Qatar’s Housing Market:

Balancing the Disparity Between High-end and Affordable Options

Qatar’s housing market faces a notable divide between luxury properties and affordable options. This case study explores how The Pearl Gates can address this gap by offering solutions that cater to both high-end and budget-conscious buyers.

Analysis of Housing Affordability and Potential Mortgage Savings in Qatar:

Overview:

Qatar is currently facing a crucial situation regarding the cost of housing. The presence of contemporary and luxury buildings in its skyline accentuates the increasing disparity within the housing industry. Despite being one of the wealthiest countries in the world, Qatar is facing considerable difficulties in its housing market due to rapid economic expansion and a growing population. The ever-increasing discrepancy between high-end real estate projects and affordable housing alternatives is affecting both Qatari nationals and the majority of expatriates.

Given the prevailing atmosphere of ambition and opulence, the demand for affordable housing has become increasingly pressing. This research comprehensively examines housing affordability in Qatar, utilizing data to analyze factors like government regulations, rental costs, home prices, and income levels. The objective is to highlight residents' difficulties and suggest pragmatic measures to narrow the affordability disparity.

Analysis of Housing Affordability:

The level of housing affordability in Qatar varies significantly, especially for expats. Income levels, property prices, and mortgage financing costs are the primary factors that affect affordability.

