Introduction

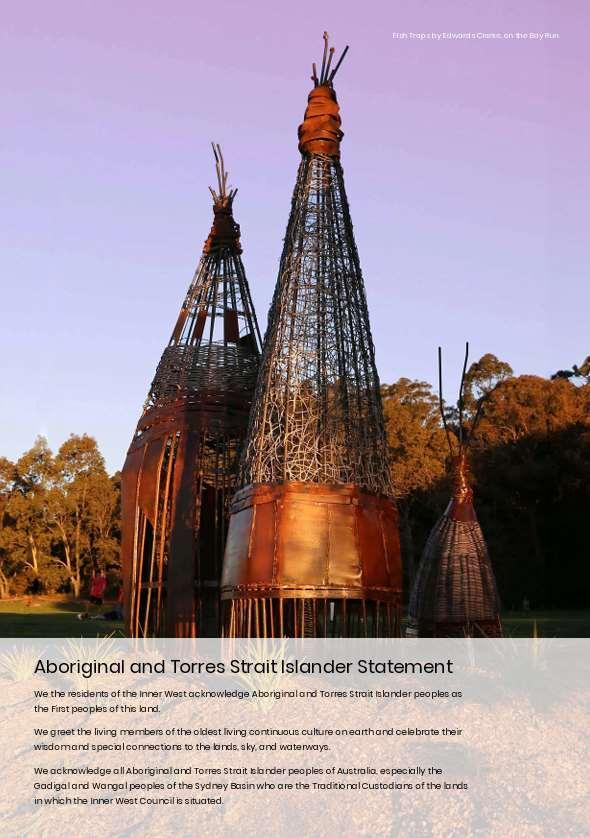

AboriginalandTorresStraitIslanderStatement

IntegratedPlanningandReporting

UndertheNSWLocalGovernmentAct1993,councilsarerequiredtodevelopahierarchy ofplansknownastheIntegratedPlanningandReporting(IPR)Framework.

Thisframeworkassistscouncilsindeliveringtheircommunity’svisionthroughlong, medium,andshorttermplans.

TheInnerWestCommunityStrategicPlan(CSP),OurInnerWest2041,identifiesthe community’svisionforthefuture,longtermoutcomes,andstrategiestogetthereand howCouncilwillmeasureprogress.

TheDeliveryProgram(DP)isafour-yearplanwhichoutlinesCouncil'scommitmentto achievingtheoutcomesandstrategiesoftheCSP.ItsetsouttheinitiativesthatCouncil willundertakeduringitstermofoffice.Theone-yearOperationalPlan(OP)sitswithinthe DeliveryProgramandcontainsdetailedactions.

TheseplansaresupportedbytheResourcingStrategywhichconsistsofkey componentsincludingtheLong-TermFinancialPlan(LTFP),theWorkforceManagement Strategy(WMS),andtheAssetManagementStrategyandPlans(AMS&P).

TheLTFPisaten-yearrollingplanthatinformsCouncil'sdecision-makingandshows howtheCSP,andcommitmentsintheDPandOPwillberesourcedandfunded.TheLTFP alsoprovidesthefinancialimplicationsofCouncil'sassetmanagementandworkforce planningbyidentifyinghowadditionalassetswillbefunded,orexistingassetsrenewed orupgraded,andchangestoservicelevels.

ExecutiveSummary

TheInnerWestCouncilwasformedaftertheamalgamationofAshfield,Leichhardtand MarrickvilleCouncilsin2016.Counciloperatesfromapositionoffinancialstabilityandis usingtheIPRFrameworktodrivelong-termfinancialsustainabilityandensureCouncil remainsfitforthefuture.TheLTFPhasincorporated‘FitfortheFuture’FinancialKey PerformanceIndicators(KPIs)alongwithstatutoryAnnualReportingKPIs.

TheoverallobjectiveofthisplanistoensurethatCouncilisfinanciallysustainable,while achievingtheoutcomesofitsCSP.Theintegratedplanningapproachrequiresthat Councilunderstandsitslong-termfinancialpositionandbestdirectsitsresourcesto achievingtheseoutcomes.

TheLTFPsetsouttwoscenariosandeachofthesemaintaincurrentservicelevelsand establishabalancedbudget.Insummary:

Scenario1–Businessasusual,maintainexistingservicelevels.

Councilcontinuestooperateanddeliveritsexistingservicelevelstothecommunity. Thecapitalworksprogramismaintainedtoensureinfrastructureisrenewedor upgradedoverthenext10years.ThisscenarioalsoensuresthatCouncilisfinancially sustainableandtherearefundsavailabletodeliverinfrastructureandservicesto thecommunity.

Scenario2–Addressestheinfrastructureassetrenewalbacklog.

CouncilcontinuestoprovideitsservicestothecommunityasperScenario1,withan additionalprocesstoreducetheinfrastructurebacklogof$29.3mfromthe2023/24 financialstatementsduringthisLTFP.Withtheplannedinfrastructurespendspread overthe10-yeartimeframe,themodelshowsCouncilbeinginageneralfunddeficit bythe2026/27financialyear.

Counciliscontinuallyreviewingitsefficiencyandeffectivenessandreinvesting efficiencygainsbackintothecommunity.Itisacknowledgedtherearechallengesthat willneedtobemonitored,particularlyincapitalworksandassetmanagement,and Councilisworkingtomeetthesechallengesandensurethatassetconditionlevelsare improved.

CouncilhasundertakenacommunityledengagementprocesstoestablishtheOur InnerWest2041-theInnerWestCommunityStrategicPlan.ThisLTFPisalignedtothe outcomesoutlinedintheCSP.However,futureunforeseenfactorscansubstantially impactCouncil’sfinancialposition,andthisplanprovidesausefulwaytoidentify possiblefutureorunexpectedfinancialissues.

FinancialPlanningContext

WorkingCapital

WorkingCapitalrepresentsmoneythatCouncilisrequiredbylawtoholdseparatelyfrom Council’sGeneralFundandcanonlybespentforspecifiedpurposes.

FundsseparatedinWorkingCapitalinclude:

Developer contributions are raised under the Environmental Planning and Assessment Act 1979. These fund the community infrastructure consistent with the contributionsplanthattheywerecollectedtofund. CouncilalsoholdsPublicDomain Contributionsthatdeveloperscontributetowards.

DomesticWasteManagementfundsareraisedundertheLocalGovernmentAct1993. Thesesupportwastecollection,recyclingandrelatedactivities.Fundsarealsoused toreplacegarbage,recyclingandgreenwastebinortruckfleets.

