Retail resilience in California

Strong job growth across the region

Retail expansion throughout Arizona

Retail resilience in California

Strong job growth across the region

Retail expansion throughout Arizona

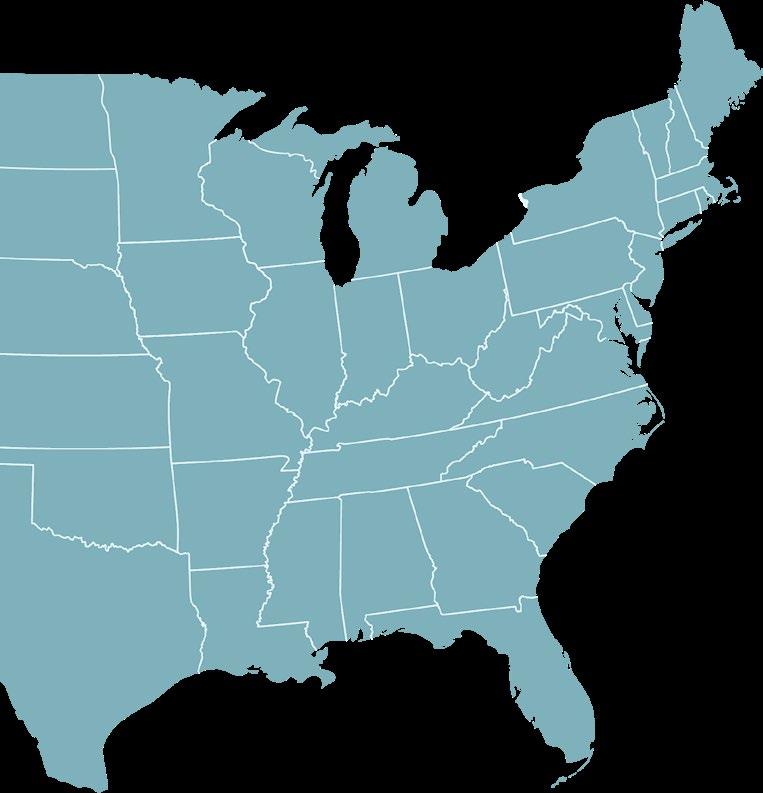

The SRS footprint mirrors the affluent population migration, steady job growth, and low unemployment in the Western U.S. These characteristics, along with easy accessibility to international markets, make this unique region ripe for retailers.

Key gateways for trade with Asia, among the largest and most important ports in the U.S.

The retail landscape in the western United States presents a mix of opportunities and challenges for commercial real estate investors. The region has seen resilient performance in retail sectors, driven by strong consumer demand, especially in areas with robust population growth such as Arizona, Nevada, and Utah. Retail spaces in these states benefit from favorable demographics, tourism, and a relatively lower cost of living compared to coastal markets like California.

However, the broader commercial real estate market is navigating a complex environment influenced by higher-for-longer interest rates and evolving consumer behaviors. While retail spaces in suburban and high-growth areas continue to perform well,

urban centers face challenges with foot traffic and shifting demand patterns post-pandemic. Despite these hurdles, retail remains one of the stronger segments in the CRE market, bolstered by the demand for essential goods, services, and experiential retail formats.

Investors are advised to focus on well-located assets, consider the impacts of rising financing costs, and be aware of the broader economic and geopolitical uncertainties that could affect the market. Strategies such as optimizing liquidity and exploring niche markets within the retail sector could help navigate these challenges while positioning for future opportunities.

California, Washington, and Colorado boast some of the highest median household incomes in the country.

Rapid population growth, with states like Nevada and Arizona growing by over 1.3% annually between 2020 and 2024.

Nevada and California continue to see billions in tourism revenue, with Las Vegas alone generating an estimated $86 billion in total economic impact in 2024. Tourism fuels local retail demand, particularly in hospitality, entertainment, and luxury shopping.

Tech hubs like Silicon Valley and Seattle foster innovation in retail technologies and e-commerce platforms and help retailers adapt quickly to online and omni-channel shopping trends.

Relatively low unemployment and ongoing job growth contribute to economic stability and expanding consumer markets in the Western U.S.

