PUBLISHING

Publisher / General Manager

Jules Kay

Associate Publisher / Head of Brand & Marketing

Richard Allan Aquino

Publishing Assistant / Marketing Relations Manager

Tanattha Saengmorakot

EDITORIAL

Editor

Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Digital Editor

Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Charles, Steve Finch, George Styllis, Jonathan Evans

CREATIVE & MARKETING

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer

Poramin Leelasatjarana (Min)

Digital Marketing Executive

Anawat Intagosee (Fair)

Senior Manager, Media & Marketing Services

Nate Dacua

Senior Executive, Media & Marketing Services

Piyachanok Raungpaka

Senior Product Lifecycle & Brand Manager

Marco Bagna-Dulyachinda

REGIONAL SALES

Director of Sales

Udomluk Suwan

Head of Regional Sales

Orathai Chirapornchai

Watcharaphon Chaisuk (Australia)

Monika Singh (India, Sri Lanka, and Australia)

Wulan Putri (Indonesia)

Tony Thirayut (Japan)

Kai Lok Kwok (Mainland China, Hong Kong, Macau, and Middle East)

Yiming Li (Mainland China, Hong Kong, and Macau)

June Fong (Malaysia)

Jess Lee (Malaysia)

Priyamani Srimokla (Middle East)

Marylourd Pique, Nel Ison (Philippines)

Alicia Loh (Singapore)

Kritchaorn Mueller (Thailand)

Nguyen Tran Minh Quan (Vietnam)

DISTRIBUTION

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries petch@propertyguru.com

Distribution Enquiries ying@propertyguru.com

Property Report by PropertyGuru is published six times a year by © 2025 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher KDN PPS 1662/10/2012 (022863)

Asia-Pacific’s wealth story is often told in superlatives. Yet behind the headlines lie powerful shifts. Knight Frank’s Wealth Report 2025 predicts that the region will generate nearly half of the world’s new ultra-high-net-worth individuals between 2025 and 2028.

Meanwhile, Altrata highlights Hong Kong and Singapore as leading secondary-home markets for the ultra-wealthy, underscoring how multiple homeownership is fuelling demand.

Our special feature on luxury residences explores how global names are aligning with a diversifying buyer base. Millennial millionaires, mobile entrepreneurs, and second-generation investors now sit alongside family dynasties, seeking homes that prioritise wellness, technology, and flexibility.

Money is also the theme of this issue’s Project Confidential, which spotlights BuGaan Pattanakarn. Sansiri’s new ultra-luxury landed development more than lives up to the fantasy of rarefied Bangkok living. Elsewhere, we speak to the legendary Alan Zeman, whose latest residential ventures in Phuket are set to burnish the island’s reputation as a luxury destination.

We also examine broader market dynamics, from the mixed fortunes of Japan and China to the rising prospects of Johor Bahru. Architecture takes centre stage with a look at Benoy’s transformative work in China, while lifestyle comes to the fore with a guide to Jimbaran, Bali, an enclave beloved by surfers and luxury travellers alike.

Duncan Forgan Property Report duncan@propertyguru.com

These home theatre companions create an immersive, blockbuster-worthy experience

Furnishings to turn your kitchen and dining area into a destination for connection

Lighting and décor fit for this season’s spooky parties

Sansiri’s new ultraluxury project captures a generational shift in wealth with marble, courtyards, and seclusion

Alan Zeman is harnessing his nose for buyer trends to take Phuket’s luxury residential sector to dizzying new heights

Qin Pang’s logic-led approach to architectural problemsolving has helped steer the progress of global design practice Benoy in China

Neighbourhood Watch: Jimbaran

This former fishing village turned surf mecca is home to some of Bali’s most glam residential and hotel properties

Special Feature: Show and tell

Asia’s ultra-wealthy want more than square footage; they crave strong stories, values, and vision

Destination: Japan

Luxury real estate in the nation, from ski resorts to city penthouses, continues to attract international buyers and investors

Dispatch: Opposites attract

Once regarded as a poor relation across the causeway, Johor Bahru is cementing its status as an integrated economic partner to Singapore

Destination: China

Concerns remain over surplus inventory built by troubled property developers as prices continue to fall across all but a handful of major cities

Dispatch: Real-world problems

Issues over marrying blockchain incentives to a physical asset class is hampering Thailand’s digital finance push

Powered by real-time data from PropertyGuru.com.my and iProperty.com.my, the new Consumer Demand Awards recognise the year’s most sought-after residential and commercial developments

With rising living costs and evolving lifestyle needs, buyers and renters in Malaysia are becoming smarter, more selective, and more data-driven than ever.

Insights from Malaysia’s leading property platforms, PropertyGuru.com.my and iProperty.com.my, reveal that property seekers are increasingly aware and informed when it comes to buying and leasing properties in the country.

Recognising these behavioural shifts, PropertyGuru Asia Awards Malaysia in partnership with iProperty have introduced the inaugural Consumer Demand Awards, recognising the most in-demand properties in the country based on real demand.

Unlike traditional awards evaluated by judging panels, these accolades are entirely data-powered, tracking actual buyer activity, including views and enquiries on PropertyGuru.com.my and iProperty.com.my from 1 January to 31 December 2024. In other words, these awards are decided free of subjective opinions—just real demand from real people.

These findings are consistent with the Property Sentiment Index, which remained stable in H2 2024, according to PropertyGuru’s biannual Consumer Sentiment Study. Young property seekers in the country are trying to adapt to the rising cost of living and higher interest rates and saving for downpayments.

Here’s what real-time data told us about what Malaysians—and Singaporeans—really sought in residential and commercial properties in 2024.

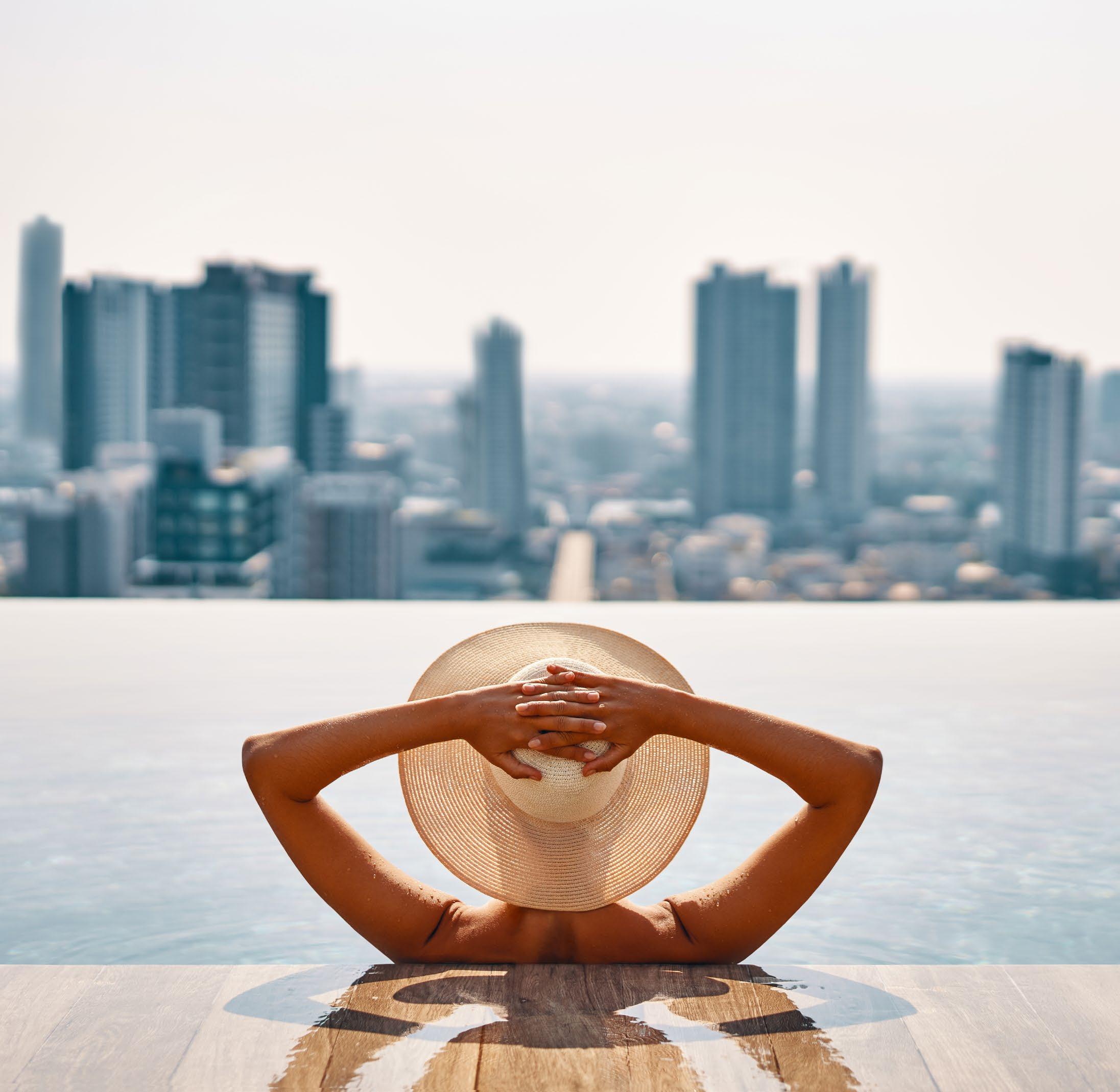

Consumers are looking for high-rise homes in well-connected urban locations such as the Kuala Lumpur (KL) City Centre and Johor Bahru, especially those with lifestyle perks such as gyms, retail, and cafes. Such areas appeal to buyers and renters with the prospect of time-saving commutes, integrated living, and appreciating property values.

Well-connected public transportation is most likely to boost a property’s value, according to 71% of property seekers surveyed by the PropertyGuru Malaysia Consumer Sentiment Study in H2 2024. When searching for a place to rent, 73% of respondents took commuting distance to workplace into account.

