Rein in the Win Application of the Year: First Place Profile

by Melissa Donovan

When executed correctly, digitally printed graphics transform a space at a fraction of the cost compared to other technologies and methods. This is why many companies look to print shops to design, print, and install graphics for limited time engagements and one-day events. In many scenarios these occur under very tight deadlines.

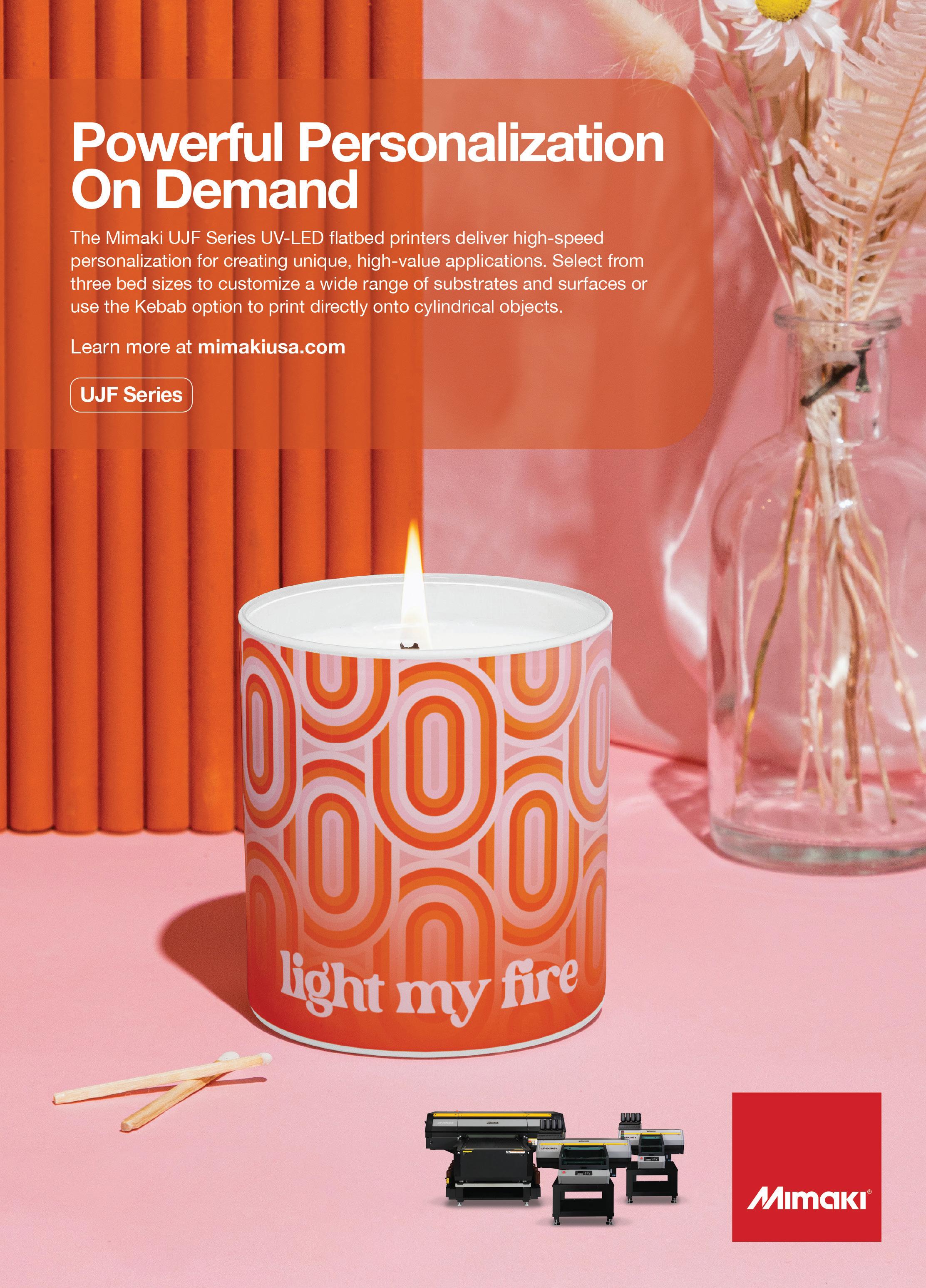

This was the case for the 2024 winner of Digital Output’s Application of the Year awards. Congratulations to FASTSIGNS - San Diego on Miramar Rd. of San Diego, CA for winning the contest for its work at HITS Del Mar Horsepark in Del Mar, CA. Before we dive into the project, let’s get a bit of a background on this particular FASTSIGNS franchisee.

The San Diego on Miramar Rd. location has evolved from “die-cut letters applied to solid color backgrounds

to new inkjet technology using water-based inks to the more current solvent and eco-solvent printer technology in both roll-to-roll and flatbed machines,” according to Shane Beard, owner/franchisee, FASTSIGNS - San Diego on Miramar Rd.

Beard has owned several FASTSIGNS centers over the last 25 years and the San Diego on Miramar Rd. location for eight years.

Call In

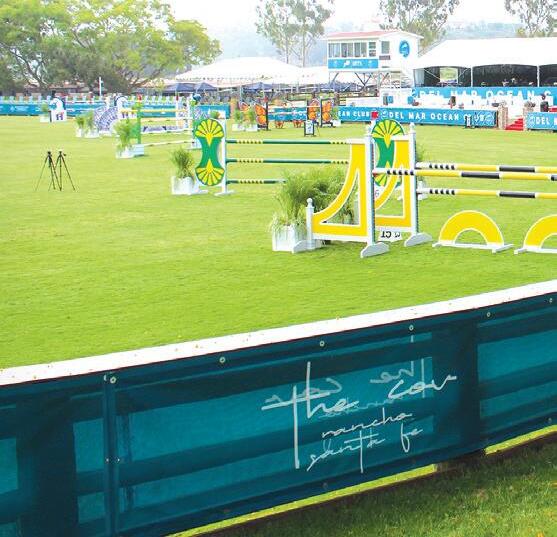

This project transformed a tired-looking facility into a dynamic, colorful, informative, and well-branded equine campus

— Shane Beard, owner/franchisee, FASTSIGNS - San Diego on Miramar Rd.

HITS Del Mar Horsepark is a 65-acre equine facility that closed due to a combination of the pandemic and state regulations, prior to this it was used extensively. HITS, LLC is an equine events company that leases the facility from the state of CA. HITS looked to host an inaugural event back in July 2023 to

