Sheldon Bosley Knight’s lettings director, Rebecca Dean, looks back at 2025

At Sheldon Bosley Knight, our department has been extremely busy, not least taking our teams and our landlords on a journey with the much talked about Renters’ Rights Act (RRA) which

finally became law on October 27. We have enjoyed working closely with our landlords and helping them understand the impending changes to the sector. This has been done through the power of video content and podcasts as well as our in-person Landlord and Investor evenings.

In addition, we have continued

to provide support with the letting and management of their property/portfolio.

This year, as last, the lettings market has continued to demonstrate a shortage of supply versus demand with rents still increasing across our regions. However, we have been able to source some good quality tenants

for our landlords which in turn has helped tenants to find a new home.

We have also been putting a lot of time and focus into guiding and supporting our staff, not least as a result of all the changes in the sector. This has been incredibly important as we want them to feel both empowered and confident to have good conversations and to enable them to provide the best services to all our clients.

Our focus for the remainder of the year and on into 2026 continues to be on supporting our landlords and making sure they have the ultimate peace of mind when letting their property/ies.

We will continue to talk to

them about the importance of our rent guarantee and legal expenses service and having a deposit alternative. This gives our landlords up to double the protection of a traditional deposit and also reduces upfront moving costs for tenants.

Looking ahead, 2026 will be an interesting year with the first phase of the RRA set to be implemented on May 1. But we are also looking forward to continuing to support our landlords and tenants throughout this journey and our aim is to help and support other landlords who remain uninformed.

I believe there is still plenty of life in the sector, it’s still a good place

The newly-enacted Renters’ Rights Act will drive rents higher as landlords respond to tougher regulation and greater compliance demands.

Research in Pegasus Insight’s Landlord Trends Q3 2025 report, shows 81% of landlords expect the legislation will make them more choosy about prospective tenants. Nearly three quarters (71%) of the 872 surveyed said they plan to raise rents to absorb new costs and restrictions.

Meanwhile, 73% believe the Act will have a negative impact on their own lettings activity and 81% think it will negatively impact the wider Private Rented Sector (PRS).

Pegasus Insight’s research also

highlights a growing disconnect between landlord and tenant expectations. While the former anticipate higher costs and reduced flexibility, the latter tend to see the reforms as a win for renters.

Responding to the findings, Sheldon Bosley Knight senior lettings manager Josh Jones said: “The Act is going to have a seismic impact on the PRS and, combined with the recent Budget, landlords will have to make some tough financial decisions.

“However, we feel it’s still a sector to stick with. Rents and yields are still robust and there continues to be a demand and supply imbalance.

“The good news is landlords can now plan with a degree

to be and invest in and we are here to provide help and support to all our clients whenever they need it. To all our readers, we wish you a wonderful Christmas and New Year and we look forward to working with you in 2026.

of certainty as we have the implementation dates for the Act. Our teams have also been working hard to support and inform all our landlords so they are well-placed to make any adjustments or decisions going forward.

“The teams are on hand to help, advise and support wherever and whenever necessary so please do get in touch.”

Landlords and investors undoubtedly drew the short straw in chancellor Rachel Reeves’ second Budget.

While the major headlines focused on the abolition of the two-child benefit cap and the chaos in which the Budget itself was announced, the housing sector was left reeling.

Anyone with a home worth more than £2 million will now be subject to a high value council tax surcharge – or mansion tax. Those with affected properties will pay a surcharge of £2,500 and those with properties worth over £5 million

surcharge of £7,500. Both charges will be in addition to the current levels of council tax and will come into effect in 2028.

But it was landlords who found themselves yet again, at the mercy of more government taxation.

From April 2027, a 2% increase will be imposed on basic, higher and additional rates of property income tax, increasing them to 22%, 42% and 47% respectively.

The chancellor said it was designed to account for the fact landlords don’t pay National Insurance on rental income.

landlords in the private rental sector is massively important and therefore stability is needed in order to retain them and encourage more investment.

“To my mind the Budget was a missed opportunity. The government could and should have brought some Christmas cheer to the private rental sector, encourage landlords to stay within it and in turn see the growth and stability we have all been crying out for.”

However Sheldon Bosley Knight’s sector adding it might actually do

She said: “The Budget has brought

“In an already challenging market implementation of the Renters’ Rights Act announced to be May 1, 2026 landlords are already feeling uncertainty.

Sales manager Lisa Hunt said: “While the new mansion tax will mainly affect properties valued above £2 million, the rise in property and savings income tax from 2027 could influence investor confidence more broadly.

