VOLUME 3 – NO 8 / AUGUST 2024

VOLUME 3 – NO 8 / AUGUST 2024

The Mint of Finland (Suomen Rahapaja) is to cease operations and wind down in an orderly manner by next year, its Managing Director Jonne Hankimaa, has announced, bringing to an end a 160-year business which first began minting coins in 1864 under the Russian emperor Alexander III.

‘The closing process is taking place on conditions of performing client projects. The goal is to ensure completion of existing contracts with clients and vendors in line with agreements’, he said.

All such projects will come to an end in Spring 2025.

The reasons for the closure were given as ‘dramatic changes in payment methods and the decline of the role of cash in daily life.’

The news is not unexpected as there has long been speculation about the future of the Mint, and the fact that it did not publish its annual results in April, as is customary, was a warning sign.

The company has lost money in recent years – €6.8 million in 2023 on a turnover of €32 million, and €10 million on a turnover of €20.9 million in 2022. Although it turned in a profit of €7.7 million in 2021 on a turnover of €32 million, this followed a string of losses in prior years.

At the start of this year, it announced the sale of its blanks business to the German producer Freiberger EuroMetall (the original owners of the business), including its blank factory in Halsbrücke, Germany and its stake

in the Spanish blank manufacturer Compañía Europea de Cospeles SA (CECOSA).

Last year, it also spun out coin collecting platform Coiniverse as an independent start-up, which it had initially set up as part of the Mint. Virtually all of the Mint’s business has been in the export of circulating coins and blanks, primarily to Asia, Europe, and Latin America, with customers including Ukraine, Estonia, Guatemala, and Colombia. Unlike other sovereign mints, which derive the majority of their income (and profits) from numismatics and precious metals, its fortunes have been dependent on an increasingly commoditised, competitive, and over-catered international market.

It could not rely on Finland’s coin requirements, which are small and never accounted for more than 5% of turnover – particularly since the country was one of the first to dispense with the 1 and 2 cent coins. This was in addition to it awarding the contract for its commemorative coins elsewhere from 2019.

The closure brings to an end all coin production in Scandinavia. The Swedish Mint was sold to the Mint of Finland in 2002, and 50% of the Royal Norwegian Mint a year later. The Royal Danish Mint closed operations in 2016 (awarding the contract for Danish coins to the Mint of Finland).

It is no coincidence that all of these countries are in the vanguard of cashless payments.

The Coin Conference takes place in Lisbon, from 28-30 October, against a backdrop of considerable change in the world of circulating coinage (no pun intended). Not surprisingly, the agenda is busy and full of substance, reflecting the key challenges, and opportunities, that face issuers and producers.

That was then, this is now

The conference starts with two workshops.

The first – ‘That was Then, This is Now – the New Priorities for Coin Issuers’ – is for central banks and coin issuers. It is a continuation of the workshop held at The Coin Conference in 2017, where the then MDC Technical Committee Customer Taskforce, led by Dieter Merkle of Schuler, brought together national authorities (central banks and finance ministries/ treasury departments) to discuss and identify their key priorities for circulating coins. Participants from 23 different countries were asked to rank these priorities in terms of public perception, seigniorage, security, trust, attractiveness, innovation and obligation – with a survey at the start and end of the workshop resulting in a surprising shift of views. This workshop will examine what has happened since then, and whether the global pandemic, geopolitical and economic turmoil, and the rise of digital payments have changed the perception and priorities of national authorities towards cash and coins. If so, how, and to what extent? And what does this mean for issuing departments, producers, and others in the cash cycle?

The Taskforce (now under the auspices of the International Mint Industry Association and still led by Dieter Merkle) will revisit the attributes of coins, involving national authorities in discussion and debate about the importance of coins and ensuring that their changing priorities (if, indeed, these have changed) are understood and acted upon by all those in the coin cycle. The second workshop – ’Commemorative Coins for an International and a Domestic Market’ – will be led by Ursula Kampmann of FAMA and CoinsWeekly.

There is a large and growing market for commemorative coins, both domestically and internationally, that not only celebrate cultural attributes, special events and achievements, but also anchor the value of coins in public consciousness and generate revenues for issuing authorities and mints. At least, that’s the theory. But whilst some commemorative coin issues are spectacular successes, others flop. To avoid this, it is essential to choose themes and motifs that will resonate with collectors. But how to do this, is the key question.

This workshop is aimed at central banks and mints that are considering producing and distributing commemorative coins commercially. It is about the rules they need to know to enter an international market. In particular, when it comes to the choice of themes and motifs, different markets have different preferences and, above all, different taboos.

