Important Information

Medical – TRS Activecare

Dental – Ameritas Group

Vision – Ameritas Group

EAP - BDA

Disability – The Standard

Permanent Life – Texas Life

Group Life – Lincoln Financial

Accident – MetLife

Hospital Indemnity - Allstate

Cancer – Transamerica

Critical Illness – MetLife

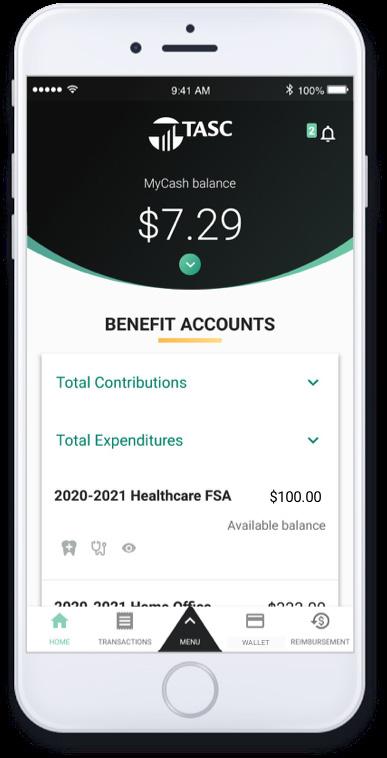

Flexible Spending Account - TASC

Health Savings Account – HSAbank

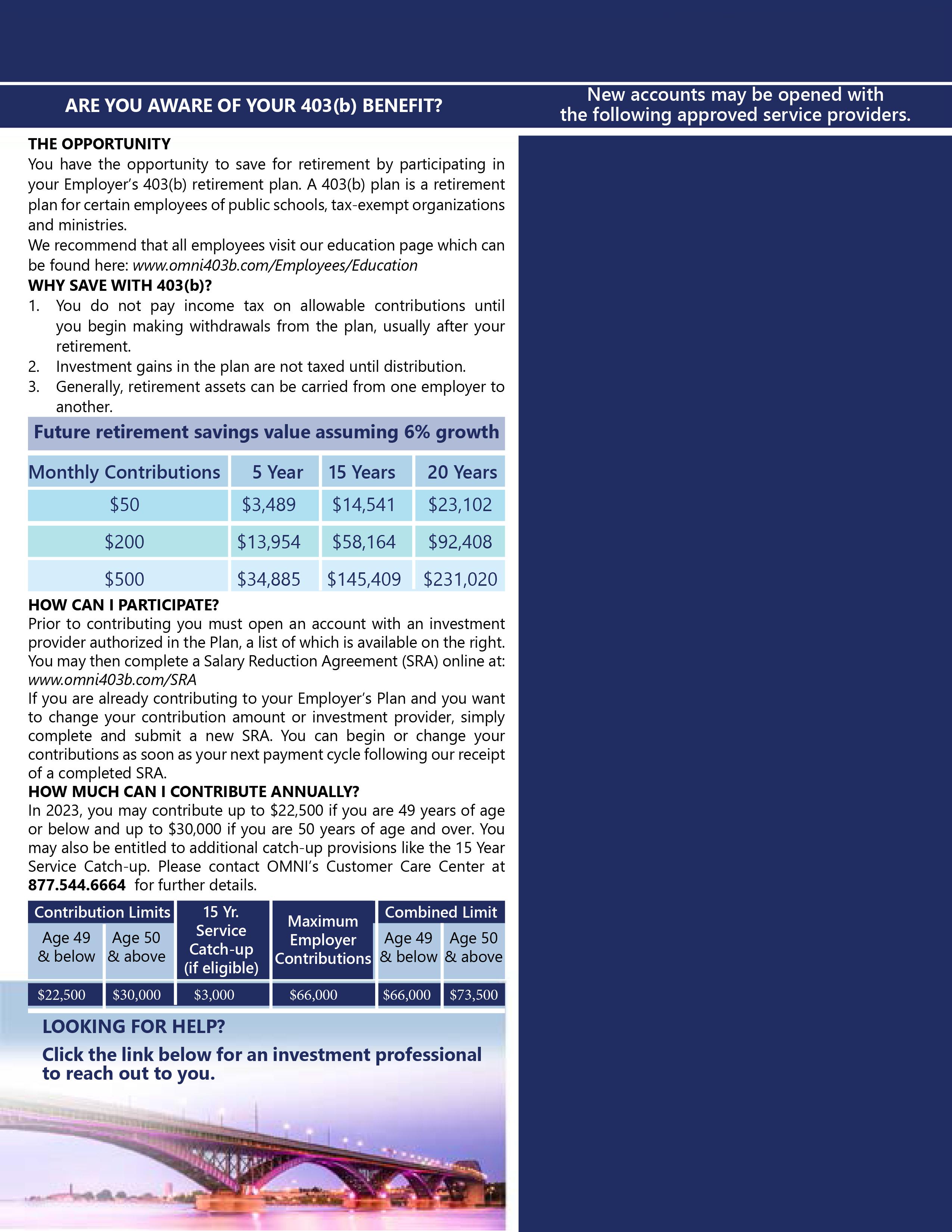

Retirement Plans – The Omni Group

The 20 3-2024 Section 125 Cafeteria Plan year begins 09/01/20 3 and ends 08/31/2024. All benefits elected during the annual open enrollment will be effective 09/01/20 3.

Medical ( , Scott & White) - Health Insurance is provided by TRS ActiveCare. Please visit www. trsactive .com for questions related to health insurance or prescription benefits.

Hospital Indemnity (Allstate) – Benefits are paid directly to the insured to help with out of pocket expenses related to a hospital confinement. Maternity benefits are included.

TeleMedicine – TelaDoc, Access to physicians for non-emergency treatment/prescriptions is currently available with TRS Aetna Health Plans only. For questions please contact Teladoc directly at 1-855TELADOC (835-2362).

Dental (Ameritas) – Coverage for preventive, basic, major, and ortho services. The plan does not contain waiting periods. Remember that annual maximums reset on September 1st and that you will not receive a card. Temporary cards are available for print on the MFISD benefits website.

Vision ( ) – Plans includes coverage for eye exams, materials (such as frames and lenses), and discounts for laser vision correction. The plan has a defined network of providers. Out of network benefits are available on a reimbursement basis only. For more information, including a list of providers visit

Disability (The Standard) – Long term income protection that is designed to provide up to 70% of your gross income.

Permanent Life (Texas Life) – Portable, permanent life insurance available for employees, their spouses and dependents. Employees can keep the coverage upon termination or retirement from MFISD.

Group Life (Lincoln) – Group term life insurance that ends when you terminate employment with MFISD. Coverage is also available for spouses and dependent children.

Critical Illness (MetLife) – Critical Illness pays a lump sum benefit if the insured is diagnosed with a covered critical illness.

Cancer (Transamerica) – Pays benefits for internal cancer diagnosis. Includes an annual cancer screening benefit.

Accident (Allstate) – Pays benefits for off the job accidents and related treatments. Includes a physical/wellness exam reimbursement.

Flexible Spending (TASC) –Make sure to spend/claim the money in your current reimbursement account by August 31, 20 3. Visit www .tasconline.com to check account balances or request information

OMNI Retirement Plans – MFISD offers tax advantaged retirement plans designed to help supplement your TRS retirement benefits. Visit www.omni403b.com for more information.

