An industry research report on airports’ social media budgets, staffing, challenges & ROI

© Copyright SimpliFlying 2012

Contents Foreword 3 Executive Summary 4 Key Findings 5 Mapping ROI to Airport Objectives and Strategic Goals 6 Social Media Budgets 13 Staffing for Social Media 16 Challenges Faced 19 Planning for the Next Year 21 Appendix 23 Methodology 24 Airport Social Media Outlook 2012 2

Foreword

Some might argue that it took the better part of the 21st century for airport executives to buy into the true need for airport marketing initiatives. Now that airports across the world have embraced the need to connect with passengers and market their services better, we are seeing increased adoption of a new type of marketing powered by social media.

Travelers today have a strong interest in social media platforms and usage is growing. In September 2012, we surveyed 55 airports across the globe to gain a better understanding of how they are positioning social media within the overall airport marketing, communications, and organizational plans.

We are delighted to share the results of this survey in the report that follows, and including a break-down of the statistics on how airports around the world are also using social media as a part of their marketing mix.

We learnt that airports are using Twitter as a channel to have a conversation with guests rather than letting such conversations happen in the community without them. Airport twitter engagement often is about communication with passengers that are physically within the terminal and/or attempting to communicate with the airport in real-time. Secondary to real-time engagement and customer service on Twitter,

news and other content is being exchanged as well.

Further, Facebook offers airports a chance to connect with passengers in their “own space” and also at a deeper level. By enhancing this channel for one-on-one communication with guests, an airport can work towards humanizing the travel experience and creating long term customer affinity.

To seek clarity on the role of social media within airports’ business strategy, this report also discloses industry benchmarks as reference points. These will help project a larger picture of how the industry views social media in terms of budget allocations, resource management as well as the business spheres in which social media is best at driving results. Finally, we wrap up by offering a projection of how the landscape is expected to develop in the near future.

Social media is constantly evolving, and the best practices amongst airports are changing too, due to the high quality programs across the world. We hope you enjoy reading this report and that it helps you to better plan your airport’s social media strategy in the upcoming year.

Shashank Nigam CEO, SimpliFlying

Airport Social Media Outlook 2012 3

Executive Summary

With the internet and smartphones becoming ubiquitous, today’s travelers nd social media to be a convenient resource, both to gather real-time information about their travel needs from airlines and airports, as well as travel tips from other travelers.

Increasingly, social media is becoming an effective tool for gathering information, sharing reviews, planning trips, gaining advice and most importantly, making the decision to travel through a particular airport. It is apparent that the age of the Connected Traveler has arrived.

Airports globally have recognized this trend and have responded accordingly by building up their social media presence. What was unclear till now is how big social media has been on airports’ business agenda and how it will pan out in the future.

To answer this, SimpliFlying conducted a research survey with 55 airports from around the world to take a closer look at the allocation of resources to social media. Some of the key ndings include:

• Over 55% of the airports surveyed invest more than 50 man-hours per month on social media, with a majority having 1-3 staff members working on it.

• 98% of the airports surveyed have social media staff working across

departments, with marketing as the most common cross-functional role.

