Owls, Jaguars and the Deep Blue Sea

PWPW is not just a banknote printer and papermaker. It also develops and produce a number of security inks, coatings and varnishes, some of the newest of which were demonstrated on three house notes in the presentation by Radosław Śliwa, PWPW’s Banknote Product Manager.

First was the Owl Note, also called the Hygienic Note, which was produced to demonstrate PWPW’s antiseptic coatings. One of these is Microb3®, which has anti-bacterial, anti-viral and anti-fungal properties and is applied to the substrate during the manufacturing process. The other is Coat4Note AB®, a post-print varnish with anti-soiling and anti-bacterial properties. Notes thus treated have demonstrated a 99.9% reduction in bacterial growth, a 99.68% reduction in viral growth, and a 100% repulsion of fungal growth.

The front of the note is vertically oriented, with the image of an owl against a fairytale forest. The reverse has the same theme, but in a horizontal format, and demonstrates a number of special effects under UV light. Second was the UNIVERSAL 5 note, developed jointly with KURZ and featuring a captivating image of a jaguar on the front against a backdrop of a forest. The objective of the project was to showcase the development and integration of unique and novel security features with modern design techniques.

The focus of the presentation was on those novel features created by its inks. They

include Iris4Note ®, a family of iridescent water-based and UV curable screen printing inks, which was used to print an iridescent patch in the shape of a flower. Fluorescent properties can also be added. Another is Opal4Note ®, a family of colour shifting water-based screen printing inks. Two different variants were combined in one stripe on the reverse for added dynamism.

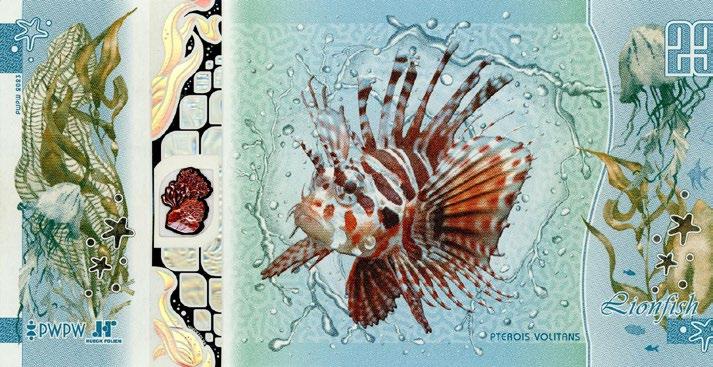

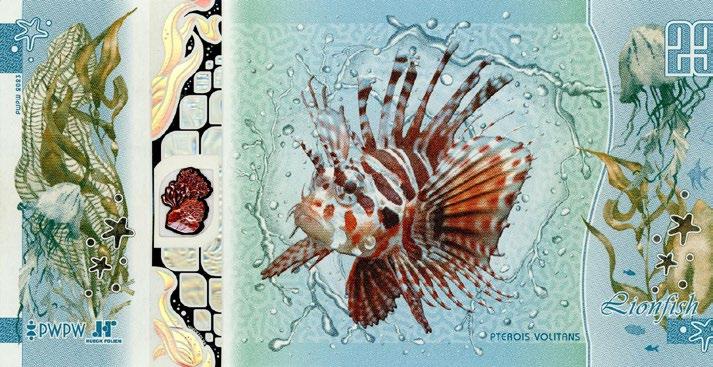

Both Iris4Note and Opal4Note can also be combined, as they were in the third of the house notes – the Coral note – with an underwater theme of marine life, seaweed and corals.

Among the ink features on the Coral note is Mir4Note ® – an iridescent ink with an IR element for machine authentication. The note also features MultiUV4Secure –a combination of fluorescent inks and a UVabsorbing layer, enabling the creation of multi-coloured graphic elements.

In summary, Radosław concluded that the objective of PWPW is to produce banknotes that are secure, durable and safe. And the trio of house notes all demonstrate two or more of these attributes.

Every Little Bit of Sustainability Helps

Gary Spinks of Security Fibres introduced his presentation at Tuesday’s Innovation Session with the acknowledgement that, in the great scheme of things, security fibres are an infinitesimally small element of security paper, and therefore the impact of more sustainable fibres is limited. Even so, he said, everyone needs to do their bit.

That bit for Security Fibres is the development of a new technique that cleans fibres of pigments, enabling paper ‘broke’ to be better recycled.

Security fibres comprise around 0.01% per tonne of paper, and 1kg of fibres is enough for 1 million banknotes. But roughly 5% of security paper produced ends up as broke – ie. the waste from trims and offcuts – which is then returned to the production line. However, because this broke already contains fibres, their presence can cause specks and defects in the resulting recycled paper.

