WELCOME

Welcome to The Salvation Army Benefits Program for Officers in the Eastern Territory. The Salvation Army strives to provide comprehensive coverage for you and your family’s health, wellness, and financial security.

We have prepared this Enrollment Guide to help you understand the benefit plans offered to you by The Salvation Army. The Salvation Army has partnered with Chesterfield Companies for the administration of these benefits.

The Benefits Program is designed to offer Officers coverage options that have the flexibility to meet both individual and family needs. This Guide can be used to assist you as you make informed benefit choices for yourself and your family.

Your Benefit Options

The Salvation Army provides a full range of benefits to address your needs now and in the future:

• Basic Life Insurance

• Voluntary Life Insurance

• Supplemental Critical Illness Insurance

• Supplemental Accident Insurance

• Auto & Home

• Pet Insurance

This Enrollment Guide is designed to help you understand the various benefit offerings. Summaries of the various benefit plans are contained in this Enrollment Guide. After reviewing the guide, you will know:

• How to enroll yourself and your eligible dependents

• How and when you can make changes

• Contribution rates

• Who to call and where to find answers when you have a question about your benefits

We want you to feel confident in your ability to choose the right benefits for your personal needs.

Remember, this Enrollment Guide gives you only a brief summary of the benefits you can choose through The Salvation Army as of the printing date of this publication and is subject to change. The specific terms of coverage, exclusions and limitations are contained in the insurance certificates.

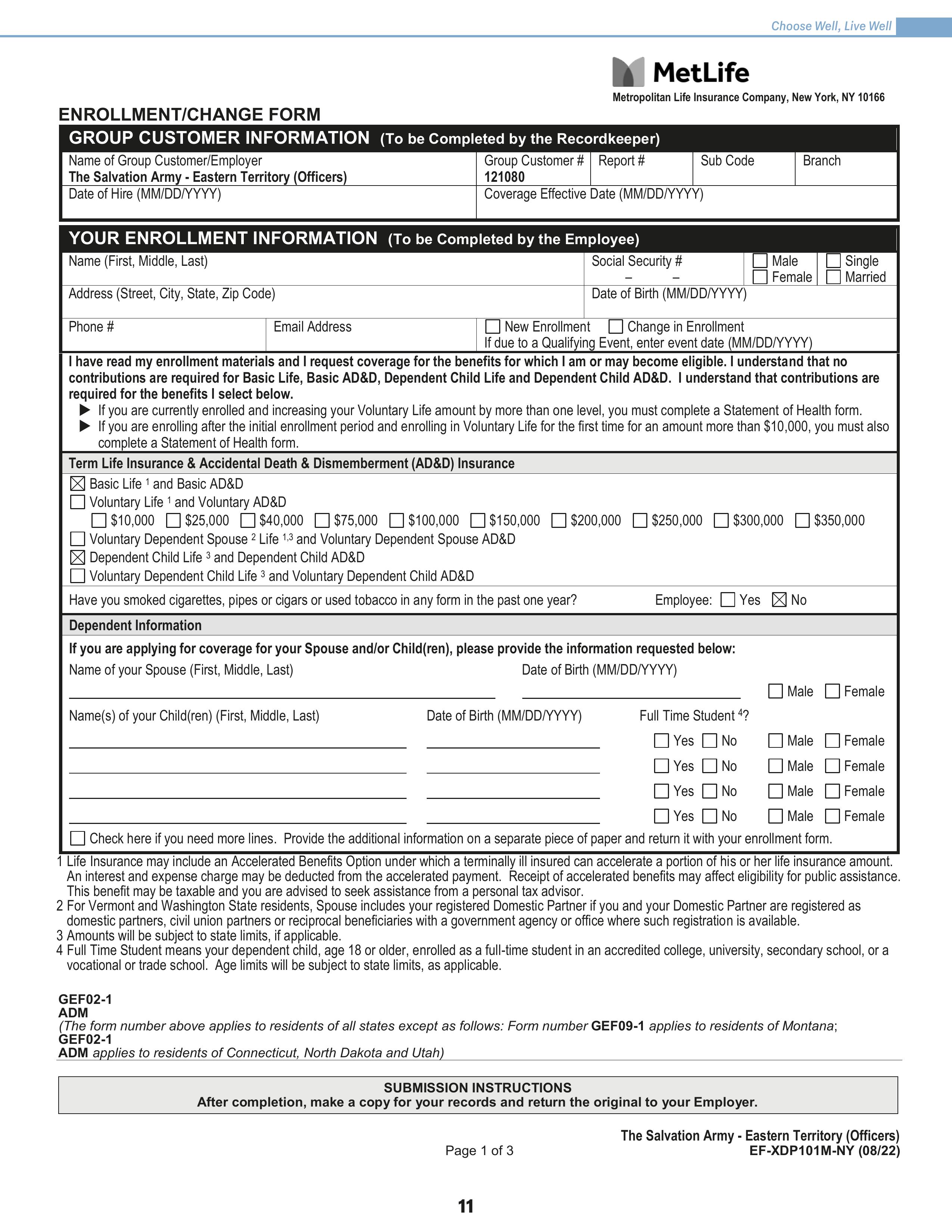

OPEN ENROLLMENT PROCESS FOR 2026

Open Enrollment is October 1, 2025 - October 31, 2025. During Open Enrollment, you will be able to review your current benefits, elect new coverage, or make changes to your existing coverage. If you are currently enrolled in benefits, your current elections will automatically roll over for the new plan year, effective January 1, 2026.

OUTSIDE OF OPEN ENROLLMENT:

If you experience a Qualifying Life Event (QLE) you can enroll or make changes to benefits by completing an enrollment form found in the back of this guide.