R&F Princess Cove by R&F Development Sdn Bhd has won the titles of Most In-Demand High-Rise Development For Sale (Malaysia) and Most In-Demand High-Rise Development For Rent (Malaysia) at the Consumer Demand Awards. The 10-tower complex features a sizable amenities floor and even boasts its own opera house, yacht club, and restaurant hub. Furthermore, prospective buyers and tenants can choose from a variety of layouts at R&F Princess Cove, including studios and multi-bedroom apartments that range from lofts to dual-key and sea-view residences.

Even in the hybrid work era, office spaces near lifestyle zones are seeing high interest from consumers. Modern offices in KL and Cheras are especially attractive because of the great value they give to startups and established investors alike.

As the commercial industry continues its flight to quality, several properties have stood out to office renters and buyers.

Mutiara Central Cheras by Mutiara Johan Group has won the titles of Most In-Demand Office For Sale (Malaysia) and Most In-Demand Office For Lease (Malaysia) at the Consumer Demand Awards. Demand For this commercial address can be attributed to its central location in the heart of Cheras Business Centre, with superb connectivity to expressways, highways, and public transport hubs, including the LRT and MRT. The offices are also situated above a seven-storey retail complex. Among its many recreational facilities, the complex features a pool, offering a place of respite for harried workers.

In Kuala Lumpur, consumers have shown their preference for The Exchange 106 by Mulia Property Development. The development has won Most In-Demand Office For Lease (Kuala Lumpur), thanks to its column-free office spaces, extensive amenities (including a sky lobby), and retail and dining options. It also features a sustainable design, having achieved the Green Building Index’s prestigious Gold Standard. A mainstay of Kuala Lumpur's skyline, the building towers 106 floors high, part of the broader Tun Razak Exchange (TRX) development.

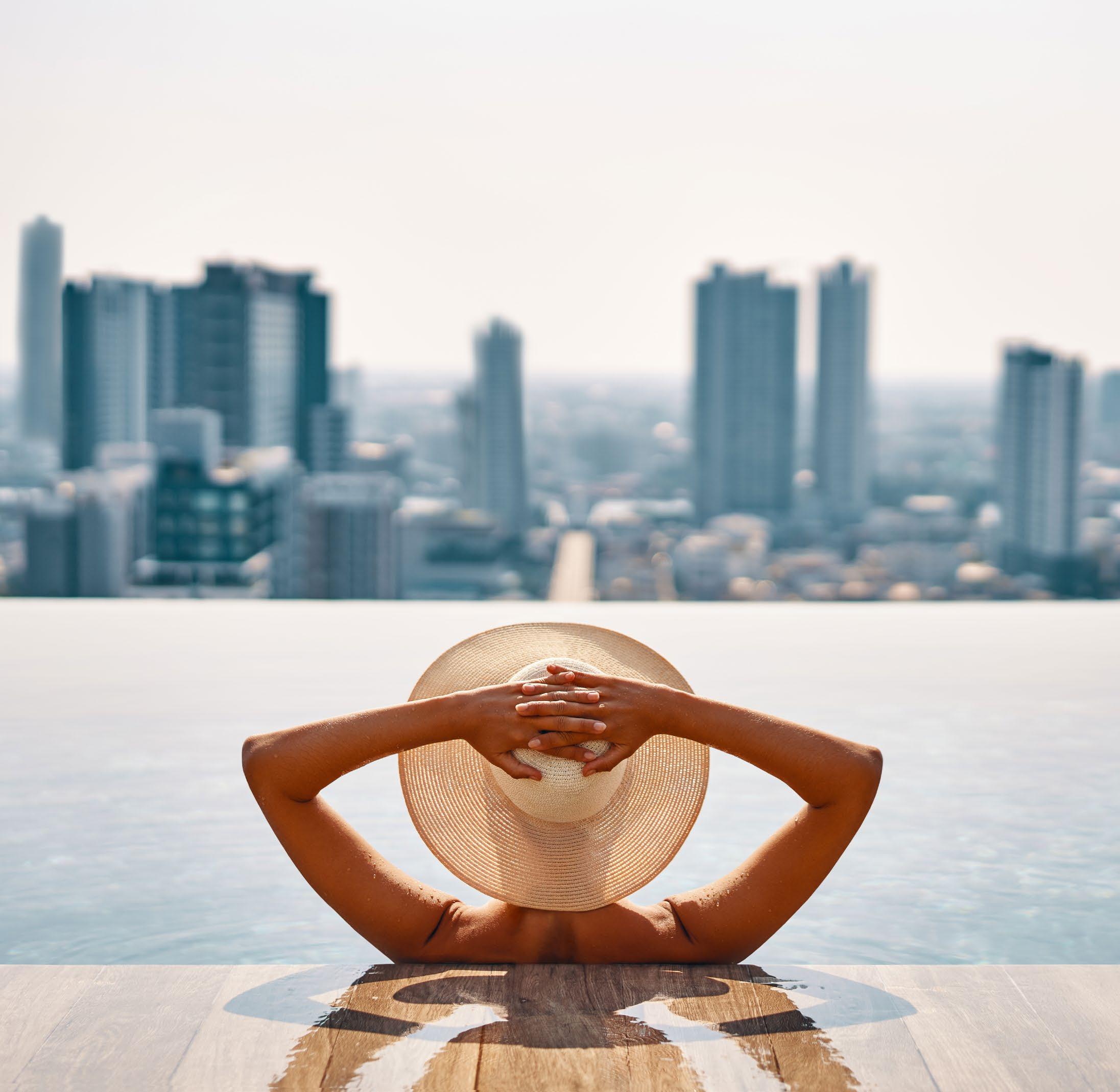

Meanwhile, City Square Office Tower by Berinda Group has been recognised as the Most In-Demand Office For Lease in Johor. Commercial property seekers appreciate the development’s impressive 24-hour security system and abundant car parking spaces. City Square Office Tower is also easily accessible from the Johor Bahru city centre via Jalan Tebrau and Jalan Wong Ah Fook, turning the office commute into a five- to 10-minute journey.

Smoother cross-border travel has renewed demand for Johor Bahru (JB), not only from Singaporean investors seeking affordable second homes but also Malaysians working in Singapore. Around 300,000 Malaysians, many of whom work in Singapore, cross the Johor-Singapore Causeway daily.

With lower property prices, waterfront living, and better cost-quality balance, homes in JB offer smart investment as much as smart living. Interestingly, this demand is not limited to high-rises. Gated estates offering privacy, greenery, and leisure-focused amenities are also gaining traction, particularly among Singapore-based buyers seeking a weekend home or lifestyle upgrade just across the border. Offices near the Causeway are equally popular, appealing to businesses leveraging the Singapore-Malaysia connection.

In Johor Bahru, R&F Princess Cove by R&F Development Sdn Bhd has been named Singapore’s Most In-Demand Malaysian High-Rise Development, having received the highest number of property searches from Singapore IP addresses. Set just across the Johor Straits from Singapore, R&F Princess Cove is winning over property seekers with its proximity to JB Sentral Bus Terminal and the adjacent KTM JB Sentral Railway Station.

R&F Princess Cove is also strategically located near two exciting new transit routes: the High Speed Railway (HSR) connecting Kuala Lumpur and Singapore and the Johor Bahru-Singapore Rapid Transit System (RTS) interchange station, linking Johor Bahru with the Singapore Woodlands MRT.

Meanwhile, Leisure Farm by Mulpha International has been recognised as Singapore’s Most In-Demand Malaysian Bungalow House. Often likened to Kenny Hills in Kuala Lumpur, Leisure Farm is Johor Bahru’s most prestigious address for luxury landed living.

Spanning acres of manicured greenery and built around lakes and themed precincts, the gated estate offers an exclusive retreat for Singaporean buyers seeking a high-end weekend home or tranquil lifestyle upgrade. With its proximity to the Second Link, international schools, and world-class leisure amenities, Leisure Farm combines cross-border convenience with

Malaysians are clicking where it counts. Popularity online often mirrors value on the ground, making web traffic a powerful indicator of property demand.

If developers get one takeaway from the Consumer Demand Awards, it is this: Trust the crowd. When thousands of Malaysians are searching for the same developments, this behaviour speaks volumes about what developers should create next, and where.

The Consumer Demand Awards offer the first step in this direction. Whether you’re buying your first home or investing in your next office, follow the data.

This isn’t a popularity contest—it’s a peek into real demand. Based purely on search and enquiry activity from 1 January to 31 December 2024, these developments stood out as the top picks for Malaysians looking to elevate their lifestyle.

Most In-Demand High-Rise Development For Sale (Malaysia):

R&F Princess Cove by R&F Development Sdn Bhd

Most In-Demand High-Rise Development For Rent (Malaysia):

R&F Princess Cove by R&F Development Sdn Bhd

Singapore’s Most In-Demand Malaysian High-Rise Development: R&F Princess Cove by R&F Development Sdn Bhd

Singapore’s Most In-Demand Malaysian Bungalow House: Leisure Farm by Mulpha International

Most In-Demand Office For Sale (Malaysia): Mutiara Central Cheras by Mutiara Johan Group

Most In-Demand Office For Lease (Malaysia):

Mutiara Central Cheras by Mutiara Johan Group

Most In-Demand Office For Lease (Kuala Lumpur): The Exchange 106 by Mulia Property Development

Most In-Demand Office For Lease (Johor): City Square Office Tower by Berinda Group

For more information on Malaysia’s most wanted properties, explore PropertyGuru.com.my and iProperty.com.my

Whether you’re screaming at scary flicks or swooning over rom-coms, these home theatre companions create an immersive, blockbuster-worthy experience

LG’s new 65-inch C5 OLED TV bursts with millions of selflit pixels, enhanced by a brightness booster, AI features, and Dolby Vision. With WebOS 25 for easy streaming and a slim profile with marble-like panelling, the set is eye candy inside and out.

