THE CLIMATE COSTS OF THE BANKING INDUSTRY

EXPOSING THE ROLE OF THE ROYAL BANK OF CANADA IN CALIFORNIA'S CLIMATE CRISIS

By Jamie Buell, Research Analyst

EXPOSING THE ROLE OF THE ROYAL BANK OF CANADA IN CALIFORNIA'S CLIMATE CRISIS

By Jamie Buell, Research Analyst

Over the last few years, California communities have been plagued by wildfires, extreme heat, flooding, and drought. Fueled by climate change, these extreme weather events put communities, workers and families at risk.

California is one of the top five states facing the most economic impacts from climate-related natural disasters. The state has suffered between $30 billion and $90 billion in losses from 2018 to 2022. Additionally, it is estimated that it will cost state taxpayers upward of $6.9 billion to cap idle and uncapped oil wells.

Unfortunately, not all communities are impacted equally. Some communities are at higher risk of negative impacts from climate change due to social and economic inequities caused by ongoing systemic discrimination, exclusion, inadequate public services, and underinvestment or disinvestment in the built environment. Those who work outdoors and in manufacturing spaces, like farmworkers and warehouse workers, are particularly vulnerable to rising temperatures and the impacts of flooding on their livelihoods.

In other words, BIPOC and working-class neighborhoods and rural areas suffer most from climate change, just as with redlining and other predatory and extractive financial practices.

Rise Economy, formerly the California Reinvestment Coalition, builds a powerful movement for economic justice, focused on knocking down the historical barriers for Black, Latinx, Indigenous and other People of Color who have faced hardships building generational wealth. We and our members fight redlining and discrimination, work toward racial justice and equity through increased access to financial services and investments, and champion state and federal policy designed to promote wealthbuilding and end predatory financial practices.

Rise Economy members have prioritized fighting climate change as a key component of ensuring that BIPOC neighborhoods in our state are healthy, stable, and able to thrive and build wealth.

The burning of fossil fuels – coal, oil and gas – is by far the largest contributor to global climate change, accounting for over 75 percent of global greenhouse gas emissions and nearly 90 percent of all carbon dioxide emissions. Despite increasing evidence linking these emissions to climate disasters, financing from banks enables fossil fuel companies to continue to extract oil, gas and coal and to expand their operations. While the banking and fossil fuel industries pursue profits together, under-resourced local governments and communities shoulder the worst impacts, costs and burdens of recovery from climate disasters

You might be familiar with JPMorgan Chase, Citibank, Wells Fargo, and Bank of America as fossil fuel financers, but what about the Royal Bank of Canada?

Royal Bank of Canada is one of the biggest culprits and an outlier in the financing of fossil fuels which accelerates climate change Since the Paris Agreement, RBC consistently ranks among the worst fossil fuel financiers, ranking as high as banks with twice as many total assets as JP Morgan Chase

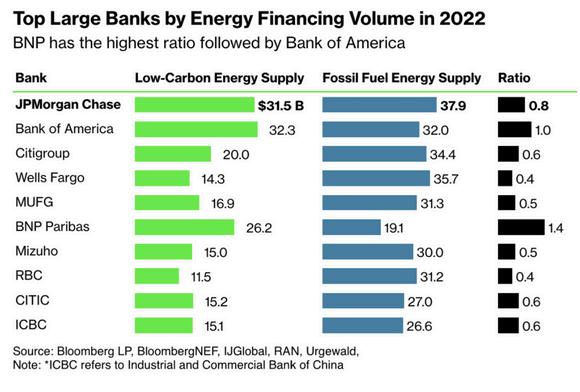

One green measure of a bank is how its fossil fuel finance compares to its financing of low-carbon-intensive projects Researchers estimate that the ratio of spending on new investment in low-carbon to fossil-fuel supply must reach 4-to-1 by 2030 to limit the global temperature rise to no more than 1 5°C, a goal set by the Paris Agreements which seeks to limit global warming by no more than 1.5°C. While the average so-called energy-supply ratio for some of the world’s top banks was 0 73 to 1 for 2022, for RBC, it was far worse, or only 0 4 In other words, while RBC should be investing in low-carbon energy supply at four times the amount it spends on fossil fuel energy supply, in reality, its investment in green energy is only forty cents to every dollar spent on fossil fuel energy supply.

“RBC consistently ranks among the worst fossil fuel financiers.”

Although based in Canada, RBC has an imprint in Califorina. Its dollars are contributing to substantial polluters and bad actors in California.

