GUESTZ SERVICED ACCOMMODATION GUIDE 2025

guestz.co.uk

Reflecting on past trends while projecting insights into future developments.

EXPLORE THE UK'S HIDDEN GEMS AND OVERLOOKED CITIES

WHAT'S HAPPENING IN THE UK STAYCATION SECTOR?

As we move past the halfway point of 2025, we’re excited to share our latest results and provide insights into the evolving UK serviced accommodation market. In this brochure, we take a comprehensive look at the wider UK staycation sector, with a particular focus on our own performance, the trends we’re observing, and the reasons behind our strategic targeting of specific regions and guest demographics. While the serviced accommodation sector has faced its challenges — including the implementation of a 100% council tax premium on second homes — we continue to witness a strong shift in consumer preference from traditional hotel stays to serviced accommodation. This growing awareness of the flexibility, comfort, and value offered by serviced stays is driving increased occupancy and boosting returns for our clients. We’ve seen consistent growth in both nightly rates and average length of stay, with every indication that this upward trend will continue into the future. We hope you find the insights in this brochure valuable. If you'd like to discuss how we can help you benefit from the opportunities in the serviced accommodation market, please don’t hesitate to get in touch.

Natalie Smith, Guestz Manager

SERVICED ACCOMMODATION AND IT'S GROWTH

INVESTOR CONFIDENCE

The serviced accommodation sector is experiencing continued growth in 2025, with a focus on long-term stays, particularly from corporate clients. Technology, sustainability, and shifting demographics (like an increase in corporate workers) are key trends in the driving market.

Strong investor activity in the sector, with significant deals completed and a robust pipeline of future deals, indicates sustained momentum and confidence.

CORPORATE DEMAND

Corporate clients remain a significant driver of growth, with many expecting this segment to continue leading the market heading into 2026.

SUSTAINABILITY FOCUS

Environmentally conscious travellers are increasingly seeking out properties with sustainable practices, such as energy-efficient appliances and waste reduction programs.

TECHNOLOGY ADOPTION

Operators are using technology for efficiency and enhanced guest experiences, including dynamic pricing, automated guest communication, and contactless check-in.

MODEST RATE INCREASES

Whilst demand is rising, especially in urban areas, factors like inflation may limit the extent of rent increases.

REVENUE PER AVAILABLE ROOM (REVPAR)

RevPAR is expected to see modest growth, particularly in regional markets, as serviced accommodation gains traction with various traveller types.

INCREASE DEMAND FOR LONG TERMS STAYS

Remote work and business travel are boosting demand for longer stays in serviced accommodation.

KEY FINDINGS SUMMARY England

*Dedicated holiday lets are entire property holiday lets and will include Yurts, Shepherds Huts etc and houses which have planning restrictions on them so they can only be holiday lets. It will not include spare rooms and houses rented occasionally by owner residents. All sources referenced in seperate page.

Wales

1.5m

"UK holidaymakers are leaving it later to book shorter stays closer to home, travel firms are reporting.

The trend is down to people trying to save money while making the most of hot weather, some of the UK's biggest holiday companies have told the BBC.

Booking.com says the number of people searching their site in July for a UK trip in the next six weeks was up 23% on last year, while AirBnB says more Brits are "embracing spontaneous getaways close to home".

£0.7bn GVA to Welsh economy 33% holiday lets cannot be a primary home due to planning restrictions 4.6m holidaymakers taking sustainable holidays 4.1% annual growth rate in dedicated holiday lets since 2016

Pitchup.com, which advertises around 3,000 UK campsites, says a quarter of this year's bookings were made with just two days' notice.

Sykes Holiday Cottages, with 23,000 properties across the UK, says the gap between booking and travel has fallen by 8% this year.

Airbnb added "all signs point to a summer where guests are again choosing quieter, affordable places".

At Butlin's holiday park in Skegness people are making reservations slightly later than in previous years - with bookings up 22% in the last two weeks.

"I think the whole industry is seeing it," resort director Andrew Leivers says.