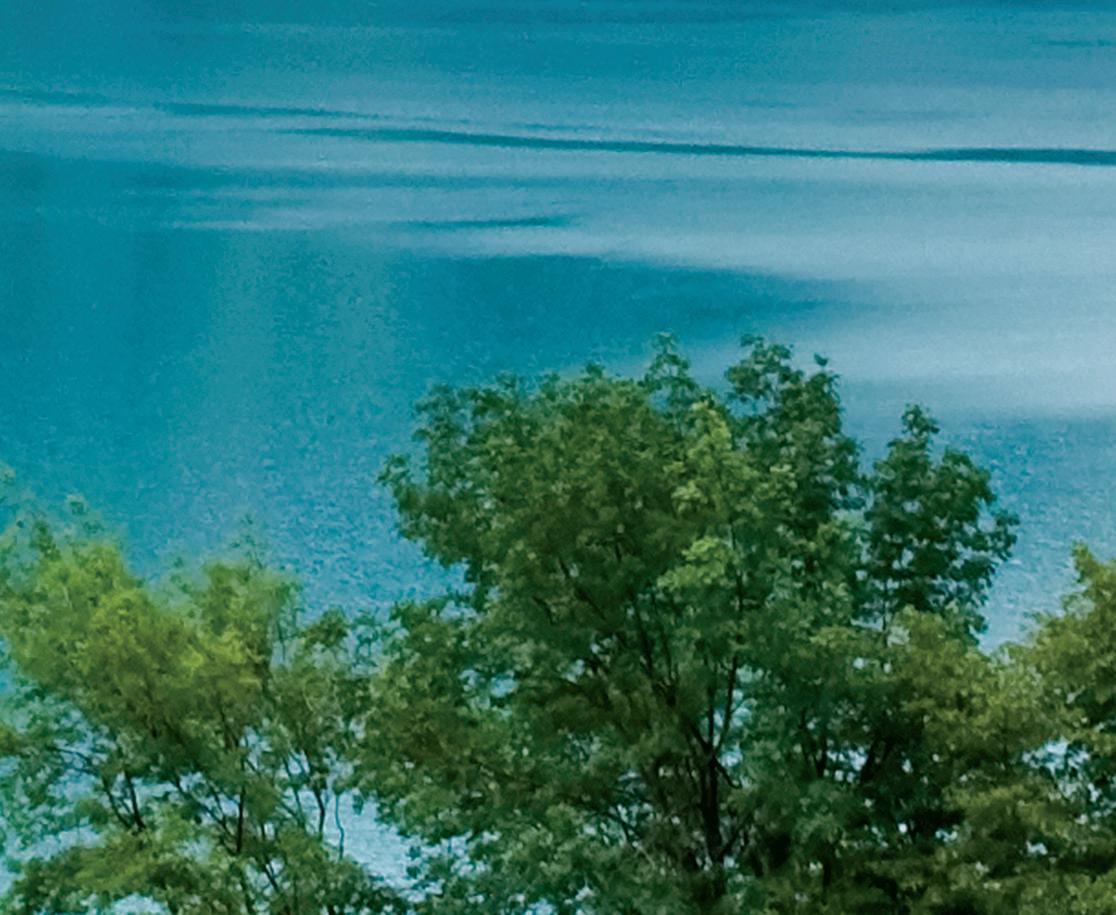

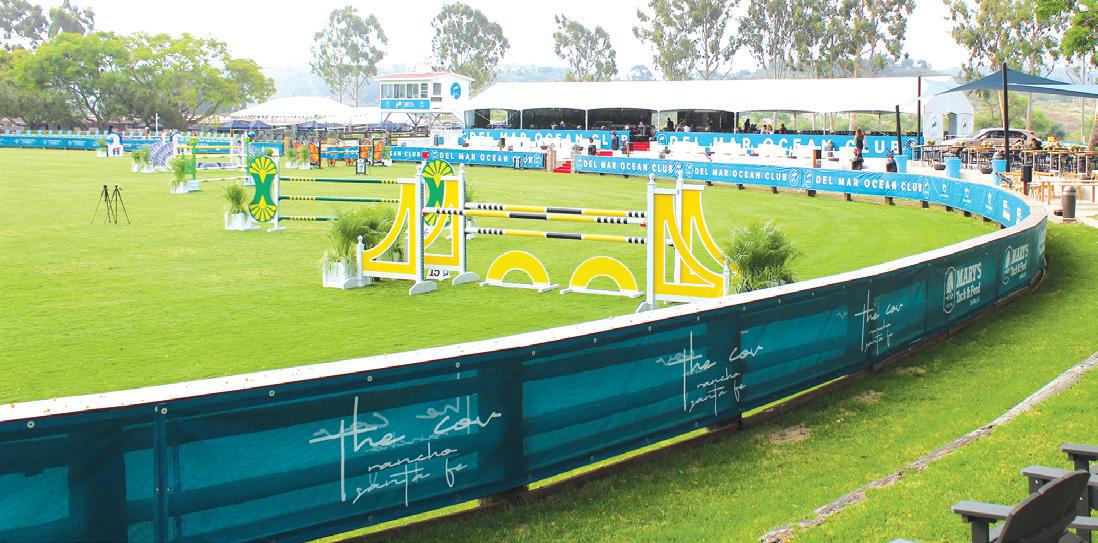

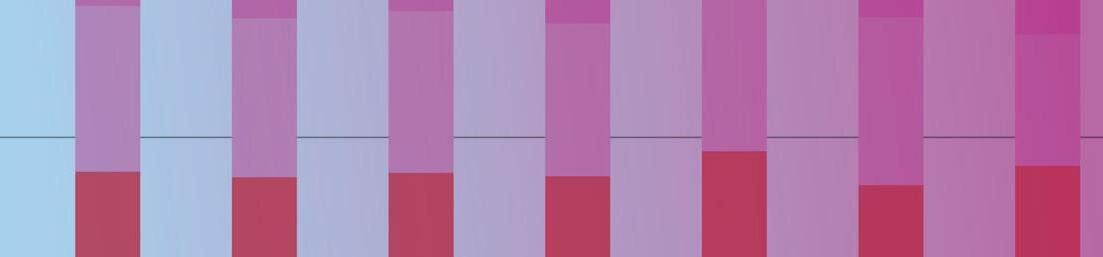

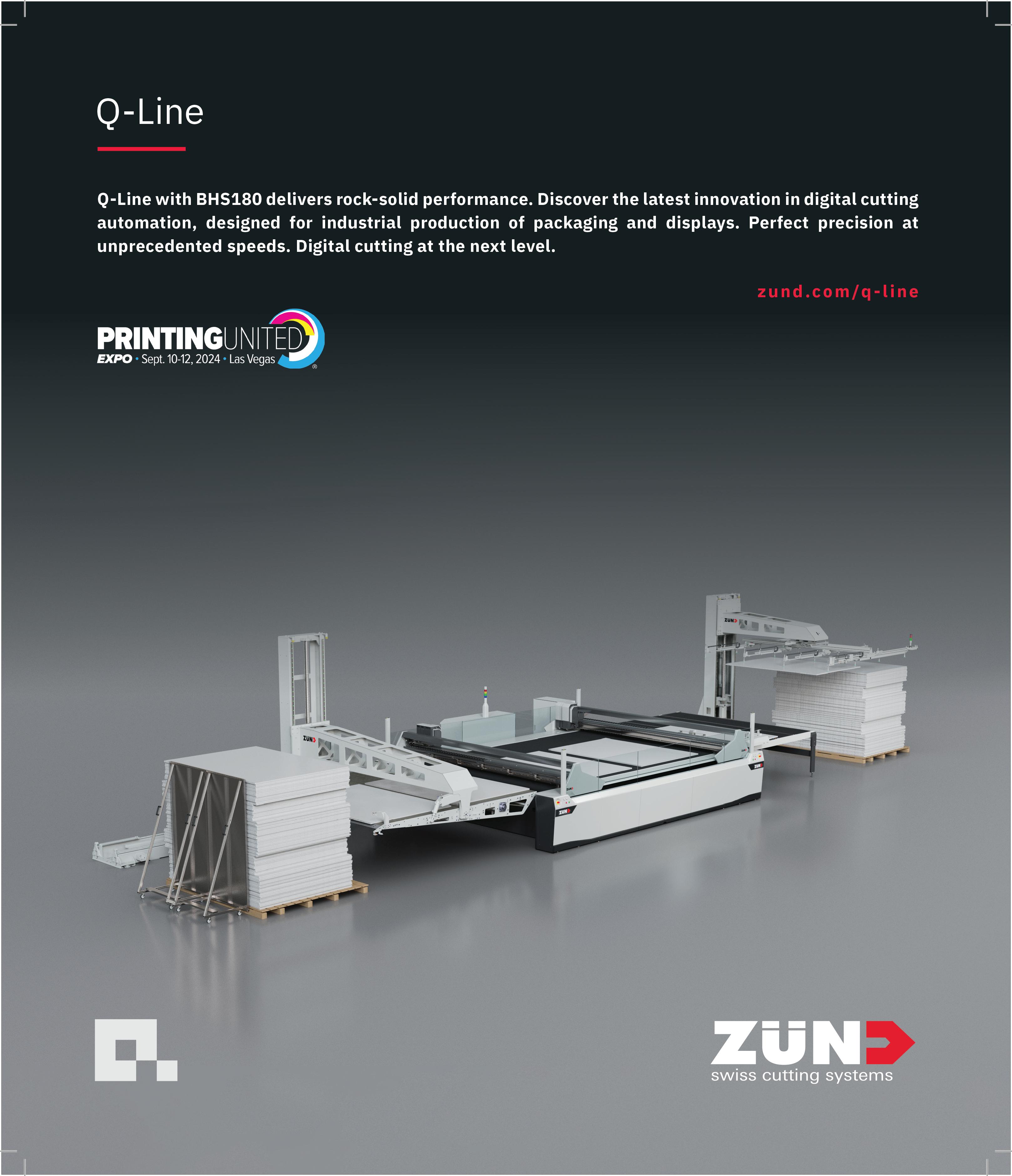

1 & 2) FASTSIGNS - San Diego on Miramar Rd.’s work for HITS Del Mar Horsepark earned it first place in Digital Output’s 2024 Application of the Year awards. Epson SureColor S60600 roll-to-roll and SureColor V7000 flatbed printers as well as a Colex Sharpcut digital cutting system and matching Bubble-Free Pro Table Applicator helped complete various graphics in three weeks.

