The Royal Dutch Mint (RDM) has signed a multi-year agreement with Finland’s Ministry of Finance for the production, marketing, and distribution of circulation and commemorative euro coins. The announcement follows the Mint of Finland’s statement last month that it would cease operations in 2025, following the completion of its existing commitments to customers and suppliers – which it expects to fulfil early next year.

Although the total market for circulating coins is relatively small –at least in comparison to the growing commemoratives sector – the RDM is taking note of new opportunities as mints either shift their operating focus (eg. The Royal Mint) or announce their closure (as is the case here).

The Mint of Finland ceased commemorative coin production in 2019, in tandem with the Ministry of Finance awarding the tender for these products to Nordic Moneta, part of the Samlerhuset Group. The

RDM has seen the opportunity to produce commemoratives in the region, particularly offering a mintbased service in Finland to replace that left by the Mint of Finland’s withdrawal from the market. In terms of circulating coinage, it also noted the financial challenges involved with the production and issuance of these coins – added value for circulating coins is so low that even if the factory is full, the price received for these coins may not cover the costs of production.

Estonia is set to introduce new rounding rules next year, with the country also planning to cease minting 1 and 2 cent coins. As cash transactions will be rounded to the nearest 5 cents, the lowest denomination coins, although remaining legal tender, will essentially become obsolete as the practical need for them disappears.

As is the case in many countries, Eesti Pank documented a lack of recirculation for low denomination coinage, despite ordering truckloads of the 1 and 2 cents coins each year. Estonia is hardly the first country to introduce coin rounding, with the Falkland Islands and Lithuania also set to introduce the same rules next year.

The central bank launched a coin collection campaign last year, collecting over €1 million worth of coins in the first week via two coin collection machines situated in post offices. Collection volumes have since slowed, although Eesti Pank’s project partner, Omniva, noted that deposits varied widely, from 17 cent returns to customers exceeding the maximum daily allowance of three kilogram deposits.

Recycling the 1 and 2 cent coins would be expensive due to their plated nature, with metal separation likely to cost more than the value of coins, said Rait Roosve, Head of Eesti Pank’s Cash and Payment Systems Division.

Interestingly, Estonia was previously the only euro area country able to produce 1 cent coins below face value, ‘yielding a small theoretical profit’, noted Roosve. However, the overall costs of processing and transporting the coins still resulted in a loss, albeit one with a minor financial impact. ‘We’ll definitely find a use for the coins… as there’s still demand for these coins elsewhere’, Roosve continued. The central bank intends to send these coin surpluses, featuring Estonia’s national reverse design, to other European countries where there is still demand for them.

Titled ‘Change’, the Royal Australian Mint’s 2023 annual report is aptly named for an organisation, and industry, that experienced multiple significant changes over the course of last year.

The Mint introduced a new royal effigy on its circulation coinage, carried out extensive renovation of its public facility, and implemented the first stage of an upgrade to its e-commerce platform.

Circulating coinage

Banks requested a total of 47 million circulating coins over the course of the year, a 57% decrease from the 110 million pieces provided in 2022-23. The Mint noted that sales of Australian circulating coin to commercial banks remained inconsistent to historical trends – with sales no longer considered regular, and total volumes also considered low.

Reduced orders from the banks was attributed to the work of the Australian Banking Association and key retailers, who engaged with the cash-in-transit sector to ensure the continued provision of cash to the community. Commercial banks then drew on their coin reserves rather than ordering new coins from the Mint, resulting in a significant reduction in revenue from the sale of Australian circulating coins to commercial banks. The coin pool, managed by the commercial banks, was 166.6 million pieces with a value of $92.1 million at the end of June 2024. A much larger pool, at 219.8 million pieces with a value of $118.7 million, was noted at the same time last year.

The value of circulating coin sales was $32.66 million, a 49% increase on the previous year. Seigniorage fell by 98%, at a modest $0.4 million. Demand for 2023-24 circulating coin specifically was 100.2 million pieces, with a value of $55.99 million.

In contrast to the decrease in Australian circulating coin sales, the Mint noted an increased demand for foreign circulating coins. It produced 73.3 million circulating coins for five other countries – Papua New Guinea, Timor-Leste, Vanuatu, Samoa, and the Cook Islands.