CouncilannuallyraisesaStormwaterManagementServiceChargeundertheLocal Government Act 1993. Any funds not used in any year must be held and used on authorisedstormwatermanagementandrelatedactivities.

SpecificpurposegrantfundingfromeithertheCommonwealthorStateGovernments mustbeheldandonlyusedforthepurposethattheyweregranted.

FundsthatCouncilprovidesforspecificpurposesinclude:

Employee Leave Entitlements: Council sets aside cash to meet accrued employee annual and long serviceleaveliabilities. Council’s Workforce Management Strategy identifiedtheneedtocashback49%oftotalleaveliabilitytomitigateanyfinancial riskssurroundingemployeeleaveentitlements.

Plant,TechnologyandVehiclereplacement:Councilhaslongtermmodelsinplaceto forecast the timing of heavy plant, motor vehicle and information technology hardwarereplacement. Funds areallocatedto ensurethereis budgetavailablefor replacement.

Funds that Council holds in trust either on behalf of other parties or under a Trust arrangementareheldseparatetoCouncilfundsandareonlyspentinaccordance withthetermsofthetrustarrangements.

Loanfunds:Whenrequired,Councilraisesloanstofunditscapitalprogram.Unspent funds areheld to ensure these works are completed. Council currently funds these worksfromitsunrestrictedworkingcapital.Seenextsection:Loanborrowing. OtherunrestrictedworkingcapitalisheldandallocatedthroughoutCouncil’sLTFPtofund otheroperationalandcapitalprojects.

Loanborrowings

Councilborrowed$40.0mtoredeveloptheAshfieldAquaticCentre.Thisloanisheldwith NSW Treasury TCorp, an organisation that provides funding opportunities for Local Government andotherStateagencies.These borrowings arerepaidfromrateincome raisedovera20-yearperiod.

Asat30June2024,Councilhadprincipaloutstandingonitsloanborrowingsof$34.3m. Council’sDebtServiceCoverratio,whichmeasurestheavailabilityofoperatingcashto service debtincludinginterestandprincipalrepayments, isforecastat22.31to1atthe endof2025/26.ThisiswellabovetheOfficeofLocalGovernment’sbenchmarkof2to1.

WhenCouncilborrowsfundsformajorcapitalprojects,thefundingisneverusedtofund operatingprojects.

Structure

Overviewofstructure

The LTFP is structured around two financial models. This is consistent with the IPR framework.Theseare:

Scenario 1 is the base scenario that captures Council’s ‘Business as Usual’ approachandmaintainsexistingservicelevels.

Scenario2modelstheeliminationoftheAssetRenewalBacklog.

TheLTFPsetsouttheassumptionsforthecompilationofeachscenarioandthefinancial outcomesoverthenexttenyears.Italsoliststhemajoropportunitiesandrisksassociated witheachscenarioprovidingananalysisofthesensitivityofthemodellingtoavarietyof changes.

Thelastsectionofthedocumentcontainshigh-levelmeasuresthatCouncil’slongterm financialperformancewillbemeasuredagainst.

GlobalVariablesandAssumptions

Below is the list of variables and assumptions identified as drivers to predict Council’s revenueandexpenditureforecastsoverthe10yearsofthisplan.Thesevariablesapply to eachoftheLTFP scenarios unless itis explicitlystated otherwise. All ConsumerPrice Index(CPI)referenceshaveanassumedrateof0%perannumforexpenditureand3.8% perannumforincome,unlessstatedotherwise.

Operatingrevenuedrivers

ThefollowingtablessummarisetherevenuedriversonwhichtheLTFPismodelled.

Operatingrevenue area Assumptions

Generalrates

Voluntarypensioner rebates

Basedonthefollowingratecapinfutureyears:

3.7%2025/26

2.5%2026/27andonwards

Counciloffersvoluntarypensionerrebatestoeligibleaged pensioners.

Thisrebatecoversthedomesticwasteandstormwater chargesforresidentownersoftenyearsorgreater.For pensionerswhodonotmeetthiscriteria,grandfathering provisionsexistsforpensionersintheformerAshfield, LeichhardtandMarrickvilleLocalGovernmentArea’s(LGA).

PensionerRateSubsidy

DomesticWaste ManagementCharge (DWMC)andrelated UserCharges

TheStateGovernmentsetsthePensionerRateSubsidyata maximumof$250perpropertyperannum.Thisisaflat subsidyanddoesnotincreaseannually.

TheDWMCismodelledoverthelifeofthePlantocover serviceprovisioncosts.Councilsareprohibitedunderthe LocalGovernmentActfromsubsidisingorreceivingaprofit fromtheDomesticWasteManagementcharge.Since2018/19 Councilhasreviewedandappliedthemethodologyof applyingcorporateoverheadstothedomesticwaste services.Thebudgethasbeenpreparedonthebasisof maintainingtheDomesticWasteManagementChargein futureyearstoallowcapacitytocoveranyreactivecost increases.

Stormwater ManagementService Charge

Thisisaflatchargeusedtofundstormwaterplanningand infrastructure. ThechargeassetundertheLocal GovernmentActandassociatedRegulationsare:

$25.00perresidentialpropertyperannum

$12.50perstrataunitperannum

$25.00per350m2 perbusinesspropertyperannum

Operatingrevenue

Assumptions

Fees Councilgenerallyincreasesthefeesfortheservicesit providedtoatleastcoverannualgeneralmovementsin costs..

Statutoryfeeshavebeenincreasedconsistentwiththe advicefromstatutorybodies.Discretionaryfeeshavebeen increasedbytheCPI.TheLTFPassumesthatthefollowingCPI increases,setsoutas: 3.8%2025/26 2.5%2026/27andonwards

Interestoninvestment

Interestonoverdue rates

TheinterestCouncilreceivesonitsinvestmentshasbeen modelledandisreviewedannually.Themodelislinkedtothe projectedlevelofreservesandforecastinterestrates.As cashisexpectedtodiminishovertimeasCouncilcompletes itssuiteofmajorprojects,amodestandsustainablelevelof interestincomecurrentlysupportsongoingoperations.

Councilchargesinterestonoverdueratestothemaximum thattheMinisterforLocalGovernmentallows.The2025/26 determinationfromtheMinisterforLocalGovernmentfor interestonoverdueratesis10.5%perannum.

Otherrevenues

Rental/leaseincome

Fines

Operatinggrants–general

Thisincludesexgratiaratespayments,incomefromstreet furnitureandcreditcardfees.Itisassumedthatthese revenuesourceswillnotincreaseandareindexedaccording tocommercialagreements.

Itisassumedthatrental/leaseincomewillincreaseatleast byCPI,inlinewithprovisionsofcurrentleases.

