4 minute read

FINANCIAL WELLNESS SPOTLIGHT: THREE HABITS TO REDUCE PHYSICIAN MONEY STRESS

Your financial wellness is tied to your mental, emotional, and physical wellbeing.

Resident doctors are all too familiar with the struggle to juggle clinical workloads, personal and family commitments and the associated stress that comes with being a physician in training. In addition to those challenges, many are also feeling an increased level of money stress particularly in the face of rising inflation, interest rates and the high cost of living throughout BC.

Advertisement

A common concern for resident doctors is the long-term consequences of dipping into their line of credit to meet their monthly expenses. With commitments such as paying off credit card balances, student loans, saving for life’s next milestone and/or building up a down payment for a home, it can feel like money stress will be a constant.

Here are three habits to help resident doctors reduce money stress based on 20 years of providing financial coaching to doctors at every stage of their medical career:

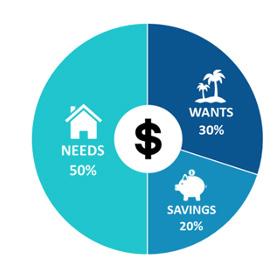

1. Create a baseline 50/30/20 cashflow spending plan.

With prime interest rates going up from 2.7% in March 2022 to 6.7% in February 2023 resulting in a 148% increase, now more so than ever resident doctors need a game plan to manage income and expenses.

Creating a cashflow spending plan aka “budget” is all about identifying what you cannot live without (needs), the nice to haves (wants) and ensuring you are saving towards your personal/ family goals. As a resident doctor, take your personal or household monthly after-tax income and divide it into three categories:

50% for Needs:

Allocate up to 50% of your income to expenses you “cannot live without” such as rent/mortgage, food, basic transportation, minimum debt repayment, and putting away money for taxes if you are earning CA shift income.

30% for Wants:

Allocate up to 30% for the experiences and luxuries that are nice to have. This includes eating out, traveling, upgrading your wardrobe or technology, etc.

20% for Financial Goals: practice contracts and longitudinal contracts.

Commit up to 20% for long-term financial goals such as saving, investing, building up a down payment for a home, and repaying debt. Based on your personal situation and savings goals, consider using your taxfree savings account (TFSA), registered retirement savings plan (RRSP), or the new First Home Savings Account (FHSA).

We also recommend that you stay on top of financial obligations such as utilities, cellphone bills, and credit card statements.

Set up autopayment features on your bank account and use an app to track your expenses. This will help you identify changing spending patterns as well as help to build up your credit score and avoid paying late charges.

We also encourage building the habit of reading books and articles on physician finances, watching a course online or listening to money management podcasts.

3. Speak to a safe person.

As a busy medical professional, it can be easy to put off prioritizing your financial wellness. However, it is essential to speak to someone if you see patterns of money stress impacting relationships and/ or affecting your emotional, mental, and physical wellbeing.

2. Increase your financial literacy.

Taking steps towards being a financially literate doctor is foundational in reducing money stress. With income being a key determinant of health, it begins with understanding how you are currently getting paid as a resident doctor and how you will be paid as a practicing physician.

With the ratification of the new Physician Master Agreement last December and an updated RDBC Collective Agreement, this is a great time to “be in the know” when it comes to recent changes to physician compensation in BC.

In residency, start with understanding how to read your pay stub as well as different ways you can get paid beyond a salary such as call shifts and clinical associate income if applicable to your specialty.

As you transition into practice, make it a habit to speak to your preceptors and colleagues about the pros and cons of feefor-service billing, alternate payment plan models, MOCAP, sessional income and consulting income. Also, keep up to date with any changes to locum contracts, new to

Help is around the corner if you need to speak to someone. Through your RDBC benefits you have access to the UBC Wellness Office and the Physician Health Program to speak to qualified Registered Clinical Counselor. We encourage you to access these benefits through RDBC’s website https://residentdoctorsbc.ca/ bargaining-benefits/benefits/

Your RDBC member benefits also include two financial coaching sessions with an experienced Financial Advisor from Financial Literacy Counsel (FLC). Take advantage of this benefit to get personalized answers to your top financial questions in residency as well as when you transition into practice.

FLC has also partnered with MNP Accountants to host the 9th Annual Tax Clinic from March 20-31, 2023, so that resident doctors throughout BC can file their tax returns virtually. Visit https://flci.ca/rdbc/ to schedule an appointment.

To access your financial coaching benefit with FLC, use the QR code below or contact them at 604.620.6630 or contact@flci.ca

About Financial Literacy Counsel

Financial Literacy Counsel (FLC) is a boutique financial education and financial planning company committed to building a financially literate world of stronger families and communities. FLC began educating doctors in 2003 through the UBC Faculty of Medicine. FLC was contracted in 2011 by VCH Employee Wellness and in 2020 by Resident Doctors of BC to increase the financial literacy of doctors and healthcare professionals. Their programs are also delivered through UBC Medicine CPD, UBC Transition into Professional Practice, BC Anesthesiologists’ Society, Burnaby Hospital Medical Staff Association, Vancouver Division of Family Practice, BC Doctors of Optometry, UBC Professional MBA, and Continuing Legal Education Society of BC (CLE-BC). FLC was the 2020 IFSE Institute Financial Literacy Champion of the Year. Learn more about FLC by visiting www.flci.ca