RIGHT?

REFERENCE-BASED PRICING NOW INCLUDES KINDER AND GENTLER APPROACHES, BUT QUESTIONS LINGER ABOUT THE VALUE OF THIS TOOL

Know that students, faculty or employees are covered during group activities.

Protecting the people in your care doesn’t stop outside the classroom or office. That’s why QBE is an expert in covering medical expenses that result from accidental injuries that occur during supervised and sponsored group activities. Turn to us, and see for yourself why we’re rated A+ by S&P and A (Excellent) by AM Best.

QBE offers a full suite of Special Risk Accident insurance products customized to fit your needs:

• K-12 Student Accident

• Participant Accident

• College Accident

We’ll find the right answers together, so no matter what happens next, you can stay focused on your future.

By Bruce Shutan

By Laura Carabello

By Bruce Shutan

By Laura Carabello

By Caroline McDonald

By Caroline McDonald

HEALTHCARE PRICED RIGHT?

Written By Bruce Shutan

REFERENCE-BASED PRICING NOW INCLUDES KINDER AND GENTLER APPROACHES, BUT QUESTIONS LINGER ABOUT THE VALUE OF THIS TOOL

RReference-based pricing (RBP) has evolved over the years – taking on different forms to generate reimbursement models that providers deem to be fair and reasonable, avoid litigation, and reduce or eliminate employee friction and balance billing. The latest iteration pushes further into patient advocacy and improved customer service for quicker problem resolution and a softer landing for health plan members.

However, few employers have actually adopted

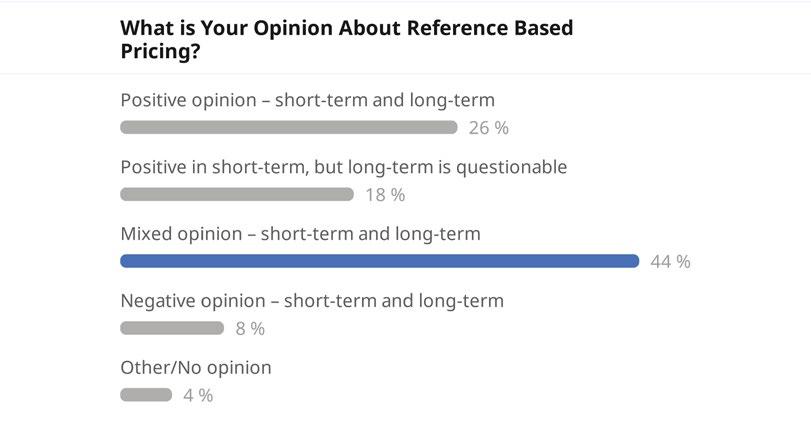

this approach. While RBP has now been around long enough to gain meaningful traction, the fact is that only about 10% to 20% of employers are estimated to have incorporated RBP into their health plans. A poll of SIIA Spring Forum attendees reflects this mixed response, with 44% feeling ambivalent about it. Just 26% of respondents had a positive opinion of RBP, 18% had a positive view in the shortterm but questionable one in the long-term, and 8% had a negative opinion in both its short and longterm value.

Some industry experts question the value of RBP, which finds itself at a crossroads where employers have the option of unbundling these services as they see fit, pursuing hybrid or competing solutions, or direct contracting without risking provider acrimony.

Under the RBP approach, which self-insured health plans use to make their coverage more affordable in the face of wild cost variations from one market or facility to the next, a reference price is set for medical procedures. It’s often, though not exclusively, a multiplier of Medicare reimbursement ranging from about 140% to 180% above that marker.

This pricing method emerged as an alternative to discounts from billed charges that traditional provider networks use to price claims based on usual, customary and reasonable (UCR) prices. It is firmly rooted in the belief that these discounts were offered on medical services whose prices were inflated to begin with, hence the need to build a better model. Supporters laud the results, though many point out that brokers have been slow to learn about or adopt this approach.

GREATER FLEXIBILITY AND CUSTOMIZATION

Even within varying RBP designs, there’s a push for improvement that acknowledges the need for greater pricing transparency and higher expectations for fiduciary responsibilities. The latter is seen as a response to the Consolidated Appropriations Act (CAA), while the former dovetails into the passage of the No Surprises Act and Transparency-in-Coverage rule.

The CAA has helped RBP vendors with regard to facility pushback because many health systems might not have known what they were allowed to bill, appeal or go through arbitration, notes Omar Arif, SVP of growth for ClaimDoc, which uses RBP to drive cost savings. “And so, we’ve seen a downward trend in the number of balance bills that we receive across our book of business, and I suspect it’s the same among other reference-based pricing vendors,” he notes. Steerage to low-cost, high-quality providers and advocacy have made RBP more palatable for employers and health plan members alike, Ariz adds.

Generally speaking, RBP has become much more flexible and customizable, says Erin Duffy, director of business development for RBP service provider Imagine 360. Self-insured employers are able to

mix and match models that may or may not include a steerage concierge or legal defense that can accommodate as few as two employees or groups with more than 10,000 lives. “In my short time in space,” she observes, “I have seen an uptick in interest from all parties – from brokers or consultants to employers at renewal.”

These developments are far removed from inauspicious beginnings. Mike Castleberry, chief revenue officer of the TPA Consociate Health, recalls meeting with ELAP Services 10 years ago when “one of the first things they talked about was how many lawyers they had on staff, how ready they were to litigate. And I remember thinking, gosh, what an interesting way to go into an HR director’s office and say, ‘Hey, I’m ready to go battle for you in court and against these providers that are causing all these troubles.’ I think what they realize now is most people don’t want to put their employees or business in that position. No one wants to go to court. That’s not fun for anybody but lawyers.”

An important lesson he says that was learned from RBP’s salad days was that an overly aggressive approach is misguided because hospitals control the entry to inpatient and outpatient care with a powerful vertical that owns everyone from the primary care physician through gerontology and every specialty between the two. “They keep you out, and you can’t outlast them,” he interjects.

In recent years, there has been more standardization of the tools needed to make RBP work, according to Brian Wroblewski, EVP for ClearHealth Strategies, which minimizes out-of-network exposure for self-insured employers. The approach evolved from a range of fully loaded, feature-rich service providers to delivering more advocacy and hand-holding touchpoints that go as far as scheduling member appointments. Another key marker involves the division of church and state in terms of handling provider and customer relations.

Given that TPAs have historically owned the member experience, he says they have strengthened those ties through advocacy that extends member service and raises comfort levels. There’s also a greater willingness to lean into boutique partners for nuts-and-bolts pricing, backend service and provider intervention.

With regard to pinning down fair and reasonable prices, his experience is that there’s not much pushback if clients are willing to engage in provider dialogue where it makes sense. “The provider community has gotten more accustomed to these types of plans, and overall, less hostility and contention exists,” he says.

RBP vendors that have sustained success over the years were able to master the core essentials of proper reimbursement, backend explanation and intervention, network access, referring cases that involve a disagreement over price and resolving disputes with the provider community, according to Wroblewski.

When a large client finds a facility that’s pushing back against a lower reimbursement, Castleberry notices that smart TPAs are willing to ask what price they’ll accept and simply make a deal. That could mean jettisoning RBP in favor of a direct contract to lock in reasonable rates. “It’s easy for the TPA to administer,” he explains. “The hospitals are now happy because they got to negotiate. They’re excited about having a direct relationship with the employer. That’s revenue coming directly to them, and it’s not going through one of the BUCAH networks.”

There are other examples of creative arrangements that seek to strike the most reasonable middle ground that pleases all parties. “If you look at what HST is doing, and their willingness to put in that balance-bill protection, where they’re taking risks on that above 140% of Medicare space, taking that out of the member and the employer’s concern, they’re kind of a hybrid,” Castleberry notes. “You get the best of both worlds: you get protection with better rights on the reference-based pricing side. However, if the provider pushes back, it’s no longer your worry; they’re gonna handle that.”

