The investment world likes to complicate everything. Our Managed Fund likes to keep it really simple. It’s made up of equities, bonds and cash, and we think to generate great returns, that’s all you need. The result is a balanced portfolio with low turnover and low fees. Beautifully straightforward, it’s been answering questions since 1987. Capital at risk. Find out more by watching our film at bailliegifford.com

05

Can market calm last and why haven’t European stocks done better? NEWS

07 The US could be in for an unprecedented supply shock

08 Associated British Foods’ first-half results send shares skidding

09 ITV receives takeover interest from French media giant Banjay

10 Imperial Brands shares hit a five-year high as investors dial down risk

10 Winking Studios shares nearly halve year-to-date after IPO excitement

11 Will better weather boost indebted JD Wetherspoon?

12 Investors eagerly await Berkshire Hathaway’s Q1 results and annual meeting on 3 May

GREAT IDEAS

1 4 Why we rate now as a great time to buy Trustpilot

1 6 Temporary lull makes this a good time to buy Redwheel UK Equity Income UPDATES

18 Keurig Dr Pepper shows its defensive qualities FEATURES

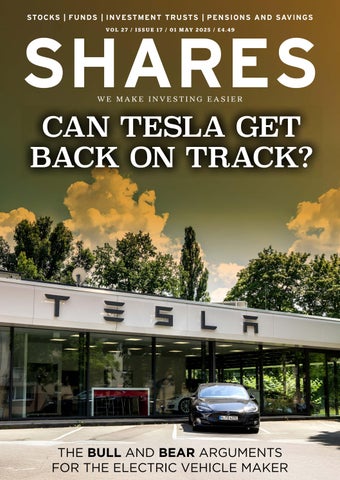

19 COVER STORY CAN TESLA GET BACK ON TRACK?

The bull and bear arguments for the electric vehicle maker

28 Small World: Delistings, contract wins, a maiden dividend and a new addition to AIM

32 Are we witnessing the beginning of the end of ‘US exceptionalism’?

24 INVESTMENT TRUSTS

Revealed: the trusts which did best through tariff turbulence

36 PERSONAL FINANCE

Five things to consider a decade after the pension freedoms

38 RUSS MOULD

Have Trump’s first 100 days taken us back to the 1970s?

42 ASK RACHEL

How does it work if I leave a SIPP to a beneficiary?

44 INDEX

Shares, funds, ETFs and investment trusts in this issue

Why Tesla finds itself at a crossroads

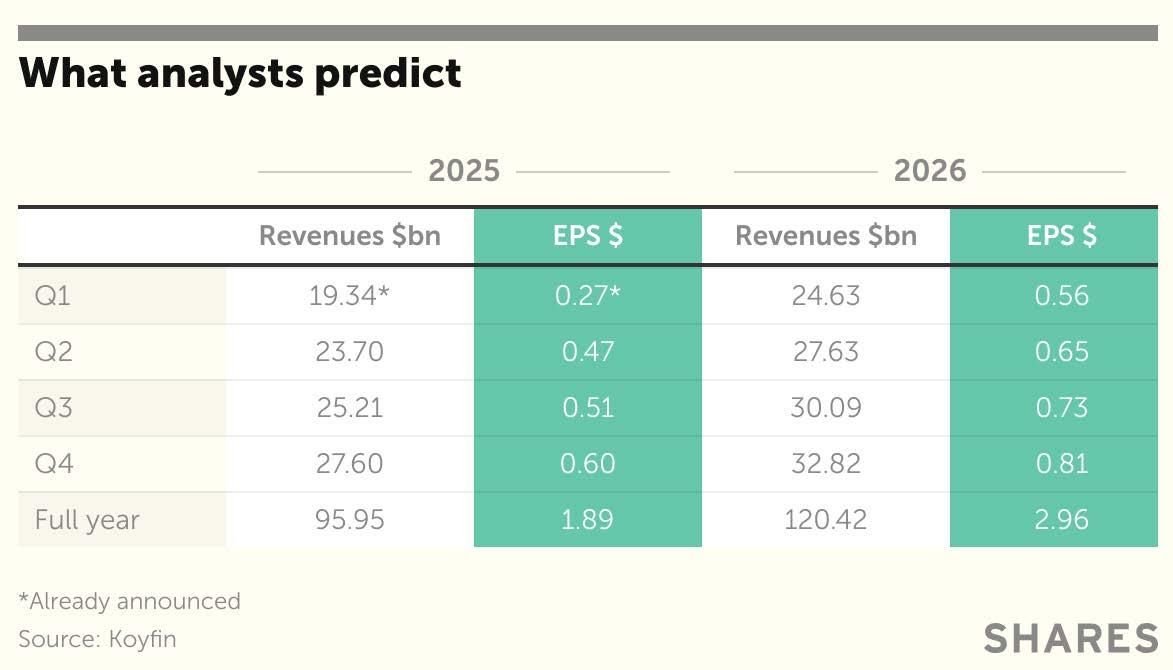

The US car maker is losing market share even as electric vehicle sales continue to rise leading analysts to downgrade expectations of future growth, so what can be done to rejuvenate the brand?

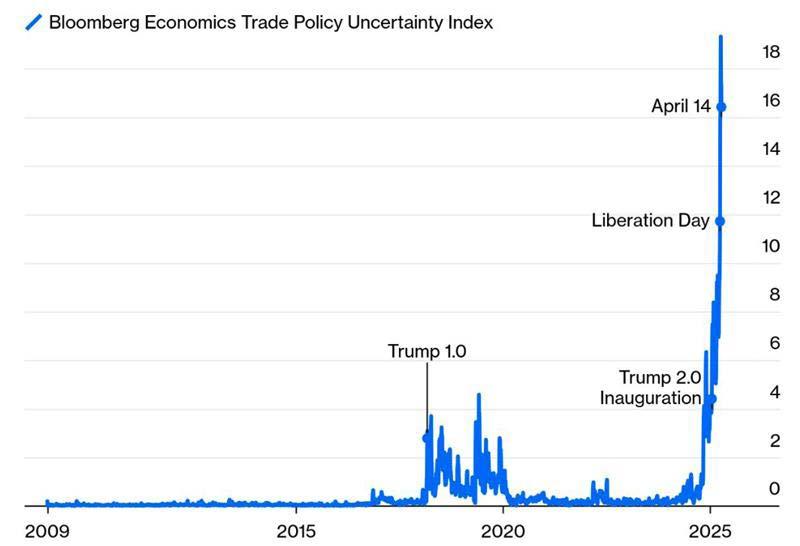

Is the age of US ‘exceptionalism’ coming to an end?

Over the past decade or more being overweight US stocks, bonds and the dollar has been a winning strategy for global investors, but the relative safety of US assets and treasury bonds in particular is being called into question

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Discover the investment trusts which have led the way since Liberation Day

Amidst the stock market turbulence caused by US tariff announcements, a select group of UK investment trusts have shone while others, which in theory should have outperformed, have not

The

impact of tariffs is already creating the beginnings of a supply shock across the Atlantic

The market has started to get over the initial shock created by Donald Trump’s announcement of punishing reciprocal tariffs on 2 April and regained some equilibrium.

As we write, an important proviso in the current times, the Trump administration has, by its standards, been a touch quieter, particularly when it comes to tariffs and its views on the direction pursued by the Federal Reserve.

This is allowing the market to focus on earnings and corporate outlooks – Google-owner Alphabet (GOOG:NASDAQ) provided some positive headlines in this regard with its better-than-expected quarterly figures and relatively bullish tone.

However, as Ian Conway explains in this week’s News section the impact of what has already been announced is only beginning to make itself felt in the real economy through supply shortages.

takes a good look at Tesla (TSLA:NASDAQ) in the wake of its disappointing quarterly numbers and asks what might be required to get the company on track.

Meanwhile, Martin Gamble previews the upcoming first-quarter numbers and annual shareholder meeting at Berkshire Hathaway (BRK.B:NYSE) – having amassed a hefty cash pile is Warren Buffett ready to put it to use after the selloff in US stocks so far in 2025?

Why haven’t European stocks done better since Liberation Day? As Bank of America’s European equity strategy team note: ‘President Trump’s historical shift in US trade policy, in combination with elevated uncertainty around US monetary and fiscal policy, has led to a reassessment of where to deploy capital.

‘European assets are an obvious alternative in this new flight to safety, especially given Germany’s shift towards fiscal spending.’ They note that during meetings in New York investors were looking for increased fund flows into Europe and for that to flatter the region’s relative performance.

As with the disruption caused by the pandemic, it may not be easy to turn things back on if and when trade deals are agreed.

Elsewhere in the digital magazine, I look at the investment trusts which have performed best since Donald Trump held up his chart in the Rose Garden and Ian Conway examines what the lasting impact of a tumultuous period for US assets might be.

Our resident technology expert Steven Frazer

‘Indeed, European-focused equity funds have just experienced the largest weekly inflow in eight years,’ they add. However, by their reckoning European outperformance versus global equities (of which US equities comprise over 70% in market cap terms) stands at just 1% since 2 April.

The answer underscores the truth of the old maxim that it’s better to travel than arrive. ‘European equities outperformed global equities by 15% between late last year and mid-March, already encapsulating the underlying European economic improvement as well as a boost from German fiscal stimulus,’ they conclude.

European assets are an obvious alternative in this new flight to safety, especially given Germany’s shift towards fiscal spending”

Capital Global Financials Trust plc

Financials

Chinese firms are either not exporting to the US or charging much higher prices

Wall Street may have stabilised in the last week as the White House has softened some of its rhetoric on global trade, but the real-world impact of the increase in tariffs is about to hit Main Street and could make the disruption caused by the pandemic ‘look like a tea-party’ according to some observers.

