Enroll Instructions

Medical – TRS Activecare

Medical Transportation - MASA

Telemedicine – 1800MD

Accident – MetLife

Critical Illness – MetLife

Hospital Indemnity - MetLife

Cancer – Guardian

Disability – The Standard

Dental – Lincoln Financial

Vision – Superior

Group Life – Lincoln Financial

Voluntary Life - Lincoln

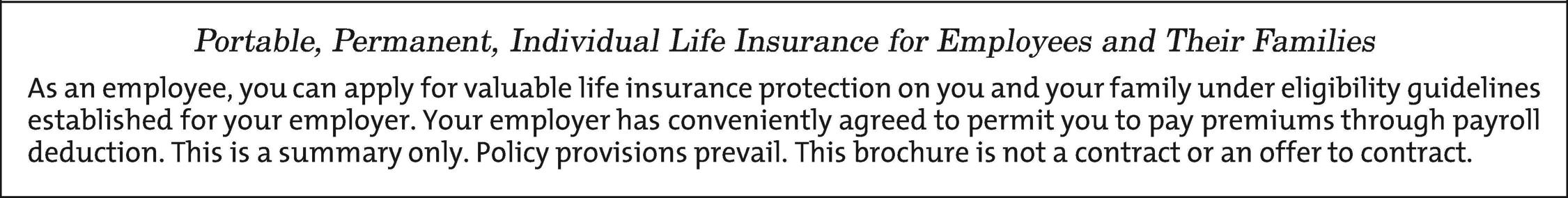

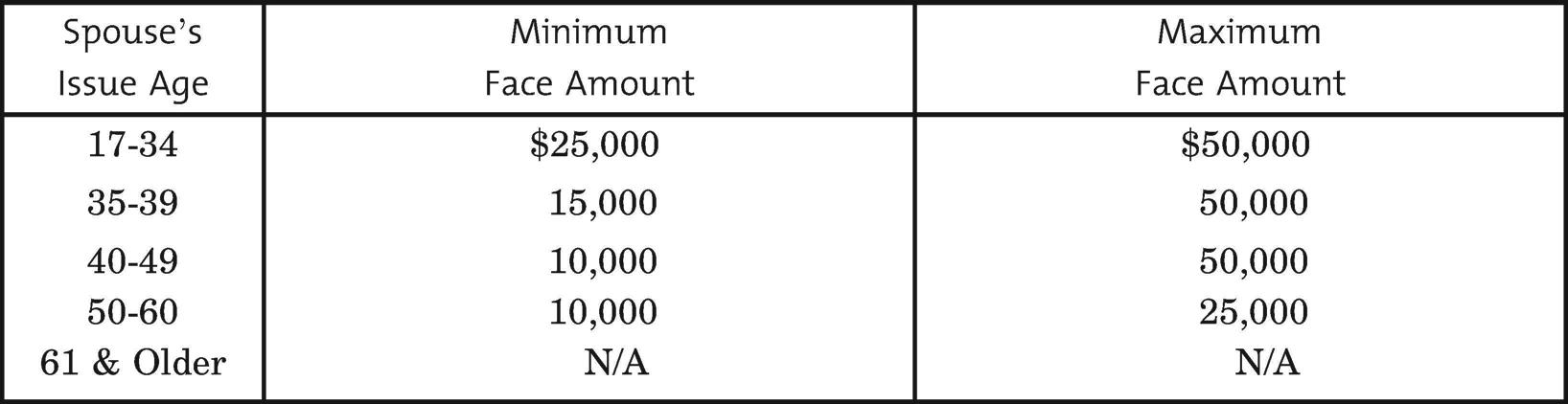

Texas Life - Permanent Life

Health Savings Account – HSAbank

Flexible Spending Account - NBS

Omni 403(b) – TPA Services

** Includes a wellness benefit of $200 per covered member, per year.

** Includes a wellness benefit of $50.

All TRS-ActiveCare participants have three plan options. Each includes a wide range of wellness benefits.

• Jim and his family were at a local festival when his daughter, Sara, suddenly began experiencing horrible abdominal and back pain, after a fall from earlier in the day.

• His wife, Heather, called 911 and Sara was transported to a local hospital, when it was decided that she needed to be flown to another hospital.

• Upon arrival, Sara underwent multiple procedures and her condition was stabilized.

• After further testing, it was discovered that Sara needed additional specialized treatment at another hospital requiring transport on a non-emergent basis.

Based on a true story. Names were changed to protect identities in compliance with HIPAA.

No matter how comprehensive your local in-network coverage may be, you still have significant exposure to out-of-network emergency transportation. Moreover, when you and your family travel outside your area, there is an 80% chance of being picked up by an out-of-network provider.

A MASA Membership prepares you for the unexpected. ONLY MASA MTS provides you with:

• Coverage ANYWHERE in all 50 states and Canada whether at home or away

• Coverage for BOTH emergent ground ambulance and air ambulance transport REGARDLESS of the provider

• Non-emergent transport services, which are frequently covered inadequately by your insurance, if at all For more information, please contact your local MASA MTS representative or visit www.masamts.com

MASA MTS is hereto protect its members andtheir families from the shortcomings of health insurance coverageby providingthem with comprehensivefinancial protectionfor lifesaving emergency transportation services, both at home and away fromhome.

