Cost Management Strategies Chronic Diseases for

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your assets, your employees and their dependents:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We'll find the right answers together, so no matter what happens, your business is prepared.

By Laura Carabello

By Bruce Shutan

By Caroline McDonald

By Joseph D. Sabol

By Anthony Murrello and Catherine Bresler

The Self-Insurer (ISSN 10913815) is published monthly by Self-Insurers’ Publishing Corp. (SIPC). Postmaster: Send address changes to The Self-Insurer Editorial and Advertising Office, P.O. Box 1237, Simpsonville, SC 29681, (888) 394-5688

Cost Management Strategies Chronic Diseases for

Written By Laura Carabello

OnceOreserved for the elderly, the growing prevalence of chronic disease among working-age Americans now requires selfinsured employers to re-tool their approach to managing associated costs. In the face of staggering chronic disease spending, improved management strategies can lead to lower expenditures, better patient outcomes and a more productive workplace.

The Centers for Disease Control and Prevention (CDC) provide some startling statistics that directly impact employers:

An analysis of the Behavioral Risk Factor Surveillance System (BRFSS) estimates that 53.8% of adults aged 18-34 report at least one chronic condition, and 22.3% have more than one.

With an aging baby boomer population, the prevalence of these conditions will likely continue to rise in coming years.

For employers extending benefits to family members, it is startling to learn that about 40% of school-age children have at least one chronic health condition. Conditions that used to almost exclusively affect older adults now impact younger adults at much higher rates. For example, stroke rates in patients ages 20-44 increased from 17 to 28 per 100,000 between 1993 and 2015.

IMPACT OF CHRONIC DISEASE IN AMERICA

Chronic disease is clearly a recipe for increased costs. The International Foundation of Employee Benefit Plans projects that in 2024, employers are expected to pay more for chronic disease management than in previous years. The organization predicts a 7% increase in healthcare costs for 2024, with chronic conditions being a top reason for the rise. Here’s why:

Utilization due to chronic health conditions (22%, up from last year)

Catastrophic claims (19%, same as last year)

Specialty/costly prescription drugs/cell and gene therapy (16%, up from last year)

Medical provider costs (14%, up from last year)

Add to this the staggering expense of $36.4B annually in lost productivity and missed work. Then consider a further burden: the advancing age of Millennials. Anyone born between 1981 and 1996 (ages 23 to 38 in 2019) is considered a Millennial, and they now represent the majority of the workforce. As a result, employers are more likely to have employees who are atrisk of, or receive treatment for, chronic conditions.

“Type 2 Diabetes poses a significant financial burden for

numerous reasons,” says Amanda Christel, BSN, RN, Orion Nurse Consultant, StarLine. “The prevalence (nearly 1 in 10 U.S. adults have Type 2 Diabetes), high-cost drugs (hello, GLP-1s!), and the potential for catastrophic complications if poorly managed, including chronic wounds, kidney disease, stroke, and blindness.”

Christel advises that managing Type 2 Diabetes truly requires a multidisciplinary approach, adding, “While medical management is often effective, lifestyle interventions are of the utmost importance to sustain results. Self-funded employers should focus on strategic plan designs with an emphasis on

reducing barriers to care, which will ultimately increase disease management compliance and help mitigate the risk for long-term, high-dollar complications.”

As plans sponsors are ultimately responsible for managing the chronic disease benefits offered through the health plan, Jesse Roderick, senior vice president, Accident & Health Claims. QBE North America says his organization supports self-insured plan sponsors through its experienced cost containment team comprised of risk and clinical professionals.

“Chronic cancers, as well as heart and circulatory conditions that cannot be resolved through standard treatments, tend to pose the greatest financial challenges for self-insured plan sponsors,” he explains. “These diseases are driving rising healthcare costs, and treatments can range from hundreds of thousands of dollars to millions depending on the specific diagnosis. These high costs, coupled with ongoing treatment needs, an increasingly fragmented healthcare system and plan designs that don’t effectively manage chronic disease benefits, can lead to complex financial challenges for the plan sponsor.”

Despite best intentions to improve patient quality of life and reduce expenditures with preventative interventions, Jakki Lynch RN, CCM, CCFA, CMAS, director of cost containment, Sequoia RIS, contends, “High-cost treatment continues as chronic disease accounts for 81% of all hospital admissions, 91% of all prescriptions filled, and 76% of all doctor visits. These statistics indicate that proactive preventative strategies are not consistently adopted by the patients and non-compliance combined with comorbidities result in significant health plan risk exposures.”

She says that even if patients adopt the preventative programs, significant high-dollar claims may occur due to the unpredictability and complexity of the chronic clinical conditions. Furthermore, with the increasing cost of hospital inpatient services, emerging therapies and chronic illnesses treated with specialty pharmacy medications, plan sponsors need impactful solutions to manage expenses,

Amanda Christel

Jesse Roderick

Jakki Lynch

2024 National Conference Title Sponsor | Booth 501, 600

Among the financial challenges that chronic conditions have on selffunded health plans, Amy Tennis, SVP, medical management for Medwatch, points to chronic kidney disease (CKD) and end-stage renal disease (ESRD) as the most frequent and costly.

“Having an effective, proactive Case and Disease Management program in place is critical in providing early identification and management of these conditions and related costs,” says Tennis, citing the role of specialized Registered Nurse (RN) Case Managers to work with and on behalf of plan members. “These professionals help to effectively manage condition(s) and improve overall health while controlling cost and monitoring the quality of the care they receive. When patients

are adhering to recommended diets, maintaining regular exercise routines, and medication regimens that are specifically tailored to each disease, an effective Disease Management program can significantly lower overall costs and improve outcomes for members.”

Expanding upon this challenge, Karen Hicks, an R.N. and certified case manager with MedWatch who specializes in all aspects of kidney care, explains, “The single most costly component of kidney failure is the ongoing costs of dialysis. On the East Coast,

Amy Tennis

dialysis costs can run anywhere from $300,000 to $500,000 per year. On the West Coast, they rapidly escalate from $500,000 to $1,000,000 or more a year.”

For diabetics that have advanced to ESRD and are on dialysis, she says it is important for a plan to address the cost of dialysis treatments and to find the best possible partner to provide credible repricing of these claims.

“Our Dialysis Claim Review and Repricing services provide clients with a proven solution that delivers a fully defensible repriced claim with average savings of 91% off of billed charges – with no patient balance billing,” says Hicks. “In addition, proactive management of the pending transplant process provides clients with access to Centers of Excellence and savings of 50% to 60%. The goal is to find lower cost options or alternatives for these treatments to help the plan save significant financial resources.”

A value-add for the Disease Management Kidney Care

Program is providing participants with information and access to numerous online resources that are readily available. These include public resources like the Kidney Smart Program and Kidney Disease Education Classes that offer patients additional information and further understanding of their condition,

Hicks is passionate about helping members through what can be a very difficult time in their lives, adding, “My mission is to provide them with as many resources as possible and be there as their advocate every step of the journey.”

Reducing the human and financial costs of chronic kidney disease (CKD) is a focus throughout the self-insured community. Scott Vold, Chief Commercial Officer, Renalogic, points out that 1 in 7 Americans have CKD, yet 90% remain undiagnosed.

“The consequences are staggering - over 500,000 Americans are on dialysis, and CKD imposes up to $100 billion in annual costs for commercial health plans,” explains Vold. “Our focus is to work closely with selffunded plans to effectively manage these CKD-related expenses. More importantly, our innovative programs help prevent plan members from progressing to dialysis, transforming lives and delivering sustainable savings.”

