You Got a Raise. And You’re Still Broke. Here’s Why

You Got a Raise. And You’re Still Broke. Here’s Why

Mike Coady Chief Executive Officer

Peter Gollogly Regional Director

Bryan Bann Regional Manager

William Bailey Group Head of Global Partners

Adeeb Khan Team Lead - Technology

Shil Shah Group Head of Tax Planning

Ashley Eyre Head of Compliance - UK

Maria Darmanin Demajo Operations Manager – Cyprus

Mohammed Kamil Khan Product Lead - Salesforce

Husain Rangwalla Chief Technology Officer

Carlo Casaleggio Group Head of Compliance

Craig Stokes Managing Director - UK

Josh Watson Group Head of People

Danny Sutherland Group Financial Controller

Veronica O’Brien Group Head of Corporate Affairs

Jaya Prakash Goulikar Head of Compliance – Middle East

Jenna Cochrane Administration and Operations Manager - USA

Rishikesh Mishra Team Leader

Skybound Wealth Management stands as a benchmark of excellence in the world of international wealth management. As an independent firm, we pride ourselves on delivering bespoke financial solutions tailored to meet the unique needs of our global clientele. Our innovative approach combines the agility of a boutique firm with the expertise and resources typically associated with a major financial institution. About Us.

Search for ‘Skybound Wealth’

Scan QR Code

To learn more about our Leadership Team, please use the QR or click here to visit our website.

Josh Burton Chief Financial Officer

Tom Pewtress Group Head of Proposition

Paul Pavli Executive Director - Cyprus

Dmitriy Ermakov Group Head of Marketing

Carla Smart Group Head of Pensions

Taylor Condon Area Manager - Spain

Elyka Ygnacio Operational Finance Manager

Maria Nikolaou Executive Director - Cyprus

$1.5billion

of client assets under management

6,000 +

international clients & growing

Welcome to the latest edition of SOAR. There’s always plenty of noise in our industry, new products, market swings, bold predictions. What matters far more, in my view, is the quality of the foundations underneath the advice people rely on.

Over the past year, we’ve focused heavily on building properly. Strengthening our teams, improving the systems that support advice, and investing in the digital infrastructure that keeps clients connected, informed, and in control. Much of that work happens behind the scenes, but it shows up where it counts, in clearer conversations, better decisions, and a smoother experience when life gets busy or complicated. We’ve also continued to grow, across regions, across capabilities, and across the specialist support that sits around our advisers. Growth on its own means very little. Growth with standards, structure, and accountability is what turns momentum into long-term outcomes for the people we look after.

This edition of SOAR reflects that approach. Practical insight. Real-world context. Guidance designed to help you feel clearer and more confident about the decisions ahead, wherever you’re based and whatever stage you’re at.

Thank you for taking the time to read it, and for the trust you place in us.

Mike Coady

Mike Coady Chief Executive Officer

08. Creating Healthy Financial Habits for 2026

12. Planning for School Fees in Dubai: A Practical Guide for Parents

16. The Paradox of Control: Active vs Passive Investing

18. Why Earning More Doesn’t Make Life Easier

20. Unseen Changes Unintended Consequences

26. The Financial Fundamentals That Every British Expat in Saudi Arabia Must Get Right

30. Filters, Feeds, and Financial Fugazi

34. Why You Should Care About Independence

44. Why Expats Leave the UAE With Less Wealth Than They Arrived And How to Avoid It

80. 54. 86. 34.

48. From Panic to Prosperity: Sensational Headlines vs. Stock Market Reality

54. The Future of Fintech Is Human-Centered, Not Feature-Heavy

58. The Great British Take Off

60. Your Tax-Free Salary in the UAE. How to Turn It Into Lasting Wealth

62. What It’s Really Like Starting a Career in Wealth Management

66. The Real Cost of Waiting to Invest: And Why There Is Never A Good Time

68. You Got a Raise. And You’re Still Broke. Here’s Why

72. 10 Finance & Tax Questions That You Should Ask When Moving From The UK To Spain

76. Financial Planning Without Borders: Creating Stability in a Life of Contracts & Countries

80. The Real Risk of Putting Everything in One Basket

84. Shil Shah Appointed Group Head Of Tax Planning

86. Budget 2025: What the Changes Mean for Your Money

90. Expanding Into Spain With Our New Mijas Office

92. Inbound to the U.S.? Financial Moves to Make Before You Arrive

96. Q4 2025 Review. Q1 2026 Outlook

104. The 24-Hour Rule: The Simple Trick That Saves You Thousands

106. In The Spotlight: Jamie Proctor

Every January, the same pattern repeats itself. People living abroad tell themselves this will be the year they finally get organised. The year they review their investments, start saving properly, think seriously about retirement, or untangle the financial loose ends that have quietly built up in the background.

And every year, life wins.

Work gets busy. Travel increases. Children, relocations, new contracts, new countries. The plan slips to March, then summer, then “after Christmas”. Suddenly, it’s January again, and very little has changed.

“Ambition is healthy. Selfdeception is not.”

After more than two decades advising people living and working internationally, across different countries, incomes, and lifestyles, one thing is consistent. People don’t struggle financially because they don’t care. They struggle because they never build habits that survive real life.

This article isn’t about motivation or good intentions. It’s about structure. Habits. Reality. The same framework I use with my clients, and the same one I apply to my own finances.

Written by Kieron Donovan Private Wealth Adviser

People who move abroad are usually capable, ambitious, and well paid. Yet financially, many are running on hope rather than structure.

Hope that the pension will probably be enough. Hope that the property will work out. Hope that the investments should be doing fine. Hope that moving home will somehow be cheaper than expected.

Hope, however, is not a strategy.

The risk for those living internationally is subtle. The longer you’re away, the easier it is to drift without noticing. There’s no home-country system catching you, no default employer pension quietly doing the heavy lifting, and no one forcing a regular review. Either you build structure deliberately, or time slips away unnoticed.

Most people say they’re saving for “the future”. It sounds sensible, but it’s also meaningless. The future has no shape, no cost, and no deadline. Vague goals create vague behaviour.

Retirement is where this becomes most damaging. A proper reason for planning forces uncomfortable but necessary questions. When do you realistically want work to become optional? Where will you live, and will that be taxefficient? What does an ordinary Tuesday look like? Are you funding freedom, or simply survival?

For many expats, this results in more than one objective. A core income pot to provide long-term security. A separate pot for flexibility, travel, healthcare, or opportunity. Sometimes a legacy pot for children or family.

Until that picture is clear, investing is guesswork. Once it is clear, the anxiety fades and numbers replace uncertainty.

“People fail because they try to change everything at once.”

This is where many plans quietly unravel. It’s common to meet people in their late forties or fifties who want to retire soon, with substantial wealth, despite having saved very little until now. Ambition is healthy. Self-deception is not. There is no shame in starting later than planned. There is a cost to pretending mathematics doesn’t apply to you.

Healthy financial habits require honesty. About time. About how much you can realistically contribute. About risk. About what is actually achievable. A realistic plan you stick to will always outperform a perfect plan you abandon.

There has never been a perfect time to invest. Markets rise and fall. Politics changes. Interest rates move. Life interferes. Waiting for certainty is how decades disappear.

Almost every seasoned international investor eventually says the same thing: “I wish I’d started earlier.” Not that they’d timed it better, just that they’d begun.

January doesn’t need optimisation. It needs momentum. Start with something. Refine it later.

“Every January, the same pattern repeats itself. People living abroad tell themselves this will be the year they finally get organised.”

People fail because they try to change everything at once. Healthy habits are boring, which is precisely why they work.

A one percent improvement feels insignificant in the moment. Over time, it compounds. Save a little more each month, invest consistently, review annually, and avoid emotional decisions, and you don’t need exceptional returns. You need consistency.

The same principle applies beyond money. Slightly earlier mornings. One extra walk each week. A simple monthly financial check-in. Compounding applies to behaviour as much as capital.

Once a year, step back and assess five areas: family, friends, health, career or business, and finances. Score each out of ten without overthinking it. Your first instinct is usually the right one.

The lowest score deserves attention first.

Not everything needs fixing, but avoidance compounds faster than neglect. Many people are surprised by how quickly this exercise exposes drift and restores clarity.

Motivation fades. Structure survives busy months, difficult weeks, and unexpected moves. People living internationally deal with multiple tax systems, changing residency rules, different currencies, fragmented pensions, and long gaps between formal reviews. This is why financial planning for expats has to be different. It’s not about products. It’s about coordination. When structure is right, decisions become calmer. Risk becomes intentional. Progress becomes measurable. Money stops being a background stress and starts supporting life, rather than complicating it.

If nothing changes, January 2027 will bring the same conversations. Not because you failed, but because life took over.

Healthy financial habits aren’t about discipline. They’re about reducing friction. If you want to start 2026 with clarity, structure, and a plan that actually fits life abroad, this is the right moment to act. January always fills quickly, and there’s a reason for that.

Perfection isn’t required. Momentum is.

“Even modest contributions can go a long way when started early.”

