GIFTSINWILLS GUIDE

Leaving a legacy of support

WELCOME

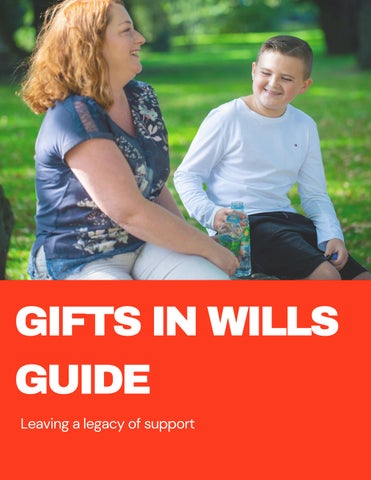

Thank you for considering leaving a Gift in your Will to St David’s Children Society.

Leaving a gift in your Will is more than a financial decision, it’s an act of compassion which will support vulnerable children in Wales and reflect your belief in a world where every child, no matter their start in life, is given the love, stability, and support they deserve.

By supporting St David’s Children Society in this way, you ' re choosing to create a legacy of love, impacting on the lives of children who have been adopted or fostered, and families who open their hearts and homes. Your gift will help us ensure that every family created receives support, care and guidance.

By remembering St David’s Children Society in your Will, you are linking your story to the stories of some of societies most vulnerable children, and building and supporting secure, stable and loving families.

This guide will walk you through the process simply and clearly Your gift, no matter the size, will make a lasting difference to the countless children and families we are privileged to support

Together, we can continue to build brighter futures, full of hope and belonging.

Jason Baker

Jason Baker CEO

ABOUTSTDAVID‘S?

St David’s is an adoption and fostering charity dedicated to finding families for vulnerable children. Our work is supported by postplacement and post-adoption care, providing ongoing personal support and expertise whenever and wherever needed.

Every adoption or foster placement begins with a child, each with a unique story. These children may have experienced trauma leading to ongoing consequences and complex needs, making them vulnerable. Our approach is grounded in the belief that every child deserves a loving, stable family environment to thrive in We act as a lifeline for children waiting to be adopted or fostered and for the families who welcome them into their hearts

The adoption and fostering journey brings both rewards and challenges. Our services are tailored to address the unique hurdles that adoptive and foster families may encounter, ensuring they have access to expert advice, emotional support, and practical assistance. We aim to empower families to tackle any issues they face.

At St David’s, we believe that by supporting families, we are nurturing brighter futures for some of Wales's most vulnerable children.

Since 2020 St David’s has placed

100 children

In one year St David’s offered over 900 hours of post adoption care and support

2 in 3 adoption placements struggle at some point, and 1 in 3 require high level support to stabilise the adoption (Selwyn, 2014)

IMPORTANCEOFLEGACY GIFTS

Each legacy gift holds the power to change children’s lives. Whether large or small, every donation contributes to the vital funds needed to support adopted and fostered children, ensuring they receive the care and opportunities they deserve.

Why We Need Legacy Donations

Legacy donations are a powerful, lasting act of support, a reflection of your belief in a better future for adopted and fostered children. These gifts directly impact the families we support, enabling us to continue offering expert guidance, understanding, and compassion when it’s needed most.

They sustain our support services

Legacy gifts help us provide vital, ongoing services for children and families, from post-adoption support and therapeutic care to lifelong guidance that nurtures secure, loving relationships

They help us plan for the future

Knowing that legacy donations are in place gives us the confidence to make long-term, strategic decisions. It offers financial stability, allowing us to prepare for future challenges and ensure families will always have somewhere to turn.

They

drive innovation and growth

These gifts allow us to reinvest in our services, developing new resources, improving access to support, and adopting best practices that help us respond to the evolving needs of children and families

They show us your belief in our mission

Perhaps most importantly, legacy gifts reflect a deep, personal connection to our cause They are an enduring symbol of your care, compassion, and commitment to ensuring that every child has the chance to grow up in a safe, supportive, and loving family.

REWARDSOFLEGACY GIVING

Leaving a gift in your Will to support adopted and fostered children is a profound way to extend your care and compassion far into the future Here’s how legacy giving creates meaningful rewards for you and for generations to come:

Make a Lasting Impact

A legacy gift creates a ripple of hope that lasts well beyond your lifetime It helps ensure that adopted and fostered children and their families continue to receive the guidance, care, and advocacy they need to thrive

Tax Advantages

Gifts left to registered charities like ours are often exempt from Inheritance Tax. This means you can make a significant difference while also potentially reducing the tax burden on your estate.