Vold refers to proprietary algorithms that analyze tens of thousands of data elements to compute reduced, justifiable costs for dialysis.

“Claims repricing is crucial in the healthcare industry because it helps ensure that costs are managed effectively and fairly with our proven savings of 84.5% against contracted dialysis rates,” continues Vold.

“By adjusting the amount paid to healthcare providers, self-funded plans can prevent overcharging and ensure that health plan members are not burdened with excessive out-of-pocket expenses.”

He says there are various solutions that help members manage CKD, including clinical intervention teams that work with members to prevent CKD progression and improve overall member well-being with early, specialized clinical care.

“These teams also assist with forestalling end-stage renal disease (ESRD) and avoid emergent dialysis, starting with care management

Karen Hicks

Scott Vold

and navigation services for late-stage CKD members,” adds Vold. “Our data-driven approach has demonstrated remarkable results -- as we are 230% more effective at identifying undiagnosed CKD compared with traditional commercial benchmarks. Lastly, our clinical program is 98.3% effective at preventing enrolled members from developing ESRD.”

WHAT CAUSES CHRONIC DISEASE?

Broadly defined, chronic diseases and conditions last a year or more and require ongoing medical attention or limit activities of daily living -- or both. A jaw-dropping 90% of the nation’s $4.5 trillion in annual healthcare expenditures are for people with chronic and mental health conditions, with the most common types spanning cancer, heart disease, stroke, diabetes and arthritis.

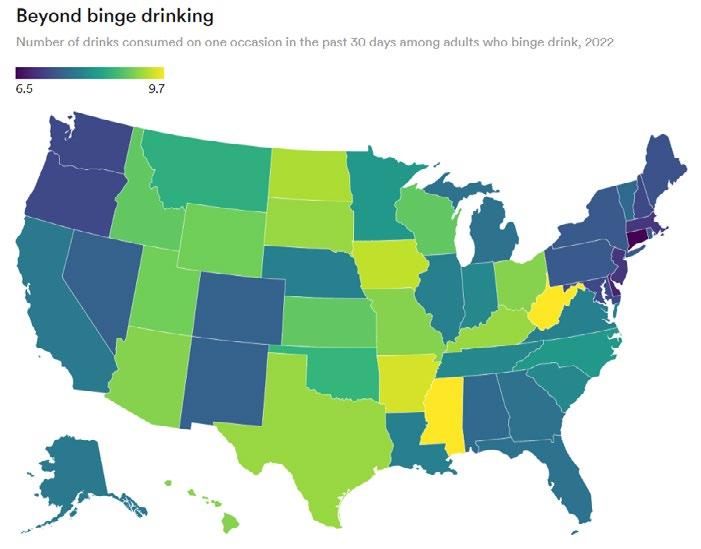

While some chronic conditions are genetic, many are exacerbated by or the result of lifestyle choices, including excess alcohol consumption, physical inactivity, tobacco use and unhealthy diet. This accounts for the results of the BRFSS survey that cites the prevalence of obesity (25.5%), depression (21.3%), and high blood pressure (10.7%), along with the likelihood that these individuals would report binge drinking, smoking or physical inactivity.

RISK FACTORS

Many preventable chronic diseases are caused by a short list of risk behaviors. While Americans have been warned for decades about the risk of cigarette smoking, it is still surprising to learn that it accounts for more than 480,000 deaths each year in the U.S. Today, over 16 million Americans are living with a disease caused by smoking, including cancer, heart disease, stroke, lung diseases, diabetes and chronic obstructive pulmonary disease (COPD), which includes emphysema and chronic bronchitis.

Currently, people tend to think of vaping and e-cigarettes as “safer” than smoking, but they are not safe.

Vaping has been linked to chronic lung diseases like asthma, bronchitis, emphysema, and chronic obstructive pulmonary disease (COPD). Vaping products contain chemicals and particles that can irritate the lungs, causing inflammation and narrowing of the airways, which can lead to short-term breathing problems like coughing and shortness of breath and, over time, permanent scarring and chronic conditions – or even cancer. Multiple studies document that people who used e-cigarettes and also smoked tobacco were at an even higher risk of developing chronic lung disease than those who used either product alone.

Vaping in the workplace is more common than one would think. New studies of companies with more than 150 employees show that the majority (61.6%) observed coworkers vaping at work, and 19.1% reported vaping at work themselves. Vaping in the workplace may impact nonusers in a variety of ways, including potential exposure to secondhand aerosol, which may be bothersome or perceived as harmful and lead to decreased productivity.

Poor nutrition is another significant risk factor for obesity and other chronic diseases, such as type 2 diabetes, heart disease, stroke, certain cancers and depression. High sugar and refined carbohydrate intake are established causes of poor health and chronic illnesses such as type 2 diabetes, obesity and various metabolic syndromes. Diets high in both saturated fat and sugar can even increase the risk of kidney and liver diseases.

Hand-in-hand with poor nutrition is a lack of physical activity, a factor that increases the risk for serious health problems such as heart disease, type 2 diabetes, obesity and some cancers. For people with chronic diseases, physical activity can help manage these conditions and complications. CDC advises that only one in four U.S. adults fully meet the physical activity guidelines for aerobic and musclestrengthening activity. A massive $117 billion in annual healthcare

costs are associated with inadequate physical activity. Getting enough physical activity could prevent:

• 1 in 10 premature deaths

• 1 in 8 cases of breast cancer

• 1 in 12 cases of diabetes

• 1 in 15 cases of heart disease

Finally, alcohol consumption is a risk factor for many chronic diseases and conditions. According to the U.S. Dietary Guidelines for Alcohol Consumption, men should limit their intake to two drinks per day, while women should stick to one. This recommendation applies to any given day, not an average over time.

The American Medical Association (AMA) first identified alcoholism as a disease in 1956 and, in 1992, published the following definition of alcoholism:

“Alcoholism is a primary, chronic disease with genetic, psychosocial, and environmental factors influencing its development and manifestations. The disease is often progressive and fatal. It is characterized by continuous or periodic: impaired control over drinking, preoccupation with the drug alcohol, use of alcohol despite adverse consequences, and distortions in thinking, most notably denial.”

According to the Alcohol Research Center, 25 chronic disease and condition codes in the International Classification of Disease (ICD)-10 are entirely attributable to alcohol, and alcohol plays a component-risk role in certain cancers, other tumors, neuropsychiatric conditions, and numerous cardiovascular and digestive diseases.

National Institute on Alcohol Abuse and Alcoholism advises drinking beyond U.S. Dietary Guidelines levels can cause liver disease, including steatosis (accumulation of fat), steatohepatitis (inflammation), fibrosis and cirrhosis (scarring), hepatocellular carcinoma, and alcohol-associated hepatitis.

UK-National Health Service says that after 10 to 20 years of regularly drinking more than 14 units a week, this consumption leads to the development of diseases such as mouth cancer, throat cancer and breast cancer. Stroke or heart disease.

Finally, excessive alcohol use over time can lead to serious behavioral health problems, including alcohol use disorder and problems with learning, memory, and mental health.

Myron Unruh, Chief Operating Officer at MINES and Associates, a leading EAP provider, says, “Alcohol use disorders and problem drinking cause a staggering level of financial and social impact in the United States. According to the CDC, approximately 178,000 alcoholrelated deaths occur each year.”

He emphasizes the gravity of these statistics and their immense burden on healthcare costs.

“Healthcare-related costs from problem drinking translate into direct costs for substance abuse treatment as well as a myriad of comorbidities well known and researched as directly and indirectly related to problem drinking, such as liver disease. Many more expenditures occur to the payer through emergency room visits, both for minor and major injuries, including motor vehicle accidents.”