"The last couple of weeks we've seen a real surge," he adds. "We've got three, four and seven-night breaks... for different people's budgets."

Among the 80,000 holidaymakers who will visit the resort this summer is the Harmston family from Lincoln.

OUR TOP 10 AREAS FOR LONGEST GUEST STAYS IN 2025

The data clearly shows that the longest stays in 2025 are concentrated in city centre locations, where demand is heavily driven by the corporate travel market. Business travellers typically require extended accommodation for projects, training, or temporary relocation, leading to significantly longer average stays compared to leisure guests. This trend highlights the resilience and profitability of urban serviced accommodation, especially in areas with strong commercial and industrial activity.

As corporate awareness of the advantages of serviced accommodation continues to grow, such as more space, cost-efficiency, and home-like amenities, we anticipate this segment will remain a key driver of consistent, long-term bookings.

THE TOP 10

Preston

Halifax

Manchester

Wirral

Warrington

Stockport

Cheltenham

Chester

Wakefield

Hull

BOOKING TRENDS

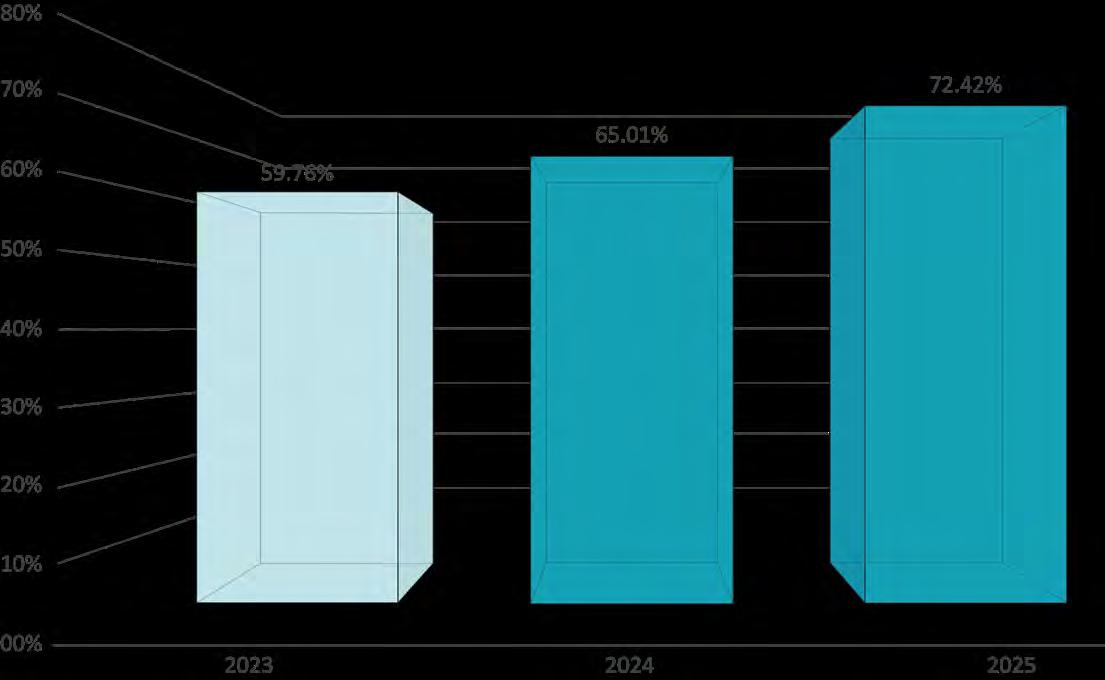

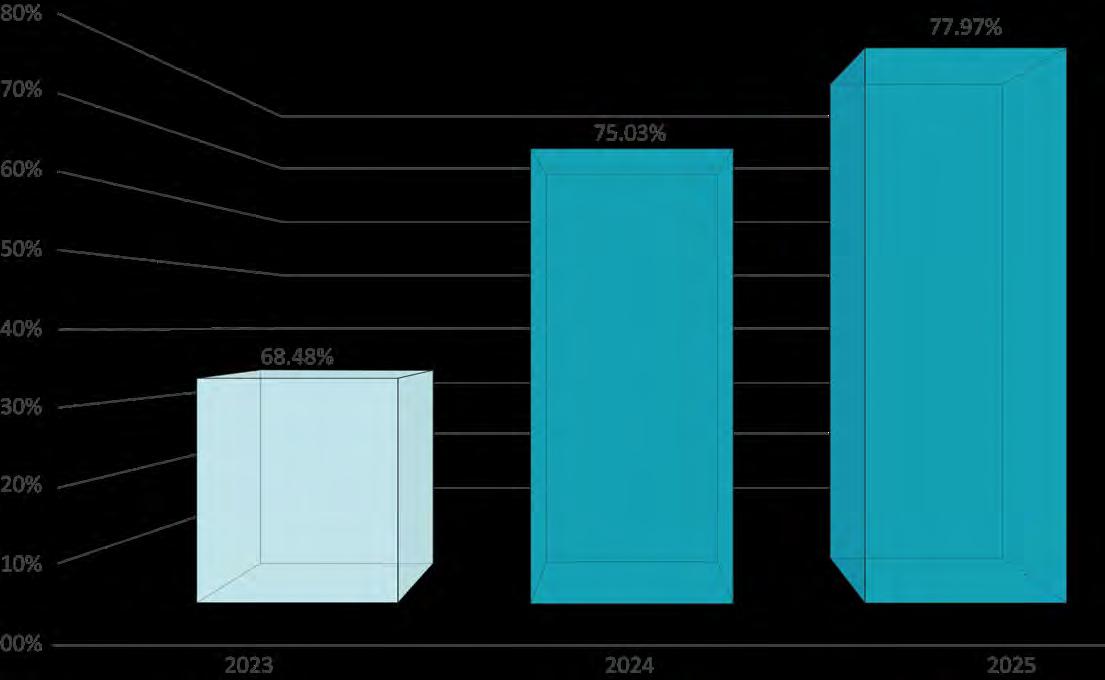

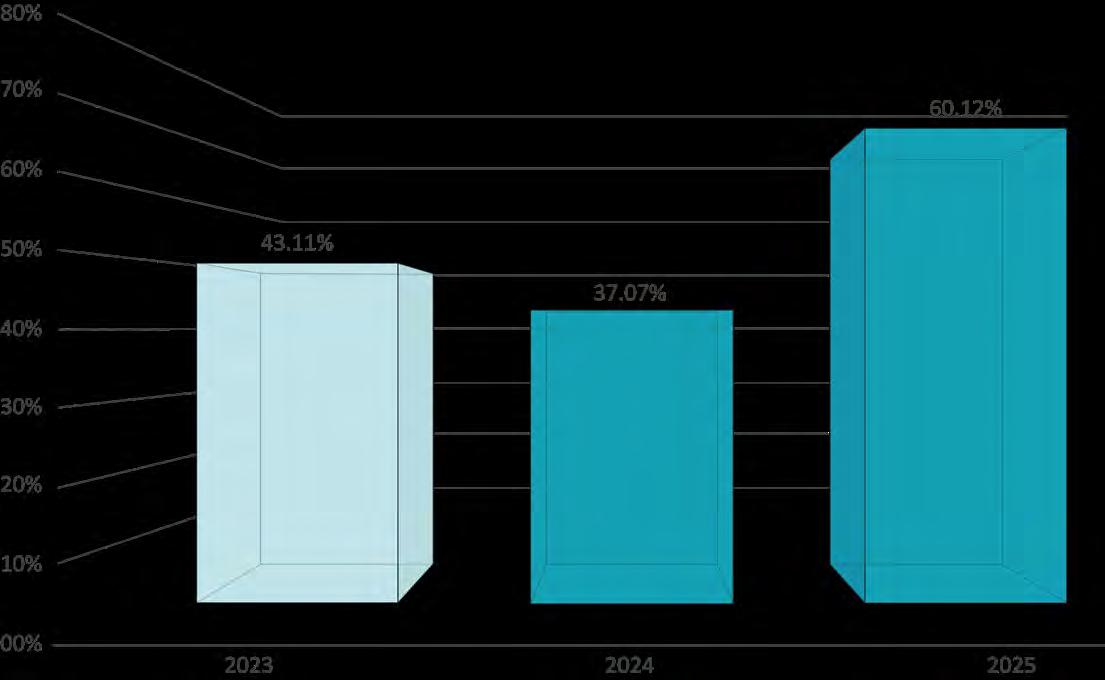

Occupancy Rates

We’re proud to report a consistent year-on-year increase in occupancy across our portfolio, even as we’ve expanded significantly with the launch of new properties in recent years.

Despite a brief dip in occupancy for our holiday apartments in 2024, 2025 has seen a strong rebound, rising to 60.12%, well above the national average of 32% for UK holiday lets (as reported by Sykes). This significant jump reflects both increased demand for domestic travel and the success of our targeted marketing and property management strategies.

