MASON ISD BENEFITS GUIDE 2023-2024 U.S. EMPLOYEE BENEFITS SERVICES GROUP 254 LANDA STREET NEW BRAUNFELS, TX 78130 WWW.MYBENEFITSHUB.COM/MASONISD YOUR FAMILY YOUR HEALTH YOUR LIFE

TABLEOFCONTENTS /v1eAicol-TRSAcliueCare 7 Denta1-Lincoln 11 Vision-Supuor 19 Disahwbf-TheHartjfrd, 20 TexasLi/ye- Punwne.nlLi/ye 24 Group & IJoluni.ar!fLi/ye- Lincoln 28 C()J1Cff&Accideni-AnterLC()J'l,PuhlieLi/ye 37 Criiicdillne.ss& Hospitaliruiemflibj-TheHartjfrrl 45 /v1eAicolTransportolion-/v1ASA 51 T�-1-800/v1D 53 IdentihJ,Thef!Protedion-IDlJolduiog, 55 HemthSM�AWJunl- EECu 57 FlexihleSperuiing,Aw;unt- NBS 60 /vlISDBeneJjiGuiJJe,,

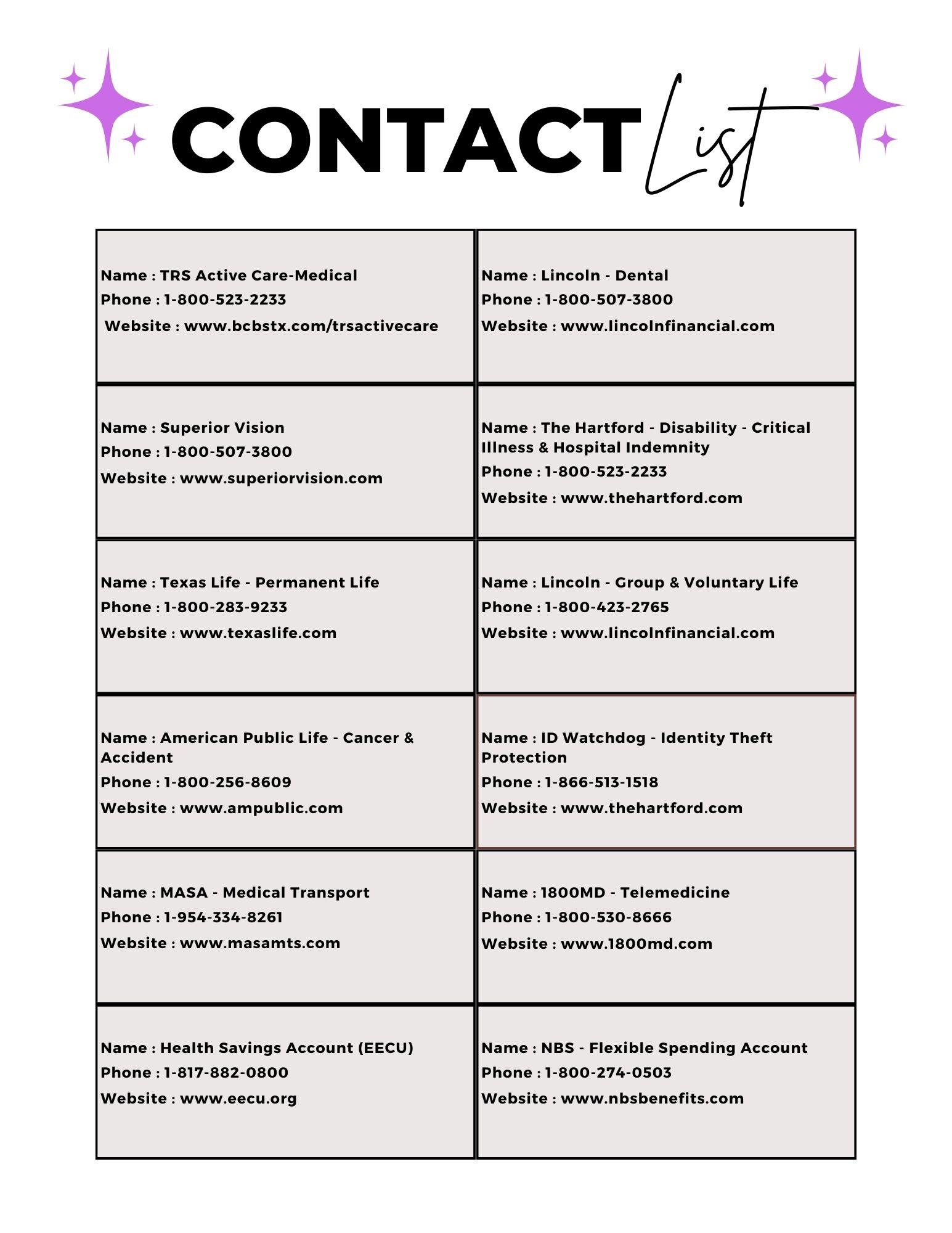

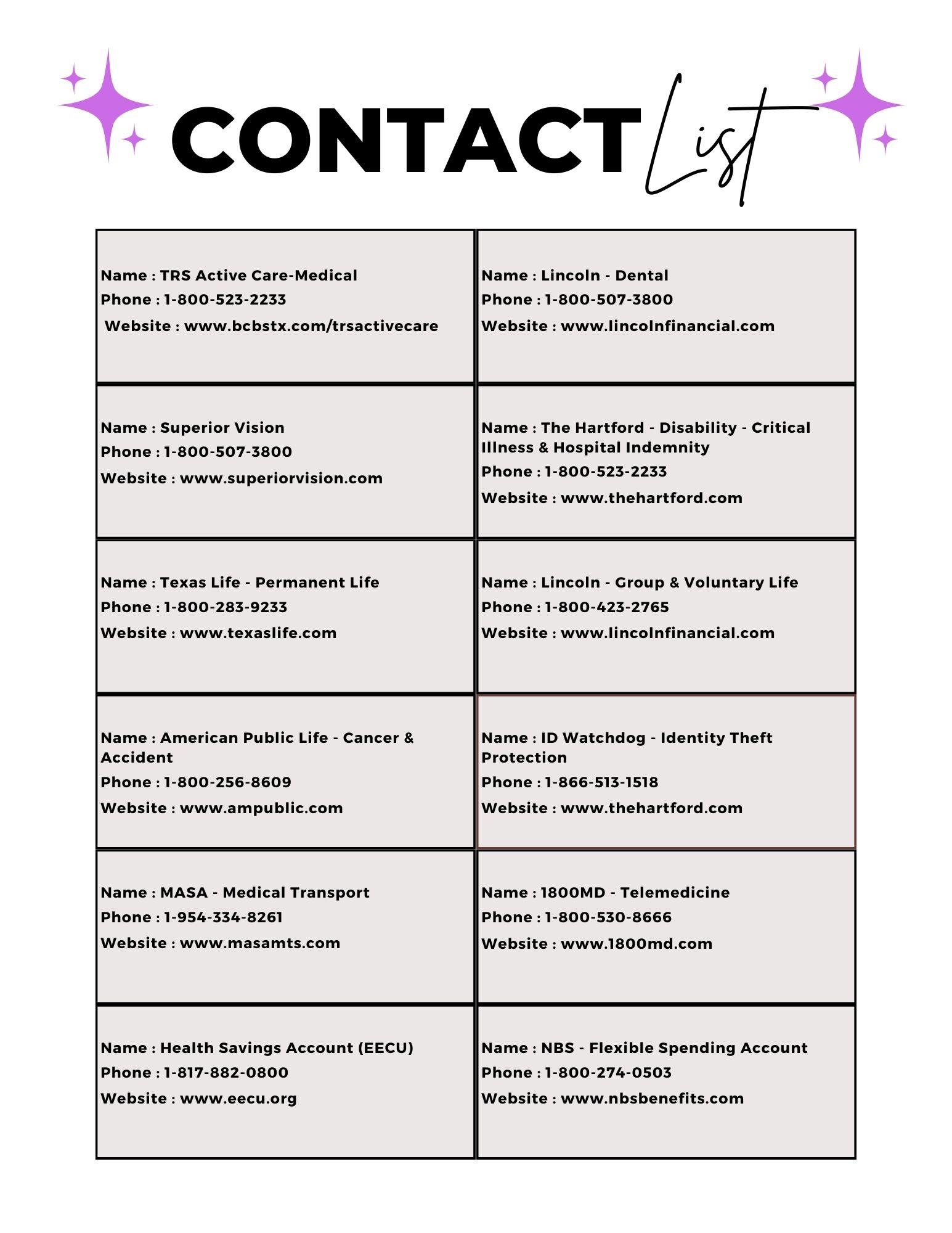

Know Your Benefits! Below is a summary of benefits offered through ISD.

Medical Insurance- TRS has been added to the benefits hub for your convenience to enroll in all benefits in one location.

Vision - Plan includes coverage for eye exams, materials (such as frames and lenses), and discounts for laser vision correction. The plan has a defined network of providers. Out-of-network benefits are available on a reimbursement basis only.

Disability - Plan provides a monthly income to an individual that is disabled due to an accident or illness. This plan provides a week bene t for pre-exis ng condi o ns for all new enrollees or increase in coverage.

Texas Life Permanent Life - Portable, permanent life insurance available for employees, their spouses, and dependents. Employees can keep the coverage upon termination or retirement from ISD.

Group Life - Group term life insurance that ends when you terminate employment with ISD. Coverage is also available for their spouses and dependent children.

Cancer - Pays benefits for internal cancer diagnosis. Includes an annual cancer screening benefit.

• • • • • • • • • • • • • 2023 OPEN ENROLLMENT INFORMATION

Flexible Spending Account (FSA)3 4 3 4 3

3

• • • • • 4

INTRODUCTION

Provid great bene t choices to you and your family is justcial welfare of the people who make our district work so well.

HOW DO I ENROLL?