Circulating coin, collectible, and investment business lines achieved a revenue of $165 million and a surplus of $19 million after tax, with collectible and investment programs achieving sales of $128 million, compared to $123 million in the previous year.

The Mint released 37 commemorative programs consisting of 182 different coins. These included products commemorating the 50th anniversary of the Sydney Opera

House and 35 years since the introduction of the $2 coin, and those celebrating The Matildas national football team, Australian ‘Big Things’, and Australian World Heritage sites, amongst others.

The new effigy of King Charles III designed by The Royal Mint designer Dan Thorne was minted on the $1 circulating coins. Over 7 million of these coins were produced during the financial year, the first of which were issued last December.

The Mint began the Visitor Experience Enhancement Project (VEEP) in 2020 to maintain the Australian National Coin Collection and its gallery, and better promote public understanding of the cultural and historical significance of coins. It temporarily closed part of its site in Canberra between January and August 2024 in order to carry out a $6.46 million refurbishment project.

New features include creative interactive installations and a coin column containing 24,432 new dollar coins that took two weeks to glue into place.

A further significant update introduced during 2023-24 was the launch of a ballot system for release day sales of high demand products. This, said the Mint, provides each entrant with a fair opportunity to purchase numismatic products whilst stopping bots and bad actors from purchasing excessive amounts of limited release products for resale on the secondary market.

For 2024-25, the Mint is forecasting revenue of $154 million, a surplus of $8 million, and a return on net assets of over 30% for the next financial year. Circulating coin revenue has been forecast at $43 million with seigniorage of $7 million, net of gallery funding, with a collectible and investment coin revenue estimated at $111 million.

The Mint progressed its programme to replace aging material handling equipment within the circulating coin hall during 2023-24, with automated guided vehicles expected to be commissioned towards the end of 2025, and a new industrial robot scheduled for 2026.

The Perth Mint also released their 202324 annual report this month, which will be covered in the November issue of Coin & Mint News™

The Singapore Bullion Market Association (SBMA) has announced five new companies as corporate members, noting that the increased membership reflects the expansion of Singapore as a precious metals hub in the Asia-Pacific region.

New members include gold trading hub Hua Seng Heng and mining industry trading company MIND ID Trading as local associates. Nihon Material (refiner, bullion and precious metals products manufacturer, and trader), Bulmint (precious metal processor and investment products manufacturer), and Sun Yip Hong Gold Dealers (trader and manufacturer of scrap precious metals) have also joined the SBMA as foreign associates.

The SBMA now has a total membership count of 74 organisations, with 55% of members comprised of local associates and 35% as foreign associates. Separately, the association has signed a memorandum of understanding with Lao Bullion Bank to exchange market knowledge, regulatory advisories, and strategic insights. The collaboration aims to enhance the Bank’s capabilities in the global bullion market and develop a gold and precious metals hub in Laos.

The Royal Mint (TRM) has released its circulating coin mintage figures for 2023, noting that there are approximately 27 billion coins currently in circulation in the UK. Just over 10% of the circulating coins minted last year were 50p coins, with a small percentage of these (4%) the new definitive Atlantic salmon 50p coins.

The low mintage of the new definitive 50p has resulted in it becoming the rarest 50p currently in circulation, with just 200,000 minted. The 2009 Kew Gardens UK 50p, with a mintage of 210,000 coins, had held the title for the last 14 years. This denomination is often remarked upon when mintage figures are announced, as it is generally considered to be the most collectable of the coins released, with TRM launching several collectable and commemorative versions each year.

TRM also minted 5 million circulating 50p to mark the coronation of King Charles III last year, in addition to the new definitive 50p. All other circulating coin mintage figures noted for 2023 solely comprise of the new definitive UK coins. Of these, the oak tree leaf 5p had the highest mintage, at 32.4 million pieces, followed by the bees £1 (10.03 million), hazel dormouse 1p and capercaillie 10p (600,000), and puffin 20p (525,000). No red squirrel 2p or national flowers £2 were minted last year.

Only two of the eight new definitives have entered circulation so far, with the remaining denominations set to be progressively released into circulation as per demand.