1 2

promote the re-opening. A phone call to FASTSIGNS - San Diego on Miramar Rd. to center manager Maria led to Beard visiting the park—three weeks prior to the planned July 15, 2023 event.

“The caller originally requested arena wraps and a fairly wide variety of signage. It was clear this project needed more than a phone call. The buildings, arenas, and the overall look of the facility were drab, weathered, and in need of a serious makeover. The scope of the project was clear from the moment I arrived. The park had zero signage other than restrooms, no barn identification numbers, no stable numbers, and no directional signs—no signs anywhere. With close to 10,000 people showing up on competition weekend they needed help fast,” explains Beard.

Looking at the Numbers

FASTSIGNS - San Diego on Miramar Rd. got to work. In three weeks it printed over 40,000 square feet of mesh banners, more than 2,400 square feet of corrugated signs, over 2,000 square feet of ACM signs, over 250 square feet of PVC signs, and four dozen horizontal and vertical flags. This totaled an estimated 120 hours of production time.

Tools of choice, Epson SureColor

S60600 roll-to-roll and SureColor

V7000 flatbed printers. They allowed the print provider to match HITS’ specific PMS teal color for the background found on many of the signs. Finishing was completed with a Colex Finishing, Inc. Sharpcut digital cutting system and matching Bubble-Free Pro Table Applicator.

Some of the more specific applications that were completed included wayfinding/directional signage throughout the park, sponsor banners, shapes/obstacles used for the riders to jump over, and flexible frames that held information cards installed on each horse stall—780 total.

Reasons for Success

HITS was pleased with the outcome—both the final graphics as well as FASTSIGNS - San Diego on Miramar Rd.’s ability to meet the quick turnaround time. It helped the print provider produce a customer testimonial video that showcases the project. The work was also featured in national TV and YouTube ads for FASTSIGNS, which ran during the Kentucky Derby this past May.

“At FASTSIGNS, we talk about transformation and unlimited possibilities. What we accomplished at the HITS Del Mar Horsepark is a testament to our brand standards and our unique ability to provide comprehensive visual solutions on tight timelines with outstanding results,” shares Beard.

Part of the success of this particular job—and completing the staggering number of applications under the three week deadline—is what Beard credits to the company’s project and customer management skills. “Another sign store or franchise may have chosen to ignore that phone call, or not thought to follow up and make the effort to make an onsite visit. They may have missed an opportunity to deliver outstanding results for a customer. We chose to act

instead, and this project really speaks to the value we bring at FASTSIGNS as well as our experience and expertise.”

Under Beard’s management, the San Diego on Miramar Rd. location continues to thrive. While he admits that 2024’s sales have leveled off from the pandemic era, with it being an election year the print provider “remains bullish on the business community and sees a steady influx of new businesses and exciting businesses bringing new products to market.”

Show-Worthy Signage

With the help of FASTSIGNS - San Diego on Miramar Rd., HITS Del Mar Horsepark was converted from a deserted space into an event-driven location. It now welcomes thousands of riders and

spectators to weekly events that include dressage, horse lunging, and dog obstacle shows.

“This project transformed a tiredlooking facility into a dynamic, colorful, informative, and wellbranded equine campus. With over 14 different outdoor arenas, one indoor arena, over 780 stalls for horses, bleachers for spectators, jumbotron screens, a VIP seating area, and elevated judges’ stands, this park went from mundane to marvelous in under three weeks,” says Beard.

FASTSIGNS - San Diego on Miramar Rd.’s work for HITS Del Mar Horsepark is an excellent example of the transformative power of digital print. Congrats again for winning Digital Output’s 2024 Application of the Year awards. D

by Cassandra Balentine

ye-sublimation (dye-sub)—transfer and direct—represents a popular method for textile printing. Ease of use and low capital cost are two primary reasons this process is appealing. Inks continue to evolve to improve quality and durability.

Transfer dye-sub involves printing to a transfer paper using dye-sub ink. Heat and pressure are then applied to convert to a gas that bonds to the fibers of a selected substrate.

With direct dye-sub, ink is jetted right to the substrate and heated. Both methods are popular for textile printing.

“Sublimation printing is one of the most common technologies used for digitally printing textiles, representing well over 50 percent of the output production. It is popular in the wide format space, but is also growing in the industrial space as

Above) INX’s DT9 and DTX inks are developed for the i3200 and i1600 Epson series of printheads. DT9 is suitable for direct printing and transfer, making it ideal for soft signage.

installations of industrial production printers have increased,” comments Simon Daplyn, product and marketing manager, Sun Chemical.

In recent years, Lily Hunter, product manager, Professional Imaging, Epson America, notes a shift in the textile industry from global to regional suppliers in response to ongoing shipping and supply constraints. “This has continued the adoption of dye-sub, underscoring its benefits for regional suppliers. Moreover, print service providers (PSPs) just getting acquainted with the technology are now understanding its full potential and recognizing its expanded capabilities.”

Rise or Decline

As the textile print industry evolves so does dye-sub.

Josh Hope, director, marketing, Mimaki USA, Inc., believes transfer dye-sub is here to stay. “The application opportunities are vast, from traditional garments, interior décor, and soft signage to hard surface transfer such as aluminum panels for artwork or tabletops for furniture decoration.”

“We expect sublimation printing to maintain and potentially grow its market share,” says Daplyn. “There has been some recent market upturn due to increased demand in the sign and display as well as sports apparel markets, and this trend is expected to continue. Sublimation is well positioned to support printing of recycled polyester, which is used increasingly in these industries. While the largest area of growth is in Asia, markets in North and South America show consistent growth.”

Learn about the convenience, e ciency, and versatility of the Easymount Hybrid laminator!

Introducing the Easymount Hybrid laminator, a brand new multi-patented system with innovative HOVER technology. This one-of-a-kind laminator combines the benefits of both a traditional roll-fed laminator and a flatbed applicator in a single machine. It is the world’s first laminator and applicator, all in one. With its roll to roll technology, you can enjoy efficient and uninterrupted long-run, roll-fed laminating. The patented floating rollers not only save time but also ensure that your boards are kept in perfect condition throughout the process. The Easymount Hybrid laminator features a modular design that can be configured to grow alongside your business. Visit vivid-online.com for more information. INFO#18

AUCTION GROUP

Don’t miss Guy’s E. Paper Inventory Reduction Online Auction!

Featuring top-notch Mid-Land Ross Cameron rewinders, printers, forklifts, printing materials & more, this event is perfect for printing industry professionals. Highlights include a 115" Cameron Duplex Slitter Rewinder, a 76" Cameron Duplex Slitter Rewinder with Crane, and a 72" Cameron Midland Ross Slitter Rewinder. Presses, huge selection of various sublimation paper rolls and more are also up for grabs. Open House: August 15th from 9:00 am to 1:00 pm at 1150 McConnel Rd., Woodstock, IL 60098. Bid Now at HansenAuctionGroup.com. Online bidding ends August 19th. For inquiries, call 920-383-1012. 10% Buyers Fee. Bryce Hansen, Registered WI Auctioneer #225. INFO#21

Automate DTF Cu ing – ExpressCutPRO Digital Die Cu er from Supply55

Engineered and manufactured by Saga, the ExpressCutPRO reduces labor and increases profits by eliminating the timeconsuming task of manually cutting direct to film (DTF) or UV DTF transfers. Featuring an integrated conveyor belt and QR workflow, allows for a fully unattended workflow experience. Increase your output while reducing operation costs with ExpressCutPRO DTF Cutters. For more information visit supply55.com, call 734-668-0755, or email sales@supply55.com. Simplify your cutting operation today with ExpressCutPRO. INFO#20

Trim USA – Custom Striping

Unique to Trim USA, the BigStripe® Custom Stripe Program gives you custom rotary slitting up to 30 inches wide, with capabilities to custom configure single or multi-color, voided, overlaid, butted, or overlapped stripes. Use your choice of today’s most popular pressuresensitive films by 3M™ and other leading manufacturers. Reflectives, opaques, and metallics are all eligible materials. These stripes are perfect for identifying fleets, railroad cars, boats, police and emergency vehicles, gas station awnings and canopies, decorative interior/exterior walls, and any other applications where big stripes are used. If you have a big job, we can cut it down to size! Visit trimusa.com. INFO#22

SUPPLY55,

VIVID LAMINATING TECHNOLOGIES

TRIM USA

HANSEN

Anne de Brouwer - Veldman, product manager, SPGPrints, points out that for a long time, direct disperse printing was the most widely used

textile printing technique for printing polyester fabrics, especially for sportswear, because disperse is known for its washing fastness.

