RAPID FLEET EXPANSION

TIME FOR DATA- DRIVEN OPERATIONS

In a recent conversation with a respected captain of industry, my key takeaway from that interaction was that often quarries and their mainstream mining counterparts contend with balancing efficiency and safety in mining operations.

The question is, are they able to prioritise both effectively?

The importance of both parameters to the success of any operation cannot be reiterated enough. Efficiency in quarrying and mining is crucial for operational success, balancing high output, reduced downtime, maintained equipment, enhanced safety and minimised costs, leading to increased profitability and sustainability.

Equally, safety in mining is paramount because it protects workers from inherent hazards, reduces accidents and associated costs. A strong safety culture fosters a more productive and efficient workforce, as workers feel secure and are more likely to focus on their tasks without fear of accidents.

However, there is almost always a trade-off between productivity/efficiency and health and safety, and in most cases the latter wins, and it must not always be the case. Operations can find balance between their productivity/ efficiency drive and their safety efforts without in some way or other neglecting either of these operational parameters.

and predictive analytics, thus simultaneously reducing risks for miners and improving operational outcomes.

Although the quarrying sector is traditionally renowned for being resistant to the uptake of new technologies, it is encouraging to see the new-generation becoming a hi-tech industry that uses vast amounts of data and data insights to enhance efficiencies and improve safety.

Gathering this data is the province of the Internet of Things (IoT), where smart devices, cameras, wearable health tech, satellites, drones, sensors and onboard computers are used to track vehicles, material, staff and equipment. All of this technology enables insights that can enhance safety, boost production and ensure efficient operations.

Locally, data technologies are now taking root in the quarrying sector. For operations to be viable, teams must move earth as efficiently as possible by monitoring fleets constantly, designing routes and usage rosters, conducting training and managing performance output in order to ensure the most effective deployment of staff, equipment and fleets in real time.

MUNESU SHOKO

Publishing Editor

Email: munesu@quarryingafrica.com

LinkedIn: Munesu Shoko Quarrying Africa

How? Firstly, developing a robust safety culture is vital for balancing efficiency and safety. A safety culture is more than just rules and procedures; it is a holistic approach to safety that permeates the entire organisation. In a mining environment, a safety culture encompasses the shared values, attitudes, perceptions and behaviours of an organisation that prioritise safety in all aspects of work, aiming to create a safe and healthy environment for all employees.

Secondly, leveraging technology can significantly enhance both safety and efficiency in mining operations. Technology hugely enhances safety and efficiency in mining through automation, real-time monitoring

In addition, the industry has already seen the benefits of automation in dangerous working conditions, enabling the removal of people from harm’s way. For example, automated drilling rigs enable for remote control, enhancing safety especially when rigs are operating close to a highwall, or when there are unstable geological conditions on the bench. In addition, automated drills follow pre-determined instructions without exceeding limitations, thus helping to extend the life of consumables and components, leading to a lower total cost of ownership.

In the quest to achieve data-driven operations, this year’s IQSA Conference will especially highlight the importance of technology under the topical ‘Navigating a Changing Landscape’ theme. With the industry constantly evolving, it is important for quarry operators to be adaptable – to be open to new ideas and willing to adjust strategies as needed.

Publishing Editor: Munesu Shoko

Sub Editor: Glynnis Koch

Admin: Linda T. Chisi

Design: Kudzo Mzire Maputire

Web Manager: Thina Bhebhe

DRILLING

MAKING

EMBRACING

ADAPTING

ADDRESSING

Quarrying Africa is the information hub for the sub-Saharan African quarrying sector. It is a valued reference tool positioned as a must-read for the broader spectrum of the aggregates value chain, from quarry operators and aggregate retailers, to concrete and cement producers, mining contractors, aggregate haulage companies and the supply chain at large.

© Quarrying Africa

Quarrying Africa, published by DueNorth Media Africa, makes constant effort to ensure that content is accurate before publication. The views expressed in the articles reflect the source(s) opinions and are not necessarily the views of the publisher and editor.

The opinions, beliefs and viewpoints expressed by the various thought leaders and contributors do not necessarily reflect the opinions, beliefs and viewpoints of the Quarrying Africa team.

Quarrying Africa prides itself on the educational content published via www.quarryingafrica.com and in Quarrying Africa magazine in print. We believe knowledge is power, which is why we strive to cover topics that affect the quarrying value chain at large.

Printed by:

Contact Information

Email: munesu@quarryingafrica.com

Cell: +27 (0)73 052 4335

Several customers running the TA 230 to date have expressed satisfaction with Liebherr’s new machine concept, which has been developed especially for challenging off-road applications.

RAPID FLEET EXPANSION

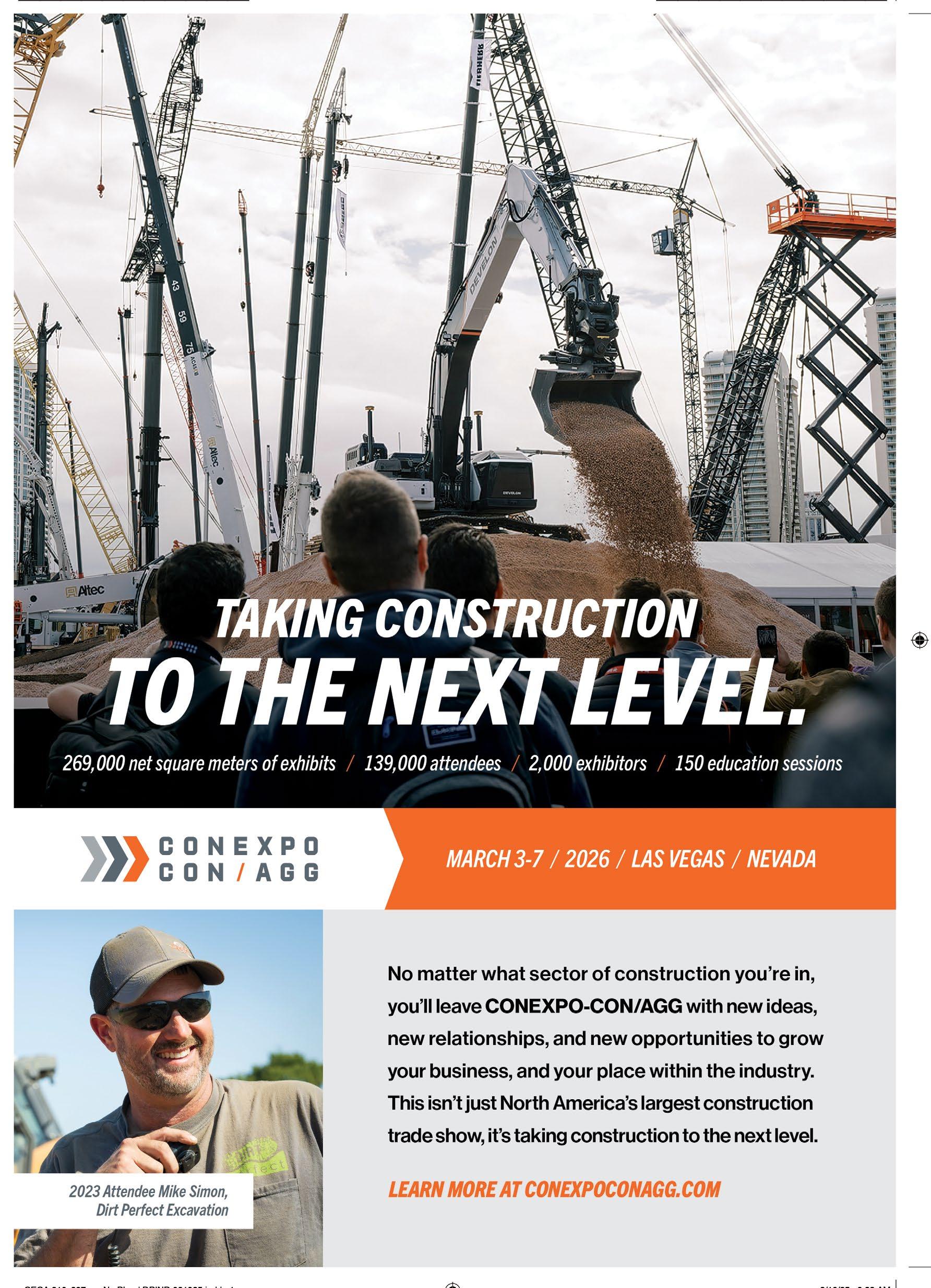

Having taken delivery of its first Liebherr TA 230 articulated dump truck (ADT) in November 2023, a leading construction, plant hire and contract mining company based in Burgersfort, Limpopo province, South Africa, has rapidly grown its fleet to four, becoming the secondlargest TA 230 operator in southern Africa. By Munesu Shoko.

In June 2022, Liebherr-Africa made its local debut in the highly-contested ADT market in southern Africa by launching its first ADT model, the 28-tonne (t) payload Liebherr TA 230. Since then, the company has deployed a sizeable number of units in the market.

One of the companies running several units in its fleet is a well-known construction, plant hire and contract mining entity based in Burgersfort, a small mining town located in the Limpopo province of South Africa, near the border with the Mpumalanga province. In less than 18 months, the company has grown its fleet to four TA 230 units.

Proving their mettle

According to Papa Olifant, key account manager at Liebherr-Africa, the machines have been deployed at a major platinum mine in the Burgersfort area, where the client is executing one of its major mining contracts. While the 28-t payload was initially a concern for this type of application, the client has offset this limitation with the truck’s quick cycle times and fuel efficiency in tough underfoot conditions, thus driving maximum productivity at a lower cost of operation.