Mintage figures are expected to look dramatically different next year, with no orders for new coins intended for general circulation sent by the Treasury to TRM so far this year, in what is believed to be a historic first (see CMN July 2024).

Minting of the final coins in the new Caribbean guilder (Cg) series, the 1 and 5 guilder, has been initiated at the RCM’s facility in Winnipeg, Canada. The first of these coins rolled off the printing press during a special ceremony held by the RCM and attended by representatives from both Curaçao and Sint Maarten.

As part of a tradition at RCM, the flag of each country for which they mint coins is given a permanent place along the driveway of their production facility in Winnipeg – with the flags of both Curaçao and Sint Maarten added to the display.

The RCM noted that the first strike was notable in several aspects, particularly as these are the first tri-metallic coins ever produced by the facility, marking a new moment technical innovation for the Mint.

The minting of these coins follows completion of the minting of the lower denominations, with all new Cg coins expected to be delivered to the Central Bank of Curaçao and Sint Maarten by the end of this year.

An announcement that Casa de Moneda Argentina is set to be restructured, losing one of its two print facilities in the process, has led to queries about the possibility of the Argentinian Mint being closed altogether.

The government made the announcement following controversy over a post made by presidential spokesman Manuel Adorni on X (formerly known as Twitter). Adorni wrote ‘It has been decided that the Mint will be closed. The end.’, posted the announcement, and subsequently deleted

the post shortly afterwards. He later said that the removal of the post was due to the situation ‘merit[ing] a slightly more extensive explanation, nothing else’. During a press conference held the following day, Adorni said that the administration viewed the mint as having ‘severe inefficiencies’. The closure of the Don Torcuato press, one of two with the ability to print banknotes, continues the trend of Argentina shifting banknote production elsewhere. The Mint was allegedly excluding from bidding for the contracts to print the new $10,000 and $20,000 banknotes, which were awarded to China Banknote Printing and Minting (CBPM) and Crane Currency.

Production at the Mint is not solely limited to banknotes, and reduction (or even complete cessation) of its production in this area does not necessarily mean that the state-owned company would close completely. However, its ARS 422.8 billion (roughly $429.1 million) deficit, coupled with the announcement, has raised queries about the continued operation of the company as whole – including the sectors involved in passports and tax stamp production amongst others and, notably for our industry, coins.

Inorcoat has announced the appointment of Goran Paladin, formerly of the Croatian Mint, as its newest sales manager for minting and high security printing. The PVD coating solutions provider noted that Paladin’s engineering background and knowledge of the full production line makes him a full stack consultant for its PVD machines.

As Director of Production of the Croatian Mint, Paladin oversaw both the introduction of the euro in Croatia and the release of the world’s smallest coin, the Hum gold coin.

Global cash ecosystem integrator and fintech company Sesami Cash Management Technologies Corporation has furthered its consolidation efforts by acquiring the Consillion Group, a provider of self-service commercial banking automation solutions.

Consillion operates in Australia, New Zealand, Singapore, and the United Kingdom, with Sesami noting that its presence across the Asia-Pacific region provides the ideal platform for the company to extend its impact in the market. It has acquired intellectual property through the agreement which, it says, will enable the next generation of automated banking solutions once combined with Sesami’s technology.

In the September issue of Coin & Mint News™, we took a took a closer look at each of the finalists’ projects in the first category of the 2024 IACA Excellent in Currency Awards, ‘Best New Commemorative/ Limited Circulation Coin’. This month, we cover the remaining two award categories – Best New Coin Product, Process or Manufacturing Innovation and Best Recirculation/Distribution Initiative or Innovation.

Presentation of the winning submissions in each category is scheduled to take place at The Coin Conference in Lisbon, Portugal on Tuesday 29 October.

The Royal Canadian Mint has developed an environmentally friendly bronze plating process for circulation coins. First developed at the RCM facility in Winnipeg, the Mint scaled up manufacturing of bronze plated circulation products through a more environmentally friendly electroplating process that does not use toxic chemicals such as cyanide chemistry.

The traditional plating process used harsh process chemistry, with related wastewater treatment requiring strong oxidising agents to chemically break down the harsh chemicals before being released in line with municipal environmental standards.