Visit last 4 digits of your SSN. (EX: John Sanderson SSN: Complete last name (excluding any special

WHO IS ELIGIBLE?

insurance at full cost.

WHO IS AN ELIGIBLE DEPENDENT?

Dependent children of any age who are disabled

Children under your legal guardianship

MID-YEAR CHANGES

or cancel coverage during the year if you have a qualifying change in the family or employment status that causes you to include:

Loss or gain of eligibility for other insurance (including

WHEN WILL I RECEIVE ID CARDS?

Everyone enrolled in Medical will receive a new Medical Card. ti -

rary ID card or give your provider the insurance company’s phone number to call and verify your coverage if you do not have an ID card at the time of service.

WHO DO I CONTACT WITH QUESTIONS?

of the following month.

NEW HIRE ENROLLMENT

• • • •

• • • •

• • @ Lynn Nicholson Benefit Administrator (325)347-1144 ext 303 lynn.nicholson@masonisd.net 5

Enrollment Instructions for THEbenefitsHUB

Site Access: To access your employer online enrollment site, THEbenefitsHUB, you can login to the following website www.mybenefitshub.com/masonisd

Username: The first six (6) characters of your last name, followed by the first letter of your first name, followed by the last four (4) digits of your SSN:

Example: Employee Name - Robert Smith, SS# 123-45-6789 User Name: smithr6789

Default Password: Complete Last Name (Excluding Punctuation) follow by the last four (4) digits for your SSN

Password Reset: Employees will prompted to update the password once you enter the site. 245 Landa Street New Braunfels, Texas 78130 Phone: (830) 606-5100

TRS-ActiveCare’s network has more doctors and hospitals than you can round up.

TRS-ActiveCare Plan Highlights 2023-24

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay its portion.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary by the type of service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; i.e. you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

762378.0523

2023-24 TRS-ActiveCare Plan Highlights

New

•Certain specialty drugs are still $0 through SaveOnSP.

This plan is closed and not accepting new enrollees. If you’re currently enrolled in TRS-ActiveCare 2, you can remain in this plan. Monthly Premiums Employee Only $420 $ $493 $ $434 $ Employee and Spouse $1,134 $ $1,282 $ $1,172 $ Employee and Children $714 $ $839 $ $738 $ Employee and Family $1,428 $ $1,627 $ $1,476 $ Total Premium Total Premium Total Premium Your Premium Your Premium Your Premium Total Premium Your Premium $1,013 $ $2,402 $ $1,507 $ $2,841 $ How to Calculate Your Monthly Premium Total Monthly Premium Your District and State Contributions Your Premium Ask your Benefits Administrator for your district’s specific premiums. All TRS-ActiveCare participants have three plan options. Each includes a wide range of wellness benefits. TRS-ActiveCare 2 • Closed to new enrollees • Current enrollees can choose to stay in plan • Lower deductible • Copays for many services and drugs • Nationwide network with out-of-network coverage • No requirement for PCPs or referrals TRS-ActiveCare Primary TRS-ActiveCare Primary+ TRS-ActiveCare HD Plan Summary • Lowest premium of all three plans • Copays for doctor visits before you meet your deductible • Statewide network • Primary Care Provider (PCP) referrals required to see specialists • Not compatible with a Health Savings Account (HSA) • No out-of-network coverage • Lower deductible than the HD and Primar y plans • Copays for many services and drugs • Higher premium • Statewide network • PCP referrals required to see specialists • Not compatible with a Health Savings Account (HSA) • No out-of-network coverage • Compatible with a Health Savings Account (HSA) • Nationwide network with out-of-network coverage • No requirement for PCPs or referrals • Must meet your deductible before plan pays for non-preventive care Wellness Benefits at No Extra Cost* Being healthy is easy with: •$0 preventive care •24/7 customer service •One-on-one health coaches

loss programs

programs

pregnancy support • TRS Virtual Health

health benefits

Immediate Care Urgent Care $50 copay $50 copay You pay 30% after deductibleYou pay 50% after deductible Emergency Care You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible TRS Virtual Health-RediMD (TM) $0 per medical consultation $0 per medical consultation $30 per medical consultation TRS Virtual Health-Teladoc® $12 per medical consultation $12 per medical consultation $42 per medical consultation $50 copay You pay 40% after deductible You pay a $250 copay plus 20% after deductible $0 per medical consultation $12 per medical consultation

•Weight

•Nutrition

•OviaTM

•Mental

•And much more! *Available for all plans. See the benefits guide for more details.

Sept. 1, 2023 – Aug. 31, 2024

new pharmacy

CVS

and

Rx Benefits! • Express Scripts is your

benefits manager!

pharmacies and most of your preferred pharmacies

medication are still included.

Doctor Visits Primary Care $30 copay $15 copay You pay 30% after deductibleYou pay 50% after deductible Specialist $70 copay $70 copay You pay 30% after deductibleYou pay 50% after deductible $30 copay You pay 40% after deductible $70 copay You pay 40% after deductible Plan Features Type of Coverage In-Network Coverage Only In-Network Coverage Only In-Network Out-of-Network Individual/Family Deductible $2,500/$5,000 $1,200/$2,400 $3,000/$6,000 $5,500/$11,000 Coinsurance You pay 30% after deductible You pay 20% after deductible You pay 30% after deductibleYou pay 50% after deductible Individual/Family Maximum Out of Pocket $7,500/$15,000 $6,900/$13,800 $7,500/$15,000 $20,250/$40,500 Network Statewide Network Statewide Network Nationwide Network PCP Required Yes Yes No In-Network Out-of-Network $1,000/$3,000 $2,000/$6,000 You pay 20% after deductibleYou pay 40% after deductible $7,900/$15,800 $23,700/$47,400 Nationwide Network No Prescription Drugs Drug Deductible Integrated with medical $200 deductible per participant (brand drugs only) Integrated with medical Generics (31-Day Supply/90-Day Supply)$15/$45 copay; $0 copay for certain generics $15/$45 copay You pay 20% after deductible; $0 coinsurance for certain generics Preferred You pay 30% after deductible You pay 25% after deductible You pay 25% after deductible Non-preferred You pay 50% after deductible You pay 50% after deductible You pay 50% after deductible Specialty (31-Day Max) $0 if SaveOnSP eligible; You pay 30% after deductible $0 if SaveOnSP eligible; You pay 30% after deductible You pay 20% after deductible Insulin Out-of-Pocket Costs$25 copay for 31-day supply; $75 for 61-90 day supply$25 copay for 31-day supply; $75 for 61-90 day supply You pay 25% after deductible $200 brand deductible $20/$45 copay You pay 25% after deductible ($40 min/$80 max)/ You pay 25% after deductible ($105 min/$210 max) You pay 50% after deductible ($100 min/$200 max)/ You pay 50% after deductible ($215 min/$430 max) $0 if SaveOnSP eligible; You pay 30% after deductible ($200 min/$900 max)/ No 90-day supply of specialty medications $25 copay for 31-day supply; $75 for 61-90 day supply

Compare Prices for Common Medical Services

*Pre-certification for genetic and specialty testing may apply. Contact a PHG

questions.

Benefit TRS-ActiveCare Primary TRS-ActiveCare Primary+ TRS-ActiveCare HD TRS-ActiveCare 2 In-Network OnlyIn-Network OnlyIn-NetworkOut-of-NetworkIn-NetworkOut-of-Network Diagnostic Labs* Office/Indpendent Lab: You pay $0 Office/Indpendent Lab: You pay $0 You pay 30% after deductible You pay 50% after deductible Office/Indpendent Lab: You pay $0 You pay 40% after deductible Outpatient: You pay 30% after deductible Outpatient: You pay 20% after deductible Outpatient: You pay 20% after deductible High-Tech Radiology You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible You pay 20% after deductible + $100 copay per procedure You pay 40% after deductible + $100 copay per procedure Outpatient Costs You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible You pay 20% after deductible ($150 facility copay per incident) You pay 40% after deductible ($150 facility copay per incident) Inpatient Hospital Costs You pay 30% after deductible You pay 20% after deductible You pay 30% after deductible You pay 50% after deductible ($500 facility per day maximum) You pay 20% after deductible ($150 facility copay per day) You pay 40% after deductible ($500 facility per day maximum) Freestanding Emergency Room You pay $500 copay + 30% after deductible You pay $500 copay + 20% after deductible You pay $500 copay + 30% after deductible You pay $500 copay + 50% after deductible You pay $500 copay + 20% after deductible You pay $500 copay + 40% after deductible Bariatric Surgery Facility: You pay 30% after deductible Facility: You pay 20% after deductible Not CoveredNot Covered Facility: You pay 20% after deductible ($150 facility copay per day) Not Covered Professional Services: You pay $5,000 copay + 30% after deductible Professional Services: You pay $5,000 copay + 20% after deductible Professional Services: You pay $5,000 copay + 20% after deductible Only covered if rendered at a BDC+ facility Only covered if rendered at a BDC+ facility Only covered if rendered at a BDC+ facility Annual Vision Exam (one per plan year; performed by an ophthalmologist or optometrist) You pay $70 copayYou pay $70 copay You pay 30% after deductible You pay 50% after deductible You pay $70 copay You pay 40% after deductible Annual Hearing Exam (one per plan year) $30 PCP copay $70 specialist copay $30 PCP copay $70 specialist copay You pay 30% after deductible You pay 50% after deductible $30 PCP copay $70 specialist copay You pay 40% after deductible

www.trs.texas.gov

1-866-355-5999 with

Call a Personal Health Guide (PHG) any time 24/7 to help you find the best price for a medical service. Reach them at 1-866-355-5999 REMEMBER: Revised 05/30/23

at

TRS contracts with HMOs in certain regions to bring participants in those areas additional options. HMOs set their own rates and premiums. They’re fully insured products who pay their own claims.