Honour a Loved One

If someone close to you has benefited from adoption or fostering services, leaving a gift in your Will can be a touching tribute to their journey, helping other children and families find the same support and security.

Support a Cause Close to Your Heart

Whether you ' re passionate about ensuring lifelong support for adoptive families, enhancing therapeutic services, or promoting adoption awareness, your legacy gift can directly support the area you care about most.

Reflect Your Values

A legacy gift is a powerful way to express your belief in love, family, and the right of every child to feel safe and supported It becomes a lasting reflection of your values and the world you want to help create

Flexible and Personal

Legacy giving is completely flexible. You can choose to leave a fixed amount, a percentage of your estate, or a specific item of value. Whatever you choose, it will be used with care and purpose

Inspire Others

Sharing your decision to leave a legacy gift can encourage others to think about how they, too, can make a lasting difference Together, these acts of kindness create a powerful legacy of community and care

THEDIFFERENCEYOUR GIFTWILLMAKE

gacy Gifts Strengthen Our Support for n and Families

gifts play a vital role in shaping the future of n and fostering support. They help us grow, e, and ensure that no family faces their journey

ancing Our Services constantly working to improve the support we adopted and fostered children and their Legacy gifts help us develop new resources, expand our post-adoption services, build our offer of therapeutic services, and ensure our teams have the ongoing training they need to provide expert care

anding Post-Adoption Support (PAS) mily’s journey is unique. Legacy donations to widen the range of post-adoption support available, including counselling, therapeutic ng advice, and access to peer support groups, es feel heard, understood, and supported for

uring Free and Universal Access

eve that financial barriers should never stand ay of support. Legacy gifts help us continue to our services without any charge meaning that accessible to all who need them, whether they’re just starting out on their adoption journey or seeking help years down the line

Securing Long-Term Stability

As a charity, legacy gifts give us confidence and stability to plan for the future. They mean we can continue supporting adopted and fostered children for generations to come, providing safety, belonging, and care when it matters most.

WHYDOYOUNEEDA WILL

Your Will tells everyone what should happen to your estate (money, possessions and property) after you die. The thought of making a Will can make many people feel uncomfortable, but sadly if you don’t leave a Will, the law decides how your estate is passed on, and this might not be in line with your wishes.

A Will makes it much easier for your family or friends to sort everything out when you die, without a Will the process can be more time consuming and stressful for them Most importantly, a Will ensures by law that you can look after those closest to you

Writing a Will is especially important if you have children or other family who depend on you financially, or if you want to leave something to people de your immediate family.

mber that your Will can always be updated at oint if your circumstances change. Only the recent updated Will is valid.

HOWTOLEAVEAGIFT INYOURWILL

Here’s a simple, step-by-step guide of how to leave a gift in your Will:

1. Make a list - Start by figuring out all the assets you have - this can include properties, finances and prized possessions. This gives you an idea of what you could potentially leave to people and causes you care about.

2. Decide your beneficiaries - Your loved ones are your priority, so it’s important to take them into account first. After you’ve considered them, think about which charities or causes you’d like to leave something to

3. Choose the type of gift - Decide what kind of gift you’d like to leave. This could be:

a. Specific gift. You could choose to leave a particular item of value. This could be anything from jewellery to a piece of art, or even a property.

b. Pecuniary Gift - This means leaving a fixed amount of money. It’s a simple and generous way to support our work. Please keep in mind that over time, inflation may reduce the value of your gift, so we recommend reviewing your Will regularly or linking your gift to inflation

c. Residuary Gift - This type of gift involves leaving a share, or all, of what’s left of your estate after other gifts and commitments have been fulfilled It’s one of the most impactful ways to help us continue our mission, and its value is more likely to keep up with inflation

d. Revisionary Gift - This allows you to take care of your loved ones first, with your estate going to chosen family and friends for their lifetime, before being passed on to the charity. It’s a meaningful way to ensure both your family and vulnerable children benefit from your kindness.

e. Contingent gift - This is dependent on a certain event. For example, you could leave a gift to our charity if you other beneficiaries are no longer alive.

HOWTOLEAVEAGIFTIN YOURWILLCONTINUED...

4. Seek professional advice - Making a Will is a big decision To ensure your Will represents your wishes and is completely valid, you should get professional advice. They can also provide you with information on potential tax benefits you can gain through legacy giving.

