A research report by SimpliFlying based on survey with 148 executives from 87 airlines, regarding budget resources, challenges and metrics

Social media has secured a firm position in the marketing strategies of most airlines. Yet many executives see a chasm between where airlines are and where they should be in terms of leveraging social media to achieve business goals.

Conducted since 2010, SimpliFlying’s Airline Social Media Outlook survey has been providing insights into airlines’ use of social media to achieve business goals.

This report aims to present insight into airlines’ budget and human resource allocations, returns expected from and challenges faced in implementing social media initiatives. It also leverages the most recent survey findings to highlight where the gap is between the current state of social media use in the industry and how executives would ideally like to see social media being used by their airlines.

The Airline Social Media Outlook 2015 survey asked ten questions to 148 executives representing 87 airlines across five regions including APAC, Middle East, Europe, Americas and Africa.

• Consistent challenges executives face regarding social media (Page 4): Insufficient allocation of resources to social media efforts continues to be the top challenge faced since 2012, followed by organisational structure.

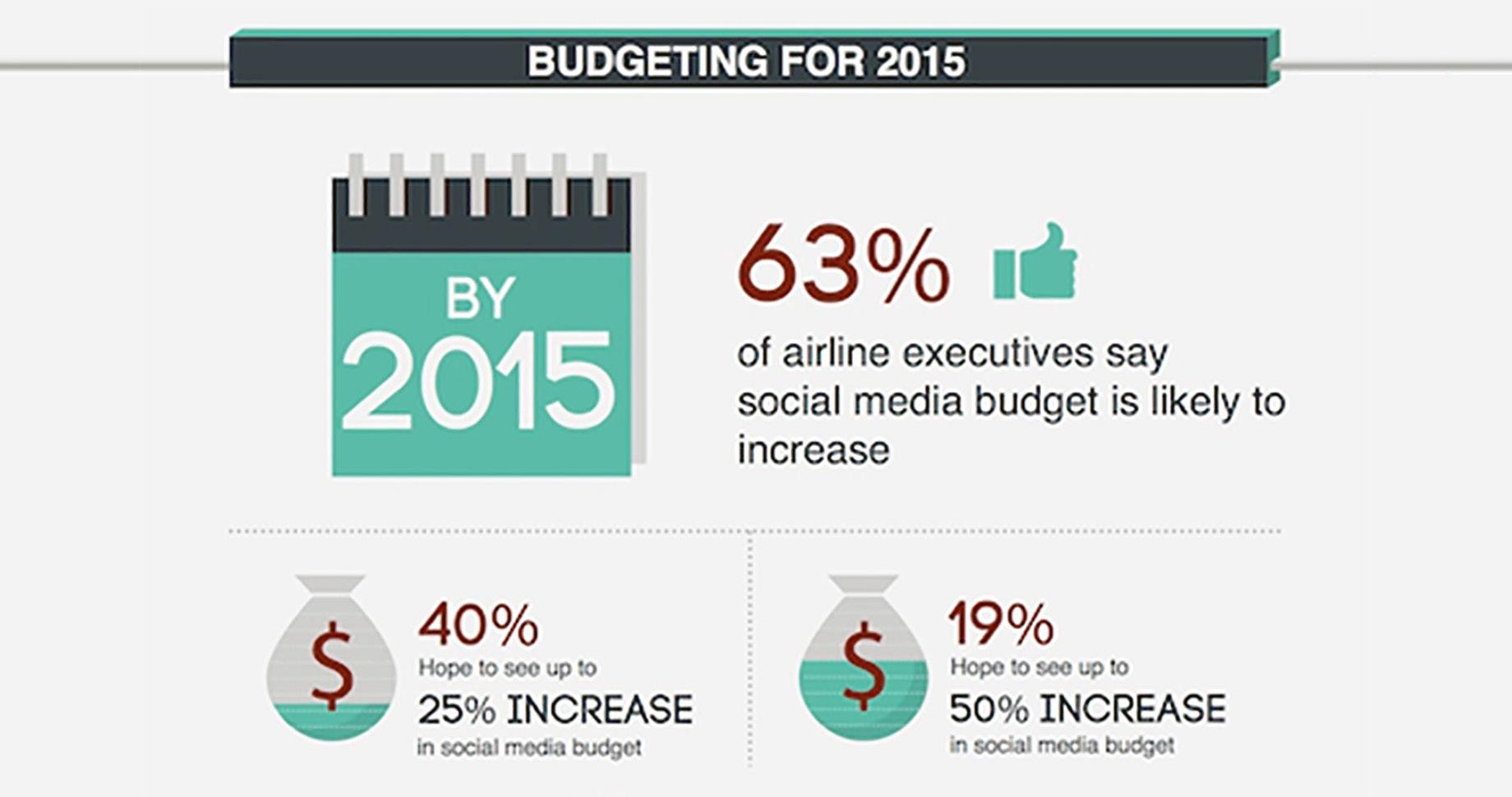

• Budgets set to increase in 2015 (Page 5): 63 percent of airline executives expect to see larger budgets for social media in 2015. The majority of them hope to see a budget increase of up to 25 percent. About half of the executives surveyed believe social media should take up 10 to 25 percent of total marketing budgets.

• More human resources are needed, preferably as dedicated teams for social media (Page 7): 84 percent of airline executives want to have more staff working on social media marketing. The majority in this group would like to see staff resources doubled. Having a team dedicated to social media operations is also preferred, as indicated by 65 percent of respondents.

• Concrete business goals to be driven by social media (Page 9): There is emerging consensus that the most important goal should be customer service, followed by brand awareness and loyalty.

• Going beyond marketing and expecting higher revenue potential (Page 10): Ideally, airline executives hope to see social media cover more ground, specifically in the

areas of customer service and eCommerce. 46 percent believe the expected impact on operating income in the next three years should be more than 10 percent.