You can choose this plan if you live in one of these counties: Austin, Bastrop, Bell, Blanco, Bosque, Brazos, Burleson, Burnet, Caldwell, Collin, Coryell, Dallas, Denton, Ellis, Erath, Falls, Freestone, Grimes, Hamilton, Hays, Hill, Hood, Houston, Johnson, Lampasas, Lee, Leon, Limestone, Madison, McLennan, Milam, Mills, Navarro, Robertson, Rockwall, Somervell, Tarrant, Travis, Walker, Waller, Washington, Williamson

You can choose this plan if you live in one of these counties: Cameron, Hildalgo, Starr, Willacy

You can choose this plan if you live in one of these counties: Andrews, Armstrong, Bailey, Borden, Brewster, Briscoe, Callahan, Carson, Castro, Childress, Cochran, Coke, Coleman, Collingsworth, Comanche, Concho, Cottle, Crane, Crockett, Crosby, Dallam, Dawson, Deaf Smith, Dickens, Donley, Eastland, Ector, Fisher, Floyd, Gaines, Garza, Glasscock, Gray, Hale, Hall, Hansford, Hartley, Haskell, Hemphill, Hockley, Howard, Hutchinson, Irion, Jones, Kent, Kimble, King, Knox, Lamb, Lipscomb, Llano, Loving, Lubbock, Lynn, Martin, Mason, McCulloch, Menard, Midland, Mitchell, Moore, Motley, Nolan, Ochiltree, Oldham, Parmer, Pecos, Potter, Randall, Reagan, Reeves, Roberts, Runnels, San Saba, Schleicher, Scurry, Shackelford, Sherman, Stephens, Sterling, Stonewall, Sutton, Swisher, Taylor, Terry, Throckmorton, Tom Green, Upton, Ward, Wheeler, Winkler, Yoakum

Remember that when you choose an HMO, you’re choosing a regional network. 2023-24 Health Maintenance Organization (HMO) Plans and Premiums for Select Regions of the State REMEMBER: www.trs.texas.gov Total Monthly Premiums Total PremiumYour PremiumTotal PremiumYour PremiumTotal PremiumYour Premium Employee OnlyN/A$ N/A$ $865.00$ Employee and SpouseN/A$ N/A$ $2,103.16$ Employee and ChildrenN/A$ N/A$ $1,361.42$ Employee and FamilyN/A$ N/A$ $2,233.34$ Central and North Texas Baylor Scott & White Health Plan Brought to you by TRS-ActiveCare Blue Essentials - South Texas HMO Brought to you by TRS-ActiveCare Blue Essentials - West Texas HMO Brought to you by TRS-ActiveCare

Prescription Drugs Drug Deductible N/A N/A $150 Days Supply N/A N/A 30-Day Supply/90-Day Supply Generics N/A N/A $5/$12.50 copay; $0 for certain generics Preferred Brand N/A N/A You pay 30% after deductible Non-preferred Brand N/A N/A You pay 50% after deductible Specialty N/A N/A You pay 15%/25% after deductible (preferred/non-preferred) Immediate Care Urgent Care N/A N/A $50 copay Emergency Care N/A N/A $500 copay before deductible + 25% after deductible Doctor Visits Primary Care N/A N/A $20 copay Specialist N/A N/A $70 copay Plan Features Type of Coverage N/A N/A In-Network Coverage Only Individual/Family Deductible N/A N/A $950/$2,850 Coinsurance N/A N/A You pay 25% after deductible Individual/Family Maximum Out of Pocket N/A N/A $7,450/$14,900

Revised 05/30/23

All Full-Time Employees Electing the High Planof Mason

ISD

Benefits At-A-Glance

Dental Insurance

High Option

The Lincoln

DentalConnect®PPO

Plan:

Covers many preventive, basic, and majordental care services

Also covers orthodontic treatment for children

Features group coveragefor Mason ISDemployees

Allowsyou to choose any dentist you wish, though you can lower your out-of-pocket costs by selecting a contracting dentist

Does not make you and your loved ones wait six months between routine cleanings

Calendar (Annual)

Deductible

Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Non-Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Deductibles are combined for basicand majorContracting Dentists’ services. Deductibles are combined for basicand majorNon-Contracting Dentists’services.

Annual Maximum $1,500 $1,500

MaxRewards® lets you and your covered family members roll a portion of unused dental benefits from one year into the next. So you have extra benefit dollars available when you need them most.

●Eligible Range (claim threshold): $800

●Rollover Amount: $350per calendar year

●Rollover Amount with Preferred Provi der: $500per calendar year

●Maximum Rollover Account Balance: $1,250

Lifetime Orthodontic Max $1,000 $1,000

Orthodontic Coverage is available for dependent children.

Waiting Period There are no benefit waiting periods for any service types

Visit LincolnFinancial.com/FindADentist

You can search by:

●Location

●Dentist name or office name

●Distance you are willing to travel

●Specialty, language and more

Your search will automatically provide up to 100 dentists that most closely match your criteria. If your search does not locate the dentist you prefer, you can nominate one—just click the Nominate a Dentist link and complete the online form.

The Lincoln National Life Insurance Company

11

Routine oral exams

Bitewing X-rays

Full-mouth or panoramic X-rays

Other dental X-rays (including periapical films)

children Sealants

(including emergency relief of dental pain)

Problem focused exams

Injections of antibiotics and other therapeutic medications

Consultations

Prefabricated stainless steel and resin crowns

Surgical extractions

Oral surgery

Biopsy and examination of oral tissue (includ ing brush biopsy)

Prosthetic repair and recementation services

Endodontics (including root canal treatment)

Periodontal maintenance procedures

Non-surgical periodontal therapy

Periodontal surgery

Bridges

Full and partial dentures

Denture reline and rebase services

Crowns, inlays, onlays and related services

Build-ups/post & core Implants & implant related services

To find a contracting dentist near you, visit www.LincolnFinancial.com/FindADentist

This plan lets you choose any dentist you wish. However, your out-ofpocket costs are likely to be lower when you choose a contracting dentist. For example, if you need a crown…

…you pay a deductible (if applicable), then 50% of the remaining discounted fee for PPO members. This is known as a PPO contracted fee.

… you pay a deductible (if applicable), then 50% of the usual and customary fee, which is the maximum expense covered by the plan. You are responsible for the difference between the usual and customary fee and the dentist’s billed charge.

Dental Coverage | At-A-Glance | High Option

Contracting Dentists Non-Contracting Dentists

DTL-ENRO-BRC001-TX Preventive Services

Fluoride treatments

Palliative treatment

100% No Deductible 100% No Deductible

Contracting Dentists Non-Contracting Dentists

Routine cleanings

Space maintainers for

Basic Services

Simple

General anesthesia and I.V. sedation 80% After Deductible 80% After Deductible Major

Contracting Dentists Non-Contracting Dentists

Fillings

extractions

Services

50% After Deductible 50% After Deductible Orthodontics Contracting Dentists Non-Contracting Dentists Orthodontic

Extractions Study models Appliances 50% 50% Contracting Dentists/Non-Contracting

Contracting Dentists Non-Contracting Dentists

exams X-rays

Dentists

12

With the Lincoln Dental Mobile App

Find a network dentist near you in minutes

Have an ID card on your phone

Customize the app to get details of your plan

Find out how much your plan covers for checkups and other services

Keep track of your claims

Lincoln DentalConnect® Online Health Center

Determine the average cost of a dental procedure

Have your questions answered by a licensed dentist

Learn all about dental health for children, from baby’s first tooth to dental emergencies

Evaluate your risk for oral cancer, periodontal disease and tooth decay

Covered Family Members

When you choose coverage for yourself, you can also provide coverage for:

• Your spouse.

• Unmarried dependent children, up to age 26.

Benefit Exclusions

Like any coverage, this dental coverage doeshave some exclusions. The plan does not cover services started before coverage begins or after it ends. Benefits are limited to appropriate and necessary procedures listed in the summary plan description.Benefits are not payable for duplication of services. Covered expenses will not exceed the summary plan description’susual and customary allowances. Plan benefits are not payable for a condition that is covered under Workers’ Compensation or a similar law; that occurs during the courseof employment or military service or involvement in an illegal occupation, felony, or riot; or that results from a self-inflicted injury. The plan does not cover an orthodontia treatment plan started before coveragebegins unless the member was receiving orthodontia benefits from the employer’s previous group dental summary plan description. In this case, Lincoln Financial will continue orthodontia benefits until the combined benefit paid by both policies is equal tothis summary plan description’slifetime orthodontia maximum. Plan benefits are not payable if the orthodontic appliance was installed after the age of 19. In certain situations, there may be more than one method of treating a dental condition. This summary plan description includes an alternative benefits provision that may reduce benefits to the lowestcost, generally effective, and necessary form of treatment. Certain conditions, such as age and frequency limitations, may impact your coverage. See the summary plan description for details. This plan includes continuation of coverage for employees with dental coverage from a previous employer. The member is required to complete the Continuity of Coverage form located on www.lfg.com. The form must be providedto us prior to the effective date to be eligible for continuation of coverage.

A complete list of benefit exclusions is included in the summary plan description.

Questions? Call 800-423-2765and mention Group ID: WTXMASOISD.

This is not intended as a complete description of the coverage offered. Controlling provisions are provided in the summary plan description,and this summary does not modify coverage. A summary plan descriptionwill be made available to you that describes the benefits in greater detail. Refer to your summary plan descriptionfor your maximum benefit amounts.

Lincoln DentalConnect® health center Web content is provided by go2dental.com, Santa Clara, CA. Go2dental.com is not a Lincoln Financial Group® company. Coverage is subject to actual summary plan descriptionlanguage. Each independent company is solely responsible for its own obligations.

The Lincoln National Life Insurance Company (Fort Wayne, IN), does not conduct business in New York, nor is it licensed to do so. In New York, business is conducted by Lincoln Life & Annuity Company of New York (Syracuse NY). Both are Lincoln Financial Group Companies.

©2020LincolnNationalCorporation LCN-2012491-013118 R 1.0–Group ID: WTXMASOISD Dental Coverage |At-A-Glance | High Option DTL-ENRO-BRC001-TX

13

Dental Rate

Here’s how little you pay with grouprates.