From the onset, says Olifant, the deal was a combination of “luck and opportunity” for Liebherr-

KEY TAKEAWAYS

Since the launch of the first Liebherr TA 230 in June 2022, several units are now operational across southern Africa

Having taken delivery of its first Liebherr TA 230 in November 2023, a Burgersfort-based mining contractor has rapidly grown its fleet to four

Feedback from the customer suggests that they have been impressed by the Liebherr machines’ performance to date, which explains the rapid expansion of the fleet

Based on the recent discussions, there is an indication that the client will ‘beef up’ their Liebherr ADT fleet significantly in the near future

Africa and its dealer partner, Kanu Equipment, which delivered the trucks and also looks after the client’s Liebherr fleet. In late 2023, the client went into the market for two ADTs, and one of the previous preferred suppliers did not have any stock available.

At the time, Liebherr-Africa had several units in stock and the client, who has a long-standing relationship with Kanu Equipment, opted to take one TA 230 on a trial basis in November 2023. Within two weeks of operation, the client decided to buy the demo and also placed an order for the second TA 230 unit, which was delivered in January 2024. During the course of last year, the client added a further two units, bringing to four their total TA 230 fleet.

“In fact, during the past 16 months, the client has grown not only their TA 230 fleet, but their Liebherr fleet at large. In less than two years, the client now operates a large number of Liebherr machines, including excavators, wheel loaders and dozers,” explains Olifant.

Beyond expectations

Feedback from the customer, says Olifant, suggests that they have been impressed by the Liebherr machines’ performance to date, which explains the rapid expansion of the fleet. In addition, he says, this demonstrates the importance of relationships in any capital equipment buying decision.

“While the client had never run Liebherr machines before, they were at ease making the decision to purchase because of their longstanding relationship with Kanu Equipment. While the equipment has proven its mettle, the complementary support from Kanu Equipment has also been central to the client’s decision to expand their fleet of Liebherr machines in a short space of time,” says Olifant.

Based on the recent discussions with the customer, Olifant tells Quarrying Africa that there is an indication that they will ‘beef up’ their Liebherr ADT fleet significantly in the near future. This will also be complemented by a large number of Liebherr excavators.

While size has been a limiting factor for LiebherrAfrica in the ADT market, currently offering only the 28-t payload model, Olifant is encouraged by the increased uptake of the TA 230 in southern Africa. “We are aware that the ADT market is currently driven by the 40-t and 45-t model sizes, and we are glad that Liebherr will soon be competing in that market segment, which will allow us to address the local market’s needs,” says Olifant.

4

Having taken delivery of its first Liebherr TA 230 in November 2023, a Burgersfort-based mining contractor has rapidly grown its fleet to four 28-t

While the 28-t payload was initially a concern for the type of application, the client has offset this limitation with the truck’s quick cycle times and fuel efficiency

265-kW

Powered by a 265-kW 6-cylinder Liebherr engine with a 12-litre displacement, the TA 230 is driven by an automatic 8-speed powershift transmission which ensures optimal force distribution

TA 230 in detail

Several customers running the TA 230 to date have expressed satisfaction with Liebherr’s new machine concept, which has been developed especially for challenging off-road applications. Modern designs in the front-end area create maximum ground clearance for greater off-road performance.

The newly designed articulated swivel joint creates sound off-road capability; it allows independent movement of the front and rear ends, thus ensuring maximum manoeuvrability. The positive-locking swivel joint with tapered roller bearing is perfect for the shear stresses associated with tough underfoot conditions, while it also withstands maximum loads and provides optimal force distribution.

The front and rear axles of the machine are secured using sturdy A-rods at the articulated swivel joint and at the rear end. On front, the truck uses hydro-pneumatic suspension for maximum comfort, which is key to the

smooth driving. The shock absorbers at the articulated swivel joint and the position of the separate and oscillating A-rods of the rear axles at the rear end, provide maximum ground clearance.

Powered by a 265-kW 6-cylinder Liebherr engine with a 12-litre displacement, the TA 230 Litronic is driven by an automatic 8-speed powershift transmission which ensures optimal force distribution. The machine impresses with great driving performance and massive pulling force, even in the most difficult ground conditions and on challenging gradients.

A combination of balanced weight distribution, permanent 6 x 6 all-wheel drive, solid, flexible mounting and large bank angle as well as the machine’s high ground clearance, enable the TA 230 Litronic to deliver unparalleled performance on uneven terrain.

The actively controlled inter-axle differential locks mean that the Liebherr TA 230 has automatic traction control. As soon as one axle experiences wheelspin, it is decelerated, and the traction is intelligently redistributed to the other axles. In addition to maximum forward drive, this reduces the power requirement and therefore translates into lower fuel consumption.

Efficiency is further enhanced by the smart gear selection, which enables the machine to adjust automatically to its current speed and load to ensure optimum torque and fuel consumption at all times. The machine therefore automatically reduces its fuel consumption per tonne of transported material.

With productivity in mind, the optimised trough ensures that more material can be moved in a short time. The front of the trough – designed for the effective transport of a 28-t payload – is straight and the sills are low so that loading with a wheel loader, for example, is easily possible across the entire length of the truck.

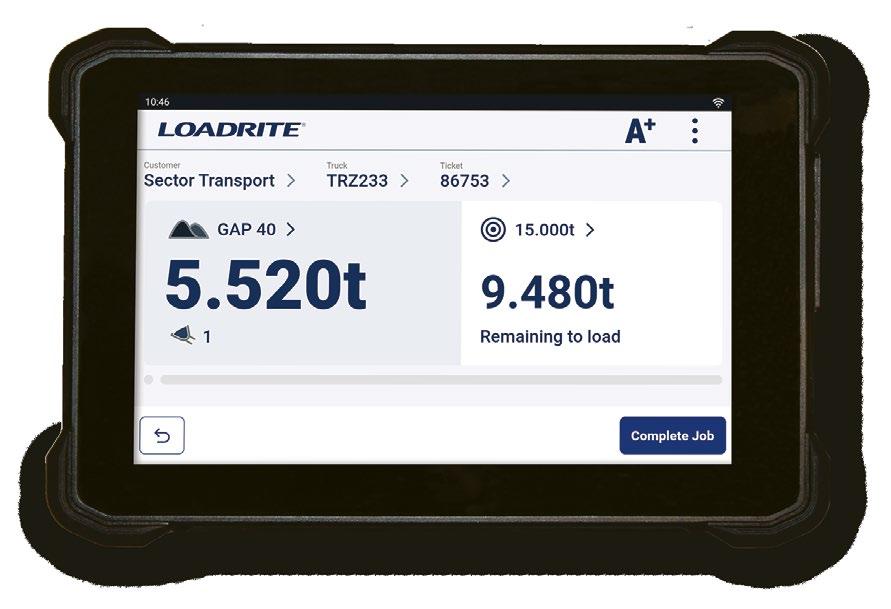

A standard Liebherr weighing system shows the current payload during loading on the display in the operator’s cab, helping eliminate guesswork in loadout processes. An optional loading light on both sides at the back of the operator’s cab shows the loading level outdoors.

“In order to accelerate the release of the material during unloading, the inner edges of the new trough are tapered. The two tipping cylinders at the side give the TA 230 Litronic high tipping pressure. The load can be tipped against the slope easily and quickly,” concludes Olifant. a

The machines have been deployed at a major platinum mine in the Burgersfort area, where the client is executing one of its major mining contracts.

Feedback from the customer suggests that they have been impressed by the Liebherr machines’ performance to date.

Designed with a unique combination of power and intelligence the TA 230 features market leading technology, an innovative weighing system, automatic traction contre, hill start assist, not to mention the superior cabin design to leave your operator feeling good. Simply put, a perfect mix of agility with outstanding performance.

