Auckland Central Market Report.

NOVEMBER 2022

Part of the group with a family factor.

CREATE RECOGNISE GROW

CITY REALTY GROUP

Part of the group with a family factor.

04. Market Comment 06.

Article – Tony Alexander: Something interesting is going to happen to houses prices at the end of 2023 08. Auckland Central Statistics 10. Recent Sales 12. Article – Owen Vaughan: Spring slump: Auckland house prices down $210,000 from market peak

14. Auction Statistics & Update with Cameron Brain 16. Marketing your property 18. Ray White Auckland Central Meet the team

Ray White Auckland Central have good number of auctions scheduled in November, noting that declines in property prices in Central Auckland may be bottoming out.

Director of City Realty Group, Daniel Horrobin, says: “The decline in property prices we’ve seen in Auckland Central has slowed down and now seems to be around the bottom of the market. The just-released November Oneroof-Valocity House Price Report show that the average property value in Auckland Central was only down 1% in the quarter to the end of October.

“With the year-on-year change in average value in this area being -8%, this shows the decline has slowed down if not completely bottomed out. This compares to many Auckland suburbs outside the central city where average property values were down between 2.5% to 5% for the quarter. So, the central city is in a slightly different situation, primed for action.

“The consensus is that as inflation remains high, OCR rates will continue to rise fuelling higher interest rates. So for those buyers looking to buy at a competitive price but avoid future mortgage rate hikes now would be a good time to act.

Reasonably priced properties remain popular in Central Auckland. This City Apartment market is predominantly driven by investors looking to achieve a good return on their investment, in a market which is well suited

to deliver higher yields. Properties which are new builds have the added advantage of still having mortgage interest deductible against tax and not being subject to the brightline test when re-sold.

There is also interest in the mid-to-upper end of the market from owner-occupiers wanting to retain a city pad to complement the primary home.

“We have double the number of auctions scheduled for November than we did in October, which included Labour Weekend. This represents a good choice for buyers and a busy auction schedule is expected to encourage healthy competition. The number of properties currently for sale in Central Auckland is in the mid-600s, so there is a decent amount of stock available.”

“Meanwhile there are high levels of inquiry for our rental portfolio and vacancy rates are going down. There is a third of the number of properties currently available to rent in Central Auckland as compared to a year ago.

People have returned to the central city after Covid restrictions have loosened and investors are anticipating more demand with next year’s predicted jump in the number of international students and migrants.”

People have returned to the central city after Covid restrictions have loosened and investors are anticipating more demand with next year’s predicted jump in the number of international students and migrants.”

City Realty Group Director 021 595 976 daniel.horrobin@raywhite.com

ANALYSIS: The Real Estate Institute of New Zealand this week revealed that on average house prices around New Zealand in October were 0.2% higher than in September and 12.4% down from the November peak. This is a somewhat surprising result, and I wouldn’t take it as an indication that house prices have actually stopped falling. One reason for caution is that when we get a measure like this getting close to zero you can easily get positive and negative numbers appearing without any real direction in prices.

Second, most of the transactions captured in the October data occurred before banks raised their fixed mortgage rates by about 0.5% following the higher than expected inflation number.

Third, we have data in hand from my monthly surveys of real estate agents and mortgage advisors showing that because

of the increase in interest rates, buyers have taken a step back from the market to see how things are going to pan out. In particular, investors have run for the hills again and there is no evidence as yet that owner-occupiers are looking to follow first home buyers into the market.

The chances are strong that house prices will continue to go down for the next few months, but the scene is being set for something interesting happening possibly from late 2023 and almost certainly through 2024. Consider these factors for instance.

The data tell us that on average around the country house prices are 26% higher than they were at the start of 2020 just before the pandemic struck. That’s a fairly large number and on that basis the near universal view is that house prices are excessively high in New Zealand and are going to fall a lot further.

Tony

Something

is going to happen to houses prices at the end of 2023

But data from statistics New Zealand tell us that over the past year average ordinary time earnings have increased about 7.4% after rising 3.5% the previous year. House prices are falling but our incomes are rising and so we can calculate by how much the ratio of average house prices to incomes has changed from pre-pandemic levels.

