ChHC®, President, Quest Insurance ssatouri@questinsurance.us & Judy Tyrrell, General Manager, Harbour Square Owners, Inc.Level 3 (also called DC Fast Charge & Supercharging) is the quickest type of charging station available for consumer vehicles today. Unlike Level 1 and Level 2 charging, Level 3 charging typically uses a 480V, three-phase power supply and bypasses the vehicle’s onboard charger to provide direct current (DC) at a much higher rate. They can add between three to 20 miles of range per minute, bringing most EV batteries back up to 80% charge in 30 minutes. For these reasons, Level 3 charging stations are commonly located near transportation routes and not found in private residences.

The Chesapeake Chapter will present an all day, extensive coverage of personal and premises safety and security within a community. All seminars are purposefully crafted with a panel of experts to bring not only in-depth but diverse information and latest trends about the myriad of ways to better protect and safeguard all related assets of a community – starting with the tangible physical property of the homes and clubhouses, to the members themselves and related interactions with others, enhanced with critical legal and insurance foundational elements, and finished with the ever prevalent computer and camera systems.

KEYNOTE SPEAKERS:

Colin O’Brien, Director of Operations, T. Cooper, Inc.

Officer Jason Goorevitz, Baltimore County Police Department

Stephen Simpkins, Executive Director, Planned Companies

8:00 – 9:30 am

– 11:45 am

2:00 – 2:45 pm

3:00 – 3:45 pm

3:45 – 5:30 pm

BREAKOUT SESSIONS:

Attendees may choose 2 out of 3 breakout sessions to attend

“Use conflict resolution to build a harmonious community.”

Speakers - Jill R. Eisner, Esq., Attorney and a level 5 Certified Mediator & Karen Wilson, J.D., Level 5 certified mediator, trained conflict coach, and Program Manager of the Mediation Program at the Conflict Resolution Center of Baltimore County

“Insurance and legal resources to protect your community.”

Speakers – Doug Henken, CIRMS, Vice President of Marketing, Community Association

Underwriters of America & Ursula Burgess, Esq., Shareholder, Rees Broome, PC

“Maximize your community’s security with cameras and computers.”

Speakers - Chris Riismandel, Owner, Epoch, Inc. & David Dick, Sr. Vice President Security Division / Partner, Glessner Technologies

Monday October 2, 2023

Maryland LIVE! Casino Hanover, MD

SCAN HERE TO REGISTER

All attendees must sign the Chapter’s suitcasing policy on their registration form

“An overall view into personal safety within your community”

Lavender Fields at Warrington Manor LLC is not like any other agricultural farm in Delaware. Lavender Fields is located in Milton and is Delaware’s premier lavender farm, carrying a large inventory of lavender plants, as well as hosting a variety of events such as tours, weddings, and classes. Lavender Fields has over 300 Years of history, starting as an 1800’s fruit farm to becoming the popular tourism destination for locals and visitors it is today.

Originally Lavender Fields was part of a 1000-acre patent made by William Penn in 1684.

Over the years the land was handed down to various families and ultimately subdivided by Joe Hudson in 1973 to the current five acres it is today. The property has always been a producing farm, starting as a major fruit grower in the late 1850s with 3,400 peach trees as well as apples, pears, and other small fruits. Grain and sugarcane were also grown, and sorghum was manufactured.

In 1958, W. Weldon and Elizabeth Brittingham, dairy farmers who owned Lewes Dairy, purchased the property, and added the silos, corn crib and milking shed where they processed their milk prior to transfer. After they sold it to the Heikels, who lived on the farm for 21 years, Pauline Petitt purchased the farm in 1994. Her father was a well-known lavender grower in England and Pauline renamed the farm “Manor at Cool Spring Bed & Breakfast and Lavender Farm” and became known locally as the “Lavender Lady”. She planted the first lavender plants and sold the first lavender products.

Marie Mayor and Sharon Harris purchased the lavender farm in 2002. In 2003 they established Lavender Fields at Warrington Manor LLC and began planting what would become 2000 lavender plants.

This 5-acre farm grows various types of lavender. Lavender bouquet bundles can be purchased in their onsite gift shop. The farm also has additional gardens

featuring herbs, dahlia, hosta, and native wildflowers. There’s even a bee and butterfly garden. There is also a labyrinth which is tucked away in a circle of trees. The labyrinth is identical to the one in the Cathedral of Chartres near Paris. While walking the labyrinth remember to follow your own path. No matter which path you follow, you will find the only exit.

If you’ve been following along, then you know that this is one of the items that should be on your Summer Bucket list. While this farm isn’t far from the busy beaches, it couldn’t feel more separated. The farm is quiet and serene, the perfect place to visit.

Lavender Fields also has stands at seven local farmers markets in Sussex County, including Rehoboth Beach, Lewes, Milton, Bethany Beach, Milford, Nassau Valley, and Garden Shack Farm in Lewes.

In addition to honey, they sell an array of personal care products made with lavender, including soap, bath salts, lip balms, teas, lotions, pet sprays, and more. They also produce lavender oil promoted as diminishing the effects of too much sun exposure. But lavender is not just for the skin. Indeed, they also offer culinary lavender (spices), lavender sea salt, and lavender honey. Another small shop on the farm features other handmade products including holiday wreaths and trees or everyday home decorations. If you haven’t visited this Delaware hidden gem, I highly suggest that you make the trip! The farm is located at 18864 Cool Spring Road, Milton, Delaware.

Written by: Jennifer Melson, CMCA, AMS Premier Property Management Regional Portfolio Community Manager 302-644-2752 jmelson@pcam.netWHAT IS BREAKING YOUR BUDGET ON THE EASTERN SHORE?

BOOTHS AND SPONSORSHIPS are now available!

Booths: $650 – includes two tickets to Happy Hour on Thursday evening!

Space is limited! Reserve your Booth or Sponsorship today!

