LANDLORD TIMES

Monthly news for landlords brought to you by:

August 2025

HEALTHY RENTAL RATES AND YIELDS HOLD FIRM IN Q2

Landlords across England and Wales continue to see healthy rental yields and values. Rental yields continue to hover around the 7% mark with values having risen on average 2.9% quarter-on-quarter. The figures have been driven by a continuation of strong tenant demand and lack of supply alongside lower property prices and a drop in interest rates resulting in a drop in mortgage rates.

The data, from specialist lender, Fleet Mortgages’ latest Buy-to-Let Rental Barometer for Q2 2025, shows Wales in the top spot with average quarterly yields of 9%.

The East Midlands remained steady at 7.5% over the year but the West Midlands suffered a dip of 0.8%, going from 8% to 7.2% between Q2 2024 and Q2 2025. Average rents in the East Midlands currently stand at £1,173, which is up on the previous quarter but down on last year’s £1,304.

In the West Midlands, average rents stand at £1,146 up on the previous quarter but down on the £1,210 from Q2 in 2024. These figures are broadly in line

with those released by Rightmove in July which show the average advertised rent of new properties coming onto the market outside London has risen by 1.2% this quarter to a new record of £1,365 per calendar month. In further encouraging news for the sector, Fleet’s lending data shows landlords remain active and committed to expanding portfolios where appropriate and where opportunity presents itself, with 39% looking to purchase and 54% owning four or more properties. The attraction of buy-to-let

for new landlords also remains strong, with first-time landlord

applications holding steady at 14% over the quarter.

The data also shows the continued dominance of limited company borrowing in the private rental sector. During Q2, 81% of all applications to Fleet came from limited companies, with only 19% from individual investors.

Elsewhere, figures from UK Finance, the mortgage companies’ trade body, show there were 58,347 new buy-to-let loans

advanced in the UK, in Q1 of this year, worth £10.5 billion. This was up 38.6% by number and 46.8% by value, compared with the same quarter in the previous year.

Sheldon Bosley Knight’s associate director, Nik Kyriacou said: “Any yield over 6% is good so to achieve 7% and up is very strong. “I hope these figures are encouraging to landlords and show not only is there plenty of life in the private rental sector,

but that it still represents a good vehicle for investment.

“Demand is high, supply still hasn’t caught up yet and interest rates are down on what they were even a year ago, so it’s a great time for continued investment.

“As ever, if any of our landlords would like advice on expanding their portfolios we are happy to help.”

More landlords investing in PRS

Pressures in the private rented sector appear to be easing as more landlords are increasing their portfolios.

A survey of more than 2,000 private landlords in England found 23% had increased their property portfolios in the last year. This is up from 19% the previous year. In contrast, the proportion of landlords saying they sold property is 14%, broadly in line with last year’s 13%.

The research, from TDS Charitable Foundation, found those who bought properties this year added an average of 2.5 each, up from 2.2 last year. This is also higher than the average of 2.3 properties sold by those selling during the same period.

Elsewhere in the survey, just over half (56%) said they had increased

rents over the past 12 months, down from 61% last year.

Separate research by the Foundation found a slight fall in the number of tenants who said they were struggling to afford rent. It now stands at 32%, down from 35% a year ago. Among full-

“This is good news for the sector and for tenants in particular. For so long we’ve been hearing landlords are selling up but this survey shows this is not entirely true.”

time students, the figure has fallen from 45% to 32%.

Sheldon Bosley Knight’s lettings manager Claire Paginton said:

“This is good news for the sector and for tenants in particular. For so long we’ve been hearing landlords are selling up but this survey shows this is not entirely true.

“Although these the numbers are small, they do represent an increasing level of confidence amongst investors which is a good thing.

“Rents continue to rise and there is still not enough supply to meet the demand, so hopefully the numbers of investors expanding their portfolios continues to increase.

“As ever we are here to help, advise and support all those wishing to do so.”

Renters' Rights Bill delayed until the autumn

The Renters’ Rights Bill won’t become law until at least the early autumn.

The Bill’s third reading took place in the House of Lords on Monday, July 21 but no time was given for it to be discussed in any detail by MPs.

It will go back for consideration by the House of Commons on September 8, just after MPs return from their summer recess.

In good news for landlords, during the report stage, peers backed an amendment to require tenants who want to keep a pet in the property with them to pay an extra deposit to cover any damage.

A previous requirement for tenants

to take out a specific insurance to cover any potential damage was dropped by the government.

Sheldon Bosley Knight’s lettings director, Rebecca Dean said: “We are pleased to hear there is a delay as this delivers a message that the proposed amendments are being given careful consideration.