TheStateGovernmentdeterminesthedollarvalueof individualfines.Thevolumeoffinesisaproductofthe compliancelevelsandthelevelofenforcementactivity.Itis assumedthattotalincomereceivedfromfinesareflat.

Itisassumedthattotalincomefromgrantswillbeflatover the10-yearprogramanddependantontheinitiativesthat StateandFederalGovernmentprovides.

Operatingrevenue area Assumptions

FinancialAssistance Grants(FAG)

TransportforNSWblock grant

Streetlightingsubsidy

Librarysubsidy

Disposalofproperty

Itisassumedthattotalincomefromgrantswillbeflat.The FAGisbasedontherelativegrowthoftheInnerWestLGAin comparisontothegrowthofWesternSydney.Thisprojection isconsistentwiththe methodologyNSWGrantsCommission usestodeterminetheannualFinancialAssistanceGrant distribution.

ThisisaStateGovernmentgrantwithnoincreaseacrossthe 10years.

ThisisaStateGovernmentsubsidyanditisassumeditwillbe flat.

TheStateLibraryofNSWsetsandadministersthissubsidy undertheLibraryRegulation. Itisassumedthatthiswillbe flat.

ThescenariosassumesthatCouncilwillnotreceiveany incomefrompropertysalesduringthe10-yearlifetimeofthe LTFP.Anyproceedsfromsalesincludingprofitswouldbe transferredtoCouncil’sunrestrictedworkingcapital.

Disposalofplant

Thescenariosassumesthatplantwillbesoldatitswritten downcostduringthe10yearsoftheLTFP.Proceedsfrom sales,includingprofits,aretransferredtoCouncil’sPlant Replacementrestrictedworkingcapital.

Operatingrevenuesensitivityanalysis

Operatingrevenueassumptionsaresensitivetoavarietyofrisksandopportunities, includingthefollowing:

FuturerateincreasesarebasedontheLocalGovernmentPriceMovementsthatthe IndependentPricingandRegulatoryTribunal(IPART)allows.Historically,rateincreases have not kept pace with increasing costs. From 2024/25, IPART simplified their modelling by measuring the annual change in NSW councils’ base costs for three groupsofcouncilswhicharemetropolitan,regionalandruralcouncils.Thenewmodel considers:

o EmployeecostsmeasuredbytheLocalGovernmentAward.

o Asset costs measured by the Reserve Bank of Australia (RBA) forecast change in the CPI adjusted to reflect the average difference between changesintheProducerPriceIndexandchangesintheCPI.

o AllotheroperatingcostsmeasuredbytheRBA’sforecastchangeintheCPI.

o IncludedisaseparateEmergencyServicesLevyfactorwhichislaggedby one year that reflects the annual change in each council’s Emergency ServiceLevycontribution.

o A population factor to measure the change in a Council’s residential population.

Rateincreases only providefor the continuation of existingservice levels. TheInner Westcommunity’schangingdemographicssuggeststheremaybedemandfornew or increased levels of services. These are not funded with ordinary IPART rate increases,whicharebasedonmovementsincostsonly.

Council has also considered rate increases due to increases in the number of dwellings as part of the State Government housing reforms that will be introduced overthenextfivefinancialyears.

The Pensioner Rate Subsidy is set at a maximum of $250 per property and has not increasedsince1993.Thiscreatesagreaterburdenonpensioners.

TheStateGovernmentdeterminesthelevelforindividualtraffic/parkingoffencefines.

TheStormwaterManagementChargeisfixedandhasnotrisensinceitsintroduction in2006/07.

Interest rates have been highlyvolatileover the past12 monthsandarestarting to decreaseandthiswillcontinueinfuturefinancialyears.Itisforecastthatinterestrates willfallandbeflatfortheremaining2024/25 financialyearanddeclineasinflation reducesoverthenextfinancialyear.

HoardingfeesandotherDevelopmentAssessmentincomeisdependentonthelevel of development activity in the Inner West LGA. Although stabilised in the past 12 months,theexpectationsarethatthiswillgrowifgreaterbuildingdensityoccursin theLGAthroughtheproposedStateGovernmenthousingreforms.

Capitalrevenuedrivers

Thefollowingtablessummarisethecapitalrevenueassumptionsonwhichthebase scenariohasbeenmodelled.

RoadstoRecoverygrant ThisisaFederalGovernmentgrant,thatCouncilusedto funditsroadsimprovementprogram.Itisassumedthiswill beflat.

Developercontributions Councilreviewsthedevelopercontributionsfundingeach year.Thefundingislinkedtotheprojectedlevelof development. Allfundsareheldinarestrictedworking capitalfundforreleasetofinanceprojectsincludedin Council’splanasaresponsetoincreasedpopulation growthintheLGA.

Capitalrevenuesensitivityanalysis

Capitalrevenueassumptionswillbesensitivetoavarietyofrisksandopportunities, includingthefollowing:

TheRoadstoRecoverygrantprogramwasintroducedin2013/14andin2019/20itwas extended until 2025/26. In May 2024, this grant was extended again until June 2029 withanincreasedleveloffundingforthenextfiveyears.Theassumptionisthatthe grantwillcontinuethroughoutthe10yearsofthisLTFP.

CouncildoesreceivecapitalgrantsotherthanforRoadstoRecovery.However,these grants are tied to specific projects and are non-recurrent. As the receipt of other capitalgrantsisdifficulttopredict,theyarenotincludedinthemodel.

Operationalexpendituredrivers

Thefollowingtablesummarisestheoperatingexpenditureassumptionsonwhichthe scenarioshavebeenmodelled.

Operationalexpenditure area

Assumptions

Salariesandwages SalaryandwagesincreasedbasedontheStateAwardthat beganon1July2023.Theseincreasesare:

3.0%+lumpsum0.5%or$1,000(whicheverishigher)in 2025/26

2.5%from2026/27andonwards

Superannuation

ThisLTFPincludesaSuperannuationincreaseto12.0%from 2025/26inlinewiththeSuperannuationGuarantee Contributions.

Itisassumedthatsuperannuationcostsformembersofthe DefinedBenefitsSchemeswillbepaidinaccordancewith thecurrentadvicefromtheTrusteesoftheScheme. Councilhasdevelopedamodeltopredictitsongoing contributionstowardtheDefinedBenefitsSchemes.

WorkersCompensation Council’sWorkersCompensationpremiumwassetat$5.9m for2024/25anditisassumeditwillincreaseto$6.8min 2024/25.Thefutureyearsincreaseisasfollows:

10%2026/27

5%2027/28

2.5%2028/29andonwards

Training Itisassumedthatexpenditureontrainingwillbeflat.

