It’s October 2040. Paloma and Carlos board an Iberia flight from Madrid to Sydney. Leaving Madrid at 10 am, the flight arrives in Sydney at 6.30 am – earlier in local time than when it departs.

This is possible since the flight time is now four and a half hours, instead of twenty –thanks to brand new hypersonic aircraft from Destinus.

Powered by green hydrogen (i.e. hydrogen generated using renewable energy), these planes fly through the stratosphere at five times the speed of sound, bridging long distances in record time.

After arriving in Sydney, hydrogen is key to the next part of their journey as well – on a flight with Rex Airlines to Coffs Harbour on the Northern Coast of New South Wales. Having phased out the last of its hydrogen-electric retrofitted Saab 340 aircraft, Rex now uses one of Embraer’s new ‘Energia’ family 30-seat hydrogen-electric aircraft for this route.

Meanwhile, New South Wales has become a leader in green hydrogen production, thanks to state and federal investment. This comes as Australia has become the world’s largest net exporter of hydrogen, as predicted by the International Energy Agency (IEA) in 2022.

Green hydrogen – used in aviation, shipping and a range of other industries – is

Recently, SimplilFlying carried out a war gaming exercise with a group of industry experts and journalists in London. Splitting into three groups, each group looked at an optimistic, neutral and pessimistic climate change scenario for the aviation industry in 2030 and then 2050.

Core to the optimists’ vision was the idea of a ‘Fuel X’, which would supplant fossil fuels and become essential to aviation, compelling major aircraft manufacturers to build new aircraft optimised for this new fuel.

Though we didn’t name it, ‘Fuel X’ will almost certainly be hydrogen. It’s right now the only viable candidate for an alternative propulsion system that can power aircraft for longer distances.

Fortunately, there have been a number of promising developments:

• ZeroAvia and Universal Hydrogen, both of which are featured in our upcoming book, Sustainability in the Air, have carried out a number of successful tests on regional aircraft retrofitted with hydrogen-electric powertrains.

• In September 2023, German company H2FLY conducted the world’s first piloted flight where liquid hydrogen (as opposed to gaseous hydrogen) was used to power a hydrogen-electric fuel cell system in a small aircraft that has the capacity to fly from London to Rome.

That said, significant challenges need to be overcome before hydrogen aviation becomes a reality. These include storage, transportation, infrastructure and the issue of hydrogen leaks.

In fact, few topics in the sustainable aviation space elicit as many strong reactions as does hydrogen.

A number of high-profile commentators and groups are convinced that hydrogen-powered flights are a fool’s errand. This includes the Hydrogen Science Coalition, which has a website dedicated to the issue. While they do believe there is some role for green hydrogen they insist this should be used to decarbonise existing hydrogen uses, and that other uses are a distraction that could even make global warming worse by delaying the roll-out of other technologies like electrification.

In contrast, the list of high-profile individuals and organisations betting on hydrogenpowered flight is a long one:

• Bill Gates, whose Breakthrough Energy Ventures fund is an investor in ZeroAvia, as well as in Koloma, a ‘white hydrogen’ project in Colorado.

• Aircraft giant Airbus, which aims to get a hydrogen-powered aircraft flying by 2035.

• Airline easyJet, which has made hydrogen a central feature of its net zero plans, and is working with engine maker Rolls-Royce.

• Air New Zealand and a series of New Zealand airports which are looking to create a hydrogen aviation cluster in the country.

• American Airlines, IAG, JetBlue, United Airlines and Alaska Airlines, all of which have invested in hydrogen aviation projects.

Governments worldwide also understand that green hydrogen is different. They are keen to support and incentivise its production. With a lot of the aviation industry’s growth expected to come from the Middle East, India and the Far East, this is a particularly compelling reason why hydrogen aviation deserves a closer look.

As a result, this report aims to provide a comprehensive overview of sustainable aviation that is focused on hydrogen. Our goal is to examine the reasons why hydrogen is a pathway that is worth investing in and explore the potential benefits it has to offer.

In our market map that comprises the second part of this report, we’ve identified over 110 companies worldwide working on different hydrogen projects. These include companies making more efficient electrolysers to those producing cheaper green hydrogen, as well as companies developing hydrogen fuel cells, and ones actually looking to get hydrogenpowered aircraft into the skies.

At SimpliFlying, we are technology-neutral and believe that weaning air travel off fossil fuels will require multiple pathways, often simultaneously. As a result, while we are ‘pro’ hydrogen, we are also pro-electric aviation and pro-sustainable aviation fuels (SAF).

We recently produced a SAF market map and report and will do the same later this year for electric and hybrid-electric aircraft (see our previous reports).

We also feature innovators in the electric, hybrid-electric and SAF spaces, along with hydrogen in our upcoming book, Sustainability in the Air, as well as in SimpliFlying CEO Shashank Nigam’s podcast of the same name

Dirk Singer Head of Sustainability, SimpliFlying dirk@simpliflying.com

Hydrogen (H2) is the most abundant element in the universe. It is found in water, organic compounds, and some minerals.

Hydrogen has a number of different uses. It can be used as a chemical feedstock or in ammonia to make fertilisers and other industrial products.

It can also be used in transportation – in cars and buses, in ships and also in aviation. It is attractive as it is a clean fuel which only produces water and no polluting emissions when burned.

Hydrogen can be made in a number of different ways, with varying degrees of emissions. These different methods are classified by colour, which is often referred to as the ‘hydrogen rainbow.’

Today’s hydrogen production is still mostly based on natural gas and coal, which together account for 95% of production. As a result, in this report, we focus only on low or zero-emission hydrogen, such as green, pink, and white hydrogen.

Source: Airbus, 2021Source: Cheng W, Lee S. How Green Are the National Hydrogen Strategies? Sustainability. 2022; 14(3):1930.

• Green hydrogen is produced using renewable energy, such as solar or wind power. This process splits water into hydrogen and oxygen using an electrolyser, and the only emission is water vapour. Green represents the holy grail of hydrogen, given that there are no greenhouse gas emissions.

• Pink hydrogen is also produced through electrolysis but powered by nuclear energy.

• Recently, white hydrogen has attracted a lot of attention. This is naturally occurring hydrogen found in underground geological deposits.

We’ve not featured blue hydrogen, given the current controversy about whether this really is a low-carbon solution. Blue hydrogen is when natural gas is split into hydrogen and CO2 but the CO2 is captured and then stored. However, one academic paper estimates that blue hydrogen could actually be more harmful to the environment than if you just burned methane alone.

1. Offers a pathway to ‘true zero’ aviation as it produces no CO2 emissions.

2. Higher energy density than batteries, opening up the potential for hydrogen aircraft to fly longer distances than their electric counterparts.

3. Once the necessary airport infrastructure is in place, hydrogen-powered aircraft can be refuelled and turned around in about the same time as jet-fuelled planes.

4. Green hydrogen is produced from renewable sources, such as solar and wind power. This makes it a sustainable option for the future of aviation.

5. The economic benefits of hydrogen can be evenly shared, with many developing countries looking to become hydrogen hubs. For example, India is investing heavily in green hydrogen while also becoming the world’s biggest aviation growth market The end result will be economic benefits and a ready-made decarbonisation solution in some of the world’s major aviation growth markets.

6. It makes economic sense. According to European NGO Transport & Environment (T&E), with the right incentives, running a hydrogen plane could be cheaper than running a conventional aircraft by 2035.

Green hydrogen also plays a part in producing so-called e-fuels. These are made by combining green hydrogen with captured carbon dioxide, and we have talked about them more in our recent SAF report.

