ADVANTAGE

Publication of the Southwest Car Wash Association

When encouraging car wash operators and vendors to support SCWA sometimes I am asked “why should I join SCWA”

In today’s dynamic and often challenging business landscape, collaboration is no longer a luxury, but a necessity. Professional business groups like SCWA offer invaluable support and collective power that an individual business owner often lacks. The larger the numbers the stronger resource base available.

SCWA has always been an excellent resource for me whether it is having a network of other car wash owners to help me solve a car wash problem; attending a workshop or webinar that provided new ideas; long term cost savings; being the first to hear about developing technologies or just having a benchmark for what is happening in the industry. Being a part of this SCWA family network we can all learn from each other and all be more successful.

The strength and resilience of the car wash community lies in its ability to unite. By coming together, car wash businesses can amplify their voice, share knowledge, access resources, and ultimately contribute to a more prosperous and sustainable future for all.

One of the major benefits of groups like SCWA stems from our ability to provide a unified voice. When businesses band together, they can effectively advocate for policies, regulations, and resources that benefit the entire car wash industry. This collective bargaining power allows us to influence decisionmakers and shape the future of their industry. Being a part of SCWA I have learned this important lesson first hand and have witnessed how SCWA has stepped forward so many times on behalf of the car wash industry. Just a few excellent examples include:

• The SCWA Water Alliance working with cities across the U. S. educating local officials in all the environmentally friendly water conservation measures exercised by car wash operations;

• Working to have the car wash industry deemed an “essential business” in many states during the COVID pandemic allowing the car washes to continue to operate;

• Finding and forming alliances with similar business groups on advocacy on important regulatory and legislative issues;

• Working with OSHA to provide safety alerts and keeping car wash owners up to date on changing regulations to avoid fines and penalties;

• Distribution of the regular SCWA Legislative & Regulatory Update email covering a broad range of critical car wash related issues.

In a more direct impact beyond advocacy, SCWA offers a platform for knowledge sharing and networking. Members can learn from each other’s successes and failures, gain insights into emerging trends, and collaborate on innovative solutions. This cross-pollination of ideas fosters growth, competitiveness, and overall industry health. One of the more popular SCWA resources offers an excellent example, the SCWA Mentors Network. This resource brings car washers together for regular idea exchanges and a proven sounding board for operators at all experience levels.

And there is even more. SCWA provides access to resources, training, and mentorship opportunities that might be otherwise unavailable to smaller businesses. From navigating complex legal frameworks to accessing funding opportunities to insights on new technologies and operations, being a part of SCWA can empower members with the tools needed to thrive.

In conclusion, the strength and resilience of the car wash community lies in its ability to unite. By coming together, car wash businesses can amplify their voice, share knowledge, access resources, and ultimately contribute to a more prosperous and sustainable future for all. Participating in SCWA is not just beneficial for individual businesses; it’s an investment in the long-term health of the entire industry economy. For me decisions are based on the bottom line - and with the dollars I have saved thru the SCWA resources and the dollars I have made by becoming a better operator and a better business person - being a part of SCWA is just a very good business decision.

Plus the life long friends I have made through my service to and my participation in SCWA is only icing on the cake. As members of SCWA I urge each of you to share with your car wash friends why being a part of the SCWA family really matters and how if we all work together we can be more successful and enhance the larger car wash community at the same time.

For many of the SCWA members we are entering the season of tropical storms and hurricanes. The following is a check list for you to be better prepared in case you are facing this situation.

Pre-Storm Preparedness Emergency Action Plan (ESP) Development

• Create an emergency action plan (EAP) and assign roles for an emergency response team (ERT) that is appropriate for your business

• ERT members should fully understand their responsibilities as well as general goals and procedures as outlined in your EAP

◦ Designate an ERT member to track weather conditions and the progress of the storm

◦ Designate an ERT leader who would have authority to implement the EAP upon reaching benchmarks outlined in your EAP, including when to cease operations and dismiss personnel

• The EAP should minimally include:

◦ Contact information for ERT members, civil authorities, etc.

◦ Plans for backup communication

◦ Details identifying critical areas of your facility and operation as well as those employees trained and authorized to initiate shutdown procedures

◦ Plans to protect and, if necessary, relocate all vital company records

◦ Plans to protect key equipment, stock/inventory, etc.

◦ Evaluation and preparation for flooding and/or windstorm-related flooding

◦ Arrangements with appropriate contractors for poststorm repairs and supplies

◦ Details for securing the site after the storm

Join the nation’s largest car wash buying group and leverage the purchasing power of over 1,500+ car washes, while still enjoying the FREEDOM to choose your suppliers!

◦ Please consult with a professional on developing the appropriate plan for your specific business operation. Each business is unique and requires careful evaluation and planning to prepare for a natural disaster.

• Continue to monitor and track the progress of the storm, its path and its intensity

• Determine if or when an emergency action plan should be initiated

• Follow your procedures on when to shut down operations that may be in the anticipated path of the storm

Proactive Measures During the Storm

Plans to evacuate the ERT before the storm reaches your area, if evacuations become necessary, should be evaluated well in advance of the storm. Please heed the advice of local and state authorities with respect to evacuations. If it is possible for members of the ERT to remain on the premises safely during the storm, the following proactive measures may be taken to prevent extensive damages:

• Monitor for possible structural damage and make repairs as needed, if possible

• For the threat of fire, monitor water pressure for the sprinkler system and identify potential causes of fire (electrical sources) - take corrective action as necessary

• Monitor for flooding from rain or tidal surge and create barriers using sandbags as needed

Actions & Evaluations After the Storm

• Secure the site evaluating and addressing any safety hazards

◦ Check for water damage to equipment, etc. before turning on electricity and consult with an electrician as necessary

◦ Ensure that fire protection equipment is in working order and, if needed, contact the local fire department for instructions on activating fire protection components.

• Survey and take pictures of all damages

• Begin salvage and clean-up as soon as possible after addressing safety concerns and work with designated contractors to:

◦ Make temporary repairs to mitigate damage (roofing, clogged drains, broken windows, etc.

◦ Remove standing water and address moisture and the potential spread of bacteria, mold, etc.

◦ Separate damaged goods, inventory/stock from undamaged items

◦ Compile an itemized list of materials and labor used in making repairs

• Contact your insurance company to report a claim for damages

• If possible, resume operations

- Southwest Car Wash Association

Carwash business owners should be aware that ACA error messages may occur for many valid reasons, that do not accurately represent an employee’s legal status, and absent other factors there is no need to fire the employee.

U

nder the Affordable Care Act (ACA) employers that offer health insurance policies must comply with information reporting requirements. AIR is an electronic filing system that was created to facilitate this process.

Upon submitting annual ACA reports, employers may get an error message from the IRS. Most commonly is the error code “1095C-010-01.” This code is generated when the first four letters of the employee’s last name and the Taxpayer Identification Number (“TIN”) on the Form 1095-C do not match the Internal Revenue Service’s (“IRS”) database.

There is no requirement to terminate an employee upon receiving an AIR error code, assuming no other factors exist. If a carwash business owner receives an error message, they can become proactive to avoid fines and other penalties.

Common scenarios include:

• A typographical error occurred when entering the employee’s name or TIN on the Form 1095-C;

• A Hispanic last name being inverted;

• An employee recently married and changed their legal name;

• Confusion over which name should be considered the last name on ACA filings when an employee has multiple last names; or

• An error in the IRS’s database.

The IRS nor any government agency has offered guidance on whether this could be considered constructive notice of an employee’s employment eligibility status. Furthermore, please note that Social Security No Match notices issued by the Social Security Administration are similar and create an obligation to solicit the correct number from the employee.

How will the IRS and ICE data sharing agreement impact employers?