“Sportswear is washed often. In other polyester markets, digital sublimation printing quickly became more popular because the process is simpler, and this technology is known to be much more sustainable because no steaming and washing is required,” continues de Brouwer - Veldman.

“While the data is not suggesting a decline in the use of dye-sub— quite the opposite, actually—I am noticing a shift in scale for the equipment and resources used to produce graphics,” admits Michael Litardo, marketing manager, Mutoh America, Inc. “In a post-COVID society, the desires for micro-scale/desktop or very large 3.2-meter-plus solutions are starting to become paramount. That said, there is still an important market segment for 44- to 75-inch printers in sports apparel, intermediate cut and sew, and print-ondemand personalization.”

Paul Edwards, VP, digital division, INX International Ink Co., sees the possibility of a gradual change in popularity for dye-sub textile printing. “The dye-sub process is somewhat ‘greener,’ meaning the amount of contaminated wastewater produced when printing with dye-sub is far less than conventional reactive dye printing. The printing process is also less complicated and suitable for local manufacture or the onshoring of products.”

Hunter expects the popularity of dye-sub to continue to grow as it’s such a versatile solution that it permeates many market segments,

1) Sublimation transfer can be used to create a range of popular fashion garments, like this dress created with Mimaki digital printers.

including apparel, home décor, wall applications, and signage applications. “There are few other wide format printing technologies that can rival the versatility of dye-sub and its ability to diversify product offerings.”

Furthermore, Hunter says select dye-sub solutions offer an expanded color gamut to enable the reproduction of challenging colors like fluorescents, creating stunning gradients and accurately matching brand colors, which significantly enhances their value proposition.

Dye-Sub Benefits

Several benefits are associated with dye-sub, including versatility, quality, and sustainability.

Hope points out that sublimation transfer is a near-waterless process. “The conventional textile dying method generates on average 14.5 liters of wastewater per square meter of fabric processed, based on our company’s research. The wastewater contains chemical substances used in pre- and postprocessing and is considered an environmental concern.”

In contrast, a fully digital textile process consisting of a sublimation transfer printer and dye-sub inks, transfer paper, and a transfer heat press can produce large quantities of printed textiles ready for finishing without using any water and with no risk of chemical contamination, shares Hope.

He points out that Mimaki offers this scenario as a complete package—TRAPIS—a digital process that generates almost no wastewater, just the amount in the waste

ink generated by the printer’s automatic maintenance function. This even includes wastewater generated in the transfer paper manufacturing process, with wastewater cut by approximately 90 percent compared to conventional digital dyeing systems.

Marco Zanella, global business development director - inkjet, INX Europe, points out that pigments have a similar profile to sublimation in terms of sustainability. “This is due to formulations being printable without pretreatments, and with minimal impact on the process. It also results in extremely low water waste impact, with only a limited amount needed for cleaning the belt in some cases.”

When formulated correctly, sublimation inks can be used in a

hybrid set up for printing, either through transfer paper or directly to the fabric. “Direct printing enables better penetration of the ink while removing an extraneous process input to the paper, though it does require chemical precision,” explains Daplyn.

Because sublimation is a dry process, it enables a simplified workflow and set up with a smaller footprint, allowing for easier adoption. “It is a fast process, which permits users to begin their print very quickly and give less attention to pre- and post-treatments that are often necessary with other technologies,” says Daplyn.

“Sublimation printing can achieve striking, vibrant results with excellent image sharpness. Though mainly used with textiles, it can

also be used to decorate a range of other surfaces,” adds Daplyn.

Unlike traditional textile dying techniques, Hunter feels that digital printing offers unparalleled design flexibility, boasting an expansive color gamut and color accuracy. “Due to cutting-edge technology, such as the PrecisionCore printhead and Nozzle Verification Technology in the Epson SureColor F-Series, precise details can be reproduced with clarity and at photographic print quality. This offers the ability for textile designers to create intricate designs featuring fine lines and details, color gradations, and vibrant colors.”

There is also the benefit of expanded color gamut in certain situations. “There are dye-sub printers that offer expanded ink sets, with colors outside of the traditional CMYK offerings. These offerings empower designers and PSPs to produce vibrant textiles to match apparel trends, safety apparel requirements, sports jerseys, soft signage, and décor that often include specific colors,” says Hunter.

There is a distinct permanence in using dye-sub that you do not get with other technologies. “Repeated washability and outdoor durability are unmatched and allow for higher consumer satisfaction,” comments Litardo.

Personalization is another perk. “Dye-sub is an ideal method for fulfilling medium to large runs of personalized apparel, making it perfect for supporting local sports clubs, teams, schools, and similar groups. Additionally, it offers a seamless way to produce one-off personalized gifts. This versatility allows businesses to extend their services beyond large batch orders, tapping into the demand for small, unique gifts,” adds Hunter.

Associated Challenges

The biggest challenge of transfer dye-sub is fabric compatibility.

Litardo points out that dye-sub is a premier method of transferring graphics to polyester-based textiles. “The biggest non-starter for dye-sub is the limitation to polyester-based materials. This doesn’t necessarily reduce the overall variety of different products that can be produced, but dampers PSPs from creating things on natural fibers such as cotton or on raw materials like uncoated metal,” says Litardo.

“Dye-sub only works well with polyester fabrics or with fabrics containing a significant amount of polyester,” notes Edwards. “That said, due to its bright and strong color gamut, it can be a great choice for sportswear applications and apparel.”

Hunter stresses that PSPs need to understand the fabric limitations for textile applications. Dye-sub is best suited for polyester fabrics, and those fabrics offer advantages including durability, rub resistance, and versatility.

Sublimation transfer printing adds multiple variables to the print production workflow, including transfer paper, fabric, and the transfer process itself. “Because of this, it is easy to get bogged down in all the possible combinations. It is advisable to simplify the paper and fabric combinations and test to ensure all aspects are working together well,” shares Hope.

Daplyn notes that many inks are not versatile enough to be used with different papers, so they must be selected for their designated use. “When switching from a low weight, uncoated paper used for fashion to a higher weight, tackcoated paper for sports apparel, the ink needs to be changed to maintain the same print quality and color uniformity.”

Edwards admits that there are some challenges as it relates to the transfer process. “Take care to ensure all the process variables such as heat, substrate type, and transfer media are under control and consistent. One dye-sub

drawback as a technology is it has a lower lightfastness than pigment or reactive dye.”

“The interaction between transfer paper and sublimation ink is sensitive. There are plenty of papers available. For economical reasons, printers would like to use lightweight papers. Some regions prefer even uncoated papers, or direct printing. Then also fastness is a crucial factor,” says de Brouwer - Veldman.

Another challenge is avoiding waste. “Transfer paper may easily become a waste product, although in many cases the paper is able to

be recycled. Another common area of waste is ink. Some of the ink and dye often remains on the paper without being transferred to the fabric during printing. To avoid ink and dye waste, it is important to select the inks with the best transfer rate,” advises Daplyn.

Dye-Sub Solutions

Dye-sub printing is well suited for a variety of textile applications. For print providers, soft signage is an easy add on. However, some of the latest technologies make the appeal for apparel applications. Dye-sub inks continue to evolve to support quality output. D

t’s time to check on the status of the wide format graphic arts. According to most, it’s been a positive last 12 months and it looks as though we will continue out the calendar year on that note. Media, hardware, and software vendors all agree that 2024 presented challenges, but nothing that couldn’t be overcome.

Satisfy Objectives

Setting and acting on goals are a blueprint for most companies. Within goals are expectations for success. At the start of any

by Melissa Donovan

fiscal or calendar year, companies of all shapes and sizes create expectations for what is to come and hope they are met.