In the week from 20 April to 26 April, port cargo figures from Wabtec Corp showed 22 container ships with over 120,000 TEU (twenty-foot equivalent container units) were scheduled to dock at the Long Beach Container Terminal in Los Angeles.

apparently deserted with no ships, no containers and no trucks, as freight heads for Vancouver instead.

There are reports 40% of cargo ships leaving China for the US are empty, and analysts at Bloomberg now estimate ocean container bookings from China to the US could fall by as much as 60% from their normal level.

The US imports $600 billion worth of goods from China annually with a retail value of $2 trillion, and 95% of those goods arrive by sea.

For the week from 4 May to 10 May that number has dropped to 16 vessels with just 77,000 TEU, and LA port director Gene Seroka predicts arrivals are likely to drop by 35% ‘as essentially all shipments out of China for major retailers and manufacturers have ceased’.

This story is being repeated across the west coast, with Puget Sound and the port of Seattle

Some US retailers, including Target (TGT:NYSE) and Walmart (WMT:NYSE), were able to rushorder inventory before the Trump administration imposed up to 145% tariffs on Chinese goods in April, but even they have warned the White House consumers will see empty shelves before long. By the middle of May, thousands of US companies will need to replenish their inventories and there are fears supply shortages could lead to mass lay-offs in the trucking, logistics and retail industries.

Unfortunately, even if the US were to cut tariffs on Chinese goods to zero tomorrow, with global supply chains and container ships already in the process of being repositioned, logistics costs would go through the roof as they did in 2021/22 when the price to ship a single container from China to the US hit $20,000.

Source: Bloomberg

In the meantime, with the US set to remove the ‘de minimus’ exemption on low-value Chinese imports and impose a 120% tariff at the end of this week, global fast-fashion, home and beauty retailer Shein has responded by raising the price of goods to the US by up to 377%, which is likely to stoke inflation. [IC]

Shares in Associated British Foods (ABF) plunged 9% earlier this week after the global consumer conglomerate posted a slide in first-half profit and downgraded fullyear guidance for its Sugar business.

Results for the six months to March 2025 showed a 21% drop in pre-tax profit to £692 million as the Sugar business delivered a £16 million loss.

The volatile Sugar arm is now expected to make a loss of up to £40 million this year against previous expectations of a £50 million to £70 million profit.

The outlook for Sugar has worsened, mainly due to lower European sugar prices and losses in Vivergo, the UK bioethanol business, but also due to challenges in Tanzania due to the overhang of high levels of sugar imports in 2024 and in South Africa due to drought.

Associated British Foods’ chief executive George Weston conceded he was ‘frustrated’ with the results, but insisted management was ‘clear on what needs to be done by way of operational and regulatory solutions to improve financial performance’.

Investors also took issue with market share erosion at Primark, the jewel in the Associated British Foods crown, where performance in the UK and Ireland continues to disappoint.

Primark’s constant-currency sales crept up 1% to £4.5 billion in the half amid growth in Europe and the US, while operating profit grew by 8% to £540 million as the cutprice clothing chain’s margins expanded from 11.3% to 12.1%.

Worryingly, however, UK and Ireland like-for-like sales fell by 6% in a ‘challenging’ market with shoppers remaining cautious, while Kantar data showed Primark’s share of the UK clothing market reduced from 6.9% to 6.7% over the 24 weeks to 2 March.

‘While we continue to assume our trading in the UK remains challenging in H2 2025, there have been some early signs of improvement in recent weeks,’ insisted Associated British Foods, which analysts at Jefferies read as a reiteration of flat margin guidance for the year.

Panmure Liberum noted various restructuring and strategic reviews have been announced for the struggling Azucarera Spanish sugar, Vivergo bioethanol and Allied Bakeries businesses.

The broker added: ‘Today’s results give further credence to our argument that a sale or carve out of the volatile Sugar business into a separate entity would make the ABF investment case more compelling.’

AJ Bell investment director Russ Mould commented: ‘While the company is sticking with its full-year guidance for the unit, Primark seems to be underperforming its peer group of late. This is worrying given warm temperatures should have increased footfall to Primark’s stores. This hasn’t escaped the attention of investors and will be causing concern for management too.’ [JC]

Source: Associated British Foods

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (James Crux) and the editor (Ian Conway) own shares in AJ Bell.

Reportedly Banjay has expressed potential interest in the whole group or just its studio production arm

Shares ITV (ITV) failed to fire despite recent reports that French media giant Banjay was in early talks with the free-to-air broadcaster to buy the whole group or just its studio production arm.

Banjay’s plans were first reported in the Financial Times and follow speculation about an approach from Abu Dhabi-backed media group RedBird IMI in January this year.

RedBird IMI was apparently keen on merging the ITV Studios business with All3Media, the producer of hit TV show Traitors. If Banjay is successful, the merger would create one of Europe’s largest TV production groups.

Banjay was originally formed back in 2008 and produced TV shows such as Peaky Blinders, MasterChef and Big Brother. In 2020, it surprised analysts by buying Endemol Shine for £2.2 billion. The TV arm Banjay Entertainment is now part of a Euronext-listed Banjay Group (BNJ:AMS) which incorporates live events and betting businesses and has a market cap of €3.6 billion.

ITV shares have lost two thirds of their value over the last decade leaving it vulnerable to bid interest.

Russ Mould, investment director at AJ Bell said: ‘ITV has been flagged as a “bid target” for what feels like forever, as the media industry continues to reshape itself, and rumours of an approach last surfaced in late 2024.

‘The case for ITV as an investment –or bid target – lies with its prime programming, since content is still extremely valuable as streaming services and broadcasters look to win and keep both subscribers and

Source: LSEG

advertisers. ITV has plenty of that in its wellstocked library of famous and well-loved TV programmes.

‘Ultimately, however, a bid would come down to cold, hard maths. ITV has a market cap of around £2.9 billion. Any buyer will also have to consider its £823 million in gross debt and £105 million in lease liabilities as part of the purchase price, although these will be partly offset by a £427 million cash pile and £137 million net pension surplus – that lot nets off at an extra £364 million on top of the market cap, which is not a formidable obstacle, although a buyer would presumably have to offer a bid premium.’

Another factor to consider is Liberty Global’s position. The media group remains ITV’s largest shareholder and it has previously been pegged as a suitor for the group. [SG]

DISCLAIMER: Financial services company

AJ Bell referenced in this article owns Shares magazine. The author of this article (Sabuhi Gard) and the editor (Tom Sieber) own shares in AJ Bell.

The tobacco company appears to be a winning stock amid the Trump tariff chaos

Over the past six months, Imperial Brands (IMB) shares have gained nearly 30% due to a robust set of full-year results reported last November and investors piling into defensive stocks since the start of 2025.

On 24 April, Imperial shares hit a fiveyear high of £30.63 as the multi-national tobacco company continues to shrug off the global crackdown by governments on people smoking and vaping and focus on its five-year strategic plan.

In its last set of results the company reported a 26% rise in nextgeneration product (NGP) revenue to £355 million and launched new blu formats to meet demand across several markets.

The company also said capital returns of circa £2.8 billion were under way for full year 2025 including a £1.25 billion buyback.

There was more good news for Imperial’s shareholders with a 4.5% increase in the full year 2024 dividend.

Analysts at Panmure Liberum hold

Singapore-based video games services company falls victim to weaker global economic backdrop and full year net profit plunge

Shares in Winking Studios (WKS:AIM) have fallen as much as 55% year-to-date after the Singapore-based video games services company reported a 70.5% fall in full year net profit for the year ending 31 December.

The company, which enjoyed a very positive initial reaction to its November 2024 IPO, said in February its gross full year 2024 profit margin was affected by lower gross profit margin from the two newly acquired

art outsourcing studios, On Point Creative and Pixelline. This could prompt some scepticism about the company’s recently announced capture of Mineloader.

The company, which is engaged in a collaboration with Taiwan’s Acer Inc (2353:TPE), said that its distribution and marketing expenses had increased 39.5% or $600,000 to $2.2 million in full year 2024.

The increase in spend was due to more investments in promotional

Source: LSEG

the tobacco stock in high regard and said in a recent note the company’s buyback programme ‘remains a thing of power and beauty within the sector. Almost 13% of the shares have been retired in little more than two years, with much more to come. Consistent delivery, a still-low valuation and that buying power means it remains our top pick.’ [SG]

activities to expand into overseas markets resulting in increased business travel and marketing costs.

Winking, whose core business involves offering outsourced game art services to the industry, likely hasn’t been helped by the volatile market backdrop given the implications this has for sentiment towards smaller growth companies. [SG)

7 May: Card Factory, 1Spatial

7 May: Smiths News

2 May: Shell, Standard Chartered

6 May: International Workplace Group

7 May: Georgia Capital, JD Wetherspoon

8 May: Derwent London, Harbour Energy, IMI, InterContinental Hotels Group, Mondi

Trading at the hard-pressed high pubs champion has proved solid rather than spectacular over recent periods

Investors will be hoping recent better weather and a series of major sporting events have boosted takings at pubs group JD Wetherspoon (JDW), now readying its third quarter update for release on 7 May. In common with the rest of the hospitality sector, JD Wetherspoon trades against a tough backdrop of weak consumer confidence and higher costs following hikes in National Insurance and the National Living Wage. As such, confirmation of another quarter of like-for-like sales growth would be welcomed by investors, who’ll also pore over chairman Tim Martin’s customary utterances on the issues impacting the pubs industry, including a tax system he argues ‘inexplicably benefits supermarkets’. Despite a tough market backdrop, the FTSE 250 pubs play delivered

robust 4.8% like-for-like sales growth for the half ended 26 January 2025. Unfortunately, pre-tax profits fell 8.6% to £32.9 million as the estate shrunk and higher labour costs ate into Wetherspoon’s alreadyskinny operating margins, which fell from 6.8% to 6.3%. Encouragingly, management said the second half had started well with like-for-likes up 5% in the 7 weeks to 16 March, and hotter weather should boost sales at the value-oriented pubs chain.

