PU SE HEALTHY, WEALTHY & WISE INSIDE THIS ISSUE 5 Resident Doctors Appreciation 2023 Recap 9-12 Resident Spotlight: Dr. Harry Liu 15-16 2022-2025 Collective Agreement Update march 2023 | issue 50

The purpose of Resident Doctors of BC is to support residents in fulfilling their education to become well-informed, prepared and professional physicians to enhance patient care.

MISSION STATEMENT

• To advocate for contractual matters

• To support members’ education and encourage excellence in the teaching environment

• To promote its members’ professional, personal and financial well-being

• To foster collegiality among its members throughout British Columbia

• To facilitate collaboration with the community and other professional groups

CONTACT US

Phone 604-876-7636 | 1-888-877-2722

Email info@residentdoctorsbc.ca

Facebook Resident Doctors of BC

Twitter @ResidentDocsBC

Instagram @ResidentDocsBC

350 - 1665 West Broadway Vancouver, BC V6J 1X1

www.residentdoctorsbc.ca

CONTENTS 2 A Word From Our Executive Director

5

to reduce

money stress

7 tax

and credits for residents physicians 23

29 Distributed

Resident Doctors Appreciation Week Recap 9 Resident Spotlight: Dr. Harry Liu 15 Changes in the new Collective Agreement 2022-2025 17 Financial Wellness Spotlight: Three habits

physician

21

deductions

Life Insurance: How much do I really need?

Site: Kamloops

A WORD FROM OUR EXECUTIVE DIRECTOR

To our members,

It is with gratitude and great excitement that I am writing to you at the beginning of a new RDBC Collective Agreement. After a long and gruelling process listening to your feedback, developing policy proposals, and negotiating with the employer alongside a star-studded team of RDBC staff and residents, we were able to strike a new CA that secured increases in compensation and call, expanded benefits coverage, introduced new stipends to reduce the costs of residency, expanded support for Indigenous residents, and increased language clarity in the agreement.

Your resounding endorsement of the new CA is not only a vote of confidence in our ability to realize our strategic goals, but also a reminder that our work to represent and advance the interests of residents will be ever continuing. Our staff has already begun to collect information to enforce the new policies introduced in this round of the Collective Agreement and brainstorm ideas for consideration at the next round of Collective Bargaining. It is our hope that our members will continue to engage with us on all matters to do with their work and contract, and keep us informed about the topics closest to their interests and priorities.

As the ink dries on the final pages of the new Collective Agreement, we are looking forward to meeting more of you face-to-face (or zoom-to-zoom, as the case may be) in the upcoming months. Plans have already been made for virtual Collective Agreement town halls for surgery programs and Physical Medicine & Rehabilitation in the month of March, and we are anticipating more trips to sites such as Prince George and hospitals in the Interior. The team at RDBC is always available to meet with you to discuss anything in the Collective Agreement, or serve as a sounding board for the many ups and downs of resident life!

Sincerely,

Lona Cunningham Executive Director

A WORD FROM OUR

PRESIDENT

2

UPCOMING EVENTS

March 15

Board Meeting

March 20 - 31

Virtual Tax Clinic

Month of May

Wellness Month

3

Plan Your Own Social

Resident Doctors of BC wants to help you and your residency program plan a social event. We will sponsor up to $750 (up to $1,700 if two programs collaborate) towards your program social event.

Interested? Visit our website and look under ‘Initiatives’!

4

4

RESIDENT DOCTORS APPRECIATION WEEK 2023 RECAP

Thank you to all our residents who participated in this year’s Resident Doctors Appreciation Week!

Resident Doctors of BC and a group of residents had the opportunity to visit the BC Legislature Building in Victoria for Resident Appreciation Week 2023. On February 8, RDBC hosted a breakfast and invited MLAs from various ridings to attend and meet the future physicians of BC. There was a great turnout and residents had the chance to meet and chat with MLAs about the importance of their work, and residency in general.

Our Health & Wellness and External Relations Committees worked hard this year to organize a couple events for Resident Doctors Appreciation week. We dropped off snacks at some of our local resident lounges and hosted Virtual Trivia Night. Lastly, we held the “Appreciate a Resident” contest.

Do you have feedback on these events, or ideas for what you would like to see happen during future years? Don’t hesitate to send an email to info@residentdoctorsbc.ca. Your feedback is instrumental in guiding RDBC to better engage with our residents!

5

RESIDENT ENGAGEMENT DINNER WITH THE MINISTRY OF HEALTH

FEBRUARY 8, 2023

As part of an initiative to further engage the residents and the Ministry of Health, we have been working with the Ministry to host more dinners that allow residents and ministry officials to meet, and discuss residency.

This year, residents once again met with the Ministry over dinner and discussion on February 8, 2023 in Victoria, as part of Resident Appreciation Week. We were able to build on the dinner prior to further establish the importance of residents in British Columbia, and their status as the future physicians of the province. We also want to say thank you from the organization to everyone who showed up to support our residents. We look forward to future dinners and discussions on medical practice in British Columbia.

