The Australian property market is displaying characteristic end-of-spring moderation as it transitions into the holiday period. While growth continues, the pace has tempered considerably, with house prices increasing by 0.4 per cent and unit values up by 0.3 per cent over the month.

The approach to Christmas has brought its traditional impact on market momentum, evidenced by declining listing volumes and diminishing buyer urgency. This seasonal slowdown coincides with broader market dynamics, including improved inflation figures that have reinforced expectations of potential interest rate relief, though this is not anticipated until mid-2025.

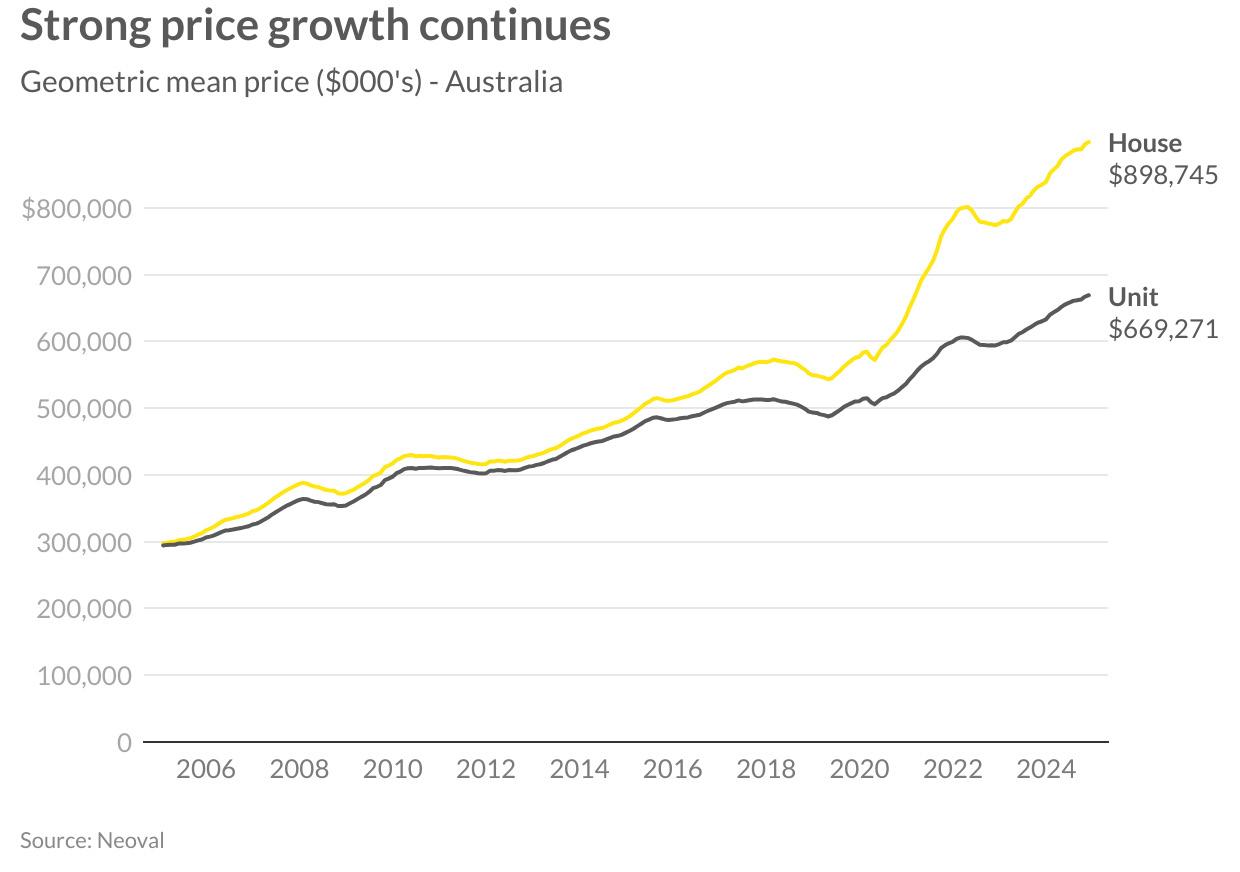

Looking at the broader picture, the market’s annual performance demonstrates sustained strength despite recent moderation. House prices have achieved a robust 7.7 per cent appreciation over the past 12 months, pushing the national average to $898,745. The unit market, while experiencing more modest growth, has recorded a healthy 5.8 per cent annual increase, with the national mean now reaching $669,271.