As aMason ISDemployee, you can take advantage of this dental coveragefor less than $1.11a day. Plus, you can add loved ones to the plan for just a little more.

Your estimated cost is itemizedbelow.

The Lincoln National Life Insurance Company

Please see prior page for product information.

Dental Coverage |Rate Calculation | High Option

DTL-ENRO-BRC001-TX

Coverage MonthlyRate Employeeonly $33.21 Employee& spouse $63.49 Employee& child/children $80.85 Employee& family $111.22 14

All Full-Time Employees Electing the Low Planof Mason

ISD

Benefits At-A-Glance

Dental Insurance

Low Option

The Lincoln

DentalConnect®PPO

Plan:

Covers many preventive, basic, and majordental care services

Also covers orthodontic treatment for children

Features group coveragefor Mason ISDemployees

Allowsyou to choose any dentist you wish, though you can lower your out-of-pocket costs by selecting a contracting dentist

Does not make you and your loved ones wait six months between routine cleanings

Calendar (Annual)

Deductible

Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Non-Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Deductibles are combined for basicand majorContracting Dentists’ services. Deductibles are combined for basicand majorNon-Contracting Dentists’services.

Annual Maximum $1,500 $1,500

MaxRewards® lets you and your covered family members roll a portion of unused dental benefits from one year into the next. So you have extra benefit dollars available when you need them most.

●Eligible Range (claim threshold): $800

●Rollover Amount: $350per calendar year

●Rollover Amount with Preferred Provi der: $500per calendar year

●Maximum Rollover Account Balance: $1,250

Lifetime Orthodontic Max $1,000 $1,000

Orthodontic Coverage is available for dependent children.

Waiting Period There are no benefit waiting periods for any service types

Visit LincolnFinancial.com/FindADentist

You can search by:

●Location

●Dentist name or office name

●Distance you are willing to travel

●Specialty, language and more

Your search will automatically provide up to 100 dentists that most closely match your criteria. If your search does not locate the dentist you prefer, you can nominate one—just click the Nominate a Dentist link and complete the online form.

The Lincoln National Life Insurance Company

15

Routine oral exams

Bitewing X-rays

Full-mouth or panoramic X-rays

Other dental X-rays (including periapical films)

emergency relief of dental pain)

Problem focused exams

Injections of antibiotics and other therapeutic medications

Consultations

Prefabricated stainless steel and resin crowns

Surgical extractions

Oral surgery

Biopsy and examination of oral tissue (includ ing brush biopsy)

Prosthetic repair and recementation services

Endodontics (including root canal treatment)

Periodontal maintenance procedures

Non-surgical periodontal therapy

Periodontal surgery

Bridges

Full and partial dentures

Denture reline and rebase services

Crowns, inlays, onlays and related services

Build-ups/post & core Implants & implant related services

To find a contracting dentist near you, visit www.LincolnFinancial.com/FindADentist

This plan lets you choose any dentist you wish. However, your out -ofpocket costs are likely to be lower when you choose a contracting dentist. For example, if you need a crown…

…you pay a deductible (if applicable), then 50% of the remaining discounted fee for PPO members. This is known as a PPO contracted fee.

… you pay a deductible (if applicable), then 50% of the usual and customary fee, which is the maximum expense covered by the plan. You are responsible for the difference between the usual and customary fee and the dentist’s billed charge.

Dental Coverage | At-A-Glance | Low Option

Contracting Dentists Non-Contracting Dentists

DTL-ENRO-BRC001-TX Preventive Services

Routine cleanings Fluoride treatments Space

Sealants Palliative treatment (including

90% No Deductible 90% No Deductible Basic

Contracting Dentists Non-Contracting Dentists

maintainers for children

Services

Fillings Simple extractions General anesthesia and I.V. sedation 50% After Deductible 50% After Deductible Major

Contracting Dentists Non-Contracting Dentists

Services

50% After Deductible 50% After Deductible Orthodontics Contracting Dentists Non-Contracting Dentists Orthodontic

X-rays Extractions Study models Appliances 50% 50% Contracting Dentists/Non-Contracting

Contracting Dentists Non-Contracting Dentists

exams

Dentists

16

With the Lincoln Dental Mobile App

Find a network dentist near you in minutes

Have an ID card on your phone

Customize the app to get details of your plan

Find out how much your plan covers for checkups and other services

Keep track of your claims

Lincoln DentalConnect® Online Health Center

Determine the average cost of a dental procedure

Have your questions answered by a licensed dentist

Learn all about dental health for children, from baby’s first tooth to dental emergencies

Evaluate your risk for oral cancer, periodontal disease and tooth decay

Covered Family Members

When you choose coverage for yourself, you can also provide coverage for:

• Your spouse.

• Unmarried dependent children, up to age 26.

Benefit Exclusions

Like any coverage, this dental coverage doeshave some exclusions. The plan does not cover services started before coverage begins or after it ends. Benefits are limited to appropriate and necessary procedures listed in the summary plan description.Benefits are not payable for duplication of services. Covered expenses will not exceed the summary plan description’susual and customary allowances. Plan benefits are not payable for a condition that is covered under Workers’ Compensation or a similar law; that occurs during the courseof employment or military service or involvement in an illegal occupation, felony, or riot; or that results from a self-inflicted injury. The plan does not cover an orthodontia treatment plan started before coverage begins unless the member was receiving orthodontia benefits from the employer’s previous group dental summary plan description. In this case, Lincoln Financial will continue orthodontia benefits until the combined benefit paid by both policies is equal to this summary plan description’slifetime orthodontia maximum. Plan benefits are not payable if the orthodontic appliance was installed after the age of 19. In certain situations, there may be more than one method of treating a dental condition. This summary plan description includes an alternative benefits provision that may reduce benefits to the lowestcost, generally effective, and necessary form of treatment. Certain conditions, such as age and frequency limitations, may impact your coverage. See the summary plan description for details. This plan includes continuation of coverage for employees with dental coverage from a previous employer. The member is required to complete the Continuity of Coverage form located on www.lfg.com. The form must be providedto us prior to the effective date to be eligible for continuation of coverage.

A complete list of benefit exclusions is included in the summary plan description.

Questions? Call 800-423-2765and mention Group ID: WTXMASOISD.

This is not intended as a complete description of the coverage offered. Controlling provisions are provided in the summary plan description,and this summary does not modify coverage. A summary plan descriptionwill be made available to you that describes the benefits in greater detail. Refer to your summary plan descriptionfor your maximum benefit amounts.

Lincoln DentalConnect® health center Web content is provided by go2dental.com, Santa Clara, CA. Go2dental.com is not a Lincoln Financial Group® company. Coverage is subject to actual summary plan descriptionlanguage. Each independent company is solely responsible for its own obligations.

The Lincoln National Life Insurance Company (Fort Wayne, IN), does not conduct business in New York, nor is it licensed to do so. In New York, business is conducted by Lincoln Life & Annuity Company of New York (Syracuse NY). Both are Lincoln Financial Group Companies.

©2020LincolnNationalCorporation LCN-2012491-013118 R 1.0–Group ID: WTXMASOISD Dental Coverage |At-A-Glance | Low Option DTL-ENRO-BRC001-TX

17

Dental Rate

Here’s how little you pay with grouprates.

As aMason ISDemployee, you can take advantage of this dental coveragefor less than $0.64a day. Plus, you can add loved ones to the plan for just a little more.

Your estimated cost is itemizedbelow.

The Lincoln National Life Insurance Company

Please see prior page for product information.

Dental Coverage |Rate Calculation | Low Option

DTL-ENRO-BRC001-TX

Coverage MonthlyRate Employeeonly $19.14 Employee& spouse $36.66 Employee& child/children $46.51 Employee& family $64.13 18

plan benefits for Mason ISD

Benefits through Superior National network

Co-pays apply to in-network benefits; co-pays for out-of-network visits are deducted from reimbursements

1 Materials co-pay applies to lenses and frames only, not contact lenses

2 Standard contact lens fitting applies to a current contact lens user who wears disposable, daily wear, or extended wear lenses only. Specialty contact lens fitting applies to new contact wearers and/or a member who wear toric, gas permeable, or multi-focal lenses.

3 Covered to provider’s in-office standard retail lined trifocal amount; member pays difference between progressive and standard retail lined trifocal, plus applicable co-pay.

4 Contact lenses are in lieu of eyeglass lenses and frames benefit

Discount features

Look for providers in the provider directory who accept discounts, as some do not; please verify their services and discounts (range from 10%-30%) prior to service as they vary.

Discounts on covered materials

Frames: 20% off amount over allowance

Lens options: 20% off retail

Progressives: 20% off amount over retail lined trifocal lens, including lens options

Specialty contact lens fit: 10% off retail, then apply allowance

Maximum member out-of-pocket

The following options have out-of-pocket maximums5 on standard (not premium, brand, or progressive) lenses.

Single vision Bifocal & trifocal

Scratch coat $13 $13

Ultraviolet coat $15 $15

Tints, solid or gradients $25 $25

Anti-reflective coat $50 $50

Polycarbonate $40

High index 1.6 $55

20% off retail

20% off retail

Photochromics $80 20% off retail

5 Discounts and maximums may vary by lens type. Please check with your provider

Discounts on non-covered exam, services and materials

Exams, frames, and prescription lenses: 30% off retail

Lens options, contacts, miscellaneous options: 20% off retail

Disposable contact lenses: 10% off retail

Retinal imaging: $39 maximum out-of-pocket

LASIK

Laser vision correction (LASIK) is a procedure that can reduce or eliminate your dependency on glasses or contact lenses. This corrective service is available to you and your eligible dependents at a special discount (20-50%) with your Superior Vision plan. Contact QualSight LASIK at (877) 201-3602 for more information.

The Plan discount features are not insurance.

All allowances are retail; the member is responsible for paying the provider directly for all non-covered items and/or any amount over the allowances, minus available discounts. These are not covered by the plan.

