Qatar’s economy heavily depends on the oil and gas sector, significantly influencing its GDP and national revenue. This dependency creates a strong linkage between the country’s real estate market, particularly the residential sector, and fluctuations in oil prices.

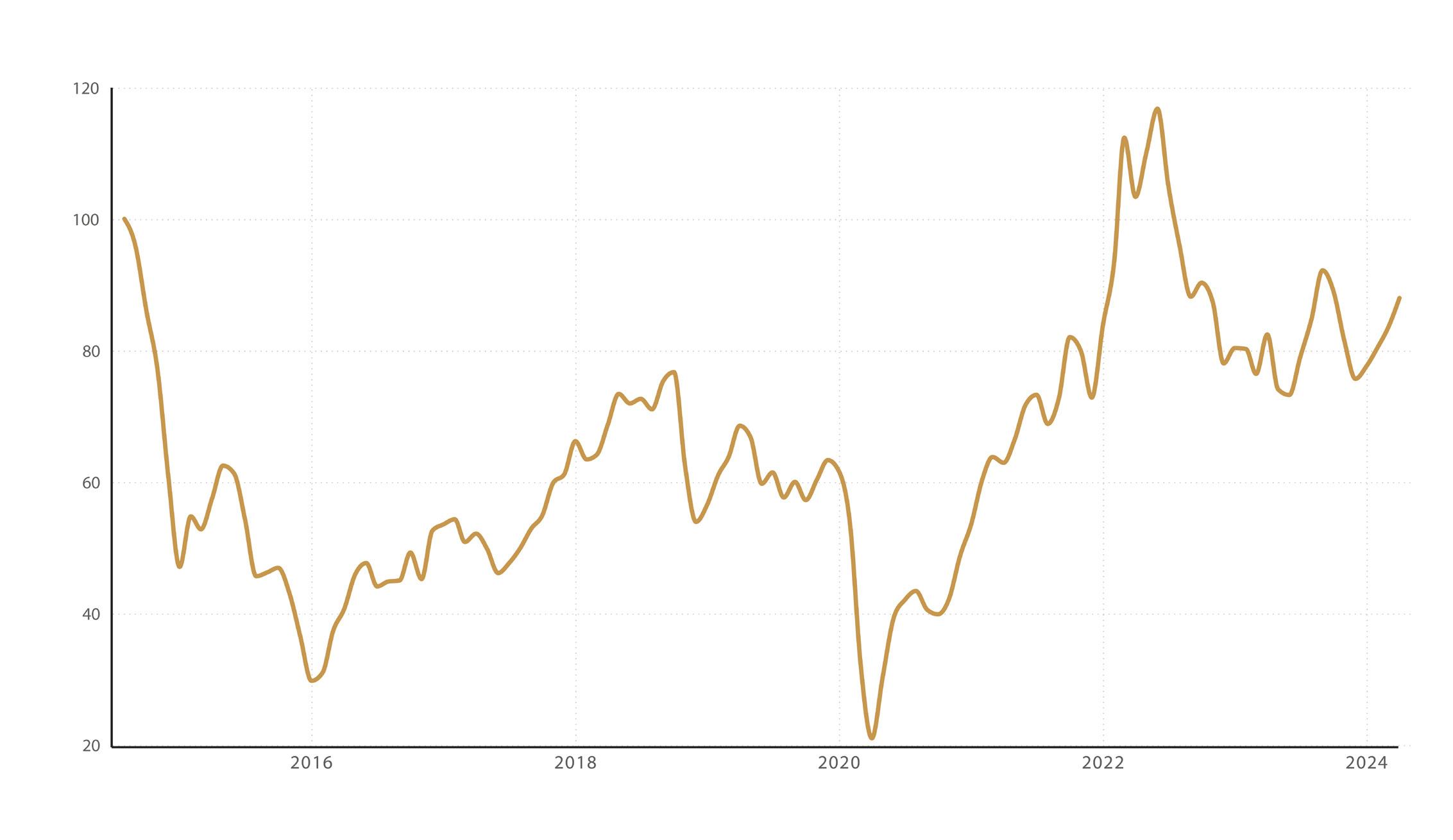

The Brent Crude oil price is a critical determinant of economic trends in oil-dependent nations like Qatar. Over the past decade, oil prices have been highly volatile, influenced by global economic events, geopolitical tensions, and shifts in supply and demand dynamics.