6

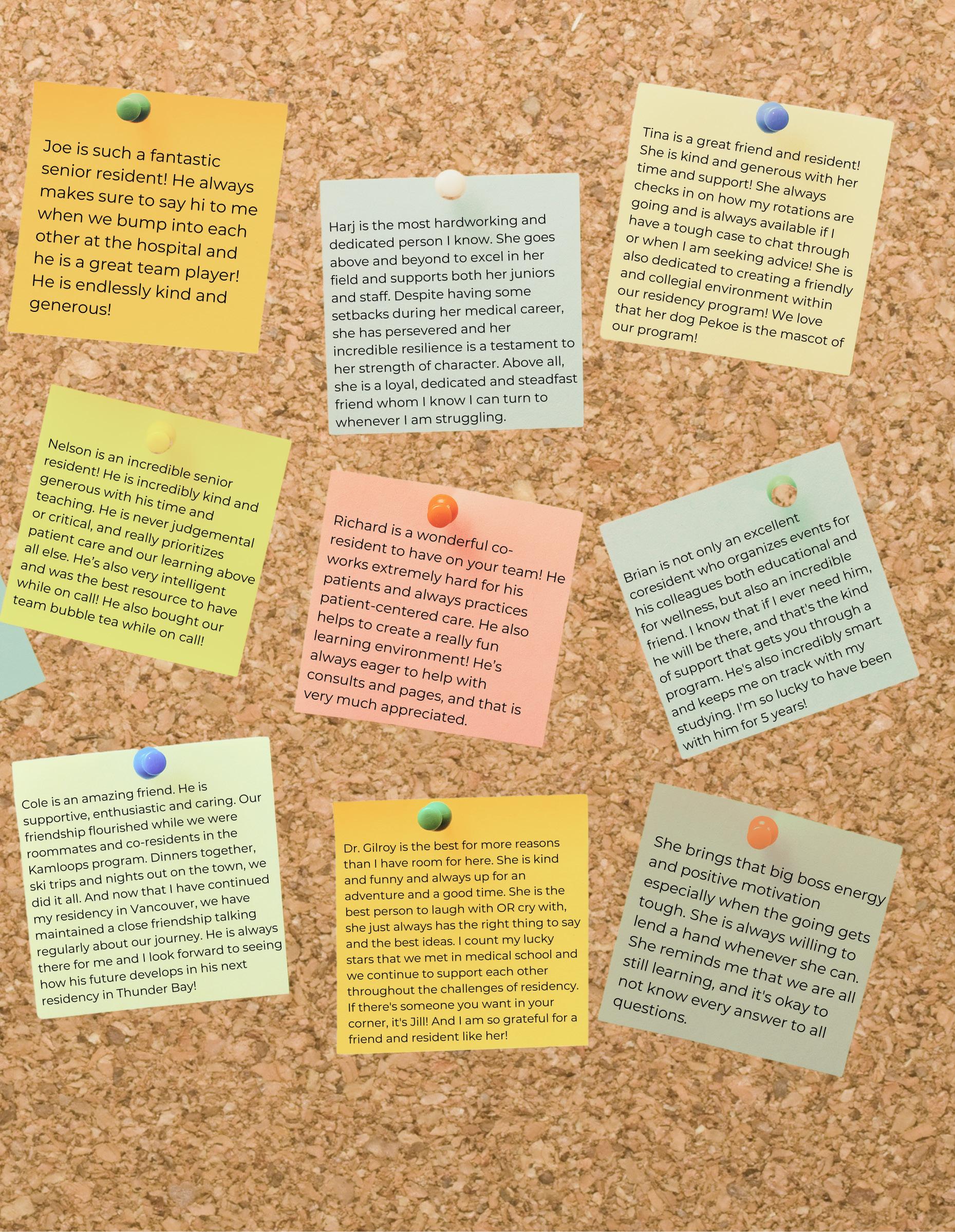

TO: RESIDENTS FROM: RESIDENTS

7

Interested in submitting a dedicated and anonymous appreciation for a fellow resident? Check out our Paging Positivity, where we feature thank you notes between residents!

8

MARCH, 2023

Dr. Harry Liu, PGY-4, Dermatology

You are passionate about “Choosing Wisely Canada”. Could you briefly describe the concepts to us (perhaps in the context of the programs you’ve worked in!) and why you believe it’s important in dermatology and healthcare in general?

For clarity, Choosing Wisely Canada (CWC) is a national campaign on resource stewardship. It is based on the notion that unnecessary tests, procedures, and treatments often do more harm than good, resulting in poor clinical outcomes and significant waste in the Canadian healthcare system. For example, unnecessary imaging tests for low back pain are associated with increased healthcare costs and unnecessary radiation to patients. My journey of advocating for the effective use of healthcare resources started in 2017 when I completed a systemic review under the supervision of Dr. Brian Rowe to investigate the effectiveness of interventions to decrease image ordering for low back pain in the Emergency Department. The paper was published and featured on the front cover of the journal, Academic Emergency Medicine, and became one of the Top 10 most accessed journal articles in 2018. Many readers reached out to me, and I had lots of meaningful conversations on resource stewardship which enhanced my interest on CWC.

One example of resource stewardship in dermatology is that antibiotics are sometimes routinely prescribed for bilateral swelling and redness of the lower leg (“bilateral cellulitis”). It is associated with antibiotic resistance and prolonged hospital stay.

I have also seen severe cutaneous adverse reaction like Stevens-Johnson syndrome from unnecessary use antibiotics for “bilateral cellulitis”. One of the recommendations developed by the Canadian Dermatology Association with CWC in 2020 is “Don’t routinely prescribe antibiotics for bilateral lower leg redness and swelling”. In residency, I combined my interests in resource stewardship and medication in dermatology together. I led a team to create casebased educational videos to teach medical trainees about these CWC dermatology recommendations to decrease unnecessary tests and treatments. I am proud to say that the project received the American Academy of Dermatology Resident Quality Improvement Award in 2022.

I firmly believe that resource stewardship is essential for our Canadian healthcare system. I hope more medical trainees can learn more about CWC so everyone can be empowered to initiate conversations with patients to help them decide what tests and procedures are right for them. It will ultimately lead to a sustainable healthcare system and stronger patient-physician relationships.

9 RESIDENT SPOTLIGHT

DR. MEAGAN MCKEEN

You’ve done a lot of work on skin of colour. Could you briefly talk about your work on this topic and how you’ve used (or plan to use) research on skin of colour to help patients of colour?

Common skin conditions often manifest differently on darker skin, and there are also skin conditions that are more common in skin of colour (SOC) patients. Studies have shown patients with skin of colour are underrepresented in medical training and textbooks, leading to missed diagnoses and healthcare inequalities. My first exposure to the topic was when I published a paper titled “Dermatology Education in Skin of Colour: Where We Are and Where Do We Go?” in the Canadian Medical Educational Journal in 2021. For that paper, the awareness of this disparity in dermatology was raised, and I became more and more interested in the topic. In 2022, I participated in the SOC Society Diversity in Dermatology Trials Task Force in Washington DC and developed a deep appreciation of the lack of SOC in clinical trials and research. It inspired me to publish several clinical cases on SOC patients in various scientific journals.