Discounts are subject to change without notice.

Disclaimer: All final determinations of benefits, administrative duties, anddefinitions are governed by the Certificate of Insurance for your vision plan. Please check with your Human Resources department if you have any questions.

Superior Vision Services, Inc. P.O. Box 967 Rancho Cordova, CA 95741 (800) 507-3800 superiorvision.com The Superior Vision Plan is underwritten by National Guardian Life Insurance Company. National Guardian Life Insurance Company is not affiliated with The Guardian Life Insurance Company of America, AKA The Guardian or Guardian Life NVIGRP 5-07 0420-BSv2/TX superiorvision.com (800)507-3800

Copays Monthly premiums Services/frequency Exam $10 Emp. only $7.80 Exam 12months Materials1 $25 Emp. + spouse $15.46 Frame 12months Contact lens fitting $0 Emp. + child(ren) $15.17 Contact lens fitting 12 months (standard & specialty) Emp. + family $22.95 Lenses 12months Contact lenses 12 months (based on date of service)

Vision

In-network Out-of-network Exam (ophthalmologist) Covered in full Up to $42 retail Exam (optometrist) Covered in full Up to $37 retail Frames $125 retail allowance Up to $68 retail Contact lens fitting (standard2) Covered in full Not covered Contact lens fitting (specialty2) $50 retail allowance Not covered Lenses (standard) per pair Single vision Covered in full Up to $32 retail Bifocal Covered in full Up to $46 retail Trifocal Covered in full Up to $61 retail Progressives lens upgrade See description3 Up to $61 retail Factory scratch coat Covered in full Not covered Contact lenses4 $120 retail allowance Up to $100 retail

19

BENEFIT HIGHLIGHTS FOR:

Mason Independent School District

EDUCATOR DISABILITY INSURANCE OVERVIEW

What is Educator Disability Income Insurance?

Educator Disability insurance combines the feat ures of a short-term and long-term disability plan into one policy. The coverage pays you a portion of your earnings if you cannot work because of a disabling illness or injury. The plan gives you the flexibil ity to choose a level of coverage to suit your need.

You have the opportunity to purchase Disability Insurance through your employer. This highlight sheet is an overview of your Disability Insurance. Once a group policy is issued to your employer, a certificate of insurance will be available to explain your coverage in detail.

Why do I need Disability Insurance Coverage?

More than half of all personal bankruptcies and mortgage foreclosures are a consequence of disability1

1 Facts from LIMRA, 2016 Disability Insurance Awareness Month

The average worker faces a 1 in 3 chance of suffering a job loss lasting 90 days or more due to a disability2

2Facts from LIMRA, 2016 Disability Insurance Awareness Month

Only 50% of American a dults indicate they have enough savings to cover three months of living expenses in the event they’re not earning any income 3

3Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2018

ELIGIBILITY AND ENROLLMENT

Eligibility You are eligible if you are an active employee who works at least 17.5 hours per week on a regularly scheduled basis.

Enrollment You can enroll in coverage within 31 days of your date of hire or during your annual enrollment period.

Effective Date Coveragegoes into effect subject to the terms and conditions of the policy. You must satisfy the definition of Actively at Work with your employer on the day your coverage takes effect.

Actively at Work You must be at work with your Employer on your regularly scheduled workday. On that day, you must be performing for wage or profit all of your regular duties in the usual way and for your usual number of hours. If school is not in session due to normal vacation or school break(s), Actively at Work shall mean you are able to report for work with your Employer, performing all of the regular duties of Your Occupation in the usual way for your usual number of hours as if school was in session.

20

FEATURES OF THE PLAN

Benefit Amount You may purchase coverage that will pay you a monthly flat dollar benefit in $100 increments between $200 and $8,000 that cannot exceed 66 2/3% of your current monthly earnings. Earnings are defined in The Hartford ’s contract with your employer.

Elimination Period You must be disabled for at least the number of days indicated by the elimination period that you select before you can receive a Disability benefit payment. The elimination period that you select consists of two numbers. The first numb er shows the number of days you must be disabled by an accident before your benefits can begin. The second number indicates the number of days you must be disabled by a sickness before your benefits can begin.

For those employees electing an elimination p eriod of 30 days or less, if your are confined to a hospital for 24 hours or more due to a disability, the elimination period will be waived, and benefits will be payable from the first day of hospitalization.

Maximum Benefit Duration Benefit Duration is the maximum time for which we pay benefits for disability resulting from sickness or injury. Depending on the schedule sele cted and the age at which disability occurs, the maximum duration may vary. Please see the applicable schedules b elow based on your election of either the Premium or Select benefit option.

Premium Option: For the Premium benefit option –the table below applies to disabilities resulting from sickness or injury

Select Option: For the Select benefit option –the table below applies to disabilities resulting from injury Age

Mental Illness, Alcoholism and Substance Abuse: Duration

Select Option: For the Select benefit option –the table below applies to disabilities resulting from sickness

Prior to 68 24 Months

Age 68-69 To Age 70, but not less than 12 months

Age 70 and older 12 Months

You can receive benefit payments for Long-Term Disabilities resulting from mental illness, alcoholism and substance abuse for a total of 24 months for all disability periods during your lifetime.

Any period of time that you are confined in a hospital or other facility licensed to provide medical care for mental illness, alcoholism and substance abuse does not count toward the 24 month lifetime limit.

Disabled Maximum Benefit Duration

to

To Normal Retirement Age

Age

To Normal Retirement Age

Age

36 months Age

30 months Age

27 months

24 months

21 months

18 months

Prior

63

or 48 months if greater

63

or 42 months if greater

64

65

66

Age 67

Age 68

Age 69 and older

Maximum

Age Disabled

Benefit Duration

21

Partial Disability Partial Disability is covered provided you have at least a 20% loss of earnings and duties of your job.

Other Important Benefits Survivor Benefit - If you die while receiving disability benefits, a benefit will be paid to your spouse or child under age 25, equal to three times your last monthly gross benefit.

The Hartford's Ability Assist service is included as a part of your group Long Term Disability (LTD) insurance program. You have access to Ability Assist services both prior to a disability and after you’ve been approved for an LTD claim and are receiving LTD benefits. Once you are covered you are eligible for services to provide assistance with child/elder care, substance abuse, family relationships and more. In addition, LTD claimants and their immediate family members receive confidential services to assist them with the unique emotional, financial and legal issues that may result from a disability. Ability Assist services are provided through ComPsych®, a leading provider of employee assistance and work/lifeservices.

Travel Assistance Program – Available 24/7, this program provides assistance to employees and their dependents who travel 100 miles from their home for 90 days or less. Services include pre-trip information, emergency medical assistance and emergency personalservices.

Identity Theft Protect ion –An array of identity fraud support services to help victims restore their identity. Benefits include 24/7 access to an 800 number; direct contact with a certified caseworker who follows the case until it’s resolved; and a personalized fraud resolution kit with instructions and resources for ID theft victims.

Workplace Modification provides for reasonable modifications made to a workplace to accommodate your disability and allow you to return to active full -timeemployment.

PROVISIONS OF THE PLAN

Definition of Disability Disability is defined as The Hartford’s contract with your employer. Typically, disability means that you cannot perform one or more of the essential duties of your occupation due to injury, sickness, pregnancy or other medical conditions covered by the insurance, and as a result, your current monthly earnings are 80% or less of your pre -disability earnings.

Once you have been disabled for 24 months, you must be prevented from performing one or more essential duties of any occupation, and as a result, your monthly earnings are 66 2/3% or less of your pre-disability earnings.

Pre-Existing Condition Limitation

Your policy limits the benefits you can receive for a disability caused by a pre-existing condition. In general, if you were diagnosed or received care for a disabling condition within the 3 consecutive months just prior to the effective date of this policy, your benefit payment will be limited, unless you have been insured under this policy for 12 months before your disability begins.

If your disability is a result of a pre -existing condition, we will pay benefits for a maximum of 4 weeks.

22

Continuity of Coverage If you were insured under your district’s prior plan and not receiving benefits the day before this policy is effective, there will not be a loss in coverage and you will get credit for your prior carrier’s coverage.

Recurrent Disability What happens if I Recover but become Disabled again?

Periods of Recovery during the Elimination Period will not interrupt the Elimination Period, if the number of days You return to work as an Active Employee are less than one-half (1/2) the number of days of Your Elimination Period. Any day within such period of Recovery, will not count toward the Elimination Period.

Benefit Integration

Your benefit may be reduced by other income you receive or are eligible to receive due to your disability, such as:

•Social Security Disability Insurance

•State Teacher Retirement Disability Plans

•Workers’ Compensation

•Other employer-based disability insurance coverage you may have

•Unemployment benefits

•Retirement benefits that your employer fully or partially pays for (such as a pension plan)

Your plan includes a minimum benefit of 10%ofyour elected benefitor $100.

General Exclusions

You cannot receive Disability benefit payments for disabilities that are caused or contributed to by:

•War or act of war (declared or not)

•Military service for any country engaged in war or other armed conflict

•The commission of, or attempt to commit a felony

•An intentionally self-inflicted injury

•Any case where your being engaged in an illegal occupation was a contributing cause to your disability

•You must be under the regular care of a physician to receive benefits

Termination Provisions

Your coverage under the plan will end if:

•The group plan ends or is discontinued

•You voluntarily stop your coverage

•You are no longer eligible for coverage

•You do not make the required premium payment

•Your active employment stops, except as stated in the continuation provision in the policy

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries, including underwriting company Hartford Life and Accident Insurance Company. Home Office is Hartford, CT. All benefits are subject to the terms and conditions of the policy. Policies underwritten by the underwriting company listed above detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued. This Benefit Highlights Sheet explains the general purpose of the insurance described, but in no way changes or affects the policy as actually issued. In the event of a discrepancy between this Benefit Highlights Sheet and the policy, the terms of the policy apply. Complete details are in the Certificate of Insurance issued to each insured individual and the Master Policy as issued to the policyholder. Benefits are subject to state availability. © 2020 The Hartford.