BASIC LIFE INSURANCE (AUTOMATIC ENROLLMENT)

BASIC LIFE AND AD&D BENEFITS (EMPLOYER-PAID)

The Salvation Army provides Officers with Basic Life and Accidental Death and Dismemberment (AD&D) Insurance at no cost to you.

Officers do not need to do anything to enroll in Basic Life Insurance, but will need to complete the enrollment form in the back of this guide to update your beneficiary. If you are also participating in the voluntary life program your designated beneficiary will be the same as the Basic Life.

Coverage is available to eligible dependents under age 26 and those handicapped dependents over age 26, restrictions do apply.

Basic Term Life $40,000 benefit

Accidental Death and Dismemberment

If you are seriously injured or lose your life in an accident, you may be eligible for a benefit equal to your Basic Term Life coverage.

VALUE ADDED SERVICES

As part of the Basic Life coverage through MetLife, you have access to valuable additional services, at no cost to you.

Grief Counseling Services

Officers, their dependents, and their beneficiaries are eligible to receive Grief Counseling Services provided by LifeWorks at no extra cost.

Grief Counseling is valuable, confidential support that can provide the comfort and guidance you need at the most difficult of times. You can call to discuss any situation you perceive as a major loss including: death of a loved one, divorce, losing a pet, or receiving a serious medical diagnosis.

Research specialists are also available to provide referrals for providers and services such as support groups, storage facilities, estate sale planners, and more.

Simply call a dedicated toll free number: 1 (888) 319-7819, 24 hours a day, seven days a week, to speak with a licensed professional counselor.

For Grief Counseling, contact LifeWorks

Toll Free Number: (888) 319-7819 or log on to their website https://metlifegc.lifeworks.com

Username: metlifeassist | Password: support

Funeral Planning Services

The Basic Life coverage also comes with Funeral Planning Services provided by Dignity Memorial. Dignity Memorial provides discounts of up to 10% off funeral, cremation and cemetery services and unlimited access to the Dignity Memorial planning website: https://metlife.thedignityplanner.com

Will Preparation and More

Another value added service offered as part of the Basic Life with MetLife is access to the self service website, willscenter.com, for preparation of wills, powers of attorney and other legal documents. The site is secure, easy to use, and available 24/7 at no cost to you. Simply go to willscenter.com, create an account and start creating the documents you need.

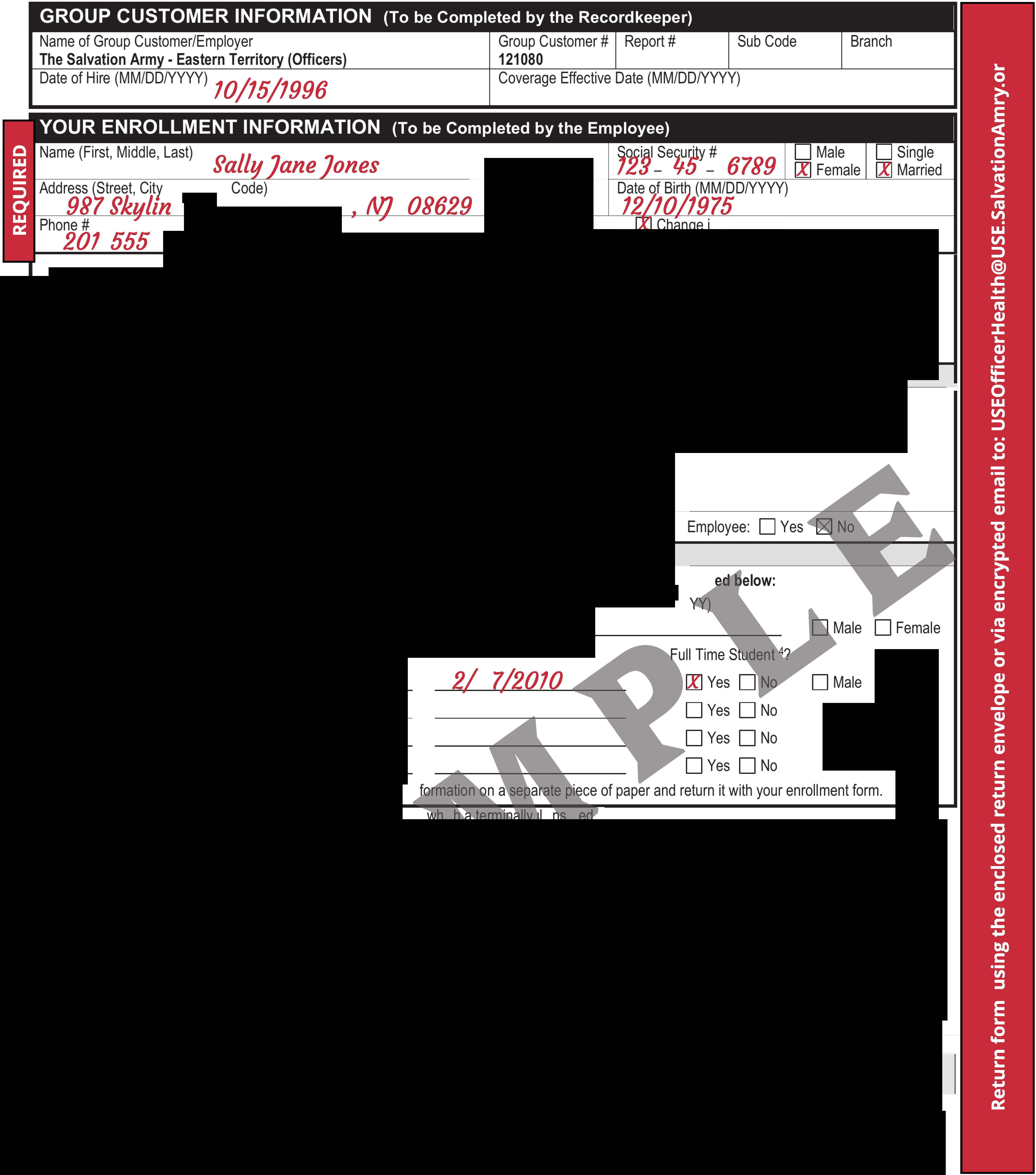

VOLUNTARY LIFE INSURANCE

VOLUNTARY LIFE AND AD&D BENEFITS

You may purchase Voluntary Life Insurance coverage that includes Accidental Death & Dismemberment Insurance (AD&D) through convenient payroll deduction. The Voluntary Life Insurance benefit is an optional insurance coverage that requires enrollment and a deduction to your allowance.

