The Qatar Dynamic House Price Index (QD-HPI) serves as a measure to observe changes in residential real estate prices in Qatar over time. This index offers insights into property values by reflecting general trends in the real estate market. Typically, the index is compiled from transactions across various types of properties and locations, enabling the tracking of fluctuations within the housing market.

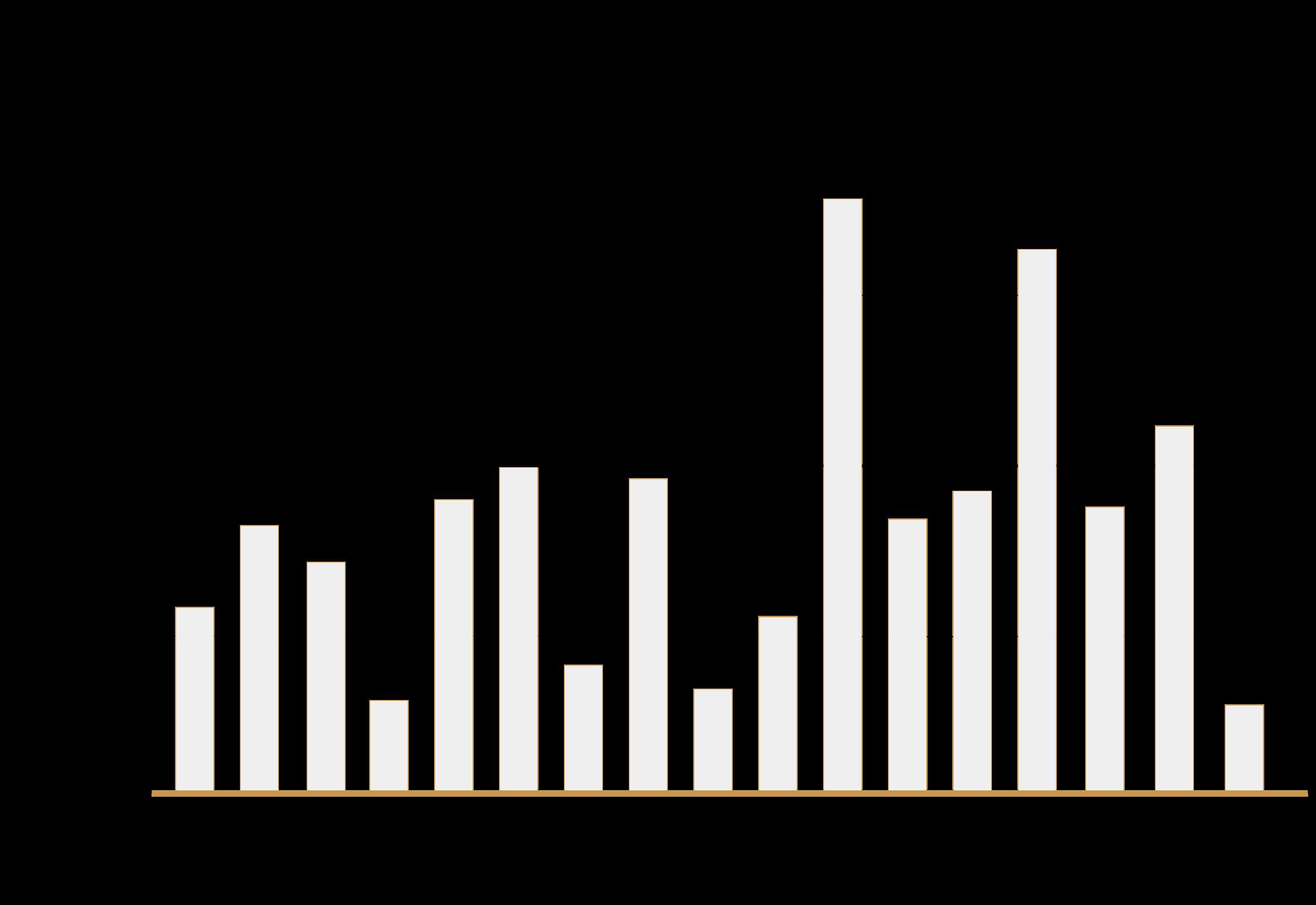

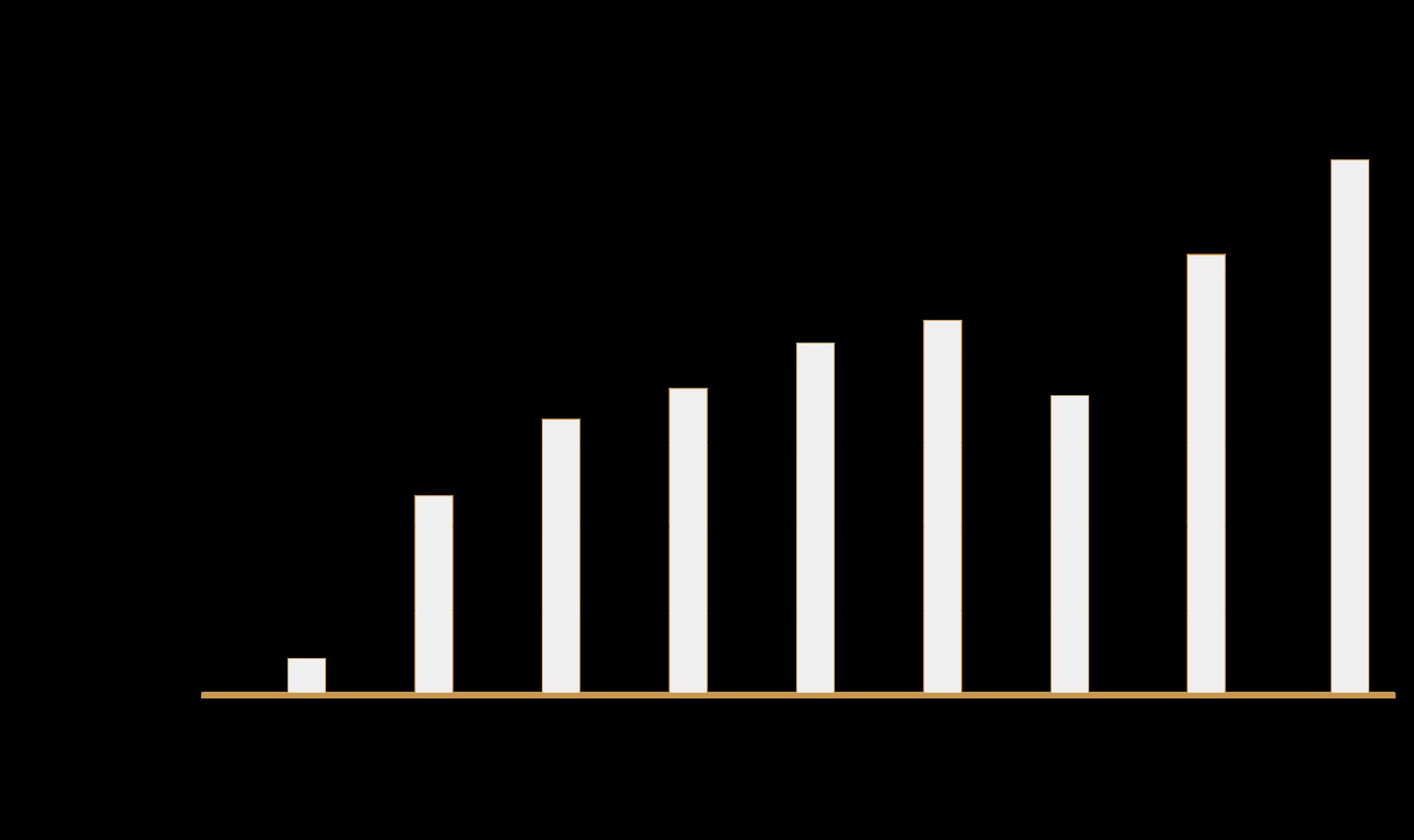

From 2016 to 2024, the QD-HPI fluctuated between values of 303.6 and 207, reflecting significant shifts in Qatar’s housing market.