23

life insurance highlights

For the employee purelife-plus

Voluntary permanent life insurance can be an ideal complement to the group term and optional term life insurance your employer might provide. This voluntary universal life product is yours to keep, even when you change jobs or retire, as long as you pay the necessary premium. Group and voluntary term life insurance may be portable if you change jobs, but even if you can keep them after you retire, they usually cost more and decline in death benefit.

The contract, purelife-plus, is underwritten by Texas Life Insurance Company, and it has the following features:

•HighDeathBenefit. With one of the highest death benefits available at the worksite,1 purelife-plus gives your loved ones peace of mind, knowing there will be life insurance in force when you die.

•RefundofPremium. Unique in the marketplace, purelife-plus offers you a refund of 10 years’ premium, should you surrender the contract if the premium you pay when you buy the contract ever increases. (Conditions apply.)

•AcceleratedDeathBenefitDuetoTerminalIllnessRider. Should you be diagnosed as terminally ill with the expectation of death within 12 months, you will have the option to receive 92% of the death benefit, minus a $150 ($100 in Florida) administrative fee. This valuable living benefit gives you peace of mind knowing that, should you need it, you can take the large majority of your death benefit while still alive. (Conditions apply.) (Form ICC07-ULABR-07 or Form Series ULABR-07)

21M066-C R0222 2009 (exp0523) 24

AdditionalFeatures

•MinimalCashValue. Designed to provide a high death benefit at a reasonable premium, purelife-plus provides peace of mind for you and your beneficiaries while freeing investment dollars to be directed toward such tax-favored retirement plans as 403(b), 457 and 401(k).

•LongGuarantees. Enjoy the assurance of a contract that has a guaranteed death benefit to age 121 and level premium that guarantees coverage for a significant period of time (after the guaranteed period, premiums may go down, stay the same, or go up). 2

You may apply for this permanent coverage, not only for yourself, but also for your spouse, children and grandchildren.3

QUICK QUESTIONS 3

You can qualify by answering just 3 questions – no exams or needles.

DURING THE LAST SIX MONTHS, HAS THE PROPOSED INSURED:

Been actively at work on a full time basis, performing usual duties?

Been absent from work due to illness or medical treatment for a period of more than 5 consecutive working days?

Been disabled or received tests, treatment or care of any kind in a hospital or nursing home or received chemotherapy, hormonal therapy for cancer, radiation, dialysis treatment, or treatment for alcohol or drug abuse?

PureLife-plus is a Flexible Premium Adjustable Life Insurance to Age 121. As with most life insurance products, Texas Life contracts and riders contain certain exclusions, limitations, exceptions, reductions of benefits, waiting periods and terms for keeping them in force. Please contact a Texas Life representative or see the Purelife-plus brochure for costs and complete details. Contract Form ICC18-PRFNG-NI-18, Form Series PRFNG-NI-18 or PRFNG-NI -20-OHIO.

1 Voluntary Whole and Universal Life Products, Eastbridge Consulting Group, December 2018

2 Guarantees are subject to product terms, limitations, exclusions, and the insurer’s claims paying ability and financial strength

3 Coverage not available on children in WA or on grandchildren in WA or MD. In MD, children must reside with the applicant to be eligible for coverage.

21M066-C R0222 2009

(exp0523)

1 2 3 25

PureLife-plusispermanentlifeinsurancetoAttainedAge121thatcanneverbecancelledaslongasyoupaythenecessarypremiums.Afterthe GuaranteedPeriod,thepremiumscanbelower,thesame,orhigherthantheTablePremium.Seethebrochureunder”PermanentCoverage”.

monthlypremiums

ExpressIssue GUARANTEED MonthlyPremiumsforLifeInsuranceFaceAmountsShown PERIOD AgetoWhich Issue Coverageis Age Guaranteedat (ALB) $10,000 $15,000 $25,000 $40,000 $50,000 $75,000 $100,000 $125,000 $150,000 TablePremium 15D-1 9.25 81 2-4 9.50 80 5-8 9.75 79 9-10 10.00 79 11-16 10.25 77 17-20 10.25 15.05 18.25 26.25 34.25 42.25 50.25 75 21-22 10.50 15.45 18.75 27.00 35.25 43.50 51.75 74 23 10.75 15.85 19.25 27.75 36.25 44.75 53.25 75 24-25 11.00 16.25 19.75 28.50 37.25 46.00 54.75 74 26 11.50 17.05 20.75 30.00 39.25 48.50 57.75 75 27-28 11.75 17.45 21.25 30.75 40.25 49.75 59.25 74 29 12.00 17.85 21.75 31.50 41.25 51.00 60.75 74 30-31 12.25 18.25 22.25 32.25 42.25 52.25 62.25 73 32 13.00 19.45 23.75 34.50 45.25 56.00 66.75 74 33 13.50 20.25 24.75 36.00 47.25 58.50 69.75 74 34 14.25 21.45 26.25 38.25 50.25 62.25 74.25 75 35 10.05 15.25 23.05 28.25 41.25 54.25 67.25 80.25 76 36 10.35 15.75 23.85 29.25 42.75 56.25 69.75 83.25 76 37 10.80 16.50 25.05 30.75 45.00 59.25 73.50 87.75 77 38 11.25 17.25 26.25 32.25 47.25 62.25 77.25 92.25 77 39 12.00 18.50 28.25 34.75 51.00 67.25 83.50 99.75 78 40 9.25 12.75 19.75 30.25 37.25 54.75 72.25 89.75 107.25 79 41 9.95 13.80 21.50 33.05 40.75 60.00 79.25 98.50 117.75 80 42 10.75 15.00 23.50 36.25 44.75 66.00 87.25 108.50 129.75 81 43 11.45 16.05 25.25 39.05 48.25 71.25 94.25 117.25 140.25 82 44 12.15 17.10 27.00 41.85 51.75 76.50 101.25 126.00 150.75 83 45 12.85 18.15 28.75 44.65 55.25 81.75 108.25 134.75 161.25 83 46 13.65 19.35 30.75 47.85 59.25 87.75 116.25 144.75 173.25 84 47 14.35 20.40 32.50 50.65 62.75 93.00 123.25 153.50 183.75 84 48 15.05 21.45 34.25 53.45 66.25 98.25 130.25 162.25 194.25 85 49 15.95 22.80 36.50 57.05 70.75 105.00 139.25 173.50 207.75 85 50 16.95 24.30 39.00 61.05 75.75 112.50 86 51 18.15 26.10 42.00 65.85 81.75 121.50 87 52 19.45 28.05 45.25 71.05 88.25 131.25 88 53 20.45 29.55 47.75 75.05 93.25 138.75 88 54 21.45 31.05 50.25 79.05 98.25 146.25 88 55 22.55 32.70 53.00 83.45 103.75 154.50 89 56 23.55 34.20 55.50 87.45 108.75 162.00 89 57 24.75 36.00 58.50 92.25 114.75 171.00 89 58 25.85 37.65 61.25 96.65 120.25 179.25 89 59 27.05 39.45 64.25 101.45 126.25 188.25 89 60 28.55 41.70 68.00 107.45 133.75 199.50 90 61 29.85 43.65 71.25 112.65 140.25 209.25 90 62 31.45 46.05 75.25 119.05 148.25 221.25 90 63 33.05 48.45 79.25 125.45 156.25 233.25 90 64 34.75 51.00 83.50 132.25 164.75 246.00 90 65 36.65 53.85 88.25 139.85 174.25 260.25 90 66 38.75 90 67 41.05 91 68 43.55 91 69 46.05 91 70 48.65 91

Non-Tobacco

PureLife-plus StandardRiskTablePremiums Non-Tobacco

Form:21M013-ICCEXP-A-M-1LO 26

PureLife-plusispermanentlifeinsurancetoAttainedAge121thatcanneverbecancelledaslongasyoupaythenecessarypremiums.Afterthe GuaranteedPeriod,thepremiumscanbelower,thesame,orhigherthantheTablePremium.Seethebrochureunder”PermanentCoverage”.