Site Access To access your employer online enrollment site, , you can ebsite

mployee ame Robert Smith, SS# 123-45-6789

Default Password

User Name: smith 6789

Password password once you enter the site.

To include dependents on any of your coverages through MFISD you must provide the dependents name, date of birth, and social security number.

Choose your benefits carefully. Several of the employee benefits plan contributions are made on a pre-tax basis and per IRS regulations, contribution amounts cannot be changed unless you experience a qualified life event. Qualifying life events include:

Marriage, divorce, legal separation;

Death of spouse or dependent;

Birth or adoption of a child;

Changes in employment for spouse or dependents;

Significant cost or coverage changes;

You must submit your benefit change requests and include required documentation within 30 days of the event. Also note that per the IRS, only changes consistent with the life event are allowed.

New employees must enroll within 30 days of their hire date. If employees fail to enroll within the 30 days, all benefits will be waived.

Except for health insurance, plans will be effective on th e first of the month following the date of hire. Health Insurance can be effective the date of hire or the first of the month following date of hire. Please be aware that if you choose date of hire as effective date for health insurance, you will be charged for the entire month.

Please carefully review your paycheck(s) to ensure all deductions are correct. If you find a discrepancy in your paycheck, please contact U.S. Employee Benefits immediately at (888) 836-5100. Discrepancies must be communicated within 30 days from the effective date of the policy.

For contact information, claim forms, benefits guides and more please visit

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay its portion.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary by the type of service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; i.e. you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

New Rx Benefits!

• Express Scripts is your new pharmacy benefits manager! CVS pharmacies and most of your preferred pharmacies and medication are still included.

•Certain specialty drugs are still $0 through SaveOnSP

• Individual maximum-out-of-pocket decreased by $650. Previous amount was $8,150 and is now $7,500.

• Family maximum-out-of-pocket decreased by $1,300. Previous amount was $16,300 and is now $15,000.

• Teladoc virtual mental health visit copay decreased from $70 to $0.

• Individual maximum-out-of-pocket increased by $450 to match IRS guidelines. Previous amount was $7,050 and is now $7,500.

• Family maximum-out-of-pocket increased by $900 to match IRS guidelines. Previous amount was $14,100 and is now $15,000. These changes apply only to in-network amounts.

• Family deductible decreased by $1,200. Previous amount was $3,600 and is now $2,400.

• Primary care provider and mental health copays decreased from $30 to $15.

• Teladoc virtual mental health visit copay decreased from $70 to $0.

• No changes.

• This plan is still closed to new enrollees.

*Pre-certification for genetic and specialty testing may apply. Contact a PHG at

questions.

TRS contracts with HMOs in certain regions to bring participants in those areas additional options. HMOs set their own rates and premiums. They’re fully insured products who pay their own claims.

You can choose this plan if you live in one of these counties: Austin, Bastrop, Bell, Blanco, Bosque, Brazos, Burleson, Burnet, Caldwell, Collin, Coryell, Dallas, Denton, Ellis, Erath, Falls, Freestone, Grimes, Hamilton, Hays, Hill, Hood, Houston, Johnson, Lampasas, Lee, Leon, Limestone, Madison, McLennan, Milam, Mills, Navarro, Robertson, Rockwall, Somervell, Tarrant, Travis, Walker, Waller, Washington, Williamson

You can choose this plan if you live in one of these counties: Cameron, Hildalgo, Starr, Willacy

You can choose this plan if you live in one of these counties: Andrews, Armstrong, Bailey, Borden, Brewster, Briscoe, Callahan, Carson, Castro, Childress, Cochran, Coke, Coleman, Collingsworth, Comanche, Concho, Cottle, Crane, Crockett, Crosby, Dallam, Dawson, Deaf Smith, Dickens, Donley, Eastland, Ector, Fisher, Floyd, Gaines, Garza, Glasscock, Gray, Hale, Hall, Hansford, Hartley, Haskell, Hemphill, Hockley, Howard, Hutchinson, Irion, Jones, Kent, Kimble, King, Knox, Lamb, Lipscomb, Llano, Loving, Lubbock, Lynn, Martin, Mason, McCulloch, Menard, Midland, Mitchell, Moore, Motley, Nolan, Ochiltree, Oldham, Parmer, Pecos, Potter, Randall, Reagan, Reeves, Roberts, Runnels, San Saba, Schleicher, Scurry, Shackelford, Sherman, Stephens, Sterling, Stonewall, Sutton, Swisher, Taylor, Terry, Throckmorton, Tom Green, Upton, Ward, Wheeler, Winkler, Yoakum

*Deductible applies to a complete pair of glasses or to frames, whichever is selected.

**The Costco and Walmart allowance will be the wholesale equivalent.

Contact Lenses Elective Allowance can be applied to disposables, but the dollar amount must be used all at once (provider will order 3 or 6 month supply). Applies when contacts are chosen in lieu of glasses. For plans without a separate contact fitting & evaluation (which includes follow up contact lens exams), the cost of the fitting and evaluation is deducted from the allowance.

Additional Glasses 20% off additional complete pairs of prescription glasses and/or prescription sunglasses.*

Frame Discount

VSP offers 20% off any amount above the retail allowance.*

Laser VisionCare VSP offers an average discount of 15% off or 5% off a promotional offer for LA SIK Custom LASIK and PRK. The maximum out-of-pocket per eye for members is $1,800 for LASIK and $2,300 for custom LASIK using Wavefront technology, and $1,500 for PRK. In order to receive the benefit, a VSP provider must coordinate the procedure.

Low Vision

With prior authorization, 75% of approved amount (up to $1,000 is covered every two years).

Based on applicable laws, reduced costs may vary by doctor location.

*Deductible applies to a complete pair of glasses or to frames, whichever is selected.

**The Costco and Walmart allowance will be the wholesale equivalent.

Allowance can be applied to disposables, but the dollar amount must be used all at once (provider will order 3 or 6 month supply). Applies when contacts are chosen in lieu of glasses. For plans without a separate contact fitting & evaluation (which includes follow up contact lens exams), the cost of the fitting and evaluation is deducted from the allowance.

Additional Glasses 20% off additional complete pairs of prescription glasses and/or prescription sunglasses.*

Frame Discount VSP offers 20% off any amount above the retail allowance.*

Laser VisionCare

VSP offers an average discount of 15% off or 5% off a promotional offer for LASIK Custom LASIK and PRK. The maximum out-of-pocket per eye for members is $1,800 for LASIK and $2,300 for custom LASIK using Wavefront technology, and $1,500 for PRK. In order to receive the benefit, a VSP provider must coordinate the procedure.

Low Vision

With prior authorization, 75% of approved amount (up to $1,000 i s covered every two years).

Based on applicable laws, reduced costs may vary by doctor location.

Rely on the support, guidance and resources of your Employee Assistance Program.

There are times in life when you might need a little help coping or figuring out what to do. Take advantage of the Employee Assistance Program1 (EAP) which includes WorkLife Services and is available to you and your family in connection with your group insurance from Standard Insurance Company (The Standard). It’s confidential — information will be released only with your permission or as required by law.

You, your dependents (including children to age 26)2 and all household members can contact master’s-degreed clinicians 24/7 by phone, online, live chat, email and text. There’s even a mobile EAP app. Receive referrals to support groups, a network counselor, community resources or your health plan. If necessary, you’ll be connected to emergency services.