In this workshop, participants will work together to identify the most important markets and connect these with the most popular motifs involved, learning about how the collector market works, how to avoid intercultural sensitivities and differences, new techniques for commemorative coins, and what it takes to offer coins that are interesting to collectors.

The main programme, taking place on Tuesday 29 and Wednesday 30 October, will be formally opened by the Bank of Portugal and is divided into seven sessions:

Setting the Scene – Cash and Coins

Circulation – the Central Bank and Issuer Perspective

Circulation – the Market Perspective

Sustainability

Production, Inspection, Authentication and Innovation (Parts 1 and 2)

Around the World in 80 Minutes (Case Studies).

The agenda will conclude with a panel discussion – ‘Coins in 2035 – What Will the Industry Look Like?’ – led by Simon Lake, formerly of The Royal Mint and now an advisor to the Mint of Poland.

The first session, ‘Setting the Scene’, will comprise a series of presentations on The Circulating Coin Landscape (Currency Publications); Cash, Cryptos, CBDC: What is Money? (Monnaie de Paris); Analysis of Legislation in Favour of Cash (International Mint Industry Association); Coin Usage in Countries with High Inflation (FMA Secure); and Recent Coin and Currency Matters: A European Perspective.

Given that one of the most urgent issues for central banks and treasuries as regards circulating coins is getting them to circulate effectively once issued,

rather than disappearing from circulation, leading to artificial shortages and high replacement costs, two sessions will be dedicated to Circulation, from the issuer and market perspectives, respectively.

The former session will hear from the Federal Reserve Financial Services (FedCash Services), European Commission, Bank of Portugal, and Bangko Sentral ng Pilipinas.

The latter will hear from companies involved in technologies and programmes to facilitate coin recirculation and repatriation, including Brinks, Crane Payment Innovations, Global Coin Solutions, Leftover Currency, and Proditec.

The theme of circulation, aligned to recycling and end of life coins, continues into the next session on Sustainability, with speakers from the UK’s CIEC, Arrandene, M-One, and the European Mint Directors Working Group, who will give an update on a research study they are conducting on the environmental impact of cash versus digital payments. Participants will also hear from the Royal Canadian Mint, Schuler, Carveco, Spaleck, ACSYS Lasertechnik, IQ Structures, Inorcoat, Mint of Poland, and INCM, in what promise to be two fascinating sessions on production and innovation, with some of the topics being presented for the first time.

The penultimate session – Around the World in 80 Minutes – will hear about coin programmes and initiatives in Pakistan, Austria, Spain, Canada, and Morocco. Following the conference, there will be a tour (for central banks and coin issuers) of the Portuguese Mint (INCM), the honorary sponsors of the conference, along with Valora, the Portuguese state banknote printers. Those unable to take part in the tour will still have the opportunity to visit INCM earlier in the programme, as they are hosting the welcome reception at the start of the conference.

Other events include the presentation of the IACA Excellence in Currency Awards 2024 (see page 4) and dinner on the evening of 29 October. Following the conclusion of proceedings on 30 October, the customary Coin Conference Football Match, sponsored by M.One, will take place, to which all are invited (as players and/or spectators).

The Coin Conference focuses specifically on circulating coins as part of countries’ currency strategies and normally attracts an audience of around 200, divided equally between issuers (central banks), mints, and suppliers. With the current focus on circulation and sustainability, and the recent changes among suppliers, this conference comes at a critical time for issuers and producers alike in debating the future of circulating coins. thecoinconference.com

The Royal Mint (TRM) has officially launched its new gold recovery factory at its site in Llantrisant, South Wales. The 3,700m² facility uses world-first patented chemistry from Canadian company Excir, extracting gold from printed circuit boards (PCBs) found in everyday items, in minutes. Excir’s chemistry works at room temperature, creating a more energy efficient and cost-effective method of gold recovery.

The new factory has the capacity to process up to 4,000 tonnes of PCBs from e-waste every year, equivalent to the printed circuit boards from 1.2 million servers. It has been designed to ensure that valuable finite resources are recovered and other materials appropriately treated for onward processing.

Recovered, high purity gold will reduce the dependence on traditional mining activity and encourage more sustainable industry practices, said TRM. The Mint is already using recovered gold in its jewellery business, 886, in addition to silver recovered from medical and industry x-ray films.

