For over 15 years, SimpliFlying has been a trusted partner to airlines, airports, and technology firms worldwide. We have been on a mission to help build trust in aviation. To empower the industry to soar to new heights through digitalisation, innovation, and a steadfast commitment to sustainability.

We're not just sought after strategy consultants, we are passionate advocates for meaningful change. Headquartered in Singapore, our global team based out of Canada, India, Spain and the UK is dedicated to equipping aviation and technology executives with the tools, insights, and strategies needed to navigate the complexities of sustainable aviation.

From major airlines and airports to aircraft manufacturers and travel technology companies, our extensive client base underscores our reputation as a trusted partner in the aviation industry since 2008.

At SimpliFlying, we're committed to helping you navigate the complexities of sustainable aviation and thrive in an ever-changing landscape.

Here are some ways we can help you in your sustainability journey:

Connect sustainable tech startups with investors and industry

SimpliFlying Immersions pioneer a new era of real-life connections through immersive experiences, deep learning, and cutting-edge innovation exchange. We do this by facilitating site visits and bringing aviation leaders to startup facilities to offer a platform for tangible collaborations to take shape.

Discover the next wave of sustainable travel technology

The SimpliFlying Launchpad brings ready-to-scale technologies that can help accelerate sustainable travel to decision-makers in aviation. We curate the best startups and scaleups, help them build an aviation-specific brand strategy, and introduce them to airlines and airports ready to put a pilot in place.

Share your vision with a global audience

Like 80+ other CxOs in the industry, enlist your CEO or Head of Sustainability to be interviewed by Shashank Nigam. Share your vision for the future of travel on the world’s best-known sustainable aviation podcast "Sustainability in the Air". Find out more on becoming a partner.

Grow your brand in aviation

SimpliFlying has helped a multitude of technology firms scale up in aviation – from launching an airplane to marketing an Airbus A380 engine. We can help you amplify your brand and help build awareness with key decision-makers.

Stay informed, stay ahead

We deliver in-depth monthly or quarterly briefings to the senior leadership teams on a topic/issue of your choosing. You can also sign up for a series of briefings that cover key aspects of the present and future of sustainable aviation.

Why it matters? Carbon dioxide removal (CDR) is emerging as a crucial tool for industries, especially aviation, in achieving 2050 net-zero goals. It offers dual benefits: it is a critical component in e-fuel production and an alternative to controversial carbon offsetting programs.

E-fuels, produced by combining green hydrogen with captured CO2, offer a promising pathway for aviation decarbonisation. However, the limited global supply of biogenic CO2 (320-370 million tonnes per year) is insufficient to meet potential demand from aviation and other hard-to-abate sectors.

Several airlines and aerospace companies have made significant commitments to carbon removal, including partnerships with CDR startups and purchases of carbon removal credits.

Various CDR methods exist, including Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), Enhanced Rock Weathering, Biochar, and nature-based solutions like afforestation and soil carbon sequestration.

Current CDR costs, particularly for DAC, are as high as $600-$1,000 per ton of CO2. Projections for future costs vary widely, from optimistic estimates of $110-$137 per ton to more conservative projections of $341-$374 per ton.

Emerging technologies like Direct Ocean Capture (DOC) and DAC system advancements promise to reduce costs and improve carbon removal efficiency.

The CDR landscape faces several challenges, including high energy requirements, scalability issues, and controversies surrounding using captured CO2 for Enhanced Oil Recovery (EOR).

The U.S. and Canada have implemented policies to support CDR development, including tax credits and funding for DAC projects. The EU and other countries are also developing supportive policies.

Given the complexities involved, the aviation industry needs a diversified strategy that incorporates various CDR technologies alongside other decarbonisation efforts.

The future of CDR in aviation depends on technological breakthroughs, regulatory changes, market dynamics, and international cooperation on climate change. While promising, CDR should be part of a broader strategy that includes efficiency improvements, sustainable fuel development, and fundamental changes to air travel approaches.

As industries worldwide grapple with their 2050 net-zero goals, carbon dioxide removal (CDR) – capturing and removing CO2 via various methods – is emerging as a crucial tool in the fight against climate change.

According to the Intergovernmental Panel on Climate Change (IPCC), all 1.5-degree pathways, even with overshoot, depend on carbon removals coming into play. As a result, according to McKinsey, the global market for CDR could reach $1.2 trillion by 2050.

For the aviation sector, which faces unique decarbonisation challenges, CDR offers a dual opportunity that could reshape the industry's approach to sustainability.

First, CDR plays a vital role in the production of e-fuels, also known as electrofuels or Power-to-Liquid fuels (PtL). These synthetic fuels combine 'clean' hydrogen, produced using renewable energy sources, with captured CO2.

E-fuels offer an almost circular solution: CO2 is captured from the atmosphere, used as a feedstock to produce fuel, burned in aircraft engines, and then potentially recaptured, creating a closed-loop system.

This process provides a drop-in replacement for conventional jet fuel, requiring no modifications to existing aircraft or infrastructure. Moreover, it also offers higher lifecycle emission reductions compared to legacy sustainable aviation fuels (SAF) made from fuel crops or waste. In fact, both the United Kingdom and the European Union have introduced an e-fuels sub-mandate within their wider SAF mandates.

Second, CDR presents a more credible alternative to increasingly controversial carbon offsetting programs. Over the past two years, carbon offsetting – still a mainstay of many airline sustainability programs – has faced significant reputational challenges.

News reports have questioned the effectiveness of several high-profile schemes and the methodology of carbon offsetting, leading over 80 non-profits to call for excluding carbon offsets from netzero roadmaps.

In comparison, CDR offers a more direct and verifiable method of compensating for aviation emissions. Instead of relying on indirect offset projects, airlines can invest in technologies that physically remove CO2 from the atmosphere, providing a more tangible and measurable impact.

Source: Climate Impact Partners

Source: MIT Technology Review

Major cost barriers still exist before CDR can reach its full potential. While experts consider $100-$200 per tonne the sweet spot for widespread adoption, current prices are considerably higher – ranging from $300-$1,000 per tonne. Bridging this cost gap is crucial for making CDR a practical climate solution.

This report focuses on the role of CDR in achieving net-zero emissions, with a particular emphasis on aviation.

We explore the landscape of CDR technologies, their costs, and their potential impact, paying particular attention to how these developments could reshape the future of sustainable air travel.

We'll look at the various CDR technologies available, the challenges in scaling them up, and the innovative solutions developed to reduce costs. We'll also examine how airlines already incorporate CDR into their sustainability plans and what the future might hold for this promising technology in the aviation sector.

By understanding the potential of CDR, its current limitations, and the path forward, stakeholders in the aviation industry can better prepare for a future where active carbon removal plays a central role in achieving and maintaining net-zero emissions.

Dirk Singer Head of Sustainability, SimpliFlying dirk@simpliflying.com

There is a growing CDR toolkit comprising various carbon removal methods, each with different advantages and drawbacks. These technologies range from enhancing natural processes to newer engineered solutions.

Carbon dioxide removal (CDR) technologies comparison

Direct Air Capture (DAC): Direct source of captured CO2 for E-fuel production; potential for on-site airport capture for fuel synthesis.

BECCS: Biomass could be used to produce SAF while capturing CO2; captured CO2 could be used for E-fuel production.

Biochar: Potential for offsetting aviation emissions through investment in biochar projects.

Enhanced Weathering: Primarily an offset mechanism for aviation emissions.

Ocean Alkalinization: Primarily an offset mechanism for aviation emissions.

Direct Ocean Capture: Potential for coastal airports to implement capture systems; captured CO2 could be used for E-fuel production; partnership opportunities for airlines with oceanfront operations.

Seaweed Cultivation: Potential source of biomass for SAF production; seaweed-based products for aviation bioplastics; hydrogen production from seaweed could fuel future aircraft; carbon credits for airlines investing in seaweed farms.

Nature-based removals leverage the power of natural ecosystems to absorb and store carbon. These methods include:

• Afforestation and reforestation: Forests are the heavy lifters in the CDR world, responsible for removing about two gigatons of CO2 annually. By 2050, they could potentially remove 0.5-3.6 gigatons per year. However, these methods face challenges such as competition for land with agriculture and urban development and the risk of carbon release due to forest fires or pests.

• Soil carbon sequestration: This method stores carbon in our soil by implementing no-till farming, cover cropping, and more innovative grazing practices. By 2050, it could potentially remove 0.6-5.0 gigatons of CO2 annually. The main challenges lie in accurately measuring and verifying stored carbon and ensuring it stays put if farming practices change.