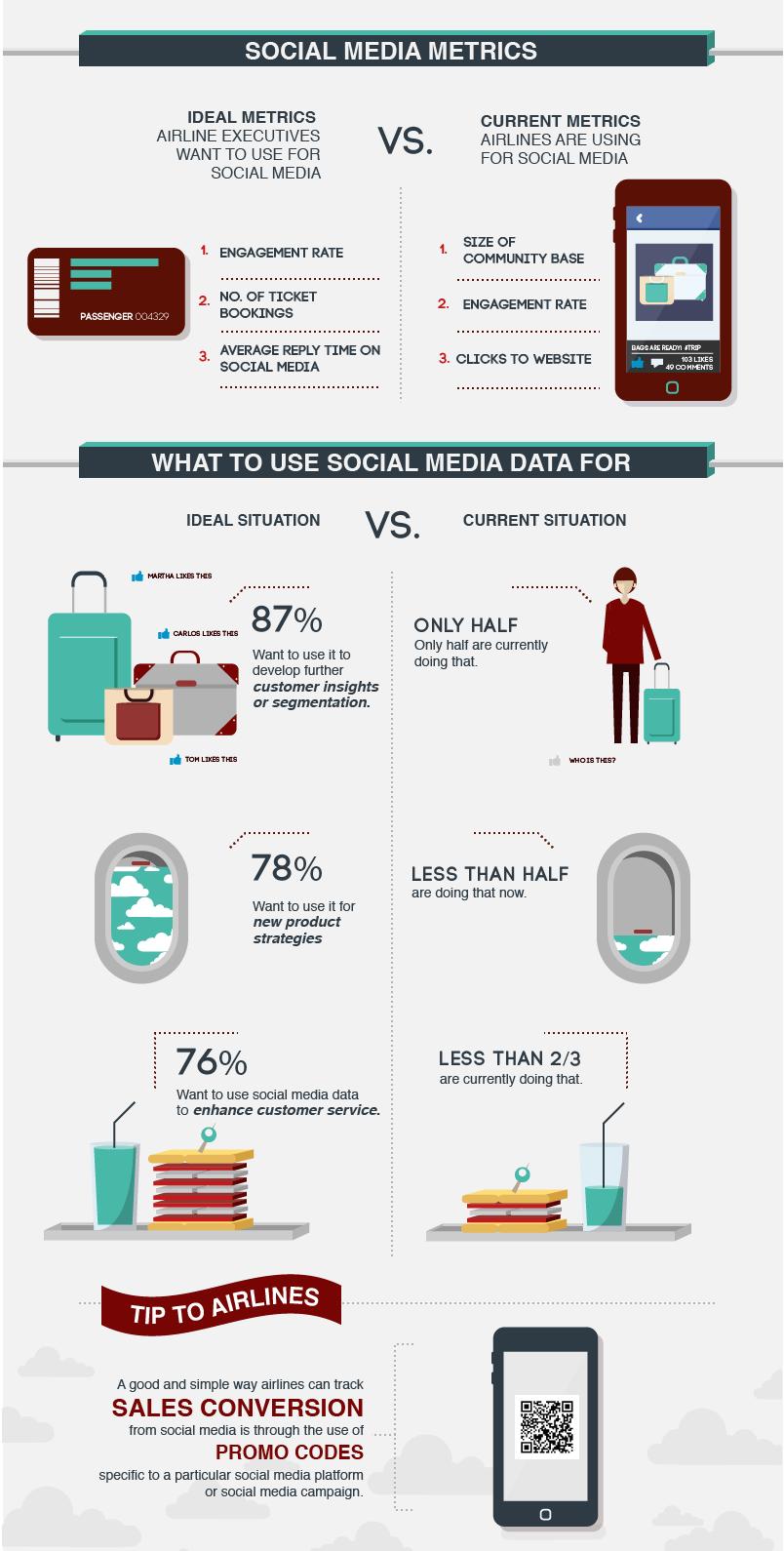

• Key metrics for measuring performance are evolving (Page 12) : Size of fan base size has fallen lower on executives’ agenda, in favour of other metrics such as engagement rate and number of ticket bookings.

• Expansion of social media data usage is desired (Page 13): Up to 87 percent of executives want these data to play more aggressive roles, such as informing the design of new product strategies or providing customer insights for market segmentation.

These findings help to shed more light on the difficulties as well as the opportunities (Page 14) presented by social media when planning for 2015.

The three most common challenges airline executives face in implementing social media strategies are insufficient allocation of resources to social media, hurdles due to organisational structure (i.e., inflexible team structure) and insufficient budgets and technological infrastructure.

These results are consistent with those from the last survey, conducted in 2012, with “insufficient allocation of resources” ranked as the most prominent challenge. This could imply that the demand for social media are growing faster than the airline organisations expected.

Organisational structure was cited as the second most common challenge faced by airline executives. Lack of technology infrastructure has risen to third place, up from fourth place two years ago, and tied with lack of budget as the third most commonly cited challenge by airline executives.

% of respondents, n=148

Top Challenges Faced by Airline Executives Regarding Social Media

Insufficient allocation of resources to social media

Lack of technology infrastructure

Lack of budget

Lack of training

Difficulty in finding fucntional talent (i.e. internal or third-party)

