INVEST IN FANTASY

The power of imagined worlds and the ways to play them

Will a US lawsuit take an even bigger bite out of its share price?

VOL 26 / ISSUE 12 / 28 MARCH 2024 / £4.49

APPLE:

•

•

•

The latest annual repor ts key information document (KID) and factsheets can be obtained from our website at www fidelity co uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Ser vices (UK) Limited Issued by FIL Investment Ser vices (UK) Limited, a firm authorised and regulated by the Financial Conduct Authority Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited Investment professionals include both analysts and associates Source : Fidelity International 30 September 2023. Data is unaudited UKM1223/384820/SSO/1224 Cut t hrou gh wit h convic tion FIDELIT Y INVESTMENT TRUSTS Truly global and award-winning, the range is supported by expert portfolio managers, regional research teams and on-the - ground professionals with local connections With over 450 investment professionals across the globe, we believe this gives us stronger insights across the markets in which we invest This is key in helping each trust identify local trends and invest with the conviction needed to generate long-term outperformance Fidelity’s range of investment trusts :

Fidelity Asian Values PLC

Fidelity China Special Situations PLC

Fidelity Emerging Markets Limited

•

•

•

Fidelity European Trust PLC

Fidelity Japan Trust PLC

Fidelity Special Values PLC

value of investments can go down as well as up and you may not get back the amount you invested Overseas investments are subject to currency fluctuations The shares in the investment trusts are listed on the London Stock Exchange and their price is affected by supply and demand

investment trusts can gain additional exposure to the market, known as gearing, potentially increasing volatility. Investments in emerging markets can more volatile that other more developed markets Tax treatment depends on individual circumstances and all tax rules may change in the future

find out more, scan the QR code, go to fidelity.co.uk/its or speak to your adviser. Available in an ISA

The

The

To

06 Why Apple US antitrust probe has spooked investors

07 Gold and stocks scale new heights after dovish Fed meeting

08 Activist investor buys into Scottish Mortgage as buyback is announced

09 Next shares reach new all-time high as earnings top estimates

09 Dowlais shares skid to record low on bumper provision

11 Outlook in focus as Hilton Food posts full-year results

12 Progress on job cuts and direct-to-consumer sales in focus at Levi Strauss

13 Markets move higher on more ‘dovish’ central bank comments

15 Why British Airways owner International

18 JPMorgan UK Small Cap Growth & Income:

20 Despite being an ‘old kid on the block’ F&C Investment Trust can still deliver strong returns

28 March 2024 | SHARES | 03 Contents NEWS

GREAT IDEAS

Consolidated

Airlines is worth buying

larger, more

lower costs UPDATES

liquid,

UNDER THE BONNET Spectris is another unrecognised long-term growth compounder FEATURES 28 COVER STORY INVEST IN FANTASY

power of imagined worlds and the ways to play them

Small world: a look at some of the month’s interesting small-cap stories 35 Sweet like chocolate: the total return stocks profiting from the sale of tasty treats 40 EMERGING MARKETS Why the Taiwanese market is more than just TSMC 43 FINANCE How to make the most of the big gilt revival 48 DANIEL COATSWORTH

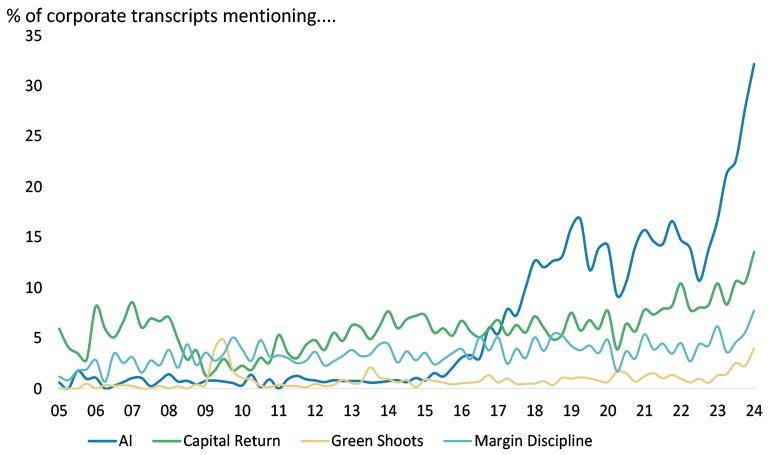

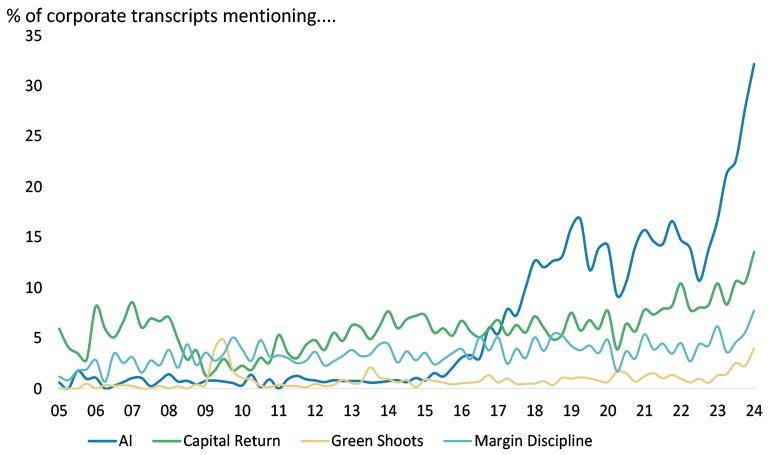

catchy names like the Magnificent Seven hook in investors

ASK RACHEL How can you pay into a grandchild’s ISA? 59 EDITOR’S VIEW

do European companies really care about right now? 61 INDEX

funds, ETFs and investment trusts in this issue 33 48 52 28

22

The

33

How

52

What

Shares,

Three important things in this week’s magazine

Exploring the power of fantasy worlds

Shares looks at the firms which are cashing in on this growing genre and looks ahead to its potential in the metaverse.

Sweet like chocolate: the total return stocks profiting from the sale of tasty treats

Spectris is another unrecognised long-term growth compounder

W2 3

The sweet taste of success

With Easter just days away we dive into the world of the chocolatiers and pick a pair of winners.

Why is Spectris considered a ‘high-quality’ company? We explain what makes specialist engineering firm Spectris tick and why it is a favourite with fund managers.

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

04 | SHARES 28 March 2024 Contents

28 March 2024 | SHARES 35 Feature Shares in chocolate makers have soured due to short-term headwinds, but long-term investors could potentially still benefit from their compounding power One of the chocolate industry’s seasonal peaks, Easter is upon us with eggs from the world’s major brands adorning retailer’s shelves. Chocolates are tough for consumers to resist at this time of year, but is this an opportune time to put money to work with purveyors of one of the world’s most popular little luxuries? SWEET CONSUMER CATEGORY According to MarkNtel Advisors, the global chocolate market was valued at $421 billion in 2023 and is forecast to grow at a CAGR (compound annual growth rate) of around 4.7% between 2024 and 2023, with growth supported by the consumer’s sweet tooth and increasing demand for organic, vegan, sugar-free, and gluten- free chocolates from more health-conscious chocoholics.

Chocolate, snacks and confectionery have been great consumer categories for decades and with consumption rising in emerging markets amid the expansion of the middle classes, exciting long-run opportunities exist for the snack food conglomerates that dominate the industry. Sales growth from this sub-sector of the consumer staples industry can be pedestrian at times, but resilient demand and the pricing power the key players possess, conferred by must-have brands, translates into robust cash flows and progressive dividends which investors can then reinvest. This means the small band of publicly listed chocolate sellers have the capacity at least to deliver decent total returns. INFLATIONARY PRESSURES LEAVE SOUR TASTE However, as prices have risen to offset elevated cocoa and sugar costs, chocolate market growth has recently slowed in the EU and the US, as the Morgan Stanley charts provided demonstrate, and the risk is further price increases will impact volumes going forwards. Cocoa is scaling record highs as adverse weather in major growing regions, tree illness and capacity shortages lead to expectations of an even wider supply deficit this season, which could create a headwind to volumes for chocolate companies as pricesIndustryrise.heavyweights Hershey (HSY:NYSE), the Milton Hershey-founded, Michele Buck-bossed chocolatier behind some of planet Earth’s most popular candies, and Dairy Milk maker Mondelez International (MDLZ:NASDAQ), have recently served up slower growth as consumers rein in spending in response to price hikes. Cocoa prices have soared 1970 1980 1990 2000 2010 2020 0 1,000 2,000 3,000 4,000 5,000 Chart: Shares magazine Source: LSEG 22 SHARES 29 March 2024 Under the Bonnet:Spectris Analysts have low-balled earnings estimates for this year

henever there is a discussion about ‘quality’ UK industrial stocks, the name Spectris (SXS) is often thrown into the ring although we suspect many investors, while being familiar with the company in a general sense, have little idea what it actuallyLookingdoes. on Stockopedia, the company has a 99th percentile quality ranking, which backs up its reputation, but it is classified as a large-cap technology stock and a ‘high-flyer’, which doesn’t help a great deal in explaining the business. So, what does Spectris actually do and is it an interesting investment? A BRIEF INTRODUCTION Spectris is divided into two main business units, making precision measurement equipment and software for some of the world’s most technically demanding applications, from aerospace and electronics to electric vehicles, and helping to solve a myriad of environmental issues such as monitoring and reducing micro-plastics and even working out how Galapagos tortoises self-right themselves. Spectris Scientific makes equipment for material analysis for the pharmaceutical, semiconductor and materials sectors, measuring particles down to the nano scale to help its customers shape everything from proteins, metals and polymers to controlling the manufacturing process, and contributes 56% of the group’s turnover. Spectris Dynamics is a global leader in advanced virtual and physical testing and high- precision sensors for the automotive, machine manufacturing, aerospace and technology sectors, and contributes the remaining 44% of group turnover. It works in what it calls attractive, sustainable, structural growth markets with high barriers to entry, using an asset-light model and investing