The new procedure is environmentally friendly in both the plating process and during the subsequent wastewater treatment – where it does not require the strong oxidisers. The Mint noted that the electroplating process is therefore safer, more efficient, and cost-effective in terms of wastewater treatment and chemical management.

The RCM has patented this technology, with bronze plated products able to be used as candidate materials for both mono colour coins and bi-colour higher denominations.

The United States Mint recently undertook a circulating blank annealing furnace retrofit, aiming to reduce natural gas usage and pollutant output while maintaining thermal and operational characteristics of the furnaces utilised at the Mint’s plants in Philadelphia and Denver.

The protective atmosphere used in the annealing process was switched from the traditional exogas generated by natural gas combustion to a mixture of high purity gas at a ratio of 97% nitrogen to 3% hydrogen. Both of these gases are created in cabinet generators near the furnaces, utilising electricity and water provided by the local utility company.

Elimination of the production of carbon monoxide, a by-product of natural gas combustion to generate the exogas atmosphere, resulted in a reduction of energy required to ventilate the production area. The furnaces were also retrofitted with higher efficiency recuperative burners to further reduce natural gas consumption. The retrofit has resulted in an overall reduction of the output of carbon dioxide and other greenhouse gases by 2,000 metric tons per year.

Increased blank quality was also noted by the US Mint. The nitrogen/hydrogen atmosphere reduces the amount of oxides forming on the blanks during the annealing process, reducing chemical usage during post-processing and the cleaning of coin blanks, resulting in reduced wastewater output.

Elimination of a flammable environment and the reduced carbon monoxide generated has additionally improved safety at the facilities. While hydrogen is now present, the 3% hydrogen ratio is not classified as a flammable atmosphere.

The Monnaie de Paris produced a commemorative €25 silver coin to mark the centenary of the death of Gustave Eiffel – the French civil engineer and architect of the world famous Eiffel Tower and several other iconic monuments. The proof coin features an NFC chip on its reverse, located under a pad printed resin depicting the top of the Eiffel Tower. Details of the

coin’s technical specifications are revealed when the chip is scanned.

The chip also enables the owner of the coin to register for a digital certificate on the blockchain, from a dedicated Monnaie de Paris mobile application which provides privileged access to a selection of content dedicated to Gustave Eiffel and his work. The coin owner is then able to view documents from the archives of the Musée d’Orsay, selected by Monnaie de Paris and the association of Gustave Eiffel’s descendants.

The Monnaie de Paris noted that the coin was the first in the world to incorporate an NFC chip and a digital certificate on blockchain, driving a paperless strategy for proof of ownership and authenticity in the future.

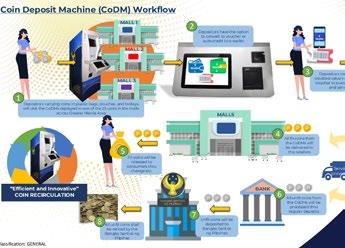

The BSP deployed coin deposit machines (CoDMs) in high foot traffic locations to address the issue of artificial coin shortages, and promote financial inclusion and digitalisation. A total of PHP 798.5 million worth of coins, or 215.3 million pieces, had been collected from the CoDMs as of end June this year.

The campaign was successfully integrated into mainstream customer routines by placing CoDMs in convenient locations like shopping malls and retail stores, where users are able to deposit accumulated coins at any of the 25 CoDMs in the Greater Manila Area whilst completing errands.

Bringing convenient access to CoDMs aligns with the BSP’s commitment to leveraging technology to advance financial inclusion. The CoDM project is expected to contribute millions of pesos in cost savings, with less coins requiring minting to solve the issue of shortages. This potential reduction in minting costs also translates to reduced storage facilities and transportation logistics, as well as more efficient use of national resources.

A targeted communication campaign through various media platforms accompanied the deployment of the CoDMs. This included live promotional events covered by the press and explainer videos uploaded to the BSP’s social media accounts.

The Central Bank of Eswatini embarked on a Coin Management Efficiencies Project as part of its strategic objective to ensure an adequate supply of cash. The initiative aimed to enhance coin recirculation in the country, reduce coin hoarding, and lower coin monetisation expenses. It involved the installation and deployment of coin vending machines, coin counting/sorting machines, and coin packaging systems.