At the moment that ratio is only 8% above where it was at the start of 2020. Just under a year ago that ratio was almost 30% above pre-pandemic levels. The extent to which house prices have gone beyond the pale is a lot less than people are thinking. In fact, if we allow for the long-term upward trend in the ratio of house prices to incomes things are about where that trend suggests they “should” be.

The only real reason there is downward pressure on house prices on average at the moment is because interest rates are at above average levels, there are some fears of recession, credit availability is tight, net migration flows are negative, tax rules have dissuaded investors, and many people are waiting for prices to bottom out before buying.

Once people start losing their fears of interest rates rising further and start thinking about interest rates falling at some point perhaps from late 2023 there could be an interesting response in the housing market. The net migration numbers are

already becoming less bad as a rising net outflow of Kiwis is being offset by migrants coming in.

Forecasts for how high unemployment will get are being scaled back amidst evidence of strong labour demand. Banks are bit by bit easing their very tight lending criteria. Investors meanwhile are keeping a close eye on the political opinion polls and if it looks like Labour will lose office they will likely re-enter the market in anticipation of interest expense deductibility being restored.

I don’t for a second read the 0.2% rise in house prices in October as a signal that the upward phase of the house price cycle is reappearing. But because the change followed a 0.7% fall in September, 1.3% falls in August and July, and falls averaging 1.9% a month from March through to June, the trend in the monthly changes is obvious. We are solidly in the endgame for the downward leg of the price cycle.

The real questions now for those in a position to buy but waiting for the bottom are these. How confident are you that you will see the price bottom before everyone else, and how sure can you be that the stock of listings currently 72% higher than a year ago will remain robust enough to allow you to find the property most suited to your needs?

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

ADDRESS

BEDROOMS

1002/45 Union Street 1 $825,000 31-OCT-22 7C/30 Liverpool Street 2 $135,000 31-OCT-22 606/85 Customs Street West 1 $150,000 31-OCT-22 2F/1 Grey Avenue 1 $545,000 31-OCT-22 3D/148 Quay Street 3 $1,238,000 31-OCT-22 608/22 Nelson Street 1 $683,000 30-OCT-22 2/78 Greys Avenue 3 $1,950,000 28-OCT-22 1010/11 Liverpool Street 2 $450,000 28-OCT-22 85 Daldy Street 2 $1,765,000 27-OCT-22 102/52 Sale Street 1 $900,000 27-OCT-22 115/77 Halsey Street 2 $273,000 26-OCT-22 609/147 Nelson Street 1 $495,500 26-OCT-22 17/139 Quay Street 1 $70,000 21-OCT-22 522/72 Nelson Street 2 $311,400 20-OCT-22 11/126 Vincent Street 4 $1,730,000 20-OCT-22 1010/1 Hobson Street 1 $607,500 20-OCT-22 501/8 Mount Street 5 $610,000 20-OCT-22 328/72 Nelson Street 2 $340,000 19-OCT-22 2312/10 Waterloo Quadrant 1 $280,000 19-OCT-22 1404/70 Anzac Avenue 2 $800,000 19-OCT-22 607/27 Union Street 2 $610,000 18-OCT-22 2902/10 Commerce Street 3 $2,700,000 18-OCT-22 3M/23 Emily Place 0 $300,000 18-OCT-22 6B/23 Emily Place 1 $380,000 18-OCT-22 2A/14 Waterloo Quadrant 1 $195,888 18-OCT-22 411/47 Beach Road 1 $420,000 18-OCT-22 19 Fisher-Point Drive 3 $1,220,000 17-OCT-22 610/72 Nelson Street 1 $168,000 17-OCT-22 1C/508 Queen Street 1 $80,000 17-OCT-22 13H/33 Mount Street 1 $190,000 17-OCT-22 809/11 Liverpool Street 2 $405,000 14-OCT-22 2B/155 Queen Street $105,000 14-OCT-22 5B/25 Rutland Street 1 $101,000 13-OCT-22

Sales data is from REINZ and covers the entire Central Auckland property market.