Analysts are expecting a big slowdown in organic growth this year Revenue £1.45bn £1.5bn LFL change 9.7% 3.4% Adj ProfitOperating £262m £272m Operating Margin 18.1% 18.1% EPS 199p 207p DPS 79.2p 86.3p 2023 Actual 2024 Forecast Table: Shares magazine Source: Spectris company-compiled consensus as of 24 February 2024 Spectrishelpssolveamyriadofenvironmentalissuesincluding workingouthowGalapagostortoisesself-rightthemselves 28 SHARES | 28 March 2024 The world of fantasy is clearly having a moment. The rise of ‘romantasy’ authors like Sarah J Maas, who has been a big part of UK publishing outfit Bloomsbury’s (BMY) recent success, have taken the genre out of its previous male-dominated realm to a whole new audience. Bloomsbury’s surging sales and the ongoing phenomenon that is Games Workshop (GAW) are two examples on the UK market which show the devotion fantasy worlds can inspire. Warren Buffett disciple and manager of CFP SDL UK Buffettology General (BKJ9C67) Keith Ashworth-Lord once described Games Workshop, which represents 9% of the portfolio, as the ‘nearest thing to legal drug dealing on the stock market’, with the tabletop games firm ticking one of the key boxes he looks for in a business: capturing a piece of its customers’ minds. But this concept is a global one which is applicable beyond the fantasy genre. Imagined worlds are powerful – connecting with people on an emotional and intellectual level and driving a connection which creates significant barriers to entry and pricing power for the owners of the relevant intellectual property.

power of imagined worlds and the ways to play them INVEST FANTASYIN The metaverse and virtual reality could strengthen the bond between people and their favourite characters and worlds

ignites investors’ imagination as shares rise

The

Reddit IPO

48% on debut

Phoenix shares take flight after results blow past forecasts

FTSE 100 within touching distance of new all-time high

7%

JD Wetherspoon shares fall

on slowing sales growth 1

There’s no better investment return than the freedom to live well Whatever your financial goals, a Janus Henderson Investment Trust invests for your future actively, expertly and diligently. Whether you’re looking for growth or a steady income, our range of trusts aims for competitive returns across a diverse selection of global investments. And with decades of investment trust experience behind us, you can look forward with confidence. Explore our Investment Trust range at www.janushenderson.com/JHIT INVESTMENT TRUSTS Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Why Apple US antitrust probe has spooked investors

Technology giant faces threat to key Services arm

Technology giant Apple (AAPL:NASDAQ) is facing an epic fight with regulators after the US Department of Justice launched a lawsuit accusing the iPhone maker of violating antitrust laws and suppressing competition by blocking rivals from accessing hardware and software features on its devices.

The challenge, announced last week (21 March), saw shares in Apple lose more than 4%, their biggest one-day fall since August 2023 according to Bloomberg. The decline also brings Apple’s year-todate slide to 11%, erasing around $293 billion from its market value.

The sell-off stands in contrast to the rest of big tech. The US-listed Roundhill Magnificent Seven ETF, which tracks the performance of the ‘Magnificent Seven’ stocks, is up 19% year-to-date.

Antitrust legal challenges are par for the course in the technology industry, but they are typically brushed off by analysts and investors with most eventually settled by hefty fines before being consigned to history. But Apple now finds itself under threat on three of its most important fronts – Europe, China and now its own backyard.

Apple became a powerhouse stock due to its innovation and growth, but without iconic chief executive Steve Jobs at the helm innovation has come to a standstill. The company killed its multiyear attempt to build an electric car, is behind in the AI race, and has been unimpressive in delivering the ‘wow’ factor in new iPhone releases.

The US suit also puts Apple’s Services business in the watchdog’s crosshairs, the firm’s biggest source of growth in recent years. Home to the App Store, Apple Pay and Apple Music, and fed

by more than two billion Apple devices in use, services revenue expanded 9% in fiscal 2023 while product revenue, including iPhones, Macs and iPads, dropped 3%. Adding to the threat, despite only accounting for 22% of Apple’s sales, services generated more than a third of profit.

Analysts have flagged similarities to the groundbreaking antitrust battle that brought the US and Microsoft into opposition in the 1990s, with Apple now having to defend itself over accusations it has abused the significant power it has accumulated over users.

The decline also brings Apple’s year-to-date slide to 11%, erasing around $293 billion from its market value”

Despite the heightened threat to Apple, Morningstar analysts remain supportive. ‘We still believe most Apple users opt into the firm’s premium closed ecosystem, and we don’t predict significant attrition for the firm’s products and services even in a more open environment,’ said William Kerwin.

‘We assume the suit will result in some opening of Apple’s walled garden ecosystem, similar to what we expect from the European Union’s Digital Markets Act,’ added Kerwin. [SF]

News 06 | SHARES | 28 March 2024

Apple ($) Jan 2024 Feb Mar 170 175 180 185 190 195 Chart: Shares magazine • Source: LSEG

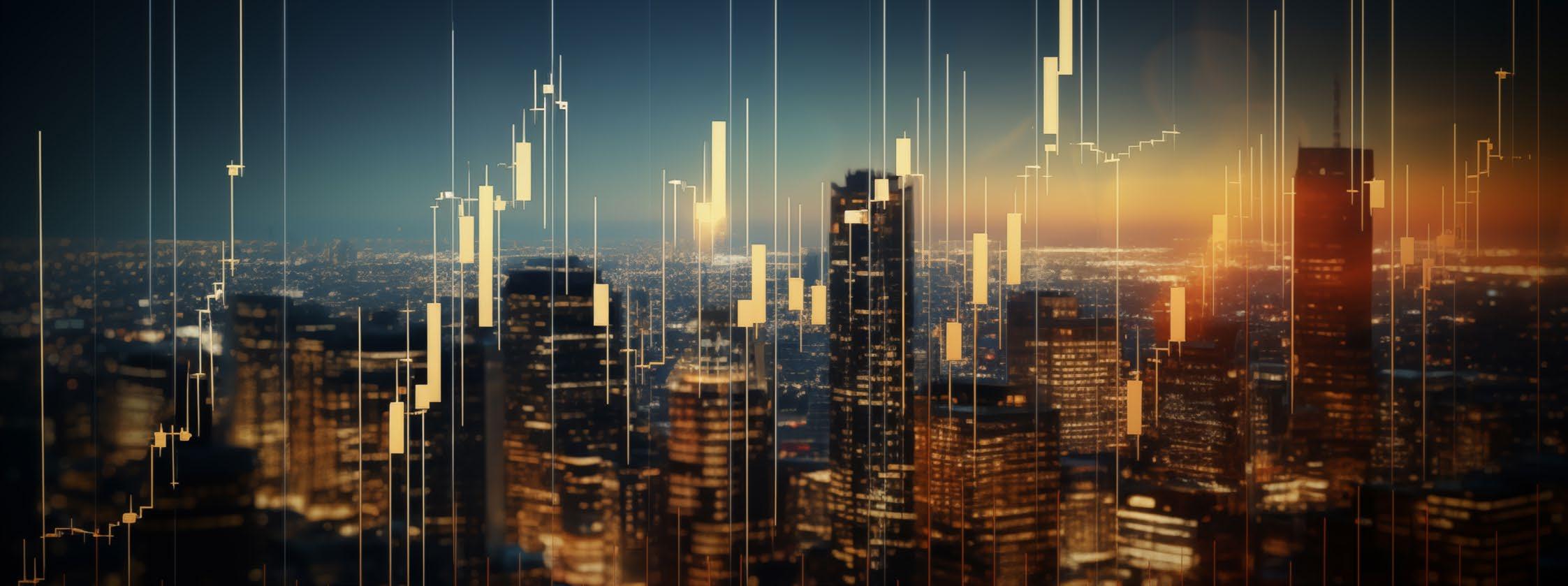

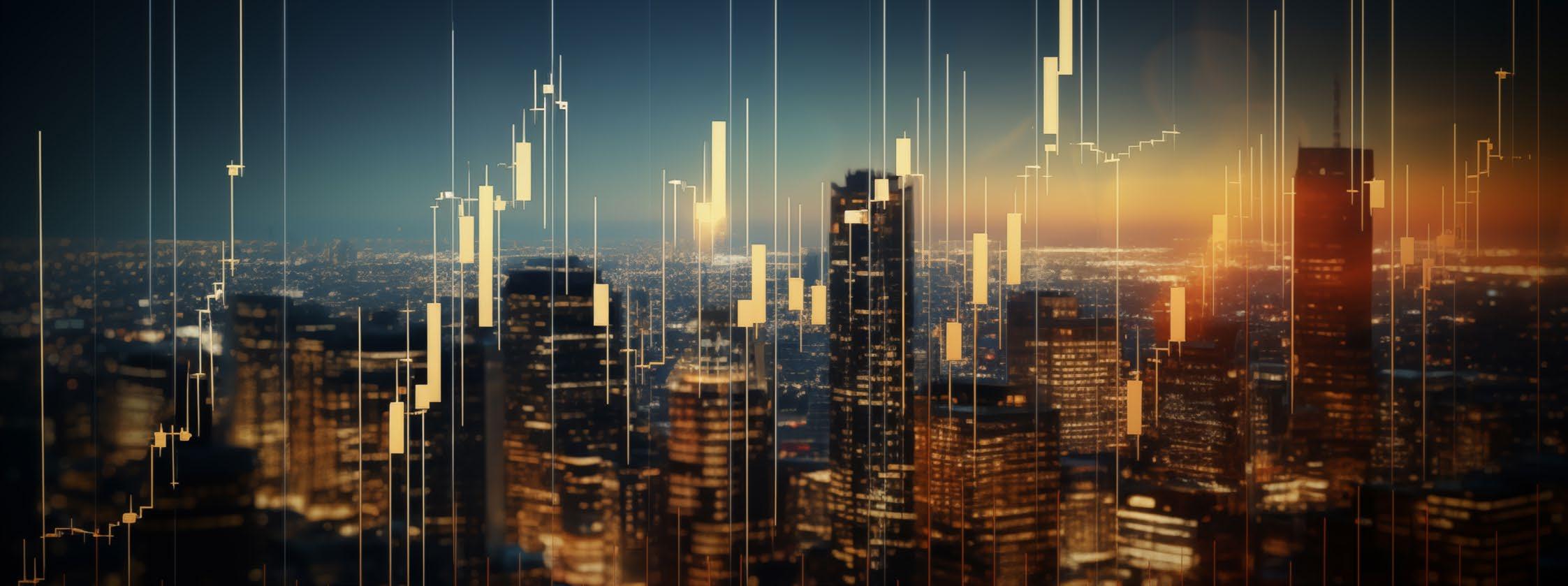

Gold and stocks scale new heights after dovish Fed meeting

For investors, what Federal Reserve chair Jay Powell says during press conferences following interest rate decisions is more important than the official statement accompanying each rate decision.