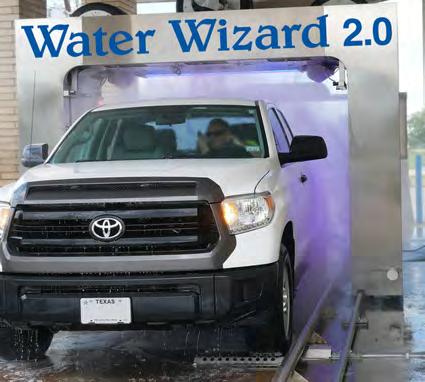

Connected cameras track a vehicle from the pay station to the tunnel, ensuring that the equipment will provide the purchased services to the correct vehicle, Davy explains. Controllers also provide safety for the consumer by controlling the conveyor and other equipment, automatically pausing the tunnel when there is a problem. This tight control can allow for customers to receive a custom “light show” in the tunnel as well, Davy states. This feature can create a unique experience for each customer based on what was selected and purchased. Modern controllers can even activate unique signage or special lighting for any visiting unlimited wash club members.

In April of 2025, the IRS and ICE issued a notice that they now have a data sharing agreement. ICE can now submit names and addresses of individuals facing final orders of removal or that are under federal criminal investigation. Under the Trump administration the potential impact is that this could lead to further investigation into the company’s immigration compliance. Thus, it is important that employers are in full compliance with immigration laws, especially in preparing and retaining Form I-9s for their employees.

Are there situations where an employer can be excused from liability?

Another advantage controllers enable is to-the-inch application of chemicals. This precise application means operators can effectively control their washes’ chemical costs. When set up correctly, equipment only sprays the vehicle, not the gap between vehicles, Davy notes. This to-the-inch application continues through the entire tunnel and applies to such services as ceramic coatings, wax applications and other necessary chemistry. This universal control not only saves on chemistry costs, but it also provides customers a better wash experience.

Businesses can avoid liability if an employer can establish the reasonable cause defense because they acted responsibly before, the error subsequently occurred, and there were either significant mitigating factors or the failure was due to events beyond the filer’s control. This means that employers must submit an initial solicitation and if required additional solicitations.

An employer’s obligation is to solicit information. After receiving an error code for mismatched information, employers should review their records. If the information entered matches the records received employers should submit a second solicitation before the end of the year and document the steps that they took to rectify the incorrect TIN. If the error message is not resolved a third annual solicitation should be conducted, even if an employee has left the company and the business has reportable tax information for that employee.

Energy efficiency can be another advantage. “Your tunnel controller also helps you save electricity by driving each piece of machinery in the tunnel, activating your vehicle frequency-driven devices and controlling signage and lighting around your facility,” Davy continues. “Additionally, your tunnel controller can help conserve energy by leaving your dryers on when multiple cars are in the tunnel, avoiding costly start-ups of the dryer system. Without wasting chemical or electricity, you are better able to control your per-car costs and make each service more profitable.”

The reasonable cause defense requires that all solicitations are conducted within the calendar year that the penalty is being proposed.

Bath points to efficient look-ahead features in a carwash tunnel that can include the controller keeping the blowers running for the following vehicle. Again, this step saves energy and creates cost savings. “There are many features that can help operators save power, water, etc. When you understand all these modern-day features, your process will benefit as well as your cost savings,” Bath says.

penalty is imposed on small businesses. After Augst 1, 2024 penalties for filing late or incorrect returns start at $310 with a maximum cap of $3,783,000 for large business and $1,261,000 for small business. Remember to avoid knee-jerk reaction to terminate but remember the IRS solicitation rule.

With the ramped-up speeds and maximum loading efficiency needed, it is easy to see the importance of proper control in the world of express tunnel washing. Integrated and cooperative monitoring systems have proven to be a profit protector for many bustling car care operations. How do modern controllers enable these monitoring systems to prevent both loading issues and damage complaints in carwash tunnels?

If the IRS issues an official penalty notice businesses can incur large fines. For the year 2024 a large business, those that earn a gross income over $5 million, may incur a minimum penalty of $630 per return or statement and there is no maximum cap if the IRS finds that the business intentionally disregarded their responsibilities. The same

Here, camera systems can provide on-site tracking and help avoid delays caused by a loader, which prevents slowed productivity and missed rollers. Inside the tunnel, cameras can even stop the conveyor when the vehicle is not where it is supposed to be, Davy states. Stopping the tunnel can prevent costly accidents and the downtime they create. These anti-collision systems allow a carwash to run vehicles closer together, further increasing valuable throughput and revenue on busy days.

Also, it is important for employers to be mindful of the innocent bystander that calls your business to report that their identity was stolen, and income is being reported to their social security number. If employers ignore these calls and do not review their company records to investigate the matter this could lead them to complain to ICE and trigger an investigation into the business’ immigration compliance. Businesses should complete the current version of Forms W-2c and W-3c for every year that the employee’s income was reported to the victim’s social security number.

Monty & Ramirez, LLP will present a webinar on Form I-9 Compliance, Error Messages, SSA No Match issues and Innocent Bystander Identity Theft on July 15th, 2025 @ 2PM CST.

- Jacob M. Monty, Nallely I. Rodrguez, Monty & Ramirez LLP; SCWA Legal Firm

Vehicle proximity devices, such as sonar, help identify features on vehicles so a wash can provide a better clean, Davy notes. For example, these devices can detect the windshield location, allowing for special windshield wash services or side mirror rinses. It is also possible to identify truck beds, allowing a wash to automatically turn off devices. This can prevent too much soap from being dumped into the truck bed or turn off blowers so they will not blow debris out of the bed onto other vehicles.

Operating a car wash, just like any business, can be stressful. The ICS Merchant Services team has the experience and insight needed to help you navigate network security and PCI compliance issues and bring you peace of mind.

Our powerful suite of security solutions are just what you need to stop the threats to you and your customers. Plus, we advocate for you within the payment card and security industries to make your needs heard.

So put your trust in ICS, and rest easy.

f you’re in the car wash business and haven’t given your brand a face, you might be missing out on one of the most powerful (and fun) ways to make a splash. Mascots aren’t just for cereal boxes and sports teams. In the car wash world, a great character - like a soap-happy dinosaur or granny bubble dressed for all occasions - can be your hardestworking team member. Always smiling, always on-brand, and always unforgettable. When done right, a mascot doesn’t just clean up your image, it helps drive customers back again and again.

In Frisco, Texas, Dino Clean Car Wash is impossible to miss - and unforgettable once you see it. Towering dinosaur statues, including a proud triceratops and a long-necked sauropod, greet visitors before they even reach the wash tunnel. But it’s the mischievous velociraptor that steals the spotlight. Strategically positioned at the tunnel entrance, it sprays unsuspecting vehicles with a burst of water, catching drivers off guard and instantly delighting passengers. It’s a moment of surprise and laughter that makes kids squeal, adults crack up, and social media go wild. The dino encounter has become a viral favorite, earning Dino Clean plenty of love on TikTok and Instagram as guests share their reactions and tag their friends in the fun. More than just decoration, these prehistoric pals create an experience that sticks with people long after their cars are clean.

But this Jurassic twist on the typical car wash isn’t just for show, it’s smart business. Owner Marinko Mandich, a local dad and lifelong dinosaur fan, took a creative approach when faced with a Texas regulation requiring green space for commercial properties. Instead of settling for grass or shrubs, he brought in full-size dinosaur statues, turning a zoning requirement into a standout feature. The result is more than a themed car wash, it’s a full-blown roadside attraction and a self-marketing machine! The dinos draw attention, drive picnic traffic, and spark word-of-mouth buzz in the community. Families now treat their weekly wash like a mini adventure, with kids begging to go and parents proudly posting the visit online. While Dino Clean may not be the first dinosaur-themed car wash out there, it’s earned a reputation for turning an everyday chore into a roaring good time.

To deepen its connection with the community, Dino Clean introduced the Dinomite Community Awards. These awards are a fun and heartfelt series of certificates and prizes that celebrate local businesses and organizations whose employees go the extra mile. Each week, a nominated

business is surprised with free $25 top washes for the entire team to recognize their hard work and community service. It’s a simple yet powerful way to spread positivity, support neighbors, and turn routine recognition into a memorable moment. And of course, it’s all delivered with Dino Clean’s signature charm and a dash of prehistoric flair.