Many American employers and employees believe that their health insurance policies cover most, if notall ambulance expenses

Thetruth is, they DONOT!

Even after insurance payments for emergency transportation, you couldreceive a bill up to $5,000 for ground ambulanceand as high as $70,000 for air ambulance. The financial burdens for medical transportation costs are veryreal.

Across the US there are thousands of ground ambulance providers and hundreds of air ambulance carriers. ONLYMASA offers comprehensive coverage since MASA is a PAYERand not aPROVIDER!

ONLY MASA provides over 1.6million members with coverage for BOTH ground ambulance and air ambulance transport, REGARDLESS of which provider transports them.

Members are covered ANYWHEREin all50 states andCanada!

Additionally, MASA provides a repatriation benefit: if a member is hospitalized more than 100 miles from home, MASA can arrangeand pay to have them transported to a hospital closer to their place of residence.

Any

BENEFITS

A MASA Membership prepares you for the unexpectedandgives you the peaceof mind to access vital emergency medical transportation no matter where you live, for a minimal monthlyfee.

• Onelow fee for the entire family

• NO deductibles

• NO health questions

• Easy claims process

For more information, pleasecontact Your Broker or MASA Representative

Ground. Any Air. Anywhere.™

What is 1.800MD?

1.800MD is a national telehealth company specializing in convenient, quality medical care. With board-certified physicians in all 50 states*, those in need can obtain diagnosis, treatment and a prescription, when necessary, through the convenience of a telephone and digital communications.

*Subjecttostateregulations.

I have a pre-existing condition. Will 1.800MD still accept me?

Absolutely! 1.800MD is not insurance. We do not deny access to quality care because of pre-existing conditions.

Can I get a consultation after hours or on weekends?

Yes. 1.800MD is available 24 hours a day, seven days a week and 365 days a year.

Talk to a doctor any time, day or night, on the weekend or when traveling away from home. No inconvenience or hassle of traveling to the doctor’s office, urgent care or ER and waiting to be seen.

SAVES MONEY

1.800MD reduces unnecessary doctor’s office and emergency room visits. Up to 70 percent of all urgent care and emergency room visits are unneeded, costly and can be handled with a 1.800MD telephone or video consultation.

With an average of 15 years of internal medicine, family practice or pediatrics experience, you can rest assured each physician is properly licensed in your state, board-certified and verified by the National Physician Data Base and the American Medical Association.

Real-time access to medical records, and the ability to send them to your primary care physi-cian or other providers.

The 1.800MD member portal contains information and tools to help you make informed health care decisions.

If a 1.800MD physician recommends medication as part of your treatment plan, the prescription will be digitally sent to the local pharmacy of your choice.

• Unlimitedlifetimemaximumbenefitwithnoage-relatedbenefitreductions

• Benefitspaidbasedonthescheduleofbenefitsprovidedforeachcoveredaccident

• WaiverofPremium:Premiumiswaivedfollowinga60-dayperiodofdisabilityduetoacovered accidentforaslongasthecoveredpersonremainsdisabled.

• Portabilityisincluded.

SpecificInjuryBenefit

Fractures

Closed/Non-SurgicalTreatment

Hip,Thigh(Femur)

Vertebrae,Bodyof(excludingVertebral Process)

Pelvis

Leg(Tibiaand/orFibula)

UpperArm(Humerus) $3,000.00

ShoulderBlade $3,000.00

Collarbone $3,000.00

UpperJaw,Maxilla(exceptAlveolarProcess) $2,500.00

Inadditiontoanybenefit-specificexclusion,benefitswillnotbepaidforanylosswhich,directlyorindirectly,in wholeorinpart,iscausedbyorresultsfromanyofthefollowingunlesscoverageisspecificallyprovidedforby nameinthisCertificate:

1.Aninjuryincurredwhileworkingforpayorprofit;

2.Intentionallyself-inflictedinjury,suicide,oranyattemptorthreatwhilesaneorinsane;

3.Participatinginwaroranyactofwarwhetherdeclaredorundeclared;

4.Commissionorattempttocommitafelony;

5.Commissionoforactiveparticipationinariot,insurrection,orterroristactivity;

6.Engaginginanillegalactivityoroccupation;

7.Flightin,boarding,oralightingfromanaircraftoranycraftdesignedtoflyabovetheearth’ssurface,including anytravelbeyondtheearth’satmosphereexceptafare-payingpassengeronaregularlyscheduledcommercial orcharterairline;

8.Practicingfororparticipatinginanysemi-professionalorprofessionalcompetitiveathleticcontest,including officiatingorcoaching,forwhichthecoveredpersonreceivesanycompensationorremuneration;

9.Sickness,exceptforanybacterialinfectionresultingfromanaccidentalexternalcutorwoundoraccidental ingestionofcontaminatedfood;

