Mike Coady Chief Executive Officer

Peter Gollogly Regional Director

Paul Pavli Executive Director - Cyprus

Josh Watson Group Head of People

William Bailey Global Partners Manager

Taylor Condon Area Manager

Bethany Ward Partnerships Manager

Ashley Eyre Head of Compliance - UK

Michelle Koh Operations Manager - Asia

Husain Rangwalla Chief Technology Officer

Carlo Casaleggio Group Head of Compliance

Veronica O’Brien Group Head of Corporate Affairs

Craig Stokes Managing Director - UK

Adeeb Khan Team Lead - Technology

Dmitriy Ermakov Group Head of Marketing

Danny Sutherland Group Financial Controller

Maria Darmanin Demajo Operations Manager – Cyprus

Jenna Cochrane Administration and Operations Manager - USA

Skybound Wealth Management stands as a benchmark of excellence in the world of international wealth management. As an independent firm, we pride ourselves on delivering bespoke financial solutions tailored to meet the unique needs of our global clientele. Our innovative approach combines the agility of a boutique firm with the expertise and resources typically associated with a major financial institution.

Follow Us On Social Media

Search for ‘Skybound Wealth’

Josh Burton Chief Financial Officer

Tom Pewtress Group Head of Proposition

Carla Smart Group Head of Pensions

Bryan Bann Regional Manager

Richard Gartland Area Manager - Cyprus

Jaya Prakash Goulikar Head of Compliance – Middle East

Elyka Ygnacio Operational Finance Manager

Tyrone Witehira Regional Manager - Asia

Maria Nikolaou Executive Director - Cyprus

$1.3billion

of client assets under management

6,000 +

international clients & growing

This year, Skybound Wealth was named Company of the Year and recognised for Excellence in Advisory Practice and Excellence in Client Service across multiple regions. These awards are a proud moment for us, but they’re really about you. Your trust, loyalty, and partnership made them possible.

For more than two decades, we’ve built Skybound Wealth to serve the modern international investor: people whose lives, careers, and families move across borders but who expect the same standard of advice wherever they are. That means global regulation, personal relationships, and technology that makes planning clear, accountable, and portable.

In this edition, you’ll find articles that speak directly to that mission, from tackling tax traps and pension planning, to managing risk, protection, and opportunity across jurisdictions. You’ll also see how we’re continuing to evolve through innovation, education, and inclusion, ensuring that world-class advice remains accessible to everyone who needs it.

Thank you for continuing to trust us with your goals and your future. It’s a responsibility we take seriously, and one we’re proud to keep earning, every day.

Mike Coady

Mike Coady Chief Executive Officer

08. Why Skybound Wealth Stands Out

The Human Side Of Money: A Complete Guide For Expats

20. Why High Earners Go Broke: Avoid These Financial Traps And Secure Your Future 24. From Planning To Doing The Hardest Financial Step