• Coastal and marine CDR (blue carbon): Mangroves, seagrasses, and salt marshes quietly store away carbon in what is called "blue carbon" ecosystems. While the potential here is smaller – about 0.1-1.0 gigatons of CO2 per year by 2050 – these methods offer additional benefits like coastal protection and marine habitat preservation.

On the technological end of the spectrum, different companies have developed solutions that actively remove CO2 from the atmosphere. These include:

• Direct air capture and storage (DACCS or just DAC): These systems work like giant CO2 vacuum cleaners and can extract CO2 directly from the air anywhere on Earth before storing it deep underground in rocks. The potential is enormous – 0.5-5.0 gigatons of CO2 per year by 2050.

However, this technology is still at a very early stage of development. Consider this: the world's largest DAC facility, Climeworks' Mammoth plant in Iceland, takes in only 36,000 tonnes of CO2 annually. Meanwhile, costs range from $600 to $1000 per ton of CO2, and these systems require significant energy to operate.

How it works? There are three main DAC methods:

• Liquid solvent DAC: Large fans blow air through a structure containing a liquid chemical solution. As the air passes through, the liquid absorbs the CO2 like a sponge absorbs water. Once the liquid is full of CO2, it's heated to release the concentrated CO2, which can then be stored or used. The fluid is then cooled and reused, making it a continuous process.

• Solid sorbent DAC: This method is similar to Liquid Solvent DAC but uses solid materials that attract CO2 instead of a liquid. Air is blown through these filters, and the CO2 sticks to them. When the filters are full, they're heated in a closed chamber to release the concentrated CO2. The filters cool down and are ready to be used again.

• CaO ambient weathering DAC: This approach mimics and accelerates a natural process called weathering. It uses a substance called calcium oxide (CaO), also known as quicklime. CaO is spread out to maximise its exposure to air. After it absorbs CO2, the calcium carbonate is collected and heated to very high temperatures. This releases the CO2 for capture and turns the material back into CaO, ready to be used again.

• Bioenergy with carbon capture and storage (BECCS): This method offers a double benefit: it produces energy while removing CO2 from the atmosphere. It involves growing biomass (which absorbs CO2 as it grows), using it for energy production, and then capturing and storing the CO2 emitted during this process. Like DACCS, BECCS can potentially remove 0.5-5.0 gigatons of CO2 annually by 2050.

• Enhanced rock weathering: This accelerates the natural rock weathering process by spreading finely ground rocks over large areas. It's still in the early stages, with smallscale trials in the UK and U.S., but the potential is significant: 2-4 gigatons of CO2 per year by 2050.

• Biochar: This technique involves producing charcoal-like material from biomass through a method called pyrolysis and then applying it to soils, where it can store carbon for hundreds or even thousands of years. Current global production capacity is small, but it could potentially scale up to 0.5-2.0 gigatons per year by 2050.

• Biogenic CO2 capture: This method involves capturing CO2 from organic sources such as ethanol plants, pulp and paper mills, or biomass power plants. It's currently one of the most cost-effective and widely used methods for e-fuel production. However, its scalability is limited by the availability of suitable biogenic CO2 sources.

• Direct ocean capture (DOC): The ocean naturally absorbs vast amounts of CO2 from the atmosphere, making it a potentially rich source for carbon capture. This emerging technology extracts CO2 directly from seawater.

Source: Science

Companies like Equatic and Brineworks are developing systems that not only remove CO2 but can also produce hydrogen as a byproduct, which makes them particularly useful for e-fuel production.

Several radical new approaches are gaining prominence:

• Ocean alkalinity enhancement: This involves adding alkaline materials to the ocean to boost its CO2 absorption capacity. It's still in the research phase, but the potential is enormous – possibly up to 100 gigatons of CO2 annually.

• Artificial upwelling: This technique brings nutrient-rich deep ocean waters to the surface to stimulate phytoplankton growth and carbon sequestration. It's still at the conceptual stage, but it could potentially remove 0.1–1.0 gigatons of CO2 per year. A mix of these technology-based removals will likely be necessary for the aviation industry to achieve net-zero goals.

In particular, DAC and biogenic CO2 capture hold promise for producing e-fuels, while other methods could provide offsetting options for residual emissions. Direct ocean capture is also generating significant interest due to its potential synergies with hydrogen production, which could also be valuable for e-fuel synthesis.

While much of the focus on carbon removals has been on DAC technologies, point-source carbon capture and storage (CCS) remains a significant part of the landscape. This method involves capturing CO2 directly from industrial sources such as power plants, cement factories, or steel mills. Despite being promoted by some as a crucial tool in the fight against climate change, point source CCS has faced considerable criticism and doubts about whether it’s effective and actually does what it claims to do.

Proponents of point-source CCS argue that it allows for a more gradual transition: they argue in favour of capturing CO2 from fossil fuel-powered facilities while working on newer technologies.

However, the reality belies these claims:

• Underperformance: Many point source CCS projects have failed to meet their capture targets. For example, the world’s largest CCS facility, Chevron’s Gorgon plant in Western Australia, located next to a natural gas facility of the same name, has underperformed by 50%+.

• High costs: Such projects are often extremely expensive. The costs for the Kemper project in Mississippi ballooned from an initial estimate of $3 billion to $7.5 billion before being shut down.

• Enhanced oil recovery: A significant portion of captured CO2 isn’t being used to fight climate change at all. Instead, it’s being used to retrieve more oil through a process called enhanced oil recovery (EOR).

The oil industry uses this technique to extract more oil from existing fields. The most common method involves injecting carbon dioxide into oil reservoirs, which mix with the oil, making it easier to extract.

The Institute for Energy Economics and Financial Analysis (IEEFA) says that enhanced oil recovery has historically been the dominant use of captured CO2. In recent years, about 73% of CO2 captured globally has been used for EOR.

Why does big oil like EOR so much? It makes economic sense. It can extract an additional 3060% from oil fields, prolong their life, and use existing infrastructure, ultimately saving these firms money.

• Fossil fuel industry involvement: As a result of all this, many of the most prominent players in CCS are fossil fuel giants. Often, they even receive public subsidies for these projects. For instance, the Petra Nova project in Texas received $195 million in U.S. Department of Energy grants. Meanwhile, the UK government has announced a £22 billion ten-year CCUS programme backed by the energy giants.

• Minimal impact: Even successful CCS projects may have a limited impact on overall emissions. In fact, critics claim they are a smokescreen, making it look like emissions are going down when the opposite happens. For example, the Sleipner project in Norway, often cited as a CCS success story, has potentially led to 25 times more CO2 emissions from burning refined gas than it has sequestered.

• Leakage risks: There are concerns about the long-term stability of underground CO2 storage. The In Salah project in Algeria was suspended due to concerns about the integrity of the seal and movements of trapped CO2.

Ultimately, while point source carbon capture may have a role to play in hard-to-abate industries like cement production, its application in the power sector and its close ties to enhanced oil recovery raise serious questions about its effectiveness as a climate solution. The high costs, technical challenges, and potential for misuse as a greenwashing tool suggest that point source CCS should be approached with caution and scepticism.

Source: Bloomberg

The viability of scaling carbon removal hinges largely on its cost, particularly for sectors like aviation seeking to decarbonise. While experts agree that prices will fall as the technology matures, they debate both the magnitude and timeline of these reductions.

Pulling CO2 out of the air using DAC technology is expensive right now. It costs between $600 and $1,000 to remove one metric ton of CO2.

To put this in perspective, one tonne is about the amount of CO2 produced by a roundtrip flight from New York to London for one passenger. Obviously, at that cost, only the super-rich like Bill Gates currently use carbon capture to offset their flights.

There are some positive signs, though. The price of DAC credits (essentially, paying someone else to remove CO2 for you) has been falling. In 2022, the average price was $1,261 per ton. By 2023, it had dropped to $715 per ton – a 43% decrease in one year.

Airlines have historically relied on traditional carbon offsets like reforestation, which often cost less than $10 per ton of CO2. Even premium forest offsets rarely exceed $50 per ton.

Some airlines offer passenger offset programs for just $1-2 per flight – though these low prices have drawn scepticism about their credibility.

The contrast is stark – with DAC costing up to 100 times more than conventional offsets, this price gap represents a major barrier to adoption in the industry.

Copyright Business Wire 2016

Published in the journal Joule, a recent study from the prestigious Swiss institute ETH Zurich examined the potential future costs of DAC. Their findings paint a more cautious picture than other predictions.