‘The Royal Mint is transforming for the future, and the opening of our Precious Metals Recovery factory marks a pivotal step in our journey’, said CEO Anne Jessopp. ‘We are not only preserving finite precious metals for future generations, but we are also preserving the expert craftmanship The Royal Mint is famous for by creating new jobs and reskilling opportunities for our employees.’

TRM has also been engaging with industry bodies to help produce the first standard by the International Organization for Standardization (ISO) for the definition of recycled gold.

The UK banking system is reported to be storing indefinitely around £4 million worth of unwanted copper coins.

New industry data shows that around 260 million surplus coins are being stored, including two thirds of all the 225 million 2p coins in the UK, in addition to 110 million 1p coins. The surplus of both now exceeds the amount in circulation.

Surveys suggest that more than half of these that enter circulation are used just once before ending up in storage, whilst one in 12 are thrown away.

The Royal Mint has not recycled or melted down surplus coins since it closed its

smelting facility more than a decade ago and only accepts damaged coins collected by banks.

There are an estimated 27 billion coins in circulation, but the UK Treasury says it has ‘no plans’ to change the mix of UK coins in the system. 30 million 1p coins were minted in 2022 and none in 2023, while no 2p pieces have been minted since 2021. More than 1 billion pennies were minted in 2000.

Even though the UK coins have all been redesigned, no orders have been placed with TRM this year. Previously, it has been stated that there are enough small denominations to last 10 years, as these latest figures bear out (see CMN July 2024).

The Centrale Bank van Curaçao en Sint Maarten (CBCS) has unveiled the designs for the new Caribbean guilder coins and banknotes via simultaneous events held on both islands.

The designs draw inspiration from the World Under the Sea where fish swim freely, seeing no borders, noted the Bank during the unveiling. The theme serves as a metaphor for the unity shared between the countries of Curaçao and Sint Maarten within its monetary union.

Caribbean guilder coins have similar but distinct designs for Curaçao and Sint Maarten, with each set to circulate interchangeably on both islands. The Cg 5 and the Cg 1 guilder coins feature the effigy of the King of the Netherlands, King Willem-Alexander, on the obverse. The obverse of the lower denominations, the 1, 5, 10, 25, and 50 cent coins, depict an orange blossom alongside an inscription of either ‘Curaçao’ or ‘Sint Maarten’.

The reverse of the Sint Maarten 1 and 5 guilder coins depict the national coat of arms and green sea turtles, while the reverse of the Curaçao 1 and 5 guilder coins feature the island of Curaçao surrounded by the Caribbean Sea, its waves formed by the words ‘Curaçao’. Two green sea turtles complement the design.

© CBCS.

The reverse of the lower denomination coins feature the denomination in the centre of the coin, placed between imagery representing the Caribbean sky and waves and surrounded by a constellation of three groups of 10 pearls representing the date 10-10-10 – the date on which both countries became autonomous within the Kingdom

of the Netherlands. Three favoured tellin shells break up the groups of pearls and both, together with the wave imagery, form the link to the underwater world depicted on the banknotes.

Minted by the Royal Canadian Mint, the coins – alongside the banknotes, printed by Crane Currency – are scheduled to enter circulation next March. The CBCS has launched a new mobile application ‘My Caribbean Guilder’, to help familiarise the public and businesses on the characteristics of the new currency.

In addition, the CBCS launched a dedicated webpage on the new currency, caribbean-guilder.com. The CBCS will also commence training sessions for commercial bank and retail personnel on the new banknotes and coins as the monetary union transitions to the new currency and as the Caribbean guilder banknotes and coins replace those of the Netherlands Antilles.

The UK’s first £1 coins featuring King Charles III have now entered circulation, the second of the updated series to be distributed. Almost 3 million (or 2.975 million if being precise) of the bimetallic coins have been issued to post offices and banks across the country.

Depicting two British bees, the new coin follows that of the Atlantic salmon 50p released towards the end of last year and continues the conservation theme carried on all of the UK’s new definitive coins. In addition to the monarch’s effigy, the coins have been redesigned to incorporate a uniting theme, with the end results symbolising the four nations of the UK and paying tribute to a cause historically important to King Charles III – the conservation of the natural world.

The remaining coins in the series – the 20p puffin, 10p capercaillie (the world’s largest grouse), 5p oak tree leaf and acorns, 2p red squirrel, and 1p hazel dormouse – are set to be released in line with demand from banks and UK post offices. As no orders for new coins intended for general circulation have been sent by the Treasury to The Royal Mint this year (see CMN July 2024), this may be some time yet.