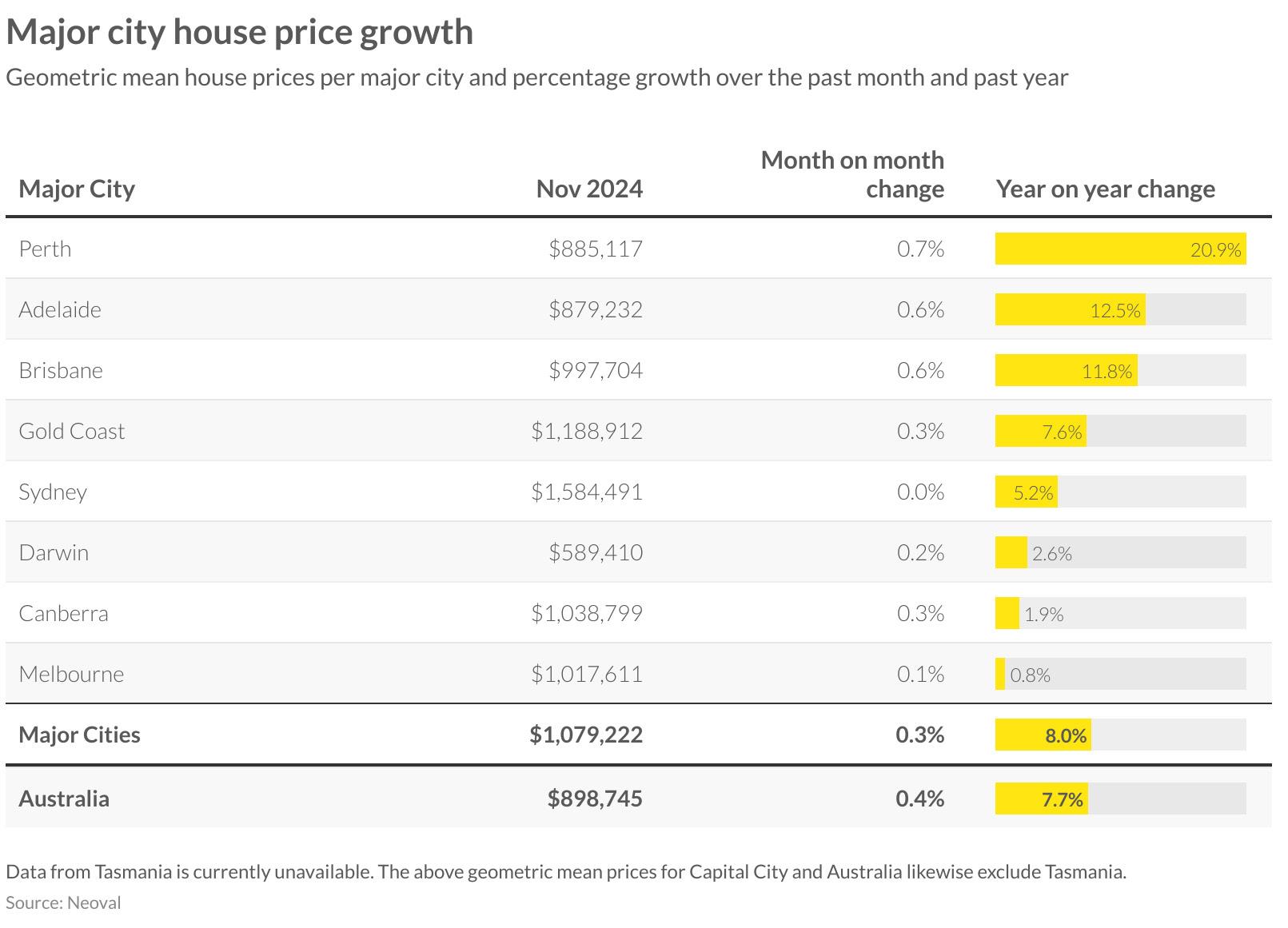

House prices across Australian regions have maintained their upward trajectory this month, though with notable variations across markets. Sydney, the nation’s largest property market, has reached a temporary plateau with its mean price holding steady at $1,584,491. While showing no monthly movement, its annual growth of 5.2 per cent now trails the national average, signaling a shift in market dynamics.

Perth continues its remarkable performance, leading both monthly and annual growth metrics. With a monthly gain of 0.7 per cent contributing to an exceptional annual appreciation of 20.9 per cent, Perth’s market remains the nation’s strongest performer. Adelaide and Brisbane are maintaining strong momentum, each recording 0.6 per cent monthly increases. These historically more affordable markets continue to set new price benchmarks, with Perth reaching $885,117 and Adelaide achieving $879,232.

New to our Ray White Now report, the Gold Coast has emerged as a major player, surpassing both Canberra and Melbourne with a mean price of $1,188,912, representing a solid 7.6 per cent annual increase. This milestone reflects the growing prominence of this coastal market in Queensland’s property landscape.

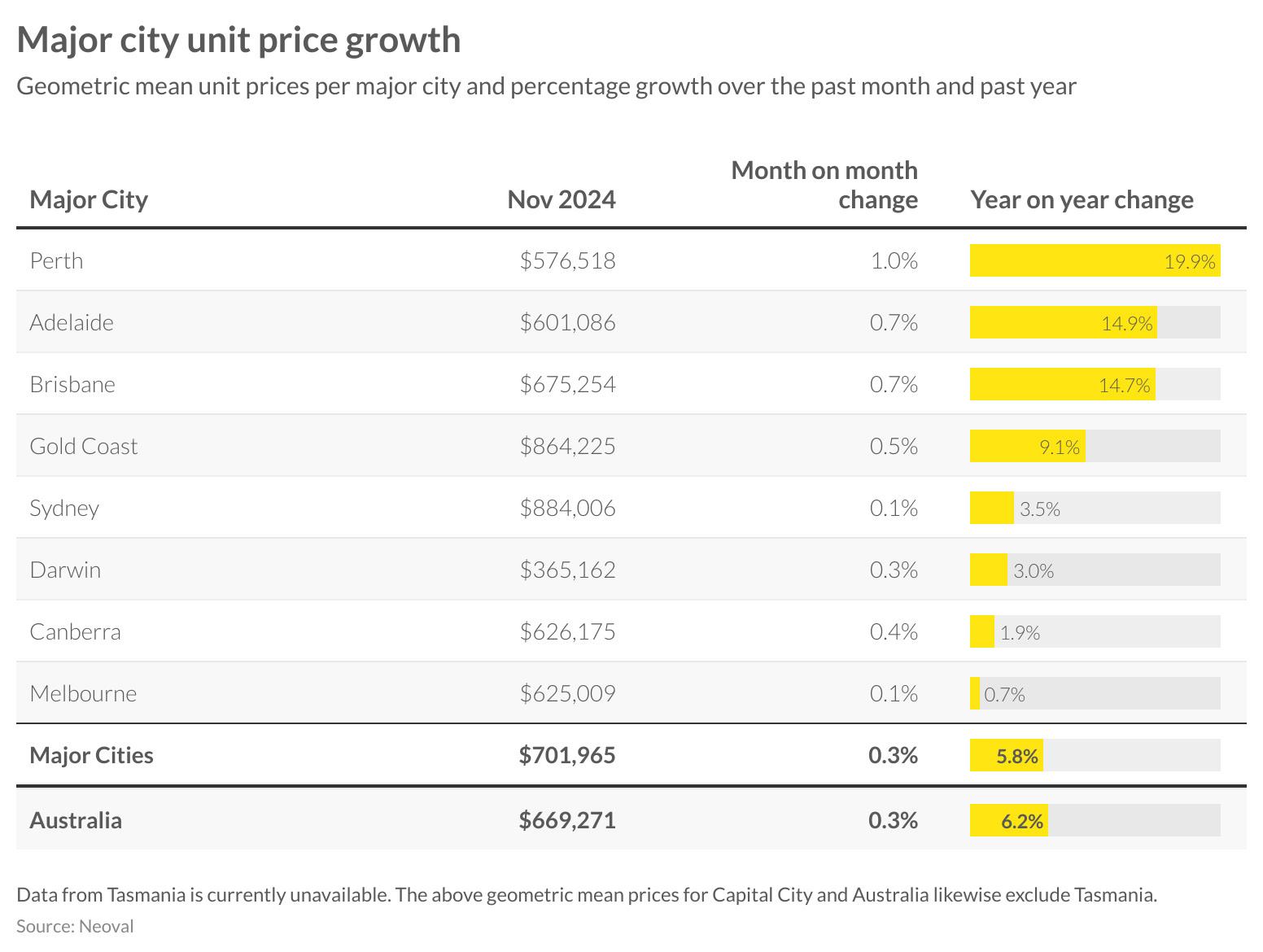

The final weeks of spring reveal continued variation in unit market performance across Australia’s major cities, reflecting similar patterns to the housing sector. In the key markets, Sydney and Melbourne have shown limited momentum, recording marginal gains to reach $884,225 and $625,009 respectively.

Perth’s unit market continues its remarkable run, leading both monthly and annual growth metrics. A robust monthly gain of one per cent has contributed to an impressive annual appreciation of 19.9 per cent, bringing the average unit price to $576,518. Strong performance is also evident in Adelaide and Brisbane, both posting 0.7 per cent monthly increases. Their annual growth rates approaching 15 per cent significantly exceed the major city average of 5.8 per cent.

The Gold Coast continues to assert itself as a premium unit market, advancing 0.5 per cent to reach $864,225, maintaining its position as the second-highest priced unit market after Sydney. Meanwhile, the smaller capital city markets of Canberra and Darwin are demonstrating greater resilience than Melbourne, where market conditions remain subdued.