Myron Unruh

SELF-INSURED EMPLOYERS TAKE ACTION

Anticipating a higher prevalence of serious or chronic disease diagnoses matters greatly to employers because the management of these conditions can be complex and expensive. Consider the impact of costly treatments, increased use of specialty medications — which can account for nearly half of an employer’s health care spend -hospitalizations and higher utilization of medical services. Strategies and interventions for managing these costs vary widely.

Jakki Lynch assembled a more granular list of the various preventative strategies that health plans utilize to improve patient outcomes and control these costs:

• Preventive Care Programs

• Chronic Disease Management Programs

• Predictive Modeling

• Evidence-based Care Pathway Platforms

• Value-Based Contracting with Providers

• Remote Patient Monitoring

• Specialty Pharmacy Management

• Behavioral Health Support

“The key interventions for plan sponsors to reduce the inpatient facility and high-cost specialty pharmacy exposure requires insightful contracting and claim payment integrity review, which ensures correct reimbursement and accurate payment of plan benefits,” she explains. “With the combination of a strategic claim payment integrity program, plan sponsors can leverage a fact-based understanding of the provider’s billing practices supported by historical paid

claims outcomes for a targeted negotiation while also allowing for the right to review the claims.”

She says if the plan has access to a reasonable claim payment contract, charges should be clinically reviewed to ensure propriety and accuracy.

“A financially effective contract alone does not ensure plan benefits are properly determined,” cautions Lynch. “The contract rate should only be applied to plan eligible charges.”

She points out that effective payment integrity programs are supported by focused expertise, including clinicians, charge master specialists and settlement resolution teams. While some health plans may employ automatic claim editing adjudication processes to review high dollar claims, formulaic technology-based algorithm programs have a limited impact since artificial intelligence cannot review medical records, identify key clinical charge adjustments, and communicate the findings to the providers and facilities to ensure consensus for the charge adjustments.

“Claim Payment Integrity is a technical high dollar claim and medical record review which determines if the charges are coded accurately, appropriately documented and are free from impropriety,” says Lynch.

“Analyzing high dollar claims requires specialized expertise and resources. Health plan sponsors may not have the staff, time, or experience to identify and construct the clinical, network and coding nuances inherent to complex claims.”

Roderick offers this recommendation, “A cost management strategy that effectively manages health plan benefits for chronic diseases starts with a straightforward approach to the plan design. In general, there has been an ongoing shift towards plans with higher deductibles. While these higher deductibles can save on overall costs, they discourage

participants from seeking care and can create compliance issues when the plan sponsor wants to tailor their health plan by adding a new program or providing access to a top-tier provider that helps participants manage their chronic disease at a lower cost and with a better outcome.”

He suggests narrow network plans as another cost management strategy don’t lend themselves to chronic disease treatment.

“Many employers offer these as an effective way to curb costs since providers within narrow networks typically accept lower reimbursement rates than out-of-network providers,” he continues. “While intentionally designed to be more affordable, narrow network plans limit the providers a participant may be able to access, and when looking at the best strategies to manage chronic diseases, this option might result in no material cost reduction to the plan and disappointing patient outcomes.”

Finally, he advises that the most effective cost management strategies are referenced-based pricing plan designs that set limits on what the plan will cover for specific services based on a referenced price.

Steadfast protection for the unpredictable Stop Loss coverage that weathers any storm

Our Stop Loss Insurance mitigates the impact of devastating medical claims through flexible contracts, customizable plans and a consultative, client-focused approach. Our experience and service in the Stop Loss market has provided a guiding hand for nearly half a century - while maintaining a pulse on new trends. We work with self-funded groups down to 100* lives and individual deductibles down to $25,000. Our Stop Loss Edge program offers an innovative way to take advantage of self-funded health plan coverage for employers with 100*-500 employees. Whether you’re carving out Stop Loss for the first time or an experienced client looking for cost containment solutions, we can help. We’ll be by your side every step of the way.

Visit voya.com/workplace-solutions/stop-loss-insurance for more information

* 150 enrolled employee minimum for policies issued in CA, CO, CT, NY, or VT.

Stop Loss Insurance is underwritten by ReliaStar Life Insurance Company (Minneapolis, MN) and ReliaStar Life Insurance Company of New York (Woodbury, NY). Within the State of New York, only ReliaStar Life Insurance Company of New York is admitted, and its products issued. Both are members of the Voya® family of companies. Voya Employee Benefits is a division of both companies. Stop Loss Policy #RL-SL-POL-2013; in New York Policy #RL-SL-POL-2013-NY. Product availability and specific provisions may vary by state.

©2024 Voya Services Company. All rights reserved. CN3558760_0526 216993 216993_053124

“Carving out the pharmacy benefit manager (PBM) can help reduce costs too, as this provides transparency around negotiated prices and allows the plan sponsor to better tailor their formulary to meet participants’ needs,” he concludes. “In addition, point solutions can be added to a plan sponsor’s health plan that allow participants access to chronic disease-specific programs. These programs can be tailored in multiple ways, and the plan sponsor should work in collaboration with their broker and administrator when adding a specific point solution to their health plan.”

DISEASE MANAGEMENT PROGRAMS HELP TO CONTROL COSTS

Effective chronic disease management requires a multi-pronged approach involving the plan enrollee, healthcare providers and employer-sponsored programs. For instance, it may be helpful to follow the recommendations of the CMS Innovation Center when it decided to permit next-generation accountable care organizations (ACOs) to reward disease management program (DMP) participation –also called “structured treatment programs.” These include:

• Involve structured treatment plans based on the latest medical research that aim to guarantee high-quality care for patients. DMPs ensure the close coordination of various treatments and regular checkups as well as advice and instruction about coping with disease.

• Provide education on self-care management that empowers enrollees to take control of their health and learn ways to sustain an improved quality of life.

• Emphasize preventive care, including regular screenings and checkups.

• Emphasize and promote the benefits of regular exercise and a nutritious diet.

• Integrate wellness programs that promote healthy lifestyles.

DEEPER DIVE INTO DMPS

Preventive Care

There is widespread consensus that the best way to reduce chronic disease spending is to stop diseases before they happen or before they progress to severe stages. According to the CDC, aggressive, late-stage cancer cases require higher-cost interventions than slow or early-stage cancer cases demanding less invasive procedures. Endof-life phase treatment for breast cancer costs, on average, $76,100 per patient, whereas the average initial phase treatment costs less than half that amount ($35,000).

Proven approaches to preventive care include regular screenings, counseling and checkups; routine immunizations; and preventive services for men, women, children and youth. The U.S. Preventive Services Task Force (USPSTF) has issued recommendations on a broad scope of preventive care services for chronic diseases,

such as affirming the benefits of colorectal cancer and hypertension screenings for certain age groups. They also advise that breast cancer screening can help find breast cancer early, when it is easier to treat, recommending that women who are 40 to 74 years old and are at average risk for breast cancer get a mammogram every 2 years.

To effectively address alcoholism, Myron Unruh offers this perspective: “Whether a member of a health plan struggles with problem drinking, excessive drinking, or binge drinking, a supportive cost containment strategy is important. A portion of problem drinkers will also struggle with numerous admissions to costly treatment centers.”

He says that, undoubtedly, the most effective strategy for cost containment is early prevention and detection of excessive alcohol use. For most individuals, outpatient techniques such as motivational interviewing, cognitive-behavioral therapy, and support groups are timely and appropriate for reducing the number of alcoholic drinks an individual consumes each week. The corresponding support of a healthy lifestyle reduces the effects of healthcare costs.