All exhibitors must sign the Chapter’s suitcasing policy on their registration form

Friday, November 10, 2023

8:00 am – 2:15 pm

Princess Royale Hotel 9110 Coastal Hwy • Ocean City, MD 21842

For hotel reservations please call the Princess Royale at 1-800-476-9253 and reference the check in date; the group name: Chesapeake Chapter CAI Expo and the block code: 23CAIEXPO

Thursday 2:00 – 4:00 pm – Exhibitor set-up

am –

pm – Lunch & Expo (Expo ends)

– 1:15 pm – Breakout Sessions #1

– 1:30 pm – Break

1:30 – 2:15 pm – Breakout Sessions #2

The Delmarva Committee of the CAI Chesapeake Chapter is pleased to present the 2023 Expo topic:

The Expo General Session will be held in the morning and include three industry specific experts presenting topics covering environmental, infrastructure and insurance pressures causing unprecedented costs and increases directly impacting the Eastern Shore. The afternoon session will offer four breakout sessions giving attendees the opportunity to take a “Deeper Dive” into several topics which include budgetary concerns for common interest communities on the Eastern Shore, how environmental impacts affect architectural guidelines or MD/DE legislative updates.

General Session Speakers:

• Todd Fritchman, Envirotech

• Jeremy Walbert, Becker Morgan

• Christa Brady, USI Insurance Services

After the General Session, attendees will be able to select from 2 of the 4 afternoon sessions based on the times offered:

1. MD/DE Legislative update – Speaker: Chad Toms, WHITEFORD

2. Comprehensive Environmental Management Services and Planning Needs for the HOA Governed Subdivision –Speaker: Todd Fritchman, Envirotech

3. A panel discussion on the effects of inflation on your budget –Speakers: Noni Roan, Pinnacle Financial Partners, Gary Saylor, Atlantic Maintenance Group, & Jeremy Walbert, Becker Morgan

4. Communicating the unprecedented increases in your budget –Speakers: Tara Laing, CMCA, AMS, PCAM, Sentry Management, Michele Nadeau, CMCA, AMS, Legum & Norman, Igor Conev, CMCA, AMS, PCAM, CIRMS, Mann Properties

Friday, November 10, 2023

8:00 am – 2:15 pm

Princess Royale Hotel

9110 Coastal Hwy • Ocean City, MD 21842

For hotel reservations please call the Princess Royale at 1-800-476-9253 and reference the check in date; the group name: Chesapeake Chapter CAI Expo and the block code: 23CAIEXPO

TICKET PRICING: Members - $40

Non-Members $60

Join us for Happy Hour Thursday evening at the Princess Royale! Tickets - $35

Atlantic Maintenance Group

Becht Engineering BT, Inc.

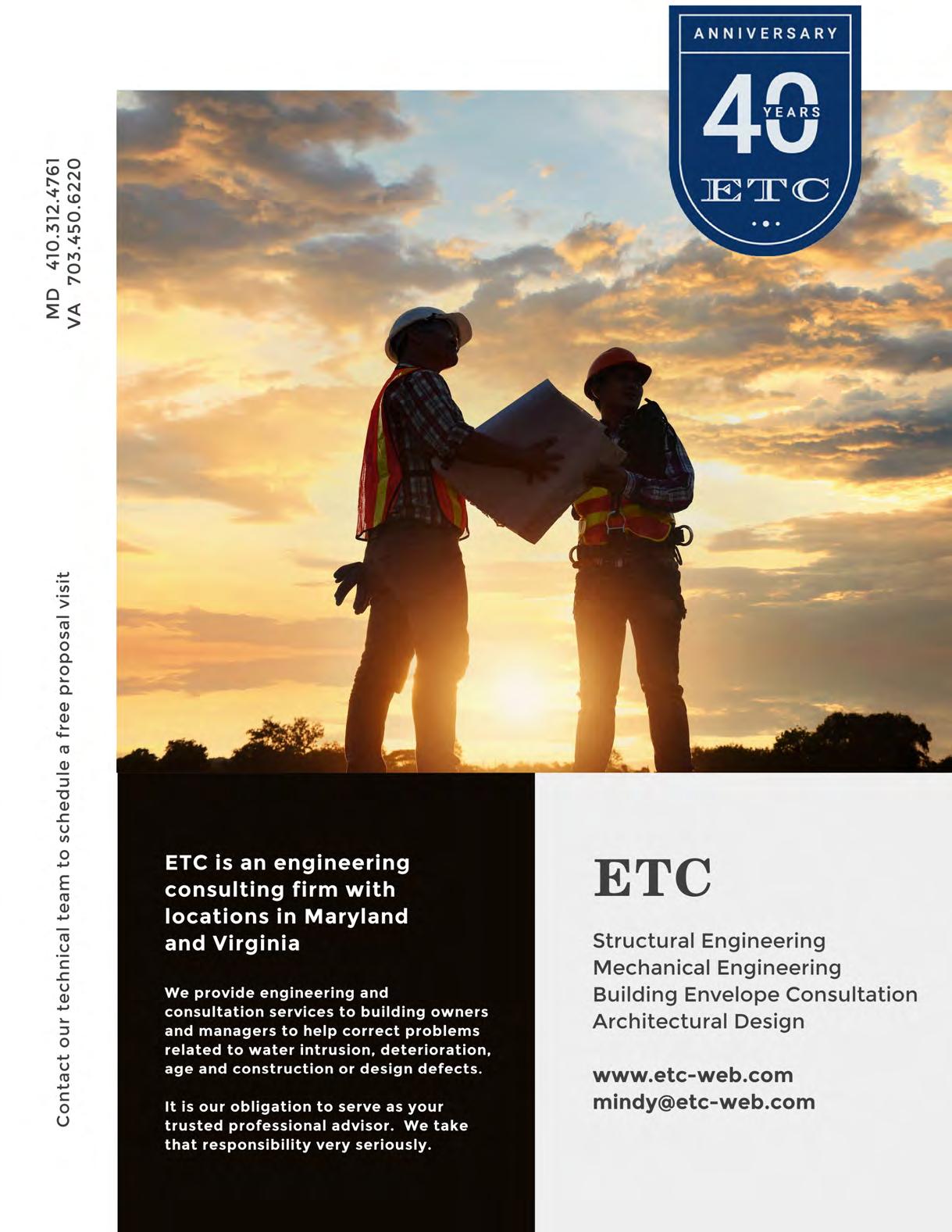

ETC, Inc

Hann & Hann Construction Services

Kris Konstruction Roofing Professionals

Mid Atlantic Asphalt, Inc.