Enrollment and Evidence of Insurability

As a new hire, you are guaranteed enrollment in Voluntary Life Insurance at any level if you apply within 31 days of commissioning. You may elect one of the following amounts:

$10,000 $25,000

$40,000 $75,000

$100,000 $150,000

$200,000 $250,000

$300,000 $350,000

If you do not enroll within your initial eligibility period, you must wait until the next open enrollment period to enroll. At that time, you will only be eligible to elect the coverage amount of $10,000 without answering any medical questions. During each subsequent open enrollment period, you will be able to increase only by one level (e.g., $10,000 to $25,000) without evidence of insurability.

Due to IRS regulations, no changes are permitted outside of open enrollment, unless you have a qualifying life event.

Please note: If you participate in the voluntary life program the beneficiary you list on your enrollment form will be the same for both your Basic Life and Voluntary Life Insurance coverage.

Age Reductions

If you are 70 or older, your Voluntary Life Insurance coverage will reduce as follows:

* Per $1,000 of coverage

To calculate your per pay premium, you'll take the applicable rate for your age and multiply it by $1,000 of coverage.

for a 55-year-old

For Your Dependents

You may also elect Voluntary Life Insurance coverage for your spouse and eligible dependent children. You may elect spouse coverage in the amount of $10,000. For your eligible dependent children, you may elect coverage in the amount of $10,000. For children under six months of age, coverage is limited to $500. For a child to be eligible, he or she must be your dependent child under the age of 26.

Officers must have coverage in order to elect spouse and dependent coverage.

* The minimum Voluntary Life

Reduce or Terminate Coverage

If you are currently enrolled in Voluntary Life Insurance, you can reduce or terminate coverage during the open enrollment period. Due to IRS regulations, no changes are allowed outside of open enrollment, unless you have a qualifying life event.

VALUE ADDED SERVICES

When you enroll in Voluntary Life Insurance, you automatically have access to services for grief counseling, funeral planning, and will preparation to protect the ones you love.

Grief Counseling Services

Officers, their dependents, and their beneficiaries are eligible to receive Grief Counseling Services provided by LifeWorks at no extra cost.

Grief Counseling is valuable, confidential support that can provide the comfort and guidance you need at the most difficult of times. You can call to discuss any situation you perceive as a major loss including: death of a loved one, divorce, losing a pet, or receiving a serious medical diagnosis.

Research specialists are also available to provide referrals for providers and services such as support groups, storage facilities, estate sale planners, and more.

For Grief Counseling, contact LifeWorks:

Toll Free Number: (888) 319.7819 or log on to their website https://metlifegc.lifeworks.com

Username: metlifeassist | Password: support

Will Preparation and More

Another value added service offered as part of the Voluntary Life with MetLife is access to the self service website, willscenter.com, for preparation of wills, powers of attorney and other legal documents. The site is secure, easy to use, and available 24/7 at no cost to you. Simply go to willscenter.com, create an account and start creating the documents you need.

Funeral Planning Services

Continuation of Coverage

Life Insurance coverage can be continued after termination of employment or retirement from The Salvation Army.

Coverage will be moved to a different type of life insurance policy and premiums will increase. For more information about continuation of life insurance coverage, please contact Chesterfield Insurance Agency at (866) 896-5831

Will Preparation Service with an Attorney

Having an up-to-date will is one of the most important things you can do for your family. Once your Voluntary Life coverage becomes effective, you can use this service at no cost to you. Just follow the steps below to access the Will Preparation Service with the assistance of an attorney.

Step 1: Visit legalplans.com/estateplanning and create an account, or call MetLife Legal Plans' toll-free number at 1 (800) 821-6400, MondayFriday, 8:00 a.m. - 7:00 p.m., Eastern Time and provide The Salvation Army group number 121080. A Client Service Representative will assist you in locating a participating plan attorney in your area and provide you with a case number.

Step 2: Make an appointment to meet with the participating attorney.

Step 3: That’s it. When you use a plan attorney, you do not need to submit any claim forms. However, you also have the flexibility of using a nonnetwork attorney and being reimbursed for covered services according to the fee schedule.

The Voluntary Life coverage also comes with Funeral Planning Services provided by Dignity Memorial. Dignity Memorial provides discounts of up to 10% off funeral, cremation and cemetery services and unlimited access to the Dignity Memorial planning website: https://metlife.thedignityplanner.com

SUPPLEMENTAL AFLAC INSURANCE

We understand that every family's needs are different, and at times, you may need extra insurance protection based on your personal family circumstances. As an officer of The Salvation Army, you may apply for supplemental Aflac insurance policies, which are at a special group rate and can be purchased through convenient payroll deductions. There are two types of supplemental Aflac policies that are available to you:

• Critical Illness

• Accident

How to File a Claim or Review Policy Benefits Online

1. Go to: www.Aflac.com

2. Click: “Log In/Register” (top-right corner)

3. Register with:

• Your date of birth

• Your ZIP code (if you do not have your certificate number)

4. Once logged in, you can:

• View policy details

• File a claim

• Track claim status

The full schedule of benefits included with the Plan are located in the Aflac brochure which is available by requesting a copy from your Officer Health Information Manager, or by calling Chesterfield Insurance Agency at (866) 896-5824

This Plan has limitations and exclusions that may affect benefits payable.