Your program includes up to three face-to-face assessment and counseling sessions per issue. EAP services can help with:

Depression, grief, loss and emotional well-being

Family, marital and other relationship issues

Life improvement and goal-setting

Addictions such as alcohol and drug abuse

Stress or anxiety with work or family

Financial and legal concerns

Identity theft and fraud resolution

Online will preparation

WorkLife Services

WorkLife Services are included with the Employee Assistance Program. Get help with referrals for important needs like education, adoption, travel, daily living and care for your pet, child or elderly loved one.

Online Resources

Visit workhealthlife.com/Standard3 to explore a wealth of information online, including videos, guides, articles, webinars, resources, self-assessments and calculators.

1 The EAP service is provided through an arrangement with Morneau Shepell, which is not affiliated with The Standard. Morneau Shepell is solely responsible for providing and administering the included service. EAP is not an insurance product and is provided to groups of 10–2,499 lives. This service is only available while insured under The Standard’s group policy.

2 Individual EAP counseling sessions area available to eligible participants 16 years and older; family sessions are available for eligible members 12 years and older, and their parent or guardian. Children under the age of 12 will not receive individual counseling sessions. The Standard is a marketing name for StanCorp Financial Group, Inc. and subsidiaries. Insurance products are offered by Standard Insurance Company of Portland, Oregon in all states except New York. Product features and availability vary by state and are solely the responsibility of Standard Insurance Company.

SI 17201 (7/17) EE

888.293.6948

NOTE: It’s a violation of your company’s contract to share this information with individuals who are not eligible for this service.

With EAP, assistance is immediate, personal and available when you need it.

Standard Insurance Company has developed this document to provide you with information about the optional insurance coverage you may select through the Marble FallsIndependent School District. Written in non-technical language, this is not intended as a complete description of the coverage. If you have additional questions, please check with your human resources representative.

A minimum number of eligible employees must apply and qualify for the proposed plan before Voluntary LTD coverage can become effective. This level of participation has been agreed upon by the Marble FallsIndependent School District and TheStandard.

To become insured, you must be:

A regular employee ofthe Marble FallsIndependent School District,excluding temporary or seasonal employees, full-time members of the armed forces, leased employees or independent contractors

Actively at work at least 20hours each week

A citizen or resident of the United States or Canada

Please contact your human resources representative for more information regarding the following requirements that must be satisfied for your insurance to become effective. You must satisfy:

Eligibility requirements

An eligibility waiting period(check with your human resources representative)

An evidence of insurability requirement, if applicable

An active work requirement. This means that if you are not actively at work on the day before the scheduled effective date of insurance, your insurance will not become effective until the day after you complete one full day of active work as an eligible employee.

You may select a monthly benefit amount in $100 increments from $200 to $7,500; based on the tables and guidelines presented in the Rates section of these Coverage Highlights. The monthly benefitamount must not exceed 70percent of your monthly earnings.

Benefits are payable for non-occupational disabilities only. Occupational disabilities are not covered.

Plan Maximum Monthly Benefit: 70percent of predisability earnings

Plan Minimum Monthly Benefit: 25 percent of your LTD benefit beforereduction by deductible income

The benefit waiting period is the period of time that you must be continuously disabled before benefits become payable. Benefits are not payable during the benefit waiting period. The maximum benefit period is the period for which benefits are payable. The benefit waiting periodand maximum benefit period associated with your plan options are shown below:

1 0 days 3 days To Age 65 for Accident and 3 Years for Sickness

2 14 days 14 days

3 30 days 30 days

4 60days 60 days

5 90 days 90 days

6 180 days 180 days

Options1-6: Maximum Benefit Period of 3 years for Sickness

If you become disabledbefore age 64, LTD benefits may continue during disability for 3 years. If you become disabled at age 64or older, the benefit duration is determined by your age when disability begins:

AgeMaximum Benefit Period

642 years 6 months

652 years

661 year 9 months

671 year 6 months

681 year 3 months

69+1 year

Options1-6: Maximum Benefit Period To Age 65 for Accident

If you become disabled before age 62, LTD benefits may continue during disability until you reach age 65. If you become disabled at age 62 or older, the benefit duration is determined by your age when disability begins:

AgeMaximum Benefit Period

623 years 6 months

633 years

642 years 6 months

652 years

661 year 9 months

671 year 6 months

681 year 3 months

69+1 year

With this benefit, if an insured employee is hospital confined for at least four hours, is admitted as an inpatient and ischarged room and board during the benefit waiting period, the benefit waiting period will be satisfied. Benefits become payable on the date of hospitalization; the maximum benefit period also begins on that date. This feature is included only on LTD plans with benefit waiting periods of 30 days or less.

Adetaileddescription of the preexisting condition exclusion is included in the Group Policy. If you have questions, please check with your human resources representative.

Preexisting Condition Period: The 90-day period just before your insurance becomes effective Exclusion Period: 12months

The Standard may pay benefits for up to 90 days even if you have a preexisting condition. After 90 days, The Standard will continue benefits only if the preexisting condition exclusion does not apply.

For the plan’s definition of disability, as described in your brochure, the own occupation period is the first 24months forwhich LTD benefits are paid.

The any occupation period begins at the end of the own occupation period and continues until the end of the maximum benefit period.

Employee Assistance Program (EAP) – This program offers support, guidance and resources that can help an employee resolve personal issues and meet life’s challenges.

Family Care Expense Adjustment – Disabled employees faced with the added expense of family care when returning to work may receive combined income from LTD benefits and work earnings in excess of 100 percent of indexed predisability earnings during the first 12 months immediately after a disabled employee’s return to work.

Special Dismemberment Provision – If an employee suffers a lost as a result of an accident, the employee will be considered disabled for the applicable Minimum Benefit Period and can extend beyond the end of the Maximum Benefit Period

Reasonable Accommodation Expense Benefit –Subject to The Standard’s prior approval, this bene fit allows us to pay up to $25,000 of an employer’s expenses toward work-site modifications that result in a disabled employee’s return to work.

Survivor Benefit –A Survivor Benefit may also be payable. This benefit can help to address a family’s financial need in the event of the employee’s death.

Return to Work (RTW) Incentive –The Standard’s RTW Incentive is one of the most comprehensive in the employee benefits history. For the first 12 months after returning to work, the employee’s LTD benefit will n ot be reduced by work earnings until work earnings plus the LTD benefit exceed 100 percent of predisability earnings. After that period, only 50 percent of work earnings are deducted.

Rehabilitation Plan Provision –Subject to The Standard’s prior approval, rehabilitation incentives may include training and education expense, family (child and elder) care expenses, and job-related and job search expenses.

LTD benefits end automatically on the earliest of:

The date you are no longer disabled

The date your maximum benefit period ends

The date you die

The date benefits become payable under any other LTD plan under which you become insured through employment during a period of temporary recovery

The date you fail to provide proof of continued disability and entitlement to benefits

Employees can select a monthly LTD benefitranging from a minimum of $200to a maximum amount based on how much they earn. Referencing the appropriateattached charts, follow these steps to find the monthly costfor your desired level of monthly LTD benefit and benefit waiting period:

1.Find the maximum LTD benefit by locating the amount of your earnings in either the Annual Earnings or Monthly Earnings column. The LTD benefit amount shown associated with these earnings is the maximum amount you can receive. If your earnings fall between two amounts, you must select the lower amount.

2.Select the desired monthly LTD benefitbetween the minimum of $200and the determined maximum amount, making sure not to exceed the maximum for your earnings.

3.In the same row, select the desired benefit waiting period to see the monthly cost for that selection.

