2023-2024 Benefits Guide [DI Employee Benefits lt;J ServicesGroup Rusty Freeman & Associates LLC 245 Landa Street New Braunfels, TX 78130 Phone: (830) 606-5100 www.usebsg.com

SAN MARCOS CONSOLIDATED Independent School District District Contact Melissa Patton HR Benefits & Leave Specialist Office: (512) 393-6796 Email: Melissa.Patton@smcisd.net U.S. Employee Benefits Group Contacts Valerie Galan Marlene Freeman Executive Account Manager Senior Account Manager Office: (830) 606-5100 Email: vgalan@usebsg.com mfreeman@usebsg.com SUPPORT CONTACTS The benefit booklet highlights certain features from the different policies and riders but is not the insurance contract. Please refer to the group master application or your policy for all full disclosures of benefits

Table of Content

Important Information

Login Information

Medical – TRS Activecare

Medical Gap – Zurich SIS

Dental – MetLife

Vision – Davis Vision

Disability – The Standard

Employee Assistance Program – Alliance Work Partners

Texas Life - Permanent Life

Group Life – Lincoln Financial

Cancer – Loyal American

Critical Illness – MetLife

Accident – MetLife

Flexible Spending Account - TASC

403(b) Plans - The OMNI Group

Medical Transportation – MASA

Page

Benefit Phone Website TRS ACTIVECARE – MEDICAL 1-866-355-5999 WWW.BCBSTX.COM/TRSACTIVECARE ZURICH SIS – GAP PLAN 1-800-382-2150 WWW.ZURICHNA.COM METLIFE – DENTAL 1-800-942-0854 WWW.METLIFE.COM DAVIS VISION – VISION 1-877-923-2847 WWW.DAVISVISION.COM THE STANDARD – DISABILITY 1-800-368-1135 WWW.STANDARD.COM ALLIANCE WORK PARTNERS – EAP 1-800-343-3822 WWW.AWPNOW.COM TEXAS LIFE – PERMANENT LIFE 1-800-283-9233 WWW.TEXASLIFE.COM LINCOLN – GROUP & VOLUNTARY LIFE 1-800-423-2765 WWW.LINCOLNFINANCIAL.COM LOYAL AMERICAN – CANCER 1-800-366-8354 WWW.LOYALAMERICAN.COM METLIFE – CRITICAL ILLNES 1-800-438-6388 WWW.METLIFE.COM METLIFE – ACCIDENT 1-800-438-6388 WWW.METLIFE.COM 1-800-422-4661 WWW.TASCONLINE.COM THE OMNI GROUP- 403(B) PLANS 1-877-544-6664 WWW.OMNI403B.COM MASA – EMERGENCY TRANSPORTATION 1-800-643-9023 WWW.MASAMTS.COM 4-5 6 13-15 7-12 16-22 23-25 26-30 31-32 33-35 36-40 41-47 48-51 52-59 60-61 63-64 62 TASC– FLEXIBLE SPENDING ACCOUNT (FSA)

Benefit Contacts

23 4 3 4 3. • • • • • • • • • • • • 3 • • 3 4

QUALIFYING EVENT AND MORE IMPORTANT INFORMATION

• • • • • 30 836 5

Default Password

Password

Site Access

6

TRS-ActiveCare has more doctors and hospitals than the hill country has hills.

TRS-ActiveCare Plan Highlights 2023-24

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay its portion.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary by the type of service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; i.e. you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

762376.0523

7

2023-24 TRS-ActiveCare Plan Highlights

• Express Scripts is your new pharmacy benefits manager! CVS pharmacies and most of your preferred pharmacies and medication are still included.

•Certain specialty drugs are still $0 through SaveOnSP.

This plan is closed and not accepting new enrollees. If you’re currently enrolled in TRS-ActiveCare 2, you can remain in this plan. Monthly Premiums Employee Only $395 $ $463 $ $408 $ Employee and Spouse $1,067 $ $1,204 $ $1,102 $ Employee and Children $672 $ $788 $ $694 $ Employee and Family $1,343 $ $1,528 $ $1,388 $ Total Premium Total Premium Total Premium Your Premium Your Premium Your Premium Total Premium Your Premium $1,013 $ $2,402 $ $1,507 $ $2,841 $ How to Calculate Your Monthly Premium Total Monthly Premium Your District and State Contributions Your Premium Ask your Benefits Administrator for your district’s specific premiums. All TRS-ActiveCare participants have three plan options. Each includes a wide range of wellness benefits. TRS-ActiveCare 2 • Closed to new enrollees • Current enrollees can choose to stay in plan • Lower deductible • Copays for many services and drugs • Nationwide network with out-of-network coverage • No requirement for PCPs or referrals TRS-ActiveCare Primary TRS-ActiveCare Primary+ TRS-ActiveCare HD Plan Summary • Lowest premium of all three plans • Copays for doctor visits before you meet your deductible • Statewide network • Primary Care Provider (PCP) referrals required to see specialists • Not compatible with a Health Savings Account (HSA) • No out-of-network coverage • Lower deductible than the HD and Primary plans • Copays for many services and drugs • Higher premium • Statewide network • PCP referrals required to see specialists • Not compatible with a Health Savings Account (HSA) • No out-of-network coverage • Compatible with a Health Savings Account (HSA) • Nationwide network with out-of-network coverage • No requirement for PCPs or referrals • Must meet your deductible before plan pays for non-preventive care Wellness Benefits at No Extra Cost* Being healthy is easy with: •$0 preventive care •24/7 customer service •One-on-one health coaches •Weight loss programs

programs

pregnancy support • TRS Virtual Health

health benefits

Immediate Care Urgent Care $50 copay $50 copay You pay 30% after deductibleYou pay 50% after deductible Emergency Care You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible TRS Virtual Health-RediMD (TM) $0 per medical consultation $0 per medical consultation $30 per medical consultation TRS Virtual Health-Teladoc® $12 per medical consultation $12 per medical consultation $42 per medical consultation $50 copay You pay 40% after deductible You pay a $250 copay plus 20% after deductible $0 per medical consultation $12 per medical consultation

•Nutrition

•OviaTM

•Mental

•And much more! *Available for all plans. See the benefits guide for more details.

Sept. 1, 2023 – Aug. 31, 2024

New Rx Benefits!

Doctor Visits Primary Care $30 copay $15 copay You pay 30% after deductibleYou pay 50% after deductible Specialist $70 copay $70 copay You pay 30% after deductibleYou pay 50% after deductible $30 copay You pay 40% after deductible $70 copay You pay 40% after deductible Plan Features Type of Coverage In-Network Coverage Only In-Network Coverage Only In-Network Out-of-Network Individual/Family Deductible $2,500/$5,000 $1,200/$2,400 $3,000/$6,000 $5,500/$11,000 Coinsurance You pay 30% after deductible You pay 20% after deductible You pay 30% after deductibleYou pay 50% after deductible Individual/Family Maximum Out of Pocket $7,500/$15,000 $6,900/$13,800 $7,500/$15,000 $20,250/$40,500 Network Statewide Network Statewide Network Nationwide Network PCP Required Yes Yes No In-Network Out-of-Network $1,000/$3,000 $2,000/$6,000 You pay 20% after deductibleYou pay 40% after deductible $7,900/$15,800 $23,700/$47,400 Nationwide Network No Prescription Drugs Drug Deductible Integrated with medical $200 deductible per participant (brand drugs only) Integrated with medical Generics (31-Day Supply/90-Day Supply)$15/$45 copay; $0 copay for certain generics $15/$45 copay You pay 20% after deductible; $0 coinsurance for certain generics Preferred You pay 30% after deductible You pay 25% after deductible You pay 25% after deductible Non-preferred You pay 50% after deductible You pay 50% after deductible You pay 50% after deductible Specialty (31-Day Max) $0 if SaveOnSP eligible; You pay 30% after deductible $0 if SaveOnSP eligible; You pay 30% after deductible You pay 20% after deductible Insulin Out-of-Pocket Costs$25 copay for 31-day supply; $75 for 61-90 day supply$25 copay for 31-day supply; $75 for 61-90 day supply You pay 25% after deductible $200 brand deductible $20/$45 copay You pay 25% after deductible ($40 min/$80 max)/ You pay 25% after deductible ($105 min/$210 max) You pay 50% after deductible ($100 min/$200 max)/ You pay 50% after deductible ($215 min/$430 max) $0 if SaveOnSP eligible; You pay 30% after deductible ($200 min/$900 max)/ No 90-day supply of specialty medications $25 copay for 31-day supply; $75 for 61-90 day supply $0 $672 $277 $948 $68 $809 $393 $1,133 $13 $707 $299 $993 $618 $2,007 $1,112 $2,446 8

What’s New and What’s Changing

This table shows you the changes between 2022-23 premium price and this year’s 2023-24 regional price for your Education Service Center.