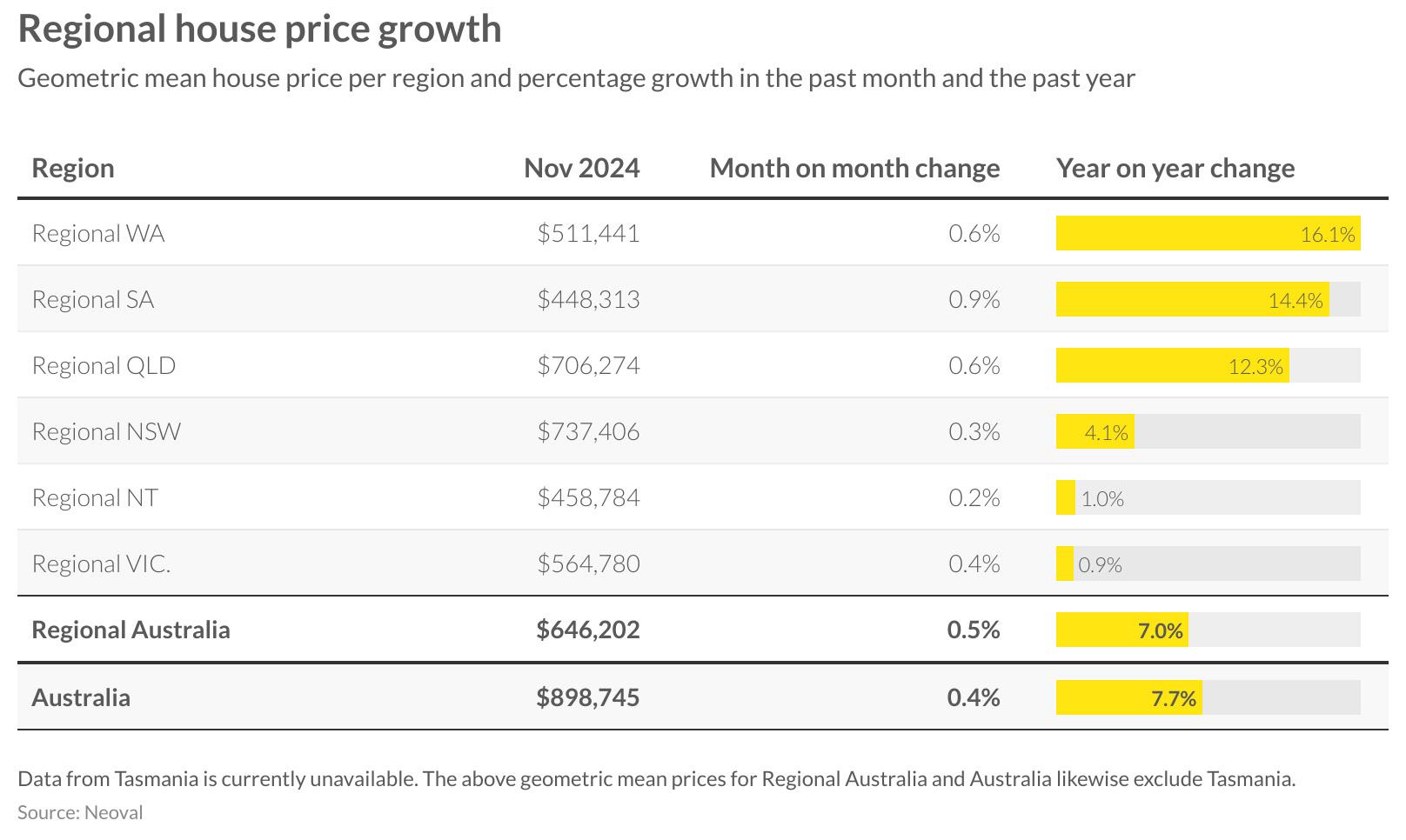

Regional housing markets have once again demonstrated stronger performance than their metropolitan counterparts, recording an overall monthly gain of 0.5 per cent, highlighting their continued appeal as a more affordable housing option. Regional South Australia has emerged as this month’s standout performer with a 0.9 per cent increase, while regional Western Australia and Queensland maintain strong momentum, each posting 0.6 per cent monthly gains. These regions, benefitting from their relative affordability compared to capital cities, have contributed significantly to annual growth rates that considerably surpass the national regional average of seven per cent.

Regional New South Wales retains its position as the country’s most expensive regional market with a mean price of $737,406, despite recording a modest 0.3 per cent monthly increase and annual growth of 4.1 per cent. Regional Victoria shows similar moderation, achieving a 0.4 per cent monthly gain, resulting in an annual appreciation of 0.9 per cent.

As these markets move into the summer period, coastal areas across New South Wales, Victoria, and Queensland typically experience heightened activity. This seasonal pattern often brings increased interest to beachside locations, potentially offsetting the broader market moderation seen in some regions. This cyclical uplift in coastal markets provides an interesting counterpoint to the varying growth patterns observed across different regional areas.