Written by Mike Coady Chief Executive Officer

I’ve spent over 20 years advising families in Dubai, and as a father of four myself, I know the pressure that school fees can place on a household. The numbers can be daunting, the rules confusing, and the stakes feel personal, because they are.

Families often come to me when the stress peaks, suddenly facing bills that don’t match expectations, or struggling with multiple children at different schools. The most common causes are familiar: changes in employment, bonuses or commissions that never materialise, and fee inflation that quietly compounds year after year.

“Raising children in Dubai is an incredible opportunity, but it comes with financial responsibility.”

Dubai schools operate under KHDA’s School Fees Framework, linked to the Education Cost Index, which sits at 2.6% for 2024–25 and 2.35% for 2025–26. At first glance, those increases seem small. But with two or three children, the impact is significant.

I often see what I call “lifestyle drag.” Families match a tax-free income with a tax-free lifestyle, then find themselves squeezed by a fixed education bill that doesn’t bend. Cars, rent, and holidays can be adjusted. School fees cannot.

If fees are already overdue, the key is transparency. Ignoring statements only makes matters worse. Schools in Dubai can withhold report cards, block transfer certificates, and decline re-enrolment if balances remain unpaid. In Abu Dhabi, ADEK formalises this with a threewarning process and suspension limits. Engage early, agree on a staged repayment plan, and avoid rolling debt onto high-interest credit cards. If bridging is unavoidable, a 0% installment plan or short-term loan linked to a clear cashflow event can help, but annual fees should never become a long-term liability.

Top-tier schools can now charge over AED 120,000 a year for senior grades. With two children, the increase in cost is obvious; but it doesn’t need to become unmanageable. The families who thrive ring-fence education costs, automate contributions to a dedicated fund, and adjust lifestyle spending before they ever compromise schooling.

A useful rule of thumb is to keep school fees within 10–15% of net household income. In reality, many families I meet are spending 25–40% in peak years.

By contrast, the reactive approach; paying fees with a card in September and worrying in November, is how short-term pressure turns into long-term debt.

Education is non-negotiable for most families, but the most expensive school is not always the best fit. Curriculum, KHDA inspection trends, and the full cost over a five- to seven-year horizon matter more than a single year’s bill.

The financial mistakes I see most often are families committing without modelling the long-range cost, underestimating fee inflation, or switching schools unnecessarily.

Each change brings new deposits, uniforms, and lost discounts.

“Families often come to me when the stress peaks, suddenly facing bills that don’t match expectations, or struggling with multiple children at different schools.”

Even modest contributions can go a long way when started early. AED 3,000 a month into a diversified portfolio at 7% annualised growth could build more than AED 1.2 million over 18 years. Practical steps include automating contributions into a dedicated education fund, keeping six to twelve months of fees in reserve Also, mapping out the full cost of both school and university, so you plan for the entire journey, is vital.

Over the past decade, there has been more transparency from KHDA and ADEK around fee structures and deposits, alongside steadily rising costs at the top end. Families are now more proactive, exploring scholarships, setting up structured savings plans, and asking the right questions early.

Raising children in Dubai is an incredible opportunity, but it comes with financial responsibility. You can wait until fees overwhelm your budget, or you can take control now with a clear, structured plan.

If school fees are a pressure point for your family, the sooner you put structure in place, the easier it becomes. I’ve helped families across Dubai prepare for education costs with strategies that provide clarity, flexibility, and peace of mind, and I’d be happy to help you do the same.

We all want to feel in control, yet markets have a way of proving otherwise. That’s why the choice between active and passive investing matters so much.

Every investor wrestles with this in some form. Do you try to outthink the market, or do you accept that consistency often wins? Both approaches have their strengths and weaknesses, and both say something about the kind of investor you are.

Active investing appeals because it feels proactive. You are making decisions, applying research, and responding to what the market is doing. In moments of crisis, from the financial crash in 2008 to the COVID shock in 2020, skilled managers who held cash or defensive positions were able to soften losses and recover more quickly.

This matters because very few people truly “sit tight” when their portfolio drops. Seeing your savings fall sharply is difficult, and the ability to adjust can prevent rash decisions. That is one reason active strategies continue to hold appeal, even though many funds underperform their benchmarks over long periods.

Passive investing takes the opposite view: that markets are broadly efficient and that cost, not activity, is the main driver of returns. Low-cost index funds have shown they can match market performance closely, year after year. Perhaps the biggest benefit is behavioural. By taking away the temptation to tinker, passive investing helps protect people from themselves. Study after study shows that individual investors often underperform the very funds they hold, simply because they buy and sell at the wrong times. Passive investing builds discipline into the process, keeping ego and emotion in check.

Written by Sean Russell Private Wealth Adviser

“Every investor wrestles with this in some form. Do you try to outthink the market, or do you accept that consistency often wins?”

The reality is that both approaches can work, but not for everyone and not in every environment. Some investors value the responsiveness of active management. Others prefer the stability of a passive plan.

In practice, many resilient portfolios blend the two, using a passive core for long-term growth and stability, while layering active elements on top to manage risk or target specific opportunities. This creates room for control when it matters most, while still benefiting from the discipline of staying invested.

Investing is never only about numbers. It is also about temperament. Do you need the reassurance of flexibility, or the comfort of sticking with a plan? Do you prefer to act, or to trust?

Answering those questions matters as much as selecting the right funds. Because ultimately, your portfolio is not just a collection of assets. It is a reflection of how you see the world, how you deal with uncertainty, and what kind of control you are truly looking for.

That reflection is easier when you have someone to challenge your assumptions, test the balance between active and passive, and ensure the strategy fits you.

If you are unsure which approach is right for you, start the conversation with Skybound Wealth today.

Written by Maximillian Gerstein Private Wealth Partner

Everyone thinks that earning more money is the solution. That once you hit a certain number, life becomes easier, simpler, and less stressful. But ask anyone earning six figures, the stress doesn’t go away. In fact, in many cases, it gets worse.

More money comes with more responsibility. A higher standard of living, more financial commitments, larger expectations, and far more opportunity to get it wrong. And the brutal truth? The more money you earn, the more important it is to have a plan.

Just because you earn well doesn’t mean you’re safe. I’ve seen people earning £200,000+ a year with zero savings, expensive debt, no investment strategy, and no plan for the future. But they look successful. Nice car, nice house, premium lifestyle. They’re living on the edge, and don’t even realise it. We think more money will solve our problems. But without structure and discipline, it just amplifies them.

This is where most people go wrong. As income increases, so does spending. It’s called lifestyle inflation, and it’s the number one reason high earners stay broke.

Here’s how to break that cycle:

Before you spend anything, allocate a fixed amount to savings and investments every single month. This isn’t about living like a monk, it’s about building a foundation.

Treat your future like a bill, something that gets paid first. Automate it, make it invisible, and make it non-negotiable.

If you earn well, you should be saving more, not spending more. And yet most people do the exact opposite.

“Earning power means nothing without purpose.”

Have a Goal? Fund It. No Excuses.

Earning power means nothing without purpose. Let’s say you want to retire with £1 million by age 55. You're currently 30 years old, which gives you 25 years.

If you invest consistently at a 7% annual return, you need to contribute around £1,400/month. That’s achievable for many high earners. But if you save that money in the bank, earning virtually 0% interest, you’d need to contribute over £3,300/month to reach the same goal.

That’s a £1,900/month difference, or £570,000 more over 25 years, simply because of poor strategy.

To reach £1,000,000 by saving £1,400 a month in a bank account with 0% interest, you'd have to contribute for nearly 60 years, specifically, 59.6 years. Compared to investing, which can get you there in about 30 years at 7% growth, you'd need an extra 30 years of contributions if you’re just saving in cash.

This is why discipline isn’t just about how much you save. It’s about how you save. Smart decisions compound over time, and so do the consequences of inaction.

Now ask yourself: Are you working hard just to make your bank richer, or are you building wealth for yourself?

Being disciplined with your money isn’t boring. It’s not restrictive. It’s power. It’s control. It’s freedom. The people who win financially aren’t always the highest earners. They’re the ones who put structure in place and stick to it.

They tax themselves. They invest before they spend. They understand that building wealth isn’t a vibe, it’s a habit. And if you’re not doing that? Then your income becomes your trap.

The more you earn, the more you have to lose. Which means the need for a clear, structured, disciplined financial plan only increases.

This isn’t about cutting back or feeling guilty. It’s about ensuring that your income is working for you, not just funding a lifestyle you can’t sustain.

And if that feels like too much? If the numbers, the planning, the structure all feel overwhelming? Get help. That’s what I do.

I don’t just build investment portfolios, I build financial lives that allow my clients to live well now and in the future.

Written by Carla Smart Chartered Financial Planner & Group Head of Pensions

Recent research by Schroders Personal Wealth found that over half (51%) of UK adults say they are unaware of major upcoming pension and tax policy changes that could reshape retirement and inheritance planning. That lack of awareness could have far-reaching financial consequences, particularly with the UK’s transition from a domicile-based to a residencybased inheritance tax regime and new rules on pension death benefits.

“Awareness and sound financial advice have never mattered more.”

This article summarises the key developments, explains why they matter, and outlines what can be done to prepare.