From USD2,699.99, lg.com

Even the smartest TVs deserve breathtaking sound. The Sonos Premium Immersive Set—including the Arc Ultra soundbar, Sub 4, and Era 300 speakers—delivers 9.1.4 Dolby Atmos surround and earthshaking bass powered by nearly 30 audio drivers.

EUR2,356, sonos.com

Turn any room into your personal theatre with the Epson Home Cinema LS11000. This projector delivers dazzling 4K clarity, powered by multiarray laser diodes and 3LCD technology. With radiant brightness, rich contrast, and ultra-low lag, it performs as well for gaming as for movies.

USD4,499.99, epson.com

With the brilliance of 2,600 ANSI lumens, the BenQ GP520 projector brings powerful home theatre on the go. Featuring HDR10+ support, integrated speakers, and a compact design, it projects 4K images from 50 to 180 inches, perfectly aligned, on any wall.

USD1,499, benq.com

The Google TV Streamer unifies your favourite streaming services in one sleek hub. Enjoy 4K HDR with Dolby Vision and Atmos, personalised recommendations, 32GB storage, and an ultra-fast processor. With smart home integration, it also controls lights and other devices—so you only stand up for popcorn.

USD99.99, store.google.com

From morning coffee to evening cocktails and gourmet dinners, these furnishings turn your kitchen and dining area into a destination for connection

FROM THIS PERCH

The Blu Dot Racer Stool brings style to your kitchen bar with a unique cushioned seat featuring a peekaboo design. Standing 30 inches tall, it has a powder-coated sledge base and multiple fabric options, including mould-resistant Sunbrella and durable Maharam.

USD595, bludot.com

Songmics’ stackable shelves maximise cabinet and countertop space with a clever, customisable design. Sturdy enough to hold 33 pounds, they neatly organise jars, plates, cutlery, and even cookbooks. Stacked, nested, or standalone, these shelves tidy your kitchen and streamline storage instantly.

USD49.99, songmics.com

USD5,999.95, dometic.com DETAILS

Green Row’s Easthill dining table exudes rustic appeal and eco-friendly elegance, thanks to FSC-certified construction in Vietnam. Set on solid-oak turned legs, the table extends from six to eight seats with an oak-grain plank top—perfect for gatherings big or small.

USD1,999, greenrow.com

Red Barrel Studio’s modinspired kitchen cart offers storage and counterspace on demand. With a butcherblock top, wine rack, spice shelves, and lockable wheels, it’s a mobile yet sturdy solution for small spaces. Finished in mint green or white, it adds farmhouse chic to any kitchen.

USD395, wayfair.com

The Dometic Mobar 550 S Mobile Bar takes your F&B prep outdoors. This weatherproof, stainless-steel cart not only has a cuttingboard top and dry storage, but also an LED-lit, dual-zone refrigerator with a 39-bottle capacity.

Things don’t have to go bump in the night with lighting and décor fit for this season’s spooky parties

Put your dinner guests in the mood with Crate & Barrel’s Nightfall Appetiser Plates. Gothic decals—black cats, bats, crows, skulls, and moths—adorn this 10-piece set of handglazed ceramic plates. A black-finished iron stand completes the set, summoning six-inch servings in dark style.

USD59.95, crateandbarrel.com

Terrain’s exclusive Rattan Bat fuses seasonal whimsy with artisanal craftsmanship. Available in multiple sizes, this handwoven nocturnal creature adds texture to walls, mantels, and chairs—a festive accent in the spirit of Samhain.

From USD72, anthropologie.com

Studio Arhoj’s porcelain Ghost Light softly glows when holding a tealight or LED. Handmade in Copenhagen, it’s a spectral sight with its translucent glaze and wideeyed charm. At just 16 centimetres tall, it makes a haunting table centrepiece or ambient window display.

USD42, arhoj.com

The MacKenzie-Childs Squashed Glossy Medium Pumpkin reinvents holiday décor with eccentric style. Hand-painted in the brand’s trademark Courtly Check, the resin piece comes with a golden stem and shiny finish. An eyecatching alternative to your usual orange gourds, it easily steals the autumnal spotlight.

USD149, mackenzie-childs.com

Pottery Barn’s Skeleton Cheeseboard is a coffin-shaped wooden tray with skeletal metal details: Its bony “hands” hold everything from crackers to fruit and charcuterie. A macabre twist on an entertaining essential, it spreads Halloween fun in a cheesy way.

USD54.97, potterybarn.com

Sansiri’s new ultra-luxury project captures a generational shift in wealth with marble, courtyards, and seclusion

BY AL GERARD DE LA CRUZ

In the afterglow of The White Lotus, one might expect Thailand to quake under global demand for cinematic stays and homes. But BuGaan Pattanakarn, an ultraluxury landed development from Sansiri, more than lives up to the fantasy.

Snapped up by high-net-worth Thais, the 17 limitededition, three-storey homes along leafy Pattanakarn Road were named Best Housing Development at last year’s PropertyGuru Thailand Property Awards.

Averaging 578 square metres, with price tags climbing past THB176 million (USD5.5 million), the homes target “old money” or their ambitious heirs. Each residence opens onto its own pool and courtyard within a gated enclave that reads like an atlas of material and landscaping choices.

Sansiri completed the standalone mansions in 2023, before launching sales—a calculated move that lets buyers experience the properties firsthand.

The neighbourhood was no accident. Seven years ago, Sansiri planted its flag on Soi Pattanakarn 30 with Baan Sansiri Pattanakarn, a super-luxury development of twostorey homes that sold out in under two years. The prime

location remains one of the closest low-rise enclaves to Thonglor, Ekkamai, Sukhumvit, and other central Bangkok hubs, with quick links to major roads and expressways.

Land has only grown scarcer since, topping THB170,000 per square wah. So when a rare, six-rai parcel became available on Soi Pattanakarn 32, Sansiri seized the opportunity.

“For us, we create not only houses but also communities where families can thrive and where innovation meets sustainability,” says Vatanyu Tantivong, vice-president of aesthetics and interior design at Sansiri. “A house is not just a place to live but a sanctuary, a place that balances beauty with functionality.”

Like the old money it courts, BuGaan Pattanakarn takes inspiration from the past. Bangkok design practice b | u | g studio drew on Renaissance-era urban planning, laying out the 10,313-square-metre site on an orthogonal grid.

The European references run throughout. Landscaping specialists TK Studio imported a thousand-year-old olive tree from Spain and set it beside a fully enclosed, five-metre marble wall at the entrance. The arrival court is paved with granite cobblestones, lending a sense of permanence.

ON A COMPACT URBAN PLOT, THE RESIDENCE INCLUDES AN INNER COURTYARD AND, FOR THE FIRST TIME IN A SANSIRI

A clubhouse, fitted with artisanal Polish fitness equipment and fronted by a monumental fountain, anchors the community alongside a central garden. Two main axes ease traffic flow, while Syzygium antisepticum trees and tropical shrubs, arranged in geometric masses, reinforce the ordered landscape.

The master plan minimises sightlines between homes, preserving seclusion. Buildings are staggered to prevent direct frontage views, instead opening to sunlight and air.

The homes themselves continue an architectural narrative termed the “Modern Classic Twist,” merging Mid-Century Modernism with 1950s–70s Italian design. Wide openings and open-plan layouts appeal to a clientele trading highdensity pieds-à-terre for prestigious detached addresses.

One show home doubles as a tribute to the late American hotel designer Edward Tuttle. The villa bears signatures of his aesthetic, from kang beds and full-height mirrors to appliqués and dual vanities. “With our philosophy and attention to detail, we design and craft every element, from materials to interiors, without compromise,” says Vatanyu.

In a first for Sansiri, each residence comes with a 10-metre

lap pool on the second floor, the façades carefully composed to screen swimmers from prying eyes. The homes also centre on a private courtyard, with a lift connecting all levels and parking space for collectable supercars.

Declaring a love for Italian heritage and Art Deco, Waranz Design Group curated artworks and decorative lighting pieces for every house. The Bangkok-based designers also translated those influences into sculptural furniture, refined palettes, and sumptuous materials. Marble archways and bespoke flooring patterns underwent multiple refinements as colours, textures, and finishes were mixed. “We crafted interiors that embody individuality and cultivated taste,” they note.

Mat Dept clad the project in StoneSurface, an ultra-thin stone veneer seen on landmarks like the MahaNakhon tower. For BuGaan Pattanakarn, b | u | g studio specified a premium Silvergrey variant, enhanced with Layer+ technology and finished through intensive grinding.

“Within construction constraints, we selected natural stone veneer as the primary material, incorporating varied textures and finishes to form a layered composition,” the studio explains.

In our view, ‘old money’ is not about overt displays of luxury but quiet elegance found in the details

If BuGaan Pattanakarn follows a “Modern Classic Twist,” its show home spins a different thread: “Modern Authentic Twisted.”

Developed with Design Realization Siam, the Thai arm of Edward Tuttle’s Paris practice, the residence channels the late designer’s hospitality vision into private interiors.

Tuttle’s vocabulary of local materials, simple order, and modest form translates well into the showpiece. “There are many projects that imitate European or mid-century styles, or whatever happens to be trendy,” the team says. “But what we try to do is create the best version of ourselves.”

The villa includes telling touches of Tuttle: Jim Thompson fabrics, Gilles Caffier ceramics, and custom furniture.

Tuttle famously collaborated with Thompson, experimenting with silk to create contemporary, non-traditional patterns that were still unmistakably Thai. “Modern Authentic Twisted has always defined what we do,” the team explains. “It’s a metaphor for silk yarn from a village loom, used to make traditional cloth. It allows designers to weave their own fabric into furniture. It is the perfect match.”

In the end, the home is not just a model unit but a remembrance. “We wanted this to be a memory of Edward,” they add.