28. Life Insurance For Expats: It’s Not About You. It’s About Them

30. How Skybound Wealth Supports The Modern Expat Investor

34. Swiss Vested Benefits: 10 Misconceptions That Could Be Costing You

40. Thinking Of Moving Your Business To The UAE? Here's Why It’s A Smart Move

44. Why Expats Shouldn’t Ignore Old Workplace Pensions

114. In The Spotlight: Zain Shahin 24. 30. 92. 74. 44.

48. How British Expats Can Avoid UK Tax On Their Pension Income

52. Unlocking Saudi: Why The Kingdom’s New Property Law Could Redefine Global Investment For Expats

56. Skybound Wealth Launches Athletes & Creators: Supporting Professionals Beyond The Spotlight

60. The Financial Mirage Of Gulf Expats: Why TaxFree Salaries Disappear Without Planning

64. Two Wallets, One Plan: How Couples Can Manage Money Together

66. Success Without Structure Is Just Noise: Why Financial Planning Is About More Than Money

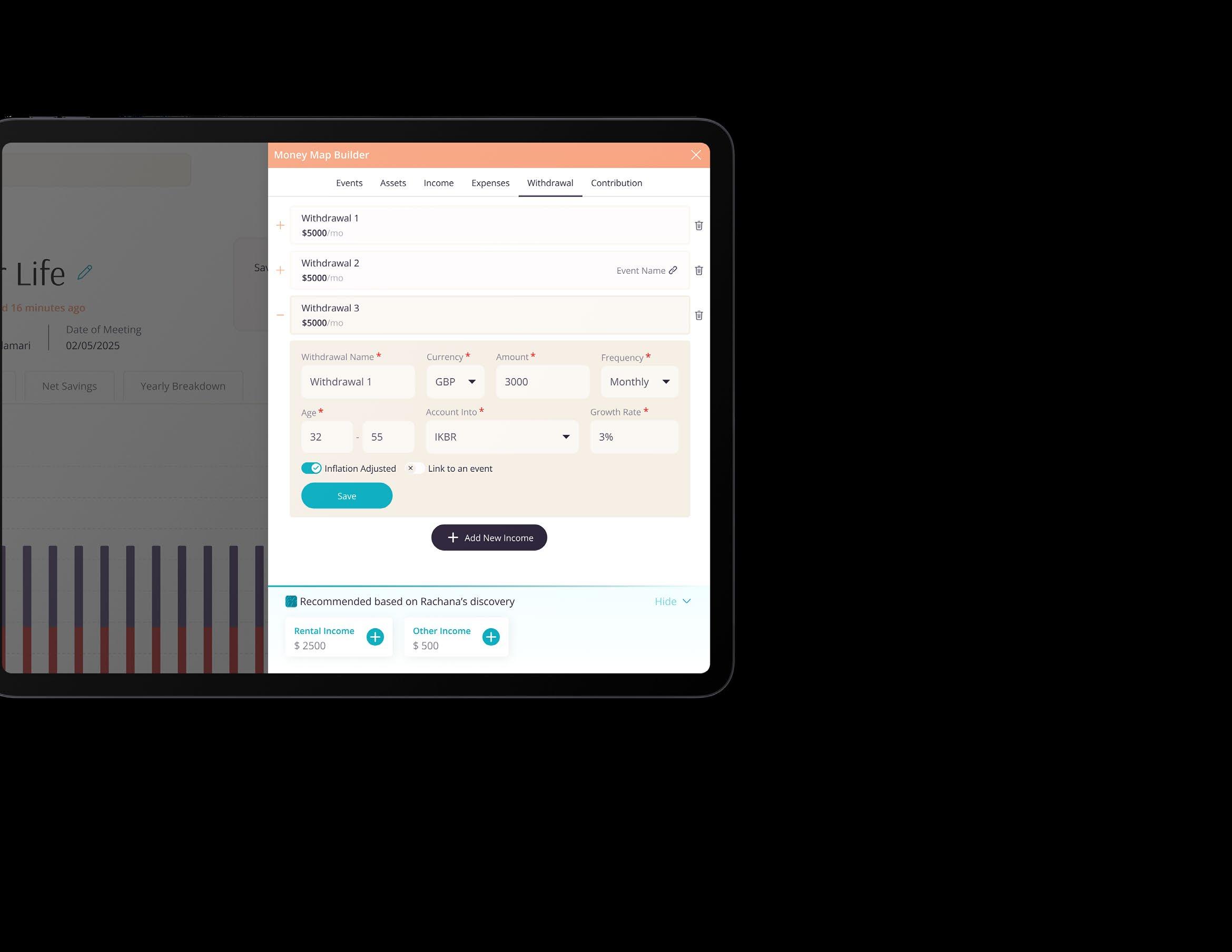

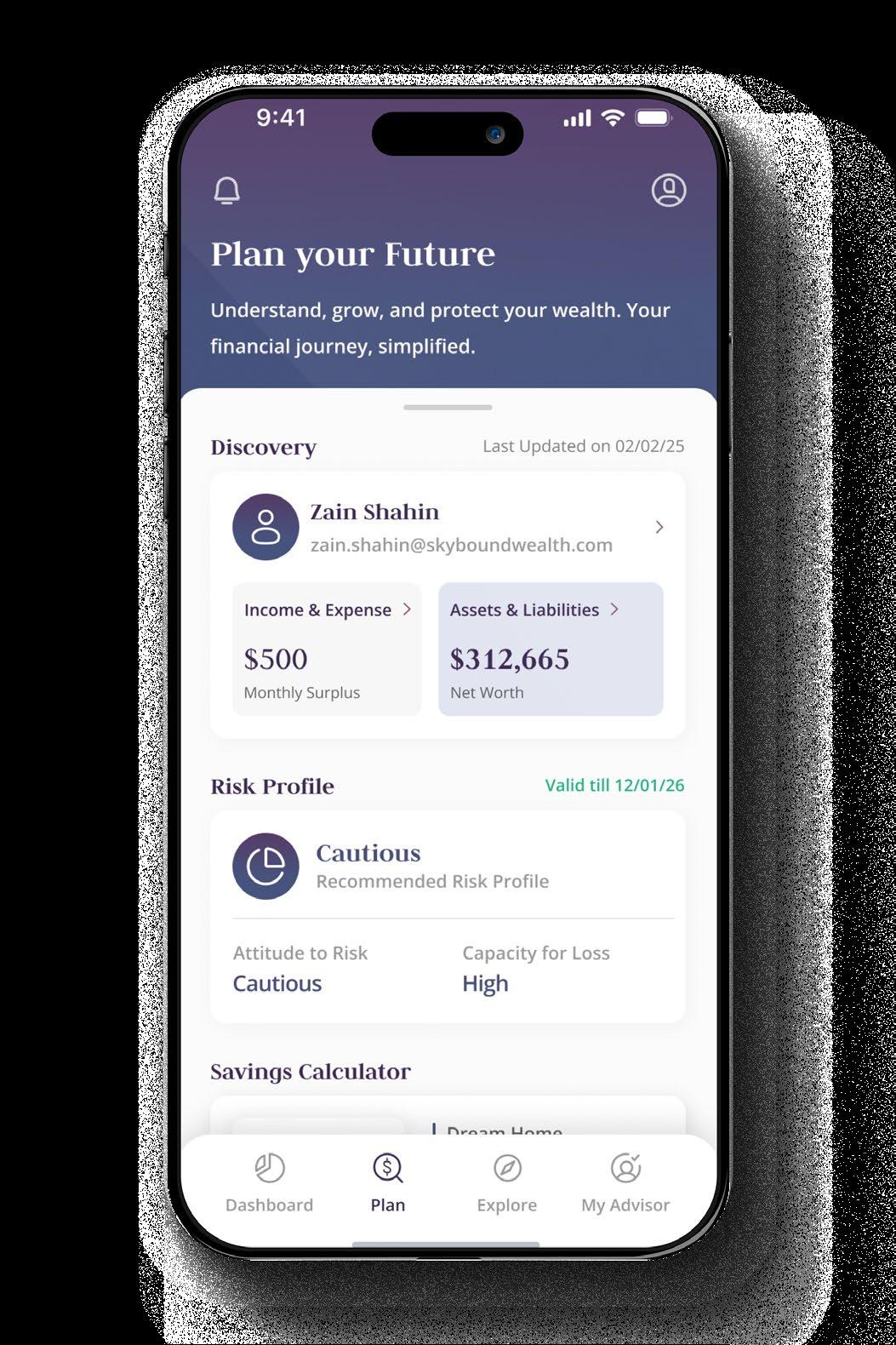

70. Skybound Wealth Launches Moneymap

74. The New Faces Of Wealth: How Gen Z Millionaires & Billionaires Are Reshaping Global Finance

80. Why Playing It Safe With Cash Could Be Your Riskiest Move Yet

84. Spotlight On The Pension Dashboard: A Game-Changer For Savers

88. UK Pensions & Inheritance Tax: What Every British Expat Needs To Know

92. Renting Out Uk Property As A Spanish Tax Resident: What You Must Know In 2025

96. Understanding Financial Emigration & Tax Emigration For South Africans Abroad

100. Moving Back To The UK? Here’s How To Avoid A Nasty Surprise From HMRC

104. Quarterly Report: Q1 2025 Review & Q2 2025 Outlook

110. Five Tax Traps For Brits Moving To Spain

112. Less Than 1 In 10 People Seek Financial Advice In The UK. Don’t Be One Of Them

It’s easy to say you put clients first. At Skybound Wealth, we built an entire business model to prove it.

From multi-jurisdiction regulation to proprietary technology and a client experience measured in engagement, not promises, our difference isn’t in what we claim, it’s in what we deliver.

Today, Skybound operates across five continents, serving more than 6,000 clients and managing over $1.3 billion in savings and investments. We’ve been recognised with multiple industry awards, most recently Company of the Year and Excellence in Client Service at the 2025 Investment International Awards.

But the real achievement lies behind those results: the systems, people, and standards that make excellence repeatable

How we turned a promise into a platform for global advice

IT’S IN WHAT WE

When you hold licences across the UK, EU, Switzerland, UAE, USA, and beyond, global advice stops being a slogan and becomes a service.

A Dubai family with assets in Cyprus and the UK doesn’t need three advisers. One Skybound adviser can manage their portfolio and protection seamlessly, drawing on multiple licences under one roof. The result: faster decisions, fewer handoffs, and one standard of advice.

Investment Depth That Clients Can Feel Our investment edge comes through Skybound Capital, our global investment partner managing over $2 billion across institutional mandates, funds, and discretionary portfolios. With dedicated CIOs and strategists in London, Hong Kong and South Africa, clients benefit from real insight, not outsourced opinion. It’s a level of investment governance few advisory firms can claim, and even fewer can replicate.

Our technology wasn’t built to automate advisers out of the process. It was built to put them, and their clients, at the centre of it.

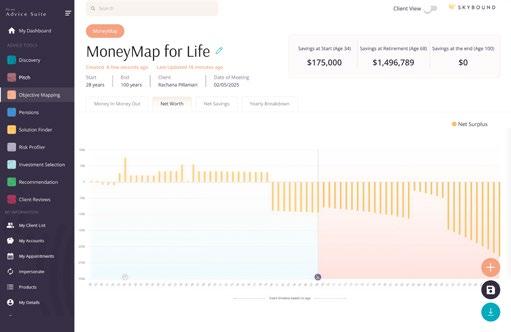

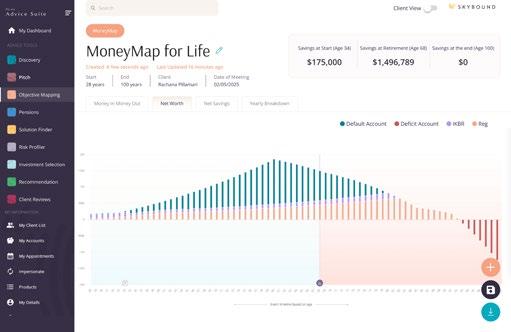

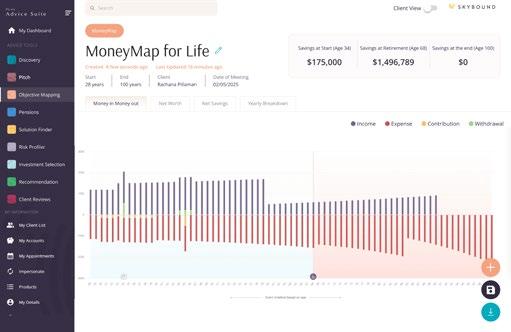

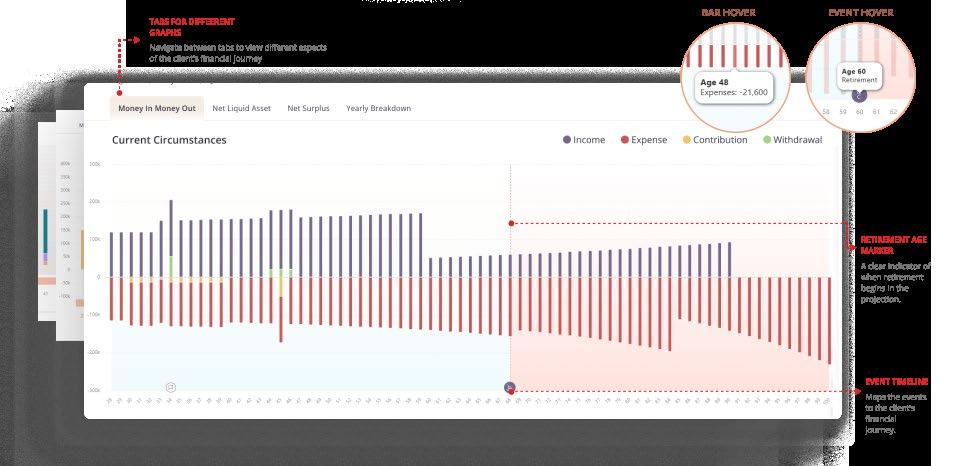

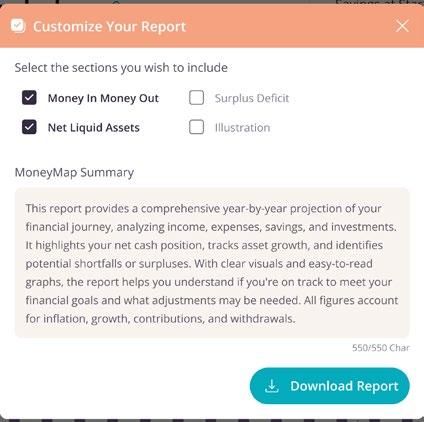

The Plume Advice Suite powers the entire advice cycle: from discovery and solutionfinding through to investment selection, licence routing, and instant report generation. It delivers regulator-ready recommendations faster, with less room for error.

MoneyMap, our interactive forecasting tool, turns financial planning into real-time visual decisions. Clients can model outcomes, stress-test goals, and see instantly how small changes alter their future.

Advisers manage it all through the Client Manager Dashboard, while Client App 2.0 keeps clients informed minute-by-minute, valuations, reviews, communications, all in one secure place. This isn’t technology for technology’s sake. It’s clarity, accountability, and trust, made visible.

Exceptional service doesn’t live in quarterly reviews, it lives between them.

We’ve built a communication rhythm that keeps clients informed, educated, and supported all year. Bespoke review packs. SOAR, our quarterly magazine for internationally mobile professionals. Altitude, our monthly newsletter now read by more than 6,000 subscribers. Webinars, events, and ondemand insights that turn complex markets into clear action.

But numbers only tell half the story. The real measure of success is that clients no longer need to ask what’s happening with their plan, they already know.

Behind every system stands a person who makes it work.

We now have over 70 qualified advisers, 12 chartered and a significant training budget dedicated to continuous professional development.

Our Academy brings new advisers through a structured pathway of mentorship and technical mastery. While the book buyout scheme secures long-term continuity for clients and advisers alike.

Our employee Net Promoter Score of +37 tells its own story, good people come here, and they stay. Because when you give professionals the right tools, culture, and trust, excellence becomes the default.

In a world where opportunity often outpaces scrutiny, discipline is a competitive advantage. Every product and provider passes through a centralised due-diligence process that prioritises transparency, governance, and sustainability. We’ve said no more than once, and we’ll keep doing so.

Boring on purpose? Maybe. But we’ll always choose predictable over precarious, and principle over profit.