For liquid solvent DAC (which uses a special liquid to absorb CO2), they estimate costs could come down to about $341 per ton. But this would only happen once we remove a massive amount of CO2 – 1 billion tons per year. They predict costs of around $374

per ton at the same large scale for solid sorbent DAC (which uses solid materials to trap CO2). For CaO ambient weathering DAC, they estimate $371 per ton.

While lower than the current DAC costs, that’s obviously nowhere near the $100-$150 mark. There are several reasons why ETH Zurich has expressed caution when it comes to DAC pricing:

• Massive scale-up required: These technologies must be scaled up enormously to reduce costs significantly. The projections are based on removing 1 billion tons of CO2 annually, a quantum leap from current capabilities.

• Enormous energy demands: The energy demands of DAC are enormous. A single DAC system requires 1,500-2,650 kWh to capture just one ton of CO2 – equivalent to what an average American home uses over 2-3 months. For context, offsetting one U.S. person's annual carbon footprint (16 tonnes) through DAC would consume as much energy as dozens of households use in a year.

To put this in aviation terms: capturing a single ton of CO2 using DAC consumes roughly the same energy that 555 passengers use at a small or midsized airport annually – highlighting the massive scale of energy needed for meaningful carbon removal.

• The chicken-and-egg problem: There's a circular challenge at play. We need more DAC plants to bring costs down through economies of scale and technological learning. However, it's hard to justify building more plants while the costs remain high.

The ETH researchers argue that without major technological breakthroughs or very strong government support, DAC costs might not fall as quickly or as much as some hope. The energy requirements alone pose a significant hurdle to widespread adoption, especially at the scale needed to significantly impact global CO2 levels.

Source: Munich Airport

In contrast to the ETH study, a Milkywire climate transformation fund report paints a much more optimistic picture. This report is based on information from companies that are actually working on DAC technology.

The latest data shows DAC costs trending downward, with companies currently charging a median price of $530 per tonne of CO2 captured and stored. These companies project even steeper drops as they scale up operations – anticipating costs as low as $137 per tonne when handling millions of tonnes annually, with some forecasting prices down to $110 per tonne. Their optimistic outlook stems from expected technological advances and economies of scale.

So why do we see such different projections from these two reports?

• The ETH study is an academic analysis of the big picture and potential obstacles. The Milkywire report is based on the projections of companies in the field who may be more optimistic about overcoming challenges.

• DAC companies might be counting on breakthrough technologies or processes that the ETH researchers are more cautious about assuming.

• The ETH study looks at what might happen when we remove billions of tons of CO2 per year, which is a massive scale-up from where we are now. The DAC companies might focus on nearer-term goals at more minor (but still significant) scales.

For the aviation industry, these conflicting cost projections and technological uncertainties create a challenging planning environment. The future of carbon removal in aviation hinges on three critical areas.

First, the technology landscape remains highly uncertain, particularly regarding costs. While Direct Air Capture's viability depends on achieving significant cost reductions from current levels of $500+ per tonne to projected targets of $100-200, emerging alternatives like Direct Ocean Capture offer promising possibilities.

DOC could potentially provide lower-cost solutions by leveraging the ocean's natural CO2 absorption capacity and generating valuable byproducts like hydrogen for sustainable aviation fuels. This technological uncertainty requires airlines to maintain flexible sustainability strategies that can adapt to rapid developments and breakthrough technologies.

Second, airlines must approach this challenge strategically through careful planning and partnerships. Rather than betting on a single solution, carriers should build diverse carbon removal portfolios that balance risk and potential across multiple technologies. Strategic industry partnerships and targeted R&D investments could help tailor these technologies to aviation's unique needs, with geographic considerations helping determine the most effective mix of solutions for each airline.

For instance, carriers with significant coastal operations might find DOC more attractive, while those operating in regions with abundant renewable energy might lean towards DAC. These partnerships could also help airlines secure early access to carbon removal capacity, which could become crucial as demand grows.

Source: Aerospace Global News

Third, external factors will significantly shape the industry's carbon removal journey. Growing regulatory oversight and public pressure may justify the higher costs of verifiable carbon removal methods, especially as traditional offset programs face increased scrutiny over their effectiveness and permanence. Current offset prices of $3-50 per tonne are increasingly viewed as unrealistically low.

Government support, through policies like the U.S. 45Q tax credit offering up to $180 per tonne for DAC, will play a crucial role in making these technologies economically viable for widespread adoption. As international aviation emissions regulations tighten and carbon pricing becomes more prevalent, airlines that invest early in robust carbon removal strategies may gain a competitive advantage.

E-fuels have emerged as a promising solution for reducing carbon emissions in aviation without requiring significant changes to existing aircraft or infrastructure.

These synthetic fuels, produced by combining green hydrogen with captured CO2, offer a pathway to create drop-in replacements for conventional jet fuel. E-fuel production involves the following key steps:

• Carbon capture: CO2 is captured from various sources.

• Hydrogen production: Electrolysis, powered by renewable energy, splits water into hydrogen and oxygen.

• Synthesis: Captured CO2 and green hydrogen are combined to produce hydrocarbons, including jet fuel.

Currently, e-fuels can be five times more expensive than conventional Jet A fuel, primarily due to the cost of acquiring CO2 and H2 feedstocks. While hydrogen production challenges are beyond the scope of this report, the CO2 supply presents immediate concerns in terms of both cost and availability.

A comprehensive report by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping has highlighted a critical challenge in e-fuel production. The report estimates that the global supply of biogenic CO2 suitable for e-fuel production is only 320-370 million tonnes per year, far short of potential demand from hard-to-abate sectors like aviation and shipping. Key findings include:

• Supply vs. demand gap: The supply-demand dynamics of carbon dioxide for sustainable fuel production present significant challenges. Analysis reveals that the global supply of biogenic CO2 falls drastically short of future needs. Even if entirely dedicated to maritime use, current biogenic CO2 supplies could only decarbonise 43% of today's shipping fleet.

The aviation sector's ambitions are even more challenging—its goal to transition half of its fuel to e-fuels by 2050 would require 450-500 million tonnes of CO2 annually, exceeding the world's entire biogenic CO2 supply.

• Cross-industry competition: The competition for this scarce resource extends beyond transportation. Multiple sectors, including road transport, chemical manufacturing, and steel production, are vying for the same limited CO2 supply. This competition will intensify as the aviation and maritime industries continue their projected growth trajectories, further widening the gap between CO2 supply and demand for e-fuel production.

• Infrastructure and environmental constraints: Adding to these challenges are geographical and practical constraints. Biogenic CO2 sources are concentrated in specific regions, creating potential logistical bottlenecks and geopolitical tensions. Any attempt to increase supply through expanded bioethanol production raises serious environmental concerns, particularly around land use.

The mismatch between available biogenic CO2 and potential demand underscores the urgent need to develop and scale up alternative CO2 capture technologies. Rapid innovation is being driven by the urgent need identified in reports like the Maersk study.

Brineworks: Developed a novel seawater CO2 extraction method, claiming potential costs below $100 per tonne.

Equatic: Developing DOC systems producing hydrogen as a byproduct.

Advanced DAC technologies: Climeworks’ third-generation technology, which will be deployed in Louisiana, will be twice as efficient in capturing CO2 while cutting energy use in half.

The limited supply of biogenic CO2 underscores the critical need for developing and scaling diverse CO2 capture technologies. A mix of methods will likely be necessary to meet e-fuel production demands for aviation and other sectors.

The aviation industry must monitor and potentially invest in these developing technologies to ensure a sufficient and sustainable CO2 supply for e-fuel production. Policymakers need to carefully consider how to regulate and incentivise different CO2 capture methods to support the transition to sustainable aviation fuels while ensuring genuine carbon neutrality.

Several airlines, as well as Airbus and Boeing, have made a series of announcements and investments in the carbon removals space.