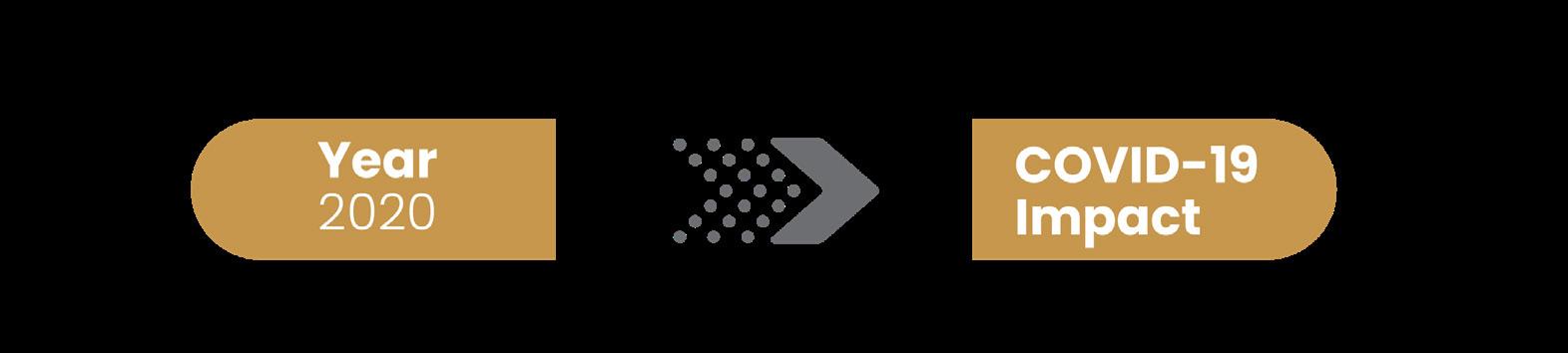

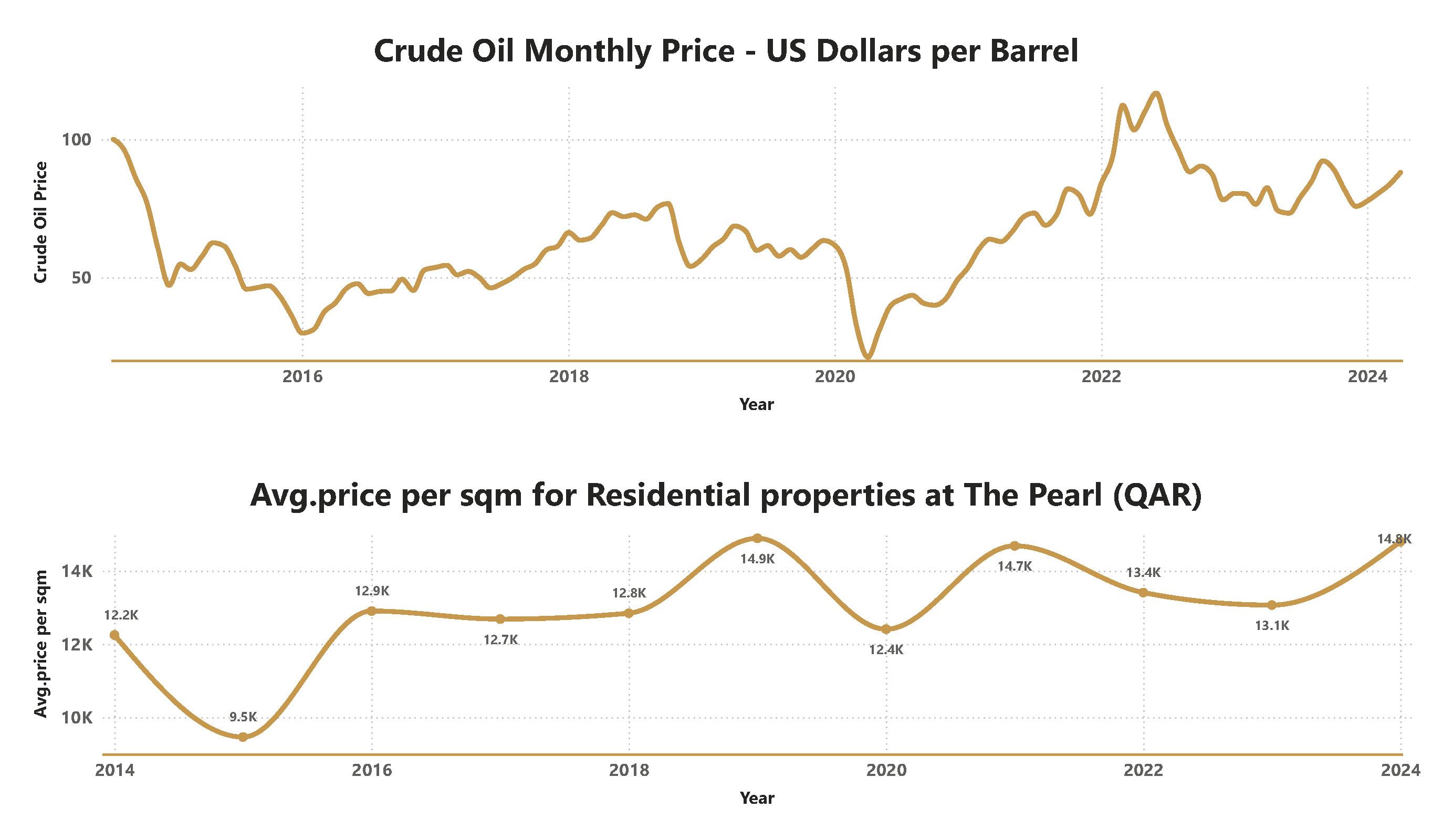

Crude Oil Monthly Price - US Dollars per Barrel

Between August 2014 and January 2016, oil prices plummeted from $100.05 to $29.78—a 70% decline driven by oversupply, weakened global demand, and strategic decisions by major producers, marking one of the most severe downturns in oil market history.

Oil prices gradually recovered, exceeding $60 per barrel by late 2017, aided by coordinated production cuts from OPEC and non-OPEC countries that helped stabilize the market.

The COVID-19 pandemic caused a severe reduction in global demand, pushing oil prices down to $21.04 per barrel in April 2020 due to worldwide lockdowns and restrictions.

As restrictions eased, oil prices surged past pre-pandemic levels, peaking at $112.40 in March 2022, influenced by renewed demand and geopolitical tensions, particularly the Russia-Ukraine conflict.

Oil prices stabilized between $80 and $90 per barrel, reflecting a balanced market outlook amid post-pandemic adjustments and economic stabilization.

Average Price per sqm of Residential Properties (2020)

Average Price per SQM

Average Price per sqm of Residential Properties (2021)

Average Price per sqm of Residential Properties (2024)

Price per SQM

In 2020, property prices were relatively low and stable, with Doha recording the highest average at 9.6k QAR per sqm, far exceeding other districts. In 2021, all districts experienced significant price increases, with Doha nearly doubling to 17.9k QAR per sqm, indicating a market surge driven by heightened demand and economic optimism. However, 2022 saw a market correction, with prices declining across most districts; Doha’s average fell to 11.0k QAR per sqm, though it remained the most expensive.