Meanwhile, our city apartments continue to perform exceptionally well, with occupancy rising steadily each year. As these apartments mature in the market and accumulate more positive reviews, they naturally gain guest trust and visibility. We expect city apartment occupancy to surpass 80% as we move into 2026, particularly as new sites gain traction.

These results highlight the strength and resilience of our model, with new properties integrating smoothly into our portfolio and contributing positively to overall performance within a relatively short time frame.

City Apartments

Holiday Apartments

BOOKING FIGURES

Combined share of Airbnb + Booking.com fell from 69.45% (2023) to 45.5% (2025).

Corresponding increase in Direct + Relocation Agent bookings from 30.55% to 54.51%.

Suggests greater brand recognition, referral traffic, and success with B2B/relocation partnerships.

STRONG GROWTH IN RELOCATION AGENT BOOKINGS

% share doubled from 9.13% > 16.86%.

Average length of stay grew to 21.3 days – the highest among all sources.

Likely tied to corporate relocations and extended stays, ideal for maximising occupancy and revenue.

SIGNIFICANT RISE IN AVERAGE LENGTH OF STAY

AirBNB: From 4.3 > 8.9 days (+107%)

Booking.com: 5.2 > 7.7 days (+48%)

Direct: 9.2 > 10.7 days (+16%)

Relocation Agents: 15.3 > 21.3 days (+39%)

2024

2023

AirBnB – 23.31% - Average length 4.3 days

Booking.com – 46.14% - Average length 5.2 days

Direct – 21.42% - Average length 9.2 days

Relocation agent – 9.13% - Average length 15.3 days

AirBnB – 17.99% - Average length 9.1 days