The answer, says Gary, is a technique whereby the paper from which the fibres are made is coated with a barrier prior to the addition of the pigment(s). This has no impact on the fibres’ durability or performance. But when it comes to recycling the paper broke containing those fibres, this can be immersed in a proprietary detergent solution for two hours that lifts away the barrier, taking the pigments with it.

So, whilst the fibres remain in the broke, they are colourless and have no impact on the subsequent paper produced.

2 3 4 5 1

BANKNOTE CONFERENCE 2024 | DAY 3 / 16 MAY 2024

IACA Awards – the Winners Are…

Yesterday’s conference dinner saw the announcement and presentation of the IACA 2024 Excellence in Currency Technical Awards, which are sponsored by Currency News.

The winner of the Best New Banknote Feature, Product or Process awards was Louisenthal for its Green LongLife™ banknote.

The substrate is, of course, the starting point for a banknote, the base material on which all else is then built. Louisenthal introduced the Green Banknote concept last year, the logic being to replace fossil materials with bio-based materials wherever possible and to reduce the carbon footprint of banknotes and facilitate their repurposing at end of life.

The Green Banknote was engineered for both durability and the minimal use of plastic. The Green LongLife banknote, launched last year, has a life twice that of standard cotton and a high bio-based contend, taking sustainability to a new level.

The Green LongLife banknote consists of:

50% FSC C1388716 wood pulp

100% certified organic cotton

Soil repellent paper coating based on renewable raw material

Fluorescent fibres made from sustainable wood pulp

Mineral oil free use of Simultan inks

Transfer foil with 70% recycled content (Galaxy ® thread and RollingStar ® LEAD Mix)

TOPnote ® varnish.

The use of recycled polyester in the thread and foil reduces CO2 emissions by 45%. Overall, the Green LongLife banknote has a carbon footprint of 6.1g CO2, 30% less than the 8.3g CO2 for the standard LongLife banknote substrate.

The Eastern Caribbean Central Bank (ECCB) won the Best Limited Circulation/ Commemorative Banknote for its commemorative $2 note – the second award for the note in as many days.

As described in yesterday’s daily, the note was issued to celebrate the ECCB’s 40th anniversary. Produced on SAFEGUARD polymer with a vertical design (in keeping with the ECCB’s new note series), it features a portrait of the Master Blaster, cricket legend Sir Viv Richards, along with turtles, fish, coral and a map of the islands. On Tuesday, the International Bank Note Society announced that the $2 note had won the Banknote of the Year 2023 award by an overwhelming majority.

The winner of the Best New Cash Cycle Innovation was Bangko Sentral ng Pilipinas (BSP) for its Coin Deposit Machine (CoDM) programme, launched last June in partnership with several retailers to promote efficient coin recirculation in the country. To date, 25 CoDMs have been installed in the Greater Manila area.

According to BSP, coins in circulation have significantly increased over the years. As of December 2023, there were 40.3 billion coins in the country, with each Filipino holding approximately 357 coins. This is almost three times the average of 121 coins per capita in 2005. While the quantity of coins is more than adequate, says BSP, the fact that two in five coins are not circulating properly is resulting in an artificial coin

shortage. As a consequence, businesses frequently give customers insufficient or no change. Hence the introduction of the programme.

The machines provide accessible, convenient, and efficient coin deposit facilities, enabling coins to be brought back into circulation. They accept all denominations of both the BSP Coin series and the current New Generation Currency Coin Series. The value of coins deposited is directly credited to users’ e-wallets. Alternatively, users can choose to redeem the value of the deposited coins in the form of shopping vouchers.

As of 31 December 2023, 105.7 million coins with a value of PHP 350.1 million had been collected from the CoDMs. The project is expected to contribute to significant coin production cost savings, estimated at PHP 38.2-162.9 million in the first year.

The three awards were voted on by IACA members in advance of the Banknote Conference. In a departure from tradition, the voting for the new category of Best House Note was carried out by conference delegates. The winner out of a shortlist of seven nominations was Bundesdruckerei for its Ignis house note.

As detailed in yesterday’s daily, this banknote also represents a departure from tradition. It forms part of the ExNihilo series of concepts for banknotes of the future, and is a radical move away from conventional banknote design. It is produced on a distinctive and unique black substrate (Durasafe, the paper layers of which have been dyed the blackest of blacks), features eye-catching imagery of the sun, flames and other fiery symbols created with special printing techniques and inks, and an embedded NFC-enabled chip providing a bridge to digital payments.

1 3 4 5 2 CURRENCY NEWS – BANKNOTE CONFERENCE 2024 – DAY 3

Enterprise Cash Management Limited Unveils ECM™ –

Centralised

Control

Enterprise Cash Management Limited (ECM), a leading provider of comprehensive cash management software solutions, announced the launch of its latest innovation, ECM™ – Centralised Control, at the Banknote Conference.