We believe transparency builds trust. That’s why every client has full visibility of costs, performance, and progress through their digital dashboard, no hidden fees, no grey areas, no surprises. In a market too often defined by opacity, we prefer daylight.

“From multi-jurisdiction regulation to proprietary technology and a client experience measured in engagement, not promises, our difference isn’t in what we claim, it’s in what we deliver.”

When you combine global regulation, proprietary technology, measurable service, and exceptional people, something powerful happens. Advice becomes joined-up.

Clients feel it. That’s why recognition follows, not because we chase trophies, but because we chase consistency.

At Skybound Wealth, our goal has never been to be the biggest. It’s to be the most trusted. And that trust is earned one client, one plan, and one result at a time.

We believe world-class advice should feel personal. It’s why our advisers build lifelong relationships, not transactions, and why every Skybound client, no matter where they live, experiences the same clarity, accountability, and care.

“BUT NUMBERS ONLY TELL HALF THE STORY. THE REAL MEASURE OF SUCCESS IS THAT CLIENTS NO LONGER NEED TO ASK WHAT’S HAPPENING WITH THEIR PLAN, THEY ALREADY KNOW.”

Written by Mike Coady Chief Executive Officer

Money has always been more than numbers. It is memory, identity, fear, pride, and hope rolled into one. For expats, money carries even more weight.

You’re not just building a nest egg. You’re balancing currencies, tax regimes, uncertain career paths, family obligations across borders, and the quiet question: Will I be okay?

I understand how overwhelming financial planning can be. At Skybound Wealth, we're committed to giving you clear, straightforward advice. No jargon, just a plan you can trust. Most financial articles start with charts and formulas. This one begins with people. Because after advising expats for decades, I’ve seen the same truth over and over: clients don’t make financial decisions with spreadsheets alone. They make them with hearts racing, palms sweating, sometimes with tears in their eyes. Financial planning is technical, but at its core, it is human.

This guide is for those who want to master both sides: the mechanics of building, protecting, and transferring wealth and the emotional reality of making decisions that truly stick.

The world is moving fast. Inflation eats away at savings, markets rise and fall in unpredictable waves, and life expectancy is climbing steadily. The average expat today will live longer, move more often, and face more complex tax rules than any generation before.

And yet, many still delay planning. Some keep everything in cash “until things feel clearer.”

Others chase get-rich-quick investments because a friend in Dubai or Singapore said it was “guaranteed.” Some even rely on company benefits without checking if they’re transferable when they move.

Here’s the harsh reality: inaction is also a decision. Waiting quietly is still choosing. But it’s choosing erosion over growth, uncertainty over clarity.

What underpins this hesitation? Emotions.

They say: “I’ll think about it,” which really means, “I feel overwhelmed.” Or: “Let’s wait and see,” which is fear dressed up as logic.

“Financial planning is technical, but at its core, it is human.”

Every plan is unique, but the foundations are consistent. For expats especially, these blocks create a structure strong enough to withstand moves, market crashes, and unexpected shocks.

Lifestyle & Cashflow Modelling

A solid plan starts with clarity. Lifestyle modelling isn’t theoretical; it turns your questions into numbers. What if you retire at 55 instead of 65? How would your plan shift if interest rates rose by 3%? Could you fund education in euros while earning in dollars? For globally mobile families, this process is often a revelation. They can finally see their life laid out, not as abstract goals, but as a living roadmap. Tools like MoneyMap and other modelling software make it visual, interactive, and real.

Savings & Investing

Even when income is strong, volatility can make it hard to build lasting wealth. Without long-term structures, many find that high salaries don’t translate into financial security. Steady investing across markets, currencies, and asset classes builds resilience. Equities provide growth, bonds offer stability, alternatives add diversification, and liquidity ensures you can handle life’s curveballs. The goal isn’t to “beat the market” but to remain invested long enough for compounding to work its quiet magic.

One truth I’ve seen repeatedly: the wealthiest plans collapse without protection. Illness, accident, or death abroad can turn financial independence into financial chaos overnight. Critical illness cover, disability protection, and international health insurance aren’t optional, they’re non-negotiable foundations.

Retirement & Pensions

Every country has its own rules. The UK offers State Pensions, SIPPs, and occupational schemes, South Africa relies on retirement annuities, and the US has 401(k)s and IRAs. For globally mobile families, the challenge isn’t simply choosing a pot, but integrating them across borders. Currency, tax, and access rules make careful coordination essential.

Tax & Estate Planning

The uncomfortable truth is that governments change the rules faster than most people change houses. Expatriates need to consider where their assets are domiciled, whether their wills cover multiple jurisdictions, and if cross-border inheritance tax could apply. Failing to plan in this area doesn’t just cost money, it can leave families exposed, vulnerable, and sometimes entangled in disputes across borders.

“Financial planning isn’t about predicting the future. It’s about preparing for uncertainty. The approach I use with clients has three steps: first, we identify the risk or opportunity. Next, we acknowledge the emotion it brings; fear, anger, sadness, or hope. Finally, we reframe it and provide a clear, actionable solution.”

This is where the wheel of emotions comes in. Most advisers (and most articles) stop at surface words: worried, angry, happy. But clients rarely live on the surface.

A client who says, “Your fees are too high,” might not be angry. They might feel disrespected, like their trust is being taken for granted. Another who says, “I’ll think about it,” isn’t calm and rational. They may feel overwhelmed, paralysed by choice and terrified of making a mistake.

When advisers miss this, conversations stall. When advisers notice and name it, trust deepens.

The Angry Client: “My last adviser was useless.”

On the surface, it’s anger, but underneath, it’s a sense of betrayal and resentment.

Acknowledging this, you might respond: “I can see you felt let down. Let’s rebuild this with complete transparency so you feel secure again.”

The Delaying Client: “Let me wait and see.”

It seems calm, but it masks fear and uncertainty.

A good response could be: “Waiting feels safer when things feel uncertain, but doing nothing has its costs too. Let’s model some scenarios so you feel more in control.”

The Regretful Client: “It’s too late for me.”

It’s not just sadness; it’s a sense of helplessness and vulnerability.

The right response reminds them: “It’s never too late to improve your future. Even small changes can create freedom. Let’s take back control together.”

The wheel isn’t perfect, but it gives advisers, and clients, a vocabulary for what’s really happening beneath the words.

Financial planning isn’t about predicting the future. It’s about preparing for uncertainty. The approach I use with clients has three steps: first, we identify the risk or opportunity. Next, we acknowledge the emotion it brings; fear, anger, sadness, or hope. Finally, we reframe it and provide a clear, actionable solution.

Practical tools underpin this process. Portfolios are stress-tested against market crashes. Liquidity is planned for job loss or relocation. Healthcare costs, particularly post-retirement, are factored in. Income is diversified across pensions, investments, rental properties, or even part-time consulting.

When clients see not just numbers but resilience, they move from feeling powerless to confident, ready to face whatever life throws at them.

A good adviser does more than optimise tax wrappers or select funds. They translate emotion into action. They sit with clients who feel vulnerable, exposed, or betrayed, and help them move toward security, fulfilment, and pride. DIY planning often skips this step. That’s why many self-taught expats end up misaligned, underprotected, and stressed.

Advisers bring perspective, spotting blind spots clients cannot see. They provide accountability, ensuring decisions get implemented. They offer objectivity, guiding through noise and panic, and they bring empathy, understanding not just the numbers but the fears and hopes attached to them.

Financial planning involves spreadsheets, risk analysis, tax structures, pensions, and insurance. But at its heart, it’s also about real people: the father who feels proud knowing his family will be secure, the mother who once felt exposed but now has peace of mind about retirement, and the couple who once felt betrayed but now trust again.

“Most advisers stop at surface words: worried, angry, happy. But clients rarely live on the surface.”

Written by Kieran Tween Private Wealth Manager

We often hear high earners say, “If I make enough money, everything else will take care of itself.” But this is a dangerous assumption that leads many into financial ruin. As someone who has worked with business owners, professionals, and executives making six or even seven figures, I’ve seen this happen more times than I can count. Despite a substantial income, many still find themselves living paycheck to paycheck. So, how can this be?

The more you earn, the more you tend to spend. A bigger house, a luxury car, lavish holidays, it’s easy to fall into the trap of believing that as long as your income grows, you’re financially secure. But ask yourself this: how long could you maintain your current lifestyle if your income disappeared tomorrow?

The Truth:

Living rich doesn’t equal building wealth. It’s a trap many high earners fall into, convinced that their income will always be there to support them. The reality? Without a strategic plan, even a high salary can lead to financial disaster. What to Do Instead:

Sure, increase your income, but make sure your assets grow at an even faster pace. It’s not just about how much you earn, it’s about what you keep and how well your wealth works for you even when you’re not actively earning.

Relying on a high salary or successful business to fuel your wealth is risky. Jobs aren’t for life. Businesses fail. Markets change. If all your money comes from active income, you’re one mistake away from instability.

What to Do Instead:

Diversify. Put your income into investments, property, stocks, or assets that work for you even when you’re not. Building wealth is about making your money work for you in the long term.

I’ve seen two extremes: high earners who hoard cash, letting inflation erode its value, and those who gamble on high-risk investments without a strategy. Both are dangerous. Sitting on cash means your wealth isn’t growing, and high-risk bets are no better than gambling.

What to Do Instead:

Have a structured investment plan. Invest in diversified assets that build wealth steadily over time. Wealth isn’t about making a big, risky bet; it’s about consistent, strategic growth.

As your income grows, so do taxes. Without tax-efficient structures, you could be losing a significant portion of your earnings. And if you’re not protecting your assets, a lawsuit or business failure could wipe it all out.

What to Do Instead:

Work with professionals who understand tax efficiency and asset protection. Protect your wealth through proper planning and structure, ensuring it continues to work for you for years to come.