Booking.com – 32.89% - Average length 6.6 days

Direct – 41.04% - Average length 10.4 days

Relocation agent – 8.08% - Average length 15.6 days

2025

AirBnB – 15.29% - Average length 8.9 days

Booking.com – 30.21% - Average length 7.7 days

Direct – 37.65% - Average length 10.7 days

Relocation agent – 16.86% - Average length 21.9 days

WHERE ARE PEOPLE STAYING?

This list reflects a healthy blend of established urban hubs, such as Chester and Halifax, alongside more leisure-driven, staycation-friendly spots like Settle and Lytham St Annes. The diversity in demand underscores the broad appeal of serviced accommodation across both business and leisure sectors.

Our city-based apartments continue to attract a wide range of guests, with a notable increase in corporate bookings year-on-year. As business travellers become more familiar with the flexibility and value of serviced stays compared to hotels, we expect this trend to grow significantly.

Looking ahead, we’re anticipating another strong year for UK holidays, with nearly two-thirds of Brits planning a staycation and over a third choosing a UK break as their main holiday. This sustained demand highlights the continued strength of the domestic travel market and the enduring appeal of holidaying closer to home.

CORPORATE VS HOLIDAY

A corporate let is a property rented by a business for its employees, contractors, or executives needing temporary housing, offering a flexible, cost-effective alternative to hotels. A holiday let is a residential property rented by individuals for short leisure stays, focusing on independence and local experience without the hotel-like services of a corporate let or serviced accommodation.