CAVEATS TO CONSIDER

While RBP supporters are bullish about the extent to which it can bend the cost curve, Wroblewski cautions that it does not reduce or eliminate balance bills compared to other plan types. Rather, he says it reduces overall economic exposure – generating enough savings that allow self-insured employers to defray issues on the back end with balance billing.

Others see more value in approaches they consider superior to RBP. Although well-intentioned, RBP has failed to provide a methodology that is transparent and understandable, explains Merrit Quarum, M.D., CEO of WellRithms, a bill-review company that uses advanced payment-integrity technology.

He identifies a laundry list of problems for employers, health plan members and providers, beginning with the use of a pure Medicare multiple that is arbitrary and incapable of offering a fair market value for medical services. Moreover, not every medical procedure has a Medicare allowance, which he says makes reasonably pricing some claims virtually impossible.

There’s also a tendency to underpay hospitals and overpay for laboratory services, Quarum adds, while regional acceptance or rejection of RBP complicates provider negotiations. The latter point undermines multistate employers’ search for standardized pricing.

Another serious issue is that providers who feel pressured to accept below-market rates will claw back reimbursement from their patients to offset any perceived shortfall, resulting in balanced billing and dissatisfaction across the board.

“RBP was intended as an enhancement for commercial plans that would be confined to high frequency and elective procedures for which both price and performance are known,” he says, “but unfortunately, it has become a substitute. This is now a standard industry practice that undermines the model’s initial purpose.”

Mindful of RBP’s shortcomings, WellRithms uses a proprietary medical pricing database to reprice medical bills based on hospital cost-to-charge ratios reported quarterly to the Centers for Medicare & Medicaid Services. Other key metrics include geographical cost variations and quarterly inflationary adjustments from the U.S. Department of Labor.

Human expertise, however, becomes just as important to the company’s bill review. For example, a team of physicians and surgeons, rather than coders or administrative personnel, scrub bills line-by-line to spot redundancies and items that never require separate billing. Quarum, who used to practice occupational medicine, says understanding the medicine behind these charges guarantees precision in claims payment accuracy, prevents overbilling, and eliminates fraud, waste and abuse.

While Medicare is one of several metrics ClaimDoc uses to reprice every facility claim that it clinically audits, the company favors a more comprehensive approach. Other key datasets include the hospital’s selfreported cost and American Medical Association guidelines, as well as UCR reasonable reports to determine fair prices that are also legally defensible. “We’re not trying to undercut our providers so that they can’t

Advocacy in Action

Legal services and innovative technology combined to defend health plans, plan sponsors and member participants nationwide aequum advocacy programs & services successfully resolve surprise billing and unreasonable out-of-network and balance billings

Efficient Claim Resolution

On average, aequum resolves claims within just 244 days of placement.

Unmatched Savings aequum has achieved a remarkable 95.6% savings off disputed charges for self-funded plans. National Expertise

aequum has successfully handled claims in all 50 states.

stay in business,” Arif explains. “But we also don’t want them taking advantage of our plans.”

CONSIDERING OTHER APPROACHES

Some industry observers believe the future will likely be brighter for direct contracting than for RBP because it’s more customizable. Castleberry notes that while employers like the stability of those arrangements, hospitals embrace an opportunity to break up their BUCAH payer mix, knowing there will be fewer dollars that can be leveraged against them.

“It gets you to that dollar amount, but you don’t have the noise or structure,” he says, “and then you typically get a better engagement. They may offer concierge service from the hospital where you get preferential treatment for your time slots for appointments.”

Semantics also play a role. “We really don’t even talk in terms of reference-based pricing anymore,” Arif admits. “We talk in terms of replacing a managed care contract that’s typically not very good for a self-funded plan with no network at all. And whether that’s a just true reference-based pricing model, a direct contracting model or combination, there are a lot of ways to do it.”

Strong relationships. More solutions.

Partner with Nationwide® to simplify Medical Stop Loss for you and your clients. Save time and effort with easy access to experienced underwriters who offer a broad range of solutions. Our flexible plans are tailored to fit your clients’ needs and reduce future risk. Plus, claims are backed by a carrier with A+ financial ratings.*

As a leader in Medical Stop Loss coverage for 20 years, and in the health business for more than 80 years, you can trust Nationwide to take care of you and your clients.

To learn why top Medical Stop Loss producers and underwriters choose Nationwide, email stoploss@nationwide.com or visit nationwidefinancial.com/stoploss.

ranking from AM Best received 10/17/02, affirmed 12/7/23, and A+ ranking from Standard & Poor’s received 12/22/08, affirmed 5/16/23.

One notable trend Wroblewski sees forming is that brokerage houses will likely begin in a more pronounced way to build their own products that are offered alongside traditional plans rather than identifying what they consider to be best-of-breed vendors in the space. While believing the overall economic impact is significant enough, he says, “It’s a slog for brokers to introduce [RBP] in a massive style, particularly if they’re working with a client that has been relatively happy in an economy that has been super strong – even with interest rates rising.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

GROUP CAPTIVE MARKET THRIVING

Written By Caroline McDonald

Written By Caroline McDonald

AsAmore organizations become aware of the benefits of participating in a captive, the number of group captives being formed has steadily increased.

The current hardening in the traditional insurance market makes them even more attractive and shows that the captive industry will continue to grow.

Captives are an excellent way for organizations to have ownership in their own insurance program. With insurance costs increasing in all areas, they can have control over the outcomes of their property/ casualty insurance coverage, targeting auto, general liability, and workers compensation.

“A group captive is a better, more engaged risk pool for the group to share risk with,” said Duke Niedringhaus, senior vice president at Marsh & McLennan Agency. “If you go back to the history of insurance, you might not know who you are sharing risk with if you’re with an insurance company.” The reality, however, is that “you are sharing risk with the overall market.”

Another reason for the growth of group captives is that they are more and more accessible to smaller companies.

“There are many group captives with accounts that are $100,000 in premium size now, and 30 years ago, that was unheard of,” said Arthur R. Collins, captive segment leader and managing director at Guy Carpenter. “The risk-taking appetite and the knowledge of captives was in its infancy, and it was a product designed for larger businesses that had financial wherewithal to understand and retain risk.”

Now that group captives are recognized as sustainable solutions for businesses of all sizes, the barriers to entry are low. A great benefit of a group captive, particularly for smaller entities, is that they share

loss control and best practices information with other businesses to contain losses and improve safety for employees,” Collins said.

The captive industry, Niedringhaus noted, was created in the mid-1980s, “and it took the industry 15-20 years to hit $1 billion in premium. Now, you could easily see $500 million a year going into this segment of the captive market.”

Including all captive managers, he said, “It’s probably $7 to $8 billion in premium. At this level, it’s starting to impact the market and how carriers are positioning themselves.”

Making an Impact

—BRMS Plan Member brmsonline.com BRMS’ dedicated Care Navigators are there for you. We’re always ready to:

( Help members navigate the healthcare maze

( Provide emotional support and guidance

( Personalize a holistic care coordination plan

( Manage costs for health plans and their members

“My case manager at BRMS is my go to. Her approach is thorough and caring. Knowing she is there has made a huge difference when going through major medical concerns. I am grateful to have her as a resource.”

WIDESPREAD BENEFITS

The Insurance Information Institute, in its report, “A Comprehensive Evaluation of the Member-Owned Group Captive Option,” highlights another benefit of captives: the advantage of direct access to reinsurance:

A captive can go directly to the global reinsurance market and purchase coverage at wholesale rates because it is essentially an insurance company. Further, the price for reinsurance coverage is driven by the captive’s own exposures and loss record, not the experience of the industry. The captive does not have to work through a commercial insurer for this access and thus saves on the expenses associated with dealing with commercial insurers – e.g., commission costs, administrative costs, and profit markup. Member companies retain much more control over the selection of and arrangements with reinsurance partners.