Around SZL 25 million worth of coins equating to 28 million pieces have been collected since the installation of a coin vending machine with a retail partner in June 2022, with the Bank noting a perceived reduction in coin hoarding by the public via the provision of a simple option for the public to deposit low value coins in particular.

The initiative has led to significant cost savings for the central bank, reducing the need for minting new coins and promoting more efficient coin circulation. The estimated cost saving is SZL 14 million, based on the average minting price for new coins, with an average 16% decline in monetisation costs over the last

two financial years. A reduction in the need for new coins also conserves natural resources, supporting environmental sustainability.

The CBE noted that its successful pilot phase can serve as a blueprint for scaling up to more locations and expanding the initiative.

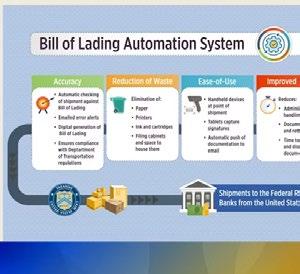

The US Mint introduced a system automating the generation and distribution of bill of lading documentation used to ship coins from the Mint to the Federal Reserve Bank (FRB). The system uses mobile devices to track and document products at the point of shipments, and automatically emails the documentation to all required parties. It also uses automated checks to ensure that shipments match the bill of lading, automatically sending email alerts when errors occur.

The system changed the existing process by moving from a largely manual operation to a digital process, improving the accuracy of shipments, streamlining approvals, and eliminating the need for paper files. The Mint noted that the manual system required large amounts of physical storage and administrative handling, and contributed to its waste stream.

Enhancements to existing inventory management systems have been utilised to streamline the generation of documentation necessary for the Mint and the FRB to conduct business, ensuring that shipping documents meets Department of Transportation regulations and matches the invoices being paid by the FRB. These documents were manually generated and digitally scanned previously, a slower process in comparison to the new digital system.

The US Mint has said that the system will continue indefinitely, with plans in place for continuous improvement, including the use of RFID for tracking.

The fourth edition of the Directory of Circulating Coins has now been published.

In the last five years, and since the last edition was published in 2019, 69 countries or monetary unions have changed their circulating coinage in some shape or form, out of a total 184 issuers. Some 20 of these have issued new series, with 17 countries discontinuing 40 coins so far, and 20 making design changes to 48 coins, whilst 10 countries have made material changes to 21 coins.

The Directory also provides details of the 321 updated coins – both those that have already occurred, including the introduction of new coins and discontinuation of those already in circulation, and those that are planned and have not yet entered or exited circulation – of which there are 98 coins. This includes those planning to update their coin obverse with a new monarch, such as King Charles III or King Frederik X. In the case of the former, four countries are progressively releasing updated coins featuring King Charles III, with a further four announcing the updates but yet to begin issuance, and at least two have announced that they plan to replacement the monarch’s effigy with another design. Some 21 countries are planning to change at least one element of their circulation coinage in the near future. Another common proposed change, in addition to the above, is the introduction of coin rounding next year, notably in Estonia, the Falkland Islands, and Lithuania.

A further five countries and monetary unions have introduced new currencies, with Curaçao and Sint Maarten and Bulgaria set to change to the Caribbean guilder and euro, respectively, in the next couple of years.

With nearly 200 pages, the Directory is the only guide to every current circulating coin in the world, providing up-to-date information, specification and images on every coin in one concise and easy-touse volume. It provides an invaluable reference and research tool for anyone involved in the design, production, issue and management of coins.

Copies of the Directory will be supplied free of charge to central banks and treasury departments worldwide, with discounts available for Coin & Mint News™ subscribers.

Earlier this month, the International Association of Currency Affairs (IACA) held a webinar titled ‘Cash Visibility: How the Royal Canadian Mint Manages Canada’s Circulation Coins in Real-Time’. As the hosts of the webinar, the Royal Canadian Mint (RCM) detailed their strategies and systems for managing cash visibility for coin in Canada.

President and CEO of the RCM, Marie Lemay opened the webinar by noting that the Mint’s journey to developing the tools and expertise to effectively navigate every aspect of Canada’s coin ecosystem has spanned decades.