In other words, monetary policy is set by the communication of rate decisions rather than the decisions themselves.

This distinction was more pronounced than usual at the 20 March meeting which, for the record, saw the central bank leave benchmark federal funds rate unchanged in the range of 5.35% to 5.5%.

Powell’s comments on interest rates, inflation and the Fed’s balance sheet were interpreted as dovish when compared with the Fed’s official statement and updated summary of economic projections which were decidedly hawkish.

Investors took on the board the message and promptly chased the S&P 500 to yet another new all-time high which it has done no fewer than 20 times so far in 2024. In other words, markets are doing the Fed’s work.

Notably, the move higher in shares was also accompanied by a record high in the price of gold which breached $2,200 per troy ounce for

the first time.

While there are other factors at play, such as central banks accumulating the yellow metal at a record pace over the last two years, the high price may also reflect worries over stickier mediumterm inflation.

Investors appear to be taking the view the Fed will let inflation run higher for longer while maintaining its official line of bringing it back to its 2% target.

On inflation for example, despite recent evidence of core inflation coming in hotter than expected, Powell suggested this could be due to ‘seasonal’ factors, implying the solid progress made at the back end of 2023 was likely to reappear.

There also seems to be a shift in emphasis towards protecting the labour market.

On the surface the US labour market appears healthy with 275,000 new jobs created in February, but broader measures are showing signs of weakness which Powell acknowledges.

For example, the NFIB (National Federation of Independent Businesses) hiring survey shows a decline in hiring intentions in recent months.

So far, the Fed has done a good job of balancing the needs of the economy with reducing inflation. By its own admission the central bank is not sure how restrictive its policy stance is or how long it will take to bring inflation down to target.

Investors are looking past the conundrum and following the old maxim of ‘don’t fight the Fed’. This is reflected in all-time highs for riskier assets such as stocks and Bitcoin, tight bond yield spreads and a resurgence of initial public offerings. [MG]

News 28 March 2024 | SHARES | 07

With stocks at all time highs financial conditions do not appear restrictive S&P 500 vs gold 1970 1980 1990 2000 2010 2020 0 2,000 4,000 S&P 500 Gold bullion LBM $/t oz Rebased to 100 Chart: Shares magazine • Source: LSEG

Activist investor buys into Scottish Mortgage as buyback is announced

Elliott Advisors has shifted its focus from Curry’s to investment trusts

It has been a busy time for shareholders in Scottish Mortgage Investment Trust (SMT), but it has been a fruitful time too with the shares hitting new 12-month highs in March.

First, the board announced it would buy back at least £1 billion worth of shares in order to help narrow the discount to NAV (net asset value).

Then, Delaware-based Elliott Advisors revealed it had taken a 5% stake in the trust through the purchase of shares and derivatives.

A quick look at trading in Scottish Mortgage over the last fortnight shows a big spike in volume on 15 March – the same day the board announced the share buyback plan – and again on 19 March.

Iain Scouller, head of investment trust research at Stifel, posits asking the trust’s board ‘Were you aware there was stake building underway when you announced the £1 billion buyback?’.

‘The market is likely to suspect the board was aware some significant trading activity was afoot, though perhaps not knowing which investor was behind it, and this was one factor in the timing of the buyback announcement.’

Scouller suggests the board may have hoped that by announcing a buyback the discount would narrow enough to dissuade would-be activists from buying shares in the near term.

Given Elliott has previous form in campaigning for change at trusts – and has had notable success to boot – the board may now be hoping the firm trades out of the shares for a quick gain if the discount narrows further.

However, given the shares have already bolted on these two bits of news, £1 billion is now only enough to buy around 8% of the trust over two years, or 4% each year, which looks less impressive than at first glance compared with Elliott’s stake.

Mortgage

highlights, Scottish Mortgage shares historically traded at a premium to NAV so Elliott may be looking for a free ride as the discount narrows although that doesn’t get to the root of the problem.

‘Part of Scottish Mortgage’s share price weakness was down to rising interest rates which negatively affected valuations of companies where the story is about future cash flow. As the share price fell, there were also suggestions that Scottish Mortgage had been taking too many wild bets on blue-sky companies that were miles off making any money,’ says Coatsworth.

Having fewer unquoted stocks would mean a more liquid portfolio but would also deprive the trust of future IPO candidates, he adds. [IC]

DISCLAIMER: Financial services

As AJ Bell investment analyst Dan Coatsworth

company AJ Bell referenced in this article owns Shares magazine. The author of this article (Ian Conway) and the editor (Tom Sieber) own shares in AJ Bell.

News 08 | SHARES | 28 March 2024

Scottish

(p) 2020 2021 2022 2023 2024 400 600 800 1,000 1,200 1,400 Chart: Shares magazine • Source: LSEG

Next shares reach new all-time high as earnings top estimates

The firm is in ‘a more positive frame of mind’ than it has been for years

Shareholders in retail bellwether Next (NXT) were breaking out the champagne after the stock price hit a new lifetime high on the release of forecast-beating results for the year to January (21 March).

Full-price sales rose a betterthan-expected 4%, with growth driven by strong online trading, suggesting the retailer’s offering continues to resonate with shoppers.

Chief executive Simon Wolfson opened his comments by saying it was

‘a long time since we started a year in a more positive frame of mind’, as the firm ended 2023 with its highest-ever levels of revenue and profit and entered 2024 ‘with new avenues of growth along with a cost base that feels under control’.

Earnings this year are seen rising just under 5% to around £960 million while the firm intends to return £540 million in dividends and buybacks. Progress is expected outside the UK with more US retailers hopefully signing up for trials and franchising

and licensing agreements agreed with leading players in India and Asia.

Shore Capital described the firm as ‘a high-class act with a deserved equity capital market following because there is a more than reasonable chance that it will beat its guidance’. [IC]

Dowlais shares skid to record low on bumper provision

Charge overshadowed the group’s strong underlying performance last year

Investors in automotive products maker Dowlais (DWL) were drowning their sorrows as the shares hit their lowest level since the firm spun out of conglomerate Melrose Industries (MRO) last year and listed as a stand-alone entity.

The group’s underlying performance for 2023 was steady if not spectacular, helped by a banner year for UK vehicle production with output topping one million units for the first time since 2019, and the board recommended an increased dividend and a

share buyback of up to £50 million.

Chief executive Liam Butterworth hailed the firm’s ‘significant progress and transformation’ in 2023 along with its strong financial and operational performance, ‘demonstrating resilience, expanding margins, generating free cash flow above our expectations and reducing our financial leverage’.

However, as part of the spinoff process the firm had to ‘take ownership’ of the powder metallurgy business, the value of which it decided to write down by £450 million after reviewing its prospects.

That sent the bottom line into deficit by a similar amount and sent the shares

News 28 March 2024 | SHARES | 09

DOWN in the dumps

Moving

HIGHER

crashing almost 10% to a new low of 81.2p. [IC] Next Apr 2023 Jul Oct Jan 2024 Apr 7,000 8,000 9,000 Chart: Shares magazine • Source: LSEG Dowlais (p) Jul 2023 Oct Jan 2024 Apr 100 120 140 Chart: Shares magazine • Source: LSEG

Sophisticated global investing made effortless

Since

Enjoy sophisticated investing made available to everyone at www.janushenderson.com/BNKR

a wide range of quality global investments in

expertly blended

growth and

1888, The Bankers Investment Trust has enabled people to access

one

portfolio. Targeting long-term

income, for those aiming to invest for their future.

BANKERS INVESTMENT TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Outlook in focus as Hilton Food posts full-year results

It’s already clear 2023 was a year of recovery after a difficult 2022 Retail meat- and fish-packing business Hilton Food (HFG) is set to report its full-year results on 3 April.

The company gave a pretty clear picture of its 2023 performance in a January trading update so the spotlight is likely to be on the outlook for 2024 and recent trading.

Hilton was hit by two damaging profit warnings in 2022, largely relating to problems in its UK seafood operation.

The business runs automated and robotised food processing, packing and logistics facilities for major international retailers across Europe, Asia Pacific and North America, and through economies of scale is able to

UK

UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

3 April: Hilton Food, Pantheon Infrastructure

secure significant efficiency savings for customers while also carving out a decent margin for itself.

Commenting on the January update, Shore Capital said: ‘Management also looks to the more medium term with confidence as it continues to explore opportunities in both new and existing markets to underpin its strategy to be the international protein partner of choice, with its combination of a highlyautomated supply chain, leading technology and multi-category food capabilities expected to drive sustained growth.’