Maternityleave

LongServiceLeave

Materialsandservices

Itisassumedthatexpenditureonparentalleavewillbe $426,000in2025/26andwillincreasebyAwardincreases.

ExpenditureonLongServiceLeavehasbeenmodelledand willincreasebyAwardincreases. Themodelisreviewed annually.

Componentsofmaterialsandcontractsexpenditureare reviewedindividually. Thebudgetincludescostestimates fortheactualexpectedexpenditure.

Operational

Disposalcosts

Oilandfuel

Streetlighting

Electricity

Gas

Water

Telephoneandmobile phone

Depreciation

Otherexpenses

StateGovernmentLevies

Thecostofwastedisposalhasbeenmodelledandis reviewedannually.

ItisassumedthatoilandfuelcostswillhaveaCPIincrease annuallyover10years.

Itisassumedthatelectricitycostswillincrease4.0%per annumforfutureyears.

Itisassumedthattherewillbea4.0%perannumincrease inelectricitycostsinfutureyears.

Itisassumedthattherewillbea4.0%perannumincreasein gascostsinfutureyears.

Itisassumedthattherewillbea4.0%perannumincrease forwatercostsinfutureyears.

Itisassumedthatfixedandmobilephoneanddatacosts willhaveaCPIincreaseperannumover10years.

Depreciationhasbeenmodelledinaccordancewith Council’sAssetManagementPlans.RefertoPage6ofthe AssetManagementPolicyandStrategy.

Thisincludescontributionstoorganisationsanddoubtful debts.ItisassumedthattheseexpenseswillhaveCPI increases.

Council’sannualcontributiontotheEmergencyServices Levy(ESL)isestimatedbasedoffthe2024/25costsanda 4.2%increaseapplied.Thecontributionamountwillbe providedtoCouncilinMay2025.TheremainingState Governmentchargesleviedtocouncilscontributetoa rangeofservicesanditisassumedthattherewillbeaCPI increasetotheselevies.

Insurance

Itisassumedthatinsurancecostswillincreaseasfollows:

3.0%2025/26 2.75%2026/27and2027/28

2.5%2028/29andonwards

Operatingexpendituresensitivityanalysis

Operatingexpenditureassumptionswillbesensitivetoavarietyofrisksand opportunities,includingthefollowing:

Thecurrentindustrialawardwasnegotiatedandappliesfrom1July2023.In2025/26 theawardwillbe3.0%+lumpsum0.5%or$1,000(whicheverishigher).

TheFederalgovernmentlegislatedforanincreasetotheSuperannuationGuarantee Charge(SGC) to 12.0% in 2025/26. Natural disasters and other unforeseeable events mayimpactincreasestoinsurancepremiumlevels.

Capitalexpendituredrivers

Thefollowingtablesummarisestheoperatingexpenditureassumptionsonwhichthe scenarioshavebeenmodelled.

Capitalexpenditurearea Assumptions

Informationand Communication

Technology–Hardware/ SoftwareProgram

LocalRoadsandLanes Program

CouncilcurrentlyleasesthemajorityofitsInformation TechnologyHardwareovera4-yearleaseterm.Software costsassociatedwithhardwareupgradesareforecast andincludedintheintheOperatingBudgetoftherelevant year.

TheLTFPprovidesforthefullcostofreplacementof existinghardwareandsoftware.Thebudgetincludesboth thehardwareandsoftwarereplacementprogram.This programreplacesassetsattheendoftheirusefullife.It alsotakesintoaccounttheconsolidationofthreeexisting datacentresintooneandtheconsolidationof maintenanceagreementsandsoftwarelicences.

Maintenancecostsareconsideredaspartofthe evaluationprocessandincludedintheoperational budgetwhererequiredforbothsoftwareandhardware.

Council’sinvestmentinitsLocalRoadsnetworkhasbeen setat$10.0min2025/26.ThesearefundedbyFAGs,Special RateVariation(SRV),RoadstoRecoveryandgeneralfunds. FundinglevelsarekeptatlevelstoensureCouncilexceeds itsRenewalRatioeveryyearforitsinfrastructureportfolio throughouttheLTFP.

Capitalexpenditurearea Assumptions

RegionalRoadsProgram CouncilownstheRegionalRoadnetwork. TheTfNSW subsidisesupkeepthroughgrants.Councilmatches fundingundertheRegionalRoadsprogramusing unrestrictedworkingcapitalorotheravailablefunding sources.

Atotalof$1.7misanticipatedtobespentonRegionalRoad capitalworksthroughoutthe2025/26financialyear.

Councilmaintainsfundinglevelstoconsistentlyexceedits RenewalRatioeachyearforitsinfrastructureportfolio throughouttheLTFP.

FootpathProgram Council’sinvestmentinitsFootpathRenewalandUpgrade Programhasbeensetat$3.3min2025/26fundedbySRV andunrestrictedworkingcapital.Councilmaintains fundinglevelstoconsistentlyexceeditsRenewalRatio eachyearforitsinfrastructureportfoliothroughoutthe LTFP.

BikeFacilitiesProgram

TrafficAmenities Program

Stormwaterupgrade andrenewalProgram

Unrestrictedworkingcapitalanddevelopercontributions areallocatedtoimprovebikefacilitiestomatchcapital grantfundingfromtheNSWorFederalgovernmentsorto funddirectworks.

ThetrafficamenitiesprogramisfundedfromDeveloper Contributions,SRV,governmentgrantfundsorother workingcapitaltoimprovetrafficamenities.Thetraffic amenitiesprogramincludedinthebudgetis$6.1m(this includes$2.3mofPAMP).Thisprogrammaycontinueto reduceasthedevelopercontributionsreducesnexuson trafficamenitiesfromwherethemajorityoftheseworks arefunded.

Councilhasaprogramofcatchmentstudiesacrossthe varioussub-catchmentswithinitsboundaries. Theseare fundedfromtheStormwaterCharge.

DrainagecapitalworksarefundedfromSRVfundsand unrestrictedworkingcapital. Additionalcapitalworksare fundedfromtheStormwaterChargeasdetailedinthe StormwaterPlan.

Thetotalbudgetis$4.1m.

Capitalexpenditurearea Assumptions

ParksImprovement Program ParkimprovementsareprimarilyfundedfromDeveloper Contributions,SRVandFederalorStateGovernment grants.Council’sParksImprovementProgramwas approximately$18.0min2025/26.