Articulated Dump truck

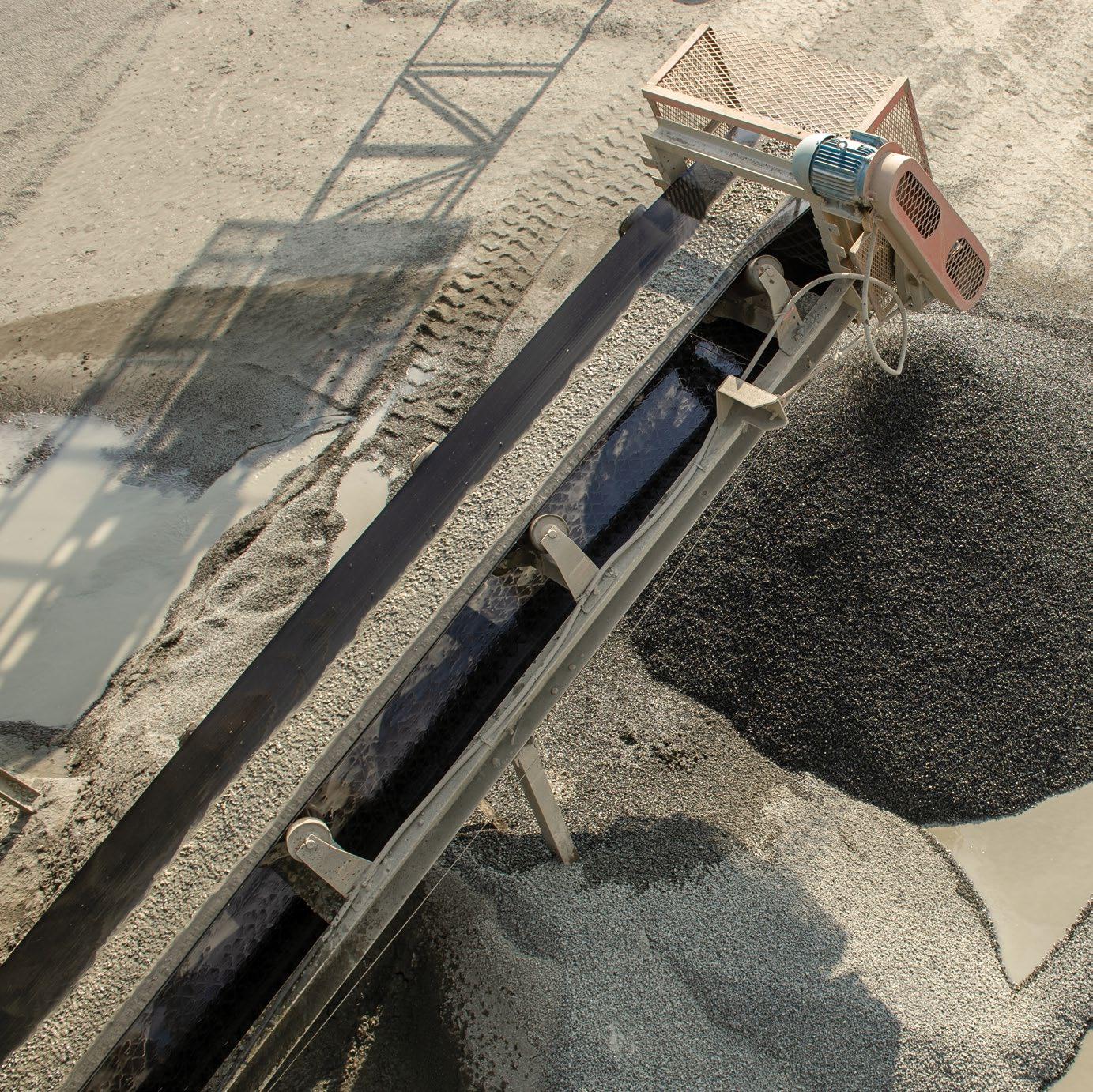

SARS contended that ‘bulk’ in terms of the ordinary dictionary meaning, suggests that the condition of aggregates does not change in the process of beneficiation.

ROYALTY TAX RELIEF FOR AGGREGATES INDUSTRY

Following a protracted legal dispute between ASPASA, the surface mining industry association, and the South African Revenue Services (SARS), regarding the calculation of royalties for the extraction of aggregates, the High Court of South Africa – Gauteng Division, has granted relief in favour of ASPASA. The ruling marks a significant milestone for the aggregates industry. By Munesu Shoko.

For many years now, payment of royalties has been a hotly contested issue between quarry owners in South Africa and SARS, as to where the value of a mined product needs to be determined in order to calculate exact payments.

Letisha van den Berg, director of ASPASA, explains that the industry’s dispute with SARS existed over the first point of sale at which the value of royalties

needed to be calculated. The ‘taxman’ argued that royalties should be calculated from any ‘stockpile’ from which the relevant aggerate product is sold, while the industry insisted that it should be from the ‘muck’ pile.

Background

ASPASA has always engaged in productive discussions with SARS and National Treasury since

Photo courtesy of Afrimat

28

ASPASA has always engaged in productive discussions with SARS and National Treasury since the introduction of the Mineral and Petroleum Resources Act 28 of 2008

KEY POINTS

2012

In 2012, an ASPASA member obtained a non-binding opinion confirming that, according to SARS, the condition specified in Schedule 2 of the aggregates pertains to the bulk rock on the quarry floor post-extraction, commonly referred to as the muck pile

For many years now, payment of royalties has been a hotly contested issue between quarry owners in South Africa and SARS

The point of contention has been as to where the value of a mined product needs to be determined in order to calculate exact payments

Following a protracted legal dispute between ASPASA, the High Court of South Africa – Gauteng Division, has granted relief in favour of ASPASA

SARS applied for leave to appeal the High Court judgment to the Supreme Court of Appeal (SCA).

ASPASA opposed the application and on March 5, 2025, SARS’ application for leave to appeal to the SCA was dismissed with costs

the introduction of the Mineral and Petroleum Resources Act 28 of 2008. The discussions were aimed at ensuring that ASPASA members, primarily small businesses and individual stakeholders operating small surface mines, remained compliant with the Act.

In 2009, ASPASA commissioned the independent multinational auditing firm KPMG to develop a memorandum outlining the appropriate approach for aggregate producers to implementing the Act. The resulting document was disseminated to members as an Industry Practice Note (IPN), which was also shared with SARS for its consideration.

The concept of ‘muck pile’ was introduced to National Treasury in 2009 to clarify its significance.

In 2011, ASPASA requested KPMG to finalise the draft IPN, which was subsequently submitted to SARS. Notably, there were no objections raised by either SARS or National Treasury regarding the IPN. Furthermore, SARS was invited to present at the IQSA Conference that same year.

In 2012, an ASPASA member obtained a nonbinding opinion confirming that, according to SARS, the condition specified in Schedule 2 of the aggregates pertains to the bulk rock on the quarry floor post-extraction, commonly referred to as the muck pile. Thus, gross sales calculations were to be based on this definition.

“In 2023, ASPASA proactively sought a Declarator from the High Court to clarify this matter for its members. The court date was scheduled for November 29, 2024, and on December 6, 2024, relief was granted in favour of ASPASA. This favourable ruling marks a significant milestone for the aggregates industry.

To provide context, where the aggregate producer sells beneficiated aggregate products after the muck pile, they had to calculate their gross sales for royalty purposes on “what they would have received” if they had sold the aggregate product in the muck pile condition. So, it is a deemed gross sales value and not what they actually receive when the beneficiated aggregate product is sold.

However, in 2019, SARS issued Interpretation Note 108, indicating a departure from the initial interpretation and stating that tax should be calculated after the beneficiation of the aggregate, specifically on the stockpile.

“In 2023, ASPASA proactively sought a Declarator from the High Court to clarify this matter for its members. The court date was scheduled for November 29, 2024, and on December 6, 2024, relief was granted in favour of ASPASA. This favourable ruling marks a

Letisha van den Berg, director of ASPASA

The question for the court’s determination was whether the word ‘bulk’ refers to, firstly, aggregates upon extraction (i.e., at the socalled muck pile), or secondly, to the beneficiated state of the aggregates stockpile at the time of the disposal of aggregates.

significant milestone for the aggregates industry,” says Van den Berg.

Point of contention

Andries Myburgh, Executive – Tax at ENS Attorneys, the legal company that represented ASPASA and its coapplicants, tells Quarrying Africa that the case concerned the meaning of the word ‘bulk’ in relation to aggregates (a mineral resource) listed in Schedule 2 of the Mineral Royalty Act.

It was a common cause fact that aggregates at the so-called ‘muck pile’ (the blasted rock at the quarry floor) are already commercial and this is the first saleable point for the mineral resource (aggregates), explains Myburgh. Products sold directly from the muck pile include gabion, armour rock and various other products used in public infrastructure such as bridges and roads.

SARS contended that ‘bulk’ in terms of the ordinary dictionary meaning, suggests that the condition of aggregates does not change in the process of beneficiation. It further argues that bulk remains bulk at whatever stage of beneficiation the aggregate is found at the time of transfer. Therefore, in SARS’ interpretation, gross sales were to be determined in terms of section 6(2)(a) and not section 6(2)(b) of the Royalty Act.

In its defence, ASPASA contended that aggregates in their unprocessed form (at the muck pile) is the first saleable point. Beneficiation of aggregates after the muck pile results in the transfer (i.e., disposal) of aggregates in a condition other than as ‘bulk’. Therefore, gross sales are supposed to be determined on aggregates as extracted –at the muck pile.

The question for the court’s determination was whether the word ‘bulk’ refers to, firstly, aggregates upon extraction (i.e., at the so-called muck pile), or secondly, to the beneficiated state of the aggregates stockpile at the time of the disposal of aggregates, explains Myburgh.

Court’s findings

On December 6, 2024, relief was granted in favour of ASPASA and its co-applicants and made a declaratory order as follows: ‘Bulk’ as used in respect of aggregates in Schedule 2 to the Mineral and Petroleum Resources Royalty Act, 28 of 2008, means the condition in which shot rock (blasted rock) exists at the muck pile prior to processing (i.e., crushing or other form of beneficiation). Accordingly, aggregates as at the muck pile is the condition stipulated by Schedule 2.

Myburgh explains that the court adopted a purposive approach – analysing the purpose, text and context, in this sequence. The purpose of the Royalty Act presents a vantage point that assists in the consideration of both text and context.

The ostensible purpose of section 6(2) of the Royalty Act is to, firstly, set a base condition for purposes of determining the royalty to avoid manipulation of the royalty by extractors, and secondly, not to penalise beneficiation where the condition has changed through a process of beneficiation.

Therefore, the dual purpose of the Royalty Act is to promote beneficiation, and to prevent undercompensation of the State by setting a base condition at which the royalty is determined. The court referred to the preamble read with section 3(1) of the MPRDA, out of which the Royalty Act was promulgated: South Africa’s mineral resources belong to the nation and the State is the custodian thereof.

In terms of text, SARS contended for the ordinary grammatical meaning of ‘bulk’ in ordinary parlance. However, the court found that the word ‘bulk’ in Schedule 2 is used in a technical context in the schedule in which it appears. In such an instance, the presumption is that the technical meaning of the term is to be interpreted. The list of the contents of Schedule 2 demonstrates that the term is used in respect of mineral resources in scientific terms.

ASPASA contended that aggregates in their unprocessed form (at the muck pile) is the first saleable point.

The Royalty Act is passed with reference to the mining industry and the words used need to be understood by those in that industry, even if it differs from the ordinary meaning of the word.

In terms of context, the court noted that Schedule 2 of the Royalty Act is the immediate context of the term ‘bulk’. The Royalty Act distinguishes between refined and unrefined mineral resources: refined minerals and their conditions are specified in Schedule 1; other minerals are defined into subcategories of concentrating, containing mineral and materials that do not contain any metal; aggregates fall within the unrefined minerals category and are referred to in Schedule 2 in the conditions specified for such materials as ‘bulk’.