Pension Death Benefits to Fall Within Inheritance Tax from April 2027

From 6 April 2027, most unused pension funds and many pension death benefits will be brought within an individual’s estate for Inheritance Tax (IHT) purposes.

Currently, pensions usually sit outside the IHT net, one of their most attractive features for long-term savers. Under the new rules, any unspent pension funds may now be subject to up to 40% IHT (above the nil-rate threshold).

The latest consultations have refined the approach: Recent consultations have helped refine how the changes will work in practice. Payments to dependents, including spouses and children, are expected to remain free from Inheritance Tax, and death-in-service benefits are also likely to stay outside the IHT net. However, the responsibility for reporting and settling any tax due will sit with executors or personal representatives, not pension providers, shifting more complexity into the estate administration process.

It’s important to be aware of the potential for double taxation. Where death occurs after age 75, the beneficiary’s withdrawal from the inherited pension will continue to be taxed at their marginal rate of income tax, in addition to the IHT charge on the value of the fund. The result could be a combined effective tax rate exceeding 60%, depending on the beneficiary’s income level and estate composition.

While finer details are still being finalised, this marks a fundamental shift in how pensions interact with the tax system, particularly for intergenerational planning.

“The 2024 Budget introduced a major reform that took effect in April 2025: the abolition of the longstanding domicile concept in UK tax law, replaced by a residency-based test.”

The 2024 Budget introduced a major reform that took effect in April 2025, the abolition of the long-standing domicile concept in UK tax law, replaced by a residency-based test. This change fundamentally alters how individuals are assessed for income tax, capital gains tax, and inheritance tax.

Under the new regime, anyone who has been UK-resident for ten consecutive years is now exposed to UK Inheritance Tax on their worldwide assets. Equally significant is what happens when people leave the UK. Rather than falling outside the system after three years, as was the case under the old domicile rules, former residents can now remain within scope for up to ten years after they cease UK residency. For internationally mobile individuals, whether they are living abroad, planning a return, or holding assets and pensions across borders, this represents a material shift. Cross-border planning is no longer a specialist edge case, it has become a central consideration.

“The UK pension and inheritance landscape is changing faster...”

Cross-Border Complexities: The Hidden Trap for International Families

Taken together, the extension of Inheritance Tax to pension death benefits and the shift to residency-based taxation create a far more complex landscape for cross-border estate and pension planning. What were once separate considerations now interact in ways that are easy to overlook and difficult to unwind.

A UK resident with pensions or assets held overseas, for example, could find both UK and foreign tax authorities laying claim to the same wealth unless a relevant double taxation treaty applies. Equally, individuals who have moved abroad but retained UK pension rights may discover that those pensions are still pulled into the UK Inheritance Tax net, even after many years of non-residency.

The challenges multiply for families with mixed residency status. Couples where one partner remains UK-based and the other lives overseas can face inconsistent tax treatment on the same pension assets, creating uncertainty over both tax exposure and estate outcomes. Compounding this further is the loss of longstanding domicile-based reliefs, such as excluded property trusts, which previously allowed offshore pensions and investments to sit outside the scope of UK Inheritance Tax.

The result is a much narrower margin for error. Without careful coordination across jurisdictions, families risk double taxation, administrative delays, and outcomes that bear little resemblance to their original intentions.

This is a major issue for professionals, expatriates and international families. Without careful coordination, these new rules could lead to double taxation, administrative delays, and unexpected liabilities.

The nil-rate band (£325,000) and residence nil-rate band (£175,000) remain frozen until 2030, meaning more estates will drift into taxable territory.

As of April 2025, HMRC introduced a new system for allocating tax codes to individuals starting to draw private pensions. The reform aims to ensure that new pension recipients are placed on the correct cumulative tax code more quickly, helping to reduce the over- or under-payment of income tax that previously affected many retirees in their first year of drawdown.

Failing to keep up with these changes is not a harmless oversight. It can translate into very real financial and practical consequences at exactly the wrong moment.

Beneficiaries or executors may be faced with unexpected Inheritance Tax bills, particularly where pensions were assumed to sit safely outside the estate. Financial plans built on outdated assumptions can quickly become distorted, leaving individuals exposed to tax charges they never anticipated. For families with international ties, the risk is even greater, with cross-border mismatches leading to double taxation or the loss of valuable treaty relief.

Flexibility has also reduced. Many of the most effective planning routes, including certain trust structures and pre-migration strategies, are no longer available under the new residencybased rules. At the same time, administrative complexity is increasing. Executors may now find themselves responsible for reporting and settling tax on pension benefits, adding pressure at an already difficult time.

Review your residency and estate exposure. If you’ve lived abroad or plan to, take the time to map out how the new rules could affect you. Revisit your pension beneficiary nominations and make sure all documentation reflects your current wishes. If you hold assets or have family members overseas, seek dual-qualified advice to ensure your arrangements remain efficient across jurisdictions. It may also be worth considering whether accelerating withdrawals or restructuring before 2027 aligns with your wider goals. Finally, keep an eye on government updates, as secondary legislation and HMRC guidance will determine the final shape of these changes.

The UK pension and inheritance landscape is changing faster, and more fundamentally, than most people realise. With pension death benefits likely to fall under IHT, and residency replacing domicile as the basis of liability, the next two years represent a critical window for review and adjustment.

“...lack of awareness could have farreaching financial consequences...”

Awareness and sound financial advice have never mattered more. Those who take time to understand and adapt to these new rules will be far better positioned to protect both their retirement income and the legacy they leave behind.

If you’d like to review how these changes could affect your own plans, get in touch today and we can discuss this and any other questions or concerns you have regarding your pensions.

That Every British Expat in Saudi Arabia Must Get Right

Written by Campbell Warnock Private Wealth Manager

Moving to Saudi Arabia is one of the most exciting chapters in any professional’s career. The earning potential, the lifestyle, and the absence of income tax create a rare opportunity to build wealth faster than you ever could back home.

But here’s the part many overlook: in Saudi Arabia, there are no automatic systems protecting your future. There’s no National Insurance, no workplace pension, and no built-in safety net. You’re in full control of what happens next. And that freedom is both empowering and risky.

After working with British professionals across the Gulf for many years, I’ve seen one truth hold firm: long-term success isn’t about who earns the most, but who gets the fundamentals right early on.

The first step is protection. Many expats assume their UK life cover follows them abroad, but it often doesn’t. Even when it does, the level of cover may no longer match your lifestyle or dependants. If your policy isn’t valid in the region or doesn’t reflect your current income, your family could be left exposed.

One of the first things we do at Skybound Wealth is review your existing protection to make sure it fits your new reality - location, income, and family circumstances included. The goal is simple: peace of mind that, wherever you are, the people who rely on you are financially secure.

Another essential pillar is estate planning. Your UK Will doesn’t automatically apply in Saudi Arabia, meaning local inheritance laws could override your wishes if the worst happens. A straightforward review, and where needed, a local Will, ensures your assets are passed on as you intend.

This is something too many clients only address after a scare or life event. The truth is, it’s much easier, faster, and less expensive to get it right from the start.

Life in Saudi Arabia can be unpredictable. Contracts end, projects shift, and global circumstances can change quickly. Having an emergency fund covering at least three to six months of expenses can make the difference between short-term disruption and long-term damage.

We often help clients set this up as the foundation layer of their plan, before anything else. It means that when opportunities arise, or challenges appear, they’re in a position to act confidently without derailing their long-term goals.

When you leave the UK, your pension contributions stop. Over time, that gap can become a serious shortfall. Think of your pension less as a product and more as a discipline. A habit that continues no matter where you live.

We help expats maintain that consistency by setting up flexible, globally compliant solutions that grow with them. Regular contributions, tax efficiency, and global access are what preserve your long-term financial independence.

“Cross-border financial planning has more moving parts than most people realise...”

Many expats continue using their UK accounts for everything, but it’s rarely efficient. Currency fluctuations, transfer delays, and hidden fees can all eat away at income and erode long-term returns. A well-structured banking setup using multi-currency or offshore accounts aligned to your income, savings, and investment strategy, helps you manage money seamlessly across borders.