Lack of senior management interest or support

Low toleance for risk or failire

Other

The budget allocation to social media initiatives is an important indicator of senior management’s buy-in to the potential of this relatively new medium.

Against a background of slashes in budget allocations to traditional marketing channels, trends regarding increases in social media budgets show promise. While the majority of responding airline executives (63 percent) expect social media budgets to increase in the year 2015, most of those surveyed (21 percent) are uncertain how large the increase will be.

40 percent of airline executives hope to see an increase of up to 25 percent in social media budgets but less than 9 percent are confident of seeing an increase of this size.

Nearly 20 percent think an even larger budget increase, of 25 to 50 percent over current budgets, is warranted.

Executives anticipate increase in social media budgets but are not confident it will be sufficient.

% of respondents*, n=148

*Figures may not add up to 100%, because of rounding.

The optimistic expectations of respondents for increases in budgets indicate both a belief at the executive level in the promise shown by social media and confidence in their and their teams’ abilities to leverage this channel. Yet the current low budget allocation uncovered in the survey may indicate that more needs to be done in order to convince decision-makers of the concrete contribution of social media to airlines’ bottom lines and business goals.

Money spent by airlines on social media initiatives currently forms a small proportion of their overall marketing budgets; however, most airline executives are convinced that in an ideal scenario, this proportion should increase considerably.