But the impact goes beyond good vibes. The awards also serve a strategic purpose by generating valuable local SEO content and backlinks to Dino Clean’s website which helps their wash rank higher on Google when people search for terms like “car wash near me.” Every award post, smiling group photo, and social media post Mandich shares creates digital visibility that boosts the Dino Clean’s reach. These community spotlights not only attract new customers but also stretch advertising dollars further by building organic engagement and real relationships. Even the dinosaurs would give it a thumbsup… if they had thumbs.

The real magic is in the consistency. While your community outreach builds trust and local buzz, a mascot becomes the steady, recognizable face of your brand—showing up day after day, post after post. Imagine this: your social media manager moves on, your general manager gets promoted, and your front-line staff cycles through as seasons change. But your brand? It still shows up with the same warm, welcoming personality your customers know and love.

That’s the power of a mascot. A thoughtfully designed character - like Mrs. Bubble, a granny soap bubble who’s hard of hearing and replies to every negative review with, “I’m sorry, I can’t hear you, dearie…” and threatens people during pollen season with, “Don’t make me come out there with my sponge!”- can embody your brand voice across every platform. She answers Facebook comments, shares holiday specials, stars in TikTok videos, and responds to emails with her signature flair—she may be soft, but she scrubs tough! She never takes a day off, never quits, and only gets better with time. As your business grows and naturally evolves, she stays rooted, ready to train the next round of summer hires just by being there. Whether your team graduates, moves on, or expands, Mrs. Bubble remains the matriarch of your marketing. She holds the line and

•Car Wash Development Since 1984

•Ground-up and remodels

•Car Wash Equipment Sales, Service, Installation and Parts

•Installation and Service on All Manufacturers

•Consulting

•CAD Drawings and Design Services

•Training (Operational and Maintenance)

•Site Selection and Evaluation

•Sell, Supply and Service Chemicals

•Chemical Evaluations and Cost Controls

•Marketing and Market Research

•Ongoing Preventative Maintenance

•Texas and Surrounding States

•24 Hour Service, 7 Days a Week

•Large Inventory of Parts, Supplies and Chemicals

• Fleet GPS Monitored for Fast, Efficient Response Times

Email: o ce@protechsc.com •

keeps your messaging fun, familiar, and on-brand. She’s part customer service rep, part brand ambassador, part social media manager, and she’s your most reliable employee.

And the impact goes beyond personality. Having a mascot like Mrs. Bubble can save serious money in marketing and staffing. Studies show that brand characters increase recognition by up to 41% and boost ad effectiveness by 22%.* Plus, they’re reusable across channels with no training, no turnover. Kids want coloring pages of her. Staff want to dress her up for holidays. She becomes a team mascot and a marketing machine. It’s a simple, scalable way to build consistency, connect with your audience, and create a brand people actually look forward to seeing.

Mascots do more than make people smile, they create measurable value for your brand. When you introduce a character like Mrs. Bubbles, a camel, or even a squirting raptor into your marketing, you’re not just adding flair, you’re building a recognizable visual asset. A well-designed character becomes part of your intellectual property, one that contributes to brand equity and can even increase the resale value of your business. Buyers don’t just want clean equipment - they want a brand people already recognize and remember.

Businesses with strong, character-driven branding often command higher valuations because they come with baked-in customer loyalty, content systems, and local name recognition. A fun, consistent mascot becomes a selfmarketing tool that works across platforms and campaigns, requiring less day-to-day input from you or your team. It’s reusable, adaptable, and always on-message.

Characters and mascots make marketing easier and more effective by giving your brand a voice that’s always on and always ready. Instead of reinventing the wheel every time you need a social post, promotion, or email, you’ve got a consistent personality to deliver the message with charm and style. Rather than saying “We’re offering 20% off,” Mrs. Bubbles can playfully whisper, “Uh-oh… someone left the suds on sale again.” It’s the kind of messaging that cuts through the noise and actually sticks. With a character in place, brainstorming becomes less of a chore and more of a conversation because you’re not starting with a blank page, you’re building off a voice your audience already knows and loves. Plus, for your customers, that voice makes the content more fun to read. Instead of skimming past another dry membership reminder, they’ll pause if a frog hops on screen saying, “Join the pond and save some green!”

But where mascots really shine is in consistency, which is something every car wash business owner knows is tough to maintain when teams change. Your social media manager might move on, your best vehicle prepper might head off to college, and your general manager could get promoted or move to a competitor’s wash. But your mascot? She still shows up, she still delivers, and she still connects with your team and car washers. That kind of stability is priceless in a business where staff turnover is part of the game. Customers may not remember every team member who helped them

last time, but they will remember Mrs. Bubbles or that splashy dinosaur. Just look at Duolingo Owl. Duo the Owl isn’t just a logo, he’s a meme-generating, tiktok stalking, fandom-building, content-creating legend. You probably have no idea who runs their marketing - or if it’s all AI nowbut you know that owl!

Your car wash mascot might not go viral tomorrow, but with the right character, you’ll have a brand asset that endures. It will show up on signs, in posts, and in customers’ minds, no matter what’s happening behind the scenes.

A great mascot isn’t just a fun addition. It’s a strategic investment in your brand’s future. It builds recognition, simplifies your marketing, strengthens community ties, and brings a consistent, trusted voice to your business no matter what changes in staffing or behind the scenes. Whether it’s a raptor with a water line or a cupcake with bubble hair and a bubbly personality, the right character becomes the face customers remember and the reason they keep coming back. So go ahead and give your car wash a face! Your car wash might have the best soaps, fastest dryers, and cleanest vacuums in town, but if you want to be unforgettable, it’s time to add a little character (ah, see what I did there?).

Whether it’s a prehistoric protector like Dino Clean’s towering dinosaurs, a cheeky personality like Mrs. Bubbles, mascots give your business a heartbeat. They’re the voice, face, and personality of your brand, working 24/7, immune to turnover, and built to last. So go ahead. Let your car wash roar, bubble, or hoot. It might just be the smartest (and cutest) business decision you’ll ever make.

*Source: Ipsos Global Study on Brand Characters, 2022.

How to Create a Mascot That Works

• Start with Your Story

Tap into what makes your wash unique. Maybe it’s your location, your personality, or a family story. Authenticity creates connection.

• Define the Personality

Is your mascot playful, wise, sassy, or sweet? Give them a clear voice and tone that fits your brand and makes content creation easier.

• Design for Flexibility

Make sure your mascot looks great everywhere - no matter what size she’s printed. She must look great on signs, social media, coloring pages, embroidered, and stickers.

• Put Them to Work

Let your mascot “speak” in posts, star in videos, and interact with customers. The more places they show up, the more recognizable they become. They don’t need to be a costume, they can be just a digital version. Let them start working online.

• Stay Consistent

Your staff might change, but your mascot shouldn’t. That familiar face builds trust and gives your brand lasting personality.

- Mel Ohlinger, Ohm Co & SCWA Member

Excellent

Coverage

Package

Special

Replacement Cost

CARWASH PROGRAM FEATURES

• Equipment Breakdown Coverage

• Crime Coverage - Theft of Money

• Sign Coverage

• Glass Coverage

• Choice of Deductibles Available

• Accounts Receivable

• Ordinance of Law

• Outdoor Property

• Money and Securities

• Valuable Papers and Records

• Newly Acquired or Constructed Property

• Hired and Non-Owned Auto Liability

OPTIONAL COVERAGES AVAILABLE

• Business Auto

• Garagekeepers Liability

• Workers Compensation

• Commercial Umbrella or Excess General Liability

• Flood

• Windstorm

• Builder's Risk

• Lessor's Risk

• Bonds

• Employment Practices Liability

• Cyber Liability

aving provided consulting, training, and operational assessments at detail shops around the country, I’ve seen it all: Stand-alone detail shops, detail centers at car washes, detail departments at dealerships. I’ve seen a range of shops from those that are absolute pits all the way up to multimillion-dollar brand-sparkling-new buildings.