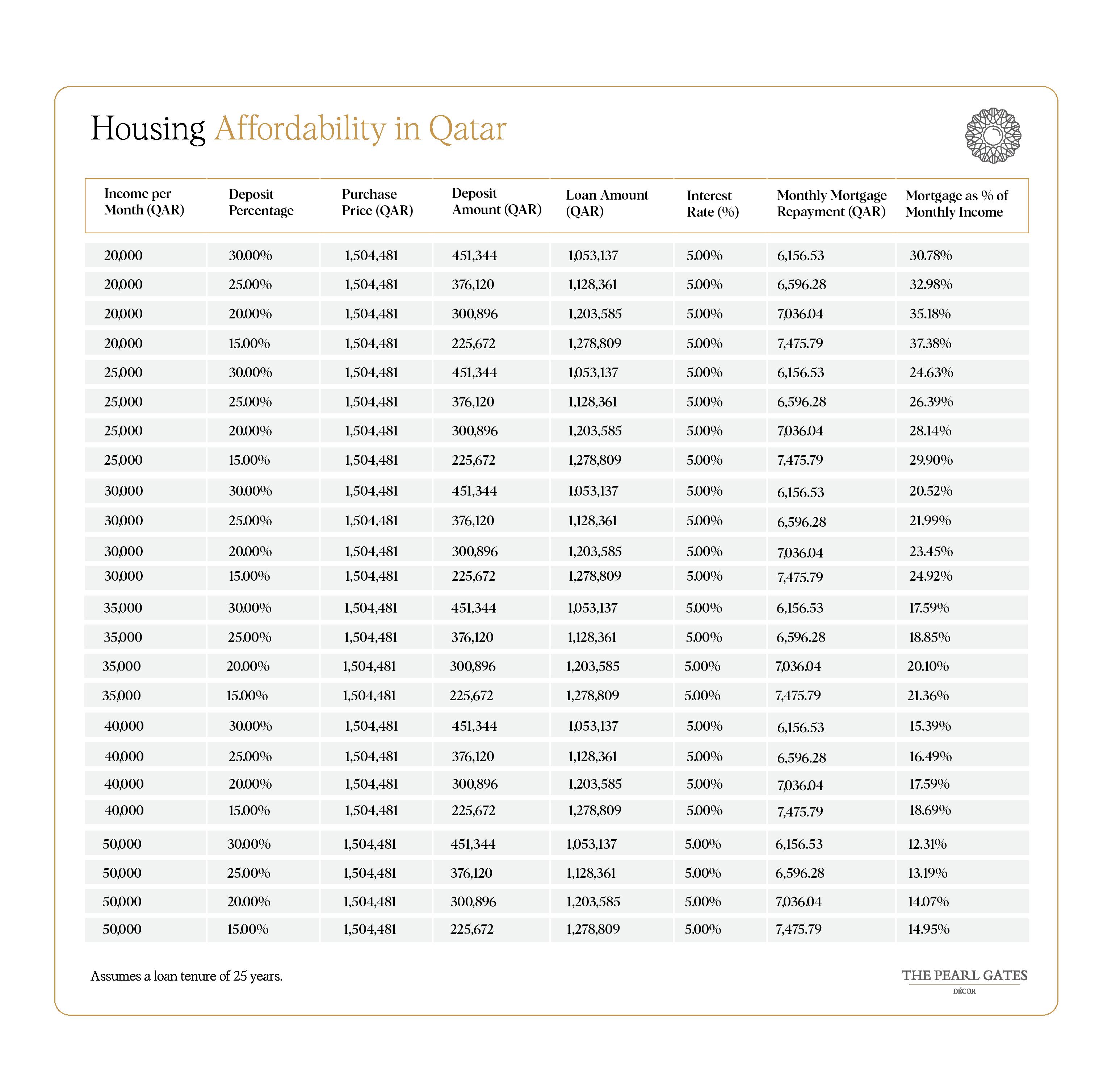

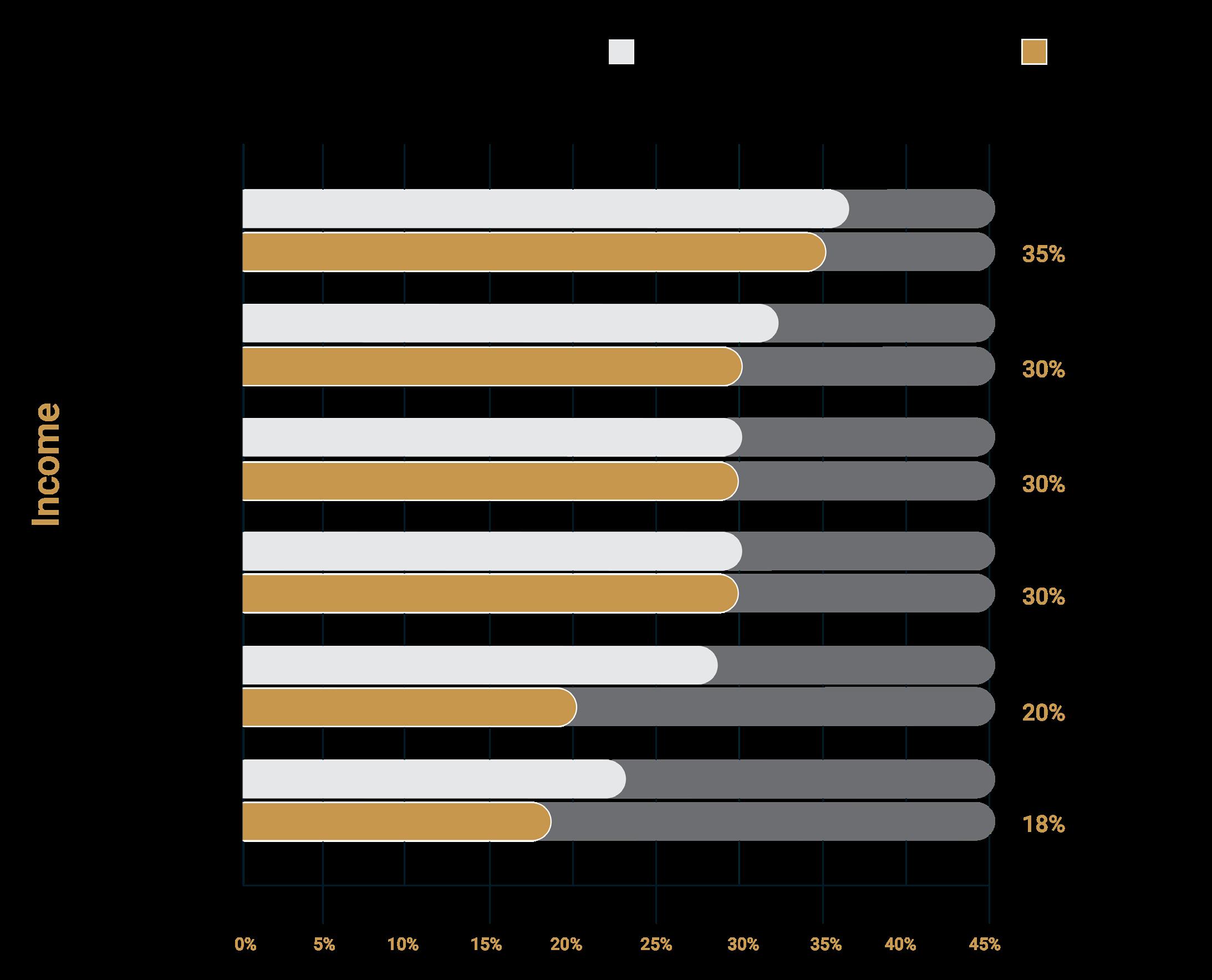

The table below shows a sample study on the monthly mortgage payments required to purchase 1.5 million property for individuals with incomes ranging from 20,000 to 50,000 QAR and a 5% mortgage interest rate.