By 2023, the market had largely stabilized, with Doha recovering slightly to 12.4k QAR per sqm. Other districts, such as Al Daayen and Al Rayyan, reverted to price levels similar to those in 2020, signaling a return to equilibrium. In 2024, the trend of stabilization persisted, with Doha still leading at 11.3k QAR per sqm, followed by Al Daayen at 6.8k QAR. Lower-priced districts, including Al Khor, Al Shamal, and Al Sheehaniya, remained stable but continued to show limited demand. Overall, the data reflects a market that has navigated past peak corrections and is establishing a balanced state.

Correlation Between Crude Oil Prices and Residential Real Estate Prices in Qatar – 2020

Crude oil prices began 2020 at approximately $62 per barrel but faced a sharp decline, reaching a low of $21.04 per barrel in April. This significant drop coincided with global lockdowns and a sharp reduction in demand driven by the COVID-19 pandemic. Prices remained depressed through midyear, with a gradual recovery starting in October and extending towards the end of the year. The Residential Real Estate Price Index in Qatar started at 225 in January 2020 and followed a downward trajectory throughout the first half of the year, bottoming out in December. This marked decline reflected a sluggish market response, with the Index exhibiting minimal fluctuations, highlighting the broader economic impact of the pandemic on the real estate sector during this period.