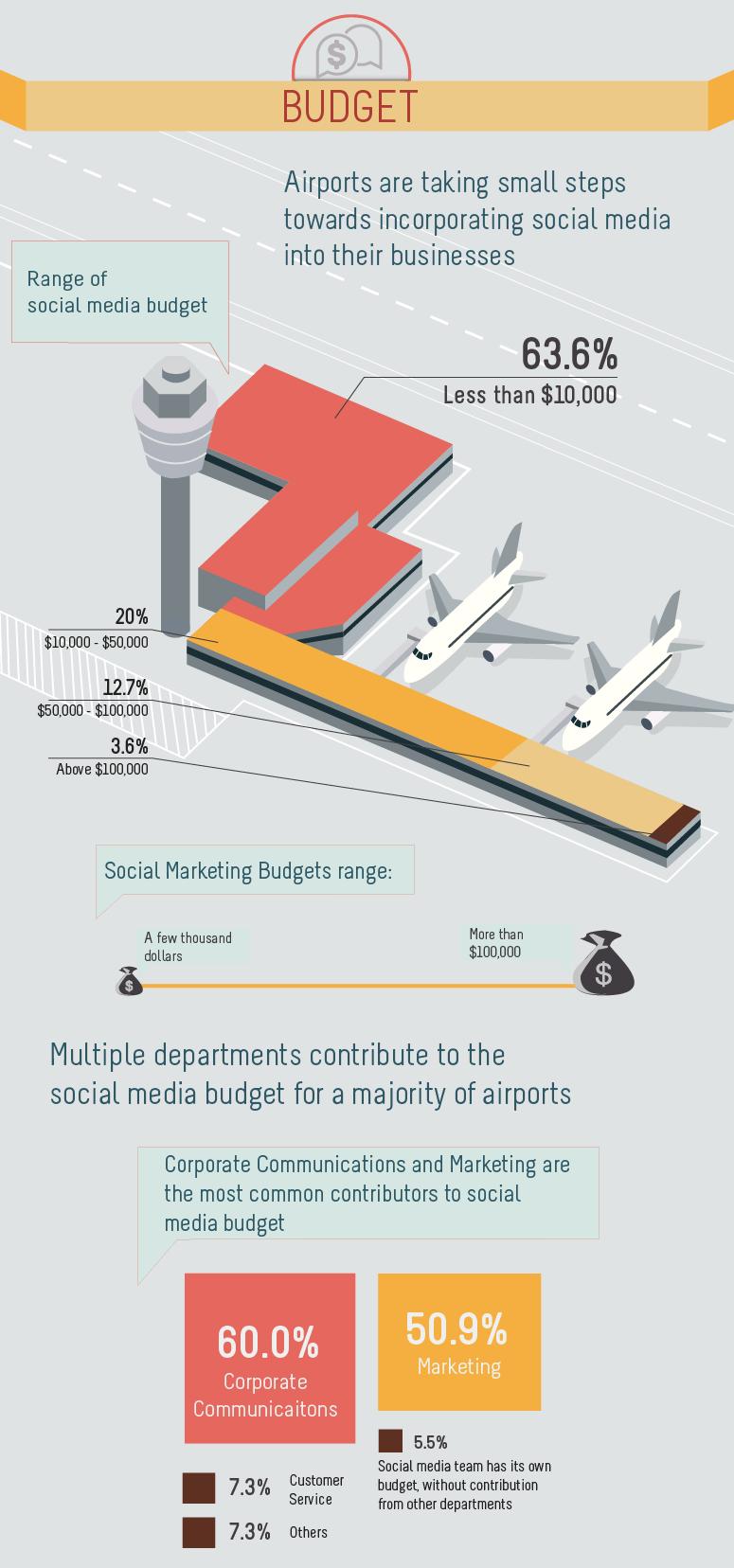

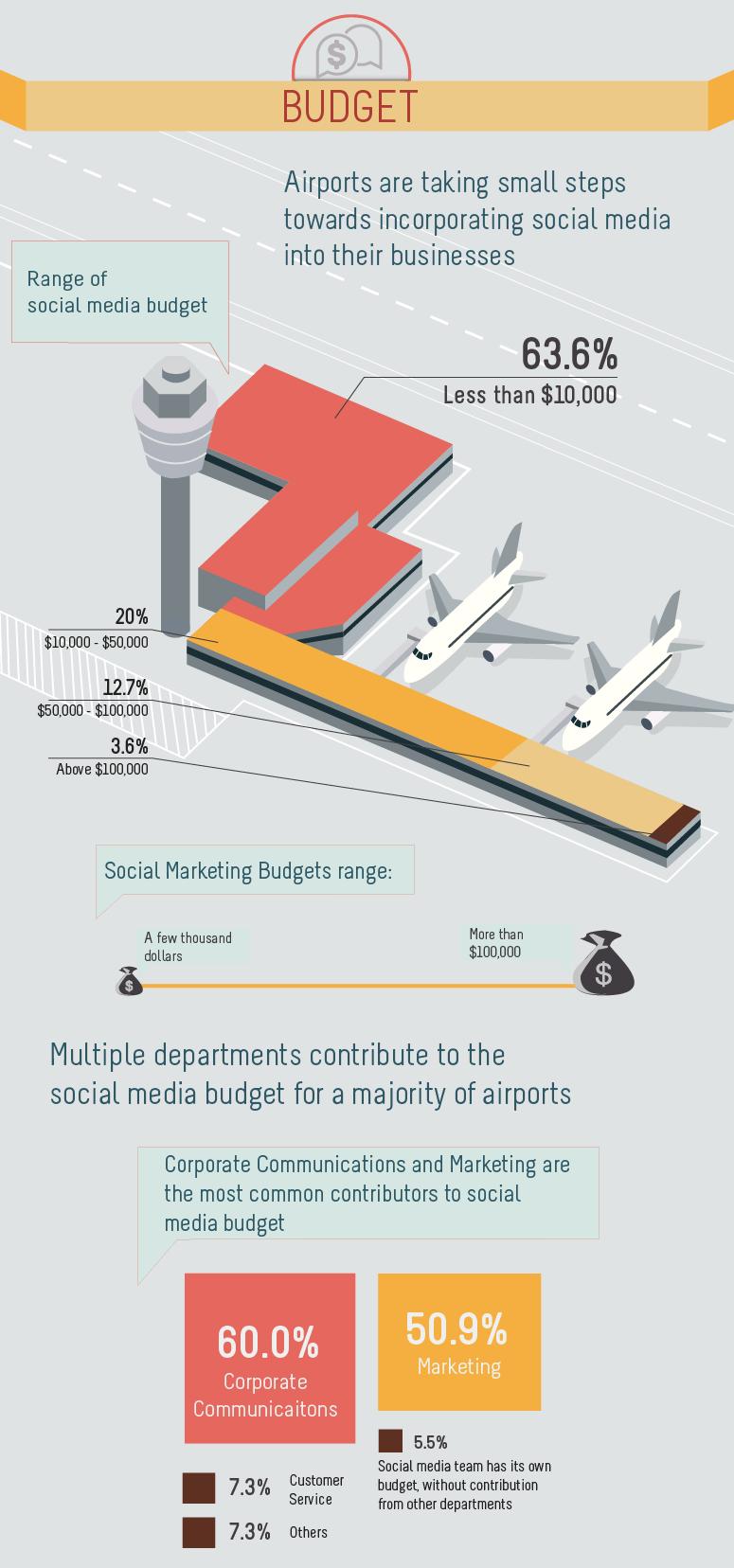

• Airports’ budgets for social media span from a few thousand dollars to more than $100,000. About 63% of the airports surveyed currently allocate less than $10,000 annually to social media, but that’s set to increase.