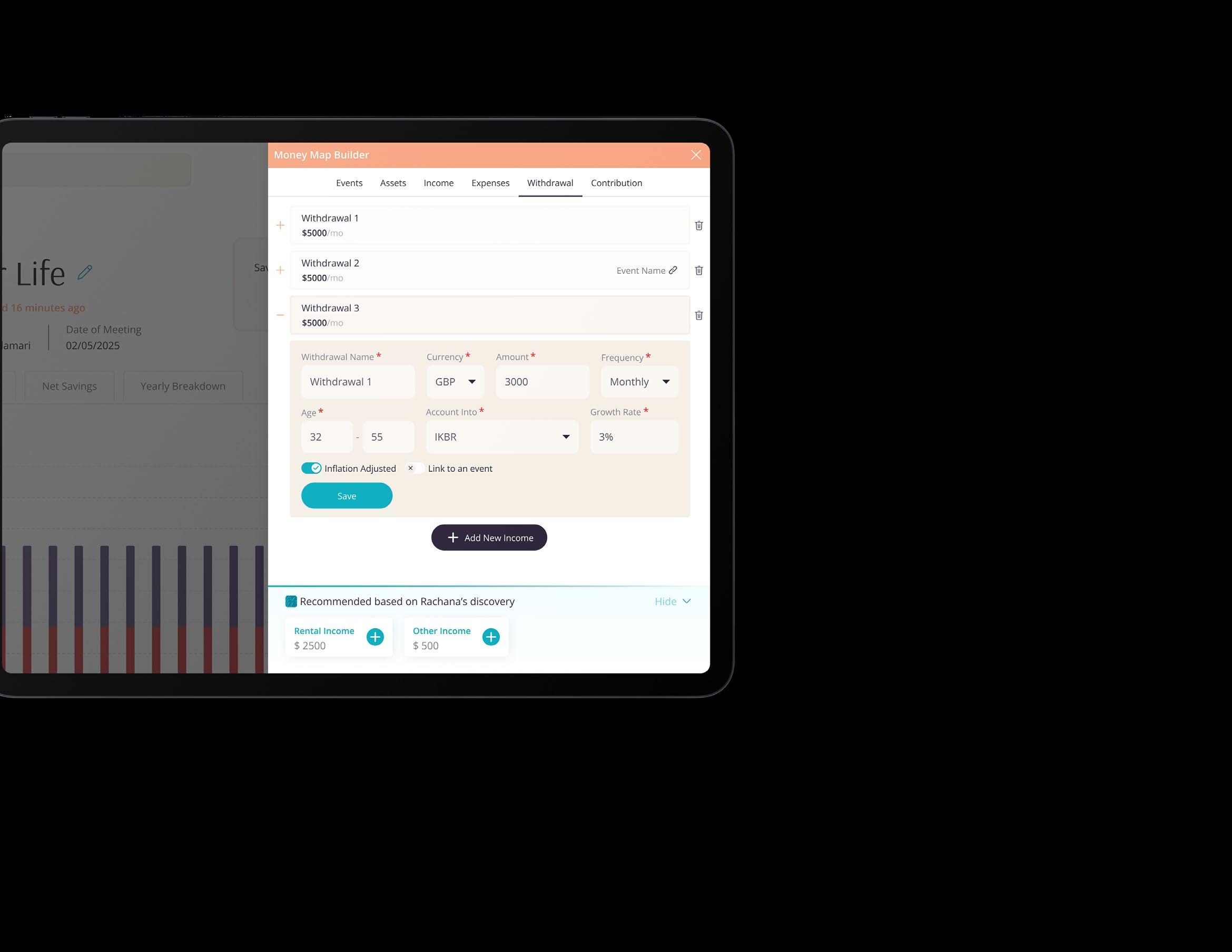

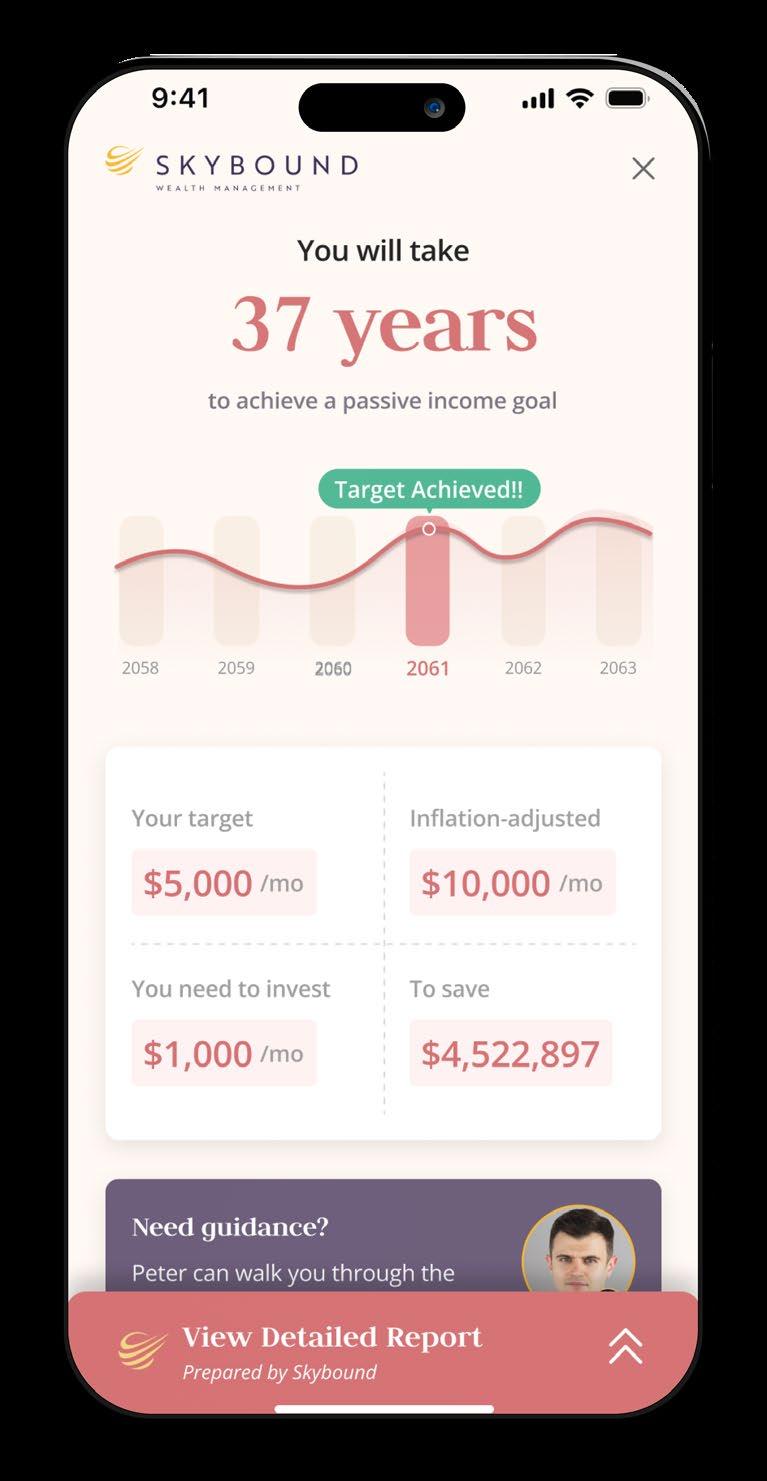

Where Skybound Wealth truly adds value is in bringing all those moving parts together through MoneyMap, our interactive financial planning tool. MoneyMap lets you see your full financial picture in one place; how your income, savings, investments, and goals align across currencies and timelines. We can model different scenarios instantly:

• What happens if you repatriate in five years?

• How do currency shifts affect your retirement fund?

• What’s the impact of funding education abroad or buying property?

Seeing those outcomes side by side turns financial decisions from guesswork into strategy. MoneyMap helps transform cross-border complexity into clarity - giving you control, visibility, and confidence in every decision.

Cross-border financial planning has more moving parts than most people realise; residency, taxation, currency, and investment regulation all overlap. The earlier you seek professional advice, the easier it is to avoid mistakes that become costly later.

At Skybound Wealth, we start with a discovery call to understand your goals and priorities, followed by a full review of your income, savings potential, and existing assets. From there, we use MoneyMap to model your future and design a plan that supports your ambitions in the Kingdom and beyond.

Saudi Arabia offers the chance to build financial independence faster than almost anywhere else, but opportunity alone doesn’t guarantee success. The expats who thrive are the ones who act early, protect what matters, and make every Riyal work towards their long-term goals.

With structure, regular saving, and the right guidance, your time in the Kingdom can be more than a career chapter, it can be the foundation of lasting financial freedom.

If you’re ready to see what your financial future could look like, start with a simple conversation. Together, we can map it out.

“After working with British professionals across the Gulf for many years, I’ve seen one truth hold firm: long-term success isn’t about who earns the most, but who gets the fundamentals right early on.”

Why Choose Skybound Wealth?

• Comprehensive coverage for expats and their families

• Tailored advice that fit your lifestyle, whether home or abroad

• Peace of mind with flexible life, health, and critical illness cover

• Expert advice to ensure your loved ones are fully protected ACT NOW

Safeguard your future today—speak to an adviser about a bespoke insurance plan.

Written by William Bailey Private Wealth Adviser

Growing up, money was something people carried but never spoke of. Even in the earlier days of my career, outside the privacy of a confidential financial review, the subject was almost entirely off-limits.

Even inside those rooms, clients would often hesitate, shuffling papers or deflecting questions rather than reveal their true numbers.

The cultural taboo around discussing income, debt, or net worth was so ingrained that extracting the facts felt less like advising and more like detective work. Silence was the norm. People could live next door to each other for decades without once discussing what they earned, what they saved, or how precarious their finances really were.

That silence has broken.

Today, money is everywhere. You cannot open Instagram, TikTok, or YouTube without being told how much someone earns, how little they work for it, or how quickly you can replicate their apparent success.

Financial conversation has escaped the meeting room and become part of the cultural bloodstream. On the surface, this is healthy. The taboo around money long prevented people from comparing notes or learning from each other’s mistakes.