MillerDodson Associates, Inc.

Minkoff Company

North Arundel Contracting, Inc.

Pinnacle Financial Partners

Rees Broome, PC

RoofPRO, LLC

Sahouri Insurance

The Falcon Group Engineers, Architects & Reserve Specialists

Tidewater Property Management, Inc., AAMC

Davis, Agnor, Rapaport & Skalny

EJF Real Estate Services

FirstService Residential

Nagle & Zaller, P.C.

Palmer Brothers Painting & General Contracting

SI Restoration

Simmerer Insurance LLC

Unlimited Restoration, Inc.

WHITEFORD

WPM Real Estate Management

Connie Phillips Insurance

Condominium Venture, Inc.

Pacific Premier Bank Community Association Banking

Truist Association Services

practice to manage the health of the downstream environment. However, often that means the stormwater pond in your community has collected large amounts of nutrients (phosphorus and nitrogen) allowing your water quality to diminish, and possibly become the eyesore of the community due to excessive aquatic weed and algae growth. A common practice to curtail poor water quality that follows nutrient loading is to install a pond fountain. These floating fountain pumps throw water in the air in a decorative display, allowing oxygen to diffuse into the water, greatly increasing water quality. High dissolved oxygen content in water is the most important piece of the water quality puzzle. After speaking to HOA board committees, we have learned there is a need to educate communities of the benefits of a floating pond fountain. Oftentimes, within a community, some homeowners believe their pond fountain is providing benefit to the water, while others see it as just a decorative feature to the landscape, with no real purpose for water quality management. The truth is, if sized properly to the water body, there is real science that shows the tremendous benefit of a pond fountain.

solid to a gas through the nitrogen cycle and thus vent out of the pond into the atmosphere. The movement of surface water by a pond fountain increases this process. The difference in nitrogen and phosphorus in water is the phosphorus cannot turn to a gas form, which creates a buildup effect of phosphorus levels. Where a fountain comes in is, by increasing the dissolved oxygen level in the water, this allows the beneficial microorganisms that naturally occur in the pond, to work more efficiently and effectively in an aerobic state by consuming organics that is the source of phosphorus and tying it up in beneficial bacteria production, rather than into harmful algae and weed blooms. In deeper ponds (10ft and deeper) diffused aeration on the bottom of the pond can be extremely effective in this nutrient cycling. However, many stormwater ponds in our area are dug to shallow depths, meaning the most beneficial aeration system is something on the surface disturbing water, like a pond fountain. Pond fountain patterns come in all shapes and sizes, from the high-reaching geysers to cascading umbrella-like patterns, there’s a pattern for everyone. So which pattern is right for you? Or more importantly, which one is right for your pond? Most often, the answer is driven by initial visual appeal and size of the pattern. Selecting the right spray pattern, however, involves more than you think.

Pattern size is most often the driving force behind pattern selection. This makes sense, of course, because even if water quality is your main goal, you’d still like an aesthetically pleasing display. However, there is a relationship between 3 operational factors that should be considered when choosing a fountain pattern. These factors are flow, pattern size, and power consumption and the relationship between these factors is give and take.

1. Flow

Flow is the amount of water going through the opening in the fountain. This is usually expressed in gallons per minute (GPM) and is directly related to the oxygen transfer rate (OTR) achieved. Dissolved oxygen (DO) is a primary ingredient in pond/lake health. The biological nature of a pond will demand DO for plants, decomposition of organics, as well as fish and microorganisms functioning within the ecosystem.

2. Patter

Patter n size is the “wow” factor that attracts people to floating fountains. Nice patterns will attract attention, distract from eyesores, and create white noise to blanket daily clatter from roads, parking lots, equipment operation, etc. Many ponds utilizing fountains are detention ponds with excess freeboard/ berm (landscaped buffer or shoreline) to handle rain

events. With a 5 ft. berm, a 10 ft. high pattern will only appear 5 ft. above the crest of the shoreline and might not provide the desired display. Although not always the case, it is typical to choose a pattern in which you look up to see the apex. But be careful, if you get a high pattern with little flow, you will have just a thin spray that easily gets blown over in heavy winds and falls short of adequate OTR. The more decorative you get on your fountain display, the less water you are moving thus less benefit to the actual water quality.

Power consumption tells a very important story. Amp draw indicates how hard a motor is working and since volts x amps = watts, this directly relates to what it costs to operate the fountain. Your pond contractor should be able to help you with electrical cost estimates per month.

A balance of these three factors will allow both benefit and presentation to your community stormwater pond.

Written by: Chris Fish of LakeSource LLC. Aquatic biologist & owner of LakeSource LLC chris@thelakesource.com

Written by: Chris Fish of LakeSource LLC. Aquatic biologist & owner of LakeSource LLC chris@thelakesource.com

833-800-5253

Introduction

It is no secret that every year floods cause significant damage to communities and homes. Afterall, flooding is the most common and costly natural disaster in the United States. Despite this fact, many communities and homeowners have found themselves to be underinsured (or not insured at all) following a flood event, most likely due to not being fully informed as to the necessity of flood insurance. To that end, this article is intended to provide a basic overview of the fundamentals of flood insurance.

Flood insurance is designed to cover direct physical loss caused by a flood. A “flood” is defined as being a general and temporary condition where two or more acres of normally dry land or two or more properties are inundated with water or mudflow.1

A “flood” event is not to be confused with a sewer back-up unless the sewer back-up itself is a direct result of flooding. Other domestic water-loss events that are not considered as a “flood” include pipe leaks, sprinkler discharge, sink back-ups, tub overflows, and other types of domestic water leaks.