• While more than half of the airports are unsure about the speci c return from their social media investment, most airports have mapped the value of their social media performance to business goals. These are mainly 1) Brand Engagement 2) Customer Service 3) Revenue.

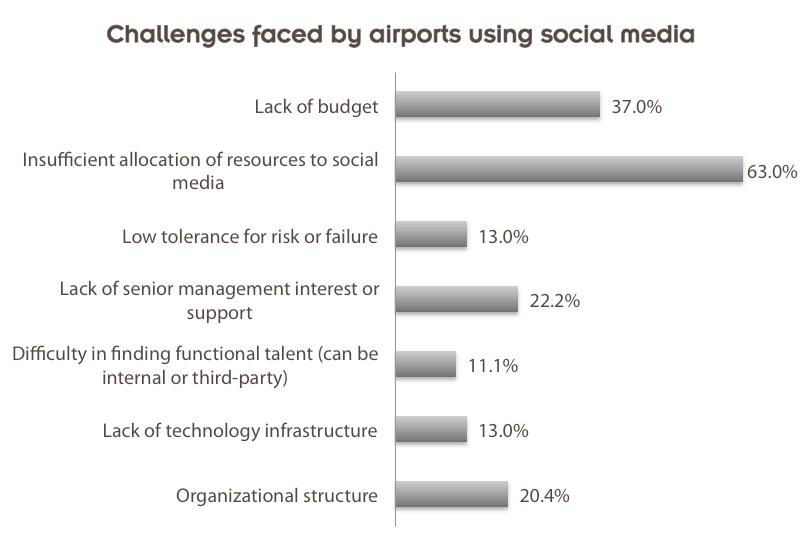

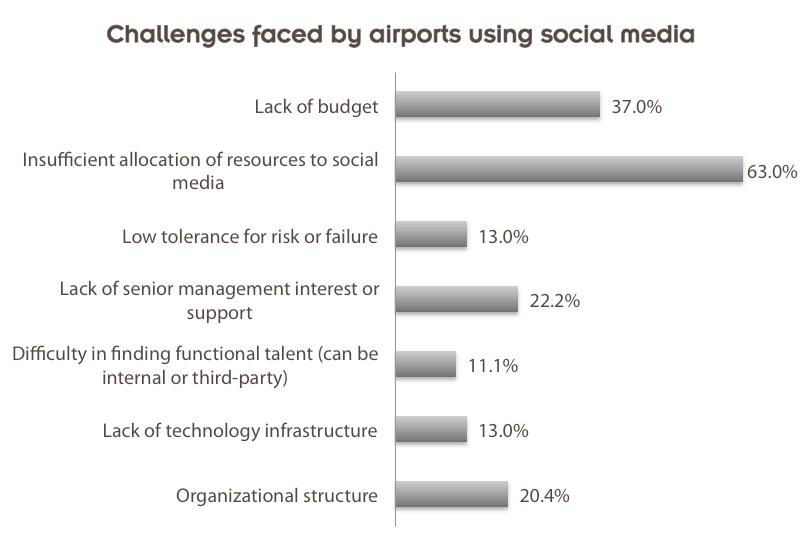

• The biggest challenge faced by airports is the insufficient allocation of resources to social media. The next biggest challenge is the lack of budget.

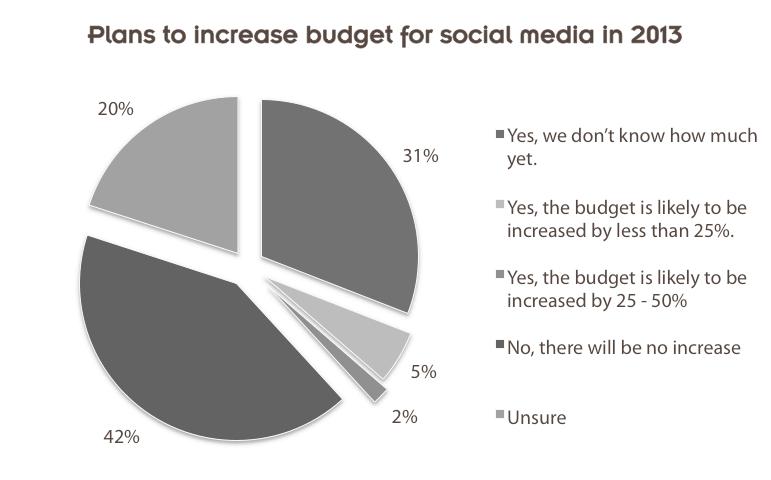

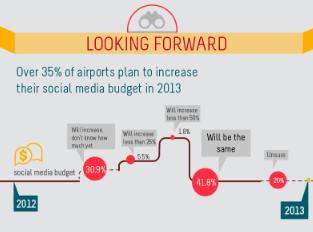

• Only about 40% of the airports surveyed plan to increase to their social media budget in the next year. In contrast, more than 70% of airlines in a recent study plan to increase overall social media spend in 2013. It is possible that airports are behind the curve in terms of investing in social media due to them adopting social media relatively late versus airlines. As such, next year’s gures should be instructive and enlightening.