SARS contended that its interpretation did not penalise beneficiation or value adding processes and that any beneficiation required to bring unrefined metals to the condition specified was already recognised and incentivised in the rate for unrefined minerals, which is lower than the rate that would be leviable on those minerals had they been transferred at the mine face.

The court held that aggregates are already commercially viable at the mine face (at muck pile) and as such, the royalty must recognise it as the first stockpile. The beneficiation of aggregates is achieved after the muck pile by crushing, washing and screening. The court found that SARS’ interpretation lost sight of the difference in price between aggregates at the muck pile and those that have undergone beneficiation. This interpretation renders section 6(2)(b) totally redundant in the context of aggregates.

State of affairs

Following the December 6, 2024 court ruling, SARS applied for leave to appeal the High Court judgment to the Supreme Court of Appeal (SCA) before the judge (Judge Labuschagne J). ASPASA opposed the application and on March 5, 2025, SARS’ application for leave to appeal to the SCA was dismissed with costs.

According to Myburgh, unless SARS petitions the SCA directly for leave to appeal the High Court judgment to the SCA, the matter ends here, and it becomes a final binding legal precedent on the meaning of the word ‘bulk’.

“From a financial standpoint, this is significant for aggregate producers because it confirms that the calculation of the mineral royalty on the value of aggregates at the muck pile as opposed to on the value of beneficiated products sold after the muck pile, is the correct approach. Based on SARS’ approach, the royalty would have been significantly higher, which impacts the financial viability of quarries, especially smaller operations,” concludes Myburgh. a Wacker Neuson excavators set the standard with efficient engines and zero-emission options for more sustainable construction. Visit your nearest dealer in South and SubSaharan Africa to explore cleaner, smarter excavation solutions.

BOOSTING PRODUCTION CAPACITY AND EFFICIENCY

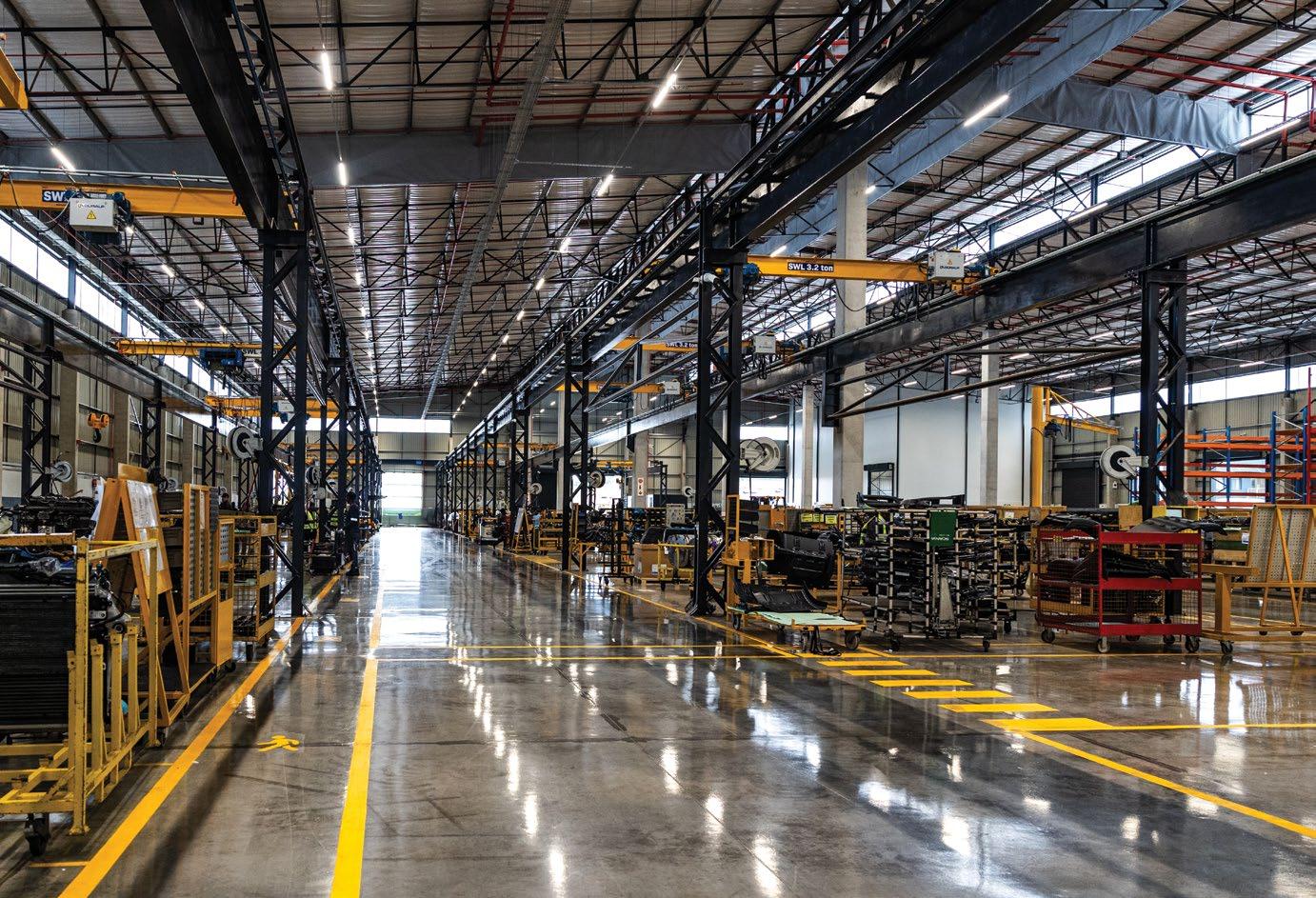

In a year that Scania celebrates 30 years in South Africa, 2025 marks yet another milestone following the company’s inauguration of its new Regional Product Centre (RPC). Officially opened on February 18, 2025, the facility boosts production capacity and efficiency, thus ensuring faster delivery times and enhanced customer support.

Munesu Shoko attended the inauguration and filed this report for Quarrying Africa

Testament to its longstanding commitment to the southern African market and to its dedication to driving progress in the local transport industry,

Scania Southern Africa has invested in a new RPC.

The investment comes exactly a year after the company relocated its head office from its long-time Aeroton base to a state-of-the-art facility in Constantia Kloof, reflecting its commitment to growth and innovation in the region.

“For over 30 years, Scania has been a steadfast partner to the local automotive, transport and logistics industries in southern Africa. Our dedication to this market extends beyond selling

KEY POINTS

Testament to its longstanding commitment to the southern African market, Scania Southern Africa has invested in a new Regional Product Centre

The investment comes exactly a year after the company relocated its head office from its long-time Aeroton base to a stateof-the-art facility in Constantia Kloof

With this facility, Scania is positioning itself to best serve its customers with high-quality, locally assembled products, ensuring faster delivery times and enhanced support

By consolidating various functions at one location, including parts warehouse and logistics, the facility maximises production efficiencies and reduces environmental impact

Scania Southern Africa has invested in a new Regional Product Centre.

30

In a year that Scania celebrates 30 years in South Africa, 2025 marks yet another milestone following the company’s inauguration of its new Regional Product Centre

“By consolidating our warehouse and assembly plant on the same site, we are reducing our carbon footprint significantly. To provide context, we are currently recycling 98% of all waste at the facility, and our target in 2025 is to further improve on this number through new packaging technologies.

vehicles; we are here to create lasting solutions to the industry and contribute meaningfully to the economy and local communities in which we operate,” says Erik Bergvall, MD of Scania Southern Africa.

Scania’s presence in southern Africa, adds Bergvall, is more than just a business; it is about partnerships, investments and trust. The company, he says, has over the years collaborated with its customers, employees and industry partners to shape the future of industry in southern Africa. The opening of the RPC reflects the company’s confidence in the region’s long-term potential and its ambition to support economic growth,

3 200

With 10 500 m² under roof, the new Scania RPC has the capacity to assemble 3 200 units a year, encompassing both trucks and bus chassis on the same line

“One exciting aspect about this development is the increased capacity and efficiency of our assembly operations. As demand for Scania’s sustainable solutions grows, we must have the infrastructure to meet this demand in an efficient way.

job creation and sustainable development.

“With this facility, we are positioning ourselves to best serve our customers with high-quality, locally assembled products, ensuring faster delivery times and enhanced support,” says Bergvall. “One exciting aspect about this development is the increased capacity and efficiency of our assembly operations. As demand for Scania’s sustainable solutions grows, we must have the infrastructure to meet this demand in an efficient way. This plant provides us with the capability to increase production, ensuring that we remain agile and responsive to the needs of our customers across southern Africa.”

Erik Bergvall, MD of Scania Southern Africa

Christian Håkansson, RPC manager at Scania Southern Africa

On time and within budget

The project, which commenced in mid-2023, was successfully completed in late 2024, with occupation taking place just before Christmas last year. Built under a strategic collaboration with Redefine Properties, the project was completed on time and within budget, confirms Christian Håkansson, RPC manager at Scania South Africa.

“When the decision was made to relocate our head office from Aeroton to Roodepoort, we carefully considered various options within South Africa,” explains Håkansson.

“After a thorough evaluation, we chose to consolidate Scania’s administrative operations into a single site and build a new production plant in Nasrec, Johannesburg.”

As the years passed, the previous assembly plant in Aereton was expanded as market needs dictated. However, the expansions were just added on, and the facility was never purpose-built, thus impacting efficiencies. One of the benefits of moving the assembly plant within the same area is that Scania managed to retain 100% of its staff, meaning that the company retained all of its important production skills.

Facility overview

With 10 500 m² under roof, the new Scania RPC has the capacity to assemble 3 200 units a year, encompassing both trucks and bus chassis on the same line.