Tobacco monthlypremiums

GUARANTEED MonthlyPremiumsforLifeInsuranceFaceAmountsShown PERIOD AgetoWhich Issue Coverageis Age Guaranteedat (ALB) $10,000 $15,000 $25,000 $40,000 $50,000 $75,000 $100,000 $125,000 $150,000 TablePremium 15D-1 81 2-4 80 5-8 79 9-10 79 11-16 77 17-20 15.25 23.05 28.25 41.25 54.25 67.25 80.25 71 21-22 16.00 24.25 29.75 43.50 57.25 71.00 84.75 71 23 16.75 25.45 31.25 45.75 60.25 74.75 89.25 72 24-25 17.25 26.25 32.25 47.25 62.25 77.25 92.25 71 26 17.75 27.05 33.25 48.75 64.25 79.75 95.25 72 27-28 18.25 27.85 34.25 50.25 66.25 82.25 98.25 71 29 18.50 28.25 34.75 51.00 67.25 83.50 99.75 71 30-31 21.00 32.25 39.75 58.50 77.25 96.00 114.75 72 32 21.75 33.45 41.25 60.75 80.25 99.75 119.25 72 33 22.00 33.85 41.75 61.50 81.25 101.00 120.75 72 34 22.25 34.25 42.25 62.25 82.25 102.25 122.25 71 35 15.30 24.00 37.05 45.75 67.50 89.25 111.00 132.75 72 36 15.75 24.75 38.25 47.25 69.75 92.25 114.75 137.25 72 37 16.80 26.50 41.05 50.75 75.00 99.25 123.50 147.75 73 38 17.25 27.25 42.25 52.25 77.25 102.25 127.25 152.25 73 39 18.45 29.25 45.45 56.25 83.25 110.25 137.25 164.25 74 40 14.15 20.10 32.00 49.85 61.75 91.50 121.25 151.00 180.75 76 41 15.05 21.45 34.25 53.45 66.25 98.25 130.25 162.25 194.25 77 42 16.15 23.10 37.00 57.85 71.75 106.50 141.25 176.00 210.75 78 43 17.55 25.20 40.50 63.45 78.75 117.00 155.25 193.50 231.75 80 44 18.25 26.25 42.25 66.25 82.25 122.25 162.25 202.25 242.25 80 45 19.25 27.75 44.75 70.25 87.25 129.75 172.25 214.75 257.25 81 46 20.05 28.95 46.75 73.45 91.25 135.75 180.25 224.75 269.25 81 47 21.05 30.45 49.25 77.45 96.25 143.25 190.25 237.25 284.25 82 48 21.95 31.80 51.50 81.05 100.75 150.00 199.25 248.50 297.75 82 49 23.25 33.75 54.75 86.25 107.25 159.75 212.25 264.75 317.25 83 50 24.35 35.40 57.50 90.65 112.75 168.00 83 51 25.45 37.05 60.25 95.05 118.25 176.25 83 52 27.05 39.45 64.25 101.45 126.25 188.25 84 53 28.45 41.55 67.75 107.05 133.25 198.75 85 54 29.75 43.50 71.00 112.25 139.75 208.50 85 55 31.15 45.60 74.50 117.85 146.75 219.00 85 56 32.75 48.00 78.50 124.25 154.75 231.00 85 57 34.35 50.40 82.50 130.65 162.75 243.00 86 58 36.05 52.95 86.75 137.45 171.25 255.75 86 59 37.75 55.50 91.00 144.25 179.75 268.50 86 60 39.55 58.20 95.50 151.45 188.75 282.00 86 61 41.85 61.65 101.25 160.65 200.25 299.25 86 62 44.05 64.95 106.75 169.45 211.25 315.75 87 63 46.25 68.25 112.25 178.25 222.25 332.25 87 64 48.45 71.55 117.75 187.05 233.25 348.75 87 65 50.85 75.15 123.75 196.65 245.25 366.75 87 66 53.45 88 67 56.25 88 68 59.15 88 69 62.25 88 70 65.55 89

PureLife-plus StandardRiskTablePremiums Tobacco ExpressIssue

Form:21M013-ICCEXP-A-M-1LO 27

Full-Time Employees

Term Lifeand AD&DInsurance

Safeguard the most important people in your life.

Think about what your loved ones may face after you’re gone. Term life insurance can help them in so many ways, like covering everyday expenses, paying off debt, and protecting savings. AD&D provides even more coverage if you die or suffer a covered loss in an accident.

AT A GLANCE:

• A cash benefit of $30,000toyourlovedonesintheeventofyourdeath,plusa matching cash benefit if you die in anaccident

• Acash benefit to you if you suffer a covered loss in an accident, suchas losing a limb or your eyesight

• Accident Plus -If you suffer an AD&D loss in an accident, you may also receive benefits for the following on top of your core AD&D benefits: coma, plegia, education, childcare, spouse training, and more.

• LifeKeys® services, which provide access to counseling, financial, and legalsupport

• TravelConnect® services, which give you and your family access to emergency medical assistance when you're on a trip 100+ miles from home

You also have the option to increase your cash benefit by securing additional coverage at affordable group rates. See the enclosed life insurance information for details.

ADDITIONAL DETAILS

Conversion: You can convert your group term life coverage to an individual life insurance policy without providing evidence of insurability if you lose coverage due to leaving your job or for another reason outlined in the plan contract. AD&D benefits cannot be conve rted.

Continuation of Coverage: You may be able to continue your coverage if you leave your job for any reason other than sickness, injury, or retirement.

Benefit Reduction: Coverage amounts begin to reduce at age 65 and benefits terminate at retirement. See the plan certificate for details.

For complete benefit descriptions, limitations, and exclusions, refer to the certificate of coverage. This is not intended as a complete description of the insurance coverage offered. Controlling provisions are provid ed in the policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A certificate of coverage will be made available to you that describes the benefits in greater detail. Refer to your certificate for your maximum benefit amounts. Should there be a difference between this summary and the contract, the contract will govern.

LifeKeys®servicesareprovidedbyComPsych®Corporation,Chicago,IL.ComPsych®,EstateGuidance®andGuidanceResources®are registered trademarks of ComPsych® Corporation. TravelConnect® services are provided by On Call International, Salem, NH. ComPsych® and On Call Internationalare not Lincoln Financial Group® companies. Coverage is subject to actual contract language. Each independent company is solely responsible for its own obligations.

Insurance products (policy series GL1101) are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), which does not solicit business in New York, noris it licensed to do so. Product availability and/or features may vary by state. Limitations and exclusions apply. Lincoln Financial Group is

BenefitsOverview | The Lincoln National Life Insurance Company GP-ERPD-FLI001-TX- ©2022 Lincoln National Corporation - LCN-1821793-0517-Q1.0

Mason Independent School Districtprovides this valuable benefitat no cost to you.

28

Voluntary TermLife Insurance

The Lincoln Term Life Insurance Plan:

• Provides a cash benefit to your loved ones in the event of your death

• Features group rates for Mason ISDemployees

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support services

• Also includes TravelConnect® services, which give you and your family access to emergency medicalassistance when you’re on a trip 100+ miles from home

Full-Time Employeesof Mason Independent School District

Benefits At-A-Glance

Employee

Guaranteed coverage amount during initial offering or approved special enrollment period

Choice of $10,000 or $20,000

Newly hired employeeguaranteed coverage amount $200,000

Continuing employeeguaranteed coverage annual increase amount

Maximum coverage amount

Choice of $10,000 or $20,000

7times your annual salary ($500,000 maximumin increments of $10,000)

Minimum coverage amount $10,000

Spouse

Guaranteed coverage amount during initial offering or approved special enrollment period

Choice of $10,000 or $20,000

Newly hired employeeguaranteed coverage amount $50,000

Continuing employeeguaranteed coverage annual increase amount

Maximum coverage amount

Choice of $10,000 or $20,000

100%of the employee coverage amount ($100,000maximumin increments of $10,000)

Minimum coverage amount $10,000

Dependent Children

6 months to age 26guaranteed

The Lincoln National Life Insurance Company

$10,000 14 days to 6 months Day 1 to 14 days $2,000 $1,000 29

coverage amount

What your benefits cover

Employee Coverage

Guaranteed Life Insurance Coverage Amount

• Initial Offering or Approval Special Enrollment: You can choose a coverage amount up to $20,000 without providing evidence of insurability.

Annual Limited Enrollment: If you are a continuing employ ee, you can increase your coverage amount by $10,000 or $20,000 without providing evidence of insurability . If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

Newly hired guarantee issue amount: When you are first offered this coverage, you can choose a coverage amount up to $200,000 without providing evidence of insurability.

If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

You can increase this amount by up to $20,000 during the next limited open enrollment period.

Maximum Life Insurance Coverage Amount

• You can choose a coverage amount up to 7 times your annual salary ($500,000 maximum) with evidence of insurability. See the Evidence of Insurability page for details.

• Your coverage amount will reduce by 35% when you reach age 65 and an additional 15% of the original amount when you reach age 70.

Spouse Coverage - You can secure term life insurance for your spouse if you select coverage for yourself.

Guaranteed Life Insurance Coverage Amount

• Initial Offering or Approval Special Enrollment: You can choose a coverage amount up to $20,000 without providing evidence of insurability.

Annual Limited Enrollment: If you are a continuing employee, you can increase the coverage amount for your spouse by $10,000 or $20,000 without providing evidence of insurability. If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

Newly hired guarantee issue amount: When you are first offered this coverage, you can choose a coverage amount up to $50,000 without providing evidence of insurability.

If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

You can increase this amount by up to $20,000 during the next limited open enrollment period.

Maximum Life Insurance Coverage Amount

You can choose a coverage amount up to 100% of your coverage amount ($100,000 maximum) for your spouse with evidence of insurability.

Dependent Children Coverage - You can secure term life insurance for your dependent children when you choose coverage for yourself.

Guaranteed Life Insurance Coverage Options: $10,000.

Voluntary Life Insurance Benefits At-A-Glance LFE-ENRO-BRC001-TX

30

Additional Plan Benefits

Benefit Exclusions

Like any insurance, this term life insurance policy does have exclusions. A suicide exclusion may apply. A complete list of benefit exclusions is included in the policy. State variations apply.

This is not intended as a complete description of the insurance coverage offered. Controlling provisions are provided in the policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A certificate of coverage will be made available to you that describes the benefits in greater detail. Refer to your certificate for your maximum benefit amounts. Should there be a difference between this summary and the contract, the contract will govern.

LifeKeys® services are provided by ComPsych® Corporation, Chicago, IL. TravelConnect® travel assistance services are provided by On Call International, Salem NH. On Call International must coordinate and provide all arrangements in order for eligible services to be covered. ComPsych® and On Call International are not Lincoln Financial Group companies and Lincoln Financial Group does not administerthese Services. Each independent company is solely responsible for its own obligations. Coverage is subject to contract language that contains specific terms, conditions, and limitations.

Insurance products (policy series GL1101) are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), whichdoes not solicit business in New York, nor is it licensed to do so. Product availability and/or features may vary by state. Limitations and exclusions apply.

©2019 LincolnNationalCorporation LCN-2016746-020518 R 1.0 –Group ID: WTXMASOISD Voluntary Life InsuranceBenefitsAt-A-Glance LFE-ENRO-BRC001-TX

Accelerated Death Benefit Included Premium Waiver Included Conversion Included Portability Included

31

Voluntary AD&D Insurance

The Lincoln AD&D Insurance Plan:

• Provides a cash benefit to your loved ones if you die in an accident

• Provides a cash benefit to you if you suffer a covered loss in an accident

• Features group rates for Mason ISDemployees

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support

• Also includes TravelConnectSM services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

Full-Time Employeesof Mason Independent School District

Benefits At-A-Glance

Employee

Maximum coverage amount

10 times your annual salary ($500,000 maximum) in $ 10,000increments

Minimum coverage amount $10,000

Your employeeAD&D coverage amount will reduce by 35% when you reach age 65,and an additional 15% of the original amount when you reach age 70 . Benefits end when you retire.