Key Plan Changes

• Individual maximum-out-of-pocket decreased by $650. Previous amount was $8,150 and is now $7,500.

• Family maximum-out-of-pocket decreased by $1,300. Previous amount was $16,300 and is now $15,000.

• Teladoc virtual mental health visit copay decreased from $70 to $0.

• Individual maximum-out-of-pocket increased by $450 to match IRS guidelines. Previous amount was $7,050 and is now $7,500.

• Family maximum-out-of-pocket increased by $900 to match IRS guidelines. Previous amount was $14,100 and is now $15,000. These changes apply only to in-network amounts.

• Family deductible decreased by $1,200. Previous amount was $3,600 and is now $2,400.

• Primary care provider and mental health copays decreased from $30 to $15.

• Teladoc virtual mental health visit copay decreased from $70 to $0.

• No changes.

• This plan is still closed to new enrollees.

2022-23 Total Premium New 2023-24 Total Premium Change in Dollar Amount TRS-ActiveCare Primary Employee Only $364 $395 $31 Employee and Spouse $1,026 $1,067 $41 Employee and Children $654 $672 $18 Employee and Family $1,228 $1,343 $115 TRS-ActiveCare HD Employee Only $376 $408 $32 Employee and Spouse $1,058 $1,102 $44 Employee and Children $675 $694 $19 Employee and Family $1,265 $1,388 $123 TRS-ActiveCare Primary+ Employee Only $457 $463 $6 Employee and Spouse $1,117 $1,204 $87 Employee and Children $735 $788 $53 Employee and Family $1,405 $1,528 $123 TRS-ActiveCare 2 (closed to new enrollees) Employee Only $1,013 $1,013 $0 Employee and Spouse $2,402 $2,402 $0 Employee and Children $1,507 $1,507 $0 Employee and Family $2,841 $2,841 $0

At a Glance Primary HD Primary+ Premiums Lowest Lower Higher Deductible Mid-range High Low Copays Yes No Yes NetworkStatewide network Nationwide network Statewide network PCP Required? Yes No Yes HSA-eligible? No Yes No Effective: Sept. 1,

2023

9

Compare Prices for Common Medical Services

*Pre-certification for genetic and specialty testing may apply. Contact a PHG at

questions.

Benefit TRS-ActiveCare Primary TRS-ActiveCare Primary+ TRS-ActiveCare HD TRS-ActiveCare 2 In-Network OnlyIn-Network OnlyIn-NetworkOut-of-NetworkIn-NetworkOut-of-Network Diagnostic Labs* Office/Indpendent Lab: You pay $0 Office/Indpendent Lab: You pay $0 You pay 30% after deductible You pay 50% after deductible Office/Indpendent Lab: You pay $0 You pay 40% after deductible Outpatient: You pay 30% after deductible Outpatient: You pay 20% after deductible Outpatient: You pay 20% after deductible High-Tech Radiology You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible You pay 20% after deductible + $100 copay per procedure You pay 40% after deductible + $100 copay per procedure Outpatient Costs You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible You pay 20% after deductible ($150 facility copay per incident) You pay 40% after deductible ($150 facility copay per incident) Inpatient Hospital Costs You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible ($500 facility per day maximum) You pay 20% after deductible ($150 facility copay per day) You pay 40% after deductible ($500 facility per day maximum) Freestanding Emergency Room You pay $500 copay + 30% after deductible You pay $500 copay + 20% after deductible You pay $500 copay + 30% after deductible You pay $500 copay + 50% after deductible You pay $500 copay + 20% after deductible You pay $500 copay + 40% after deductible Bariatric Surgery Facility: You pay 30% after deductible Facility: You pay 20% after deductible Not CoveredNot Covered Facility: You pay 20% after deductible ($150 facility copay per day) Not Covered Professional Services: You pay $5,000 copay + 30% after deductible Professional Services: You pay $5,000 copay + 20% after deductible Professional Services: You pay $5,000 copay + 20% after deductible Only covered if rendered at a BDC+ facility Only covered if rendered at a BDC+ facility Only covered if rendered at a BDC+ facility Annual Vision Exam (one per plan year; performed by an ophthalmologist or optometrist) You pay $70 copayYou pay $70 copay You pay 30% after deductible You pay 50% after deductible You pay $70 copay You pay 40% after deductible Annual Hearing Exam (one per plan year) $30 PCP copay $70 specialist copay $30 PCP copay $70 specialist copay You pay 30% after deductible You pay 50% after deductible $30 PCP copay $70 specialist copay You pay 40% after deductible

www.trs.texas.gov

1-866-355-5999 with

Call a Personal Health Guide (PHG) any time 24/7 to help you find the best price for a medical service. Reach them at 1-866-355-5999

Revised 05/30/23 10

REMEMBER:

2023-24 Health Maintenance Organization (HMO) Plans and Premiums for Select Regions of the State

TRS contracts with HMOs in certain regions to bring participants in those areas additional options. HMOs set their own rates and premiums. They’re fully insured products who pay their own claims.

You can choose this plan if you live in one of these counties: Austin, Bastrop, Bell, Blanco, Bosque, Brazos, Burleson, Burnet, Caldwell, Collin, Coryell, Dallas, Denton, Ellis, Erath, Falls, Freestone, Grimes, Hamilton, Hays, Hill, Hood, Houston, Johnson, Lampasas, Lee, Leon, Limestone, Madison, McLennan, Milam, Mills, Navarro, Robertson, Rockwall, Somervell, Tarrant, Travis, Walker, Waller, Washington, Williamson

You can choose this plan if you live in one of these counties: Cameron, Hildalgo, Starr, Willacy

You can choose this plan if you live in one of these counties: Andrews, Armstrong, Bailey, Borden, Brewster, Briscoe, Callahan, Carson, Castro, Childress, Cochran, Coke, Coleman, Collingsworth, Comanche, Concho, Cottle, Crane, Crockett, Crosby, Dallam, Dawson, Deaf Smith, Dickens, Donley, Eastland, Ector, Fisher, Floyd, Gaines, Garza, Glasscock, Gray, Hale, Hall, Hansford, Hartley, Haskell, Hemphill, Hockley, Howard, Hutchinson, Irion, Jones, Kent, Kimble, King, Knox, Lamb, Lipscomb, Llano, Loving, Lubbock, Lynn, Martin, Mason, McCulloch, Menard, Midland, Mitchell, Moore, Motley, Nolan, Ochiltree, Oldham, Parmer, Pecos, Potter, Randall, Reagan, Reeves, Roberts, Runnels, San Saba, Schleicher, Scurry, Shackelford, Sherman, Stephens, Sterling, Stonewall, Sutton, Swisher, Taylor, Terry, Throckmorton, Tom Green, Upton, Ward, Wheeler, Winkler, Yoakum

Remember that when you choose an HMO, you’re choosing a regional network. REMEMBER: www.trs.texas.gov Total Monthly Premiums Total PremiumYour PremiumTotal PremiumYour PremiumTotal PremiumYour Premium Employee Only$515.37 N/A$ $865.00 Employee and Spouse$1,293.46 N/A$ $2,103.16 Employee and Children$828.11 N/A$ $1,361.42 Employee and Family$1,488.60 N/A$ $2,233.34 Central and North Texas Baylor Scott & White Health Plan Brought to you by TRS-ActiveCare Blue Essentials - South Texas HMO Brought to you by TRS-ActiveCare Blue Essentials - West Texas HMO Brought to you by TRS-ActiveCare

Prescription Drugs Drug Deductible $200 (excl. generics) N/A $150 Days Supply30-day supply/90-day supply N/A 30-Day Supply/90-Day Supply Generics $14/$35 N/A $5/$12.50 copay; $0 for certain generics Preferred BrandYou pay 35% after deductible N/A You pay 30% after deductible Non-preferred BrandYou pay 50% after deductible N/A You pay 50% after deductible Specialty You pay 35% after deductible N/A You pay 15%/25% after deductible (preferred/non-preferred) Immediate Care Urgent Care $40 copay N/A $50 copay Emergency Care $500 copay after deductible N/A $500 copay before deductible + 25% after deductible Doctor Visits Primary Care $20 copay N/A $20 copay Specialist $70 copay N/A $70 copay Plan Features Type of CoverageIn-Network Coverage Only N/A In-Network Coverage Only Individual/Family Deductible $2,400/$4,800 N/A $950/$2,850 CoinsuranceYou pay 25% after deductible N/A You pay 25% after deductible Individual/Family Maximum Out of Pocket $8,150/$16,300 N/A $7,450/$14,900

Revised 05/30/23 $120.37 $898.46 $433.11 1,093.60 $470.00 $1,703.16 $966.42 $1,838.34 11

*ActiveCare 2 is only available to those currently under the plan, not available to new enrollees.