I am a firm believer that it is important for our medical trainees to become competent in the management of skin diseases in SOC patients because there are distinct differences in the prevalence, disease manifestations, and treatments required for certain skin conditions in this population. In the “Beyond Skin Deep” online multidisciplinary dermatology modules my team created for medical students, we included various cases that focused on the care of SOC patients to help medical students provide better care for them. There has been an increasing number of initiatives on SOC medical education, including the Skin Spectrum Summit in Canada and SOC Update in the US. I highly recommend any residents with an interest in SOC to attend these conferences. During my elective time next year, I am excited to visit the

University of Washington in Seattle to learn strategies for diagnosing and managing cutaneous lymphoma in SOC patients. After residency, I hope to develop a multidisciplinary specialized clinic with a focus on providing individualized dermatologic care to SOC patients.

It’s impressive that you have published over 20 peer-reviewed publications thus far. Could you talk about some of research work you did and what inspired you to do research? Do you have any tips for residents who are interested in doing research?

I have done research in several areas that I am curious about, including primary psychodermatology, rare complex dermatologic conditions, and medical education. Primary psychodermatology encompasses psychiatric disorders with skin manifestations, a very underserved area in dermatology. With my mentor Dr. Marlene Dytoc, over the last three years, my team reviewed the global prevalence and pharmacological interventions for all primary psychodermatologic disorders in randomized controlled trials. These conditions are often underdiagnosed, and the patients often have significantly reduced quality of life. It is a reminder of the importance of the multidisciplinary aspect of dermatology and how dermatologists can collaborate with other health professionals to provide better patient care.

The other fun part of being a resident is you get to see and treat many “Zebra” cases when working at a tertiary center, like the Vancouver General Hospital. For example, I saw and reported the first case of terbinafine-induced generalized pustular psoriasis that mimics Stevens-Johnson syndrome....

Continued on next page

10

a novel presentation of cutaneous lupus erythematosus, and coined a new clinical presentation termed “yellow bullous striae distensae” with my co-resident. There is usually no established treatment for rare diseases. Researching those conditions and publishing the cases can help physicians be more comfortable diagnosing and treating rare diseases and potentially help other patients with similar conditions worldwide.

My biggest advice for someone starting research in residency is first to follow your curiosity instead of your passion because passion needs time to build up. An excellent research topic is the one you are most curious about, and it can be anything. For example, along with my co-authors, we reviewed the content of skin cancer posts on TikTok and reported the trending pattern of tanning. It then raised the seriousness of this issue in the dermatology community. In November 2022, TikTok banned videos that encouraged sunburn and tanning. Next time, I therefore encourage you to ask yourself what you are the most curious about now before embarking on the journey of starting a new research project.

You have been named the “Culture Changer in Medical Education” by the Canadian Federation of Medical Students over the past three years. What are some of the most challenging and most awarding moments of creating the educational resources and introducing them to medical students?

I would not be where I am today without all the teachers and mentors I have met along my journey of residency so far. They include several people I already mentioned, like Dr. Dytoc and Dr. Rowe, as well as Dr. Hui Zhou, Dr. Monica Li, and Dr. Tina Alster from residency. They have all inspired my curiosity and passion for medical education and mentorship.

The most rewarding parts of creating educational resources are certainly to see students being able to use these resources to provide better patient care. For example, I made various interactive cases, podcasts, and summary notes on PedsCases.com to help medical students to develop an approach to multiple topics in pediatric dermatology, including atopic dermatitis, pediatric vitiligo, neurocutaneous disorders, etc. There was no better feeling than when students contacted me and told me the resources helped them feel more comfortable diagnosing and treating these conditions. I also enjoyed using new platforms like social media to find innovative teaching methods. For example, with the lack of in-personal clinical skill teaching for medical students during the peak of the COVID-19 pandemic, I created concise educational videos and posts to help medical students learn clinical dermatology on the Instagram page of MEDSKL.com. I was thrilled to be able to share this innovative teaching method with other educators from different universities at the 2022 Canadian Conference on Medical Education in Calgary.

11

The most challenging part of doing all these is balancing the clinical work as a resident, studying over 3000 skin conditions, and doing scientific research. Also, I am always interested in exploring innovative ways and initiatives to teach medical students; sometimes, they may not work out perfectly. Hence, there is a bit of trial and error and unavoidable disappointment. Nevertheless, with the advancement of technology and continuous innovation, I am excited to see what medical education will be like over the next 5-10 years. I hope to be part of the transformative journey for medical learners.

For more Resident Spotlight features, visit our website.

RESIDENT SPOTLIGHT

Resident Spotlight works to highlight the many different residents that make up our membership.

Interested in being interviewed? Contact diana@residentdoctorsbc.ca

12

From topics on balancing parenting in residency, personal experiences in residency, to research tracks and own initiatives in the medical field, we hope to bring you a wide variety of interviews to offer a glimpse into residency life.

Moments of Crisp Honesty

By Dr. Austin Lam, PGY-1 PsychiatryResearch Track

“If only it were all so simple! If only there were evil people somewhere insidiously committing evil deeds, and it were necessary only to separate them from the rest of us and destroy them. But the line dividing good and evil cuts through the heart of every human being. And who is willing to destroy a piece of their own heart?”

— Aleksandr Solzhenitsyn

Of kindness

Of hypocrisy

Of contradiction and multitudes

The blind spot of noumenon

Of that which is

Over-talked

Over-discussed

Ever-present

In fluctuating waves of hide and seek

Hidden and

Calcified

Conquered, they say

It comes upon you

Still

Always

Floating decorated ornament

There is not

There isn’t

There was

There still is

There may be conquest

False and deceptive

Trompe l’oeil

And forced perspectives

Holbein the Younger

Could not have trumped

Your eye

Of Vanitas, of memento mori

They say

“Remember friend as you walk by

As you are now so once was I

As I am now you will surely be. Prepare thyself to follow me.”

What remains

What has undergone

Way of experience

Train of experience

Steely kindness

Injected with doubt

Thoroughgoing insecurity

Grounded in security

Only by looking

Behind

Steely-eyed

Sceptic

If way to humanity

Lies in humanity

Then look

Look, look – circumspection.

RESIDENT SUBMISSIONS

13

THE WRITTEN WORD, ART, MUSIC.... Be Featured in the PULSE! Do you have a creative outlet? Contact us to have your work featured in future editions of the PULSE DIANA@RESIDENTDOCTORSBC.CA 14

CHANGES IN THE NEW COLLECTIVE AGREEMENT 20222025

Thank you all for your overwhelming support of the new Collective Agreement. Please see some of the new changes below.