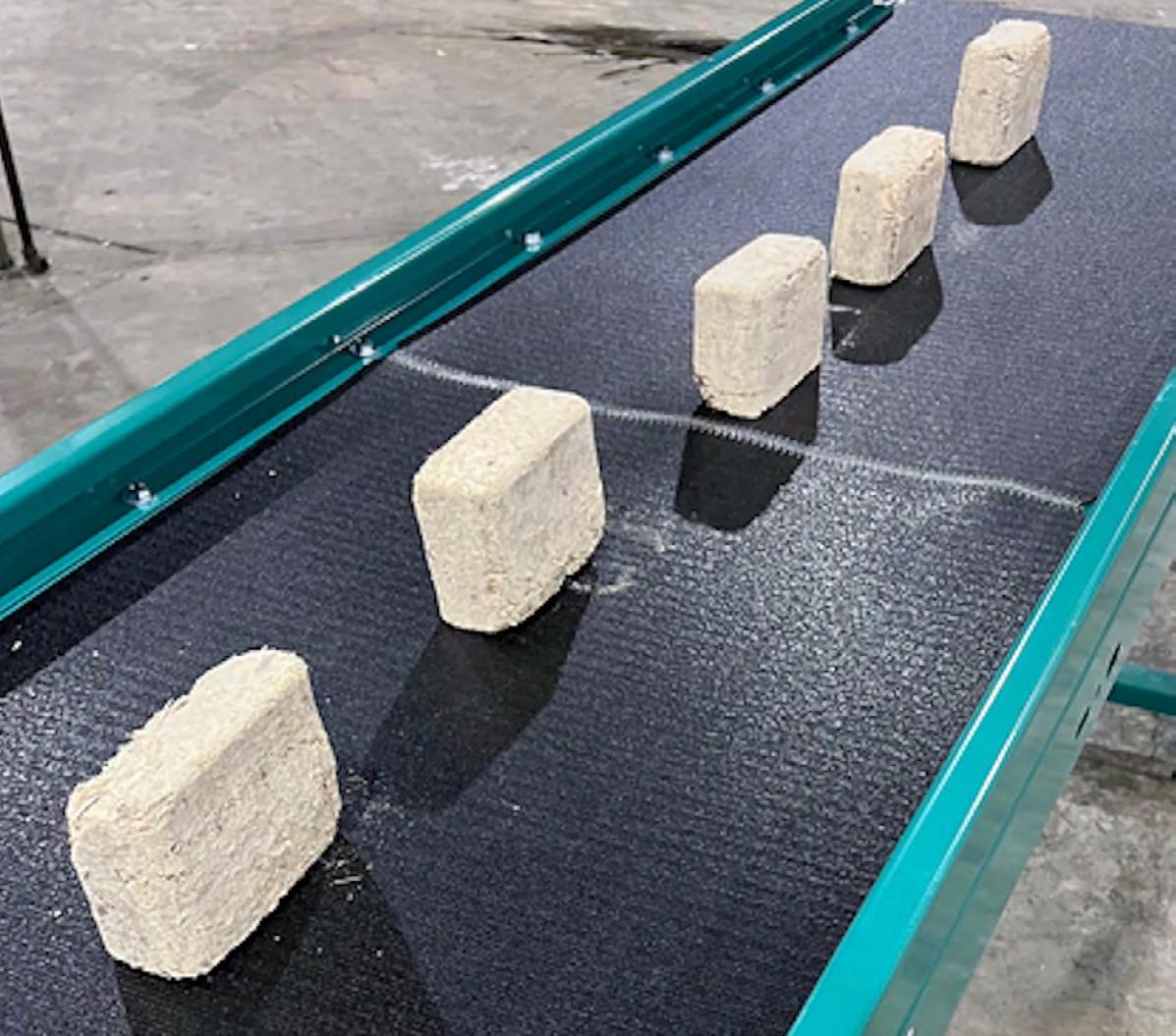

In late 2023, the airline announced a partnership with Graphyte, a carbon removal startup backed by Breakthrough Energy Ventures. American agreed to purchase credits equivalent to 10,000 tons of carbon removal, to be delivered in early 2025. Graphyte uses an innovative "carbon casting" process that converts plant byproducts from agriculture and timber industries into carbon-dense bricks. These bricks, which have absorbed carbon dioxide through photosynthesis, are then sealed and stored underground to prevent decomposition and carbon release.

British Airways has also made significant commitments in the carbon removal space. In September 2024, the airline announced a deal to purchase more than £9 million worth of carbon removal credits over six years. It positioned itself as the largest purchaser of carbon removals in the UK and the largest airline purchaser globally. The airline is working with CUR8, a UK-based company specialising in sourcing highquality carbon removal credits, to build a diverse portfolio of projects. These projects include capturing CO2 emissions from whisky distilleries in Scotland and repurposing them into building materials, enhanced rock weathering techniques to lock away carbon, reforestation efforts in Scotland and Wales, and international projects such as carbon capture from rivers and oceans in Canada and a biochar project in India. British Airways has also purchased credits from Climeworks, which operates DAC plants in Iceland,

Source: GreenAir News

and 1PointFive, a U.S.-based company developing a DAC plant in Texas.

Like American Airlines, British Airways sees carbon removal as an essential part of its pathway to net-zero emissions by 2050. The airline expects that roughly onethird of its emissions reductions by 2050 will come from carbon removals, with the rest coming from improvements in aircraft technology, operational efficiencies, and sustainable aviation fuels.

British Airways is not the only airline customer of Climeworks. Earlier this year, the company announced a partnership with Swiss International Air Lines (SWISS) and the Lufthansa Group. The partnership involves a long-term carbon removal agreement extending initially until 2030, with the option to extend and purchase additional carbon removal volumes in the future. As part of the Lufthansa Group, SWISS will use Climeworks' direct air capture and storage technology to address unavoidable CO2 emissions.

United Airlines

In 2023, the airline announced that it was investing $5 million in Svante, a carbon capture technology company. Svante's technology uses structured absorbent beds, or "filters," to capture CO2 from industrial sites and the air. The captured CO2 can then be used to create sustainable aviation fuel or safely stored underground.

United sees this investment as part of a strategy to reduce its own emissions and help scale up carbon removal technologies that could benefit the entire aviation industry. The airline has set ambitious goals to reduce its greenhouse gas emissions by 100% by 2050 without relying on traditional carbon offsets.

Source: United Airlines

Source: Equatic

Equatic's technology uses electrolysis to split seawater into hydrogen and oxygen. Then, atmospheric air is passed through the processed seawater to trap CO2 in solid minerals and dissolved substances. This approach aims to provide a precise accounting of CO2 removal while producing hydrogen that can be used in various applications, including powering the removal process.

Airbus Boeing has also entered the carbon removal arena. In May 2023, Boeing announced a deal with Equatic, a startup spun out of UCLA that combines carbon dioxide removal using seawater with hydrogen production. The agreement allows Boeing to purchase 62,000 metric tons of CO2 removal and 2,100 metric tons of "carbon-negative" hydrogen, which the company sees as a potential feedstock for cleaner jet fuel.

Airbus has launched its carbon removal initiative, the Airbus Carbon Capture Offer (ACCO). This service, developed in collaboration with 1PointFive, uses DACCS technology to offer carbon removal credits to airlines worldwide. Several major airlines, including Lufthansa, Air France-KLM, and easyJet, have signed up for this initiative.

A critical factor in the growth of CDR space is that governments worldwide recognise the need to support different technologies, including DAC. The United States and Canada have emerged as leaders in this field, implementing significant policy measures to accelerate the development and deployment of CDR technologies.

In August 2022, the United States passed the Inflation Reduction Act (IRA), marking a watershed moment for climate action and CDR technologies. The IRA significantly enhances the existing 45Q tax credit, which has been a cornerstone of U.S. policy support for carbon capture and storage since 2008.

Key features of the IRA's support for CDR include:

• Increased tax credits: The 45Q credit for DAC has been raised to $180 per metric ton of CO2 permanently stored.

• Lower eligibility thresholds: Projects only need to capture 1,000 metric tons of CO2 annually to qualify, down from previous thresholds of 100,000 tons for industrial facilities and 500,000 tons for power plants.

• Extended timeline: The project deadline to begin construction has been pushed from 2026 to 2033, providing more time for project development.

• Direct pay option: Tax-exempt entities can now receive the credit directly, expanding the pool of potential project developers.

In June 2023, Canada passed Bill C-59, establishing the Carbon Capture, Utilization, and Storage (CCUS) Investment Tax Credit. The policy aims to support the growth of CDR technologies in Canada, focusing on industrial-scale projects.

Key aspects include:

• Generous tax credits: DAC projects are eligible for a 60% tax credit on capital investments, while CO2 transport and storage equipment qualifies for a 37.5% credit.

• Provincial boost: In Alberta, companies can receive an additional 12% credit, bringing the total potential credit to 72% of capital expenses. Note that Alberta is a centre of the oil and gas industry, so projects here tend to be point-source carbon capture.