Source:Stockopedia,

At the interim stage, management continued to expect ‘a reasonable outcome for the financial year, subject to its future sales performance’, and in a show of confidence, investors were also treated to a 4p half-time dividend. Indebted JD Wetherspoon faces an additional £1,500 in costs per pub, per week following increases in national insurance and labour rates and as such, has not ruled out further price rises this year. As the pugnacious Martin has warned: ‘The combination of much higher VAT rates for pubs than supermarkets, combined with increased labour costs will weigh heavily on the pub industry.’ [JC]

Warren Buffett’s Berkshire Hathaway (BRK-B:NYSE) exited 2024 on a high, generating a record fourth-quarter operating profit for the third straight year, driven by strong growth in its insurance operations.

Berkshire more than doubled the size of its cash pile to a record $334.2 billion, as the conglomerate sold a net $134.1 billion of stocks, including selling down half of its Apple (APPL:NASDAQ) holding.

Berkshire is expected to release first-quarter results at its annual shareholder meeting on 3 May. The annual pilgrimage to Omaha is often referred to as the ‘Woodstock for Capitalists’ and attended by more than 40,000 loyal Buffett fans hoping to glean snippets of investing wisdom.

Give the volatile market backdrop to this year’s meeting, investors will be keen to learn if Berkshire has been opportunistically deploying some of its huge cash pile and what impact tariffs might have on Berkshire’s nearly 200 businesses.

The company revealed it had increased its holdings in the five Japanese trading houses it invested

in five years ago, to close to 10% in each, in regulatory filings on 17 March.

This followed comments by Buffett in his annual letter to shareholders in February where he said the five trading houses agreed to ‘moderately relax’ the 10% limits that capped Berkshire’s holding to 10% each.

Buffett wrote: ‘Over time, you will likely see Berkshire's ownership of all five increase somewhat.’

As far as the numbers are concerned, the consensus expectation is for Berkshire to report fully diluted earnings per share of $4.81, down 7% from the same quarter in 2024.

Buffett usually plays down the net profit number and encourages investors to focus on after-tax operating earnings, which exclude the movements in the value of Berkshire’s public stock portfolio.

QUARTERLY RESULTS

2 May: Chevron, Cigna, Cboe Global, Exxon Mobil, Franklin Resources, T Rowe

5 May: Berkshire Hathaway, Celanese, Ford Motor, Loews, ON Semiconductor, Palantir, Realty Income, Tyson Foods, Vertex, Williams

6 May: AMD, Arista Networks, Constellation Energy, Datadog, Duke Energy, Eaton, Electronic Arts, Gartner, Global Payments, Super Micro Computer

7 May: Arm, Dayforce, DoorDash, Occidental, Uber Tech, Verisk, Vistra Energy, Walt Disney

Source: Zacks

Source: Zacks

Berkshire shares have handsomely outperformed the S&P 500 index so far in 2025, gaining nearly 17% compared with a 7% drop in the benchmark index. [MG]

8 May: AConocoPhillips, Expedia, Match Group, MercadoLibre, Paramount Global, Warner Bros Discovery

Why we rate now as a great time to

We believe de-rating is a temporary setback on longer path up

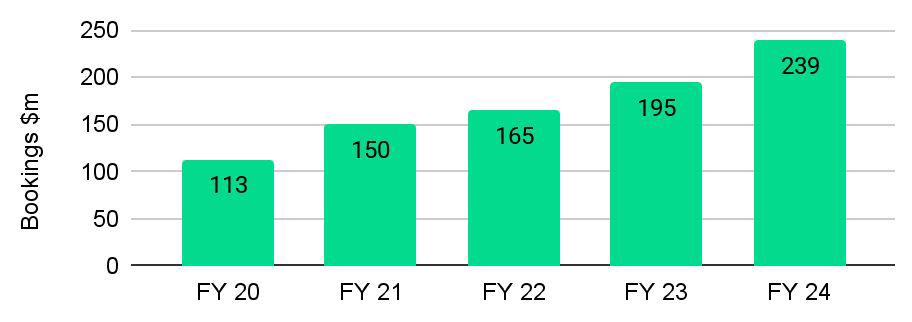

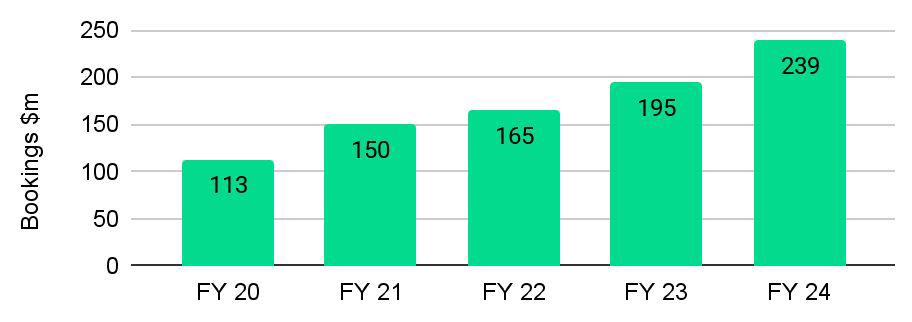

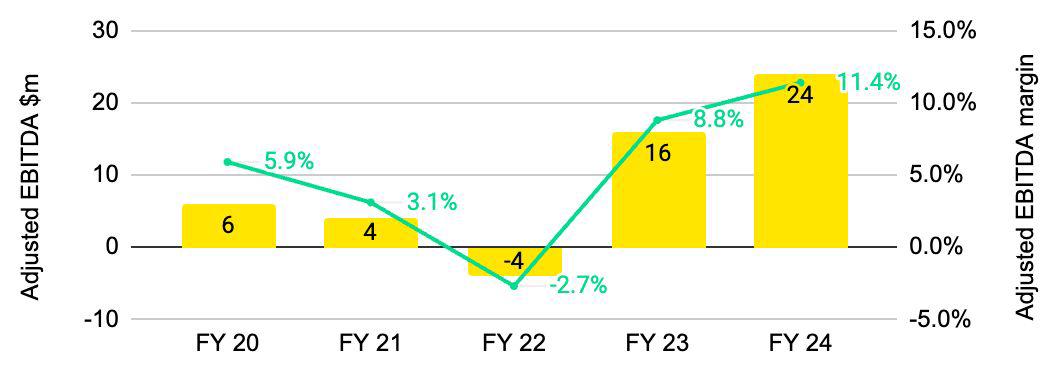

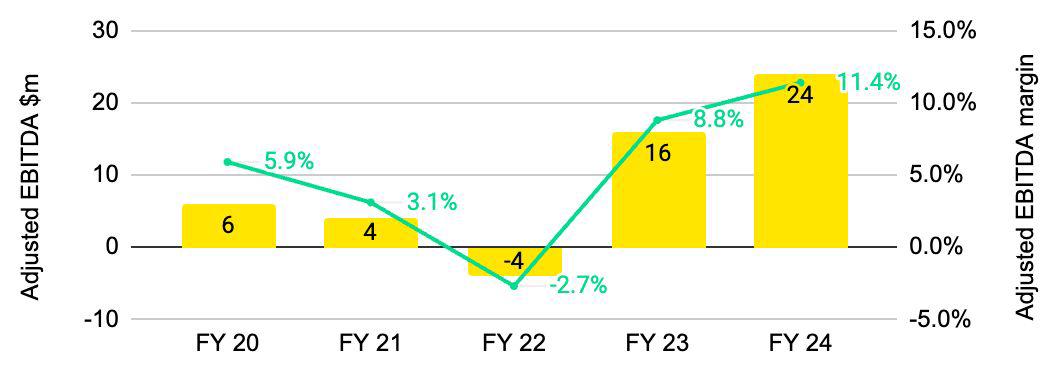

Trustpilot (TRST) 220p

Market cap: £910 million

‘Trustpilot’s re-rating has only just begun – buy the stock now’. This is what we wrote at the beginning of 2024 when the stock traded at 161p. The shares ended the year at around 300p.

Donald Trump’s economic policy has sent stock in the goods and services ratings platform plunging of late. In uncertain times, investors typically retrench from higher growth, higher risk investments to more stable and reliable options, and this is what has helped send Trustpilot stock spinning lower, falling from 355p in February to 220p now.

Shares believes this has created a new entry point opportunity for this exciting growth company, and we are not alone. In March, analysts at UBS flagged the opportunity to clients when the shares were trading at 278p, noting that full year results

from the online reviews platform were comfortably ahead of average City forecasts, following a year of ‘continual upgrades with each set of results’.

‘This is indicative of the organic upgrade cycle that the company has been on over the previous 12 months’, wrote analysts at Berenberg in April, with the stock named as one of the investment bank’s top tech picks in the UK market.

‘Progress in North America has been a key positive’, where second half bookings growth was 29% and net dollar retention rates have improved dramatically in the region, to the point that it is now above the group average.

Berenberg thinks the stock could hit 420p over

Like many digital commerce businesses, Trustpilot’s business grew rapidly during the pandemic. Today, the company hosts more than 300 million reviews and annual recurring revenues were running at $230 million at the end of 2024. Or in other words, about 93% of $246 million 2025 forecast revenue is covered from day one, around 80% for 2026’s $287 million consensus estimate, according to Stockopedia data.

Thousands of businesses now turn to Trustpilot for customer transparency and the underlying consumer data analytics it provides. Crucially, this creates valuable network benefits. The more consumers that use the platform and share their own opinions, the richer the insights the company can offer clients.

Done well, this creates a virtuous circle where consumers feel drawn to Trustpilot because it is where meaningful services are listed and reviewed, and the more consumers that use Trustpilot, the more businesses will feel they cannot afford not to be on the platform.