Serviced accommodation, which can include both corporate and holiday stays, provides a fully furnished space with services like housekeeping, Wi-Fi and utilities, blending home comforts with hotel convenience.

CORPORATE LET

• Purpose: Business travel, relocation, short-term projects.

• Guest: A company or organisation, not an individual.

• Duration: Short to medium-term, from weeks to several months.

• Benefits: More comfortable and cost-effective than hotels for extended stays, and more flexible than long-term rentals.

HOLIDAY LET

• Purpose: Leisure travel and holidays.

• Guest: Individual holidaymakers.

• Duration: Short stays, such as weekends or weeks.

• Benefits: Offers flexibility and independence for travellers

WHAT IS A CORPORATE LET?

A corporate let is a property typically rented by a business, not an individual. They are fully furnished and fully equipped for a ‘home away from home’ experience.

Length of stays tend to be for a minimum of 14 days and can go on for several months depending on the length of work the guest has in that particular area.

GROWING CORPORATE LET DEMAND

The demand for temporary accommodation for corporate workers has grown significantly over recent years due to several factors:

REMOTE WORK & BUSINESS TRAVEL:

The rise of remote work and the evolving nature of business travel has contributed towards the requirement for more temporary accommodation without the need for an employee to take out a 12-month long term rental.

SELF - CONTAINED REQUIREMENTS:

Many workers now prefer to stay in self-contained properties where they can make their own meals and feel more at home, rather than the feeling of living out of a suitcase. Most hotels don’t provide these sorts of facilities which is why many guests have turned to serviced accommodation or aparthotel rooms.

FLEXIBILITY & TECHNOLOGICAL ADVANCEMENTS:

Most apart-hotels or serviced accommodation have the technology in place now to allow for self-check ins. This can be important particularly for the likes of night shift workers that prefer the flexibility of checking themselves in at any time of the day.

WHY PEOPLE HOLIDAY IN THE UK

IT'S EASIER

43% of people feel it's more convenient with shorter travel time and less planning required.

CHEAPER

LESS STRESSFUL

35% appreciate avoiding the hassles of airports, jet lag, and long planning.

35% value the savings, from avoiding flights to enjoying better deals on lodging and experiences.

LET'S COMPARE THIS GENERATIONALLY

GEN Z (18 – 28)

Leading the Staycation Movement: Gen Z is most likely to choose staycations in 2025. 71% plan one, and 45% are making it their main holiday. They’re drawn to immersive, experience-rich escapes like eco-retreats, glamping, and wellness breaks. Affordability and sustainability being their top priorities. They seek authenticity, eco-conscious stays, and wellness-focused escapes. Keeping in mind that they have strong preference for solo trips, driven by mental wellbeing, safety considerations, and the appeal of a quiet “you” escape.

The major staycation instigators, Millennials have been a key driver behind the staycation boom. Over half plan to spend more time holidaying in the UK, seeking digital detoxes and escapism. Preferring staycations rich in local flavour, like cultural activities, historical locations, and family-friendly experiences. However, Millennials are open to spontaneous travel (“bleisure”) and favour rentals like Airbnb, especially for group trips. This drive comes from having lower social batteries and wanting to 'touch grass' more.

BABY BOOMERS (61+)

The classic & comfortable travellers, Boomers prefer reliable, traditional holidays. Staycations are attractive due to easy travel, familiarity, and comfort. Boomers are putting value in their relaxation and low-effort trips, often favouring hotel or resort stays for convenience. However, what drives the Boomers isn't social media influence or pop culture, they rely more on informative advertising and trusted sources.

SERVICED ACCOMMODATION VS. HOTELS

Serviced accommodation, such as serviced apartments, offers a more spacious and private “home away from home” experience. These units typically include self-catering facilities like kitchens and living areas, making them ideal for longer stays or those seeking more independence. In contrast, hotels usually provide smaller, single rooms designed for short-term stays. They focus on convenience and service, often offering on-site amenities like restaurants, 24-hour reception, and daily housekeeping.