“However, for many individuals, a more involved treatment plan is necessary, which may include ongoing support and abstinence from alcohol,” states Unruh. “This treatment may include detoxification, residential, and longer-term outpatient supportive therapies to aid one in recovery. For both lower and higher levels of problem drinking, knowledgeable clinical case

management teams of professionals can develop a tailored approach to treatment that considers high-quality and cost-containment services.”

CARE MANAGEMENT & COORDINATION

Industry advisors recommend that employers Invest in care management and clinical programs that help employees and their families navigate care with a combination of timely outreach, clinical support and personal guidance for managing chronic conditions. Enabling better communication and access to care overcomes the disjointed nature of the current healthcare system, bridging the gap between primary care and specialty care and easing the referral experience. The goal is to ensure access to the most appropriate care and treatment at the lowest possible cost.

They also suggest transitioning patients to outpatient settings whenever possible by collaborating with hospital partners to move chronic disease patients to environments that reduce preventable admissions and lower costs.

As enrollees seek care from multiple providers, it is important that DMPs ensure coordinated care among physicians with different specialties. Remember that a specific condition should account for comorbidities with additional mental, behavioral, and physical conditions that can influence a member’s treatment adherence and patient experience.

The key is to ensure information sharing that keeps patients in the

loop regarding care coordination elements that are essential for strong collaboration between providers of multiple specialties. Thought leaders write in The New England Journal of Medicine that effective DPMs include:

• Accessible care from a range of healthcare providers: primary care, specialty care, acute care and long-term care,

• Strong channels for robust communications and transitions among providers

• Emphasis on whole person health

• Simple communication with patients

Roderick’s team contracts with several vendors that can assist its clients with point solution programs for a wide range of chronic diseases, as well as pharmacy benefit managers (PBMs) that can work in collaboration with the plan sponsor and other PBMs that may already be integrated into the health plan design.

“We generally act as a facilitator to help introduce vendors to the plan sponsor or their representative, and through our partnerships, we can help provide a preferred rate. Ultimately, we are here to offer

solutions and options that help our clients manage high-cost conditions.”

MEMBER ENGAGEMENT

Top-down employer support for chronic disease management is essential, as benefits leaders focus on the ultimate goal of empowering members to take control of their health.

Successful member engagement is fundamental to member satisfaction, as confirmed year after year by the J.D. Power member survey.

The most effective member engagement communications take an omnichannel approach. This

A SPECIALIST APPROACH TO HEALTHCARE

includes connecting with members through multiple mediums, such as text, email, apps, and paper mail. Content should promote health and wellness and discourage unhealthy habits or behaviors, such as tobacco and alcohol use, poor nutrition and physical inactivity.

Many employers are investing in and developing health and wellness programs that may encourage employees to complete healthy activities, and they are analyzing claim data to help them focus on specific health concerns. These programs may include enhanced care coordination, medication management, disease-specific education, self-monitoring tools and peer support.

Some employers may take a step further by introducing a wellness program that provides employees with diabetes with low-cost/nocost access to glucose meters, insulin pumps, diabetes educators, and online support groups.

The key is to educate, motivate and support employees with resources that can help them to adopt healthier behaviors and lifestyles. This involves refining communication strategies based on members’

preferences, partnering with other stakeholders that can encourage program participants and sharing decision-making responsibility with members. Many programs offer free or discounted gym memberships, healthy food options, wellness challenges and rewards for reaching health goals.

Some employers are also introducing financial wellness benefits and programs to alleviate the financial stress that often accompanies managing a chronic condition. In some instances, they are designing their plans to offer $0 copays for services like primary care, virtual care and urgent care visits or

condition-specific coverage for necessary treatments, devices or procedures. Other resources can include one-on-one financial coaching, online educational sessions, budgeting tools and more.

When tackling the issues associated with alcoholism, Unruh says it is critical to message members who surpass the recommended consumption limits. He explains that using a population health framework is the key model to reduce health plan costs. This includes various targeted campaigns, such as promoting Employee Assistance

Programs for self-insured plans and advocating techniques like SBIRT (Screening, Brief Intervention, and Referral to Treatment).

“It’s essential to ensure that primary care providers, emergency room personnel, and other healthcare professionals are proficient in administering SBIRT,” continues Unruh. “The ultimate objective is to decrease the number of individuals consuming more than the recommended amount of alcohol. Achieving this goal will yield significant reductions in future claims costs associated with conditions such as cancers, heart disease, liver cirrhosis and diabetes.“

Furthermore, when a screening does determine that a member requires a higher level of care, cost-containment for alcohol use disorders comes from an astute clinical case management program that is member-centric. This involves a case manager developing a therapeutic relationship with a member and maintaining ongoing engagement through the various steps of treatment with the member.

“Often, as a member graduates through various levels of care, the one constant is their dedicated clinical case manager,” he explains. “This

case manager should be supported by a team taking an integrated care team approach that surrounds the member with the support services needed. This collaborative model, which can include other treatment providers and family, ensures comprehensive support and accountability and minimizes the risk of the member disengaging from treatment.”

On a positive note, while problem drinking can be persistent and costly, recovery from alcohol use disorders is achievable. Cost containment strategies, Employee Assistance Programs, Population Health Management Strategies, and Clinical Case Management can be effective in reducing residual hospital admissions, preventing costly comorbidities, and supporting members to healthier, happier lives.

TRENDS TO WATCH

Chronic disease is expected to continue to increase in the United States, as the Mayo Clinic estimates some 170 million Americans will suffer from at least one chronic illness by 2030. The prevalence and cost of chronic disease in the United States is still growing and will continue to increase, not just the result of the Baby Boomer generation aging but also accelerated disease prevalence among children and younger adults. The number of people in the U.S. battling chronic diseases like diabetes, obesity and heart disease has risen steadily since the mid-1990s.

These projections should concern self-insured employers because the management of these conditions can be complex, expensive and impactful to workplace performance and productivity. They often require costly treatments, specialty medications — which analysts say can account for nearly half of an employer’s health care spend.

The Business Group on Health anticipates that in 2024, employers will go “back to basics” on physical health – with a renewed emphasis on prevention and primary care. They acknowledge that these are not new strategies but signal the urgency felt by companies of all sizes to avoid deferred care and the associated late-stage conditions and costs. Certain advances in medical treatment may translate into more personalized, precise care that includes biomarker screenings, pretreatment genetic testing and utilization of cell and gene therapies.

In the newest report from PwC, analysts predict healthcare costs are set to rise between 7% and 8% in 2025, with spending growth likely to reach a 13-year high. Prescription drug costs, closely associated with chronic diseases, are a major contributor. The analysts call out GLP-1s as a driver to watch since these drugs – initially developed for treating diabetes -- are now prescribed for obesity and other

conditions. Costs per member on GLP-1s have risen steadily over the past several years, reaching $23.16 in the first half of 2023 compared to $8.99 in 2021.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www. cpronline.com

ERISA AT 50

As the premier employee benefits law marks a golden anniversary this month, experts weigh in on its historical significance and handicap preemption battles

Written By Bruce Shutan

TThis month marks the 50th anniversary of the Employee Retirement Security Income Act known as ERISA, a law that has bonded the growing selfinsurance community for half a century. In recent interviews with The Self-Insurer, various industry experts reflect on the historical significance of this landmark legislation, an endless stream of preemption challenges and implications of the Chevron deference ruling on the doctrine of judicial deference regarding administrative action, as well as what they expect for the next 50 years and beyond.

ERISA is the single most important law in employee benefits because it provides a uniform framework from which self-insured employers can create their own health plans, according to Jennifer Chung, a partner with McDowell Hetherington LLP.