“Despite a substantial income, many still find themselves living paycheck to paycheck.”

The Silent Killer of Wealth

It’s easy to say, “I’ll deal with this later.” But “later” rarely comes. By the time most high earners realise the importance of financial planning, it’s often too late to reap the benefits of years of lost growth.

What to Do Instead:

Start today. The best time to take control was yesterday. The second-best time is now.

High earners often assume that as long as they’re earning a good salary, they’re financially secure. But without proper planning, those earnings can quickly vanish in a haze of poor spending, missed opportunities, and financial missteps.

If any of this resonates with you, you’re not alone. But here’s the good news: it’s never too late to make a change. You don’t have to do it alone.

Let’s have a conversation about how you can structure your wealth, avoid common financial traps, and build long-term security. No pressure, no sales pitch, just honest advice to help you secure your future.

Imagine a world where your investments deliver a consistent return, year after year. Argen Capital offers exactly that – a remarkable opportunity to earn an 8% fixed return per annum, designed for those who seek stability and security.

Our innovative approach, developed by Skybound Capital, provides you with the peace of mind that comes with a steady income stream, while also allowing you to take control of your financial future.

Discover how Argen Capital can work for you. Contact us today to learn more about this exclusive investment opportunity and take the first step towards securing your financial future.

Written by Ben Stockton Private Wealth Adviser

Financial planning rarely fails because of complicated maths or lack of investment options. The real challenge sits between our ears, it’s human nature that derails even the best-laid plans.

And as someone who spends my days helping people build financial security, I can tell you this: the hardest part of financial planning isn’t designing a brilliant strategy. It’s getting people to actually follow through.

If you ask people why they’re not taking action on their finances, the excuses sound eerily similar:

“I’ll sort it out when things calm down.”

“I’m still researching my options.”

“I’ve got time. It’s not urgent yet.” But life never really calms down. There’s always a project at work, a family event, a looming expense. And “not urgent” has a funny way of becoming very urgent overnight.

I’ve seen people delay life insurance because they’re healthy and busy, only to fall ill, making cover impossible to secure at any price. I’ve worked with clients in their fifties trying desperately to catch up on pension savings they should’ve started in their thirties. And I’ve met high earners who assumed their salary alone would guarantee financial security, only to discover that income can vanish shockingly fast when circumstances change.

Financial consequences rarely feel immediate. That’s what makes procrastination so dangerous. Consider retirement savings. The difference between starting in your thirties versus your forties can be staggering. Someone investing £500 a month from age 30 could retire with twice as much as someone starting at 40, even if the second person tries to save more aggressively later on. Time, quite simply, is the most powerful multiplier in wealth building.

Or look at investing. A £100,000 portfolio growing at 6% annually becomes roughly £320,000 over 20 years. Wait five years to start, and you’ll end up with around £237,000 instead. That’s £83,000 lost, not because you picked the wrong fund, but because you hesitated.

These numbers aren’t theoretical. I’ve sat across the table from clients who’ve said, “I wish I’d done this ten years ago.” The regret is real, and the cost is often higher than people expect.

Some of the smartest people I know are the worst offenders when it comes to financial procrastination. Why? Because intelligence often fuels perfectionism. High achievers want the perfect plan, the perfect timing, the perfect conditions. But perfect doesn’t exist. Markets shift. Tax rules change. Life throws curveballs. The cost of standing still is often far higher than the cost of taking imperfect action.

I’ve seen clients transform their financial path by simply automating £100 a month into an investment account. Was it their dream portfolio? No. But it broke the inertia. And inertia is the real enemy.

“Financial security isn’t built on good intentions. It’s built on action, even if it’s imperfect or small at first.”

One of the biggest myths about financial planning is that waiting is harmless. People assume that putting things off is neutral. It’s not.

Every day you wait is a day your money could have been growing, or a day your family remains unprotected. Inaction has a cost, it just hides itself well.

A client of mine once insisted on waiting until the market “felt safer” before investing his cash. Over two years, his money sat in a current account earning nearly zero while inflation quietly eroded its value. Meanwhile, the markets rose more than 15%. He lost tens of thousands in potential gains, simply because he was paralysed by fear of making a mistake.

So how do you escape the quicksand of financial procrastination?

• Start Small, But Start - Don’t wait until you can save £1,000 a month. Start with £50 or £100. Small habits snowball over time.

• Automate Everything You Can - Set up standing orders to savings, investments, or pension contributions. The less you have to think about it, the more likely it’ll happen.

• Prioritise Protection - Before chasing returns, make sure your family and income are protected against the worst-case scenarios.

• Review Annually - Life changes, and so should your plans. Review your finances once a year to keep things on track.

• Accept Imperfection - You’ll never have complete certainty. The goal is progress, not perfection.

Financial security isn’t built on good intentions. It’s built on action, even if it’s imperfect or small at first.

So ask yourself: What’s one financial step you could take today? Maybe it’s calling your adviser. Maybe it’s opening that investment account. Maybe it’s getting your will drafted. The specific step doesn’t matter as much as the fact that you’re finally moving forward.

Because the hardest part of financial planning isn’t knowing what to do. It’s deciding to do it, today, not someday. And the sooner you start, the more options you’ll have. That’s the real secret to financial success.

“Some of the smartest people I know are the worst offenders when it comes to financial procrastination. Why? Because intelligence often fuels perfectionism.”

“I’ve seen people delay life insurance because they’re healthy and busy, only to fall ill, making cover impossible to secure at any price.”

Why Choose Skybound Wealth?

• Comprehensive coverage for expats and their families

• Tailored advice that fit your lifestyle, whether home or abroad

• Peace of mind with flexible life, health, and critical illness cover

• Expert advice to ensure your loved ones are fully protected ACT NOW

Safeguard your future today—speak to an adviser about a bespoke insurance plan.

IT’S NOT ABOUT YOU. IT’S ABOUT THEM

Written by Leo Geldenhuys Private Wealth Adviser

When someone says “insurance,” most thoughts go to car, home, or travel cover, everyday protections we buy without hesitation. But when it comes to life insurance or critical illness cover, something changes. Questions arise: Do I really need it? Isn’t it too expensive? Won’t I be fine without it?

Here’s a reality many expats don’t consider: life and critical illness insurance aren’t for you, they’re for the people you leave behind. Your spouse, kids, parents, or even your business partners. It’s not personal, it’s protection.

Insurance doesn’t feel tangible. You don’t see it, feel it, or enjoy instant value like with a vacation or a new gadget. Add that to the optimism bias, “it won’t happen to me”, and it’s easy to put off. Yet life won’t wait for convenience.

Why It Matters: Thinking Beyond Yourself

Consider this:

If something unexpected happened, would your family still be able to cover school fees, mortgage payments, or everyday living expenses? Could they focus on grieving without the added stress of financial strain?

Stories like this aren’t rare. One widow shared how her world shifted overnight. With a modest household income of $42,000, she suddenly had responsibility for two teens and her elderly mother. The life insurance her husband had in place became the safety net that kept them afloat, without it, the impact would have been devastating.

Many expats hesitate to take out life or critical illness cover, and it often comes down to a few persistent myths.

Some think, “I’m young and healthy, I don’t need insurance.” The truth is, the younger and healthier you are, the easier and cheaper it is to get coverage. Waiting only limits your options and drives up costs.

Others worry it’s too expensive. In reality, most expats overestimate premiums, life insurance can cost less than a daily coffee or a single meal out.

Some rely on savings alone, assuming that will be enough. Savings help, of course, but few of us could cover ongoing living costs, school fees, or unexpected hospital bills for years. Insurance is what protects your nest egg.

Then there’s the temptation to “sort it out later.”

The problem is, later isn’t guaranteed. Premiums rise, health changes, and opportunities disappear.

And the myth that insurers don’t pay out? Most reputable providers have payout ratios above 95%. The real challenge is simply having the right policy in place.

Living and working abroad can bring exciting opportunities, but it also adds layers of complexity when it comes to protecting your loved ones. Standard life insurance assumptions don’t always apply once you cross borders.

• Global coverage counts: A policy tied to one country might not protect you if you move.

• Mind the gaps: The DIME method (Debt, Income, Mortgage, Education) helps you cover what really matters, rather than guessing.

• Rules can change: Legal and tax requirements vary from country to country, so planning carefully is key.

Taking the time now to understand these differences ensures your protection truly works wherever life takes you, and gives you peace of mind that your family is covered no matter what.

Here’s a thought experiment I pose to clients: If your insurer offered your family £500,000 tomorrow in exchange for a few hundred pounds a month, would you accept? Of course. That’s the power of insurance, it turns a small, predictable cost into life-changing security.

The Real Value Life and critical illness insurance isn’t just about numbers on a policy, it’s about the peace of mind that comes from knowing your loved ones won’t face financial hardship if the unexpected happens. It gives your family stability in moments of crisis, allowing them to focus on healing rather than scrambling to cover bills or tuition. It ensures your plans and legacy continue, even when you can’t be there, and it gives you the freedom to live today with confidence, knowing tomorrow is taken care of.

Getting It Right

Start by mapping out your family’s financial needs using the DIME approach; Debt, Income, Mortgage, and Education, to make sure you’re covering what truly matters. Choose global or portable cover so that moving abroad doesn’t leave gaps in protection. Check the details carefully, paying attention to payout ratios and policy terms, and act sooner rather than later. Rates are lower and options wider when you’re younger and healthy. Finally, speak with an expert who can guide you through the complexities of cross-border insurance, helping you make decisions with confidence.

Car insurance covers what can be replaced. Home insurance covers the building. Life and critical illness insurance cover the people who matter most.

Ask yourself this: can your loved ones manage if something happened and you weren’t prepared?