BEDROOMS

307/369 Queen Street 1 $888,000 12-OCT-22 1101/430 Queen Street 2 $405,000 12-OCT-22 1606/8 Airedale Street 2 $570,000 12-OCT-22 305/57 Wakefield Street 2 $600,000 12-OCT-22 602/47 Wakefield Street 1 $195,000 12-OCT-22 403/57 Mahuhu Crescent 1 $105,500 12-OCT-22 104/57 Mahuhu Crescent 2 $155,000 12-OCT-22 128/26 Te Taou Crescent 2 $50,000 12-OCT-22 2 The Boardwalk 2 $1,175,000 11-OCT-22 102/155 Beaumont Street 1 $790,000 11-OCT-22 9I/508 Queen Street 1 $90,000 10-OCT-22 806/45 Union Street 2 $1,100,000 7-OCT-22 703/369 Queen Street 1 $548,000 7-OCT-22 401/369 Queen Street $794,700 7-OCT-22 402/369 Queen Street $871,200 7-OCT-22 1501/76 Wakefield Street 5 $2,500,000 7-OCT-22 2407/6 Lorne Street 1 $410,000 7-OCT-22 4H/23 Emily Place 1 $225,000 7-OCT-22 9D/8 Scotia Place 1 $146,800 6-OCT-22 405/155 Beaumont Street 2 $1,575,000 5-OCT-22 401/134 Halsey Street 1 $1,025,000 5-OCT-22 1204/369 Queen Street 2 $1,479,631 5-OCT-22 20C/34 Kingston Street 2 $310,000 5-OCT-22 1309/11 Liverpool Street 1 $173,000 5-OCT-22 42/155 Beaumont Street $1,575,000 5-OCT-22 207/369 Queen Street 1 $803,000 4-OCT-22 524/8 Dockside Lane 2 $150,000 4-OCT-22 610/70 Daldy Street 2 $1,380,000 3-OCT-22 1021/147 Nelson Street 1 $515,000 3-OCT-22 1012/22 Nelson Street 1 $305,000 3-OCT-22 1H/82 Wakefield Street 1 $61,500 3-OCT-22 3B/16 Gore Street $130,000 1-OCT-22

ANALYSIS: The latest housing market figures from the Real Estate Institute of New Zealand underscore what agents and sellers will have fast realised – spring has failed to spring.

The market usually experiences a spring lift in sales volumes and prices over September, October and November, but this year the nationwide median sales price is well down on last year and sales volumes are hitting the lows most would expect in real estate’s quietest period – late December/January, when the market takes a break.

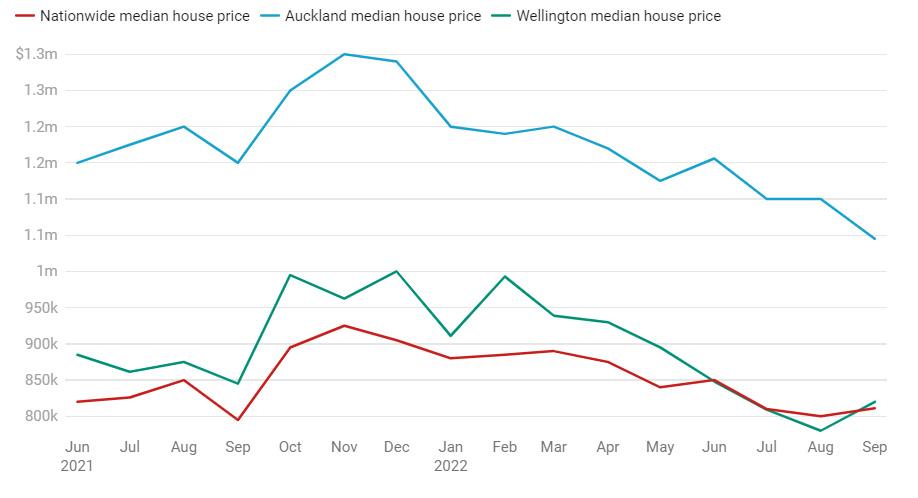

While the nationwide median price for October was a 1.9% improvement on the month before, it was, at $825,000, still down 7.5% on where it was a year ago. And nationwide sales in October were down 34.7% year-on-year – from 7486 to 4892 –and down 2.4% on September.