If you have questions regarding how to determine your monthly LTD benefit, the benefit waiting period, or the premium payment ofyour desired benefit, please contact your human resources representative.

If you become insured, you will receive a group insurance certificate containing a detailed description of the insurance coverage. The information presented above is controlled by the group policy and does not modify it in any way. The controlling provisions are in the group policy issued by Standard Insurance Company.

Sponsored by: Marble Falls Independent School District

Coverage Life $10,000

Guarantee Issue $10,000

AD&D Will Equal the Life Benefit

Benefit Reduction Employee

Benefits will reduce: 50% at age 70

Additional Benefits

See Understanding Your Accelerated Death Benefit

Benefits Page: Seat Belt, Airbag, and Common Carrier Conversion

Enrolling for Coverage

Eligibility: All employees in an eligible class.

(Please see other side)

Accelerated Death Benefit

Accelerated Death Benefit provides an option to be paid a portion of your life insurance benefit when diagnosed as terminally ill (as defined in the policy). The death benefit will be reduced by the amount withdrawn. To qualify, you must be covered under this policy for the amount of time defined by the policy.

AD&D

Conversion

Accidental Death and Dismemberment (AD&D) insurance provides specified benefits for a covered accidental bodily injury that directly causes death or dismemberment (e.g., the loss of a hand, foot, or eye), subject to policy limitations.

If you terminate your employment or become ineligible for this coverage, you have the option to convert all or part of the amount of coverage in force to an individual life policy on the date of termination without Evidence of Insurability. Conversion election normally must be made within 31 days of your date of termination.

Guarantee Issue

For timely entrants enrolled within 31 days of becoming eligible, the Guarantee Issue amount is available without providing Evidence of Insurability. Evidence of Insurability will be required for any amounts above this, for late enrollees or increases in insurance, and it will be provided at your own expense.

Seat Belt, Airbag, & Common Carrier

If you die as a result of a covered auto accident while wearing a seat belt or in a vehicle equipped with an airbag, additional benefits are payable up to $10,000 or 10% of the principal sum, whichever is less. If loss occurs due to an accident while riding as a passenger in a common carrier, benefits will be double the amount that would otherwise apply as outlined in the certificate.

Term Life

A death benefit is paid to the designated beneficiary upon the death of the insured. Coverage is provided for the time period that you are eligible and premium is paid. There is no cash value associated with this product.

LifeKeysSM Online will & testament preparation service, identity theft resources and beneficiary assistance support for all employees and eligible dependents covered under the Group Term Life and/or AD&D policy.

TravelConnectSM

Travel assistance services for employees and eligible dependents traveling more than 100 miles from home.

For assistance or additional information Contact Lincoln Financial Group at (800)423-2765; reference ID: MARBLEFALL www.LincolnFinancial.com

Sponsored by: Marble Falls Independent School District

Life Benefit Employee Spouse Dependent

Employee must elect coverage for Spouse or dependents to be eligible.

Amount Choice of $10,000 increments

Choice of $5,000 increments

Age 14 Days to 6 months: $250

6 months to age 26 (if unmarried regardless of student status): $10,000

Newborn children to age 14 days are not eligible for a benefit Minimum Amount $10,000 $5,000 $10,000

Maximum Amount $500,000, limited to 5 times your annual salary $250,000, limited to 50% of employee amount $10,000

Guarantee Issue for Newly Eligible Employees

$100,000 $10,000

AD&D Benefit Employee Spouse

Amount Benefit amount equal to the life amount elected by you.

Same as employee

Benefit Reduction Employee Spouse

Benefits will reduce: 50% at age 70; Benefits terminate at retirement

Benefits terminate at employee’s attainment of age 70

Eligibility Employee Spouse and Dependents

All employees in an eligible class. Cannot be in a period of limited activity on the day coverage takes effect.

Additional Benefits

See Definition: Accelerated Death Benefit

See Definition: Portability

See Definition: Conversion

See Definition: Seat Belt, Airbag, and Common Carrier

Accelerated Death Benefit

Accelerated Death Benefit provides an option to withdraw a percentage of your life insurance coverage when diagnosed as terminally ill (as defined in the policy). The death benefit will be reduced by the amount withdrawn. To qualify, you have satisfied the Active Work rule and have been covered under this policy for the required amount of time as defined by the policy. Check with your tax advisor or attorney before exercising this option.

AD&D Accidental Death and Dismemberment (AD&D) insurance provides specified benefits for a covered accidental bodily injury that directly causes dismemberment (e.g., the loss of a hand, foot, or eye). In the event that death occurs from a covered accident, both the life and the AD&D benefit would be payable. This insurance is optional and can be purchased by you and your Spouse .

Conversion

If you terminate your employment or become ineligible for this coverage, you have the option to convert all or part of the amount of coverage in force to an individual life policy on the date of termination without Evidence of Insurability. Conversion election must be made within 31 days of your date of termination.

Guarantee Issue

For timely entrants enrolled within 31 days of becoming eligible, the Guarantee Issue amount is available without any Evidence of Insurability requirement. Evidence of Insurability will be required for any amounts above this, for late enrollees or increase in insurance, and it will be provided at your own expense.

Limited Activity

Portability

A period when a Spouse or dependent is confined in a health care facility; or, whether confined or not, is unable to perform the regular and usual activities of a healthy person of the same age and sex.

If coverage has been in force for at least 12 months, you may continue coverage for a specified period of time after your employment by paying the required premium. Portability is available if you cease employment for a reason other than total disability or retirement at Social Security Normal Retirement Age. A written application must be made within 31 days of your termination.

Seat Belt, Airbag, and Common Carrier

If you die as a result of a covered auto accident while wearing a seat belt or in a vehicle equipped with an airbag, additional benefits are payable up to $10,000 or 10% of the principal sum, whichever is less. If loss occurs for you due to an accident while riding as a passenger in a common carrier, benefits will be double the amount that would otherwise apply as outlined in the certificate.

Term Life Benefit provided to the designated beneficiary upon the death of the insured. The benefit is provided for the time period that you are eligible and premium is paid. There is no cash value associated with this product.

Exclusion: Suicide Benefits will not be paid if the death results from suicide within 2 years after coverage is effective. May apply if employee contributes toward the premium.

Additional Benefits

LifeKeysSM Online will & testament preparation service, identity theft resources and beneficiary assistance support for all employees and eligible dependents covered under the Group Term Life and/or AD&D policy.

TravelConnectSM Travel assistance services for employees and eligible dependents traveling more than 100 miles from home.

For assistance or additional information Contact Lincoln Financial Group at (800)423-2765; reference ID: MARBLEFALL www.LincolnFinancial.com

Monthly Employee Premium

Life and Accidental Death and Dismemberment Premium for sample benefit amounts

Employee and Spouse premiums are calculated separately. Refer to Program Specifications for your maximum benefit amounts. Benefits and premium amounts reflect age reductions.

This is an estimate of premium cost. Actual deductions may vary slightly due to rounding and payroll frequency.

Use this formula to calculate premium for benefit amounts over $100,000

Premium covers all dependent children regardless of the number of children.

Employee and Spouse premiums are calculated separately. Spouse premiums will be calculated based on the Employee Age Refer to Program Specifications for your maximum benefit amounts. Benefits and premium amounts reflect age reductions.

This is an estimate of premium cost. Actual deductions may vary slightly due to rounding and payroll frequency.

Example: Use this formula to calculate premium for benefit amounts over $50,000

Premium covers all dependent children regardless of the number of children.