TheCapitalProgramalsoincorporatesexpenditureonCouncil’s‘MajorProjects’as follows: Project

LeichhardtParkAquaticCentreMajorProject

GreenWay

HensonParkGrandstandStage2

MainStreetRevitalisation

$10.0million

$7.3million

$6.2million

$5.8million

LeichhardtOval $3.0million InclusivePlaygrounds

million

MortBayPark $1.6million

CallanParkAllWeatherSportingField

Capitalexpendituresensitivityanalysis

$0.3million

Capital expenditure assumptions are sensitive to a variety of risks and opportunities, includingthefollowing:

Council has prepared Asset Management Plans for each of the four infrastructure assetgroups(seeaccompanyingAssetManagementPlans). Asdataisupdatedon the condition of these assets it is likely that further investment will be required to ensureroads,footpaths,drainage,bikenetworks,parksfacilities,buildingsandthelike continuetobeavailableforboththecurrentandfuturegenerationslivingintheInner West.

IncreasinginvestmentstopromoteaccessibilitywillalsoberequiredastheInnerWest populationages.Thiswillbeplannedtoensureanaccessibilitycontinuumbetween local roads, streetscapes and footpaths and transport infrastructure that the State Governmentmanagesincludingtrains,busesandlightrail.

Non-financialassumptions

TheInnerWestCouncil’sCSPprovidesanoverviewofthemajorissuesimpactingupon thelocalcommunity.Thedataandanalysisusedtoarriveatthoseissuesalsoinformthe preparationofthisLTFP.

Scenarios

Scenario1:businessasusual

Overview

Scenario1ispredicatedon:

Continuationofexistingservicesatcurrentservicelevels

Continuationofexistinglevelsofinvestmentininfrastructurerenewal

Continuationofexistingincomesources

Thisscenarioalsoincorporatesthefollowing‘majorprojects’:

LeichhardtOval

LeichhardtParkAquaticCentreMajorProject

GreenWayProgram

CallanParkAllWeatherSportingField

HensonParkGrandstandStage2

MainStreetRevitalisation

InclusivePlaygrounds

MortBayPark

Context

Council was formed by the amalgamation of Ashfield, Leichhardt and Marrickville CouncilsinMay2016anduntilservicereviewsarecomplete,servicelevelswillremainas they were in the former Councils. Council is currently operating from a position of financial stability and has used the IPR Framework to drive the long-term financial sustainabilityandensureCouncilisfitforthefutureasastand-aloneentity.

ItisevidentthatwhileCouncil’simmediateandlong-termfinancialpositioniscapableof delivering existing services at their current levels given current costs, an uncertain economic environment and the changing nature of the Inner West community will generateneworexpandedneedsforservicesandforassociatedfunding.

The State Government caps Council’s major income source (rates) and they have historically grown at a slower pace than salaries, State Government levies and other costs. As a result, Council has reviewed its expenditure and income generated and prioritisedprogramstoensureahighlevelofserviceisprovidedtothecommunitywhile remainingfinanciallyresponsible.Councilhascommittedtoacontinuousimprovement programthroughoutthelifeofthisplan.

Scenario1outlinesthemethodofdeliveringbusinessasusualandScenario2outlinesthe method for dealing with the infrastructure renewal backlog. These scenarios are illustrativeonly.Asandwhentheneeddevelopstofundmajorinfrastructure,providenew orexpandedservicesorinvestmoreininfrastructuremaintenance,Councilwillengage withtheInnerWestcommunityanddeveloptheseoptionsfurther.

Financialprojections

ThefollowingtablesoutlinethefinancialimpactofScenario1:Businessasusualoverthe next10yearsbyexternalreportingcategory.

Scenario1-InnerWestCouncil-10YearIncomeStatementProjection

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)

IncomefromContinuingOperations

RatesandAnnualCharges181,952191,918198,655205,230211,771217,760223,380229,172235,107241,225247,490 UserFeesandCharges60,91366,14467,68669,40771,03172,03573,74475,63777,43779,42281,456 InterestIncome9,3289,8187,8646,6616,4466,2336,1705,8595,7925,7255,760 OtherIncome19,76619,89119,93119,97120,01320,05520,09920,14420,19020,23720,285 RentalIncome10,39311,32111,40211,12210,11910,20610,29510,38610,47910,57510,673 OperatingGrants&Contributions10,35311,86610,66410,25310,25110,25110,19310,19310,19310,19310,193 CapitalGrants&Contributions40,57631,55562,04920,18920,50718,70818,70818,70818,70818,70818,708 Gain/LossonDisposalofAssets(1,109)(920)614100160(402)(1,747)(130)(920)(920)(920)

TotalIncomefromContinuingOperations332,171341,592378,865342,933350,297354,846360,843369,969376,986385,165393,646

ExpenditurefromContinuingOperations

EmployeeBenefitsandOncosts149,127156,351159,451163,600167,668171,837176,111180,483184,953189,534194,230

BorrowingCosts723678638596553510465420373326277 MaterialsandServices95,584100,387101,263102,005105,208104,964106,387108,878111,108112,600114,783 Depreciation34,20438,93639,71340,50641,31542,13942,98143,83944,71545,60746,518 OtherExpenses13,67213,61413,96314,29014,62614,96015,30315,65616,01816,39116,774

TotalExpensesfromContinuingOperations293,311309,967315,028320,997329,370334,411341,247349,276357,166364,458372,583

NetOperatingResultfromContinuing Operations

38,86031,62563,83821,93620,92720,43519,59620,69319,82020,70721,063

NetOperatingResultbeforeCapitalItems(1,716)701,7891,7474211,7278881,9851,1111,9992,355

Scenario1-InnerWestCouncil-StatementofFinancialPosition

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)

ASSETS

Currentassets

Cashandcashequivalents104,35876,51764,99955,62658,75558,44561,45665,26569,96376,28977,644

Investments83,18963,01433,83429,87626,05233,64240,25647,05750,23154,38057,937 Receivables49,24446,53643,97641,55739,27237,11235,07133,14231,31929,59627,969 Inventories207208209210211212213214215217218

Other-----------

Non-currentassetsclassifiedas‘heldforsale’-----------

Totalcurrentassets

Non-currentassets

236,998186,275143,018127,270124,291129,411136,996145,678151,729160,482163,767

Investments58,95058,95058,95058,95058,95058,95058,95058,95058,95058,95058,950 Receivables-----------

Inventories-----------

Infrastructure,property,plantandequipment3,030,8673,110,5883,214,3953,248,9243,271,0173,285,8293,298,6563,309,2613,325,0613,337,8443,351,132 Investmentsaccountedforusingtheequitymethod-----------

Investmentproperty73,43075,26677,14878,69180,26581,87083,50785,17786,88188,61990,391