Since the Paris Accord, RBC has:

Provided nearly $20.26 billion in financing to 8 companies that are among the largest emitters of greenhouse gasses in California

Provided $3.114 billion to Phillips 66, a large oil and gas company that owns and operates refineries and other facilities in the state

Provided $4 078 billion to Marathon Petroleum Corp, a large national oil and gas company that owns multiple facilities, including the Martinez refinery.

Provided $560 million to California Resources Corporation, which owns 11 7% of all oil wells in California California Resources Corporation trails only Chevron and Aera Energy in terms of oil well ownership – the latter of which recently merged with California Resources Corporation

The merged company will be the owner of the most idle or orphan wells, with roughly 37,000 uncapped wells in its portfolio, estimated to cost between $1 billion and $3.5 billion to eventually plug. RBC’s funding of California Resources Corporation represents 27% of the company ’ s total equity financing since the Paris agreements Of California Resource Corporation’s oil wells, 64% are in BIPOC neighborhoods Twenty-four percent are in low-to-moderate-income neighborhoods.

[8]

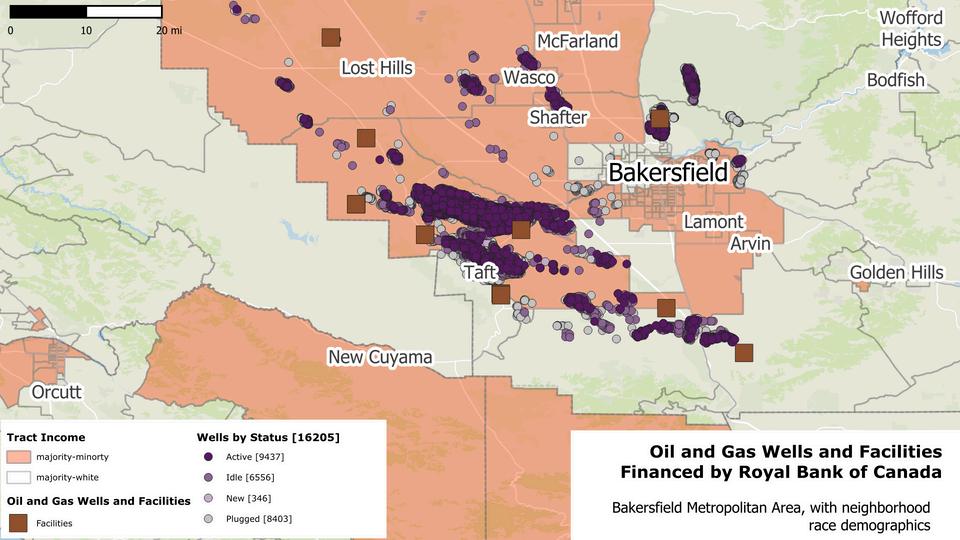

California Resources Corporation owns 24,742 oil and gas wells, with the majority (16,205) located in the Bakersfield area

Oil well data from California Department of Conservation’s Geologic Energy Management Division (CalGEM)’s All Wells database, as of 03/28/2024. Wells are limited to the following types: dry gas, gas, gas storage, unclassified injection, multiple uses including production, oil and gas, cyclic steam, steam flood, wastewater disposal, and water flood; and those with the operational status “Plugged”, “Idle”, “Active”, or “New.” Facilities and their greenhouse gas emissions retrieved from the Environmental Protection Agency (EPA)’s Facility Level Information on Greenhouse Gas Tool (FLIGHT), 2021 reported data. Census tract demographics retrieved from FFIEC 2023 Census Flat File, which utilizes the 2020 Census Demographic and Housing Characteristics File and 20162020 American Community Survey to report minority population as percent of tract population rounded to two decimal places.

Sixty-eight percent (8,598) of wells in Bakersfield are active or idle, and 72% are located in BIPOC neighborhoods. Of particular concern is that 89% of RBC-funded California Resource Corporation’s new wells in Bakersfield are located in BIPOC neighborhoods Seventy percent of all new wells in the state were in BIPOC neighborhoods

Active and idle oil wells contribute to substantial pollution and create disparate health outcomes among the local communities that are subjected to living near drilling sites Studies have found an average of 66% of active and idle oil wells leak methane, which aside from being a major contributor to climate change also puts residents at greater risk of asthma, cancer, and other negative health outcomes Idle, abandoned, and even plugged wells have been found to be sites of pollution and spillage despite the decommissioned status. The fossil fuel industry’s harm to the environment and local communities persists throughout the entire lifecycle of extraction activity

In Wilmington, a community within the city of LA that has the highest concentration of active wells, over half are within 200 meters of residential land, and nearly two-thirds are within 3,200 feet of residential land Residential neighborhoods close to these wells exceed the average percentage of non-white residents in the county, with 85-99% of residents identifying as people of color