The US Mint’s ‘Liberty Through Perseverance’ $100 gold coin has been awarded the top prize in this year’s Coin of the Year (COTY) awards. The 2024 awards honour coins dated 2023 in 10 categories of competition, as decided by an international panel of judges.

The coin, which also won in the ‘Best Gold Coin’ category by a margin of 30%, is the sixth released in the US Mint’s Liberty series. It features a bristlecone pine tree on the obverse and a young bald eagle standing on a rocky outcropping moments before it takes flight on the reverse.

Voting for the overall COTY award was tight, with the final ballot ‘so evenly distributed that the top five coins were separated by a margin of just 10 votes’, said Thomas Michael, COTY coordinator. This did not stop the Liberty coin ‘surg[ing] past the next closest competitor by half of that spread’. This year marks the second year that the COTY ceremony was held in conjunction with the American Numismatic Association’s World’s Fair of Money ® , which took place in Rosemont, Illinois. The winners of each category are as follows:

Most Historically Significant Coin: Cameroon, silver 2,000 francs CFA, ‘Sumerian Civilization’

Best Contemporary Event Coin: Ukraine, silver 10 hryvnias, ‘The Courage to Be. UA’

Best Gold Coin: United States, gold $100, ‘Liberty Through Perseverance’

Best Silver Coin: Austria, silver €20, ‘The Neutron Star’

Best Crown Coin: Cook Islands, silver $10, ‘Astrolabe’

Best Circulating Coin: China, brass 5 yuan, ‘Sheng Role – Chinese Peking Opera Art’

Best Bi-Metallic Coin: Austria, silver niobium €25, ‘Global Heating’

Most Artistic Coin: Latvia, silver €5, ‘Riga Fashion’

Most Innovative Coin: France, gold €200, ‘Pierre Hermé’

Most Inspirational Coin: Canada, silver $50, ‘Allegory of Peace’.

More information about each of the coins can be found on Numismatic News

The finalists for the 2024 IACA Excellence in Currency Awards have been announced, with presentation of the winning submissions scheduled to take place at this year’s Coin Conference in Lisbon, Portugal. They are as follows:

Banco de México – 20 peso coin commemorating the bicentennial of diplomatic relations between Mexico and the United States. Issued last year with a mintage of 5 million coins, the bi-metallic commemorative has been produced in a dodecagonal shape and features an interrupted milled edge and latent image depicting the number ‘200’.

Central Bank of Eswatini – E50 coin produced to celebrate the Bank’s 50th anniversary. With the theme of ‘Telling Eswatini’s History using Currency’, mintage was limited to 1,000 coins featuring five distinct elements – the Sibebe Rock, the main international airport, Central Bank of Eswatini’s building, an NFC tap and pay symbol, and circuit board imagery.

Central Bank of The Bahamas –25 cent coin produced by the Royal Canadian Mint to celebrate the Bank’s 50th anniversary. With 3 million of this coin issued by the central bank, this commemorative was the first painted coin issued in its history and features selectively coloured designs on both sides.

National Bank of Kazakhstan – 1,000 tenge commemorating the 30th anniversary of Kazakhstan’s national currency. Issued as part of the Bank’s ‘Outstanding Events and People’ series, only 300 pieces were minted of this coin – which features a tantalum insert, a rare and technologically challenging inclusion in numismatic production.

Royal Canadian Mint (RCM) – Environmentally friendly plating process for circulation coins. Developed at the RCM facility in Winnipeg, the Mint scaled up manufacturing of bronze plated circulation products through a more environmentally friendly electroplating process that does not use toxic chemicals such as cyanide chemistry.

US Mint – Circulating blank annealing furnace retrofit. The project has resulted in a reduction in the environmental impact of coin

manufacturing through the prevention of excess pollution output in the form of carbon dioxide, carbon monoxide, and wastewater. There has also been a reduction in natural gas usage, in addition to increased blank quality post-retrofit.

Monnaie de Paris – NFC-enabled silver €25. Produced to commemorate the centenary of the death of Gustave Eiffel, this coin features an NFC chip on the reverse. When scanned, coin owners can access technical specifications, view content and information related to Eiffel himself and register for a personal digital certificate on blockchain.

Bangko Sentral ng Pilipinas – Coin Recirculation Program: Integrating Digitalization and Financial Inclusion. The BSP has deployed coin deposit machines (CoDMs) in several locations to address the issue of artificial coin shortages, and promote financial inclusion and digitalisation. A targeted communication campaign accompanied deployment of the CoDMs.