With a staff complement of 83 people, the facility has a 14,5% female representation, which Cornelius Viljoen, workshop manager RPC South Africa at Scania South Africa, is proud of. While there is room for improvement, Viljoen says this achievement has taken greater effort to achieve and the company has plans to further improve in its quest to put more women into ‘blue collar’ working environments.

By consolidating various functions at one location, including parts warehouse and logistics, the facility

maximises production efficiencies. “Our new assembly plant is strategically located next to our parts storage and distribution centre, which strengthens synergies between our assembly operations and parts supply chain,” says Bergvall. “This integration translates into faster turnaround times, improved logistics and customer experience.”

Consolidating various functions at one site has also helped Scania reduce its environmental impact. “By consolidating our warehouse and assembly plant on the same site, we are reducing our carbon (CO2) footrpint significantly. To provide context, we are currently recycling 98% of all waste at the facility, and our target in 2025 is to further improve on this number through new packaging technologies,” explains Håkansson.

Evolution in operation

Commenting on the significance of the new assembly plant, Bergvall says the facility represents an evolution in Scania’s operations. The expansion, he adds, also means greater job opportunities, youth development and a stronger contribution to the South African economy. By investing in local talent and infrastructure, Scania is not only supporting economic growth, but is also helping shape the future of transport in the region.

Bergvall says the investment is proof of Scania’s commitment to strengthening its presence in key markets in the world. This, he says, reflects the confidence the company has in the African market – its potential to drive sustainable and innovative transport solutions.

“Scania’s focus on efficiency, sustainability and innovation will not only benefit the local market, but also contribute to our overall worldwide mission to drive the shift towards sustainable transport solutions. As we look ahead, our goal is to be at the forefront of a future where transport is smarter, cleaner and more efficient,” concludes Bergvall. a

Scania Southern Africa executives during the inauguration ceremony of the new RPC.

98%

Scania is currently recycling 98% of all waste at its new assembly facility, with a target to further improve on this number in 2025 through new packaging technologies

Industry associations such as IQSA and ASPASA have been commended for their role in moulding a resilient quarrying sector in South Africa.

NAVIGATING A CHANGING QUARRYING LANDSCAPE

With the quarrying sector, and the mining environment at large, constantly evolving, it is important for quarry operators to be adaptable – be open to new ideas and be willing to adjust strategies as needed. In line with this approach, this year’s IQSA Conference, taking place in Durban on April 3-4, will be held under the theme, ‘Navigating a Changing Landscape’. Chairman Jeremy HunterSmith unpacks some of the changes in the industry and how operators can adapt. By Munesu Shoko.

There is a general agreement that the quarrying sector is evolving, with a renewed focus on the environment and energy efficiency, amongst other areas of attention. However, HunterSmith notes that quarrying is fundamentally the same process as it was in years gone by, but it is what individuals working in the industry have

learned through years of experience, that is shaping the industry. That is what this year’s conference will highlight to help create a safer, healthier and productive quarrying environment.

“While quarrying has always been referred to as ‘other’ within the mining sector, it is governed by the same legislation as the mainstream mining sector. Given that we mine a low-value, high-volume

3-4

This year’s IQSA Conference, taking place in Durban on April 3-4, will be held under the theme, ‘Navigating a Changing Landscape’

KEY POINTS

This year’s IQSA Conference will be held under a ‘Navigating a Changing Landscape’ theme

To navigate some of the challenges facing the industry, new technology is coming to the fore, simplifying some of the daily tasks

Operations are encouraged to fast-track their traffic management plans and identify areas where significant risk exists

Delegates to this year’s conference can also look forward to a full programme, with some formidable guest speakers

product, the constant change in legislation, which by its nature is very expensive to comply with, has meant that aggregate operations have found it extremely onerous to stay on top of costs,” says Hunter-Smith.

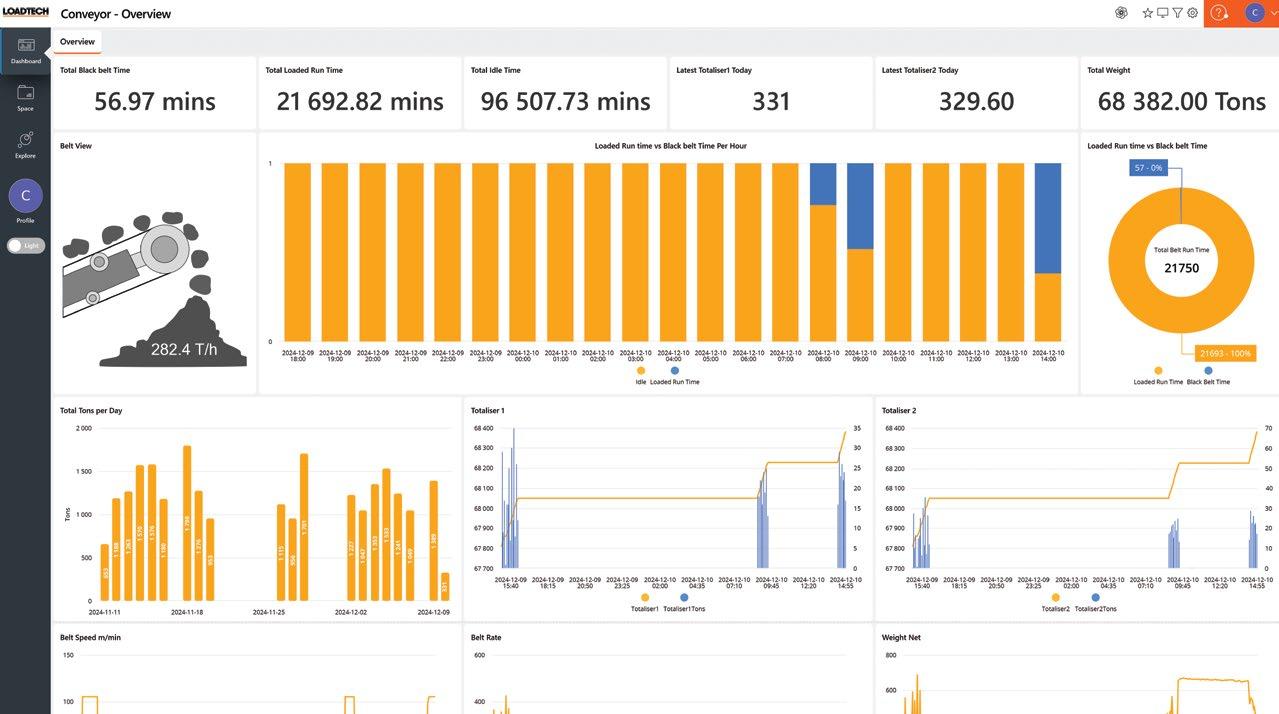

To navigate some of the challenges facing the industry, he says, new technology is coming to the fore and it is encouraging to see many operations adopting technology to simplify some of the daily tasks. For example, the use of drones for quarry mapping and surveying, belt scales for data at the quarry operator’s fingertips and better blasting systems for optimal blasts, are some of the new approaches redefining tasks in quarrying.

“It is, however, important to note that quarries are only able to adopt these new technologies once the construction industry improves and more substantial contracts come to market across South Africa. In turn, this stimulates the economy. Yes, there are some fantastic projects on the go, such as the N3 highway upgrade between Pietermaritzburg and Durban, but there needs to be a drive from government to create a conducive environment for private construction investment as well,” says Hunter-Smith.

Respond to changes

Hunter-Smith reiterates the need for quarry owners to prioritise the adoption of technology to enhance safety, improve efficiency, reduce costs and minimise environmental impact through data analysis, and remote operation, ultimately leading to a more sustainable and productive industry.

He also urges operations to fast-track their traffic management plans and identify areas where significant risk exists. This, he says, will inform whether there is need

PDS/CAS

South Africa is a global leader in the adoption of PDS/ CAS in mining, driven by legislation mandating the use of this technology on trackless mobile machinery in order to enhance safety and prevent accidents

“Our commodity is not valued in thousands of dollars as do the likes of gold and platinum, but rather a few hundred rands per tonne, and this makes big, quick changes difficult in our environment. That is why we have adopted a longterm game with moderate, but constant improvement to our operations.

Jeremy Hunter-Smith, chairman of IQSA

to adopt new technology such as proximity detection systems (PDS) and collision avoidance systems (CAS). South Africa is a global leader in the adoption of PDS/ CAS in mining, driven by legislation mandating their use of this technology on trackless mobile machinery (TMM) to enhance safety and prevent accidents.

While there is a better understanding and commitment to the entire PDS/CAS rollout process, Hunter-Smith highlights some of the challenges for the quarrying industry. One of the major ones is that the technology does not come cheap, yet quarries do not make large amounts of money.

“Our commodity is not valued in thousands of dollars as do the likes of gold and platinum, but rather a few

hundred rands per tonne, and this makes big, quick changes difficult in our environment. That is why we have adopted a long-term game with moderate, but constant improvement to our operations. These can be observed in the amazing results of the ASPASA audits. Hats off to the ASPASA auditing team and the great work they do to make a difference in the quarrying industry – to guide and share positive practices that make the difference,” says Hunter-Smith.

Big role

Hunter-Smith commends industry associations such as IQSA and ASPASA for their role in moulding a resilient quarrying sector. ASPASA, he says, has its hands full, helping its members navigate the changes that affect their operations, as well as lobbying with the various governmental bodies on behalf of the industry.

“Letisha van den Berg and her team at ASPASA are doing a remarkable job navigating these changes and also paving the way forward for a sustainable industry,” says Hunter-Smith. “IQSA is there to promote the training and education that is required to ensure the next set of leaders are ready for future changes and how possibly to deal with them. The new, young members should look within the IQSA membership for a mentor to assist and guide them in their career path within the industry.”

More expectations

Delegates to this year’s conference can also look forward to a full programme, with some formidable guest speakers. Peter van Kets, a renowned keynote speaker, will kickstart the conference. Van Kets is one of the world’s top professional endurance adventurers, a conservationist and an international keynote and inspirational speaker.