10.Voluntaryingestionorinhalationofanynarcotic,drug,poison,gasorfumes,unlessprescribedortakenunder thedirectionofaphysicianandtakeninaccordancewiththeprescribeddosage;

11.Operatinganytypeofvehiclewhileundertheinfluenceofalcoholoranydrug,narcoticorotherintoxicant includinganyprescribeddrugforwhichthecoveredpersonhasbeenprovidedawrittenwarningagainst operatingavehiclewhiletakingit.Undertheinfluenceofalcohol,forpurposesofthisexclusion,means intoxicated,asdefinedbythelawoftheStateinwhichthecoveredaccidentoccurred;

12.Carethatisnotrecommendedandapprovedbyaphysician.

Subcategory Benefit Limits (Applies to Subcategory)

Benefit

Admission Benefit 1 time(s) per calendar year

Confinement Benefit

15 days per calendar year

ICU Supplemental Confinement will pay an additional benefit for 15 of those days

Admission

ICU Supplemental Admission (Benefit paid concurrently with the Admission benefit when a Covered Person is admitted to ICU)

Confinement²

ICU Supplemental Confinement (Benefit paid concurrently with the Confinement benefit when a Covered Person is admitted to ICU)

GroupNumber: 00574523

ACancerinsuranceplanthroughGuardianprovides:

•Lump-sumcashpaymentsforcertainprocedures,screeningsandtreatmentsrelatedtoacoveredcancerdiagnosis,inaddition towhateveryourmedicalplancovers

•Paymentsaremadedirectlytoyouandcanbeusedforanypurpose

•Abilitytotakethecoveragewithyouifyouchangejobsorretire

•Affordablegrouprates

AboutYourBenefits:

COVERAGE-DETAILSOption1Option2

INITIALDIAGNOSISBENEFIT- BenefitispaidwhenyouarediagnosedwithInternalcancerforthefirsttimewhileinsuredunderthisPlan.

BenefitAmount(s)

BenefitWaitingPeriod- Aspecifiedperiodoftimeafteryour effectivedateduringwhichtheInitialDiagnosisbenefitswillnotbe payable.

Benefit

Pre-ExistingConditionsLimitation: Apre-existingcondition includesanyconditionforwhichyou,inthespecifiedtimeperiodprior tocoverageinthisplan,consultedwithaphysician,received treatment,ortookprescribeddrugs.

Portability: AllowsyoutotakeyourCancercoveragewithyouif youterminateemployment.PortedCancerplanterminatesatage70.

Child(ren)AgeLimits

FEATURES

Anti-Nausea

AttendingPhysician

Blood/Plasma/Platelets

$100; $100 for Follow-Up screening

3monthsprior/6months treatmentfree/12monthsafter.

3monthsprior/6months treatmentfree/12monthsafter.

BoneMarrow/StemCell

ExperimentalTreatment

Option1

BoneMarrow:$7,500

StemCell:$1,500

50%benefitfor2ndtransplant. $1,000benefitifadonor

Option2

BoneMarrow:$7,500

StemCell:$1,500

50%benefitfor2ndtransplant. $1,000benefitifadonor

$100/dayupto$1,000/month$100/dayupto$1,000/month

ExtendedCareFacility/SkilledNursingcare $ 100/dayupto90daysperyear$100/dayupto90daysperyear

GovernmentorCharityHospital

$300perdayinlieuofallother benefits $300perdayinlieuofallother benefits

HomeHealthCare $50/visitupto30visitsperyear$50/visitupto30visitsperyear

HormoneTherapy $25/treatmentupto12treatments peryear

$25/treatmentupto12treatments peryear

Hospice $50/dayupto100days/lifetime$50/dayupto100days/lifetime

HospitalConfinement $300/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement

$300/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement

$400/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement Immunotherapy

ICUConfinement $400/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement

Outpatientandfamilymemberlodging-Lodgingmustbemorethan 50milesfromyourhome.

OutpatientorAmbulatorySurgicalCenter

PhysicalorSpeechTherapy

Prosthetic

ReconstructiveSurgery

SecondSurgicalOpinion

SkinCancer

$75/day,upto90daysperyear$75/day,upto90daysperyear

$250/day,3daysperprocedure$250/day,3daysperprocedure

$25/visitupto4visitspermonth, $400lifetimemax

SurgicallyImplanted:$2,000/device, $4,000lifetimemax

Non-Surgically:$200/device,$400 lifetimemax

BreastTRAMFlap$2,000

Breastreconstruction$500

BreastSymmetry$250 Facialreconstruction$500

$25/visitupto4visitspermonth, $400lifetimemax

SurgicallyImplanted:$2,000/device, $4,000lifetimemax

Non-Surgically:$200/device,$400 lifetimemax

BreastTRAMFlap$2,000

Breastreconstruction$500

BreastSymmetry$250

Facialreconstruction$500

$200/surgeryprocedure $200/surgeryprocedure

BiopsyOnly:$100

ReconstructiveSurgery:$250

Excisionofaskincancer:$375

Excisionofaskincancerwithflap orgraft:$600

BiopsyOnly:$100

ReconstructiveSurgery:$250

Excisionofaskincancer:$375

Excisionofaskincancerwithflap orgraft:$600

SurgicalBenefit

WaiverofPremium-Ifyoubecomedisabledduetocancerthatis diagnosedaftertheemployee'seffectivedate,andyouremain disabledfor90days,wewillwaivethepremiumdueaftersuch90 daysforaslongasyouremaindisabled.