CHANNELLING DESIGNER EDWARD TUTTLE’S TASTE-MAKING SENSIBILITIES, THIS VILLA EVOKES LUXURY THAI HOTELS WITH JIM THOMPSON FABRICS AND NATURAL WOOD

Marble defines the project’s sense of luxury. Sansiri makes an annual pilgrimage to the Marmomac fair in Verona, sourcing natural stone directly from quarry owners. Imported blocks line foyers, bathroom walls, countertops, and sinks. The main gate gleams with black Belvedere marble streaked with golden-brown veins.

“In our view, ‘old money’ is not about overt displays of luxury but quiet elegance found in the details,” says b | u | g studio. “We expressed this through balanced proportions, clean lines, and tactile warmth.”

Construction began in 2021, with Sansiri employing a single contractor—unusual in a city where most singlehouse projects juggle many. By 2025, the development had generated THB1.45 billion in revenue.

Most buyers are Thai end-users familiar with the location, according to the company. A smaller share comprises seasoned investors seeking detached houses.

The abodes suit Sansiri’s intended clientele, with extensive customisation options for a new generation of affluent buyers seeking individuality through bespoke spaces. The project’s mantra says it best: “My home speaks for myself.”

“We craft luxury for a young generation,” says Vatanyu. “We curate the art of living—custom-making, handpicking, and designing to deliver world-class living memories.”

Inherited wealth looks different today. Sansiri has seen a generational shift since its pioneering foray into Pattanakarn Road. Where buyers of Baan Sansiri prized plot sizes and façades, BuGaan’s residents assign more value to interiors, proportions, material quality, and privacy.

These shifts are crystallising as Thailand—where 20% of the population is now over 60—undergoes one of the largest intergenerational wealth transfers in history.

BuGaan Pattanakarn reflects this new reality, keeping pace with the heirs on home soil. “This is just the beginning for us,” says Vatanyu. “We look forward to pushing boundaries, elevating standards, and setting new benchmarks for luxury living in Thailand.”

A POOLSIDE LOBBY LOUNGE PROVIDES A REFINED SETTING FOR BUSINESS AND LEISURE AT THE CLUBHOUSE, COMPLEMENTED BY A PANORAMIC FITNESS STUDIO FEATURING PENT. EXERCISE EQUIPMENT

ALAN ZEMAN IS EXCITED ABOUT PHUKET’S POTENTIAL AS A HUB FOR HIGH-END INVESTORS

Luxury used to be about surface: brands, finishes, reputation. That’s changed. Now it’s about how people use space. How it supports their routine, their health, and their values

Asia real estate legend Alan Zeman is harnessing his deep knowledge and nose for buyer trends to take the luxury residential sector in Phuket to dizzying new heights

BY LIAM ARAN BARNES

SUDARA IS DESIGNED TO DELIVER LUXURY AT AN ACCESSIBLE PRICE, SAYS ZEMAN

“I doubt you can still find outlooks like this anywhere on Phuket,” says Andara’s sales manager. “Or the world for that matter.”

It could easily come off as sales patter. But he’s got a point. The view from one of the resort’s grandest hilltop villas is the very definition of cinematic. Kamala Bay curves below, rooftops glint on Millionaire’s Mile (a famously salubrious stretch of high-end residential homes), and the Andaman stretches out in layers of deepening blue.

Even the Andara staff can’t resist a few selfies against the backdrop whilst we wait on the terrace for Alan Zeman, Asia real estate development legend and Andara mastermind, to finish a last-minute call with a prospective buyer from Hong Kong.

The midday sun breaks through the clouds, bouncing off the surface of the infinity pool. It’s getting hot. Fortunately, the Provençal rosé about to be consumed with lunch is on ice. The in-villa chef checks if we’re ready for his take on Thai classics. We are.

A few minutes later, Zeman rocks up in one of his signature high-collared white shirts, yoga pants, and spotless designer trainers. Best known as the founder of Hong Kong’s Lan Kwai Fong nightlife district, Zeman developed Andara more than

15 years ago as a personal retreat that quickly turned into one of Phuket’s most luxurious resorts and helped set the tone for the island’s upscale evolution.

But the topic of our alfresco lunch is Sudara, his new hillside development just down the bay. Built on a dramatic slope in Bang Tao, it’s aimed at a new generation of buyers seeking liveability, rental returns, and bold but restrained design.

We also discuss Phuket’s post-pandemic renaissance, the shifting psychology of luxury buyers, and Zeman’s newfound love of Chinese EVs.

Let’s start with what you’re building now. What sets Sudara apart in today’s market?

Sudara is designed to deliver the feeling of a luxury resort at a more accessible price. That’s what people want now: something beautiful, but also smart.

One of the big moves we made was putting all the parking underground. It’s rare in Phuket. Most developers avoid it because of the cost. But it completely transforms the environment. You get more space for gardens, proper landscaping, and a stronger sense of arrival. The whole place feels cleaner, more peaceful. It adds 15–20% to the cost, but it increases value and helps the project move faster.

We’re also thinking about the sensory experience: lighting, textures, aromatherapy. I had a designer in just the other day to talk about scent. That’s the level of detail we’re working at. People sometimes walk into the sales office thinking it’s a spa and ask for a massage. That tells you something about how it feels.

How are buyers responding?

Interest has been strong mainly from Hong Kong, the Middle East, Europe, and Russia. We’ve seen buyers come in, look around, and make decisions quickly. When the product is good, it sells itself.

Rental appeal is another draw. The market’s changed. Phuket used to have a high and low season. That’s gone. Climate change has brought new demand, especially from the Middle East. In Dubai, it’s 55°C. Here, it’s 35°C—and that feels like a relief! So, what used to be quiet months are now full. That shift has changed the rental model completely.

Are you still focused solely on residential, or are there plans for something more?

For now, we’re finishing phase one of Sudara, and that’s already got enough pre-sales for bank financing. We’re starting construction right away. Thai banks have been more

conservative since the pandemic, and because of the wider geopolitical situation, but we’ve worked with them for years and built trust.

We’ll roll into Phase 2 next. Originally, we were going to do three more residential blocks, but the market’s changing, so we’re keeping it flexible. Maybe a hotel, maybe something branded. You’ve got to respond to what people want and what the world looks like by the time you’re ready to build. I like to leave room to pivot. Once you start pouring concrete, it’s too late.

You’ve built a reputation for delivering not just product, but experience. What makes the Andara and Sudara brands work?

It starts with trust. People walk into an Andara villa or a Sudara unit and they feel calm, looked after, and comfortable. That’s not something you can fake. It’s about every decision from the lighting to the furniture and the layout.

We’ve had so many repeat guests at Andara that they feel like part of the family. The same thing’s happening at Sudara. Homeowners from all corners of the world are coming in, feeling connected, and forming a community. That kind of loyalty gives us room to grow.

PHUKET

We’ve also brought in someone in Bangkok to explore brand expansion, offering Andara and Sudara as management flags for other properties. There’s a real appetite for experienced operators who can deliver both standards and service. It’s the next natural step.

You’ve said Phuket is ‘growing up.’ What’s driving that shift?

It’s no longer just a holiday destination. People are choosing to live here. They’re enrolling their kids in international schools. They’re accessing quality healthcare. The airport’s strong. The lifestyle works.

The shift is visible. Walk around Boat Avenue (luxury mall) at night, and you see it. People from all over the world are settled in and going about their lives. It’s still a resort, but it’s also becoming a functioning city. That changes the type of product people look for, too. It needs to suit daily life rather than just weekend escapes.

Are their expectations changing, too?

Completely. The checklist is longer. People want wellness, flexible layouts, natural light, and proper workspaces. They want to feel part of a neighbourhood.

At Sudara, we’re already seeing homeowners connect. Some are from Germany, some from the UK, and others from Asia. They meet at breakfast and exchange stories. That sense of belonging happens naturally. It’s hard to quantify, but it makes a huge difference.

You’ve worked across Asia for decades. What’s your outlook on luxury real estate in the region?

Luxury used to be about surface: brands, finishes, reputation. That’s changed. Now it’s about how people use space. How it supports their routine, their health, and their values.

The buyers coming in now live across regions. They work in one city, invest in another, and travel often. Property must keep up with that. It has to feel intuitive, personal, and highfunctioning.

Branded residences can help if the name carries weight. But execution matters more than branding. Smaller players can stand out if they’re focused and local. There’s room for everyone if the product is smart.

They’re already here. Younger investors, especially across Asia, are entering the market with different priorities. They’re less impressed by excess. They want functionality, connection to nature, and flexibility.

Optionality is key. Live in it, rent it, sell it, whatever fits their moment. Developers who understand that will thrive.

How do you see proposals for casino development in Thailand playing out?

I think it’ll happen—but likely as integrated entertainment complexes, not just gaming floors. Think Marina Bay Sands in Singapore. It’ll be a full offering of hotels, shows, retail, food, and wellness.

Thailand already has the brand. Tourists love it. With the right model, it could become a major draw. Phuket might even lead the way. It’s manageable, it has the airport and the infrastructure, and the demand is there.

What matters is quality. If it’s done well, it’ll bring in tax revenue, tourism spend, and better public services. But it must be world-class.

I’ve been lucky to contribute to Hong Kong’s growth, and now Phuket’s. I still love the process of seeing something come to life and knowing it works for people.

We’re living in an accelerated world. AI, EVs, and geopolitical shifts, for example, are all reshaping how we live and invest. Developers must anticipate more, adapt quicker, and build for longevity.

I just bought an EV from China. Never thought I would! It’s packed with tech, drives beautifully, and costs a fraction of a certain German car. It’s a small decision, but it says a lot about how quickly things shift and how important it is to stay open to change.

That kind of mindset matters in business. But it also matters in leadership. Progress depends on good government. You can feel the momentum in Bangkok, in Phuket, and elsewhere in the region.

There’s a lot still to do. But the direction feels right.