Even when you live well, accidents happen. Treatment can be vital to recovery, but it can also be expensive. And if an accident keeps you away from work during recovery, the financial worries can grow quickly. Most major medical insurance plans only pay a portion of the bills. Our coverage can help pick up where other insurance leaves off and provide cash to help cover the expenses.

With accident insurance from Allstate Benefits, you can gain the advantage of financial protection, thanks to the cash benefits paid directly to you. You also gain the financial empowerment to seek the treatment needed to get well.

Key Features

• Guaranteed Issue coverage, meaning no medical questions to answer

• Coverage available for dependents

• Premiums are affordable and are conveniently payroll deducted

• Coverage may be continued, as long as premiums are paid to Allstate Benefits

See reverse for plan details

Our coverage pays you cash benefits that correspond with a variety of covered occurrences, such as: dismemberment; dislocation or fracture; hospital confinement; ambulance services; and more. The cash benefits can be used to help pay for deductibles, treatment, rent and more.

With Allstate Benefits, you can protect your finances against life’s slips and falls. Are you in Good Hands? You can be.

THIS IS NOT A POLICY OF WORKERS’ COMPENSATION INSURANCE. THE EMPLOYER DOES NOT BECOME A SUBSCRIBER TO THE WORKERS’ COMPENSATION SYSTEM BY PURCHASING THIS POLICY, AND IF THE EMPLOYER IS A NON-SUBSCRIBER, THE EMPLOYER LOSES THOSE BENEFITS WHICH WOULD OTHERWISE ACCRUE UNDER THE WORKERS’ COMPENSATION LAWS. THE EMPLOYER MUST COMPLY WITH THE WORKERS’ COMPENSATION LAW AS IT PERTAINS TO NON-SUBSCRIBERS AND THE REQUIRED NOTIFICATIONS THAT MUST BE FILED AND POSTED.

Our cash benefits provide you with greater coverage options because you get to determine how to use them.

Finances

Can help protect your HSAs, savings, retirement plans and 401ks from being depleted

Travel

You can use your cash benefits to help pay for expenses while receiving treatment in another city

Home

You can use your cash benefits to help pay the mortgage, continue rental payments, or perform needed home repairs for your after care

Expenses

The lump-sum cash benefit can be used to help pay your family’s living expenses such as bills, electricity and gas

Accidental Death

Dismemberment

Hospital Confinement

Intensive Care

Accident Physician Treatment

Emergency Room Services

Benefit Enhancements

Lacerations

Skin Graft

Paralysis

Blood and Plasma

Appliance

Physical Therapy

Ruptured Spinal Disc Surgery

Open Abdominal or Thoracic Surgery

Prosthesis

Family Member Lodging

Accident Follow-up Treatment

Computed Tomography (CT) Scan and Magnetic Resonance Imaging (MRI)

Additional Rider

Outpatient Physician’s Benefit

Access Your Benefits and Claim Filings

Common Carrier Accidental Death

Dislocation or Fracture

Daily Hospital Confinement

Ambulance

X-ray

Burns

Brain Injury Diagnosis

Coma with Respiratory Assistance

General Anesthesia

Medicine

Non-Local Transportation

Eye Surgery

Medical Supplies

RehabilitationUnit

Post-Accident Transportation

Tendon, Ligament, Rotator Cuff or Knee Cartilage Surgery

Accessing your benefit information using has never been easier. is an easy-to-use website that offers you 24/7 access to important information about your benefits. Plus, you can submit and check your claims (including claim history), request your cash benefit to be direct deposited, make changes to personal information, and more.

Allstate Benefits is the marketing name used by American Heritage Life Insurance Company, a subsidiary of The Allstate Corporation. © Allstate Insurance Company. www.allstate.com or allstatebenefits.com

For use in enrollments sitused in: TX

This material is valid as long as information remains current, but in no event later than April 5, 2020. Group Accident benefits are provided by policy form GVAP2, or state variations thereof. Outpatient Physician’s Benefit Rider provided by rider form GOPBR, or state variations thereof.

Coverage is provided by Limited Benefit Supplemental Accident Insurance. The policy is not a Medicare Supplement Policy. If eligible for Medicare, review Medicare Supplement Buyer’s Guide available from Allstate Benefits. This information highlights some features of the policy but is not the insurance contract. For complete details, contact your Allstate Benefits Agent. This is a brief overview of the benefits available under the Group Voluntary Policy underwritten by American Heritage Life Insurance Company (Home Office, Jacksonville, FL). Details of the insurance, including exclusions, restrictions and other provisions are included in the certificates issued.

The coverage does not constitute comprehensive health insurance coverage (often referred to as “major medical coverage”) and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

Protection for hospital stays when a sickness or injury occurs

Life is unpredictable. Without any warning, an illness or injury can lead to a hospital visit – and costly out-of-pocket expenses.

Expenses associated with a hospital stay can be financially difficult if money is tight and you are not prepared. But having the right coverage in place before you experience a sickness or injury can help eliminate your financial concerns and provide support at a time when it is needed most.

Allstate Benefits offers a solution to help you protect your income and empower you to seek treatment.

Key Features

• Guaranteed Issue coverage, meaning no medical questions to answer

• Coverage available for dependents

• Premiums are affordable and are conveniently payroll deducted

• Coverage may be continued, as long as premiums are paid to Allstate Benefits, as defined under the Portability provision. See reverse for plan details

Our Indemnity Medical insurance pays a cash benefit for hospital confinement. This benefit is payable directly to you and can keep you from withdrawing money from your personal bank account or your Health Savings Account (HSA) for hospital-related expenses. This is especially helpful since statistics show the average hospital stay is approximately 5 days,1 which can add up quickly. On top of that, the number of people who forgo or delay needed health care due to the high cost has nearly doubled in the past 10 years2. These facts make it increasingly important to not only protect your finances if faced with an unexpected illness, but also to empower yourself to seek the necessary treatment. With Allstate Benefits, you can feel assured that you have the protection you need if faced with a hospitalization. Are you in Good Hands? You can be.

THIS IS NOT A POLICY OF WORKERS’ COMPENSATION INSURANCE. THE EMPLOYER DOES NOT BECOME A SUBSCRIBER TO THE WORKERS’ COMPENSATION SYSTEM BY PURCHASING THIS POLICY, AND IF THE EMPLOYER IS A NON-SUBSCRIBER, THE EMPLOYER LOSES THOSE BENEFITS WHICH WOULD OTHERWISE ACCRUE UNDER THE WORKERS’ COMPENSATION LAWS. THE EMPLOYER MUST COMPLY WITH THE WORKERS’ COMPENSATION LAW AS IT PERTAINS TO NON-SUBSCRIBERS AND THE REQUIRED NOTIFICATIONS THAT MUST BE FILED AND POSTED.