If you’re unsure how much protection is right, or whether your current policy actually works for your expat situation, a short conversation now could make all the difference for the people you care about most.

“If something unexpected happened, would your family still be able to cover school fees, mortgage payments, or everyday living expenses?”

Written by Mike Coady Chief Executive Officer

In this exclusive Gulf News feature, Mike Coady, CEO of Skybound Wealth, and one of the most respected names in international finance, shares Skybound Wealth is reshaping the future of wealth planning for expats. From global tax pressure to the two-year myth that quietly derails so many lives abroad, this article is a must-read for anyone serious about securing their financial future.

If you're living internationally, earning well, and planning for the future, you’ve already realised that wealth is more than a good salary. You need structure. You need clarity. And above all, you need advice that works wherever life takes you.

“It’s no longer enough to recommend just an investment. Clients want a portable strategy built around their entire financial life. That’s where Skybound leads.”

Read the Full Gulf News Article - Making Wealth Management Accessible: The Skybound Way

What major trends are currently shaping global wealth management, especially for expat investors?

The old wealth management playbook is no longer effective, especially for expats. Many now live internationally but are taxed or assessed by multiple jurisdictions. Add to that market volatility, inflation, shifting residency rules, and increased global tax scrutiny, and there’s little room for error.

But more than just regulatory changes, the bigger shift is in mindset. Expats increasingly realise that high income doesn’t guarantee lasting wealth. They want clarity and structured planning from advisers who truly understand their mobile lifestyle. It’s no longer enough to recommend a fund, clients want a strategy that’s portable across borders, whether that’s Dubai, the UK, Europe, or beyond.

As a result, demand for proper cross-border planning, tax structuring, succession planning, and pension portability is rising. Traditional advisers often fall short in these areas. Expats now expect more, and rightly so.

What’s often missed in the industry is how wide-ranging the need for advice is. At Skybound Wealth, we’re making wealth management more accessible, not only for the ultra-wealthy, but also for professionals, entrepreneurs, young families, and anyone serious about their financial future. That’s our differentiator. We speak your language, meet you where you are, and simplify the complex. This isn’t an exclusive service, it’s something more people deserve to understand and benefit from.

With over 25 years in international finance, what leadership principles have shaped your approach at Skybound Wealth?

Lead from the front. Stay close to the client. Never ask your team to do what you wouldn’t do yourself. That’s been my leadership ethos from the beginning. I still join client meetings, coach advisers, and push for higher standards. Having built teams across the US, UK, Europe, the Middle East, and Asia, I’ve seen first-hand that culture outperforms strategy. Great plans mean nothing if your team isn’t proud to deliver them. At Skybound, we’ve built a culture of performance grounded in integrity, accountability, and ambition. And that’s what delivers real results.

How does Skybound Wealth differentiate itself in a highly competitive advisory landscape?

We’re global in reach but local in regulation, a rare and powerful combination. We hold licenses in key regions and can support clients wherever life takes them. But it’s our operating model that really stands out.

We’re fully independent, no product-pushing, no in-house funds. With investment expertise via Skybound Capital and access to top-tier fund managers globally, we offer clients a high-quality, diversified portfolio built entirely around them. Technologically, we’ve built something unique. Our proprietary systems, AI tools, and client engagement portals are unmatched in our space. They’re not just sleek, they’re designed to enhance the advice process itself.

Our holistic approach. For us, financial advice isn’t just about fund selection or chasing returns, it’s about addressing the whole picture. That starts with protection. It’s always my first conversation with clients. Without a safety net, any growth strategy is built on shaky ground. Protection is the foundation, from which we help clients grow across investments, pensions, tax, and succession. We don’t just track numbers, we take responsibility.

“We’re investing in the right people, in the right places, for the right reasons.”

What are the most common financial planning mistakes expats make, and how do you help clients avoid them?

The biggest mistake? Assuming their situation is temporary. Many say, “I’m just here for two years,” but a decade can pass quickly. Others chase returns while ignoring structure, mishandling property, overlooking pensions, or missing major tax advantages.

We help clients avoid these missteps through a coherent strategy, not just products. We connect pensions, investments, protection, tax, and succession planning across borders. That’s how long-term wealth is built.

“If you're living internationally, earning well, and planning for the future, you’ve already realised that wealth is more than a good salary.”

As CEO, what’s your focus for the next phase of growth at Skybound Wealth, both regionally and globally?

Our mission is clear: to be the leading advisory firm for international clients. That means expanding into new markets, building standout sub-brands, hiring top talent, and pushing our tech advantage even further.

But growth must be purposeful. It only matters if it enhances client outcomes, improves service, and strengthens our team. My role is to ensure we scale with integrity, staying agile, client-focused, and true to the values that built Skybound in the first place.

Life Isn’t Temporary. Your Planning Shouldn’t Be Either

Too many expats delay serious financial planning because they think they’ll “just be here two years.” The reality? Most stay longer. And without the right structure, the cost of delay can be enormous. We help you plan like you’ll stay, even if you move again. The first thing we ask isn’t “what fund do you want?” It’s “what happens if life goes off course?” Protection isn’t optional, it’s foundational. And we build from there.

Independent, Global, and Personal

Unlike many firms, we’re not tied to a single product, bank, or fund. That means we only work for you. With licensed entities and advisory teams across the UK, Europe, Switzerland, Middle East, USA and beyond, we deliver truly portable planning.

Written by Peter Gollogly Regional Director

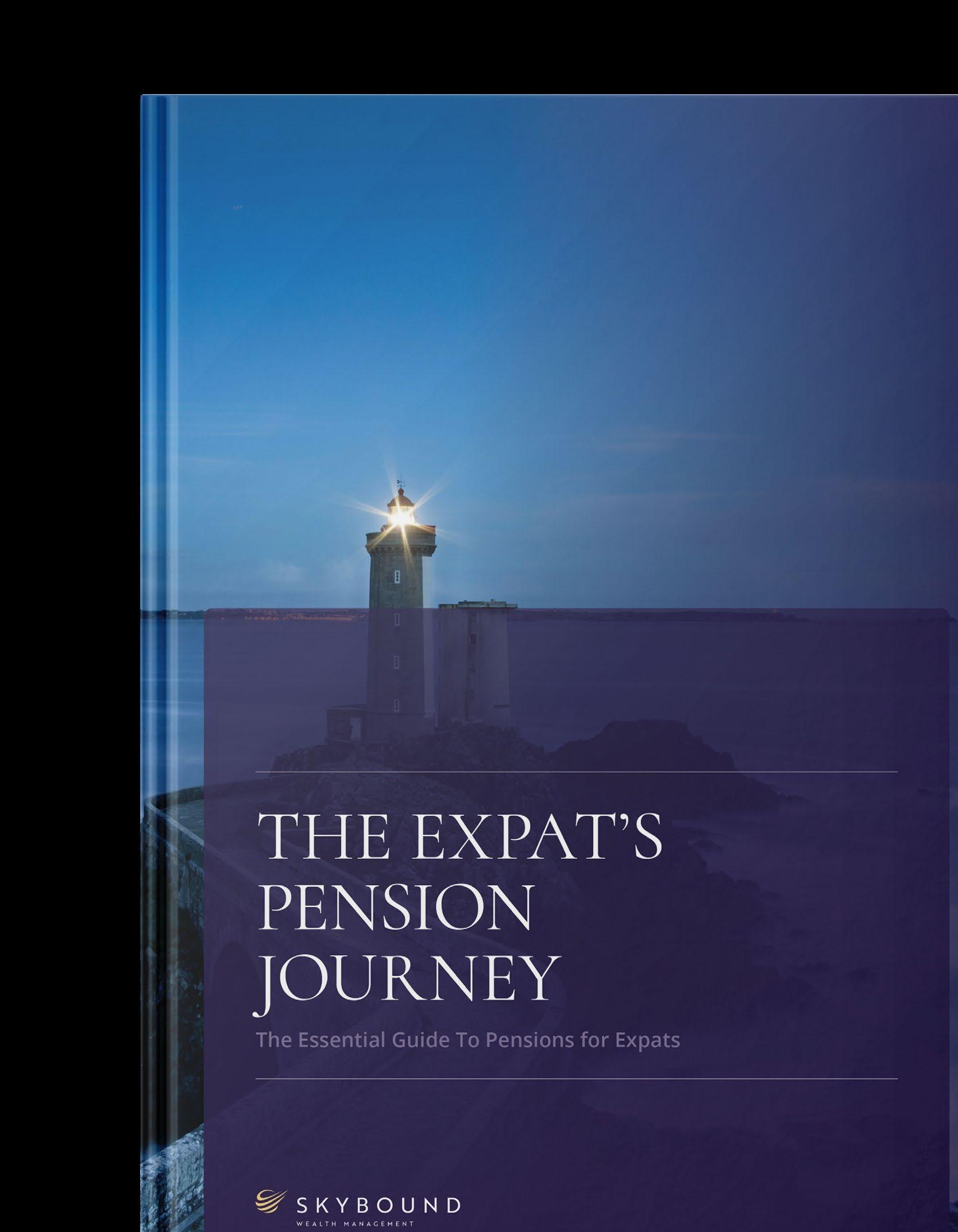

When people think about pensions in Switzerland, they tend to picture something solid, automatic, and well-managed in the background. And to some extent, that’s true. The Swiss system is built on three pillars:

• Pillar 1, the state pension

• Pillar 2, the occupational pension from your employer

• Pillar 3, the voluntary private savings layer

Together, these are designed to support retirement, but Pillar 2 in particular plays a much larger role for internationally mobile professionals. It’s compulsory while employed and often one of the most valuable long-term assets a person builds up in Switzerland.