Reinsurers also benefit from doing business with group captives. “The ability to target these opportunities is somewhat limited, in that the policy-issuing company needs to have unique capabilities and expertise to properly service the captive,” Collins said. “This includes policy/

regulatory administration, claims oversight, unique underwriting expertise, collateral management and reinsurance/excess capacity management. It takes time to develop this type of platform, which results in highly serviced, durable reinsurance partnerships.”

Ultimately, captive owners and insurers have “a shared desire to maintain stable partnerships over longer periods of time. This helps to ensure stability in the event of an unexpected loss and to keep collateral at manageable levels over time,” Collins said.

RISK CONTROL DRIVES PROFITS

Key to a profitable captive is risk control.

“With group captives, you’re sharing risk with a better, more engaged risk pool,” Niedringhaus said. “They work well, whether they are homogenous or heterogenous.” He added, “The common theme is best-in-class engaged owners, a great safety culture and very engaged in managing risk.”

For example, he said, “Statistically, the fatality rate for workers’ comp claims in group captives is about 50 percent of statistical averages. Of all the compelling statistics of the group captive, that is at the top.”

The reason, Niedringhaus said, is “attention to risk management: Don’t have the claim in the first place.”

GROUP CAPTIVE HEADWINDS

While the market is climbing, there are some events that can throw a curve, Niedringhaus said. These are:

Acquisitions: Typically, a national company or private equity company will buy out a mid-market account. If the account is with a group captive, it will often get rolled into a national program, or the private equity will pull it out of the group captive.

Property insurance: It’s so challenging that it can dictate the overall program placement. So, if you’ve got one insurance company writing all lines of coverage, including property, and you want to take the casualty lines and put them into a group captive, the market pain of buying property coverage alone might prevent a company from joining a group captive.

Umbrella placement: It can also be a headwind for a company to join a group captive and break an insurance company partnership, where the insurer is providing all lines of coverage. To take umbrella out of a total program with one insurer is a headwind, Niedringhaus explained.

A CAPTIVE OWNER’S PERSPECTIVE

Dwight Werts, second-generation owner of Werts Welding & Tank Service, Inc., has been a member of Archway captive in St. Louis for ten years. The captive was started in 1994 and has 300 members.

“Our company is 66 years old, and I am the second generation. My dad started the business, and my son is also involved,” he said.

Businesses in the captive, Werts said, include temporary staffing companies, lumber yards, and trucking businesses. Also, part of his captive are four of his customers in the tank truck fuel oil delivery business.

What led him to a captive, he said, was the annual meetings with their insurers to discuss coverage.

“They would always come in at the last minute and say ‘Here’s your renewal, it’s the best we can do, it went up another 25 percent. If you’d like to shop and look around, you’ve got three days.’ We just kept seeing our rates go up and we had no control over it,” Werts said.

“Insurers say to keep your losses down, and that’s how you control your rates,” he explained. “One year, we had no claims, and our rates went up. I asked how our rates could go up without any claims, and they said, ‘That’s the market.’”

That was when he realized that “A lot of the rate increases had nothing to do with our industry or our safety record. It was about their investments in the marketplace. We felt helpless.”

Added to this, he said, was his experience as a pilot, flying his own plane to visit the company’s eight branches in the U.S.

“One year, they said that the reason we had so much rate increase was because of our airplane, that we were flying employees, and if there was an accident, there would be a workers’ compensation claim.”

Eventually, he stopped flying and sold the plane. “I had to sign a document that I would not be flying it or flying employees anymore,” Werts said. “The next time the rate came in, I had an increase. They said, ‘Well, it’s the market.’ That’s when it really hit me that it wasn’t working.”

Once he began looking into the captive market, “I talked to people and found out there were more people in captives than I realized,” he said.

The company is now part of a group captive for workers compensation, liability and automobile. “There are all types of business in our captive. Many different industries in many different states.” Werts said.

Being part of a captive has been a good experience, he said. “We get a nice check back every year because we keep our claims down. If you play well and you have a good record, you get rewarded. We also work with a reinsurer through our captive.”

Part of keeping claims down, he added, is the commitment to safety. As an example, “We got our people on board, and we have safety programs and meetings. We just had CPR and defibrillator training for all our employees,” Werts said.

Caroline McDonald is an award-winning journalist who has reported on a wide variety of insurance topics. Her beat includes in-depth coverage of risk management and captives.

Depend on Sun Life to help you manage risk and help your employees live healthier lives

By supporting people in the moments that matter, we can improve health outcomes and help employers manage costs.

For over 40 years, self-funded employers have trusted Sun Life to help them manage financial risk. But we know that behind every claim is a person facing a health challenge and we are ready to do more to help people navigate complicated healthcare decisions and achieve better health outcomes. Sun Life now offers care navigation and health advocacy services through Health Navigator, to help your employees and their families get the right care at the right time – and help you save money. Let us support you with innovative health and risk solutions for your business. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life.

For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico. © 2024 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

BRAD-6503-z

#1293927791 02/24 (exp. 02/26)

SIIA MEMBERS SHARE OPINIONS ON SELF-INSURANCE INDUSTRY TRENDS

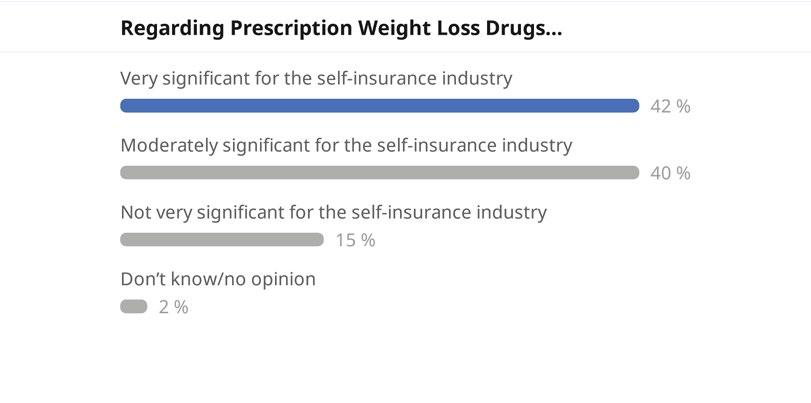

AsApart of SIIA’s recent Spring Forum in San Antonio, many members participated in a live audience polling session during which the aggregated, anonymous responses were displayed in real time. Those responses are published here.

Somebody has to come in second.

Make sure it’s not you.

There are no insurance MVP trophies, no best PowerPoint awards, no fantasy broker leagues. You show up first with the best option for your client, or you lose. We never take this for granted. That’s why we leverage all of our people, data and relationships to reach one goal: We help you win.

We help you win.

Written By Laura Carabello

Written By Laura Carabello

EMPLOYERS NAVIGATE NEW FRONTIERS IN CELL AND GENE THERAPY

WeWlive in an age of medical miracles now exemplified by the introduction of potentially life-saving cell and gene therapies (CGTs). This is just the beginning, as industry observers predict that succeeding generations are going to experience even more astounding cures that none of us could ever envision.

“This is truly amazing stuff -- really miraculous – and makes me think of Star Trek medical care,” observes Shaun Peterson, vice president of Voya Financial and chair of SIIA’s new Cell & Gene Task Force. In this latter capacity, he will provide the welcome remarks for the association’s upcoming Cell + Gene Therapy Stakeholder Forum. “First and foremost, it’s a given that the outcomes that could happen

from some of these treatments are extraordinary, and the improvement in life quality is most important.”

Cell therapy is the transfer of live cells into a patient to lessen or cure a disease using cells from the patient or a donor.

Gene therapy is used to treat or cure a disease by replacing a missing or mutated gene in the targeted cell to “correct” the missing function.

From an actuarial perspective, Peterson acknowledges the financial burden of these million-dollar treatments, adding, “There’s the price piece, but pricing doesn’t have to be a stand-alone component of care. There is some management that needs to be done to ensure that the drugs are appropriately placed in the benefit structure, administered in the right setting and actually paid for in a reasonable way. There are a lot of levers and moving parts to this healthcare equation, with people scratching their heads and wondering how providers get paid and where people are making money.”