Independent consumer studies have found that 87% of consumers in the UK and US find ads more trustworthy with the Trustpilot logo and star rating than without, while 63% of EU consumers agree that a good Trustpilot score makes them more likely to buy from a brand.

although the Trustpilot brand is already rooted in the minds of millions of consumers worldwide.

One area on concern has been rising investment costs not passing through the P&L, yet this does not seem out of kilter with what management indicated through 2024. It has been putting capital to work with product improvements and development. We believe this will be less lumpy going forward and we like that Trustpilot is focusing on a product roadmap to retain and grow its market presence.

The other obvious worry is that Trumponomics will send the US and likely the global economy into recession. Whether that comes to pass is anyone’s guess, but while Trustpilot will doubtless have to adjust in that event, we believe it has levers to pull to come out the other side in great shape. Free cash flow yield, a measure of how much cash a company converts from revenues, is set to almost triple over the next three years.

Keep the top line growing as planned and profits will come thicker, and faster as operating margins dramatically improve. Last year, these were calculated at 6.9% by Berenberg analysts. They are expected to be 8.8% this year, 9.8% in 2026, and 10.8% in 2027.

Fierce competition from the likes of New Yorklisted Yelp (YELP:NYSE) and others is a certainty

As is stands, Stockopedia’s consensus forecasts data implies 2025 and 2026 EPS (earnings per share) of $0.04 and $0.053, equating to 3p and 4p roughly, or at a three-year average growth rate of close on 25%, way above the market average.

So, while the current 12-month rolling PE (price to earnings) multiple stands at a lofty 65, this is a business which should grow into its valuation over time. [SF]

The managers have a proven track history of finding value ‘in plain sight’

(BG34293) 124p

Assets: £501 million

Managed by the duo of Ian Lance and Nick Purves, the TM Redwheel UK Equity Income Fund (BG342C6) is the spiritual successor to the pair’s former five-star-rated income fund which they ran at Schroders (SDR) more than 15 years ago. With a similar brief, to generate income and capital growth in excess of the FTSE All Share Total Return Index, the Redwheel fund has demonstrated its pedigree over one, three and five years, beating the benchmark by a considerable margin.

Year-to-date the fund has found the going somewhat harder, as have many buy-and-hold strategies, which makes this an opportune moment to add to or open new positions in our view.

Source: LSEG

familiar household names with broadcaster ITV (ITV) the only non-FTSE 100 stock.

Lance and Purves run a tight ship, so the fund typically holds between 25 and 45 stocks with an 80% weighting in UK equities, a 20% weighting in overseas stocks and a bias towards value.

The top 10 holdings, which at the end of March accounted for just over 49% of assets, are all

The duo don’t try to reinvent the wheel when it comes to value investing, nor do they stray from their areas of core competence by chasing illiquid or risky stocks.

Instead, they undertake deep-dive fundamental research to find value ‘hiding in plain sight’ as they put it, and when they find businesses they like selling for far less than their intrinsic value they don’t hold back.

A case in point is electricals retailer Currys (CURY), where Redwheel was the largest shareholder with a 14.6% stake when it was approached last year by US takeover specialists Elliott Advisors.

Redwheel as an institution backed the

company’s rejection of the 62p per share offer, a decision which was fully vindicated by the stock’s subsequent rally, with the shares now trading at 108p or almost 75% above the opportunistic bid price.

The fund also owned major stakes in Royal Mailoperator IDS and insurer Direct Line, both of which were acquired last year at a premium of more than 40% to the prevailing share price.

The managers are far from passive, however, and they take a proactive approach by encouraging investee companies to buy their own shares to create value when they are trading at a substantial discount to book value.

This strategy worked particularly well at Barclays (BARC) and NatWest (NWG), which reduced their share count by 9% and 5% respectively last year and saw their share prices rise by 83% and 72% as a result.

Yet rather than celebrate the fund’s success last year and risk ‘anchoring’ expectations based on current share prices, Lance argues valuations are a better guide to future returns.

Despite the strong performance of a number of holdings, the average PE (price to earnings) ratio across the portfolio at the start of 2025 was just

nine times, which for many companies is still well below their historic average valuation.

In the context of the increase in market volatility since the start of the year, investors have a natural tendency to protect themselves and ‘run for cover’, says Lance, but historically this has resulted in lower returns than sticking to your investment strategy.

‘In our view, it is especially true that at times like these that one needs to put emotion to one side, focus on the long term and stay true to one’s investment philosophy.

‘Our approach is and has always been, to think long term and buy what we believe to be fundamentally sound businesses at a significant discount to their true economic worth, on the basis that, eventually, this economic worth will be reflected in a higher share price’

In line with the firm’s value approach, we believe the annual management charge of 0.79% is competitive, especially considering how well the fund has looked after investors relative to other income funds, the IA index and the FTSE All Share Total Return benchmark. [IC]

Keurig Dr Pepper

$34.40 Loss to date: 0.6%

We flagged the attractions of Keurig Dr Pepper (KDP:NASDAQ) at $34.60 on 13 June 2024, highlighting the North American beverages play’s diverse brand portfolio – including the iconic, purplish-red canned Dr Pepper – pricing power and cash generation.

Shares also highlighted the drinks group’s ‘palate-pleasing’ growth story under new CEO Tim Cofer, an experienced consumer packaged goods executive with a track record of driving growth, leading transformations and creating shareholder value.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Admittedly, the shares are pretty much flat on our entry price, but given the recent tariffs-induced sell-off in global equity markets, that demonstrates

Keurig Dr Pepper is performing its role as a defensive portfolio pick. At the time of writing, the stock is up 7.1% in a tumultuous 2025-to-date, outperforming the declines seen in the wider US market.

On 24 April, the Snapple, Canada Dry and Green Mountain brands owner delivered a first-quarter earnings beat with organic growth exceeding expectations and the recently acquired GHOST energy drinks brand delivering a stronger-thanexpected contribution. Keurig Dr Pepper also reiterated full-year guidance for mid-single-digit sales growth and earnings per share (EPS) growth in a high-single-digit range.

Jefferies described the robust outlook, which incorporated pressure from tariffs and consumer uncertainty, as ‘a win when others are revising lower’.

Though the stock price has yet to fizz higher, investors should continue to buy Keurig Dr Pepper for its earnings resilience and the cash generation which will support further dividend increases and share buybacks.

Source: LSEG

‘The beverage business is a steady compounder with exposure to faster-growing categories via partnerships,’ enthuses Jefferies, which sees potential for a strong summer ahead given the momentum behind the new Dr Pepper Blackberry drink and the continued distribution roll-out of GHOST. ‘Coffee is a struggle but should be fine long term. International has momentum, contributing at an accelerated rate.’ [JC]

First quarter earnings from Tesla (TSLA:NASDAQ) landed with a thud and came as a stark reminder of the company’s dual identity: a visionary leader in electric vehicles and autonomous technology, yet a business grappling with nearterm financial turbulence, and a brand damage stink that could

linger far longer.

By Steven Frazer News Editor

While cheerleader-in-chief Elon Musk cranked up the hype, with ambitious plans for a Robotaxi service, humanoid robot Optimus, and cost leadership, Tesla’s top and bottom lines crumbled, marking its worst quarter since Q2 2022, and Wall Street didn’t sugarcoat it.

Goldman Sachs, CFRA Research, RBC Capital, Cantor Fitzgerald, JPMorgan all took the red pen to forecasts and price targets, and even Wedbush Securities analyst Dan Ives, typically among Tesla and CEO Musk’s biggest backers, called the report a ‘fork in the road moment’ for the electric vehicle company in a post on social media platform X.

‘We knew Q1 Tesla deliveries would be soft, but these numbers were bad’, he wrote. ‘We are not going to look at these numbers with rose coloured glasses... they were a disaster on every metric. Refresh issues but brand crisis key.’

That brand crisis can be traced back to Musk’s position with the Department of Government Efficiency, or DOGE, an alleged effort to cut waste and fraud in the US government that has split opinions. Whatever investors might believe DOGE to be, it’s hard to argue that Musk hasn’t amplified criticism amid accusations of racism and antisemitism.

We knew Q1 Tesla deliveries would be soft, but these numbers were bad, we are not going to look at these numbers with rose coloured glasses... they were a disaster on every metric. Refresh issues but brand crisis key”

DAN IVES, Wedbush, Securities analyst

Source: LSEG

Tesla shares, at $274, are down 28% year-todate, pushing the rolling 12-months PE (price to earnings) back into triple-digits.

Musk now appears to have relented to investors’ wishes to put aside his political activities and refocus his attention on his primary company, if not completely, at least taking a large step in that direction.

Yet much damage has already been done. Musk’s antics have spawned a nationwide protest movement called Tesla Takedown, aimed at boycotting the company and driving down its stock price. And it appears to have been successful in persuading many progressive Tesla owners to either sell their vehicles or buy alternatives.

Even after the quarterly numbers were released, it emerged that Tesla’s European sales had fallen again, 28.1% year-on-year, in March.

There have also been unrelated violent attacks on Tesla stores and vehicles around the world, including several cases of arson and vandalism. President Trump has said suspects caught defacing Tesla vehicles would be charged with ‘domestic terrorism’.

Tesla’s Q1 results unambiguously demonstrated the financial pressure the company is now under. Net income dropped to $409 million, while revenue fell 9% to $19.34 billion. Operating income tumbled 66% to $399 million, far below analysts’ $1.13 billion estimate, due to a 13% year-on-year decline

in vehicle deliveries, weaker regulatory credit sales, and soaring operating expenses tied to AI development and other new initiatives.

To make matters worse, other income took a $234 million hit from Bitcoin-related losses.

The auto division’s struggles were especially acute. Auto gross margin, excluding regulatory tax credits, came in around 12.5%, down from 18.4% in Q1 2024 and marking the lowest since Q2 2012, when Tesla delivered 5,612 vehicles.