Even the most generous health plans do not cover all of the expenses of a serious health condition

Eligibility and Enrollment

If you do not enroll within your initial eligibility period, you must wait until the next open enrollment period to purchase an Aflac policy.

Aflac open enrollment occurs annually during the month of October. During the open enrollment period, all Officers are eligible to enroll for an Aflac policy without answering any medical questions, but actively-at-work and pre-existing condition limitations apply. An enrollment form can be found in the back of this guide.

Your enrollment selection in the other benefits plans does not affect your eligibility to purchase an Aflac policy. Aflac policies remain in effect for the entire plan year and cannot be modified or canceled mid-year unless you have a qualifying life event, such as a change in marital or employment status.

Supplemental Insurance offers an optional layer of financial protection for you and your loved ones. Benefits are paid directly to you, so you can use the funds however you choose.

There are no health questions or physical exams required.

Why We Offer Supplemental Insurance Products

CRITICAL ILLNESS INSURANCE

A critical illness plan helps prepare you for the added costs of battling a specific critical illness. The good news is that many people with a critical illness survive these lifethreatening battles. With this plan, the goal is to help you and your family cope with and recover from the financial stress of surviving a critical illness.

• Benefits are payable for:

• Cancer (Internal or Invasive)

• Heart Attack (Myocardial Infarction)

• Stroke (Apoplexy or Cerebral Vascular Accident)

• Major Organ Transplant

• End-Stage Renal Failure

• Coronary Artery Bypass Surgery (25%)

• Carcinoma In Situ (25%)

• Coma**

• Paralysis**

• Burns*

• Loss of Sight**

• Loss of Speech**

• Loss of Hearing**

• Spouse coverage is available.

• Each dependent child is covered at 50 percent of the primary insured amount at no additional charge.

• Lump-sum benefits paid directly to the insured following the diagnosis of each covered critical illness (unless otherwise assigned).

• Benefit amounts available for $5,000 up to $30,000 for employees and $15,000 for spouse.

• You and your spouse must be between the ages of 18 and 69 when you initially apply for coverage.

*Benefit is only payable for burns due to, caused by, and attributed to, a covered accident.

**Benefits are payable for loss due to a covered underlying disease or a covered accident.

Health Screening Benefit

Pays $100 per year per covered person for completing an approved preventive screening. Covered screenings include (but are not limited to):

• Physical exams

• Mammograms

• Colonoscopies

• Pap smears

• Blood tests (including cholesterol and diabetes screenings)

How to Claim Your Health Screening Benefit

1. Complete an approved screening after a 30 day waiting period

2. Log in to www.Aflac.com and submit a claim online

3. Receive $100 directly to your bank account or via check

Bi-Weekly Rates for Critical Illness Insurance*

-

NON-TOBACCO - Spouse

*Rates include cancer benefit, $100 health screening benefit, and no additional riders.

ACCIDENT INSURANCE

Accident insurance provides benefits to help cover the costs associated with unexpected bills. When a covered accident occurs, charges that may be accumulating can vary such as:

• Emergency costs (ambulance ride, emergency room)

• Medical treatments (bandages, stitches, casts)

• Surgical procedures (surgery and anesthesia)

• Hospital admission

Accident insurance benefits:

• are available for spouse and/or dependent children

• have no limit on the number of claims

• supplements and pays regardless of any other insurance program

• require no underwriting to qualify for coverage

• you must be between the ages of 18 and 69 and your spouse must be between the ages of 18 and 64 when you initially apply for coverage

Benefit Changes

The wellness benefit will be removed effective 1/1/26 from the Accident policy. The following benefits have increased with no change to the rate:

Officer/ Spouse

Bi-Weekly Rates for Accident Insurance

ADDITIONAL INSURANCE OPTIONS

HOMEOWNERS AND AUTO

As an Officer of The Salvation Army, you are eligible for exclusive group discounts on homeowners and/or auto insurance through Farmers GroupSelect SM at any time after commisioning.

Please Note: Home Insurance is not part of the Farmers GroupSelect SM benefit offering in the states of MA and FL.

Discounts include:

• Group Discount of up to 15%

• Tenure Discount of up to 20%

• Monthly automatic bank deduction of up to 5%

• Multi-Policy Discount of up to 10% when you insure both your auto and your home.

A variety of other policies are also available, including renter's, condo, personal excess liability, and boat.

Auto Insurance Savings

PET INSURANCE

Pets can play a significant role in our lives, and it is important to keep them safe and healthy. MetLife Pet Insurance can help reimburse you for covered unexpected veterinary expenses for your pet. You are eligible to apply for MetLife Pet Insurance coverage any time after commissioning.