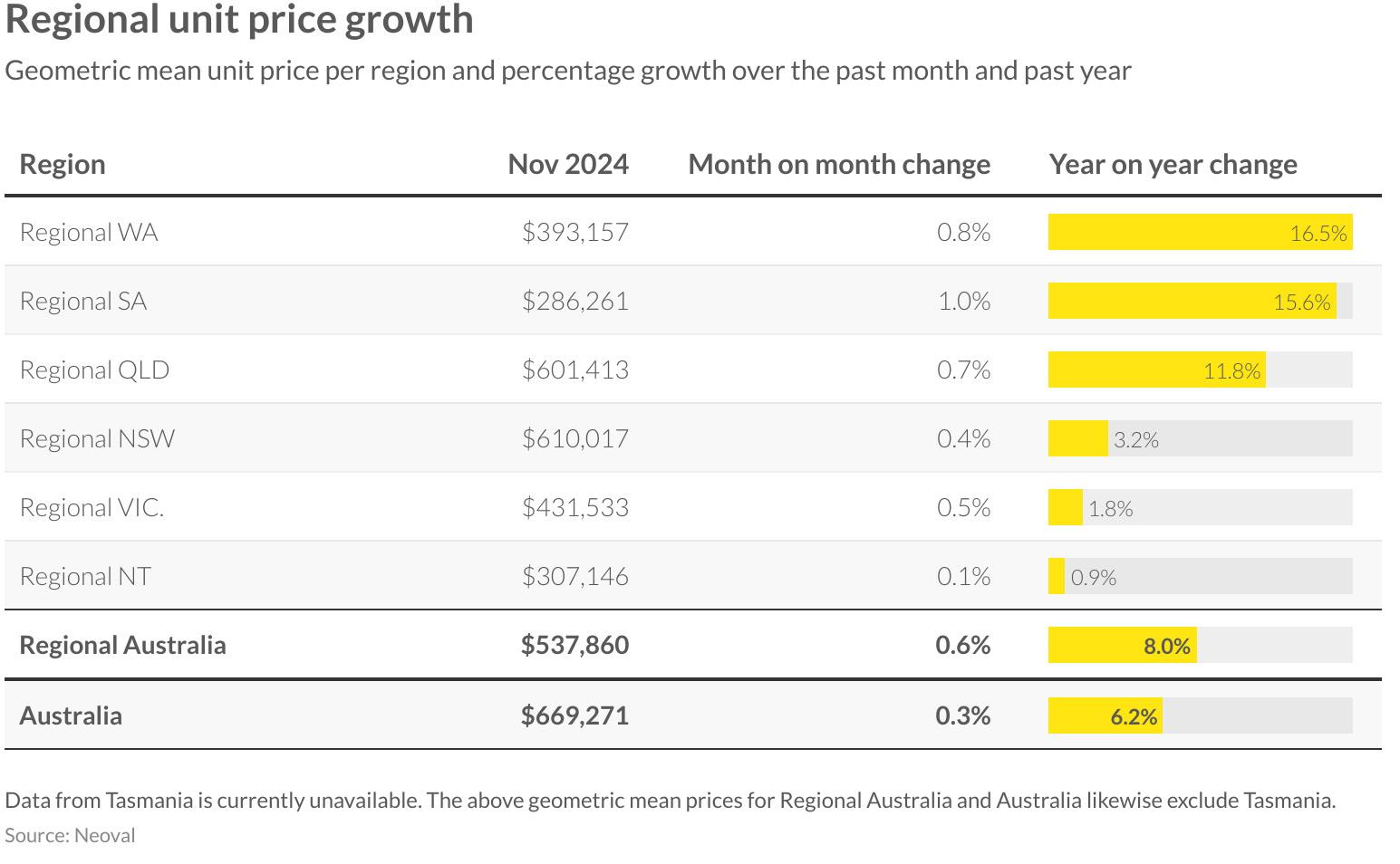

The regional unit sector continues to demonstrate strong performance, outperforming regional houses this period, recording an average monthly gain of 0.6 per cent across the country, with an annual appreciation of eight per cent.

South Australia’s regional unit market leads the monthly gains with a one per cent increase, bringing the mean price to $286,261. This represents a substantial year on year growth of 15.6 per cent. Regional Western Australia follows closely with a 0.8 per cent monthly rise and maintains the strongest yearly growth at 16.5 per cent.

Queensland’s regional unit market has shown positive momentum with a 0.7 per cent monthly increase and an 11.8 per cent annual growth rate. The average price now eclipsing $600,000 positions it just below regional New South Wales, where units average $610,017 despite a more modest year on year growth of 3.2 per cent.

Regional Victoria and the Northern Territory have recorded monthly improvements of 0.5 per cent and 0.1 per cent respectively. However, both regions show more conservative annual growth, with Victoria up 1.8 per cent and the Northern Territory registering just 0.9 per cent compared to last year.

CAPITAL CITY HOUSE PRICES (%CHANGE) | SINCE LAST MONTH

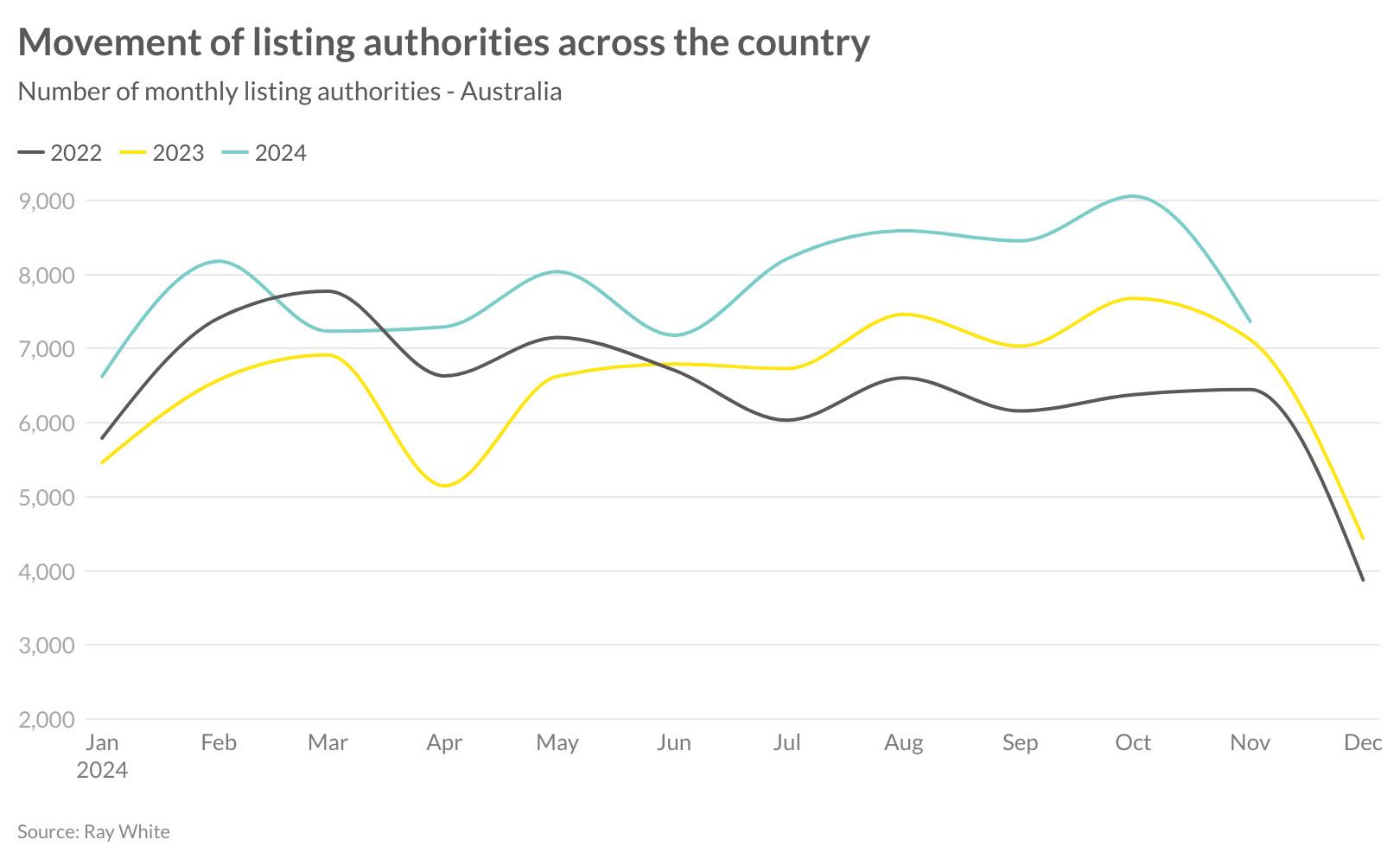

LISTINGS ACTIVITY

Ray White’s listing authority data, which carries particular significance given the company’s market-leading position, provides crucial forward-looking insights into market supply. The latest 28-day rolling sum indicates a seasonal decline in authorities, marking the onset of the traditional Christmas slowdown. While this downturn follows established yearly patterns, it’s noteworthy that 2024’s figures maintain a slight edge over previous years.

The November decline in authorities has manifested across all states, though South Australia and Northern Territory have demonstrated the most resilience, showing minimal decreases. Queensland has emerged as the strongest performer among the eastern states, while New South Wales, ACT, Victoria, and Tasmania have each recorded substantial declines exceeding 23 per cent. Western Australia has seen authorities decrease by nearly 20 per cent.

This widespread reduction in listing authorities aligns with typical summer patterns and suggests a natural pause in market activity over the coming months. This seasonal lull appears well-timed following an active 2024, providing an opportunity for market participants to reset. The prospect of improved financing conditions in 2025 adds a layer of optimism, suggesting buyers may benefit from this temporary market respite to reassess their positions for the new year.