Research from the University of Cambridge in 2022 even suggested that financial openness, when genuine, improves saving habits and reduces anxiety. People no longer have to feel alone when asking whether they should invest, save, or budget differently. But with openness has come distortion.

Where once the silence left people guessing about their neighbour’s wealth, today the noise online is so deafening that truth has become impossible to separate from performance.

Influencers, “finfluencers,” and selfproclaimed wealth gurus have turned financial life into a spectacle - a clown show, even for those more cynical. Many exaggerate earnings, hide losses, or inflate lifestyles to sell an image, and with it, a product, a course, or a subscription.

A study by the FCA in 2023 found that one in six young investors made financial decisions based primarily on social media content.

The fallout is visible across markets. In the US, the collapse of FTX left countless retail investors burned after crypto influencers propelled legitimacy into what turned out to be fraud. In India, regulators have had to curb “stock market astrology” promoted by YouTube personalities promising impossible returns.

“The insecurity is real, even when the numbers aren’t. And it’s powerful enough to warp behaviour.”

In my own meetings, I see the consequences directly.

A few months ago, I sat down with a couple in Dubai who came to me in near-panic after maxing out three credit cards on a “luxury lifestyle masterclass” that promised to teach them how to buy property with “other people’s money.”

Their salaries were strong, together over £250,000 a year, but their savings were close to zero. Every month they watched people online claim to be buying apartments or holiday homes, and instead of questioning the claims, they assumed they were falling behind. Their debt was not the result of bad fortune but of comparison.

Then there was an online meeting more recently with an expat in Saudi Arabia. A man in his fifties, highly successful, who admitted he had delayed retirement planning for years because he felt inadequate.

“Everyone I follow online seems to have five properties by now,” he told me, “so what’s the point of starting late?”

The irony, of course, was that he had the means to retire comfortably if he began planning properly. But the sense of already being behind had frozen him into inaction.

And then, inevitably, the Crypto-Chaser.

The young professionals who sit across from me clutching screenshots of their trading accounts, flicking from images of their incredible +40% return one afternoon to their respective -85% drop weeks later.

“It looked like everyone else was winning,” I’m often told. The truth, realised only after the crash, is that most of those people were either lying or had already sold.

“Financial conversation has escaped the meeting room and become part of the cultural bloodstream.”

The insecurity is real, even when the numbers aren’t. And it’s powerful enough to warp behaviour. Some double down on risky bets to “catch up,” others delay planning altogether, paralysed by the fear that they are already too far behind.

The irony is painful. Social media has made it easier to discuss money but harder to see it clearly. The language of success has been colonised by those with the strongest incentive to mislead.

As an adviser, you learn quickly that the quietest client in the room often has the strongest balance sheet, while the loudest boasts often conceal fragile scaffolding.

Online, that truth is inverted: performance is everything, reality an afterthought.

Psychologists have long understood this tendency. Leon Festinger’s social comparison theory argued that people measure their own worth not in absolute terms, but by constantly evaluating themselves against others. That instinct is now weaponised at scale.

Every leased supercar filmed on JBR, every rented Airbnb presented as “my villa,” every cropped screenshot of a trading account; each of these is an invitation to feel less successful by comparison.

The effect is magnified in cities like Dubai, where wealth is not only earned but performed daily. It creates an endless arms race of appearance, where financial planning; the slow, quiet work of building lasting wealth, feels dull compared to the glamour of quick wins.

And yet, beneath the noise, the fundamentals haven’t changed. Compounding remains indifferent to Instagram. Diversification doesn’t care how many followers someone has.

Time in the market still beats timing the market, no matter how many “get rich quick” strategies flood your feed.

The paradox of this cultural moment is that while more people are talking about money than ever before, fewer are listening to the truths that matter.

The scroll never ends. Every day brings another reel of rented cars, filtered penthouses, or “six-figure side hustles” wrapped in neon captions. It’s a hall of mirrors where the loudest voices are often the least credible, and where comparison corrodes quietly, swipe by swipe.

Wealth isn’t built on curated feeds or borrowed backdrops. It’s built in silence, in discipline, and in decisions that rarely make good content. The internet will always shimmer with illusion. The question is whether you chase it, or step away to build something real.

If you’d like to cut through the noise and build a financial plan grounded in reality, speak to Skybound Wealth today.

“...independence is the decisive factor that determines whether your adviser is aligned with your best interests or with someone else’s agenda.”

Written by Josh Burton CFO & Private Wealth Adviser

After more than a decade living overseas and working within a wealth management firm that specialises in advising highnet-worth (HNW) expatriates, I’ve witnessed every kind of financial advice imaginable – from wellintentioned guidance to blatantly product-driven sales. One thing has become crystal clear: the real question isn’t who offers you advice, but who that adviser truly works for.

For anyone wondering how to choose the right wealth management firm, independence should be the first thing you look for, because it defines who your adviser really works for.

In a world full of banks, brokers, influencers, and even robo-algorithms all vying to assist you in growing your wealth, independence is the decisive factor that determines whether your adviser is aligned with your best interests or with someone else’s agenda. This article dives into why independent, unbiased advice matters more than ever for HNW expats, and how it protects your long-term goals in an increasingly global financial life.

When it comes to financial advice, not all advisers have the same freedom to choose what’s best for you. Independent advisers can offer products and solutions from across the entire market, whereas “tied” or “restricted” advisers are limited to a single provider or a narrow list. Working with a restricted adviser is a bit like shopping at a supermarket that only stocks one brand; you may get something that works, but you’ll never know if there was a better, cheaper option on the shelf next door. In fact, U.K. regulations introduced in 2013 (the Retail Distribution Review) require firms to either provide independent, whole-ofmarket, fee-based advice or else be classified as “restricted”. Yet, despite these standards, many large wealth management firms remain restricted in practice.

On the surface, independent advice is now common - according to data released by the FCA in August 2024, 86% of financial advisers in the UK are classified as independent. But labels can be misleading. Many banks and private wealth institutions technically meet minimum requirements yet still incentivize their advisers to favor proprietary funds or specific products. Even fewer advisers carry the highest credentials which can be an indicator of advanced expertise. The core issue is bias: a restricted adviser might be perfectly honest and well-meaning, but if their toolbox only contains tools from one provider, your strategy could be suboptimal by design.

Example: Imagine you have $1 million to invest. A restricted adviser tied to Bank A will likely propose Bank A’s funds, even if they charge higher fees (say 2% annually) than a comparable fund from elsewhere at 0.8%. That 1.2% fee difference on $1M is $12,000 per year, real money off your returns. An independent adviser would have the freedom to choose the lower-cost, better-performing fund from the whole market, potentially saving you tens of thousands over time.

“True independence thrives within a framework of regulation, transparency, and accountability.”

Independence doesn’t mean “anything goes” - far from it. True independence thrives within a framework of regulation, transparency, and accountability. The most reputable wealth management firms serving expats ensure they are properly licensed in multiple jurisdictions, providing clients the peace of mind that advice is given under recognized regulatory standards. Firms like Skybound Wealth Management hold multiple regulatory licences across the UK, UAE, Europe, and the US, ensuring clients receive advice that meets the highest international standards.

For example, a firm might be regulated by the UK’s Financial Conduct Authority (FCA) for its British operations, by the Securities and Commodities Authority (SCA) and Central Bank in the UAE, by CySEC in Europe, and even registered with the U.S. SEC for American clients. This multi-layered regulatory structure isn’t just bureaucratic box-ticking – it has real benefits for clients. It means your adviser is answerable to oversight bodies in each region, must meet ongoing competency and ethics requirements, and that there are avenues for client recourse if something goes wrong.

Just as importantly, being licensed in multiple countries allows your advice to travel with you. An expat’s life is rarely confined to one jurisdiction; you might be in Dubai today, move to the UK in a few years, then on to Singapore or back to Dubai for retirement. An independent firm that’s regulated in all the places you touch can continue to advise you seamlessly through these moves, adjusting your strategy to each new regulatory environment. Your financial plan remains consistent and compliant from one country to the next. In contrast, if you use a local adviser who is only licensed in one country, you may be left in the lurch (or forced to find a new adviser) when you relocate.

Ultimately, regulation gives confidence and independence gives choice – together they form the foundation of trust in a client-adviser relationship. Knowing that your wealth manager is both free to act in your best interest and held to high professional standards worldwide is crucial for peace of mind. Especially for HNW individuals, who often require more sophisticated strategies, having that “freedom with accountability” means you get the best of both worlds: unrestricted advice and the security of a robust oversight framework.

As an expatriate, your financial life seldom fits neatly within one country’s borders. You might earn in one currency, invest in a second, hold property or pensions in a third, and plan to retire in a fourth. The more global your life, the more complex your financial puzzle becomes. This is where an independent firm really proves its worth – by taking a holistic, whole-world approach to your wealth. Instead of being constrained by a single nation’s products or rules, an independent expat adviser can integrate multiple jurisdictions into one coherent strategy.

Consider some of the cross-border challenges HNW expats face and how a holistic adviser addresses them:

“A great adviser should communicate clearly, listen to your goals, and make you feel comfortable.”