$0.50/mileupto$1,000perround trip/equalbenefitforcompanion

Scheduleamountupto$4,125Scheduleamountupto$4,125 Transportation/CompanionTransportation-Benefitispaidifyou havetotravelmorethan50milesonewaytoreceivetreatmentfor internalcancer.

$0.50/mileupto$1,000perround trip/equalbenefitforcompanion

TheGuardianLifeInsuranceCompanyofAmerica,NewYork,NY

• Cancer –Cancermeansyouhavebeendiagnosedwithadisease manifestedbythepresenceofamalignanttumor characterizedbytheuncontrolledgrowthandspreadofmalignantcellsinanypartofthebody.Thisincludesleukemia, Hodgkin'sdisease,lymphoma,sarcoma,malignanttumorsandmelanoma.Cancerincludescarcinomasin-situ(inthenaturalor normalplace,confinedtothesiteoforigin,withouthavinginvadedneighboringtissue).Pre-malignantconditionsorconditions withmalignantpotential,suchasmyelodyplasticandmyeloproliferativedisorders,carcinoid,leukoplakia,hyperplasia,actinic keratosis,polycythemia,andnonmalignantmelanoma,molesorsimilardiseasesorlesionswillnotbeconsideredcancer. CancermustbediagnosedwhileinsuredundertheGuardiancancerplan.

• ExperimentalTreatment –Benefitswillbepaidforexperimentaltreatmentprescribedbyadoctorforthepurposeof destroyingorchangingabnormaltissue.AlltreatmentmustbeNCIlistedasviableexperimentaltreatmentforInternal Cancer.

ManageYourBenefits:

Gotowww.GuardianAnytime.comto accesssecureinformation aboutyourGuardianbenefits.Youron-lineaccountwillbeset upwithin30daysafteryourplaneffectivedate.

LIMITATIONSANDEXCLUSIONS:

ASUMMARYOFCANCERLIMITATIONSANDEXCLUSIONS:

ConditionalIssueunderwritingisrequiredonthoseenrollingoutsideofthe initialenrollmentperiodorannualopenenrollmentperiod.

Thisplanwillnotpaybenefitsfor:Servicesortreatmentnotincludedinthe Features.Servicesortreatmentprovidedbyafamilymember.Servicesor treatmentrenderedforhospitalconfinementoutsidetheUnitedStates.Any cancerdiagnosedsolelyoutsideoftheUnitedStates.Servicesortreatment providedprimarilyforcosmeticpurposes.Servicesortreatmentfor premalignantconditions.Servicesortreatmentforconditionswithmalignant potential.Servicesortreatmentfornon-cancersicknesses.

NeedAssistance?

CalltheGuardianHelpline(888)600-1600,weekdays,8:00AM to8:30PM,EST.RefertoyourmemberID(socialsecurity number)andyourplannumber:00574523

Cancercausedby,contributedtoby,orresultingfrom:participatinginafelony, riotorinsurrection;intentionallycausingaself-inflictedinjury;committingor attemptingtocommitsuicidewhilesaneorinsane;acoveredperson’smentalor emotionaldisorder,alcoholismordrugaddiction;engaginginanyillegalactivity; orservinginthearmedforcesoranyauxiliaryunitofthearmedforcesofany country.

IfCancerinsurancepremiumispaidforonapretaxbasis,thebenefitmaybetaxable. Pleasecontactyourtaxorlegaladvisorregardingthetaxtreatmentofyourpolicy benefits.

Thisdocumentisasummaryofthemajorfeaturesofthereferencedinsurancecoverage. Itisintendedforillustrativepurposesonlyanddoesnotconstitute acontract.Theinsuranceplandocuments,includingthepolicyandcertificate,comprisethecontractforcoverage.Thefullplandescription,incl udingthe benefitsandallterms,limitationsandexclusionsthatapplywillbecontainedinyourinsurancecertificate.Theplandocumentsarethefinalarbiterof coverage.Coveragetermsmayvarybystateandactualsoldplan.Thepremiumamountsreflectedinthissummaryareanapproximation;ifthereisa discrepancybetweenthisamountandthepremiumactuallybilled,thelatterprevails.