“The industry can also look forward to a presentation by David Msiza, Chief Inspector of Mines at the Department of Mineral and Petroleum Resources, who will give insights into some of the new developments from a regulator’s perspective. We will also have a political and policy analyst, Theo Venter, who will paint the political and policy picture for the industry,” explains HunterSmith.

In addition, the awards dinner, where the top performing operations in environmental management and health and safety are recognised, is always a major highlight of the conference. “We will also use the evening to recognise individuals who go the extra mile to add value to the industry. This year, we will also honour some IQSA members with the longest membership – some of them having been part of the association for more than 20 years,” concludes HunterSmith. a

This year, IQSA will also honour some of its long-serving members – with some of them having been part of the association for more than 20 years

It is encouraging to see quarries adopting technology to simplify some of the daily tasks, for example, the use of drones for quarry mapping and surveying.

We are proud of our Free Statebased Qwa Qwa Quarry for being recognised as the Top Performer in the ASPASA ISHE Audit 2024.

At Afrimat, our responsibility extends to both our people and the planet. We are deeply committed to providing a safe and healthy workplace for all, employing proactive risk management to prevent health and safety incidents.

This commitment to our people is mirrored in our dedication to environmental sustainability, as we strive to unlock the earth's mineral potential responsibly and build a better world.

DEMONSTRATING COMMITMENT TO ZERO HARM

Findings from the 2024 ISHE Audit, an annual health and safety audit conducted by ASPASA, demonstrate that members of the surface mining industry association are committed to the zero harm objective, aiming to ensure that every worker returns home unharmed every day. By Munesu Shoko.

ollowing another round of ISHE audits in 2024, ASPASA auditor Marius van Deventer tells Quarrying Africa that members of the association have once again demonstrated high levels of compliance to ensure employee occupational health and safety in the workplace.

A total of 74 audits was conducted on member operations in 2024, with an average score of 90,16%, achieving the highest score of 98,24%. In addition, 13 more audits were conducted at non-mining operations operating under the Health and Safety Act. The average score achieved by these operations was 88,56%.

Both audit protocols were reviewed in 2024, with some scores and weight of scores changed to put emphasis on compliance issues that the Department of Mineral and Petroleum Resources (DMPR) Inspectorate deems pressing for the industry. While compliance with these new requirements proves to be difficult for members operating in multiple DMPR regions due to different interpretations by the Inspectorate, Van Deventer is encouraged by the great effort that ASPASA members have made to comply.

“The general takeaway from last year’s audit is that compliance among all audited quarries and other operations is of a very high standard. Every year the audit casts the spotlight on areas of improvement and it is encouraging to see the continuous improvement efforts by members to meet these audit protocol requirements,” says Van Deventer.

Scope

The ISHE audit covers all operations at the quarry that fall under the legal requirements of the Mine Health and Safety Act and other applicable regulations. Audits are also conducted on member

The results of the 2024 ISHE Audit are of extremely high standard. All participating members should be commended for their exceptional efforts, commitment and performances during the year.

Marius van Deventer, ASPASA ISHE auditor

For the fourth year running, Afrimat Qwa Qwa was named the Top Overall Performer in the 2024 ISHE Audit.

operations that are governed under the Occupational Health and Safety Act.

A structured audit process is followed by in-depth inspections of facilities on site. The auditor then inspects the documentation of the operation’s health and safety system. Legal registers, inspections, pre-start checklists, licences to operate machines and isolation records, amongst others, are some of the important documents that form part of an operation’s health and safety system. The audit process also evaluates employee knowledge on technical, plant, machinery and mining area legal requirements, which is key to maintaining a safe working environment.

98,24%

A total of 74 audits was conducted on member operations in 2024, with an average score of 90,16%, achieving the highest score of 98,24%

KEY POINTS

Following another round of ISHE audits in 2024, ASPASA members have once again demonstrated high levels of compliance to ensure employee occupational health and safety in the workplace

The ISHE audit covers all operations at the quarry that fall under the legal requirements of the Mine Health and Safety Act and other applicable regulations

Audits are also conducted on member operations that are governed under the Occupational Health and Safety Act

The overall health and safety performance of ASPASA members was exceptionally good in 2024, demonstrated by the highest number of operations achieving Showplace Status (95% and above) since the introduction of the audit protocol

Both audit protocols were reviewed in 2024, with some scores and weight of scores changed to put emphasis on compliance issues that the DMPR Inspectorate deems pressing for the industry

20

A record 20 operations achieved Showplace Status (95% +) during the 2024 ISHE Audit

Breakdown of achievements in the 2024 ISHE Audit (Mining)

Showplace Status (95% +) 20 operations

5 Shield Status (90-95%) 34 operations

4 Shield Status (80-90%) 13 operations

3 Shield Status (70-80%) 6 operations

2 Shield Status (60-70%) 1 operation

1 Shield Status (50-60%) None Participation (< 50%) None

Breakdown of achievements in the 2024 ISHE Audit (Non-mining)

Showplace Status (95% +) 2 operations

5 Shield Status (90-95%) 5 operations

4 Shield Status (80-90%) 5 operations

3 Shield Status (70-80%) None

2 Shield Status (60-70%) 1 operation

1 Shield Status (50-60%) None

Participation (< 50%) None

Van Deventer confirms the addition of a new protocol to the 2024 audit process, which was aimed at testing and educating employees on their ability to conduct major accident investigations and respond to enquiries by the DMPR. The audit protocol was based on actual industry accidents that occurred during the previous year. The protocol has been revised again for the 2025 audit and extensive changes have been agreed by members.

“A key role of the audit process is to provide guidance and add impetus to the industry’s drive for zero harm. Knowledge and experience are shared right across the industry to uplift the understanding, attitude and behaviour of all employees responsible for managing health and safety,” explains Van Deventer.

Audit findings

The overall health and safety performance of ASPASA members was exceptionally good in 2024, demonstrated by the highest number of operations achieving Showplace Status (95% and above) since the introduction of this audit protocol.

“Total commitment is required in the industry’s quest for zero harm, and ASPASA members audited in 2024 have demonstrated just that,” says Van Deventer. “The audit outcomes have again shown that ASPASA members

are fully committed to the health and safety of their employees and interested parties affected by their operations.”

Van Deventer says there was a general improvement from the previous year’s audit at most of the sites, with members plugging the compliance gaps that had been identified during the 2023 audit. These operations, he says, need to be applauded for their continuous efforts to improve and dedication to health and safety.

One of the positive takeaways from last year’s audit was the appetite for information-sharing in the industry, which has become a crucial aspect of the audit. Quarry managers are eager to learn from each other’s best practices to improve their own health and safety performance.

“There were a number of positives to write home about in the 2024 audit. One of them is the general improvement in the compliance to machine guarding requirements. In addition, mine development in accordance with mine planning and no serious incidents of mine failure recorded is something that members of ASPASA should be commended for. In general, employees are better informed about requirements and knowledge of safe working conditions. More importantly, no fatalities were recorded among ASPASA members during the audit period,” says Van Deventer.

Areas of improvement

While the industry generally exhibited high health and safety standards, there were several areas of concern cited in the audit report. Van Deventer says one of the major concerns was the several serious injuries recorded during the auditing period.

“This is very unfortunate, but action steps have been taken to prevent recurrence,” he says. “In some instances, proper investigations of accidents and incidents remains unsatisfactory, with operations failing to establish the root cause of the accident, which is key to closing the loop and establishing control measures to prevent it from happening again.”

Other areas of concern highlighted in the 2024 audit, which will receive special attention during the 2025 audit, include compliance to own standards and procedures; liaison with local communities and neighbours, especially when it comes to blasting events; too many lost time injuries, disabling injuries and reportable injuries recorded; and identification of risks

Eskay Crushers was named the Top Independent Performer and the overall runner-up in the 2024 ISHE Audit.

Marius van Deventer (far right front) with the Eskay Crushers team during an audit last year.

and/or non-compliances. Operations should also improve on their pre-start inspections of plant and trackless mobile machinery (TMM), stresses Van Deventer.

Other areas of focus include the need for full implementation of traffic management plans; improving housekeeping in plants; repeat findings from previous audits; full compliance to isolation and lockout requirements; attention to accident/incident investigations to establish root causes; near miss reporting; contractor management; and emergency training and mock drills.

Audit results

In the quarrying space, a total of 74 audits was conducted on mining operations, with an average score of 90,16%, up from the 89,84% achieved during the 2023 audit. For the fourth year running, Afrimat Qwa Qwa was named the Top Overall Performer with a 98,24% score, highlighting the operation’s unparalleled focus on health and safety performance. Afrimat Qwa Qwa also achieved a Showplace Status for the fifth consecutive year.

Eskay Crushers was named the Top Independent Performer and the overall runner-up with a 97,7% score. Located in Piet Retief, a small town situated in Mpumalanga province, Eskay Crushers has continuously set the bar high in terms of compliance. “I have been auditing Eskay Crushers since 2008, and every year the operation has demonstrated continuous improvement to its health and safety standards. Mine manager John Davis and his team are committed to ensuring a safe and healthy environment for all,” says Van Deventer.

On non-mining operations governed by the Occupational Health and Safety Act, 13 audits were conducted during 2024, with an average score of 88,26% achieved. Van Deventer commends the achievement, highlighting that it was the first time for most of these operations to be audited under the ASPASA audit protocol.

“The results of the 2024 ISHE Audit are of extremely high standard. All participating members should be commended for their exceptional efforts, commitment and performances during the year,” concludes Van Deventer. a

Despite significant challenges in recent years, the South African construction industry remains a critical pillar of the domestic economy.