By 2042, there are expected to be 685 million passenger flights in India, compared to 165 million today. A Barclays report shows that India has the second-largest backlog of orders from the major aircraft manufacturers, after the United States. All those extra flights imply extra carbon.

Here, hydrogen is the key – India has a $2.11 billion incentive plan to kick-start the country’s green hydrogen industry.

African countries also see significant potential in green hydrogen. A report by the European Investment Bank, the International Solar Alliance and the African Union talks about a $1 trillion economic opportunity for the continent.

Producing green hydrogen, of course, requires water and renewable energy. India boasts some of the world's most affordable solar energy, while Morocco is home to the vast Noor Ouarzazate solar complex, utilising Concentrated Solar Power (CSP) technology for 24-hour electricity in desert regions.

Concerning water, essential for green hydrogen production, the Rocky Mountain Institute (RMI) says that the global water supply impact is minimal. They highlight that water usage for green hydrogen is often lower than for fossil fuel-derived hydrogen. In waterscarce regions, alternatives like treated wastewater or desalinated seawater can reduce dependence on freshwater.

Thus, countries outside North America and Europe can produce green hydrogen without overburdening local resources, positively impacting their economies.

India, with its expanding aviation industry, presents a prime opportunity for decarbonisation via green hydrogen. E-fuel companies can position near airports, utilising abundant renewable energy and subsidised green hydrogen for local jet fuel production. Furthermore, aircraft companies looking at hydrogen-powered planes have opportunities to set up shop in nations supporting green hydrogen and collaborate with local airports to enhance storage and refuelling facilities.

Green hydrogen is a global solution. In our SAF report, we were struck by how almost all SAF companies are in Europe and North America. In 2021, 80% of the world’s SAF supply was actually in California.

The idea of using hydrogen in air travel has many detractors. Here are some of the common criticisms:

1. Energy density: Hydrogen has a much lower volumetric energy density than jet fuel. This means it takes significantly larger volumes of hydrogen to supply the same energy as jet fuels (or SAF), hence requiring more space to store enough energy to power flights, especially for long distances.

2. Storage: Liquifying hydrogen tends to improve its energy density. However, liquid hydrogen must be stored at extremely low temperatures (-253°C) which requires specialised and heavy cryogenic storage systems.

3. Production: Most hydrogen is currently produced from fossil fuels, which undermines the environmental benefits of hydrogen-powered flight.

4. Cost: Hydrogen produced from renewable sources is significantly more expensive than fossil fuel-based ‘grey’ hydrogen.

5. Infrastructure: Developing a hydrogen refuelling infrastructure at airports worldwide requires significant investment. There is also the question of how to get the hydrogen to aircraft.

6. Leakage: Hydrogen can leak into the atmosphere, contributing to global warming.

7. Contrails and NOx: Hydrogen still contributes to both of these.

8. Usage of resources: Using green hydrogen in aviation diverts it away from sectors where it could do more good in terms of decarbonisation.

We’ll go through these points in more detail, and provide some possible answers to them.

Critics point out that hydrogen has a much lower volumetric energy density than conventional jet fuel. This means that hydrogen-powered aircraft would need larger fuel tanks, which would take up more space and weigh more. This would reduce the aircraft's payload and range.

In an explainer video, Bernard van Dijk of the Hydrogen Science Coalition says that even if you liquify hydrogen, the energy density per volume is still four times lower than if you power an aircraft by conventional jet fuel (or SAF). Meanwhile, a piece in Physics Today quotes Rajesh Ahluwalia, a hydrogen and fuel-cell researcher at Argonne National Laboratory, saying that based on the combined fuel and tank weight, aviation fuel has the advantage over hydrogen by a factor of 1.6

As a result, Dijk estimates that hydrogen aircraft can take 15-40% less payload due to the heavy and large compressed/liquid hydrogen tanks. The hydrogen needs to be stored in the fuselage, or on large external tanks, which reduces the drag of the aircraft.

Hence, to fly great distances, you need to redesign the aircraft. As an example, Airbus’s ZEROe project that focuses on hydrogen to power air travel, introduces four new concept aircraft designs to adapt to the new fuel.

Design seems to be one answer to this challenge. David Butters, Head of Engineering for LH2 Storage and Distribution at Airbus admitted that adapting cryogenic tank technology for commercial aircraft represents major design and manufacturing challenges. As a result, Airbus is looking into creating “innovative solutions that will meet demanding aerospace requirements”, for example through tanks which are lighter and more cost-effective to manufacture.

Liquid hydrogen requires special, well-insulated fuel tanks to prevent hydrogen from evaporating. Being heavy and expensive, these add to the weight and cost of the aircraft. Hydrogen is also highly flammable, which some sceptics say leads to considerable safety concerns in the event of a leak.

Michael Barnard, a vocal hydrogen critic, has written a long piece in CleanTechnica arguing that these storage problems make hydrogen flight unsafe. He condemns the idea of longitudinal hydrogen tanks for storage highlighting the potential for

hydrogen to “leak into the under deck that is directly below the passengers or into the passenger cabin of the aircraft in sufficient quantities [such] that a simple electrical short or closing circuit or coffee machine coil or microwave could cause ignition.”

One of the solutions for this is actually mentioned in Barnard’s article – new plane designs. Barnard explains that “virtually all of the renderings of hydrogen-fueled planes look like flying wings, instead of narrow tubes with long wings”. This essentially makes room for the H2 to be carried on the plane, and separates the tanks from the passengers.

He is, however, quick to dismiss this solution, adding that “these aeroplanes… won’t fit in the current airports.” But neither did the A380s. Airports modified their infrastructure and gates to take account of the new plane. So while infrastructure is a challenge, which we discuss below, the point is, it’s not insurmountable.

Currently, 95%+ of the world’s hydrogen supply is made from fossil fuels. So not unreasonably, the question often comes up – where is all this green hydrogen going to come from?

This is one of the easier objections to address. In an excellent article titled “Five Hydrogen Myths – Busted,” the Rocky Mountain Institute (RMI) says that “green hydrogen is ready to play a major role in global emissions reductions by 2030.”

The RMI illustrates considerable efforts being made by countries around the world to produce green hydrogen, with 34 having national strategies around it. According to the RMI, “GigaWatt-scale projects are happening now, and demand is growing.”

While greenhouse gas-intensive grey hydrogen costs around €1-€2 per kilo, as of 2023 green hydrogen can cost as much as €8 per kilo.

A number of companies are looking to scale green hydrogen production by pushing the boundaries of electrolysis – the process by which water is split into hydrogen and oxygen.

• Bill Gates-backed start-up Electric Hydrogen or EH2 is tight-lipped about its technology but claims “innovative electrolysis stacks with record-breaking efficiency.”

• In Israel, researchers from Tel Aviv University also claim to have produced green hydrogen at a record 90% efficiency level. This new method could provide a significant improvement over the conventional electrolysis process which is about 70%-80% efficient.

• Australian hydrogen startup Hysata has received considerable funding from the Australian Federal Government, the Queensland State Government and private investors to produce what it calls the ‘world’s cheapest green hydrogen.’

• With green hydrogen needing water, students in Malaga, Spain, have developed a solar desalination system that has 17% energy consumption compared to normal desalination plants.

Universal Hydrogen CEO Paul Eremenko, quoted in our upcoming book ‘Sustainability in the Air’, envisions a future where the cost of green hydrogen will soon be at par with jet fuel without subsidies. Eremenko also mentions the role of regulations in making green hydrogen cost-competitive. For example, the US Inflation Reduction Act offers a “massive subsidy” amounting to $3 per kilo of green hydrogen.