The broker also noted ‘the breadth of growth

What the market

opportunities that have been cultivated across a range of international markets and protein categories, supported by the monetisation of the automation and technology capabilities now operating under the Greenchain Solutions umbrella’. [TS]

What the market

News: Week Ahead 28 March 2024 | SHARES | 11

Hilton Food (p) Apr 2023 Jul Oct Jan 2024 Apr 700 800 Chart: Shares magazine • Source: LSEG

expects of Hilton Food 2023 50.4p £4.05bn 2024 60.6p £4.2bn EPS Revenue Table: Shares magazine • Source: Stockopedia

What the market

expects of Hilton Food 2023 50.4p £4.05bn 2024 60.6p £4.2bn EPS Revenue Table: Shares magazine • Source: Stockopedia

expects of Hilton Food 2023 50.4p £4.05bn 2024 60.6p £4.2bn EPS Revenue Table: Shares magazine • Source: Stockopedia

Progress on job cuts and direct-to-consumer sales in focus at Levi Strauss

Shares

Iconic denim products maker Levi Strauss (LEVI:NYSE) may be one of the oldest companies in the US, tracing its origins all the way back to 1853, but it remains highly relevant today.

It regularly scores near the top in apparel brand rankings in both the US and internationally and the company’s shares are on a strong run ahead of its first-quarter numbers (to the end of February) on 3 April.

Earnings have consistently come in ahead of expectations in recent quarters, although those expectations have been pitched pretty low at times as management have guided them down. This will be the first release under new chief executive Michelle Gass who took

over from Chip Bergh on 29 January. There was modest disappointment in January when the fourth-quarter earnings were accompanied by a muted outlook. Shareholders will be looking for an update on plans to cut between 10% and 15% of the firm's global workforce in the first half of 2024 with the aim of saving $100 million in costs for the year to 30 November 2024.

The company is also trying to sell more through its own physical stores and website rather than through third parties. Retailers are still pretty cautious about taking on too much stock amid fairly muted consumer demand over the last couple of years thanks to cost-of-living pressures. [TS]

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

1 April:

PVH, Nano X

2 April: Freedom

3 April: Acuity Brands, Blackberry, Acuity Brands, Novagold, Levi Strauss

4 April: RPM, Lamb Weston Holdings, Simply Good Foods

News: Week Ahead 12 | SHARES | 28 March 2024

in the

brand have

in

Levi Strauss ($) Apr 2023 Jul Oct Jan 2024 Apr 14 16 18 Chart: Shares magazine • Source: LSEG What the market expects of Levi Strauss Q1 forecast $0.20 $1.53bn EPS Revenue Table: Shares magazine • Source: Zacks What the market expects of Levi Strauss Q1 forecast $0.20 $1.53bn EPS Revenue Table: Shares magazine • Source: Zacks What the market expects of Levi Strauss Q1 forecast $0.20 $1.53bn EPS Revenue Table: Shares magazine • Source: Zacks

iconic denim

enjoyed a strong run

recent months

Markets move higher on more ‘dovish’ central bank comments

Three UK and US interest rate cuts are being penciled in this year

As expected, there was no change in benchmark interest rates either in the UK or the US last week but markets found plenty to like in the commentaries from both central banks.

Bank of England governor Andrew Bailey sounded more optimistic on rate cuts than many had predicted given inflation is still over

3% against the bank’s official 2% target.

Macro diary 28 March to 04 April 2024

Macro diary 28 March to 04 April 2024

Macro diary 28 March

Bailey told the BBC: ‘We don't have to actually get inflation all the way back to target… to cut rates for instance, what we have to do is be convinced that it is going there. We should act ahead of time in that sense because we have to be forward looking.’

He also said it was ‘reasonable’ for financial markets to price in two or three rate cuts this year given the ‘very encouraging’ progress on bringing inflation down so far.

In a similar vein, Federal Reserve chair Jerome Powell said strong recent inflation data didn’t change ‘the overall story, which is that of inflation moving down gradually on a sometimes bumpy road to 2%’.

Powell also confirmed market expectations of three interest rate cuts this year, although he stressed the timing depended on officials becoming more confident inflation was coming down adding ‘it’s appropriate for us to be careful’.

Next week sees the release of both manufacturing and services indices in the UK, the US and the Eurozone, all of which will be widely watched.

Focus will also be on the US jobs market where there are several data points for the Federal Reserve to parse while it considers the next step in its interest-rate policy in early May. [IC]

News: Week Ahead 28 March 2024 | SHARES | 13

28-Mar US Q4 GDP 3.2% 29-Mar US February Core PCE Price Index 2.8% 01-Apr US March ISM Manufacturing 47.8 02-Apr UK March Nationwide House Price Index 1.2% UK March Manufacturing PMI 49.9 Eurozone March Manufacturing PMI 45.7 US February JOLTS Job Openings 8.86m 03-Apr Eurozone March CPI 2.6% US March Non-Farm Payrolls 140k US March Services PMI 51.7 04-Apr UK March Services PMI 53.4 Eurozone March Services PMI 51.1 US March Challenger Job Cuts 84.6k Date Economic Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

28-Mar US Q4 GDP 3.2% 29-Mar US February Core PCE Price Index 2.8% 01-Apr US March ISM Manufacturing 47.8 02-Apr UK March Nationwide House Price Index 1.2% UK March Manufacturing PMI 49.9 Eurozone March Manufacturing PMI 45.7 US February JOLTS Job Openings 8.86m 03-Apr Eurozone March CPI 2.6% US March Non-Farm Payrolls 140k US March Services PMI 51.7 04-Apr UK March Services PMI 53.4 Eurozone March Services PMI 51.1 US March Challenger Job Cuts 84.6k Date Economic Event Previous

Shares magazine • Source: Morningstar, central bank websites

Table:

to 04 April 2024 28-Mar US Q4 GDP 3.2% 29-Mar US February Core PCE Price Index 2.8% 01-Apr US March ISM Manufacturing 47.8 02-Apr UK March Nationwide House Price Index 1.2% UK March Manufacturing PMI 49.9 Eurozone March Manufacturing PMI 45.7 US February JOLTS Job Openings 8.86m 03-Apr Eurozone March CPI 2.6% US March Non-Farm Payrolls 140k US March Services PMI 51.7 04-Apr UK March Services PMI 53.4 Eurozone March Services PMI 51.1 US March Challenger Job Cuts 84.6k Date Economic Event Previous Table: Shares magazine • Source: Morningstar, central bank websites Next Central Bank Meetings & Current Interest Rates 11-Apr European Central Bank 4.5% 01-May US Federal Reserve 5.5% 09-May Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites Next Central Bank Meetings & Current Interest Rates 11-Apr European Central Bank 4.5% 01-May US Federal Reserve 5.5% 09-May Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites Next Central Bank Meetings & Current Interest Rates 11-Apr European Central Bank 4.5% 01-May US Federal Reserve 5.5% 09-May Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Invest in a portfolio built for lifetimes A favourite with investors looking for long-term, dependable returns, The City of London Investment Trust is well regarded for its dividend increases and capital growth prospects. The Trust invests in leading businesses that are listed on the London Stock Exchange, providing investors with a good-value gateway to large, international companies. Create a lasting investment legacy at www.janushenderson.com/CTY CITY OF LONDON INVESTMENT TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Why British Airways owner International Consolidated Airlines is worth buying

Strong consumer demand and premium leisure offerings are helping to support its turnaround in fortunes

International Consolidated Airlines (IAG) 162p

Market cap: £7.98 billion

Unloved by investors during the pandemic British Airways owner International Consolidated Airlines (IAG) has experienced a revival of fortunes due to strong consumer demand and holidaymakers paying higher ticket prices. Despite the ongoing cost-ofliving crisis – people are still prioritising holidays.

In a recent full year trading update at the end of February, the airline group said it had restored 95.7% of 2019 capacity.

Passenger unit revenue for the year was 8.2% higher than in 2022 ‘with strong leisure traffic recovery and business traffic recovering more slowly’ although the premium leisure segment continued to perform ‘very well’.

Operating profits nearly tripled from €1.3 billion to €3.5 billion surpassing the previous record of €3.3 billion made by the company pre-pandemic in 2019.

The group, which also owns Spain’s Iberia and Ireland’s Aer Lingus, has a positive outlook for 2024 and is generating significant free cash flow.

We don’t think this improving picture is reflected in an extremely grudging price to earnings ratio of just 4.5 times based on 2024 consensus forecasts.

IMPROVING SENTIMENT

The airline group is at least getting a more sympathetic hearing from the analyst community.

Great Ideas: Investments to make today 28 March 2024 | SHARES | 15

International

(p) 2020 2021 2022 2023 2024 100 200 300 400 Chart: Shares magazine • Source: LSEG

Consolidated Airlines

Great Ideas: Investments to make today

Analyst James Hollins from French investment bank BNP Paribas recently observed the company had: ‘Fixed our bear thesis; leverage is down. British Airways is improving, Iberia is at record strength, shareholder returns are resuming, Heathrow is full again and core wage deals are fixed mid-term.’

Savi Syth, analyst at US investment bank, Raymond James highlights: ‘IAG’s greater exposure to favourable trends in the transatlantic and intraEuropean markets, improving competitive capacity set up, and opportunity to initiate cash returns to shareholders.’

The company has adapted to and acknowledged the post-pandemic realities of flying in Europe grabbing a high share of transatlantic traffic and offering premium leisure travel to consumers.

It is making improvements to its service which could help it maintain and grow its market share. There is planned investment in areas including a digital concierge service, WhatsApp text assistant and call-centre Smart Voice assistant.

There will also be touchpoints across the airport journey, better digital self-service in disruption and digital assistance in the customer care channel.

British Airways customers will benefit from increased in-flight entertainment and a premium proposition across its cabins. The airline is also going to further develop its call centre in Delhi using better IT and systems and an initiative-taking care team.

WORST IS OVER

Analyst Nicholas Mauder of Kepler Cheuvreux no longer believes the airline operator will see a passenger yield decline this year. Passenger yield is

an important metric for the airline sector – it shows the average fare paid per mile or kilometre, per passenger.

Mauder has significantly increased his EBIT (earnings before interest and taxation) estimate for 2024 to €3.74 billion.