INSIGHT INTO THE STATE OF CONSTRUCTION IN SA

While the South African construction sector remains a vital component of the economy –contributing approximately 5% to the country’s GDP and employing over 1,3-million people – it faces numerous challenges that require strategic interventions to stimulate investment. Elsie Snyman, CEO of Industry Insight, unpacks the state of affairs and provides insight into what needs to be done to stimulate construction investment. By Munesu Shoko.

The significance of the construction sector to any economy cannot be emphasised enough. By creating jobs, stimulating investment, improving infrastructure, contributing significantly to gross domestic product (GDP) and facilitating economic growth through its intersectoral linkages with other industries, construction is the physical foundation needed for the economy to thrive.

Despite significant challenges in recent years, the South African construction industry remains a critical pillar of the domestic economy, contributing 5% to the nation’s GDP in expenditure terms, with a labour force exceeding 1,3-million as of the third quarter of 2024.

Notably, the sector has a high employment multiplier effect – for every R1-million invested, it generates employment for more than four individuals, and this figure rises to an estimated nine jobs when including associated roles in the material manufacturing sector. These figures, says Snyman, underscore the industry’s significant role in both economic output and job creation within South Africa.

State of affairs

After enjoying an historic growth phase during the run-up to the 2010 Soccer World Cup, the South African construction industry has generally withstood a rocky period during the past decade. Despite substantial investments in renewable energy and a political push to enhance infrastructure ahead of the May 2024 elections, the performance in building and construction remained weak, with the construction sector experiencing an 8% year-on-year decline in investment during the first three quarters of 2024, following a 3,7% contraction in 2023. Factors such as higher interest rates, increased inflation and political uncertainties were key constraints to private sector investment, a key driver in the building sector.

The challenges were not only unique to the building sector, with the civil construction segment also facing difficulties, with a 7,6% year-on-year decline in investment during the same period. However, confidence among civil contractors rebounded in the latter half of 2024, attributed to government efforts to boost infrastructure spending.

The South African construction sector experienced an 8% year-on-year decline in investment during the first three quarters of 2024, following a 3,7% contraction in 2023

KEY POINTS

Despite significant challenges in recent years, the South African construction industry remains a critical pillar of the domestic economy

The construction industry contributed 5% to South Africa’s GDP in expenditure terms, with a labour force exceeding 1,3-million as of the third quarter of 2024

Factors such as higher interest rates, increased inflation and political uncertainties have been key constraints to private sector investment, a key driver in the building sector

Despite these challenges, sentiment towards the listed construction sector improved during the latter part of 2024. Notably, cumulative market capitalisation values increased by 76% year-on-year in the second half of 2024

“The civil industry presented a mixed scenario, with weak investment growth alongside improved confidence. Investment in construction works fell by 1,7% year-onyear in 2023, which accelerated to a 7,6% year-on-year decline in the first three quarters of 2024. Yet, confidence levels among civil contractors showed a notable rebound during the second half of 2024, reaching an eight-year high of 50 in the third quarter of 2024, according to the FMB/BER Confidence surveys,” says Snyman. This follows a concerted effort by the government, prior to the May 2024 elections, to increase infrastructure expenditure, given the debilitating economic impact of failed economic infrastructure deeply entrenched across all government spheres.

Spending priorities

Despite these initiatives, the reallocation of funds in the 2024 Budget from transport and energy to water services, coupled with a decline in social infrastructure expenditure, has raised concerns about the government’s investment strategy.

“Infrastructure spending priorities announced in the 2023 Budget, which included the 2023/24 financial period, suggested higher levels of investment in the transport and energy sectors, with an encouraging overall real increase of 4,5% projected over the Medium-Term Expenditure Framework (MTEF) period (2023/24 to 2025/26),” says Snyman.

“We also observed an 11% year-on-year increase in public sector civil tender activity during the first six months of 2024, compared to the same period in 2023. However, 8%

50

Confidence levels among civil contractors showed a notable rebound during the second half of 2024, reaching an eight-year high of 50 in the third quarter of the year

“We observed an 11% year-on-year increase in public sector civil tender activity during the first six months of 2024, compared to the same period in 2023. However, this was followed by a post-election slump, as tender activity fell by 17% year-on-year during the second half of 2024.

Elsie Snyman, CEO of Industry Insight

this was followed by a post-election slump, as tender activity fell by 17% year-on-year during the second half of 2024,” she adds.

In the 2024 Budget, the government reallocated infrastructure funding, shifting focus from transport and energy sectors towards water services. This shift coincided with a continued real decline in social infrastructure expenditure estimates, notably in housing, education and health sectors.

Overall, projections for total public sector infrastructure expenditure indicate an average 0,1% decline in real terms over the MTEF period up to 2026/27, suggesting a governmental approach contrary to widely advocated investment strategies.

Year-on-year change in the estimated value of projects out to tender (2023 vs 2024).

Key challenges

The industry, says Snyman, continues to grapple with challenges such as intimidation from groups known as the “Construction Mafia”, corruption, project cancellations and payment delays. In 2024, project postponements increased by 27% year-on-year, affecting over 200 projects, while cancellations rose by 82%, impacting 344 projects, as reported by industry sources such as Databuild. Profit margins also declined, averaging less than 2% up to the third quarter of 2024, down from 5,2% in 2023, primarily due to intensified competition.

reaching 979 000 tonnes, with a notable 43% year-on-year growth in the second half of the year.

“The surge in cement imports poses a significant threat to domestic cement producers, who are already contending with higher input costs and logistical challenges. These developments underscore the pressing need for strategic interventions to bolster the competitiveness of South Africa’s manufacturing sector and safeguard its role in the country’s infrastructure development initiatives,” notes Snyman.

A few bright spots

Despite these challenges, sentiment towards the listed construction sector improved during the latter part of 2024. Notably, cumulative market capitalisation values increased by 76% year-on-year in the second half of 2024, indicating renewed investor confidence in the sector.

R658-billion

The decline in public sector tender activity in both building and civil sectors during the latter half of 2024 may adversely affect turnover in the short to medium term. The extent of this impact will largely depend on how swiftly the new Government of National Unity (GNU) can rejuvenate tender processes, particularly at provincial and local government levels. Early 2025 has seen increased friction within the GNU, linked to the signing of the Expropriation Act in January 2025. This development has the potential to undermine investor confidence, thereby slowing private sector investment.

In addition, the manufacturing sector in South Africa is grappling with numerous challenges, including escalating input costs, logistical constraints and the threat of imports, all of which adversely affect suppliers of construction materials. A prominent example is ArcelorMittal South Africa’s recent announcement to wind down its long-steel operations, a decision expected to impact approximately 3 500 direct and indirect jobs.

The local cement manufacturing industry faces similar hurdles. Cement imports increased by nearly 20% in 2023,

“On a more positive note, building approvals for new private sector construction appear to have reached a low point, with demand for non-residential buildings and housing gradually improving towards the end of 2024. This trend is partly attributed to a more favourable interest rate environment. However, considering that project approvals typically have a lead time of 12 to 18 months, the building sector may continue to face challenges at the start of 2025,” says Snyman.

The outlook for further interest rate cuts in 2025 has become more uncertain due to renewed global economic uncertainties. Following three consecutive cuts, the South African Reserve Bank reduced the key interest rate to 7,5% on January 30, 2025. While further reductions are anticipated throughout the year, with projections suggesting a rate of approximately 7,25% by year-end, these expectations are contingent upon the absence of unforeseen economic shocks.

Unlocking investment

Commenting on what needs to be done, Snyman says, to address the significant fiscal challenges and reduce escalating debt levels, increasing private sector investment is essential.

“This will require bold actions by the government to restore investor confidence, reduce regulatory obstacles and create a conducive environment for private sector participation. Despite over R658-billion in new project announcements in 2024, the uptake has been slow, indicating the need for effective implementation strategies,” she concludes. a

Despite over R658-billion in new project announcements in 2024, the uptake has been slow, indicating the need for effective implementation strategies

North West: -429

North Cape Province: 1 387

Free State: -3 464

North Cape Province: 1 387

Eastern Cape: -1 396

KwaZulu Natal: -1 931

Limpopo: -201

Mpumalanga: -3 422

Gauteng: -4 206

Drilling Diameter ø65~102mm

Drifter 22hp / 17kw

Air Flushing 5.5 m3 / min Drill Steel T38, T45

Pilot Crushtec has launched the DynamiTrac J100S – a compact dual-power mobile jaw crusher with a 40 to 100

CRUSHING NEW VOLUMES

To meet the need for compact crushing gear in selected applications, Pilot Crushtec International is launching the DynamiTrac J100S, a self-sustaining, dual power, compact mobile jaw crusher with a hanging screen. With a throughput range between 40 and 100 tonnes per hour (tph), the J100S is particularly suited for construction, recycling and small-scale mining operations. By Munesu Shoko.

Latest from Pilot Crushtec is a costeffective, compact mobile jaw crusher that is set to offer new capabilities in the sub-100 (tph) mobile crushing environments. Taking feed sizes up to 400 mm, the DynamiTrac J100S offers throughput from 40-100 tph, depending on material properties and feed size, amongst others. With a crusher feed opening of 700 mm x 500 mm, the machine has a closed side setting (CSS) range of 30-110 mm, as well as a 2 m³ heaped hopper capacity and a feed height of 2,5 m.

Charl Marais, sales manager South Africa at Pilot Crushtec, says the machine fits the bill for

construction and recycling applications. “In South Africa, this is a typical infrastructure machine. It gives construction contractors a cost-effective tool to keep on site for crushing material on demand, particularly backfill material. Given that it also comes with a double-deck hanging screen, contractors can also deploy it for on-site re-crushing of construction materials into required product sizes,” explains Marais.

Recycling is yet another area where the DynamiTrac J100S will find application. Using a single machine, demolition contractors can now break down material into manageable sizes, screen it into preferred sizes (using the double-deck

tph throughput, ideal for construction, recycling and small-scale mining.