Intangibleassets5,5936,1816,3866,3866,3866,4466,4466,4466,4466,5066,506 Rightofuseassets286293301307313319326332339346352

Non-currentassetsclassifiedas‘heldforsale’----------Other-----------

Totalnon-currentassets

3,169,1273,251,2783,357,1793,393,2583,416,9313,433,4153,447,8853,460,1663,477,6773,492,2653,507,331 TOTALASSETS3,406,1253,437,5533,500,1983,520,5283,541,2223,562,8263,584,8803,605,8443,629,4063,652,7473,671,099

LIABILITIES

Currentliabilities

Payables77,99158,49343,87032,90336,19339,81241,80343,89346,08748,39250,811 Incomereceivedinadvance-----------

Contractliabilities25,29922,76920,49218,44318,07415,36319,20422,08421,53223,68624,870 LeaseLiabilities119122126128131133136139141144147

Borrowings2,0471,8171,8581,9001,9431,9862,0312,0762,1232,1702,219 Provisions26,89521,51617,21313,77011,0168,8137,0505,6404,5123,6102,888

Liabilitiesassociatedwithassetsclassifiedas‘heldforsale’-----------

Totalcurrentliabilities

Non-currentliabilities

132,352104,71983,55967,14467,35666,10770,22373,83274,39678,00280,935

Payables----------Incomereceivedinadvance-----------

Contractliabilities-----------

LeaseLiabilities169173177181185188192196200204208

Borrowings28,69326,87525,01723,11721,17519,18817,15815,08212,95910,7898,570 Provisions2,4941,9951,5961,2771,021817654523418335268 Investmentsaccountedforusingtheequitymethod----------Liabilitiesassociatedwithassetsclassifiedas‘heldforsale’-----------

Totalnon-currentliabilities

31,35529,04326,79024,57522,38120,19418,00415,80113,57711,3279,045

TOTALLIABILITIES163,708133,762110,34991,71989,73786,30188,22789,63387,97389,32989,981

Netassets3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

EQUITY

Retainedearnings2,467,7102,499,3352,563,1732,585,1092,606,0362,626,4712,646,0672,666,7602,686,5792,707,2872,728,350

Revaluationreserves774,707804,456826,676843,700845,449850,053850,586849,451854,853856,132852,768

Councilequityinterest

3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

Totalequity3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

Cashflow from Operating Activities Receipts

Scenario 1 - Inner West Council - Statement of Cashflows

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

Cashflow from Investing

Activities

PurchaseofInvestmentProperty

ContributionspaidtoJointVentures&Associates

Netcashprovided(orusedin)InvestingActivities4,723

Cashflow from Financing Activities Receipts

ProceedsfromBorrowing&Advances Payments

PaymentsofBorrowing&Advances(2,047)

LeaseLiabilities

Scenario2:Assetmanagementinfrastructurerenewalbacklog

Overview

Scenario2aimstodemonstratetheeffectsof fundingtheinfrastructurebacklogtomeet theneedsofthecommunityandispredicatedon:

Continuationofexistingservicesatcurrentservicelevels.

Anexpandedcapitalrenewalprogramtoreducedinfrastructurebacklogwithinthetime horizonofthisLTFP.

Assumptions

The annual budget includes provisions for operations, maintenance, renewal and new expenditureoninfrastructure.Whenrenewalfundingisinadequate,anyunfundedrenewal demand is deferred, which generates a backlog. Council’s Asset Management Strategy states that the asset renewal funding ratio is to be a minimum of 110% until the renewal backloghasbeenaddressed.

Council identified an infrastructure renewal backlog in the 2023/24 financial reports. The renewal backlog was estimated at approximately $29.3m across its asset portfolio. To addressthisbacklog,additionalfundsarerequired.TherenewalfundingplannedinScenario 2 is insufficient to reduce the backlog of deferred renewal demand, therefore a loan of $23.0mwouldberequiredin2026/27.

Sensitivityanalysis

TheassumptionsonwhichScenario2arepredicatedwillbesensitivetoavarietyofrisks andopportunities,includingthefollowing:

Community engagement will provide a critical input to the service levels that the communityexpects.

Theadditionalrenewalworkswillbebasedontheconditionratingsoftheassets.

Financialprojections

ThefollowingtablesoutlinethefinancialimpactoftheScenario2:Reducetheinfrastructure backlogoverthenext10yearsbyexternalreportingcategory.

Scenario2-InnerWestCouncil-10YearIncomeStatementProjection

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)

IncomefromContinuingOperations

RatesandAnnualCharges181,952191,918198,655205,230211,771217,760223,380229,172235,107241,225247,490 UserFeesandCharges60,91366,14467,68669,40771,03172,03573,74475,63777,43779,42281,456 InterestIncome9,3289,8187,8646,6616,4466,2336,1705,8595,7925,7255,760 OtherIncome19,76619,89119,93119,97120,01320,05520,09920,14420,19020,23720,285

RentalIncome10,39311,32111,40211,12210,11910,20610,29510,38610,47910,57510,673 OperatingGrants&Contributions10,35311,86610,66410,25310,25110,25110,19310,19310,19310,19310,193 CapitalGrants&Contributions40,57631,55562,04920,18920,50718,70818,70818,70818,70818,70818,708 Gain/LossonDisposalofAssets(1,109)(920)614100160(402)(1,747)(130)(920)(920)(920)

TotalIncomefromContinuingOperations332,171341,592378,865342,933350,297354,846360,843369,969376,986385,165393,646

ExpenditurefromContinuingOperations

EmployeeBenefitsandOncosts149,127156,351159,451163,600167,668171,837176,111180,483184,953189,534194,230

BorrowingCosts723678638596553510465420373326277 MaterialsandServices95,584100,387101,263102,005105,208104,964106,387108,878111,108112,600114,783 Depreciation34,20438,93639,71340,50641,31542,13942,98143,83944,71545,60746,518 OtherExpenses13,67213,61413,96314,29014,62614,96015,30315,65616,01816,39116,774

TotalExpensesfromContinuingOperations293,311309,967315,028320,997329,370334,411341,247349,276357,166364,458372,583

NetOperatingResultfromContinuing Operations

38,86031,62563,83821,93620,92720,43519,59620,69319,82020,70721,063

NetOperatingResultbeforeCapitalItems(1,716)701,7891,7474211,7278881,9851,1111,9992,355

Scenario2-InnerWestCouncil-StatementofFinancialPosition

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)

ASSETS

Currentassets

Cashandcashequivalents104,35867,26246,48927,86130,99030,68033,69137,02541,24847,09947,929 Investments83,18963,01433,83429,87626,05233,64240,25647,05750,23154,38057,937 Receivables49,24446,53643,97641,55739,27237,11235,07133,14231,31929,59627,969 Inventories207208209210211212213214215217218