Impact of the Economic Blockade (2017): The 2017 GCC blockade had a profound impact on Qatar’s economy, undermining investor confidence and causing an oversupply in the real estate market. This resulted in a nearly 13% drop in the HPI from January 2017 to July 2018.

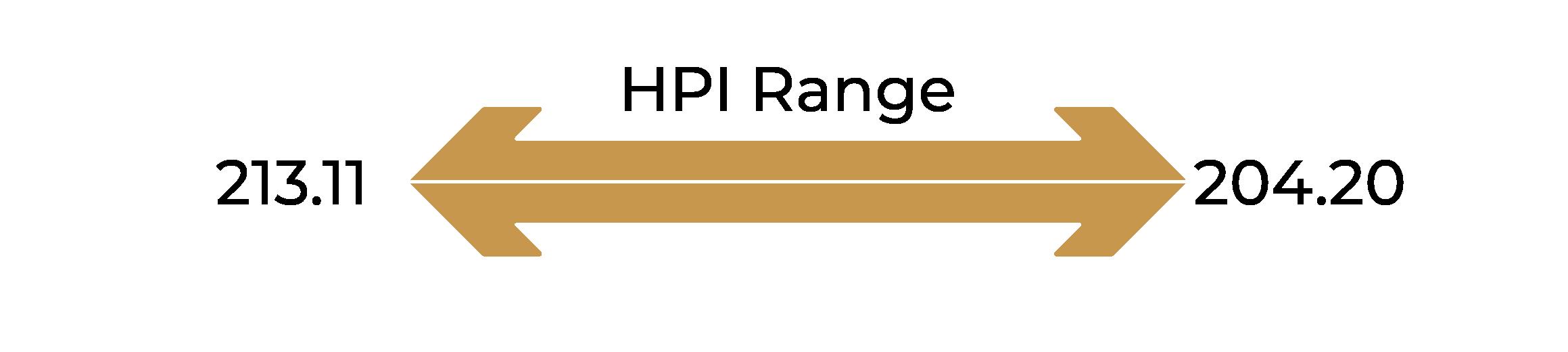

COVID-19 Impact and Recovery (2020): The global pandemic introduced significant challenges, leading to reduced demand and a drop in the HPI to 204.2 in January 2021. However, government interventions and real estate incentives contributed to market stabilization.

World Cup Effect (2022): In anticipation of the FIFA World Cup 2022, the housing market experienced a rebound, with HPI values showing positive growth during 2022 and 2023.

Post-World Cup Adjustments (2023-2024): Following the World Cup, Qatar’s real estate market underwent an adjustment period, with the HPI experiencing a decline due to shifting market dynamics. Despite these fluctuations, prime areas like The Pearl and Lusail have remained resilient, with ongoing demand expected to support long-term investment strategies.

Initial Post-World Cup Recovery (January 2023)

Mid-Year Stabilization (July 2023)

Upward Trend (January 2024)

Current Market Position (June 2024)

Initial Post-World Cup Recovery (January 2023) : The HPI rose by 6.5%, reflecting residual demand from the World Cup and a continued interest in luxury properties. The index was 223.89 in January 2023.

Mid-Year Stabilization (July 2023): A minor decline of 2.34% was observed, indicating a cooling market as temporary demand subsided. The index was 218.65 in July 2023.