“It determines plan language. It determines how claims and appeals are processed and reviewed. And so, it plays a huge part in the plans themselves and how they get administered,” she says.

Sarah Millar, a partner with Faegre Drinker, says that as much as COBRA, HIPAA, the Affordable Care Act and other major employee benefits legislation have had an impact on health care, they’re all built around ERISA. Created for employer-sponsored plans, she notes that it serves as a foundational structure for how health care operates in the modern world.

The national and standard framework ERISA has put in place allows employers to design, provide and administer gold-level health care and retirement benefits to their workforce across the country, observes Dillon Clair, director of state advocacy for the ERISA Industry Committee known as ERIC. “It provides fertile ground for employers to innovate and continue providing bigger and better employee benefits,” he adds.

ERISA’s tenets involve a three-legged stool built on governance, fiduciary duties and preemption, explains SIIA Counsel Chris Condeluci, a principal and sole shareholder of CC Law & Policy PLLC who actually went to law school to become an ERISA attorney because of his interest in retirementsecurity issues.

That third leg, he says, is what ensures uniformity in the rules that govern both retirement and self-insured health plans, which is critical for keeping the cost of plan administration low for national and global employers.

PREEMPTION’S BATTLEGROUND

For all of the kudos ERISA has

earned on the eve of its golden anniversary, the law continues to be challenged by state lawmakers and regulators. It offers a major lesson in federalism that preempts states from jumping into certain spaces, according to Clair. In the process, he says, it prevents a patchwork of inconsistent or incompatible state laws so that employers with employees all over the country can provide the same benefits to everyone and don’t have to constantly comply with a series of different state laws.

Clair cautions that some peripheral ERISA preemption issues, such as health benefit mandates and all-payer claims database reporting requirements, could grow to be more of a threat. But for now, he says the biggest conflict with ERISA preemption is state pharmacy benefits manager (PBM) issues.

Years ago, local pharmaceutical associations sought to level the playing field for mom-andpop PBMs and independent pharmacies that were being edged out by large pharmacy networks being managed and designed by PBMs. Those efforts, Clair notes, led to legislation aimed at state licensing of PBMs and mandating minimum dispensing fees that tagged $7 onto every prescription bill. “If a rising tide lifts all boats, then a sinking tide sinks them all as well,” he explains.

That all changed with the landmark Rutledge case in 2020,

Dillon Clair

Jennifer Chung

which, while not unraveling ERISA preemption principles, affirmed that states could impose dispensing fees and similar laws. The ruling was clear about what states could do, he says, but fell short of spelling out what they were not allowed to do.

Sarah Millar

An overly broad interpretation of the U.S. Supreme Court’s ruling in Rutledge v Pharmaceutical Care Management Association is responsible for a fresh assault on ERISA, with industry observers fearing that an invitation to unintended consequences could widen. In upholding an Arkansas law requiring PBMs to pay pharmacies no less than their acquisition costs for prescriptions, the high court ruled that it was not pre-empted by ERISA. That decision allows states to regulate health care costs, including health plan contractors such as PBMs.

Following Rutledge, Oklahoma and Tennessee enacted laws in 2020 and 2021 that established minimum dispensing fees but

also tried to control the network practices of PBMs that administer self-insured ERISA plans. Examples include any-willing-provider provisions, restricting mail-order pharmacies and placing network adequacy requirements on PBMs. Other states to keep an eye on where similar battles are unfolding include Florida, Georgia, Louisiana and New York.

Be that as it may, Clair hastens to add that there’s a growing recognition among state regulators, including Kentucky’s insurance commissioner, that they may run afoul of ERISA when attempting to pass new laws or regulations – even if they’re well-intentioned. ERIC supports aspects of state PBM laws, such as transparency reporting and rebate pass-through measures.

One cause of litigation challenging preemption of ERISA in favor of the application of state laws is political gridlock at the federal level in a divided nation that makes it difficult to enact federal changes in the law, Millar suggests. “And so, the states have stepped in and have been much more active in a variety of ways,” she adds.

Ironically, she notes that when congressional representatives think through the big picture with respect to benefit plans and have meaningful discussions with one another, they have been able to make progress in certain areas. “There has been some strong bipartisan federal legislation on the retirement plan side,” she says, adding that health care is a much more divisive issue.

PBM-related state regulation has repeatedly run face first into ERISA preemption powers, most notably losing in the Tenth Circuit Court with an Oklahoma law a number of other states have mirrored that has not yet been taken up by the Supreme Court, Condeluci points out. He says the Supreme Court ruled in Rutledge that if a state law is only having an impact on the financial aspect of a plan and not plan administration, then it can continue, but what these stakeholders misunderstand is that their law does impact plan administration and plan design.

Chung believes that many decisions on preemption over state laws pertaining to plan administration have stood the test of time, calling it the law’s crowning achievement. States are increasingly attempting to enact insurance code provisions,

Christopher Condeluci

corporatesolutions.swissre.com/esl

regulations or statutes that are applicable to self-funded plans, Chung reports. One example is Missouri where there’s a prompt-pay penalty statute whose insurance code is defined to include self-funded plans. However, she doesn’t see such activity as intentional efforts to erode ERISA preemption overall, as much as individual issues that need to be decided on a case-by-case basis due to changing times, considerations, and interests.

People use the word preemption too loosely, opines Adam Russo, Esq., CEO of the Phia Group, LLC. “They may say, ‘isn’t that preempted by ERISA?’ No, not always. You actually have to understand what ERISA covers and doesn’t cover, and what rights the states have under certain circumstances,” he explains, noting for instance that stop-loss insurance is not covered under ERISA. “It’s

Contact us for a free demo and no commitment evaluation at info@CMSPricer.com

an expansive law that’s used inappropriately at certain times.”

With 50 states that have their own legislation, regulations, and courts, as well as 11 federal circuit courts, Russo says there will always be differences of opinion about what constitutes preemption as it relates to case law. A great example is the gagclause prohibition.

“If you’re a self-funded plan with a provision in your plan document that ties to a network agreement, and a lot of them do, it has language in there that allows for gag clauses,” he says. “That’s obviously preempted by the federal law of ERISA.”

Adam Russo

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health.

Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

THE IMPACT OF CHEVRON DEFERENCE

As for any ERISA implications for recently ending the Chevron deference, Chung says it doesn’t necessarily mean that Department of Labor (DOL) opinions won’t matter.

“I think practically speaking, people might still refer to them for guidance, especially in the context of setting up or administering plans, for example,” she says. “But if there are going to be disputes that must be addressed by the courts, that’s definitely going to lead to increased litigation and cost.” Narrowing the bodies that can address the

numerous issues that come up in the context of a comprehensive law like ERISA is going to present challenges, Chung adds.

“If there’s ever going to be a perfect example of a Chevron deference challenge, it’s the mental health parity law,” Condeluci believes, “because the regulations are so inconsistent with the statute of Congress’s intent that the court will likely look at the statute and say, ‘how could the tri departments – DOL, HHS and Treasury – come up with this interpretation in the reg?’”

A potential risk involved with Chevron deference is it removes certainty in terms of how to apply employee benefits law, Millar reports. “Some of these laws are so complicated that it would be almost impossible to have the legislation itself address all possible issues and nuances, and so without regulatory interpretation and implementation, there would be a lot of questions,” she cautions.

In the face of such uncertainty, she says vendors would be more reluctant to make investments in products and services that will implement changes made by law. Employers also would be less willing to implement and take advantage of these changes, she adds, for fear of blowback and risking a wrong interpretation.