Central Bank of Eswatini – Coin Management Efficiencies Project. The initiative aimed to enhance coin recirculation in the Kingdom, reduce coin hoarding, and lower coin monetisation expenses via the installation and deployment of coin vending machines, coin counting/sorting machines, and coin packaging systems.

US Mint – Bill of Lading Automation System. The system automates the generation and distribution of bill of lading documentation used to ship coins from the Mint to the Federal Reserve Bank. It comprises mobile devices which track and document the products, with automated checks to ensure shipments match documentation. The system replaces a manual process that required large amounts of physical storage and administrative handling, and that contributed to the Mint’s waste stream. Full details about each of the finalists’ projects will follow in next month’s issue of Coin & Mint News™.

Global Coin Solutions (GCS) was established in Toronto, Canada in 2015 with charitable support at the heart of the business. Nearly a decade on, it continues to evolve and expand – focusing latterly on the recent incorporation of GCS Japan. Coin & Mint News™ spoke to founder and CEO, Scott Hutchings, about the company’s ethos and process, the challenges facing coin repatriation, and why collaboration is key to efficient and sustainable coin recirculation.

Q: Firstly, could you tell us about your background and the company’s origins.

A: Around 11 years ago I joined the industry, working for a UK-based currency exchange business that was also involved in foreign currency fundraising. I applied for the job and really got hooked into what they were doing. Following the closure of that business, I considered next steps for not just people that I worked with but also the charities we were involved with, leading me to look at starting Global Coin Solutions.

Travelex foreign coin services was fairly instrumental in terms of assisting me in assessing the situation and getting started. Global Coin Solutions started business 10 February 2015, and we had staff and clients straight away, with an outlet for our foreign currency through Travelex. It’s grown since then and turned into what we are now. The biggest difference between us and others in this space is that we are not a currency exchange, we repatriate the currency to somebody else.

Q: Much of what you do is related to the charitable sector. What would you say is the driving ethos behind the company?

A: Just simply the ability to help. Charities have been doing this for decades in places like the UK, and as long as they have been doing this there is foreign currency to be sorted.

That hasn’t happened here in Canada or in the US. There’s a massive accumulation of currencies that are just sitting around doing nothing and, especially when you look at the last four and a half years or so, the need has never been greater domestically. There is so much going on internationally and always people to help, and these organisations directly help people. My personal mandate is to work with as many charities as possible, and put people to work. It ultimately comes down to the more charities we do help, the more money gets raised, and the more people it takes to do all of that work.

We have a programme here in Ontario called the Ontario Living Wage Network, which involves companies that have stood up and said they are willing to pay a living wage, not a minimum wage. It’s the right thing to do from a business-employee perspective, but it also makes sense that we pay our employees well enough so that they don’t need to use the services of the charities that we’re trying to help.

Q: Could you expand a little on how GCS operates?

A: The process for collection and sorting is much the same regardless of the organisation, whether it’s a charity and currency for donation or a transit organisation, for example.

We work with the organisation on packing the currency and sending the necessary packaging materials, if required. GCS is based across the road from Toronto airport, which is useful for transporting coin to us.

We then collect the currency, weigh it, and set it up for the sorting process. All deliveries are kept separate from each other and the sorting process takes place by hand, as there is currently no machinery that will sort currency the way that we do. The coins are separated manually by currency and then we use machines to separate by denomination and do the counting.

At the end of the month, we collate all of the denominations from all the different currencies and customers and count them all again to reconcile our inventory – and then prepare for shipment. We work on a monthly basis with the goal that everything that we collect in a month is sorted within

that month, and then shipped out at the beginning of the next month.

The shipping process follows this, which takes time and is almost exclusively by ocean freight. It is just not cost effective to ship coins by air due to the weight. Once coins are received at the other end, they are then verified by the receiver.

Q: And how does the fee process work?

A: The receiver always incurs a fee, because there is cost involved with the recirculation of coin in any country, not to mention import and export fees. These fees are deducted, as an agreed upon percentage, from the value of each shipment. Our fees only occur from the process, we don’t charge our clients for what we do. Even the freight cost of moving a shipment to Toronto is incorporated in our fees to them.

Q: GCS is obviously based in Canada; does it have a specific geographical focus due to its location?

A: There is a focus on growing the charity base and those that we work with in Canada, as we are located here. We also work with charities in the US, moving that currency across to us, and handling it as if as if it is ours from here in Toronto.