“This will be the biggest change in history for the lettings industry and is one which will impact greatly on landlords and their decision to continue to invest and let property.

“We are hopeful that as agents, we will still be given a grace period to prepare for the enforcement of this Bill once it has been passed through parliament. This will ensure

we have everything in place to support our tenants and landlords through the changes although this is something we are already working on.”

To hear Rebecca and senior lettings manager Josh Jones discuss the updates in our latest podcast click the logo below.

Industry focused event for landlords and investors

Details are being finalised for an industry-focused event due to take place at Stratford-upon-Avon town hall next month.

Mike Cleary MARLA

The free Landlord and Investor Evening will feature presentations covering a range of topics including updates on the Renters’ Rights Bill, financial advice, rent guarantee and

Co-Owner

whether they are looking to add to their investments, wanting to diversify or sell some or all of their portfolio.

Organiser, Josh Jones, Sheldon Bosley Knight’s senior lettings manager said: “We want to demonstrate clearly how Sheldon Bosley Knight is uniquely

tailored solutions to ensure they remain compliant, profitable and confident in their investments.

“We urge all landlords to join us to gain vital insights and discover how

LAND& PROPERTYTALK

Unplugged SHELDON BOSLEYKNIGHT

Landlords’ views needed on Decent Homes Standard consultation

Landlords are urged to give their views on the government’s updated proposed Decent Homes Standard (DHS).

If implemented, it will apply to the private rental sector for the first time.

Changes include updating the definition and raising the minimum standards of property repair; revising the list of building components which must be kept in a reasonable state of repair; introducing a window restrictor requirement; security measures to stop intruders; a requirement for floor coverings for new tenancies;

updating “thermal comfort” requirements; and introducing a new standard for damp and mould.

This will also be linked to Awaab’s Law, regulations which are also being consulted on now.

Housing minister Matthew Pennycook MP said: “The standard in its current form no longer reflects the present-day needs of tenants or landlords. For these reasons and more, it needs to be modernised.

“Regardless of who is your landlord, there should be a universally accepted and understood

minimum standard of safe and decent housing for all tenants and landlords across the country.”

Sheldon Bosley Knight’s lettings manager Sophie Biddle said: “The vast majority of landlords already provide decent homes for their tenants. However we welcome this opportunity for everyone in the industry to have their say.”

The consultation runs until September 10, 2025. Click Consultation on a reformed Decent Homes Standard for social and privately rented homes - GOV.UK to take part.

UK adults aspire to be landlords

A third of UK adults would like to be a landlord in the future.

Despite the implications of the forthcoming Renters’ Rights Bill and other financial and legal challenges of being a landlord in the current market, just over half of adults are exploring ways of entering the buyto-let market.

Market Financial Solutions’ poll of 2,000 people found 60% believe property investment is an effective means of building long-term wealth and 37% said they would rather invest in a rental property than stocks and shares.

It also found if they were to win £1 million in the lottery, almost 58% would use some or all of it to buy property.

Of those aged between 18 and 34, the figure was 68% and for those aged 35 to 54, it was 64%.

Elsewhere the survey found 61% wanted to develop a portfolio of BTL properties so they could be a full time landlord and 24% said they would consider buying a BTL property before owning a home.

Just over two thirds (68%) said aspiring to be a landlord was a realistic goal for the future with just over half (53%) taking steps to understand the rules and regulations of the sector.

In terms of funding their aspirations, the study found 30% had taken a second job, 44% were working more hours, 52% were setting money aside each month, 33% are living with friends and family to save money and 28% have used an inheritance.

The report states the baby boomer generation is “sitting on around £2.89 trillion in property

wealth” which eventually has to be handed down to either a younger generation or sold off.

Sheldon Bosley Knight’s regional lettings manager Jo Egan said: “This research is heartening. Despite the implications of the Renters’ Rights Bill, these figures show the buyto-let sector is still an attractive investment.

“It’s especially good to see the numbers of younger people who would like to become landlords.

“The private rental sector really needs good, young landlords to come into the market to ensure its longevity.

“If anyone is looking to expand their portfolio and would like advice or help to do so, please do get in touch.”