Qin Pang’s logic-led approach to architectural problem-solving has helped steer the progress of global design practice Benoy in China

BY LIAM ARAN BARNES

Ask Qin Pang what he’d design with no brief or constraints, and he sidesteps the usual suspects. No museums. No cultural landmarks. No skyline-piercing towers. What he imagines is larger, stranger, and altogether more elemental.

“It would be a megastructure that functions like nature itself: filtering air, processing waste, and generating energy without becoming the centrepiece,” says the architect leading the Shanghai office of global design practice Benoy. “Housing would take a back seat. At that scale, humans are like birds in a forest.

“They’re not the purpose of the structure, but inhabitants finding shelter within a larger system.”

His focus is on the process. Logic. Systems that can withstand complexity. And after two decades navigating China’s rapid urban transformation, he has become more interested in what architecture enables than what it shows.

It’s a philosophy that has helped guide Benoy’s evolution in China.

“We have always adhered to respecting common sense and rational logic,” Pang says. “Balancing perspectives from operations, target groups, and culture, we infuse projects with unique spatial personalities and positive public space.”

That method faced its sternest test in Shanghai’s Xujiahui district. Eight years ago, Pang’s team entered an international competition to renew the No.6 Department

Store, a focal point of urban life for generations.

The renewal extended to neighbouring malls, public spaces, and pedestrian links, but also demanded thorny fixes: rerouting flows from multiple subway exits, reconciling the site’s red line with underground lines, and restitching skywalks and elevated green space into the fabric of the district.

“It felt like an impossible task,” he recalls. “But with support from the government, commitment from the client, and collaboration across disciplines, the issues were quickly resolved.”

For him, the experience showed that the interests of government, market, and community can be highly unified if you maintain patience, professionalism, and trust. It also reinforced his belief that complex projects cannot be solved in one sweep.

“We break projects into stages, focus on the primary issue at each point, and solve problems one by one until a comprehensive solution emerges,” he says.

That discipline has been shaped by the pressures of China’s densest cities. In places like Shanghai or Shenzhen, where land use, commercial return, and community expectations collide, Pang sees clarity as the architect’s greatest contribution.

“There is no contradiction between commercial success and urban quality,” he says. “They can complement and reinforce one another.”

QIN PANG DEPLOYS A MEASURED, LOGICAL APPROACH TO ARCHITECTURE WITH BENOY IN CHINA

Balancing perspectives from operations, target groups, and culture, we infuse projects with unique spatial personalities and positive public space

The definition of value, he adds, has shifted. “A decade ago, clients measured success in sales per square metre. Today, they ask how spaces can adapt to changing markets or support cultural connections. The value of architecture lies in its spiritual significance beyond physical worth.”

Return on investment remains central, but the calculation has broadened—factoring in brand equity, civic role, and long-term relevance alongside short-term profit. Pang calls this an integrated approach: a continuum from urban planning to interiors and energy systems, designed to sustain coherence at every scale.

“From the beginning, you set up a framework that guides decisions across disciplines and keeps the project aligned with its purpose.”

Alongside his practice work, Pang teaches and sits on juries at institutions across China, from Tongji University to Xi’an University of Architecture and Technology. “During rapid urbanisation, architects needed to judge quickly, make decisions promptly, and reconcile contradictions under intense pressure,” he says. “But as the pace slows and renewal becomes the priority, the value of design now lies at the micro scale.”

He believes the next generation must move beyond single-discipline training, connecting architecture with new fields of knowledge to develop methods of their own. “They must be able to demonstrate value at a smaller scale, but also in a way that injects vitality back into cities of every tier.”

That question of value extends beyond China’s borders, shaping how its architecture is understood abroad. Pang argues the world often lags in recognising the scale and ambition of China’s urban projects.

“I don’t think there are misconceptions so much as a lack of awareness,” he says. “China has opened up, engaged in dialogue, and learned from the world, but Western understanding of Chinese culture has been relatively slow to update. The recognised standards and evaluation systems for architecture are still rooted in Western knowledge.”

He hopes for a more balanced exchange, one where Chinese and international perspectives inform each other rather than remain siloed. “People need to use their own eyes and experiences to understand all aspects of the world,” he says. “Only then can we collaborate effectively on the challenges facing humanity and the planet.”

That ambition to think in systems rather than spectacles is, for Pang, the real measure of design. His imagined megastructure may remain hypothetical, but its logic already guides his work.

“It’s not about showing off form,” he says. “It’s about enabling function, life, and continuity.”

Whether in the renewal of a Shanghai landmark or the planning of a new district, Pang’s aim is the same: to create systems that endure, and to design environments where people—like birds in a forest—can thrive within a larger whole.

On the West Bund in Xuhui District, Mangoohub is a hybrid of workplace, stage, and cultural platform. The masterplan centres on a media square conceived as a public arena, where art shows, broadcasts, and festivals can spill into the city. “We wanted to avoid the sealed box that media centres often become,” says Qin Pang. “By opening the ground plane and treating the square as a broadcast stage, the building connects both to Shanghai and to the digital audience.” With office towers, flexible event spaces, and a riverside frontage, the project gives a broadcaster’s brand a distinctly urban form.

Two towers—273 metres and 173 metres high—anchor Alibaba’s new hub in the Wuchang district of Wuhan, rising above a six-storey retail podium and four levels of underground space. The geometry borrows from the interlocking Kongming lock, expressed in offset volumes and layered façades. “The lock was a way to think about resilience,” notes Qin Pang. “We wanted a form that looks simple at a distance but reveals a complex structure as you approach.” The blend of retail, offices, and shared amenities creates both a skyline marker and a working campus designed for internet firms and entrepreneurs.

Spanning 850,000 square metres, Nanjing Alibaba Centre is the company’s first selfbuilt and self-held park in Jiangsu. Six office blocks, a shopping centre, long-stay apartments, and a “trendy play street” are tied together by the one-kilometre Ali Corridor. More than a link, it acts as a linear public space with terraces and social nodes. “We thought of it as a spine,” says Qin Pang. “The corridor is not just about moving people but about creating chance encounters.” With LEED certification, the complex positions itself as an urban ecosystem where work and life interweave.

The Golden Bund Masterplan outlines a vision for a “Digital Capital,” integrating industry, culture, and sustainability. Its framework—“one belt, one axis, three areas”—organises the site into a global platform for business incubation, digital fashion, and ecological innovation. The design borrows from river culture and cloud technology, linking heritage with emerging industries. “We wanted a plan that reads like a system, not just a map,” says Qin Pang. “Each part talks to the others—commerce to culture, ecology to education—so the city evolves as a connected network.” With super-integration, super-ecology and a zero-carbon framework, the plan is both a digital hub, and a sustainable prototype.

Set beside the UNESCO-listed At-Turaif district, Bujairi Terrace was designed as a contemporary global destination anchored in Najdi architectural traditions. The scheme combines 27 F&B venues with cultural spaces, landscaped courtyards, galleries, and leisure amenities. “We had to create something modern enough to be a global draw, but rooted enough to belong next to At-Turaif,” says Qin Pang. “The Najdi style gave us that continuity, while the public realm brought the contemporary layer.” Framing dining terraces and cultural venues around lush outdoor spaces, the project delivers a landmark where tradition and modern lifestyle co-exist.

18 Cross, Singapore

Between Chinatown and the CBD, 18 Cross reimagines a 14,000-sqm site with a layered mix of heritage and contemporary architecture. Eighteen conserved shophouses, six new-build shophouses, a four-storey podium, and a 15-storey office tower form the scheme. The design concept, “Heart,” creates a porous network of alleys, courtyard, and social spaces that restore vibrancy to the precinct. “We wanted heritage to feel alive, not preserved behind glass,” says Qin Pang. “By stitching old shophouses into new forms, the project becomes part of the city’s rhythm again.” The result blends retail, workspace, and culture while strengthening community identity in a fastchanging district.

BY JONATHAN EVANS

Jimbaran, a former fishing village turned surf mecca, is home to some of Bali’s most glam residential and hotel properties

Damara Estate Jimbaran Hijau

Due to be completed in Q1 2026, this four-storey, 287-unit development is the combined effort of developer Greenwoods Group, interior designers ARHPA Studio, and architect MaeMoo. It sits at the confluence of many of Jimbaran’s bestknown addresses. Its tall windows and 60% green space add to the feeling of spaciousness. On Damara Estate’s doorstep are all kinds of family-friendly activities: Go Kart Bali, Balinese culture at the award-winning SAKA Museum, and the Sidewalk Jimbaran shopping mall. For outdoorsy types, New Kuta Golf Bali course beckons, while Balangan Beach is never far away. Residences are divided into four types: Damita, Dahayu, Daksa and Damita Signature, all detached homes with parking that allow users to reconnect with nature.

This elegant, bijou estate comprising 65 two-storey units aims to blend luxurious modernity with Balinese design’s clean lines, neutral palette, and traditional patterns. Scheduled for completion in mid-2027, the development features landscaped gardens, courtyards, and terraces interwoven throughout, courtesy of architects Studio ANSO, Studio ARHPA, and landscapers Hilltown Management. Sustainability and smart technology are at the forefront of mind, while plentiful water features, walking paths, pools, pavilions, fountains, and greenery add to the relaxed, freeing ambience. Communal spaces, including a gym, yoga shala, meeting rooms, and dining areas, foster a feeling of community among all ages even pets are welcome. Natadesa is also near international educational institutions (Biosphere Ecogreen School, Dyatmika School).

Garuda Wisnu Kencana Cultural Park

An extraordinarily ambitious, now iconic statue in this expansive, 240-hectare Badung park, GWK was designed and sculpted by architect Nyoman Nuarta, and inaugurated in 2018. This Hindu monolith was 20-plus years in the making and inspired by the Indian epic Mahabharata. It stands 121m tall and 64m wide, and was intended to become emblematic of Bali with its portrayal of the god Vishnu riding the mythological bird Garuda, Indonesia’s national symbol. It’s among Southeast Asia’s tallest statues and the 16th largest in the world; religious authorities denied its further expansion because it would disturb the island’s spiritual balance. GWK is so large that it’s visible from Tanah Lot, the ancient temple 30km away; to give a human perspective, a grown man could fit inside its eye socket.