New hydrogen projects, however, will be subject to the whims of both demand and favourable economics. Moreover, subsidies and incentives from conducive regulations will take a while to produce results. Despite this, Eremenko remains optimistic and predicts a surge in capacity in the coming years, likening it to an "avalanche of hydrogen.”

Adithya Bhashyam, a hydrogen analyst at BloombergNEF, also shares Eremenko’s view. Bhashayam and his team predict that 2030 onwards producing hydrogen via a new green hydrogen plant could be 18% cheaper than continuing to produce it in a grey facility.

Think tank Transport & Environment estimates that the total cost of developing hydrogen aircraft for European aviation would be €299 billion by 2050.

Only 5% of this €299 billion estimate comes from the cost of developing the aircraft. Building the airport infrastructure will use up twice that amount, with a 12% contribution, while transportation costs will be about 6%. The production of hydrogen will be the biggest cost.

Source: Transport & Environment, 2023

Once produced, hydrogen needs to be transported. This involves a number of challenges.

Since hydrogen has a much lower volumetric energy density than conventional fuels such as gasoline or diesel, it takes up more space to store the same amount of energy. That means more ship capacity to transport hydrogen.

Moreover, due to its corrosive nature, hydrogen can damage the regular metal storage tanks. Hence, special materials will be required for storing and transporting it.

Nick Barilo, the Executive Director of the Center for Hydrogen Safety doesn’t think that these problems are insurmountable. He says there is no one “best” hydrogen transportation method. Today, the hydrogen industry delivers hydrogen “through a variety of means, and delivery modes are based on a balance of economics and safety.” Barilo says that those delivery methods could include on-site production, trucking or “1000’s of miles of pipelines.”

In particular, when it comes to pipelines, Barilo sees a role: “It would not be surprising to see increased development of pipeline infrastructure where multiple plants can provide high reliability and redundancy. Existing networks on the US Gulf Coast (and elsewhere) show how these pipeline systems can deliver enormous quantities of hydrogen with comparable safety and reliability of the existing natural gas grid.”

That’s transportation. What happens at the airport?

All airports – departure and arrival, as well as diversion airports, will need to be hydrogen-enabled.

In particular, each airport will need to plan for:

• New refuelling facilities: These will need to be designed to safely store and dispense hydrogen, and they will need to be able to refuel aircraft quickly.

• New safety regulations: Since hydrogen is highly flammable, new safety regulations will need to be developed to ensure the safe handling of hydrogen at airports.

• New training: Airport staff must be trained in safe hydrogen aircraft handling and refuelling, covering associated risks and maintenance procedures.

Many airports are already planning for this. For example, in the UK ‘Project NAPKIN’ brings together London Heathrow Airport, Cranfield Aerospace Solutions, London City Airport, Highlands and Islands Airport and Rolls Royce among others. This group is looking at aircraft requirements and concepts, as well as the infrastructure needed.

In September 2023, the Hydrogen in Aviation Alliance (HIA) was established in the UK to accelerate hydrogen aviation, which includes easyJet, Rolls-Royce, Airbus, Ørsted, GKN Aerospace and Bristol Airport, Meanwhile, earlier in 2023, New Zealand saw the creation of the New Zealand

Hydrogen Aviation Consortium, whose members include Airbus, Air New Zealand and Christchurch Airport.

Nick Barilo, executive director of the Center for Hydrogen Safety (CHS) said H2 could be made on-site as well as piped in. However, he says that “on-site production is highly dependent upon economics, the space available for equipment, and the availability of required feedstocks/utilities.”

Barilo says that small airports may be able to meet demand long-term with trucked-in hydrogen, but demand at medium/large airports will probably exceed the ability to reliably deliver cost-effectively. Here he sees a solution where hydrogen could

be delivered by pipelines from off-site production and locally liquefied for use at the airport.

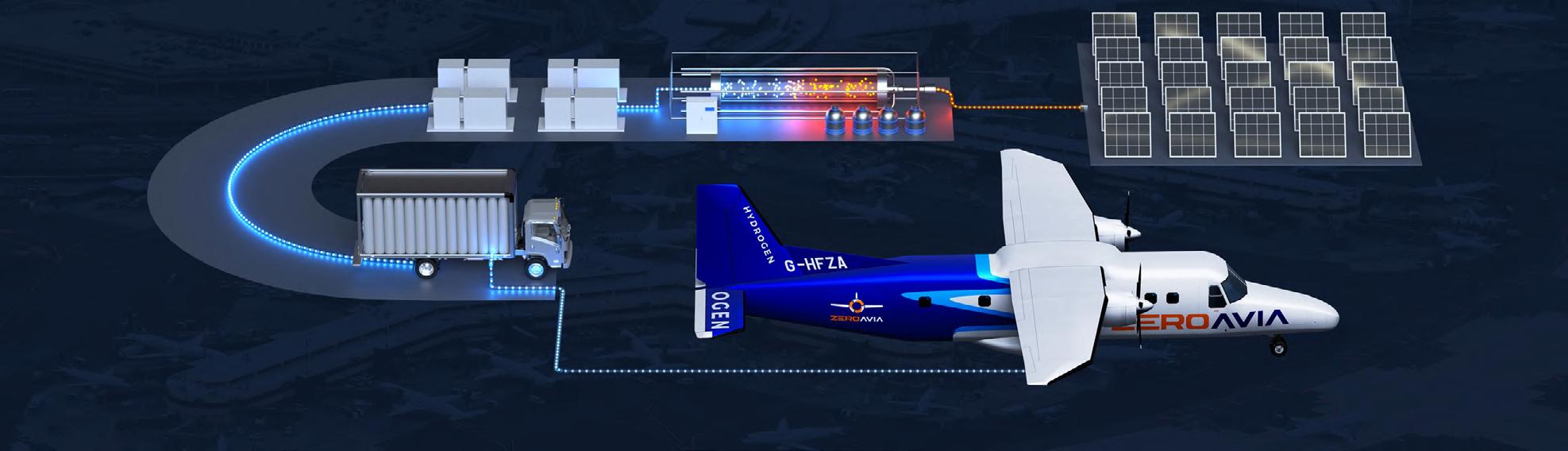

ZeroAvia, which is modifying existing aircraft with hydrogen-electric powertrains, is looking at the option of local production. In March 2023, it signed an agreement with Nordic energy company Fortum, to investigate the development of hydrogen at airports.

Universal Hydrogen, which is also retrofitting aircraft using hydrogen fuel cells, has a different solution. It is working with US hydrogen production company Plug

Power, to transport hydrogen ‘capsules’ to airports, where they can be slotted onto modified aircraft.

Universal Hydrogen CEO Paul Eremenko likens this to a Nespresso-style solution. Nespresso users buy their coffee capsules and slot them into a compatible machine. Universal Hydrogen works the same way – the H2 capsules are designed to be compatible with modified aircraft, such as the ATR-72.

Listen to John-Paul Clarke in conversation with Shashank Nigam in the Sustainability in the Air Podcast

We have previously mentioned the issues around potential H2 leaks on the ground or on an aircraft, given that it is highly flammable. This will, of course, require extra safety checks.

Moreover, hydrogen also has a bit of an image problem, with a lot of the media still talking about the 1938 Hindenburg airship disaster. In fact, in the early days of ZeroAvia, founder Val Miftakhov used to have a slide in his pitch deck with a picture of the Hindenburg so that he could preempt any questions about it.