Airport Social Media Outlook 2012 4

Key Findings

The Airport Social Media Outlook 2012 has helped to highlight and uncover insights on airport social media budgets, staffing, ROI and challenges.

Key ndings for this research report have been illustrated in an infographic. For the full version, please click here

Airport Social Media Outlook 2012 6

Mapping ROI to Airport Objectives and Strategic Goals

The need to effectively evaluate Return on Investment (ROI) for social media activities is more emphasized than ever before as businesses across the world are being made to keep a tighter leash on their spending. A research by eConsultancy (2011) has shown that 41% of the companies and agencies surveyed had absolutely no idea if social media has any impact on their nances1 .

One of the models that SimpliFlying has developed for airlines and airports to track relative ROI is by tying it to three key performance indicators: Revenue, Engagement, and Reach, with each having its own set of metrics. This model needs to be customized and applied to the speci c performance metrics of each airport.

Measuring the return on social media investment for airports can be difficult. This stems, rst and foremost, from the

knowledge that airports operate under unique and different types of aviation activities . Moreover, many airports measure performance through their own indicators.

As noted in the 2012 ACI World Guide to Airport Performance Measures2 , different airports are operating “under very different circumstances in terms of aviation activities, commercial activities, site constraints, governance and ownership structure, etc., and as a result, individual airports will nd different performance indicators to be most relevant and useful.” Airport size also play a factor in the performance indicators that are measured, creating a need for airports to identify the performance indicators speci c to their airport and market before attempting to track ROI.

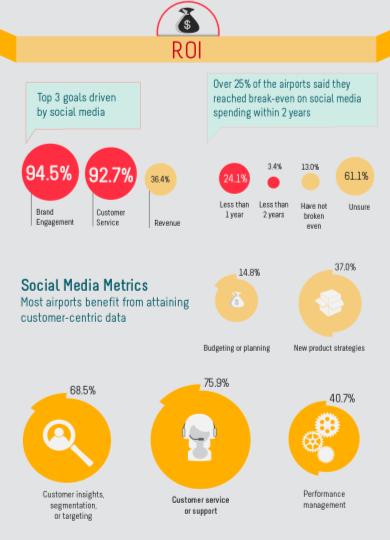

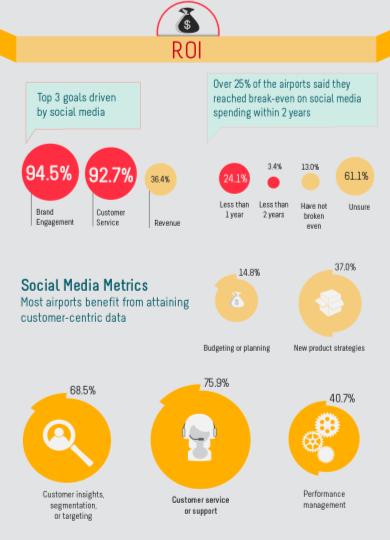

In this study, airports were asked to share their experience of nding a break-even point in social media. Almost a quarter of the airports surveyed claimed to have reached break-even within one year while about 60% are unsure.

While the measurement of social media fforts within airports are understandably difficult to track and relate to nancial performance, many airports indicated mapping their social media performance to business goals. The two most prominent business drivers for airports and social

Airport Social Media Outlook 2012 7

Source: SimpliFlying

media are Brand Engagement (94.5%) and Customer Service (92.7%). Revenue (36.4%), while third in line, is currently a far cry compared to brand engagement and customer service when it comes to being recognized by airports as a main business goal driven by social media.

Brand Engagement

Social media creates a channel for the airport to truly communicate with the passengers, in their own space, on their own networks, creating a multiplier effect for the brand. It creates an opportunity for the airport to develop a relationship with the guests, rather than just creating advertising acquaintances.

These new mediums allow airports to engage with passengers in a way that was

unheard of traditionally. By speaking directly to passengers while they are within the terminal, airports can now engage passengers while they are using the facility. This new method of communication can help the airports to empower social advocates and “airport fans” that, in turn, can pass on valuable word-of-mouth marketing messages for the airport.

Customer Service

Customer service, guest relations, passenger experience. No matter what your speci c airport calls it, it is a major component of airport operations.

Some of the rst airports to dedicate resources to social media with a focus on customer service include The Portland International Airport (PDX, Portland, OR) and

Airport Social Media Outlook 2012 8

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

The Toronto Pearson International Airport (YYZ, Toronto, ON). Both have taken customer service and social media to a new level with call centers lled with trained and dedicated “Twitterers”. These airports are working to train staff to respond real-time to customer service issues that come in through the Twitter channel, just as they would to a call from a guest on the phone. These two airports represent a sampling of ways in which social customer service is nding its way into airports of all sizes.

Revenue

Given that only 36.4% airports are linking social media to revenue, it can be said that many airports are missing out on a possible opportunity to use social media to contribute to their bottom lines.

There is a potential here for more airports to begin to use social media to drive nonaeronautical revenues, through partnerships with tenants and airport vendors. The use of social media for specials and to push discounts and sales can in uence purchases and visits to the shopping and dining facilities at the airports.