Refineries such as the Los Angeles Refinery, owned by Phillips 66 and Valero and funded by RBC, surround the Wilmington community Wilmington is also home to more than 3,000 wells owned by California Resources Corporation and funded by RBC

RBC also finances companies that operate 63 refineries, resulting in 33.4 million metric tons of greenhouse gas emissions in 2021 alone – accounting for over a third of all GHG emissions from large facilities reported to the EPA These companies include:

Calpine Corp, which owns 14 refinery sites in the state;

Marathon Petroleum, which owns the Los Angeles refinery and part of the Martinez refinery; PBF Energy, which owns the Martinez refinery and Torrance refinery;

Phillips 66, which owns the Wilmington refinery, where nearby residents have the sixthlowest life expectancy out of Los Angeles’ communities The refinery has been found to contribute to about 87% of the city’s excess cancer risk;

Sempra, a high-emitting utilities company;

Valero Energy Corp, which owns the Benicia refinery – which was recently issued a $1 75 million fine for safety violations in connection with the death of a contract worker at the refinery;

And, Shell PLC, a former owner of a statewide well operator, and named in a lawsuit brought by the California Attorney General alleging deceptive marketing and liability for harms caused by climate change

Refineries like the Martinez refinery subject its local residents to pollution of toxic metals and large fires releasing more than 200,000 pounds of renewable diesel fuel and smoke that led to a multi-agency investigation and major penalty from Bay Area air regulators

Wilmington is also home to more than 3,000 wells owned by California Resources Corporation and funded by RBC.

Multiple analyses of RBC’s climate policies indicate that the bank is falling short of its assertions it’s addressing climate change InfluenceMap found RBC's policies to be misaligned with its commitment to achieve net zero emissions by 2050 and gave the bank a D+ score for its climate governance and policy engagement efforts Furthermore, there is a lawsuit alleging that RBC is greenwashing - portraying itself as environmentally friendly when it is not - and failing to work toward the necessary solutions

Even RBC’s own climate report admits that a majority of the bank’s fossil fuel clients are not aligned with 1 5ºC aligned emissions reduction targets, and RBC has failed to set an absolute emissions reduction target for its business Despite stated goals, RBC continues to rely on misaligned efforts such as unproven carbon capture and storage projects (CCS), biomass energy (burning of trees to produce power) and categorizing of sustainability-linked loans and bonds to fossil fuel companies as “Sustainable Finance.”

Additionally, RBC owns City National Bank, a bank that has failed BIPOC communities in California

In 2023, the United States Department of Justice charged City National Bank with redlining Black and Latino neighborhoods in the greater Los Angeles area, and entered into the largest redlining settlement in the nation’s history, requiring the bank to pay $31 million and change its practices

[25]

OfCalifornia Resource Corporation’soil wells,64%arein BIPOC neighborhoods.

City National's lending disparities are troubling and extend beyond the numbers. The 2022 data from the Home Mortgage Disclosure Act indicates that City National Bank's mortgage lending in Black and Latino neighborhoods is significantly lower compared to lending in white neighborhoods, especially in metropolitan areas such as Los Angeles/Long Beach/Anaheim, San Francisco-Oakland-Berkeley, and Oxnard-Ventura In the Oxnard-Ventura MSA, City National Bank's lending in Black and Hispanic tracts was only 12% of the market average lending in these neighborhoods.

Across North America, groups have been advocating for, and in some cases, achieving reforms from RBC and CNB to protect our climate, environment, and communities. Rise Economy proudly stands shoulder to shoulder with them. This report is part of larger effort from Rise Economy, demanding more from RBC and CNB

The 2022 data from the Home Mortgage Disclosure Act indicates that City National Bank's mortgage lending in Black and Latino neighborhoods is significantly lower compared to lending in white neighborhoods.

The data presented in this report highlights the critical need to hold RBC and CNB accountable for their role in perpetuating both climate change and economic inequity. RBC and CNB must take meaningful action to repair the harm they’ve caused and commit to a more just and sustainable future – lest they intend to cement their institutional legacies as agents of climate destruction.

On the next page, you’ll find our list of demands of RBC and CNB

We want the Royal Bank of Canada and City National Bank to commit to a Community Benefits Agreement that does the following

1

2

3

Stop funding fossil fuels.

Create a plan and timeline for phase-outs of financing of the dirtiest fossil fuels Work towards an end of financing of all new fossil fuel extraction activities.

Address harm caused by fossil fuel financing.