However, Miftakhov now points out that there are hundreds of thousands of hydrogen vehicles in use every day, which run without major hydrogen-related incidents.

Similarly, Barilo says that numerous other vehicles including passenger cars, heavyduty trucks, forklifts, locomotives, and ships have been powered by hydrogen. He argues that acceptance has been high within these markets.

The world has also moved on since 1938. “The status of aircraft and the hydrogen industry has benefited from almost 100 years of technology growth and experience since the 1930s”, says Barilo. “Consumers today have an expectation of safety and generally have a high confidence level in

An example of ZeroAvia's hydrogen airport refueling ecosystem (HARE): from renewable hydrogen production to zero-emission flight.the adequacy of modern codes and standards.”

However, there is another potential problem. Hydrogen in the atmosphere can contribute to global warming. In a report in December 2022, Reuters spoke to two scientists, who said that even 10% leaks during production, storage, transportation and use would negate any benefits over fossil fuels.

The issue, according to Fred Krupp of the Environmental Defence Fund, is that companies are able to detect larger leaks that could present a safety hazard, but not the small ones that contribute to global warming.

However, some companies such as Aerodyne Research, are currently looking at a solution to detect smaller leaks. Meanwhile, Airbus is also researching the issue with MIT and the German Aerospace Center.

Barilo thinks that the problem has been overstated since no fuel is immune from losses or inefficiencies: “It is true that hydrogen systems could have some losses or leakage, but a properly designed system would account for and recover these losses.”

He argues that hydrogen-powered aircraft wouldn't release significant amounts to the atmosphere during use, as it would be a safety issue. “While parked, such losses can be managed by recapturing,” he adds.

Hydrogen-powered aircraft can emit nitrogen oxides (NOx) and contrails just like traditional planes. NOx, formed when fuel combusts at high temperatures, deteriorates air quality. Contrails, on the other hand, are formed when aircraft exhaust water vapour condenses around soot or ice particles.

In contrast, hydrogen-electric aircraft, powered by a hydrogen fuel cell driving an electric motor, do not emit NOx. This absence of NOx is a reason ZeroAvia's CEO, Val Miftakhov, opted for hydrogen-electric propulsion.

While these aircraft might still form contrails, the increased water crystals, combined with the absence of harmful gases and particulates, are believed to reduce detrimental contrails, as noted by Jenny Kavanagh from Cranfield Aerospace Solutions.

Airlines are now exploring contrail avoidance tech. One notable company, SATAVIA, based in Cambridge, UK, suggests minor flight route alterations to avoid creating persistent contrails that amplify global warming. SATAVIA's Dr. Adam Durant confirms that their technology is equally effective with hydrogen-powered planes as with those using traditional jet fuel or SAF.

There are two separate arguments here. First, hydrogen is not always the best solution, and, on occasion, can be more expensive than other alternatives such as electrification.

In its hydrogen myth buster, the Rocky Mountain Institute agrees, saying that “in theory, hydrogen can be used to decarbonize almost every sector. But just because it can, doesn’t mean it should.”

An example is public transport. According to one estimate, hydrogen-powered buses cost more than twice as much to operate per km than battery-electric ones. As a result, there is not much of an argument for making airport ground vehicles hydrogen-based. Electrification will clearly be the most energy and cost-effective route.

The second argument comes from climate activists who argue that the aviation sector is overconsuming scarce resources. They advocate for prioritising other sectors – like ammonia production for fertilisers – for green hydrogen allocation. These advocates also raise concerns about diverting renewable energy towards producing green hydrogen for aviation.

However, with electrolysers becoming more efficient and countries enhancing their production capacities, there's a counter-view that there might be sufficient green hydrogen to meet all demands.

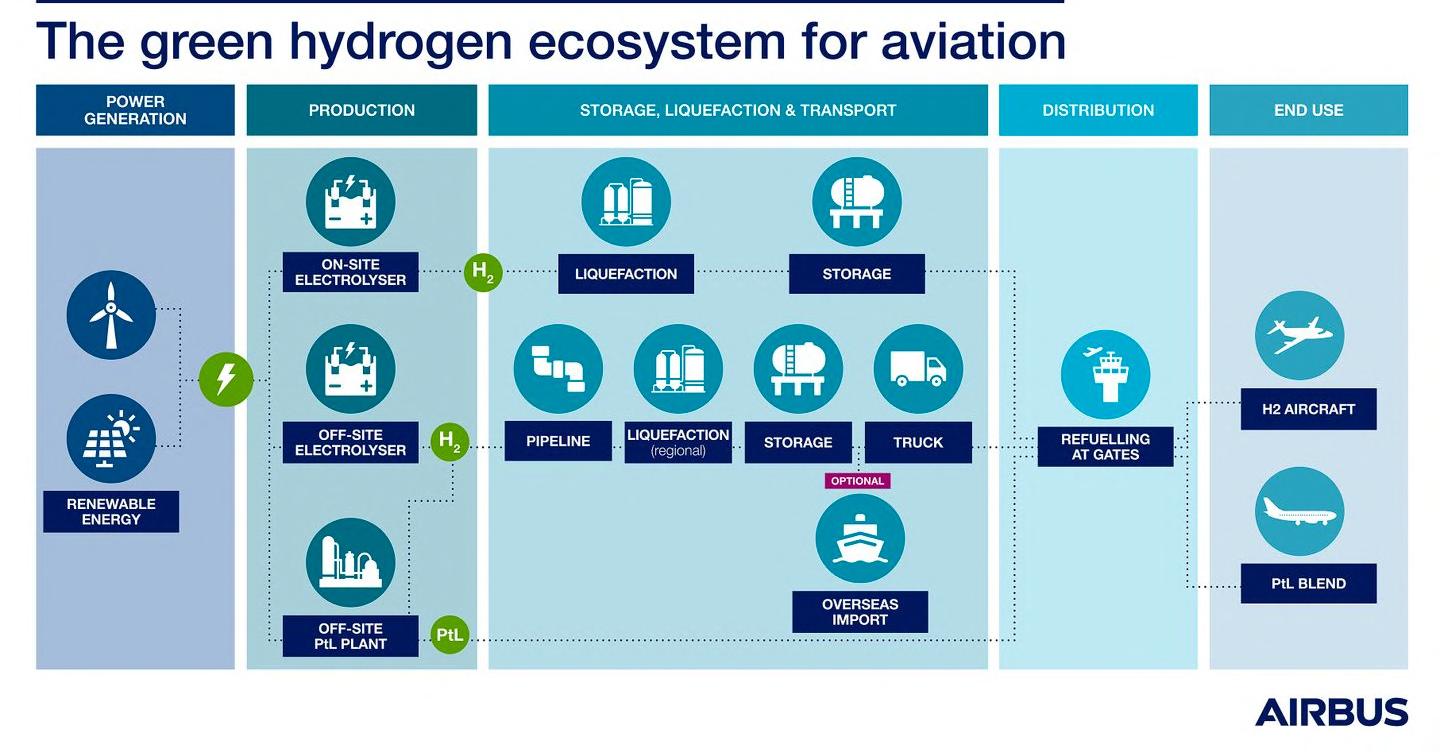

As the aviation industry faces increasing pressure to reduce its carbon footprint, the green hydrogen value chain is emerging as pivotal in the quest for sustainable aviation.

To transform green hydrogen from a specialised role to a prevalent energy source, concerted efforts from both supply and demand aspects are crucial.

In the following sections, our market map offers a snapshot of the different areas within the green hydrogen aviation value chain, complemented by a directory of key providers. Note that some companies are exploring various hydrogen-related solutions and may fit in more than one category.