Effective Date: All changes to the collective agreement came into effect December 23, 2022 unless otherwise stated (e.g. new benefits that start on January 1, 2023 & 2024. This includes the official addition of the National Day for Truth and Reconciliation as a statutory holiday, new rules regarding statutory Holiday Pay, and the increase to 6 hours of uninterrupted rest while on duty for 24 or more hours.

Retroactive pay: HEABC has been advised by Vancouver Coastal Health that the General Wage Increase effective April 1, 2022 is scheduled to be paid on the March 11, 2023 paycheque. This retroactive payment will include all hours worked between April 1, 2022 and March 3, 2022.

Benefits: New benefits that were scheduled to begin in January 2023 are in effect. Residents can access their new Mental Health and Vision allowances through the Pacific Blue Cross website. Any new and eligible benefits used after the January 1, 2023 may be claimed through PBC.

Residents graduating in 2023 will receive

their full benefit entitlements. Residents who used their previous vision allowance within the last 24 months will be eligible for the difference between the old and new allowances for new vision expenses incurred after January 1, 2023.

Please note that the Health Spending Account comes into effect January 2024.

For specific benefits questions (e.g. how to file a claim), please contact PBC directly.

Call: The changes to Call Types and the increases in stipends started on January 16, 2023, the first day of Block 8. While the call stipend submission process has not changed, there are some new questions for you to help us keep better track of Resident workload. The new rates are available on our website here. Our team has been working closely with our IT contractors on updating callstipend.ca to ensure there is as little disruption to you and the submission process as possible while we update the system.

If you encounter difficulties or if you have call-specific questions, please contact schedules@residentdoctorsbc.ca.

Once again, we would like to thank our members for their enthusiasm, hard work, and support. If you have any questions or concerns, please do not hesitate to reach out to us at info@residentdoctorsbc.ca or call us at (604) 876-7636.

15 FEATURE

�entati�e ��ree�ent

16 �� MENU 0 1 0 � �������� �a�es �ill increase �� ��� �� ���� �� ����� ���� �� ��� ������� ��������� ����������� ��� ���������� 0 3 ���� ���lo�er �aid �������� ���� �� ������ ���� ������� ��������� 0 2 1 1 Reconciliation in action �� ��������� ���������� �������� ��� �������� ���� ����� ��� ���������� ����������� ���������� ��� ������������� �e� Call ���es� �� ������� ������� ���� ���� ����������� 0 5 0 � �ncl�sion o� �ental Health �� ����� �� ���� �������� ���� ����� ���� �� � Health Care ��endin� �cco�nt� �� ����� ����� ���� ��� ��� �������� �� ���� ��������� � �rainin� �ti�end ���� ���� �� ����� �� ��������� ����� ��� ���� �� ���� ������� ������� �� ���� ������ ����� ���� �� � �echnolo�� �ti�end ����� �� ����� ���� �� �������� ������� ���� ��� ������� ����� �ncrease �� ��� ������������ ������� ������� �����

HIGHLIGHTS Call �ti�end Rate �ncrease� �� ��� ���� ����� 04 ������� ��������� ������� �������� ���� �� increased ���� ��� �������� ����� 0� 0� 10 12 ��� ������ ���lo�er �ill �e �a�in� �or e�e e�a�s�

FINANCIAL WELLNESS

SPOTLIGHT: THREE HABITS TO REDUCE PHYSICIAN MONEY STRESS

Your financial wellness is tied to your mental, emotional, and physical wellbeing.

Resident doctors are all too familiar with the struggle to juggle clinical workloads, personal and family commitments and the associated stress that comes with being a physician in training. In addition to those challenges, many are also feeling an increased level of money stress particularly in the face of rising inflation, interest rates and the high cost of living throughout BC.

A common concern for resident doctors is the long-term consequences of dipping into their line of credit to meet their monthly expenses. With commitments such as paying off credit card balances, student loans, saving for life’s next milestone and/or building up a down payment for a home, it can feel like money stress will be a constant.

Here are three habits to help resident doctors reduce money stress based on 20 years of providing financial coaching to doctors at every stage of their medical career:

1. Create a baseline 50/30/20 cashflow spending plan.

With prime interest rates going up from 2.7% in March 2022 to 6.7% in February 2023 resulting in a 148% increase, now more so

than ever resident doctors need a game plan to manage income and expenses.

Creating a cashflow spending plan aka “budget” is all about identifying what you cannot live without (needs), the nice to haves (wants) and ensuring you are saving towards your personal/ family goals. As a resident doctor, take your personal or household monthly after-tax income and divide it into three categories:

50% for Needs:

Allocate up to 50% of your income to expenses you “cannot live without” such as rent/mortgage, food, basic transportation, minimum debt repayment, and putting away money for taxes if you are earning CA shift income.

30% for Wants:

Allocate up to 30% for the experiences and luxuries that are nice to have. This includes eating out, traveling, upgrading your wardrobe or technology, etc.

20% for Financial Goals:

Commit up to 20% for long-term financial goals such as saving, investing, building up a down payment for a home, and repaying debt. Based on your personal situation and savings goals, consider using your taxfree savings account (TFSA), registered retirement savings plan (RRSP), or the new First Home Savings Account (FHSA).

We also recommend that you stay on top of financial obligations such as utilities, cellphone bills, and credit card statements.

17 FINANCES

Alphil Guilaran, Co-Founder of Financial Literacy Counsel Inc.

Set up autopayment features on your bank account and use an app to track your expenses. This will help you identify changing spending patterns as well as help to build up your credit score and avoid paying late charges.

practice contracts and longitudinal contracts.

We also encourage building the habit of reading books and articles on physician finances, watching a course online or listening to money management podcasts.

3. Speak to a safe person.

As a busy medical professional, it can be easy to put off prioritizing your financial wellness. However, it is essential to speak to someone if you see patterns of money stress impacting relationships and/ or affecting your emotional, mental, and physical wellbeing.

2. Increase your financial literacy.

Taking steps towards being a financially literate doctor is foundational in reducing money stress. With income being a key determinant of health, it begins with understanding how you are currently getting paid as a resident doctor and how you will be paid as a practicing physician.

