A fact sheet examining how credit unions are failing California families

By Jamie Buell, Research Analyst

For many families, living paycheck to paycheck is a harsh reality due to decades of economic injustices – but that reality should not come with additional penalties. Yet, overdraft (OD) and nonsufficient fund (NSF) fee charges do just that.

These “junk fees,” as they are commonly called, compound financial hardship, often leading to closed accounts, and damaged credit, and ultimately creates a barrier to achieving other markers of financial stability such as securing housing, starting a business, or purchasing a home. The Consumer Financial Protection Bureau (CFPB) has shown how OD and NSF fees hit lower-income households, Hispanic and Black consumers the hardest.

While credit unions market themselves as community-friendly and consumer-first alternatives, a growing body of evidence tells a different story. The following data presented in this fact sheet uncovers the systemic inequities baked into their practices and calls for urgent attention from policymakers.

1

State-chartered credit unions charged over $250 million in overdraft and nonsufficient fund fees in 2023, making up 16 of the top 20 highest feecharging institutions.

4

2

Despite holding less than half in deposits, state-chartered credit unions’ total OD and NSF fees were over 4 5 times the total amount collected by state-chartered banks.

Thirteen of the top 20 fee-charging credit unions have a low-income designation, potentially disproportionately harming lowincome customers with their junk fees.

5

Agencies like the CFPB and California’s DFPI must be preserved and strengthened to ensure consumer protections.

6

3

State-chartered credit unions rely more on OD and NSF fees revenue than state-chartered banks.

A strong state-level CRA could evaluate financial institutions on its excessive charges, and give downgrades or penalties depending on the severity of the charges, while also creating a regulatory obligation for institutions to reinvest in the communities it serves.

7

CalAccount could save consumers a cumulative $3.3 billion in OD and NSF charges.

Investigative reports have exposed some troubling trends, from Frontwave Credit Union’s collection of junk fees from its young Marine membership base to Navy Federal Credit Union’s disproportionate denials of Black borrowers, and even Citadel Federal Credit Union is facing a redlining lawsuit

The release of state-chartered institutions’ OD and NSF fee revenue as mandated by SB 1415 (Limon 2022) has also been pivotal in illuminating the reality of credit unions’ business model and provision of financial services. Our reporting on the data collected and published by the Department of Financial Protection and Innovation (DFPI) found that by almost all measures, credit unions fared worse when it came to charging NSF and OD fees than its state-chartered bank counterparts