Regardless of geographic location, property owners seeking peace of mind should consider purchasing flood insurance. Communities and homeowners located in high-risk flood areas may be required to have flood insurance, especially those having government-backed mortgages. Even if you live outside a high-risk area, your lender may still require flood insurance.

If flood insurance is covered under a condominium association’s master policy, should individual unit owners consider purchasing their own flood coverage?

Flood coverage under the association’s master policy pertains to structure and contents of the condominium building itself. In the event of a flood, damages to an individual unit owner’s personal contents, belongings, betterments/improvements, are NOT covered under the association’s master policy. Additionally, the master policy does not afford coverage for the temporary living expenses of an individual unit owner should said owner’s unit become inhabitable. For those reasons, individual unit owners, particularly those that live on the lower levels of the building, are encouraged to procure flood coverage under their individual HO6 policy.

Is there a difference between the National Flood Insurance Program (NFIP) and private flood programs?

The NFIP is a federal initiative that offers flood insurance coverage to homeowners, renters, and businesses (including associations). The goal of NFIP is to minimize the impact of flooding on individuals and businesses by providing affordable flood insurance, flood hazard mapping, and flood plain management. Coverage under a NFIP policy is paid out by the government and funded through taxpayer money, with coverage limited to $250,000/home and $100,000 for contents. In comparison, private flood insurance can be less expensive while offering higher coverage limits and broader coverages.

Flood risk assessment involves determining the potential of flooding in a specific area. The Federal Emergency Management Agency (FEMA) assigns flood zones and creates Flood Insurance Rate Maps (FIRMs) that identify areas of high and moderate to low flood risk. Flood insurance premiums are most often based on these flood zones and the property’s elevation in comparison to the base flood elevation.

Several factors are considered in determining one’s annual flood premium, such as flood risk (flood zone), amount of coverage and deductible limit, location/ design/age of insured structure, and location of the insured structure’s contents.

Under FEMA’s Risk Rating 2.0: Equity in Action program, FEMA has the ability and tools to address rating discrepancies by incorporating more flood risk variables. Those variables include flood frequency, multiple flood types (river overflow, storm surge, coastal erosion, and heavy rainfall), distance to a water source, as well as property characteristics such as reconstruction cost and elevation.

Most flood insurance policies have a mandatory 30-day waiting period from the time of purchase until the coverage takes effect. This waiting period is designed to prevent lastminute purchases in anticipation of an approaching flood; thus, it is imperative for property owners to plan ahead and not wait until a flood event is imminent.

There are several steps communities and homeowners can take to minimize the physical impact of a flood event. These include elevating utilities and electrical systems, installing flood-resistant barriers or shields,

and maintaining free-flowing draining systems. Routine property inspections are a vital step in ensuring your community or home is prepared for a flooding event.

Having flood insurance is crucial to protecting communities and individual homes from the financial distress of flood damage. By understanding the fundamentals of flood insurance, evaluating flood risk, and obtaining appropriate coverage, communities and homeowners can protect their properties from the uncertainties of flood-related damage. Associations should consult with a professional insurance advisor who specializes in community associations to determine optimal flood coverage. Likewise, individual homeowners should discuss their flood coverage needs with a professional personal lines agent to ensure their personal belongings and contents are appropriately protected.

1 www.fema.gov

2 www.floodsmart.gov

3 National Weather Service

Written by: Christa M. Brady, AMS®, PCAM® Vice President – USI Community Associations Practice 703-205-8765

christa.brady@usi.com

For more information and to view the list of courses offered in 2023, visit www.caionline.org/LearningCenter/ Education-for-Managers/Pages/ default.aspx

Friday, October 27, 2023

6:00 – 10:00 pm

Historic Savage Mill

8600 Foundry St, Savage, MD 20763

Member tickets: $95 Non-Member tickets: $115

Cocktail Hour, Buffet, DJ & Dancing, Open Bar, Photo Booth & More!

Awards will be given for best Broadway costume!

I have been in the insurance industry for over 50 years specializing in the habitational sector and have seen the cycles that our industry goes through – known as the UPS and DOWNS of the insurance market. Today we are experiencing a HARD market in insurance. This results in fewer carriers, higher premiums, higher deductibles, and restricted or limited coverage for habitational properties. As a result of the hard market, we are seeing programs that were specifically designed for community associations being discontinued, insurance policies being non-renewed or canceled, increasing property values and more insurance inspections.

How are you coping with these changes? According to the Foundation for Community Association Research*:

83% of insurance professionals across the country are experiencing a significant number of policy cancellations. 96% are seeing significant policy premium increases. For 55% of these policies, the annual increase ranges from 11 to 25%.

What is causing this rise in cancellations and insurance premiums? Carriers are re-evaluating each account. The habitational market has been seeing a rise in claims and increasing cost of claim payments, increasing property values and the aging of the community (especially those buildings over 40 years old and roofs over 20 years old). Over the past several years, we have seen extreme weather events – floods, fires, record snow falls, and hurricanes. In addition, we had the pandemic, supply chain issues, inflation, and high liability awards that surpass a reasonable or rational amount. So, you ask, how does that affect us in Maryland?

Every insurance carrier will evaluate a risk to determine how much they will pay for the smaller claims. The carrier then purchases reinsurance to protect from a major loss. Anytime there is a major insurable event, the payment of those claims comes from the reinsurance market. As the reinsurance market pays out these claims, they raise their premiums to the insurance carrier. Therefore, all of us are paying higher premiums because the reinsurance market has increased their premiums.

Even quality rated associations are seeing their insurance premiums increase. How can your community survive in 2023 and beyond?

1) Start with a well-run, professionally managed community and understanding board.

2) Take initiative and try to avoid claims, identify issues, and correct them.

3) Evaluate your reserves to make sure the association account is adequately funded.

4) Continuously review maintenance and identify existing and upcoming repairs that need to be made.

5) Inspect your property for trip hazards.

6) Implement and use water sensors for leaking pipes and appliances.