Tapping Social Media Metrics

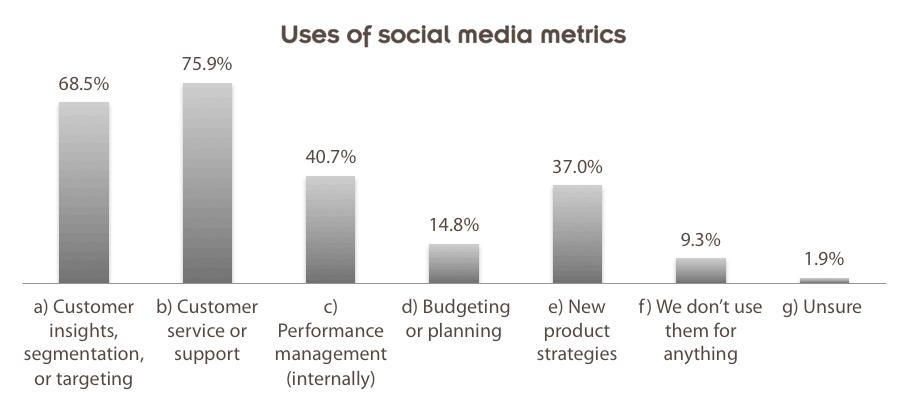

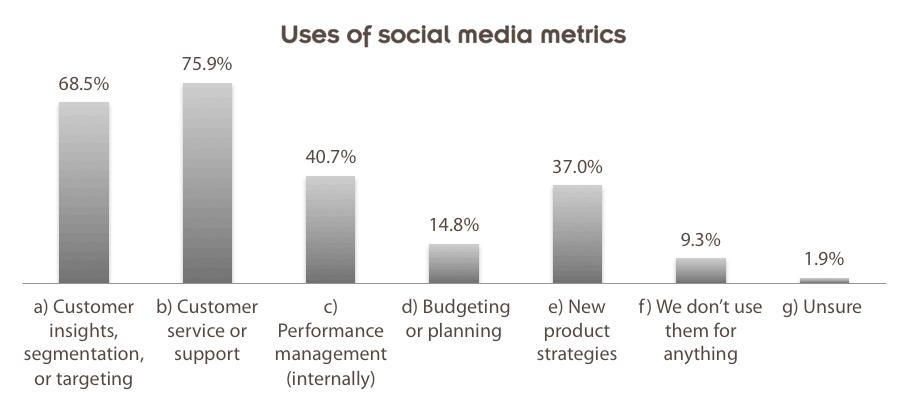

The majority of airports surveyed are deriving data for at least three uses: Customer Service Support (75.9%), Customer Insights (68.5%) and Performance Management (40.7%)

Under 20% of the airports surveyed use metrics from social media for budgeting or planning purposes while more than 75% of the airports are using them for customer service. The gap between these two gures

Airport Social Media Outlook 2012 9

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

suggest that airports have not fully assimilate social media into their corporate strategy planning, which would account for why they are not using the metrics for budgeting.

Recommendations

As noted in the 2012 ACI World Guide to Airport Performance Measures, different airports are operating “under very different circumstances” than both airlines, and, potentially, even other airports.

It would be bene cial to an airport to take a look at the six airport speci c performance indicators as de ned in the ACI World guide and determine which of these may link with their social media strategy.

ACI World lists these six Airport Performance indicators 3 as being:

1. Core (Number of Pax/Operations)

2. Safety and Security

3. Service Quality

4. Productivity/Efficiency

5. Financial and Commercial

6. Environmental

By looking at these airport speci c drivers, an airport can better decide how to position social media efforts to reach their performance goals and show a return on social media investment. Choosing the ones that best relate to social media would be good as a next step for an airport. Our recommended performance indicators for airports that want to start tracking social return would be: Service Quality (Customer Service), Financial and Commercial (Driving non-aeronautical revenues through Social Media), and Productivity and Efficiency.

Airport Social Media Outlook 2012 10

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

Fitting with this process, an important business goal that airports should be aiming to drive is customer loyalty.

In July 2011, SimpliFlying and Cran eld University conducted a study researching frequent iers’ attitude toward social loyalty programs. Results from this study4 offer compelling evidence for airlines to act upon integrating social media into their loyalty programs. Airports could also tap into this knowledge by rolling out their own social loyalty programs.

Airports have been working to incorporate rewards programs into their marketing and customer service plans throughout the past few years. 5 The adoption rate of the Thanks Again airport rewards program has been astounding. According to the company, Thanks Again provides airport guests and travelers the opportunity to earn additional rewards when parking, shopping, and dining at 170+ airports across the United States.6

Estonian Air and BalticMiles (both SimpliFlying clients) are among the pioneering airlines that are seeing great success with their social loyalty programs. These programs are a step ahead of traditional airline loyalty programs and incorporated social reward points for social advocacy: recommendations and reviews shared on social networks.

We see this as an opportunity for airports as well, to take newly developed parking and

dining rewards programs, and including social rewards in the mix for additional airport check-ins and/or reviews.

Social loyalty is a further extension of brand engagement at its nest. It attests the level of trust and reliability that the travelers commit to the airlines, spreading word-ofmouth marketing to their network of friends and families.