California’s young and affluent consumers create a vibrant retail environment. Silicon Valley’s presence in California continuously drives technological innovation in retail.

With a GDP of approximately $4.08 trillion, California remains the largest state economy in the U.S. and the world’s fifth-largest economy. The state continues to be driven by strong contributions from the information technology sector. California’s popularity as a tourist destination further boosts retail opportunities, especially in major cities like Los Angeles and San Francisco.

2024 was a year of moderated growth. California’s job market, particularly in the tech sector, faced headwinds due to higher interest rates and inflation. The state’s housing market is expected to recover from a slump, especially in single-family home construction, which should help stabilize the broader economy.

The UCLA Anderson Forecast suggests that while California’s economy will grow faster than the U.S. average, it will do so at a restrained pace. Risks such as potential changes in national economic policies and geopolitical tensions could impact this growth trajectory.

California’s economy is experiencing a period of slower growth, driven by ongoing challenges in the labor and housing markets, but remains resilient with key sectors continuing to contribute positively.

#1 in new business starts 5th

Largest economy in the world

Fortune 500 companies call California home

Source: CoStar Retail Markets

West Coast Advantage

California’s position on the West Coast provides direct access to the Pacific Ocean, making it a prime gateway for trade with Asia.

Crucial Port Cities

The state is home to some of the busiest ports in the country, including the Ports of Los Angeles and Long Beach. These ports handle a significant portion of U.S. container cargo, facilitating the import and export of goods across the globe.

Los Angeles International Airport (LAX) and San Francisco International Airport (SFO), play a key role in air freight logistics.

Tax credit, funding, and job training programs promote growth and expansion within California.

• California Competes Tax Credit

• Advanced Transportation and Manufacturing Sales and Use Tax Exemption

• Research & Development Tax Credit

• Zero-Emission Vehicle Funding Opportunities

• Employment Training Panel

• Economic Development Rate Program

Source: U.S. Bureau of Labor Statistics Metro Areas, Esri Metro Areas

Southern California

Tenant Services

Owner Services

Capital Markets

ON MARKET

Lumberjack Square in Bakersfield, CA

Price: $14,083,000 | CR: 7.50% NOI: $1,056,241

CVS in Los Angeles, CA

Price: $10,242,000 | CR: 4.75% NOI: $486,484

Walgreens in Buena Park, CA

Price: $9,500,000 | CR: 5.58%

Chick-fil-A in Placentia, CA

Price: $8,488,000 | CR: 4.30% NOI: $365,000

RECENTLY CLOSED

Ralphs at Market Lofts in Los Angeles, CA

Sale Price: $20,900,000

Marketplace at The District

Tenant Services

Owner Services Capital Markets

Willow Glen Anchor Space

Northern California ON MARKET

28,845 SF in San Jose, CA

Watsonville Square

1,400 - 2,104 SF in Watsonville, CA

Former Walgreens Spaces 10 sites within San Francisco, CA

Holiday Market in Redding, CA

Price: $13,108,000 | CR: 6.50% NOI: $852,000

BP in Sacramento, CA

Price: $9,526,000 | CR: 5.00% NOI: $476,300

RECENTLY CLOSED

Crossroads Shopping Center in Fremont, CA

Sale Price: $16,600,000

Planet Fitness/Total Wind in Santa Rosa, CA

Sale Price: $13,954,703

The Pacific Northwest region has experienced robust economic growth in recent years, creating a fertile ground for retail expansion. The region’s strong economy is driven by diverse industries, including technology, manufacturing, and agriculture. The Pacific Northwest is also home to tech giants like Microsoft, Amazon, and Intel which have fueled job growth and increased disposable income levels. Anchoring Portland’s “Silicon Forest,” Intel maintains its largest global site in the region, contributing to a thriving technology sector that employs more than 70,000 people. Portland has established itself as a global hub for athletic and outdoor apparel, serving as the headquarters for Nike, Adidas, Columbia Sportswear, and Under Armour, while also attracting brands like On Running, Hoka, Lululemon, and Arc’teryx to establish a corporate presence in the city. As a result, consumer spending is on the rise across the region.

Population growth in the Pacific Northwest is another critical factor bolstering retail expansion. The region continues to attract a young, educated, and affluent demographic. This population growth has led to increased demand for diverse retail offerings, from high-end boutiques to large retail chains, catering to a variety of consumer preferences.