Mauder says the company has the cleanest unit cost outlook among its counterparts. He adds: ‘Our (significantly increased) estimates are above consensus, and an eventual share buyback could be the catalyst the market needs to acknowledge the value we see in IAG shares.’

FUEL COST WORRIES

The main sticking points for the company are slower than expected recovery of business travel and ongoing volatility in the cost of fuel.

In the recent annual results, the company noted fuel unit costs were up 0.7% versus 2022, however the group’s investment in more fuel-efficient aircraft should help offset increased costs of emissions trading schemes.

The airline is 92% booked for the first quarter of 2024 and 62% booked for the first half of 2024, ahead of last year on both measures.

The company plans to grow capacity by around 7% in 2024 and rebuild its pre-pandemic long haul capacity and grow Iberia in the attractive Latin American market. [SG]

16 | SHARES | 28 March 2024

Airlines - consensus forecasts € € 2024E 31.0 billion 0.4 2025E 32.3 billion 0.5 Revenue Earnings per share (EPS) Table: Shares magazine • Source: Stockopedia

International Consolidated

Jump on the engines of European growth Join Europe’s dynamic smaller companies on their journey to success, as they drive strong, consistent potential returns for investors. The European Smaller Companies Trust discovers and invests in the businesses that are powering the exciting transformation of today and tomorrow. Let them power your portfolio too at www.janushenderson.com/ESCT EUROPEAN SMALLER COMPANIES TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

JPMorgan UK Small Cap Growth & Income: larger, more liquid, lower costs

Enlarged trust is a canny way to capture a rerating of unloved UK small cap stocks

JPMorgan UK Small Cap Growth & Income (JUGI)

293.5p

Market cap: £403.4 million

Amajor trend in the investment trust sector is mergers between sub-scale trusts with similar remits to create funds large enough and sufficiently liquid to attract wealth managers and retail investors.

One example which Shares believes offers a compelling proposition is JPMorgan UK Small Cap Growth & Income (JUGI), which is the resut of the combination of JPMorgan UK Smaller Companies and stablemate JPMorgan Mid Cap, which shared the same managers and had plenty of portfolio overlap.

With assets now knocking on £500 million, the enlarged entity is more liquid, has lower fees spread across a broader asset base and a wider investment universe. Furthermore, the name change reflects a new enhanced dividend policy targeting a 4% yield on NAV (net asset value) to be paid from a combination of income and capital.

Trading at an attractive 12.5% discount to NAV, the trust offers a stronger total return with income alongside the capital growth potential of the small-cap asset class where valuations remain attractive in absolute and relative terms as shown by surge in M&A activity.

JP Morgan Small Cap Growth & Income

tomorrow’s medium- and large-caps.

The trust’s greater scale gives Brittain and Patel the freedom to invest across an enlarged universe including FTSE 250 constituents and smaller AIM-traded companies. At last count, the portfolio was heavily overweight consumer discretionary versus its benchmark, meaning the trust offers a play on the uptick in domestic consumer confidence with unemployment low and real wages rising.

Managers Georgina Brittain and Katen Patel are bottom-up stock pickers with an excellent performance track record who look to capitalise on the lack of research at the smaller end of the UK market to find highly innovative or disruptive firms. Able to leverage JPMorgan’s deep research capability, their approach aims to identify companies which can grow rapidly and become

Select FTSE 250 names such housebuilder Bellway (BWY) and central London REIT Shaftesbury Capital (SHC) have been rolled into the new-look JPMorgan Small Cap Growth & Income, whose eclectic mix of growth stocks includes promotional products marketer 4imprint (FOUR), airline-to-package holidays provider Jet2 (JET2:AIM), cakes-to-cooking sauces maker Premier Foods (PFD), software firm Bytes Technology (BYIT) and online ticketing platform Trainline (TRN).

Previously, JPMorgan charged 0.65% on net assets up to £300 million and then 0.55% on assets above that amount. For the enlarged trust, the threshold has been lowered to £200 million. [JC]

Great Ideas: Investments to make today 18 | SHARES | 28 March 2024

(p) 2020 2021 2022 2023 2024 100 200 300 400 Chart: Shares magazine • Source: LSEG

Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. Henderson Far East Income Limited is a Jersey fund, registered at IFC-1, The Esplanade, St Helier JE1 4BP, Jersey, and is regulated by the Jersey Financial Services Commission. Asia’s known for growth, we love it for income For a whole new source of income, look East. Asia Pacific companies are growing their profits and their dividends too. It’s a unique opportunity for investors to tap into, with Henderson Far East Income Investment Trust. Discover the attractions of Asia’s income at www.janushenderson.com/HFEL HENDERSON FAR EAST INCOME

Despite being an ‘old kid on the block’ F&C Investment Trust can still deliver strong returns

The 156-year-old trust has reported its 53rd consecutive rise in annual dividends

F&C Investment Trust (FCIT) Price: 974p

Gain to date: 4.42%

We suggested investors buy F&C (FCIT), one of the oldest collective investment trusts in the world, back in October 2022 on the grounds it was a ‘safe bet’.

Fast forward 18 months to the spring of 2024 and the trust founded in 1868 and managed by Columbia Threadneedle is still delivering consistent returns despite a difficult macroeconomic and geopolitical backdrop.

WHAT HAS HAPPENED SINCE WE SAID BUY?

The trust has largely been putting in a robust performance and living up to its strategy of delivering ‘long-term growth and capital income’ to investors, even if returns look a little prosaic against Magnificent Seven-driven global markets.

In its latest set of results (8 March) for the year to 31 December 2023, the trust declared an 8.9% increase in the full-year dividend to 14.7p per ordinary share. This represented the 53rd consecutive rise in annual dividends.

The trust’s growth in dividends over the past decade, at 63.3%, is almost double that of UK inflation over the equivalent period.

In a recent ‘fireside chat’ with shareholders, F&C chair Beatrice Hollond said: ‘We are hoping to pay an increased dividend this year [which must go to our annual general meeting first] which is an 8.9% increase, which means over one, three, five and 10

years we have paid a real dividend increase. The F&C board wants to be able to sustain that overall.’

In addition, over a 10-year period it has delivered a total shareholder return of 203%, equivalent to 11.7% a year.

Net asset value per share, with debt at market value, rose from 932.1p to 1,022.1p and F&C’s share price rose from 904p to 962p in the year ended 31 December 2023.

WHAT SHOULD INVESTORS DO NOW?

Stick with F&C. The trust prides itself in the consistent performance of its managers. Since inception there have only been 11 managers, with just three since 1969. This continuity is reassuring in our view.

To ensure new and existing shareholders get value for money, F&C has lowered ongoing charges from 0.54% to 0.49%. [SG]

Great Ideas Updates 20 | SHARES | 28 March 2024

F&C Investment Trust (P) Apr 2023 Jul Oct Jan 2024 850 900 950 Source: LSEG

The simply smarter way to invest for high income Henderson High Income Trust has a simple aim of delivering high and stable investment income. So it takes the smart approach of blending UK equities and bonds. Helping investors boost their potential income while benefiting from increased stability. Find out how simple it is to invest for high income at www.janushenderson.com/HHI HENDERSON HIGH INCOME TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