What many people don’t realise is what happens to their Pillar 2 pension when they leave their job. The funds don’t disappear, and they don’t pay out automatically, they move into something called a vested benefit account. And that’s where most mistakes begin. Vested benefits are widely misunderstood. Some people don’t know they exist. Others pick a provider based on convenience rather than suitability. And many wait too long to ask the right questions, often missing important planning windows around tax, relocation, or retirement.

Over the last 8 years, I’ve worked with clients across Switzerland and beyond to help them avoid these mistakes and make smarter decisions about how, when, and where to take control of their pension.

Here are the ten most common misconceptions I still come across, and why reviewing your position sooner rather than later could save you serious money and stress.

“One of the most avoidable mistakes is assuming your pension will be looked after once you leave. It won’t be, unless you take control.”

“I can access my Pillar 2 funds whenever I want after leaving my job.”

You can’t. Your funds become vested benefits, which are subject to strict withdrawal rules. Unless you are leaving Switzerland permanently (and not to an EU or EFTA country), buying a main residence, or starting a Swiss-registered business, you are not eligible for early access. Too many people assume they’ll be able to draw on their pension for flexibility during a move or career break. In reality, access is blocked without proper planning.

“Any vested benefit account will do, they’re all the same.”

They’re not. Some offer poor interest rates, limited investment options, and very little visibility. Others offer managed portfolios, lower fees, and better tax positioning.

The default option is rarely the most effective one, yet it’s where many pensions end up when no active decision is made. A short review can show how much you might be giving up by staying where you are.

3 4

“The account will automatically be set up when I leave my job.”

It won’t. If you don’t make a choice, your pension is typically sent to a default institution such as the Substitute Occupational Benefit Institution. These accounts tend to be inflexible, offer low returns, and come with limited communication.

One of the most avoidable mistakes is assuming your pension will be looked after once you leave. It won’t be, unless you take control.

“Vested benefit accounts are only relevant when you retire.”

They’re relevant the moment you leave employment. That’s when the money moves, and the decisions you make at that point can affect your long-term outcome.

Which canton you hold your account in, whether the funds are invested, and which provider you use all play a role in shaping your pension’s value over time. Leaving it until your 60s is often too late.

5 6 7 8

“Investment options within my Swiss pension are limited and underperforming.”

Some are, but that’s a choice, not a rule. Certain foundations offer globally diversified portfolios that are professionally managed and regularly reviewed.

If your current provider is offering low returns and no flexibility, it’s worth asking what alternatives are available. You may be able to achieve far more without taking unnecessary risk.

“I’m moving abroad, I’ll just transfer my Pillar 2 into a foreign pension.”

This catches people out regularly. Transfers out of Switzerland are extremely limited, especially if you’re moving to an EU or EFTA country. Even where they’re technically possible, they can come with punitive tax consequences or poor onward planning options.

It’s essential to understand not just whether a transfer is allowed, but whether it makes sense based on your destination country’s rules.

“Vested benefit accounts provide annuity-style payments at retirement.”

They don’t. A vested benefit account is a holding structure. It doesn’t pay you an income unless you actively choose to convert the funds into an annuity or another product.

I’ve met clients expecting their pension to start paying them automatically at retirement. It doesn’t. And leaving that decision too late can reduce your options and flexibility.

“Tax doesn’t matter, I’ll just deal with it when I withdraw.”

That’s when it becomes a problem. The location of your account, the timing of the withdrawal, and whether your home country has a tax treaty with Switzerland all affect what you’ll actually receive. Some cantons charge far lower lump-sum tax rates than others. Planning ahead can reduce the overall bill significantly, but only if you act in time.

“What many people don’t realise is what happens to their Pillar 2 pension when they leave their job.”

“The tax is the same no matter where I withdraw my vested benefits in Switzerland.”

It isn’t. Cantonal tax treatment varies widely. Some foundations will even restrict your ability to transfer accounts before withdrawal, which limits your flexibility.

I’ve seen clients reduce their tax bills by thousands simply by moving their account from one canton to another, legally, efficiently, and well before they accessed their funds.

“I can combine my Swiss pensions with overseas schemes when I leave.”

In most cases, no. Swiss pension law keeps mandatory and extra-mandatory benefits separate, and most international schemes won’t accept them. Even where partial transfers are allowed, they rarely offer the flexibility or recognition people expect.

Repatriation planning needs to start with the assumption that your Swiss pension will stay ringfenced, and work from there.

Many of the issues above aren’t complex, they just get overlooked. People assume the system will work quietly in their favour. But without clear action, even a well-funded pension can underperform or be eroded by tax and admin gaps.

If you’ve left a role, changed country, or are thinking about accessing your funds in the next few years, reviewing your vested benefit account is a smart place to start.

Book a call with Peter Gollogly and we’ll make sure your pension isn’t being left behind.

“When people think about pensions in Switzerland, they tend to picture something solid, automatic, and well-managed in the background. And to some extent, that’s true.”

Here's Why It’s a Smart Move

Written by Josh Burton CFO and Private Wealth Adviser

As taxes rise and business becomes more complicated back home, many entrepreneurs are asking: Should I move my business to the UAE?

Having relocated to Dubai myself, I’ve been in your shoes. I played a key role in relocating Skybound Wealth’s finance function and ensuring everything was set up for long-term success. Moving your business internationally requires more than just basic advice, you need someone who understands the challenges you’ll face. That’s where I come in.

The UAE offers a wealth of opportunities for business growth. Whether you're coming from the UK, Europe, or beyond, it’s one of the best places to scale your business, and we’re here to help you make it happen from day one.

Relocating to the UAE offers significant advantages for businesses seeking a more tax-efficient, stable, and globally connected environment. The UAE boasts one of the most attractive tax regimes in the world with 0% personal income tax, low corporate tax at just 9% on profits above AED 375,000, and no capital gains tax on personal investments. These features allow you to retain more of your earnings and invest without the usual tax burdens.

Additionally, the UAE offers 100% foreign business ownership in many Free Zones, giving you full control of your business. It serves as an ideal launchpad for global expansion, with easy access to the GCC, Asia, and Africa. Political and economic stability provides a secure foundation for growth, while its high quality of life, including world-class healthcare, education, and safety, makes the UAE a destination for tech founders, entrepreneurs, and family businesses looking to scale.

Relocating your business to the UAE requires more than just grabbing a business license. It demands strategic planning to ensure your business thrives. Here's a checklist to guide your process:

1. What’s the Best UAE Business Structure for You?

The decision between Free Zone, Mainland, or Offshore affects key factors such as visa eligibility, tax treatment, client access, and regulatory compliance. The right structure will depend on your business model, industry, and plans for growth.

2. How Will You Extract Profits Tax-Efficiently?

The decision between salary and dividends has a direct impact on your tax liability. Additionally, director fees or management charges can be strategic tools to reduce your tax burden. You'll also need to decide between retaining profits or reinvesting them, with each choice shaping the financial trajectory of your business.

3. How Will Your Home Country Treat the Move?

Your tax residency status will determine whether your home country still considers you a tax resident. It's important to consider exit charges and capital gains, as well as any ongoing filing obligations, such as the UK's SA109 form, to ensure compliance.

Pro Tip: Engaging with a cross-border financial expert can save you headaches in the long run.

4. What Happens to Your Existing Company?

You’ll need to decide whether your home-country business will remain active, become dormant, or be closed. This decision impacts your tax obligations and compliance requirements.

5. Do You Need a UAE Visa and Emirates ID?

A business license alone doesn’t grant residency. Structuring your business correctly is crucial for securing visa sponsorship for both you and your family, and ensuring your banking and legal status in the UAE are properly established.

“The UAE boasts one of the most attractive tax regimes in the world with 0% personal income tax, low corporate tax at just 9% on profits above AED 375,000, and no capital gains tax on personal investments.”

“For expatriate business owners, Key Man Insurance and Shareholder Protection are essential tools for safeguarding the future of their businesses.”

When moving your business internationally, you need more than just basic advice. You need someone who’s walked the path and understands the practical challenges you’ll face. As your Personal CFO, I take the same strategic thinking I used for Skybound Wealth’s own relocation and apply it to helping business owners like you.

This isn’t just about tax efficiency in the UAE; it’s about aligning your global assets, investments, and wealth strategies with your bigger life goals.

Setting up a business in the UAE is just the beginning. Structuring it for long-term success requires expert guidance. Here's how we can help:

• Choose the optimal UAE company structure for your needs.

• Understand the corporate tax and VAT implications of doing business in the UAE.

• Develop cross-border income and dividend strategies.

• Ensure compliance in both your home and host countries.

• Build a long-term financial freedom strategy for your business and personal wealth.

Whether you're new to the UAE or in the process of setting up, let's ensure your business is structured for success.

If you're thinking about moving your business to the UAE, now is the time to act. Let us help you make this transition as smooth and tax-efficient as possible, while securing both your business and personal financial future.

Contact us today to explore how Skybound Wealth can make your move to the UAE successful.

Written by Michael Sappal Private Wealth Adviser

Thousands of British expats are unknowingly leaving retirement savings behind, scattered across forgotten schemes, trapped in outdated investments, or sitting idle under poor performance. For many, these pension pots represent one of their largest assets, yet they often go unnoticed.

Since the UK’s auto-enrolment rules were introduced back in 2012, millions of workers have been automatically enrolled in workplace pensions, often without fully understanding them. As careers, companies, and even countries change, pensions tend to stay where they were until action is taken.

For expats, this presents a unique challenge. Multiple pensions, across various jobs, within a system they no longer live in. Some are quietly growing, while others may be drifting off course. But without regular review, you could be leaving money, and options, on the table.

A quick reality check is all it takes to understand where you stand. Do you know how your old pensions are invested? Are you aware of the fees you're paying, and whether they’re fair? Were the funds you’re invested in chosen by you, or just accepted as default? Have you tracked their performance since day one? And have you checked whether any of your pensions include valuable legacy benefits?