The most frustrating scenario for me is to go into an operation in which the owner has invested heavily in the shop set-up without consulting with someone about the facility elements that can be included to maximize the efficiency and effectiveness of the detail operation. I can offer many examples of situations in which a simple design fix could save hundreds of hours of labor costs per year. If you run a car wash or other operation and are considering adding detailing, here are the questions that you must answer. I encourage anyone to contact a consultant in the detail industry before designing, building, outfitting, or purchasing supplies for a detail center. I can guarantee that such a consultation will end up saving you countless dollars of misspent money, as well as the unknown cost of years of unnecessarily inefficient operation.

Services Provided

The types of services that will be provided has a major impact on the design of the facility. Candid conversations must be had to determine the list of services that best fit the community.

• What kind of services will be provided by the detail center?

{ Which types of “foundational” detailing services?

Express detailing?

Full-service detailing?

Wholesale, dealership, or fleet detailing?

Hand washing?

{ Specialized Auto Appearance Services?

Premium Appearance Protection, i.e., Ceramic coating?

Advanced detailing services, i.e., paint correction, wheel polishing, glass polishing, odor removal, headlight removal, convertible top rejuvenation, trim restoration

{ Additional reconditioning services?

Paintless dent and ding removal,

Windshield chip repair,

Leather re-dyeing and interior surface repair,

Painted wheel repair, and,

Minor body paint repairs and spot-blending

{ Cosmetic enhancement and customization services (tint, wraps, aftermarket installations)?

• Is it possible that any of the listed services could be added in the future even though they are not currently offered?

• Will you need a “clean” bay for specialized application services?

The “prep wash”, which is a thorough bathing of the vehicle in preparation for detailing, is far more extensive than a simple maintenance wash provided by an automatic car wash. Since washing is such an important part of the detailing process, it is important to figure out how and where this activity will occur. And, providing full-service hand-washing adds a new twist to the space considerations.

• What types of car washing will we need to do for the detail shop?

{ Full-service wash

{ Prep wash for express detailing

{ Prep wash for full-service detailing

{ Custom or special needs wash (e.g., hand wash, oversize vehicle wash, decontamination)

• What’s the best way to have cars washed?

• Do we need a separate wash bay for the detailers?

• Does an automatic car wash make sense?

• Why can’t we just let the detailers wash their cars in the automatic car wash?

• How do we ensure spot-free rinsing? Is it even important?

• What’s to be done with the runoff?

How much space is needed with respect to the expected number of vehicles processed per day and the types of services to be provided? Not enough workspace is a common mistake in designing buildings intended to be used for detailing.

• How many bays do we need?

• What types of vehicles will be serviced? Passenger, RV, truck, boat?

• Is it possible in the future to have an increased number of vehicles processed per day?

• How large should the bays be?

• What about non-operational space?

{ Utility room

{ Employee accommodation

{ Counter space

and above par for wash results to reach maximum efficiency. Monitoring the equipment with daily and weekly checks are a must to prevent potential mishaps or out-of-control usage — water, chemistry, etc.

{ Manager’s office space

{ Customer lounge

{ Restrooms

{ Storage Vehicle Flow

“Speaking from the standpoint of our systems only, if completely biodegradable chemicals are always used and routine maintenance followed, quarterly nutrients need to be added to the system, and an annual filter change is required,” Gibney says.

Unimpaired movement of vehicle is critical to reducing wasted time. Getting cars in and out of detail bays, as well as moving from the wash bay to the detail bay, as well as incoming customer vehicle movement . . . these are all things that must be considered when laying out the overall footprint of the facility.

It’s one thing to have a state-of-the-art working area, but we must also take serious consideration about the facilities that are necessary to foster hospitality toward our customers.

• How will the vehicles arrive to the shop?

• Do you expect to have customers dropping off vehicles?

• Do you expect to have off-the-street drop-in customers?

If you have multiple checking or savings accounts, consider consolidating to one of each, preferably at the same bank-more accounts mean higher odds of overdrafts. Especially troublesome are accounts with automated withdrawals or payments-easily overdrawn if no one is paying close attention. If there are lots of CDs, savings accounts and/ or moneymarket accounts at different institutions, some could be easily overlooked.

• Are you offering while-you-wait services?

• Does it make sense to create a “destination” atmosphere?

• Will customer refreshments be needed?

• What are the vehicle movement issues at a detail center?

{ Getting cars in and out of the detail bays

{ Moving cars from the wash tunnel exit to the detail area

If maintained correctly, the final results provided by closed-loop carwashing should rival conventional wash quality, the NWI team states. The path to achieve this quality is not without some increased maintenance requirements and equipment costs. But, these factors should be weighed against the savings of reduced water and sewer costs to determine the feasibility and profitability of closed-loop operation.

{ Moving cars from the detail wash bay to the detail bays

{ Receiving incoming detail customers

• Where will the vehicle drop-off area be located?

Ideally, a closed-loop wash is using completely biodegradable chemicals, operating a true restoration system that removes chemicals from the water and following the manufacturer’s required maintenance, Gibney concludes. If so, customers will not be able to tell any difference in wash quality compared to the use of fresh water.

• Where will finished vehicles be parked?

• Are finished vehicle likely to be soiled while parked after completion?

• Where will keys be housed?

• How many times do the vehicles need to be moved during the detail process?

By freelance contributor, Jonathan Abrams, Professional Carwashing & Detailing .

• Will detail bay entrances be blocked by other activities occurring on the property?

• What direction do the bay entrances face, and can this have an impact on production?

• What kind of bay doors will be used?

{ How will they be opened/closed?

“People” Space

Employees may need to have dedicated space for breaking. The manager of a high-volume shop will likely need office space or desktop area for all the administrative tasks. And what about the customers???

• Employees Space:

{ Will employees be changing on-site?

{ Where will employees lunch and break?

Could someone step in and successfully manage your financial affairs if you are unable to do so yourself? Of course, you could execute a "financial power of attorney'' designating someone as a "financial agent" to act on your behalf in financial matters if you're incapacitated. But just drafting that document with an attorney, which you should do, doesn't guarantee that this relative, friend or adviser will know what to do. The issue isn't so much whether he/ she lacks financial savvy-it's that figuring out someone else's finances on the fly is a massive challenge.

{ Where will employees keep their personal belongings?

{ Employee restroom

• Manager Space:

Having a financial plan in place for health emergencies is especially on many people's minds now because of the coronavirus pandemic, but an incapacitating emergency could come up at any time. Here's how to prepare finances for an emergency handoff…

{ Dedicated office or desk behind the counter

• Customer Space:

{ Is there a need for a sales counter or reception area?

{ Waiting area?

{ Customer restroom?

{ Space for retail sales?

Consolidate credit cards and bank accounts. Missed credit card payments are among the most common missteps when someone takes over your finances. The more cards you use, the greater the odds that there will be a problem. Cut back to only two, if possible.

How will your customers interface with your operation?

• Will it be necessary to have a separate customer restroom facility?

• Will you offer customer pick-up and drop-off?

Customer Parking and Vehicle Storage

Stick with paper statements. It's perfectly fine for you to access your accounts online, but it's easy for someone else to overlook or be shut out of your online only accounts, which may be difficult to access. Bills and statements that arrive in the mail provide a wonderful fail-safe. That's true even if the financial agent doesn't live near you-your mail can be forwarded to that person by the post office or a trusted neighbor.

What will be done with vehicles that are in transition or completed? We want customers to feel like they have a clear place to arrive.

• How many customers do you expect to entertain in person at any one time?

• Will drop-off customers need a space to park their vehicles? How many?

• What will you do with completed vehicles?

• Will you be keeping vehicles overnight?

Create a concise guide to your finances. Having all of your financial information in one place will save your designated agent a lot of time and greatly reduce the odds that something will be missed. Handwrite this list, or type and print it. But don't save it on your computer or send it via e-mail-that would increase the risk that this sensitive info could be stolen. Among the details to include...

• Is a pick-up and drop-off lane or area needed?