According to ECM, this next-generation analytics platform is designed to transform the cash supply chain by providing unparalleled visibility into the end-toend cash cycle, enhancing insights with advanced analytics models, and improving data accuracy and performance related to banknote processing equipment.

As such, says the company, ECM™ –Centralised Control represents a significant leap forward in cash management technology, offering a robust platform that delivers real-time data and analytics to optimise the efficiency and security of the cash cycle.

Key features of ECM – Centralised Control include:

End-to-End Cash Cycle Visibility: comprehensive oversight of the entire cash supply chain, from issuance to destruction, ensuring every stage is monitored and managed effectively.

Advanced Analytics Models: stateof-the-art analytics can be leveraged to derive actionable insights that can drive strategic decisions, improve operational efficiency, and reduce costs.

Enhanced Banknote Data: detailed data regarding banknote performance, including wear and tear, circulation patterns, and counterfeit detection, ensure the highest standards of currency integrity.

Process Performance Metrics: the performance of banknote processing equipment from any manufacturer can be monitored an evaluated, enabling the identification of areas for improvement and ensuring optimal operation.

Equipment Manufacturer Agnostic: like all ECM solutions, ECM™ –Centralised Control can work with data from a wide variety of equipment manufacturers including both CPS and G&D processing machines.

The Directory of Currency & Technology Suppliers

The wait is over and the latest edition of The Directory of Currency & Technology Suppliers is now here.

This sought-after directory is an essential resource for central banks and issuers, printers and mints, and everyone in the cash cycle to identify suppliers and partners. The latest edition is the seventh since its introduction in 2004.

The directory, which was last published in 2018, features seven dedicated sections covering all

‘We are thrilled to introduce ECM™ –Centralised Control to the market,’ said Jamie Cockerell, Managing Director of ECM. ’Our new analytics product is a game-changer for the cash supply chain, offering unprecedented visibility and insights that empower our clients to achieve greater efficiency, security, and cost savings. We are confident that ECM™ – Centralised Control will set a new standard in the industry,’ he added, ‘and we are excited to share it with the attendees at the Banknote Conference.’ ECM was formed with the specific objective to drive forward innovation, having been spun out of sustainable cash processing specialists, CPS.

This strategic move marks a significant milestone, allowing ECM to focus exclusively on software innovation and operate as a dedicated software company, free from the constraints of a hardwarecentric business model.

Reflecting on the new structure, Jamie Cockerell said: ‘we formed ECM a little over a year ago, and that time has been transformational, with the results of the new structure plain to see with the launch of the new technology today. With a renewed vision and clear mandate, ECM is positioned to lead the industry in developing advanced software solutions that address the complex challenges of cash management.’

The formation of ECM signifies a deliberate and strategic effort to harness the power of technology and drive progress in the cash management sector, he noted, adding that clients can expect a seamless transition and continued excellence in service delivery as ECM builds on the strong foundation established by CPS.

ECM is headquartered in the UK, with a global footprint of technical specialists, developers, analysts, project managers and consultants in nine countries around the world. Its software products and services are sold to financial institutions, central banks, and commercial organisations worldwide are in use at 150 cash processing centres across 30 countries.

aspects of systems, solutions and services for the cash cycle, from specification to end of life, and all stages in between. Over 500 companies are listed.

The Directory is available free of charge for a limited period to Banknote Conference delegates. Click on the image to download your copy.

1 2 4 5 3

MAY 2024

The ECM team in Fort Worth, including Jamie Cockerell, second from left.

CLICK HERE –LIMITED TIME

The Cost of Cash

Dr Georges Chalhoub from the Bank of Lebanon (BoL) described the extensive study it has carried out into the performance of a range of banknote substrates and specifications in different parts of Lebanon. This work focused on preproduction, design, feature, specification and substrate choices. A second phase is planned which will consider post-production performance.

The BoL considers the cost and durability of the banknote substrate as key in the context of how it is printed, the climate and cash handling habits.

Methodology

The first phase does not address directly cash handling performance, but does focus on testing:

Several substrate groups

Single side and double sided intaglio printed notes

Varnished and unvarnished banknotes, including cationic UV cured varnishes

Climate: a humid coastal climate, a cool mountain climate and the dry Bekaa valley.

In addition, the different variants were compared against the current specification banknotes. 13 different variants were tested in total.

The test was possible because of the ability of the BPS M7 sorting machines to read banknote serial numbers and for the data to be extracted and organised in a database. The data included all detector data along with the location and date

of reading.

In total, seven million notes circulated for 30 weeks and were read in at least three cycles so that note life could be identified along with reasons for unfitness grouped by region. The results were also compared with a survival probability cycle developed by the central bank in Poland.

When notes were returned, they were divided into a ‘white’ list of notes that were returned to circulation, if fit, or shredded, if not. A ‘black’ list of notes was sent to the laboratory. 10% were retained and the balance returned to circulation.