What is the Optimal Mortgage Payment Ratio?

Recommended Percentage of Gross Monthly Income towards mortgage payments by Financial Experts - 25% to 30% 25% to 30% Saving

Main Discoveries: Mortgage Payments

What is the Optimal Mortgage Payment Ratio? Financial experts recommend that individuals allocate 25% to 30% of their gross monthly income towards mortgage payments. This ensures that homeowners can effectively handle their mortgage obligations while covering their other living expenses.

Financial Evaluation:

Individuals with a monthly income ranging from QAR 25,000 to QAR 50,000 can afford mortgage repayments for a property worth QAR 1.5 million. This assumes a 5% interest rate and a deposit ranging from 15% to 30% of the property value. The mortgage repayments should be at most 30% of their monthly income.

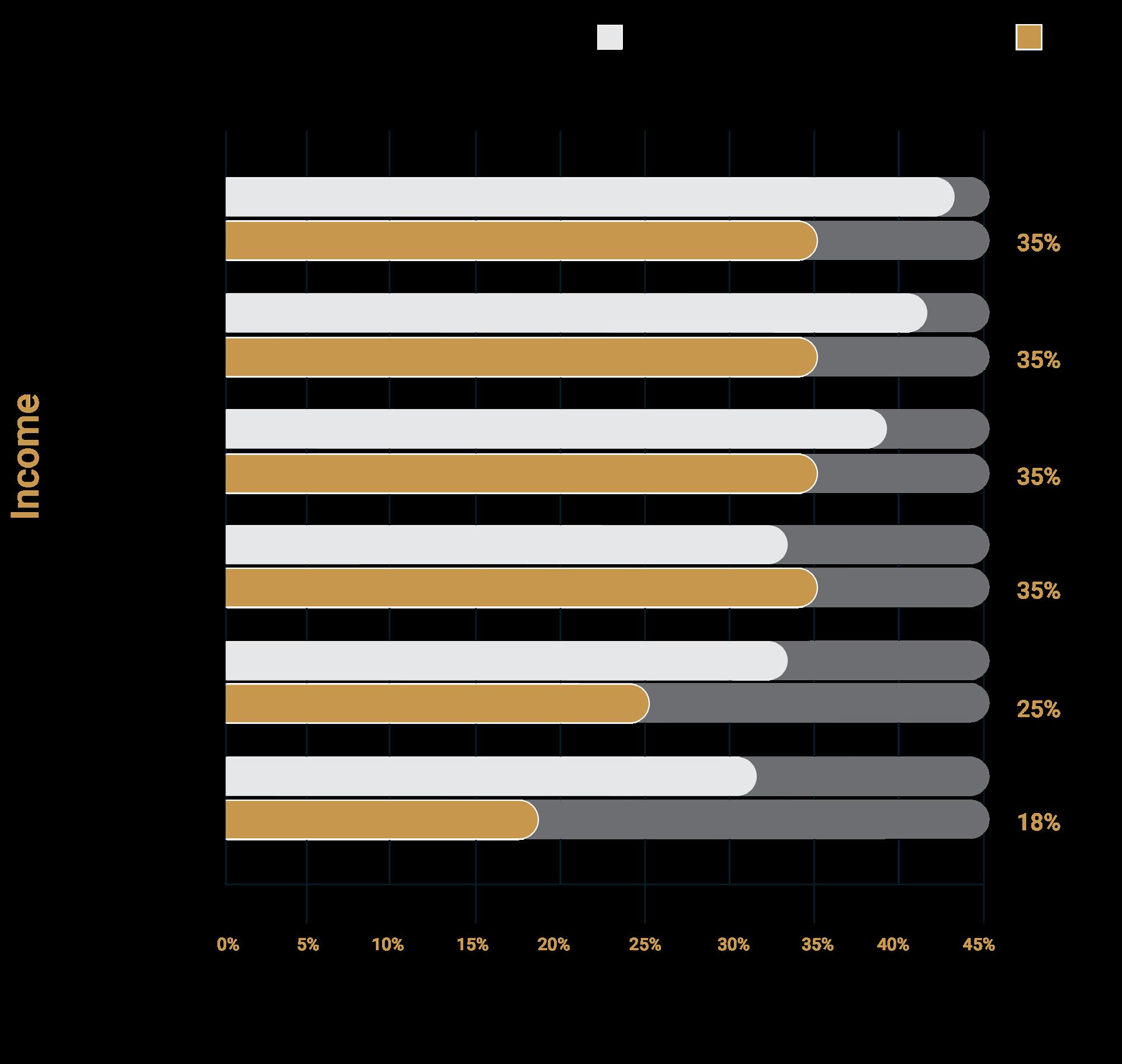

Percentage of Monthly Income Required for Mortgage Payment

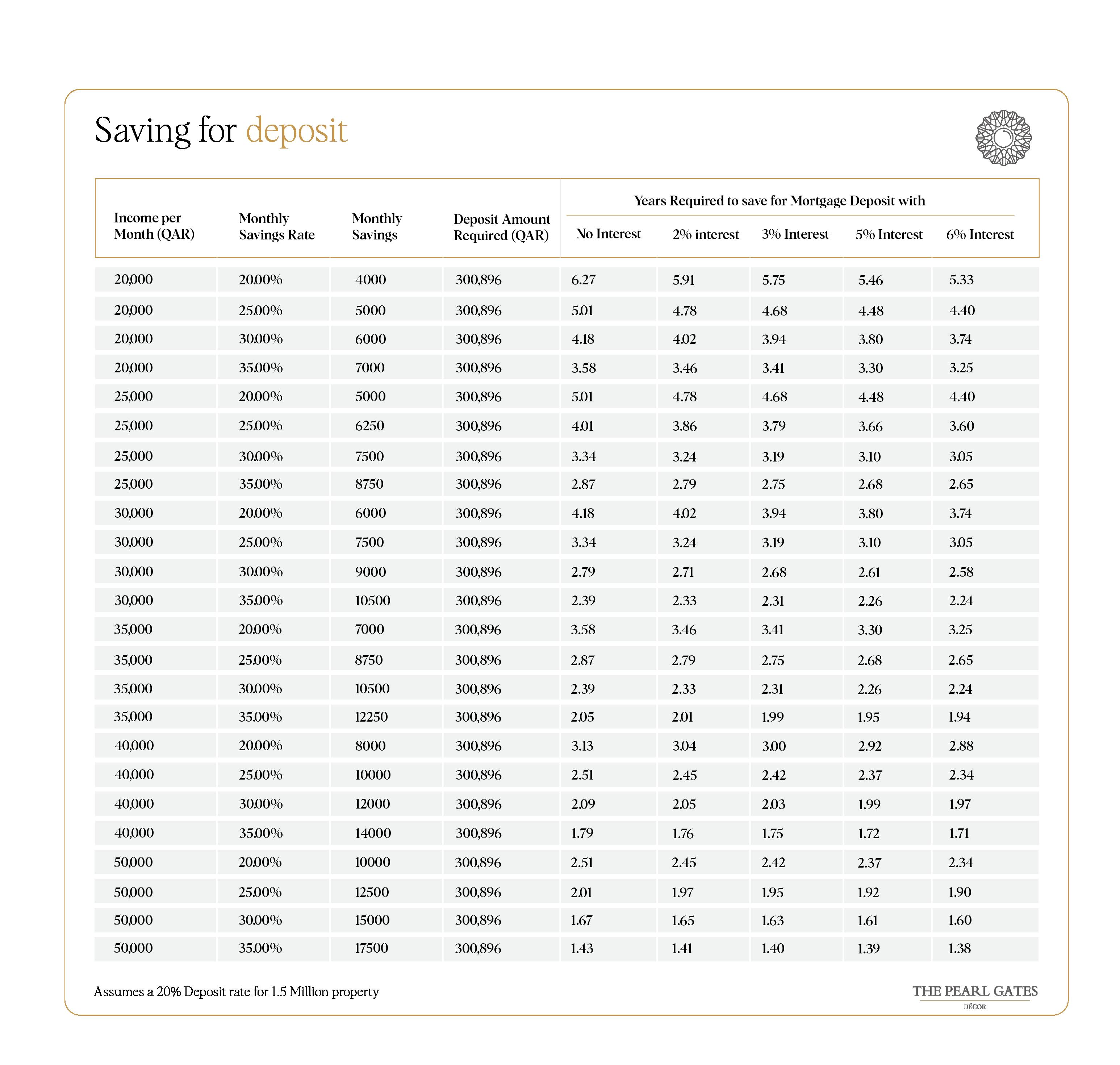

Time Needed to Accumulate Funds for a Mortgage Down Payment:

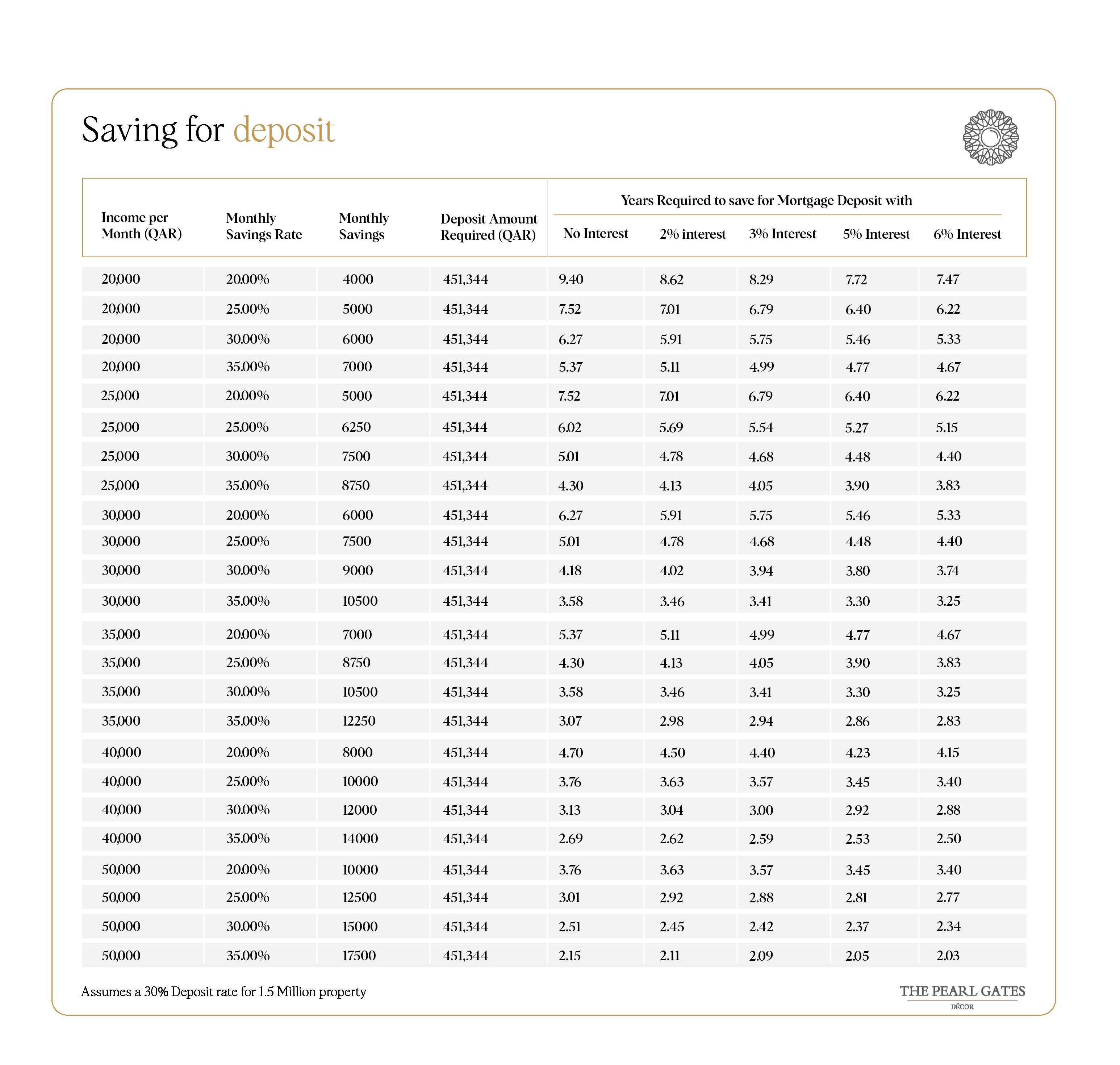

With a monthly income of QAR 50,000, it would take less than 3.5 years to accumulate enough savings to make a 30% down payment on a QAR 1.5 million house.