Meanwhile, tariffs on Chinese-sourced battery cells and rare-earth magnets for its Optimus robot programme add to expenses and complexity to its supply chain. Capital expenditures are projected to exceed $10 billion for the year.

The energy division provided a bright spot. Energy storage gross profit hit a record, driven by soaring demand for its Megapack utility-

scale battery.

Amid the gloom, Musk presented a typically bold vision of Tesla’s future built on AI, robotics, and self-driving cars, which he argues will propel Tesla to new financial heights. According to Musk, these products could make Tesla the most valuable company in the world one day, possibility worth more than the next five largest companies combined. That’s some chutzpah.

The CEO announced plans to launch a fully autonomous Robotaxi service in Austin by June 2025, with ambitions to deploy millions of vehicles by mid-2026, although similar promises in the past are still to arrive. This may hinge on Tesla’s AI software and its sensor-free approach, which Musk claims offers a cost advantage over lidar-dependent rivals like Alphabet’s (GOOG:NASDAQ) Waymo, a remote sensing technology that use active signals to detect and

Source: Statista, company reports

map objects much like radar but using laser pulses instead of radio waves.

Tesla also reported progress on Optimus, with plans to scale production to thousands of units by year-end. Musk also highlighted a manufacturing breakthrough, the ‘unboxed, production method for Cybercab, which promises low-cost, highly automated assembly. But the challenges are significant.

Investors are now left to weigh Musk’s longterm roadmap against the reality of dwindling margins, rising costs, and political headwinds. Which direction the company and its share price take may hinge on two questions: Can Musk execute his vision for autonomous vehicles and energy storage while navigating geopolitical risks and cost pressures? And will investors give the company enough time to do so?

Macrotrends, company reports.

There are some positives to be found if you look beneath the surface: Tesla’s energy business is thriving, its AI investments could redefine mobility, and its cost advantages in manufacturing remain unmatched. But the negatives are daunting. With operating expenses up 42% year-on-year, capital spending soaring, and quarterly net income at a fiveyear low, the company’s financial flexibility is thinning out.

Ultimately, for all the grand promises, Tesla remains for now principally a car maker. Much will depend on whether the company is able to arrest the decline in deliveries seen so far in 2025.

These names have stood out during a difficult period for financial markets

The period since ‘Liberation Day’ – when the Trump administration announced sweeping reciprocal tariffs – has been extremely volatile and ultimately negative for financial markets.

This is reflected in the average performance of the investment trust universe which, excluding VCTs, comes in at -1.9% based on Shares analysis of Sharescope data up until 24 April. It is no surprise to see vehicles investing in China and Vietnam under the cosh given their tariff exposure, as well as global investors with significant US holdings and North American specialists. However, some trusts have held up well and even thrived during this period.

You can see the table of top performers for yourself but there are some interesting themes which stand out from the data. Given tariff uncertainty is not going away, their robust showing may offer some clue to their future performance, although obviously no guarantees.

INFRASTRUCTURE AND RENEWABLES IN DEMAND

Perhaps the biggest detectable overarching theme

in terms of the winners is the strong representation for renewables and infrastructure trusts.

This may reflect an improved sentiment towards the sector in general, something we flagged at the end of February. These trusts were trading on heavy discounts thanks to the increase in interest rates since 2022, which increased their borrowing costs, but also the appeal of alternative assets like cash and government bonds.

Recent M&A in the sector has been a catalyst but it cannot have hurt during the last four weeks that these are long-term, often highly important, assets offering a stream of inflation-linked income with limited exposure to the day-to-day vagaries of global trade. The potential for interest rate cuts as central banks look to cushion the economic impact of tariffs could also be a supportive factor.

This dynamic also seems to be helping real estate investment trusts (REITs for short) with more niche names like Social Housing REIT (SOHO), which recently appointed Atrato Partners as its new investment manager, and Target Healthcare

A collection of trusts, notable for their absence in the group of outperformers, are the capital preservation specialists – Capital Gearing Trust (CGT), Personal Assets Trust (PNL) and Ruffer Investment Company (RICA). While they have not necessarily shone that brightly through the

recent market turbulence the accompanying chart suggests they have at least behaved as they ought to based on their remit. Compared with the MSCI World, which has seen some significant ups and downs, these names have comparably been much more steady.

REIT (THRL), whose main UK-listed counterpart Care REIT (CARE) received a successful bid in midMarch, among those to stand out. Another, Urban Logistics REIT (SHED), is subject to a £476 million bid from LondonMetric (LMP), helping to explain its place in the leaderboard. While TR Property Investment Trust (TRY), which has a broader remit, has also performed creditably.

Perhaps more surprising is the presence of two Japanese trusts in the list – given the headline Nikkei 225 index is flat to slightly lower over that period. Nippon Active Value Fund (NAVF) unveiled robust results on 8 April.

A rare global fund which has performed well is Lindsell Train (LTI) which has benefited compared with its rival trusts thanks to a relatively lowly allocation towards the US market. According to

figures for the end of March, Lindsell Train went into Liberation Day with an 18.1% allocation to US stocks, both directly and through fund and trust holdings, compared with a weighting for American shares of more than 70% in the MSCI World Index.

Hedge fund Brevan Howard combines macroeconomic research with strict risk management. Its BH Macro Fund (BHMG) has a history of outperforming in bear markets and during foreign exchange and interest rate volatility and therefore it’s no great surprise to see this trust outperformed the wider market during the recent ups and downs.

However, it is worth noting BH Macro charges higher fees than traditional funds, with ongoing charges of 2.21% according to the Association of Investment Companies, can underperform at times, and its positions are often hard to decipher. Muted foreign exchange and interest rate volatility left the shares largely stagnant for much of the 2010s.

By Tom Sieber Editor

Aiming for higher returns shouldn’t have you on the edge of your seat.

If you’re eager for the kind of returns that active management generates but don’t want to live life constantly on the edge, Alliance Witan is for you. Our unique investment process is designed to quietly deliver long-term capital growth by investing in companies around the world without you needing to leave your comfort zone. We’ve increased our dividend every year for an impressive 58 years, making this an ideal equity centrepiece for your portfolio. So sit back and relax, secure in the knowledge that your investment is just working away in the background. To find out more visit: alliancewitan.com

This month’s whirlwind tour stretches from cell therapeutics and brain software to radio frequency mesh networks and digital media

Barely a month seems to go by without another small cap company announcing its intention to delist from the London stock market.

The latest escapee is leading cell therapeutics firm MaxCyte (MXCT:AIM) which announced its intention to cancel its AIM listing on 15 April.

The proposed cancellation, if approved by shareholders, is expected to take place on 25 June. The board of directors believe the AIM delisting has the potential to enhance liquidity of the company’s share which trade on Nasdaq, while also removing duplicative costs of dual listings.

The directors note that over the last 12-months more than 94% of the average daily trading volume

has been transacted on the Nasdaq exchange. The company has a market capitalisation of £200 million.

MaxCyte was listed on AIM in March 2016 and raised £10 million to accelerate the development of the firm’s research and development platform and expand sales and distribution.

Another small cap exit from London in April was De La Rue (DLAR), after the Bank of England bank note maker agreed a takeover from private equity group Atlas for an all-cash consideration of 130p per share.

The board of directors of the 211-year-old firm recommended the proposed takeover which, if approved by shareholders, equates to a 19% premium to the closing price on 11 December 2024 when the company revealed it was in discussions with a consortium looking to take a partial equity stake in the business at 125p per share.

The offer price is 38% above the close on 14 October when De La Rue announced the sale of its authentication division to US-based industrial technology company Crane NXT for £300 million.

Companies coming to the stock market via new listings and IPOs (initial public offerings) have been few and far between in the last couple of years, so it was pleasing to see leading professional services provider MHA (MHA:AIM) take the plunge on 15 April.

The provider of audit, tax, accountancy and consultancy services raised approximately £98 million by way of an institutional placing of 98.8 million shares and a retail offering of 2.2 million shares at 100p per share.

Following the floatation MHA has a market capitalisation of around £271 million and a free float of 36.1%.

A relative lack of liquidity in small company’s shares means they often get a nice boost when announcing new orders and winning new business. That was the case for brain software group Cambridge Cognition (COG:AIM) whose shares jumped 4% after it secured a £1 million contract for a late-stage Autoimmune Disease trial.

The company said it was selected by an existing customer and views the win as ‘an endorsement of our product value and service excellence.’

The win follows quickly on the heels of a major £1.2 million agreement for phase three clinical trials in adolescents with Major Depressive Disorder.

Global leader in narrowband radio frequency mesh networks, CyanConnode (CYAN:AIM) revealed a £70 million contract (14 April) from the government of Goa’s electricity department to deploy approximately 750,000 smart meters.

For the uninitiated a mesh network is comprised of devices or nodes which communicate directly with each other, forming a decentralised network where any node can act as a relay. They are designed to be energy efficient and cost effective.

‘The contract validates our strategy, firmly establishes our credentials as an AMISP (Advanced Metering Infrastructure Service Provider), and substantially enhances our ability to secure further tenders,’ explained executive chair John Cronin.

‘This success is set to deliver a step change, accelerating CyanConnode’s future revenue growth and profitability,’ added Cronin.

Source: LSEG

Digital media, marketing and technology company Brave Bison (BBSN:AIM) reported a fourth consecutive year of revenue and profit growth for 2024 and gave a 2025 outlook ahead of

market expectations, sending the shares up 13% on 10 April.

The company said it has reached sufficient size and scale to begin paying dividends to return excess cash to shareholders.

The board declared a final dividend for 2024 of

approximately 0.02p per share representing 20% of operating cash flow after lease costs, the firm’s first dividend since listing 12-years ago.

Regenerative medical devices company Tissue Regenix (TRX:AIM) jumped 10% on 8 April after the board decided to terminate a strategic review and sale process to ‘focus on delivering sustainable growth as a standalone independent entity.’