Multi-Currency Wealth:

Fluctuations in exchange rates can make or break an expat’s fortune. (For instance, a British expatriate in the Gulf earning UAE dirhams and planning eventually to spend in GBP has to manage currency risk – the GBP/ AED rate has swung significantly over the years.)

An independent adviser can access hedging strategies or currency-specific investments to protect against forex risks, whereas a domestic bank adviser might not even mention this issue.

Tax Optimization Across Borders:

Each country has its own tax regime, and the interactions can be tricky. Expats often have to juggle dual tax residencies or take advantage of double taxation agreements. A holistic adviser will incorporate international tax planning –ensuring you’re not paying a penny more than necessary and leveraging any expat tax breaks or treaties available. (For example, UK expats in the UAE enjoy zero income tax in the UAE, but if they still have UK assets or eventually return, careful planning is needed to avoid surprises.)

“The most reputable wealth management firms serving expats ensure they are properly licensed in multiple jurisdictions...”

Retirement and Pensions:

You may have a UK pension, an overseas retirement plan, and other investments all earmarked for retirement in yet another country. An independent firm can advise on consolidating pensions or using specialized expat products (like a QROPS or SIPPs) to give you flexibility. They aren’t restricted to one provider’s pension product, so they can truly find what’s best for your likely retirement locale and lifestyle.

Estate and Trust Planning:

Estate laws vary widely. Without planning, a UAE-based Briton’s estate could be subject to UK inheritance tax, UAE inheritance rules (which, for Muslims, follow Sharia by default), or the laws of a future home country. A global adviser helps set up the right trusts, wills, or holding structures so that your legacy is protected and distributed according to your wishes across all relevant jurisdictions.

Crucially, an independent wealth manager can access best-in-class financial products from around the world to implement these plans.

Need to invest in U.S. markets, hold a Swiss custodial account, or set up an Isle of Man trust? They can make it happen. They are not stuck with “whoever happens to be on a particular bank’s internal list” of offerings. This open architecture ensures you get the optimal tools for each aspect of your plan, not just a sufficient one.

The scale of global wealth mobility today underscores why this matters. We are living through an era of unprecedented millionaire migration – in 2025 alone, an estimated 142,000 millionaires will relocate to new countries, the highest number ever recorded. Each of those expats faces the challenges of managing wealth on a global stage. Independent, holistic advice allows you to think globally but act personally, tailoring every part of your financial plan around your unique life trajectory.

One of the greatest advantages of working with an independent, whole-of-market adviser is flexibility. Life changes – and your financial plan must change with it. Because an independent wealth manager isn’t tied to any particular product or partner, they can adjust your strategy as your circumstances and goals evolve. This adaptability can manifest in several important ways:

Changing Investment Platforms or Products: Perhaps you started out on a certain investment platform or portfolio bond that made sense a few years ago. If a new solution arises that offers lower fees or better performance, an independent adviser won’t hesitate to recommend a switch. There’s no internal bureaucracy forcing them to “stay the course” with a subpar provider. If your current fund manager raises fees or underperforms, you can move to a better alternative. Contrast this with a tied adviser, who might be stuck with their one provider even if it’s no longer ideal.

Shifting Strategies as Goals Change:

A good financial plan is not static. As an expat, you might initially be focused on growth investing, then later pivot to wealth preservation and income, and eventually to estate planning and legacy. An independent adviser can holistically redesign your portfolio and structures at each stage without conflict. For example, if you decide to buy property back home or start a business abroad, the adviser can integrate that into your plan rather than trying to fit you into a one-size-fits-all product. If you plan to repatriate to the UK or relocate to a new country, your strategy can be adjusted proactively – asset allocation, tax strategy, insurance coverages, etc., all realigned for the new environment.

“As an expatriate, your financial life seldom fits neatly within one country’s borders.”

Perhaps most importantly, truly independent advice means no hidden agenda. There’s no pressure to “sell more of product X” this quarter or retain your assets in proprietary funds. The only metric of success is your outcome. This client-first mindset encourages an ongoing dialogue: regular reviews, check-ins when legislation changes or when new opportunities arise, and an open invitation to ask questions any time. If something isn’t working for you, an independent adviser has the freedom to change it without any corporate hurdles. They are accountable to you alone.

In practical terms, this could save you significant money and headaches. For instance, say you’ve been investing through an offshore policy that originally had low fees, but over time the costs crept up or the currency exchange rates within it became unfavorable. A tied agent might gloss over those issues because they can only offer that one policy. An independent adviser will help you unwind and transfer to a better solution – perhaps moving onto a modern investment platform with fraction of the cost – even if it means extra work, because that’s in your best interest. There’s no loyalty to past products, only to your future goals.

The real advantage here is that your financial plan isn’t chained to the past. It can continuously improve. Independence ensures that advice stays dynamic – always looking for the right fit for where you are now and where you want to go. In a world of constant change (new countries, new regulations, new economic climates), this adaptability isn’t just a nice-to-have; it’s a must for protecting and growing your wealth over the long haul.

“Working with a restricted adviser is a bit like shopping at a supermarket that only stocks one brand...”

Given the above, how can HNW expats ensure they’re entrusting their wealth to the right adviser or firm? When deciding how to choose the right wealth management firm, focus on independence, regulation, and a proven track record with clients whose financial lives span multiple countries.

Here’s a checklist of key factors and questions to consider when evaluating a wealth management adviser for your international needs:

Independence and Whole-of-Market Access: Confirm whether the firm offers independent advice or is tied to specific providers. Ask directly: “Are you independent and whole-ofmarket?” An independent, unbiased adviser will be able to scour the entire market for the best solutions rather than selling in-house products. If the adviser says they are “restricted” or only work with certain partners, understand that your choices will be limited by that.

Regulatory Credentials and Reputation:

Check the firm’s regulatory licenses and registrations. Are they regulated by top-tier authorities like the FCA (UK), CySEC (EU), SCA/ Central Bank (UAE), SEC (USA), etc., in the regions relevant to you? Working with a properly licensed firm gives you legal protections and ensures the advisers meet professional standards. You can often verify an individual adviser’s credentials on regulatory websites (for example, the FCA register in the UK). Also consider the firm’s track record and reputation. How long have they been in business? Do they have positive client testimonials or industry recognition?

Experience with HNW Expats and Cross-Border Expertise:

Your chosen adviser should understand the unique needs of expatriates, especially if you’re a HNW individual with complex affairs. Ask whether they have other clients in similar situations, and how they handle cross-border issues. Do they have knowledge of international tax planning (such as how to use the UK/UAE Double Taxation Agreement, or how the US IRS treats foreign investments)? Are they familiar with pension transfers, or multi-jurisdiction trust structures? The best expat advisers often carry additional qualifications in cross-border financial planning or have a network of specialists (tax advisers, lawyers) in multiple countries.

Holistic Planning and “Whole Picture” Services: High-quality wealth management is holistic, meaning it’s not just about picking investments but about integrating tax, estate, insurance, and financial planning into a cohesive plan. Ensure the firm offers services beyond basic investing advice. Do they help with retirement forecasting? Estate and legacy planning across jurisdictions? Business succession if relevant? For HNW clients, holistic advice is essential. Beware of advisers who only push investments without discussing things like tax efficiency or asset protection.

“An expat’s life is rarely confined to one jurisdiction; you might be in Dubai today, move to the UK in a few years...”

“Knowing that your wealth manager is both free to act in your best interest and held to high professional standards worldwide is crucial for peace of mind.”

Transparency, Trust and Personal Fit: Finally, don’t overlook the intangibles. A great adviser should communicate clearly, listen to your goals, and make you feel comfortable. Are they forthcoming with answers and education, or do they drown you in jargon? Do they disclose the pros and cons of each option, including costs and risks? You are seeking a long-term financial partner, so trust and rapport matter. The firm’s culture (independent, client-first, and fiduciary-minded) often comes through in these conversations. Also consider practicalities: will they be available across time zones? Do they use modern technology for remote clients (secure portals, Zoom meetings)? Your life as an expat can be complicated – your adviser’s job is to simplify it, not add more stress. If something feels off or high-pressure, trust your instincts and keep looking.

By ticking off the above factors, you’ll greatly increase your chances of selecting a wealth management firm that is well-suited to HNW expat needs. The right firm will be independent, feetransparent, well-regulated, globally savvy, and holistic in its approach – in other words, aligned with you, not with any single product or provider.

To see what to look for when deciding how to choose the right wealth management firm explore Why Skybound Wealth Stands Out.

After ten years abroad, one truth stands out: independence isn’t a luxury, it’s a safeguard. It’s the difference between advice that serves your goals and advice that serves a balance sheet.

If you’re considering how to choose the right wealth management firm for your circumstances, or want to understand what independent, wholeof-market advice could mean for your future, book a conversation with me today.

Written by Thomas Sleep Private Wealth Adviser

Every year, thousands of professionals move to the UAE for one reason: opportunity. Tax-free income, career growth, global experience, and a lifestyle unmatched anywhere else. On paper, it looks like the perfect recipe for wealth creation.