Continuous learning and collaboration with ecosystem partners were noted as key aids in weathering many changing realities, from the growth of digital payments to the experience of the pandemic. These partnerships have also, said Marie, strengthened the integrity, effectiveness, and reliability of Canada’s national currency supply.

Coin production accounted for only 12% of the country’s coin supply, with new coins only produced when needed, and 88% of the coin demand recirculated. The RCM utilised its national coin management system – which both forecasts and manages the complex logistics, pinpointing and meeting demand – to efficiently coordinate coin series.

The RCM’s Director of Sales Foreign Operations, Jeff Hanke, then underlined how coin visibility is a global and fairly universal issue, noting that ‘just about everybody struggles with it’ around the world.

Long lifespan of coins, lack of data sharing with commercial banks, coin hoarding (both public and retail), and lack of collaboration between stakeholders were all noted as common factors contributing to the challenges in establishing coin visibility. This often results in inefficiencies, inventory

challenges, difficulties in forecasting, or the requirement of emergency orders to keep coins circulating, to name a few!

The specific composition of coins provides complications that you wouldn’t necessarily experience with banknotes, for example. In addition to taking up space, they are heavy and more difficult to move due to this excess weight.

Additionally, regional currencies face greater challenges – both in terms of banknotes and coins – in visibility, where it is difficult to tell exactly how many coins or notes are travelling between countries. Jeff then noted a few initiatives that have taken place with the aim of improving coin circulation. The United States, for example, formed the US Coin Task Force, whilst the Philippines launched its Currency Recirculation Programme, which includes the launch of the coin deposit machines (CoDMs) in the Greater Manila area.

The former investigated the issue of coin circulation specifically, rather than a general task force covering currency, uncovering several key findings that have since impacted the way that the United States considers and reacts to challenges in the coin supply chain. The latter, meanwhile, has collected over 200 million coins as of July 2024, with the CoDMs enabling the BSP greater visibility into coin movement in different areas.

The final speaker of the webinar was Lenard Cheung, Senior Director Canadian Circulation, who detailed both Canada’s

unique challenges in ensuring coin visibility and more general learnings that can be applied to the wider community.

The geography and size of Canada poses a fairly significant challenge, with 40 million customers spread across the nation. To make this more manageable, the RCM established 12 regions supported by 23 armoured car companies.

It was noted that one of the most important features of its ecosystem is not only the role that the Mint plays in managing government owned inventory, but that it also managed financial institution owned inventories every week, for each denomination in every region.

The armoured car organisations were provided with instructions not only on how much inventory they need, but also what they do not need. Extra coins that they do not need can be allocated to surplus inventory for other financial institutions to buy. According to the RCM, the instructions amount to around 26,000 forecasts a year.

Lenard then detailed three foundational points that the RCM’s end-to-end lifecycle model is built upon:

1. Visibility – knowing where inventories are located across the nation and how stakeholders are using their coin

2. Circulation – the visibility enables the RCM to understand inventory levels so that it can place coins where they are needed most

3. Improvements – continuous improvements strengthens the system and builds trust among the stakeholders. The Mint continuously asks how the process can be made more efficient and cost effective whilst maintaining integrity of the system.

A key indicator that the end-to-end lifecycle management model is working, said the RCM, is that demand is being satisfied. The more that existing coins recirculate, the less new coins are being pushed into the marketplace.

In 2023, 88% of the financial institutions’ demand was met through coins that were already circulating, with around 580 million surplus coins sold between financial institutions.

The webinar concluded with details of the RCM’s ability to get new coins into the marketplace within a week. The end-toend oversight of the system has created a strong and resilient network that is able to handle spikes in demand in addition unforeseen circumstances. The focus on continual improvements becomes increasingly important as consumer payment preferences evolve, with the Mint ensuring that no one is left behind and that Canadians who choose or need to use coin are supported.

The Spanish Mint (Fábrica Nacional de Moneda y Timbre – Real Casa de la Moneda, or FNMT-RCM) has released a commemorative silver €10 coin to celebrate a centenary of radio in Spain. This year marks 100 years since the first official radio broadcast in the country.