Additionally, consumers in the region show a strong preference for environmentally conscious brands and locally sourced products, pushing retailers to adopt sustainable practices and offer green products. This trend is especially prominent in Oregon and Washington, where there is a growing emphasis on eco-friendly retail environments, which resonates well with the region’s environmentally conscious population. Clean energy also takes up residence in the Pacific Northwest with firms like Vestas, Avangrid, and Powin focused on environmental responsibility, sustainability, and innovation.

Source: CoStar Retail Markets

SRS RECENT ACTIVITY

Tenant Services

Source: U.S. Bureau of Labor Statistics Metro Areas, Esri Metro Areas

Owner Services

Northgate Marketplace

Medford, OR

Walmart

Excess land sites throughout Oregon

Partial tenant representation list

Capital Markets

ON MARKET

Tractor Supply in Battle Ground, WA

Price: $11,564,000

Chick-fil-A in Lake Oswego, OR

Price: $6,840,000 | CR: 4.75% | NOI: $325,000

growth, population increase, and business-friendly policies position Nevada as a prime location for retail expansion.

Nevada’s economy has experienced recent significant growth, creating a strong platform for retail expansion across the state. The economic growth is largely driven by the booming tourism and entertainment industries, particularly in Las Vegas, which continues to attract millions of visitors annually. This influx of tourists contributes to high consumer spending, bolstering retail sales in both urban and suburban areas.

The state has seen consistent in-migration, particularly from California and other neighboring states, driven by Nevada’s lower cost of living and favorable tax environment. This population growth, especially in cities like Las Vegas, Reno, and Henderson, has led to an increased demand for retail services and products, encouraging both national and local retailers to expand their presence in the state.

Nevada’s economic diversification efforts have also played a significant role in supporting retail expansion. While tourism remains a dominant industry, the state has actively promoted growth in sectors like technology, manufacturing, and logistics. This diversification has created more job opportunities and increased disposable income, which in turn fuels consumer spending and supports the retail sector. Retailers are particularly drawn to Nevada’s business-friendly environment, which includes no state income tax and relatively low business taxes, making it an attractive location for expansion.

The rise of e-commerce and the integration of technology into retail operations have also influenced Nevada’s retail landscape. Retailers in the state are increasingly adopting online sales platforms and leveraging data analytics to better understand consumer behavior and preferences.

1st in the nation for solar energy capacity #7

Best state for taxes

Nevada has NO: personal income tax, franchise tax, unitary tax, inventory tax, inheritance tax or estate tax Companies employ Nevada’s workforce 238K

Capital Markets ON MARKET

Harmon Square in Las Vegas, NV

Price: $44,440,000 | CR: 6.09% | NOI: $2,707,544

Starbucks in Las Vegas, NV

Price: $2,737,000 | CR: 4.75% | NOI: $130,000

14%

Population growth in the last decade

$24B+ Annual tourism revenue

2nd Best state to start a business

4th

Best state to find a job

Colorado’s retail expansion is underpinned by strong population growth and a robust economy. The state’s increasing population, particularly in urban areas like Denver and Colorado Springs, has fueled demand for retail services. Colorado’s diverse economy, with key industries such as technology, aerospace, and healthcare, has maintained low unemployment rates, boosting consumer spending and retail growth.

Urban development and infrastructure improvements have also played a critical role. Rapid urbanization has led to the construction of new shopping destinations, making retail areas more accessible. Additionally, investments in transportation infrastructure have enhanced connectivity, encouraging foot traffic and supporting retail activity across the state.

Driven by population growth and urban development, Colorado retail thrives amid shifting consumer trends.

Tourism continues to be a major driver of retail sales in Colorado. The state’s appeal as a year-round destination attracts millions of visitors, particularly in tourist hubs like Denver, Aspen, and Vail. This influx of tourists significantly contributes to the retail sector, with spending in local shops, restaurants, and entertainment venues.

Shifts in consumer preferences are shaping the retail landscape as well. Retailers are increasingly integrating e-commerce and omnichannel strategies to meet evolving demands, while there’s a growing emphasis on sustainability and locally sourced products. The rise of suburban retail and experience-based offerings further highlight the dynamic nature of Colorado’s retail market.