Yet the reality is often very different. Many expats leave after years, sometimes decades, with less wealth than when they first arrived. Instead of financial freedom, they carry regret, debt, and the feeling of wasted opportunity.

The UAE gives you the potential to accelerate wealth like nowhere else, but without structure and discipline, it can just as easily strip it away.

The biggest culprit is lifestyle inflation. From the moment you arrive, Dubai tempts you. Luxury cars, fine dining, weekend getaways, private schools, and five-star living all seem within reach. With no tax deductions, it feels as if the money will never run out. But as salaries rise, spending rises faster, and saving is quietly forgotten. Another trap is the “two-year plan” that turns into a lifetime. Most people arrive intending to stay for a short stint, but two years become five, then ten. Without a plan, the most valuable wealthbuilding years disappear while people wait to “get serious later.” By the time later arrives, a decade of compounding has been lost.

“There’s a simple framework that separates those who leave Dubai emptyhanded from those who leave financially free.”

Then there’s the absence of automatic savings structures. Back home, most professionals benefit from pension schemes or national savings systems. In Dubai, there’s no such framework, unless you build it yourself, nothing happens.

Poor advice also plays a role. Banks and unqualified advisers sometimes push short-term products, high-fee investments, or speculative ideas that benefit the provider more than the client. By the time expats realise, years of potential growth have been wasted.

Finally, there are behavioural blind spots. People are wired for instant gratification. “I’ll start next year,” they say, or “I earn enough, I’ll be fine.” Overconfidence and procrastination are powerful wealth destroyers.

The financial loss is painful, but the emotional toll cuts deeper. Many feel regret at wasted opportunity, shame for earning well yet saving nothing, or even betrayal by poor advice or their own decisions. I’ve seen both extremes; families who left after a decade with nothing but debt and memories, and others who departed with homes paid off and retirement funds secure. The difference wasn’t luck. It was planning.

“Costs in the UAE are climbing again.”

There’s a simple framework that separates those who leave Dubai empty-handed from those who leave financially free.

Start by tracking every dirham. The average Dubai household spends almost half its income on housing alone. Without visibility, costs quietly consume everything. Budgeting exposes waste and restores control.

Next, pay yourself first. Decide a fixed percentage of income -15 to 30 percent, and save it automatically as soon as your salary arrives. Saving should come before lifestyle, not after.

For example, a professional earning 60,000 AED a month who saves 20 percent and invests at 7 percent could leave after 15 years with more than 4 million AED. Stretch that to 30 years and the figure exceeds 9 million.

Then, invest long term. Avoid short-term speculation and high-cost products. Instead, focus on globally diversified portfolios and structured retirement solutions that compound steadily and tax-efficiently.

Always protect what you build. Without state safety nets, a single health shock can unravel a family’s finances. Critical illness, disability, and life cover are essential, as are properly drafted wills to ensure assets pass where intended.

Finally, stay accountable. Knowledge alone doesn’t change behaviour. Regular reviews, ongoing cashflow planning, and working with a qualified adviser provide the structure and discipline that self-management often lacks.

Two expats, both earning 60,000 AED a month. One saves 20 percent and invests consistently at 7 percent for 20 years. ending with around 6.3 million AED. The other spends everything. Same salary, same city, two radically different outcomes. The only difference was action.

Costs in the UAE are climbing again. School fees rise faster than inflation, rents are up, and healthcare premiums continue to increase. Meanwhile, global tax authorities are tightening reporting and residency rules, closing longstanding loopholes. Add market volatility, and the need for structured, disciplined planning has never been greater.

The UAE remains one of the best places in the world to build wealth, but only for those who take control of it.

“Instead of financial freedom, they carry regret, debt, and the feeling of wasted opportunity.”

Your UAE Chapter Can Still Be the Wealth-Building One

When you leave the UAE, whether in two years or twenty, one truth will remain: either you built wealth, or you didn’t. The difference isn’t what you earned, but how you planned, behaved, and protected your future.

The clock is already ticking, but it’s never too late to start. Build your budget, save first, invest long term, protect your family, and stay accountable. Do that, and you’ll leave the UAE not just with memories, but with financial freedom.

Returning to the UK is more than just a change of address. It’s a financial event with far-reaching implications, from tax rules to pension planning, investment structure, and more. But don’t worry, we’re here to guide you through it.

Download Our Essential Guide To Ensure You’re Financially Prepared And Positioned For Success.

Written by Tom Pewtress

Group Head of Proposition & Head of USA

When markets fall, headlines howl. A red day on the FTSE or S&P500 and suddenly the front pages are predicting financial Armageddon. Fear grabs attention, and the media knows it. But while the headlines shout about billions “wiped out,” history quietly shows something very different: crashes recover, often faster than anyone expects, and rarely with the same dramatic fonts.

If it bleeds, it leads – and in financial news, if it plummets, it practically screams. UK media outlets have never been shy about splashing dramatic headlines during market turmoil. Major political upsets, economic policy blunders, or global pandemics tend to produce front pages that read like the end of days for investors.

These attention-grabbing headlines play on our anxieties in real time, even when subsequent events prove the panic was short-lived. It’s not that the news is wrong, markets really do fall during crises, but the breathless tone can make temporary declines feel like permanent doom.

For long-term investors, it’s critical (and admittedly contrarian) to remember that markets have a habit of recovering quietly while the headlines are still loudly forecasting disaster.

When the UK voted to leave the EU in June 2016, the immediate media reaction was apocalyptic. The Guardian ran the headline “FTSE 100 and sterling plummet on Brexit vote” as markets sold off in shock. The pound hit a 31-year low overnight, and £85 billion was wiped off UK bluechip stocks within days. Tabloids coined terms like “Brexageddon” to capture the panic.

Yet the enduring story of Brexit and markets is far less grim. In fact, after that initial 8% plunge on referendum day, the FTSE 100 staged a recovery within days – by 1 July it was above its pre-vote level, marking its largest single-week rise since 2011. By mid-July 2016, the index was over 20% higher than its February 2016 low, entering a new bull market, and in the three years following the vote, UK shares as a whole rose about 28% according to schroders.com, despite all the gloomy predictions.

The sensational headlines of June 2016 were literally true (markets did plummet), but they weren’t the whole truth. Lost in the noise was the fact that disciplined investors who stayed the course saw UK stocks regain and even surpass their pre-Brexit values in short order.

The Brexit sell-off was loud, but the recovery was fast - a reminder that headlines panic instantly while markets often repair quietly.

Nothing sells papers like a proper market meltdown, and the global financial crisis gave the British press plenty of fodder. As the credit crunch intensified in October 2008, one Guardian piece described “panic selling” sending shares into “freefall” during what analysts dubbed “the great crash of 2008”.

On 10 October 2008, the FTSE 100 fell nearly 9% in a day, its worst drop since the 1987 crash. The article noted £89.5 billion wiped off Britain’s biggest companies in a single session and veteran traders called the day a “bloodbath” born of “pure blind panic. Such language was hardly exaggeration – and in isolation, it truly was a frightening moment. But fast-forward a bit: global markets bottomed out in early 2009 and then began one of the longest bull runs in history.

An investor reading only the 2008 headlines might have wanted to bury cash in the garden; an investor looking at the long-term trend saw an opportunity. Indeed, someone who bought a world index fund at the depth of the crisis and held on would have enjoyed well over a decade of growth afterward. The media’s focus was on the crash, with far less fanfare when the recovery quietly kicked in. Bad news made the front page, while the subsequent record highs (reached a few years later) received far fewer column inches. The 2008 crash was terrifying in real time, yet those who held their nerve caught more than a decade of growth that the headlines never bothered to celebrate.

Ruble crisis/ Collapse of Long-Term Capital Management

1600 Black Monday Kuwait invasion First Gulf War Collapse of the Soviet Union 90's recession Peso crisis Asian financial crisis Y2K/ Popping of the tech bubble 9-11 SARS/ Second Gulf War Avian flu Global financial crisis Russian invasion of Crimea Chinese stock market crash Brexit vote Hong Kong riots COVID-19

Post-COVID inflation surge Russian invasion of Ukraine

Sources: MSCI, RIMES. As of August 31, 2023. Data is indexed to 100 on January 1, 1987, based on the MSCI World Index from January 1, 1987, through December 31, 1987, the MSCI ACW with gross returns from January 1, 1988, through December 31, 2000, and the MSCI ACWl with net returns thereafter. Shown on a logarithmic scale. Past results are not predictive of results in future periods.

“...what followed those scary headlines was one of the fastest market rebounds ever recorded.”

“If it bleeds, it leads –& in financial news, if it plummets, it practically screams.”

In March 2020, as the COVID-19 pandemic spread, markets worldwide went into free-fall, and the press into full panic mode. “Black Monday” comparisons dominated the news when, on 12 March 2020, the FTSE 100 plunged 10.9%, its worst one-day drop since the 1987 crash.

BBC News plainly declared: “FTSE 100, Dow, S&P 500 in worst day since 1987”, reporting that the UK’s main index had lost over 10% in a single day. The Guardian and others chronicled the “historic losses” and “markets in turmoil” as economies shut down. It was hard to find any silver lining in headlines during those frenetic weeks – even typically staid outlets used words like “plunge”, “cratered”, and “free fall”. But once again, what followed those scary headlines was one of the fastest market rebounds ever recorded.