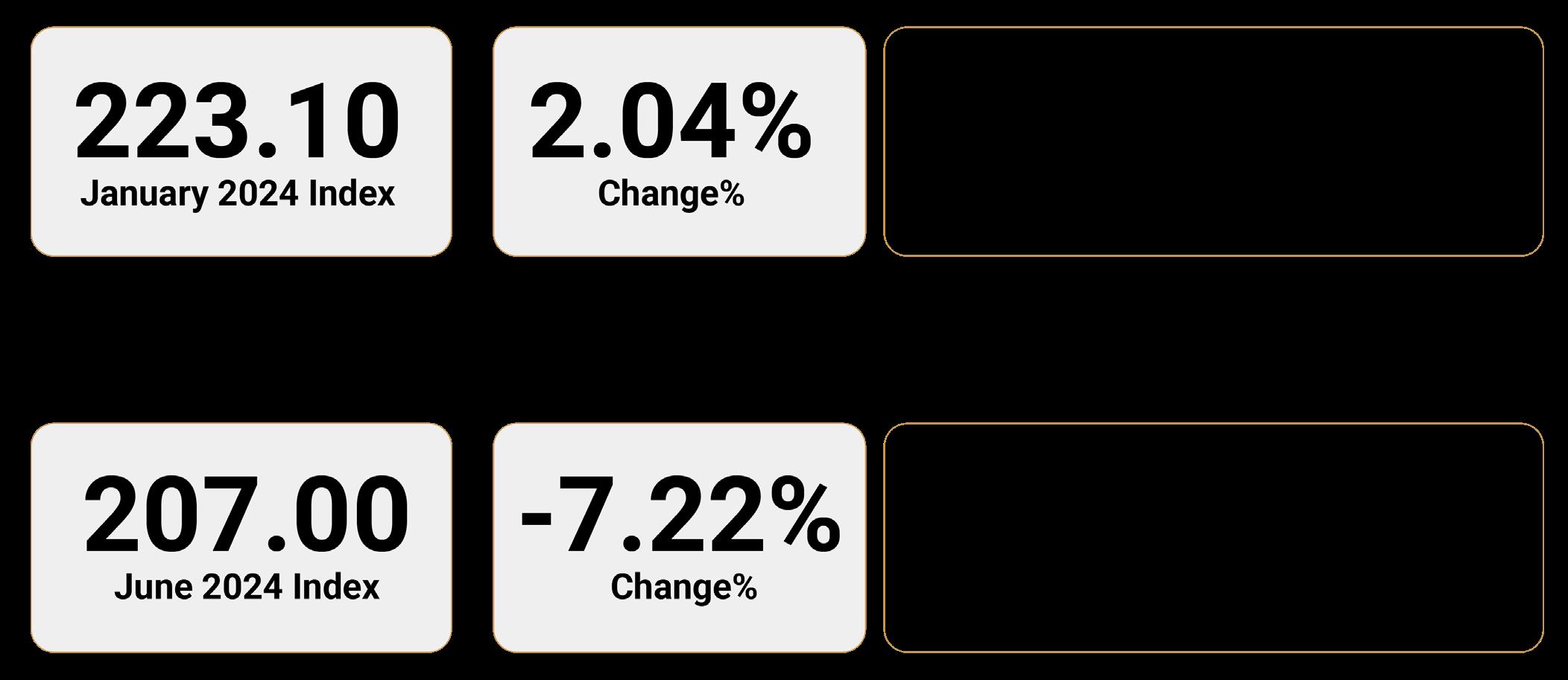

Upward Trend (January 2024): The HPI showed a slight increase of 2.04%, reaching 223.10, likely due to strategic property acquisitions and government incentives.

Current Market Position (June 2024):* A significant drop of 7.23% brought the index to 207.00 in June 2024, indicating challenges such as oversupply and reduced demand.