Amalgamated Life Insurance Company

Medical Stop Loss Insurance—

The Essential, Excess Insurance

As a direct writer of Stop Loss Insurance, we have the Expertise, Resources and Contract Flexibility to meet your Organization’s Stop Loss needs. Amalgamated Life offers:

• “A” (Excellent) Rating from A.M. Best Company for 48 Consecutive Years

• Licensed in all 50 States and the District of Columbia

• Flexible Contract Terms

• Excellent Claims Management Performance

• Specific and Aggregate Stop Loss Options

• Participating, Rate Cap and NNL Contract Terms Available

Ashley Hume, chief commercial officer, Emerging Therapy Solutions and part of the Forum planning group, says that prior to the COVID-19 wave, it was actually hard to get people’s attention on these therapies. “Then the furor subsided, and a number of therapies came to market, although everybody was primarily concerned about cost. Riskbearing entities like self-insured employers, plan sponsors and their reinsurance brokers started to pay attention and support all of the work that needed to be done to manage members impacted by these rare diseases.”

She says that as these therapies gained regulatory approval and members started accessing treatment -- albeit at a catastrophic price tag -- the challenge became to get members to the right centers for proper evaluation and then to ensure cost containment for the actual treatment.

These and other issues are the focus of the Forum as self-insured employers and their consultants weigh the pros and cons of covering the cost of these ultra-expensive medications and deciding how best to approach the delivery of care. SIIA stands as a source of truth to support this multi-faceted decision-making process.

Since the long-term benefits and risks of these new treatments are largely unknown, financing these therapies is precarious for payers and the pharmaceutical companies developing them.

“Forum attendees are going to hear from all of the different stakeholder groups who will assess where we thought we would be since the time we met at last year’s event,” says Hume. “Really, a lot has happened. This year, we are including manufacturers that actually produce the therapies, along with representatives from different companies that are developing

SCRIPT CARE

The new logo captures SCL’s tenure in the market, as well as our

to develop solutions for

We deliver best-in-class solutions that cover your clients and support you with experts in data analytics, underwriting, claim reimbursements, dedicated account management and CompanionCARE SM

With CompanionCARE, you have access to experts in large case management and emerging therapies.

Our stop loss contracts are backed with the strength reflected in our A+ AM Best company rating.

In addition to specific and aggregate stop loss insurance, Companion Life offers an array of innovative products:

and introducing marketplace solutions that will help self-insured employers adapt to the evolving CGT realities. Everyone is coming together to talk about how the market is approaching CGT risk management.”

Some of the leading CGT manufacturers will provide an overview of how their product launches have progressed since gaining regulatory approval last year. Attendees can also expect to learn about pricing implications, value-based payment arrangements, warranties, and patient access considerations. Rounding out the discussion will be an FDA spokesperson to talk about the approval process and why accelerated approval pathways impact medical policy and key coverage decision considerations.

PATIENT ADVOCATES SPEAK OUT, PROVIDERS WEIGH IN

Patient voices will be heard during additional panels featuring patient advocacy organizations. Several patients who have received or are going to receive gene therapy for sickle cell anemia will relate stories about their personal treatment journeys with the new gene therapy that has drawn significant market attention.

OUR RESULTS SPEAK FOR THEMSELVES.

On average, our clients’ medical claims trend is 50 percent lower than PwC Health Research Institute’s medical cost trends.

Nova is committed to the people that health plans serve and the businesses they support.

Let us show you what’s

WHO WILL PAY FOR SICKLE CELL GENE THERAPY?

The December 2023 FDA approval of the first two gene therapies to treat sickle cell disease (SCD) was an important step forward in managing the most common and clinically significant inherited blood disorder across the United States. As approved centers prepare to begin offering exagamglogene autotemcel (exa-cel; Casgevy, Vertex Pharmaceuticals) and lovotibeglogene autotemcel (lovo-cel; Lyfgenia, Bluebird Bio), many questions remain about cost, insurance coverage and access.

According to the American Academy of Family Physicians, the list price of Casgevy, the first and only CRISPR-based gene editing therapy for SCD and transfusion-dependent beta thalassemia (TDT), is approximately $2.2 million.

Source: Specialty Pharmacy Continuum, February 2024

Not to be overlooked, the provider community and medical facilities will describe the challenges they face and how these issues may affect patient access, including administrative policies from payers, payment policy issues and regulatory obstacles. While confronting these situations, physicians continue to reinforce their commitment to offering life-saving care while also addressing concerns about sustainability.

“The Fourm’s provider panel will tackle some of their thorniest concerns for delivering patient-centered care without incurring substantial receivables or facing uncertainties regarding payment,” says Hume. “We are truly honored to have the participation of Stephan A. Grupp, MD, PhD, the first physician to infuse a patient commercially with CAR-T therapy about ten years ago.”

The NIH National Cancer Institute defines CAR T-cell therapy as a type of treatment in which a patient’s T cells (a type of immune cell) are changed in the laboratory so they will bind to cancer cells and kill them.

Hume continues, “Dr. Grupp will discuss what’s happened, how this market has evolved and what it’s like as a provider to manage these complex therapies. He is highly qualified to lead this discussion as Section Chief of the Cellular Therapy and Transplant Section, Inaugural Director of the Susan S and Stephen P Kelly Center for Cancer Immunotherapy, and Medical Director of the Cell and Gene Therapy Laboratory and Children’s Hospital of Philadelphia.”

From the perspective of a medical center, the provider panel will also address what it’s like to be looking at taking title of a $3 million drug and just hoping you’re going to get paid.

NOT JUST ANOTHER BIG CLAIM – THEY’RE CATASTROPHIC

With a 25-year career spanning involvement in the stop-loss and reinsurance industries and managing various books of business across many different employers, Shaun Peterson shares this perspective, which serves as a preview of the Forum:

‘My involvement in dealing with catastrophic claims leads me to say that a lot of these cell and gene therapies are really catastrophic claims. But people often ask me, ‘As an actuary, why are you involved here, and why do you care?’ In reality, the way the business works is I don’t need to care. We could just continue perpetuating the same old, same old approach and be resigned that big claims happen.”

He explains that actuaries look at their experience to set their rates. “If there are more large claims, we raise our rates and keep going forward. If there are more and more big claims, we will raise our rates again and continue to go forward – it’s just wash, rinse, repeat.”

He shares, “I don’t have to care, but the economics of it aren’t the incentive that drives my involvement. The reality is that I have to come home and look my kids in the face. If ten years from now, when I decide to retire, I want to look back and say, ‘Yes! I feel like I made a difference, and I made an impact.’”

The issues around CGTs are where Peterson has chosen to lean in because “It is the beginning of a paradigm shift in medical treatments and the costs of those treatments.”

He values his position because it provides a perspective that is broader than most of his clients, meaning that he can see across three, four or five million employees and see how these claims are emerging.

“Current treatments are for diseases that are still ultra rare, super-orphan conditions that affect an incredibly small percentage of the population,” he explains. “Yet when these diseases occur, they incur a huge expense of two, three or four million dollars. While your average employer probably won’t even see one of these claims, ten years from now, there will likely be more.”

3 KEY REASONS TO PARTNER WITH PHARMPIX

MANAGE SPECIALTY COSTS

Targeted strategies maximize co-pay assistance programs and discounts that reduce up to 40% of specialty drug spend.

PROACTIVE TECHNOLOGY

Real-time review of claim adjudication results in savings of 5% to 25%.

BEST-IN-CLASS NETWORK

Ensure members have access to care with 65K retail pharmacies across the U.S. through powerful network contracting.

For actuaries like Peterson, it’s more an issue of aggregating costs across an enterprise -+/-5 million employees -- and looking at the frequency of disease to assess the potential impact. While he emphasizes that the average employer is not going to see many of these rare diseases, there are some exceptions.

“There’s now some gene therapies for multiple myeloma and others that are in the pipeline where there’s going to be some more frequency,” he points out. “These are going to be costly, but probably not nearly as costly as some of the super-orphan drugs we’ve seen. But I can actually see these trends so I can help other people understand them.”