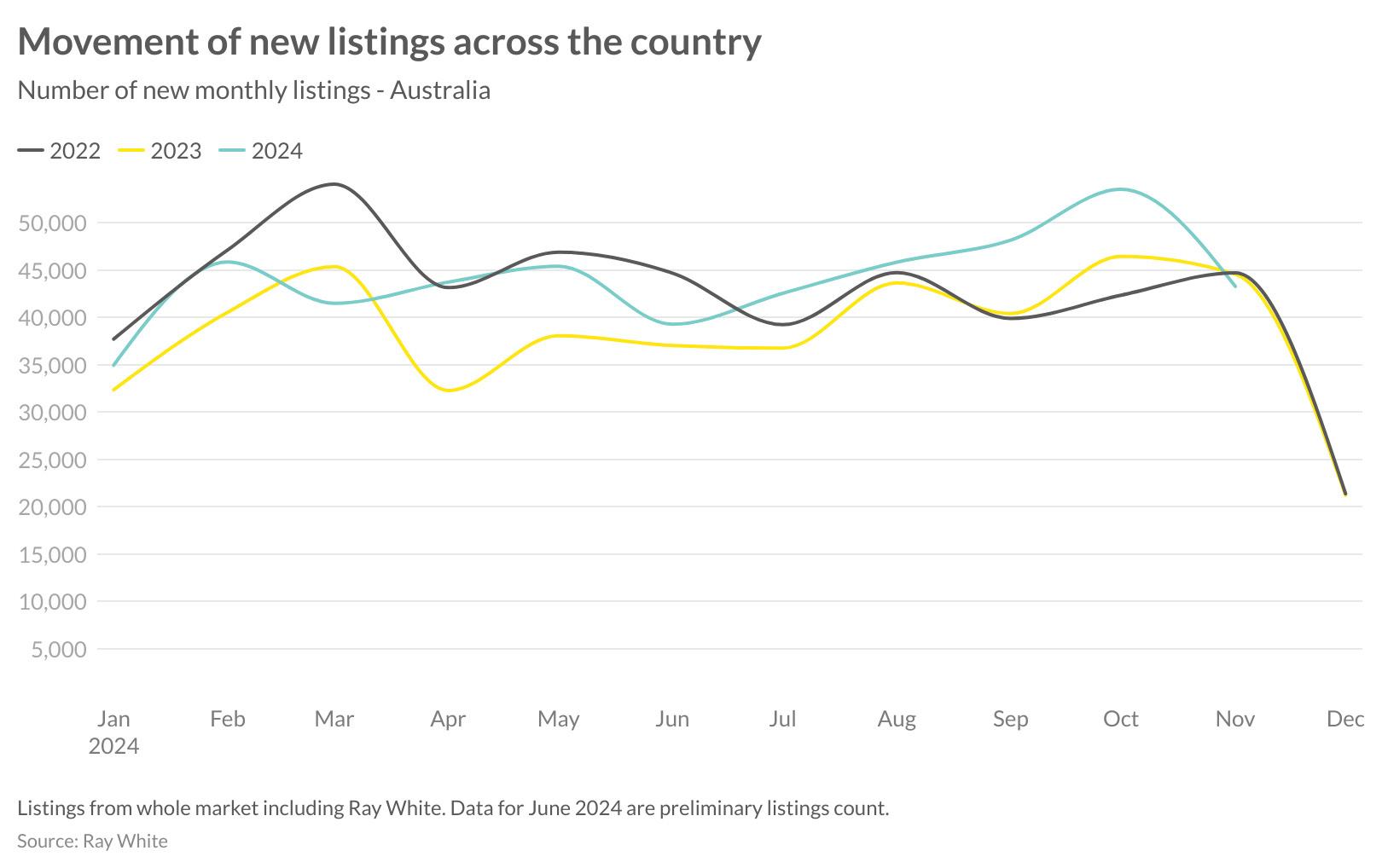

The property market has experienced a notable revival in listing activity during the recent quarter, with October’s preliminary figures revealing a substantial increase to nearly 55,000 listings. This marks a significant shift from the cautious winter period, when inflationary concerns had prompted both buyers and sellers to adopt a more conservative stance toward property decisions.

Recent momentum has surpassed previous years’ levels, buoyed by encouraging economic indicators that point to potential interest rate adjustments in the new year. This improved outlook has helped reinvigorate market participation from both buyers and sellers who had previously remained on the sidelines.

Property owners who had been hesitant to list their homes are now showing increased readiness to enter the market. This anticipated expansion in available properties could fundamentally alter market dynamics, presenting enhanced opportunities for prospective buyers who have been awaiting more favourable conditions.

As we look toward 2025, the market appears poised for increased activity. The combination of improving economic conditions, potential interest rate relief, and growing seller confidence suggests a more vibrant and dynamic property landscape in the months ahead.