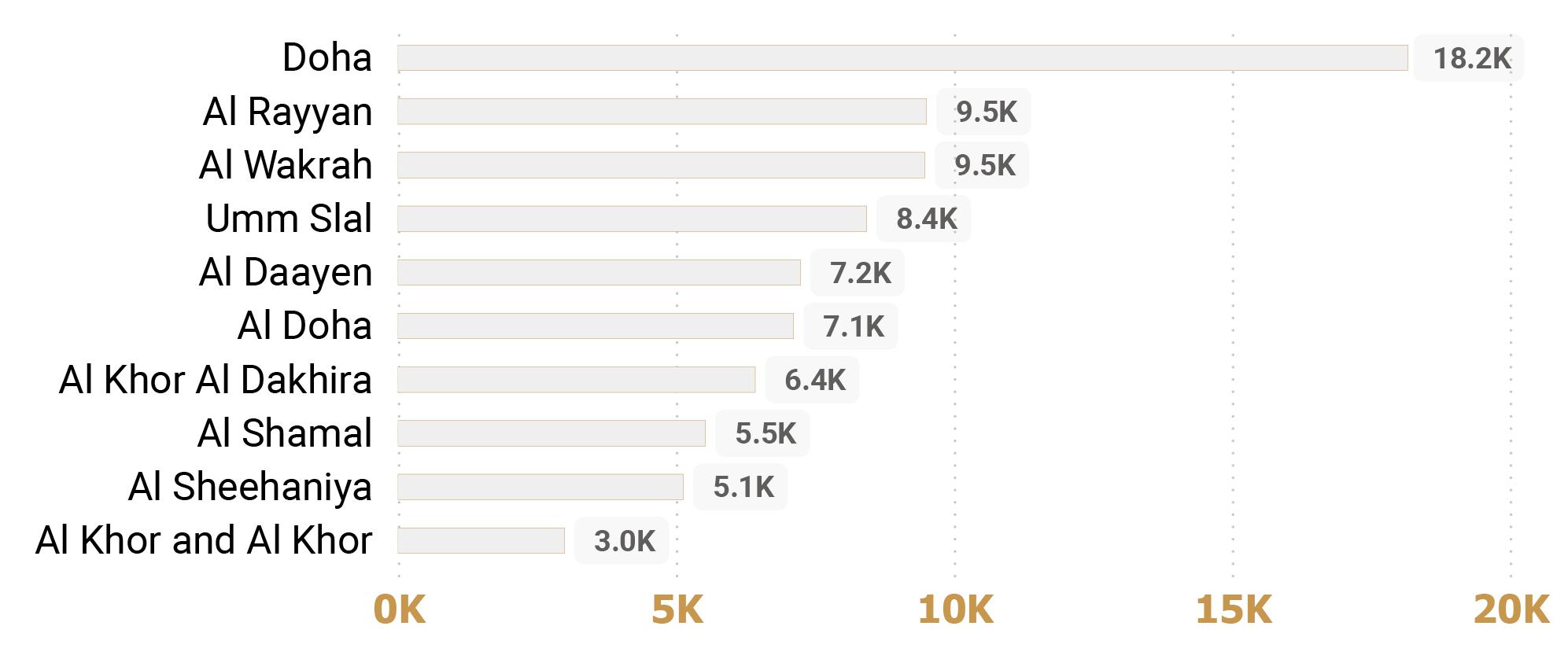

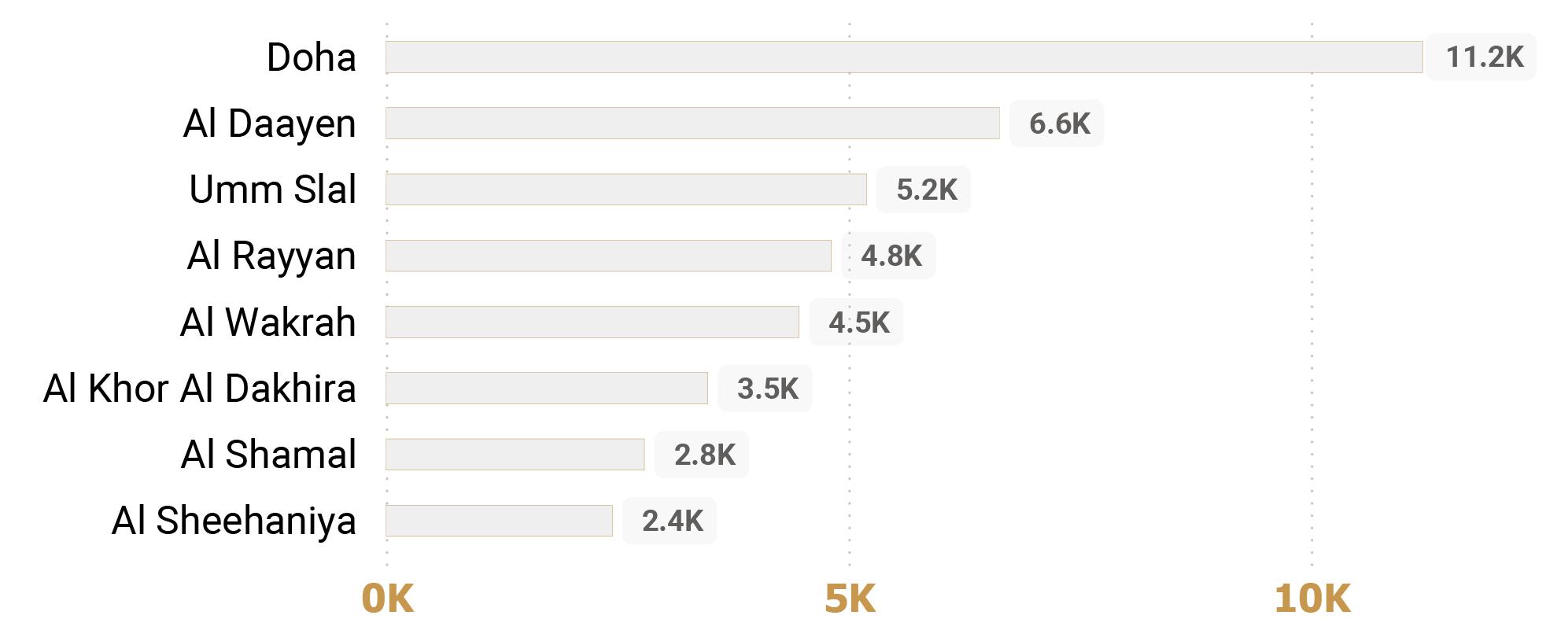

Average Price per SQM of Residential Properties in various municipalities in the year 2021

Average Price per SQM

Average Price per SQM of Residential Properties in various municipalities in the year 2022

Average Price per SQM

Average Price per SQM of Residential Properties in various municipalities in the year 2023

Average Price per SQM

Average Price per SQM of Residential Properties in various municipalities in the year 2024

Average Price per SQM

Population Forecast

Population

From 2015 to 2023, Qatar’s population grew steadily, surpassing 3 million by 2023. This growth, driven by large infrastructure projects, including those for the FIFA World Cup 2022, had varying impacts on the HPI.

Despite population growth, the HPI declined sharply due to economic factors and shifts in demand toward lower-income expatriates, who had minimal influence on high-end property prices.

As population growth resumed post-pandemic, the HPI saw a short-term recovery, peaking in early 2023.

Following the World Cup, the HPI declined despite continued population growth, suggesting an ongoing market correction. This period may present opportunities for long-term investors to acquire properties at lower prices.

Investors are advised to focus on segments currently undervalued due to market dips but with strong long-term demand potential. This includes affordable housing, properties in strategic locations like Lusail, and units near emerging business hubs, which could offer solid returns as the market stabilizes.