Spouse

Maximum coverage amount 50%of the employee coverage amount ($250,000maximum)in $5,000 increments

Minimum coverage amount $5,000

You can secure AD&D insurance for your spouseif you select coverage for yourself.

Benefits end when you retire

Dependent Children

6 months to age 26 Maximum coverage amount $25,000

Minimum coverage amount $25,000

Day 1 to 14 days Maximum coverage amount

Day 14 to age 6 months

$1,000 $2,000

You can secure AD&D insurance for your dependent children when you choose coverage for yourself.

The Lincoln National Life Insurance Company

32

Note: See the policy for details and specific requirements for each of these benefits

Benefit Exclusions

Like any insurance, this AD&D insurance policy does have exclusions. Benefits will not be paid if death results from suicide, or death/dismemberment occurs while:

Intentionally inflicting or attempting to inflict injury to one’s self

Participating in a war, act of war, or riot

Serving on full-time active duty in the armed forces of any state or country (this does not include duty of 30 days or less training in the Reserves or National Guard)

Flying on any non-commercial airplane or aircraft, such as a hot air balloon or glider (see the contract for details and exceptions)

Flying on a commercial airline or aircraft as a pilot or crewmember

Committing or attempting to commit a felony

Deliberately inhaling gas (such as carbon monoxide) or using drugs other than those taken as prescribed by a licensed physician

Driving while intoxicated, impaired, or under the influence of drugs

In addition, this AD&D insurance policy does not cover sickness or disease, including the medical and surgical treatment of a disease.

A complete list of benefit exclusions is included in the policy. State variations apply.

This is not intended as a complete description of the insurance coverage offered. Controlling provisions are provided in the policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A certificate of coverage will be made available to you that describes the benefits in greater detail. Refer to your certificate for your maximum benefit amounts. Should there be a difference between this summary and the contract, the contract will govern.

LifeKeys® services are provided by ComPsych® Corporation, Chicago, IL. TravelConnect® travel assistance services are provided by On Call International, Salem NH. On Call International must coordinate an d provideall arrangements in order for eligible services to be covered. ComPsych® and On Call International are not Lincoln Financial Group companies and Lincoln Financial Group does not administerthese Services. Each independent company is solely responsible for its own obligations. Coverage is subject to contract language that contains specific terms, conditions, and limitations.

Insurance products (policy series GL1101) are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), which does not solicit business in New York, nor is it licensed to do so. Product availability and/or features may vary by state. Limitations and exclusions apply.

©2020 LincolnNationalCorporation -LCN-2016756-020518-07–R1.0 –Group ID: WTXMASOISD

LFE-ADD-BRC001-TX Additional

Safe Driver Benefit Included Education Benefit Included Spouse Training Benefit Included Felonious Assault Included Child Care Benefit Included Coma Benefit Included Common Disaster Benefit Included Exposure Benefit Included Disappearance Benefit Included Common Carrier Benefit Included

Plan Benefits

Voluntary AD&D Insurance At-A-Glance 33

Voluntary Accidental Death & DismembermentInsurance

Here’s how little you pay with grouprates.

MonthlyPremium Calculation for You

The estimated monthlypremium for AD&D insurance is determined by multiplying the desired amount of coverage (in increments of $10,000) by the premium rate. See table at right for select coverage amounts.

$____________ X 0.0000400 = $ coverage

Note: Rates are subject to change and can vary over time.

MonthlyPremium Calculation for Your Spouse

The estimated monthlypremium for AD&D insurance is determined by multiplying the desired amount of coverage (in increments of $5,000) by the premium rate. See table at right for select coverage amounts.

$____________ X 0.0000700 = $

Note: Rates are subject to change and can vary over time.

MonthlyPremium Calculation for Your Dependent Children

The estimated monthlypremium for AD&D insurance is determined by multiplying the desired amount of coverage (in increments of $25,000) by the premium rate. See table at right for select coverage amounts.

$__________ X 0.0000700 = $

Note: Rates are subject to change and can vary over time.

Note: You must be an active Mason Independent School Districtemployeeto select coverage for a spouse and/or dependent children. To be eligible for coverage, a spouseor dependent child cannot be confined to a health care facility or unable to perform the typical activities of a healthy person of the same age and gender.

The Lincoln National Life Insurance Company

Please see prior page for product information. Voluntary AD&D

At-A-Glance

Insurance

LFE-ADD-BRC001-TX

rate monthlypremium

amount premium

Coverage Amount Monthly Premium $10,000 $0.40 $100,000 $4.00 $250,000 $10.00 $500,000 $20.00

amount premium rate monthlypremium

coverage

Coverage Amount Monthly Premium $10,000 $0.70 $50,000 $3.50 $100,000 $7.00 $250,000 $17.50

amount premium rate monthlypremium

coverage

Coverage Amount Monthly Premium $25,000 $1.75

34

MonthlyVoluntary Life Insurance Premium

Here’s how little you pay with grouprates.

Spouse|

The Lincoln National Life Insurance Company

Please see prior page for product information.

LFE-ENRO-BRC001-TX

Voluntary Life Insurance At-A-Glance

Employee|MonthlyPremiums for Select Life Insurance Coverage Amounts Employee Age Range $10,000 $30,000 $60,000 $100,000 $200,000 $500,000 0-24 $0.54 $1.62 $3.24 $5.40 $10.80 $27.00 25-29 $0.54 $1.62 $3.24 $5.40 $10.80 $27.00 30-34 $0.72 $2.16 $4.32 $7.20 $14.40 $36.00 35-39 $0.81 $2.43 $4.86 $8.10 $16.20 $40.50 40-44 $0.99 $2.97 $5.94 $9.90 $19.80 $49.50 45-49 $1.53 $4.59 $9.18 $15.30 $30.60 $76.50 50-54 $2.88 $8.64 $17.28 $28.80 $57.60 $144.00 55-59 $4.95 $14.85 $29.70 $49.50 $99.00 $247.50 60-64 $7.92 $23.76 $47.52 $79.20 $158.40 $396.00 Employee Age Range $6,500 $19,500 $39,000 $65,000 $130,000 $325,000 65-69 $7.18 $21.53 $43.06 $71.76 $143.52 $358.80 Employee Age Range $5,000 $15,000 $30,000 $50,000 $100,000 $250,000 70-74 $9.27 $27.81 $55.62 $92.70 $185.40 $463.50 Employee Age Range $5,000 $15,000 $30,000 $50,000 $100,000 $250,000 75-79 $9.27 $27.81 $55.62 $92.70 $185.40 $463.50 Employee Age Range $5,000 $15,000 $30,000 $50,000 $100,000 $250,000 80-99 $9.27 $27.81 $55.62 $92.70 $185.40 $463.50

for Select Life Insurance Coverage Amounts Employee Age Range $10,000 $50,000 $80,000 $100,000 $200,000 $250,000 0-24 $0.54 $2.70 $4.32 $5.40 $10.80 $13.50 25-29 $0.54 $2.70 $4.32 $5.40 $10.80 $13.50 30-34 $0.72 $3.60 $5.76 $7.20 $14.40 $18.00 35-39 $0.81 $4.05 $6.48 $8.10 $16.20 $20.25 40-44 $0.99 $4.95 $7.92 $9.90 $19.80 $24.75 45-49 $1.53 $7.65 $12.24 $15.30 $30.60 $38.25 50-54 $2.88 $14.40 $23.04 $28.80 $57.60 $72.00 55-59 $4.95 $24.75 $39.60 $49.50 $99.00 $123.75 60-64 $7.92 $39.60 $63.36 $79.20 $158.40 $198.00 65-69 $11.04 $55.20 $88.32 $110.40 $220.80 $276.00 35

MonthlyPremiums

Group

for Your Dependent Children

One affordable monthlypremium covers all of youreligible dependent children.

Note: You must be an active Mason Independent School Districtemployee to select coverage for a spouseand/or dependent children. To be eligible for coverage, a spouseor dependent child cannot be confined to a health care facility or unable to perform thetypical activities of a healthy person of the same age and gender.

The Lincoln National Life Insurance Company

page for product information. Voluntary Life Insurance At-A-Glance LFE-ENRO-BRC001-TX Dependent Children Monthly Premium for Life Insurance Coverage Coverage Amount Monthly Premium $10,000 $2.00

Please see prior

Rates

36

Accident Insurance

THIS IS NOT A POLICY OF WORKERS’ COMPENSATION INSURANCE. THE EMPLOYER DOES NOT BECOME A SUBSCRIBER TO THE WORKERS’ COMPENSATION SYSTEM BY PURCHASING THIS POLICY, AND IF THE EMPLOYER IS A NON-SUBSCRIBER, THE EMPLOYER LOSES THOSE BENEFITS WHICH WOULD OTHERWISE ACCRUE UNDER THE WORKERS’ COMPENSATION LAWS. THE EMPLOYER MUST COMPLY WITH THE WORKERS’ COMPENSATION LAW AS IT PERTAINS TO NON-SUBSCRIBERS AND THE REQUIRED NOTIFICATIONS THAT MUST BE FILED AND POSTED.

APSB-21402(TX)-0219

Mason ISD

Supplemental Limited Benefit Accident Expense Insurance (A-3)

37

38

SummaryofBenefit

DiagnosticTesting 1testpercalendaryear

Follow UpDiagnosticTesting 1testpercalendaryear

MedicalImaging

Surgical Anesthesia

BoneMarrowTransplant Maximumperlifetime

StemCellTransplant Maximumperlifetime

Prosthesis SurgicalImplantation/Non Surgical(notHairPiece)1devicepersite,perlifetime

HospitalConfinement

PerdayofHospitalConfinement(1 30days)

PerdayforEligibleDependentChildren(1 30days)

PerdayofHospitalConfinement(31+days)