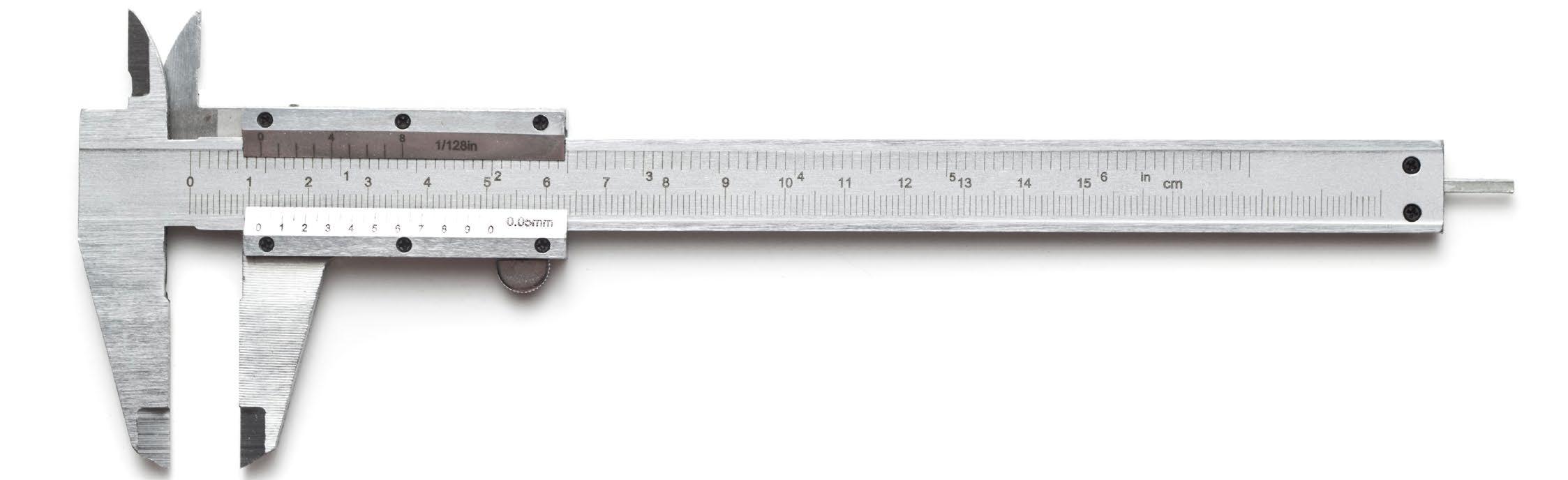

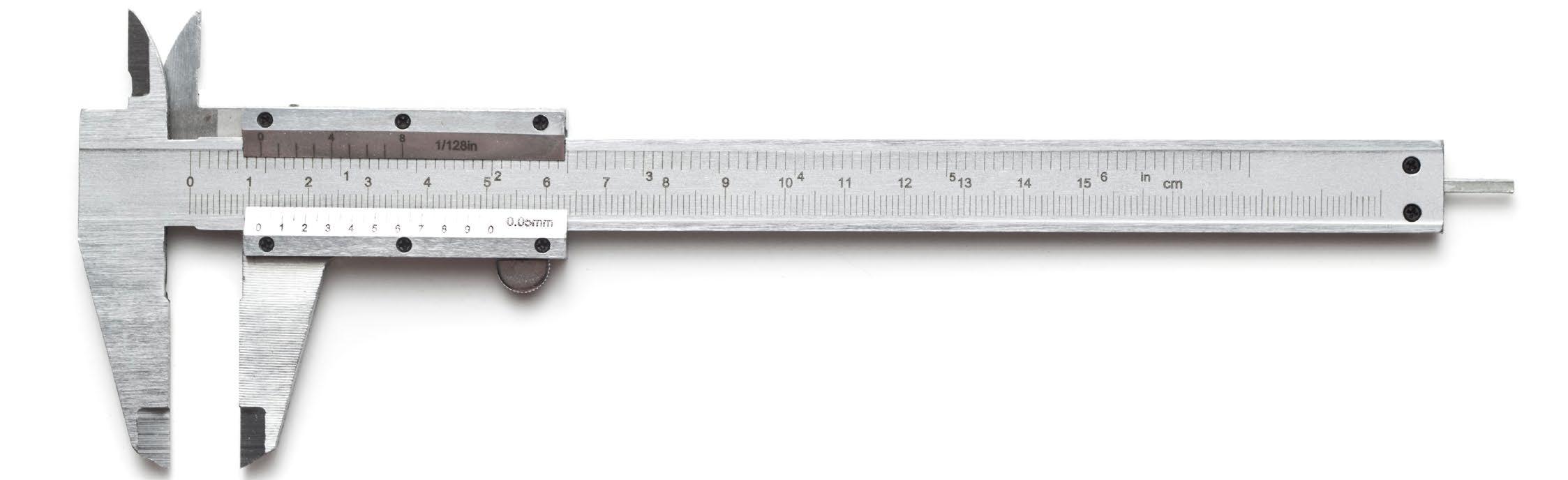

Spectris is another unrecognised long-term growth compounder

Analysts have low-balled earnings estimates for this year

Whenever there is a discussion about ‘quality’ UK industrial stocks, the name Spectris (SXS) is often thrown into the ring although we suspect many investors, while being familiar with the company in a general sense, have little idea what it actually does.

Looking on Stockopedia, the company has a 99th percentile quality ranking, which backs up its reputation, but it is classified as a large-cap technology stock and a ‘high-flyer’, which doesn’t help a great deal in explaining the business.

So, what does Spectris actually do and is it an interesting investment?

A BRIEF INTRODUCTION

Spectris is divided into two main business units, making precision measurement equipment and software for some of the world’s most technically demanding applications, from aerospace and electronics to electric vehicles, and helping to solve a myriad of environmental issues such as monitoring and reducing micro-plastics and even working out how Galapagos tortoises self-right themselves.

Spectris Scientific makes equipment for material analysis for the pharmaceutical, semiconductor and materials sectors, measuring particles down to the nano scale to help its customers shape everything from proteins, metals and polymers to controlling the manufacturing process, and contributes 56% of the group’s turnover.

Spectris Dynamics is a global leader in advanced virtual and physical testing and highprecision sensors for the automotive, machine manufacturing, aerospace and technology sectors, and contributes the remaining 44% of group turnover.

It works in what it calls attractive, sustainable, structural growth markets with high barriers to entry, using an asset-light model and investing

Analysts are expecting a big slowdown in organic growth this year

22 | SHARES | 29 March 2024 Under the Bonnet: Spectris

Revenue £1.45bn £1.5bn LFL change 9.7% 3.4% Adj Operating Profit £262m £272m Operating Margin 18.1% 18.1% EPS 199p 207p DPS 79.2p 86.3p 2023 Actual 2024 Forecast Table: Shares magazine • Source: Spectris company-compiled consensus as of 24 February 2024

Spectris helps solve a myriad of environmental issues including working out how Galapagos tortoises self-right themselves

in its own R&D (research and development) as well as seeking out attractive bolt-on acquisitions to maintain its industry-leading position in each business.

The firm has set itself some fairly rigorous financial and sustainable targets, including a midteens percentage return on capital employed, a 20% operating profit margin, 80% to 90% free cash flow conversion, to be net zero across its operations by 2030 and to be net zero across its ‘value chain’ – meaning including its suppliers and distributors – by 2040.

With a market cap of £3.4 billion, the group is within touching distance of the FTSE 100 index, but as it is it sits at the top of the FTSE 250 mid-cap index alongside budget airline EasyJet (EZJ), insurer Hiscox (HSX) and housebuilder Vistry (VTY)

Its closest peers in terms of the stock market are Halma (HLMA), which we looked at in a previous edition of Under The Bonnet, and Oxford Instruments (OXIG).

HOW IS THE COMPANY DOING?

Spectris has spent the last couple of years streamlining itself, with the defining moment being the sale of the low-margin Omega unit in 2022 for £410 million bringing disposals over the three years

Under the Bonnet: Spectris

to that point to over £1 billion.

The sale was well-received by the market given it fetched a multiple of more than 20 times 2021 adjusted EBITDA (earnings before interest, tax, depreciation and amortization) compared with the group’s valuation at the time of just 11 times EBITDA.

As well as returning cash from the Omega deal, Spectris consulted with its major shareholders before making a canny US acquisition in the shape of Dytran Instruments, a US sensor-maker, strengthening its offering and expanding its sales presence in the key North American aerospace and defence market for relatively little outlay.

Shortly after Spectris acquired it, Dytran booked a ‘notable’ order from a large spacecraft manufacturer, and the deal serves as a good example of the firm’s ability to compound growth through selective M&A.

Last year, the company reported a 10% increase in like-for-like revenue to £1.45 billion. It also posted an 18% increase in operating profit to a record £262 million – representing an 18% margin on sales – and a 25% increase in earnings per share to almost 200p. This confirms our analysis that it has compounded profits at just shy of 10% per year on average since the late 1980s, a feat to which few

29 March 2024 | SHARES | 23

2023 Sales by two biggest divisions Sales £704m Sales £543m LFL change 12% LFL change 6% Adj Op Profit £124.4m Adj Op Profit £56.2m Operating Margin 22% Operating Margin 17% Scientific Dynamic Table: Shares magazine • Source: Spectris 2023 Annual report

UK firms can lay claim.

Cash conversion was 103%, well above the medium-term target of 80% to 90%, and return on capital employed was 18.5%, again above the selfimposed target of mid-teen returns.

2023 marked the third year of double-digit likefor-like sales growth, and it is worth noting both divisions contributed to the outcome with Scientific revenue up 12% and Dynamic revenue up 6%, while operating margins at both businesses were higher at 22% and 17.2% respectively.

Even more impressive, on top of a £300 million buyback, which was extended by a further £150 million at the time of the results, the firm raised its dividend to make it 34 years of continued growth in its payout to shareholders.

WHAT IS THE OUTLOOK FOR 2024?

Interestingly, analysts are downbeat about the company’s growth prospects this year, meaning expectations are low, which can be quite helpful if you a growth company as it means there is scope

to surprise the market to the upside.

Berenberg’s Callum Battersby describes Spectris as facing a ‘challenging organic set-up, particularly in the first half’ due to the tough comparison with last year when it was working through a sizeable backlog of orders which had been delayed due to supply-chain issues.

He expects the group to report lower like-forlike revenue in the six months to June, meaning a ‘significant’ recovery is needed in the second half for the firm to show any top-line growth.

This means there are downside risks to earnings forecasts and ‘the shares are more likely to next move down than up’, he concludes.

Tom Fraine and Akhil Patel at Shore Capital are equally gloomy, expecting consensus operating profit forecasts to be downgraded by between 7% and 8% due to divestments leading to a mid-single-digit downgrade to pre-tax earnings.

In summary they flag ‘the uncertain short-term outlook and lack of a clear catalyst’.

Our collective intelligence allows us to invest wisely

Under the Bonnet: Spectris

Issued and approved by Witan Investment Services Limited FRN: 446227 on 31 January 2024. Witan Investment Trust is an equity investment. Your capital is at risk.

Therefore, it’s fair to say there isn’t a lot of love for Spectris at the moment which can often be the best time to look at a company.

For what it’s worth, the company-compiled consensus sees 2024 like-for-like sales growing at 3.4% this year against almost 10% last year while adjusted operating profits is seen inching up to £272 million and earnings per share are forecast to grow a miserly 3.5% to 207p.

The first test of whether analysts are on the right track will come in early May when the firm reports its first-quarter earnings, so we will wait with baited breath.

FUND MANAGERS VIEWS

Leigh Himsworth, manager of the Fidelity UK Opportunities Fund (BH7HNY7) and an FE Alpha Manager for the last 15 years, has given Spectris and fellow engineering firm IMI (IMI) a top-10 place in the portfolio.

The fund specialises in finding ‘unrecognised opportunities’ among companies with ‘significant

long-term growth that has yet to be appreciated by the market’, which would seem to sum up Spectris fairly well.

‘Spectris has always been a decent business with historically robust turnover through cycles and strong cash generation to boot. It has taken the current, excellent management team however to tweak each part of the business to hone the divisions into more distinct business units with a well-articulated plan that highlights the groups aims,’ comments Himsworth.

‘Careful asset management is delivering a rejuvenated business that offers investors growth in excess of 10% and operating margins just short of 20%, with a balance sheet that is forecast to have over £400 million of cash by the end of 2026 giving management a ‘nice’ headache of many possible options. Such a cash position means the stock trades on a highly attractive sub-10 times EV/ EBIT (enterprise value to earnings before interest and taxes) to December 2026, a significant discount to the quality peers in the space.’