7) Convert your community to non-smoking.

8) Restrict or eliminate grills.

9) Limit the number of rentals. Start thinking about your insurance renewal in advance. Now is the time to have an annual review of your insurance. Be sure to discuss any upcoming insurance changes in coverage, property values and deductibles. Try to identify areas where improvements can be made to avoid claims. Don’t wait until the last minute to take the necessary steps to prepare for your renewal. Planning ahead will soften the impact on your budget.

Written by: Connie E Phillips, CIC, EBP, CIRMS Certified Insurance Counselor (CIC) National Community Association Institute Educated Business Partner (EBP)Community Insurance and Risk Management Specialist (CIRMS) 888-439-0479

cpi@insurance-financial.net

*Reference: https://foundation.caionline.org/research/snap-surveys/ April 2023 - Insurance Coverage Trends in Community Associations.

OF COMMUNITIES SURVEYED:

47% condominiums require homeowners to carry individual HO-6 policies 28% have an insurable value appraisal 12% are ocean front or subject to tidal water

24%

64% 12%

91% Yes

■ 6% No ■ 3% Unsure

How much money per homeowner did the increase premium cost (per year)?

17% ■ N/A

45% ■ UNDER $100

24% ■ BETWEEN $101–$500

5% ■ BETWEEN $501–$1,000

4% ■ BETWEEN $1,001–$2,000

5% ■ MORE THAN $2,001

45% 17% 24% 5% 4% 5%

For renewal of property and casualty coverage, were high deductibles or per unit deductibles forced by the insurer?

24% Yes

■ 12% Unsure

SPONSORED BY

62% No

98% carry property and casualty insurance 98% carry directors and officers insurance 84% carry fidelity & crime insurance 46% carry cybersecurity insurance

How did you fund the premium increase?

50% Increased individual assessments

43% Used operating funds

7% Imposed a special assessment

2% Took out a line of credit

2% Used contingency funds

1% Used reserve funds

5% Other 6% N/A

Does your property & casualty plan cover at least 100% of the replacement value of property owned by the community association?

70% Yes

■ 10% No ■ 16% Unsure ■ 4% Other

Are you experiencing a significant number of property and casualty policy cancellations among your clients?

Are you experiencing a significant number of property & casualty policy premium increases for your community association clients?

What are the contributing factors to the rising premiums and cancellations?

Are you seeing a significant number of property casualty policy premium increases for your community clients?

Are you experiencing a significant number of property and casualty policy cancellations among their community clients?

American Pool

Atlantic Maintenance Group

Bopat Electric Co., Inc.

BrightView Landscape Services

Complete Landscaping

Condominium Venture, Inc.

Doodycalls Pet Waste Removal

Fellner Legal Services

First Citizens Bank

Hann & Hann Construction Services

Knott Mechanical

Kolb Electric

Kris Konstruction Roofing Professionals

Law Office of Cynthia Hitt Kent

Lerch, Early, & Brewer, Chartered

Minkoff Company

North Arundel Contracting

Palmer Brothers Painting & General Contracting

Pinnacle Financial Partners

Pro Painting & Contracting

Raine & Son

Rees Broome

RoofPro

Sahouri Insurance

SBC Outdoor Services

SI Restoration

The Witmer Group

Thomasville Restoration

Toepfer Construction Co., Inc.

Tri State Restorations, LLC

VPS Recreation

FLIGHT #1 –

First Place: Larry Edmonds, David Hollinsworth, Ryan Bates, Dave Thomas

Second Place: Tom Collup, Taylor Leonard, Erik Nurmi, Andrew Gisriel

FLIGHT #2 –

First Place: Ray Megill, Chris Cross, Bill Knight, Richard Zmuda

Second Place: Frank Cataldi, Greg Falter, Rob Hessel, Dustin Thompson

FLIGHT #3 –

First Place: Aaron Mindell, Brian Bichy, Andrew Spencer, Patrick Kenealy

Second Place: Brian Smith, Andy Barnes, Jim Belliveau, Patrick Smith

Longest Drive Men – Andrew Gisriel

Longest Drive Women – Tammy Brende

Closest to the Pin Men – Andrew Gisriel

Closest to the Pin Women – Jennifer Bennett

Straightest Drive Men – Glenn Loveland

Straightest Drive Women – Jennifer Bennett

Putting Contest -

First Place: David Gates

Second Place: Brian Mohan

• Chase Hudson, Chair, Sahouri Insurance

• Thomas (T.J.) Socks, Vice-Chair, Becht Engineering BT

• James Anderson, Board Liaison, Becht Engineering BT

• Claire Donohue, SI Restoration

• Scott Duke, The W itmer Group

• Joe Esposito, Hann & Hann Construction Services

• Rasneek Gujral, Rees Broome, PC

• Austin Haspert, Foam Solutions

• Matthew Merckel, Tidewater Property Management

• Evan Picciotto, Kris Konstruction Roofing Professionals

• Keith Rivers, Atlantic Maintenance Group

• Linda Sheets, Kolb Electric

• Keith Stains, Property Management People

Thank you to all the volunteers who came out on Wednesday, August 16th to help with the Marley Glen School Clean-Up!

Over 55 years ago, the Fair Housing Act (“FHA”) was enacted to protect against discrimination in housing based on race, color, religion, gender, disability, and various other protected factors. That statute is heavily relied upon today to alleviate barriers that result in separate and unequal housing based on protected factors such as race. Despite the longstanding existence of the FHA, discrimination in housing remains.

In January 2023, the U.S. Department of Justice filed a Statement of Interest in the case of Louis et al. v. SafeRent, et al. (D. Mass.). The Department of Justice files such statements in federal cases where the matter is one of national importance to explain to a Court why a case between private parties is of interest to the United States. In this particular case, two plaintiffs, who were Black rental applicants using housing vouchers to pay for a portion of their rent, alleged race discrimination under the FHA against SafeRent. The plaintiffs were denied rental housing based on their “Safe Rent Score”, a score derived from the defendant’s algorithm-based screening software. The plaintiffs allege the scoring system has an unlawful disparate impact on Black and Hispanic rental applicants as the algorithm relies on certain factors that disproportionately disadvantage those communities, such as credit history, eviction history, and nontenancy related debts. Further, the system failed to account for the use of housing vouchers which increase a tenant’s ability to pay rent. In addition to the artificial intelligence issues this case could present, this case is an example of how some screening processes adversely impact minorities.