Jimbaran’s modest size means it’s sometimes overshadowed by larger, trendier districts such as Seminyak and Canggu. But that’s precisely what gives it such allure. Artists and a laid-back spirituality brought it popularity prepandemic as Bali’s organic living area of choice. It’s also rife with tantalising, sophisticated stayovers, including AYANA Resort & Spa, art-hotel RIMBA, the InterContinental, Four Seasons, and Le Méridien. The quality of life has increased by leaps and bounds from a time not long ago when there was no electricity or potable water here, so it’s little surprise that developers are focusing their efforts on Jimbaran.

Jimbaran Fish Market (Pasar Ikan)

Situated at the north end of Jimbaran Beach, this massive market should top the list of any self-respecting pescatarian’s must-see attractions. Aside from its insights into community life, it’s a sensory assault, especially if you arrive as the morning catch is hauled in. All the familiar ocean-dwellers are here: giant tuna, trevally, salmon, snapper, and tropical favourites, including rainbow runner and multifarious sharks. Further into the market, there’s ample opportunity for retail therapy with a more distinctively local flavour. The dried fruit and herbs prevalent in Balinese cuisine dangle in plastic bags; hard-hitting coffee is available, including kopi luwak, or civetcat coffee; while at other stalls, vendors arrange leaves, tobacco and flowers into immaculate canang sari, the palm-leaf basket offerings of gratitude that adorn Bali’s temples and outdoor shrines.

One of Bali’s most visited attractions, this Hindu sea temple (pura segara) is dedicated to the Supreme God of Indonesian Hinduism and perches atop a 70m-high cliff in the Bukit Peninsula. It was significantly expanded a millennium ago by a Javanese sage and is also known as Luhur, a contraction of ngeluhur (“to go up”). At 6pm every evening, with the sunset as the backdrop, there’s a kecak (local dance and musical) performance. Its scenic qualities aside, Uluwatu has major spiritual significance, for it was here that another Javanese sage attained moksha, or nirvana. One of the temple’s most identifiable and notorious factors is its preponderance of long-tailed macaques, who take great delight in snatching visitors’ belongings such as cameras, sunglasses, and flip-flops (which they can, and do, eat).

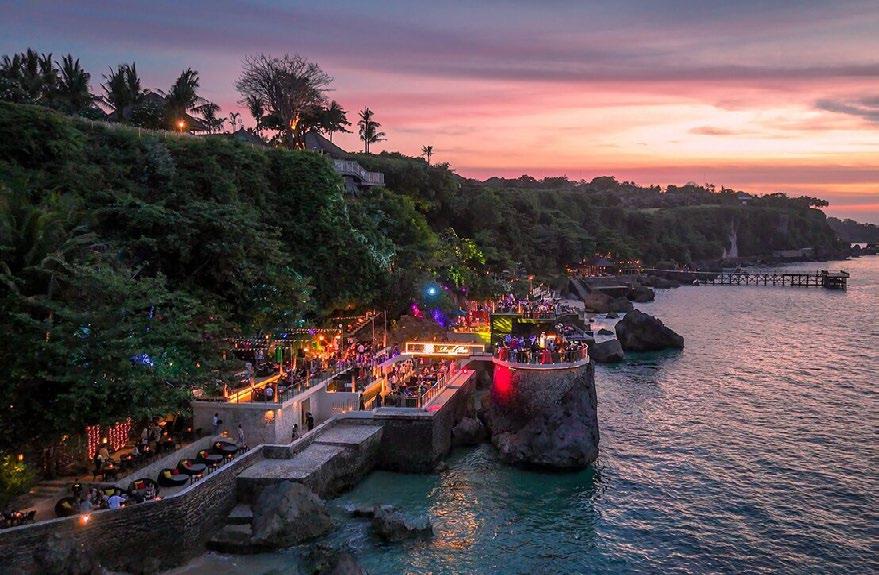

A highly popular and perennially fashionable highlight of AYANA Resort in Badung, the chic, 270m-spanning Rock Bar is a sunset setting par excellence situated just above the Indian Ocean. Affording imperious vistas of the cobalt-blue sea’s crashing waves as well as serving cocktails, finger food, or refined cuisine and live music, the open-air bar has everything an early-evening hotspot could reasonably offer, aside from perhaps fire dancers. Its seven distinct seating areas, each giving a different vantage point, centre on a glassencrusted bar sparkling with thousands of layers of recycled glass canes. The bar was the handiwork of Kyoto-born craftsman Seiki Torige, a Japanese émigré and consummate world traveller best known as one of the world’s most acclaimed glass artists.

Despite global uncertainty, luxury real estate in Japan—from ski resorts to city penthouses—continues to attract international buyers and investors, underscoring the country’s unique appeal as a nexus for global capital and lifestyle aspirations

BY AL GERARD DE LA CRUZ

RESIDENTIAL PROPERTY PRICES IN WINTERSPORTS HUBS LIKE NISEKO CONTINUE TO SOAR

Even during its infamous Lost Decade, Japan never lost its sheen, as the world devoured its anime and cultural exports long before South Korea’s K-wave took over screens and playlists.

Today, in a fragmented world of geopolitical tensions, Japanese real estate holds greater appeal for property seekers seeking a haven. From Hokkaido’s chalets to Tokyo’s penthouses, property seekers are tripling residential valuations even as escalating input costs drag developers down.

It’s all happening against the backdrop of tectonic macro shifts. Japan’s economy expanded at an annualised 1% in the April-June quarter, its fifth straight period of growth, buoyed by exports and capital spending.

In January, the Bank of Japan raised borrowing costs to 0.5%, the highest in 17 years. This was after lifting rates in 2024 for the first time since 2007, effectively ending the world’s last negative interest rate regime.

“Japan’s interest rates remain low compared to the US and

Europe so the immediate impact is minimal when a rate rise is small and expected,” says longtime investment banker Eddie Guillemette, CEO of Niseko-based property specialist Midori no Ki (MnK). “REITs probably feel the higher borrowing costs the most, given the amount of leverage they have.”

For policymakers, the balancing act is delicate. The corporate goods price index jumped 2.6% in July from a year earlier as US President Donald Trump’s tariffs cast shadow over growth prospects.

Tourism has been a powerful economic catalyst, driving upward pressure on the real estate market. Since Japan fully reopened its borders in 2022, foreign arrivals have broken records year after year. In 2024, international visitors hit 36.9 million; the first half of 2025 alone drew a new high of 21.5 million.

Popular tourist hubs understandably logged steep price spikes. The National Tax Agency reports average land values climbed 2.7% nationwide in 2024, the fourth consecutive annual gain.

Demand from UHNWI appears sustainable over the medium term, supported by asset diversification, succession planning, and yen weakness

The Asia-Pacific region is home to more than 160,000 UHNWI as of 2024, a figure expected to rise by nearly 50% by 2028.

It’s an expected source of demand for Japan’s luxurious homes. The number of residential transactions above JPY500 million in 2024 alone equalled the total of the previous decade combined, according to data from the Real Estate Information Network System (REINS).

The market’s marquee deal had been the Aman Residences penthouse, which sold in 2023 for a staggering JPY30-40 million per tsubo.

Other luxury brands are racing in. This year, Aston Martin and VIBORA unveiled №001 Minami Aoyama, the first supercardesigned home in Japan.

“Luxury condos in Tokyo and Osaka have strong demand from wealthy Asian buyers, especially Chinese and people from Southeast Asia,” says Eddie Guillemette, CEO of Niseko-based resort property specialist Midori no Ki (MnK).

The former are especially galvanising demand in the market. In 2018, Chinese nationals made up 40% of the foreign population in Chiyoda, Tokyo’s financial heart, according to Savills research. By 2024, their share had risen to 55%.

In the 1990s, Japan was far from the tourism behemoth it is today, the strong yen making travel prohibitively expensive. The dynamic has since flipped.

This summer, the yen slid past 150 to the dollar, with analysts warning of further depreciation to 155. About 10% of inbound tourist households report net assets exceeding USD1 million, leaving some extra to consider the country’s luxury residences.

Yet the tourist boom is uneven. Nearly 73% of all overnight stays are concentrated in the prefectures of Tokyo, Osaka, Kyoto, Hokkaido, and Fukuoka, the Japan Tourism Agency reports.

Osaka, which welcomed a record 14.6 million visitors in 2024, saw land values in its Naniwa ward fly by nearly 18% on demand for apartments convertible into private lodgings. Unlike Tokyo, Osaka allows more minpaku rentals in designated special zones, a policy which has stoked international investor interest.

Momentum has built since construction began in April on the

MGM Osaka Integrated Resort, Japan’s first casino complex. Home to renowned theme parks, the city also hosted Expo 2025. Consequently, average condominium prices have surpassed JPY1.2 million (USD8,130) per square metre.

Tokyo remains undervalued compared with peers like Manhattan, London, and Hong Kong, according to Savills Japan. “While it lags in liquidity and international visibility, Tokyo’s strengths, such as low crime and high-quality construction, are increasingly recognised,” says Tetsuya Kaneko, the real estate firm’s head of research and consultancy.

These fundamentals have propelled eye-watering price gains in the capital. The average cost for a second-hand, 70-square-metre condominium in Tokyo’s 23 wards hovered at JPY100.9 million in May, up by more than a third from a year earlier, according to research firm Tokyo Kantei.