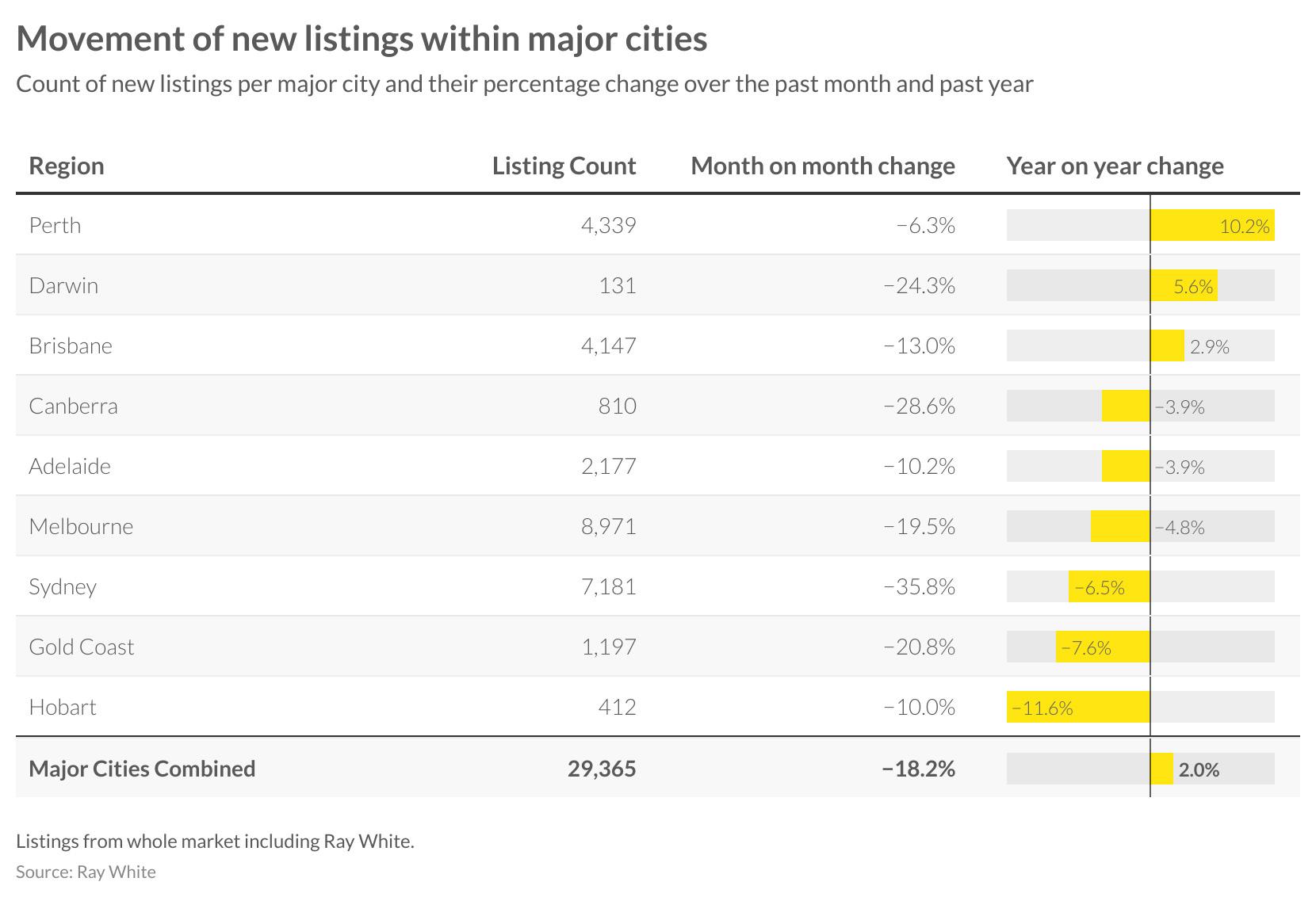

As the property market enters its traditional pre-Christmas slowdown, listing volumes across Australia’s major cities have shown a notable decline. While the aggregate annual growth remains positive at two per cent, November recorded a significant monthly decrease of 18.2 per cent in major city listings.

Melbourne has emerged as the market leader in listing volumes, surpassing Sydney with 8,971 properties available, though this represents a 4.8 per cent decline compared to the previous year. This shift in market dynamics provides an interesting insight into the changing patterns of vendor confidence across major metropolitan areas.

Perth continues to demonstrate resilience in the face of seasonal trends. Despite a monthly decline in listings, the market has maintained the strongest annual growth at 10.2 per cent, driven by homeowners looking to capitalise on continued positive capital appreciation. Meanwhile, Brisbane’s market reflects growing vendor caution, with listings falling 13 per cent over the month, though still maintaining a modest 2.9 per cent annual increase.

As the year draws to a close, each region is responding distinctively to local market conditions, price movements, and broader economic factors, creating contrasting market performance across the country.

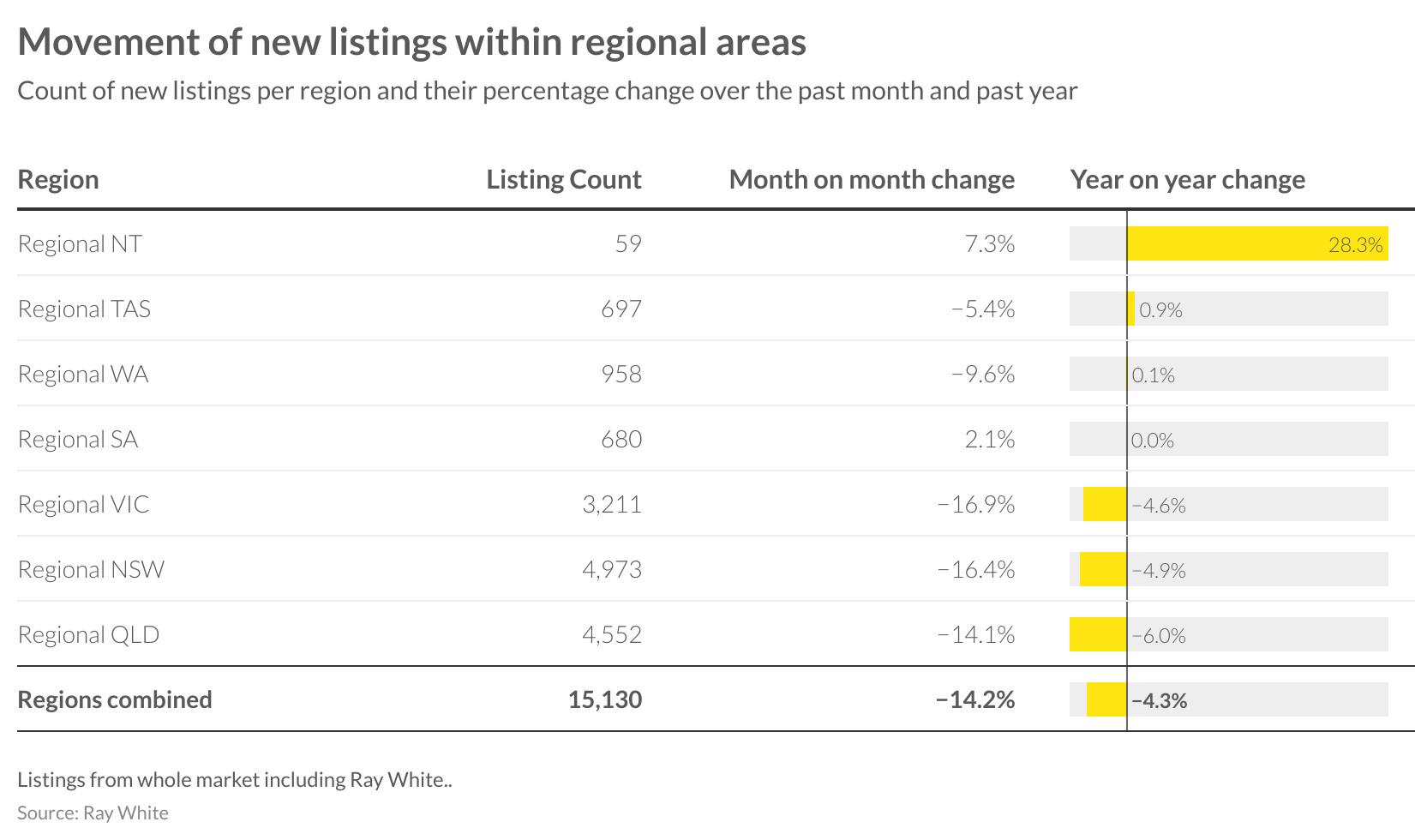

Regional property markets are displaying varying dynamics as the year draws to a close, with notable divergences across different states. The Northern Territory’s regional market stands out with remarkable growth, posting a 7.3 per cent monthly increase and an exceptional 28.3 per cent annual rise, albeit from a relatively modest base.

Tasmania has maintained positive momentum in listing volumes, achieving a limited 0.9 per cent year-on-year improvement. South Australia’s regional market has bucked the broader downward trend, recording a 2.1 per cent monthly increase in listings. Meanwhile, regional Western Australia has experienced a cooling in listing activity despite strong price appreciation throughout 2024, showing only minimal annual growth.

Regional Victoria has experienced an unexpected deceleration following several months of robust activity, with listings declining 16.9 per cent this month, pushing annual figures into negative territory. While Regional New South Wales maintains its position as the market with the highest absolute listing volumes, it too has seen a softening, with listings down 4.9 per cent compared to the previous year.