An electrolyser is an apparatus that produces hydrogen through a chemical process (electrolysis) that separates the hydrogen and oxygen molecules in water using electricity. To generate low-carbon hydrogen, renewable or nuclear electricity is used.

Two primary electrolyser technologies are used for green hydrogen production:

• High-temperature electrolysis operates at elevated temperatures and can utilise excess heat, making it more energy-efficient

• Proton Exchange Membrane (PEM) electrolysis, on the other hand, operates at lower temperatures and is known for its compact design and versatility.

Electrolysers for dedicated hydrogen production have traditionally been built in small volumes for niche markets, but the anticipated increase in production volumes and associated growth in factory size are expected to reduce investment costs for all electrolyser technologies.

The manufacturing capacity for electrolysers has been seeing substantial growth, surpassing a 25% increase in 2022 compared to the previous year. It’s worth noting that currently Europe and China account for two-thirds of global manufacturing capacity.

Founded: 2022

HQ: USA

accelerazero.com

Founded: 2017

HQ: Italy

enapter.com

Founded: 2007

HQ: Denmark

greenhydrogensystems.com

H2Pro

Founded: 2019

HQ: Israel

h2pro.co

Founded: 2020

HQ: USA

eh2.com

EVoLOH

Founded: 2020

HQ: USA

evoloh.com

Founded: 1997

HQ: Germany

h-tec.com

Founded: 2017

HQ: USA

hydrogenoptimized.com

Hynamics (EDF Group)

Founded: 2018

HQ: France

hynamics.com

ITM Power

Founded: 2000

HQ: UK

itm-power.com

McPhy

Founded: 2008

HQ: France

mcphy.com

Ohmium

Founded: 2019

HQ: USA

ohmium.com

Plug Power

Founded: 1997

HQ: USA

plugpower.com

Stiesdal Hydrogen

Founded: 2016

HQ: Denmark

stiesdal.com

SunGreen H2

Founded: 2020

HQ: Singapore

sungreenh2.com

Hysata

Founded: 2021

HQ: Australia

hysata.com

John Cockerill Hydrogen

Founded: 1817

HQ: Belgium

hydrogen.johncokerill.com

Nel Hydrogen

Founded: 1927

HQ: Norway

nelhydrogen.com

PERIC Hydrogen Tech.

Founded: 2013

HQ: China

h2peric.com

Siemens Energy

Founded: 2020

HQ: Germany

siemens-energy.com

Sunfire

Founded: 2010

HQ: Germany

sunfire.de

Sungrow

Founded: 1997

HQ: China

sungrowpower.com

Founded: 2020

HQ: UK

supercritical.solutions

Founded: 2007

HQ: USA

verdehydrogen.com

Founded: 2021

HQ: USA

verdagy.com

Currently, hydrogen is mostly produced and consumed in the same location. However, with the demand for hydrogen increasing, there is a need to further develop infrastructure that connects production and demand centres. This includes safe and efficient transportation, storage and fuelling stations at airports.

Did you know? The world’s first shipment of liquefied hydrogen from Australia to Japan took place in February 2022, marking a key milestone in the development of an international hydrogen market.

Element 2

Founded: 2020

HQ: UK element-2.co.uk

H2 Mobility

Founded: 2015

HQ: Germany h2-mobility.de

HRS

Founded: 2004

HQ: France

hydrogen-refueling-solutions.fr

Hydrogenious

Founded: 2013

HQ: Germany

hydrogenious.net

HyNetwork

Founded: 2022

HQ: Netherlands

hynetwork.nl

GKN Hydrogen

Founded: 2021

HQ: Germany

gknhydrogen.com

H2Go Power

Founded: 2014

HQ: UK

h2gopower.com

Hydrogen Airport

Founded: 2023

HQ: France

hydrogen-airport.com

HyNet NW

Founded: 2022

HQ: UK

hynethydrogenpipeline.co.uk

Hyzon Motors

Founded: 2019

HQ: USA

hyzonmotors.com

McPhy Nel Hydrogen

Founded: 2008

Founded: 1927

HQ: France HQ: Norway mcphy.com nelhydrogen.com

Founded: 1997

HQ: USA plugpower.com

Ryze Hydrogen

Founded: 2018

HQ: UK ryzehydrogen.com

Founded: 2021

HQ: UK cp.catapult.org.uk

Provaris

Founded: 2017

HQ: Australia

provaris.energy

Universal Hydrogen

Founded: 2018

HQ: UK hydrogen.aero

The global low-emission hydrogen production market is still relatively nascent, representing less than 1% of total hydrogen production in 2022. While the pipeline of green hydrogen projects is growing at an impressive speed, only 4% of these projects are under construction or have reached a final investment decision. Among the key reasons are uncertainties about demand, lack of regulatory frameworks and available infrastructure to deliver hydrogen to end users.

1s1 Energy

Founded: 2019

ACWA Power

Founded: 2004

1s1energy.com

Air Products

Founded: 1940

HQ: USA

HQ: USA airproducts.com

Black & Veatch

Founded: 1915

HQ: USA bv.com

BP

Founded: 1909

HQ: UK

Constellation Energy

Founded: 1999

HQ: USA

constellationenergy.com

EDF Group

Founded: 1946

HQ: France

bp.com edf.fr

acwapower.com

AMEA Power

Founded: 2017

HQ: UAE

HQ: Saudia Arabia ameapower.com

Bloom Energy

Founded: 2001

HQ: USA bloomenergy.com

Chariot Energy

Founded: 2007

HQ: UK

chariotenergygroup.com

DRIFT Energy

Founded: 2021

HQ: UK

drift.energy

Emmerald Green Hydrogen

Founded: 2020

HQ: UK

emeraldgreenhydrogen.com

Enertrag

Founded: 1998

HQ: Germany

enertrag.com

Fortescue

Founded: 2003

HQ: Australia fortescue.com

FuelCell Energy

Founded: 1916

HQ: USA

fuelcellenergy.com

Hiringa Energy

Founded: 2017

HQ: New Zealand

hiringaenergy.com

Hy2Gen

Founded: 2017

HQ: Germany

hy2gen.com

Hydreen

Founded: 2023

HQ: India

hydreen.in

Hynamics (EDF

Founded: 2018

HQ: France

hynamics.com

Everfuel

Founded: 2017

HQ: Denmark

everfuel.com

Fortum

Founded: 1998

HQ: Finland fortum.com

HiiRoc

Founded: 2019

HQ: UK hiiroc.com

Hoeller

Founded: 2016

HQ: Germany

hoeller-electrolyzer.com

HyDeal

Founded: 2020

HQ: Spain

hydeal.com

Hygenco

Founded: 2020

HQ: USA

hygenco.in

Koloma

Founded: 2021

HQ: USA

koloma.com

Lhyfe Linde

Founded: 2017

HQ: France

lhyfe.com

Masdar

Founded: 2006

HQ: UAE masdar.ae

NGHC Founded: 2021

HQ: Saudi Arabia

nghc.com

Norwegian Hydrogen

Founded: 2020

HQ: Norway

norwegianhydrogen.com

Orsted

Founded: 2006

HQ: Denmark

orsted.co.uk

Peregrine Hydrogen

Founded: 2023

HQ: USA

peregrinehydrogen.com

Reliance Industries

Founded: 1958

HQ: India

ril.com

Founded: 1879

HQ: UK

lindehydrogen.com

Mitsubishi Power Americas

Founded: 2001

HQ: USA changeinpower.com

New Fortress Energy

Founded: 2014

HQ: USA

newfortressenergy.com

Octopus Hydrogen

Founded: 2021

HQ: UK

octohydrogen.com

P2X

Founded: 2020

HQ: Finland

p2x.fi

Pure Hydrogen

Founded: 2007

HQ: Australia

purehydrogen.com.au

Sasol

Founded: 1650

HQ: South Africa sasol.com

Shell Founded: 1907

HQ: Netherlands shell.com

SinoHytec

Founded: 2012

HQ: China

Stargate Hydrogen

Founded: 2021

HQ: USA

sinohytec.com stargatehydrogen.com

Thor Hydrogen

Founded: 2020

HQ: Canada thorhydrogen.com

Topsoe

Founded: 1949

HQ: Denmark topsoe.com

UNIWASTEC AG

Founded: 2021

HQ: Switzerland

Yara Clean Ammonia

Founded: 2021

HQ: Norway

uniwastec.com yara.com

There are two main ways that hydrogen can be used to power an aircraft:

• Hydrogen combustion engines: Hydrogen can be burned in a jet engine in the same way that jet fuel is burned today. However, since liquid hydrogen is not a drop-in fuel like SAF, this requires the development of new engines.

• Hydrogen fuel cells: Hydrogen fuel cells convert hydrogen and oxygen into electricity. The electricity can then be used to power an electric motor, which drives the aircraft –commonly referred to as ‘hydrogen-electric’. In both cases, just like jet fuel, the hydrogen fuel needs to be stored on the aircraft which poses unique challenges. For example, it can be done as a compressed gas, which is less efficient but easier to handle. Or as liquid hydrogen, which requires cryogenic temperatures (-253 degrees Celsius).

Founded: 1974

HQ: USA

cfmaeroengines.com

Founded: 1906

HQ: USA

aerospace.honeywell.com

Founded: 2020

HQ: USA

hydroplane.us

Founded: 2004

HQ: France

pragma-industries.com

Founded: 2021

HQ: Australia

titanh2.com

H2Fly

Founded: 2015

HQ: Germany

h2fly.de

HTWO by Hyundai Motor

Founded: 2020

HQ: South Korea

htwo.hyundai.com

Founded: 2008

HQ: Sweden

powercellgroup.com

Rolls-Royce

Founded: 1906

HQ: UK

rolls-royce.com

Founded: 2023

HQ: UK

bath.ac.uk

Retrofitting existing aircraft with hydrogen engines or fuel cell propulsion systems offers the potential for emission-free flight without the need to develop entirely new aircraft. While retrofitted fuel cell aircraft may not match the payload and range capabilities of their fossil-fueled counterparts, they do exhibit greater energy efficiency, according to an analysis by the International Council on Clean Transportation (ICCT). Moreover, the current fuel cell technology may not generate sufficient power to propel narrowbody aircraft. Therefore, many companies have been focusing on retrofitting regional turboprop aircraft instead.

Cranfield Aerospace Solutions

Founded: 1997

HQ: UK

cranfieldaerospace.com

Dovetail Electric Aviation

Founded: 2021

HQ: Australia

dovetail.aero

Stralis Aircraft

Founded: 2021

HQ: Australia

stralis.aero

ZeroAvia

Founded: 2017

HQ: USA / UK

zeroavia.com

Deutsche Aircraft

Founded: 2019

HQ: Germany

deutscheaircraft.com

H3 Dynamics

Founded: 2015

HQ: France

h3dynamics.com

Universal Hydrogen

Founded: 2020

HQ: USA

hydrogen.aero

Some companies are choosing to embark on the ambitious endeavour of building new hydrogen-powered aircraft from scratch.

Revolutionary aircraft designs would allow new aerodynamic concepts and better integration of liquid hydrogen storage (e.g., with a blended-wing-body design).

Nonetheless, it's important to acknowledge that radically new aircraft concepts have certain drawbacks. This includes the somewhat unpredictable path to commercialisation, marked by extensive development efforts required to ensure the aircraft's aerodynamic stability, as well as the optimisation of cabin design, manufacturing processes, and operational procedures.

Aircraft development cycles occur about every 15-20 years until a new aircraft platform is introduced. For short-range aircraft, the next window of opportunity is expected to be around 2030-2035.

Founded: 1970

HQ: France

airbus.com

Aviation H2

Founded: 2021

HQ: Australia

aviationh2.com.au

Founded: 2020

HQ: France

bluespiritaero.com

Founded: 1969

HQ: Brazil

embraercommercialaviation sustainability.com

Founded: 2007

HQ: UK

hybridairvehicles.com

Alaka'i

Founded: 2006

HQ: USA

alakai.com

Founded: 2020

HQ: France

beyond-aero.com

Destinus

Founded: 2021

HQ: Switzerland

destinus.ch

Founded: 1996

HQ: Netherlands

fokkernextgen.com

Founded: 2022

HQ: Germany / UK

lyteaviation.com

Founded: 2016

Founded: 2008

HQ: USA HQ: USA natilus.com ottoaviation.com

Vertiia

Founded: 2017

HQ: Australia vertiia.com

Our market map comprises over 110 companies in the hydrogen space. Here, we’ve picked out ten to watch. They include hydrogen aircraft companies, infrastructure providers, and green hydrogen producers: Cranfield Aerospace Solutions, Destinus, Embraer, Fokker, Hy2Fly, Hydrogen Airport, Hysata, Lyte Aviation, Universal Hydrogen and ZeroAvia.

Based in: Bedforshire, UK

CEO: Paul Hutton

Key Product: Hydrogen fuel cell powered aircraft

Major customers: Air New Zealand, EVIA AERO, MONTE

Website: cranfieldaerospace.com

Cranfield Aerospace Solutions (CAeS) was originally spun out of Cranfield University, one of the world’s best-known aerospace higher education institutions. Earlier this year, it announced that it would merge with Britten Norman, a manufacturer known for producing small short takeoff and landing (STOL) aircraft such as the Islander. Their shared objective is to develop true-zero aircraft using hydrogen-electric powertrains. Chief Strategy Officer Jenny Kavanagh talks about CAeS wanting to become a “little Airbus” in a four-stage process. (Read our interview with Jenny Kavanagh on Sustainability in the Air.)

Steps one and two will be to retrofit existing aircraft, starting with the nine-seat Islander. Steps three and four will be to produce a new aircraft, which Kavanagh feels is necessary due to design issues. Here, CAeS wants to produce “an aircraft that gets the best out of the propulsion system.”

The ultimate aim is to produce aircraft with just under 100 seats by the middle of the next decade.

In December 2022, Air New Zealand announced that Cranfield Aerospace Solutions (CAeS), would be part of ‘Next Gen Aircraft’, the flag carrier’s ambitious zero-emissions aircraft programme. It was the only British company selected out of 30 candidates.

Another customer is EVIA AERO, which plans to be a zero-emissions regional airline in Germany. EVIA has ordered 15 conversion kits for small regional aircraft from CAeS. Meanwhile, MONTE Aircraft Leasing (MONTE) has signed a Letter of Intent with Cranfield Aerospace Solutions (CAeS) to purchase 40 modification kits to convert Britten-Norman Islanders to hydrogen-electric power.

Based in: Vaud, Switzerland

CEO: Mikhail Kokorich

Key Product: Hypersonic hydrogen-powered aircraft

Website: destinus.ch

While supersonic aircraft company Boom Supersonic has received much media attention over the years, some aircraft manufacturers have an even bigger ambition. Rather than merely flying supersonic aircraft at speeds faster than that of sound, they want to go a step further. Hypersonic travel, if it becomes a reality, will allow flights between Europe and Australia at Mach 5 i.e. in as little as four hours.