Currently, slightly more than half of all airlines surveyed allocate less than 10 percent of their marketing budgets to social media. Yet, more than two-thirds of airline executives consider this inadequate. Nearly half would like to see this portion growing to 10 to 25 percent of their marketing budgets while about one-third think that social media is promising enough to merit capturing more than 25 percent of marketing budgets.

% of respondents*, n=148

*Figures may not add up to 100%, because of rounding.

To request for all charts from this report in a ooncise slide deck for re-use, please email at charts@simpliflying.com

Levels of human resources allocated to social media initiatives vary across airlines, at times indicating a limited commitment to this channel. Currently, only about one-fifth of the airline executives surveyed indicated that their airlines have 5 or more full-time staff dedicated to social media, with half of this group having at least 10 full-time social media staff. Even though 45 percent of the respondents think there should be at least 5 full-time staff dedicated to social media, the majority of the airlines (74 percent) actually have fewer than 5 full-time equivalent staff working on social media. In fact, within this group, more than half think that 10 fulltime staff or more is the ideal number.

% of respondents*, n=148

No. of full-time equivalent staff working on social media

Fewer than 5 full-time

10 full-time or more, less than 100

5 full-time or more, less than 10

100 full-time or more Unsure

*Figures may not add up to 100%, because of rounding.

When asked to compare between current and ideal staffing levels, unsurprisingly, 84 percent of the airline executives want to have more staff working on social media marketing. The majority in this group (66 percent) would like to see staff doubled. Yet, more important than the number of staff airlines dedicate to social media is the productivity of the staff employed, which depends significantly on the technological infrastructure and organisational structure.

Ideally, a team dedicated to social media operations is preferred by airline executives, as indicated by 65 percent of them. Yet 45 percent of the responding executives indicate that their airlines currently employ a distributed team structure where responsibilities for digital marketing cut across teams and departments. Only about 34 percent currently employ a dedicated team structure.

Only 8 percent currently engage an external agency or third party for social media, with intentions to incorporate social media in-house. Exhibit

Airline executives prefer having a dedicated social media team to borrowing resources from other departments.

% of respondents*, n=148

External agency, or third party

*Figures may not add up to 100%, because of rounding.

There is emerging consensus among the airline executives surveyed that the most important goal social media should drive is customer service, rather than the current emphasis on brand awareness. One possible reason could be that customer service is more tangibly delivered and measured, and this would indicate executives’ need to use social media to drive concrete business goals. Another reason is simply because a large number of passengers reach out to airlines when in need.

The top three business goals currently driven by social media according to airline executives are brand awareness, improving customer service and driving loyalty, which are consistent with what they would like to focus on ideally.

Interestingly, the majority of executives (76 percent) who want to increase social media budgets by up to 25 percent also chose customer service as one of their top 3 goals. This reflects the labour intensive nature of providing customer service on social media.

As more brands across various industries, including airlines, take to social media to provide customer service, there is increasing pressure to leverage these media to respond to queries at lightning speed.

% of respondents, n=148

Improving

Brand awareness

Drive loyalty

Crisis Management

Drive ancillary revenues

Increase load factor

Increase yields

Cost reduction

To request for all charts from this report in a ooncise slide deck for re-use, please email at charts@simpliflying.com

The preference for a dedicated team may indicate that airline executives would like to increase the visibility of the social media function within the organisation so it rises on the organisational agenda. Marketing is the dominant department when it comes to airline social media — and ideally so, according to 88 percent of the airline executives. That said, airline executives wish to see more involvement from other departments as well, namely customer service, corporate communications and eCommerce.

While social media is often seen as an extension of corporate communications, airline executives wish to see it cover more ground in other functions, e.g., customer service. Several airline executives also wish to see inflight service crew and even human resources departments become involved in social media within the organisation. This speaks to the cross-cutting relevance of social media initiatives, both inward- and outward-looking, for the different departments within airlines.

Regarding the potential of social media to add to the airlines’ bottom lines, there appears to be a mismatch of expectations between senior management and executives. One possibility is that because the general expectation for returns from social media is low, senior managers show lukewarm support, at best. Given current budget allocations, resources and efforts through social media channels, nearly 60 percent of the surveyed executives cite only up to a 10 percent expected impact of social media on operating income. However, executives believe that social media has greater revenue potential. More than 31 percent of executives believe that the expected impact of social media on their airlines’ operating income in the next three years should be between 5 and 10 percent, while 46 percent believe the expected impact should be more than 10 percent.

