“Very informative and useful conference. I received a lot of very useful and valuable information about tax stamps and traceability. Thank you!.”

Georgia Revenue Service

“Very informative and useful conference. I received a lot of very useful and valuable information about tax stamps and traceability. Thank you!.”

Georgia Revenue Service

We are delighted to be holding the 2025 Tax Stamp & Traceability Forum™ in the beautiful city of Cape Town, South Africa

Recently voted best city in the world by Time Out, Cape Town combines stunning natural beauty with a vibrant culture and diverse culinary delights. There’s nothing quite like it!

As far as the conference is concerned, we have some interesting topics lined up:

The revised ISO tax stamp standard is in its final stages of preparation, and Project Leader Ian Lancaster will host an interactive workshop on the improvements made to the standard and how you can implement them.

Our plenary sessions will include the following topics and speakers:

› The University of Cape Town’s Research Unit on the Economics of Excisable Products will present two papers: an updated simulation model for estimating the breakeven cost of implementing tobacco track and trace in South Africa, and an evaluation of track and trace compliance in Pakistan.

› Hana Ross of World Bank Group will discuss strategies to control inputs into excisable products, with a focus on raw tobacco markets.

› OpSec Security and Luminescence Sun Chemical Security will look at protecting government revenues in sectors not normally associated with tax stamps and track and trace: namely homologated communication products and reinforcing

bars used in the construction industry.

› On the digital technologies side, SICPA will describe how artificial intelligence (AI) can be used to increase compliance and revenue collection, Quantum Base will look at leveraging quantum mechanics for unique tax stamp fingerprints, and Digimarc will speak about transforming tax stamp security with game-changing digital technologies.

› On the physical security side, the International Optical Technologies Association will explore what’s next for optically variable features as they relate to tax stamps.

› Francis Tuffy of Reconnaissance will lead a panel discussion on the digital/physical debate in the face of threats from AI and quantum computing.

See you soon in Cape Town!

Nicola Sudan, Conference Director

Governments

Revenue agencies and issuing authorities

Customs and excise officials

Regulators/Enforcement

Law enforcement agencies

Investigative services

Tobacco and alcohol regulators

Industries

Manufacturers, distributors and wholesalers of tobacco, alcohol and other excise products

Tax stamp system and equipment manufacturers

Security printers and integrators

Suppliers

Labelling companies and packaging converters

Suppliers of security substrates, authentication and serialisation technologies

Other

Anti-counterfeiting and IP organisations

Academics

192 delegates from 103 organisations and 37 countries attended the Tax Stamp Forum in Georgia.

1

2

3

4

5

6 Hear about the latest track-and-trace and verification methods

7 Talk with specialist suppliers and compare authentication technologies

8 Enhance your practical knowledge with our professional development workshops

9 Make new contacts from right across the industry

10 Ask experts for advice in lively panel discussions

37 countries

103 organisations

192 delegates

Welcome and Forum Overview

Nicola Sudan, Reconnaissance International (UK)

The Global Landscape

Nicola Sudan, International Tax Stamp Association (UK)

How Much to Pay for a Track and Trace System: An Updated Simulation Model for South Africa

Kirsten van der Zee, Research Unit on the Economics of Excisable Products – University of Cape Town (South Africa)

Controlling Inputs into Production of Excisable Products

Hana Ross, World Bank Group (USA)

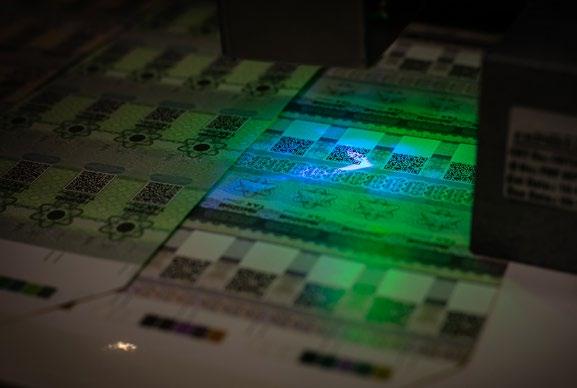

Expanding Horizons: Protecting Consumers and Government Revenues from Illicit Trade in New Emerging Sectors

OpSec Security (USA/UK)

Improved Tax Collection and Traceability of Critical Components for the Construction Industry

Stefaan D’Hoore, Luminescence Sun Chemical Security (UK)

Evaluating Compliance with Track and Trace and Other Regulations in Pakistan’s Cigarette Market

Estelle Dauchy, Research Unit on the Economics of Excisable Products – University of Cape Town (South Africa)

How Track and Trace has been Made Controversial in Pakistan, and the Way Forward

Aftab Baloch, Former Advisor – Federal Board of Revenue (Pakistan)

Integrating Excise Systems into a Comprehensive eGovernance Platform

This panel discussion looks at the move by some governments to integrate their excise systems into a comprehensive eGovernance platform that brings together multiple services under one roof. However, while some countries are moving ahead with this, others continue to keep their excise systems in a silo, away from other tax systems. Why is this? And how should solution providers be helping to change this situation?