*2013 Comparative Price Report, International Federation of Health Plans

1http://tinyurl.com/hek75ry. 2http://tinyurl.com/zmaodhj

HSA COMPATIBLE BENEFITS

First Day Hospital Confinement Benefit

Limit to Number of Occurrences

Pregnancy (Normal and Complications) Covered

Daily Hospital Confinement Benefit

Maximum Number of Days¹

Hospital Intensive Care Benefit

Maximum Number of Days²

$0

OPTIONAL EXCLUSIONS

Mental and Nervous Disorders Covered

Drug Addiction and Alcoholism Covered

Pregnancy Waiting Period

$0

ADDITIONAL OPTIONS

Removal of Pre-Existing Conditions Limitation

$0 $0

#N/A #N/A

#N/A #N/A

#N/A #N/A

#N/A #N/A

#N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A #N/A#N/A#N/A#N/A#N/A

¹ payable for each day, up to the max per continuous confinement in a hospital; not paid for any day the First Day Hospital Confinement Benefit is paid

² payable for each day, up to the max per continuous confinement in a hospital intensive care unit; pays in addition to the Fir st Day Hospital Confinement Benefit and Daily Hospital Confinement Benefit

This product can only be offered to Employer Groups in this state. Coverage for Associations are not yet available

Nancy watched as a co-worker battled lung cancer. Everyone rallied around him for support, but he still faced major financial strain due to missed work and high deductibles. Knowing her pack-a-day habit and family history, Nancy doesn’t worry if she’ll get cancer, but when. And when the time comes, she’s afraid medical insurance might not be enough.

While some individuals diagnosed with cancer have meaningful and adequate health insurance to pay for most of the cost of treatment, privately insured workers face the prospect of crippling out-of-pocket costs.

If you or one of your family members were to be diagnosed with cancer, would you want to face those chances? Now there’s a way you can add more benefits for you and your family.

With this supplemental benefit your employer is making available, you’ll not only have more resources to cope with any future diagnosis of cancer, but you’ll also have wellness benefits to help you detect cancer early when it’s most treatable.

Review the attached benefits and costs for the insurance policy your employer has designed for your consideration. It’sa long list of benefits, but they’re all important. As you read through the list of all the ways this supplemental insurance pays, think about how you could possibly pay for all these costs on your own. Fighting cancer can be challenging bothfinancially

emotionally, and the more resources you have, the better prepared you and your family will be.

per day; begins on day 91 of continuous confinement; in lieu of all other benefits (except surgery and anesthesia)

per day while hospital confined; one visit per 24-hour period

per day while hospital confined

per day while hospital confined; must be authorized by the attending physician; cannot be hospital staff or a family member

for service by a licensed ambulance service for transportation to a hospital; admittance required

per day; up to the number of days for the prior hospital stay; admittance must be within 14 days of hospital discharge

per day of covered confinement; in lieu of all other benefits

per day of hospice care; 100-day lifetime maximum; not payable while hospital confined

maximum benefit; actual benefit is determined by the surgery schedule in the contract; for multiple procedures in same incision only the highest benefit is paid; for multiple procedures in separate incisions will pay highest benefit and then 50% for each lesser procedure

maximum benefit; pays actual charges per device requiring implantation

maximum benefit; pays actual charges for wig to cover hair loss from cancer treatment

for reconstructive surgery within 2 years of the initial cancer removal; excludes skin cancer and malignant melanoma; benefit not payable if paid under any other provision of the policy

when surgery is prescribed; excludes skin cancer

maximum per day; pays actual charges for outpatient surgery at an ambulatory surgical center

maximum benefit per 12-month period; pays actual charges for treatment consultations and planning, adjunctive therapy, radiation management, chemotherapy administration, physical exams, checkups, and laboratory or diagnostic tests; transportation and lodging are not included as associated expenses

maximum benefit per 12-month period; pays actual charges

maximum benefit per 12-month period; pays actual charges for administration of blood, plasma and blood components, transfusions, processing and procurement, or cross-matching, treatment consultations and planning, physical exams, checkups, and laboratory or diagnostic tests; transportation and lodging are not included as associated expenses

maximum benefit per 12-month period; pays actual charges for drugs or chemical substances approved by the FDA for experimental use on humans or surgery or therapy endorsed by either the NCI or ACS for experimental studies received in the US or its territories

per calendar year for cancer screening tests:

mammogram

pap smear

flexible sigmoidoscopy

prostate-specific antigen

test

chest x-ray

hemocult stool specimen

ultrasound

CEA

CA125

biopsy

thermography

colonoscopy

serum protein

electrophoresis

bone marrow testing

blood screening

per calendar year for MRI scan used as diagnostic tool for breast cancer

round-trip charges or private vehicle allowance, up to 750 miles at $0.40 per mile, when required non-local hospital confinement is more than 50 miles from residence for a covered person and an adult immediate family member during confinement; payable once per confinement

per day (maximum 50 days per 12 month period) for lodging expenses for an adult immediate family member when non-local hospital confinement is required

per day (maximum 50 days per 12 month period) for lodging expenses for a covered person to receive radiation or chemotherapy on an outpatient basis if not available locally

Maximum of 45 days per covered confinement

per day, up to the number of days of the prior hospital stay when admitted within 14 days of hospital discharge

waives premium for total disability due to cancer after 60 consecutive days of total disability; total disability must begin prior to the covered person's 70th birthday

pays a one-time, lump-sum benefit when a covered person is initially diagnosed with cancer (except skin cancer), based on a microscopic examination of fixed tissue or preparations from the hemic system. Clinical diagnosis is accepted under certain conditions.

per day of confinement in an ICU such as a cardiac care unit, burn unit, or neonatal unit

per day of confinement in a step-down unit for progressive, sub-acute or intermediate care

maximum benefit; pays actual charges; per period of ICU confinement for transportation between medical facilities by a licensed professional ambulance service; benefit is not payable if paid under the base contract provision

Actual charges means the amount actually paid by or on behalf of the insured and accepted by the provider as payment in full for services provided.

We provide benefits only for cancer as defined herein, which is positively diagnosed while coverage is in force. It does not provide benefits for any other illness or disease.

We may reduce or deny a claim or void coverage for loss incurred by a covered person:

During the first 2 years from the effective date of such coverage for any misstatements in the application which would have materially affected our acceptance of the risk;

At any time for fraudulent misstatements in the application.

We will only pay for loss as a direct result of cancer. Proof of positive diagnosis must be submitted to us for each new claim. We will not pay for any other disease or incapacity that has been caused, complicated, worsened or affected by, or as a result of cancer, except as specifically covered under the contract.

If a covered hospital confinement is due to more than one covered condition, benefits will be payable as though the confinement or expense were due to one condition. If a hospital confinement or expense is also due to a disease or condition that is not covered, benefits will be payable only for the part of the hospital confinement or expense due to the covered disease or condition.

Under no condition will we pay any benefits for losses or medical expenses incurred prior to the effective date.

Pre-Existing Condition Limitation - No benefits are provided during the first 12 months for pre-existing conditions for which the covered person has been diagnosed, treated, or for which the covered person has incurred expense or has taken medication within 12 months prior to the effective date of such person's policy. Pre-existing condition also includes a condition that manifests itself in a way that would cause an ordinarily prudent person to seek medical advice, diagnosis, care or treatment.

Total Disability means the inability to perform all of the material and substantial duties of the employee's regular occupation. Total Disability will be considered to exist when under the regular care and attendance of a physician for the necessary treatment of cancer. After the first two years of Total Disability, the employee will continue to be considered Totally Disabled if unable to engage in any employment or occupation for which he or she is or becomes qualified by reason of education, training, or experience. On or after age 65, Total Disability will mean that a physician has certified that the employee is unable to perform two or more Activities of Daily Living (continence, transferring, dressing, toileting, eating and bathing) without direct personal assistance as a result of cancer.

12-Month Benefit Period - The initial 12-Month Benefit Period is the 12-month period beginning on the date of positive diagnosis. Subsequent 12-Month Benefit Periods begin on the same month and day as the immediately preceding 12-Month Benefit Period; however, if the covered person incurs no covered loss during the 3 months after the end of any 12-Month Benefit Period, the next 12-Month Benefit Period will begin on the next date a covered loss is incurred. Benefit Periods are determined separately for each covered person.