3 4 395 95 67 $672.00 72 $277.00 343 $948.00 63 $68.00 204 $809.00 88 $393.00 528 $1,133.00 408 $13.00 102 $707.00 94 $299.00 388 $993.00 $618.00 $2,007.00 $1,112.00 $2,446.00 $515.37 $120.37 ,293.46 $898.46 828.11 $433.11 1,488.60 $1,093.60

95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 12

Zurich Specialty Health Supplemental GAP Medical

*This maximum applies to the entire family unit, regardless of the number of covered persons within the family unit. An “occurrence” is the treatment, or series of treatments, for a specific sickness or injury. All expenses related to the treatment of the same or related sickness or injury will accrue toward the out-patient maximum for one occurrence, regardless of whether such treatment is received in more than one calendar year period. If, however, a Covered Person is treatment-free, at any time, for at least 30 consecutive days, they may qualify for an additional outpatient maximum benefit if the family maximum per calendar year has not been met.

Monthly Rates*

Employees and dependents enrolled in the company sponsored Major Medical Plan may enroll for coverage in the Zurich Supplemental GAP Medical Plan.

– Plan 1 Inpatient Expense Benefit Per Covered Person $1,500 per Plan Year Per Family N/A Outpatient Expense Benefit I Per Covered Person $1,000 per Injury or Sickness per Plan Year Maximum Per Family* 4 outpatient occurrences per Family per Plan Year

Coverage Summary

Four-Tier Rates Under 40 Age 40-49 Age 50+ Composite Employee Only $26.45 34.16 $71.62 N/A Employee & Spouse $48.62 62.77 $131.60 N/A Employee & Children 61.27 81.44 $126.26 N/A Employee & Family 86.42 105.81 $184.66 N/A

13

Serving customers for almost 150 years

Zurich Insurance Group

Founded in Switzerland in 1872, we are one of the world’s most experienced global insurers

• Eligibility

Doing business in the U.S. since 1912

Approximately 55,000 experienced professionals worldwide

Approximately 9,000 employees in North America

Providing a wide range of property and casualty, and life insurance products and services in more than 215 countries and territories

North America contributed approximately $1.43 billion toward Zurich’s $4.2 billion in operating profit in 2020

Insurance a broad range of Middle Market customers as well as more than 95 percent of the Fortune 500

Providing multinational solutions in the U.S. for almost 50 years

Strong investor proposition; resilient business model, clear strategy, and responsible and impactful business

Zurich North America is one of the largest providers of insurance solutions and services to businesses and individuals.

To learn more, visit www.zurichna.com

• Employees enrolled in the company’s sponsored Major Medical Plan are eligible for Gap medical coverage. Employee’s dependents are also eligible for coverage.

• Eligibility waiting period

• Same as Major Medical Plan.

• Inpatient Expense Benefit – Benefits will be paid if a covered person is confined to a hospital as a direct result of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan.

• Outpatient Expense Benefit – Benefits will be paid for outpatient treatment of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan.

• Combined Inpatient and Outpatient Expense Benefit –Benefits will be paid if a covered person is confined to a hospital or receives outpatient treatment as a direct result of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan. All benefits are subject to the Policy Deductible and the Supplemental Medical Coinsurance percentage for the Plan Year shown on the following pages:

• Policy Deductible – Benefits will be payable after the Covered Person has met the “Per Covered Person” Policy Deductible or after the “Per Family” Policy Deductible has been met, whichever occurs first.

• Supplemental Medical Co-insurance – The maximum percentage that will be paid under this Policy for covered expenses incurred by a covered person.

• Plan Year – A consecutive 12-month period during which a covered person’s coverage under the policy is in force.

Zurich 1299 Zurich Way, Schaumburg, Illinois 60196-1056 800.382.2150 www.zurichna.com

14

General exclusions and limitations

This coverage does not cover any loss, treatment, or services resulting from any of the following:

1. Suicide or any attempt at suicide

2. Intentionally self-inflicted Injury or Sickness, while sane or insane

3. Declared or undeclared war, or any act of declared or undeclared war

4. Full-time active duty in the armed forces of any country or international authority

5. Any Injury or Sickness for which the Covered Person is entitled to benefits pursuant to any workers’ compensation law or other similar legislation

6. The Covered Person’s commission of or attempt to commit a felony, assault, sexual assault, riot or insurrection or any Injury resulting from the Covered Person’s provocation of an attack against them

7. Travel or flight in or on (including getting in or out of, or on or off of) any vehicle used for aerial navigation, if the Covered Person is

a. Riding as a passenger in any aircraft not intended or licensed for the transportation of passengers

b. Performing, learning to perform or instructing others to perform as a pilot or crew member of any aircraft

c. Riding as a passenger in an aircraft owned, leased or operated by the Policyholder or the Covered Person

8. Skydiving, parasailing, parachuting, hang-gliding, bungee-jumping and participation in a contest of speed in power driven vehicles

9. Dental or vision services, including treatment, surgery, extractions, or x-rays, unless: (a) resulting from an Accident occurring while the Covered Person’s coverage is in force and if performed within 12 months of the date of such Accident; or (b) due to congenital disease or anomaly of a covered newborn child

10. Treatment or services for Injury and Sickness provided outside of the United States

11. Rest care or rehabilitative care and treatment (this does not include rehabilitation for treatment of physical disability)

12. Voluntary abortion except, with respect to the Covered Person: (a) where the Insured or the Insured’s Dependent’s life would be endangered if the fetus were carried to term; or (b) where medical complications have arisen from abortion

13. Elective cosmetic surgery (except newborn circumcision)

14. Sterilization and reversal of sterilization

15. Any expense which is not Medically Necessary

16. Prescription drugs

17. Any loss for which the Covered Person is not required to pay a Health Benefit Plan Deductible, co-payment and/or Health Benefit Plan Coinsurance under the Covered Person’s Health Benefit Plan; and

18. Any expense or benefit that is excluded under the Covered Person’s Health Benefit Plan

Health Benefit Plan Limitation

If a Covered Person does not have a Health Benefit Plan on the Covered Person’s Effective Date under this coverage, the Company’s sole obligation will then be to refund all premiums paid for that Covered Person.

15

Dental

Metlife 1-800-942-0854

Network: PDP Plus

Child(ren)’s eligibility for dental coverage is from birth up to age 26.

*Negotiated Fee refers to the fees that participating dentists have agreed to accept as payment in full for covered services, subject to any co payments, deductibles, cost sharing and benefits maximums. Negotiated fees are subject to change.

Reimbursement for out of network services is based on the lesser of the dentist's actual fee or the Maximum Allowable Charge (MAC). The out of network maximum allowable charge is a scheduled amount determined by Metlife

R&C fee refers to the Reasonable and Customary (R&C) charge, which is based on the lowest of (1) the dentist's actual charge, (2) the dentist's usual charge for the same or similar services as determined by Metlife. Applies to type A, B, and C Services.

FAQ: Do I need an ID card?

No. Simply notify your dentist that you are enrolled in the MetLife Preferred Dentist Program and they can verify coverage at 1-800-942-0854

PLAN OPTION 1 High Plan PLAN OPTION 2 Low Plan Coverage Type In-Network % of Negotiated Fee * Out-of-Network 80% of R&C Fee *** In-Network % of Negotiated Fee * Out-of-Network % of Scheduled Amount ** Type A: Preventive (cleanings, exams, X-rays) 100% 100% 80% 80% Type B: Basic Restorative (fillings, extractions) 80% 80% 50% 50% Type C: Major Restorative (bridges, dentures) 50% 50% 40% 40% Type D: Orthodontia 50% 50% 50% 50% Deductible† Individual $50 $50 $50 $50 Family $150 $150 $150 $150 Annual Maximum Benefit Per Person $1,000 $1,000 $1,000 $1,000 Orthodontia Lifetime Maximum Per Person $1,500 $1,500 $750 $750

San Marcos Consolidated ISD GROUP NUMBER: 221743

16

M o n t h l y C o s t

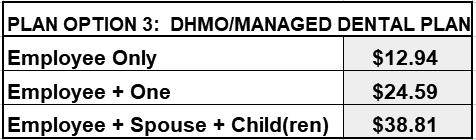

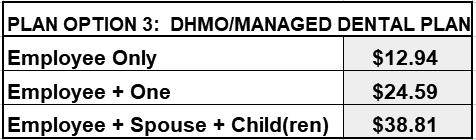

The following monthly costs are effective through August 31st, 202 Your premium will be paid through convenient payroll deduction. The Monthly costs shown below for “Employee + Spouse + Child(ren)” include the cost for all eligible children.

Plan Option 1: High Plan Plan Option 2: Low Plan

Employee Only

$3 Employee Only $

Employee + One Employee + One $

Employee + Spouse + Child(ren) $ Employee + Spouse + Child(ren) $

List of Primary Covered Services & Limitations

The service categories and plan limitations shown represent an overview of your Plan Benefits. This document presents the majority of services within each category, but is not a complete description of the Plan.