In March 2023, the U.S. Department of Justice and the Consumer Financial Protection Bureau (“CFPB”) filed a Statement of Interest in the case of Connolly v. Lanham (D. Md.), a lawsuit filed under the FHA, in addition to other laws, where the plaintiffs, Black homeowners, allege an appraiser and lender violated the FHA by lowering the valuation of their home because of their race and by denying them a refinance based on that appraisal. The Justice Department and CFPB statement explains how it is illegal for a lender to rely on an appraisal it knows or has reason to believe is discriminatory.

These recent cases illustrate the continued existence of housing discrimination. Many Maryland residents do not have a meaningful choice when it comes to housing, as those decisions are made for them based on income, systematic housing discrimination, and barriers to upward mobility. In addition, people of color are often in communities with greater exposure to environmental harms and risks of climate calamities such as flooding or extreme heat.

To further bolster the FHA and address inequities, the U.S. Department of Housing and Urban Development (“HUD”) announced a new proposed rule to Affirmatively Further Fair Housing (“AFFH”). The AFFH seeks to remedy the lingering effects of housing discrimination and disparity in access to housing, as well as to expand upon existing HUD policy to foster transparency and accountability with regard to housing practices and policies.

Under AFFH, recipients of HUD funds must take “meaningful actions, in addition to combating discrimination, that overcome patterns of segregation, eliminate inequities in housing and related community assets, and foster inclusive communities free from barriers that restrict access to opportunity based on protected characteristics.”

24 C.F.R. § 5.152. To ensure compliance, HUD has created guidance designed to help program participants identify fair housing issues in their communities through data provided by HUD and local information and highlight meaningful actions to implement to address those issues. Under the proposed rule, “meaningful actions” are those things which reduce or end significant disparities in housing needs and access to opportunity, replace segregated living patterns with integrated and balanced living patterns, transform racially and ethnically concentrated areas of poverty into well-resourced areas of opportunity, and foster and maintain compliance with civil rights and fair housing laws and requirements. 24 C.F.R. § 5.152

AFFH does not enumerate specific actions HUD recipients must take to address fair housing issues. However, it does empower recipients to be part of the solution in remedying housing discrimination. In short, the AFFH helps local communities and governments do a deeper analysis as to why certain groups are disproportionately impacted and prompts solutions. This type of grassroots approach is necessary to overcome historic barriers that have resulted in unequal access to housing and homeownership and in segregated and economically depressed communities. By encouraging HUD recipients to engage their communities to confront issues, all become vital stakeholders.

While the AFFH is still in its drafting phase, the proposed new rule has sparked new hope in communities to remove barriers and eradicate systemic racism and segregation in housing.

Written by: Tiffany M. Releford Partner, Whiteford 202-659-6764 treleford@whitefordlaw.comSome of our Chesapeake Chapter members and Board members had a great day on Tuesday, August 1st partnering with The Complete Player Charity and their STEAM campers. The day was spent working with the campers and educating them on how to run a Board meeting and about real-world career skills and knowledge! We look forward to collaborating again in the future!

703-284-0561

Tavarious.Butts@Truist.com

Friday, October 27, 2023

6:00 – 10:00 pm

Historic Savage Mill

8600 Foundry St, Savage, MD 20763

Dinner, Drinks, Dancing & more!

Awards will be given for best Broadway costume!

Targeted housing discrimination has occurred for close to a century. In the 1930’s, Franklin D. Roosevelt established a home buying aid to help bolster the economy. Unfortunately, this aid was only given to white people. The National Housing Act of 1934 backed mortgage loans to promote homeownership, but only for white people. Thus, Redlining was born.

Redlining in Baltimore began in 1910 when a white homeowner sold property to a black attorney, thus bringing black residents into a white neighborhood. In turn, official and unofficial housing discrimination policies were put in place to stop this from occurring again. One of the first official policies was Baltimore City Ordinance 610, known as the West Plan. This ordinance, passed by the City of Baltimore in December of 1910, stated that no Black resident could move on to a block in which more than half of the residents were white and vice versa. Many Baltimore Communities followed suit and created covenants that restricted black people from moving in. This forced them to move to communities with a lack of resources and investment.

In 1937, the Federal Homeowners’ Loan Corporation (HOLC) published its Residential Security Map of Baltimore. This map graded the lending risk factors and desirability of neighborhoods in Baltimore. While initially part of the New Deal’s National Housing Act of 1934, intended to help prevent foreclosures, the maps soon became a symbol of race-based housing discrimination. Most of Baltimore’s black neighborhoods were graded with a D and colored in red (redlining), with high rents and poor-quality housing. The consequences of redlining persist in Baltimore to this day. Denied access to fair lending practices, black residents face significant barriers to homeownership, wealth accumulation, and upward mobility. The impact is evident in the stark racial segregation and economic disparities that persist in the city. Predominantly black neighborhoods continue to face disinvestment, inadequate infrastructure, and limited access to quality education and healthcare. Denied loans and other financial services to certain neighborhoods based on their racial composition has had a profound impact on the city of Baltimore and other cities across the country. These neighborhoods

experience a lack of investment in schools, infrastructure, and essential services, exacerbating social and economic disparities. This legacy continues to shape the landscape of Baltimore today, with persistent racial segregation and unequal access to opportunities.