Owner Services

Ave South Ground-up mixed use project in Loveland, CO

Foothills Mall

Regional mall in Fort Collins, CO

Shops at Northfield

Dominant shopping district of Central Park

Southlands

Super regional center in Aurora, CO

Block 162

Capital Markets

ON MARKET

Sandstone Care in Boulder, CO

Denver’s newest Class A office high-rise Partial tenant representation list

Price: $15,667,000 | CR: 6.75% | NOI: $997,665

Starbucks in Lakewood, CO

Price: $3,167,000 | CR: 6.00% | NOI: $190,015

RECENTLY CLOSED

Kindercare in Broomfield, CO

Sale Price: $9,351,725

Arizona’s retail sector is poised for expansion. The state’s rapid population growth, ranking among the fastest in the U.S., is creating increased demand for retail goods and services. This demographic shift is complemented by steady job market expansion across various sectors, including tech and healthcare, contributing to higher disposable incomes and consumer spending.

The tourism industry’s strong rebound post-pandemic is driving retail sales in popular destinations, while the resilient housing market is spurring growth in home goods and related retail segments. Arizona has also emerged as a significant hub for e-commerce fulfillment centers, supporting both online and brick-and-mortar retail operations. The state’s business-friendly environment, characterized by favorable tax policies and regulations, has attracted retailers looking to expand or relocate.

Arizona is home to a surging ecosystem of global giants, early stage entrepreneurs, and tech-savvy millennial talent.

Ongoing investments in infrastructure and urban development are creating new retail corridors and additional opportunities for growth. Collectively, these factors paint a picture of a dynamic and expanding retail landscape in Arizona, with multiple drivers supporting continued growth and innovation in the sector.

Lowest in the nation at 2.5% and the sixth lowest corporate income tax

Immediately accessible to three of the world’s largest economies (California, Texas, and Mexico)

#2 state for workforce quality and availability, and #1 in higher education degree opportunities

Arcadia Crossing in Phoenix, AZ

SEC Thomas Road & 44th Street

Canyon Trails Towne Center in Goodyear, AZ

NEC Yuma Road & Cotton Lane

Ahwatukee Foothills Towne Center in Phoenix, AZ

SWC Ray Road & I-10

Skyline Ranch Marketplace in San Tan Valley, AZ

NEC Hunt Highway & Gary Road

Asante Trails in Surprise, AZ

SWC Pat Tillman Boulevard & 163rd Avenue

Tractor Supply in Holbrook, AZ

Price: $8,182,000

RECENTLY CLOSED

Shoppes at Pebble Creek Marketplace in Goodyear, AZ

Sale Price: $7,185,000

Walgreens in Phoenix, AZ

Sale Price: $5,200,000

• Today, retailers need a myriad of industrial facilities to serve their rising e-commerce distribution needs.

• Retail owners and landlords are finding it increasingly important to embrace non-traditional retail tenants to remain relevant.

• Net lease investors are finding industrial a lucrative option to diversify their asset portfolio.

Garrett Colburn

President

949.698.1161 | garrett.colburn@srsre.com

RETAIL Newport Beach, San Diego, Inland Empire, San Francisco, Los Angeles

Terrison Quinn

Executive Vice President & Managing Principal

949.698.1107 | terrison.quinn@srsre.com

RETAIL Newport Beach, San Diego, Inland Empire, San Francisco, Los Angeles

Matthew Mousavi

Senior Managing Principal & Co-Head of National Net Lease

949.698.1116 | matthew.mousavi@srsre.com

CAPITAL MARKETS Newport Beach

Patrick Luther

Senior Managing Principal & Co-Head of National Net Lease

949.698.1115 | patrick.luther@srsre.com

CAPITAL MARKETS Newport Beach

Tom Power

Executive Vice President & Principal 415.908.4942 | tom.power@srsre.com

RETAIL San Francisco

Nick Wirick

Senior Vice President & Principal

951.669.1002 | nick.wirick@srsre.com

RETAIL Inland Empire

Ed Beeh

Executive Vice President & Managing Principal

602.682.6040 | ed.beeh@srsre.com

RETAIL Phoenix

Erik Christopher

Senior Vice President & Managing Principal 303.390.5252 | erik.christopher@srsre.com