The approach of summer has traditionally impacted Queensland’s regional market, and this year is no exception. November recorded a 14.1 per cent decline in listings, though volume remains substantial at 4,552 properties. This seasonal pattern typically persists until cooler weather returns in 2025.

AUCTION INSIGHTS

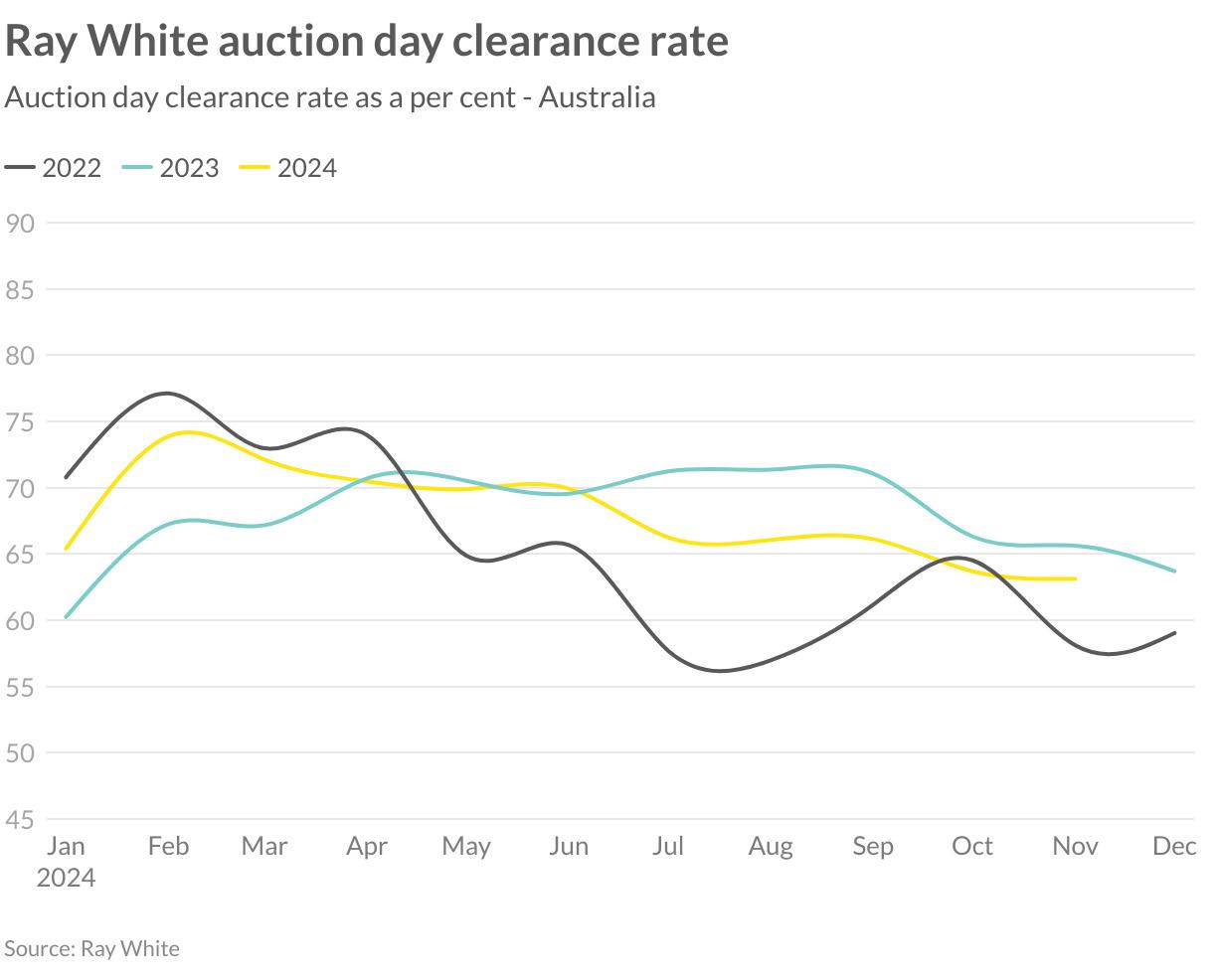

November’s auction market data reveals a continued moderation in activity, with clearance rates settling at 63.11 per cent. While this represents a decline from 2023’s performance, it remains stronger than 2022 levels. This adjustment in clearance rates reflects both seasonal patterns and broader market dynamics as the year draws to a close.

The approach to the holiday season has brought its traditional impact on market momentum. The combination of softening price growth and constrained listing volumes has tempered buyer urgency, particularly as participants begin to look toward 2025. This seasonal slowdown is following established historical patterns, with the Christmas period typically marking a natural pause in market activity.

Despite this moderation, underlying market fundamentals remain sound. The prospect of potential interest rate reductions in the coming year continues to influence market sentiment positively, though immediate activity is naturally dampened by seasonal factors. The conclusion of the spring selling season, traditionally the year’s most active period, signals a transition to the quieter summer months.