DID YOU KNOW

People booking accommodation around their pets is on the rise. 28% of all bookings made in 2025 across all booking sites are for pet friendly accommodation.

Our most search for property features:

1. Pet Friendly

2. Parking

3. Hot Tubs

4. Country Walks

5. Proximity to the Beach

2025 BIG TRAVEL TRENDS

Countryside walks are Brits’ #1 staycation activity, closely followed by historic landmarks and picturesque pub gardens. Iconic comforts like fish and chips, castle visits, and ice cream vans ranked highly in national surveys.

Nearly half of consumers now prioritise eating at restaurants featuring locally sourced and seasonal ingredients, with sustainability becoming a key value. 42% were conscious of this in 2023, rising to 49% in 2024.

UK breaks

More Brits are choosing UK breaks, with 63% planning a staycation. That’s over a third making it their main holiday of the year!

We’re also seeing a boom in Gen Z travel, as the 18–28 age group leads the charge:

• 71% are opting for a UK break

• 45% plan to make it their primary holiday

Summer bookings are heating up, too, with year-on-year demand continuing to grow as guests seek sunshine without the passport hassle.

Solo Traveller

Solo staycations are on the rise, with a notable 28% increase in solo bookings in 2024, showing that more travellers are embracing the freedom of going it alone.

Last Minute

We’re seeing a shift toward last-minute travel, with average booking lead times dropping by 8% year-on-year, from 114 days in 2024 to 105 days in 2025.

That said, in-demand locations like Cornwall and Cumbria are still being snapped up early, with travellers booking an average of six months in advance.

Meanwhile, nearly a quarter of all stays are now booked within just one month of departure, highlighting the growing trend of spontaneous staycations.

Holiday Spending

Holiday spending is on the rise, with UK travellers planning to spend more on their main domestic break in 2025, reflecting a growing desire for quality, comfort, and memorable experiences.

This increase in staycation spend is also making a wider impact, with domestic tourism expected to contribute around £24 billion to the UK economy this summeralone, highlighting the sector’s importance for local communities and businesses across the country.

POP CULTURE AND IT'S INFLUENCE

Bristol's tourism is largely through the creation of a Sherlock Locations Trail, which allows visitors to explore filming sites from the popular BBC series and discover the city through a cinematic lens. This trail fosters a form of "screen tourism," where iconic film locations become attractions, bringing visitors who are interested in the show and its associated stories to specific Bristol sites.

Let’s explore how TV shows, films, and music have shaped UK travel trends, inspiring people to discover destinations across the country.

Taylor Swift’s song “The Lakes” has sparked a huge rise in tourism to the Lake District, with TikTok driving the trend. Following her world tour, the track went viral, gaining over 3.4 million views under #TheLakesTaylorSwift. This surge in attention led to a 311% increase in bookings reported by UK holiday provider Parkdean Resort, as fans flock to explore the areas poetic charm.

While Anglesey may not yet mirror the large-scale tourism spikes seen in places like Bath (Bridgerton) or the Lake District (Taylor Swift effect), it is steadily emerging as a compelling destination for screen tourism and music-driven travel. With high-profile film shoots, growing festival offerings, and investment in local creative infrastructure, the island is wellpositioned to ride the wave of pop culture tourism in the years ahead.

SHERLOCK

TAYLOR SWIFT

HOUSE OF THE DRAGONS

Anglesey

Lake District

Bristol

Around 10% of travellers admit social media, particularly TikTok and Instagram playing a major role in where they choose to visit.

Top 5 activities most inspired by social media:

1. Hiking & cycling (outdoor adventures)

2. Viral hidden gems & quirky attractions

3. Castle & heritage stays

4. Aesthetic escapes

5. Exploring cultural & heritage sites

Emma Freyling from Visit Bath, external said: "The value to the local economy is about £5m, from the afternoon teas, walking tours and hotel stays all themed around Bridgerton. This was a 78% rise in tourism after the Netflix release.

With the announcement of Oasis’ reunion tour, travel interest to the UK skyrocketed—searches for Manchester surged by around 700% compared to the previous year.