At Colex Finishing, Inc., Keith Verkem, national sales manager and senior product manager, believes “this year has been very good with continued growth in all segments of our business.”

“The start of 2024 was very positive for the digital business at INX, with revenue and

earnings meeting expectations. There is significant interest in digital printing and we are identifying and addressing several exciting new opportunities in our core packaging markets,” shares Paul Edwards, VP of the digital division, INX International Ink Co.

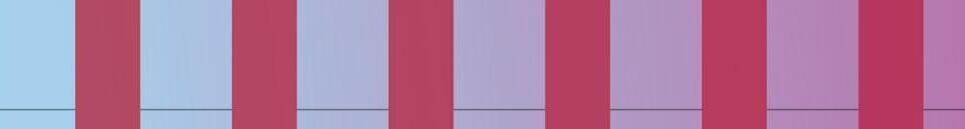

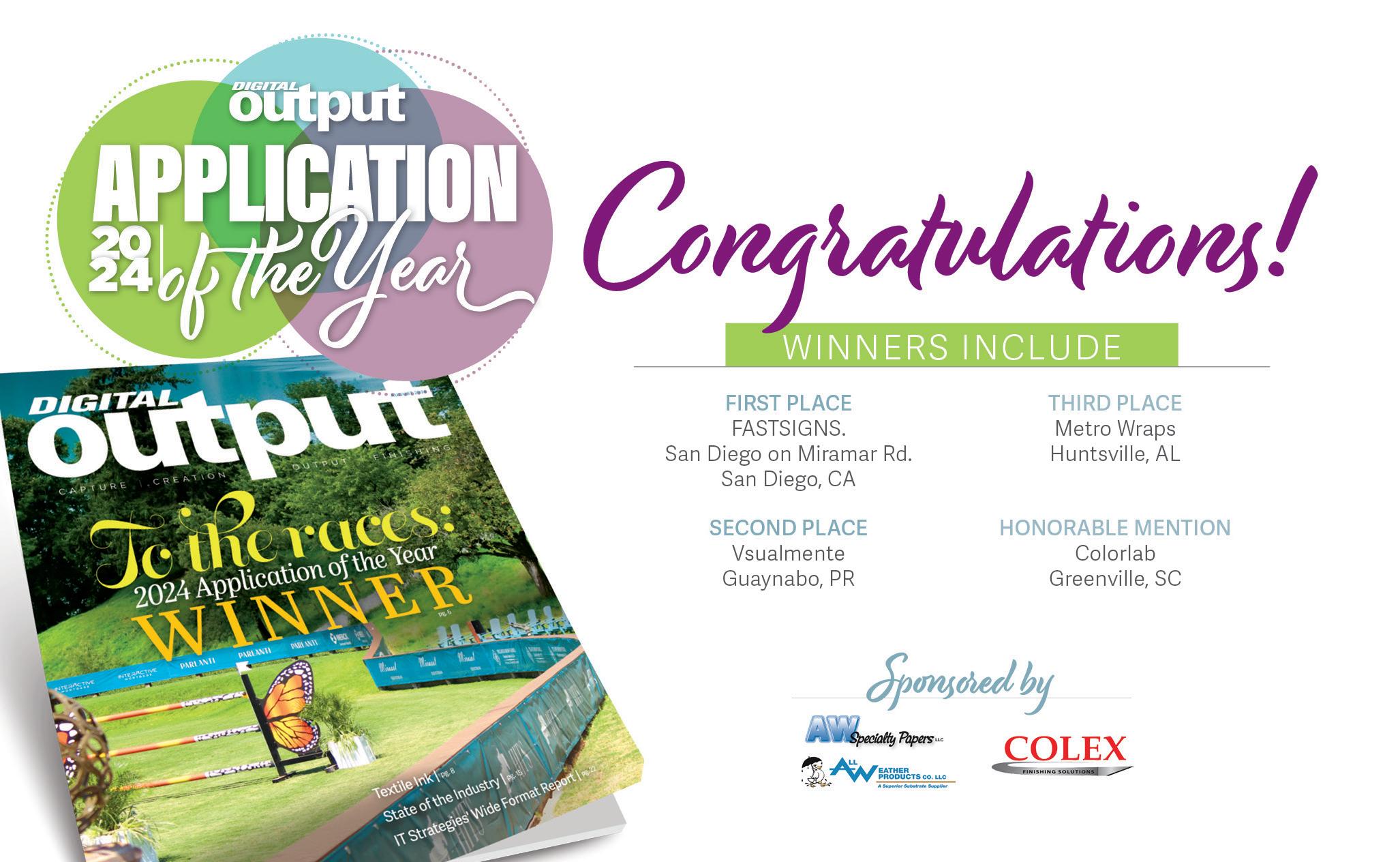

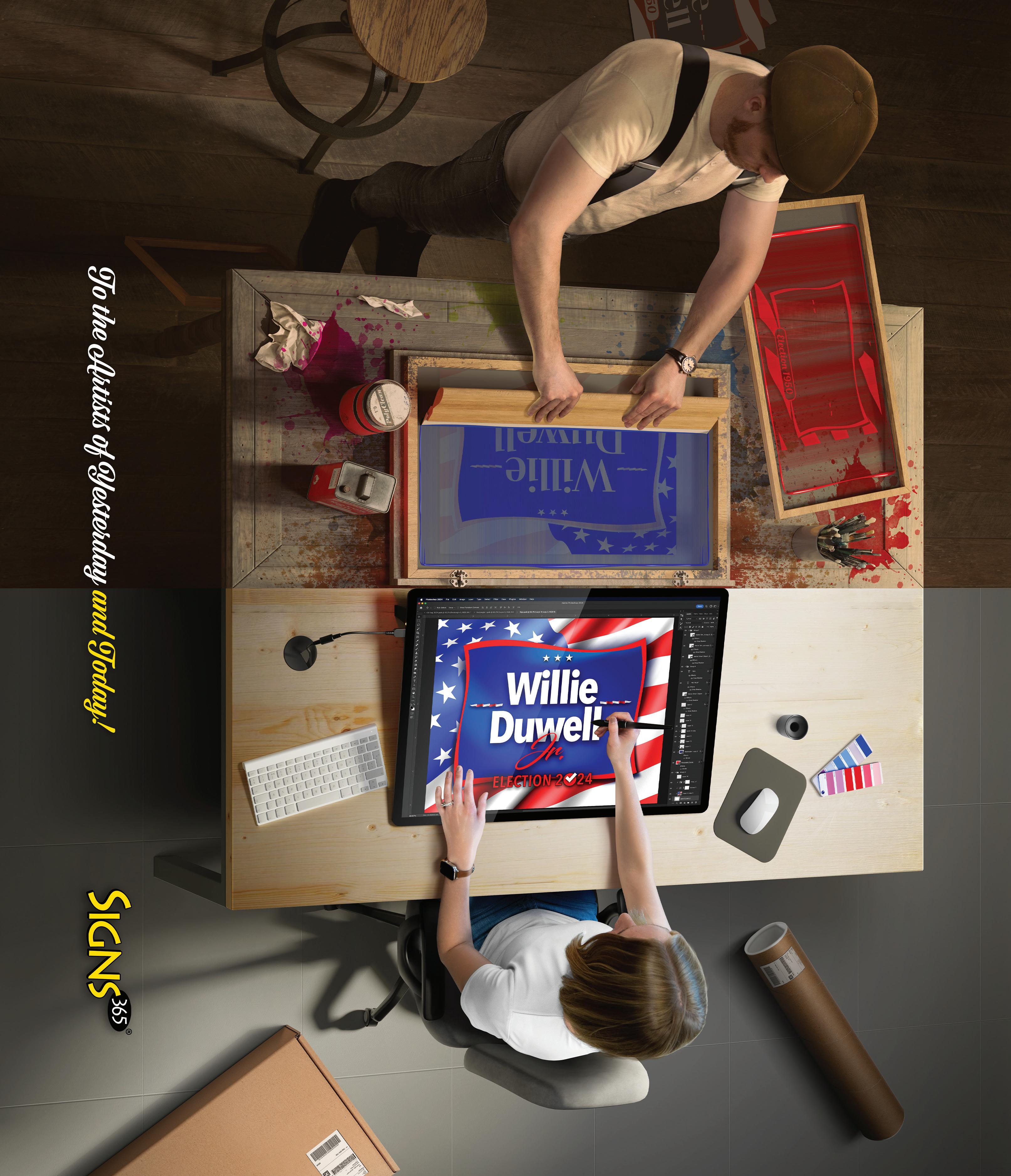

Above, left to right) Vsualmente, Guaynabo, PR, won second place in Digital Output's 2024 Application of the Year contest for creating two floating fascias 35 feet long by 16.5 feet wide by three feet high out of General Formulations’ 285 RoughMark for Zone 3 restaurant in San Juan, PR.