One hurdle to proving this point is that, unlike other marketing channels, the impact of social media initiatives on an airline’s revenue is difficult to track, not only due to significant network externalities but also due to the complicated processes involved in flight bookings, particularly for online reservations. Therefore, most airlines track click-through rates, which is a far from perfect measure. A simple way airlines can track sales conversion from social media is through the use of promo codes specific to particular social media platforms or campaigns.

% of respondents*, n=148

Less than 5%

*Figures may not add up to 100%, because of rounding

The metrics used to measure the performance of social media initiatives have evolved, with fan base falling lower on executives’ agenda in favour of other metrics such as engagement rate and number of ticket bookings. The top three metrics currently used to measure social media performance by airlines captured in the survey are size of fan/follower base (67 percent), engagement rate (64 percent) and clicks to websites (46 percent). While size of fan/follower base is currently used by 67 percent of airlines, almost half of the executives surveyed prefer other key performance indicators (KPIs) in its place. Currently, only 28 percent of airline executives reported average response time as one of the top three metrics tracked by their airlines.

In fact, airline executives appear to lean towards more concrete metrics such as ticket bookings and average response time, indicating a better understanding of the nexus between social media and business goals. Airline executives think that the top three metrics for social media should be engagement rate (70 percent), number of ticket bookings (55 percent) and size of fan/follower base (44 percent), which tied with average reply time (44 percent) as the third most desired social media metric chosen by airline executives. Again, the importance of social media for customer service has been emphasized.

Airline executives have become more knowledgeable and also more demanding about the use of social media. 55 percent want to see ticket bookings used as KPI to measure social media performance. Tracking ticket bookings from social media efforts, however, has been difficult for most airlines, so most are currently tracking clicks to their website as a proxy social media metric.

% of respondents, n=148

(i.e.

No. of ticket bookings

Average reply time on social media

Clicks to websites

Sales enquiries

Unsure

Currently, data from social media is predominantly used for customer service purposes (as indicated by 50 percent of airline executives). A full 18 percent of airline executives indicated that the data from social media is rarely being utilized for further purpose or insights.

Most executives want this data to play a more aggressive role, such as informing the design of new product strategies or providing customer insights for market segmentation. Currently only 44 percent of airlines are using social media for customer insights, but double that number of executives (87 percent) want to see their airlines doing so. Two other top areas where executives think social media data should be used are new product strategies (78 percent) and customer service (76 percent).

Customer insights/segmentation can play a very important role in how airlines formulate their fare strategy and structure their promotions and even loyalty programs. These have a direct impact on the airlines’ bottom lines. The ability to use social media data to proactively draw customer insights is likely to help airline executives secure larger social media budgets and drive more business goals via social media. While 38 percent of airline executives want to see social media data being used for budgeting/planning purposes, only 12 percent report that their airlines are currently doing so.

To request for all charts from this report in a ooncise slide deck for re-use, please email at charts@simpliflying.com

• Clarify the vision and business goals: As social media is a relatively new item on the business agenda for most airlines, the only way that airlines can draw on its potential to drive business goals is to actively associate or link the organisation’s vision to social media.

• Make sure to use what you collected: Many airlines tend to collect data to justify their social media campaigns but fail to go beyond data collection to actually utilize these data, which can often provide many insights about their customers. Customer insights/segmentation can play a very important role in how airlines formulate their fare strategy and structure their promotions and even loyalty programs. All these have a direct impact on the airlines’ bottom lines.

• Optimize social media output with technological infrastructure: More manpower is required as social media claims a more active role in the ways airlines engage passengers. However, in the interest of productivity, it is important that airlines invest in the technological infrastructure required to handle the large volume of data as passengers become demanding and expect more. Investment in the relevant technological infrastructure such as social media integrated CRM systems also allows airlines to mine these data to draw further customer insights.

The Airline Social Media Outlook 2015 survey asked ten questions to 148 executives representing 87 airlines across five regions including APAC, Middle East, Europe, Americas and Africa.

Special thanks to IATA for the support behind this research survey.

Copyright © 2014 SimpliFlying. All rights reserved.