We handle the Canadian currency and repatriate the US currency back to the United States, but other organisations help to clear the rest of the currencies, whether it’s sterling, or euro, or even Japanese yen. I’m sending it to somebody else who’s buying it at a discounted percentage, because they then have to physically move it back to wherever it is. The movement of currency internationally has its own challenges, and this is one of the big changes with the establishment of the Japan office, where we will have a place to send currencies from the Asia Pacific region and sort and send them out from there.

The new office will increase the volume of work that we have in the region, and we’ve been reaching out to charitable and commercial customers in the area. One of the focus areas will be on consolidating Philippine pesos from around the world and working with the Central Bank of the Philippines to repatriate this currency for recirculation.

Building a charitable base is always our prime focus, but we are happy to work with anybody. We don’t necessarily have all the answers and all the pieces in place, but we will work to figure out a solution.

Q: What led you to open a new branch in Japan?

A: It all started with a client in Japan, Pocket Change, which has kiosks throughout the country that accept banknotes and coins and convert the deposits into e-money or vouchers. Four different currencies in coin are accepted and users also have the option to donate their coin in these currencies, in addition to donating unrecognized or nonaccepted coins from other currencies. Around 800 to 1,000 kg of coin a month is donated via this process.

The donation coin would be collected, packed, and then transported to the end charity without knowing exactly what was in there. We were approached to help with sorting and counting this coin, but it doesn’t make sense to move coins that are likely from the Asia Pacific region to the other side of the world and receive a lower value for it. I had already been thinking about international expansion and so shifted my focus to operating in Tokyo, rather than another location.

We started those discussions with Pocket Change, and the company asked if we would process and handle all of their coin, not just those donated. This is a bigger operation than we had originally envisioned, as their transaction coin is much larger than that donated. We will be handling all of the logistics around moving, sorting, and counting that transaction coin, in addition to handling the donation coin. We plan to expand into supporting other charitable endeavors in Japan and possibly the surrounding region.

Through those discussions, it became very clear that we needed a better logistics solution than we previously had. We are now working with a global logistics provider that will transport what we need to the places where we need it, door to door, and with a blanket annual insurance policy that will cover every shipment –wherever and whenever it’s going. This is a big cost savings solution, and it will enable us to interface with companies

doing similar work to save them a lot of time, effort, and significant dollars.

As we are building the business in Japan, we are also focused on building this global network of repatriation for everybody. One of my objectives is to work with people. I’m not looking to expand to every country and region. There are existing players in different parts of the world and we want to work with them, connecting those organisations with surplus coinage with those involved in repatriating coin.

Q: What do you see as the main challenges facing coin repatriation?

A: Collaboration is key to coin repatriation. We need assistance and collaboration from the coin industry to help repatriate this coin and get it recirculating. Customs can certainly be a challenge when importing coins, for obvious reasons, and I’m not suggesting we get around these requirements, but understanding that we have the support of the issuer or mint to repatriate the coin certainly helps.

Sometimes it’s a policy situation in terms of accepting, or not accepting, volumes of imported coin. For example, whilst GCS is able to export US coin from Canada, where it is recirculated into the country, at the end of the day it’s a drop in the bucket to general US coin circulation. There isn’t a clear solution to this, but we need to work together to find ways to make this work for everyone. Coin repatriation does not just help general circulation, but also in terms of sustainability, which has become an increasingly important topic for issuers.

Q: How does coin repatriation assist in creating a more sustainable coin cycle? As we repatriate this coin, it’s recirculated instead of becoming stuck and requiring more coin production to replace those not

circulating. The percentage of coins that are minted, released, and have a single use is staggering. Part of that is all of the foreign coin that travels around the world and then just sits there, which is such a waste.

The volume of coin circulating outside of a domestic market is small relative to the overall volume in circulation, but repatriation provides an opportunity to reuse those less used coins or mint new coin from recycled materials instead of freshly mined materials. It’s difficult to argue for this in places where coin in circulation exceeds demand but there is that focus on sustainability and ESG for many mints around the world, and a lot of them want to find a way to do the right thing. Hopefully that will include repatriation of their coin.

Q: Looking to the future, where do you hope to see both GCS and the wider coin repatriation community in the next few years?

A: GCS may have another office or two in the next five years, but I don’t know exactly where those will land. There is no intention of setting up somewhere such as the UK, or even Europe, where there are well established companies there doing good work. As mentioned, I’m not looking to compete with people who are already in that space.

On the repatriation side, I hope that we are able to open up a lot more avenues and that we can develop good relationships with organisations around the world that are looking to find a more effective and sustainable way to keep coin in circulation.