There were more than 1000 fewer sales in Auckland last month than there were in October 2021. Market conditions for Auckland last spring were admittedly a lot

different to what they are now – you’ll find no one’s talking about FOMO any more, with fears about cost of living and interest rates taking over.

Funnily enough, the spring lift in sales for Auckland was late in arriving, with sales volumes in September down on the month before, but the spectre looming over the city’s housing market back then was Covid and the lockdown restrictions. After a month of uncertainty, buyers decided to jump back into the market, pushing sales volumes to just over 3100 in November and the city’s median sale price to a peak of $1.3m.

It’s been all downhill for Auckland since then, with its median sale price in October down $210,000 since market peak. Average monthly sales so far this spring in the city are up just 1.46% on average monthly sales over winter. The spring lift in sales for the city in 2019 was 12%, and in 2020 it was a spectacular 33%.

The chart shows the changes in the median sale price for NZ as well as Auckland and Wellingtonthe two biggest metros that have been most vulnerable to shifts in the market.

Clearly, a late spring surge isn’t on the cards for the city, or the rest of the country, this year. The big question for the market is when will sales activity pick up? December and January are typically quiet months, and the market doesn’t start to hit its stride

until late February / early March. That suggests the market is facing at least four more uncomfortable months until buyers may decide to return in greater numbers –although the market should steel itself for lower sales, and by extension lower prices.

Our auction Numbers have increased and we are expecting a very busy last quarter for 2022, and a quick and busy start of 2023 with Auction Bookings already in for February 2023.

Our Auction clearance rate of 64.7% is still one of the highest throughout the Auckland market and something we are still very proud of. Auction 63.5% Clearance Rate 31 Average Days on Market VS

The marketing strategy is designed to reach the breadth of the active and passive buyer pool in the most effective manner, based on their Media consumption.

Our marketing strategy comprises of 3 key components; property portals, social and multi-channel digital strategy and print media.

A COMPREHENSIVE MARKETING STRATEGY TO REACH ACTIVE & PASSIVE BUYERS.

There are 3 key portals, TradeMe Property, Realestate.co.nz and Oneroof.co.nz.

Property Portals generally attract active byers in the market, OneRoof has a unique position as it reaches both active and passive property buyers due to the diversity of information it has on the platform including property

The Ray White City Realty Group has introduced a state-of-the-art digital solution that is powered by artificial intelligence to reach the breadth of the active and passive buyer pool across social media and multiple digital channels, including news and other high traffic websites. The programme is fully automated in the back end, it creates an audience

listings, estimated property values, market news and commentary. It is important to run campaigns across all 3 to effectively cover the breadth of the active buyer pool and a part of the massive buyer market. None of the property portals have complete market coverage and each of these portals have a set of unique audiences.

segment of active buyers specific to the property as well as reaching the passive buyer pool. The campaign is structured to deliver quality leads for the property, and it auto optimises spend across social media and multiple digital channels, skewing the spend towards channels that are performing the best.

Print continues to play an important role to cover the breadth of the market reaching quality and highly engaged audiences. It takes criteriabased search out of the equation with respect to the active market and is the most effective medium to reach the all important passive buyer

market. This is clearly evidenced by the fact that the New Zealand herald has seen a massive 48% increase in its print readership over the last 18 months and average time spent reading the paper is over 50 minutes. The value of print is also well supported by agent feedback.

Based in the heart of Auckland City, Ray White Auckland Central is an award-winning agency in Auckland City that specialise in apartment sales for investment, luxury waterfront and lifestyle.

Our 183+ dedicated professionals who understand this unique market, are all top performers who have contributed to our phenomenal results. As the Auckland central market continues to experience unprecedented growth, our Lorne Street & Wynyard Quarter offices are well positioned to maintain its leadership in the market.

City Realty has a strategic partnership with LoanMarket, to provide clients with the best mortgage advice and rates with brokers throughout our offices that provide Home Loans, First Home Buyers Loans, Construction Loans, Refinance, Selfemployed Loans and Vehicle Finance – whatever the loan, LoanMarket can help.

Our office achieved the No.4 Ray White office in the world for 2018 and the No. 2 Ray White office in New Zealand for 2018 and we do the highest volume of sales across all agencies in New Zealand.