ALLELIGIBLEEMPLOYEESBenefitSummary

TheGuardianLifeInsuranceCompanyofAmerica,NewYork,NY

Contract#GP-1-CAN-IC-12

The Lincoln

DentalConnect® PPO Plan:

Covers many preventive, basic, and major dental care services

Also covers orthodontic treatment for children

Features group coverage for Hondo Independent School District employees

Allows you to choose any dentist you wish, though you can lower your out-of-pocket costs by selecting a contracting dentist

Does not make you and your loved ones wait six months between routine cleanings

Calendar (Annual)

Deductible

Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Non-Contracting Dentists

Individual: $50

Family: $150

Waived for: Preventive

Deductibles are combined for basic and major Contracting Dentists’ services. Deductibles are combined for basic and major Non-Contracting Dentists’ services.

Annual Maximum $1,000 $1,000

MaxRewards® lets you and your covered family members roll a portion of unused dental benefits from one year into the next. So you have extra benefit dollars available when you need them most.

$500

$250 per calendar year

$250 per calendar year

$1,000

Lifetime Orthodontic Max $1,000 $1,000

Orthodontic Coverage is available for dependent children.

Waiting Period

This plan includes an additional waiting period if you do not enroll within the defined timeframe when it is first offered to you or within an annual open enrollment period.

12 months for basic services

12 months for major services

12 months for orthodontic services

Routine oral exams

Bitewing X-rays

Full-mouth or panoramic X-rays

Other dental X-rays (including periapical films)

Routine cleanings

Fluoride treatments

Space maintainers for children

Problem focused exams

Consultations

Palliative treatment (including emergency relief of dental pain)

Fillings

Prefabricated stainless steel and resin crowns

Simple extractions

Surgical extractions

General anesthesia and

Prosthetic repair

sedation

recementation services

Injections of antibiotics and other therapeutic medications

Oral surgery

Biopsy and examination of oral tissue (including brush biopsy)

Endodontics (including root canal treatment)

Periodontal maintenance procedures

Non-surgical periodontal therapy

Periodontal surgery

Bridges

Full and partial dentures

Denture reline and rebase services

Crowns, inlays, onlays and related services

Build-ups/post & core

To find a contracting dentist near you, visit www.LincolnFinancial.com/FindADentist

This plan lets you choose any dentist you wish. However, your out-of-pocket costs are likely to be lower when you choose a contracting dentist. For example, if you need a crown…

…you pay a deductible (if applicable), then 50% of the remaining discounted fee for PPO members. This is known as a PPO contracted fee.

… you pay a deductible (if applicable), then 50% of the usual and customary fee, which is the maximum expense covered by the plan. You are responsible for the difference between the usual and customary fee and the dentist’s billed charge.

Find a network dentist near you in minutes

Have an ID card on your phone

Customize the app to get details of your plan

Find out how much your plan covers for checkups and other services

Keep track of your claims

Lincoln DentalConnect® Online Health

Determine the average cost of a dental procedure

Have your questions answered by a licensed dentist

Learn all about dental health for children, from baby’s first tooth to dental emergencies

Evaluate your risk for oral cancer, periodontal disease and tooth decay

When you choose coverage for yourself, you can also provide coverage for:

• Your spouse or domestic partner.

• Unmarried dependent children, up to age 26.

Like any coverage, this dental coverage does have some exclusions. The plan does not cover services started before coverage begins or after it ends. Benefits are limited to appropriate and necessary procedures listed in the summary plan description. Benefits are not payable for duplication of services. Covered expenses will not exceed the summary plan description’s usual and customary allowances. Plan benefits are not payable for a condition that is covered under Workers’ Compensation or a similar law; that occurs during the course of employment or military service or involvement in an illegal occupation, felony, or riot; or that results from a self-inflicted injury. The plan does not cover an orthodontia treatment plan started before coverage begins unless the member was receiving orthodontia benefits from the employer’s previous group dental summary plan description. In this case, Lincoln Financial will continue orthodontia benefits until the combined benefit paid by both policies is equal to this summary plan description’s lifetime orthodontia maximum. Plan benefits are not payable if the orthodontic appliance was installed after the age of 19. In certain situations, there may be more than one method of treating a dental condition. This summary plan description includes an alternative benefits provision that may reduce benefits to the lowestcost, generally effective, and necessary form of treatment. Certain conditions, such as age and frequency limitations, may impact your coverage. See the summary plan description for details.

A complete list of benefit exclusions is included in the summary plan description.

Here’s you pay group rates.

As a Hondo Independent School District employee, you can take advantage of this dental coverage for less than $1.31 a day. Plus, you can add loved ones to the plan for just a little more.

Your estimated cost is itemized below.

1 -office standard retail lined trifocal amount; member pays difference between progressive and standard retail lined trifocal, plus applicable co-pay

Contact lenses and related professional services (fitting, evaluation and follow-up) are covered in lieu of eyeglass lenses and frames benefit

The Plan discount features are not insurance.

All allowances are retail; the member is responsible for paying the provider directly for all non-covered items and/or any amount over the allowances, minus available discounts. These are not covered by the plan. Discounts are subject to change without notice.

Disclaimer: All final determinations of benefits, administrative duties, anddefinitions are governed by the Certificate of Insurance for your vision plan. Please check with your Human Resources department if you have any questions

Safeguard the most important people in your life.