There are already cases emerging that cast doubt on critical laws, such as the No Surprises Act, which Millar notes is being used to reinforce arguments on why certain regulatory interpretations should be invalidated or determined to be unconstitutional. She says that type of legal challenge would serve to slow payments that need to be made in the event of billing disputes, furthering the level of uncertainty in opposition to what that legislation was intended to do.

“The purpose of preemption is to give deference to federal law and regulatory interpretations,” she explains. “But many of the challenges to preemption focus on state law. One way to look at the loss of Chevron is that it’s a different way for state law to gain precedent over federal law.”

LOOKING AHEAD

Irrespective of what the next 50 years of ERISA will bring, Millar sees a continuation of tension between federal and state rules. But she’s also hopeful that opportunities will arise to streamline patchworks of state laws that tie the hands of larger employers.

With various developments and advances in the healthcare industry, Chung expects that ERISA will continue to be refined or consistently

interpreted in some respect. “There have been many changes over the years,” she notes, “and when interested parties resort to the judicial system, that presents an opportunity to make the law more thorough and fitting with the needs for the particular time.”

Condeluci expects a continuation of additional laws and/or regulations implementing all the laws that have been stacked up upon ERISA and that the employee benefit industry will continue to work through preemption challenges as they arise. “I have faith in the next 50 years that ERISA is going to be here doing what it was originally intended to do,” he predicts.

a Leading National TPA

Marketing Stop Loss

Compliance Concierge

Reporting Clinical Management

Everything you need to optimize your health plan under one roof.

Our specialized teams can provide guidance and service in areas like:

• Plan performance analysis and consultation

• Regulatory requirements and compliance

• Full-service concierge and navigation tools

• Custom-built scalable plans

Not just a TPA, a partner.

As an advisor to multi-state employers that must comply with a variety of increasingly complex issues because of the role of divergent state laws, Millar laments how paid leave, for example, is incredibly difficult to administer.

“The role of states in mandating paid leave makes it very challenging to provide those types of benefits in multiple states,” she says. “You still have differences in reporting requirements and it’s almost impossible to actually have a single scheme without an occasional exception. I would hope that’s an issue that, at some point, gets addressed at the federal level to provide a meaningful benefit with an

administrative simplification for employers to actually be able to provide those benefits. It’s almost like we need a renewal of the original grand bargain that ERISA gave us.”

When ERISA was enacted in the year Russo was born, he notes that employers didn’t have as many different locations as they now do in a post-COVID remote access world with an ability to dial in from anywhere, anytime. That means they can hire the best and brightest from a much larger labor pool, and it doesn’t matter where they live, which reinforces the importance of protecting the uniformity of employee benefit plans for multi-state or multi-national employers.

“I would make the assumption that more people are going to be working in various states for the same organizations,” he says. “If you think about why ERISA was created in the first place, one of the main reasons is because you have companies with employees in multiple locations. If you’re Coca-Cola, how are you supposed to apply 50 different laws to your employee benefit plan? It’s a big need for why you need that preemption. I don’t see that changing.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

SIIA EXPORTS EDUCATION AND NETWORKING TO DUBLIN, IRELAND

OverOthe past two decades, SIIA has periodically held international conferences in various locations around the world. This summer, the association brought the event to Dublin, Ireland, which attracted attendees from the United State as well as several other countries.

The educational program covered topics related to international employee benefits, captive insurance, behavioral health, emerging risks, medical travel and healthcare cost trends. According to Program Chairman Greg Arms, key takeaways included.

KEY EDUCATIONAL TAKE-AWAYS

Self-insurance and captives for employee benefits globally are well established and growing by double digits

• Captives overall are now considered “mainstream,” with growth accelerating in recent years, even more so outside the US (12% Int’l growth vs 7% in the US in 2023). $185 billion premiums are now included in over 6500 captive set-ups.

• Group captives are relatively new in Europe, compared to the US and are described as the “mutualization of risks” where like-minded firms come together in a single risk pool

• Cyber risk is the big new exposure for captives, with a focus on risk mitigation and resilience. However, the huge cyber failure on Friday 7/19 was a non-malicious event, which was a surprise, very different than expected malicious IT failures.

• In-depth discussions on “hot button” healthcare issues, including: claims data, digital, AI, Cell + Gene Therapies, RX Infusions, prevention, chronic conditions, and mental health.

• The updates on Lloyd’s and Lloyd’s Ireland were fascinating: it began 350 years ago by ship captains and private investors, now an $80 billion premium global insurance leader. Interestingly, US sourced placements represent the majority of Lloyd’s business.

UNIQUE NETWORKING OPPORTUNITIES

In addition to the educational program, the conference featured multiple organized network events, including a golf outing and a tour and hosted dinner at the Guinness production facility. Of course, plenty of additional socializing took place in various pubs and restaurants in the area of the conference hotel.

SPONSORSHIP SUPPORT MADE THE EVENT A REALITY

SIIA cannot produce international conferences without the support of key corporate partners, so it would like to acknowledge the support of this year’s event sponsors:

•

•

•

•

•

•

•

•

•

EMPLOYER STOPLOSS SURVEY RESULTS REVEAL KEY MARKET TRENDS

Written By Joseph D. Sabol

ForFthe past 23 years, D.W. Van Dyke & Co. has produced Industry Surveys that focus on key aspects of the Employer Stop-Loss Medical business. The surveys are open to all Stop-Loss Carriers and MGUs interested in participating. Participation in these surveys has remained consistently high throughout the years, particularly with MGUs and Direct Stop-Loss carriers.

The flagship survey – Stop-Loss Premium and Persistency Survey, was originally launched in March 2002 and recurs annually. This survey focuses on January 1st renewal persistency, new business production, and the range of renewal increases placed. In July 2003, the Actual vs Target Loss Ratio Survey was first released and was designed so that neither the Actual Loss Ratio nor Target Loss Ratio are known – only the relationship between the two points is given. The final survey, which was launched in 2002, also focuses on Premium growth, Persistency and Production for the February through July business cycle.

The results of the individual surveys provide the participants with a way to measure their own performance against other companies. However, that is not the full benefit of the surveys. Having access to multiple years of data has also provided additional insights into market trends and the correlation across the different survey data points. To better appreciate some of these insights and trends, we must first look at the overall Employer Stop-Loss Market.

It will not come as a surprise to anybody in the Employer Stop-Loss Market how much it has grown as measured by premiums. As the chart below shows, it has been blue skies and green grass for the last 15 years. The ESL market has grown more than 400% during that period and more than doubled in just the last 6 years - reaching $35.4 billion at year-end 2023.

While the previous chart shows impressive growth over an extended period, a closer look reveals a consistent pattern. As the chart below illustrates, it seems that the two years preceding every U.S. Presidential election year have consistently grown at a higher rate, averaging more than 14.5% growth during those years. Conversely, the year of the election and the following year have had noticeably lower growth rates averaging just 8.1% in those years.

Also on this chart are two anomalous years during this period. One of those was in 2009, which was the only year in the last 15 years that saw a reduction in premium volume. One possible explanation could be related to the impacts of the 2008 financial crisis and the economic contraction. Another possibility could be related to the negotiations in Congress on healthcare prior to the passage of the Affordable Care Act (ACA) in 2010.

The second anomaly year occurred in 2013, which saw the most significant growth rate at 22.7%. This was prior to the full implementation in 2014 of the ACA, which in part mandated that employers with more than 50 employees had to provide healthcare coverage. In the D.W. Van Dyke Survey for January 2014, we observed, for the first time, a decline in the average premium per group, suggesting that more small employer groups were entering the Employer Stop-Loss market. We continued to observe a decline in the average premium per group in 2015 and 2016 as more employer groups lost their “grandfather” status and entered the ESL market. The open question is whether 2024 will follow the same pattern.