Benefits Include:

• Accidental injuries

• Illnesses

• Exam Fees

• Surgeries

• Medications

• Ultrasounds

• Hospital Stays

• X-Rays and Diagnostic Tests

CONTACTS

Benefits Contacts At-a-Glance

If your inquiry is regarding: Contacts

Enrolling in all of the company’s benefits offerings

• Changing benefits during the year

• Updating beneficiaries

• Initiating a Life or AD&D insurance claim

• Obtaining insurance certificates

Providing customer service feedback regarding benefit vendors

• Reviewing policy information

• Changing an address

Updating beneficiary information

• Filing a claim or checking claim status

• Continuing life insurance after termination or retirement

• Applying for waiver of premium while on a disability

• Applying for an accelerated benefit due to a terminal diagnosis

• Grief counseling services for those experiencing a loss

The Salvation Army Officer Health Services Manager E-Mail: USEOfficerHealth@USE.SalvationArmy.org

• Will preparation with assistance from an attorney

• Reimbursement for will services

• Funeral planning services

• Getting a quote on home, renters, or auto insurance

• Getting a quote on pet insurance

Aflac Group Customer Service

Online: Aflac.com

Phone: (800) 433-3036

Fax: (866) 849-2974

Mail: PO Box 84075, Columbus, GA 31993

Chesterfield Insurance Agency (Life Insurance through MetLife) Phone: (866) 896-5831

LifeWorks

Online: https://metlifegc.lifeworks.com (Username: metlifeassist; Password: support) By Phone: (888) 319-7819

MetLife Legal Plans By Phone: (800) 821-6400 Group #: 121080

Dignity Memorial Online: https://metlife.thedignityplanner.com

Farmers GroupSelectSM

Phone: (888) 909-3638 Program Code: BZH

MetLife Online: https://quote.metlifepetinsurance.com By Phone: (800) GET-MET8 (438-6388)

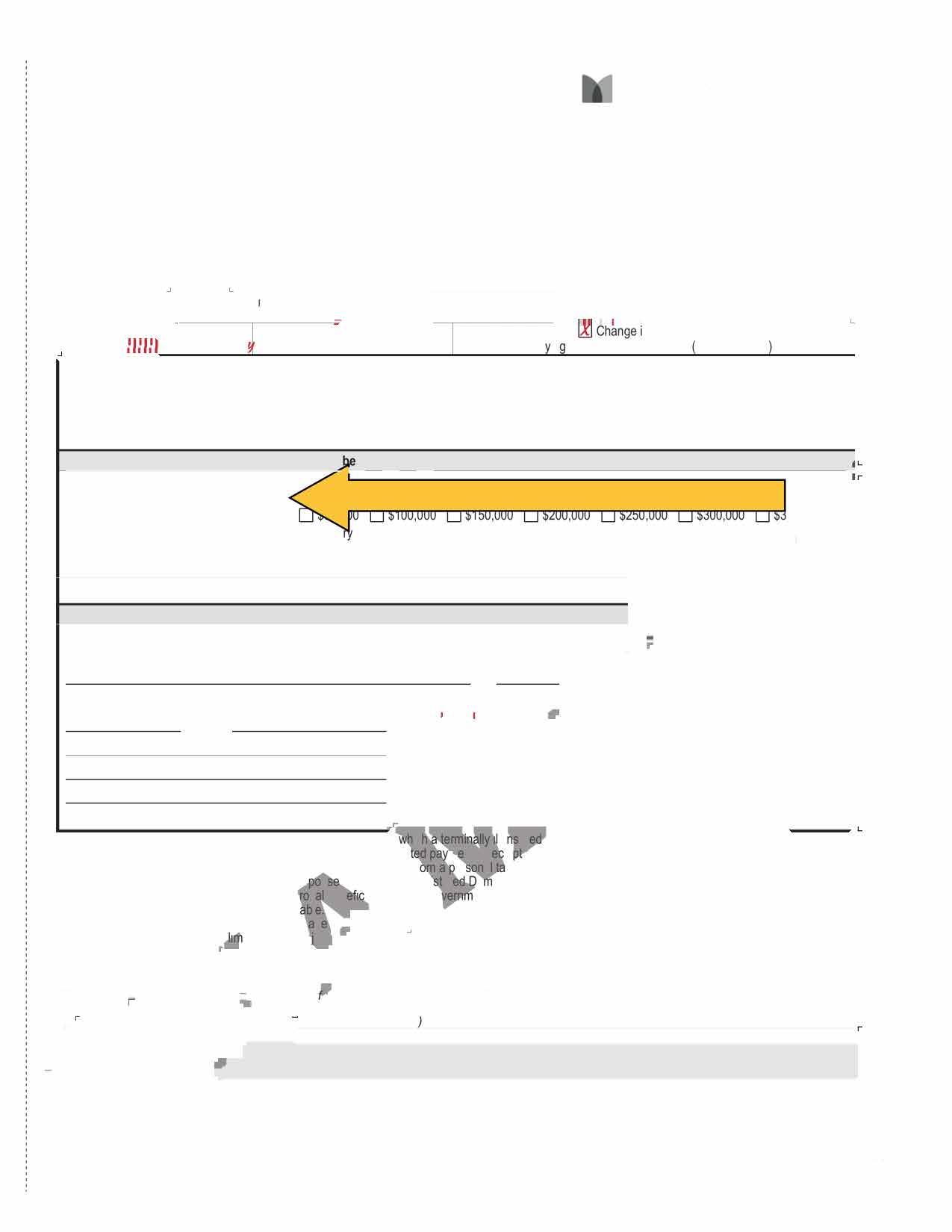

enrollmentform. Withsuchdesignationanypreviousdesignationofabeneficiaryforsuchcoverageisherebyrevoked.

IunderstandIhavetherighttochangethisdesignationatanytime. Ialsounderstandthatunlessotherwisespecifiedinthegroupinsurancecertificate, insurancedueuponthedeathofaDependentispayabletothe Employee.

D Checkifyouneedmorespaceforadditionalbeneficiariesandattachaseparatepage. Includeallbeneficiaryinformation, andsign/datethepage.