He says the question then arises about appropriate disease management and how we impact those claims. He anticipates that this topic is likely to be a good part of the upcoming discussion.

“While I don’t have a clinical background and am not a treatment expert, I do know people within the industry and can get involved by bringing these people together to have a productive conversation,” he offers. “Again, this is the reason these issues are important to me and why I lean in. I have a perspective that other people don’t have, and I can bring people together who actually know what is involved and are in it day-to-day. The Forum is an ideal setting to have these conversations, try to make things better and figure out what better looks like.”

WHAT’S TOP OF MIND FOR EMPLOYERS?

Hume reports that employers of all sizes have a lot of different concerns, noting her experience with one group representing multiple employers and the feedback from their recent CEO forum.

“CGTs and the surging costs of specialty drugs was the number one issue on their list, with GLP weight loss drugs trailing far behind,” says Hume. “I mean, employers are getting hammered. What’s critical for an employer is ensuring that they know what their coverage is, especially their stop-loss or reinsurance coverage. “

Employers want to have the right tools in place to ensure that their members are receiving care at the right facilities; as she advises, “You really don’t want your members going to community hospital to receive a 3-million-dollar therapy. You do want to make sure that it’s a hospital that’s ready to address what could happen with those members.”

Given the large price tags associated with many CGTs, there will be a panel dedicated to the introduction of various financial risk transfer strategies that enable employers to cover important new treatments. The session will provide perspectives on stop-loss coverage, MGU, reinsurance and captive insurance.

“We’ll get some insights about what employers should be most concerned about – price or serving their workforce?” adds Hume.

Peterson counsels that there is a delicate balance between the upside or upfront cost of CGTs vs. the impact of this investment in terms of outcomes around people’s ultimate health status.

“There is consensus on the value of health improvement, but the jury is still out as to whether the initial high cost is outweighed by the subsequent cost benefits,” he explains. “There’s the simple economics of it, the demand and capacity component. When you’re talking about an ultra-rare disease, the individual costs can be quite high. When you’re talking about something that’s more common, such as CGTs for the more prevalent disease states like diabetes, the costs are going to be lower, and the treatments will likely be more accessible.”

He points out that advisors and brokers are an important part of this decision-making process because the vast majority of the

Seamless and transparent—the way healthcare should be.

Our decades of experience have taught us how to elevate member health and drive down costs.

• Transition & Implementation: Member experience elevated through education and targeted communications

• Ongoing Support & Plan Maintenance: Partnership achieved through ongoing payment analysis, vendor coordination, and continual monitoring of member experience

• Quarterly Reporting Review: Plan optimization and renewal preparation through guided performance analysis and consultation

We love what we do.

employers in this country are not really equipped to address the business issues of delivering healthcare to their employees,

“Companies make bicycles, produce automobiles, grow fruit or operate retail sites, but they didn’t decide to be in the business of delivering healthcare to their employees, nor should they necessarily be experts in that area,” he comments. “They need the help of their consultants and advisors as well as the products and services that the selfinsurance industry provides.”

Peterson says there’s a good reason the companies involved in SIIA exist – from stop-loss and medical management firms to bill review companies, captives, brokers and advisors.

“There’s a healthy support structure in this market to guide individual employers, regardless of whether or not they’re looking at CGTs from a pure financial standpoint or a paternal/fraternal perspective relative to how they’re trying to really deliver value for their employees.”

A LOOK AT THE CGT LANDSCAPE

Industry analysts point to 2023 as a breakthrough year for CGTs, with seven FDA approvals in the US and one in the European Union. Currently, more than 2,000 clinical trials are being conducted globally. With approximately 10% of them in Phase III, these thought leaders say it is likely that 75 therapies will be approved much sooner than 2030. Projections for 2024 are set at about 17 approvals between the US and EU.

Below is a brief introduction to CGTs currently approved by the FDA and available in the United States. For complete indications, safety, and packaging information, visit the manufacturer’s website. List pricing is based on current known therapy cost from publicly available information and does not include administration or treatment costs. Thanks to Emerging Therapy Solutions for providing this research.

GENE THERAPIES

Adstiladrin®

(nadofaragenefiradenovec-vncg)

Condition: Bladder cancer

Company: Ferring Pharmaceuticals

Approved: December 2022

Current WAC*: $60,000 per instillation

More: ferring.com

Casgevy

(exagamglogene autotemcel)

Conditions: Sickle cell disease, Beta-thalassemia

Company: CRISPR Therapeutics and Vertex Pharmaceuticals

Approved: December 2023, January 2024

Current WAC: $2,200,000 (SCD), $2,200,000 (TDT)

More: vrtx.com

Elevidys®

(delandistrogenemoxeparvovec-rokl)

Condition: Duchenne muscular dystrophy

Company: Sarepta Therapeutics

Approved: June 2023

Current WAC: $3,200,000

More: sarepta.com

Hemgenix®

(etranacogenedezaparvovec-drlb)

Condition: Hemophilia B

Company: CSL Behring

Approved: November 2022

Current WAC: $3,500,000

More: cslbehring.com

Treats bladder cancer in adults

Adstiladrinis a novel adenovirus vector-based in-vivo gene therapy from Ferring Pharmaceuticals for the treatment of adult patients with high-risk Bacillus Calmette Guerin (BCG)-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS) with or without papillary tumors. This is the first gene therapy approved to treat bladder cancer.

Treats sickle cell disease and transfusion-dependent beta-thalassemia in patients aged 12 years and older

Casgevy is an autologous genome-edited hematopoietic stem cell-based gene therapy indicated for the treatment of patients aged 12 years and older with sickle cell disease (SCD) with recurrent vaso-occlusive crises (VOCs) or with transfusion-dependent beta-thalassemia (TDT) who need regular blood transfusions. It was the first-ever approved therapy using CRISPR/ Cas9 gene-editing technology.

Treats Duchenne muscular dystrophy in ambulatory patients aged 4 to 5 years old

Elevidysis is an adeno-associated virus-based in-vivo gene therapy for the treatment of ambulatory DMD pediatric patients aged 4 through 5 years with a confirmed mutation in the DMD gene. This indication is approved under accelerated approval based on the expression of Elevidysmicro-dystrophin observed in patients treated with Elevidys, with continued approval contingent upon confirmatory trial(s). It is contraindicated in patients with any deletion in exon 8 and/or exon 9 in the DMD gene.

Treats hemophilia B in adults

Hemgenix, an adeno-associated virus vector-based gene therapy for the treatment of adults with Hemophilia B (congenital Factor IX deficiency) who currently use Factor IX prophylaxis therapy or have current or historical life-threatening hemorrhage or have repeated, serious spontaneous bleeding episodes is the first in-vivo gene therapy approved by the United States (US) Food and Drug Administration (FDA) for treating hemophilia B in adults and uses an Adeno-Associated Virus Type 5 (AAV5) vector.

Lyfgenia (lovotibeglogeneautotemcel)

Condition: Sickle cell disease

Company: bluebird bio, Inc.

Approved: December 2023

Current WAC: $3,100,000

More: bluebirdbio.com

Cell Therapies

Abecma® (idecabtagenevicleucel)

Condition: Multiple myeloma

Company: Bristol Myers Squibb

Approved: March 2021

Current WAC: $498,408

More: abecma.com

Treats sickle cell disease in patients aged 12 years and older

Lyfgeniais a one-time ex-vivo lentiviral vector gene therapy approved for the treatment of patients 12 years of age or older with sickle cell disease and a history of vaso-occlusive events (VOEs). Lyfgeniaworks by adding a functional β-globin gene to patients’ own hematopoietic (blood) stem cells (HSCs).

Treats adult patients with relapsed or refractory (r/r) multiple myeloma

Abecma is a B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T-cell therapy. Abecma is approved for adult patients with r/r multiple myeloma after four or more prior lines of therapy, including an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 monoclonal antibody.

Start Realizing the Possibilities!