CEO David Lee said: ‘Demand for our market differentiated tissue products remains strong and will be augmented with product line enhancements with existing and new customers to drive additional growth in 2025’.

The board insisted it will continue to assess the best route forward to deliver the ‘substantial’ value that exists in the business, which is not being reflected in the share price.

Martin Gamble Education Editor

Rob Abraham,

Supermarket Income REIT plc (SUPR) is a real estate investment trust dedicated to investing in grocery properties. The Company focuses on grocery stores which are omnichannel, fulfilling online and inperson sales. Its supermarkets are let to leading supermarket operators in the UK and Europe, diversified by both tenant and geography. The Company’s assets earn long-dated, secure, inflationlinked, growing income.

Abbas Barkhordar, Portfolio Manager

The Schroder AsiaPacific Fund (SDP) provides UK investors access to the high growth potential of the Asia Pacific region (excluding Japan) through a diversified portfolio of selected stocks. Managed by Richard Sennitt and Abbas Barkhordar, the fund aims for long-term capital growth by investing in highquality, undervalued companies that are poised to benefit from Asia’s rapid economic development.

Katie Shortland, CFO - Chris Belsham, CEO

NWF Group (NWF) is a specialist distributor across the UK - a vital link in the supply chain, connecting essential suppliers with customers. The company operate in three markets benefitting from scale and capability barriers to entry.

Investors are falling out of love with treasury bonds and the dollar

The market upheaval of the last month may be over for now, but it has left global investors with a big lingering doubt – can they still trust the US?

The day after US stocks enjoyed one of their biggest rallies in history (9 April), equities, bonds and the dollar all went into reverse as traders liquidated US assets in favour of safer alternatives.

Just as an example, the Swiss franc surged the most in a decade while gold climbed to a new all-time high above $3,200 per ounce and it has subsequently touched $3,500 per ounce before retrenching.

As analysts at Bloomberg put it, these moves in stocks, bonds and the dollar all point towards ‘the same sobering conclusion; Trump’s chaotic tariff rollouts – regardless of where the eventually settle – is rapidly undermining confidence in the US economy and threatening to keep markets on edge for the next three months as traders wait to see how it will all play out’.

Until this year, it was taken as read the dollar was

the world’s reserve currency, 10-year treasury yields represented the ‘risk-free rate’, and the lofty valuation of the US stock market was a reflection of the ‘exceptional’ companies which dominate the indices and their equally exceptional earnings growth.

Now, some of the brightest and best analysts and investors are openly asking whether US assets are still the ‘go-to’ choice or whether they should be reducing their exposure and looking elsewhere for returns.

Deutsche Bank’s head of foreign exchange research George Saravelos argues ‘the market is reassessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarisation’.

Since 1947, the dollar has been the world’s reserve currency, which has meant the US has enjoyed structurally lower borrowing costs than other countries as well as being able to buy foreign goods, services and assets effectively ‘on credit’.

Source: LSEG

Little wonder Valery Giscard d’Estaing, French minister of finance and economic affairs in the early 1960s, described the US as having an ‘exorbitant privilege’.

According to a UBS reserve manager survey,

Source: Bloomberg

today over half the world’s central bank reserves are in US dollars – essentially ‘rainy-day’ money to be used in the event of an emergency.

For private companies, that ratio is likely to be higher, however, as the dollar is still the main currency used in international trade and finance.

Yet, as economic regionalism or nationalism increases and supply chains shorten thanks to re-shoring, trade in global goods is likely to decline meaning there will be less demand for reserve currencies in the future.

Paul Donovan, chief economist at UBS Global Wealth Management, lists five criteria which ‘make’ a reserve currency – liquidity, access, stability, political influence and rule of law.

‘Superficially, dollar liquidity would seem to be secure,’ says Donovan, although there are questions over access as the Federal Reserve is rumoured to be considering ending swap arrangements under pressure from the administration.

There are also questions over whether, in an attempt to force the value of the dollar down to ‘normalise’ its trade balance, the US could impose capital controls on its trading partners – something it has only done up until now against Russian central bank assets.

Stability, geopolitics and the rule of law all ‘have the potential to weaken the dollar’s reserve status,’ says Donovan, and while they haven’t had a meaningful effect as yet, this is potentially the area where the private sector has the most concerns.

Large money-managers are beginning to weigh the idea of a shift to a ‘multi-polar’ system in which currencies like the euro assume a larger role than in the past.

‘There is a good case for the end of dollar exceptionalism,’ JPMorgan Asset Management’s chief investment officer, with $3.6 trillion under management, told the Financial Times in an interview.

Source: LSEG

Mike Riddell, fixed income portfolio manager at Fidelity International and a regular contact of Shares, said in the same interview the recent sharp move higher in longer-dated government bond yields coupled with a weaker US dollar looks like ‘good old capital flight’.

Apart from the dollar, the easiest way for countries, sovereign wealth managers and other large investors to reduce their exposure to the US is by selling treasuries.

The 10-year US treasury has always been considered a ‘risk-free’ way to invest, with the return on equities and other riskier assets determined by a ‘risk premium’ set by the market.

With the 10-year bond suffering heavy selling alongside equities and the dollar, sending the yield up by almost 0.5% in just a week, something which hasn’t happened since 2001, the assumption that it is truly risk-free is starting to be challenged.

‘There is real pressure across the globe to sell treasuries and corporate bonds if you are a foreign holder,’ said Peter Tchir, head of US macro strategy at Academy Securities.

Although the market for US government debt is enormous at nearly $30 trillion, the volatility caused by on-off tariff announcements has caused huge amounts of strain and it took the intervention of the Boston Fed president to reassure markets with the message the central bank could intervene to

Bonds are typically seen as less risky than stocks because they offer a predictable return and they rank above shares in a company’s capital structure, so if it were to get into trouble bondholders would get some or all of their money back while shareholders could end up with nothing.

Government bonds are considered the safest of all investments because the risk of the US (or the UK, in the case of gilts) going bust in negligible.

Usually, when there are ructions in the equity market, investors retreat to the safety of bonds, especially treasuries which are backed by the full faith and credit of the US.

Bond prices and yields are inversely correlated, so when prices go up due to strong demand yields go down and when demand is weak – such as when stock markets are booming – yields go up.

It is very unusual for stock prices and government bond prices to move the same way at the same time, as they have started to due to tariffs.

stabilise things if markets became ‘disorderly’.

Worryingly, according to analysts at JPMorgan, ‘market depth’ – which is the ability to absorb large trades without major moves in prices – has worsened ‘significantly’ in recent weeks with even

smaller trades causing volatility, which is causing some investors at the margin to lose confidence.

As one European bank executive said in an interview with the Financial Times: ‘We are concerned, because the movements you see point to something else other than a normal sell-off. They point to a complete loss of faith in the strongest bond market in the world.’

Ernie Tedeschi, a former top economist in the Biden administration and currently director of economics at Yale University’s Budget Lab, added: ‘If treasuries are no longer a safe-haven asset that has major implications for balance sheets across the board – businesses, nonprofits, pensions, households – so much of world finance is predicated on US treasuries being safe.’

The implications go further still – even a modest shift out of treasuries and the dollar would raise the cost of US borrowing at a time when interest costs are already rising.

As Howard Marks, founder of Oaktree Capital Management, put it in a recent note, the world’s high opinion of the US economy, rule of law and fiscal solidity has allowed it to hold a ‘golden credit card’ with no limit and no bills.

This has enabled the US to run fiscal deficits in each of the last 25 years and all but four of the last 45, including trillion-dollar-plus deficits in each of the last five years.

‘In other words, we’ve been able to live beyond our means,’ says Marx, ‘with the federal government spending more than it takes in via taxes and fees. This has led to one of the worst things about the US: the $36 trillion national debt and the grossly irresponsible behaviour in Washington that caused it.’

If other countries become less willing to buy treasuries and demand higher interest rates, what would happen to the trade deficit given big creditor nations already own plenty of US debt?

Having started 2025 with the certainty president Donald Trump’s policies would be good for the US, and therefore ‘US exceptionalism’ and the lofty valuation of US stocks was set to continue, we now live in a world full of uncertainties – over the appeal of the dollar, the risk-free status of 10-year

treasuries and the attractiveness of US stocks in a world of policy uncertainty.

When uncertainty increases, consumers and companies tend to react by spending less, which reduces demand, thereby reducing growth.

The longer demand is held back, the more the supply side has to contract to avoid a mismatch, so there is a double hit to growth.

Studies find increased uncertainty over inflation and/or economic growth makes consumers put off buying durable goods, de-risk their investments and work harder.

Businesses react by reducing prices, then reducing employment and investment, and ultimately by spending less on new technology or upgrading their facilities, all of which acts as a drag on future growth.

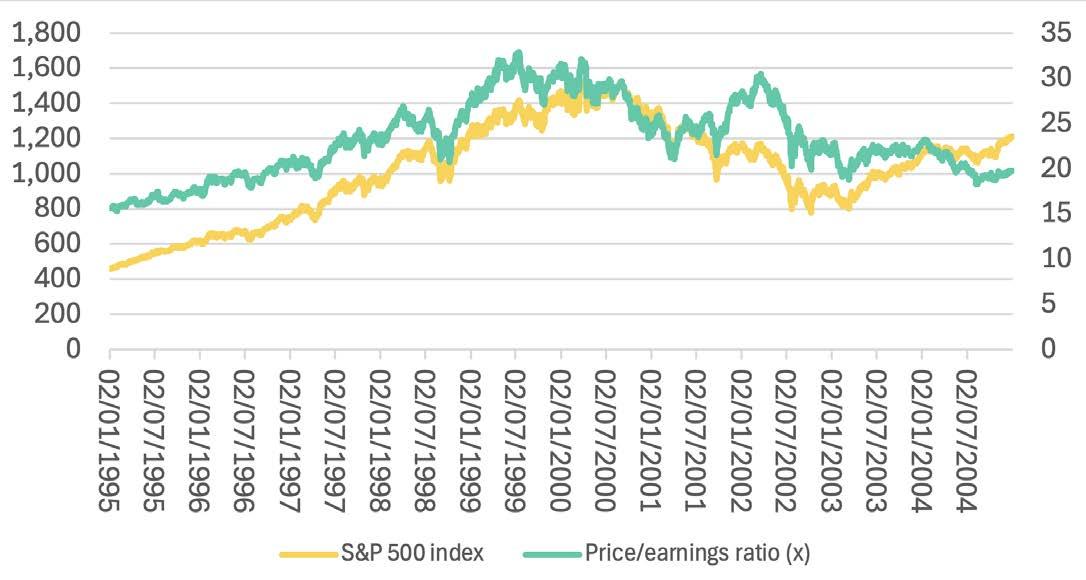

Investors react to uncertainty by demanding a higher return to compensate them for the increased risk, which means a larger risk premium on stocks than they paid in the past.