RETAIL Denver

Tony Pierangeli

Senior Vice President & Managing Principal

303.390.5257 | tony.pierangeli@srsre.com

RETAIL Denver

David Pinsel

Managing Principal, National Industrial Services

310.991.8377 | david.pinsel@srsre.com

INDUSTRIAL Los Angeles

Richard Schwartz

Executive Vice President & Senior Managing Principal 949.868.1389 | richard.schwartz@srsre.com

INDUSTRIAL Newport Beach

Matt Martinez

Senior Vice President & Managing Principal

360.946.4240 | matt.martinez@srsre.com

RETAIL Pacific Northwest

Jeffrey Garza Walker

Executive Vice President & Managing Principal

602.682.6042 | jgw@srsre.com

INDUSTRIAL Phoenix

We’re always looking for top talent at SRS. Reach out to any member of our leadership team for more information on joining SRS Real Estate Partners.

Robbie Petty EVP & Managing Principal robbie.petty@srsre.com

Scott Ellsworth SVP & Principal scott.ellsworth@srsre.com

Chuck Gibson SVP & Principal chuck.gibson@srsre.com

Alan Houston SVP & Principal alan.houston@srsre.com

Brian Polachek SVP & Principal brian.polachek@srsre.com

Brad Balbo Senior Vice President brad.balbo@srsre.com

Stephanie Davis Senior Vice President stephanie.davis@srsre.com

Anna Sepic Senior Vice President anna.sepic@srsre.com

Gregory White

Senior Vice President greg.white@srsre.com

Ivan Garcia Vice President ivan.garcia@srsre.com

Chris Abdayem, CCIM Senior Associate chris.abdayem@srsre.com

Victoria Williams Senior Associate victoria.williams@srsre.com

Gary Chou EVP & Managing Principal gary.chou@srsre.com

Aron Cline

602.682.6025 Retail Phoenix

602.682.6063 Retail Phoenix

602.682.6035 Retail Phoenix

602.682.6022 Retail Phoenix

602.682.6045 Retail Phoenix

602.682.6016 Retail Phoenix

602.682.6054 Retail Phoenix

602.682.6044 Industrial Phoenix

602.910.3799 Capital Markets Phoenix

602.682.6030 Industrial Phoenix

602.682.6052 Retail Phoenix

602.899.0062 Industrial Phoenix

949.506.2012 Capital Markets Newport Beach

EVP & Managing Principal aron.cline@srsre.com 949.506.3209

Calvin Short EVP & Managing Principal calvin.short@srsre.com 949.506.2009

Matthew Alexander

Don Edrington

Chuck Klein

Joey Reaume

EVP & Principal matt.alexander@srsre.com

EVP & Principal don.edrington@srsre.com

EVP & Principal chuck.klein@srsre.com 619.223.3017

EVP & Principal joey.reaume@srsre.com 949.506.2015

Carlos Lopez Executive Vice President carlos.lopez@srsre.com

Rich Walter

John Few

Pat Kent

Scott Landgraf

Andrew Peterson

John Redfield

James DeRegt

Brad Fox

Jeff Gates

Debra Hoppe

Nick Krakower

Casey Mahony

Jeff Straka

Christopher Tramontano

Patrick Weibel

Executive Vice President rich.walter@srsre.com

SVP & Managing Principal john.few@srsre.com

SVP & Principal pat.kent@srsre.com

SVP & Principal scott.landgraf@srsre.com

SVP & Principal andrew.peterson@srsre.com

SVP & Principal john.redfield@srsre.com

Senior Vice President james.deregt@srsre.com

Senior Vice President brad.fox@srsre.com

Senior Vice President jeff.gates@srsre.com

Senior Vice President debra.hoppe@srsre.com

Senior Vice President nick.krakower@srsre.com

Senior Vice President casey.mahony@srsre.com

Senior Vice President jeff.straka@srsre.com

Senior Vice President chris.tramontano@srsre.com

Senior Vice President pat.weibel@srsre.com

Chris Beauchamp Vice President chris.beauchamp@srsre.com

Joe Chichester Vice President joe.chichester@srsre.com

Townsand Cropsey Vice President townsand.cropsey@srsre.com