The reverse features an image of a microphone and headphones, surrounded by graphics depicting radio waves. The obverse features an allegorical image of a radio emitting words and musical notes in the foreground, whilst the background depicts a lined map of Spain with radio waves above.

Mintage has been limited to 5,000 pieces.

The first official joint licensed issue of the Czech Mint’s Czech lion investment coin has been released in partnership with Italian-based Power Coin. The new issue features a proof design and colouring in the elements of fire – in shades of yellow, orange, and red, with selective black-coloured sections – on the lion design reverse.

The obverse depicts the effigy of King Charles III and, as coins of the Czech Mint are issued with the licence of a foreign issuer, the name and relevant mint details of the island country of Niue.

With mintage limited to 1,000 pieces, the coloured issue is part distributed by the Czech Mint, with the other part released by Power Coin.

The Casa da Moeda do Brasil has launched a commemorative medal to mark the 140th anniversary of the Corcovado Railway, which has transported almost 60 million passengers since its establishment. The Corcovado Railroad began with an expedition by Dom Pedro I in 1824, with its construction authorised by Dom Pedro II in 1872. The crossing to the summit of Corcovado was completed in 1885, resulting in a 3,824 metre long route on steep terrain.

Minted in silver, gilded bronze, and bronze, the medal depicts the Corcovado Train over Corcovado Hill on its obverse. The landscape of Sugar Loaf Mountain and part of the Municipality of Niterói feature in the background.

The reverse features the logo of the Corcovado Train in pad printing, flanked by train track imagery.

The Royal Dutch Mint (RDM) has issued a special limited commemorative coin to mark 750 years since the city of Amsterdam (then, on 27 October 1275, a small village) first appeared in records. The coin is one of only two commemorative coins that the Mint releases on behalf of the Ministry of Finance every year.

Designed by artist Hans Gremmen, the reverse of the coin has been separated into two halves diagonally. One half depicts an old marker from 1350 featuring the Amsterdam city coat of arms – noted as the first time that the city’s coat of arms was used following the official granting of city rights in 1300. The other half of the coin consists of contemporary typography, detailing ‘750 years of Amsterdam’, key years, and the denomination.

The obverse of the coin depicts a portrait of King Willem-Alexander, with the artist drawing the portrait in the same style as that of previous Dutch monarchs.

Mintage of €10 gold coins has been limited to 750 pieces, with €5 silver and precious metal versions also available. The packaging features various icons of Amsterdam, such as the Amsterdam Central Station, Royal Palace and St Nicholas Church.

Official unveiling of the coin took place earlier this month with Amsterdam’s Deputy Mayor, Hester van Buren. This was followed by a ceremonial first strike attended by and involving the Mayor of Amsterdam, Femke Halsema, and the Dutch Minister of Finance, Eelco Heinen. RDM has also developed a series of jewellery with Weston Beamor – which is also part of the HM Precious Metals Group – to celebrate Amsterdam’s birthday.

Latvijas Banka has issued a new €5 silver coin with gold plating titled ‘Energy Coin’, with the design symbolically representative of the process of nuclear fusion. According to the Bank, the design highlights scientists’ search for an ‘inexhaustible source of energy to protect natural resources and achieve a balance between

the whims of our age and the interests of future generations’.

Struck by the RDM, the edge of the coin has been inscribed with the symbols for the free neutron and isotopes – n, 2H, 3H, and 4He – that feature in the hydrogen fusion reaction.

The obverse of the coin depicts the main fusion reaction for nuclear energy production. Nuclear components are depicted as silver hollows (neutrons) and gold-plated beads (protons). The nuclei of two hydrogen isotopes (deuterium and tritium) fuse to form a helium nucleus and a free neutron, with an opening in the centre of the coin representative of the site of the reaction.

The reverse of the coin depicts two groups of circle lines meeting at the central opening, marked with degrees of frosting and gilding. The arrangement of lines resembles both the magnetic fields of large space objects and the stylised cross-section of a toroidal fusion reactor. The relief of the coin, with a recess in the centre, represents the gravitational potential near a star or black hole.

ABC Mint has launched a five coin series entitled ‘Untamed Landscapes’, celebrating the natural beauty of Oceania. The series highlights fauna native to Oceania, with each silver bullion coin featuring a different animal found in the region – including a crocodile, kiwi bird, thorny lizard, kangaroo, and sailfish.