With the ratification of the new Physician Master Agreement last December and an updated RDBC Collective Agreement, this is a great time to “be in the know” when it comes to recent changes to physician compensation in BC.

In residency, start with understanding how to read your pay stub as well as different ways you can get paid beyond a salary such as call shifts and clinical associate income if applicable to your specialty.

As you transition into practice, make it a habit to speak to your preceptors and colleagues about the pros and cons of feefor-service billing, alternate payment plan models, MOCAP, sessional income and consulting income. Also, keep up to date with any changes to locum contracts, new to

Help is around the corner if you need to speak to someone. Through your RDBC benefits you have access to the UBC Wellness Office and the Physician Health Program to speak to qualified Registered Clinical Counselor. We encourage you to access these benefits through RDBC’s website https://residentdoctorsbc.ca/ bargaining-benefits/benefits/

Your RDBC member benefits also include two financial coaching sessions with an experienced Financial Advisor from Financial Literacy Counsel (FLC). Take advantage of this benefit to get personalized answers to your top financial questions in residency as well as when you transition into practice.

18

Continued on next page

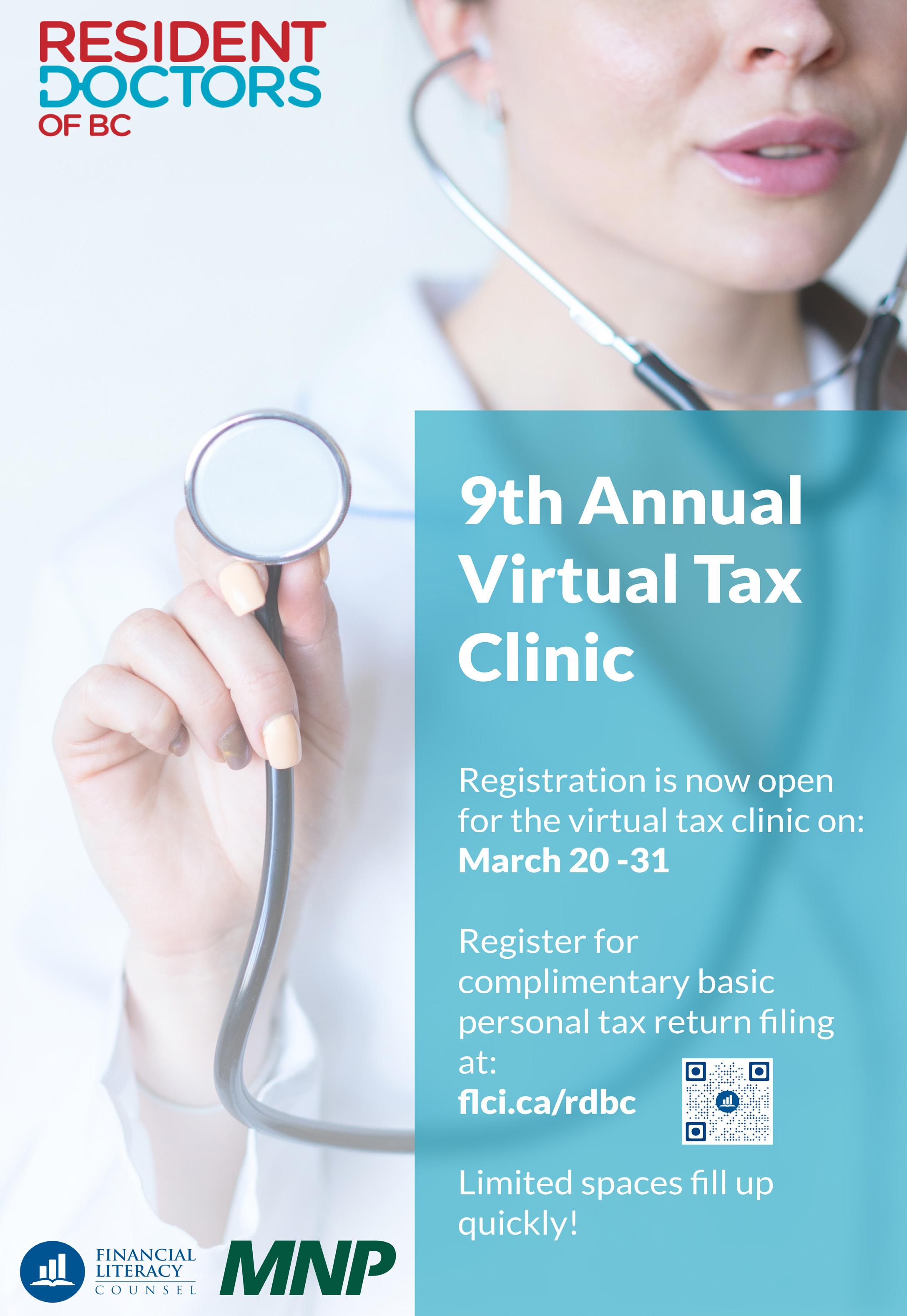

FLC has also partnered with MNP Accountants to host the 9th Annual Tax Clinic from March 20-31, 2023, so that resident doctors throughout BC can file their tax returns virtually. Visit https://flci.ca/rdbc/ to schedule an appointment.

To access your financial coaching benefit with FLC, use the QR code below or contact them at 604.620.6630 or contact@flci.ca

ABOUT FINANCIAL LITERACY COUNSEL

Financial Literacy Counsel (FLC) is a boutique financial education and financial planning company committed to building a financially literate world of stronger families and communities. FLC began educating doctors in 2003 through the UBC Faculty of Medicine. FLC was contracted in 2011 by VCH Employee Wellness and in 2020 by Resident Doctors of BC to increase the financial literacy of doctors and healthcare professionals. Their programs are also delivered through UBC Medicine CPD, UBC Transition into Professional Practice, BC Anesthesiologists’ Society, Burnaby Hospital Medical Staff Association, Vancouver Division of Family Practice, BC Doctors of Optometry, UBC Professional MBA, and Continuing Legal Education Society of BC (CLE-BC). FLC was the 2020 IFSE Institute Financial Literacy Champion of the Year. Learn more about FLC by visiting www.flci.ca

19

20

7 TAX DEDUCTIONS AND CREDITS FOR RESIDENT PHYSICIANS

Being aware of the tax breaks that you may qualify for as a resident physician can help minimize the taxes you pay. Here are seven tax deductions and tax credits that are worth looking into.