Pioneering airline social loyalty programs have also been proven to enhance social media metrics and would likely do the same for airports. For starters, new, personalized data on passengers can be obtained, something that airports have not had access to in the past.

Airport Social Media Outlook 2012 11

Social Media Budgets

Results from the study show that social media budgets for this year span a wide range. From a few thousand dollars to more than $100,000. The majority of the airports surveyed (63.6%) allocated an annual budget of less than $10,000 for social media.

The relatively smaller social media budgets allocated by airports compared to airlines could possibly indicate that airports have less con dence in social media than airlines do. Given their business models, the slower takeup is understandable. After all, airports, historically, have been seen as “enablers of travel”. While passengers will always have to buy an airline ticket to travel on a commercial airline, they are not always certain or willing to pay for airport services such as retail, food, parking etc.

Unlike airlines, which always have direct access to customers, airports do not sell tickets – rather, depending on the regulations of their nation's air system, most revenues are generated from business to business (B2B) contracts or Passenger Facility Charges (PFCs) charged to the passenger upon a ticket purchase through an airline. Resultantly, even though airlines can see more direct return in terms of number of air tickets sold, airports have a trickier job of mapping guest engagement to their partners' or their bottom line.

In addition, most social media activities for airports seem to occur using the airport’s own assets and resources. Lower costs are associated with social media spend (Facebook promotions/ads) and lower costs

Airport Social Media Outlook 2012 12

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

are incurred as compared to paying for traditional advertising space on external mediums. This also helps to explain why the allocation of marketing budget to social media is relatively small.

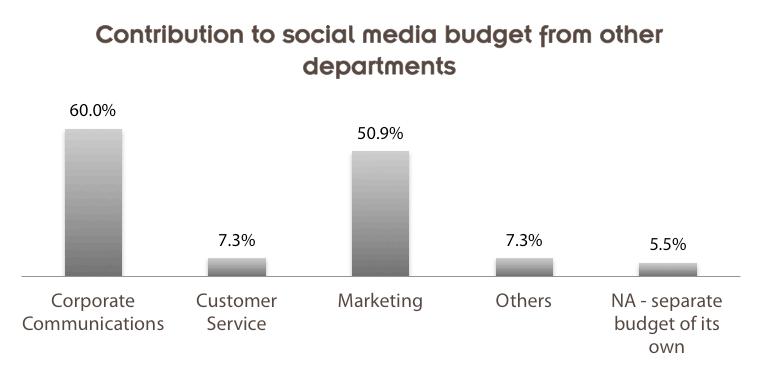

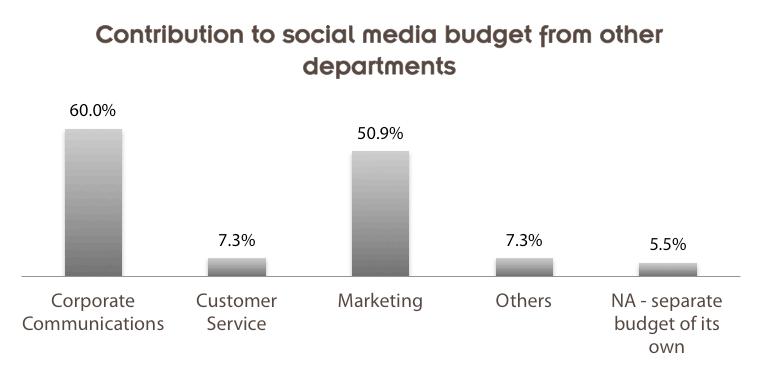

Behind the social media budgets, it has been noted that in 80% of the airports surveyed, contributions come from multiple departments

Budget Contributions

Corporate Communications (51%) and Marketing (43%) are the most common contributors to social media budget. Interestingly, while customer service is found as one of the top business goals airports are trying to achieve, the amount of budget contribution from customer service is much lower at 7.3%.

Recommendations

It would be worthwhile for airports to begin looking at the entire Connected Traveler Lifecycle when planning Social Media strategies.

By building a social strategy around the four stages of the passenger’s trip, the airport can better identify, track, and target guests. This Traveler Lifecycle suggests that the traveler dreams of a trip (SimpliDream), plans a trip (SimpliPlan), then books a trip (SimpliBook) and nally travels on his trip (SimpliTravel). At each stage of the travel lifecycle, the guest is in uencing friends and contacts by sharing information on his social networks, thereby amplifying the potential contribution to the airport’s bottom line.

Airport Social Media Outlook 2012 13

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

By strategizing around this process, the airport can better see where social media can assist with overall airport goals and objectives and budget accordingly. Since customer service is an important goal for many airports, the budget allocation from marketing may need to shift to the customer service department.

This study shows that airports are beginning to invest in social media as a part of their overall marketing or communications budgets. This indicates that airports have begun to recognize that the impact of social media on the airport’s underlying objectives is a powerful one, though the overall social media spend is still a fairly small line item.

Airport Social Media Outlook 2012 14

Staffing for Social Media

This section of the report is dedicated to analyzing the allocation of manpower by airports to social media initiatives. Speci cally:

• The number of staff working on social media

• How staffing is distributed across various departments

• The total man-hours spent on social media each month

The most common staffing setup amongst the airports surveyed is two persons (in 45.3% of the airports). The bulk of airports surveyed (83.0%) have teams consisting of 1-3 people. Some airports surveyed have up to 6 staff

members working on social media. In contrast, our recent study with airlines showed that nearly 25% of airlines have more than 10 staff assigned to social media.