Amber Edwards Vice President amber.edwards@srsre.com

Dave Faris Vice President dave.faris@srsre.com

Michael Fowle Vice President michael.fowle@srsre.com

Winston Guest Vice President winston.guest@srsre.com

Adam Handfield Vice President adam.handfield@srsre.com

Markets Newport Beach

Markets Newport Beach

Markets San Diego

Newport Beach

Kevin Held Vice President kevin.held@srsre.com

619.361.7662

McCall Huske Vice President mccall.huske@srsre.com 949.270.8202

Christopher Kehl Vice President chris.kehl@srsre.com

Greg Labarre Vice President greg.labarre@srsre.com

949.270.8235

Markets San Diego

Newport Beach

Newport Beach

619.489.9002 Capital Markets San Diego

Zach Leffers Vice President zach.leffers@srsre.com 949.270.8203

Chad Lieber Vice President chad.lieber@srsre.com 619.489.9004

Cortland Lioi Vice President cortland.lioi@srsre.com

Matt McNeill Vice President matt.mcneill@srsre.com

949.506.2007

Newport Beach

Markets Newport Beach

Markets Newport Beach

619.349.7460 Capital Markets San Diego

Alexander Moore Vice President alexander.moore@srsre.com 949.698.1164

Nick Moscicki Vice President nick.moscicki@srsre.com 949.629.4625

Dale Robbins Vice President dale.robbins@srsre.com

Tony Vuona Vice President tony.vuona@srsre.com

Zack Williams Vice President zack.williams@srsre.com

Robert Donnell First Vice President robert.donnell@srsre.com

Sarah Edwards First Vice President sarah.edwards@srsre.com

Susan Harris First Vice President susan.harris@srsre.com

Jake Prater First Vice President jake.prater@srsre.com

Stephen Sullivan First Vice President stephen.sullivan@srsre.com

Bree Casas Senior Associate bree.casas@srsre.com

Markets Newport Beach

Newport Beach

949.270.8200 Capital Markets Newport Beach

949.270.8211 Retail Newport Beach

949.506.5027

Markets Newport Beach

San Francisco

Markets Newport Beach

Markets Newport Beach

Newport Beach

Miranda Montgomery Senior Associate miranda.montgomery@srsre.com 951.669.1004

Steven Roberts Senior Associate steven.roberts@srsre.com

Hannah Rogers Senior Associate hannah.rogers@srsre.com

Parker Walter Senior Associate parker.walter@srsre.com

Kyle Zimmer Senior Associate kyle.zimmer@srsre.com

RJ Dumke Associate rj.dumke@srsre.com 949.438.3986

Tommy Feldman Associate thomas.feldman@srsre.com 949.749.7483

Inland Empire

Markets Los Angeles

Newport Beach

Newport Beach

Markets Newport Beach

George Gomez Associate george.gomez@srsre.com 949.519.1667 Capital Markets Newport Beach

Savannah Guel Associate savannah.guel@srsre.com

Jonny Justus Associate jonny.justus@srsre.com

Hoffman Moore Associate hoffman.moore@srsre.com

Nicholas Stanley Associate nick.stanley@srsre.com

Joe Beck

San Francisco

Beach

949.603.0365 Capital Markets Newport Beach

951.669.1007 Retail Inland Empire

Senior Vice President joe.beck@srsre.com 303.295.4835

Andrew Clemens Senior Vice President andrew.clemens@srsre.com

Tami Lord Senior Vice President tami.lord@srsre.com

Justin Gregory Vice President justin.gregory@srsre.com

Jim Hoffman Vice President jim.hoffman@srsre.com

Patrick McGlinchey Vice President patrick.mcglinchey@srsre.com 303.390.5219

Ryan Tomkins Vice President ryan.tomkins@srsre.com

Jack Lazzeri Senior Associate jack.lazzeri@srsre.com

Hillary Kolber Associate hillary.kolber@srsre.com

Raleigh Lau

Senior Associate raleigh.lau@srsre.com

Kim Phan Associate kim.phan@srsre.com

Denver

Denver

Pacific Northwest