Income sources. Note how each of your income streams arrives-pensions and Social Security payments often are direct-deposited into bank accounts, for example. If you

Chemicals are such a critical piece in the detail process.

• Waste testing that meets any landfill or disposal site requirements.

• Soil, water, waste and air testing.

Chris Ewert • (512) 891-7777 cewert@austin.rr.com 8127 Mesa Drive, #C-305 • Austin, TX 78759 www.integritytestingaustin.com

can attest to the exponential increase of technology inside facilities since the dawn of professional carwashing. From automated pay stations to modern wash media to effective drying systems, the pace of technical advancement has been astounding.

washes depend on functional speed and accuracy, and these important factors are generated by the best integrated controller and management systems.

This continued development has created across-theboard change in the car care industry. Speed is king, and wash cycle speeds have surged as daily vehicle counts have climbed. But, this process of acceleration also ushered in the expectation of new services and improved wash results. Now, both tight timing and effective operation have become important for every wash cycle performed.

Breeze Thru Carwash

Brown Bear Car Washes

Champion Xpress Carwash

Mammoth Holdings

Metro Express Car Washes

Mister Car Wash

Sonny’s The CarWash Factory

WhiteWater Express Car Wash

To maintain pace in this hyper-competitive market, every owner must stay current on the capabilities of today’s carwash control systems. Often called the “brain” of the modern carwash, these carwash controllers connect the different phases of automated operation. Wash equipment, business systems, HR functions and more communicate and share information. Only by learning about this technology and implementing industry best practices can a carwash owner hope to ensure dependable and profitable operation.

Benny’s Car Wash

Carisma Wash

CarWash808 Express

CLEAN

Cruise Car Wash

Living H2O

Snap Clean Car Wash

Soft Suds

Brian Bath with Innovative Control Systems notes that the newest carwash controllers allow vehicles to be processed faster than ever before. High-volume express

The list of ways a controller keeps a carwash moving is impressive. Model controllers across the industry have very efficient abilities that allow bumper-to-bumper washing while providing precise results. Bath points out that new controllers do this by allowing different types of automation, like raising the roller, to maintain a regular flow of vehicles.

Brink Results

Coleman Hanna Carwash Systems

DRB

Erling Sales & Service

G&G Industrial Lighting

Innovative Control Systems

Today, car-per-hour conveyor speeds currently vary in the industry — speeds of 150 cars per hour up to even 220 cars per hour are common across the express world, Bath reveals. The large tunnel properties where operators have 20-plus vacuum spaces have really pushed up speeds and profits across the board.

Micrologic Associates

Motor City Wash Works

National Carwash Solutions

Pro-Tech Service Company

Overall, carwash tunnel controllers help operators dial in their profits and provide a clean, dry and shiny vehicle, according to Todd Davy, senior vice president of sales for DRB Systems. Other advances that modern technology allows are integration of a controller and a point-of-sale (POS) system. To this end, the controller communicates with the POS system to make sure every customer receives the wash services for which he or she paid.

Qual Chem

Quest Car Care Products

Rinsed - Carwash CRM

Sergeant Sudz

Simple Wash Solutions

Texas Wash Works

Tommy Car Wash Systems

Ver-Tech Labs

Time-wasting and costly rewashes can become a problem if a vehicle receives the wrong services. Modern controllers work with other systems to address this issue.

Proper management of detailing chemicals can save a lot of money and downtime.

• What is the standard list of chemicals needed?

{ Express detailing { Full-service detailing { Specialized detailing services

• How will concentrates be diluted?

• How will chemicals be dispensed?

• How much storage will we need OR how much chemical will we need to have on hand to prevent running out between orders?

• Where will back-up chemical supply be stored?

• Is there space to temporarily store a pallet full of supplies without blocking production?

• Do we need treated water for dilution?

• Are any of the chemical dangerous, requiring special handling or storage?

It is common to see less than adequate electrical supply, both in existing and planned facilities. You simply must determine the expected and unexpected electrical demands of a bustling, machine-dependent detail operation.

• How many outlets do we need?

• Where should they be placed?

• How many circuits and what amperage per circuit?

• Do we need GFCI?

• How do we reduce hazards created by too many cords on the floor?

• Will we need any high-voltage circuits?

• What about charging stations for battery operated equipment?

This one of my biggest frustrations walking into old and new detail shops. There simply is not enough light and incorrect placement of existing fixtures, so that technicians are constantly struggling to be able to see what they are doing. Detailing is an activity that is highly reliant on visual feedback while working, as well as visual inspection.

• Why is lighting important for best results?

• What kind of lights provide best illumination for vehicle paint correction?

• Are overhead lights enough?

• Where should lights be placed to ensure proper illumination of the vehicle?

• Is it possible to bring in natural light?

• What about portable lighting?

• Do we need lighting that is brought into the car?

• How do we safely illuminate the wash bay?

• What about the high-end detail lights that are available?

• Will the heat or brightness of the sun hinder results during different times of the day?

I have as yet to walk into a detail facility that has enough towels. And it seams that very few detail operators know how to correctly care for the towels they have.

• What are the main issues with towels?

{ What kinds of towels are needed?

{ The variety or different types of towels that are needed?

{ Towel maintenance—washing and storage?

{ Quantity of towels needed?

• What about using a towel service?

• Is microfiber the best?

• How do I know which type of microfiber to use?

• Where will we get towels from?

{ Is the cheapest source okay?

• How many different types of towels do we need and how many of each?

• How do we keep from running out of clean towels during the workweek?

• How do we store soiled towels?

• How will they be washed?

Removing the excess dirt and debris from the inside of the car before starting the interior detail work is just as important as a good exterior wash before detailing the outside. Inadequate vacuuming equipment wastes time.

• How will we vacuum vehicles?

• Should we have a central vac system?

• Aren’t store-bought shop vacuums sufficient?

• Where do we store vacuums when not in use?

• What size vacuum hose is best and how long should the hose be?

• What about vacuum attachments?

• Will we use air purging as part of the vacuum step?

{ What type of air gun should be used?

Water is as critical to a detail operation as electrical power. Compressed air can also be important.

• Do we need a wash basin?

• Do we need spigots and where?

• Will compressed air be used as a detailing tool?

• Will we be using pneumatic polishers?

• Where should the compressor be housed?

• How do we supply air to the detail bays?

• How many air outlets and hoses are needed?

A sizeable portion of the interior detail deals with carpeting, not to mention fabric seats. There are several options for completing this task.

• How will we clean carpets and fabric seats?

• What’s the best equipment for this?

FEBRUARY 25 - 27, 2026

• Do we need built-in equipment for this?

• Where will portable equipment be stored when not in use?

• How do we reduce damage exposure to equipment in the shop?

Paint Polishing Equipment

• Do we need polishing machines?

• What types of machines do we need?

{ How many?

{ Which types are the easiest to learn and least likely to cause damage?

• What kinds of polishing pads do we need?

{ How many?

• Do we need paint measuring equipment?

Employees: Recruitment, Training, Retention, and Continuing Education

• Where should I get my detail employees from?

• Do I hire experienced detailers or train them myself?

{ How do I train employees?

{ Do I need an in-house training system?

• How do I incentivize longevity?

• Should my detailing technicians be “certified”?

• How do I keep my detailing technicians up-to-date on the current trends in detailing?

It seems like there are always more questions to answer, and here are some of the leftovers that are also very important.

• Is temperature and humidity control in the detail area really necessary?

• What will we do to manage this?

• Do we need a “clean room” bay that is separate from the rest of the shop?

• What type of flooring is going to be best?

• What are the concerns when considering what type of flooring to install?

• Where will detail technicians store required small tools, supplies, and towels?

• How do we deal with trash?

Summary

If you take an honest and thorough read of this article, you will realize there are almost too many questions to answer before designing or improving a detail operation. Doing it alone, especially with little or no actual hands-on detailing experience, can lead to many avoidable mistakes that lead to lost efficiency, frustration, and having to buy things twice— making an incorrect inadequate initial purchase followed by the correct purchase (hopefully) the second time. Talk with an expert!