5. Detail your gift - When writing your Will or updating it, you’ll need to provide specific details about your chosen gift. This includes the type of gift and our charity details. This information is crucial for ensuring the gift reaches us in the future. Your solicitor can assist you in adding the specific wording to your Will, but it might look something like this:

a. Residuary gift (a share of your estate): Please include: “I give (%) of the residue of my real and personal estate to, St David’s Children Society, Lambourne House, Lambourne Crescent, Llanishen Business Park, Llanishen, Cardiff, CF14 5GL registered charity number 509163 . ”

b Pecuniary gift (a fixed sum of money): Please include: “I give the sum of (£) to St David’s Children Society, Lambourne House, Lambourne Crescent, Llanishen Business Park, Llanishen, Cardiff, CF14 5GL registered charity number 509163 ”

6. Update your will - If you already have a Will and wish to add a gift to St David’s Children Society you can do this by adding a codocil - a document used to change a will that has already been made.

7. Let us know - You do not have to tell us of your decision, but we would love to hear from you if you decide to leave a gift. It helps us to plan for the future and, of course, we would like to say thank you. This is not compulsory and we will always respect and honour your privacy.

FINDASOLICITOR

We strongly recommend that you use a solicitor to make a Will. A solicitor will charge a fee to draw up a Will, but it is worth the expense for your peace of mind and to ensure your wishes are respected.

To find a solicitor in your area, you may wish to contact the Law Society who will put you in contact with a reputable solicitor, who will incorporate your wishes in your Will.

GLOSSARYOFTERMS

Crafting your Will can seem complicated, especially when legal language and phrases are used This glossary shouldn’t replace professional advice, but it should help to make some of the legal jargon a bit clearer. Always seek professional advice when preparing to write or update your Will.

Here’s a simplified glossary of common terms you might come across.

Estate planning: This is all about planning how your estate (your money, property and possessions) will be distributed after your death.

Executor: This is the person you choose to ensure your wishes, as written in your Will, are carried out. They sort out your estate and pass it on to the people who are meant to receive it.

Beneficiary: A person or organisation that you have chosen to receive something from your estate. This can be a loved one, a friend or a charity.

Bequest: This is just another term for a gift left to someone in your Will.

Inheritance Tax: This is a tax paid on the portion of an estate that’s passed on when someone dies, although not everything is taken into account and not everyone has to pay it Currently, Inheritance Tax is not paid on charitable gifts

Intestacy: If you die without a Will, you’re said to have died ‘intestate’. In this case, specific legal rules will be used to decide how your estate will be divided.

Probate: This legal process confirms an Executor’s authority to deal with your estate.

Trust: This is a legal arrangement where you give money, property or investments to someone else (Trustees) so they can look after them for the benefit of others (Beneficiaries).

Legacy: This is similar to a bequest, it’s any gift left in your Will for a person, organisation or charity.

Specific gift (or Specific Legacy): This is a particular item or property which is left to a specific person or organisation in a Will

Residuary gift (or Residuary Legacy): This is a gift from the leftover portion of your estate once all the debts, funeral expenses, administrative costs and all other gifts have been deducted.

Codicil: This is a legal document that adds to, substitutes or revokes a part of your existing Will

Life Interest: This is a gift in a Will that allows the Beneficiary to receive income from a fund or property for their lifetime, with the remaining funds then going to others. 10

THANKYOU

We understand that deciding to leave a legacy gift is a big decision, one that requires time and careful thought. We hope this guide offers you some helpful information as you make these decisions.

Leaving a gift in your Will is a generous and powerful way to leave a meaningful legacy We are touched that you ' re thinking of St David’s in this way and know that, with your support, we can continue to positively impact the lives of vulnerable children in Wales.

CONTACT

St David’s Children Society Lambourne House, Lambourne Crescent, Llanishen Business Park, Llanishen Cardiff, CF14 5GL

029 2066 7007 or info@stdavidscs.org

STAY IN THE LOOP

Follow us on Instagram, Facebook & YouTube

Registered Office: Lambourne House, Lambourne Crescent, Llanishen Business Park, Llanishen Cardiff, CF14 5GL

St David’s Children Society is registered as a charity with the Charity Commission for England and Wales (Registration No: 509163) and a company limited by Guarantee (Registered Cardiff 1546688)

Mae Cymdeithas Plant Dewi Sant wedi ei chofrestru fel elusen gyda Chomisiwn Elusennau Cymru a Lloegr (Rhif Cofrestru: 509163) a chwmni cyfyngedig drwy Warant (Cofrestredig Caerdydd 1546688)