“For landlords, the viability of their investments will now be under review and we anticipate an increase of portfolio sales before the April 2027 deadline. Whilst this may temporarily boost stock it will reduce the long-term available rental supply.”

For any landlords who would like advice or support with their investments, please do contact your local office and our teams will be glad to help.

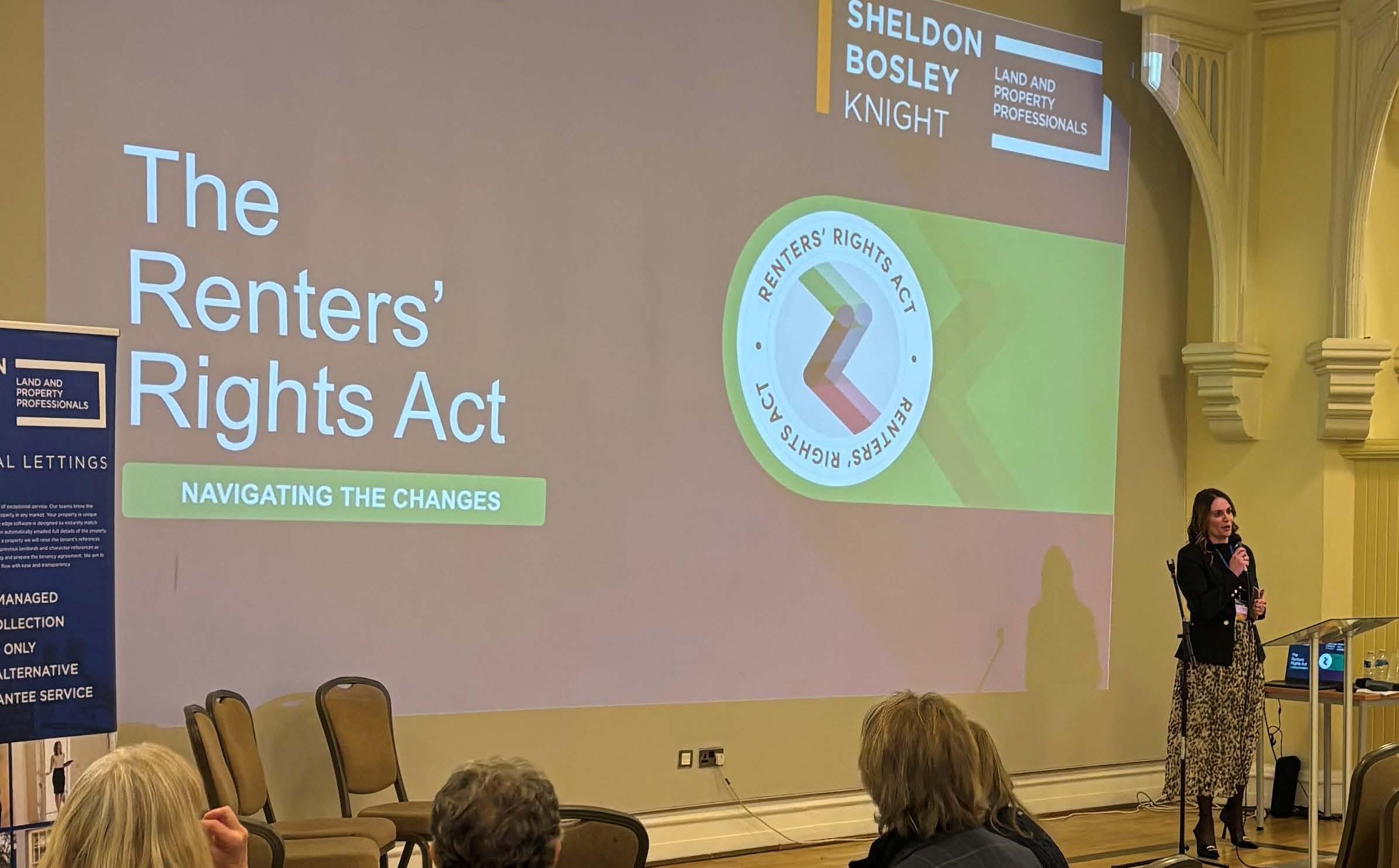

The implementation dates for the Renters’ Rights Act and what it will mean for both landlords and tenants was top of the agenda at an industry-focused event in Leicester.