- Prentice St. Clair, CD-SV-RV, RIT & SCWA Member

US Car Wash Market to Witness Strong Growth, Expected to Reach US$ 19.8 Bn by 2031 with a 5.8% CAGR

The US car wash market is rapidly evolving into one of the most dynamic sectors in the automotive service industry. Currently valued at around US$14.9 billion in 2024, the market is anticipated to grow at a compound annual growth rate (CAGR) of 5.8%, reaching approximately US$19.8 billion by 2031, according to a detailed analysis by Persistence Market Research. This growth is primarily driven by consumers’ increasing inclination toward convenience, timeefficiency, and automated service experiences, particularly in urban areas.

The market’s momentum is significantly fueled by the automatic and tunnel car wash segments, which are gaining traction due to faster service and water conservation technologies. Commercial end-users, including fleet owners and car dealerships, dominate the demand curve. Geographically, the Southern US leads the market, attributed to higher car ownership rates, favorable weather for yearround operations, and a higher concentration of highvolume car wash outlets.

Key Highlights from the Report:

• The US car wash market is expected to reach US$19.8 Bn by 2031, growing at a CAGR of 5.8%.

• Rising consumer preference for automatic and touchless car wash services is accelerating demand.

• The commercial vehicle segment remains the leading end-user group, boosting service frequency.

• The Southern region dominates the market owing to favorable climate and higher car density.

• Sustainability efforts are pushing eco-friendly car wash solutions into the spotlight.

• Mobile and subscription-based car wash services are seeing rapid adoption across metros.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/ samples/34495

Brookshire Grocery Company.

“I am excited to join the WhiteWater team at such a fantastic time for the Company. The WhiteWater culture and teamfocused approach is extraordinary, and I look forward to working with the leadership team to drive continued growth and financial results,” said Michael Arnett, CFO of WhiteWater Express.

“We are thrilled to welcome Michael as our CFO and learn not only from his financial experience but his approach to company and team growth.”

Michael will play a key role in driving the financial strategy as growth continues in existing and new markets and will be instrumental in strengthening the company’s financial foundation.

“We are thrilled to welcome Michael as our CFO and learn not only from his financial experience but his approach to company and team growth. Michael aligns fully with WhiteWater’s culture and our belief in what a great company should be,” said Steve Mathis, co-founder and CEO of WhiteWater Express.

With the addition of Michael to the WhiteWater team, Henry Shine will be stepping into a newly created leadership role of Chief Strategy Officer. In this expanded role, he will continue to lead de novo and acquisition growth as Head of Development while also driving strategic direction across key corporate functions. This position will enable Henry to concentrate on shaping and advancing WhiteWater’s longterm growth strategy.

Buc-ee’s in Fort Worth is finally getting a feature that drivers have been waiting for

Buc-ee’s appears finally ready to begin construction on a car wash at its far north Fort Worth travel center.

New Executive Leadership at WhiteWater Express Positions Company for Continued Growth

WhiteWater Express welcomes its new Chief Financial Officer (CFO), Michael Arnett, to the corporate team. Henry Shine moves to a newly created role of Chief Strategy Officer.

Michael Arnett joins WhiteWater Express with over 15 years of CFO experience at Academy Sports + Outdoors and

The Star-Telegram reported exactly one year ago that Bucee’s had filed paperwork with the state indicating a car wash was coming to its travel center at 15901 North Freeway, along Interstate 35W near Tanger Outlets and the Texas Motor Speedway.

The records suggested the car wash would open in August 2023, but construction never began.

This week, Buc-ee’s filed for a commercial building permit with the city of Fort Worth to build the car wash. The $6 million project is out to bid for a contractor.

This will be the sixth Buc-ee’s in Texas to have a car wash.

The nearest other Buc-ee’s with a car wash is in Denton on Interstate 35E.

The Buc-ee’s in Katy holds the world record for longest car wash at 255 feet, according to the company.

Buc-ee’s is famous for boasting its world record for having the largest convenience store, which opened this summer in east Tennessee, and its car washes are equally spacious. The Fort Worth car wash will be 8,606 square feet, according to the city building permit. The company claims that its car wash in Katy, built in 2017, holds the world record for being the longest — it takes five minutes to roll through.

The Buc-ee’s in Katy holds the world record for longest car wash at 255 feet, according to the company. Buc-ee’s The privately owned Buc-ee’s, based in suburban Houston, was for many years only found along Texas highways. But lately, the Beaver has been on a building spree with new locations across the U.S. . There are Buc-ee’s stores coming to northern Colorado, the Gulf Coast of Mississippi, upstate South Carolina, central Ohio and even Wisconsin. Buc-ee’s has 47 travel centers now, including in Alabama, Florida, Georgia, Tennessee, Kentucky and South Carolina. Experts say Buc-ee’s has what it takes to succeed beyond the borders of Texas, as customers consider a visit to a store to be more of an experience rather than a simple pit stop. A new Buc-ee’s is planned for Hillsboro, along Interstate 35 roughly between Fort Worth and Waco, in 2024.

Terpstra serviced major oil companies including Shell Canada, Petro Canada and Parkland Corporation.

He also served as national health and safety officer at Mondo.

Terpstra uses his extensive knowledge and hands-on experience to oversee growing service and installation operations.

“We are fortunate to have John on our team,” said Brett Bunston, president of Deltic Wash Force.

“His decades of experience and unwavering commitment to quality work perfectly align with our mission to provide outstanding service and innovative solutions to the carwash industry. His contributions have already had a tremendous impact, and we look forward to the continued influence he will have as we grow.”

Terpstra’s leadership improves operations and enhances the customer experience at Deltic Wash Force.

“I’m proud to be a part of Deltic Wash Force and to work alongside such a talented, dedicated team,” said John Terpstra. “I’m excited to continue contributing my expertise and help Deltic Wash Force grow and succeed in the carwash industry.”

Deltic Wash Force spotlights Carwash industry leader John Terpstra

Deltic Wash Force celebrates carwash industry leader John Terpstra’s 40-plus years of service and leadership in operations.

BARRIE, Ontario, Canada — Deltic Wash Force proudly highlights the exceptional contributions of carwash industry leader John Terpstra.

He plays an integral role on the team as director of service and installation.

With over 40 years of industry experience, Terpstra brings unmatched expertise and leadership.

He strengthens the company’s commitment to delivering top-tier service and installation to its customers.

Terpstra’s career covers every facet of the carwash industry. He worked for Hannah Car Wash Systems, which later merged with Sherman Wash Systems.

He also operated his own wash for several years.

Terpstra held key roles at MacNeil Wash Systems. He contributed to two Canadian companies and eventually advanced to Mondo Products.

NCS later acquired Mondo Products.

Car wash complex near Boca Raton will work with nonprofit to hire people with disabilities

El Car Wash and JARC Florida have struck a jobs partnership for the company’s new car wash and storage complex on Glades Road near Lyons Road.

A new car wash coming to suburban Boca Raton will employ adults with intellectual and developmental disabilities, according to the agent representing El Car Wash.

Don Hearing said the car wash, which will be opening its 14th location in Palm Beach County, will work with the Jewish Association for Residential Care to hire adults with developmental disabilities that are under the care of JARC Florida.

JARC’s executive director, Jeffrey Zirulnick, said in his letter of support “that business partnerships such as this strengthen social relationships, teaches responsibility, stimulates the senses and allows care-recipients to develop a sense of purpose and confidence.”

County Commissioner Maria Sachs said she was pleased to learn that the business and the nonprofit will work together to help those with developmental disabilities.

The car wash, along with a new self-storage facility, will be on Glades Road, about 430 feet west of the Lyons Road intersection. County commissioners unanimously on April 24 approved a variance for El Car Wash LLC to build the 3,429-square foot car wash and a 116,770-square-foot selfstorage building.

El Car Wash bought the 4.2-acre parcel from Christ Fellowship Church in August 2024 for $6 million. The company needed a variance because the site was required

MADE IN THE U.S.A.