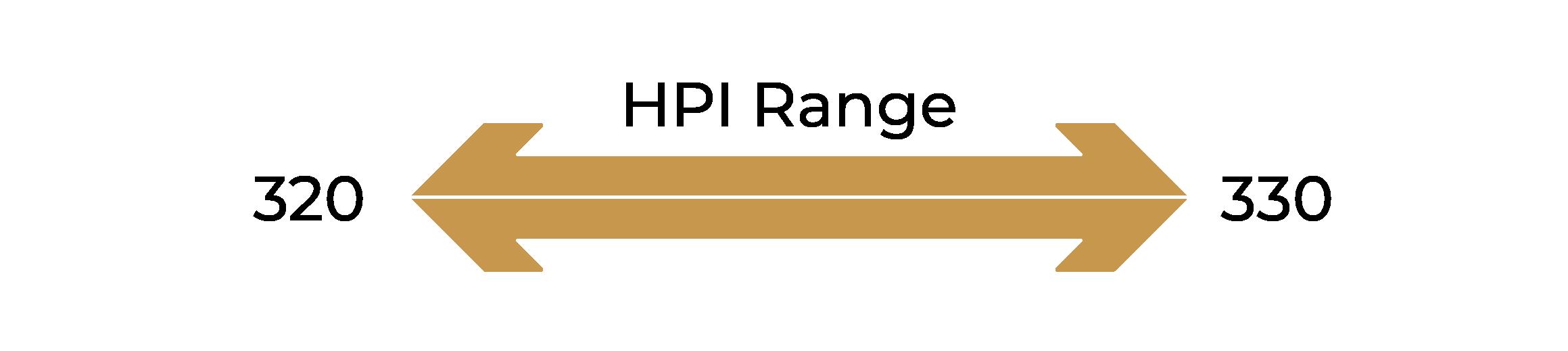

The acceleration of infrastructure projects led to a moderate increase in the HPI, with values between 320 and 330. Key developments included the Doha Metro, Hamad International Airport, and the expansion of The Pearl-Qatar.

The blockade on Qatar caused a decline in the HPI, dropping from 282.87 in January 2017 to 248.21 by July 2018, due to reduced investor confidence and economic uncertainty.

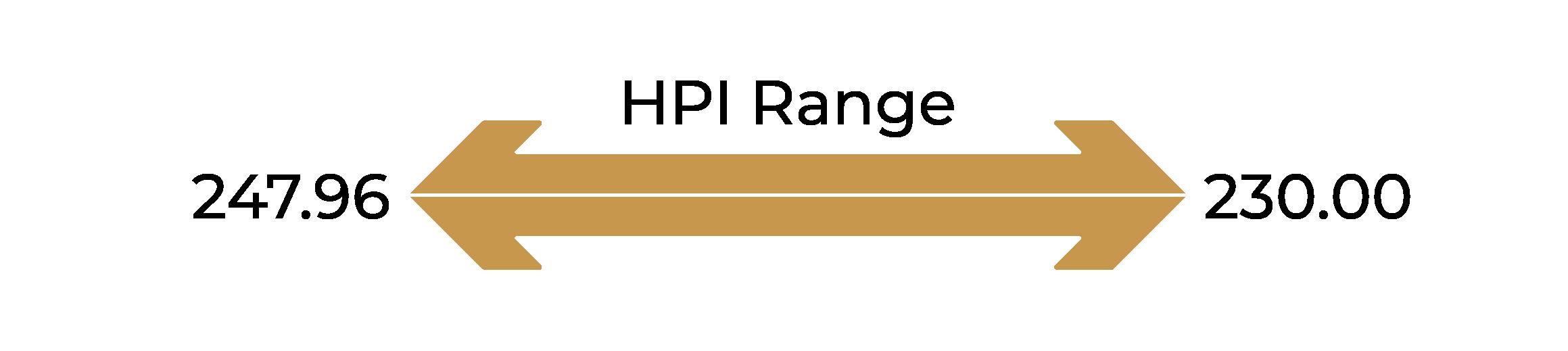

The market began stabilizing as infrastructure improvements attracted more residents and businesses. The HPI remained low but steady, with values around 230.0 by January 2020.