As the saying goes, “A rising tide lifts all boats.” This is also true for the Employer Stop-Loss Market as Health Plans, Direct Carriers and MGU’s all grew significantly during the seven-year period from 20162023. Both Health Plans and Direct Carriers more than doubled during this time with MGU’s nearly doubling at a 96% growth rate.

As shown below, the D.W. Van Dyke Survey has also seen similar growth in the participant’s premium volume, which more than doubled during this period. Participation in the survey, as weighted by premium, has consistently represented between 45% - 47% of the total ESL Market.

Given the consistent level of participation in the D.W. Van Dyke Surveys, coupled with a premium growth pattern that closely mirrors the total ESL market, it is fair to say that survey results provide an accurate depiction of the overall market.

In July 2021, during the height of Covid-19, as we were compiling the responses to the Actual vs Target Loss Ratio Survey, we began to see a positive trend relative to the Target Loss Ratio. In trying to determine if the impact was due to Covid-19 or some other factors, we found a correlation that came from overlaying the Premium Persistency Survey with the following years’ Actual vs Target Loss Ratio survey. This is illustrated in the chart below. In the 2016 Premium Persistency Survey, we observed an uptick in January 2016 renewal premium persistency.

Fast forward to the July 2017 Actual vs Target Loss Survey, which looks at the January 2016 loss ratio results eighteen months later, it became apparent that most participants, as weighted by premium, missed their target loss ratio, with more than 60% of

participants reporting premium missing Target. This same pattern repeated for January 2017 renewals when persistency hit a then all-time high of 79.2%. Once again, when preparing the July 2018 Actual vs Target Loss ratio survey, the same result emerged, only worse. This time, as measured by participants’ premium, 94.4% of participants missed their target loss ratio.

Conversely, over the next 5-year period, 2018 – 2022, the Premium Persistency remained consistently in the 76.8% - 78.2% range and the corresponding Actual vs Target Loss ratios turned for the better. However, the January 2023 Persistency shot back up again and produced almost identical results as 2016. It is difficult to ascertain the positive impact on the loss ratio attributable to COVID-19 in 2021. However, the correlation between premium persistency and the corresponding Actual vs Target Loss Ratio results should be intuitive.

Higher renewal premium persistency has repeatedly led to missing the Target Loss Ratio. In the chart below, the tipping point seems to be at 79.0% persistency. Conversely, as the persistency approaches 77.0%, the results begin to show “Better” than Target. There is probably a cumulative effect of consecutive high renewal premium persistency years which led to the January 2017 result. Similarly multiple consecutive years of

77%-78% persistency produce a positive trend in reported “Better” than Target results.

D.W. Van Dyke continues to mine the survey results for other emerging trends or correlations across surveys that can provide additional value for the participants. One of the more recent observations is an increased concentration of business written in January. Another observation is that the average premium per group for January effective dates is more than 3 times higher than those groups sold with February through July effective dates. We at D.W. Van Dyke and Co. are proud of the surveys we have produced for nearly a quarter century and look forward to continuing to do so. Our next survey request will be released in late August. If interested in participating, please Visit www.dwvd.com.

Joe Sabol service as senior vice president with D.W. Van Dyke & Co. He can be reached at jsabol@dwvd.com .

Depend on Sun Life to help you manage risk and help your employees live healthier lives

By supporting people in the moments that matter, we can improve health outcomes and help employers manage costs.

For over 40 years, self-funded employers have trusted Sun Life to help them manage financial risk. But we know that behind every claim is a person facing a health challenge and we are ready to do more to help people navigate complicated healthcare decisions and achieve better health outcomes. Sun Life now offers care navigation and health advocacy services through Health Navigator, to help your employees and their families get the right care at the right time – and help you save money. Let us support you with innovative health and risk solutions for your business. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life.

For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico.

© 2024 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

BRAD-6503-z

#1293927791 02/24 (exp. 02/26)

STATE LEGISLATURES ADJOURN – HERE’S WHAT YOU NEED TO KNOW

Written By Anthony Murrello and Catherine Bresler

TThroughout the year, SIIA’s Government Relations team monitors and advocates for the self-insurance industry on a wide range of policy proposals advanced at the State level. This includes opposing efforts to erode ERISA’s preemption powers and advocating for policies beneficial to stop-loss insurance coverage and captive insurance.

Most of this work is done between January and late Spring when the majority of the State Legislatures around the country are in session. Now that most State Legislatures have adjourned for the year, provided below is a summary of the most relevant State legislative proposals that we tracked throughout 2024. SIIA will continue to monitor those State Legislatures that are still in session, as well as any special sessions that may be called for, and we will keep you apprised of any relevant regulatory proposals that may be promulgated before the year’s end.

Connecticut:

Stop-Loss Discussion – SIIA learned that the Connecticut Commission on Racial Equity and Public Health released a fact sheet suggesting that group stop-loss arrangements and level-funded plans that are traditionally marketed to small employers employ discriminatory underwriting practices. Based on these suggestions, the Commission – as well as some legislators – are seeking to impose restrictions to curb access to stop-loss coverage for small employers.

These restrictions range from imposing higher attachment points to adopting a New York-like prohibition on selling stop-loss insurance to employers of a certain size. SIIA believes that these efforts are driven by a lack of understanding of what stop-loss insurance is and is not and a failure to understand that stop-loss insurance is a key tool used to provide coverage for excess and catastrophic risk for self-insured plan sponsors. While legislation has yet to be introduced, SIIA is working with other stakeholders to oppose this proposal as we continue to educate policymakers in the State.

Status – Not yet introduced

Illinois:

HB 5395/SB 3739 – Health Care Protection Act –Governor Pritzker’s comprehensive health insurance reform was signed into law in July and takes effect on January 1, 2025. This new law contains significant restrictions on the sale of short-term and limitedduration insurance, as well as limitations on step therapy and prior authorization. It also contains new requirements for network adequacy and transparency. The self-insurance industry was successful in excluding self-insured health plans from the bill.

Status – Signed into Law

HB 4548 – Among other PBM limitations set forth in this bill, this proposal would require health plan sponsors to pay a $10.49 dispensing fee to retail pharmacies. However, a recent House amendment exempts self-insured health plans from this new requirement. The bill is pending, having been referred to the Rules Committee on April 19.

Status – Referred to Rules Committee

HB 4256 – The Health Care

Funding Act – The Act would impose tax assessments on TPAs and self-insured health plans in order to fund vaccinations and health programs not otherwise funded by the State. Momentum for this bill (proposed by KidsVax) seems to have slowed as Illinois received strong opposition from a number of associations –including SIIA – and employer and union groups in the State. SIIA will continue to track and oppose any assessments on selfinsured health plans.

Status – Referred to Rules Committee Regulatory Proposals – The Illinois Department of Insurance (Department) released a regulatory “wish-list” at the beginning of 2024. As we previously reported, the Department suggested, among other revisions, that language affecting Accident and Health stop-loss exemptions should be revised. After receiving comments and suggestions from the self-insurance industry, the Department’s final regulatory drafts preserve insurance regulation exemptions for selfinsured health plans.

Status – We will continue to monitor and keep you apprised of any developments

Kentucky:

SB 188 – Signed by the Governor on April 5, this bill applies specifically to self-insured health plans as well as fully-insured plans. Effective January 1, 2025, the bill requires a “minimum dispensing fee” of $10.64 for “retail independent” pharmacies to be paid by the health plan. The bill also includes limitations on mail-order discounts. SIIA believes that this law is preempted by ERISA, and SIIA is meeting with other employer and labor groups to determine if an ERISA preemption lawsuit should be filed.