Think about what your loved ones may face after you’re gone. Term life insurance can help them in so many ways, like covering everyday expenses, paying off debt, and protecting savings. AD&D provides even more coverage if you die or suffer a covered loss in an accident.

AT A GLANCE:

• A cash benefit of $15,000 to your loved ones in the event of your death, plus a matching cash benefit if you die in an accident

• A cash benefit to you if you suffer a covered loss in an accident, such as losing a limb or your eyesight

• LifeKeys® services, which provide access to counseling, financial, and legal support

• TravelConnect® services, which give you and your family access to emergency medical assistance when you're on a trip 100+ miles from home

You also have the option to increase your cash benefit by securing additional coverage at affordable group rates. See the enclosed life insurance information for details.

Conversion: You can convert your group term life coverage to an individual life insurance policy without providing evidence of insurability if you lose coverage due to leaving your job or for another reason outlined in the plan contract. AD&D benefits cannot be converted.

Benefit Reduction: Benefits terminate at retirement. See the plan certificate for details. For complete benefit descriptions, limitations, and exclusions, refer to the certificate of coverage. This is not intended as a complete description of the insurance coverage offered. Controlling provisions are provided in the policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A certificate of coverage will be made available to you that describes the benefits in greater detail. Refer to your certificate for your maximum benefit amounts. Should there be a difference between this summary and the contract, the contract will govern.

LifeKeys® services are provided by ComPsych® Corporation, Chicago, IL. ComPsych®, EstateGuidance® and GuidanceResources® are registered trademarks of ComPsych® Corporation. TravelConnect® services are provided by On Call International, Salem, NH. ComPsych® and On Call Internationalare not Lincoln Financial Group® companies. Coverage is subject to actual contract language. Each independent company is solely responsible for its own obligations.

Insurance products (policy series GL1101) are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), which does not solicit business in New York, nor is it licensed to do so. Product availability and/or features may vary by state. Limitations and exclusions apply. Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations. Limitations and exclusions apply.

Hondo Independent School District provides this valuable benefit at no cost to you.

Voluntary Term Life Insurance

The Lincoln Term Life Insurance Plan:

• Provides a cash benefit to your loved ones in the event of your death

• Features group rates for Hondo Independent School District employees

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support services

• Also includes TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

Employee

Newly hired employeeguaranteed coverage amount $150,000

Continuing employee guaranteed coverage annual increase amount Choice of $10,000 or $20,000

Maximum coverage amount 5 times your annual salary ($500,000 maximum in increments of $10,000)

Minimum coverage amount $20,000

Spouse / Domestic Partner

Newly hired employee guaranteed coverage amount $50,000

Continuing employee guaranteed coverage annual increase amount Choice of $5,000 or $10,000

Maximum coverage amount 50% of the employee coverage amount ($250,000 maximum in increments of $5,000)

Minimum coverage amount $10,000

Dependent Children

6 months to age 26 guaranteed coverage amount $10,000 Age 14 days to 6 months guaranteed coverage amount $250

Employee Coverage

Guaranteed Life Insurance Coverage Amount

• Initial Open Enrollment: When you are first offered this coverage, you can choose a coverage amount up to $150,000 without providing evidence of insurability.

Annual Limited Enrollment: If you are a continuing employee, you can increase your coverage amount by $10,000 or $20,000 without providing evidence of insurability . If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

You can increase this amount by up to $20,000 during the next limited open enrollment period.

Maximum Life Insurance Coverage Amount

• You can choose a coverage amount up to 5 times your annual salary ($500,000 maximum) with evidence of insurability. See the Evidence of Insurability page for details.

Spouse / Domestic Partner Coverage - You can secure term life insurance for your spouse / domestic partner if you select coverage for yourself.

Guaranteed Life Insurance Coverage Amount

Initial Open Enrollment: When you are first offered this coverage, you can choose a coverage amount up to 50% of your coverage amount ($50,000 maximum) for your spouse / domestic partner without providing evidence of insurability.

Annual Limited Enrollment: If you are a continuing employee, you can increase the coverage amount for your spouse / domestic partner by $5,000 or $10,000 without providing evidence of insurability. If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

You can increase this amount by up to $10,000 during the next limited open enrollment period.

Maximum Life Insurance Coverage Amount

You can choose a coverage amount up to 50% of your coverage amount ($250,000 maximum) for your spouse / domestic partner with evidence of insurability.

Dependent Children Coverage - You can secure term life insurance for your dependent children when you choose coverage for yourself.

Guaranteed Life Insurance Coverage Options: $1,000, $5,000, and $10,000.

Accelerated Death Benefit Included

Premium Waiver Included

Conversion Included

Portability Included

Like any insurance, this term life insurance policy does have exclusions. A suicide exclusion may apply. A complete list of benefit exclusions is included in the policy. State variations apply.