Benefits are not payable:

For cancer diagnosed prior to the Effective Date of this Rider; For any other illness or disease other than internal Cancer; For Skin Cancer or any Cancer excluded from coverage by name or specific description.

We will only pay one daily indemnity benefit per day. We will not pay any benefits for loss resulting from:

Specifically excluded diseases or conditions in the Contract or in this Rider;

An attempted suicide while sane or insane or an intentionally self-inflicted injury; Any act of war either declared or undeclared;

Alcoholism or drug addiction;

Mental or nervous disorders;

An overdose of drugs, narcotics, hallucinogens, unless administered on the advice of a Physician; Intoxication, or being under the influence of any intoxicant or narcotic, unless administered on the advice of a Physician; Injury received while engaging in an illegal occupation or activity.

Employee insurance will terminate on the earliest of:

The date of the employee's death;

The date on which the employee ceases to be eligible for insurance;

The last date for which premium payment has been made to us;

The last date on which employment terminates;

The date the group master policy terminates; or

The date the employee sends us a written notice to cancel insurance.

Dependent insurance will terminate on the earliest of:

The date the employee's insurance terminates;

The last date for which premium payment has been made to us; The date the dependent no longer meets the definition of dependent; The date the group master policy is modified so as to exclude dependent insurance; or The date the employee sends us a written notice to cancel dependent insurance.

We will have the right to terminate the insurance of any insured person who submits a fraudulent claim under the policy.

If an employee loses eligibility for this insurance for any reason other than nonpayment of premiums, insurance can be continued by paying the premiums directly to us within 31 days after termination. We will bill the employee directly once we receive notification to continue insurance.

An individual can only have one cancer policy or certificate with us. If a person already has cancer insurance with us, such person is not eligible to apply for this insurance.

is guaranteed provided you are actively at work.3

Spouse/Domestic Partner1 100% of the employee’s Initial Benefit Coverage is guaranteed provided the employee is actively at work and the spouse/domestic partner is not subject to a medical restriction as set forth on the enrollment form and in the Certificate.3 Dependent Child(ren)2 100% of the employee’s Initial Benefit Coverage is guaranteed provided the employee is actively at work and the dependent is not subject to a medical restriction as set forth on the enrollment form and in the Certificate.3

Your Initial Benefit provides a lump-sum payment upon the first diagnosis of a Covered Condition. Your plan pays a Recurrence Benefit4 equal to the Initial Benefit for the following Covered Conditions: Heart Attack, Stroke, Coronary Artery Bypass Graft, Full Benefit Cancer and Partial Benefit Cancer. A Recurrence Benefit is only available if an Initial Benefit has been paid for the Covered Condition. There is a Benefit Suspension Period between Recurrences.

The maximum amount that you can receive through your Critical Illness Insurance plan is called the Total Benefit and is 3 times the amount of your Initial Benefit. This means that you can receive multiple Initial Benefit and Recurrence Benefit payments until you reach the maximum of 300% or $30,000 or $60,000.

Please refer to the table below for the percentage benefit amount for each Covered Condition.

22 Listed Conditions

MetLife Critical Illness Insurance will pay 25% of the Initial Benefit Amount for each of the 22 Listed Conditions until the Total Benefit Amount is reached. A Covered Person may only receive one payment for each Listed Condition in his/her lifetime. The Listed Conditions are Addison’s disease (adrenal hypofunction); amyotrophic lateral sclerosis (Lou Gehrig’s disease); cerebrospinal meningitis (bacterial); cerebral palsy; cystic fibrosis; diphtheria; encephalitis; Huntington’s disease (Huntington’s chorea); Legionnaire’s disease; malaria; multiple sclerosis (definitive diagnosis); muscular dystrophy; myasthenia gravis; necrotizing fasciitis; osteomyelitis; poliomyelitis; rabies; sickle cell anemia (excluding sickle cell trait); systemic lupus erythematosus (SLE); systemic sclerosis (scleroderma); tetanus; and tuberculosis. ADF#

The example below illustrates an employee who elected an Initial Benefit of $30,000 and has a Total Benefit of 3 times the Initial Benefit Amount or $60,000.

Heart Attack – first diagnosis

Heart Attack – second diagnosis, two years later

Kidney Failure – first diagnosis, three years later

Benefit payment of $10,000 or 100%

MetLife provides coverage for the Supplemental Benefits listed below. This coverage would be in addition to the Total Benefit Amount payable for the previously mentioned Covered Conditions.

After your coverage has been in effect for thirty days, MetLife will provide an annual benefit* of $50 or $100 per calendar year for taking one of the eligible screening/prevention measures. MetLife will pay only one health screening benefit per covered person per calendar year. For a complete list of eligible screening/prevention measures, please refer to the Disclosure Statement/Outline of Coverage.

*The Health Screening Benefit amount depends upon the Initial Benefit Amount selected. Employees would receive a $50 benefit with the $10,000 initial benefit amount or a $100 benefit with the $60,000 Initial Benefit Amount.

MetLife offers competitive group rates and convenient payroll deduction so you don’t have to worry about writing a check or missing a payment! Your employee rates are outlined below.

Premium/$1,000

Who is eligible to enroll?

Regular active full-time employees who are actively at work along with their spouse/domestic partner and dependent children can enroll for MetLife Critical Illness Insurance coverage.3

How do I pay for coverage?

Coverage is paid through convenient payroll deduction.

What is the coverage effective date?

The coverage effective date is09/01/

If I Leave the Company, Can I Keep My Coverage? 11

Under certain circumstances, you can take your coverage with you if you leave. You must make a request in writing within a specified period after you leave your employer. You must also continue to pay premiums to keep the coverage in force.

Who do I call for assistance?

Contact a MetLife Customer Service Representative at 1 800- GET-MET8 (1-800-438-6388), Monday through Friday from 8:00 a.m. to 11:00 p.m., EST. Individuals with a TTY may call 1-800-855-2880.

Please call MetLife directly at 1-855-JOIN-MET (1-855-564-6638), Monday through Friday from 8:00 a.m. to 11 p.m., EST and talk with a benefits consultant.

Footnotes:

1 Coverage for Domestic Partners, civil union partners and reciprocal beneficiaries varies by state. Please contact MetLife for more information.

2 Dependent Child coverage varies by state. Please contact MetLife for more information.

3 Coverage is guaranteed provided (1) the employee is actively at work and (2) dependents are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage. Additional restrictions apply to dependents serving in the armed forces or living overseas.

Coverage is guaranteed provided (1) the employee is performing all of the usual and customary duties of your job at the employer's place of business or at an alternate place approved by your employer (2) dependents are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage. Additional restrictions apply to dependents serving in the armed forces or living overseas.

4 We will not pay a Recurrence Benefit for a Covered Condition that Recurs during a Benefit Suspension Period. We will not pay a Recurrence Benefit for either a Full Benefit Cancer or a Partial Benefit Cancer unless the Covered Person has not had symptoms of or been treated for the Full Benefit Cancer or Partial Benefit Cancer for which we paid an Initial Benefit during the Benefit Suspension Period

5 Please review the Disclosure Statement or Outline of Coverage/Disclosure Document for specific information about cancer benefits. Not all types of cancer are covered. Some cancers are covered at less than the Initial Benefit Amount. For NH-sitused cases and NH residents, there is an initial benefit of $100 for All Other Cancers.