If you’re looking to invest your money wisely, you’ll need the right kind of investment wisdom. Our experienced fund managers from around the world search the globe for companies that offer the potential for long-term growth. At Witan, we invest collectively and responsibly for your savings or retirement.

Witan shares can be held in an ISA and bought via an online platform such as AJ Bell, or through a Financial Adviser. To find out more, visit witan.com

Under the Bonnet: Spectris

Invest in Collective Wisdom

2023 sales by sector

2023 Sales by end-market and medium-term like-for-like growth target

Peter Michaelis, manager of the Liontrust UK Ethical Fund (B8HCSD3) added Spectris to his holdings in December 2023 as part of the fund’s ‘better monitoring of supply chains and quality control’ theme.

‘Through measurement and analysis, the company’s clients can analyse and understand how to increase the effectiveness of medicines, develop longer range batteries, test new electric car designs and even electric planes,’ wrote Michaelis in his January 2024 fund commentary.

The head of Schroders’ pan-European small and mid-cap team, Andy Brough, says: ‘When companies are doing well then investors tend to assume that has always been the case but they can have spent a long period in the wilderness before they got there. We like companies that have gone from hero to zero back to hero and in most cases it is the management that make the difference.’

Brough observes that Spectris floated on the market as Fairey Group and, under the leadership

of John Poulter it became a ‘stock market darling’ with a combination of organic and sensible acquisitions.

He adds: ‘When he left the business’ share price struggled. The new management team changed the name and went on a wild acquisition spree which kept them busy but lost shareholders money.

‘When Andrew Heath arrived the first thing I did was put him in touch with John Poulter so he could hear about the time Spectris was a hero. Under the leadership of Andrew the business has been refocussed and reorganised and is now on its way back to being the hero it first started out as.’

DISCLAIMER: The author of this article (Ian Conway) has an investment in Halma.

By Ian Conway Deputy Editor

By Ian Conway Deputy Editor

26 | SHARES | 29 March 2024 Under the Bonnet: Spectris

Life sciences/pharmaceuticals £267m 18%−9% 5% to 7% Technology-led Industrials £233m 16%8% 5% to 7% Electronics and semiconductors£175m 12%19% 6% to 8% Automotive £149m 10%8% 4% to 6% Materials £142m 10%16% 5% to 6% Academic research £142m 10%29% 5% to 6% Other £341m 24%19% 3% to 5%

2023 sales Percentage of group Like-forlike growth (%) Mediumterm target Table: Shares magazine•Source: Spectris 2023 annual report

(£ million) Life sciences/pharmaceuticalsTechnology-led IndustrialsElectronics and semiconductorsAutomotive MaterialsAcademic researchOther A 267 233 175 149142 142 341

Looking for the comfort of growing income? There’s a wider world of investment income opportunities beyond the UK. With a broader perspective, Henderson International Income Trust invests in established leading businesses around the world. Helping investors access and enjoy the potential for consistent and growing income. Explore a world of income from the comfort of one investment at www.janushenderson.com/HINT HENDERSON INTERNATIONAL INCOME TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

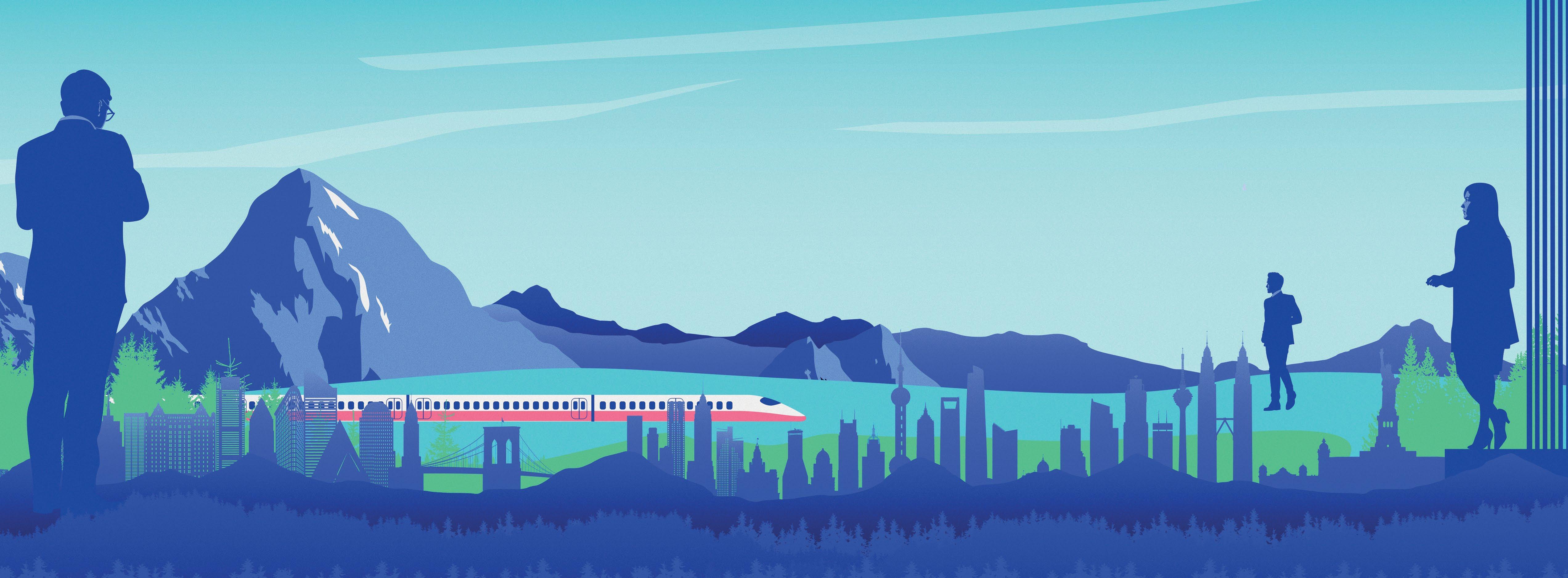

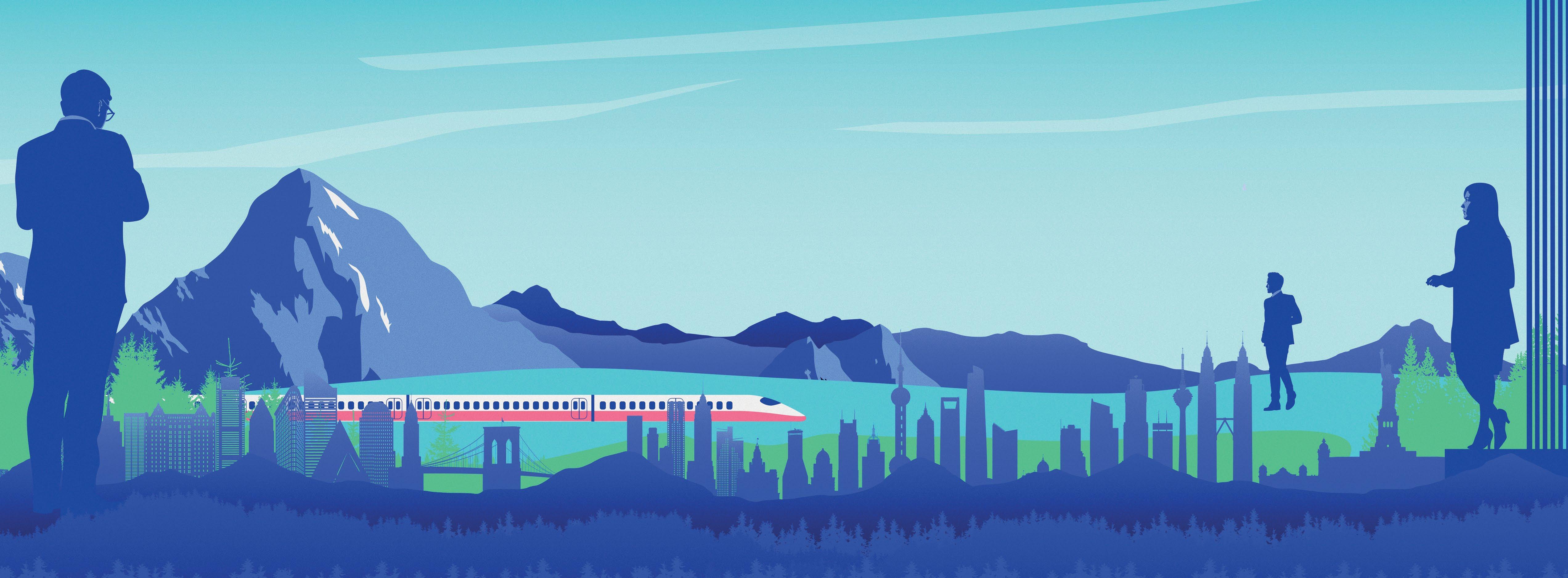

INVEST IN FANTASY

The power of imagined worlds and the ways to play them

The metaverse and virtual reality could strengthen the bond between people and their favourite characters and worlds

The world of fantasy is clearly having a moment. The rise of ‘romantasy’ authors like Sarah J Maas, who has been a big part of UK publishing outfit Bloomsbury’s (BMY) recent success, have taken the genre out of its previous male-dominated realm to a whole new audience.

Bloomsbury’s surging sales and the ongoing phenomenon that is Games Workshop (GAW) are two examples on the UK market which show the devotion fantasy worlds can inspire.

Warren Buffett disciple and manager of CFP SDL UK Buffettology General (BKJ9C67) Keith

Ashworth-Lord once described Games Workshop, which represents 9% of the portfolio, as the ‘nearest thing to legal drug dealing on the stock market’, with the tabletop games firm ticking one of the key boxes he looks for in a business: capturing a piece of its customers’ minds.