The only way for this to happen is for the ‘earnings yield’ on stocks to rise, which means the price-to-earnings ratio has to fall.

There is a great deal of evidence to support the correlation between the earnings yield and future stock market returns, and although prices of US stocks have fallen the earnings yield is still not high enough to offer attractive long-term returns.

In the view of Deutsche’s Saravelos, if the US is to remain an option, assets need to be repriced: ‘Currency and bond market weakness should ultimately lead to cheaper valuations and new equilibrium of asset pricing which becomes attractive for foreigners to invest.’

Whether this repricing happens quickly or slowly is academic – what matters is the further the market strays away from its historical norm into ‘exceptional’ valuation territory, and the longer it stays there, the more likely it is to come back to earth.

As Rob Arnott, head of Research Affiliates, says: ‘In the world of finance, capital markets and macroeconomics, time series rarely fail to exhibit long-term mean reversion.’

By Ian Conway Deputy Editor

It is more than 10 years since people were handed greater flexibility on just how they manage their retirement pot

It’s now more than 10 years since the ‘pension freedoms’ reforms announced by former chancellor George Osborne in his bombshell 2014 Budget took effect in the UK. These changes fundamentally upended the retirement system and the income choices available to millions of Brits.

That decision at a stroke opened up a whole new world of choice and flexibility to people accessing their retirement pot from age 55. The reforms have been hugely popular, enabling retirees to design an income plan that fits their lifestyle and placing responsibility for ensuring that pot lasts throughout their lifetime firmly on the shoulders of individuals. That responsibility means you need to be engaged when drawing your pension, so here are five important things you should ponder when you reach that point.

1.

If you’re accessing your pension for the first time, is now the right time to do it?

You can access your ‘defined contribution’ (DC) retirement pot from age 55, with this minimum access age set to rise to 57 by 2028. When you access your pension for the first time, you can also get up to a quarter of your pot completely tax free. However just because you can do

something doesn’t necessarily mean you should. In particular, the earlier you start taking an income, the longer that income will need to last – and the less opportunity your fund, including the tax-free cash entitlement, will have to enjoy long-term investment growth.

When deciding how and when to access your retirement pot, the value of other assets will be a significant consideration for lots of people. If you have a significant defined benefit (DB) pension, for example, you might be comfortable taking larger withdrawals from any DC pensions you have. Equally, those with ISAs or property investments will need to factor those into their retirement income planning.

2.

Which retirement income option should I go for?

Whenever in life you choose to access your pension, to get your tax-free cash you will need to choose an income option for the rest of your fund. The most popular avenue is ‘drawdown’, whereby your pension remains invested and you take a flexible income to suit your needs. This gives you flexibility over how you take an income but requires you to be comfortable taking investment risk and having responsibility for managing your

withdrawals sustainably.

You can also choose to buy an ‘annuity’, an insurance product which pays a guaranteed income for life. These are generally more suitable for people who don’t want to take any investment risk and prioritise income security. If you go down this road, it’s important to shop around for the right product, because once you buy an annuity you can’t change your mind.

The other main option is to take ad-hoc lump sums direct from your pension, with a quarter of each lump sum available taxfree. These are sometimes referred to in the jargon as ‘uncrystallised funds pension lump sums’ or UFPLS. It’s also perfectly possible to combine these income options to suit your needs. For example, you could buy an annuity to pay your fixed costs and retain flexibility and the potential to enjoy long-term growth with the rest. Equally, you could aim to take a flexible income through drawdown in the early years of retirement and then buy an annuity when you’re a bit older and likely to get a better rate.

3.

Have a plan for your tax-free cash

As mentioned earlier, when you access your pension you can take up to a quarter of your pot tax-free. For most people, the maximum tax-free cash they can take over their lifetime is £268,275. Before taking your tax-free cash, make sure you have a plan for the money. If, for example, you take your full entitlement out and then just shove it in a bank account, the money will risk being eaten away by inflation over time, and the interest will also potentially be liable to tax.

4.

Planning to keep paying into a pension? Watch out for the ‘money purchase annual allowance’

One thing you need to be aware of when accessing taxable income flexibly from your pension for the first time is the impact it will have on your annual contribution limit or ‘annual allowance’. Usually, you can contribute up to £60,000 per year into your retirement pot tax-free, but if you flexibly access your pension, for example through drawdown or by taking an ad-hoc lump sum, your

annual allowance drops to £10,000. Furthermore, you lose the ability to ‘carry forward’ unused annual allowances from the three prior tax years in the current tax year.

Taking large withdrawals can leave you without enough left in your pension later in retirement, but it can also result in you paying more income tax than is necessary. For example, if someone with no other taxable income chose to take a £20,000 taxable withdrawal in 2024/25, they would pay 0% tax on the first £12,570 and 20% tax on the remaining £7,430, leaving a total income tax bill of £1,486. If, however, they took a £10,000 withdrawal in 2024/25 and a subsequent £10,000 withdrawal in 2025/26 and had no other taxable income in both tax years, they would pay no income tax at all as both withdrawals would be below their £12,570 personal allowance. The pension freedoms do allow you to manage your tax situation better than a rigid annuity which pays you each tax year no matter what your situation. But as ever you need to do your homework around the tax bands which will apply to you to minimise the pension money you hand over to HMRC.

By Laith Khalaf AJ Bell Head of Investment Analysis

Have Trump’s first 100 days taken us back to the 1970s?

Looking at what happened under Nixon may offer a guide to the current presidency

Much as this column would like to offer something which does not mention words such as ‘Trump,’ ‘trade,’ and ‘tariffs,’ it is rather difficult to do so and at least the approach of the 100th day of the president’s second term in office gives us chance to take stock.

As we go to print, Trump’s second time in the White House looks set to give investors in US equities their roughest start to a new presidency since the Second World War, using the S&P 500

Trump’s second time in the White House looks set to give investors in US equities their roughest start to a new presidency since the Second World War”

index as a benchmark.

This is a remarkable change of heart, given the rapturous welcome given to Trump’s election victory last November, when the S&P 500 (and the dollar) soared, while US Treasury yields remained stable. The imposition of blanket tariffs, an escalation of tensions with China and then a flurry of sidesteps and backtracks, as additional reciprocal levies are delayed, exemptions are provided for technology hardware and tentative olive branches are offered to Beijing leave everyone confused and are shaking investors’ prior strong faith in American exceptionalism.

The outperformance of US equity indices, the concomitant surge in the stock market capitalisation of the S&P 500 to an all-time high as a percentage of global market cap, and the lofty (and in some cases record high) earnings multiples applied to the US market all reflected how investors thought America was already great.

Their reassessment of this view shows in how US indices have retreated and taken valuation multiples lower. Now portfolio builders must wait to

Source: LSEG Refinitiv data. ᴬJohn F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson. ᴮ Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford. ᶜDonald J. Trump up to 24 April 2025

George W. Bush took office at an unpropitious time

Source: LSEG Refinitiv data

China

Source: LSEG Refinitiv data

see if corporate earnings start to weaken to provide another challenge.

The good news is the data show a sticky start does not mean a presidency is doomed to provide poor returns over its full terms. The first stints in office for Truman and Eisenhower offer evidence for this. However, it is noticeable that the only presidencies which offered beginnings as weak as this one offer what may be uncanny echoes of current circumstances.

George W Bush took office in January 2001, just as the technology, media and telecoms bubble bull run turned into a massive bust. Investors fled as earnings disappointment, not to mention a rash of initial public offerings and secondary issues, persuaded them to realise valuation were untenably stretched.