1. Tuition tax credits: Any tuition fees you paid during residency may be eligible for the non-refundable tuition tax credit. Fees paid for admission, application, use of library or laboratory facilities, diplomas, and mandatory computer service fees may also qualify for the tuition tax credit.

Tip: If you have unused tuition tax credits from your medical school years, you can apply the unused credits to reduce taxes payable. If there are still unused credits at the end of the year, it automatically carries forward. Any amounts paid in the current year and not used or transferred to an eligible person (such as your spouse or common-law partner or, under certain restrictions, a parent or grandparent) will automatically be available to carry forward as well.

2. Interest on student loans: If you have an existing loan under the Canada Student Loans Act, the Canada Student Financial Assistance Act or a similar provincial or territorial loans program (not a personal loan or line of credit), you can claim a 15% federal non-refundable tax credit on any interest you paid in 2022.

In April 2021, the federal government announced that no interest will accrue until March 31, 2023, on the federal portion of Canada Student Loans. That said, you may nonetheless have student loan interest paid that is eligible for a tax credit on your 2022 tax return.

Tip: If you didn’t claim the interest paid on student loans in the past, you can go back and claim it for any of the previous five years.

3. Moving expenses: If you moved at least 40 kilometres to be closer to a new work location in the past tax year, you may be able to claim a tax deduction for your moving expenses. Moving expenses can include transportation and storage costs, travel expenses, temporary living expenses, the cost of cancelling a lease, and utility connections and disconnections.

Tip: If you have sold and/or purchased a home due to your move, you may be able to claim advertising, notary or legal fees, real estate commission, property transfer taxes, and other registration costs.

4. Union, professional and membership dues: If you paid for membership in a B.C. medical association or the College of Physicians and Surgeons of British Columbia, these are generally deductible for tax purposes if they are required in order to order to practice. Union dues paid to a provincial residency (e.g., Resident Doctors of B.C.) are also generally deductible.

TAXES 21

MD Financial Management

Tip: You don’t need to file your official receipts from the association or union with your tax return, but be sure to keep them in case the CRA asks to see them.

5. First-time homebuyers’ amount: If you were able to buy your first home, you might be able to claim a federal nonrefundable first-time homebuyers’ tax credit equal to 15% of up to $5,000 in the year of purchase. This can result in a tax savings of up to $750.

Tip: To qualify as a first-time homebuyer, you and your spouse or common-law partner must not have owned or lived in another home owned by either of you in the current or four preceding calendar years. You also must make the new home your principal residence within one year of purchase.

6. Child-care expenses: If you have children, the cost of daycare, babysitters and full-time caregivers is deductible, to a maximum of $8,000 a year for children who are under 7 and $5,000 a year for kids aged 7 to 16. Generally speaking, the lower-income spouse or common-law partner must claim this deduction (unless that person is at school or disabled or the two of you are separated).

Tip: In practice, the CRA generally does not attach specific child-care expenses to specific children. That is, as long as total child-care expenses don’t exceed the defined limits per child multiplied by the number of children, all eligible child-care expenses are generally allowed. To maximize your base for child-care deductions, make sure to report on your tax return all your children who are 16 years and under, and those with infirmities.

7. Medical expenses: If you incurred any medical expenses (including dental and eye care expenses) that aren’t covered by an insurance plan, you may be able to apply them against your taxable income.

There is a long list of eligible expenses, including medical cannabis, tutoring services (learning disability), travel expenses to get medical services and fertility-related procedures.

The above information should not be construed as offering specific financial, investment, foreign or domestic taxation, legal, accounting or similar professional advice, nor is it intended to replace the advice of independent tax, accounting or legal professionals.

22

LIFE INSURANCE: HOW MUCH DO I REALLY NEED?