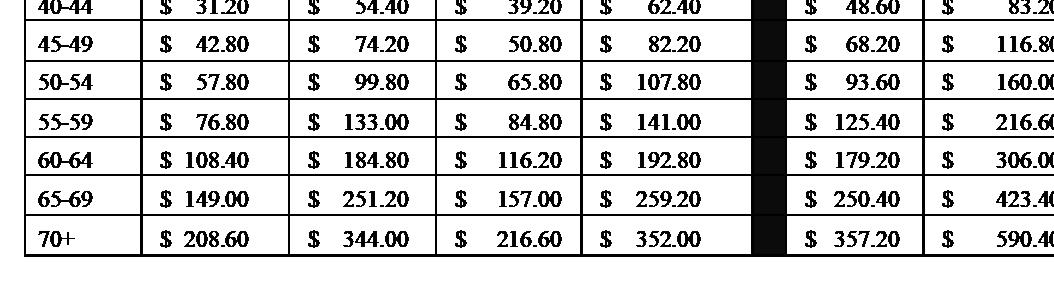

The estimated monthly premium for life insurance is determined by multiplying the desired amount of coverage (in increments of $10,000) by the employee age-range premium factor.

$____________ X ___________ = $ coverage amount premium factor monthly premium

Note: Rates are subject to change and can vary over time.

The estimated monthly premium for life insurance is determined by multiplying the desired amount of coverage (in increments of $5,000) by the employee age-range premium factor.

Note: Rates are subject to change and can vary over time.

One affordable monthly premium covers all of your eligible dependent children.

Note: You must be an active Hondo Independent School District employee to select coverage for a spouse / domestic partner and/or dependent children. To be eligible for coverage, a spouse / domestic partner or dependent child cannot be confined to a health care facility or unable to perform the typical activities of a healthy person of the same age and gender.

PureLife-plusispermanentlifeinsurancetoAttainedAge121thatcanneverbecancelledaslongasyoupaythenecessarypremiums.Afterthe GuaranteedPeriod,thepremiumscanbelower,thesame,orhigherthantheTablePremium.Seethebrochureunder”PermanentCoverage”.

PureLife-plusispermanentlifeinsurancetoAttainedAge121thatcanneverbecancelledaslongasyoupaythenecessarypremiums.Afterthe GuaranteedPeriod,thepremiumscanbelower,thesame,orhigherthantheTablePremium.Seethebrochureunder”PermanentCoverage”.

Maximize your savings

A Health Savings Account, or HSA, is a tax-advantaged savings account you can use for healthcare expenses. Along with saving you money on taxes, HSAs can help you grow your nest egg for retirement.

• Contribute to your HSA by payroll deduction, online banking transfer or personal check.

• Pay for qualified medical expenses for yourself, your spouse and your dependents. Both current and past expenses are covered if they’re from after you opened your HSA.

• Use your HSA Bank Health Benefits Debit Card to pay directly, or pay out of pocket for reimbursement or to grow your HSA funds.

• Roll over any unused funds year to year. It’s your money — for life.

• Invest your HSA funds and potentially grow your savings.¹

You can use your HSA funds to pay for any IRS-qualified medical expenses, like doctor visits, hospital fees, prescriptions, dental exams, vision appointments, over-the-counter medications and more. Visit hsabank.com/QME for a full list.

You’re most likely eligible to open an HSA if:

• You have a qualified high-deductible health plan (HDHP).

• You’re not covered by any other non-HSA-compatible health plan, like Medicare Parts A and B.

• You’re not covered by TriCare.

• No one (other than your spouse) claims you as a dependent on their tax return.

The IRS limits how much you can contribute to your HSA every year. This includes contributions from your employer, spouse, parents and anyone else.2 Maximum contribution limit

$3,850

You may be eligible to make a $1,000 HSA catch-up contribution if you’re:

• Over 55.

• An HSA accountholder.

• Not enrolled in Medicare (if you enroll mid-year, annual contributions are prorated).

A huge way that HSAs can benefit you is they let you save on taxes in three ways.

1 You don’t pay federal taxes on contributions to your HSA.3

2 Earnings from interest and investments are tax-free.

3

Distributions are tax free when used for qualified medical expenses.

¹ Investment accounts are not FDIC insured, may lose value and are not a deposit or other obligation of, or guarantee by the bank. Investment losses which are replaced are subject to the annual contribution limits of the HSA.

2 HSA contributions in excess of IRS limits are subject to penalty and tax unless the excess and earnings are withdrawn prior to the tax filing deadline as explained in IRS Publication 969.

3 Federal tax savings are available regardless of your state. State tax laws may vary. Consult a tax professional for more information.

Medical/Dental/Vision Copays and Deductibles

Prescription Drugs

Physical Therapy

Chiropractor

First-Aid Supplies

To take advantage of a health FSA, start by choosing an annual election amount. This amount will be available on day one of your plan year for eligible medical expenses.

Payroll deductions will then be made throughout the plan year to fund your account.

A dependent care FSA works differently than a health FSA. Money only becomes available as it is contributed and can only be used for dependent care expenses.

Both are pre-tax benefits your employer offers through a cafeteria plan. Choose one or both — whichever is right for you.