40-100 tph

Taking feed sizes up to 400 mm, the DynamiTrac J100S offers throughput from 40-100 tph, depending on material properties and feed size

KEY POINTS

Pilot Crushtec International is launching its DynamiTrac J100S, a self-sustaining, dual-powered compact mobile jaw crusher

The J100S is particularly suited for construction, recycling and small-scale mining operations

The dual-powered, compact mobile crusher offers many benefits, including no permits to transport due to weight, cost savings and reduced maintenance costs

To provide even more flexibility to start-up mining customers, the J100S comes to market together with its static counterpart – the DynamiTrac MJ100

hanging screen) and remove metal/rebar using a standard overband magnet.

In addition, the J100S will also offer costeffective crushing capabilities to smallscale, low-production mining operations. In the past few years, says Wayne Warren, Africa sales manager at Pilot Crushtec, there has been a growing number of startup mining companies in southern Africa and this machine speaks directly to their operational needs.

Best of both worlds

A major talking point on the J100S is the fact that it is a self-sustaining, dualpowered machine that comes with an on-board generator. In addition, this machine can also be plugged into mains electricity, offering contractors the best of both worlds – the cost-efficiency of a static plant and the mobility of a tracked machine.

“This dual-powered, compact mobile crusher offers many benefits, including environmental friendliness, cost savings and reduced maintenance. The electric drive saves contractors money on fuel, which is generally a big operational cost in mobile crushing. Additionally, the electric motor is easier to maintain and has fewer

30-100 mm

With a crusher feed opening of 700 mm x 500 mm, the machine has a closed side setting range of 30-110 mm

breakdowns than the diesel-powered counterpart,” explains Warren. The generator of the machine is driven by a Cat C3.6 engine which balances compact size, reliability and performance. This engine is offered in ratings ranging up to 106 kW (142 hp) @2 200 rpm. It is an efficient motor which is renowned for its fuel economy.

The DynamiTrac J100S features a hanging screen for efficient material separation, enhancing versatility in compact crushing applications.

The DynamiTrac J100S is equipped with an intuitive control panel for seamless operation and precise crusher management.

Benefits abound

The option of a two-deck screen maximises the machine’s versatility. The detachable screen enables the production of two screened products and any oversize material is recirculated back into the crusher using a return conveyor. The compact machine is therefore essentially a jaw crusher, a screen and a conveyor on one tracked chassis. This eliminates the need for another machine to work in closed circuit with the jaw crusher. Having a single machine doing the job of two machines, says Warren, offers significant cost benefits for the customer – both from a capital and operational cost perspective.

2,5 m

“The machine also benefits from some of the features found on larger mobile crushing offerings. For example, it comes with a hydraulic CSS adjustment. This allows for fine adjustments to the crushing force through precise control of the hydraulic pressure, enabling adaptation to different material sizes,” says Warren, adding that the push-button mechanism makes the machine simple to operate, with all the necessary parameters displayed.

More flexibility

To provide even more flexibility to start-up mining customers, the J100S comes to market together with

its static counterpart – the DynamiTrac MJ100, which is basically the same machine without tracks and the hanging screen. Having previously offered Pilot Modular solutions in the smaller 5-30 tph capacity range and at the large end of the crushing scale –120 tph and above – the MJ100, with a capacity of 40-100 tph, offers new capabilities, allowing Pilot Crushtec to offer a comprehensive modular solution for crushing needs in the sub-100 tph bracket.

Francois Marais, sales and marketing director at Pilot Crushtec, says the arrival of the MJ100 and the J100S highlights Pilot Crushtec’s commitment to developing solutions that expressly address customer needs. For the past 35 years, he adds, the company has built a reputation for its quality of products and outstanding service levels.

“In today’s dynamic business environment, flexibility, reliability and cost-effectiveness are essential parameters for achieving operational excellence, especially in cost-sensitive environments such as construction and small-scale mining. The addition of the MJ100 and the J100S allows us to expand our product footprint and help our customers achieve their production needs. The range will benefit from the same level of support that our customers have become accustomed to,” concludes Marais. a

The DynamiTrac J100S is equipped with an oversize belt for efficient discharge of larger material, ensuring smooth operation and productivity.

The J100S comes with a 2 m³ heaped hopper capacity and a feed height of 2,5 m

Compared with some of the competition’s machines, a Kleemann train is said to achieve on average up to 40% reduced fuel consumption.

UNLOCKING NEW COMMINUTION GROWTH

To unlock the next phase of market share growth in a different area from its traditional stronghold, i.e., the road-making equipment market, Wirtgen Group South Africa is making its Kleemann mobile crushing and screening range a special focus. In a one-onone with Quarrying Africa, sales manager Waylon Kukard unpacks some of the initiatives to grow the brand and what makes the Kleemann range tick. By Munesu Shoko.

Having launched the first Kleemann units in 2010, Wirtgen Group South Africa has to date put some 80 units into the local market

250 tph

With the arrival of the 250-tph MR 100 NEO, Kleemann now has an impactor suited for smaller crushing operations, such as brickyards and recycling applications

13 l

Kleemann jaw crushers operating in the field are averaging 13 litres of diesel per hour

The Kleemann MOBISCREEN MSS 502 EVO screen has just won the 2025 German Design Award for its technically innovative approaches.

Traditionally, the Wirtgen Group has established itself as a market leader in the road-making equipment market, not only in Africa, but globally. Brands such as Wirtgen, Hamm and VÖGELE, amongst others, dominate the various segments of the road construction equipment market.

“Being such a well-established road equipment manufacturer with such high market shares across various product groups, the focus has always been on maintaining our leadership position in those traditional domains. However, at a group level, we are confident that our next wave of market share growth will come from Kleemann, a product that has already proven its prowess in Europe, but is still to find the same level of acceptance in the local market,” says Kukard.

Installed base

Having launched the first Kleemann units in 2010, Wirtgen South Africa has to date put some 80 units into the local market. While the majority of these machines are operating in South Africa, several machines are also hard at work in neighbouring countries.

Beyond South Africa’s borders, Wirtgen South Africa has capable dealer partners in markets such as Zimbabwe and Botswana. Under the stewardship of Machinery Exchange, the brand is on a growth trajectory in Zimbabwe, with some two trains – each comprising an MC 110 EVO2 jaw crusher, an MCO 9 EVO2 cone crusher and an MSC 703 EVO screen. In total, six Kleemann machines have been delivered in Zimbabwe in the past two years alone, with prospects to commission more trains in the near future.

While Botswana has in recent years turned its infrastructure development attention to water and pipelines, Parts Sales Botswana, the Wirtgen dealer in the country, has enjoyed good success, with an installed base of seven Kleemann machines, confirms Kukard.

Growth initiatives

While the installed base in southern Africa is fairly encouraging, Kukard believes that the brand remains uncommon, especially among some of the major mining contractors who undertake large crushing and screening

KEY POINTS

Wirtgen South Africa is making its Kleemann mobile crushing and screening range a special focus

The company has appointed two experienced sales personnel to drive the Kleemann brand in key mining regions of South Africa

The company believes it has the right product and support to grow its market share in the large contracting market

As part of the renewed focus on Kleemann, Wirtgen South Africa is launching a demo programme to give prospective customers first-hand experience of the performance of the Kleemann machines

jobs. Traditionally, the uptake has been high among construction contractors who are already familiar with the company’s road construction product range and the aftermarket support that comes with it.

“Those customers have come to understand the capabilities of the Kleemann range and are also aware of the Wirtgen quality and what we stand for,” says Kukard. “The target is to penetrate the large contracting market. We have the right product and support to grow our market share in this market segment, which is why we are placing a huge focus on the Kleemann offering.”

Consequently, Wirtgen South Africa has put its dedicated approach in motion with the appointment of two experienced sales personnel to drive the Kleemann brand in key mining regions of South Africa. Based in Mpumalanga, the first Kleemann sales specialist, Christo Kotze, looks after the Mpumalanga and Limpopo provinces. The second Kleemann sales specialist, Morne Oelofse, has been deployed in Kimberley, from where he looks after customers in Northern Cape and Free State territories. Kukard says these deployments are strategic in the quest to broaden Kleemann’s foothold in these important mining regions.

Wirtgen South Africa is particularly excited about the MOBIREX MR 100 NEO impact crusher, which closes a crucial gap in the company’s impact crushing offering.

As part of the renewed focus on Kleemann, Wirtgen South Africa is launching a demo programme to give prospective customers, especially the big mining contractors, first-hand experience of the performance of the machines. In addition, the company is also introducing a rental facility which, according to Kukard, provides customers with the opportunity to test the brand before they commit to any outright purchasing decisions.

Model range and strengths

While Kleemann offers a large range of crushers and screens, the most common models locally are the MC 110 EVO2 jaw crusher, the MCO 9 EVO2 cone crusher, the MSC 703 EVO classifying screen and the recently launched MSS 802 EVO scalping screen.

The Kleemann range has to date distinguished itself with a range of capabilities. Firstly, says Kukard, it is a sturdy machine – the stability of the chassis results in better crushing performance, and this has been proven on many reference sites where the machines have been deployed.

Another key competitive edge of the Kleemann offering is its lower fuel consumption, largely driven by new technology engines combined with on-board generators that drive most components. This is particularly important for customers in southern Africa, where fuel prices are known to be very high.

“Compared with most of our competition’s machines, a Kleemann train achieves on average up to 40% reduced fuel consumption,” he says. “To provide context, the annual fuel saving on one train will cover the customer’s full capital cost of a screen, which contributes to lower cost per tonne. The productivity of the machines has also been exceptional, with production rates on par with some of the best in this market, if not better, at a 40% reduction in fuel consumption.”

Kleemann jaw crushers operating in the field are averaging 13 l of diesel per hour, while cone crushers are running at about 21 l per hour, which is “unheard of”, according to Kukard.