Status – Signed into law, but we will continue to monitor and keep you apprised of developments

Maine:

LD 1829 – An Act to reduce prescription drug costs by requiring referenced-based pricing, this bill would prohibit dispensing, delivering, or administering prescription drugs that exceed a specified “reference rate.” The Act does not apply to selfinsured health plans, but self-insured plans operating in the State are permitted to opt-in to the referenced-based pricing program. Action on this proposal has yet to be taken, as LD1829 is currently held in Committee and has been recommended for further study. It is not uncommon for States in the same region to introduce similar bills. As a result, SIIA will continue to monitor any action taken in Maine or the surrounding States.

Status – Held in Committee on Health Coverage, Insurance, and Financial Services

We provide unmatched member support, quality solutions and swift resolution paths. You retain clients.

Michigan:

Stop-Loss

Filing Objections

– As SIIA has reported, members notified us of a number of stop-loss rate filing objections by the Michigan Department of Insurance and Financial Services (DIFS). In response, SIIA formed a stakeholder group of affected members and sent a formal letter to DIFS detailing our objections to DIFS’s unsubstantiated rate increase restrictions. SIIA subsequently requested a meeting to discuss these objections, as we believe that there is no statutory or regulatory basis justifying DIFS’s actions. DIFS communicated to SIIA that member companies should provide actuarial justifications for requested rate increases. We have been told that several members have received rate approvals since SIIA’s exchange with DIFS, which we believe is a direct result of our advocacy. SIIA will continue to advocate on behalf of our members in Michigan and other States as these issues arise.

Status – We will continue to monitor and keep you apprised of any developments

Minnesota: HF 4332/ SF 3879 – This bill proposes a 2% assessment on claims paid by “health plan companies, TPAs, and excess or stop-loss insurers.” Assessments are to be paid to fund MinnesotaCare and Minnesota’s Medical Assistance Program. Opposition to these bills is based on increasing costs to an already high cost of providing health benefits. Note that this is the same bill that SIIA reported on when it was introduced in 2023. SIIA – along with a coalition of stakeholders – oppose the 2024 version of the bill, and we will continue to oppose the bill if reintroduced in 2025.

HEALTH COST IQ EXISTS TO HELP SELF-INSURED ENTITIES SAVE MONEY WITHIN THEIR HEALTH PLANS

Leveraging its proprietary HealthAnalytIQ software platform, HCIQ can:

Identify problematic utilization patterns and risk trends

Forecast future healthcare costs

Predict potentially high-use, high-cost members

Identify medical claims payment irregularities and pharmacy utilization inefficiencies Armed with these

Status – Held in the Health and Human Services Committee

New Hampshire:

HF 5247/SF 5234 – Embedded in the omnibus and appropriations bill, the MN Legislature approved a $1.85 million appropriation for fiscal year 2024 to study a Universal Health Plan program. In fiscal year 2025, there is another $580,000 appropriation for the same study. While we have yet to see a legislative proposal or results from any study, SIIA will oppose any efforts to enact a single-payer system.

Status – We will continue to monitor and keep you apprised of any developments

Health Plan Memo – In February, the New Hampshire Health Plan issued a Memo requiring, among other things, TPAs to register as “assessable” entities in the State. As a result, TPAs – along with stop-loss insurance carriers – must submit to reporting the number of lives covered by the health plans they administer and then pay an assessment on those covered lives. SIIA is interested in member feedback on this direct assessment on TPAs. Please contact us.

Status – In effect

HB 353 – Universal Healthcare Bill – Introduced in 2023, this bill sought to establish an interstate Compact for Universal Healthcare. At the beginning of the 2024 session, the bill was unfavorably reported by Committee. SIIA opposed the bill and will continue to oppose similar bills as they are introduced.

Status – Held

in Committee

Amalgamated Life Insurance Company Medical Stop Loss Insurance—

The Essential, Excess Insurance

New Jersey:

Efforts to Limit Stop-Loss Coverage – The Department of Banking and Insurance (DOBI) released its FYI 2025 Budget Document and Q&A, which includes suggestions of small group insurance market interference and anti-selection due in part to selfinsuring. Even though SIIA and related stakeholders were successful in defeating a 2019 legislative proposal that would have prohibited the sale of stop-loss insurance to small employers, conversations about resurrecting such a proposal continued in 2024. SIIA and other stakeholders will continue to oppose legislative and regulatory attempts to prohibit or limit the sale of stop-loss insurance and the ability to sponsor a self-insured health plan.

Status – We will continue to monitor and keep you apprised of any developments

AB 2777 – This bill would remove the exception for self-insured health plans from laws relating to PBMs. SIIA believes this bill is preempted by ERISA, and we lobbied legislators advising them to oppose the bill. The bill did not make it out of Committee this year, but we will continue to monitor and oppose the proposal in 2025.

Status – Held in Financial Institutions and Insurance Committee

Rhode Island:

HB 8242 –Rhode Island Comprehensive Health Insurance Program –

This bill would establish a universal, comprehensive, single-payer healthcare insurance program. The program would be funded by consolidating government and private payments into a Medicare-for-all style single-payer program. SIIA opposes any universal health plan proposals that create additional financial burdens on employers, particularly on any organization sponsoring a self-insured health plan. This bill was introduced near the end of session and is being held for further study. While it

is unlikely to pass this year, we will continue to oppose proposals that limit employer choice in providing health benefits for their employees.

Status – Held for further study

Anthony Murrello is SIIA’s government relations manager. Catherine Bresler serves as state policy advisor.

STOP-LOSS CAPTIVE PARTNERING IS A GROWING TREND

Written By Caroline McDonald

AsAorganizations increasingly turn to captives for their insurance needs, more and more are using them for medical stop-loss coverage for employee health insurance.

“This is the fastest growing segment within employersponsored, self-funded health plans,” said Steve Gransbury, President, Health Solutions at Captive Resources LLC. “It creates a shared layer of risk for the captive participants to manage claim volatility.”

A group captive for self-funded employer health plans is a mechanism for the captive participants “to manage volatility and protect against the severity of risk,” he said. “We’re seeing employer-sponsored health insurance plans from all areas of industry.”

In its Captive Trends and Insights report of 2023, Marsh noted that of its captives, traditional property-casualty coverages lead in growth, with 42 percent for property & Casualty, 25 percent for commercial life, and 20 percent for employee benefits – with 37 percent of those formed for medical stop-loss, and 13 percent for financial and other lines.

Every industry has claims of all sizes, and they all have health plans Gransbury noted. With a captive they can “open themselves up to the right partnerships to be able to manage and control costs.”

Josh Bicknell, director of captive initiatives, captive Insurance solutions at GPW and Associates, Inc., noted that he is seeing a broad range of companies joining stop-loss captives.

“It’s manufacturing businesses, beer distributors, drink distributors; it’s school systems, banks and any industry where you have 100 or more employees,” he said, adding that, “We also have some participants with even less. If you’re in a wholly controlled stop-loss group, you could have 50 or 75 total lives in your business.”

Growth is increasing in a large way, he said, as the commercial market has tightened. “While the property market is what you hear about the most, stop-loss group captive growth is expanding,” Bicknell

Advocacy in Action

said, “as it has become extremely difficult to find affordable policies and health insurance and benefits coverage. Medical stop-loss has become very tight.”

Every industry has a need for employee healthcare coverage, Bicknell said. With a group program, there is the benefit of many participants in the captive. “As a result, the fronting carrier issuing the paper for the health insurance can provide a lower, more competitive rate overall. Then there is the advantage of saving money while capturing underwriting profit,” he said.

ADDED BENEFITS