Held at Leicester’s Great Hall in St Martins House Conference Centre, it was the second organised by Sheldon Bosley Knight’s lettings team designed to give landlords updated information on current issues within the private rental sector (PRS).

Topics discussed in presentations included an update on the dates for the Renters’ Rights Act’s (RRA) implementation, finances, rent guarantee and referencing and taxation.

However, it was without doubt, the RRA and the finer points within it,

which landlords and investors were keen to understand and hear about.

Sheldon Bosley Knight’s lettings director, Rebecca Dean, said:

"The evening was a great success as we took our knowledge and expertise to the Great Hall in St Martins House Conference Centre in Leicester city centre.

“We got to meet with, and speak to, lots of our current landlords as well as presenting on important topics which included an update on the lettings market, landlords’ taxation, financial services, the importance of quality referencing and rent guarantee and of course the much talked about Renters' Rights Act.

“With an implementation date of phase one of the Act now confirmed as May 1, 2026, we

were keen to update our landlords on the reforms and give them assurances on how we are going to support them through the changes.

“We have received some superb feedback and we will be committing to putting on more events for our landlords during 2026 and expect they will just as insightful, informative and successful.”

For more on the event tune into our podcast here.

The first phase of reforms within the Renters’ Rights Act will take effect from May 1, 2026.

Making the announcement, the Ministry of Housing, Communities and Local Government said from this date all new and existing private tenancies in England will move to the new system.

Phase one will focus on tenancy reform, including measures such as the abolition of Section 21s, reform of section 8, a ban on rental bidding, the end of fixed term tenancies and the right for tenants to request a pet.

Phase two, likely to be brought in at the end of next year will see the introduction of a Landlord Ombudsman and a new private rental sector (PRS) database.

Phase three will focus on the Decent Homes Standard and Awaab’s Law after a formal consultation period.

The news has been welcomed by Sheldon Bosley Knight’s lettings director, Rebecca Dean who said landlords and tenants have now got clarity on what is happening and when.

However she warned the government would need to sort out the backlog in the court system urgently if the Act was to be a success.

She said: “With the implementation date being May 1, 2026, it’s a relief we have been given the grace period we were initially promised to be able to prepare our business, staff and our clients.

“At Sheldon Bosley Knight, we have already put a lot into the preparation of what’s to come which includes consistently keeping our landlords well informed of any new information and what the changes will look like.

“We will continue to provide information, help, guidance and support to any of our landlords who need it.”

You can find out more about this by tuning into our podcast here.

Landlords are increasingly favouring semi-commercial property when it comes to expanding their portfolios. Shawbrook says applications increased by 58% in H1 of this year compared to the same period in 2024. The bank has also seen a 32% increase in applications for new purchase applications in H1 year-onyear, compared to a 24% increase in the same period between 2023 to 2024.

Retail space below flats is continuing to prove the most popular option with nearly seven in 10 (69%) investors opting for this type of commercial property in H1, up from 60% a year ago.

The survey also found HMOs are increasing in popularity and made

up 26% of the bank’s buy-to-let business, a slight increase from 25% in H1 2024.

Sheldon Bosley Knight’s senior commercial agent, Ben Maiden said there were many benefits for landlords looking to shift.

He said: “Landlords are looking at commercial property for a variety of different reasons. Firstly, there is the potential for higher returns. We’re primarily operating in markets where yields sit higher than in residential. However obviously higher yields reflect higher risk so this will take into consideration anticipated empty void periods and the length of marketing campaigns to secure a tenant in the future.

“Commercial leases are also much

more straightforward and easier to manage when it comes to nonrenewal, eviction or lease terms.

“Reimbursement of costs are another major factor. Whilst residential landlords have to cover many of the tenants costs, commercial landlords, depending on the areas being let, relinquish responsibility for much of the maintenance, taxes and insurances (building insurance is taken out by the landlord and recharged to the tenant).”

If any of our landlords would like advice or help with their portfolio or are thinking of switching to commercial, please do get in touch with our teams as they’d be glad to help.

The Renters’ Rights Act, which gained Royal Assent at the end of October will see the biggest change in the private rented sector for a generation.

Setting out the detail, the government has published its

Guide To The Renters Rights Act which can be found here:

https://www.gov.uk/government/ publications/guide-to-therenters-rights-act/guide-to-therenters-rights-act

We have summarised the six key measures below which will be brought in during the first phase of the implementation of the Act on May 1, 2026.