Correlation:

In the early months, there was a simultaneous decline in both crude oil prices and the Real Estate Price Index, highlighting the direct impact of the pandemic on both sectors. In the latter half of the year, a divergence was evident as crude oil prices began to recover while the real estate index continued its decline. This suggested a delayed recovery in the real estate market relative to oil. The initial sharp drop in crude oil prices had an immediate and noticeable effect on the real estate market, underscoring the sensitivity of Qatar’s real estate sector to global oil market shocks.

Correlation Between Crude Oil Prices and Residential Real Estate Prices in Qatar – 2021

During the first quarter, both the Real Estate Price Index and Crude Oil Prices demonstrated a steady upward trend. The Real Estate Price Index rose gradually from approximately 205 to 215, indicating moderate growth in the residential market. Simultaneously, Crude Oil Prices exhibited an upward trajectory, increasing from around $55 to $65 per barrel, suggesting strengthening market dynamics in the oil sector.

In the second quarter, the Real Estate Price Index continued its upward momentum, reaching approximately 219 by June. This growth was mirrored by Crude Oil Prices, which saw a more pronounced rise, peaking at approximately $72 per barrel by the end of the quarter. The synchronous movement in both indices highlights the continued positive market sentiment across sectors.

From July to September, the Real Estate Price Index showed signs of stabilization, hovering around 220 with minimal fluctuations, suggesting a period of relative market equilibrium. In contrast, Crude Oil Prices experienced a slight dip, decreasing to approximately $70 per barrel, reflecting mild adjustments in the global oil market.

In the final quarter of the year, the Real Estate Price Index initially improved but subsequently declined, closing the year at approximately 212. A similar pattern was observed in Crude Oil Prices, which fluctuated before settling at $72 per barrel by December.

Throughout the first half of the year, there was a notable positive correlation between Crude Oil Prices and the Real Estate Price Index, with both indicators demonstrating steady growth from January to June.

In the latter half of the year as well, the price Index followed a similar pattern as exhibited by the crude oil prices, suggesting a strong positive correlation for the year.

Crude Oil prices fluctuated between approximately $80 and $117 per barrel. Prices started at around $83 in January, increasing steadily to reach a peak in the month of June. Following this peak, a consistent decline ensued, with prices hitting their lowest point in September. There was a modest recovery in October, before another decline towards December.

Real Estate Price Index ranged between approximately 210 and 220. The index demonstrated an upward trend from January to April, mirroring the crude oil price movements with peaks around April and June. After June, the index experienced a sharp decline, reaching its lowest in August, consistent with the crude oil price pattern. Post-September, the index showed a steady recovery, with significant increases towards the end of the year, particularly in December.

Both crude oil prices and the Real Estate Price Index in Qatar demonstrated aligned peak patterns during the first half of the year, subsequently declining to their lowest levels in August-September. This trend suggests a strong correlation between these metrics, highlighting that fluctuations in crude oil prices significantly influence the performance of the Qatari residential real estate market. However, in the latter half of the year, the correlation diverged as crude oil prices experienced a slight decline, while the residential real estate index showed a robust recovery. This divergence indicates that other factors, such as market sentiment, economic policies, or demand dynamics, may have contributed to the resilience of the real estate sector despite the downturn in oil prices.

Crude oil prices exhibited significant volatility throughout the year, ranging from approximately $75 to $95 per barrel. The market experienced a notable upward trajectory beginning in June, reaching a peak in September, followed by a downward correction that brought prices to their lowest level in December.

Similarly, the Residential Real Estate Price Index fluctuated within a range of 212 to 226. The index commenced the year at a higher level but trended downward, reaching its minimum in May. Post-May, the index showed a partial recovery, though it remained highly volatile, with another decline observed in September. However, a sharp rebound was noted towards the end of the year, culminating in a peak in December.