Massive fiscal and monetary intervention, combined with investor optimism about eventual recovery, propelled global equities upward long before the news headlines turned positive. By the end of 2020, many stock indices had erased a large chunk of their losses. In the ensuing years, markets not only recovered but soared: the S&P 500 in the US, for instance, doubled from its pandemic lows by late 2021.

The UK’s FTSE 100 was a bit slower to bounce back, but it did claw its way up and by early 2023 was regularly flirting with all-time highs. The irony is rich – while front pages in 2020 were filled with dire pronouncements of a new Great Depression, a patient investor who didn’t panic was wellpositioned to profit from the eventual upswing. COVID headlines screamed collapse, but markets staged one of the fastest rebounds on record proving again that fear moves quicker than facts.

It’s often said that “markets climb a wall of worry.” In plain terms, despite a constant backdrop of alarming headlines, global markets have historically trended upward over the long run. The problem is that bad news gets the banner headlines, whereas recoveries are often treated as back-page news or a footnote.

A record high in the FTSE or S&P might get a brief mention, but it rarely commands the inch-high font of a crash or crisis. This media bias toward negativity isn’t a grand conspiracy; it’s the simple reality that fear and drama draw eyeballs. But for investors, it poses a challenge: tuning out the noise when the noise is blaring 24/7.

The historical episodes above – Brexit, the 2008 crash, COVID, the 2022 mini-budget – all taught the same lesson: short-term panic can be a longterm investor’s friend (if handled with discipline). Those who sold in fear during the Brexit vote missed out on the rapid rebound that followed. Those who went to cash in early 2020 locked in losses while others rode the rocket back up in late 2020 and 2021.

And those who dumped UK assets at the height of the mini-budget chaos would have been doing so right before UK stocks surged to new heights a few months later. Time and again, staying invested through the turmoil – or even adding to one’s portfolio when prices are cheap – has been rewarded once the storm passes.

Why We Panic - and How to Resist It

Humans are wired to feel losses twice as strongly as gains. That’s why scary headlines hit harder than good news. Successful investors recognise this bias and structure their portfolios (and habits) to protect against it.

“The Brexit sell-off was loud, but the recovery was fast”

“Humans are wired to feel losses twice as strongly as gains. That’s why scary headlines hit harder than good news.”

For globally minded investors (like many expatriates, HNWIs, and other seasoned market players), the takeaway is clear: context is everything. Sensational media coverage can make every downturn feel like a once-in-alifetime catastrophe. But if you zoom out, most of these events are bumps on a long upward road. None of this is to say that bad news should be ignored or that risks aren’t real. Markets do occasionally undergo severe corrections, and not every recovery is instant or guaranteed. However, history shows that betting against human progress – which is essentially what a permanent bear stance amounts to – has been a losing proposition. The world economy endured world wars, depressions, oil shocks, and yes, pandemics, and the long-term trajectory of welldiversified equity portfolios has still been upward.

The next time you see a screaming headline about billions wiped off markets or some “crisis” trending on social media, remember how these same stories played out in the past. The cacophony of bad news will always drown out the quiet good news of recovery.

As an investor, your job is to maintain that longterm discipline and discern signal from noise. Or put more cheekily: when the tabloids are shouting “Sell, sell, sell!”, it might be time to check if your favourite quality stocks are on sale. Stay informed, by all means – just don’t let sensational headlines dictate sound investment strategy. In the end, patience and perspective are the real superpowers in finance. Over decades, markets have rewarded those who keep calm and carry on investing, while panic has rarely paid off. And that’s something you won’t likely see in tomorrow’s headlines – but it’s well worth remembering when everyone else forgets.

Written by Husain Rangwalla Chief Technology Officer

For over a decade, the financial-technology industry has lived in a race for more - more apps, more data, more dashboards. The result has been a paradox: as digital tools have become more advanced, most people feel less in control of their money.

The average investor now spends more time navigating technology than understanding their portfolio. At Skybound Wealth, we’ve come to a different conclusion: innovation isn’t about building more technology. It’s about building less - so people can think more clearly.

Every major fintech product begins with the same intention - to simplify the financial experience. But somewhere between ambition and release notes, simplicity gets lost in translation. Features pile up. Notifications multiply. Interfaces start to speak the language of engineers, not end users.

In wealth management, that complexity is more than an inconvenience - it’s a risk. When clients can’t interpret what they see, they disengage. And when they disengage, even the most advanced systems fail their purpose.

Our development team realised that true digital progress isn’t measured in the number of functions shipped, but in the confidence restored to the people using them.

When we rebuilt the Skybound ecosystem, we started with one principle:

If a feature doesn’t make understanding easier, it doesn’t belong. Instead of chasing automation for its own sake, we asked:

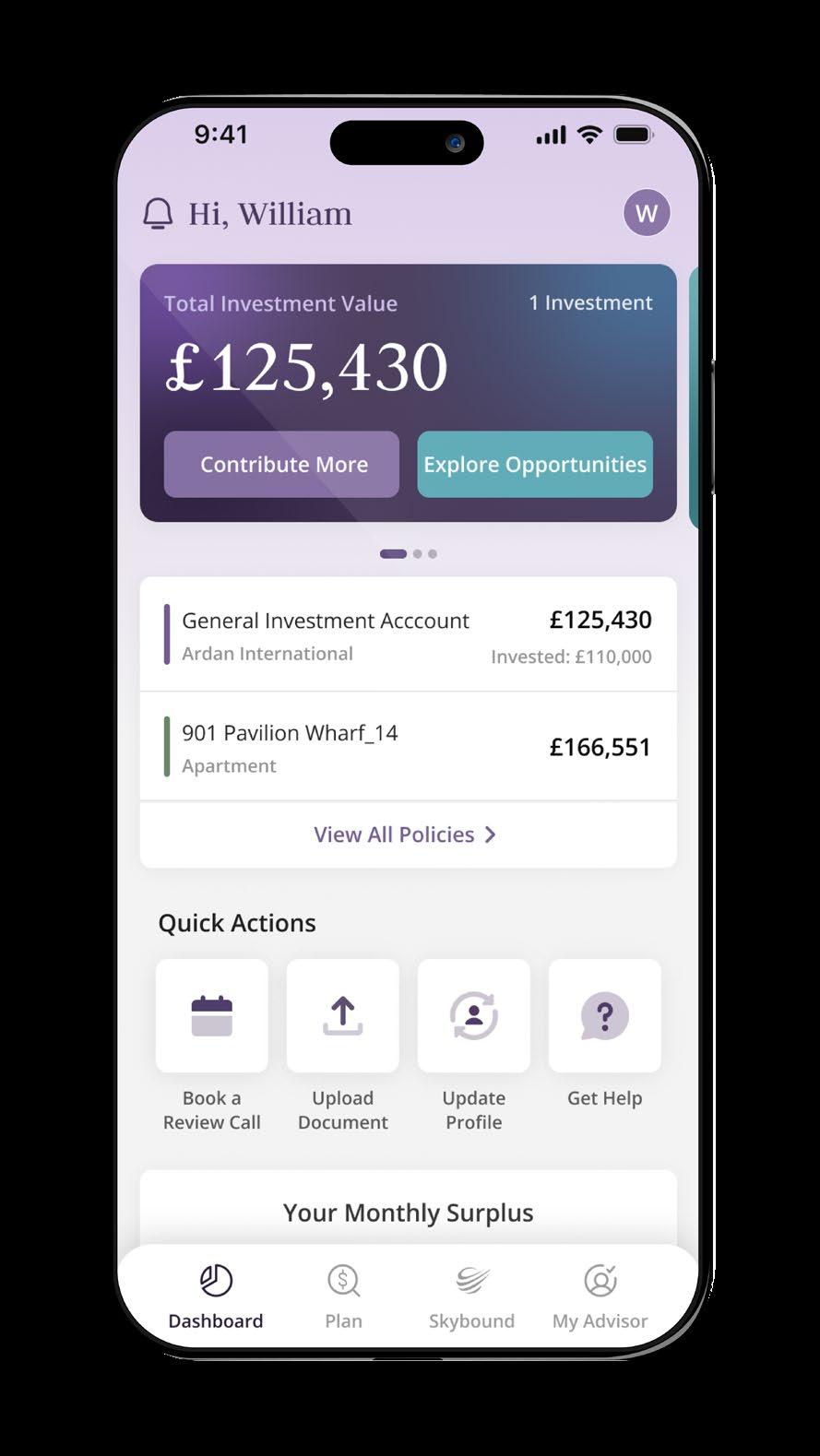

• How can a client instantly know where they stand financially - without a manual?

• How can an adviser spend less time interpreting data and more time offering insight?

Every decision, from navigation structure to colour contrast, followed that logic. The result is an interface that looks minimal, but operates with layered intelligence. We deliberately removed noise - merging dozens of data points into visual clarity - so that human judgment could re-enter the process.

If you want to see how this philosophy works in practice, explore Plume here.

“We deliberately removed noisemerging dozens of data points into visual clarity...”