Other-----------

Non-currentassetsclassifiedas‘heldforsale’-----------

Totalcurrentassets

Non-currentassets

236,998177,020124,50899,50596,526101,646109,231117,438123,014131,292134,052

Investments58,95058,95058,95058,95058,95058,95058,95058,95058,95058,95058,950 Receivables-----------

Inventories-----------

Infrastructure,property,plantandequipment3,030,8673,119,8433,232,9053,276,6893,298,7823,313,5943,326,4213,337,5013,353,7763,367,0343,380,847 Investmentsaccountedforusingtheequitymethod-----------

Investmentproperty73,43075,26677,14878,69180,26581,87083,50785,17786,88188,61990,391 Intangibleassets5,5936,1816,3866,3866,3866,4466,4466,4466,4466,5066,506 Rightofuseassets286293301307313319326332339346352 Non-currentassetsclassifiedas‘heldforsale’----------Other-----------

Totalnon-currentassets

3,169,1273,260,5333,375,6893,421,0233,444,6963,461,1803,475,6503,488,4063,506,3923,521,4553,537,046 TOTALASSETS3,406,1253,437,5533,500,1983,520,5283,541,2223,562,8263,584,8803,605,8443,629,4063,652,7473,671,099

LIABILITIES

Currentliabilities

Payables77,99158,49343,87032,90336,19339,81241,80343,89346,08748,39250,811 Incomereceivedinadvance-----------

Contractliabilities25,29922,76920,49218,44318,07415,36319,20422,08421,53223,68624,870 LeaseLiabilities119122126128131133136139141144147

Borrowings2,0471,8171,8581,9001,9431,9862,0312,0762,1232,1702,219 Provisions26,89521,51617,21313,77011,0168,8137,0505,6404,5123,6102,888 Liabilitiesassociatedwithassetsclassifiedas‘heldforsale’-----------

Totalcurrentliabilities

Non-currentliabilities

132,352104,71983,55967,14467,35666,10770,22373,83274,39678,00280,935

Payables-----------

Incomereceivedinadvance-----------

Contractliabilities-----------

LeaseLiabilities169173177181185188192196200204208

Borrowings28,69326,87525,01723,11721,17519,18817,15815,08212,95910,7898,570 Provisions2,4941,9951,5961,2771,021817654523418335268 Investmentsaccountedforusingtheequitymethod----------Liabilitiesassociatedwithassetsclassifiedas‘heldforsale’-----------

Totalnon-currentliabilities

31,35529,04326,79024,57522,38120,19418,00415,80113,57711,3279,045 TOTALLIABILITIES163,708133,762110,34991,71989,73786,30188,22789,63387,97389,32989,981

Netassets3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

EQUITY

Retainedearnings2,467,7102,499,3352,563,1732,585,1092,606,0362,626,4712,646,0672,666,7602,686,5792,707,2872,728,350 Revaluationreserves774,707804,456826,676843,700845,449850,053850,586849,451854,853856,132852,768

Councilequityinterest

3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

Totalequity3,242,4173,303,7913,389,8483,428,8093,451,4853,476,5243,496,6533,516,2113,541,4333,563,4183,581,118

Scenario2-InnerWestCouncil-StatementofCashflows

2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35 ($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)($'000)

CashflowfromOperatingActivities

Receipts

Rates&AnnualCharges181,952191,918198,655205,230211,771217,760223,380229,172235,107241,225247,490 UserCharges&Fees60,91366,14467,68669,40771,03172,03573,74475,63777,43779,42281,456 Investment&InterestIncome9,3289,8187,8646,6616,4466,2336,1705,8595,7925,7255,760 RentalIncome10,39311,32111,40211,12210,11910,20610,29510,38610,47910,57510,673 OperatingGrants&Contributions10,35311,86610,66410,25310,25110,25110,19310,19310,19310,19310,193 CapitalGrants&Contributions40,57631,55562,04920,18920,50718,70818,70818,70818,70818,70818,708 Other19,76619,89119,93119,97120,01320,05520,09920,14420,19020,23720,285

Payments

EmployeeBenefits&On-Costs(149,127)(156,351)(159,451)(163,600)(167,668)(171,837)(176,111)(180,483)(184,953)(189,534)(194,230)

Materials&Contracts(95,584)(100,387)(101,113)(101,855)(105,058)(104,814)(106,237)(108,728)(110,958)(112,450)(114,633)

BorrowingCosts(723)(678)(638)(596)(553)(510)(465)(420)(373)(326)(277) OtherExpenses(13,672)(13,614)(13,963)(14,290)(14,626)(14,960)(15,303)(15,656)(16,018)(16,391)(16,774)

NetCashprovided(orusedin)OperatingActivities74,17371,481103,08662,49262,23263,12764,47464,81265,60467,38568,651

CashflowfromInvestingActivities

Receipts

SaleofInvestmentSecurities162,651164,278165,921167,580169,256170,948172,658174,384176,128177,889179,668

SaleofRealEstateAssets

SaleofInfrastructure,PropertyPlant&Equipment749518518518518518518518518518518 Payments

PurchaseofInvestmentSecurities(33,051)(143,056)(135,460)(163,027)(163,526)(175,906)(176,800)(179,385)(174,914)(178,845)(185,458)

PurchaseofInfrastructure,Property,Plant&Equipment-(125,626)(128,499)(152,980)(84,290)(63,408)(57,012)(55,807)(54,919)(60,990)(58,926)(60,330) PurchaseofInvestmentProperty

ContributionspaidtoJointVentures&Associates

Netcashprovided(orusedin)InvestingActivities4,723(106,759)(122,001)(79,220)(57,160)(61,452)(59,432)(59,401)(59,258)(59,364)(65,602)

CashflowfromFinancingActivities

Receipts

ProceedsfromBorrowing&Advances

Payments

PaymentsofBorrowing&Advances(2,047)(1,817)(1,858)(1,900)(1,943)(1,986)(2,031)(2,076)(2,123)(2,170)(2,219) LeaseLiabilities

NetCashFlowprovided(orusedin)Financing Activities

(2,047)(1,817)(1,858)(1,900)(1,943)(1,986)(2,031)(2,076)(2,123)(2,170)(2,219)

NetIncrease/(Decrease)inCash&CashEquivalents76,848(37,096)(20,773)(18,628)3,129(311)3,0113,3344,2235,851830

PlusCash&CashEquivalents-beginningofyear27,510104,35867,26246,48927,86130,99030,68033,69137,02541,24847,099

Cash&CashEquivalents-endofyear104,35867,26246,48927,86130,99030,68033,69137,02541,24847,09947,929

PlusInvestmentsonhand-endofyear142,139121,96492,78488,82685,00292,59299,206106,007109,181113,330116,887

TotalCash&CashEquivalents&Investments246,497189,226139,273116,687115,993123,272132,897143,032150,429160,429164,816

PerformanceMonitoring

InnerWestCouncilusesthefollowingindicatorstomeasureitsfinancialperformance.These measures arelinked tothose usedin Council’s published financial statements and to the indicators used by the NSW Office of Local Government in its annual publication of comparative information on councils in NSW. This means that the measures and the Council’s progress against them, are both transparent and comparable. A table of the projectedratesisprovidedattheendofthissection.