Accommodation saw a 242% increase compared to typical levels with accommodation prices spiking nearly 400%, going from an average of £104 to £416 per night.

The city’s film-friendly infrastructure, such as its complimentary filming permits has helped it secure highprofile productions like Enola Holmes 2, The Crown, and David Copperfield.

Hull now celebrates this cinematic connection with a themed walking trail called “It Must Be Hullywood”.

Chester and Wrexham tourism leaders are collaborating to leverage the popularity of Wrexham AFC and its Netflix documentary Welcome to Wrexham. The region is exploring crossborder tourism packages connecting Chester’s heritage with Wrexham’s football appeal.

However, the Netflix show Peaky Blinders, filmed near Chester is also leaving fans feeling they're back in time with the untouched filming locations.

Take a look at our predictions for the market over the next 12 months on the next page!

BRIDGERTON OASIS

HULLYWOOD

WREXHAM AFC

Hull

Chester Manchester Bath

PREDICTIONS FOR 2026

2026 SERVICED ACCOMMODATION MARKET OUTLOOK

The future of short-term accommodation in the UK is bright, with staycations gaining popularity as travellers seek hassle-free, flexible holidays. Rising flight costs, ecoconscious choices, and a desire to explore closer to home are driving this shift. At the same time, growth in corporate bookings, fuelled by hybrid work, project travel, and relocations, is boosting demand for quality accommodation. Together, these trends are creating exciting opportunities for both guests and property owners in 2026 and beyond.

EXPANSION BEYOND TRADITIONAL HUBS

This growth is no longer confined to major tourist cities or London suburbs. Infrastructure investments, regional regeneration, and strategic destination branding are driving a new wave of SA growth in “second-tier” towns like Morecambe, Preston, Rotherham, and Hull, reshaping the UK’s SA landscape.

KEY 2026 SERVICED ACCOMMODATION TRENDS

1. MID - TERM “HYBRID STAYS” ON THE RISE

Properties designed for stays of 2 to 12 weeks will outperform traditional nightly rentals, especially among contractors, remote teams, and healthcare or energy sector workers.

2. GROWTH OF “SECOND TIER” TOWNS

Emerging destinations such as Morecambe, Preston, Rotherham, and Hull offer low operating costs, attractive yields, and benefit from regeneration-driven tourism growth.

3. DIGITAL NOMADS HEAD REGIONAL

Smaller towns with reliable Wi-Fi, vibrant coffee scenes, and good transport links are expected to attract longer-term digital nomads seeking hybrid lifestyles.

4. CORPORATE TRAVEL RESURGENCE

Infrastructure and energy projects across the North West, Midlands, and Scotland will continue fuelling steady mid-week bookings from corporate travellers.

5. THE GROWTH OF APARTHOTELS

Aparthotels, also known as apartment hotels, emerging as one of the fastestgrowing segments within the serviced accommodation market. Combining the flexibility of a self-contained apartment with the convenience and amenities of a hotel, they’re increasingly popular with both leisure and corporate travellers seeking longer, more comfortable stays.

For investors, these trends highlight the potential of targeting regional towns with strong local appeal and growth prospects, rather than solely focusing on traditional urban or tourist hubs. The demand for flexible, mid-term accommodation solutions looks set to continue rising, supported by a diverse traveller base from corporate clients to remote workers and digital nomads. INVESTMENT OPPORTUNITIES FACTORS DRIVING DEMAND IN 2026

• A shift from purely leisure travel to blended travel (bleisure and workcations).

• Corporate travel recovery post-COVID, particularly in sectors such as construction, energy, and healthcare.

• Regional tourism infrastructure projects increasing occupancy rates outside of big cities.

• Limited quality hotel stock in regeneration areas creating opportunities for serviced accommodation.

• Record UK demand on platforms like Booking.com and Airbnb for locations emphasizing value, walkability, and local character

AMAZING UK TRAVEL WITH US

If you're a landlord looking for free advice or if you're looking to become a landlord but not sure where to start, book a free call with our friendly, professional team.