Redlining has a significant impact on property values in neighboring areas as well. The spillover effect happens when the city disinvests in one area which in turn hurts the neighboring areas. The lack of property maintenance and limited access to resources and amenities lead to a general decline in the overall quality of the neighborhood. These factors can negatively influence the desirability of neighboring areas, leading to a decrease in property values. Recognizing the detrimental effects of redlining, efforts have been made in recent years to address and confront this legacy and promote fair housing practices in Baltimore. Community organizations, activities, and policymakers have advocated for policies that advance equitable housing opportunities, combat housing discrimination, and invest in underserved neighborhoods. Initiatives like the Baltimore Housing Mobility Program provide housing vouchers and support for low-income families to access housing in higher-opportunity areas.

To this day, the historical legacy of redlining continues to impact property values and perpetuate disparities in many communities . By addressing the systemic inequalities resulting from redlining, communities can work towards creating more inclusive and economically vibrant communities that benefit both the affected areas and their neighboring properties.

References:

https://www.mdhistory.org/baltimores-pursuit-of-fair-housing-a-briefhistory/

https://www.history.com/news/housing-segregation-new-deal-program

Written by: Dani Bressler, CAS, EBP, Toepfer Construction Co., Inc dbressler@toepferco.com & Elisabeth Kirk, TRC Engineering, EBP ekirk@trc-engineering.com

CAI founded, incorporated as a 501(c)(6) nonprofit Orange County CA and the Washington Metropolitan were the first two chartered chapters.

CAI hosted its first national conference in New Orleans, LA

CAI Research Foundation incorporated as a 501(c)(3). Now called the Foundation for Community Association Research1

The first Guide for Association Practitioners (GAP) publications--Association Management—printed

First issue of Law Reporter

Central Maryland Chapter incorporated as a 501(c)(6). 1994 reincorporated as Chesapeake Region Chapter 2

CAI launched The Professional Management Development Program for credentialing managers

The first managers awarded the esteemed Professional Community Association Manager (PCAM)

First Issue of Common GroundTM

First state legislative action committee-California

CAI created the National Board of Certification for Community Association Managers (NBC-CAM)

In 2013 the name changed and became the International Community Association Managers

International Certification Board (CAMICB)2

Certified Manager of Community Associations (CMCA) examination first administered

Community Insurance and Risk Management Specialist designation

First online course

First online webinar

First international chapter—South Africa

Educated Business Partner distinction

44,000 members

CAI celebrates its 50th anniversary

Fifty years ago—1973—the Community Associations Institute (CAI) was created. Lincoln “Linc” Cummings, one of its founding leaders, is still very present and an ongoing ambassador of the history and accomplishments of CAI. “We created and established CAI as the preeminent source of information, training, guidance, and research on community associations in the country….CAI was a social experiment with policy and decision making shared equally with the interest groups in the successful creation and operation of community associations”.1

Mr. Cummings was reared in Newton, MA. He received his Bachelor of Science in Industrial Engineering from Lehigh University in 1956. His 67+ year career includes engineering with Olin Mathieson Chemical Corporation and IBM, many management roles at IBM, a commissioned officer in the United States Air Force, a community association consultant and president/CEO of Cummings and Associates, among others. He summarizes most of his work years as being “focused on people motivation, training, and management”, adding his “biggest personal challenge other than performing as best as possible, was to always be aware, have empathy and develop a win-win for all”.2

While working as an IBM executive in Gaithersburg, MD, Linc served as Board president of his Montgomery Village Whetstone Homeowner Association and as Vice President of the master association Montgomery Village Foundation. He recalls hosting monthly sharing luncheons with the developers and General Managers of two other large planned-communities--Columbia MD and Reston VA. 3 Because of his professional acumen and community association experience Linc was invited to be the Homeowner member of a leadership group creating a nonpartisan, nonprofit research and education organization supporting community associations.4 It would become CAI.

CAI recognizes among its founders the Urban Land Institute (ULI), the National Association of Home Builders (NAHB), the United States League of Savings Associations (USLSA), the Veterans Administration, builder/developers and a number of community association professionals. In 1964 ULI--a multi-disciplinary institute of real estate and land use experts--published “Technical Bulleting No 50: The Homes Association Handbook’’ recommending the creation of a national organization.5 Byron Hanke, the principal author, was a Harvard-educated urban planner and author of influential works on common interest communities. The concept of a nonprofit support organization crystallized in Hanke’s 1971 “A Proposal for a National Council of Homes Associations”. 6 In 1973, the NAHB gave Hanke a $30,000 grant to create such an organization.7,8

Cummings recalls for two years Bryon Hanke hosted at his home a monthly meeting of the planners. The group included David Rhame, a local developer and Chair of The National Association of Housing

Cooperatives, David Stahl, Executive Vice President of the ULI, and Lincoln Cummings, the homeowner businessman. Rhame, Stahl and Cummings subsequently traveled extensively across the United States to raise additional funds and promote the new organization.9

Education was always a priority initiative. The leadership began building educational opportunities to make industry expertise widely available. Cummings and others again traveled across the country to host in-person events. Eventually, the leaders concluded the best way to engage and educate was locally--through a Chapter system.10 In 1974, Orange County California and Washington Metropolitan (DC) were the first two chartered Chapters. During those formative years, Linc served as charter vice president (1973-1975) and president (1975-1976). He testified before the US House Ways and Means Committee on tax policy, successfully advocated for a Directors & Officers (D&O) policy, chaired the New Dimensions Task Force, formed and led the CAI Research Foundation11, now the Foundation for Community Association Research. A decades-long homeowner volunteer leader, Linc and his wife Martha Klein Cummings personally endowed through the FCAR the annual Homeowner Leader of the Year Award.

In 1991 and again in 2022, CAI honored Linc with the Byron Hanke Award for his lifetime commitment to homeowner education. Other awards include the CAI-RF Leadership Award (1979), Honorary Advisory Award (1983), Distinguished Service Award (1985), Academy of Authors (1991), Leadership Award (1997).12 Lincoln Cummings, still an active member of CAI, most recently attending the 2023 DC Expo and the National Conference in Dallas. He continues to model the enthusiasm, character and expertise of the organization he helped found.