6 In certain states, the covered condition is Severe Stroke.

8 Please review the Outline of Coverage for specific information about Alzheimer’s Disease.

The Occupational HIV benefit is not available with all plans or in all states. Please review the Disclosure Statement or Outline of Coverage/Disclosure Document for specific information about the Occupational HIV benefit if it is available to you.

10 In most states there is a 30 day waiting period for the Health Screening Benefit. There is no waiting period for MD sitused cases. The Health Screening Benefit is not available to NH sitused cases or NH residents. There is a separate mammogram benefit for MT residents and for cases sitused in CA and MT.

11 See your certificate for details.

METLIFE’S CRITICAL ILLNESS INSURANCE (CII) IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Like most group accident and health insurance policies, MetLife’s CII policies contain certain exclusions, limitations and terms for keeping them in force. Product features and availability vary by state. There is a preexisting condition exclusion. There is a Benefit Suspension Period between Recurrences. Attained Age rates are based on 5-year age bands and will increase when a Covered Person reaches a new age band. Rates are subject to change. A more detailed description of the benefits, limitations, and exclusions can be found in the applicable Disclosure Statement or Outline of Coverage/Disclosure Document available at time of enrollment. For complete details of coverage and availability, please refer to the group policy form GPNP07-CI or GPNP10-CI, or contact MetLife for more information. Benefits are underwritten by Metropolitan Life Insurance Company, New York, New York.

MetLife's Critical Illness Insurance is not intended to be a substitute for Medical Coverage providing benefits for medical treatment, including hospital, surgical and medical expenses. MetLife's Critical Illness Insurance does not provide reimbursement for such expenses.

L0515424452[exp0716][All States]

Metropolitan Life Insurance Company, New York, NY 10166. PEANUTS © 2015 Peanuts Worldwide, LLC

A Flexible Spending Account (FSA) puts more money in your pocket by reducing your taxable income when you contribute pretax dollars to pay for common expenses like these:

Medical/dental office visit co-pays

Dental/orthodontic care services

Prescriptions, vaccinations, and OTC

Eye exams; prescription glasses/lenses

Daycare expenses

Before & after school care

Nanny/nursery school

Elder care

• Determine your elections based on your estimated out-of-pocket expenses for the year

• Your employer may offer other types of Benefit Accounts too; ask for details

• For a complete list of eligible expenses, see IRS Publications 502 & 503 at irs.gov

Each $1 you contribute to your FSA reduces your taxable income by $1. With less tax taken, your take-home pay increases!

Consider this example: (for illustration only)

Richard has:

• Gross monthly pay of $3,500

• $600 per month in eligible expenses

Here is his net monthly take-home pay:

That’s a net increase in take-home pay of $166 every month!

To estimate potential savings based on your income and expenses, use the Tax Savings Calculator at www.tasconline.com/tasc-calculators

See how easy it is to start saving with a TASC Benefit Account. See details on reverse.

Check with your employer for plan specifics and review at the IRS limits at www.tasconline.com/benefits-limits

The more you contribute, the lower your taxable income will be. However, it’s important to be conservative when choosing your annual contribution based on your anticipated qualified expenses since:

• The money you contribute to your benefit account can only be used for eligible FSA expenses.

• Any unused FSA funds at the close of the plan year are not refundable to you. (A grace period or carryover option may be in place for your plan. Check with your employer for plan guidelines and allowances.)

Your contribution will be deducted in equal amounts from each paycheck, pretax, throughout the plan year.

Your total annual contribution to a Healthcare FSA will be available to you immediately at the start of the plan year. Alternatively, your Dependent Care FSA funds are only available as payroll contributions are made.

your funds easily using the TASC Card.

This convenient card automatically approves and deducts most eligible purchases from your benefit account with no paperwork required. Plus, for purchases made without the card, you can request reimbursement online, by mobile app, or using a paper form.

Reimbursements happen fast—within 12 hours—when you request to have them added to the MyCash balance on your TASC Card. You can use the MyCash balance on your card to get cash at ATMs or to buy anything you want anywhere Mastercard is accepted!

START by making a conservative estimate of how much you expect to spend on eligible out-of-pocket expenses for the year.

COMPARE your estimate to the IRS limits. If your estimate is higher than these annual contribution limits, consider making the maximum contribution allowed.

MyCash Account: Included on your TASC Card for faster reimbursement deposits and non-benefit purchases.

TASC Mobile App: Track and manage all benefits and access numerous helpful tools, anywhere and anytime! Search for “TASC” (green icon).

Questions? Ask your employer or contact your Plan Administrator: Total Administration Services Corporation

• www.tasconline.com

• 1-800-422-4661

Maximize your savings

A Health Savings Account, or HSA, is a tax-advantaged savings account you can use for healthcare expenses. Along with saving you money on taxes, HSAs can help you grow your nest egg for retirement.

• Contribute to your HSA by payroll deduction, online banking transfer or personal check.

• Pay for qualified medical expenses for yourself, your spouse and your dependents. Both current and past expenses are covered if they’re from after you opened your HSA.

• Use your HSA Bank Health Benefits Debit Card to pay directly, or pay out of pocket for reimbursement or to grow your HSA funds.

• Roll over any unused funds year to year. It’s your money — for life.

• Invest your HSA funds and potentially grow your savings.¹

You can use your HSA funds to pay for any IRS-qualified medical expenses, like doctor visits, hospital fees, prescriptions, dental exams, vision appointments, over-the-counter medications and more. Visit hsabank.com/QME for a full list.

You’re most likely eligible to open an HSA if:

• You have a qualified high-deductible health plan (HDHP).

• You’re not covered by any other non-HSA-compatible health plan, like Medicare Parts A and B.

• You’re not covered by TriCare.

• No one (other than your spouse) claims you as a dependent on their tax return.

The IRS limits how much you can contribute to your HSA every year. This includes contributions from your employer, spouse, parents and anyone else.2 Maximum contribution limit

You may be eligible to make a $1,000 HSA catch-up contribution if you’re:

• Over 55.

• An HSA accountholder.

• Not enrolled in Medicare (if you enroll mid-year, annual contributions are prorated). Triple

A huge way that HSAs can benefit you is they let you save on taxes in three ways.

1 You don’t pay federal taxes on contributions to your HSA.3

2 Earnings from interest and investments are tax-free.

3

Distributions are tax free when used for qualified medical expenses.

¹ Investment accounts are not FDIC insured, may lose value and are not a deposit or other obligation of, or guarantee by the bank. Investment losses which are replaced are subject to the annual contribution limits of the HSA.

2 HSA contributions in excess of IRS limits are subject to penalty and tax unless the excess and earnings are withdrawn prior to the tax filing deadline as explained in IRS Publication 969.

3 Federal tax savings are available regardless of your state. State tax laws may vary. Consult a tax professional for more information.

•American Century Services LLC

•American Funds Service Company

•American United Life Ins Co 1

•Aspire Financial Services

•Equitable (formerly AXA)

•Fiduciary Trust Intl-Franklin Templeton

•GWN/Employee Deposit Acct

•Horace Mann Life Ins. Co.

•Invesco OppenheimerFunds

•Midland National Life Ins. Co.

•National Life Group (LSW)

•PlanMember Services Corp.

•RBFCU Retirement Program

•Security Benefit

•Sentinel Group Funds, Inc.

•TransAmerica

•Vanguard Fiduciary Trust Co.