• Extended timeline: The credit applies to projects beginning construction before 2040, with rates decreasing by half from 2031 to 2040.

• Targeted approach: The policy focuses on supporting large-scale industrial projects, particularly in sectors like oil and gas, cement, and steel production.

Unlike the U.S. IRA, which provides ongoing operational support through production tax credits, Canada's approach emphasises reducing upfront capital costs. This strategy may be particularly beneficial for new technologies and first-of-a-kind projects that face significant initial investment hurdles.

Source: Jason Franson/Bloomberg

While the U.S. and Canada are at the forefront of CDR policy support, other countries are also taking steps to encourage the development of these technologies:

Source: Institute for Agriculture & Trade Policy

United Kingdom: The UK government has announced a £22 billion programme to support point-source carbon capture and blue hydrogen production.

European Union: The EU is developing a Carbon Removal Certification Framework and has included CDR in its Innovation Fund, which supports lowcarbon technologies.

Norway: The country has been a pioneer in carbon capture and storage, with its $2.8 billion Longship project receiving significant government funding.

CDR technologies present both promising opportunities and significant challenges for the aviation industry in its quest for decarbonisation. CDR's potential to contribute to net-zero goals is clear, but numerous technical, economic, and ethical considerations exist.

The aviation sector's interest in CDR is twofold: as a crucial component in e-fuel production and as an alternative to controversial carbon offsetting programs.

However, the path to scaling carbon removal faces several significant obstacles. Biogenic CO2 supply falls far short of projected demand from aviation and shipping, as highlighted by the Mærsk Mc-Kinney Møller Center. While DAC offers potential, its high energy requirements

and costs – currently too expensive for widespread adoption – remain major hurdles.

Adding to these challenges are concerns about the climate benefits of certain applications, particularly when captured CO2 is used for Enhanced Oil Recovery. These technical, economic, and ethical challenges create significant uncertainty for industry planning and investment.

Source: Mærsk Mc-Kinney Møller Center

Aviation's path to net-zero emissions will likely require a mix of carbon removal solutions. This includes advancing DAC technology for better efficiency, exploring promising alternatives like Direct Ocean Capture, maintaining strategic investments in nature-based solutions, and linking carbon removal directly to sustainable aviation fuel production.

Finally, developing and deploying CDR technologies at the required scale will not happen without significant policy support and investment. Governments and regulatory bodies must play a crucial role in:

• Setting clear, long-term targets for emissions reductions in aviation

• Providing financial incentives for CDR development and deployment

• Establishing robust frameworks for measuring and verifying carbon removal

• Ensuring that CDR complements, rather than replaces, efforts to reduce emissions at source

Private investment will also be crucial, with airlines, fuel producers, and technology companies all playing roles in driving innovation and scale.

The evolution of carbon removal in aviation will likely be shaped by several key factors. Potential breakthroughs in materials science and engineering could substantially lower DAC costs, while stricter emissions regulations and carbon pricing could improve economic viability. Meanwhile, shifting consumer and investor priorities toward sustainability may accelerate adoption. The success of these developments will be significantly influenced by international climate cooperation and policy alignment.

The path to net-zero emissions is challenging, but CDR technologies offer a potential way forward. However, these technologies are not a panacea and must be part of a broader strategy that includes efficiency improvements, sustainable fuel development, carbon pricing, operational improvements, the development of new propulsion systems, and fundamental changes to how we approach air travel.

Source: Climeworks

We’ve identified twelve innovative companies in the carbon removal space.

Based in: Oman

CEO: Talal Hasan

Website: 4401.earth

44.01 turns CO2 into rock through mineralisation. The company, founded in 2020 in Oman, gets its name from the molecular mass of carbon dioxide, which is – you guessed it –44.01.

The company's technology accelerates a natural process that typically takes hundreds or thousands of years, reducing it to under 12 months. Their process involves dissolving captured CO2 in water (creating what they describe as a type of "sparkling water") and injecting this mixture deep underground into peridotite rock formations. When the carbonated water contacts the rock, it triggers a chemical reaction that permanently transforms the CO2 into solid carbonate minerals.

Source: 44.01

The technology operates like oil and gas exploration in reverse - instead of extracting hydrocarbons, it puts CO2 back into the subsurface. The fluid is denser than subsurface water, preventing it from returning to the surface. Underground conditions of increased pressure and temperature, combined with the high CO2 concentration in the injection fluid, enable rapid mineralisation. The company uses various geochemical and geophysical monitoring techniques to confirm successful mineralisation.

In July 2024, 44.01 secured Series A funding of $37 million, led by Equinor Ventures and UAE-based Shorooq Partners. The company has attracted an impressive roster of investors, including Amazon's Climate Pledge Fund, Breakthrough Energy Ventures, Air Liquide Venture Capital, Siemens Financial Services, Climate Investment, and Sam Altman's Apollo Projects.

Key differentiating factors

• Safety: The process has no adverse impact on the local environment or water sources

• Permanence: Once mineralised, the CO2 cannot escape back into the atmosphere

• Scalability: Peridotite formations exist on every continent, offering potential for global deployment

• Cost-effectiveness: Limited ongoing costs after mineralisation

Commercial feasibility

44.01 has already completed successful pilot projects in Oman and the UAE. In December 2023, the company launched a project in Fujairah, UAE, in partnership with Adnoc, Masdar, and Fujairah Natural Resources Corp.

The pilot uses DAC to capture CO2 from the atmosphere. The whole process is powered by clean solar energy from Masdar.

This project marked two firsts: the first mineralisation project in the UAE and the first peridotite mineralisation project to use seawater for CO2 injection.

Future

Looking ahead, 44.01 is scaling up its operations significantly. The company has partnered with Air Capture to develop Project Hajar in Oman's Hajar mountains. This project will be their most significant to date, with the project's potential was recognised when it was named among the finalists for the XPRIZE Carbon Removal competition in May 2024.

CEO: Gudfinnur Sveinsson

Based in: Netherlands Website: brineworks.tech

Brineworks, a Dutch startup, has developed a seawater electrolyser that powers a Direct Ocean Capture (DOC) system.

Technology

The process works by splitting seawater into acid and base streams. The acid lowers the seawater's pH, releasing CO2 as a gas, while the base stream later neutralises the pH. This method takes advantage of the ocean's vast capacity to absorb atmospheric CO2, which is about 50 times more than the atmosphere.

Read our detailed interview with Brineworks CEO Gudfinnur Sveinsson at Sustainability in the Air

What makes Brineworks' approach particularly promising is its potential costeffectiveness. While current DAC methods cost between $230-835 per tonne of CO2, Brineworks believes it can eventually achieve costs below $100 per tonne with its latest electrolyser version. This could be significant for the aviation and maritime industries, where cost-effective CO2 capture is crucial for e-fuel production.

The company has made significant progress since its founding, having already built and tested its electrolyser with actual seawater at a test facility in Gran Canaria. In June 2023, Brineworks secured $2.2 million in pre-seed funding, led by Nordic VC firm Pale Blue Dot, with First Momentum Ventures and Nucleus Capital also participating.

Key differentiating factors

The technology offers several key advantages:

• Vast resource availability: Oceans cover 71% of Earth's surface

• Consistent supply: Ocean CO2 concentrations remain relatively stable

• Flexible location options: Can be placed near renewable energy sources

• Minimal land use: Unlike biogenic sources, doesn't compete with agriculture

• Dual output: Produces both CO2 and green hydrogen, key components for e-fuel production

Brineworks plans to establish a pilot plant to extract CO2 from seawater next year, though the location is still being determined. The company aims to roll out its technology globally over the next 10-15 years, with scaling largely dependent on regulatory frameworks around point source capture and sustainability criteria for e-fuels in the aviation and maritime sectors.

Source: Brineworks

Their vision is particularly compelling: enabling any coastal nation to produce sustainable fuel from seawater, requiring only seawater and renewable energy. This could enhance both aviation and maritime fuel production while supporting global decarbonisation efforts.

Based in: Switzerland / Iceland

CEO: Dr. Christoph Gebald and Dr. Jan Wurzbacher

Website: climeworks.com

If there is one carbon removals company that people outside the industry have heard of, it is Climeworks. That’s because the Swiss firm operates the world's largest DAC facility, with its newest plant, Mammoth, having started operations in Iceland in May 2024. The facility is designed to capture up to 36,000 tons of CO2 annually, representing a tenfold increase in capacity from their previous facility, Orca.