Abolition of section 21 – so called “no fault evictions”

Landlords will no longer be able to use section 21 of the Housing Act 1988 to serve notice on a tenant to regain possession of their property. Instead, they will need to use a section 8 possession ground which will be expanded to enable recovery of the property when reasonable, for example, to sell or move into.

Fixed term tenancies will go and all new and existing ones will become Assured Periodic Tenancies (APTs). Landlords will only be able to serve notice via a valid Section 8 ground. Tenants will have a 12-month protected period at the start of the tenancy during which time, landlords cannot evict them unless there is a

breach of the tenancy. Tenants will be able to give two months’ notice to leave.

Rent increases will only be allowed once every 12 months and any increases under rent review clauses will not be allowed. Landlords must give at least two months’ notice of any increase. If a tenant believes the proposed rent increase exceeds market rate, they can challenge this at the first-tier tribunal, who will determine what the market rent should be.

Bidding wars will end as landlords and agents will not be allowed to ask for, suggest or accept more than the advertised rent. This will apply even to those tenants who wish to bring a pet into the property.

Landlords and agents will not be allowed to ask for more than one month’s rent in advance. Instead, a landlord can only request a tenant pays in advance for each rental period. Even if a tenant voluntarily offers to pay advance rent, this will be unlawful.

Tenants will have a formal right to request to keep a pet. Landlords must consider the request and respond within 28 days. If they refuse, a valid reason must be given. A valid reason could include it being against the terms of a lease or if the property was unsuitable for a pet. Landlords are also not able to require insurance covering pet damage or increase the deposit to cover the additional risk.

£188,000 STARTING PRICE GROSS YIELD OF 6% 83 LUXURY RIVERSIDE

A stunning riverside development in the heart of Market Harborough’s Welland Quarter.

• One-bedroom apartment

• Central Evesham location

• Share of freehold in process

• Close to town and amenities

• Current rent value of £685 pcm

• EPC - D

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

£100,000

• Potential rent value of £825 pcm

• EPC - C

yield of 8.2% £120,000

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer David Wilson Homes. With various property styles there is plenty to suit your investment needs.

> Luxury three- and four-bedroom homes at Heritage Grange located just a short drive from Leamington Spa and Warwick.

> Built within 14.3 acres of green space, enjoy scenic walks and a family-friendly play area.

> Energy efficient homes with solar panels and EV car charging points.

> 20 minute drive to Leamington Spa and Warwick town centres with a regular bus service available.

> Close to the M40 motorway with easy links to Birmingham and Oxford.

> Discover countryside living with city convenience.

*Discounts and exclusive multiple unit packages are only available

For more information please contact Jack Richardson and the New Homes Team on 01789 333 466

To

• End-terraced family home

• Ground floor WC and upstairs bathroom

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

• Current rent value of £1,200 pcm

• EPC - E

• Walking distance to railway station

• Secure gated development and CCTV

• 10-year warranty and 999-year lease

• Walking distance into city centre (0.5 miles)

• Potential rent value of £1,995 pcm

• Lift access

Rodborough House, Coventry Gross yield of 6.8% £349,995

Poplar Road, Coventry Gross yield of 4.9% £190,000 *All

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 sq ft)

• Centrally located close to the town centre

Large car park

Bourton on the Water, GL54 2HQ

• The property comprises a modern two-storey industrial unit of approximately 373.05 m2 (4,015 sq ft) GIA

• The property is let on a six-year full repairing and insuring lease to Entwined Productions Ltd from April 10, 2024

• Suitable for B2 and B8 uses

• Current rental £34,000 per annum

• Modern, two-storey office extending to approx. 1,575 sq ft

• Let to Raycom Ltd on a five-year FRI lease from June 2022, providing secure income

• Current rental £14,500 per annum

• Bright office space with suspended ceilings, LED lighting, partitioned meeting rooms, kitchen and WC

• Situated in Abbey Lane Court, an established business park with on-site parking and easy access to A46 and Evesham town centre 9

• Generating £149,221 rental income per annum

• Service charge income of £38,962 per annum

• 1.35-acre freehold site with three, high-quality bespoke office buildings

• Thriving business park with landscaped gardens and ample on-site parking

• Prior approval for conversion to 27 one- and two-bedroom flats

• Planning permission granted to split flat into two, one-bedroom flats

• Part exchange considered 9 Abbey Court Lane, Evesham Gross yield of 2.4% £825,000

• Highly desirable location

• Residential accommodation to be vacant upon sale

• Current rental £20,000 per annum