Plan Option 1: High Plan Plan Option 2: Low Plan

Type A –Preventive How Many/How Often

Prophylaxis (cleanings)

Oral Examinations

Topical Fluoride Applications

X-rays

Sealants

Type A –Preventive How Many/How Often

Two per calendar yearProphylaxis (cleanings)

Two exams per calendar yearOral Examinations

One fluoride treatment per calendar year for dependent children up to his/her 14th birthday

Full mouth X-rays; once per 5 years

Bitewings X-rays; one set per calendar year

One application of sealant material every 60 months for each non-restored, nondecayed 1st and 2nd molar of a dependent child up to his/her 14th birthday

Topical Fluoride Applications

X-rays

Two per calendar year

Two exams per calendar year

One fluoride treatment per calendar year for dependent children up to his/her 14th birthday

Full mouth X-rays; once per 5 years

Bitewings X-rays; one set per calendar year

Sealants

One application of sealant material every 60 months for each non-restored, nondecayed 1st and 2nd molar of a dependent child up to his/her 14th birthday

Type

Fillings

Fillings

Simple Extractions Simple Extractions

Crown, Denture and Bridge

Repair/ Recementations

Oral Surgery

General Anesthesia

Space Maintainers

When dentally necessary in connection with oral surgery, extractions or other covered dental services

Space maintainers for dependent children up to his/her 14th birthday.

Crown, Denture and Bridge

Repair/ Recementations

Oral Surgery

General Anesthesia

Space Maintainers

When dentally necessary in connection with oral surgery, extractions or other covered dental services

Space maintainers for dependent children up to his/her 14th birthday.

Restorative How Many/How Often

B – Basic

–

Restorative

Many/How Often

Type B

Basic

How

17

Type C – Major Restorative How Many/How Often

Type C – Major Restorative How Many/How Often

Endodontics Endodontics

Implants

Bridges and Dentures

Replacement once every 10 years

Initial placement to replace one or more natural teeth, which are lost while covered by the plan Dentures and bridgework replacement; one every 10 years

Replacement of an existing temporary full denture if the temporary denture cannot be repaired and the permanent denture is installed within 12 months after the temporary denture was installed

Implants

Bridges and Dentures

Replacement once every 10 years

Initial placement to replace one or more natural teeth, which are lost while covered by the plan Dentures and bridgework replacement; one every 10 years

Replacement of an existing temporary full denture if the temporary denture cannot be repaired and the permanent denture is installed within 12 months after the temporary denture was installed

Crowns, Inlays and Onlays

Replacement once every 10 years

Periodontics Periodontal scaling and root planing once per quadrant, every 24 months

Periodontal surgery once per quadrant, every 36 months

You, your spouse and your children, up to age 26, are covered while Dental insurance is in effect

All dental procedures performed in connection with orthodontic treatment are payable as Orthodontia

Payments are on a repetitive basis

20% of the Orthodontia Lifetime Maximum will be considered at initial placement of the appliance and paid based on the plan benefit’s coinsurance level for Orthodontia as defined in the plan summary

Orthodontic benefits end at cancellation of coverage

Crowns, Inlays and Onlays

Replacement once every 10 years

Periodontics Periodontal scaling and root planing once per quadrant, every 24 months

Periodontal surgery once per quadrant, every 36 months

Your children, up to age 19, are covered while Dental insurance is in effect.

All dental procedures performed in connection with orthodontic treatment are payable as Orthodontia

Payments are on a repetitive basis

20% of the Orthodontia Lifetime Maximum will be considered at initial placement of the appliance and paid based on the plan benefit’s coinsurance level for Orthodontia as defined in the plan summary

Orthodontic benefits end at cancellation of coverage

The service categories and plan limitations shown above represent an overview of your plan benefits. This document presents the majority of services within each category, but is not a complete description of the plan.

Type D –Orthodontia How Many/How Often

Type D –Orthodontia How Many/How Often

18

Frequently Asked Questions

Who is a participating dentist?

A participating dentist is a general dentist or specialist who has agreed to accept negotiated fees as payment in full for covered services provided to plan members. Negotiated fees typically range from 30%-45% below the average fees charged in a dentist’s community for the same or substantially similar services. †

How do I find a participating dentist?

There are thousands of general dentists and specialists to choose from nationwide --so you are sure to find one that meets your needs. You can receive a list of these participating dentists online at www.metlife.com/mybenefits or call to have a list faxed or mailed to you. What services are covered under this plan?

The certificate of insurance sets forth the covered services under the plan. Please review the enclosed plan benefits to learn more.

May I choose a non-participating dentist?

Yes. You are always free to select the dentist of your choice. However, if you choose a non-participating dentist your out-of-pocket costs may be higher.

Can my dentist apply for participation in the network?

Yes. If your current dentist does not participate in the network and you would like to encourage him/her to apply, ask your dentist to visit www.metdental.com, or call 1-866-PDP-NTWK for an application. †† The website and phone number are for use by dental professionals only.

How are claims processed?

Dentists may submit your claims for you which means you have little or no paperwork. You can track your claims online and even receive email alerts when a claim has been processed. If you need a claim form, visit www.metlife.com/mybenefits or request one by calling

Can I get an estimate of what my out-of-pocket expenses will be before receiving a service?

Yes. You can ask for a pretreatment estimate. Your general dentist or specialist usually sends MetLife a plan for your care and requests an estimate of benefits. The estimate helps you prepare for the cost of dental services. We recommend that you request a pre-treatment estimate for services in excess of $300. Simply have your dentist submit a request online at www.metdental.com or call 1-877-MET-DDS9. You and your dentist will receive a benefit estimate for most procedures while you are still in the office. Actual payments may vary depending upon plan maximums, deductibles, frequency limits and other conditions at time of payment.

Can MetLife help me find a dentist outside of the U.S. if I am traveling?

Yes. Through international dental travel assistance services * you can obtain a referral to a local dentist by calling +1-312-356-5970 (collect) when outside the U.S. to receive immediate care until you can see your dentist. Coverage will be considered under your out-of-network benefits. ** Please remember to hold on to all receipts to submit a dental claim.

How does MetLife coordinate benefits with other insurance plans?

Coordination of benefits provisions in dental benefits plans are a set of rules that are followed when a patient is covered by more than one dental benefits plan. These rules determine the order in which the plans will pay benefits. If the MetLife dental benefit plan is primary, MetLife will pay the full amount of benefits that would normally be available under the plan, subject to applicable law. If the MetLife dental benefit plan is secondary, most coordination of benefits provisions require MetLife to determine benefits after benefits have been determined under the primary plan. The amount of benefits payable by MetLife may be reduced due to the benefits paid under the primary plan, subject to applicable law.

Do I need an ID card?

No. You do not need to present an ID card to confirm that you are eligible. You should notify your dentist that you are enrolled in the MetLife Preferred Dentist Program. Your dentist can easily verify information about your coverage through a toll-free automated Computer Voice Response system.

19

†Based on internal analysis by MetLife. Negotiated fees refer to the fees that in-network dentists have agreed to accept as payment in full for covered services, subject to any co-payments, deductibles, cost sharing and benefits maximums. Negotiated fees are subject to change.

††Due to contractual requirements, MetLife is prevented from soliciting certain providers.

*AXA Assistance USA, Inc. provides Dental referral services only. AXA Assistance is not affiliated with MetLife, and the services and benefits they provide are separate and apart from the insurance provided by MetLife. Referral services are not available in all locations.