But this concept is a global one which is applicable beyond the fantasy genre. Imagined worlds are powerful – connecting with people on an emotional and intellectual level and driving a connection which creates significant barriers to entry and pricing power for the owners of the relevant intellectual property.

28 | SHARES | 28 March 2024

THE 10 LAYERS OF THE METAVERSE

The whole idea of taking real estate in people’s brains could become even more powerful as technology develops and artificial intelligence, virtual reality and the metaverse move into the mainstream. The opportunities for businesses with the right intellectual property could be significant given the ability for people to engage with fictional characters and universes on a deeper level.

This sort of symbiotic relationship is not new, cartoons in the 1980s were used as a means of selling toy ranges and more recently the huge success of Mattel’s Barbie film has shown the power of this form of cross-pollination.

It is also an effect which has played out in Walt Disney’s (DIS:NYSE) theme parks for decades. As media commentator Matthew Ball described it in an essay a few years ago: ‘There is nothing that can compare to the impact of a child being hugged by her heroes. The ability to enjoy your favourite intellectual property as “you” is unique and lasts a lifetime.’

The development of the metaverse could, for example, allow you to be a member of the Avengers or enter Hogwarts as a new wizarding pupil from the comfort of your own home, reinforcing your connection with these characters and universes.

As the graphic shows, there are several layers of the metaverse from content and experiences through to the platforms, infrastructure and

operating systems and accessories

enablers including chip makers like Nvidia (NVDA:NASDAQ). Technology giant Microsoft (MSFT:NASDAQ) is an example of a business which might operate across several of these layers. Its presence in this nascent market was bolstered by its torturous acquisition of games company Activision Blizzard which eventually completed in October 2023 for $75.4 billion.

The deal provides Microsoft with ownership of established brands like World of Warcraft and Call of Duty. At the time the transaction was first unveiled in January 2022 Microsoft chair and chief executive Satya Nadella said: ‘Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms.

‘We’re investing deeply in world-class content, community and the cloud to usher in a new era of gaming that puts players and creators first and makes gaming safe, inclusive and accessible to all.’

When it comes to the hardware required to make the metaverse a reality, Apple’s (AAPL:NASDAQ) launch of a virtual reality headset feels like a watershed moment. While the company’s recently launched Vision Pro product hasn’t been without teething problems, its track record suggests it will eventually get things right and that the hefty price tag will begin to come down over time making it accessible to a broader market.

28 March 2024 | SHARES | 29

monetisation

Source: McKinsey, 2022

THE ROLE OF GAMING

Writing in 2022, consultancy McKinsey argued: ‘The “proto-metaverse” exists, fueled by a powerful force: the gaming experience. Gaming eclipses other subsectors of the entertainment industry with its popularity. With more than three billion users globally and a total value of more than $200 billion, the gaming sector is larger than movies and music.’

Sandbox games and massive multiplayer online role-playing games like the Grand Theft Auto series, World of Warcraft and, at the more kidfriendly end of the spectrum, Minecraft and Roblox (RBLX:NYSE), give you considerable freedom to tinker with the environment of the game and to interact with other players online.

Meanwhile, Nintendo’s (7974:TYO) Pokémon Go, launched in 2016, brought the concept of augmented reality into the mainstream –with people able to capture the creatures in the real world.

Entertainment giant Disney’s recent tie-up with video game outfit Epic Games – the company behind the hugely popular Fortnite game – looks interesting in this context.

As part of the joint venture Disney is taking a $1.5 billion equity stake in Epic. The plan is to create a ‘persistent universe’ using Epic’s Unreal Engine software framework allowing consumers to play, watch, shop and engage with content and characters and stories from Disney, Pixar, Marvel, Star Wars and Avatar. Disney IP (intellectual property) already features in the existing Fortnite universe and this looks to be a much more ambitious concept.

Disney as a business faces lots of challenges right now, from succession planning to its streaming strategy and onerous investment in its parks, but it is possible to see significant potential in a more concerted move into the gaming sphere with the company only at the foothills of fully exploiting its IP.

H ow virtual worlds work in the gaming sector

Example virtual worlds

Platform characteristics

Organisational structure

Second Life

Roblox

Fortnite

World of Warcraft

Centrally owned

Decisions are based on adding shareholder value

Data storage

Platform format

Payments infrastructure

Digital assets ownership

Content creators

Activities

Centralised

PC/console

Virtual reality/augmented reality hardware

Mobile/app

Traditional payments (credit/debit card/Apple pay/Google pay)

Leased within platform where purchased

Example model: platform or app store earns 30% of every game purchase; 70% goes to developer User

Identity

Payments

Game studios/and or developers

Socialisation

Multiplayer games

Game streaming

E-sports

In-platform avatar

In-platform virtual currency

30 | SHARES | 28 March 2024

interaction

Content revenues Commercial

Table: Shares magazine. Source: McKinsey, 2022

WAYS TO INVEST IN FANTASY, IMAGINED WORLDS AND THE METAVERSE

GAMES WORKSHOP (GAW) £100.20

Tabletop games business Games Workshop (GAW) has a devoted fanbase and has only begun to scratch the surface of tapping into this devotion. A deal with Amazon (AMZN:NASDAQ) to develop its Warhammer 40,000 universe into films and a TV series, long in the gestation, was confirmed in December 2023. This provides a potential stream of income for the business – Jefferies has estimated it could earn $1 million for each episode of any future series aired – plus a very high-profile shop window for its IP.

MICROSOFT (MSFT:NASDAQ) $422.60

At the forefront of AI (artificial intelligence), cloud computing and data which will provide the infrastructure behind the metaverse, Microsoft (MSFT) also has a footprint at the front end thanks to its capture of Activision Blizzard and the World of Warcraft and Call of Duty franchises. The shares are not cheap at 31.8 times 2024 consensus forecast earnings but that reflects the strengths of a business which also enjoys a leading position in corporate software and communication tools like Teams and Microsoft 365. Microsoft is firmly plugged into the future of work and entertainment.

ETF OPTIONS

While it will likely be some time before anything hits the screens, and there are risks of alienating devotees if execution is poor, Games Workshop is already generating significant licensing revenue. This is highly attractive as it comes with extremely limited costs attached. The company is also cognisant of the dangers of getting it wrong. It says: ‘We will continue to grant licences to carefully chosen partners that respect the need for us to have complete ownership of our unique IP, to ensure no harm is done to the core business.’ The shares trade on a price-to-earnings ratio for the 12 months to 31 May 2025 of 21.5 which seems undemanding for what is a pretty unique business.

Gaming and metaverse ETFs

There are several exchange-traded funds which aim to track the development of the metaverse but these are modestly-sized and new to the market. The largest, with assets of £25 million, is iShares Metaverse (MTAV) which has an ongoing charge of 0.5%. The portfolio includes names like Meta Platforms (META:NASDAQ), Nvidia and Electronic Arts (EA:NASDAQ). A larger and more established product exists which tracks the video game and e-sports market in the form of VanEck Video Gaming and eSports (ESGB). This has an ongoing charge of 0.55% and provides exposure to Nintendo and Take-Two Interactive Software (TTWO:NASDAQ) among others.

28 March 2024 | SHARES | 31

iShares Metaverse 25 0.5% 49.3% L&G Metaverse ESG Exclusions 6 0.39% 49.1% Franklin Metaverse 3 0.3% 43.4% HANetf ETC Group Global Metaverse 11 0.65% 38.3% VanEck Video Gaming and eSports 438 0.55% 21.6% Global X Video Games & Esports 3 0.5% 0.0% ETF Size (£m) Ongoing charges One-year performance Table: Shares magazine • Source: JustETF

Good things come in smaller packages Smaller companies often have the potential to outperform their bigger rivals. Designed for investors aiming for long-term returns, The Henderson Smaller Companies Investment Trust uncovers UK small companies with strong foundations and dynamic growth prospects. Discover the smaller companies doing good things for investors at www.janushenderson.com/HSL HENDERSON SMALLER COMPANIES INVESTMENT TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Small world: a look at some of the month’s interesting small-cap stories

Takeovers, take-privates and the most successful IPO of 2024

We begin this article with the cautionary tale of former high-flying cloud telephony and conferencing firm LoopUp (LOOP:AIM)

At the beginning of March, the firm dropped a bombshell on investors by announcing the board had unanimously decided that canceling its listing on AIM and raising money from a handful of private backers was ‘in the best interests of the group and our shareholders’.

The stock price promptly crashed and trading volumes went through the roof as shareholders piled through the exit, rescuing what little cash they could before their shares became worthless.

There was happier news for investors in smartbuilding systems provider Smartspace Software (SMRT:AIM) with the firm announcing it had received a cash offer at 90p per share from SIS, a provider of visitor authentication systems.

Having seen a previous offer at 82p per share from Skedda fall by the wayside, the 169% premium to Smartspace’s undisturbed share price back in December was warmly welcomed although 90p still doesn’t feel like a knock-out blow considering the shares were trading at £10 a decade ago and £100 even longer ago than that.

Shareholders in cadmium-free quantum dotmaker Nanoco (NANO) were also in the pink after the firm announced it would return up to £33 million via a tender offer for £30 million worth of stock at 24p and a £3 million open-market buyback.

The cash is part of the proceeds from the firm’s successful litigation against Korean giant Samsung for infringement of its IP (intellectual property) and represents nearly half its market cap.

With the shares trading below 21p and the register open until 9 April there would seem to be scope for a small arbitrage with the proviso that only 38.5% of all outstanding shares can be tendered.

Finally, new listing MicroSalt (SALT:AIM), which pitches itself as ‘a major potential disrupter in the

food market’ thanks to its product of the same name, which contains 50% less sodium than regular salt, announced it had received a Notice of Allowance from the US patent office.

That means the claims it made in its patent for MicroSalt are valid, so if successful the firm could get a patent all the way to 2039 which was one of the hooks it used to attract investors to its IPO (initial public offering).