A cafeteria plan enables you to save money on group insurance, healthcare expenses, and dependent care expenses. Your contributions are deducted from your paycheck by your employer before taxes are withheld. These deductions lower your taxable income which can save you up to 35% on income taxes!

Our convenient NBS Smart Card allows you to avoid out-of-pocket expenses, cumbersome claim forms and reimbursement delays. You may also utilize the “pay a provider” option on our web portal.

Lab Fees

Psychiatrist/Psychologist

Vaccinations

Dental Work/Orthodontia

Eye Exams

Laser Eye Surgery

Eyeglasses, Contact Lenses, Lens Solution

Prescribed OTC Medication

Get account information from our easy-to-use online portal and mobile app. See your account balance, contributions and account history in real time.

Life’s not always flexible, but your money can be.

After the enrollment period ends, you may increase, decrease, or stop your contribution only when you experience a qualifying “change of status” (e.g. marriage, divorce, employment change, dependent change).

Be conservative in the total amount you elect to avoid forfeiting money at the end of the plan year.

From baby care to pain relief, shop the largest selection of guaranteed FSA-eligible products with zero guesswork at FSA Store. Is your health need FSA-eligible? Find out using our comprehensive Eligibility List.

Get $10 off using code NBS1819.

Shop FSA Store at fsastore.com/nbs

The Dependent Care Assistance Program (DCAP) allows you to use tax-free dollars to pay for child day care or elder day care expenses that you incur because you and your spouse are both gainfully employed.

To participate, determine the annual amount that you want to deduct from your paycheck before taxes. The maximum amount you can elect depends on your federal tax filing status ($5,000 if you are married and filing a joint return or if you are a single parent, $2,500 if you are married but filing separetely)

Your annual amount will be divided by the number of pay periods in the plan year and that amount will be deducted from each paycheck.

You can use the DCAP for expenses incurred for:

• Your qualifying child who is age twelve or younger for whom you claim a dependency exemption on your income tax return.

• Your qualifying relative (e.g. a child over twelve, your parent, a spouse’s parent) who is physically or mentally incapable of caring for himself or herself and has the same principal place of abode as you for more than half of the year.

• Your spouse who is physically or mentally incapable of caring for himself or herself and has the same principal place of abode as you for more than half of the year.

Only the custodial parent can claim expenses from the DCAP. The custodial parent is generally the parent with whom the child resides for the greater number of nights during the calendar year. Additionally, the custodial parent cannot be reimbursed from the DCAP for child-care expenses while the child lives with the non-custodial parent because such expenses are not incurred to enable the custodial parent to be gainfully employed.

The expenses which are eligible for reimbursement must have been incurred during the plan year and in connection with you and your spouse to remain gainfully employed.

Examples of eligible expenses:

• Before and After School and/or Extended Day Programs

• Daycare in your home or elsewhere so long as the dependent regularly spends at least 8 hours a day in your home.

• Base cost of day camps or similar programs.

Examples of ineligible expenses:

• Schooling for a child in kindergarten or above

• Babysitter while you go to the movies or out to eat

• Cost of overnight camps

This means that you are working and earning an income (i.e. not doing volunteer work). You are not considered gainfully employed during paid vacation time or sick days. Gainful employment is determined on a daily basis.

If you are married, then your spouse would also need to be gainfully employed for your day care expenses to be eligible for reimbursement.

You are also considered gainfully employed if you are unemployed but actively looking for work, you are self-employed, you are physically or mentally not capable of self-care, or you are a full-time student (must attend for the number of hours that the school considers full-time, must have been a student for some part of each of 5 calendar months during the year, cannot be attending school only at night, does not include on-the-job training courses or correspondence schools).

• You cannot be reimbursed for dependent care expenses that were paid to (1) one of your dependents, (2) your spouse, or (3) one of your children who is under the age of nineteen.

• In the event that you use a day care center that cares for more than six children, the center must be licensed.

• You must provide the day care provider’s Social Security Number/Tax Identification Number (EIN) on form 2441 when you file your taxes.

The IRS allows you to take a tax credit for your dependent care expenses. The tax credit may provide you with a greater benefit than the DCAP if you are in a lower tax bracket. To determine whether the tax credit or the DCAP is best for you, you will need to review your individual tax circumstances. You cannot use the same expenses for both the tax credit and the DCAP, however, you may be able to coordinate the federal dependent care tax credit with participation in the DCAP for expenses not reimbursed through DCAP.

For more information, please call 1(800) 274-0503

•American Funds Service Company

•Ameriprise Financial/RiverSource

•Athene Annuity and Life (Aviva)

•Conseco Insurance Company

•Equitable (formerly AXA)

•GWN/Employee Deposit Acct

•Jefferson National Life

•National Life Group (LSW)

•PlanMember Services Corp.

•PlanMember Services Corp.

•PlanMember Services Corp.

•ROTH - Equitable (formerly AXA)

•Security Benefit

•The Legend Group, A Lincoln Investment Company

•Thrivent Financial for Lutherans

•TransAmerica

•Voya Financial (Reliastar)