Fifty years after its founding, CAI has 45, 000 members and 64 chapters, including the United States, Canada, the Middle East, and South Africa, and relationships with Australia, South Africa and the United Kingdom.13 The Foundation for Community Association Research estimates in 1970 there were 10,000 community associations in the United States, 700,00 housing units, housing 2.1 million people. Its “Fact Book 2021” reports significant increases: 358,000 community associations, 27.7 million housing units, housing 74.2 million people. FCRC gauges twenty-nine percent of the US population now lives in a community association.14 By 2040, CAI anticipates the community association housing model will be the primary form of housing in the United States in 2040.15

References

1 Lincoln Cummings, personal document, “What made CAI special/Important/ valuable during my time Of service”, undated.

2 Lincoln Cummings, personal document, “CAI Interview Questions, paragraph 5, January 15 2015.

3 Lincoln Cummings, personal email to Cathy (sic)(Cindy) McKoin, March 31 2023

4 Lincoln Cummings, personal document, “CAI Interview Questions, paragraph 2, January 15, 2015.

5 Community Associations Institute (2023), “CAI Celebrates 50 Years”, caionline.org/AboutCAI/Pages/ History.aspx

6 George Liebmann (April 1, 2022) “The Other Government: the Residential Community Association” The American Conservative, American Ideas

7 Foundation for Community Association Research (FCAR), “Who Is Byron Hanke?”,Foundation.caionline.org/scholarships/recent-fellowshiprecipients/hanke_bio/

8 In 2017 the Byron Hanke family made a $30,000 legacy gift to FAR for graduate student research on community associations—The Byron Hanke Fellowship.

9 Lincoln Cummings, personal email to Barbara Byrd Keenan, Executive Vice President CAI, RE: 25th Anniversary Celebration Recollections, October 21, 1998.

10,11 Lincoln Cummings, personal email to Vicki Santaniello RE: CAI Education/ Credentials--50th Anniversary, March 17, 2023.

12 Lincoln Cummings, personal email to Barbara Byrd Keenan, Executive Vice President CAI, RE: 25th Anniversary Celebration Recollections, October 21, 1998.

13,15 Community Associations Institute, (May 10, 2023), press release, “Community Associations Institute (CAI) Celebrating 50th Anniversary at Dallas Conference”.

14 Foundation for Community Association Research (2022). “Statistical Review: Summary of Key Association Data and Information” and “20212022 U.S. National and State Statistical Review”, foundation.caionline.org

Written by: Cindy McKoinmanagers conquer

With underlying mortgages, capital improvement loans, reserve accounts, lockbox & payment processing, and unit loans, we’re the real estate bank with unreal services.

What have you gained through your membership in CAI?

The Chesapeake Region Chapter loves our members, and we want to know!

CRCCAI launched “Testimonial Tuesdays”, giving our membership an opportunity to express how membership with CAI has influenced your career, education, board, or business.

Please send us your testimonial to be featured on our social media pages over the next coming months! Use the link below to submit your testimonial!

www.surveymonkey.com/r/FRZV2GJ

When you lead your community on a path to change, each and every decision is an important one. With competing priorities, juggling it all as a community leader can seem complex. But it doesn’t have to be.

No matter the property type, our local team has the expertise and solutions to anticipate your needs and respond. Our service-first philosophy means we don’t stop until what’s complicated becomes uncomplicated. Welcome to life, simplified.

• Atlantic Maintenance Group

• Community Association Management Professionals

• Community Association Underwriters of America

• DMA Reserves, Inc.

• Hann & Hann Construction Services

• LS Systems

• MillerDodson Associates

• National Cooperative Bank

• Nexterior Contracting

• Palmer Brothers Painting & General Contracting

• Pinnacle Financial Partners

• Tidewater Property Management

• Toepfer Construction Co., Inc

• TRC Engineering

“Many thanks toour Social Committee for putting this event together!”

JANUARY

Wednesday, 18th - Charting Your Course Webinar (9-10 am)

Wednesday, 25th - How to Get the Most Out of Your Management

Contract Homeowner Webinar (6:30-8:30 pm)

FEBRUARY

Wednesday, 15th

Breakfast Webinar: Money Management (9:30 am - Noon)

MARCH

Wednesday, 22nd

Breakfast Seminar: Deeper Dive Into Reserve Studies & Funding

Ten Oaks Ballroom, Clarksville, MD

APRIL

Wednesday, 12th - Happy Hour at Guinness Brewery

Halethorpe, MD

Friday, 21st - Delmarva Breakfast Seminar: Budget Roundtable

Atlantic Sands Hotel & Conference Center Rehoboth, DE

MAY

Monday, 8th - Delmarva Golf Outing

Glen Riddle Golf Club, Berlin, MD

Wednesday - Saturday, 17th - 20th - CAI National Conference Dallas, TX

Wednesday, 24th - Breakfast Webinar: Board Meetings (9:30 am - Noon)

JUNE

Thursday, 15th - Multi-Chapter Block Party

Lone Oak Farm Brewing Co., Olney, MD

JULY

Wednesday, 12th - Manager Huddle (Virtual)

Thursday, 20th - Crab Feast

Sandy Point Park Annapolis, MD

AUGUST

Tuesday, 1st - The Complete Player Charity Event

Monday, 14th - Golf Outing

Norbeck Country Club, Rockville, MD

Wednesday, 16th - Landscaping Day

Marley Glen School, Glen Burnie, MD

Date TBD - Manager Huddle (Virtual)

SEPTEMBER

Wednesday, 13th - Breakfast Seminar:

“The Top Five Things You Should Know Before You

Ten Oaks Ballroom, Clarksville, MD

OCTOBER

Monday, 2nd - Annual Expo & Symposium

LIVE! Casino and Hotel Hanover, MD

Friday, 27th - Annual Social historic Savage Mill, Savage, MD

Friday, 10th - Delmarva Expo Princess Royale, Ocean City, MD

Wednesday, 13th - Breakfast Seminar: Strange But True Things That Happen in Our Industry and at Your Community Ten Oaks Ballroom, Clarksville, MD