None of this could be laid at Bush’s door and a difficult macroeconomic environment also

The good news is the data show a sticky start does not mean a presidency is doomed to provide poor returns over its full terms”

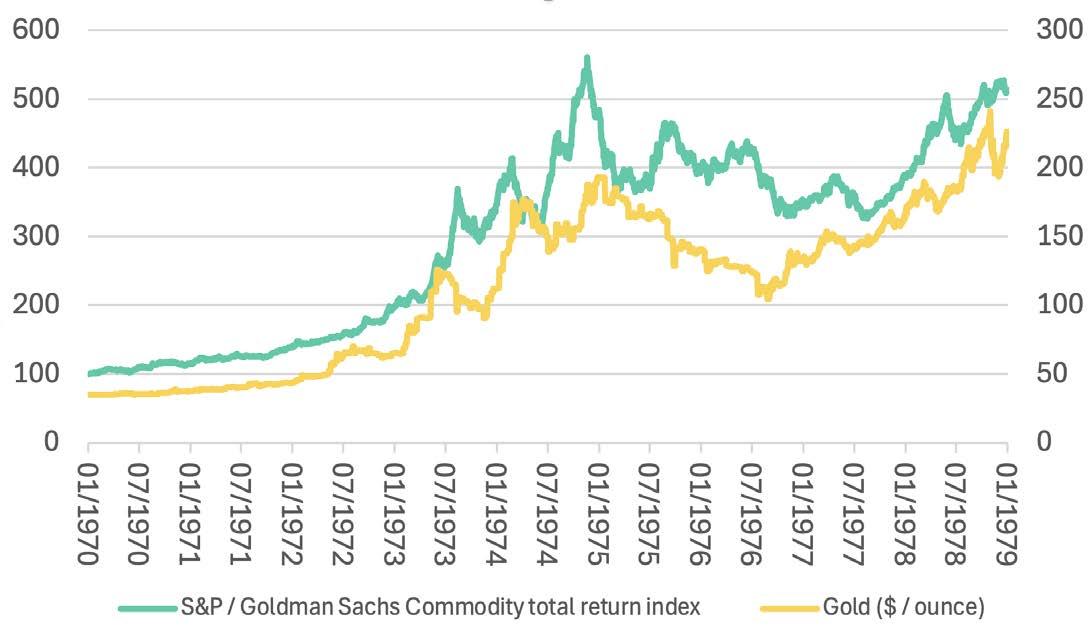

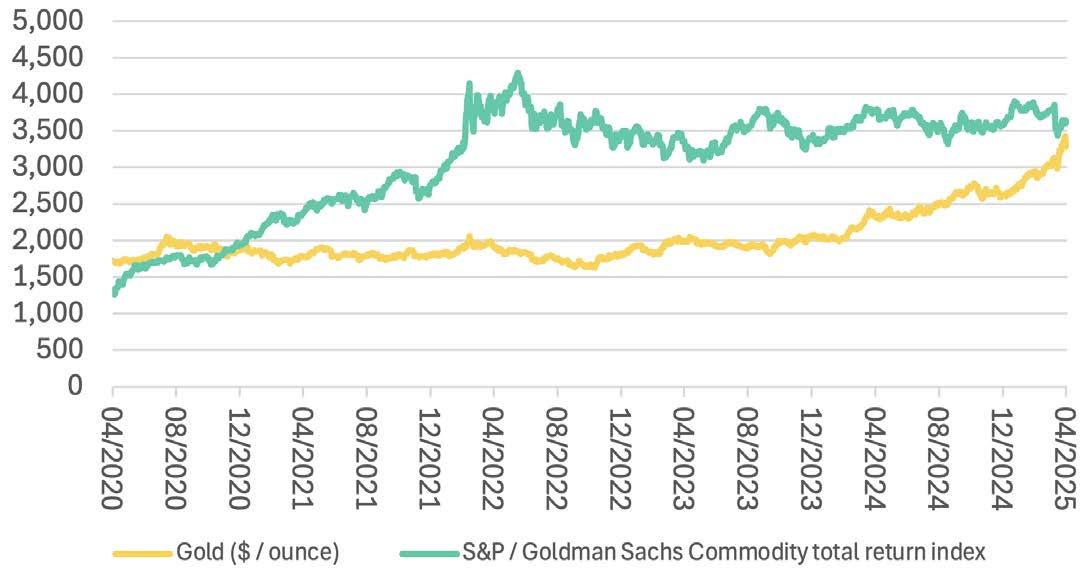

made Nixon’s second term a treacherous one for US equity investors. However, this is where the echoes with current events get stronger still, thanks to the so-called Nixon shock of summer 1971. To help fund military conflict in Vietnam and welfare programmes at home, Nixon took the dollar off the gold standard, let the US currency slide and imposed tariffs on imports in an attempt to reset the global financial system to American advantage. An unexpected oil price spike in 1973, thanks to an Arab embargo in the wake of American support for Israel, complicated matters no end, but Nixon’s actions set off a chain of events that ushered in an era of inflation, if not stagflation, and misery (in real terms) for anyone who owned US equities, US bonds or cash – only gold and ‘real’ assets (commodities) provided a real bolt-hole.

Trump’s determination to lessen America’s trade deficit, weaken the dollar and re-set global trade terms smacks of Nixon’s plan, and also comes at a time when Federal finances hem in the president, albeit this time in the form of record borrowing levels rather than the straitjacket of the gold standard.

Investors must now answer two sets of (interrelated) questions. Do markets now feel less

Russ Mould: Trump’s first 100 days

Gold (and commodities) may, again, be the best guide here”

comfortable owning dollar-denominated assets, owing to the Trump presidency’s policies, how they are being implemented? If so, they may have further to fall as valuations are recalibrated lower to reflect such doubts and the scope for policy error and earnings disappointment. If not, the current chaos could indeed be a classic chance to ‘buy on the dip.’

Is the economic environment now going to be markedly different (as it was after the Nixon shock)? Since the Great Financial Crisis, low growth, low inflation and low interest rates have prevailed, to be benefit of long duration and secular growth and yield asset such as tech and biotech stocks and (long-dated) bonds. If the world is different, with more inflation, higher and more volatile interest

Gold and commodity prices are hinting at a major change in the macro backdrop

Source: LSEG Refinitiv data

rates and less predictable growth, is it not logical to expect different asset options to outperform? Gold (and commodities) may, again, be the best guide here.

I am interested in planning for my beneficiaries as much as my own finances. I understand that my SIPP beneficiaries can inherit their share as a SIPP. Is that right? If they have (or open) an AJ Bell SIPP, can they inherit into their SIPP directly, all done within AJ Bell, not having to go via an external cash payout?

Could it be done ‘in specie’? Would their SIPP be exactly as if they had earned the money and paid in to their SIPP, or would it be different? Would its crystallisation status be the same as the crystallisation status of my SIPP, or would it all be as if crystallised or would it all be as if uncrystallised?

Graham

Rachel Vahey, AJ Bell Head of Public Policy, says:

One of the big attractions of saving into a defined contribution pension – such as a SIPP – is the ability for your family and loved ones to inherit your pension pot when you die. It’s worth recapping who can inherit, how they can take the funds, and what tax they may pay.

First – who can inherit? The answer is a pension saver can nominate anyone to receive their pension pot. This could be a family member, or it could be someone unrelated. It doesn’t have to be someone who is financially dependent on the pension saver. The pension saver nominates the person by making an expression of wishes, also called a nomination. This can be done in writing and many pension providers will have a form for this. However, ultimately, it’s up to the trustees of

the pension scheme to decide who does inherit. In deciding this they will look at the expression of wishes, and probably any will for information –but they are not bound by either document. They will also look at the individual’s family position, including who was financially dependent on them. If the chosen beneficiary is either a dependant or a nominee, then they can choose to take the inherited pension pot as an income through drawdown, for example in a SIPP, (or buying an annuity with the pot) or as a lump sum. If the chosen beneficiary is not a dependant or nominee, then they can only take the funds as a lump sum. This reduces their options considerably, especially if they want to control the amount of tax they pay by taking out the funds gradually. So, it’s always good to make sure nomination forms are up to date to give your loved ones as many options as possible.

If the beneficiary is a nominee or dependant and chooses to take drawdown then usually they will have a choice about whether to take it through a beneficiary’s drawdown plan with the original pension scheme or with a different provider, for example in a SIPP. However, that depends on

the pension schemes. Some schemes may not offer the ability to take a beneficiary’s drawdown within their rules, and in these circumstances the beneficiary will have to transfer to another pension scheme.

If the beneficiary transfers to another pension scheme, then whether they could do that in specie or whether they have to sell their investments and transfer them as cash will again depend on the rules of the pension schemes involved, and probably what sort of investments the pension pot holds.

It’s worth asking pension schemes what their rules say. The AJ Bell SIPP will offer your beneficiary a beneficiary’s drawdown plan with us. But if they want to transfer we will facilitate an in specie transfer where the receiving scheme is happy to accept the investments.

A beneficiary’s drawdown plan is usually held separate to any other pension account the beneficiary has with the pension provider. They can take an income from the beneficiary’s drawdown plan from any age – they do not have to be age 55 or over. They can only take an income – they cannot take any tax-free cash lump sums, even if the member had not taken any lump sums in their

lifetime, so these payments won’t affect their lump sum allowances for their own pension savings.

Finally, taxation. If the pension member died before age 75, then any lump sums will be tax free, as long as the value of the lump sum when added to all the other tax-free lump sums the member received during their lifetime and were paid out on death is less than their Lump Sum and Death Benefit Allowance. This is usually set at £1,073,100. Any excess would be taxed as the beneficiary’s income.

(Just to note if there are still funds in the beneficiary’s drawdown plan when they die, then these funds will count towards the beneficiary’s own Lump Sum and Death Benefit Allowance when their successor is working out whether they have to pay income tax on any lump sums received.)

If the beneficiary instead took an income from a drawdown plan or annuity, then this would always be tax free, regardless of how much money there was in the account and across all the member’s pension pots.

If the member was aged 75 or over when they died, then any lump sum or income paid to the beneficiary will be taxed in the same way as income. Currently, the pension pot is usually free from inheritance tax. The government has proposed changing this so, from April 2027, it will be included in the estate for inheritance tax. However, we have not yet received final rules, and this position could change before that date.

DISCLAIMER: AJ Bell referenced in this article owns Shares magazine. The author (Rachel Vahey) and editor (Tom Sieber) of this article own shares in AJ Bell.

Send an email to askrachel@ajbell.co.uk with the words ‘Retirement question’ in the subject line. We’ll do our best to respond in a future edition of Shares Please note, we only provide information and we do not provide financial advice. If you’re unsure please consult a suitably qualified financial adviser. We cannot comment on individual investment portfolios.

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS:

Dan Coatsworth

Danni Hewson

Laith Khalaf

Russ Mould

Laura Suter

Rachel Vahey

Hannah Williford

Shares magazine is published weekly every Thursday (50 times per year) by AJ Bell Media Limited, 49 Southwark Bridge Road, London, SE1 9HH. Company Registration No: 3733852.