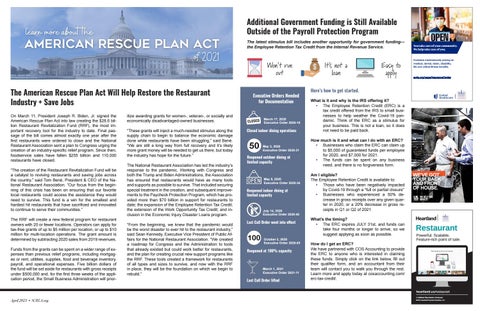

Additional Government Funding is Still Available Outside of the Payroll Protection Program The latest stimulus bill includes another opportunity for government funding— the Employee Retention Tax Credit from the Internal Revenue Service.

Won’t run out

The American Rescue Plan Act Will Help Restore the Restaurant Industry + Save Jobs On March 11, President Joseph R. Biden, Jr. signed the American Rescue Plan Act into law creating the $28.6 billion Restaurant Revitalization Fund (RRF), the most important recovery tool for the industry to date. Final passage of the bill comes almost exactly one year after the first restaurants were ordered to close and the National Restaurant Association sent a plan to Congress urging the creation of an industry-specific relief program. Since then, foodservice sales have fallen $255 billion and 110,000 restaurants have closed. “The creation of the Restaurant Revitalization Fund will be a catalyst to reviving restaurants and saving jobs across the country,” said Tom Bené, President & CEO of the National Restaurant Association. “Our focus from the beginning of this crisis has been on ensuring that our favorite local restaurants could access the assistance they would need to survive. This fund is a win for the smallest and hardest hit restaurants that have sacrificed and innovated to continue to serve their communities.” The RRF will create a new federal program for restaurant owners with 20 or fewer locations. Operators can apply for tax-free grants of up to $5 million per location, or up to $10 million for multi-location operations. The grant amount is determined by subtracting 2020 sales from 2019 revenues. Funds from the grants can be spent on a wider range of expenses than previous relief programs, including mortgages or rent, utilities, supplies, food and beverage inventory, payroll, and operational expenses. Five billion dollars of the fund will be set aside for restaurants with gross receipts under $500,000 and, for the first three weeks of the application period, the Small Business Administration will prior-

itize awarding grants for women-, veteran-, or socially and economically disadvantaged-owned businesses. “These grants will inject a much-needed stimulus along the supply chain to begin to balance the economic damage done while restaurants have been struggling,” said Bené. “We are still a long way from full recovery and it’s likely more grant money will be needed to get us there, but today the industry has hope for the future.” The National Restaurant Association has led the industry’s response to the pandemic. Working with Congress and both the Trump and Biden Administrations, the Association has ensured that restaurants would have as many tools and supports as possible to survive. That included securing special treatment in the creation, and subsequent improvements to the Paycheck Protection Program, which has provided more than $70 billion in support for restaurants to date; the expansion of the Employee Retention Tax Credit; the extension of the Work Opportunity Tax Credit; and inclusion in the Economic Injury Disaster Loans program. “From the beginning, we knew that the pandemic would be the worst disaster to ever hit to the restaurant industry,” said Sean Kennedy, Executive Vice President of Public Affairs for the National Restaurant Association. “We created a roadmap for Congress and the Administration to tools that already existed but could work better for restaurants, and the plan for creating crucial new support programs like the RRF. These tools created a framework for restaurants of all types and sizes to survive, and now with the RRF in place, they will be the foundation on which we begin to rebuild.”

Executive Orders Needed for Documentation

March 17, 2020 Executive Order 2020-10

Closed indoor dining operations

May 3, 2020 Executive Order 2020-31

Reopened outdoor dining at limited capacity

May 8, 2020 Executive Order 2020-34

Reopened indoor dining at limited capacity

July 14, 2020 Executive Order 2020-45

Last Call Order went into effect

October 2, 2020 Executive Order 2020-63

Reopened at 100% capacity

March 1, 2021 Executive Order 2021-11

Last Call Order lifted

It’s not a loan

Easy to apply

You take care of your community. We help take care of you.

Exclusive members-only pricing on medical, dental, vision, disability, life and critical illness benefits.

scrla.org/page/InsuranceCenter

Here’s how to get started. What is it and why is the IRS offering it? • The Employee Retention Credit (ERC) is a tax credit offered from the IRS to small businesses to help weather the Covid-19 pandemic. Think of the ERC as a stimulus for your business. This is not a loan, so it does not need to be paid back. How much is it and what can I do with an ERC? • Businesses who claim the ERC can claim up to $5,000 of guaranteed funds per employee for 2020, and $7,000 for 2021. • The funds can be spent on any business need, and there is no forgiveness form. Am I eligible? The Employee Retention Credit is available to: • Those who have been negatively impacted by Covid-19 through a “full or partial closure” • Businesses who experienced a 50% decrease in gross receipts over any given quarter in 2020, or a 20% decrease in gross receipts in Q1 or Q2 of 2021 What’s the timing? • The ERC expires JULY 31st, and funds can take four months or longer to arrive, so we suggest applying as soon as possible. How do I get an ERC? We have partnered with COS Accounting to provide the ERC to anyone who is interested in claiming these funds. Simply click on the link below, fill out their qualifier form, and an accountant from their team will contact you to walk you through the rest. Learn more and apply today at cosaccounting.com/ erc-tax-credit/.

WE’VE GOT YOUR BACK. AND FRONT OF HOUSE.

Restaurant

Powerful. Scalable. Feature-rich point of sale.

heartland.us/restaurant

April 2021 • SCRLA.org

A Global Payments Company ©2019 Heartland Payment Systems, LLC