If you’ve hesitated to answer any of these questions, you're not alone. Many expats haven’t reviewed their pensions in years, and in some cases, even decades. But just because you haven’t looked at them lately doesn’t mean they’re irrelevant. In fact, it makes them all the more urgent.

Living outside the UK adds layers of complexity to your pensions, and with the constant changes to rules and regulations in both the UK and abroad, staying informed is essential. For many expats, it’s easy to lose contact with pension providers when the postal updates are sent to an old UK address. Without knowing where your pensions are or how they’re performing, you could be leaving money behind.

Adding to this, significant tax changes are on the horizon. From April 2027, UK pensions will form part of your estate for inheritance tax purposes. This is a game-changer for expats who thought their pensions would pass on tax-free.

Moreover, currency risk is another oftenoverlooked issue. Many UK pensions are still invested in sterling. If your retirement spending is planned in euros, dollars, or dirhams, exchange rate fluctuations could reduce the value of your income over time. These aren’t just theoretical risks, they are very real challenges that we help expats address every day.

Some older UK pension schemes still hold valuable features that modern pensions often don’t offer. These hidden gems can significantly enhance your retirement planning, if assessed properly.

Guaranteed Annuity Rates (GARs), for example, can offer rates far higher than what’s available today, if used wisely. Some legacy plans also offer Enhanced Tax-Free Cash, allowing you to withdraw more than the standard 25% tax-free amount. Additionally, Pension Term Assurance provides life cover with tax relief, a rare and valuable feature. If you were contracted out, your pension might even offer Guaranteed Minimum Pensions (GMP), which can be incredibly valuable. Each of these features needs careful consideration. Depending on your goals, they could either add substantial value to your retirement strategy or be completely irrelevant. Either way, they require attention to ensure they align with your current financial plans.

Not all older pensions are hidden treasures. In fact, they can be riddled with outdated limitations that could hinder your retirement strategy. For example, many older pensions automatically "lifestyle" your investments as you approach retirement age, reducing risk without your input. While this may be smart for those buying annuities, it could be entirely wrong if you plan to keep investing or draw down flexibly. Other pensions lack flexibility and can’t accommodate modern retirement options like phased withdrawals or beneficiary drawdown. Furthermore, if your scheme offers only a limited selection of outdated funds, you could be missing out on better global investment opportunities.

The key to unlocking the full potential of your pensions is a simple strategy: Review. Rethink. Realign.

At Skybound Wealth, we regularly help expats uncover pensions they didn’t even realise they had and identify opportunities they didn’t know they were missing. The goal is to take a part of your financial life that’s been on autopilot for years and put it back under your control. We’ll provide you with full transparency on performance, costs, benefits, and risks, because your future deserves more than crossing your fingers.

If you haven’t reviewed your pensions since moving abroad, it’s time to act. Start by reconnecting with lost providers. Consolidate your scattered pots where appropriate, and ensure your pensions are aligned with your current goals, location, and tax situation. We’ll guide you through every step of this process, ensuring it’s done clearly, carefully, and with your long-term success in mind.

“Since the UK’s auto-enrolment rules were introduced back in 2012, millions of workers have been automatically enrolled in workplace pensions, often without fully understanding them.”

“One common mistake expats make is applying too late. It’s important to do this before taking any significant income from your pension.”

Written by Tom Pewtress Group Head of Proposition & Private Wealth Partner

If you’ve left the UK behind, your pension may not need to be taxed there. But that’s exactly what happens to many expats drawing income from UK pensions, often without them even realising it.

The fix? It’s called an NT (No Tax) Code, and it can mean the difference between building your retirement and losing up to 45% of it to emergency tax. Here’s everything you need to know.

Many UK pension providers automatically apply PAYE (Pay As You Earn) tax, even if you live in Miami, Madrid, or Dubai. This often means tax is deducted at source using a generic emergency code, which can result in 20%, 40%, or even 45% being withheld unnecessarily. For example, if you withdraw £50,000 from your SIPP, you could lose over £20,000 straight away, simply because the system doesn’t know you’re a non-resident.

“An NT code doesn’t mean “no tax ever.” It simply means that the UK will not tax your pension income. However, you still have tax obligations in your country of residence.”

An NT (No Tax) Code tells HMRC: “This individual is no longer a UK tax resident and lives in a country with a tax treaty. Don’t deduct UK tax from their pension.” As a result, your pension gets paid out gross, no UK tax withheld, and you settle your tax affairs in your current country of residence. Who’s Eligible?

You can apply for an NT code if you’re a non-UK tax resident under HMRC’s Statutory Residence Test, you receive UK pension income, whether from a SIPP, final salary, or defined contribution scheme, and you live in a country that has a Double Taxation Agreement covering pensions. Common countries include the USA, France, Spain, the UAE, Saudi Arabia, Oman, and many others. What Happens If You Don’t Apply?

UK pension schemes often use the standard 1257L Month 1 tax code, which works like this:

Withdrawal Amount

£1,047.51 - £4,189

£4,189 - £11,475 40%

£11,476+ 45%Tax

You then face the burden of completing a UK tax return, reclaiming the tax, and waiting months for repayment, every year.

First, confirm that you are genuinely nonresident under UK rules. HMRC will assess your days in the UK, ties to property, work, and family. Next, trigger a PAYE record by requesting a small pension payment, typically around £1,000, since HMRC cannot issue an NT code without an existing record. Then, complete the correct form. Most individuals use Form DT-Individual, which declares your foreign residency and UK pension income, though some countries have their own versions. All forms and country-specific variations can be found on the HMRC website. You will also need to obtain local residency certification to prove that you are a tax resident in your new country. This usually means providing a Tax Residency Certificate from the relevant authority. Examples include a certificate from the Federal Tax Authority in the UAE, a certificate of tax residence from the French Tax Office, IRS Form 6166 in the United States, a Certificado de Residencia Fiscal in Spain, a certificate from the Zakat, Tax and Customs Authority in Saudi Arabia, or a certificate issued by the Tax Authority of Oman. If you’re unsure how to obtain this, check with your local tax office or its official website.

Once your forms and certification are ready, submit them to HMRC along with your pension details. Processing typically takes 12–16 weeks. Finally, confirm that your NT code is active, as HMRC sends it directly to your pension provider. Make sure it has been applied before taking your next pension withdrawal.

Need help applying for your NT code or reviewing your pension strategy? Book a call with Tom Pewtress today.

One common mistake expats make is applying too late. It’s important to do this before taking any significant income from your pension. If you wait, you risk having a large portion of your withdrawal taxed unnecessarily. Another mistake is missing documentation, particularly tax residency proof. Without this documentation, your application may be delayed or rejected. Some expats also end up using the wrong form. While most individuals need to complete Form DT-Individual, some countries have bespoke versions of this form. Make sure to use the correct form for your country of residence.

Lastly, unclear residency can be a problem. HMRC may question situations where your residency status is borderline. Ensure that you meet the criteria to avoid delays in processing your application.

There are several types of pensions that can qualify for the NT code. SIPPs (Self-Invested Personal Pensions) are eligible, including income drawdown, UFPLS (Uncrystallised Funds Pension Lump Sum), and annuity-style withdrawals. Workplace schemes also qualify, such as final salary pensions, AVCs (Additional Voluntary Contributions), and personal pensions. In some cases, your State Pension can qualify, depending on the Double Taxation Agreement (DTA) in place between the UK and your country of residence.

An NT code doesn’t mean “no tax ever.” It simply means that the UK will not tax your pension income. However, you still have tax obligations in your country of residence. You will need to report your pension income in the country where you live. If applicable, you may also need to pay tax on it there. It’s essential to maintain good records of your pension income and any taxes paid to ensure compliance with your local tax laws.

A client recently moved to Dubai and took £70,000 from his SIPP. Without an NT code, he lost over £28,000 to emergency tax. We helped him reclaim it, and ensured all future withdrawals are paid gross, without delay. This is the kind of planning that makes a real difference.

The NT code process isn’t complicated, but it is slow. If you wait until after your withdrawal, the damage is done. At Skybound Wealth, we specialise in this process, especially for British expats in the Middle East and Europe, and the USA. We know the paperwork, the tax offices, the timelines, and how to get it right first time.

Written by Mike Coady Chief Executive Officer

I recently had the opportunity to discuss with Arabian Gulf Business Insight the hot topic of Saudi Arabia’s ground breaking new property law, which is set to transform the investment landscape for expats.

Here, I take a closer look at what this change really means and share my thoughts on how it creates exciting new opportunities for global investors, businesses, and professionals looking to build a long-term future in Saudi Arabia. "It’s not just about owning property. It’s about getting a front-row seat to one of the boldest economic reinventions of our time."

That’s the feeling I’ve had speaking with clients, developers, and institutional partners in recent months. There’s a stirring in the air, not unlike Dubai in the early 2000s. But this time, it’s Saudi Arabia rewriting the rulebook.

In July 2025, the Saudi government released what may be the most consequential piece of real estate legislation in its modern history: a new law that allows foreign individuals and companies to buy and own property in the Kingdom, legally, directly, and, for the first time, without the scaffolding of local ownership workarounds. It comes into effect in January 2026, and while the headlines were measured, those of us who’ve worked across global jurisdictions know what this signals: Saudi Arabia is opening its doors not just to tourists or talent, but to long-term capital.

“ The new property law opens up the residencyownership loop, allowing foreign investors to anchor their capital in appreciating assets tied to Saudi Arabia’s ongoing national growth.”