Positive trends are a theme at Jessup Manufacturing Company. “We not only maintained but also increased our market presence and customer engagement. We are seeing significant traction across various market segments,” admits Mike Richardson, business development manager, Jessup.

Jodi Sawyer, senior business development manager - retail, Flexcon Company, Inc., has observed lowered inventory levels and buying patterns returning close to pre-pandemic levels. Based on her research, according to OAAA, out of home advertising revenue increased 6.8 percent in the first

quarter of 2024 compared to the previous year with transit advertising growing by 18.8 percent and placed-based ads by 12.7 percent.

Another major media player in the industry, FDC Graphic Films, Inc., is also experiencing a successful 2024. “It met our expectations and, in some cases, exceeded them. While digital signage continues to be in demand, so does the versatility of wide format printing across a diverse range of industries and applications. From outdoor signage and banners to vehicle wraps, murals, and interior décor, wide format printing is still used to create eye-catching and impactful visual experiences in various settings,” notes Laura Reid, VP of marketing, FDC.

Despite success, there are challenges like price pressures due to continued inflation and just-intime demand. “With interest rates continuing to be high, we see most clients price shopping on every order without concern for application or lifespan requirements as well as only stocking what they need versus inventory for future demands as we experienced during the height of raw material shortages,” admits Dennis Leblanc, senior business development manager NA, Drytac.

“The industry remained resilient and strong amid a lot of economic

1) Colorlab of Greenville, SC took home the honorable mention in this year’s Application of the Year awards for its work in this lobby space. The 60x32-foot wall mural was printed on DreamScape Mystical with a Canon Colorado UVgel printer. Graphics on other sections of the wall and glass used Drytac ViziPrint. 2) Metro Wraps in Huntsville, AL won third place for its wrap on an Audi RS6 Wagon for Horsepower Therapy.

uncertainty. We expect the back half of 2024 to remain strong. Our demand continues to grow despite softening print equipment sales and we continue to watch how this will impact the sales of media,” shares Cassandra Yu, market segment development manager, Avery Dennison Graphics Solutions.

It was a busy first half of the year for Significans Automation. “As news of the benefits of print and packaging automation spreads, commercial printers and packaging converters are more open to adopting tailored software solutions for their businesses. Some deploy it in smaller phases, realize the benefits and fast return on investment, then move on to full, customized, in-shop automation. Others require an overhaul of their legacy workflow software including other profit-eroding processes,” explains Marc Raad, president, Significans Automation.

Sebastien Hanssens, VP marketing, Caldera, points out it was a Drupa year, which meant many companies part of that show seemingly revolved their marketing initiatives around the trade event that occurs every four years.

Zund America, Inc. focused on its Q-Line at Drupa and hopes to ride the wave of excitement generated from the premiere into the second half of 2024, according to Martin Thornton, business segment manager, Zund America.

Kornit Digital set strategic initiatives around its Apollo printer. In the first quarter, the response for the Apollo was highly positive and received multiple preorders,

according to Sharon Donovich, director, Kornit.

At press time, Mimaki USA, Inc. was a month into its fiscal year, but Josh Hope, director, marketing, Mimaki USA, says it received great feedback from its newly introduced high-production products; the JFX600-2531 UV LED flatbed printer and the CFX Series digital flatbed cutter.

It is also an election year in the U.S. and while Bobby Cagle, NA sales director, SAi, says 2024 was a positive year for his company, “the latter half of the year may present challenges due to the uncertainties

associated with it being an election year. We remain vigilant and prepared to adapt to any changes that may arise.”

“Election spending on advertising media will increase in the second half of the year along with seasonal promotions, leisure travel, and sports and entertainment events. Samples and quotes increased and those are leading indicators of growth. We expect good second half growth with 2024 finishing with moderate overall growth,” notes Sawyer.

Erik Norman, president, swissQprint America, foresees the back

half of swissQprint unit sales to exceed the first half—unless the economy takes an unexpected turn. “Most printers we speak to are seeing growth in their business, but at a slower pace than in 2023. We still see many printers taking a somewhat cautious outlook given our macro-economic and political landscape.”

Ecological Outlook

Sustainability continues to be a focus, whether the conversation is on recyclability, circular economics, or reusability. There are positive indicators that the industry is heading in the right direction in terms of sustainability.

New products amplify the commitment. Lintec of America, Inc., for example, produces a recycled content PET film at almost an identical cost as a virgin film. “Four years ago we switched our economy print treated optically clear film made from virgin polyester to one that was made with 80 percent recycled content PET. It has performed exceptionally well,” shares Jim Halloran, VP sales and marketing, Lintec.

“Market acceptance of products with recycled, compostable, and bio-based content increase as consistent quality and performance improve,” notes Sawyer.

Amanda Smith, marketing communications manager, Mactac, says that the wide format industry is now prioritizing sustainability— especially as customer demand increases. “More end users promise to invest in sustainable practices, but we also must continue to develop and implement sustainable strategies that reduce waste, conserve resources, and promote sound environmental practices.”

“As consumers and end users continue to drive growing demand for sustainable solutions the rate of innovation to decrease costs is not moving at the same pace,” admits Yu. To overcome this challenge, Yu believes “it will require the entire value chain to commit together to take on a portion of the increased cost in order to accelerate the industry forward.”

According to Edwards, “in regards to the cost of sustainable products, technology advancements will help reduce these costs. But the substantial adoption of these products

3)

by end users will ultimately have the most impact on cost reductions over time.”

There is still progress to be made, however “the wide format printing industry is undoubtedly moving in the right direction regarding sustainability. The decreasing costs of sustainable products and the increasing emphasis on recyclability and circular economics are positive indicators that the industry is committed to achieving long-term environmental sustainability,” shares Richardson.

Cagle agrees, stating that overall the industry is moving in the correct direction. “Manufacturers are making strides in developing sustainable inks and materials. In addition, recycling rates of substrates are at their highest. However, the industry’s need for longevity and durability in products sometimes conflicts with sustainability goals.”

“We are seeing more economic options for sustainable materials and more printers are becoming intentional about how to bring sustainability into their operations—via energy use, material handling, and other practices. Our

role as an OEM is to keep doing our part by making swissQprint’s sustainability initiatives visible as well as economically viable, and by offering products that are ecologically friendly,” expresses Norman.

Sustainability is a top priority for Kornit and this is reflected in its Apollo printer. “It opens new possibilities for sustainability with no minimum order quantity, justin-time production, and usage of water-based pigment inks that are compliant with the highest standards and low carbon footprint,” explains Donovich.

TRAPIS, Mimaki’s digital textile process, generates almost no wastewater, just the amount in the waste ink from the printer’s automatic maintenance function. “Including wastewater generated in the transfer paper manufacturing process, wastewater is cut by approximately 90 percent compared to conventional digital dyeing systems,” shares Hope.

Zund America conveys a commitment to sustainability in its manufacturing process. “As a Swiss machine manufacturer, Zünd has always put emphasis on building high-precision, high-quality, longlasting equipment with most components originating from regional suppliers, creating a short and reliable supply chain. The well-known modularity and upgradability of Zünd cutters further extends their lifespan, contributing even more to sustainability,” attests Thornton.

Sustainable practices on the back end of production are also of note, like recycling and reusing, points out Reid. FDC runs a program that provides a no-cost supply of scrap vinyl film for local schools, community art classes, and public library media labs to create art while reducing the amount of vinyl film remnants that enter landfills.

Streamlined Automation

It was discussed a lot last year and continues to be a hot topic into 2024—automation.

“Automation reduces human touch points and errors, speeds up production, and drastically reduces the overall cost of production. When you take it to the next level and deploy customized workflow automation, the numbers are game changing,” attests Raad.