Institutional capital, once wary of Japan, is even flowing back. “For many years, Japan’s real estate market was a no-fly zone for Japanese and foreign institutional investors while places like Niseko benefited from strong demand from

OSAKA’S MARKET IS BOOMING, THANKS TO DEMAND FOR APARTMENTS CONVERTIBLE INTO PRIVATE LODGINGS

affluent, foreign retail investors,” says Guillemette. “Since the end of Covid, demand has been strong across the board, but supply has not kept up.”

Japan’s steady income streams, coupled with the weak yen, have attracted family offices as well as ultra-wealthy individuals. Foreign investment in multifamily and luxury residential deals topped JPY740 billion in 2024.

“The positive carry in Japan—net income minus borrowing costs—has been relatively attractive compared with the US and Europe, where there are higher borrowing costs and similar income or yield,” says Guillemette. “The challenges

in China’s real estate market and the higher valuations in places like Australia and Singapore might be fuelling some diversification into Japan.”

Globalisation is palpable across Tokyo’s 23 wards, where nationals from not only China but also South Korea, Vietnam, and the Philippines dominate. Savills reports that around a third of the capital’s top-tier units are already foreignoccupied.

With March listings already commanding JPY40 million per tsubo, penthouses priced at JPY100 million per tsubo may no longer be fantasy, analysts predict.

“Condominium prices remain resilient due to structural undersupply, rising construction costs, and ultra-low vacancy rates in core areas,” says Kaneko. “Wealth accumulation among HNWI (high-net-worth individuals) and sustained foreign demand further underpin pricing strength.”

Indeed, not all jostle for the market from outside the archipelago. The Nomura Research Institute estimates households in Japan with more than JPY500 million in assets jumped from 90,000 in 2021 to 118,000 in 2023. Tokyo alone had nearly 6,500 ultra-high-net-worth individuals (UHNWI) last year, up more than 10%, according to wealth advisory Altrata. The UBS Global Wealth Report predicts Japan will

Tokyo’s residential market is splitting in two: Prime districts are booming while outer wards are softening.

Land prices in the city’s central five wards (C5W) are nearly 15% higher than in 2021, according to Savills Japan. The broader 23ward area isn’t far behind, up more than 10%. But beneath the averages lies a widening gap.

“We expect the bifurcation between prime and peripheral markets to persist, and potentially widen further in the short term,” says Tetsuya Kaneko, head of research and consultancy at Savills Japan. “Prime areas continue to offer wealth preservation, lifestyle appeal, and liquidity while peripheral markets remain more exposed to affordability and interest rate sensitivity.” Enhanced transport connectivity and urban upgrades could help outer-ward submarkets recover, he adds.

Although Japan’s recent rate hikes have modestly raised borrowing costs, levels remain low by international standards. Nevertheless, the hikes are expected to influence the bifurcation.

“This is likely to dampen price appreciation and mortgage activity in peripheral areas while prime segments, typically supported by cash-rich buyers, should remain relatively insulated,” says Kaneko. “This dynamic is also contributing to the widening bifurcation in market performance.”

have the third-largest millionaire population by 2028.

Japan’s resort markets show similar altitudes of decadence. Land prices in wintry Hanazono soared nearly 20% last year while Hakuba rose more than 32%, the nation’s highest increase for the second year running.

In Niseko, the influx of affluence has priced out local workers. “Residential property prices, both land and buildings, have increased rapidly over the past few years, making it harder for my full-time staff to buy property in certain locations,” says Guillemette. “That is leading professional staff to move further away from the ski resort centres.”

Cement, concrete, and lumber costs in Niseko rose to 38% last year, with skilled labour shortages expected to delay hotel completions past 2029, according to the consultancy C9 Hotelworks. Guillemette anticipates sustained demand for homes within a 20-minute drive of the mountains, likely elevating prices 5-15%, unless supply, policy, or currency shifts intervene.

“For resort towns like Niseko, where I am located, tourism is both a blessing and a curse for residents,” he says.

Overlaying this is Japan’s ageing society. Worker departures from hubs like Niseko may benefit towns with ageing populations. Inherited properties are trickling onto the market, creating opportunities for cautious yet ambitious buyers in the super-aged nation. “Younger generations, while less inclined toward homeownership than previous cohorts, still aspire to own homes, especially in convenient locations—if affordability allows,” says Kaneko.

This introduces a final layer of demand: foreign nationals who aren’t primarily tourists or investors but are instead filling employment shortages. Many come on specialised visas with minimum income thresholds and eventually join the property market. These highly skilled visa holders surged in number by more than 150% between 2018 and 2024.

The recent immigration-friendly trends carry caveats, with Prime Minister Shigeru Ishiba warning that individuals with “certain past records” will be barred from entry.

Wherever the demographic winds carry Japan, the demand picture looks dovish, lifted by affluent property seekers across Asia Pacific. With limited supply expected until the end of the decade, the very top of the market will remain robust and ready to welcome major developments in the years ahead.

“Demand from UHNWI appears sustainable over the medium term, driven by asset diversification, succession planning, and yen weakness,” says Kaneko. “Japan’s reputation as a stable, low-risk destination continues to attract global capital.”

If not in its homes, Japan will always project influence through soft power. But for now, a rare confluence of global escapism and uncertainty has made its property market a kabuki theatre for volatility and upside.

TOKYO’S

Tourism has powered Japan’s post-pandemic recovery, triggering a scramble for hotel assets.

Preliminary hotel investment volumes reached a record JPY1.1 trillion, cornering 20% of all real estate transactions in 2024, Savills estimates. Towards the end of 2024, average daily rates in Tokyo leapt 20% year-on-year to the mid-JPY30,000s.

The boom has led to local grievances throughout the country. Nearly 60% of residents surveyed by the Jalan Research Centre say their neighborhoods already feel “crowded” or “somewhat crowded.”

Kyoto has become a flashpoint, with residents complaining of congested streets, overwhelmed temples, and the erosion of local character. Despite moves to become year-round destinations, resorts like Niseko regularly hit gridlock during Christmas, New Year, and Lunar New Year.

“During those peak periods, Niseko is at full capacity. Traffic is heavy around the resort, and shops and restaurants are full,” Guillemette says. “Beyond those three weeks, it’s manageable.”

As Japan pursues its target of 60 million visitors by 2030, the housing and quality-of-life implications are increasingly difficult to ignore.

“Tourism tends to feel like overtourism when the number of people visiting makes daily living difficult for residents,” Guillemette adds.

Concerns remain over surplus inventory built by troubled Chinese property developers as prices continue to fall across all but a handful of major cities

BY STEVE FINCH

When Evergrande Group’s stock was delisted in Hong Kong on August 25, it came as little surprise to the markets. Shares had been suspended for 18 months, since January 2024, leading to automatic removal from the Hong Kong Stock Exchange, as flagged by the regulator two weeks in advance.

“In terms of market impact, the delisting barely moves the needle,” says David Zhang, a policy analyst at Trivium, a Beijing-based intelligence advisory. “Evergrande has been the face of China’s property crisis for years, and markets have thoroughly digested each stage of its collapse.”

Yet the fallout within the group and among partners continues. Hundreds of Evergrande projects remain incomplete, and fears linger that the company’s slow demise acts as both a contagion and precursor for other large, indebted Chinese developers.

A week before the delisting, a court in Guangzhou instructed subsidiary Evergrande Real Estate Guangdong to begin bankruptcy proceedings. The following day, financial partner Shengjing Bank announced its own delisting from the mainland and Hong Kong. Formerly part-owned by Evergrande, the bank’s decline has mirrored that of its former parent, with trading volumes in Shengjing Bank stock negligible in recent months as investors steered clear of Evergrande-affected assets. Based in Shenyang in the north-east, Shengjing Bank’s customers are mainly from the surrounding region, thousands of kilometres from Evergrande’s Guangzhou headquarters—an indication of how far the financial fallout has spread.

Guangdong, Evergrande’s home province, remains the most affected in terms of unfinished residential projects, with more than 150 still to be completed. Yet its plethora of empty housing units—and the many buyers who have paid deposits

but remain unable to move in—extends nationwide.

In Sichuan, Evergrande has yet to complete 85 residential sites; 67 in Shandong; and 60 in Liaoning, among dozens of other provinces. Last year, there were an estimated 48 million pre-sold homes across China awaiting completion including those by Evergrande and other indebted developers, according to Bloomberg Intelligence.

“What really matters now is whether the surviving property giants, who remain under severe financial strain, can weather the storm,” says Zhang of Trivium. “If household names like Country Garden or Vanke were to go the way of Evergrande, it would look to many Chinese as proof that years of government intervention hadn’t worked, and the damage to confidence would be far greater.”

The continued slide in housing prices indicates that underlying market dynamics remain weak, with no end in sight. Of the largest cities in China, only Shanghai and Hangzhou recorded price growth

While many of China’s big cities have seen signs of improvement in their more desirable centres, the capital continues to record stronger activity on its outskirts, where prices have stabilised amid a steady flow of new buyers.

In August, the Beijing government announced its latest policy to promote this more affordable periphery by further relaxing purchase restrictions, allowing more first-time buyers, and introducing favourable mortgage terms for properties outside the Fifth Ring Road, around 10 kilometres from the centre.

The subway system has expanded over the past two years to reach the Fifth Ring, including Line 12 and the Changping Line South extension in the north-east, which opened in late 2024. The city government is planning further new lines this year linking parts of the popular Chaoyang District beyond the Fifth Ring.

In the first seven months of 2025, more than 80% of new home sales in the capital were outside the Fifth Ring Road, alongside more than half of all secondhand transactions, according to China Index Academy. Although average new home prices in Beijing fell 3.6% in the year to July, the market remained stable compared with June, making Beijing one of the few major cities not to report price regression over the same period.

HANGZHOU

on new housing units above 1% in the year to July, and just five of 70 cities saw any increase at all. Worse still, the second-hand housing market recorded price declines in every major city, according to official central government data released in August. Among the three worst performers for new builds, two—Beihai and Tangshan—were tier-three cities, with declines of 6.7% and 6.5% respectively.