**Refer to your dental benefits plan summary for your out-of-network dental coverage.

Exclusions

This plan does not cover the following services, treatments and supplies: Services which are not Dentally Necessary, those which do not meet generally accepted standards of care for treating the particular dental condition, or which we deem experimental in nature; Services for which you would not be required to pay in the absence of Dental Insurance; Services or supplies received by you or your Dependent before the Dental Insurance starts for that person; Services which are primarily cosmetic (for Texas residents, see notice page section in Certificate); Services which are neither performed nor prescribed by a Dentist except for those services of a licensed dental hygienist which are supervised and billed by a Dentist and which are for:

o Scaling and polishing of teeth; or

o Fluoride treatments;

Services or appliances which restore or alter occlusion or vertical dimension; Restoration of tooth structure damaged by attrition, abrasion or erosion; Restorations or appliances used for the purpose of periodontal splinting; Counseling or instruction about oral hygiene, plaque control, nutrition and tobacco; Personal supplies or devices including, but not limited to: water picks, toothbrushes, or dental floss; Decoration, personalization or inscription of any tooth, device, appliance, crown or other dental work; Missed appointments;

Services:

o Covered under any workers’ compensation or occupational disease law;

o Covered under any employer liability law;

o For which the employer of the person receiving such services is not required to pay; or

o Received at a facility maintained by the Employer, labor union, mutual benefit association, or VA hospital;

Services covered under other coverage provided by the Employer;

Temporary or provisional restorations;

Temporary or provisional appliances;

Prescription drugs;

Services for which the submitted documentation indicates a poor prognosis; The following when charged by the Dentist on a separate basis:

o Claim form completion;

o Infection control such as gloves, masks, and sterilization of supplies; or

o Local anesthesia, non-intravenous conscious sedation or analgesia such as nitrous oxide. Dental services arising out of accidental injury to the teeth and supporting structures, except for injuries to the teeth due to chewing or biting of food;

Caries susceptibility tests;

Initial installation of a fixed and permanent Denture to replace one or more natural teeth which were missing before such person was insured for Dental Insurance, Other fixed Denture prosthetic services not described elsewhere in the certificate; Precision attachments, except when the precision attachment is related to implant prosthetics;

20

Initial installation of a full or removable Denture to replace one or more natural teeth which were missing before such person was insured for Dental Insurance, Addition of teeth to a partial removable Denture to replace one or more natural teeth which were missing before such person was insured for Dental Insurance,

Adjustment of a Denture made within 6 months after installation by the same Dentist who installed it; Implants supported prosthetics to replace one or more natural teeth which were missing before such person was insured for Dental Insurance,

Fixed and removable appliances for correction of harmful habits;

Appliances or treatment for bruxism (grinding teeth), including but not limited to occlusal guards and night guards;

Diagnosis and treatment of temporomandibular joint (TMJ) disorders. This exclusion does not apply to residents of Minnesota;

Repair or replacement of an orthodontic device;

Duplicate prosthetic devices or appliances;

Replacement of a lost or stolen appliance, Cast Restoration, or Denture; and Intra and extraoral photographic images

Limitations

Alternate Benefits: Where two or more professionally acceptable dental treatments for a dental condition exist, reimbursement is based on the least costly treatment alternative. If you and your dentist have agreed on a treatment that is more costly than the treatment upon which the plan benefit is based, you will be responsible for any additional payment responsibility. To avoid any misunderstandings, we suggest you discuss treatment options with your dentist before services are rendered, and obtain a pre-treatment estimate of benefits prior to receiving certain high cost services such as crowns, bridges or dentures. You and your dentist will each receive an Explanation of Benefits (EOB) outlining the services provided, your plan’s reimbursement for those services, and your out-of-pocket expense. Procedure charge schedules are subject to change each plan year. You can obtain an updated procedure charge schedule for your area via fax by calling 1-800-942-0854 and using the MetLife Dental Automated Information Service. Actual payments may vary from the pretreatment estimate depending upon annual maximums, plan frequency limits, deductibles and other limits applicable at time of payment.

Cancellation/Termination of Benefits: Coverage is provided under a group insurance policy (Policy form GPNP99 / G.2130-S) issued by Metropolitan Life Insurance Company (MetLife). Coverage terminates when your membership ceases, when your dental contributions cease or upon termination of the group policy by the Policyholder or MetLife. The group policy terminates for non-payment of premium and may terminate if participation requirements are not met or if the Policyholder fails to perform any obligations under the policy. The following services that are in progress while coverage is in effect will be paid after the coverage ends, if the applicable installment or the treatment is finished within 31 days after individual termination of coverage: Completion of a prosthetic device, crown or root canal therapy.

Like most group benefit programs, benefit programs offered by MetLife and its affiliates contain certain exclusions, exceptions, reductions, limitations, waiting periods and terms for keeping them in force. For complete details of coverage and availability, please refer to the certificate of insurance or contact MetLife.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166 L0319512645[exp0520][xNM] © 2019 MetLife Services and Solutions, LLC DN-ANY-PPO-DUAL

21

Facts & Stats

Visits to the dentist can be expensive. From preventive care to major services, dental is a smart way to protect your smile and your pocketbook.

You get coverage for a wide range of services through a network of carefully selected participating dentists who agree to significantly lower costs than typical dental charges.

for example cleanings, x-rays and sealants

At the time of enrollment, you pre-select a participating dentist. Each enrolled family member may select a different participating dentist. Your primary care dentist also helps coordinate specialty care for you.

John’s primary care dentist identifies a molar that failed to erupt and advises that John needs to have it extracted.

for example fillings and extractions

for example crowns and root canals

The cost of an impacted tooth extraction ranges from $225-$600 per tooth in the U.S. By using a participating dentist, John pays the copay only, which depending on his exact plan, could range from just $10-$60

for soft tissue impacted tooth extraction.

What you need to know about a dental HMO/managed care plan:

• Significantly lower costs for dental services through a growing network of participating dentists.

• No deductibles, annual maximums or claims forms to complete.

• fees for materials and procedures requiring multiple services (i.e. root canals and crowns)

• For added convenience, MetLife’s Mobile App is available on the iTunes® App Store and Google Play. After downloading, you can use it to find a dentist, view your claims and access your ID card.

Smiles are free, but they are worth a lot

Range from $225 - $600 $0$100$200$300$400$500$600 $60 max

22

SanMarcosConsolidatedISD

Welcome to Davis Vision!

care for your vision and eye health - a key part of overall health and wellness!

If you are not currently enrolled, please visit our member site at davisvision.com or call 1.877.923.2847 and enter client code 8100 to locate providers or for additional information.

Find a Provider

View Your Member Information Benefits

Request an ID Card

Make an appointment.

Tell your provider you are a Davis Vision member with coverage through San Marcos Consolidated ISD. Provide your member ID number, name and date of birth, and do the same for your covered dependents seeking vision services. Your provider will take care of the rest!

plastic lenses in any single vision, bifocal, trifocal or lenticular prescription. Covered in full. (See below for additional lens options and coatings.)

Covered in Full Frames:

Frame Allowance: VisionworksFrame Allowance:

Any Fashion or Designer level frame from Davis Vision’s Collection/2 (retail value, up to $160).

$125 toward any frame from provider plus 20% off any balance./1 No copay required.

$175 allowance plus 20% off any balance toward any frame from a Visionworks family of store locations./4 No copay required.

From Davis Vision’s Collection/2, up to: Four boxes/multi-packs* Eight boxes/multi-packs*

$150 allowance toward any contacts from provider’s supply plus 15% off balance./1 No copay required.

Covered in full with prior approval.

*Number of contact lens boxes may vary based on manufacturer’s packaging.

1/ Additional discounts not applicable at Walmart, Sam’s Club or Costco locations

2/ The Davis Vision Collection is available at most participating independent provider locations. Collection is subject to change. Collection is inclusive of select toric and multifocal contacts.

3/ Including, but not limited to toric, multifocal and gas permeable contact lenses.

4/ Enhanced frame allowance available at all Visionworks Locations nationwide.

5/Transitions® is a registered trademark of Transitions Optical Inc.

Please note: Your provider reserves the right to not dispense materials until all applicable member costs, fees and copayments have been collected. Contact lenses: Routine eye examinations do not include professional services for contact

may not be exchanged for eyeglasses. Progressive lenses: If you are unable to adapt to progressive addition lenses you have purchased, conventional bifocals will be supplied at no additional cost; however, your copayment is nonrefundable. May not be combined with other discounts or offers. Please be advised these lens

SPCVX01122web 8/18/17

lens types and coatings! Member Price Davis Vision Collection Frames: Fashion | Designer | Premier ..................................$0 | $0 | $25 Tinting of Plastic Lenses.............................................................................................................$0 Oversize Lenses.........................................................................................................................$0 Scratch-Resistant Coating..........................................................................................................$0 Ultraviolet Coating ....................................................................................................................$12 ..............................................$35 | $48 | $60 Polycarbonate Lenses ...............................................................................................................$0 High-Index Lenses ..................................................................................................................$55 Progressive Lenses: Standard | Premium | Ultra .................................................$50 | $90 | $140 Polarized Lenses .....................................................................................................................$75 Photochromic Lenses (i.e. Transitions®, etc.)/5 ......................................................................$65 Scratch Protection Plan: Single Vision | Multifocal Lenses .............................................$20 | $40 Frequency Once everyIn-network Copay In-network Coverage Eye Examination 12 months$10Covered in full.

Spectacle Lenses 12 months$25 Clear

Frame 24 months$0

Includes dilation when professionally indicated.

Contact Lens & Follow Up Care 12 months$0 Davis Vision Collection Contacts: Specialty Contacts/3: Covered in full. 15% discount/1 15% discount/1 Contact Lenses (in lieu of eyeglasses) 12 months$0 Covered

Full Contacts: Planned Replacement Disposable Contact Lens Allowance: :

in

Using Your Benefits is Easy! 1-800-999-5431 davisvision.com

23

SanMarcosConsolidatedISD

Welcome to Davis Vision!

care for your vision and eye health - a key part of overall health and wellness! If you are not currently enrolled, please visit our member site at davisvision.com or call 1.877.923.2847 and enter client code 8101 to locate providers or for additional information.