For example, when implementing workflow automation Significans Automation’s clients have seen job processing times reduced from eight hours to five minutes, labor costs cut by up to 75 percent, lead times cut from up to three weeks to one or two days, and yearly capacity up by 30 percent.

“One important consideration is the continued battle to find skilled talent. Automation solves this lingering problem, allowing print businesses to do so much more with the equipment and staff they already have,” adds Raad.

Steve Lynn, director of labels and packaging - sales, Durst North America, says the biggest trend in the industry is requests for automation to control more operator functions reducing the need for

The winner of 2024 Application of the Year awards is FASTSIGNS - San Diego on Miramar Rd. of San Diego, CA. The company won for its multifaceted project used during the inaugural season of HITS Del Mar Horsepark in Del Mar, CA.

skilled labor and allowing shorter runs to be produced more efficiently with less human touches. “From prepress, all through production to shipping, equipment and software must handle as much of the entire production process with minimal human intervention.”

At the end of the day, Donovich admits it is all about being “profitable, agile, and flexible” and automation in a digital print production house achieves all three.

While printing used to be “heavily manual,” according to Hanssens, “now that it is a mature market and processes higher production volumes, print service providers (PSPs) want to print and cut smarter.” This is why automated systems are critical from hardware to software solutions.

“Automation helps customers achieve production deadlines more efficiently. It helps minimize or eliminate operator errors, which in turn limits waste. This of course helps customers be more profitable,” agrees Verkem.

There is a strong drive to maximize productivity while minimizing human labor and design hours, according to Cagle. “Automation plays a crucial role in this by enabling faster, more efficient production processes. For instance, allowing customers to upload designs and specify quantities for stickers that can be automatically setup streamlines production, increases profitability, and reduces labor costs.”

“In today’s environment it’s all about eliminating—or at the

very least accelerating—processes through automation. This, of course, will only work if the automation put in place is actually reliable. That is why it is so important for customers to thoroughly investigate and test equipment before investing in automation,” recommends Thornton.

Norman believes that PSPs embracing automation and other technologies that impact productivity both operationally and in business development will sell better, market better, and produce more efficiently, resulting in them becoming industry leaders.

Continued Challenges

Some areas of concern in 2023 included market maturity, consolidation, and creating higher productivity equipment to satisfy demand. These continued into 2024 and new ones have emerged.

“2023’s concerns were not annual, but rather, about a market that is maturing. In addition, wide format printing has become increasingly integrated with digital technologies, such as augmented reality

and variable data printing. These integrations allow for interactive and personalized experiences, enhancing the effectiveness of printed communication and marketing campaigns. As this market evolves, we must continue to be focused on delivering cost-effective, valueadded products and services with quality and consistency in parallel to these advanced technologies,” notes Reid.

Between market maturity, consolidation, and creating higher productivity equipment to satisfy demand, Norman believes all of them are normal variables that will continue for some time.

“Much of these concerns are the same. It is not only about being more productive but also hitting the production requirements with less people,” agrees Verkem.

Raad expects the worldwide printing market to continue to mature holistically—depending on the region, with some countries maturing faster than others. “This will in turn depend on several factors such as the types of consumer

Cassandra Yu, market segment development manager, Avery Dennison Graphics Solutions 120 graphics.averydennison.com

Sebastien Hanssens, VP marketing, Caldera 121 caldera.com

Keith Verkem, national sales manager and senior product manager, Colex Finishing, Inc. 122 colex.com

Dennis Leblanc, senior business development manager NA, Drytac 123 drytac.com

Steve Lynn, director of labels and packaging - sales, Durst North America 124 durstus.com

Laura Reid, VP of marketing, FDC Graphic Films, Inc. 125 fdcfilms.com

demand, availability of raw materials, supply chain bottlenecks, and economic and political stability.”

“Market maturity continues to be an area of concern in 2024 as growth has slowed or is slimmer than prior years. There continues to be downward price pressure from tightening budgets and cost controls and a higher percentage of the advertising spend often goes toward digital advertisements where the production costs are lower and implementation is faster,” explains Sawyer.

On the topic of consolidation, “more profitable PSPs are looking to absorb competitors or owners are looking to retire after being in the industry for 30 years and looking to sell,” suggests Hanssens.

“While there has been some market consolidation, growth in the demand for automation across all sectors continues to offer many opportunities. This is especially true for suppliers who meet this demand with wide ranging, customizable workflow solutions. Incidentally, consolidation, too, can

Jodi Sawyer, senior business development manager - retail, Flexcon Company, Inc.

flexcon.com

Paul Edwards, VP of the digital division, INX International Ink Co. 127 inxinternational.com

Mike Richardson, business development manager, Jessup Manufacturing Company 128 jessupmfg.com

Sharon Donovich, director, Kornit Digital 129 kornit.com

Jim Halloran, VP sales and marketing, Lintec of America, Inc. 130 digitalwindowgraphics.com

Amanda Smith, marketing communications manager, Mactac 131 mactac.com

bring about growth, with a need for updating or adding equipment with more advanced levels of automation,” shares Thornton.

Not only is there consolidation among PSPs, but distributors and manufacturers as well. “In the wide format market we continue to see mergers and acquisition activity at all levels of the supply chain from retailers and brands to printers to regional and national distributors to materials manufacturers and OEMs,” cites Sawyer.

“Jessup is committed to addressing this dynamic market environment by delivering exceptional value to resellers. The strategy involves expanding our product portfolio and enhancing our technical expertise. We aim to empower our resellers and PSPs to thrive amidst industry changes,” shares Richardson.

Higher productivity continues to be a request and is now met much easier thanks to technological advancements. “It’s a given that customers will always want higher productivity as their businesses grow,” explains Hope.

Hope, director, marketing, Mimaki USA, Inc

mimakiusa.com Bobby Cagle, NA sales director, SAi

thinksai.com

Marc Raad, president, Significans Automation

significans.com

Erik Norman, president, swissQprint America

swissqprint.com

Martin Thornton, business segment manager, Zund America, Inc.

zund.com

“Higher productivity is an advantage that most should see as an opportunity to review current production flow and look to areas of improvement that directly impact the bottom line,” says Leblanc.

In 2024, the team at SAi observed a shift in customer preferences away from large, high-productivity equipment. “Feedback from printer resellers indicates a growing demand for smaller format equipment—64 inches and under—aligning with our company’s strategic focus,” says Cagle.

Emerging concerns include “alternative technologies to traditional

print technologies and media, which will be something to watch as they evolve. We see digital screens replacing physical signage in retail environments. LCD and LED panels rapidly replacing outdoor signage,” notes Yu.

Norman believes there is a greater need for versatility and differentiation. “More printers are sharing that buyers are seeking to print on a wider variety of substrate options and looking for more embellishment capability.”

“Given the continued uncertainty around inflation and interest rates, there is a risk of some level

of economic slowdown, which could affect both capital and ink demand. This is a concern, although it is not apparent at this time. There are some signs of raw materials supply issues becoming more prevalent again, which would be a concern if instances continue to grow,” notes Edwards.

Coming Up Next

With risk there is reward, and many PSPs—as well as the vendors that service them—are positioned to flourish in the last part of 2024. Annually, Digital Output holds the Application of the Year awards and invites members of the industry to nominate

themselves, peers, or customers. The winners are some of the best examples of innovation in the sign and graphics industry.

Congratulations are in order for FASTSIGNS - San Diego on Miramar Rd. of San Diego, CA, it won the 2024 Application of the Year awards for its work at the HITS Del Mar Horsepark in Del Mar, CA. Learn more about the project on page 6 and check out some of the images throughout this article. The second, third, and honorable mention winners are also represented visually here. Read about these winning applications online at digitaloutput.net. D

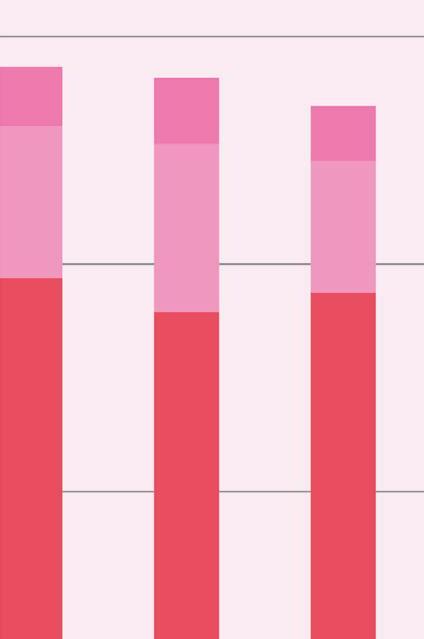

he wide format graphics inkjet industry is over 30 years old and continues to be a replacement market. There was modest hardware unit growth from 2022 to 2023 (Chart A). Some vendors recovered from their 2022 supply chain challenges; others continued to struggle with getting product to market, which resulted in shifts in market share but no incremental growth overall.