Recent data further suggests “the divergence is widening” between dynamic hubs such as Shanghai and Hangzhou and smaller cities, which remain “oversupplied and weak,” says James Macdonald, head of research for China at Savills, who describes the positive official data for Shanghai and Hangzhou as “somewhat misleading.”

“In Shanghai, much of the uplift comes from new launches in prime central areas where caps on sale prices have been loosened, pushing values higher,” says Macdonald. “Broader suburban areas and the second-hand market remain weak, so the growth figure does not reflect a broad-based recovery. Hangzhou shows similar dynamics.”

Shanghai has continued to show mixed signs in recent months, with sales of new high-end units plummeting by more than 50% in the second quarter compared to the first. But average transaction prices and second-hand unit

volumes are rising, according to Savills data.

The decrease in new, high-end sales is partly due to a fall in new project launches, as developers seek to match supply to still fragile demand for fear of further fuelling the market’s chief problem: oversupply.

Shanghai’s city government continues efforts to clear inventory and boost sales. In June, Minhang District acquired 7,500 square metres of unsold housing stock and converted it to rentals. In late August, the city government announced a further relaxation of housing purchase restrictions outside the outer ring road, alongside additional reductions in mortgage costs, in its latest bid to spur the market.

In May, China’s central bank cut benchmark rates, continuing a downward trend in mortgage costs. By August, average mortgage rates in China had fallen to about 3.13%, down from 3.35% a year earlier. In Shanghai, rates had dropped to just above 3% by July, down from just over 5% in 2021 when China’s housing crisis began.

Chengdu, in south-western China, is one of the few cities to have recorded any residential price growth over the past year, fuelled partly by a sharp reduction in supply within its first ring road. This led to a 6.5% increase in house prices

MACAU’S REAL ESTATE SLUMP HAS SEEN PROPERTY PRICES DROP

40% SINCE THE MARKET PEAK IN 2018

A mansion in Hong Kong sold for HKD1.09 billion (USD140 million) in August, the highest price achieved for a residential property so far in 2025.

The property, located on The Peak, spans just over 1,000 square metres and features five bedrooms, a private lift, and a large terrace and garden. Only one other sale this year, in Kowloon Tong, has crossed the HKD1billion threshold. Falling interest rates, a pause in the US-China trade war, and a stock market rally have buoyed sentiment in Hong Kong.

“While mainland buyers continue to dominate the super-luxury segment, there has been a noticeable resurgence of foreign purchasers,” says Jack Tong, research director at Savills Hong Kong. Executives in the financial services industry have been key drivers of luxury acquisitions.

In May, home prices rose 0.4% after a four-month decline, as developers were encouraged by lower rates and offered more flexible payment options. Agents also report particularly strong growth in luxury rents, with Knight Frank forecasting up to 5% growth in this segment through the rest of the year.

in central Chengdu in the first half of 2025 compared to the same period in 2024, “driven by strong demand and rapid inventory reduction,” says Sophy Pan, Savills’ senior research manager for Western China. The Chengdu government earlier this year unveiled plans to cut new land supply, particularly in areas with backlogs of unfinished or unsold units.

While Chengdu has seen partial recovery, neighbouring Kunming in Yunnan province remains the worst-performing large market in the country, with prices down 6.9% in the year to July.

Whether the wider economy can help stabilise China’s property sector remains unclear. Stronger-than-expected economic data in the second quarter showed 5.3% growth for the first half of the year, above the government’s 5% annual target, spurring optimism among analysts.

Morgan Stanley, Goldman Sachs, UBS, and Nomura raised

GDP forecasts as new economic data and a mid-May USChina agreement saw tariffs on Chinese goods fall from 135% to 30%.

“However, the temporary nature of the tariff reductions and unresolved structural issues underscore the need for continued negotiations,” according to a second-quarter China outlook by BBVA Research.

Although stronger economic performance is expected to boost consumer confidence, the housing market is still some way from benefiting. Smaller markets require more than a lift in optimism, says Macdonald of Savills.

“The issue is less about sentiment and more about fundamental oversupply,” he says. “Even if every household purchased one unit, many markets would still be left with excess stock.”

This bleak outlook points to a “new normal” for China’s

housing market, in which the pre-pandemic scramble by speculative investors to buy new units appears over, at least for now.

The central government had long sought to curb speculation, although likely not to such a drastic extent. In late 2016, President Xi Jinping first declared his now infamous statement “Houses are for living in, not for speculation,” which shaped policy before and after the global pandemic. Observers note the slogan has largely disappeared from official pronouncements since August 2025, when Economic Daily printed an editorial insisting the principle was “not out of date.” Whether by accident or design, Xi’s phrase has become less state policy and more reality nearly a decade later, particularly in smaller cities.

“The speculative appetite that once drove sales has largely evaporated, leaving limited demand beyond genuine end-users,” says Macdonald. “Without price appreciation prospects, investors have little incentive to buy, and that weighs heavily on these markets.”

The speculative appetite that once drove sales has largely evaporated, leaving limited demand beyond genuine end-users

Property prices in Macau fell by around 30% between June 2024 and June 2025, according to data from the Macau Financial Services Bureau (FSB).

Since the market peak in 2018, prices have dropped 40%. “This year, the downturn in Macau’s property market has deepened, with no sign that the sharp fall in transaction prices will stop,” the FSB warns. The local housing sector is now caught in a “vicious cycle,” with new owners who bought with mortgages facing negative equity and years of repayments effectively wiped out.

The FSB has urged urgent measures, including lowering the minimum down payment to 15%, offering subsidies, and reducing transaction costs such as stamp duty, notarial fees, and other taxes. Macau’s gaming-dependent economy has continued to falter since the Covid-19 pandemic, shrinking 1.3% in the first quarter of 2025.

The International Monetary Fund in April halved its GDP forecast for Macau this year to 3.6%. Output remains just 85% of 2019 levels. Despite a 15% increase in visitor numbers in the first five months of 2025, overall spending has fallen, particularly on gaming, though noncasino expenditure rose nearly 13% in the first quarter.

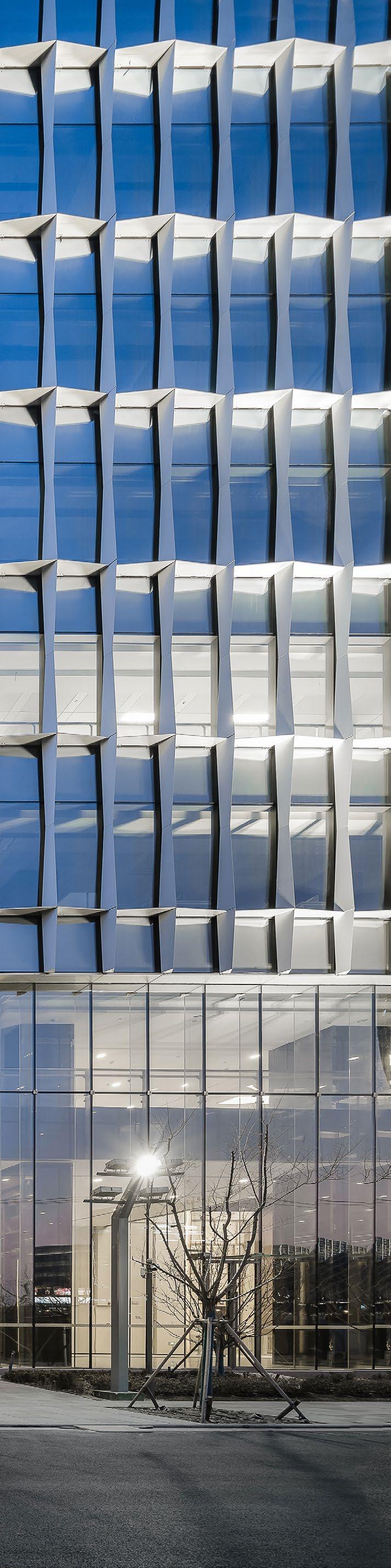

Asia’s ultra-wealthy want more than square footage — they crave stories, values, and vision. Developers are responding with bold, meaning-driven creations

BY LIAM ARAN BARNES

LUXURY RESIDENCES CONTINUE TO SPROUT AROUND THE REGION IN DIVERSE DESTINATIONS INCLUDING JAKARTA AND FUZHOU (PICTURED HERE)

In Bangkok, the future of luxury living apparently involves a car park in the clouds. The Porsche Design Tower, now selling “Sky Villas” priced up to THB1.25 billion (USD40 million), lets residents drive their supercars up a spiral ramp and into glass-walled garages adjoining their living rooms. Forget wellness suites or sound-healing rooms; Here, the centrepiece is a daily automotive performance. A Ferrari or Porsche 911 isn’t simply parked; it’s lit and displayed like a household deity.

It’s hard not to grimace at the excess. The tower’s glowing crown and Mission R-inspired frame are closer to a stage set than architecture, while its “Passion Spaces” elevate parking into theatre. For the ultra-rich, wellness might mean cryotherapy chambers elsewhere. In this case, it’s the quiet comfort of knowing your Lamborghini sleeps beside you.

The spectacle is unashamedly brazen, yet it captures something telling about the region’s shifting definition of

luxury. Prestige today is less about square footage or skyline views and more about identity, expression, and display. Bangkok and Tokyo’s rise in Julius Baer’s 2025 Global Wealth and Lifestyle Index—up six places each to 11th and 17th, respectively—underlines the region’s growing appetite for luxury experiences as well as assets.

Across Asia, branded residences are booming, from wellness sanctuaries in Bali to discreet urban projects in Tokyo and automotive-inspired spectacles in Bangkok. The common thread is intent: homes that signal wealth, certainly, but also a worldview.

According to the Asia Branded Residences Market Review 2025 by C9 Hotelworks, the region now has a branded residence pipeline worth USD30.7 billion, spanning more than 67,000 units across 283 developments.