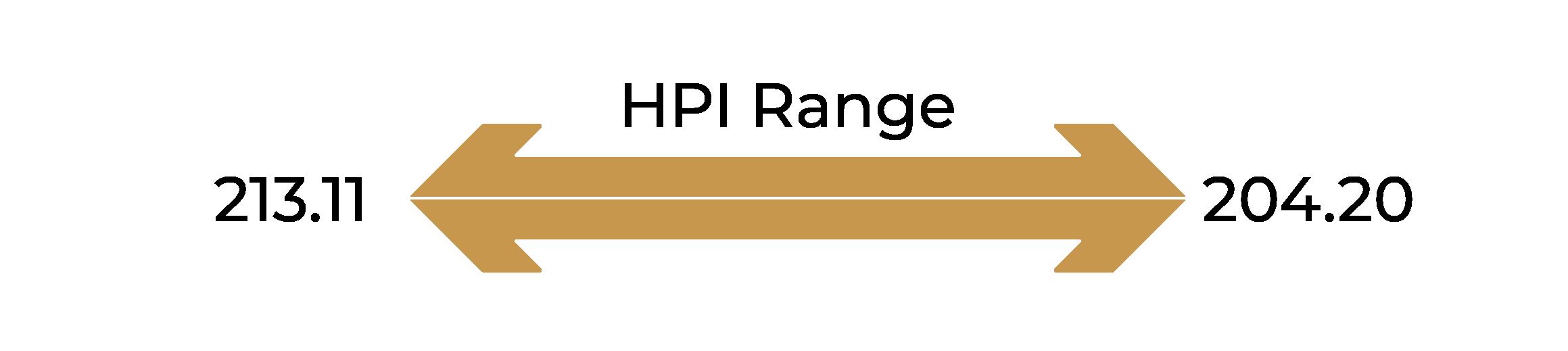

The COVID-19 pandemic led to a significant drop in the HPI, which bottomed out at 204.2 in January 2021 before stabilizing in 2022.

The anticipation of the World Cup drove temporary demand, especially for rental properties and shortterm accommodations. This created a brief recovery in the HPI as demand spiked.

Following the World Cup, the HPI experienced a minor dip as the market corrected itself from the temporary spike in demand. However, strategic areas like Lusail, The Pearl, and Msheireb have maintained stable or slowly appreciating property values.

In the aftermath of the 2014-2015 oil price shock, Qatar’s economic growth decelerated, leading the Qatar Central Bank (QCB) to align interest rate increases with the U.S. Federal Reserve. From 2016 to 2019, this tightening cycle elevated mortgage costs, constraining affordability and property demand. As a result, the House Price Index (HPI) experienced a continuous decline from 303.6 in Jan 2016 to 231.63 in Jul 2019.

in 2019

in 2016

in Jan 2016

in Jul 2019

In response to the COVID-19 pandemic, the QCB joined global central banks in reducing rates during 2020 to stimulate economic activity. Although lower borrowing costs were introduced, initial market uncertainty weighed on demand, leading to further declines in the HPI from 230 in Jan 2020 to 204.2 in Jan 2021. As confidence gradually returned, the market began stabilizing towards late 2021, with improved demand.

in 2020

in Jan 2020

in 2021

In 2022, inflationary pressures led to renewed interest rate hikes, including by the QCB. Simultaneously, the post-World Cup market experienced cooling demand as the temporary surge receded. These factors combined to exert downward pressure on the real estate market. Higher rates and a cautious investment environment drove subdued property demand, contributing to a moderate HPI decline during this period.

in Jan 2021 6.25 in 2024

in Jan 2022

in 2022

in June 2024

There is a clear inverse relationship between interest rates and the HPI. Periods of rising interest rates, such as 2016-2019 and 20222023, generally correspond with declines in the HPI, while periods of low rates, like 20202021, are associated with price stabilization or slight recoveries.

As global inflationary pressures ease, central banks may slow down or pause rate hikes, which could stabilize borrowing costs. If the QCB follows this trend, the reduced pressure on mortgage rates could lead to a recovery in Qatar’s HPI.

Based in Qatar, The Pearl Gates stands as a distinguished entity within the real estate industry, distinguished by a team of seasoned professionals united by a shared commitment to a core principle: understanding and addressing the evolving needs of the market with finesse, tact, and diplomacy—reflecting the brand’s unwavering values.

In a landscape where others may offer similar services, what sets us apart is the fusion of your unique experience with our unparalleled expertise. The insightful team at The Pearl Gates possesses an extensive wealth of Qatari real estate knowledge. As locals, we take pride in our dedicated approach, consistently delivering a comprehensive range of property services with genuine enthusiasm and a warm smile. Our mission is to elevate the real estate experience, ensuring that every interaction with us is marked by professionalism, integrity, and a commitment to exceeding your expectations.

Banyan Tree Residences at Doha Oasis,Core N & O, Floor-R1, Al Khaleej St, Doha | +974 5086 7771| contacts@thepearlgates.com | www.thepearlgates.com