Of this set of airports, however, only 20% indicated that they have at least one dedicated social media staff member, working on solely social media and no other function. Most airports employ an alternative approach – the cross-functional model.

Cross-Functional Model

Of the airports surveyed, 98% utilize a crossfunctional model where staff members working on social media also perform other departmental roles. Likewise, in the Airline

Airport Social Media Outlook 2012 15

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

Outlook report, the cross-functional model seemed to be the preferred approach.

Among these airports, marketing (72.2%) is the most common cross-functional role, followed by corporate communications (70.4%). This can be attributed to the fact that corporate communications and marketing are the key contributors to the social media budget (as shown in the previous section under ‘Social Media Budget’.) On the contrary, in our Airline Outlook report, customer service is the most common cross-functional role in 2012, preceded by corporate communications in 2011.

Most of the airports (over 70%) claimed that social media activities are conducted in an integrative fashion across the different departments of the airport. Only a minority noted that each department does its share of

social media activities separately or was unsure of the make-up.

Man-Hours Investment

In an effort to more accurately indicate the manpower allocation to social media, the airports were asked how many man-hours were spent on social media each month. This takes into account the number of people and the number of hours a month they spent working only on social media.

It is interesting to see the gap between the number of airport man-hours spent versus the number of man-hours in our recent 2012 Airline Outlook report. Only 45% of the airports surveyed indicate that they spend more than 50 man-hours per month on social media, while over 75% of the airlines recently surveyed invest more than 90 man-hours per

Airport Social Media Outlook 2012 16

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

month on social media, which means at least 4 hours a day dedicated to social media. We might infer that this difference is due to the difference in business model and operations. In an airport, customer touch-points are distributed across various airport facilities, of which retail comprises a big part. As such, it may not occur to the airport management to invest so many man-hours into real-time customer service – a huge focus of social media for many airlines as surveyed in the recent Airline Outlook 2012 report.

Nevertheless, as the Connected Traveler continues to grow to engage airlines, it is likely that he may begin to expect the same from the airport as well while traveling An increased uptake in customer service through social media, such as the Twitter call center at the Portland International Airport (PDX), where customer service through Twitter has been placed in the trained hands of the callcenter staff, might be an indication of how airports too may begin to increase the number of man-hours spent on social media in the upcoming years.

Recommendations

Due to the large variability in airport sizes, the scope may also vary greatly when it comes to staffing.

Larger airports may nd the staffing available to dedicate a speci c person to social media, while smaller airports may nd themselves in

a place where the same person who does airport marketing also performs sole social media related duties.

With the increasing prevalence of social media and the rise of the Connected Traveler, we recommend that more airports begin to train customer service teams to function on social media. Training staff members who are already designated to answer customer calls will help to free up marketing and/or communications staff to work on other social media strategy items.

Airport Social Media Outlook 2012 17

Challenges Faced

Social media is a relatively new resource that came under the spotlight as a viable business tool for communications less than ve years ago. The learning curve for social media, for entities that seek to drive speci c business goals, is a steep one, often punctuated with new bumps – thanks to the rapid emergence of new platforms such as Facebook, Twitter, Pinterest and more. While many companies have adopted social media, many have done so without truly understanding it. This explains the often sporadic campaigns that not just take more time to plan and execute, but yield less sustainable results as well.

Lack of Resources and Budget

The biggest challenge that over 60% of airports using social media face is the

insufficient allocation of resources to social media. Half or more of the airports facing this challenge are investing fewer than 50 manhours per month on social media. Among these airports, more than 75% of them allocate an annual budget of less than $10,000. In fact, the second biggest challenge cited by 37% of the airports is the lack of budget.

The study shows that a large group of the airports has underestimated the amount of time and resources that was needed on the social media front.

Airport Social Media Outlook 2012 18

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

Recommendations

To address and reduce the number of setbacks in social media programs, airports would be best advised to conduct a quarterly review that ties the progress of social media efforts and the number of man-hours plus budget spent on it.

With social media efforts, it is important that airports keep in tune with the ever-changing and evolving social platforms, and continually look to see which new platforms may best serve their interests. As always, it is worth noting that no airport should jump into social media simply to join the crowd. Airports should not be aiming to create social media plans. Rather, they should be looking at their entire communications and marketing plans, and identifying how social media can be integrated into those plans in order to shore them up. By doing this, airports can better see where staffing and man-hours can come from and where additional investment is needed.

Airport Social Media Outlook 2012 19

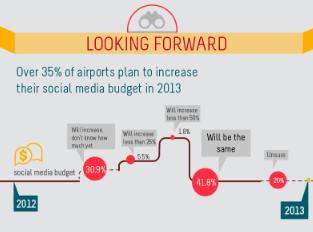

Planning for the Next Year

When it comes to the expected impact of social media on an airport’s operating income in the next three years, over 67% of the airport respondents are unsure.

Of the 32% of airports that expect to see some impact on operating income, nearly a quarter say they expect to see less than 5% contribution from social media. This uncertainty is also re ected in their plans for social media budgets next year.