Full Name(First, Middle, Last)

Address(Street, City, State, Zip)

Full Name(First, Middle, Last)

Address(Street, City, State, Zip)

Full Name(First, Middle, Last)

Address(Street, City, State, Zip)

Ifallthe

diebeforeme, Idesignateas

Address(Street, City, State, Zip)

Full Name(First, Middle, Last) Address(Street, City, State, Zip)

DECLARATIONS ANDSIGNATURE

Bysigningbelow, Iacknowledge:

1. Ihavereadthisenrollmentformanddeclarethatallinformation Ihavegivenistrueandcompletetothebestofmyknowledgeandbelief.

2. Ideclarethat Iamactivelyatworkonthedate Iamenrollingand, if Iamenrollingforanycontributorylifeinsurance, that Iwasactivelyatworkforatleast 20 hoursduringthe7calendardaysprecedingmydateofenrollment. Iunderstandthatif Iamnotactivelyatworkonthe scheduled effectivedateof insurance, suchinsurancewillnottakeeffectuntil Ireturntoactivework.

3.Iunderstandthat, onthedatedependentinsuranceforapersonisscheduledtotakeeffect, thedependentmustnotbeconfinedathomeundera physician'scare, receivingorapplyingfordisabilitybenefitsfromanysource, or Hospitalized. Ifthedependentdoesnotmeetthisrequirementonsuch date, theinsurancewilltakeeffectonthedatethedependentisnolongerconfined, receivingorapplyingfordisabilitybenefitsfromanysource, or Hospitalized. Hospitalized meansadmissionforinpatientcareinahospital; receiptofcareinahospicefacility, intermediatecarefacility, orlongterm carefacility; orreceiptofthefollowingtreatmentwhereverperformed: chemotherapy, radiationtherapy, ordialysis.

4.Iunderstandthatif Idonotenrollforlifecoverageduringtheinitialenrollmentperiod, orif Idonotenrollforthemaximumamountofcoverageforwhich I ameligible, evidenceofinsurability satisfactorytoMetLifemayberequiredtoenrollfororincreasesuchcoverageaftertheinitialenrollmentperiodhas expired. Coveragewillnottakeeffect, oritwillbelimited,untilnoticeisreceivedthatMetLifehasapprovedthecoverageorincrease.

5.Iauthorizemyemployertodeducttherequiredcontributionsfrommyearningsformycoverage.ThisauthorizationappliestosuchcoverageuntilIrescinditinwriting.

6.Iaffirmativelydeclinecoverageforanybenefitsforwhich Iameligiblewhich Idonotrequestonthis enrollmentform.

7.Ihavereadthe Beneficiary Designationsectionprovidedinthisenrollmentformand Ihavemadeadesignationif Isochoose.

8.IhavereadtheapplicableFraudWarning(s)providedinthisenrollmentform. New York (only applies to Accident and Health Insurance): Any person who knowingly and with intent to defraud any insurance company or otherpersonfiles an application for insurance or statement ofclaim containing any materiallyfalseinformation, orconcealsfor the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a

not to exceed five thousand dollars and the stated value of the claim for each such violation.

FRAUD WARNINGS

Before signing this enrollment form, please read the warning for the state where you reside and for the state where the contract under which you are applying for coverage was issued.

Alabama, Arkansas, District of Columbia, Louisiana, Massachusetts, New Mexico, Ohio, Rhode Island and West Virginia : Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Colorado: It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies to the extent required by applicable law.

Florida: Any person who knowingly and with intent to injure, defraud or deceive any insurance company files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Kansas and Oregon: Any person who knowingly presents a materially false statement in an application for insurance may be guilty of a criminal offense and may be subject to penalties under state law.

Kentucky: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maine, Tennessee and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

New Jersey: Any person who files an application containing any false or misleading information is subject to criminal and civil penalties.

New York (only applies to Accident and Health Insurance): Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five th ousand dollars and the stated value of the claim for each such violation.

Oklahoma: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Puerto Rico: Any person who knowingly and with the intention to defraud includes false information in an application for insurance or files, assists or abets in the filing of a fraudulent claim to obtain payment of a loss or other benefit, or files more than one claim for the same loss or damage, commits a felony and if found guilty shall be punished for each violation with a fine of no less than five thousand dollars ($5,000), not to excee d ten thousand dollars ($10,000); or imprisoned for a fixed term of three (3) years, or both. If aggravating circumstances exist, the fixed jail term may be increased to a maximum of five (5) years; and if mitigating circumstances are present, the jail term may be reduced to a minimum of two (2) years.

Vermont: Any person who knowingly presents a false statement in an application for insurance may be guilty of a criminal offense and subject to penalties under state law.

Virginia: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated the state law.

Pennsylvania and all other states: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

GEF09-1

FW (The form number above applies to residents of all states except as follows: Form number GEF09-1 applies to residents of Montana ; GEF09-1

FW applies to residents of Connecticut, North Dakota and Utah )

3 of 3

EXAMPLEBASICLIFE I NOCOST

Update/DesignateBeneficiary

ENROLLMENTICHANGEFORM

,State,z� e Drwe Trenton EmailAddress D New Enrollment n Enrollment - -1212 fall Jones@Ufe.falvationflrm!f.Orq IfduetoaQualif in Event,entereventdate MM/DD/YYYY

I have read my enrollment materials and I request coverage for the benefits for which I am or may become eligible. I understand that no contributions are required for Basic Life, Basic AD&D, Dependent Child Life and Dependent Child AD&D. I understand that contributions are required for the benefits I select below.

► IfyouarecurrentlyenrolledandincreasingyourVoluntary Lifeamountbymorethanonelevel,youmustcompleteaStatement ofHealthform.

► IfyouareenrollingaftertheinitialenrollmentperiodandenrollinginVoluntaryLifeforthefirsttimeforanamountmorethan$10,000,youmustalso completeaStatementofHealthform.