One such company is Switzerland-based Destinus, which expects its hypersonic aircraft to be powered by liquid hydrogen.

Of course, getting to hydrogen-fuelled hypersonic travel will be a long road, and will take at least a decade or more. The company has trialled a subsonic drone and plans to progress to a supersonic drone prototype next year, eventually aiming for hypersonic.

Destinus says its strategy is to test the technology on remote-piloted drones first, before developing piloted aircraft that can carry passengers.

Initially, the Destinus S, expected to enter service at some point in the 2030s, will fly up to 25 passengers at hypersonic speeds. This will be followed by the Destinus L in the 2040s, carrying 300+ passengers.

Clearly, this is an ambitious undertaking, which has many sceptics. However, Destinus has a Plan B to keep the company afloat – making and selling hydrogen gas turbines while the development of the aircraft happens in the background.

With part of the Destinus team now based in Spain, the startup has also been awarded grants for two projects worth a total of 26.7 million euros by the Spanish Government to expand its hydrogen propulsion capabilities.

Source: DestinusBased in: São José dos Campos, Brazil

CEO: Arjan Meijer

Key Product: New hydrogen-electric regional aircraft

Major Customers: Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft to airlines worldwide

Website: embraercommercialaviationsustainability.com/concepts/#energia

Embraer, the world's third-largest commercial aircraft manufacturer, is set to launch a new family of regional aircraft called Energia in the next decade. The first in this lineup will be a hybrid-electric aircraft. However, the next Energia generation, slated for 2035, features hydrogen fuel cells. This will carry up to 30 passengers in a 1-2 configuration and will boast a 70% reduction in noise and zero CO2 emissions.

Embraer's focus on smaller aircraft with the Energia family provides a stepping stone for advancing and refining new technologies, with the potential to scale to larger aircraft on the horizon.

Embraer contends that these aircraft will not only be cost-effective for airlines but could also provide cheaper fares for passengers, potentially even surpassing the affordability of electric cars. Comparing a 200-300 nautical mile trip by car to a hydrogen fuel cell aircraft journey, Embraer predicts that the latter will be 2.5 times faster, 25% less expensive, and emit 25% less CO2 per passenger.

Embraer already sees a need for at least 4000 of its new regional aircraft by 2035. However, that demand could be as high as 20,000 aircraft due to the cheaper operating costs and other benefits Embraer has identified for the Energia family.

Based in: Hoofddorp, The Netherlands

CEO: Juriaan Kellermann

Key Products: Conversion of the Fokker 100 and a new hydrogen aircraft by 2035

Website: fokkernextgen.com

The successor of the legendary Dutch regional aircraft maker Fokker, Fokker NextGen is aiming to produce a new aircraft running on liquid hydrogen to be in service by 2035, with a range of 2500 km.

The first stage is to modify a Fokker 100 aircraft – a regional jet plane with a capacity of 100+ passengers – to run on a hybrid-hydrogen configuration. According to the company, “the Fokker 100 will be converted for liquid hydrogen fuel, but will also be able to fly on sustainable aviation fuel (SAF), kerosene, or a combination of fuels.” This modified aircraft is due to have its first test flight in 2028.

Meanwhile, assembly of the new clean sheet aircraft prototype will start in 2032 with first flights in 2033. It will be ready to be delivered to customers in 2035.

Though the company hasn’t released more details of this aircraft, the digital images on the Fokker NextGen website show a 2-3-2 configuration, implying that it will be somewhat larger than the regional turboprops and jets that Fokker used to produce.

In a show of confidence in the concept aircraft’s potential, Fokker NextGen has received €25 million in funding from the Dutch Government, and an undisclosed amount from the EU’s Clean Aviation Fund.

Source: Fokker Next Gen

Based in: Stuttgart, Germany

CEO: Dr Josef Kallo

Key Product: Hydrogen fuel cells / hydrogen-electric powertrains

Website: h2fly.de

A subsidiary of American eVTOL (electric vertical take-off and landing aircraft) company Joby, H2FLY achieved a historic aviation milestone in September 2023 by completing the world's first piloted flight of a liquid hydrogen-powered electric aircraft.

The company’s HY4 demonstrator aircraft, equipped with a hydrogen-electric fuel cell propulsion system and liquid hydrogen, completed a series of successful piloted flights, including one lasting over three hours.

This accomplishment was the culmination of Project HEAVEN, an EU-supported consortium led by H2FLY. The consortium includes Air Liquide, Pipistrel Vertical Solutions and the German Aerospace Center (DLR).

Next year, H2FLY plans to open a Hydrogen Aviation Center at Stuttgart Airport, which is co-funded by the Ministry of Transport Baden Württemberg. The company says that the Hydrogen Aviation Center will become a focal point to the future of Europe’s aviation industry by providing fuel cell aircraft integration facilities.

H2FLY says that by the end of the decade its first commercial fuel cell system will be certified and operational in aircraft applications across the globe. By the early 2030s, the company’s next-generation scaled-up system will be certified, operational, with the potential to “truly decarbonize at least half of the global air traffic.”

Based in: Paris, France

CEO: Matthieu Piron

Key Products: Making airports hydrogen ready

Website: hydrogen-airport.com

A lot of projects worldwide are looking at getting airports hydrogen-ready. One of those is France’s Hydrogen Airports, a joint venture between Group ADP, which runs the Paris area airports, and energy company Air Liquide.

Hydrogen Airport aims to get airports up and running to handle hydrogen flights by 2035, by estimating the hydrogen volumes required, organising the supply chain, preimplementing the storage infrastructure, carrying out safety studies and carbon impact studies.

Within the framework of this joint venture, Air Liquide says it is bringing its expertise in hydrogen, which ranges from the production of renewable or low-carbon hydrogen, to liquefaction, storage, and the distribution of hydrogen for aircraft, while Groupe ADP contributes its expertise in airport infrastructure and operations.

Though based in France, Hydrogen Airport says that it is targeting a global market, with initial business development efforts focused on approximately 200 international and regional airports of a given critical size located in current or future hydrogen hubs (North America, Europe, Asia-Pacific).

Source: Hydrogen AirportBased in: Wollongong, NSW, Australia

MD: Dr Paul Barret

Key Product: Next-generation electrolysers to produce cheaper green hydrogen

Website: hysata.com

Hysata, an Australian company, is developing a new type of electrolyser which could make it more economical to produce green hydrogen. Hysata's electrolyser has achieved an efficiency of 95% in testing, which is significantly higher than the 70% average for conventional alkaline electrolysers.

Founded in 2019, Hysata has generated considerable excitement among investors. In August 2023, Hysata closed an oversubscribed Series A round for A$42.5 million (US$27.5 million). This was followed up by A$23 million funding from the Australian Federal and Queensland State Governments.

This is to help fund an electrolyser demonstration unit at Stanwell Power Station, outside of Rockhampton, Queensland. The company is now looking ahead to a Series B round, where the goal is to raise another A$100 million (US$68 million).

One of the members of Hysata’s advisory council is clean energy expert Michael Liebreich, who has previously expressed some scepticism about using hydrogen in transportation. In an article for Bloomberg, Liebreich cast doubt on hydrogen-powered aircraft, though he did accept a use case for e-fuels made from green hydrogen.

Liebreich has since modified his views, admitting that long-haul aviation powered by hydrogen is possible, though significant infrastructure and transport challenges remain.