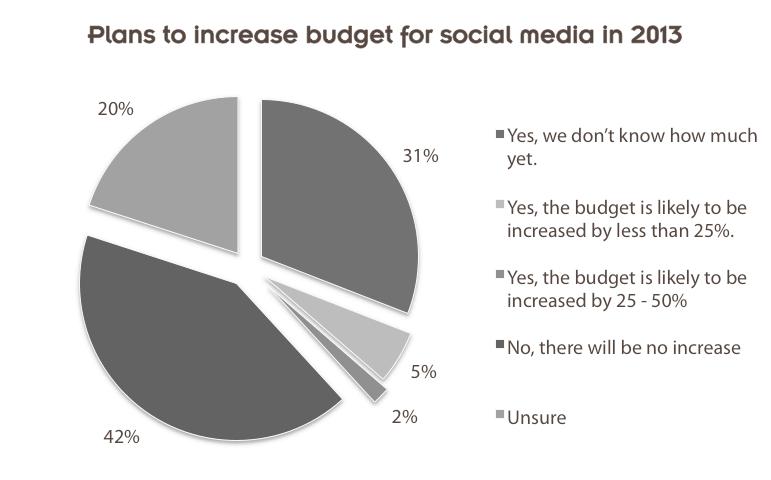

Of the airports studied, the majority has yet to decide how much to increase their social media budgets by in the upcoming year and 20% of the airports are unsure if they will increase their social media spend at all.

Among the remaining airports, about half do not plan for any increase while the other half plans to increase the budget allocation for social media in 2013.

It is apparent that unlike airlines – where over 70%, as re ected in our Airline Outlook report, plan to increase their social media budget - there is more uncertainty among airports as to how much they should commit to social media.

The apparent hesitation to commit a larger budget to social media should not be seen however as a sign that airports are not considering social media as a serious tool to buttress their marketing and

Airport Social Media Outlook 2012 20

Source: SimpliFlying Airport Social Media Outlook 2012 Survey

communications strategies. Instead, the reverse is true. It is worth noting that currently airports are still developing strategies around shifting and allocating manpower to manage their social media strategies. Given that most airports are allocating existing resources to their social media strategies, it is understandable that they are not yet sure if they will need to put more dollars into social media. A better way to measure how seriously airports are taking social media is to note the increasing social engagement as well as the shift in customer service to social media platforms. While the dollars might not indicate it yet, social media is already a major talking point at many airports.

For now, it is also more apt that airports build social strategies around the areas that have been identi ed as most relevant to them: namely, brand engagement and customer service.

The need for and the effectiveness of successful airport social media engagement initiatives are hinged on a couple of crucial factors: rst, the rise of the Connected Traveler: today’s modern traveler who constantly stays engaged in his social networks. Second, correctly identifying the platforms on which to reach this audience and cultivating social advocates. To achieve this, airports need to be sure to build up a good backend structure and work with airline partners to best connect with travelers through all stages of the traveler lifecycle. Many airports surveyed already have plans to

do so in the coming year and we are eager to see the results of next year's survey.

Airport Social Media Outlook 2012 21

Appendix

1 Econsultancy, The State of Social Media 2011, November 2011

2 Guide to Airport Performance Measures, February 2012, Airports Council International, http:// www.aci.aero/aci/aci/downloads/ ACI_APM_Guidebook_2_2012.pdf, Page 1 (accessed September 15)

3 Guide to Airport Performance Measures, February 2012, Airports Council International, http:// www.aci.aero/aci/aci/downloads/ ACI_APM_Guidebook_2_2012.pdf, Page iii (accessed September 15, 2012)

4 Shashank Nigam, The future of loyalty programs will be powered by social media, September 28, 2011, SimpliFlying.com, http://simpli ying.com/2011/ infographic-the-future-of-loyalty-program-will-bepowered-by-social-media/ (accessed August 20, 2012)

5 Nancy Trejos, Airport court iers with rewards programs, December 27, 2012, USA Today Travel, http://travel.usatoday.com/ ights/story/2011-12-26/ Airports-court- iers-with-rewards-programs/ 52233586/1 (accessed September 15, 2012)

6 New Rewards Program Launch at Eastern Iowa Airport, July 25, 2012, Thanks Again, LLC, http:// thanksagain.com/new-rewards-program-launching-ateastern-iowa-airport/ (accessed September 15, 2012)

Airport Social Media Outlook 2012 22

Methodology

The information contained within this report is sourced from an in-depth survey conducted with 55 airports around the world. Data derived from the survey is gleaned across all participating airlines without disclosing any information concerning any individual participant.

Special thanks to ACI Europe for their assistance in reaching out to their member airports to be a part of this report.

For further information, please contact report@simpli ying.com

Airline Social Media Outlook 2012 23

SimpliFlying is a leading consulting rm that has advised over 25 airlines and airports on customer engagement strategy to drive business goals. Headquartered in Singapore, SimpliFlying also has staff in New York, Boston, Valencia and Vancouver. One of the Top 5 most in uential on Twitter, with over 10,000 followers, SimpliFlying is also recognized by FlightGlobal for having one of the Top 2 aviation blogs.

www.SimpliFlying.com Twitter: @simpli ying

© Copyright SimpliFlying 2012

Helping airlines & airports engage travelers pro tably