Using

Make an appointment.

Tell your provider you are a Davis Vision member with coverage through San Marcos Consolidated ISD. Provide your member ID number, name and date of birth, and do the same for your covered dependents seeking vision services. Your provider will take care of the rest!

plastic lenses in any single vision, bifocal, trifocal or lenticular prescription. Covered in full. (See below for additional lens options and coatings.)

Covered in Full Frames:

Frame Allowance: VisionworksFrame Allowance:

Any Fashion, Designer or Premier level frame from Davis Vision’s Collection/2 (retail value, up to $195).

$150 toward any frame from provider plus 20% off any balance./1 No copay required.

$200 allowance plus 20% off any balance toward any frame from a Visionworks family of store locations./4 No copay required.

From Davis Vision’s Collection/2, up to: Four boxes/multi-packs* Eight boxes/multi-packs*

$200 allowance toward any contacts from provider’s supply plus 15% off balance./1 No copay required.

Covered in full with prior approval.

*Number of contact lens boxes may vary based on manufacturer’s packaging.

1/ Additional discounts not applicable at Walmart, Sam’s Club or Costco locations

The Davis Vision Collection is available at most participating independent provider locations. Collection is subject to change. Collection is inclusive of select toric and multifocal contacts.

Including, but not limited to toric, multifocal and gas permeable contact lenses.

Please note: Your provider reserves the right to not dispense materials until all applicable member costs, fees and copayments have been collected. Contact lenses: Routine eye examinations do not include professional services for contact

may not be exchanged for eyeglasses. Progressive lenses: If you are unable to adapt to progressive addition lenses you have purchased, conventional bifocals will be supplied at no additional cost; however, your copayment is nonrefundable. May not be combined with other discounts or offers. Please be advised these lens

SPCVX01123web 8/18/17

Enhanced

5/Transitions®

2/

3/

4/

frame allowance available at all Visionworks Locations nationwide.

is a registered trademark of Transitions Optical Inc.

lens types

coatings!

Davis Vision Collection Frames: Fashion | Designer | Premier ....................................$0 | $0 | $0 Tinting of Plastic Lenses.............................................................................................................$0 Oversize Lenses.........................................................................................................................$0 Scratch-Resistant Coating..........................................................................................................$0 Ultraviolet Coating ......................................................................................................................$0 ..............................................$35 | $48 | $60 Polycarbonate Lenses ...............................................................................................................$0 High-Index Lenses ..................................................................................................................$55 Progressive Lenses: Standard | Premium | Ultra .....................................................$0 | $40 | $90 Polarized Lenses .....................................................................................................................$75 Photochromic Lenses (i.e. Transitions®, etc.)/5 ......................................................................$65 Scratch Protection Plan: Single Vision | Multifocal Lenses .............................................$20 | $40 Frequency Once everyIn-network Copay In-network Coverage Eye Examination 12 months$10Covered in full.

Spectacle Lenses 12 months$25 Clear

Frame 12 months$0

and

Member Price

Includes dilation when professionally indicated.

Contact Lens & Follow Up Care 12 months$0 Davis Vision Collection Contacts: Specialty Contacts/3: Covered in full. 15% discount/1 15% discount/1 Contact Lenses (in lieu of eyeglasses) 12 months$0 Covered in Full Contacts: Planned Replacement Disposable Contact Lens Allowance: :

Your Benefits is Easy!

a Provider

1-800-999-5431

davisvision.com Find

24

View Your Member Information Benefits Request an ID Card

Frequently Asked Questions

How can I contact Member Services?

Call 1.800.999.5431 for automated help 24/7. Live help is also available seven days a week: Monday-Friday, 8 a.m.-11 p.m. | Saturday, 9 a.m.-4 p.m. | Sunday, 12 p.m.-4 p.m. (Eastern Time). (TTY services: 1.800.523.2847.)

Our Collection offers a great selection of fashionable and designer frames, most of which are covered in full. No wonder 8 out of 10 members select a Collection frame. Log on to our member Web site at davisvision.com and take a look!

When will I receive my eyewear?

Your eyewear will be delivered to your network provider generally lens coatings, provider frames or out-of-stock frames may delay the standard turnaround time.

Claim forms are only required if you visit an out-of-network provider. Claim forms are available on our member Web site.

eyeglasses or contact lenses on different dates or through different provider locations. Complete eyeglasses must be obtained at one time, from one provider. You may not split between a network recommend that all services be obtained from a network provider.

Yes; however, you receive the greatest value by staying in-network. If you go out-of-network, pay the provider at the time of service, then submit a claim to Davis Vision for reimbursement, up to the following amounts: eye exam - $35 | single vision lenses - $25 | bifocal - $40 | trifocal - $45 | lenticular - $80 | frame - $55 | elective contacts - $65 | visually required contacts - $150.

Your vision plan does not cover medical treatment of eye disease or injury; vision therapy; special lens designs or coatings, other than those described herein; replacement of lost eyewear; nonprescription (plano) lenses; contact lenses and eyeglasses in the two pair of eyeglasses in lieu of bifocals.

DAVIS VISION EXTRAS!

One Year Breakage Warranty Repair or replacement of your plan covered spectacle lenses, Collection frame or frame from a network retail location where the Collection is not displayed. Access a higher frame allowance by visiting a Visionworks family of store locations/6

Additional Savings At most participating network locations, members receive up to 20% off additional eyeglasses, sunglasses contact lenses./7

Mail Order Contact Lenses Replacement contacts (after service ensures easy, convenient, purchasing online and quick, direct shipping to your door. Log on to our member Web site for details.

Laser Vision Correction Up to 25% discount off participating provider’s U&C or 5% off advertised special (whichever is lower). Log on to our member Web site for details and to locate a provider. A One-time/lifetime allowance of $200 is available.

Low Vision Services Comprehensive low vision evaluation

Eye Health & Wellness Log on and learn more about your eyes, health and wellness; common eye conditions that can impair vision; and what you can do to ensure healthy eyes and a healthier life.

For more details… and responsibilities, or more information about Davis Vision, please log on to our member Web site or contact us at 1.800.999.5431.

Davis Vision has made every effort to correctly summarize your vision plan features contract with Davis Vision, the terms of the contract will prevail.

Fully insured product Underwritten by HM Life Insurance Company. Administered by Davis Vision, which may operate as Davis Vision Insurance Administrators in California. 6/ Enhanced frame allowance available at all Visionworks Locations nationwide. 7/Additional discounts not applicable at Walmart, Sam’s Club or Costco locations. 25

The Standard - Voluntary Long Term Disability (LTD) Insurance

Standard Insurance Company has developed this document to provide you with information about the optional insurance coverage you may select through San Marcos CISD. Written in non-technical language, this is not intended as a complete description of the coverage. If you have additional questions, please check with your human resources representative.

Employer Plan Effective Date

A minimum number of eligible employees must apply and qualify for the proposed plan before Voluntary LTD coverage can become effective. This level of participation has been agreed upon by San Marcos CISD and The Standard.

Eligibility

To become insured, you must be:

A regular employee of San Marcos CISD, excluding temporary or seasonal employees, full-time members of the armed forces, leased employees or independent contractors

Actively at work at least 15 hours each week

A citizen or resident of the United States or Canada

Employee Coverage Effective Date

Please contact your human resources representative for more information regarding the following requirements that must be satisfied for your insurance to become effective. You must satisfy:

Eligibility requirements

An eligibility waiting period (check with your human resources representative)

An evidence of insurability requirement, if applicable

An active work requirement. This means that if you are not actively at work on the day before the scheduled effective date of insurance, your insurance will not become effective until the day after you complete one full day of active work as an eligible employee.

Benefit Amount

You may select a monthly benefit amount in $100 increments from $300 to $8,000; based on the tables and guidelines presented in the Rates section of these Coverage Highlights. The monthly benefit amount must not exceed 66 2/3 percent of your monthly earnings.

Benefits are payable for non-occupational disabilities only. Occupational disabilities are not covered.