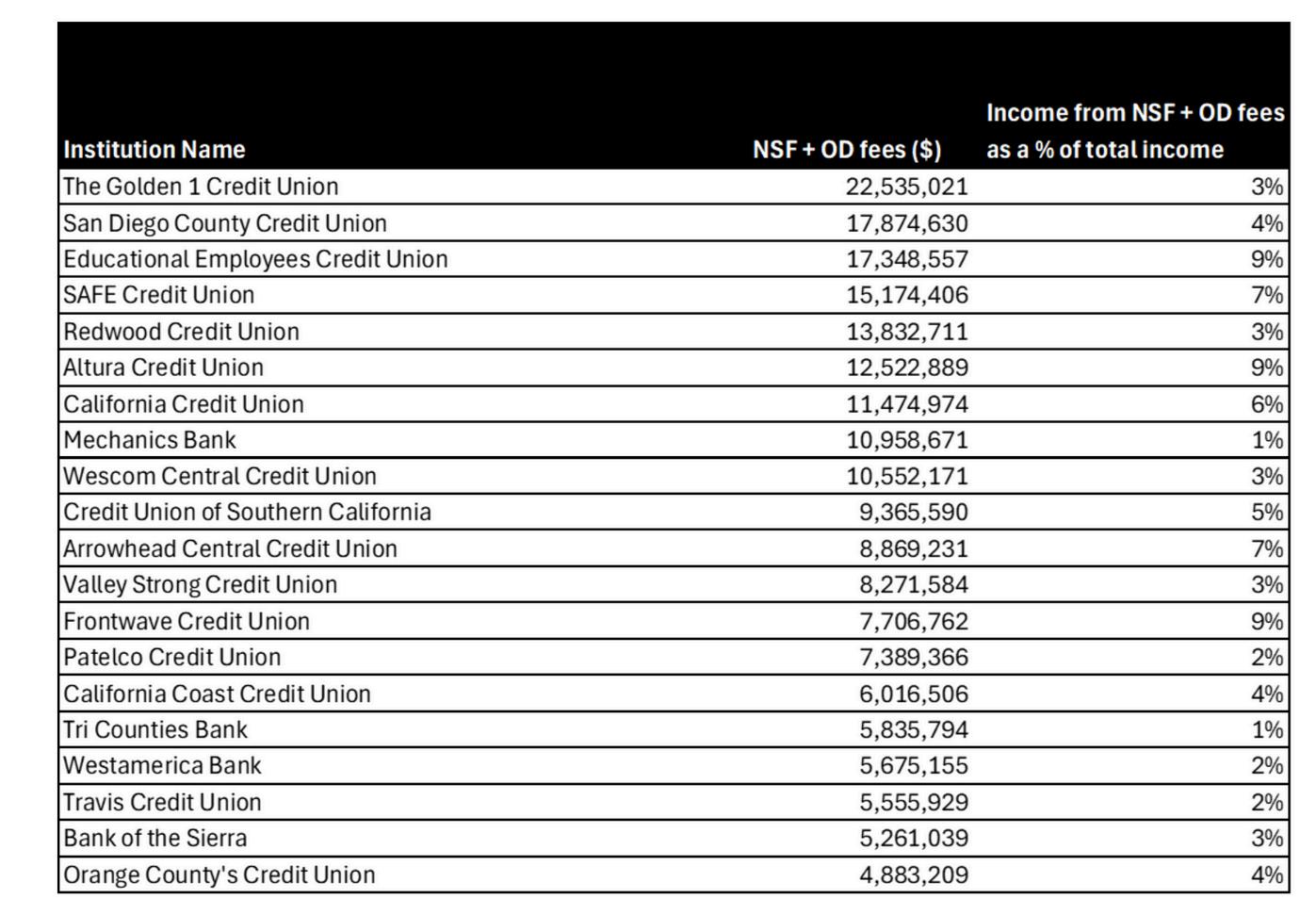

Last year ’ s analysis of the data found that credit unions were the worst actors when evaluating NSF and OD by both total revenue in dollars and as a proportion of total income. The story remains the same a year later. When ranking institutions according to the dollar amount in revenue from NSF and OD fees, credit unions make up 16 of the top 20 highest fee-charging institutions in 2023.

The top 20 institutions for dollar amount revenue in junk fees collected a total of $207,104,195. This represents 65% of total OD and NSF fees collected by state-chartered institutions, which in total collected over $316.5 million in OD and NSF fees.

Further, state-chartered credit unions are less than half the size of state-chartered banks, measured by deposits, yet collect over 4 5 times the total amount in junk fees than state-chartered banks

We found that credit unions reported that more of its income was made up of NSF and OD fee revenue compared to state-chartered banks. This trend remains the same, where First Imperial Credit Union reported 15% of its total income was derived from NSF and OD fee revenue. The highest percentage of total income from NSF and OD fees reported by a state-chartered bank was Bank of the Sierra, at 3%

Collecting so much OD/NSF fee revenue and depending so heavily on this revenue for income is incongruous with the claims of being community-minded and serving members’ needs as the credit union industry often maintains Additionally, a credit union can benefit from a low-income designation by the NCUA when over half of its membership is low-income. This designation grants the credit unions special provisions like access to additional grants and capital, and the ability to accept non-member deposits.

Thirteen of the top 20 fee-charging credit unions – as measured by total revenue in dollars from OD and NSF fees – have a low-income designation

These thirteen credit unions amassed $134.7 million in junk fee revenue from their majority low-income membership base. These credit unions are disproportionately harming low-income customers with their junk fees, given their focus on low-income members This finding further exemplifies the contradictory claims that credit unions are better-serving communities

This data reporting from the DFPI is crucial to understanding the business model of credit unions and the impact of fees on consumers and has led to some state legislation like Bradford’s SB 1075, which sets limits on the NSF and OD fees credit unions can charge Yet further policy change is needed

Trump’s previous administration gutted crucial consumer protections and agencies that provide safeguards to ensure financial institutions rightly serve the communities most in need of equitable financial access – LMI and BIPOC communities It’s safe to assume that the administration will attack crucial institutions like the CFPB and weaken oversight and enforcement by bank regulators like the OCC as they have done in the past Agencies like the CFPB and California’s Department of Financial Protection and Innovation (DFPI), which provide essential and strong consumer protections against things like junk fees must be protected and strengthened. The DFPI in particular must increase and enhance oversight of financial institutions to protect consumers and prevent abuses, especially knowing that the federal-level institutions will face attacks and deregulations

Second, California officials should enact a state-level CRA housed under the DFPI to cover state-chartered banks and state-chartered credit unions, as well as other institution types. While state-chartered banks are covered by the federal-level Community Reinvestment Act (CRA), which creates an affirmative obligation for banks to meet the credit needs of low-to-moderate-income communities and individuals, credit unions are not covered at all Even within the existing CRA, junk fees like OD and NSF are rarely considered in a bank’s performance evaluation.

A state-level CRA could go above and beyond the federal legislation to provide greater oversight and accountability against things like unfair and excessive consumer fees that hinder the economic stability of LMI and BIPOC borrowers and communities A strong state-level CRA could evaluate financial institutions on their excessive charges, and give downgrades or penalties depending on the severity of the charges, while also creating a regulatory obligation for institutions to reinvest in the communities they serve.

Third, a universal public banking option for the state, such as that being established under AB1177, or the California Public Banking Option Act, would allow wide access to a no-fee, no overdraft, zero-penalty debit account for consumers It has been estimated that CalAccount, a program established by the legislature to provide a no-junk fee bank account option to all Californians, could save consumers a cumulative $3.3 billion in OD and NSF charges. This sum saved in fees could generate an estimated $4.2 billion reinvested in the state economy

The numbers don’t lie. Despite their public image, credit unions have become some of the most aggressive collectors of fees that trap families in cycles of debt Agencies that offer essential consumer protections and accountability of financial institutions must be strengthened, and state level policies are needed to remedy this cycle of financial harm.