The data suggests an inverse correlation between crude oil prices and the REPI during the latter half of the year. Crude oil prices reached their peak when the real estate index was at its low, and conversely, when crude oil prices declined, the price index increased. This inverse relationship implies that in 2023, the performance of the Qatari real estate market did not consistently mirror oil price movements, indicating the presence of additional influencing factors.

The divergence between crude oil prices and the price index in the latter part of the year suggests the influence of external factors, including changes in investor behavior, global economic trends, or domestic policies specific to the real estate sector. The substantial rise in the REPI in December, despite falling oil prices, may indicate strategic market maneuvers, such as increased demand or regulatory support for real estate.

The analysis of 2023 data reveals a nuanced relationship between crude oil prices and the REPI in Qatar. While crude oil prices peaked in the middle of the year, the real estate market demonstrated a delayed and inverse reaction. This suggests that oil prices alone were not the sole determinants of market trends.

The data from early 2024 indicated a negative correlation between the Price Index and Crude Oil prices. As crude oil prices rose steadily from $77.67 to $88.01, the Price Index consistently declined from 223.18 to 202.46. This inverse relationship suggested that rising crude oil prices were exerting downward pressure on real estate values, potentially due to increased costs impacting the broader economy, which dampened demand or investor sentiment in the real estate market during that period.

Between Crude Oil Prices and Residential Real Estate Prices in Doha Municipality

Crude oil prices have demonstrated a general upward trajectory over the analyzed period, marked by a substantial increase from 2020 to 2021, followed by a slight decline in 2022 and a subsequent rebound in 2023.

Similarly, the average price per square meter for residential properties in Doha Municipality exhibited an upward trend, with particularly robust growth in 2021. However, a significant decline from this peak was observed in the subsequent years.

The data indicates a moderate positive correlation between crude oil prices and residential property prices in Doha Municipality. A strong positive correlation was evident in the initial years of the period under review. From 2022 to 2023, both crude oil prices and the residential property price index showed signs of stabilization, suggesting a continued but moderate correlation between the two variables. This pattern highlights the influence of oil price dynamics on the residential real estate market, albeit with varying degrees of impact over time.

During this period, property prices at The Pearl maintained stability around QAR 12,800 per square meter, while oil prices rose from $47 to $73 per barrel. The moderate increase in property values aligns with the economic uplift driven by higher oil prices, indicating sustained demand in the real estate market.

Initially, property prices rose to QAR 14,900 per square meter, but a subsequent sharp decline in oil prices to $21 per barrel led to a reduction in property prices to approximately QAR 12,000 per square meter. This downturn was primarily attributed to the global economic impact of the COVID-19 pandemic.

Property values demonstrated substantial growth, reaching QAR 14,800 per square meter, as crude oil prices rebounded to $117 per barrel. This recovery phase was characterized by renewed economic confidence and heightened investment activity, with the concurrent rise in property and oil prices underscoring the postpandemic market resurgence.

During this period, property prices slightly declined to QAR 14,700 per square meter, alongside a decrease in oil prices to $82 per barrel. This phase of stabilization reflects evolving market dynamics, suggesting a recalibration of economic conditions as the market transitions beyond its peak recovery phase.

A Pearson Correlation Coefficient of 0.67 indicates a moderate to strong positive correlation between crude oil prices and residential property prices at The Pearl, demonstrating that fluctuations in oil prices have a significant influence on real estate values in the area.

Based in Qatar, The Pearl Gates stands as a distinguished entity within the real estate industry, distinguished by a team of seasoned professionals united by a shared commitment to a core principle: understanding and addressing the evolving needs of the market with finesse, tact, and diplomacy—reflecting the brand’s unwavering values.

In a landscape where others may offer similar services, what sets us apart is the fusion of your unique experience with our unparalleled expertise. The insightful team at The Pearl Gates possesses an extensive wealth of Qatari real estate knowledge. As locals, we take pride in our dedicated approach, consistently delivering a comprehensive range of property services with genuine enthusiasm and a warm smile. Our mission is to elevate the real estate experience, ensuring that every interaction with us is marked by professionalism, integrity, and a commitment to exceeding your expectations.

Banyan Tree Residences at Doha Oasis,Core N & O, Floor-R1, Al Khaleej St, Doha | +974 5086 7771| contacts@thepearlgates.com | www.thepearlgates.com