My children are not going to see the end of cash and so we need to find better ways to recirculate coin and get it somewhere where it can actually be used again.

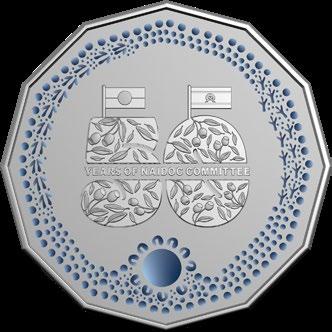

The Royal Australian Mint (RAM) has produced a coin to commemorate the 50th anniversary of the National Aboriginal and Islander Day Observance Committee (NAIDOC) being formed entirely of Indigenous peoples. The 50 cent coloured frosted coin honours both the historic milestone and achievements of Aboriginal and Torres Strait Islander peoples, and was designed by Dagoman, Wardaman, Gurindji artist Cortney Glass.

© RAM.

The reverse design features the Aboriginal and Torres Strait Islander flags above the ‘5’ and ‘0’ of the coin, respectively. Native plants are depicted inside the numbers, which together form both the coin denomination and the total sentence ‘50 Years of NAIDOC Committee’. Traditional representations of kangaroo and emu tracks encircle the design which, on the coloured coin, are highlighted in blue.

The Dan Thorne effigy of King Charles III features on the reverse, with mintage of the coloured coin limited to 50,000 pieces.

The National Bank of Poland has continued its ‘History of Polish Coin’ series by issuing a silver coin titled ‘The Domestic Copper Grosz of King Stanisław August’. The proof coin features selective plating and reproductions of coins issued during the King’s late 18th century reign – with a new monetary system introduced in 1766. The reverse of the coin features a reproduction of the obverse of a copper coin minted in 1786 on the right side, bearing the King’s royal monogram under a crown emblem. The left side of the coin depicts a stylised coat of arms representing the King.

The obverse of the coin also features a reproduction of a copper coin minted in 1786 on the right side, showing the reverse design. The design depicts a similar coat of arms to the stylised version detailed on the other side of the silver coin, in addition to the inscription ‘GROSZ Z MIEDZI KRAIOWEY’ (‘Domestic Copper Grosz’). The State Emblem of Poland within a circle features

on the left-hand side of the obverse design, similar to that of a modern-day circulating coin. The Roman goddess Juno Moneta is depicted in the background, taken from a medal struck in 1766/7 to commemorate the monetary reform and opening of a new mint in Warsaw.

Produced by the Mint of Poland, mintage of the coin has been limited to 10,000 pieces.

The Bank of Portugal has paid tribute to legendary hero Ulysses with the release of a €5 coin designed by artist Gonçalo Viana. Also known as Odysseus, centuriesold legends hold that the ancient hero had a hand in founding the city of Lisbon, after stopping there on his way home from the Trojan War.

The obverse of the coin depicts a scene from the Odyssey, with Ulysses tied to a ship’s mast in the centre and surrounded by seven sirens – with the body of a bird, wings and claws extended – on the outer edge of the design.

© Bank of Portugal.

The reverse of the coin features Ulysses armed with a bow and arrow in the centre, surrounded by a serpent forming seven curves with its body, suggestive of the seven hills of Lisbon. Legend has it that the hero was loved by the Queen of Ophiussa (situated on what is now Lisbon), whose arms turned into serpents as she chased after Ulysses as he headed out to sea. These serpents, as legend goes, then became Lisbon’s seven hills.

Mintage was limited to 30,000 coins with normal finish.

The Perth Mint has released a new coin paying tribute to the kookaburra, also known as ‘Kaa Kaa’ to the Indigenous Nyoongar people of south-western Australia. Designed by Whadjuk-YuetBallardong artist Kevin Bynder, who has previously created designs of Maali (black swan) and Yongka (kangaroo) for the Mint, the coin features a colourful representation of the bird.

The beady-eyed bird features markings symbolising white ochre, a natural earth pigment with which ancestors painted themselves when performing the kookaburra Dreaming dance. The background includes coloured dots, with

shades of blue representing the morning, day, and evening sky, whilst greens and browns denote leaves during the Nyoongar seasons of Djeran, Kambarang, Birak and Bunuru.

Each silver coin – mintage of which has been limited to 2,000 pieces – has been individually ‘antiqued’, intended to give it a unique finish similar to surface abrasions of an ancient artefact, noted the Mint.