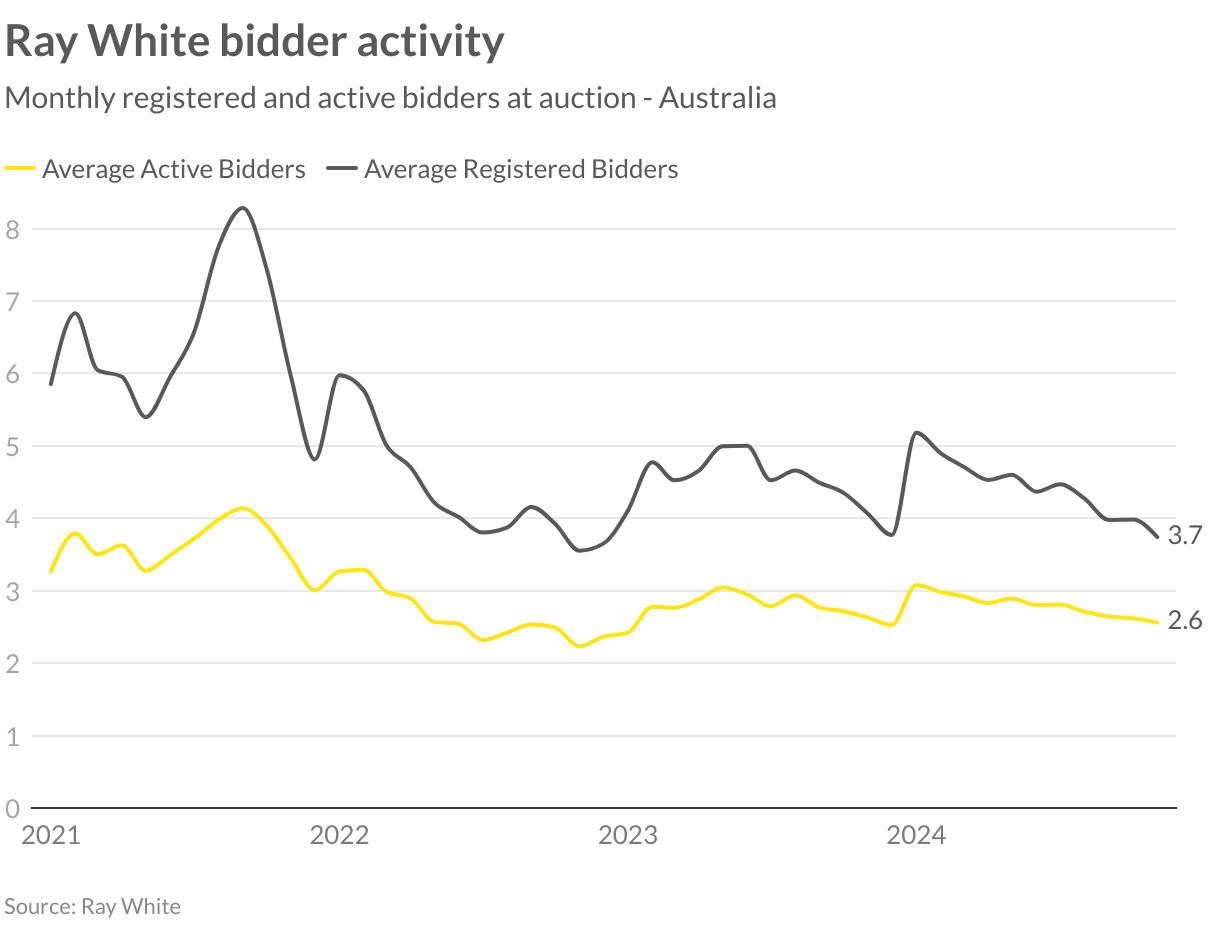

As the market approaches the holiday period, auction participation metrics continue their gradual moderation. November data shows auctions attracting an average of 3.7 registered bidders, with 2.6 actively participating in the bidding process. While this represents a slight softening from earlier months, it maintains parity with participation levels recorded during the same period last year, suggesting stable underlying market engagement despite seasonal factors.

The market continues to navigate affordability challenges, with the combined impact of cumulative price growth and elevated borrowing costs influencing buyer behaviour. However, as we look toward 2025, several factors could reshape market dynamics. The growing consensus around potential interest rate reductions in the coming year, coupled with evolving listing volumes, may provide fresh momentum to auction participation once the traditional holiday slowdown concludes.

While current participation rates have eased from their peaks, the prospect of more favourable financing conditions and potential shifts in property availability could help restore stronger bidder engagement. However, the timing and extent of any recovery will largely depend on the market’s response to these changing conditions once activity resumes post-holiday period. This balance between current market constraints and future opportunities suggests a market in transition, with the traditional year-end lull providing time for both buyers and sellers to reassess their positions ahead of 2025.

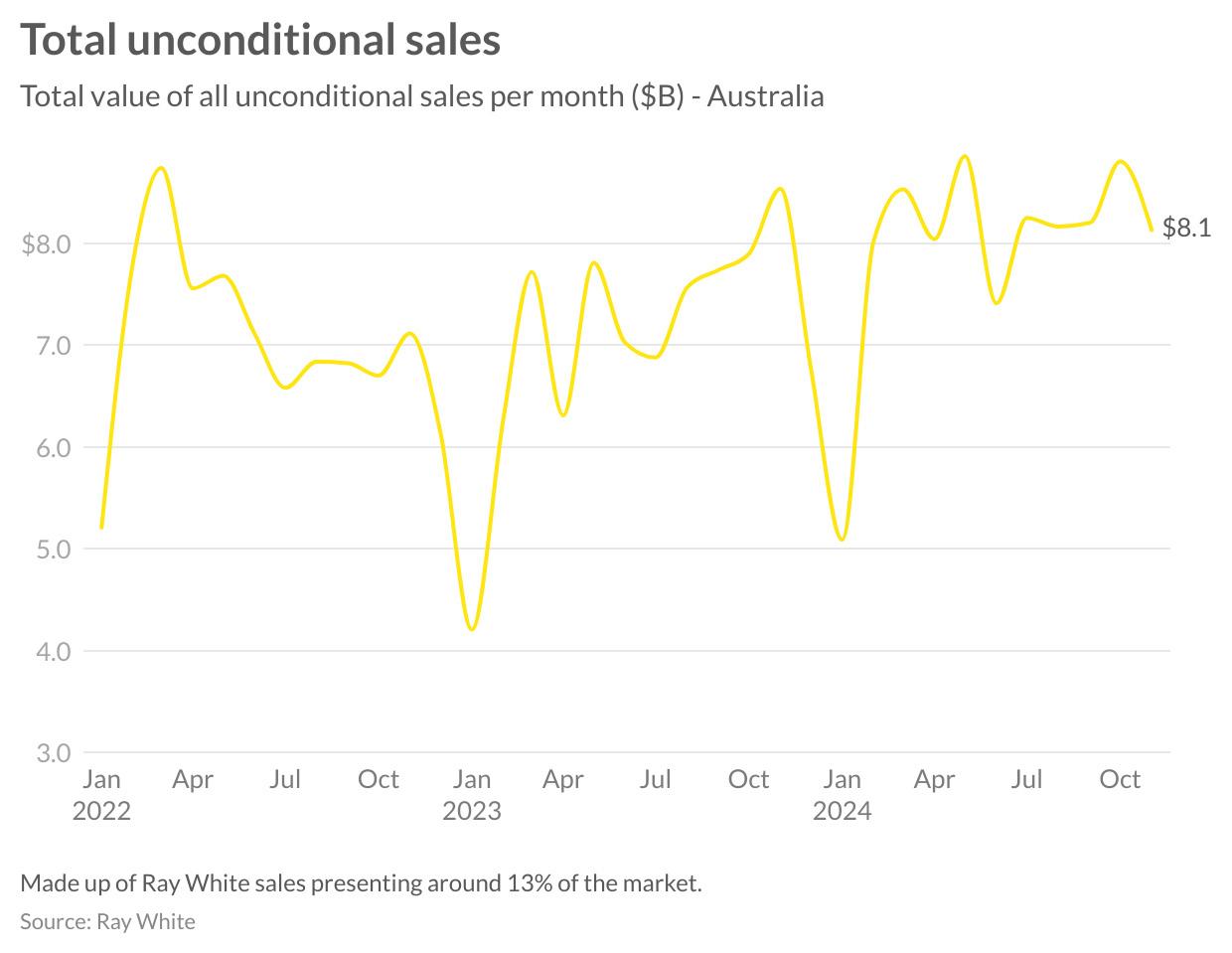

The Ray White Group’s latest performance data reflects the culmination of a strong spring selling season, with October’s revised figures confirming robust unconditional sales values across the nation. As the market transitions into its traditional year-end phase, early November figures maintain strong momentum despite the approaching holiday slowdown.

Preliminary November unconditional sales have held steady at $8.1 billion, matching October’s early results and surpassing figures from previous November periods. This resilience in sales value, even as the market enters its seasonal deceleration, suggests underlying strength in transaction quality, if not quantity. Both South Australia and Western Australia recorded their best November on record.

As the market approaches the Christmas period, the anticipated seasonal lull in activity is beginning to manifest through declining listing volumes and authorities. However, the maintenance of strong sales values despite these seasonal headwinds indicates sustained buyer commitment to completing transactions before year’s end.