There is competition for output in wide format graphics as commercial printers look for new sources of revenue and

by Marco Boer

profit. Historically most commercial print providers deemed wide format to be too small of a business, but as revenues and profits continue to decline, wide format graphics is an appealing source of profits.

As organic demand grows effectively at the rate of the economy, expansion by commercial printers into wide format graphics means greater competition for output. This new competition has led existing dedicated wide format print service providers (PSPs) to complain that output profit margins are eroding, which

in turn pushes the market towards more productive, lower running cost systems.

Total vendor hardware and ink revenue declined slightly in 2023 as the blended average hardware selling price across all segments sold decreased. This doesn’t mean prices of hardware are decreasing, but rather the mix of products sold shifted to lower cost units due to inflation and higher interest rates.

Ink revenues were strong, in part because of increasing ink prices per liter.

Manufacturers have stronger pricing control over ink than hardware. The other factor in high ink revenues is that the average monthly print volumes per printer installed is increasing, as PSPs postpone upgrades due to high interest rates.

From a hard reset in 2020, IT Strategies projects wide format graphics inkjet revenues will grow five percent annually between 2024 and 2029—compared to unit shipment growth of about one percent during that same period. However, IT Strategies projects that even at that growth rate vendor revenues don’t return to 2019 revenues until 2029.

Now let’s get into specifics per ink type—aqueous, dye-sublimation (dye-sub), eco-solvent, latex, and UV-curable.

Editor’s Note: The charts referenced in the article start on page 25.

Aqueous

Total aqueous unit sales were up eight percent from 2022/2023, significant growth in a mature market segment. It should be noted that 2021’s COVID pent-up recovery demand put 2021 sales still 15 percent above 2023 sales. Averaging out 2019 to 2023 sales due to the impact of COVID, average annual sales would be around 26,000 units per year. This puts 2023 sales of 26,000 units right where expected.

Sales of 24-inch devices declined about ten percent from 2022 to 2023, in favor of graphics 36 inches and over, which grew 24 percent during the same period (Chart B).

The installed base grew marginally, but in the outer years as retirements of pre-2019 units kick in, IT Strategies anticipates those retirements to prevent the installed base from growing as new sales are projected to be “flatish”. One reason

for the retirements is that IT Strategies expects many older units in the base to be retired due to lack of usage (Chart C).

One additional source of competition for aqueous wide format is from other specialties like dye-sub and canvas prints printed on latex. Eco-solvent and latex are also expected to continue to steal share from aqueous as they feature lower cost inks.

IT Strategies expects vendor revenues for hardware and ink to grow at a two percent compound annual growth rate (CAGR) through 2029. While no one likes slow growth, it is an indication of market maturity (Chart D).

Eco-Solvent/Latex

Designed for outdoor and indoor use, eco-solvent and latex are expected to see a slight decrease in unit sales from 2023 through 2029, following a slight decline from 2022/2023. One reason for the decline is that in a replacement market of older, slower units, not as many new higher productivity machines are required (Chart E).

Similar to aqueous, there is a lot of transition. There is a high rate of retirements of older machines, and new replacement sales have kept the installed base flat, with uptick expected in outer years as these products start to displace more screen/offset output (Chart F).

Low-end latex printers sell for under $50,000; high-end latex printers sell for over $100,000. The high-end latex printers are often used for décor printing. They account for a small part of the

installed base, but because of their productivity they capture a far greater proportional share of revenues than eco-solvent or low-end latex printers.

Combined, eco-solvent and latex account for almost half of vendor revenue share of the wide format graphics print market, making it the largest revenue segment (Chart G).

UV-Curable Flatbed

UV-curable inkjet presses are productive and offer the lowest cost of print—providing there is sufficient print volume. Initially offered in flatbed format to conform to conventional screen press formats, roll-to-roll UV-curable printers now account for about two thirds of all UV-curable wide format graphics printers sold.

The UV-curable market was hard hit by COVID, as demand for high-volume signage disappeared. There was a strong recovery in UV flatbed after COVID through 2022, but inflationary presses took a toll on new hardware sales and often caused postponement (Chart H).

What is pushing growth is particularly sub-$75,000 products on the low end. Those units are key to driving flatbed UV-curable unit growth and account for more than 40 percent of all low-end flatbed shipments. It is important to note that IT Strategies excludes UV-curable flatbed printers with a width of less than 30 inches.

The high-end flatbed unit shipments recovered in 2023 despite the inflationary pressures, mainly because of pent-up demand due to a 2022 shortage of components.

The component shortage did not affect all vendors equally, and some captured significant gains in market share in 2022. Those gains erased in 2023, leading some to other three year warrantees in order to persuade customers to buy their printers.

UV-curable printers tend to last longer than other categories of graphics printers. The durability has prevented the installed base from declining as much as in other segments of the wide format graphics market (Chart I).

In comparison to aqueous and ecosolvent/latex technologies, UV-curable flatbed installations account for only about eight percent of the entire installed base of wide format graphics printers. UV-curable flatbed printers are closest in productivity to replace screen print. This is why IT Strategies projects the six

percent growth in installed base 2023 to 2028 will drive six percent growth in hardware and ink revenue (Chart J).

UV-Curable Roll

IT Strategies segments the market for roll-to-roll UV-curable printers between low-end under $150,000 and high-end over $150,000. Over 90 percent of low-end printers are priced under $75,000, some as low as $16,000. The young base of low-end roll-to-roll drives installed base growth since there are fewer retirements, unlike the more mature high-end roll-to-roll installed base, which is seeing higher rates of retirements (Charts K and L).

Because of the relatively young installed base, the compound growth of the installed base and rising average monthly print volumes, hardware and ink revenue growth are expected to be very positive

through 2029 in both the low-end and high-end of the roll-to-roll UV-curable market segment, with a projected three percent CAGR from 2024 to 2029 (Chart M).

Soft Signage/Dye-Sub

The majority of low-end, dye-sub soft signage printers sell for under $15,000. They are easy to buy, and provided there is a capable operator, offer among the highest margins of wide format output. The resurgence of trade shows helped fuel the use of existing installed soft signage printers and belatedly translated into growth of new dyesub soft signage printer sales in 2023 bringing them back to 2020 levels (Charts N and O).

Despite the high value created by soft signage it remains the smallest of all wide format graphics segments. However, rising productivity of hardware drives up AMPVs,

resulting in higher consumable revenues per printer, ultimately getting the hardware and ink vendor revenues back up to 2019 levels sometime after the forecast period (Chart P).

The Bottom Line

Relatively low-priced aqueous and eco-solvent/latex printers continue to dominate unit sales of wide format printers, capturing a steady combined share of market of about 80 percent of units sold (Chart Q).

More important than units is revenue from hardware and ink. UV-curable printers capture about ten percent of the units sold, but because of their productivity, they account for over 33 percent of the vendor revenue spent by PSPs on buying hardware and inkjet ink.

The market is likely to continue to consolidate with centralized control over job orders, processing, and tracking of costs. All of this will require hardware manufacturers to think broader about the products they need to offer, from software to finishing, in order to help their customers make the transition from what is still mostly a mom-and-pop business to a more professionally managed business.

Editor’s Note

Productive wide format printers coupled with consumables that offer more bang for the buck seems to be what most PSPs look for. Combine that with innovative designs and applications that help customers standout as well as workflow and integration systems that ease the pain of a minimized labor force, and wide format graphics continues to persevere. D

About the Author

Marco Boer, VP, IT Strategies, is recognized as a trusted consultant to the digital printing industry. He has a reputation for being able to put complex information and concepts into a context that is easily understood by his audience. With more than 25 years of experience in advising and guiding senior executives of Fortune 1000 and smaller innovative companies to successful business solutions in emerging digital printing markets, Boer has developed a deep understanding of inkjet printing technology and its applications.