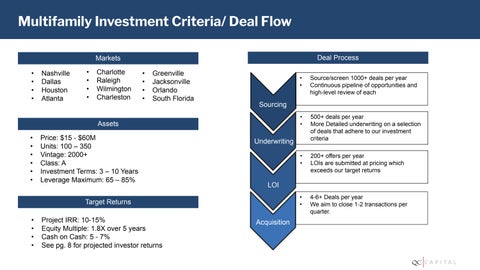

Multifamily Investment Criteria/ Deal Flow Deal Process

Markets • • • •

Nashville Dallas Houston Atlanta

• • • •

Charlotte Raleigh Wilmington Charleston

• • • •

Greenville Jacksonville Orlando South Florida

Price: $15 - $60M Units: 100 – 350 Vintage: 2000+ Class: A Investment Terms: 3 – 10 Years Leverage Maximum: 65 – 85%

Project IRR: 10-15% Equity Multiple: 1.8X over 5 years Cash on Cash: 5 - 7% See pg. 8 for projected investor returns

• •

500+ deals per year More Detailed underwriting on a selection of deals that adhere to our investment criteria

• •

200+ offers per year LOIs are submitted at pricing which exceeds our target returns

• •

4-6+ Deals per year We aim to close 1-2 transactions per quarter.

Underwriting

LOI

Target Returns • • • •

Source/screen 1000+ deals per year Continuous pipeline of opportunities and high-level review of each

Sourcing

Assets • • • • • •

• •

Acquisition

5