Technology

The company's direct air capture process begins with large industrial fans drawing atmospheric air through filters containing specialised sorbent materials that bind with CO2. Once these filters reach saturation, they're heated with steam to release the concentrated CO2. This captured gas is then combined with water and injected deep underground, where it reacts with basaltic rock and mineralises within approximately two years, according to the company.

Key differentiating factors

In June 2024, Climeworks announced their Generation 3 technology, claiming significant improvements in efficiency and cost-effectiveness.

Source: Climeworks

The new system reportedly doubles CO2 capture capacity per module while halving energy consumption. The design has shifted from rectangular container stacks to a cube-shaped structure, which the company states optimises air flow and space usage. These improvements are part of Climeworks' effort to reduce capture costs from current levels of approximately $500-1,000 per ton to between $250-350 by 2030.

The company powers its Iceland operations with geothermal energy from a neighbouring power plant. Moreover, Climeworks has partnered with Carbfix for the storage component of their operation, utilising Iceland's volcanic geology for permanent CO2 storage.

Climeworks has secured several major commercial agreements. Corporate clients include Microsoft, H&M, JP Morgan Chase, Shopify, and Lego. In the airline space, Climeworks works with the Lufthansa Group and British Airways.

Since its founding 15 years ago, Climeworks has raised approximately $810 million in funding. Further, the U.S. Department of Energy has designated up to $600 million in funding for Climeworks' American projects. The company maintains a research and development team of 180 people and has established itself as one of the leading companies in the direct air capture sector.

Looking ahead, Climeworks has set targets to reach megaton capacity by 2030 and gigaton capacity by 2050. The company's expansion plans include several significant projects beyond Iceland, for example it is part of Project Cypress in Louisiana, a DAC hub that aims to remove over one million tons of CO2 annually when completed. Climeworks is also developing projects in North Dakota, California, Norway, Kenya, and Canada.

Source: Climeworks

Based in: USA / Singapore

CEO: Gaurav Sant

Website: equatic.tech

Equatic uses seawater electrolysis to simultaneously remove CO2 and produce green hydrogen. The company emerged from UCLA's Institute for Carbon Management and has attracted significant attention for its potential to deliver carbon removal at scale while generating clean energy.

Technology

At the heart of Equatic's technology is an innovative seawater electrolysis process that splits seawater into acid and base streams without producing harmful chlorine - a longstanding challenge in the field.

The Secret of Seashells and How They Could Save Our Ocean

Source: The Earthshot Prize

The process begins by using renewable energy to apply an electric current through ocean water and an electrolyser, splitting the water into green hydrogen and oxygen. Atmospheric air is then passed through the processed seawater, where CO2 is captured as dissolved bicarbonate ions and solid mineral carbonates. The system maintains neutral water composition by dissolving alkaline rocks before safely returning the processed water to the ocean.

Read our detailed interview with Equatic COO Edward Sanders at Sustainability in the Air

A key breakthrough in their technology is the development of oxygen-selective anodes (OSAs) manufactured in San Diego, California. These anodes feature specially designed catalysts that don't react with seawater's salt content, allowing for safe hydrogen generation while avoiding chlorine production. The anodes are highly durable, requiring only a new catalyst coating every three years to maintain performance for decades.

Equatic's approach has numerous advantages. Rather than requiring scarce freshwater resources, its system uses abundant seawater and can operate wherever there's a coastline and renewable energy. The process doesn't require specific geological formations or CO2 pipelines, and its modular design allows for systematic expansion. The energy requirements are relatively modest at 1.4-megawatt hours per tonne of CO2 removed, and the carbon storage in carbonates is permanent.

What sets Equatic apart is its dual-revenue stream model, generating income from both carbon removal credits and green hydrogen production, which helps subsidise carbon removal costs. The company has secured significant backing and partnerships, including funding from the U.S. Department of Energy's ARPA-E, partnerships with Singapore's National Water Agency and Deep Sky for North American expansion, and support from the Chan-Zuckerberg Initiative and Boeing. Their innovation was recently recognised as a TIME "Best Invention of 2023."

Source: Equatic

An offtake agreement signed with Boeing commits Equatic to removing 62,000 metric tons of carbon dioxide and delivering 2,100 metric tons of carbon-negative hydrogen to Boeing over a period of more than five years, beginning in the mid-2020s. This deal, reported to be substantially larger than other corporate carbon capture agreements (such as Climeworks' 25,000-tonne contract with JP Morgan), aligns with Boeing's "SAF&" strategy for industry decarbonisation, which includes hydrogen as a crucial component of e-fuels.

Equatic is rapidly moving from pilot to commercial scale. Their current Los Angeles and Singapore pilot facilities remove about 100 kilograms of CO2 and produce several kilograms of hydrogen daily.

The company's new Singapore demonstration plant (Equatic-1) will significantly increase capacity and capture 3,650 metric tonnes of carbon annually.

Even more ambitious is their planned commercial facility in Quebec, which aims to remove 109,500 tonnes of CO2 and generate 3,600 tonnes of green hydrogen annually by 2026. The company expects to achieve costs below $100 per tonne of CO2 removed before 2030 through these developments.

CEO: Dr Luke Marshall and Mac Thompson

Based in: Australia Website: fugu.energy

Fugu Carbon, an Australian startup founded by Mac Thompson and Dr. Luke Marshall, is approaching carbon capture and recycling through its solid direct air capture (S-DAC) technology.

Operating from its R&D facility in Glebe, Sydney, Fugu has developed what it calls "Fizzmakers" – shipping container-sized machines designed to extract CO2 from the atmosphere.

The company recently secured $1.7 million in seed funding led by Investible, with participation from Jelix Ventures, Electrifi Ventures, and London-based carbon removal specialist Counteract.

Source: Fugu

Fugu believes that what sets its approach apart is its focus on mass manufacturability and cost-effectiveness. The machines are built using mass-manufactured parts and incorporate solid sorbent filters that can be upgraded as technology advances. The technology is designed to work in conjunction with renewable energy sources, utilising excess solar and wind power when available. This approach helps keep operating costs low while ensuring the carbon capture process itself remains environmentally friendly.

In an investment note, Ben Lindsay from Investible said that Fugu particularly stood out because it met their key investment criteria for S-DAC systems: quick deployment capability, leverage of existing supply chains for appropriate economics, and the ability to incorporate future innovations in adsorbents.

Lindsay described Fugu as "the Westinghouse of S-DAC," referring to their ability to use currently available components at industrial scale, and likened their upgradeable design

to a "Nintendo 64" that could swap in new adsorbents as they become available.

Moreover, the founders bring significant expertise from their previous roles at Sun Cable, where Marshall served as CTO and Thompson as COO, working on one of the world's largest solar farm projects. This experience of scaling massive renewable energy infrastructure is particularly attractive to investors.

The company's ambitious vision is to produce 2,000 machines annually at manufacturing facilities located in major carbon markets around the world. Their ultimate goal is to achieve the removal of one gigatonne (1 billion metric tonnes) of CO2 from the atmosphere annually by 2032. Crucially, Fugu aims to bring down the cost of carbon capture to make green CO2 price-competitive with fossil-derived alternatives. Fugu plans to sell the captured CO2 to various industries, including chemicals, beverages, pharmaceuticals, and the emerging sustainable aviation and maritime fuel sector.

CEO: Barclay Rogers

Based in: Arkansas, USA Website: graphyte.com

Through its "Carbon Casting" technology, Arkansas-based Graphyte claims to offer a durable, affordable, and immediately scalable carbon removal solution.

Rather than using energy-intensive direct air capture methods, Graphyte leverages nature's existing carbon capture mechanism – photosynthesis – and then prevents the captured carbon from re-entering the atmosphere.

The Carbon Casting process begins with collecting biomass by-products from timber and agriculture industries, then drying this material to eliminate microbes and halt decomposition. The processed biomass is condensed into dense blocks and wrapped in an environmentally safe, impermeable barrier before being stored and monitored in state-ofthe-art underground sites.

In July 2024, Graphyte secured substantial backing with a $30 million Series A funding round, co-led by Prelude Ventures and Carbon Direct Capital, with participation from Bill Gates' Breakthrough Energy Ventures and Overture. This investment fuels an aggressive expansion plan, with four additional carbon removal facilities planned for 2025 and 2026.

Graphyte says that its approach to carbon removal has enabled it to achieve remarkable cost efficiencies. It can achieve $100 per carbon tonne, far undercutting competitors who typically charge between $600 and $1,000 per tonne.