Using Artificial Intelligence to Increase Compliance and Revenue Collection

Ruggero Milanese, SICPA (Switzerland)

Leveraging Quantum Mechanics for Unique Tax Stamp Fingerprints

Quantum Base (UK)

Outsmarting Counterfeiters: Transforming Tax Stamp Security with Game-Changing Digital Technologies

Judy Moon, Digimarc Corporation (USA)

Future-Proofing Tax Stamps: Using Physical Features in SoftwareSupported Authentication and Data Management

Thomas Brücklmeier and Benno Schmitzer, LEONHARD KURZ (Germany)

Alternatives for Printing Tax Stamps

Barna Barabas, JURA Security Printing (Hungary)

What’s Next for Optically Variable Features?

Chander S Jeena, International Optical Technologies Association (UK)

The Digital/Physical Debate in the Face of Threats from AI and Quantum Computing

The Vaping – and Illicit Vaping – Boom

Sven Bergmann (virtual), Venture Global (USA)

Traceability Success Stories: It’s Not Just About Revenue

Francisco Mandiola, FMA SECURE (Chile)

This programme is provisional and subject to modification. The latest version can be found at taxstamptraceabilityforum.com

Madras

Chaired by Ian Lancaster, Project Leader Come to this workshop to learn about improvements in the revised international tax stamp standard and how you can implement it.

The International Organization for Standards published its guidance standard for tax stamps (full title: Guidelines for the content, security, issuance and examination of excise tax stamps) in 2018.

It is ISO practice to review standards every five years, and when this one was reviewed in 2023 it was agreed that a) it is a valuable standard, but b) it needed updating. So for the last couple of years that updating review has been taking place, through a small drafting group of experts, chaired by Ian Lancaster as Project Leader, with support and input from the International Tax Stamp Association.

At the time of writing, the draft revised standard is going through the ISO committee approval processes, which should see the updated standard published in the first half of 2026.

At this workshop, Ian will explain the main revisions to the standard, then in small group discussions you be able to see for yourself some of those changes and to work with others to consider what they mean for you.

If you work in a tax authority – which is who the standard is for – you will be able to discuss with likeminded people the suitability of those changes and how you could start to implement the standard’s recommendations in your workplace.

If you are a producer of tax stamps, or a component or consumables supplier, then you will also be discussing with others how these improvements impact you and your relationship with tax authority customers.

Examples of improvements in the standard include an expanded section on the function of tax stamps and a new annexe on assessing the efficacy and suitability of authentication features – both in response to suggestions during the review stakeholder consultation.

Another important change is removing ‘excise’ from the standard’s title, on the grounds that the range of directly taxed goods has expanded significantly, so that it is no longer only excisable goods that have a tax stamp. Come to this workshop to learn more about these and other changes and to explore how you and your organisation can follow the recommendations in this standard.

This event will be useful for both tax stamp issuers and suppliers.

The venue for the 2025 Tax Stamp & Traceability Forum™ is the Westin Cape Town, located at the gateway to the V&A Waterfront, and offering breathtaking views of Table Mountain, the city skyline, and the Atlantic Ocean.

On Monday 7 April we host the welcome cocktail and exhibition opening with our sponsors and exhibitors presenting the latest developments in tax stamp and track and trace technologies in a relaxed atmosphere.

Located in the heart of Cape Town, GOLD Restaurant provides an authentic African experience that goes beyond dining. On Tuesday 8 April, GOLD will take you on an immersive journey through African culture, featuring a 14-dish ‘taste safari’ paired with traditional Mali puppets and vibrant entertainment. The dress code for the evening will be casual.

On Wednesday 9 April we host the exhibition closing and farewell cocktail with the final chance to spend time with our sponsors and exhibitors showcasing the latest developments in tax stamp and track and trace technologies.

“Excellent tax stamp topics and speakers and well moderated.”

De La Rue

To be part of Tax Stamp & Traceability Forum™ 2025, go to taxstamptraceabilityforum.com to book online.

Fees

£2,350 Standard delegate

Pre-Conference Workshop Fee

£350

Governments and International Tax Stamp Association members: Free of charge

Discounts

Government representatives: Free of charge

The first two representatives from government revenue, customs and enforcement agencies can attend for free; additional delegates from the same organisation: £1,200

State enterprise subsidiaries: £1,650

Tax Stamp & Traceability News subscribers: £2,200

International Tax Stamp Association members: £1,900

Tax Stamp & Traceability News™ is the monthly newsletter for specifiers, users and suppliers of tax stamp programmes.

Subscribers qualify for a 10% discount when registering for the Tax Stamp & Traceability Forum. To become a subscriber, visit taxstamptraceabilitynews.com

Fees do not include travel, visas, accommodation or accompanying spouse or social partner fees for the cocktails/dinner.

Delegates are responsible for arranging their own travel and accommodation. Details of special booking rates and how to make your hotel reservation can be found at taxstamptraceabilityforum.com under the venue page.

If you have any questions about the conference, contact the conference team:

Nicola Sudan, Conference Director

Weronika Komorowska, Conference Manager

Tel: +44 (0)1932 785 680

Fax: +44 (0)1932 780 790

Email: events@recon-intl.com

Conference Language: The conference will be conducted in English.

Your Conference Organiser: The event is organised by Reconnaissance International, the leading source of business intelligence and services, for sectors with security, authentication and trust at their core. Visit reconnaissance.net

Release: The organisers accept no liability for personal injury or any loss of or damage to delegates’ personal effects. We reserve the right to cancel, modify or postpone the event without prior notice and to refuse admission to any person (with payments refunded).

Terms and Conditions: Visit reconnaissance. net/terms for full terms and conditions.

Tel: +44 (0)1932 785 680

Email: events@recon-intl.com reconnaissance.net