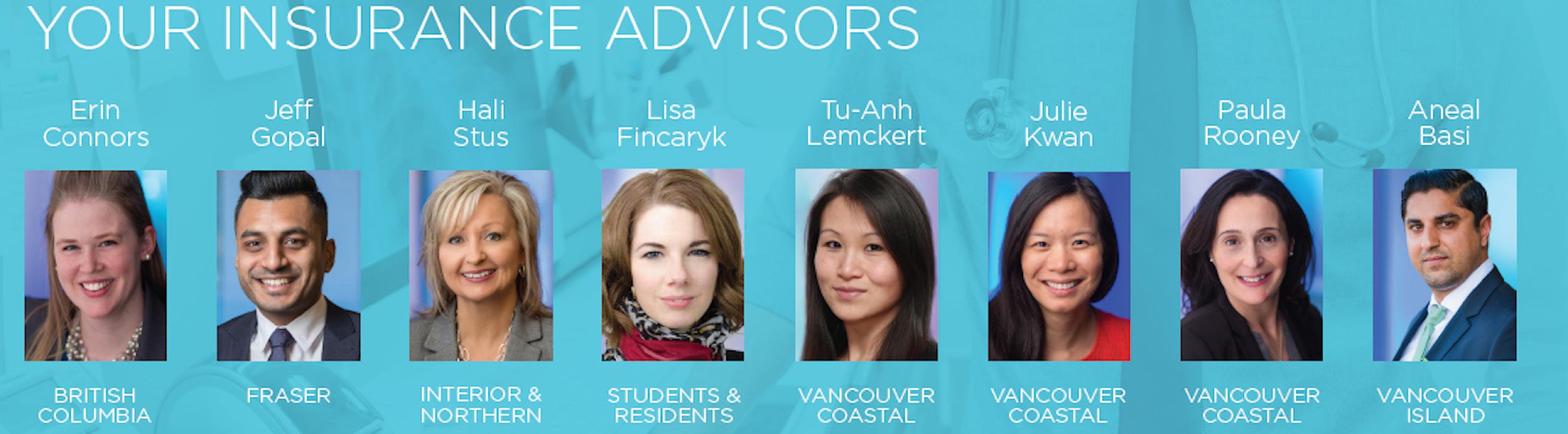

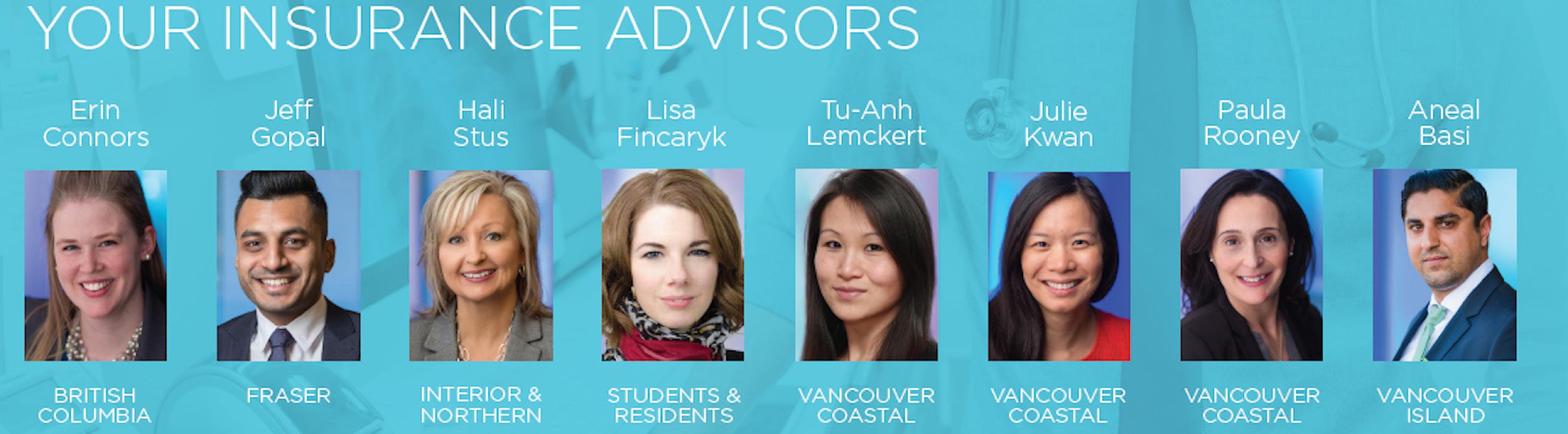

Hali Stus – Insurance Advisor, Members’ Products and Services

When speaking with our members about life insurance, I am often asked, “How much do I really need?” That depends on a few key areas of consideration, and there is no onesize-fits-all approach. An experienced advisor can help you walk through your specific situation and will generally look at the following areas:

final tax filings and legal fees to settle your estate. Residents who’ve had the opportunity to live debt free by the generosity of family often consider using life insurance to leave family money to repay them for their financial contribution, pay for funeral costs, or to take time off work to grieve.

Primary Capital Needs: These are outstanding debts such as a student debt, line of credit, or mortgage. Some residents are the primary income earner for their family. If they pass away, they want debt repaid to ensure their surviving family are not encumbered with loans and that assets are not reposed by creditors and instead pass to loved ones.

Income Replacement: This discussion is highly individualized, based on one’s situation and one’s comfort level with risk. If your spouse works outside the family home, is their income enough to cover living needs for the surviving family after all debts are paid off? The amount needed will vary based on the lifestyle and age of the children (if applicable). If there are no dependents, then the income replacement need may be minimal.

Secondary Capital Needs: These include money to cover the cost of dependents’ post-secondary education, charitable bequests, and final expenses, including burial,

Residents can apply for $100,000 of Doctors of BC life insurance without medical questions.

INSURANCE

23

If you were a UBC medical student, you may add this coverage to existing life coverage you may have obtained during your studies, for a total of $200,000. Everyone’s needs are unique and you may require more coverage. If you prove good health, you may apply for up to $5M life coverage for you or your spouse. We are also able to offer individual policies through several major Canadian insurers.

How often should you review your life insurance? If it has been several years since you last reviewed or made changes to your insurance, please review your beneficiary details to ensure they accurately reflect your intentions. It’s an unhappy surprise for your heirs to find out after your death that your beneficiaries are out of date.

If you have questions and want to discuss your personal life insurance requirements, please speak with a non-commissioned, licensed Doctors of BC Insurance Advisor to get a proper assessment.

Email insurance@doctorofbc.ca or call 604-638-7914 for a complimentary appointment. Visit https://www.doctorsofbc.ca/ for more information on available plans.

24

FINANCES FOR RESIDENTS, BY RESIDENTS

FINANCIALPULSE.CA 25

Available on Podbean & Apple Podcasts

26

We are looking for residents who would want to contribute to our next episode! Contact diana@ residentdoctorsbc.ca for more info!

Health Initiatives for March 2023

Brain Health Awareness Month

Brain Health Awareness Month raises awareness about maintaining optimal brain health through healthy habits like diet and exercise. Activities like reading, writing, puzzles, and language learning are good for brain health. Protect the brain from injury by wearing helmets and following safety procedures. During March, Brain Health Awareness Month, try something new for a healthy mind.

Liver Health Month

Liver Health Month takes place in March. Various organizations and healthcare professionals may hold events and campaigns aimed at increasing awareness of liver health, preventing liver diseases, and promoting liver disease screening and treatment. Research efforts are continuously leading to exciting breakthroughs in the diagnosis and treatment of liver disease. However, not all patients have access to these advancements. Liver disease affects 1 in 4 people in Canada, yet the issue remains overlooked, leading to a negative impact on liver healthcare.

As a patient, family member, physician, nurse, or allied health professional, you can help by raising awareness about liver disease. Dispelling misconceptions, sharing stories, emphasizing the importance of liver health,

and advocating for government policies can make a difference. By speaking out and acting, we can improve liver healthcare and increase awareness about liver disease in Canada.

Nutrition Month 2023

For nutrition month this year Canada is drawing attention to the importance of making informed food choices and developing healthy eating habits. Food is nourishments, but it’s so much more. Food unites us at the kitchen table and can improve health, prevent disease and keep us well for longer. Check out some of our quick and healthy snacks on the next page that you can assemble for those long hospital/ clinic days.

Colorectal Cancer

Colorectal cancer is the third most commonly diagnosed cancer in Canada. While we cannot change risk factors like family cancer history or age, there are ways to lower the risk of developing it. Going for screenings, keeping up with physical activity, healthy diet and not smoking all lower the chances of developing colorectal cancer.