•

•

•

•

•

Power of the Pen

Amtagvi (lifileucel)

Condition: Metastatic melanoma

Company: Iovance Biotherapeutics

Approved: February 2024

Current WAC: $515,000*

More: amtagvi.com

Breyanzi® (lisocabtagenemaraleucel)

Condition: Large B-cell lymphoma & DLBCL, and follicular lymphoma

Company: Bristol Myers Squibb

Approved: February 2021, June 2022

Current WAC: $487,477

More: breyanzi.com

Carvykti (ciltacabtageneautoleucel)

Condition: Multiple myeloma

Company: Janssen Pharmaceutical/Legend Biotech

Approved: February 2022

Current WAC: $478,950

More: carvykti.com

Treats adult patients with unresectable or metastatic melanoma Amtagvi is a tumor-derived autologous T-cell therapy indicated for the treatment of adult patients with unresectable or metastatic melanoma previously treated with a PD-1 blocking antibody, and if BRAF V600 mutation positive, a BRAF inhibitor with or without a MEK inhibitor. Amtagviis a tumor-infiltrating lymphocyte (TIL) cell therapy and is the first and only one-time, individualized T-cell therapy approved for solid tumor cancer. This indication is approved under an accelerated approval based on overall response rate (ORR) and duration of response. Iovance is also conducting TILVANCE-301, a phase III clinical trial to confirm clinical benefit.

Treats adult patients with r/r large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL) & r/r follicular lymphoma

Breyanzi, a CD19-directed CAR-T therapy indicated for adult patients with r/r LBCL, including DLBCL not otherwise specified (including DLBCL arising from indolent lymphoma), high-grade B-cell lymphoma, primary mediastinal large B-cell lymphoma, and follicular lymphoma grade 3B. Expanded indication is for those who have: refractory disease to first-line chemoimmunotherapy or relapse within 12 months of first-line chemoimmunotherapy; or refractory disease to first-line chemoimmunotherapy or relapse after first-line chemoimmunotherapy and are not eligible for hematopoietic stem cell transplantation (HSCT) due to comorbidities or age. It is not indicated for the patients with primary central nervous system lymphoma.

Treats adult patients with r/r multiple myeloma

Carvykti is a B-cell maturation antigen (BCMA)-directed CAR T-cell therapy. Carvykti is approved for adult patients with r/r multiple myeloma after four or more prior lines of therapy including an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 monoclonal antibody.

Kymriah® (tisagenlecleucel)

Condition: Acute lymphoblastic leukemia, large B-cell lymphoma & DLBCL, and follicular lymphoma

Company: Novartis Pharmaceuticals

Approved: August 2017, May 2018, May 2022

Current WAC: $543,828 (ALL), $427,048 (DLBCL, FL)

More: kymriah.com

Lantidra® (donislecel-jujn)

Condition: DiabetesType 1

Company: CellTransInc.

Approved: June 2023

Current WAC: N/A

More: celltransinc.com

Omisirge® (omidubicel-onlv)

Condition: Umbilical cord-blood transplant for blood cancers

Company: GamidaCell

Approved: April 17, 2023

Current WAC: $338,000

More: gamida-cell.com

Treats patients up to age 25 with r/r B-cell precursor acute lymphoblastic leukemia (ALL) and adult patients with r/r large B-cell lymphoma, including DLBCL and r/r follicular lymphoma

Kymriah is a CAR T-cell therapy approved for patients up to 25 years of age with B-cell precursor ALL that is refractory or in second or later relapse. In 2018, Kymriah was approved for an expanded indication to include adult patients with r/r large B-cell lymphoma after two or more lines of systemic therapy. In May 2022, Kymriah was approved for another expanded indication for adult patients with r/r follicular lymphoma after two or more lines of systemic therapy. This expansion was approved under an accelerated approval; continued approval for this indication may be contingent upon clinical benefit in a confirmatory trial.

Treats adults with Diabetes Type 1

Lantidra is approved for the treatment of adults with type 1 diabetes who are unable to approach target glycated hemoglobin (average blood glucose levels) because of current repeated episodes of severe hypoglycemia (low blood sugar) despite intensive diabetes management and education. It is the first allogeneic (donor) pancreatic islet cellular therapy made from deceased donor pancreatic cells for the treatment of type 1 diabetes.

For patients requiring umbilical cord blood transplantation for blood cancer treatment

Omisirgeis a substantially modified allogeneic (donor) cord blood-based cell therapy intended for use in adults and pediatric patients 12 years and older to quicken the recovery of neutrophils (a subset of white blood cells) in the body and reduce the risk of infection for individuals with blood cancers planned for umbilical cord blood transplantation following a myeloablative conditioning regimen (treatment such as radiation or chemotherapy). Related conditions include acute lymphoblastic leukemia, acute myeloid leukemia, myelodysplastic syndromes, and others.

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health.

Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

Tecartus® (brexucabtageneautoleucel)

Condition: Acute lymphoblastic leukemia

Company: Kite, a Gilead Company

Approved: July 2020 (MCL), October 2021 (ALL)

Current WAC: $424,000

More: tecartus.com

Yescarta® (axicabtageneciloleucel)

Condition: Large B-cell lymphoma & DLBCL, and follicular lymphoma

Company: Kite, a Gilead Company

Approved: October 2017, April 2021, April 2022

Current WAC: $462,000

More: yescarta.com

Treats adult patients with r/r B-cell precursor acute lymphoblastic leukemia (ALL) and adult patients with r/r mantle cell lymphoma

Tecartus is a CAR-T therapy indicated for the treatment of adult patients with r/r B-cell precursor ALL.Tecartus is also indicated for the treatment of adult patients with r/r mantle cell lymphoma. This was approved under an accelerated approval; continued approval for this indication may be contingent upon clinical benefit in a confirmatory trial.

Treats adult patients with r/r large B-cell lymphoma, including diffuse large B-cell lymphoma (DLBCL) and r/r follicular lymphoma

Yescarta is a CAR T-cell therapy that is indicated for the treatment of adult patients with r/r large B-cell lymphoma after two or more lines of systemic therapy, including DLBCL not otherwise specified, primary mediastinal large B-cell lymphoma, high grade B-cell lymphoma, and DLBCL arising from follicular lymphoma. In 2021, Yescarta was approved for an expanded indication to include adults with r/r follicular lymphoma after two or more lines of systemic therapy. In April 2022, Yescarta was approved for another expanded indication for adult patients with large B-cell lymphoma that is refractory to first-line chemoimmunotherapy or that relapses within 12 months of first-line chemoimmunotherapy. It is not indicated for the treatment of patients with primary central nervous system lymphoma.

Five Decades of Excellence

Growing with confidence. We continue to expand and diversify, with over 100 classes of speciality insurance provided through approximately 4,000 experts around the world, contributing to our global success. TMHCC is a leader within our industry and trailblazer in the specialty insurance landscape. After half a century of successful expansion, we now have a presence in over 180 countries. We want to express our deepest gratitude to all of our employees, clients, brokers, and agents who have contributed to these five decades of excellence. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

IGNITING THE DISCUSSION

“At the end of this Forum, we really want participants to have a full picture of what is happening to all market sectors, open up discussions and conduct dialogue based upon what they heard,” concludes Hume. “There’s going to be an opportunity for attendees to express their thoughts and exchange ideas on where we go from here.”

As CGTs move into the mainstream and take on higher prevalence conditions, both Hume and Peterson concur that there’s just a lot we don’t know.

“We don’t know if higher prevalence will bring down the price point so there’s a lot of questions around how far the manufacturer community will go with pricing,” says Hume. “The main reason the price tags are so high for rare disease treatment is because manufacturers have to recover the cost of product development for small populations. But the pipeline is just full of activity for these higher prevalence conditions.”

She believes that every employer is really on the fence right now, and there will be multiple questions that require answers regarding coverage.

“There’s a lot of unknowns, and employers face a lot of challenges,” she admits. “Denying coverage might result in bad press, especially if an employee has a child with spinal muscular atrophy and they can’t

access the gene therapy. That’s going to make news, appear on social media and be announced on every single pulpit where a parent can bring attention for their child.”