REMOTE SYSTEM ACCESS REAL TIME EMAIL ALERTS Choose top-of-the-line features to invest in your future.

CUSTOMIZED INTERFACE ADAPTABLE INTEGRATION UL508A CERTIFIED

to be 5 acres. Hearing said his client was unable to purchase additional land to comply with the 5-acre requirement. Access will be from Glades Road. The car wash will have 34 vacuum stations. Hearing produced letters of support from the Jewish Federation, the West Boca Community Council and Lotus Palm, a neighborhood near the car-wash site. Another El Car wash is coming to Palm Beach County; this one near the Glades and Lyons road intersection, west of Boca Raton

The SCWA members listed below have joined SCWA since our last issue. We Appreciate Your Support!

Shay Baig Turtle Wax Pro Park Ridge IL

As for the self-storage facility, Hearing said it will have a minimal demand on public services. He noted that safety will be insured through the use of high-definition cameras. Entry will be controlled with real-time monitoring. With the population growing in the region, Hearing said there is a demand for another car wash and self-storage. Christ Fellowship buildings on the parcel will be demolished to make way for redevelopment.

“The variance request is designed to ensure that the proposed development will be compatible with surrounding land uses,” the applicant said in documents filed with the county. Landscaping and buffering will mitigate any potential impacts.

El Car Wash, a Miami-based chain, has been expanding its footprint in Palm Beach County. Four years ago, it bought Motor City Car Wash’s three sites in the county for $10.2 million and also has added new locations.

Mark Ferris Lone Star Shine Celina CA

Omar Molinari

Brown Bear Car Washes-CWE Seattle WA

Steve Palmer

Brown Bear Car Washes-CWE Seattle WA

Jacob Shenderovich

Brown Bear Car Washes-CWE Seattle WA

Aaron Breazeale Quik’s Carwash Fort Worth TX

Blake Harrelson myAnalyst Myrtle Beach SC

Mel Ohlinger OhmCo Neenah WI

Cori Rodgers Quality Wash Solutions Dayton OH

Angela Stubbs Stubbs Insurance & Financial Austin TX

Scott Uszynski Sharky’s Carwash Keller TX

fter clawing back more than $1 billion in back taxes last year, a more assertive IRS has pledged to raise tax-return audit rates by more than 50% on wealthy individuals by 2026. Many ongoing disputes with taxpayers will wind up in US Tax Court, an independent judicial authority created by Congress for taxpayers fighting IRS determinations. The Tax Court’s judgments often provide valuable insight about tax matters that you can use to avoid unnecessary penalties, deficiencies and mistakes…

Bottom Line Personal asked leading accountants Edward Mendlowitz, CPA, ABV, PFS, and Maryann Reyes, CPA, PFS, to highlight four recent cases and lessons that will help you keep more of your money…

The Not-So-Innocent Spouse

Case study: Sydney Ann Chaney Thomas lived with her husband, Tracy Thomas, and two daughters in an affluent suburb of San Francisco. After the 2007–2009 recession, the marriage began to break down and the couple became mired in credit card and mortgage debt. To help pay that debt, they took early withdrawals from retirement accounts totaling about $263,000 during 2012, 2013 and 2014—but they didn’t pay the IRS the full amount of taxes due on their joint tax return for those years. Tracy Thomas assured his wife in texts that the “taxes and mortgages have been dealt with.” When he died suddenly in 2016, that proved to be false. The IRS mailed Sydney Thomas a Notice of Deficiency (NOD) for $60,633 plus accrued interest. She petitioned for tax relief as an “innocent spouse,” claiming she shouldn’t be responsible for the deficiency and penalty because her husband had been verbally and physically abusive to her, preventing her from questioning or challenging payment of the liability.

IRS position: When married couples sign a joint federal income tax return computed on their aggregate incomes, each spouse is fully liable for the accuracy of the return and for the entire amount of tax found to be owing.

Tax Court ruling: Ms. Thomas was liable for all back taxes and penalties. The judge found her lacking in two criteria necessary to qualify for innocent-spouse relief. First—was Ms. Thomas’s lack of knowledge about the unpaid taxes credible? Given the couple’s troubled financial history, the judge found there was little reason for her to believe that her late husband had actually paid the taxes or trust his word. Second—did economic hardship make her unable to pay the back taxes? Following Mr. Thomas’s death and receipt of the IRS NOD, Ms. Thomas had spent lavishly, traveling to Rome, Paris and Florence. She bought a Jaguar Land Rover and paid for her daughters’ cell phones and car insurances. Lesson: Many spouses let their partners take care of the taxes and money without realizing they are personally responsible for liabilities. If something goes wrong, innocentspouse cases are very difficult to win in court. Before you sign a joint return, at the very least, study the first two pages of the return, and understand what your joint income and your deductible expenses are, as well as the taxes you both

owe. If you’re worried about a spouse’s tax misdeeds, you have the option to switch to a “married, filing separately” return. This severs joint liability, although it can reduce some tax breaks.

Sydney Ann Chaney Thomas v. Commissioner, 162 T.C. NO. 2 Taxes on Legal Settlements and Jury Awards

Case study: In 2005, the Indiana State Police investigated the death of a 14-year-old girl. Her stepfather Roman Finnegan and his wife, Lynnette, were arrested on charges of medical neglect, and two other children were removed from the home and placed in foster care. Ultimately, all criminal charges against the Finnegans were dismissed. They then sued for violations of their civil rights. Roman Finnegan dramatically testified to a jury, “There were days that I could not get out of bed. I had attacks in which I couldn’t breathe. I thought they were heart attacks, but they were diagnosed as post-traumatic stress syndrome (PTSD).” The Finnegans won their court case, and in 2017, accepted a $25 million settlement. They did not include the proceeds in their gross income on their tax returns because they maintained the PTSD was caused by the actions of the lawsuit’s defendants, making the settlement money excludable from taxation. IRS position: The settlement proceeds were includable in gross income and subject to tax. Under federal law, damage awards or settlements are excludable from taxation only if they were received “on account of personal physical injuries or physical sickness.”

US Tax Court ruling: The Court sided with the IRS. For damages to be excludable, there must be a direct causal link between the legal action and the physical injury or sickness. Emotional distress typically does not qualify for exclusion. Moreover, the Finnegans’ original lawsuit did not seek damages for PTSD, and the subsequent settlement clearly established that the payment was compensation for violations of the plaintiffs’ constitutional rights stemming from the defendants’ conduct and the emotional pain caused therefrom.

Lesson: Many people are awarded legal settlements for mental, emotional and physical injuries they have suffered. You and your attorney should deliberate over potential damages and craft the wording of the settlement document with an eye toward tax implications.

Estate of Roman J. Finnegan and Lynnette Finnegan v. Commissioner, T.C. Summary Op. 2024-2

Careless Recordkeeping

Case study: Patricia Chappell had worked as a tax-return preparer since 1996. During tax year 2015, she operated a sole proprietorship called Quik Tax in Ohio. On Schedule C of her federal tax return Ms. Chappell reported gross receipts of $152,521 and expenses totaling $140,768, which included (among other things) vehicle expenses of $15,385 for the Toyota Prius that she used for business and personal driving. At the end of March 2015, she started tracking her mileage using a cell phone GPS app. Of the roughly 15,000

miles she drove, she reported about 13,500 for business and 1,500 for personal use. The IRS disallowed all her business expenses related to her vehicle and assessed her an accuracyrelated penalty of 20% of the underpayment of her taxes. Ms. Chappell disputed the penalty and claimed any inaccuracies were, in part, caused by having to care for her elderly disabled mother that year and suffering herself from a painful tumor.

IRS position: Ms. Chappell’s recordkeeping of her deductions was careless and inaccurate. The 20% penalty was applied because her negligence caused a substantial underpayment of taxes, which is typically defined as an amount greater than $5,000, or 10% of the tax that was required to be shown on the taxpayer’s return.