Source: Hysata

Based in: Hamburg, Germany / London, UK

CEO: Freshta Farzam

Key Products: The ‘SkyBus’, a 44-seat hydrogen-hybrid-electric eVTOL

Website: lyteaviation.com

LYTE Aviation’s SkyBus is designed to be a 44-seat hydrogen-electric eVTOL and conventional engines (for which SAF can be used).

The inspiration for the SkyBus comes from the Fairey Rotodyne, a 1950s aircraft that combined helicopter and aeroplane capabilities. In contrast to the Rotodyne, LYTE's eVTOL will have low emissions, cost-effective operations, and minimal noise pollution.

LYTE believes the SkyBus can serve a wide range of use cases due to its capacity of 44 passengers, its 1000 km range, and the fact that it only needs a vertiport, not a runway. It could also eliminate the need for train tracks and highways in remote areas, preserving the environment.

The initial use case presented by LYTE focuses on the greater Seattle area, where the SkyBus could offer an alternative to ferry and tollway commuting, saving time, reducing CO2 emissions, and alleviating stress for daily commuters.

Despite the significant financial investment required, LYTE is confident of the business case due to the revenue potential of disrupting the regional aviation and transportation market. LYTE is also developing a cargo version of the aircraft called the SkyTruck, with plans to introduce both aircraft within the current decade.

Source: Dimensional Energy

Based in: Hawthorne, California

CEO: Paul Eremenko

Key Products: Hydrogen electric conversion kits, hydrogen transportation and infrastructure

Major Costumers: Air New Zealand, ACIA Aero Leasing, Avmax, Connect Airlines

Website: hydrogen.aero

Universal Hydrogen is developing a hydrogen logistics network to decarbonise aviation. The company's goal is to make hydrogen-powered flight a reality by 2025.

The company is taking a two-pronged approach. First, working with green hydrogen producer Plug Power, the company is developing a modular hydrogen capsule system that can be transported over the existing freight network from production sites to airports. Universal Hydrogen says that this makes it easier and more cost-effective to distribute hydrogen to airports around the world.

Second, it is developing a conversion kit that can be used to retrofit existing regional aircraft to fly on hydrogen. This will allow airlines to transition to hydrogen-powered flight without having to purchase new aircraft.

CEO Paul Eremenko has likened this approach to a ‘nespresso’ style solution where readymade capsules are slotted into retrofitted, compatible aircraft.

In March 2023, “Lighting McClean”, a converted Dash-8, completed a successful test flight. This was the largest hydrogen-powered flight to date. Universal Hydrogen has a range of heavyweight investors including Airbus, Toyota Ventures, JetBlue Ventures, American Airlines and Mitsubishi. Earlier this year, Air New Zealand announced that Universal Hydrogen would be part of its Mission Next Gen Aircraft program.

Listen to Paul Eremenko in conversation with Shashank Nigam in the Sustainability in the Air PodcastBased in: Hollister, California / Kemble, Uk

CEO: Val Miftakhov

Key Products: Hydrogen-electric powertrains

Major Costumers: American Airlines, United Airlines, Alaska Airlines, Air Cahana, MONTE Aircraft Leasing, Ravn Alaska, Natilus, Red Sea Development Company

Website: zeroavia.com

Founded by electric vehicle industry veteran Val Miftakhov, ZeroAvia wants to put hydrogen-electric power trains in aircraft, from small regional planes all the way to 100200+ seat narrow bodies.

The ZA600 powertrain is the company's initial focus, designed for small regional aircraft accommodating up to 19 passengers. With a target certification date of 2025, the ZA600 is set to be ZeroAvia's first commercial product. Using a converted Dornier-228, ZeroAvia’s test flight programme is well underway; the company says it is on track to meet the 2025 date

Following closely behind, the ZA2000 is projected to enter service in 2026 – this will power large regional turboprops.

Subsequently, ZeroAvia intends to roll out the ZA-2000RJ powertrain by the end of the decade for regional jets. Eventually, the company aims to venture into the 100-200 seat narrowbody market – it has made progress by successfully testing a high-temperature fuel cell that could one day be used on larger aircraft like the Boeing 737 and Airbus A320.

The company is also looking at the logistical task of ensuring airports can support hydrogen-electric aircraft. To address this, the company envisions establishing hydrogen hubs at strategic airports.

ZeroAvia's Hydrogen Airport Refuelling Ecosystem (HARE) project involves producing green hydrogen on-site at airports using renewable energy. Shell is collaborating with ZeroAvia to bring this vision to life. Airport partners include Edmonton International Airport in Canada and AGS Airports (owner of Glasgow, Aberdeen and Southampton Airports) in the UK.

Source: ZeroAviaThat’s not all. ZeroAvia is also working with tourism projects such as The Red Sea Development Company in Saudi Arabia, which will see tourists being flown over the Red Sea in zero-emissions Cessna Caravan seaplanes.

ZeroAvia boasts an impressive array of backers and investors, positioning the company at the forefront of the next generation of sustainable aviation. This includes major players such as the Bill Gates Breakthrough Energy Fund and the Climate Pledge Fund backed by Amazon.

Additionally, prominent airlines like British Airways and Iberia's parent company, IAG, United Airlines, Alaska Airlines, and American Airlines have joined the ranks of supporters. Other notable investors include Saudi Arabia's NEOM development project, the German climate technology fund AENU, Shell Ventures, and Barclay's Sustainable Capital Investment Vehicle.

Listen to Val Miftakhov in conversation with Shashank Nigam in the Sustainability in the Air Podcast.

Hosted by SimpliFlying CEO and Founder Shashank Nigam, Sustainability in the Air is the world’s leading sustainable aviation podcast.

Over the past year, aviation CEO guests have included Scott Kirby (United Airlines), Tony Douglas (formerly Etihad, now Riyadh Air), Val Miftakhov (ZeroAvia), Gregory Constantine (AIR COMPANY), Patrick Roux (SkyTeam), Paul Griffiths (Dubai Airports), John Pagano (Red Sea Global) and Adam Goldstein (Archer).

Listen and subscribe to the podcast here:

green.simpliflying.com/podcast

See other episodes

Meanwhile, our Sustainability in the Air website includes weekly articles on sustainable aviation tech startups; reports on subjects as diverse as SAF and eVTOLs; and regular newsletters read by thousands of industry professionals to understand the ever-evolving space of sustainable aviation and the industry’s potential pathways to net zero by 2050.

Climate change concerns are making the aviation industry turn to sustainable aviation fuel (SAF), electric, and hydrogen-powered aircraft to cut emissions. However, scaling these technologies requires significant innovation.

Sustainability in the Air highlights the journeys of entrepreneurs, executives, and investors who are navigating these challenges and paving the way for the future of aviation.

Available on Amazon starting November 1, 2023.

Sneak preview one of the chapters today at sustainabilityintheair.com

Over the past fifteen years, SimpliFlying has worked with over 100 airlines and airports globally to help build trust in travel. We have also helped various technology companies scale up within aviation. Here are some ways we can help you in making the future of travel more sustainable:

Let your CEO be interviewed by Shashank Nigam and share your vision for a sustainable future for travel on Sustainability In the Air. Find out more on becoming a partner.

We can help you build thought leadership on a particular topic that you'd like to "own". Check out a sample report we did with a partner recently.

SimpliFlying has helped a multitude of technology firms scale up in aviation. From launching an airplane to marketing an Airbus A380 engine. We can help you simplify your brand and help build awareness with key decision makers.

Get in touch!