Peterson expresses his gratitude for all the scientific advancement that is bringing these opportunities to so many people.

“On Rare Disease Day, I attended an awareness event at the University of Minnesota where we discussed how much has changed,” he shares. “We heard from patient advocates and families who have suffered losses. Now, these warrior champions are fighting against a rare disease and they’re making such great progress, which is so wonderful for these families because access is a problem. There are a hundred different challenges to accessing a therapy

TPA SUMMIT

even after it is approved. I encourage people to stay hopeful and keep fighting for access.”

For employers and manufacturers, he says it’s important to understand the other’s perspective with a goal to hopefully see a path to a mutual conversation about how to manage CGTs.

“This Forum will foster mutual understanding of each other’s perspectives and help facilitate that conversation in a better way,” he observes. “I think the diversity of the people who are going to be attending and presenting is probably the biggest value of the event.”

Peterson anticipates that this Forum will lead to a greater understanding of the right approaches, adding, “We look forward to examining how stakeholders can reach across the aisle in some areas to come up with a plan or actions that will ultimately facilitate the distribution of CGTs in a way that is providing the desired outcomes as efficiently as possible.’

He emphasizes that the goal is to get the right care in the right place and make sure the wrong care is not getting delivered in the wrong venue, noting, “Optimally, care should be financed or paid for, and that’s the goal in bringing everyone together. Outcomes are the number one priority given that we don’t have to just take the initial hypothesis that the price determines how or where treatment should be delivered.”

He calls for expanded conversation about how we support those optimal outcomes and make sure that there’s limited misuse, better efficiency in the delivery of care and enhanced value.

“Balancing the initial payment versus subsequent health improvements should be the focus -- it’s not a math problem, it’s an outcome problem,” he stresses. “But there’s math that needs to

be done behind the management to make sure that we’re also optimizing the math on the other end.”

Sources

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10910012/

https://www.linkedin.com/pulse/access-one-all-longer-rare-howbiotech-ensure-cgts-masses-green/?trk=organization_guest_mainfeed-card_reshare_feed-article-content

https://www.lupus.org/resources/what-is-lupus

https://www.cms.gov/priorities/innovation/innovation-models/cgt

https://healthpolicy.usc.edu/wp-content/ uploads/2024/01/2024.01.19_USC_Schaeffer-Response-to-HELPRFI-on-Access-to-Cell-and-Gene-Therapy.pdf

https://www.labcompare.com/10-Featured-Articles/610359-Outlookon-Cell-and-Gene-Therapy-2024-and-Beyond/

https://www.specialtypharmacycontinuum.com/Operations-andManagement/Article/02-24/Who-Will-Pay-for-Sickle-Cell-GeneTherapy-/72832?sub=&tken=FA3067C4A78BD6D1D996F723A E1F87AFCA26CDC161AAEA7B52ECE27B8245B&enl=true&dg id=--DGID--&utm_source=enl&utm_campaign=20240223&utm_ content=1&pos=1&utm_medium=title

https://www.cancer.gov/publications/dictionaries/cancer-terms/def/ car-t-cell-therapy

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Medical Stop Loss from Berkshire Hathaway Specialty Insurance comes with a professional claims team committed to doing the right thing for our customers – and doing it fast. Our customers know they will be reimbursed rapidly and accurately – with the certainty you would expect from our formidable balance sheet and trusted brand. That’s a policy you can rely on.

SIIA RESPONDS TO HOUSE COMMITTEE REQUEST FOR INFORMATION ON HOW TO BUILD UPON AND STRENGTHEN ERISA

OnOJanuary 22nd, the House Education and the Workforce Committee sent a Request for Information (RFI) to stakeholders in the employer-sponsored health plan community seeking feedback on ways the Committee can build upon and strengthen ERISA in specific areas, including ERISA preemption, ERISA’s fiduciary requirements, and other areas such as Data-Sharing, Cybersecurity, and Direct and Indirect Broker/Consultant Compensation.

SIIA specifically provided feedback on ERISA preemption, highlighting the significance of ERISA’s preemption powers and pointing out that the main reason for the enactment of ERISA itself was to ensure that, for example, health benefit plans are subject to a uniform Federal system of regulation, instead of a “patchwork” set of requirements established by each of our nation’s 50 States. We also shared with

the Committee our White Paper on ERISA preemption that we developed last Fall. As we reported, our White Paper provides an overview of how ERISA is structured and enforced, an explanation of ERISA’s requirements applicable to self-insured group health plans, and a detailed discussion of ERISA’s preemption provision and how the Supreme Court determines whether and when a state law is preempted by ERISA.

SIIA also informed the Committee of the difficulties plan sponsors and their service providers are experiencing when it comes to accessing a complete and accurate set of pricing and health claims data. We highlighted that, in practice, owners of the provider networks continue to refuse to share pricing and claims information with plan sponsors by pointing to contractual restrictions set forth in “downstream” agreements with the plan sponsor and/or other plan service providers. We also explained that plan sponsors and their service providers believe that the presence of these contractual restrictions are prohibited “gag clauses” that prevent the plan sponsor from lawfully “attesting” that the plan is in compliance with the Gag Clause Prohibition. As a way to resolve these issues, we provided

the Committee with detailed amendments to the Gag Clause Prohibition statute (set forth in ERISA section 724), which we hope the Committee will consider recommending that the full House and Senate pass into law.

Lastly, SIIA commented on fiduciary issues by discussing the recent Johnson & Johnson (J&J) employee-participant lawsuit filed against J&J (as plan sponsor) and the plan’s fiduciaries (in their individual capacities), contending that J&J and the plan’s fiduciaries breached their fiduciary duties by failing to prevent the plan from overpaying for covered benefits. We

corporatesolutions.swissre.com/esl

specifically highlighted this lawsuit to explain that plan sponsors need access to a complete and accurate set of pricing and claims data so plan sponsors and the plan’s fiduciaries can satisfy their fiduciary duties of acting prudently and adequately monitoring the plan’s service providers. We encouraged the Committee to consider our recommended amendments to ERISA section 724 as a solution.

SIIA’s RFI submission can be found here or you can request a copy from Anthony Murello at amurrello@ siia.org.

SIIA will continue to keep members updated on any Congressional activity relating to ERISA. In the meantime, if you have any questions or if you would like to talk further about any ERISA-related issues, please contact Chris Condeluci(ccondeluci@siia.org) or Anthony Murrello (amurrello@siia.org).

COPAY ASSISTANCE PROGRAMS AND COMPLIANCE RISKS – NO FREE LUNCH

Written By Alston & Bird Health Benefits Practice

Written By Alston & Bird Health Benefits Practice

S

Self-insured

plans looking for creative ways to minimize prescription drug costs are turning to vendors offering programs that attempt to utilize funds from drug manufacturers and other sources to subsidize these costs. Some of these programs involve leveraging the availability of drug manufacturer coupons or assistance and/ or assistance from third parties (sometimes charitable) to pay for expensive prescription drugs. The catch: this assistance is available to the individuals who have been prescribed these drugs and not to the plans themselves.

Program sponsors attempt to overcome this hurdle by giving participants the option to either enroll in programs that use manufacturer assistance/alternate funding or not enroll in these programs and face either higher copays or the full cost for certain

drugs. Programs like copay maximizers and alternate funding programs are designed to take advantage of otherwise available financial assistance, but they raise potential compliance risks associated with these designs.

Some of these designs clash with Affordable Care Act (“ACA”) rules on the annual maximum out-of-pocket limits (“the MOOP”) for essential health benefits (EHBs) and/or raise red flags under the tax code and the Employee Retirement Income Security Act (“ERISA”). Self-insured plans need to be mindful of these compliance pitfalls and be aware of how proposed regulatory changes can adversely impact the touted benefits of these programs.