Term

Accidental

[:8J Basic Life 1 and BasicAD&D

D Voluntary Life 1 andVoluntaryAD&D If electingadditionalVoluntary Lifeat

0 $10,000 □ $25,000 0 $40,000

D VoluntaryDependentSpouse 2 Life 1-3 andVolunta Dependent SpouseAD&D

[:8J DependentChildLife 3 andDependentChildAD&D

D VoluntaryDependentChildLife 3 andVoluntaryDependentChildAD&D

Haveyousmokedcigarettes,pipesorcigarsorusedtobaccoinanyforminthepastoneyear? Dependent Information

If you are applying for coverage for your Spouse and/or Child(ren), please provide the information request NameofyourSpouse(First,Middle, Last)

Name(s)ofyourChild(ren)(First,Middle, Last) TraeelJ TinaJones

DateofBirth(MM/DD/YY

DateofBirth(MM/DD/YYYY)

D Checkhereifyouneedmorelines. Providetheadditionalin

1 Life InsurancemayincludeanAccelerated Benefits Optionunder ic •1i ur canaccelerateaportionofhisorherlifeinsuranceamount. Aninterestandexpensechargemaybedeductedfromtheaccelera m nt. R ei ofacceleratedbenefitsmayaffecteligibilityforpublicassistance. Thisbenefitmaybetaxableandyouareadvisedtoseekassistancefr er a xadvisor.

2ForVermontandWashingtonStateresidents,S u includesyourregI er o estic PartnerifyouandyourDomestic Partnerareregisteredas domesticpartners,civilunionpartnersorrecip c ben • iarieswithago entagencyorofficewheresuch registrationisavailable.

3 Amountswillbesubjecttostatelimits,ifapplic I

4FullTimeStudentmeansyourdependentchild, g 18 vocationalortradeschool. Age • itswillbesutl ec

GEF02-1

ADM

liedasafull-timestudentinanaccreditedcollege,university,secondaryschool, ora sapplicable.

(The form nu o residents o all states except as follows: Form number GEF09-1 applies to residents of Montana; GE A orth Dakotaand Utah

SUBMISSIONINSTRUCTIONS

completion, make a copy for your records and returnthe originalto your Employer.

TheSalvationArmy- Eastern Territory (Officers) EF-XDP101M-NY (08/22)

Beneficiaries must be 18 years or older. Designations must total

derstand Ihavetherighttochangethisdesignationatanytime. Ialsounderstandthatunlessotherwise

urancedueuponthedeathofaDependentispayabletothe Employee.

Checkifyouneedmorespaceforadditionalbeneficiariesandattachaseparatepage. Include

IIName(First,Middle,Last)

vin ones 921-9'1--5678 11/09/1965

p)

,Middle,Last)

Address(Street,Cily,State,Zip)

Full Name(First,Middle,Last)

Address(Street,City,State,Zip) Social

;j_!y,State,Zip) J<.oad Ruthe

Middle,Last) es

1.Ihavereadthisenrollmentformanddeclarethatallinformation Ihavegivenistrueandcompletetothebestof

2. Ideclarethat Iamactivelyatworkonthedate Iamenrollingand,if Iamenrollingforanycontributorylifeinsuran 20 hoursduringthe7calendardaysprecedingmydateofenrollment. Iunderstandthatif Iamnot o insurance,suchinsurancewillnottakeeffectuntil Ireturntoactivework.

3. Iunderstandthat,onthedate dependent insuranceforapersonisscheduledtotakeeffect, otbec un era physician'scare,receivingorapplyingfordisabilitybenefitsfromanysource,orHospitalized esnotm Irementonsuch date, theinsurancewilltakeeffectonthe datethedependentisnolongerconfin ilitybene anysource,or Hospitalized. Hospitalized meansadmissionforinpatientcareinahospital; r ermediatecarefacility,orlongterm carefacility; orreceiptofthefollowingtreatmentwhereverperformed: chemo

4.IunderstandthatifIdonotenrollforlifecoverageduringtheinitialenr

ximumamountofcoverageforwhich ameligible, evidenceofinsurability satisfactory toMetLifemayber aftertheinitialenrollmentperiodhas expired. Coveragewillnottakeeffect,oriiwillbelimited,untilnotic overageorincrease.

5. Iauthorizemyemployertodeducttherequiredcontributionsfrommyear onappliestosuchcoverageuntilIrescinditinwriting.

6. Iaffirmativelydeclinecoverage for anybenefits for which Iameligibl rollmentform.

7. IhavereadtheBeneficiaryDesignationsectionprovidedinthisenr esignationif Isochoose.

8.IhavereadtheapplicableFraudWarning(s)pro New York (only applies to Accident and Health I mgly andwith intent to defraud any insurance company or otherpersonfiles an application for insurance t materially false information, or conceals for the purpose of misleading, information concernin fraudulent insurance act, which is a crime, and shall also be subject to civil penaltynot to exceed • the claim for each such violation.

10/15/2025 DateSigned(MM/DD/YYYY)

Continental American Insurance Company, a wholly-owned subsidiary of Aflac Incorporated, is the insuring company. EMPLOYEE APPLICATION

Please Mail: P.O. Box 84078 Columbus, GA 31993 800.433.3036

Spouse's Name (if coverage is requested)

Name/Relationship (estate unless designated otherwise)

1 Have you ever been treated or diagnosed by a medical professional for Acquired Immune Deficiency Syndrome (AIDS) or AIDS-Related Complex (ARC)?

2

3

In the last 7 years, have you been treated for or diagnosed with cancer or any malignancy, including: carcinoma, sarcoma, Hodgkin’s Disease, leukemia, lymphoma, or a malignant tumor? Cancer does not include basal cell or squamous cell carcinoma of the skin.

Have you ever been treated for, or diagnosed with, any of the following:

a)Stroke, heart attack, heart condition, heart trouble (or any abnormality of the heart including artery disease), diabetes, or any liver disorder;

b)Kidney (renal) failure or end stage kidney (renal) disease;

c)Organ transplant; d)Emphysema; or

e)High blood pressure, resulting in your now taking 3 or more medications for treatment?