The note life of laboratory and circulating notes were estimated. It allowed BoL to simulate in the laboratory what was happening in real circulation. In this era of Artificial Intelligence (AI), this is, effectively a future supervised learning model. Phase 1 is now concluded and BoL has published its results. Asked in the question and answer session, Dr Chalhoub said that two sided intaglio with a cationic cured varnish gave the best performance overall in Lebanon’s varied circulating environment.

Getting to Grips with Microorganisms

Guilmar Ernesto Moncayo Ponce from the Bank of Mexico provided information about progress on the first of a three phase project looking at the presence and role of microorganisms on banknotes.

When the COVID pandemic happened, staff at the Bank of Mexico were sent on a three month lockdown. They noticed on their return that some banknotes in the laboratory had continued to wear while stored in the safe. This prompted the start of a study to understand how banknotes degrade, and the risk to health, due to the presence of microorganisms.

The first phase, 2022-23, explored which microorganisms are present. The second phase, 2023-24, is exploring the impact of those microorganisms, and the final phase in 2025 will investigate possible mitigation.

Which microorganisms are present?

The study is looking for ‘degraders’ and pathogens. Microscopy is being used to establish presence, microbiology viability, molecular analysis diversity and biochemistry compatibility.

Banknotes have been collected from bank branches at Central de Abastos, metro stations at Mexico City’s two main hospitals and the city’s main street market. The study uses 200 fit and unfit cotton and polymer notes – the 20F, 50F1, 100F and 200G series of peso notes.

In order of what was found most, traces of viruses, fungi and bacteria were found with the lower denomination notes having the most diverse collections. The pathogens identified as present did not represent a material risk. Enzymes and metabolic evidence of material degradation from these traces were found.

The banknote substrate determines the humidity and availability of organic matter which propagate the degradation. Most of the nutrients found came from human contact. A baseline of not less than 5,000 microorganisms was found on all the notes.

Impact of the microorganisms

The scope for the second phase is now agreed. The state of wear will be established by microscopy, reanimation by microbiology, traceability by molecular analysis and degradation by biochemistry. It will look at the impact on degradation and human health.

1 2 3 5 4

CURRENCY NEWS – BANKNOTE CONFERENCE 2024 – DAY 3

Taking in the sights of Fort Worth - the delegation of Banknote Conference speakers en route to a thankyou dinner.

Editor: Astrid Mitchell.

Message from the Currency News Team

We hope that you have enjoyed reading these dailies at the Banknote Conference, which give a brief snapshot of some of the key topics and technologies discussed or demonstrated over the past three days.

We will be following up on those topics and technologies in the monthly issues of Currency News™ and its two sister publications, Coin & Mint News™ and Cash, Payment & CBDC News™

As a reminder, if you don’t already subscribe, there is a 25% discount off the first year’s subscription, plus three extra months free of charge. Moreover, if you already subscribe to Currency News, you get 50% off the subscription price of Coin & Mint News and/ or Cash, Payment & CBDC News.

All three newsletters bring you all the news and analysis relating to their specific sectors on a monthly basis, supplemented by weekly news updates. In addition, the subscription

includes our Tender Alert Service and access to the Currency Index – a database of all the world’s banknotes and coins.

You also qualify for discounts on the various reports and directories that complement these newsletters. In addition to the newly-published Directory of Currency & Technology Suppliers, the next publication to look out for is the Directory of Circulating Coins, the fourth edition of which will be published in October to coincide with the Coin Conference.

Please feel free to contact us at info@ currency-news.com to set up your subscription.

Follow Us

Join the Social Media Society. Get access to events, publications, services, and a thriving community of experts who will inform you on the latest news around the world. We keep you focused on what matters. The editorial team welcomes your news, contributions and comments. Please send these to info@currency-news.com

Sign up now for our free monthly Currency News™ article: currency-news.com

Currency Publications, publisher of Currency News, is a joint venture between Reconnaissance International and Currency Research

1 2 3 4 5 28–30 OCTOBER 2024 Lisbon, Portugal Subscribe Now Currency Publications Ltd 2.4 The Beacon, Beaufront Park, Anick Road, Hexham, Northumberland, NE46 4TU, UK Tel +44 (0)1932 785 680 Email: info@currency-news.com MAY 2024

company).

Currency Publications Ltd (a Reconnaissance/Currency Research

Copyright

No part of this publication may be reproduced, stored in a retrieval system or translated in any form or by any means – electronic, mechanical, photocopying, recording or otherwise – without the prior permission of the publishers. While every effort has been made to check the information given in this publication, the publishers cannot accept any responsibility for any loss or damage arising out of, or caused by the use of, such information. Opinions expressed in Currency News are those of the individual authors and not necessarily those of the publisher.

2024. All rights reserved