In our prior article, we detailed compliance issues regarding copay accumulators. Copay accumulators are programs that exclude the value of the manufacturer’s assistance from accumulating toward the plan’s ACA MOOP. Regulations that allowed this practice were vacated by a United States district court for the District of Columbia. An appeal from this decision was originally filed, but the government withdrew this appeal, indicating that the United States Department of Health and Human Services (HHS) would propose new regulations.

In the interim, HHS has stated, informally, that it will not take enforcement action against plans that do not apply coupons or other

manufacturers’ assistance toward the ACA MOOP. Our prior article also detailed the compliance issues that counting the assistance might raise for high deductible health plans (HDHPs) as to an individual’s eligibility for a Health Savings Account.

In this month’s article, we will focus on two related programs dealing with manufacturers and other prescription drug assistance: copay maximizer programs and alternative funding programs.

Bringing

gene therapies to your employees while protecting your bottom line

Gene therapies are estimated to treat almost 110 million people from 2020 to 2034.* As the gene therapy pipeline grows, so do the claims and financial risk for employers. Wellpoint can help you minimize that risk.

Wellpoint’s Gene Therapy Solution works as a provision of our stop loss policy to protect employers from unknown financial risk while providing access to life-changing therapies for rare and complex conditions. Our solution includes the Wellpoint-approved Gene Therapy Drug List with:

• Perpetual “laser-free” coverage for those gene therapy drugs listed in the Wellpoint solution once the initial underwriting is approved.

• No stop loss claims from these drugs for simpler administration. All stop loss claims from the drug list are removed from a client’s claims experience at renewal.

To learn how our Gene Therapy Solution can protect your company, contact your Wellpoint representative.

• Copay Maximizer Programs: Under a copay maximizer program, the program vendor identifies certain drugs that have available manufacturer assistance, and the plan then sets the copay at that amount or higher in order to extract—or “maximize”—the full value of the assistance. For example, if the maximum amount of annual copay assistance for a particular drug is $24,000, then the patient copay is set at $2,000 per month. Another aspect of these programs is that the drugs identified by the vendor are not treated as an EHB for purposes of ACA MOOP. If a plan classifies a drug as a non-EHB and a plan participant chooses not to enroll in the program and pays the increased copayment instead, that copayment would not accumulate towards the ACA MOOP. Similarly, even assuming that copay and other manufacturer’s assistance would have to be counted toward the ACA MOOP under the rationale of the D.C. district court decision on copay accumulators, the ACA MOOP requirements only go to EHBs and the promotors of these programs would argue that even under that rationale they do not need to be counted because they are not EHBs.

• Alternative Funding Programs: Alternative funding programs (“AFPs”) are facilitated by vendors who search for manufacturer’s assistance or organizations that assist people in paying for expensive prescription drugs. These alternate funding sources can also be charities and are often set up by drug manufacturers. Qualifying for these funds usually requires that a person be uninsured or have no insurance for the prescribed drug (i.e., the drug is excluded from their health plan formulary) and often requires a household income equal to or lower than a specified amount. Plans with an AFP generally exclude certain drugs identified by the AFP vendor from the plan’s formulary. However, the plans will sometimes cover a certain drug on an exception basis after a participant has requested funds from an alternate funding source and been denied. If a drug is excluded from a plan’s formulary, then any payment for the drug and any assistance toward the payment for that drug would not count toward the ACA MOOP because it is not covered by the plan in the first instance. But, if covered on an exception basis, there is an open question of whether it is actually allowed to be excluded from MOOP.

These programs, in one form or another, have proliferated in recent years because they purport to allow plans to shift some of the cost for expensive specialty drugs onto the manufacturer while also sparing the participant from these costs. A critical feature of these programs is that the assistance— whether from the drug manufacturer or an alternate source—purportedly does not count toward the ACA MOOP. The plan uses vendors to help participants find and access assistance so that the participant pays nothing, and the plan also benefits because the longer it takes for the participant to reach the ACA MOOP, the longer the plan can shift some of the cost onto the drug manufacturer or alternate funding source.

Another aspect of the design of some of these programs is classifying the drugs in the program as non-EHBs. Under current ACA rules, self-insured group health plans do not have to cover EHBs, but if they do, then the participant’s cost share must count towards the plan’s ACA MOOP. Currently, selfinsured plans have some flexibility in defining which drugs are EHBs. If the drug is not an EHB under the plan, the plan is not required to count any cost share towards MOOP, regardless of the source. This approach of classifying certain high-cost drugs as non-EHBs drives the plan participant to choose between a subsidized “free” drug through the copay maximizer or paying the higher copay, which doesn’t help them to reach the ACA MOOP any faster. Under an AFP, the drug is not covered at all

(absent receiving a waiver from the plan), so the participant has the choice of enrolling in the AFP and getting the drug for free or paying the full cost of the drug. Again, under either alternative, the vendor’s view is that nothing counts toward the ACA MOOP.

MOPPING UP THE MOOP: WILL ALL COVERED DRUGS HAVE TO BE CLASSIFIED AS EHBS UNDER A COPAY MAXIMIZER PROGRAM?

As detailed in our article on copay accumulators, HHS attempted to clean up the ACA MOOP issue in its 2021 Notice of Benefit and Payment Parameters (“NBPP”) by allowing plans to disregard the value of drug manufacturer assistance for purposes of the ACA MOOP. That regulation adopted in the 2021 NBPP was vacated by the D.C. district court, and the issue of whether manufacturer’s assistance must be counted toward the ACA MOOP is in a state of limbo, given the HHS nonenforcement position on the issue.

However, that still leaves the copay maximizer programs, which provide that if a participant does not enroll in the program and pays the higher copay, that copay still does not apply to ACA MOOP because the drug is not an EHB. On April 2, 2024, regulators finalized the 2025 NBPP, which requires that non-grandfathered individual and small group market plans covering prescription drugs in excess of the regulatory standard (the state benchmark standard or at least

one drug in every United States Pharmacopeia (USP) category and class) to treat any additional drugs in the USP category and class as EHBs for purposes of the ACA MOOP (with a limited exception).

In the proposed 2025 NBPP, there was some question about whether the rule would apply to self-insured plans, which would effectively end the practice of classifying some drugs as nonEHBs. Regulators clarified in the preamble to the rule and in the FAQ About Affordable Care Act

Implementation Part 66 (“FAQ Part 66”) that this policy will not apply to self-insured plans under 2025 NBPP but that future rulemaking will be proposed to apply these same standards to large group market health plans

and self-insured group health plans. If that happens, selfinsured plans could still impose higher cost-sharing requirements for more expensive drugs through their copay maximizer programs but would have to count any amount paid by the participant towards the plan’s ACA MOOP.

In the preamble to the 2025 NBPP, regulators noted that “it is not apparent that [plans] are capable of readily explaining the rationale behind designations of ‘non-EHB’ for specific drugs to consumers in advance of their enrollment in the plan,” adding that even if this rationale could be explained, “it is unreasonable to expect enrollees to be able to understand the complicated impacts that getting coverage for specific ‘non-EHB’ drugs would have on enrollee out-of-pocket costs and consumer protections.” Although the policy does not technically apply to self-insured plans just yet, plans that exclude certain drugs from EHB as part of a copay maximizer program should take note of these signals from regulators.

COMPLIANCE CONCERNS FOR ALTERNATE FUNDING PROGRAMS

Even if self-insured plans had to classify all covered prescription drugs as EHBs, a plan could still exclude certain drugs from coverage altogether. Excluding drugs from the formulary is a common feature of AFPs, which access funds from alternate funding sources that are usually

set up to help individuals who are either entirely uninsured or whose health plans do not cover a particular drug. Some AFP vendors require the plan to be amended to exclude certain drugs identified by the vendor, and the vendor then works with participants to apply for assistance. These alternate funding sources, however, have no obligation to the plan or to its participants, and assistance may be denied. The plan administrator may respond to a denial from an alternate funding source by overriding the exclusion and providing a tax-free reimbursement to the participant for the cost of the excluded drug. As beneficial as these AFP programs may be for controlling costs, they create a number of risks for plans.

TAX CONSEQUENCES