This pricing advantage stems partly from the capital efficiency of their approach, with new plants costing approximately $10 million to build, compared to the billion-dollar investments required for other carbon capture technologies.

American Airlines became its inaugural customer in November 2023, committing to purchase 10,000 tons of permanent carbon removal for delivery in early 2025. This partnership supports American Airlines' goal of reaching net-zero emissions by 2050. The company has also recently expanded its market reach by launching an online platform for carbon removal credits, making them available to individuals and small businesses. This initiative runs alongside their participation in the U.S. Department of Energy's Carbon Dioxide Removal Purchase Pilot Prize program.

The company's Loblolly Project facility began operations in early 2024 and represents a significant step forward in carbon removal capacity. Graphyte says it could become the world’s largest carbon removals plant.

Starting with an initial target of 15,000 metric tons of CO2 removal in its first year, the facility aims to reach 50,000 metric tons annually by early 2025. Looking further ahead, Graphyte has set an ambitious goal of removing 5+ million tons annually by 2030.

Based

in: California, USA

CEO: Shashank Samala

Website:

heirloomcarbon.com

Heirloom leverages limestone's natural properties to remove CO2 from the atmosphere. Operating North America's first commercial DAC facility, the company has pioneered an approach that accelerates natural carbon capture processes while securing major partnerships with industry leaders.

At the heart of Heirloom's technology is limestone, one of the world's most abundant and inexpensive minerals, containing approximately 50% CO2 by composition. The company's process begins by extracting CO2 from limestone using renewable energypowered electric kilns, creating calcium oxide that acts like a sponge for atmospheric CO2. This material is spread on vertically stacked trays where it pulls CO2 from the air before being returned to the kiln to restart the cycle. The captured CO2 is then permanently stored either underground or in concrete, ensuring long-term removal from the atmosphere.

Source: Heirloom

This approach has attracted support from prominent investors, including Bill Gates' Breakthrough Energy Ventures, Microsoft's Climate Innovation Fund, and several other leading climate-focused investment firms.

Under the leadership of CEO Shashank Samala, Heirloom has implemented what it calls "high-road" principles. These include ensuring their technology isn't used as cover for increased emissions, maintaining robust measurement and verification systems, providing strong worker protections, and creating meaningful community benefits agreements. The company's commitment to sustainability extends to its operations, with all facilities powered by renewable energy.

Heirloom's approach has attracted significant commercial interest, exemplified by its landmark agreement with Microsoft to remove up to 315,000 metric tons of CO2 over multiple years. The company has also formed strategic partnerships with CarbonCure for concrete storage solutions and Leilac for electric kiln technology, demonstrating its commitment to developing a comprehensive carbon removal ecosystem.

The company’s initial commercial facility in Tracy, California, removes 1,000 metric tons of CO2 annually.

In a significant expansion announced in June 2024, Heirloom unveiled plans for two major facilities in Northwest Louisiana. The first facility, scheduled to begin operations in 2026, will capture 17,000 tonnes annually, while the second facility, part of Project Cypress, aims to remove 300,000 tonnes per year starting in 2027.

Based in: Knoxville, Tennessee

CEO: Anca Timofte

Website: theholocene.co

Holocene is a DAC startup based in Knoxville, Tennessee that has developed a unique approach to removing carbon dioxide from the atmosphere.

Technology

The company says that a distinctive four-step process sets it apart from other DAC solutions:

• Step 1: CO2 absorption: Creates a man-made waterfall containing amino acids, where CO2 is captured from passing air into a water solution

• Step 2: Solid formation: Concentrates CO2 by mixing the amino acid solution with a guanidine solution to form solid crystals

• Step 3: Solid-liquid separation: Separates the CO2-containing solids from the liquid, allowing the amino acids to be recycled

• Step 4: Regeneration: Applies low-temperature heat from renewable sources to release pure CO2 for permanent underground storage

Funding

The company has received support from various organisations, including LaunchTN, the Department of Energy, and Breakthrough Energy Fellows.

Key differentiating factors

What makes Holocene's approach particularly innovative is its efficiency and scalability. The system operates at ambient temperatures, requires no solvents or hazardous materials, and uses only widely available industrial equipment. In May 2024, the company demonstrated its first industrial pilot facility, showing an impressive 80% capture rate and the ability to reduce atmospheric CO2 from 450 parts per million to less than 90 parts per million.

Source: Holocene - Climate Corporation

The company's approach addresses several key challenges in the DAC industry:

• Cost efficiency by targeting $100 per ton, significantly lower than current industry standards;

• Using low-temperature heat from renewable sources for energy efficiency;

• Ensuring scalability through the use of commonly available materials and equipment;

• Prioritising environmental safety by operating without hazardous materials or waste.

Founded in 2022, the company has quickly established itself as a promising player in the carbon removal industry, culminating in a landmark $10 million agreement with Google in September 2024 to deliver carbon removal credits at $100 per ton - the lowest price on record for DAC technology, and the benchmark that is usually used for when DAC becomes commercially competitive.

The company has gained significant recognition and support from major players in the climate technology space. Beyond the Google agreement, Holocene has secured a purchase agreement with Frontier Climate (backed by Stripe, Shopify, and H&M Group) and was selected as one of 25 direct air capture companies named to the XPRIZE Top 100 Teams in their Carbon Removal competition.

Holocene's pilot facility in Tennessee demonstrates the company's rapid scaling capabilities – achieving a 100,000-times scale-up in less than 12 months, from beakerscale technology to an industrial facility with approximately 10 tonnes of CO2 per year capacity. The company aims to begin delivering carbon removal services in the early 2030s.

Based in: Netherlands / Namibia

CEO: Daniel Hooft

Website: kelp.blue

Kelp Blue represents an ambitious attempt to harness the ocean's natural carboncapturing potential through the cultivation of giant kelp forests. Founded by former oil executive Daniel Hooft, who left the fossil fuel industry seeking to make a positive impact on climate change, the company has established its first operations in the cold, nutrientrich waters off Namibia's coast.

The company's approach to carbon capture centres on the giant kelp, which can grow up to two feet per day, reaching lengths of 164 feet.

Unlike traditional carbon capture technologies, this nature-based solution leverages the kelp's natural ability to absorb CO2 through photosynthesis. What makes kelp particularly effective is that when pieces break off and sink into the deep ocean, they can sequester carbon for centuries – essentially replicating the same process that created oil fields millions of years ago.

Currently, they operate a 35-hectare test farm, but the potential for expansion is significant. The company has attracted serious attention from investors, including a $2 million investment from De Beers Group, which sees the project as a way to offset its own carbon emissions.

What sets Kelp Blue's approach apart is its location strategy. They chose Namibia after extensive research into ideal growing conditions.

The area benefits from the Benguela Current, which is twice as productive as the Chile current and nine times more productive than the California current. This cold, nutrient-rich water creates perfect conditions for kelp growth, and importantly, the location is expected to remain viable even as ocean temperatures rise globally. Rather than creating vast, unbroken stretches of kelp forest, the company

Source: Kelp Blue

Source: Kelp Blue

takes inspiration from nature, creating patches of kelp forest that mimic natural ecosystems. Their approach involves attaching kelp to "reef blocks" on the ocean floor in shallower waters and using screw anchors in deeper areas. This infrastructure has shown remarkable results in terms of biodiversity, with the number of species in their first farm area increasing from 140 to approximately 900 in just months.

The carbon capture potential of kelp forests extends beyond direct sequestration. The company processes harvested kelp into biostimulants for agriculture, which can help improve soil health and increase carbon storage in farmland. They're also developing sustainable alternatives to carbon-intensive products like leather, potentially creating additional carbon benefits through the displacement of highemission traditional products.

The scale of Kelp Blue's ambition is substantial. By 2029, they aim to remove over 1 million tons of CO2 annually through 70,000 hectares of giant kelp farms located 30-100 kilometers offshore from Lüderitz, Namibia.

While carbon capture is a primary goal, the project delivers multiple co-benefits: creating sustainable products, boosting marine biodiversity, and providing economic opportunities in coastal communities. In Namibia alone, they expect to create over 400 direct jobs and support 800-1,000 indirect jobs in a region previously dependent on declining diamond mining and fishing industries.

Kelp Blue's vision extends globally, with plans to expand to New Zealand and Alaska. The company is investing in technology to scale its operations, including the development of a solar-powered robotic harvester that can efficiently trim the kelp canopy while leaving the main plant intact to continue growing and sequestering carbon.