By saving 25% of their monthly salary, individuals who earn QAR 40,000 can reach this objective in just 3.5 years.

Individuals with a monthly income of QAR 35,000 must save 35% of their earnings each month to accumulate enough money for a deposit within less than 3.5 years.

It is difficult for individuals with incomes ranging from QAR 20,000 to QAR 30,000 to save up a 30% deposit in less than 3.5 years.

Lowering the deposit to 20% dramatically enhances affordability. Individuals with a monthly income of QAR 50,000 can accumulate the necessary deposit for a property valued at QAR 1.5 million in under 2.5 years.

By saving 20% of their earnings, individuals with a QAR 40,000 salary can achieve the objective in less than 3 years.

Individuals with a monthly salary of QAR 35,000 or QAR 30,000 can accomplish this goal in three years by setting aside 30% of their earnings.

By saving 30% of an income of QAR 25,000 and 35% of an income of QAR 20,000, one can accumulate enough money for a deposit in less than 3.5 years.

Recommendations for Enhancement:

Reduce Deposit Requirements: Reducing the initial deposit to 20% or less alleviates the financial strain, allowing a wider variety of income levels to afford homeownership.

Mortgage Schemes with Flexible Deposit Options: Implementing tiered deposit alternatives, changing interest rates for larger deposits, and introducing step-up payment plans could improve accessibility.

The Significance

of

Interest

Rates and Loan-to-Value (LTV) Ratios: Why Are They of Great

Importance?

When buying a house, two essential criteria, namely interest rates and Loan-to-Value (LTV) ratios, are critical in evaluating affordability. However, what is the true definition of these terminologies, and what is the significance behind their importance?

Suggestion:

Lowering Initial Deposit Requirements and Ensuring Manageable Payments

We propose reducing the first payment to 20% of the property’s appraised worth to enhance home affordability. This modification would enable a more significant number of individuals to own a residential property at an earlier point in time. They shouldn’t surpass 30% of the buyer’s monthly income to ensure that monthly mortgage payments remain affordable. This method guarantees that individuals can attain homeownership without overwhelmingly burdening their financial situation.

Adhering to this approach, persons earning between QAR 25,000 and QAR 50,000 can effectively manage their monthly mortgage obligations.

Loan-to-Value (LTV) ratios: The loan-toValue (LTV) ratio represents the proportion of your home’s value that you obtain as a loan from the bank. As an illustration, if you purchase a property valued at QAR 500,000 and take a loan of QAR 400,000, your Loan-to-Value (LTV) ratio would be 80%. A lower loan-to-value (LTV) ratio typically indicates that you have provided a higher initial payment, decreasing the lender’s exposure to risk. This frequently results in more favorable loan conditions for you, such as reduced interest rates. Conversely, a greater loan-to-value (LTV) ratio could lead to increased interest rates due to the lender assuming greater risk. 20% ALLEVIATES THE

Interest Rates: Interest rates denote the expense of obtaining a loan. When obtaining a mortgage, the bank provides you with the necessary funds, but they impose a cost for utilizing their capital, known as the interest rate, which is expressed as a percentage of the loan amount. A reduced interest rate results in a decreased total payment over the duration of your mortgage, enhancing your house’s affordability. Nevertheless, if interest rates increase, your monthly payments also increase, which could make it difficult for you to afford your desired home.

What is their significance?

These two factors are crucial since they immediately impact your capacity to finance a home. Reduced interest rates have the potential to result in significant savings, ranging from hundreds to tens of thousands of dollars, across the duration of your mortgage. Similarly, a favorable loan-to-value (LTV) ratio might provide access to more advantageous financing alternatives, thus enhancing the feasibility of your property purchase.

Essentially, thoroughly comprehending interest rates and loan-to-value (LTV) ratios can enable you to make more informed and intelligent choices when purchasing a house. These levers can either facilitate your journey toward homeownership or create obstacles along the road. Mastering the art of navigating these factors is crucial in acquiring a home that aligns with your aspirations and financial constraints.

The Qatar Central Bank (QCB) plays a significant role in Qatar’s financial system.

The QCB establishes regulations regarding interest rates and loan-to-value (LTV) ratios, which affect Qatari citizens and foreign residents.

Citizens of Qatar:

For properties valued up to QAR 6 million, the maximum loan-to-value (LTV) ratio is 80%, and the repayment period can be up to 30 years.