The Saudi government has confirmed that foreign ownership of property will be legal starting in January 2026. However, this will be restricted to designated areas, such as Riyadh, Jeddah, NEOM, and the Red Sea coast. Investors will be granted full ownership rights, as well as leasehold, usufruct, and mortgage rights. However, Makkah and Madinah will remain off-limits to foreign ownership, with only very limited corporate exceptions. All transactions related to foreign property ownership will be handled through the Real Estate General Authority (REGA).

What’s Still in the Grey:

While the law has been announced, some crucial details remain unclear. For example, exact zoning maps indicating where foreign ownership will be permitted have yet to be released. Pricing and any premium fees for foreign buyers also remain to be determined. Additionally, financing options for foreign nationals will likely be limited, with full access potentially only available to residents or through local banks. The tax implications for international investors are still being clarified, and as always, navigating these uncertainties will require experience and foresight.

This is where experience matters. We’ve seen this kind of legislative rollout before. It always starts with a broad legal stroke, then regulators paint in the lines. And it’s in those fine lines where the real advantage lies for those who move early.

Saudi Arabia isn’t tinkering at the edges. Vision 2030 is a blueprint for wholesale transformation, from energy to education, tourism to tech, and now, from ownership restricted to open investment.

To put this into perspective, the Kingdom has committed over $1.3 trillion to large-scale projects like NEOM, Qiddiya, The Line, and the Red Sea Project. These initiatives are part of a broader effort to reshape the country’s infrastructure and attract global talent. Saudi Arabia is also targeting 100 million visitors annually by 2030, demonstrating its commitment to becoming a major global hub. Already, the country has launched Premium Residency, akin to a "Saudi Green Card," and established special economic zones designed to welcome international investors.

Opening real estate to foreign ownership isn’t a gimmick. It’s a strategic shift to diversify the economy, invite longer-term stays, and attract new demographics of capital.

I’ve worked with expats across the Gulf for over two decades. And here’s what I know: most don’t want to rent forever, especially in a place with serious long-term potential. The new property law opens up the residency-ownership loop, allowing foreign investors to anchor their capital in appreciating assets tied to Saudi Arabia’s ongoing national growth. Businesses will now be able to own commercial premises in strategic growth zones, offering new opportunities for expansion. For professional expats whether doctors, engineers, or executives; the law enables long-term financial planning with a true sense of stability and opportunity for the future.

“Saudi is the next big thing, so we’re making the shift.”

— Sufyan El Faitouri, DarGlobal

“Nothing is black and white, it’s still grey. But that’s a good thing. It’s the right time to be there.”

— Dory J. Sakr, BARNES Dubai

These aren’t just quotes from agents, they’re sentiments from people in the thick of it. And I agree with them. The law may still be in outline form, but timing matters in real estate more than certainty ever will.

Let’s not forget: when Dubai first allowed foreign freehold ownership, the world shrugged. But those who acted early didn’t just buy apartments, they bought into a city that would become a global powerhouse.

I remember sitting in meetings in 2004, explaining to clients why a patch of sand near Jumeirah was about to become a business hub. Many hesitated. Those who didn’t? Today they’re sitting on multimillion-dirham returns. Saudi feels similar, but on a larger scale.

If you’re an investor, expat, or even a business owner eyeing the Kingdom, ask yourself:

• Which zones will be released first, and why?

• Is there rental demand in those areas already?

• How will liquidity work for resale?

• What’s the legal recourse under Saudi law?

• Can I use my property to support a residency or business licence?

• How is Skybound Wealth positioned to guide me through this change?

This isn’t about speculation. It’s about strategic curiosity. Saudi Arabia is rewriting its relationship with the world. And property, arguably the most intimate, long-term kind of economic trust, is now on the table. You don’t need to move tomorrow. But if you’re not paying attention now, you’ll be reacting later.

At Skybound Wealth, we help clients do the opposite: prepare, plan, and position early, before the headlines become history.

If you’re curious about investing in Saudi property, or simply want to understand what this shift could mean for your portfolio, this is the time to talk.

As featured in Arabian Gulf Business Insight. Expanded with exclusive insights from Mike Coady, CEO of Skybound Wealth and 20-year Dubai resident.

Supporting Professionals

Beyond the Spotlight

For athletes and creators, success often comes early - but so do the challenges. A professional footballer’s career, for example, averages less than 12 years, compressing lifetime earnings into a short window. Studies have shown that nearly 80% of athletes experience financial difficulty within a few years of retiring, often due to volatile incomes, poor planning, or a lack of guidance during their peak years.

Creators face their own complexities. The global creator economy is now valued at over $100 billion, yet many creators rely on multiple income streams across different platforms, currencies, and jurisdictions. Income can fluctuate dramatically based on algorithms, sponsorships, or platform changes, leaving them vulnerable without the right financial structures in place.

These realities mean that what should be a period of opportunity can also become one of uncertainty. Without proper support, athletes and creators risk entering the next phase of their lives with fewer options and financial instability.

That’s why Skybound Wealth has launched Athletes & Creators by Skybound Wealth: a dedicated division designed to provide stability, structure, and long-term confidence for sports professionals, footballers, and creators worldwide.

Athletes

Athletes often enter professional sport at a young age, with their prime earning years concentrated in a narrow window. Contracts can be lucrative but unpredictable, and careers are vulnerable to injury, form, or selection. Add to this the reality of crossborder lifestyles - moving between clubs, leagues, and countries - and the financial picture becomes even more complex. Taxes, residency rules, and relocation costs all compound the difficulty of building long-term financial security.

Creators, on the other hand, are at the heart of one of the fastest-growing global industries. But with success comes volatility. Income may come from a mix of advertising revenue, sponsorship deals, brand collaborations, and platform monetisation - often across multiple countries. This leads to issues such as double taxation, inconsistent cash flow, and limited financial protection. Unlike athletes, who may have agents or player associations, many creators navigate these challenges largely on their own.

In both worlds, the story is often the same: an intense but short-lived earning phase, followed by the uncertainty of what comes next.

At first glance, athletes and creators may seem like very different worlds - one built on physical performance, the other on digital presence. But financially, they share striking similarities:

• Both generate significant earnings early in life, often before the age of 30.

Both face volatile and unpredictable income streams, tied to performance, platforms, or contracts.

• Both live increasingly international lives, with opportunities - and obligations - spanning multiple countries.

And both require a plan not just for today, but for the decades that follow once the spotlight fades.

By bringing athletes and creators together under one division, we recognise these shared dynamics and provide a proposition tailored to their realities. This allows us to combine our expertise in crossborder wealth management, coaching, and longterm planning into a single, powerful offering.

Skybound Wealth is positioned to serve this audience. With offices across the UK, EU, GCC, Switzerland, Asia, and the US, our teams bring:

• Cross-border expertise to optimise tax, residency, and legal complexities.

Institutional-grade investment management to grow and protect wealth.

• Structured coaching and education to guide clients through big decisions with clarity.

Proprietary technology that provides real-time insights, clarity, and control across jurisdictions.

But this division goes beyond market-standard wealth management. It is designed for people, not portfolios. Financial wellbeing means ensuring athletes and creators, and their families, have the confidence, structure, and options they need, both during their careers and long after.

"The global creator economy is now valued at over $100 billion..."

Studies have shown that nearly 80% of athletes experience financial difficulty within a few years of retiring, often due to volatile incomes , poor planning, or a lack of guidance during their peak years.

At the heart of Athletes & Creators is the philosophy that money is only part of the story. Structured coaching, education, and guidance are the cornerstones of this division.

We work to ensure clients understand not just their contracts and cash flow, but also the long-term implications of their decisions. From tax structuring and protection strategies to succession planning, the goal is to help clients build sustainable income streams, safeguard family commitments, and remain financially secure when their careers evolve or conclude.

This approach turns financial planning into empowerment, giving athletes and creators the tools to thrive in the moment, while also preparing for the decades that follow.

As Mike Coady, CEO of Skybound Wealth, explains: “Athletes & Creators is not about portfolios, it’s about people. We want every client to finish their career with options, not obstacles. That means protecting families, investing with discipline, and building a transition plan that works in the real world.”

The launch of Athletes & Creators reflects both the growing opportunity in this market and Skybound Wealth’s commitment to expanding its expertise to meet evolving client needs.

By combining human guidance, cutting-edge technology, and a global presence, Skybound is setting a new standard in how athletes and creators are supported - during their careers and long after they end.

Why Tax-Free Salaries Disappear Without Planning

Written by William Bailey Global Partners Manager & Private Wealth Adviser

Dubai is a city where fortunes are worn on wrists and parked in driveways. In glass towers along Sheikh Zayed Road and beachfront villas on the Palm, expats earn salaries their counterparts back home could barely imagine. Paychecks arrive heavy and clean, untouched by tax, pensions, or national insurance.

With them often comes a quiet conviction: this will last. Contracts renew, promotions come, and lifestyles inflate. Tomorrow, many assume, will look like today, just bigger, shinier, better. But that conviction is a mirage. And like all mirages, it vanishes the moment you reach for it.

Psychologists call it linear projection bias - the tendency to assume the future will look like the present. Nobel laureates Daniel Kahneman and Amos Tversky proved that people overweight the now and underweight disruption. The gambler on a winning streak believes the next roll will be lucky. The Dubai executive assumes the next contract will be bigger. The consultant justifies credit card debt for school fees, convinced the bonus will cover it. It feels rational. But it’s not, it’s a sandcastle. Beautiful on Instagram, but built against an incoming tide.

Across the Gulf, the same patterns repeat. Procrastination creeps in, with many telling themselves, “I’ll start saving after the next bonus, after the next promotion, after I settle in.”

Lifestyle inflation pushes spending on cars, villas, holidays, and schools higher as income rises, while savings stall. Dependence on employers for housing, schooling, and health insurance leaves families vulnerable when contracts can vanish in just 30 days.