The project has attracted attention from carbon removal experts and competitions, including being named a finalist in the X Prize for carbon removal. While achieving gigaton-scale carbon removal – removing a billion metric tons of CO2 annually – would require hundreds of millions of hectares of kelp farms, the company sees this as technically possible through a distributed network of smaller farms.

CEO: Dr Nicholas Chadwick

Based in: London, UK Website: missionzero.tech

Mission Zero Technologies is a London-based startup aiming to pioneer a new approach to DAC. Founded in 2020, the company has developed an electrochemical technology that captures CO2 directly from the atmosphere using a modular, energy-efficient system.

The company's technology is inspired by biological processes that manage CO2 in the body and operates through a four-step process: first, fans pull in atmospheric air; second, the carbon is dissolved in a water-based solvent; third, electrodialysis releases the carbon from the solvent as a gas; and finally, pure CO2 is produced ready for either sustainable use or permanent removal.

Source: Mission Zero Technologies

In March 2024, Mission Zero secured £21.8 million in Series A funding led by 2150, with participation from World Fund, Fortescue, Siemens Financial Services, and Breakthrough Energy Ventures. This funding will help accelerate the development of their next-generation system, designed to capture 1,000 tonnes of CO2 annually, with aims to scale to megatonne capacity by decade's end.

Mission Zero’s DAC systems are designed to be modular, fitting into standard shipping containers for easy transport and installation. The technology requires only electricity and water to operate, making it highly flexible in terms of location and scale. Unlike other DAC technologies that require high temperatures, Mission Zero's electrochemical process uses 3-5 times less energy than established alternatives.

The company has three significant projects underway:

• University of Sheffield (UK): Their first operational plant, deployed in December 2023, captures 50 tonnes of CO2 annually and is being used to pioneer SAF production.

• O.C.O Technology (UK): A 250-tonne capacity system scheduled for 2024 deployment in Norfolk, focusing on creating carbon-negative building materials.

• Deep Sky (Canada): Another 250-tonne system is being deployed in Alberta, aimed at permanent carbon storage through mineralisation.

The company is targeting aggressive cost reductions, aiming to be competitive with commodity CO2 sources, with a target price of less than $300 per tonne by 2026. Their technology has already demonstrated significant cost improvements, with the cost of their latest system showing a 60% reduction compared to their first deployment.

CEO: Martin Freimüller

Based in: Kenya Website: octaviacarbon.com

Octavia Carbon, a Kenyan cleantech startup founded in 2022 is pioneering DAC technology in East Africa.

Source: 3BL Media

The technology works by using machines to filter CO2 directly from the atmosphere. The captured CO2 is then liquefied and injected into the porous basalt of Kenya's Rift Valley, where it gradually mineralises into solid rock, providing a permanent storage solution. This process helps combat climate change by reducing excess CO2 in the atmosphere, which contributes to ozone layer depletion and increased UV radiation.

Read our interview with CEO Martin Freimüller at Sustainability in the Air.

The company recently secured $5 million in seed funding to develop its DAC storage plant, positioning itself as one of only 18 companies globally building machines specifically for DAC technology.

The funding round was co-led by Lateral Frontier and E4E Africa, with participation from Catalyst Fund, Launch Africa, Fondation Botnar, and Renew Capital. This investment will help accelerate the deployment of Project Hummingbird, which will be the first DAC+Storage project in the Southern Hemisphere, making Octavia the second DAC company globally to inject CO2 underground and offer DAC+Storage carbon credits.

What makes Octavia Carbon unique is its strategic location in Kenya, which Freimüller describes as "the world's best place for direct air capture." The company capitalises on Kenya's abundant geothermal resources, with the country being the world's secondlargest producer of geothermal energy. This provides Octavia with clean, 24/7 power, which is crucial for cost-effective DAC operations. About 80% of their energy needs are met through geothermal heat, significantly reducing operational costs.

The company has shown impressive early traction, having pre-sold 2,000 tons of carbon dioxide and secured $1.1 million in carbon credit prepayments. Their business model primarily revolves around selling carbon credits to corporations and individuals looking to offset their carbon emissions. From people working around a kitchen table, Octavia has grown to a team of 60, including 40 engineers.

Currently, Octavia Carbon is working to significantly reduce the cost of CO2 extraction to bring this down to $100 per ton, making the technology more economically viable at scale.

Their immediate goal is to capture 1,000 tons of CO2 per year through their Project Hummingbird pilot plant, scheduled to launch by the end of 2024.

The company's approach is particularly significant in the context of climate justice, as Kenya, like many Global South countries, has contributed minimally to global carbon emissions yet faces severe consequences of climate change. By building a cutting-edge climate tech industry in Kenya, Octavia Carbon says it is not only addressing global environmental challenges but also driving sustainable development and creating highskilled jobs in East Africa.

Source: Octavia Carbon

Based in: Israel / USA

CEO: Adam Shiner

Website: repair-carbon.com

RepAir is a DAC company that has developed a highly efficient electrochemical technology for removing carbon dioxide from the atmosphere. Founded in 2020, the company is headquartered in Israel with operations in the U.S. and Europe.

The technology is built around standardised "StackDAC" modules, designed for mass manufacturing and easy scaling. These modules use abundant materials like massproduced nickel electrodes and injection-moulded recycled polymers, reducing costs while improving reliability and assembly efficiency. The modular design allows for quick installation and scaling across various sites.

The company's core technology represents a significant advancement in DAC efficiency. Their electrochemical process uses 70% less energy than conventional carbon capture methods, requiring only 0.6 MWh per ton of CO2 captured compared to the industry standard of 2.5 MWh. Unlike traditional DAC solutions, RepAir's system operates at ambient temperature without requiring heat, uses no solvents or liquids, and produces no hazardous waste materials.

The company's technology has garnered significant attention for its potential to make carbon capture economically viable at scale. Their target is to reduce costs to around $50 per ton at gigaton scale, far cheaper than competing solutions. This dramatic cost reduction could make large-scale carbon removal financially feasible for the first time.

In November 2023, RepAir unveiled its field prototype, demonstrating the technical performance of its carbon capture solution in an operational environment.

The company's business strategy focuses on both carbon dioxide removal and reduction efforts. Beyond atmospheric capture, RepAir's technology can also capture CO2 from diluted point sources, such as aluminium smelting processes, making it versatile for various industrial applications.

Source: RepAir

They have several significant projects in development:

• France: Partnering with C-Questra to develop the EU's first onshore Direct Air Capture and Storage (DACS) project near Paris, aiming to remove 100,000 tons of CO2 annually by 2030 and scale to megaton levels by 2035.

• Greece: Collaborating with EnEarth (a subsidiary of Energean) to capture and store CO2 in the Prinos saline aquifer, with operations starting in early 2026 and targeting up to 3 million tons of CO2 annually by 2028.

Looking ahead, RepAir aims to establish gigafactories in collaboration with strategic manufacturing partners to scale production quickly and efficiently.

This glossary covers the main terms and abbreviations used throughout the document.

• Afforestation: Planting trees in areas with previously no trees to increase carbon sequestration.

• Artificial upwelling: A conceptual technique that brings nutrient-rich deep ocean waters to the surface to stimulate phytoplankton growth and carbon sequestration.

• Bioenergy with carbon capture and storage (BECCS): A carbon removal method that involves growing biomass (which absorbs CO2 as it grows), using it for energy production, and then capturing and storing the CO2 emitted during this process.

• Biogenic CO2: Carbon dioxide that is produced from biological sources, such as ethanol plants, pulp and paper mills, or biomass power plants.

• Biochar: A charcoal-like material produced from biomass through pyrolysis and applied to soils to store carbon for long periods.

• Blue carbon: Carbon captured by coastal and marine ecosystems, including mangroves, seagrasses, and salt marshes.

• Carbon capture and storage (CCS): The process of capturing carbon dioxide emissions from industrial sources and storing them underground to prevent their release into the atmosphere.

• Carbon dioxide removal (CDR): A range of techniques and technologies to remove carbon dioxide directly from the atmosphere.

• Carbon offsetting: The practice of compensating for carbon emissions by funding projects that reduce or remove an equivalent amount of carbon dioxide from the atmosphere.

• CaO ambient weathering DAC: A direct air capture method that uses calcium oxide (quicklime) to absorb CO2 from the air, mimicking and accelerating the natural weathering process.

• Coastal and marine CDR: Carbon dioxide removal techniques that leverage coastal and marine ecosystems to absorb and store carbon.

• Direct air capture (DAC): A technology that extracts CO2 directly from the ambient air using chemical processes.