27

RESIDENT WELLNESS

Are you in a rush but still want to eat well? Try one of these healthy and effortless snacks for a nourishing pick-me-up that will also keep you feeling full longer.

Grab and Go; to name a few.

• Any fruit; apples, oranges, bananas, grapes, etc.

• Popcorn

• Cheese and Crackers

• Rice Cakes

• Boiled eggs

• Mixed nuts

Cinnamon Apples

Ingredients:

• 1 Apple

• 1/2 tbsp cinnamon

• 1 tsp sugar (or sweetener of your choice)

Mix the cinnamon and sugar in a container. Core and slice the apple then add to the same container. Attach the lid and simply shake!

Mason Jar Parfait

Ingredients:

• Fresh Berries of your choice

• Plain Greek Yogurt

• Seeds or nuts of your choice

• Oats (optional)

Fill the mason jar about halfway with greek yogurt, add fruit and other toppings. Place in fridge the night before a busy day for a quick and easy packable snack. This snack is high in protein, antioxidants, and healthy fats.

Smoothies

Choose a liquid base. coconut water, or any dairy-free milk for an extra creamy smoothie. Avoid fruit juices, as it adds unnecessary sugar.

Start with frozen fruits. Using frozen fruits keeps your smoothie chilled and creamy.

Add veggies. Adding fresh spinach or kale is an effortless way to sneak in greens. If adding this to your smoothie, try blending first with a little water to ensure a smooth blend.

Add healthy fats. Healthy fats will help draw in all those fat-soluble vitamins and nutrients from your fruits and veggies! Try almond butter, a drizzle of coconut oil, a slice of avocado or a variety of seeds such as chia seeds or flax seeds.

28

Kamloops

https://www.linkagephoto.com/kamloops-bc-panoramas

Kamloops

Kamloops is a gorgeous city in British Columbia located in the Thompson Valley. The word Kamloops is the English translation of the Shuswap word Tk’emlúps, meaning ‘where the rivers meet,’ and for centuries has been the unsurrendered land of the Tk’emlúps te Secwépemc within Secwepemcúl’ecw, the traditional territory of the Secwépemc people.

Kamloops is truly an all-seasons type of destination full of amazing things to do any time of the year – especially if you love the outdoors.

Things to do Art and Culture

The best way to explore the arts and culture in Kamloops is to simply take a stroll. The city of Kamloops has art galleries and outdoor art installations, including an entire Back Alley Art Gallery and a variety of sculptures and statues that will greet you along your way.

The Kamloops Art Gallery offers inspiring, provocative, and transformative art experiences of national caliber. The Gallery is well respected for its educational and public programs and through activities organized and presented in the community and region involving both contemporary and historical art.

Kamloops Agri Centre

The Kamloops Agri Centre, located in the heart of Kamloops, is a fantastic place to spend the day with friends and family. Kamloops agriculture is most famous for their sheep farming and wool production but aside from that, residents find entertainment through a variety of agricultural and rodeo events including; barrel racing, breakaway roping, team roping, team penning, cattle sorting, horse racing and spring training.

Kamloops Golf and Country Club

Do you enjoy the outdoors? Spend the day golfing at Kamloops Golf and Country Club; the oldest golf course in the Kamloops area. This eighteen-hole course is open for the season from April 7th, 2023 – October 10th, 2023. If you would rather practice your drive or work on your putt than play a whole course, the driving range features a large grass tee driving range that stretches out to 275 yards in length. The country club also includes two chipping greens, one practice bunker and an additional putting green.

Sun Peaks

Sun Peaks is a village located just 45 minutes northeast of Kamloops, it is the second-largest ski area in Canada and a year-round destination for guests in search of a

29 DISTRIBUTED SITE: KAMLOOPS

welcoming, accessible, stress-free mountain experience. If you do not like driving in the winter, there are several shuttle and transfer options to choose from that provide transportation to Sun Peaks from the city of Kamloops. Activities range from winter activities such as; skiing/ snowboarding, snow tubing, snowshoeing, dog sledding, and ice skating. If you prefer to hibernate in the winter, their summer activities include mountain biking, hiking, horseback riding and mini golf. Not to mention spas, yoga studios, axe throwing, and local shops that are open year-round.

Lake Recreation

No matter the season, Kamloops has a spot for you to cast a line. The best lakes for fishing in the area are within a 50km radius of Kamloops. The nearby lakes include various fish: rainbow trout, brook trout, lake trout, kokanee, and salmon. If fishing is not for you, there are plenty of other lake activities you can take part in.

If you prefer lounging on the beachside and going into the water for a quick dip, Riverside Beach Park has what you are looking for and it is just a few minutes away from downtown. Enjoy a picnic, stroll along the beach, or go for a swim. The park also features lawn bowling and “Music in the Park” held nightly throughout the summer at the Rotary Bandshell.

Wells Grey Provincial Park

Wells Gray Country and all the communities and lands within it are unlike any place in the world. Located an hour and a half north of Kamloops, it is here you will find the world’s only old-growth inland temperate rainforest, tranquil lakes, powerful rivers, and soaring mountain peaks as well as extinct volcanoes, lava beds, mineral springs, and glaciers and 41 named waterfalls. B.C.’s hidden untamed wilderness playground invites you to explore and unwind.

Lac Du Bois Grasslands Protected Area

Looking for something a little closer to home? Look no further than Lac Du Bois Grasslands

Protected Area which offers sweeping grassland vistas, spectacular cliffs and canyons, cool, dry forests, secret ponds, and small lakes. The park is known to have stunning and peaceful hikes. Lac Du Bois is less than 20 minutes north-west of downtown Kamloops.

Tournament Capital Centre

Kamloops is known to be the ‘Tournament Capitol of Canada’ and their facility is unmatched. This world class facility includes a Fieldhouse, Canada Games Aquatic Centre, indoor throws room, workout facilities, outdoor artificial soccer turf.

30

The Pulse newsletter is always looking for submissions from residents like you! If you have article ideas, announcements, or other interesting insights about life as a resident doctor, please contact us at: info@residentdoctorsbc.ca Physician Health Program 1-800-663-6729 Employee Wellness 1-833-533-1577 HSSBC Benefits & Payroll 1-866-875-5306 (Option 2) PU SE IMPORTANT PHONE NUMBERS