For properties valued at more than QAR 6 million, the maximum loan-to-value ratio (LTV) is 75%, and the loan can be repaid over up to 30 years.

Expatriates in Qatar:

For properties valued up to QAR 6 million, the maximum loan-to-value ratio (LTV) is 75%, and the repayment period can be up to 25 years.

For properties valued at more than QAR 6 million, the maximum loan-to-value ratio (LTV) is 70%, and the repayment period can be up to 25 years.

Quantitative Credit Easing Monetary Policies:

The QCB manipulates vital interest rates to control funds’ availability and impact the borrowing expenses. The most recent rates are as follows:

The QCB Default Rate (QCBDR) is 5.75%. - The QCB Lending Rate (QCBLR) is 6.25%. - The QCB Risk Rate (QCBRR) is 6.00%.

In general, elevated interest rates result in augmented borrowing expenses, while reduced rates stimulate borrowing and expenditure. Worldwide trends, especially those set by major central banks such as the US Federal Reserve, significantly impact these rates.

The Qatar Money Market Rate Standing Facility (QMR) is a financial mechanism.

QMR effectively controls the availability of liquid assets, influencing the rates at which short-term loans are provided and the expenses associated with mortgages. Increased liquidity generally leads to reduced borrowing expenses, while decreased liquidity has the converse impact.

Contrasting Dubai’s Mortgage Market:

Monetary Policies in the United States: The mortgage market in Dubai is strongly influenced by the United States’ monetary policies, as changes in interest rates by the Federal Reserve have a direct impact on mortgage rates in Dubai.

Cutting-edge Methods in Dubai:

Tiered Loan-to-Value (LTV) Ratios: These ratios differ depending on the order in which properties are purchased and their respective values.

Versatile Mortgage Products: Highly competitive introductory rates and exclusive conditions for environmentally-friendly homes and specified developments.

What are the potential advantages for Qatar?

Enforce Tiered Loan-to-Value (LTV) Ratios:

Establish LTV ratios that are determined by the order of property purchase and its value.

Introduce Versatile Mortgage Products:

Provide competitive beginning rates and terms specifically tailored for environmentally-friendly homes.

Offer Incentives for Strategic Developments:

Implementing favorable conditions for properties in specific developments might encourage growth and investment.

In order to specifically enhance the affordability of housing in Qatar, we suggest modifying the Loan-to-Value (LTV) ratios. Introducing tiered Loan-to-Value (LTV) ratios, where individuals purchasing houses valued below QAR 6 million for the first time may obtain LTV ratios of up to 85%, would decrease the amount of money needed for a down payment. For properties valued at more than QAR 6 million, a more cautious Loan-to-Value (LTV) ratio of 75% may be used. This architectural design reduces the initial expense for purchasers, particularly those with little financial resources, hence facilitating their ability to purchase a house. Moreover, providing advantageous loan-to-value (LTV) conditions for homes that are environmentally sustainable or strategically situated could not only increase affordability but also encourage investment.

In conclusion:

Tackling the issue of housing affordability in Qatar necessitates a comprehensive and diverse strategy. Qatar may achieve a more egalitarian and sustainable housing market by creating adaptable deposit programs, modifying interest rates, and embracing inventive mortgage methods. As the country progresses economically and socially, it is essential to address these affordability concerns to ensure fair and inclusive growth for all citizens.

THE PEARL GATES: QATAR’S REAL ESTATE EXCELLENCE

Based in Qatar, The Pearl Gates stands as a distinguished entity within the real estate industry, distinguished by a team of seasoned professionals united by a shared commitment to a core principle: understanding and addressing the evolving needs of the market with finesse, tact, and diplomacy—reflecting the brand’s unwavering values.

In a landscape where others may offer similar services, what sets us apart is the fusion of your unique experience with our unparalleled expertise. The insightful team at The Pearl Gates possesses an extensive wealth of Qatari real estate knowledge. As locals, we take pride in our dedicated approach, consistently delivering a comprehensive range of property services with genuine enthusiasm and a warm smile. Our mission is to elevate the real estate experience, ensuring that every interaction with us is marked by professionalism, integrity, and a commitment to exceeding your expectations.

Banyan Tree Residences at Doha Oasis,Core N & O, Floor-R1, Al Khaleej St, Doha | +974 5086 7771| contacts@thepearlgates.com | www.thepearlgates.com