Plan Maximum Monthly Benefit: 66 2/3 percent of predisability earnings

Plan Minimum Monthly Benefit: 10 percent of your LTD benefit before reduction by deductible income

26

Benefit Waiting Period and Maximum Benefit Period

The benefit waiting period is the period of time that you must be continuously disabled before benefits become payable. Benefits are not payable during the benefit waiting period. The maximum benefit period is the period for which benefits are payable. The benefit waiting period and maximum benefit period associated with your plan options are shown below:

Options 1-6: Maximum Benefit Period of To SSNRA for Sickness and Accident

If you become disabled before age 62, LTD benefits may continue during disability until you reach age 65 or to the Social Security Normal Retirement Age (SSNRA) or 3 years 6 months, whichever is longer. If you become disabled at age 62 or older, the benefit duration is determined by your age when disability begins:

62 To SSNRA, or 3 years 6 months, whichever is longer

63 To SSNRA, or 3 years, whichever is longer

64 To SSNRA, or 2 years 6 months, whichever is longer

652 years

66 1 year 9 months

67 1 year 6 months

68 1 year 3 months

69+ 1 year

FIRST DAY HOSPITALIZATION BENEFIT

With this benefit, if an insured employee is hospital confined for at least four hours, is admitted as an inpatient and is charged room and board during the benefit waiting period, the benefit waiting period will be satisfied. Benefits become payable on the date of hospitalization; the maximum benefit period also begins on that date. THIS FEATURE IS INCLUDED ONLY ON LTD PLANS WITH BENEFIT WAITING PERIODS OF 30 DAYS OR LESS.

Preexisting Condition Exclusion

A detailed description of the preexisting condition exclusion is included in the Group Policy. If you have questions, please check with your human resources representative.

Preexisting Condition Period: The 90-day period just before your insurance becomes effective

Exclusion Period: 12 months

Preexisting Condition Waiver

The Standard may pay benefits for up to 90 days even if you have a preexisting condition. After 90 days, The Standard will continue benefits only if the preexisting condition exclusion does not apply.

Own Occupation Period

For the plan’s definition of disability, as described in your brochure, the own occupation period is the first 24 months for which LTD benefits are paid.

Any Occupation Period

The any occupation period begins at the end of the own occupation period and continues until the end of the maximum benefit period.

Option Accidental Injury Other Disability Maximum Benefit Period 1 0 days 7 days To SSNRA for Sickness & Accident 2 14 days 14 days To SSNRA for Sickness & Accident 3 30 days 30 days To SSNRA for Sickness & Accident 4 60 days 60 days To SSNRA for Sickness & Accident 5 90 days 90 days To SSNRA for Sickness & Accident 6 180 days 180 days To SSNRA for Sickness & Accident

Maximum Benefit Period

Age

27

Other LTD Features

Employee Assistance Program (EAP) – This program offers support, guidance and resources that can help an employee resolve personal issues and meet life’s challenges.

Family Care Expense Adjustment – Disabled employees faced with the added expense of family care when returning to work may receive combined income from LTD benefits and work earnings in excess of 100 percent of indexed predisability earnings during the first 12 months immediately after a disabled employee’s return to work.

Special Dismemberment Provision – If an employee suffers a lost as a result of an accident, the employee will be considered disabled for the applicable Minimum Benefit Period and can extend beyond the end of the Maximum Benefit Period

Reasonable Accommodation Expense Benefit – Subject to The Standard’s prior approval, this benefit allows us to pay up to $25,000 of an employer’s expenses toward work-site modifications that result in a disabled employee’s return to work.

Survivor Benefit – A Survivor Benefit may also be payable. This benefit can help to address a family’s financial need in the event of the employee’s death.

Return to Work (RTW) Incentive – The Standard’s RTW Incentive is one of the most comprehensive in the employee benefits history. For the first 12 months after returning to work, the employee’s LTD benefit will not be reduced by work earnings until work earnings plus the LTD benefit exceed 100 percent of predisability earnings. After that period, only 50 percent of work earnings are deducted.

Rehabilitation Plan Provision – Subject to The Standard’s prior approval, rehabilitation incentives may include training and education expense, family (child and elder) care expenses, and job-related and job search expenses.

When Benefits End

LTD benefits end automatically on the earliest of:

The date you are no longer disabled

The date your maximum benefit period ends

The date you die

The date benefits become payable under any other LTD plan under which you become insured through employment during a period of temporary recovery

The date you fail to provide proof of continued disability and entitlement to benefits

Rates

Employees can select a monthly LTD benefit ranging from a minimum of $300 to a maximum amount based on how much they earn. Referencing the appropriate attached charts, follow these steps to find the monthly cost for your desired level of monthly LTD benefit and benefit waiting period:

1.Find the maximum LTD benefit by locating the amount of your earnings in either the Annual Earnings or Monthly Earnings column. The LTD benefit amount shown associated with these earnings is the maximum amount you can receive. If your earnings fall between two amounts, you must select the lower amount.

2.Select the desired monthly LTD benefit between the minimum of $300 and the determined maximum amount, making sure not to exceed the maximum for your earnings.

3.In the same row, select the desired benefit waiting period to see the monthly cost for that selection.

If you have questions regarding how to determine your monthly LTD benefit, the benefit waiting period, or the premium payment of your desired benefit, please contact your human resources representative.

Group Insurance Certificate

If you become insured, you will receive a group insurance certificate containing a detailed description of the insurance coverage. The information presented above is controlled by the group policy and does not modify it in any way. The controlling provisions are in the group policy issued by Standard Insurance Company.

28

Options 1-6

Annual Earnings Monthly Earnings Monthly Disability Benefit Accident/Sickness Benefit Waiting Period Cost Per Month 0-7 14-14 30-30 60-60 90-90 180-180 3,600 300 200 6.26 5.50 4.66 3.02 2.62 1.92 5,400 450 300 9.39 8.25 6.99 4.53 3.93 2.88 7,200 600 400 12.52 11.00 9.32 6.04 5.24 3.84 9,000 750 500 15.65 13.75 11.65 7.55 6.55 4.80 10,800 900 600 18.78 16.50 13.98 9.06 7.86 5.76 12,600 1,050 700 21.91 19.25 16.31 10.57 9.17 6.72 14,400 1,200 800 25.04 22.00 18.64 12.08 10.48 7.68 16,200 1,350 900 28.17 24.75 20.97 13.59 11.79 8.64 18,000 1,500 1,000 31.30 27.50 23.30 15.10 13.10 9.60 19,800 1,650 1,100 34.43 30.25 25.63 16.61 14.41 10.56 21,600 1,800 1,200 37.56 33.00 27.96 18.12 15.72 11.52 23,400 1,950 1,300 40.69 35.75 30.29 19.63 17.03 12.48 25,200 2,100 1,400 43.82 38.50 32.62 21.14 18.34 13.44 27,000 2,250 1,500 46.95 41.25 34.95 22.65 19.65 14.40 28,800 2,400 1,600 50.08 44.00 37.28 24.16 20.96 15.36 30,600 2,550 1,700 53.21 46.75 39.61 25.67 22.27 16.32 32,400 2,700 1,800 56.34 49.50 41.94 27.18 23.58 17.28 34,200 2,850 1,900 59.47 52.25 44.27 28.69 24.89 18.24 36,000 3,000 2,000 62.60 55.00 46.60 30.20 26.20 19.20 37,800 3,150 2,100 65.73 57.75 48.93 31.71 27.51 20.16 39,600 3,300 2,200 68.86 60.50 51.26 33.22 28.82 21.12 41,400 3,450 2,300 71.99 63.25 53.59 34.73 30.13 22.08 43,200 3,600 2,400 75.12 66.00 55.92 36.24 31.44 23.04 45,000 3,750 2,500 78.25 68.75 58.25 37.75 32.75 24.00 46,800 3,900 2,600 81.38 71.50 60.58 39.26 34.06 24.96 48,600 4,050 2,700 84.51 74.25 62.91 40.77 35.37 25.92 50,400 4,200 2,800 87.64 77.00 65.24 42.28 36.68 26.88 52,200 4,350 2,900 90.77 79.75 67.57 43.79 37.99 27.84 54,000 4,500 3,000 93.90 82.50 69.90 45.30 39.30 28.80 55,800 4,650 3,100 97.03 85.25 72.23 46.81 40.61 29.76 57,600 4,800 3,200 100.16 88.00 74.56 48.32 41.92 30.72 59,400 4,950 3,300 103.29 90.75 76.89 49.83 43.23 31.68 61,200 5,100 3,400 106.42 93.50 79.22 51.34 44.54 32.64 63,000 5,250 3,500 109.55 96.25 81.55 52.85 45.85 33.60 64,800 5,400 3,600 112.68 99.00 83.88 54.36 47.16 34.56 66,600 5,550 3,700 115.81 101.75 86.21 55.87 48.47 35.52 68,400 5,700 3,800 118.94 104.50 88.54 57.38 49.78 36.48 70,200 5,850 3,900 122.07 107.25 90.87 58.89 51.09 37.44 72,000 6,000 4,000 125.20 110.00 93.20 60.40 52.40 38.40 73,800 6,150 4,100 128.33 112.75 95.53 61.91 53.71 39.36 29

Options 1-6 (Continued)