Operatingperformanceratio

This ratio measures a Council’s achievement of containing operating expenditure within operating revenue. It is important to distinguish this ratio as focused on operating performance.Thismeansthat capitalgrantsandcontributions,fairvalueadjustmentsand reversalorrevaluationdecrementsareexcluded.

Ownsourceoperatingrevenue

Thisratiomeasuresfinancialflexibility,anditisthedegreeofrelianceonexternalfunding sources such as operating grants and contributions. As Council’s financial flexibility improvesthehigherthelevelofitsownsourcedrevenue.

Unrestrictedcurrentratio

TheUnrestrictedCurrentRatioisspecifictolocalgovernmentandisdesignedtorepresent a Council’s ability to meet short term obligations as they fall due. Restrictions placed on variousfundingsources(e.g.DeveloperContributions,TfNSWcontributions)complicatethe traditionalcurrentratiousedtoassessliquidityofbusinesses.Thisisbecausecashallocated tospecificprojectsisrestrictedandcannotbeusedtomeetaCouncil’sotheroperatingand borrowingcosts.

Debtservicescoverratio

This ratio measures the availability of operating cash to service debt including interest, principalandleasepayments.

Ratesandannualchargesoutstanding

Thisratioassessestheimpactofuncollectedratesandannualchargesonliquidityandthe adequacyofrecoveryefforts.

Cashexpensecoverratio

This liquidity ratio indicates the number of months a Council can continue paying for its immediateexpenseswithoutadditionalcashinflow.

Buildingandinfrastructureratio

Thisratioistoassesstherateatwhichtheseassetsarebeingrenewedagainsttherateat whichtheyaredepreciating.

Infrastructurebacklogratio

This ratio shows what proportion the backlog is against the total value of a Council’s infrastructure.

Assetmaintenanceratio

This ratio compares actual maintenance costs versus the required annual asset maintenance.Aratioofabove1.0indicatesthattheCouncilisinvestingenoughfundswithin theyeartostoptheInfrastructureBacklogfromgrowing.

Capitalexpenditureratio

This indicates the extent to which a Council is forecasting to expand its asset base with capital expenditure spent on both new assets, and also the replacement and renewal of existingassets.

InnerWestCouncil-KeyPerformanceIndicators

KeyPerformanceIndicators-Scenario1Benchmark2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

OperatingPerformanceRatio>0(0.59)%0.02%0.56%0.54%0.13%0.51%0.26%0.56%0.31%0.55%0.63%

OwnSourceOperatingRevenue>60%84.67%87.29%80.81%91.12%91.22%91.84%91.99%92.19%92.33%92.50%92.66%

UnrestrictedCurrentRatio>1.5x1.671.781.711.661.851.961.731.972.041.862.02

DebtServiceRatio>2x16.2221.8322.6822.5521.7722.3421.8322.2721.7622.0922.15

RatesandAnnualChargesOutstandingRatio<5%4.31%3.06%3.03%3.00%2.97%2.94%2.91%2.89%2.86%2.83%2.80%

CashExpenseCoverRatio>3Months8.626.144.283.633.513.764.064.384.594.884.96

InfrastructureRenewalRatio>100%129%193%271%139%111%100%101%101%100%100%100%

InfrastructureBacklogRatio<2%0.33%0.38%0.40%0.46%0.53%0.60%0.68%0.77%0.85%0.94%1.04%

AssetMaintenanceRatio>11.081.131.111.111.131.141.151.181.191.211.23

KeyPerformanceIndicators-Scenario2Benchmark2024/252025/262026/272027/282028/292029/302030/312031/322032/332033/342034/35

OperatingPerformanceRatio>0(0.59)%0.02%0.56%0.54%0.13%0.51%0.26%0.56%0.31%0.55%0.63%

OwnSourceOperatingRevenue>60%84.67%87.29%80.81%91.12%91.22%91.84%91.99%92.19%92.33%92.50%92.66%

UnrestrictedCurrentRatio>1.5x1.671.691.491.251.431.541.331.591.651.481.66

DebtServiceRatio>2x16.2221.8322.6822.5521.7722.3421.8322.2721.7622.0922.15

RatesandAnnualChargesOutstandingRatio<5%4.31%3.06%3.03%3.00%2.97%2.94%2.91%2.89%2.86%2.83%2.80% CashExpenseCoverRatio>3Months8.625.733.482.452.362.622.963.283.493.803.87

InfrastructureRenewalRatio>100%129%220%297%164%111%100%101%102%101%101%101%

InfrastructureBacklogRatio<2%0.33%0.03%0.00%0.00%0.00%0.00%0.00%0.00%0.00%0.00%0.00%

AssetMaintenanceRatio>11.081.131.101.101.121.131.151.171.181.201.22

ReviewofLong-TermFinancialPlan

A final, qualitative performance measure is the regular review of this plan. Inner West Council takesacontinuous improvementapproach tothisplan. Itis expectedthatthe document is progressively refined, as Council’s knowledge regarding the various assumptionsincreasesandasCouncilandthecommunityconsidersanddiscussesthe variousscenarios.

Councilundertakesannualreviewsofthisplanincludingeachofthescenarios.

Document Resourcing Strategy - Long Term Financial Plan 2025-2035

Custodian Version #

Adopted By ECM Document #

Next Review Date

Community

Languages

Talk free with an interpreter call 131 450

Chinese Simplified

Traditional Chinese

Italian

Vietnamese

Parliamo la vostra lingua. Per parlare gratuitamente con un interprete chiamate il numero 131 450. Chiedetegli di chiamare il Comune di Inner West al numero 02 9392 5000.

Chúng tôi nói ngôn ngữ của quý vị. Muốn nói chuyện có thông dịch viên miễn phí, hãy gọi số 131 450. Yêu cầu họ gọi cho Hội đồng Thành phố Inner West qua số 02 9392 5000.