The Central Bank of Malta released two commemorative coins, one gold and one silver, to mark its election as a non-permanent member of the UN Security Council (UNSC). Malta last held membership of the UNSC between 1983 and 1984, and also assumed the rotating UNSC Presidency position for the month of April earlier this year.

Produced by the Royal Dutch Mint, both coins feature the same design, although the silver holds a face value of €10 and the gold a face value of €50.

The obverse of the coins feature a contemporary allegorical female representation of Malta, depicted in profile with a collection of raised flags to her right. Malta’s official logo of UNSC candidacy, consisting of the lines of a luzzu, a traditional Maltese fishing boat, symbolic of local culture, and of Malta being a small island state surrounded by the sea, features on the left-hand side.

The reverse depicts the Maltese coat of arms, encircled by a wide outer ring upon which sit twelve five-pointed stars representing the EU, similar to that which appears around the obverse design of the circulating €2 coins.

Mintage of the coins was limited to 600 and 400 pieces for the silver and gold coins, respectively.

Bank Al-Maghrib has issued a commemorative 250 dirham coin to mark the 25th anniversary of the enthronement of King Mohammed VI.

The obverse depicts an artistic representation of the Ceremony of Allegiance to HM King Mohammed VI.

The reverse features the inscription ‘25th anniversary of the enthronisation of HM King Mohammed VI’ in Arabic, French, and Tifinagh characters (the script used for writing the Berber languages). The face value is also inscribed in Arabic, Tifinagh characters, and numerals. The centre of the reverse design contains an artistic representation of Morocco’s coat of arms and the year of issue in both the Gregorian and Hijri calendars.

A special postage stamp and souvenir sheet depicting some of the achievements realised under the King’s reign were released alongside the coin.

The US Mint has issued the latest quarter in its 2024 American Women Quarters™ (AWQ) Program, honouring Celia Cruz. This is the penultimate quarter in this year’s Program – with 2024 also the penultimate year of AWQ.

Celia Cruz was a Cuban-American singer and one of the most popular Latin artists

9–11 SEPTEMBER 2024

SECURITY DESIGNERS FORUM Warsaw, Poland securitydesignersforum. com

30 SEPTEMBER –

3 OCTOBER 2024

GLOBAL CURRENCY FORUM Muscat, Oman currencyassociation.org

28–30 OCTOBER 2024

THE COIN CONFERENCE Lisbon, Portugal thecoinconference.com

27–30 APRIL 2025

MINT DIRECTORS CONFERENCE Cape Town, South Africa southafrica.mintdirectorsconference.com

of the 20th century. Internationally known as the ‘Queen of Salsa’, Cruz’s numerous honours and awards include three American and four Latin Grammy awards, the Presidential Medal of Arts, and several lifetime achievement awards.

© US Mint.

The reverse design features a smiling Celia Cruz in a rumba style dress, mid performance, on the left-hand side. Inscribed to her right is Cruz’s signature catchphrase, ‘¡AZÚCAR!’ (‘SUGAR!’).

As with all other quarters in this series, the obverse of the coin depicts a portrait of George Washington, originally composed and sculpted by Laura Gardin Fraser to mark Washington’s 200th birthday.

The National Bank of the Kyrgyz Republic has issued a silver 10 som commemorative coin to mark the upcoming World Nomad Games, which is scheduled to take place 8-13 September in Astana, Kazakhstan.

Titled ‘At Chabysh’, an ancient and popular sport among the Kyrgyz involving long-distance horse racing, the coin design honours the theme with horserelated imagery. The obverse depicts two galloping riders against the background of a stylised hippodrome in the form of a horseshoe. The logo of the World Nomad Games (coloured in red), title of the coin, and denomination feature at the top of the coin.

The reverse design features the coat of arms of the Kyrgyz Republic in the centre, encircled by galloping horsemen. ‘World Nomad Games’ is inscribed in Kyrgyz and English at the top and bottom of the coin, respectively.

Mintage is limited to 1,000 pieces.

Publisher: Currency Publications Ltd (a Reconnaissance/Currency Research company).

Editor: Alex Sadler (right).

Managing Editor: Astrid Mitchell.

Annual subscription rate: from £1,030 plus postage (also includes the database and Currency News Weekly & Coin). Ask about subscriptions for multiple access, including to the Coin & Mint News e-publishing platform.

You might also be interested in our other publications – Currency News™ and Cash, Payment & CBDC News™.

The editorial team welcomes your news, contributions and comments. Please send these to info@currency-news.com coinmintnews.com

No part of this publication