Annual Earnings Monthly Earnings Monthly Disability Benefit Accident/Sickness Benefit Waiting Period Cost Per Month 0-7 14-14 30-30 60-60 90-90 180-180 75,600 6,300 4,200 131.46 115.50 97.86 63.42 55.02 40.32 77,400 6,450 4,300 134.59 118.25 100.19 64.93 56.33 41.28 79,200 6,600 4,400 137.72 121.00 102.52 66.44 57.64 42.24 81,000 6,750 4,500 140.85 123.75 104.85 67.95 58.95 43.20 82,800 6,900 4,600 143.98 126.50 107.18 69.46 60.26 44.16 84,600 7,050 4,700 147.11 129.25 109.51 70.97 61.57 45.12 86,400 7,200 4,800 150.24 132.00 111.84 72.48 62.88 46.08 88,200 7,350 4,900 153.37 134.75 114.17 73.99 64.19 47.04 90,000 7,500 5,000 156.50 137.50 116.50 75.50 65.50 48.00 91,800 7,650 5,100 159.63 140.25 118.83 77.01 66.81 48.96 93,600 7,800 5,200 162.76 143.00 121.16 78.52 68.12 49.92 95,400 7,950 5,300 165.89 145.75 123.49 80.03 69.43 50.88 97,200 8,100 5,400 169.02 148.50 125.82 81.54 70.74 51.84 99,000 8,250 5,500 172.15 151.25 128.15 83.05 72.05 52.80 100,800 8,400 5,600 175.28 154.00 130.48 84.56 73.36 53.76 102,600 8,550 5,700 178.41 156.75 132.81 86.07 74.67 54.72 104,400 8,700 5,800 181.54 159.50 135.14 87.58 75.98 55.68 106,200 8,850 5,900 184.67 162.25 137.47 89.09 77.29 56.64 108,000 9,000 6,000 187.80 165.00 139.80 90.60 78.60 57.60 109,800 9,150 6,100 190.93 167.75 142.13 92.11 79.91 58.56 111,600 9,300 6,200 194.06 170.50 144.46 93.62 81.22 59.52 113,400 9,450 6,300 197.19 173.25 146.79 95.13 82.53 60.48 115,200 9,600 6,400 200.32 176.00 149.12 96.64 83.84 61.44 117,000 9,750 6,500 203.45 178.75 151.45 98.15 85.15 62.40 118,800 9,900 6,600 206.58 181.50 153.78 99.66 86.46 63.36 120,600 10,050 6,700 209.71 184.25 156.11 101.17 87.77 64.32 122,400 10,200 6,800 212.84 187.00 158.44 102.68 89.08 65.28 124,200 10,350 6,900 215.97 189.75 160.77 104.19 90.39 66.24 126,000 10,500 7,000 219.10 192.50 163.10 105.70 91.70 67.20 127,800 10,650 7,100 222.23 195.25 165.43 107.21 93.01 68.16 129,600 10,800 7,200 225.36 198.00 167.76 108.72 94.32 69.12 131,400 10,950 7,300 228.49 200.75 170.09 110.23 95.63 70.08 133,200 11,100 7,400 231.62 203.50 172.42 111.74 96.94 71.04 135,000 11,250 7,500 234.75 206.25 174.75 113.25 98.25 72.00 136,800 11,400 7,600 237.88 209.00 177.08 114.76 99.56 72.96 138,600 11,550 7,700 241.01 211.75 179.41 116.27 100.87 73.92 140,400 11,700 7,800 244.14 214.50 181.74 117.78 102.18 74.88 142,200 11,850 7,900 247.27 217.25 184.07 119.29 103.49 75.84 144,000 12,000 8,000 250.40 220.00 186.40 120.80 104.80 76.80 30

San Marcos CISD

Employee Assistance Program (EAP)

AWP is proud to serve as your EAP, offering you and your household valuable, confidential services at no cost to you.

or any issue affecting your quality of life.

YourEAP Benefits:

All benefits can be accessed by calling: toll free 1-800-343-3822

for our deaf and hearing impaired callers, please dial 7 – 1 - 1 teen line

1-800-334-TEEN (8336)

We are available totake your call 24 hours a day,7 days a week.

LawAccess

Legal and Financial services provided by a lawyer or financial professional specializing in your area of concern. Available online or by telephone.

HelpNet

Customized EAP website featuring resources, skill-building tools, online assessments and referrals.

WorkLife

Resources and referrals for everyday needs. Available by telephone.

SafeRide

Reimbursement for emergency cab fare for eligible employees and dependents that opt to use a cab service instead of driving while impaired.

1 to 6 Counseling Sessions

Per problem, per year. Short-term counseling sessions which include assessment, referral, and crisis services.

Registration Code: AWP-SMCISD-5478

Alliance Work Partners is a professional service of Workers Assistance Program, Inc. Copyright © 2022 Workers Assistance Program, Inc. Confidential and proprietary. All rights reserved.

Alliance Work Partners is here for you as life happens.

Visit your EAP website at awpnow.com and create a customized account. Go to https://www.awpnow.com

Your benefits are designed to help you manage daily responsibilities, major events, work stresses,

Select “Access Your Benefits”

Webinar Training Series

for

31

Newsletters

Tips

Everyday Living

Criteria for Benefits Eligibility

Full Benefits:

• Employee, retiree, married/divorced spouse, partner, significant other

• Any household member, regardless of age or relationship, residing in employee’s home, including significant other and their children

• All covered employees may bring anyone with them to their authorized/covered sessions regardless of relationship to employee.

• Children and grandchildren, age 26 or under, residing in US or Puerto Rico. This includes children and grandchildren of significant other or partner.

• Any person meeting benefit eligibility prior to lay-off or termination of an employee will continue to be eligible for benefits up to 6 months from the date of employee’s lay-off or termination. Benefits are extended for 6 months from date of employee's call within this timeframe.

Assessment & Referral:

• Children and grandchildren age 27 and overof employee, married/divorced spouse, partner, or significant other living outside employee’s home

• Employee instructed by law to receive courtordered counseling

• All crisis cases (suicidal/homicidal, domestic violence, chemical dependence, substance abuse, child/elderly abuse) not otherwise covered

• Any person meeting benefit eligibility prior to lay-off or termination of an employee will continue to be eligible for assessment and referral after 6 months and up to 1 year from the date of employee’s lay-off or termination. Benefits are extended 1 year from date of employee's call within this timeframe.

Information & Referral:

• Anyone contacting Alliance Work Partners regardless of contract status

Children under the age of 18 must have a written, signed release by their guardian who has custody (whether living in the home or not) to attend counseling on their own. This release is given to their affiliate provider. Divorced parents who bring their children in for counseling mustbring a copy of their divorce decree or have signed permission from the other parent before bringing a child into counseling. Grandparents who bring their grandchildren into counseling must have proof of guardianship or written permission from the child’sparents.

Alliance Work Partners is a professional service of Workers Assistance Program, Inc. Copyright © 2022 Workers Assistance Program, Inc. Confidential and proprietary. All rights reserved.

Program

Marcos CISD 32

Employee Assistance

(EAP) San

life insurance you

keep!

You can qualify by answering just 3 questions – no exams or needles.

DURING THE LAST SIX MONTHS, HAS THE PROPOSED INSURED:

Been actively at work on a full time basis, performing usual duties?

Been absent from work due to illness or medical treatment for a period of more than 5 consecutive working days?

Been disabled or received tests, treatment or care of any kind in a hospital or nursing home or received chemotherapy, hormonal therapy for cancer, radiation, dialysis treatment, or treatment for alcohol or drug abuse?

can

purelife-plus Life insurance can be an ideal way to provide money for your family when they need it most. purelife-plus offers permanent insurance with a high death benefit and long guarantees1 that can provide financial peace of mind for you and your loved ones. purelife-plus is an ideal complement to any group term and optional term life insurance your employer might provide and has the following features: 1.Aftertheguaranteeperiod,premiumsmaygodown,staythesameorgoup. 2.CoveragenotavailableonchildreninWAorongrandchildreninWAorMD. InMD,childrenmustresidewiththeapplicanttobeeligibleforcoverage. 3.Conditionsapply.

QUICK QUESTIONS 3

1 2 3

You own it You can take it with you when you change jobs or retire You pay for it through convenient payroll deductions You can cover your spouse, children and grandchildren, too2 You can get a living benefit if you become terminally ill3 It’s Affordable 1-800-283-9233 33

FlexiblePremiumAdjustableLifeInsurancetoage121.PolicyFormICC18PRFNG-NI-18orFormSeriesPRFNG-NI-18.Somelimitationsapply.Seethe PureLife-plusbrochurefordetails.TexasLifeislicensedtodobusinessinthe DistrictofColumbiaandeverystatebutNewYork. 19M016-C1092(exp0321)

PureLife-plusispermanentlifeinsurancetoAttainedAge121thatcanneverbecancelledaslongasyoupaythenecessarypremiums.Afterthe GuaranteedPeriod,thepremiumscanbelower,thesame,orhigherthantheTablePremium.Seethebrochureunder”PermanentCoverage”.

monthlypremiums