Respect Indigenous rights and BIPOC communities (known as Free, Prior and Informed Consent) in all fossil fuel financing decisions

Ensure that oil and gas well operators have plugged or have plans for plugging all idle wells, and provide financing if necessary, for plugging and remediation of the oil well fields

Support small businesses across the state seeking to transition their operations to cleaner operations

Support efforts to transition local workforces dependent on declining industries to good jobs in green economies, technologies, and sectors. Ensure borrowers have adequate transition plans that are not greenwashing

Address discriminatory banking practices.

Invest in municipalities’ community development activities, where cities rely on revenue from fossil fuel companies to fund community development

Promote homeownership and small business ownership for BIPOC households in California

Ensure no redlining throughout our state; address redlining concerns in all regions of California

Develop policies to ensure that RBC, CNB and their clients do not engage in bluelining - denying credit or charging more to BIPOC households based on perceptions of a neighborhood's vulnerability to climate change impacts.

https://calmatters org/environment/climate-change/2023/11/climate-change-california-national-climateassessment/

https://carbontracker org/reports/there-will-be-blood/ 2

https://nca2023 globalchange.gov/#overview-section-2 3

https://www npr.org/2024/03/23/1239775435/california-wants-to-protect-indoor-workers-from-heat-thatgoal-is-now-limbo

https://www.un org/en/climatechange/science/causes-effects-climatechange#: :text=Fossil%20fuels%20%E2%80%93%20coal%2C%20oil%20and,they%20trap%20the%20sun's%20hea t.

https://about bnef com/blog/financing-the-transition-energy-supply-investment-and-bank-financingactivity/

For more information see https://interactive.carbonbrief org/one-point-five-pathways/index html 7 https://capitalandmain com/will-californias-largest-oil-well-owner-get-a-pass-on-paying-to-clean-up-itsmess 8

https://pubs acs.org/doi/10.1021/acs est 0c05279 9 https://www.lung.org/blog/methane-gas-pollution 10 https://iopscience iop org/article/10 1088/1748-9326/abf06f 11

https://libertyhill-assets-2 s3-us-west2.amazonaws com/media/documents/STAND LA LHF Power of Persistence pdf p 12.

Ibid p 10 13

https://ghgdata epa gov/ghgp/main do 14 https://grist org/health/excess-deaths-wilmington-california-covid-pollution/ 15

https://projects propublica org/toxmap/

https://www kqed org/news/11913837/state-issues-1-75m-in-fines-over-worker-death-at-valero-refinery 17 https://www courthousenews.com/wp-content/uploads/2024/06/california-v-exxon-et-al-amendedcomplaint.pdf 18

https://www.kqed org/news/11957461/in-martinez-more-residents-want-to-hold-the-refinery-accountable 19 https://www kqed org/news/11968786/recent-fires-at-marathons-martinez-refinery-spark-major-safetyconcerns 20.

https://www kqed org/news/11975650/bay-air-district-hails-decisive-victory-in-battle-to-cut-refinerypollution

IEEFA, “RBC Engagement Strategy Falls Short,” at https://ieefa org/sites/default/files/202402/RBC%20Engagement%20Strategy%20Falls%20Short February%202024 pdf; Competition Bureau Canada’s investigation of RBC accuses RBC of lacking a “credible” plan for how it will slash GHG emissions. RBC’s financing of fossil fuel expansion is wholly incompatible with its climate goals In fact, at least some of RBC’s “sustainable finance” goes to fossil fuel companies; https://oilgaspolicytracker.org/ / https://coalpolicytool org/

https://influencemap org/report/Canada-s-Big-Five-Banks-26501

https://www reuters com/sustainability/sustainable-finance-reporting/climate-activist-group-targets-majorcanadian-lenders-over-green-finance-claims-2024-01-09/

https://www justice gov/opa/pr/justice-department-secures-over-31-million-city-national-bank-addresslending-discrimination

See: https://fossilfreerbc org/ , https://rbcrevealed com/why-rbc/ , https://www indigenousclimateaction.com/, https://www nomoredirtybanks com/

A special thanks to the follwing organizations and individuals:

Kyle Ferrar from Fractracker Alliance, Dr. Madison Swayne from San Diego State University and Dr. James Sadd from Occidental College for guidance on CalGEM oil well data

The Rainforest Action Network (RAN) for helping to pull financing data for select high GHG emitters, including: California Resources Corp, Calpine Corp, Marathon Petroleum Corp, PBF Energy Inc, Phillips 66, Sempra, Valero Energy Corp and Shell PLC. For exact information about greenhouse gas emissions per facility

The frontline Canadian groups that engage RBC at its annual shareholder meetings. Thank you to The Sunrise Project.

We thank you for your continued support in our efforts to combat systemic inequities.