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

• Potential rent value of £825 pcm

• EPC - C

• 102 year lease remaining

• Two-bedroom flat in Cheylesmore

• Excellent public transport links

• Highly sought-after location

£125,000

• Potential rent value of £800 pcm

Cadet Close, Coventry

Quinton Parade, Coventry

• A charming and characterful terraced home

• Excellent central location

• Perfect for a first-time buyer or investor

• Kitchen with built-in/fitted appliances

• Current rent value of £825 pcm

• No onward chain

• EPC - D

• End-terraced family home

• Ground floor W/C and upstairs bathroom

£185,000

Road, Coventry Gross yield of 4.9% £190,000

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

• Current rent value of £1,200 pcm

• EPC - E

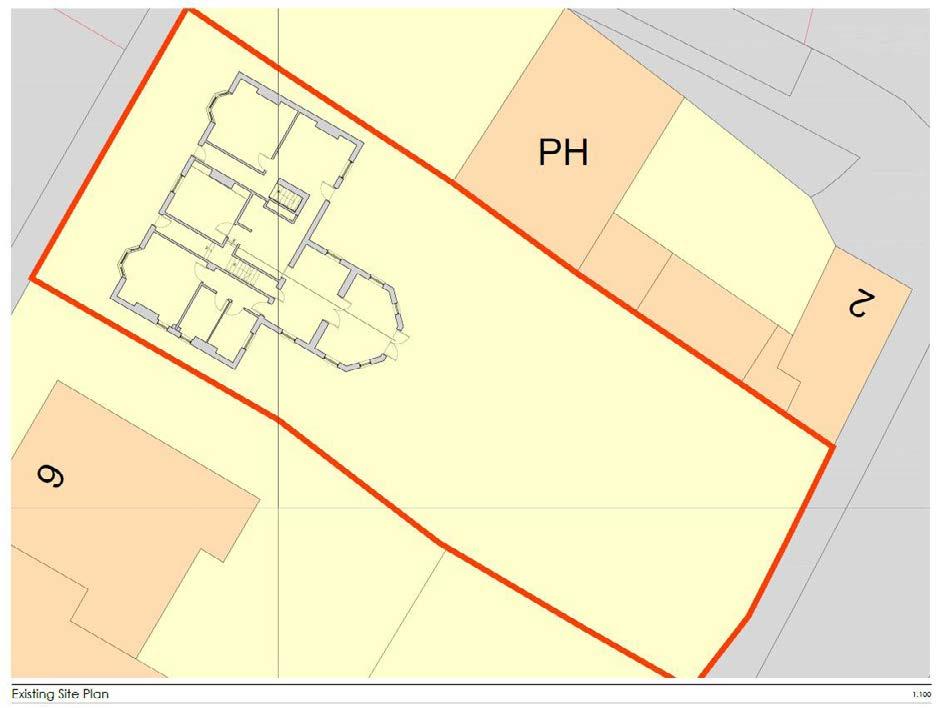

The Old Stables, High Street, Pershore

Poplar

Knightthorpe Road, Loughborough

• Ideal development/investment opportunity (Subject To Necessary Planning Permissions)

• Currently three-bedrooms, with two additional multi-use rooms upstairs

• Current rent value of £15,00 pa

• Driveway, garage and workshop store with front and rear gardens

• Walking distance to railway station

• Secure gated development & CCTV

£195,000

Rodborough House, Coventry Gross yield of 6.5% £365,000

• 10 year Warranty & 999 yrs Lease

• Walking distance into City Centre (0.5 miles)

• Potential rent value of £1,995pcm

• Lift access

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer David Wilson Homes. With various property styles there is plenty to suit your investment needs.

> Luxury three and four bedroom homes at Heritage Grange located just a short drive from Leamington Spa and Warwick.

> Built within 14.3 acres of green space, enjoy scenic walks and a family-friendly play area.

> Energy efficient homes with solar panels and EV car charging points.

> 20 minute drive to Leamington Spa and Warwick town centres with a regular bus service available.

> Close M40 motorway with easy links to Birmingham and Oxford.

> Discover countryside living with city convenience.

*Discounts and exclusive multiple unit packages are only available

For more information please contact Jack Richardson and the New Homes Team on 01789 333 466

via Sheldon Bosley Knight, and not direct with David Wilson Homes.

Kensington Road, Earlsdon, Coventry Potential

• Beautifully presented six-bedroom property

• No onward chain

• Fantastic Earlsdon location

• Six en-suites

• £650-£675 pcm per room

• Great addition to portfolio

• EPC - C

Church Street, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic

• Class E business and commercial

£450,000

• Estimated rent of £26,600 per annum

• 144.15 spm (1,550 sq ft)

• EPC - E

Gross yield of 5.6% £430,000

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 Sq Ft)

• Centrally located close to the town centre

Large Car park

LOCAL BRANCHES ACROSS THE MIDLANDS