GROUP HOSPITAL INDEMNITY INSURANCE

1 New Coverage Change in Coverage Applicant Applicant & Spouse Applicant & Children Family Cost Per Pay Period Including any Riders:

If NOT Guaranteed Issue, answer the following questions :

1 Have you ever been treated or diagnosed by a medical professional for Acquired Immune Deficiency Syndrome (AIDS) or AIDS-Related Complex (ARC) or ever tested positive for antigens or antibodies to an “AIDS” virus?

2 In the last 7 years, have you been treated for or diagnosed with cancer or any malignancy, including: carcinoma, sarcoma, Hodgkin’s Disease, leukemia, lymphoma, or a malignant tumor? Cancer does not include basal cell or squamous cell carcinoma.

3 Have you ever been treated for, or diagnosed with, any of the following:

a)Stroke, heart attack, heart condition, heart trouble (or any abnormality of the heart including artery disease), diabetes, or any liver disorder;

b)Kidney (renal) failure or end stage kidney (renal) disease; c)Organ transplant;

d)Emphysema; or

e) High blood pressure, resulting in your now taking 3 or more medications for treatment?

4 Have you ever sought advice or treatment for alcohol abuse, been arrested for driving under the influence of or while impaired by alcohol, or been arrested for or used illegal drugs or narcotics?

2 of 3

Tothebestofmyknowledgeandbelief,theanswerstothequestionsonthisapplicationaretrueandcomplete.Theyare offeredtoContinentalAmericanInsuranceCompanyasthebasisforanyinsuranceissued.

HEALTH COVERAGES:

•Doesthiscoveragereplaceorchangeanyexistinginsurance? □ YES □ NO

If yes, provide carrier:

•Areyoucurrentlycoveredunder,ordoesthiscoveragereplace,anAflacindividualpolicy? □ YES □ NO

Ifyesandifitisthesametypeofcoverageyouareapplyingforonthisapplication,pleaseidentifywhichindividual policy(ies)youalreadyhave: □ CriticalIllness □ Accident □ HospitalIndemnity

IfthiscoveragewillreplaceanyexistingAflacindividualpolicy,pleasebeawarethatitmaybeinyourbestinteresttomaintain yourindividualguaranteed-renewablepolicyviadirectbill.

IhaveconsideredallofmyexistinghealthinsurancecoveragewithAflacandbelievethisadditionalcoverageisappropriatefor myinsuranceneeds.IfurtherunderstandthatIcancontactAflacat1-800-992-3522regardingmyindividualpolicyandfor assistanceinevaluatingthesuitabilityofmyinsurancecoverage.

CoveragewillnotbecomeeffectiveunlessyouareactivelyatworkontheCertificateEffectiveDate.Ifyouarenotactivelyat workonthatdate,coveragewillbecomeeffectiveonthedateyoureturntoanactiveworkstatus.

CERTIFICATION:IcertifythatIhavereadthecompletedEmployeeApplication/Statementoflnsurabilityandthestatements andanswersthatpertaintomeandmyspouseandmychildren.Icertifythatthesestatementsandanswersaretrueand completetothebestofmyknowledgeandbelief,andthatthestatementsandanswerswillbeusedbytheinsurancecompanyto determineinsurability.IrealizeanyfalsestatementormisrepresentationintheEmployeeApplication/Statementoflnsurability mayresultinlossofcoverageundertheCertificate.IunderstandthatnoinsurancewillbeineffectuntilmyEmployeeApplication /Statementoflnsurabilityisapprovedandthenecessarypremiumispaid.

IunderstandandagreethatthecoveragethatIamapplyingformayhaveapre-existingconditionexclusion.

IauthorizetheGroupPolicyholdertodeducttheappropriatedollaramountfrommyearningseachpayperiodtopay ContinentalAmericanInsuranceCompanytherequiredpremiumformyinsurance.

IcertifythatIamactivelyatwork.Icertifythatmyspouseisnotcurrentlydisabledorunabletowork.IcertifythatIhave accuratelydisclosedmyandmyspouse'susageoftobaccoproductsinthelast12months.

Icertify,bysigningbelow,thatIamcoveredbyamajormedicalpolicyorothercoveragethatsatisfiestheminimumessential coverageundertheAffordableCareAct.

Any person who, with the intent to defraud or knowing that he or she isfacilitatinga fraudagainstan insurer, submits anapplicationor files aclaimcontaining afalse or deceptive statement may have violated state law.

Theundersignedapplicantandtheagentcertifythattheapplicanthasread,orhadreadtohim,thecompletedapplicationand thattheapplicantrealizesthatanyfalsestatementofmisrepresentationintheapplicationmayresultinthelossofcoverage underthepolicy.

DateSignatureofApplicant___

Date_SignatureofAgent_

Cancellation Form

The Salvation Army, Eastern Territory #12586

Officer Name: ________________ _________ DOB: _____________________

I would like to cancel the following Aflac Voluntary Benefit(s): □ Voluntary Critical Illness □ Voluntary Accident

Reason for Termination of Coverage: □ Cost

□ No longer need coverage

□ Purchased different coverage

□ Other

Changes must be submitted no later than October 31, 2025 to:

Mail: Officer Services and Records Department Fax: (845) 620-7719

The Salvation Army │USA Eastern Territory Headquarters 440 West Nyack Road, West Nyack, NY 10994

Email: USEOfficerHealth@USE.SalvationArmy.org

Cancellation of any Aflac Voluntary Benefits will be effective January 1, 2026.

Officer Signature: ______________________________________ Date: ________________

Please be sure to keep a copy for your records.