Each coin is connected to the larger series through the obverse designs, with the inclusion of silhouettes of countries in the region in addition to a symbolic and wellknown star constellation in the region, the Southern Cross.

The reverse of each coin depicts an effigy of King Charles III, sourced from Tokelau –where the coin is legal tender with a face value of $5.

The Crocodile coin is the first of the series to be made available, with the other four Untamed Landscapes coins set to be released over the next 12 months. Mintage of each has been limited to 175,000 pieces. Produced using 100% Australian ABC Bullion silver, the coins have been designed by Tony Dean – who has previously worked at both the Perth Mint and Royal Australian Mint – with former head of both the latter and the Mint Directors Conference, Ross MacDiarmid, advising on the series.

Seigniorage has always been important, particularly in the case of government spending, but has become increasingly so as countries look at resolving inefficient coin circulation. To that end, the RDM said that it expects circulating commemorative coins to comprise the majority of its circulating coinage orders from Finland in the near future.

The RDM noted that its agreement is with Finland’s Ministry of Finance directly, and not the Mint of Finland. Therefore, there is no automatic transfer of central bank contracts to the RDM – although it does intend to consider new central bank tenders as and when they are issued.

In terms of the new agreement, the key aim of the Mint is to provide a ‘complete package’ for coin orders, including customer support, e-commerce, and localisation of services. This includes collaboration with Mixtra Oy as its localisation partner, providing support in

4–5 NOVEMBER 2024 THE AMERICAS CASH CYCLE & PAYMENTS SEMINAR Louisiana, USA currencyresearch.com

25–27 NOVEMBER 2024

THE EMEA CASH CYCLE SEMINAR Cape Town, South Africa currencyresearch.com

2–4 DECEMBER 2024

HIGH SECURITY PRINTING ASIA Bangkok, Thailand hsp-asia.com

27–30 APRIL 2025

MINT DIRECTORS CONFERENCE Cape Town, South Africa southafrica.mintdirectorsconference.com

local languages (Finnish and Swedish) as required, methods of payment, and a local address – rather than requiring shipments back to the Netherlands, customers can instead utilise a local return address. Localisation was noted in the tender, although this is not new to the RDM, given their existing production for other countries such as Belgium (offering French language products) and Ireland (Gaeilge).

The first products for the Finnish market are expected to be released early next year. The RDM has said that branding for these products will be operated and owned by themselves, but will fall under a new, as yet unannounced, name.

In the meantime, the RDM is in the process of finalising and launching a temporary e-commerce site to invite customers to sign up and receive a free special gift, which is currently being minted at the RDM and will ship before the end of the year.

It is also considering accompanying the release of new products, particularly in the case of commemorative coins, with events such as first strike ceremonies. The RDM is well versed in organising these ceremonies, with the latest taking place at the capital city’s Ziggo Dome arena to mint the first commemorative coin produced to mark 750 years since the city of Amsterdam (then, a small village) first appeared in records (see p7).

The involvement of public figures and the media at these events aims to increase public interest (and therefore sales) for commemorative products.

The Royal Dutch Mint emphasised its commitment to being a single source provider, with the new Finnish agreement underlining its development and expansion in this area.

Publisher: Currency Publications Ltd (a Reconnaissance/Currency Research company).

Editor: Alex Sadler (right).

Managing Editor: Astrid Mitchell.

Annual subscription rate: from £1,030 plus postage (also includes the database and Currency News Weekly & Coin). Ask about subscriptions for multiple access, including to the Coin & Mint News e-publishing platform.

You might also be interested in our other publications – Currency News™ and Cash, Payment & CBDC News™.

The editorial team welcomes your news, contributions and comments. Please send these to info@currency-news.com coinmintnews.com

No part of this publication may be reproduced, stored in a retrieval system or translated in any form or by any means –electronic, mechanical, photocopying, recording or otherwise – without the prior permission of the publishers.

While every effort has been made to check the information given in this publication, the publishers cannot accept any responsibility for any loss or damage arising out of, or caused by the use of, such information. Opinions expressed in Coin & Mint News are those of the individual authors and not necessarily those of the publisher.