US Tax Court ruling: The Court reduced Ms. Chapell’s vehicle expense deduction to $6,669. The judge noted that Ms. Chapell kept no driving mileage records for the first three months of the year, and her receipts for fuel, insurance, interest on a car loan, repairs, licensing fees and depreciation were flawed. While the Court sympathized with Ms. Chappell’s personal difficulties in 2015, it also refused to wave the accuracy-related penalty. As a professional tax preparer, she should have been well-acquainted with the substantiation requirements for business deductions.

Lesson: You must be especially vigilant about documentation when taking business deductions for property that also is used for personal reasons. The IRS may waive this penalty if it’s your first time underpaying or if you acted in good faith and there was a reasonable cause for the underpayment.

Patricia S. Chappell v. Commissioner, T.C. Memo 26309-18S

Safe Harbor from Early-Distribution Penalties

Case study: In 2018, Caren Kohl, who was in her early

50s and lived in New York, found herself in dire financial straits. To pay past rent and avoid eviction, she took a distribution of $10,342 from her retirement plan. She did not report that amount as income on her tax return, nor did she report or pay the 10% penalty required for the early withdrawal. The IRS caught the error and sent her a Notice of Deficiency (NOD). Ms. Kohl conceded she did owe taxes on the distribution, but she should not have to pay the 10% penalty because the SECURE 2.0 Retirement Act allows an exemption for taxpayers suffering financial emergencies.

IRS position: Ms. Kohl was subject to the penalty because she took a distribution before the age of age 59½. The cause for exemption that she provided— “unforeseeable or immediate financial needs relating to personal or family emergency expenses”—was not available in 2018.

US Tax Court ruling: Ms. Kohl was liable for the 10% penalty on her early distribution. The penalty exemption for financial emergencies granted by Congress did not go into effect until tax year 2024. Even if the exemption had applied, Ms. Kohl would been allowed a maximum penalty-free distribution of only $1,000.

Lesson: There now are more than 20 legitimate reasons you can avoid a 10% early-distribution penalty from the IRS, including being a survivor of domestic abuse or a terminally ill patient. For the full exemption list: Go to IRS.gov and search “early withdrawal exceptions”…then choose “Retirement Topics—Exceptions to tax on early distributions.” Important: Exemptions from penalties do not exempt you from any taxes you may owe on early distributions.

Caren Kohl v. Commissioner, T.C. Memo 2024-4 - Edward Mendlowitz, CPA, ABV, PFS BottomLine

■ Fragramatics 1600 hr Turbo Motor

■ Poly or aluminum dome

■ Computer controlled timer

■ UV protected graphics

■ Filters – Four-bag system uses high performance, synthetic filtration media with 15 sq. ft. filtration area. Two easy-access service doors on rear

■ 1-1/2” dia. vac hose – high-flex, vinyl, crushable, 15 ft. long. Includes cuff and polyethylene hand tool

■ ¼” x 25’ Wire braid or coil hose with inline gauge

Specifications

■ 1.25 HP ‘Big Dog’ high output compressor

■ Brushed Stainless Steel Tank and Main Cabinet

■ Coin acceptor – mechanical

■ Electrical - 120 V ac, 25 amps

■ Mounting - One internal and two external lugs with security collars. Uses 3/8” bolts for secure installation.

■ Tank Dimensions - 18.5”dia. x 42”h

■ Unit Weight - Net 145 lbs. Ship weight 185 lbs.

■ Ships in carton/pallet: 67”h x 32”w x 31”d

■ Multi-coin acceptor

■ Lighted dome

■ Debris catcher

Options

■ Dome colors: red, orange, yellow, green, blue, white

■ Hose colors: red, orange, yellow, green, blue, white, gray, black Now available with our new air detail tool

Remove battery corrosion from electrical devices. Turn off the device, and put on gloves and eye-glasses or goggles - battery chemicals can burn skin, and flecks of dried battery discharge can damage eyes. Put a few drops of lemon juice or vinegar on the affected area with a cotton swab to neutralize the whitish base-chemical discharge. Apply isopropyl alcohol to affected areas with a cotton swab or wipes - 90% to 99% rubbing alcohol is best. After cleaning: Wipe with a microfiber cloth... use a pencil eraser to polish smaller sections...use compressed gas labeled for cleaning electronics to get rid of fibers. Dry the device before replacing the batteries.

How much money to keep in checking. Your checking account should hold enough funds to cover one month’s living expenses, plus a cushion amount to cover another two weeks’ worth of costs. Bump that up to a full two months if you’re anticipating an event that will require extra cash, such as a vacation. The bulk of your emergency fund should sit in savings accounts.

President: Jeff Blansit Austin, TX

Treasurer: Don Witt Dallas, TX

Robert Andre Tamarac, FL

Robert Greene Darien, GA

Derek Martin Garden City, ID

olunteering keeps you young. Recent finding: Measured by mortality, immune function and organ integrity, people who volunteer age less rapidly than those who don’t. The strongest effects are seen in retirees but also occur in individuals who are still working. Volunteering at least four hours per week - 200 hours per year - shows the greatest anti-aging effects. But any amount of volunteering still has a positive effect those who volunteer between one and 49 hours per year age more slowly than those who neither work nor volunteer. Researchers believe volunteering not only gives a sense of purpose but also provides healthful physical activity.

Coffee and tea might stave off dementia. Recent finding: Drinking two or more cups of coffee daily was linked with 28% lower risk for dementia over seven years. Up to two daily cups of tea also lowered risk. These cognitive benefits may derive from anti-inflammatory plant compounds found in both beverages, since inflammation is suspected to play a role in the development of dementia.

President-Elect: Tim Jones Joelton, TN

Vendor Vice President: Ted Yamin, Jr. Imlay City, MI

Veronica Attlee Dallas, TX

Carl Howard Charlotte, NC

Vice President: Drew Congleton Montgomery, TX

Past President Representative: Ryan Darby Tucson, AZ

Tyler Furney New Braunfels, TX

Iona Kearney Berthoud, CO

Truth about LED bulb “life spans.” LED life span claims on packaging, which often say the bulbs last five to 10 years, are estimates based on manufacturers’ testing - individual bulbs may not last that long. What happens with real-world use: Tiny circuits inside the bulbs needed to switch from home AC power to the DC power have soldered connections that can fail...tiny spikes in electrical power to your home can cause bulbs to wear out...old or dirty sockets, which do not transfer electricity smoothly, can cause early bulb burnout... high humidity in your home can wear down LEDs’ electrical components. Also: Using dimmable LED bulbs in dimmers designed for incandescent bulbs may put extra strain on the LEDs, causing earlier bulb failure.

GPS travel apps that do more than give directions. Google Maps provides directions...allows you to mark your parking spot so you remember where you left your car... and lets you download maps if you are going somewhere without Internet service. Waze, another Google app, uses real-time data from other Waze users to give you the most ideal routes based on shifting traffic patterns. Apple Maps comes preinstalled on iPhones and has virtually all the same features as Google Maps. Mobile Passport Control lets you upload your passport info and answer questions such as the value of any souvenirs to help streamline the process of reentering the US from abroad...and even can get you into shorter lines for customs agents.

Failing to adhere to company dress codes can be grounds for dismissal - especially if you sign a document stating that you have read and understood the company’s handbook that includes a section on how the company expects people to dress and behave. Even on casual days, there are expectations about how employees will present themselves. If you can not adhere to these, the job will be a poor fit for you and the company...and the firm will be within its rights to terminate you for failure to adhere to policy requirements.

A fast USB car charger can be a good backup power source for emergencies or long car trips. The chargers can top up smartphones, tablets, laptops and other devices using the USB Power Delivery (USB-PD) standard. Super-fast UBS car chargers also may work with USB-C E inputs. Car power inverters already provide power from accessory ports which used to be for cigarette lighters but fast car chargers are more compact and self-contained, so you don’t also need a wall charger. Chargers to consider: UGREEN 130W USB C Car Charger (Amazon, $29)...Anker iPhone 16 USB-C Car Charger (Amazon, $39).

We have taken specific measures in designing our equipment to perform exceptional at line speeds in excess of 160 cars per hour. Simply said, we clean at

More Uptime