PUBLISHING

Publisher / General Manager

Jules Kay

Associate Publisher / Head of Brand & Marketing

Richard Allan Aquino

Publishing Assistant / Marketing Relations Manager

Tanattha Saengmorakot

EDITORIAL

Editor

Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Digital Editor

Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Charles, Steve Finch, George Styllis, Jonathan Evans

CREATIVE & MARKETING

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer

Poramin Leelasatjarana (Min)

Digital Marketing Executive

Anawat Intagosee (Fair)

Senior Manager, Media & Marketing Services

Nate Dacua

Senior Executive, Media & Marketing Services

Piyachanok Raungpaka

Senior Product Lifecycle & Brand Manager

Marco Bagna-Dulyachinda

REGIONAL SALES

Director of Sales

Udomluk Suwan

Head of Regional Sales

Orathai Chirapornchai

Watcharaphon Chaisuk (Australia)

Monika Singh (India, Sri Lanka, and Australia)

Wulan Putri (Indonesia)

Tony Thirayut (Japan)

Kai Lok Kwok (Mainland China, Hong Kong, Macau, and Middle East)

Yiming Li (Mainland China, Hong Kong, and Macau)

June Fong (Malaysia)

Jess Lee (Malaysia)

Priyamani Srimokla (Middle East)

Marylourd Pique (Philippines)

Alicia Loh (Singapore)

Kritchaorn Mueller (Thailand)

Nguyen Tran Minh Quan (Vietnam)

DISTRIBUTION

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries petch@propertyguru.com

Distribution Enquiries ying@propertyguru.com

Property Report by PropertyGuru is published six times a year by

© 2025 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher KDN PPS 1662/10/2012 (022863)

Homeware heroes that tread lightly on the planet and simplify green-minded living

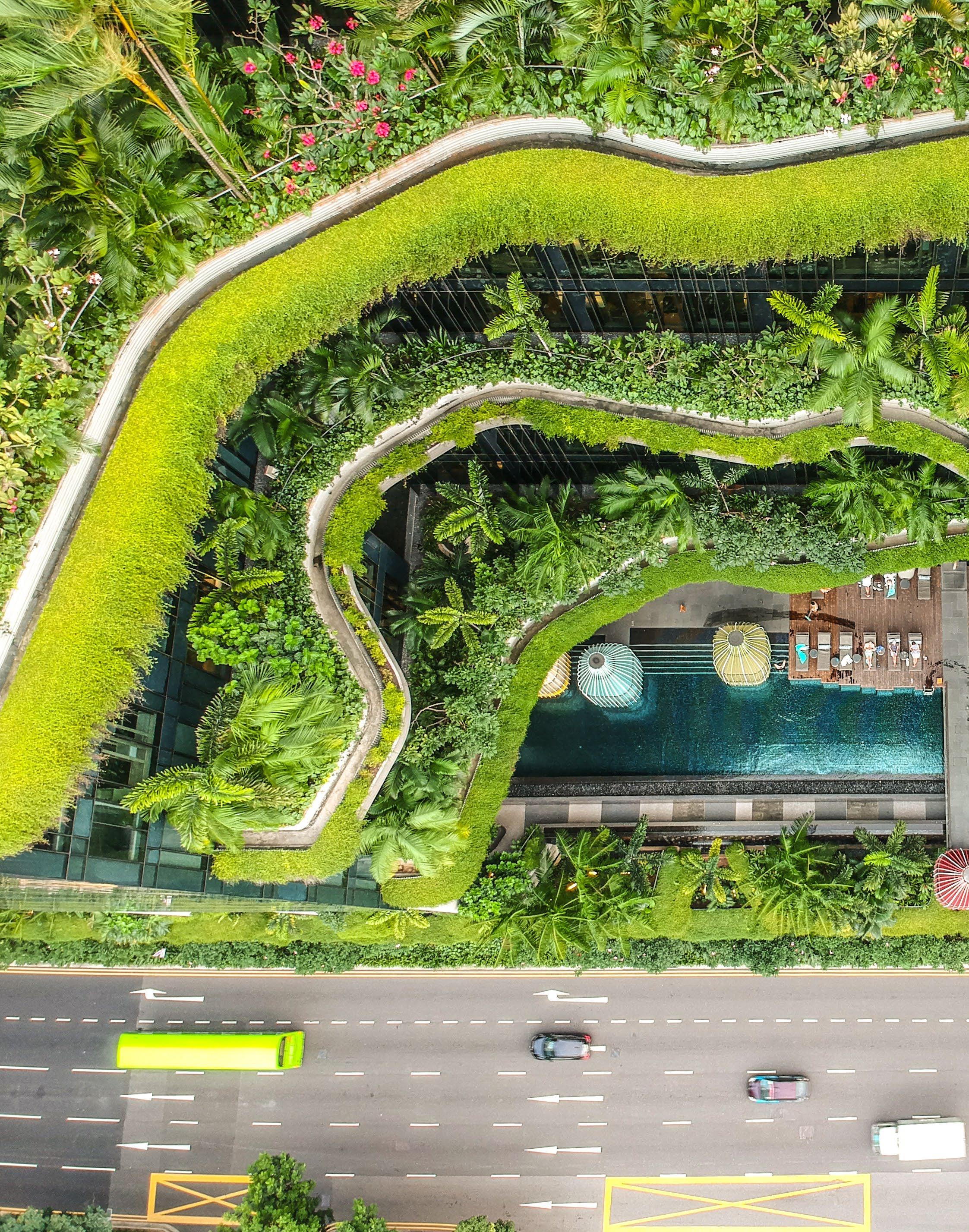

Project Confidential: It’s only natural

A Ho Chi Minh City housing development embraces biophilic design in its bid for a first-of-its-kind green certification

Engineer Ashwin Thurairajah helps Malaysia build greener through a certification system tuned to the tropics

Design Focus: Designs for life

LiFE Architecture is creating buildings that endure, adapt, and quietly improve everyday existence

Neighbourhood Watch: Bukit Jalil

Destination: Singapore

Destination: Middle East

This Kuala Lumpur suburb appeals to investors drawn to its upscale high-rises and proximity to leading medical and tech institutions 68

Foreign levies, regional wars, and buyer fatigue are putting pressure on the city-state’s housing market

Special Feature: Green means go

A new generation of buildings is redefining what it means to build for people—and the planet

Dispatch: Shaken and stirred

Concerns over Bangkok’s seismic safety in the wake of the recent Myanmar earthquake have prompted a shift toward low-rise developments

Gulf nations are shaking off a reputation for overt bling to lead a post-pandemic luxury boom

81

Dispatch: Raise the roof

Vietnam’s government has passed new regulations allowing homeowners and landlords to sell solar power back to the national grid for the first time

Green issues used to be where idealism went to sip fair-trade coffee and talk about the future. But in 2025, sustainability is where the action is, and the most forward-thinking real estate players across Asia are not just thinking green, but building it.

In this issue, we celebrate those pushing the boundaries of eco-conscious design. Our roundup of Asia’s most compelling new green projects reveals a wave of developments that are as innovative as they are responsible.

We also speak to one of Malaysia’s leading eco engineers, whose work is helping developers shift from greenwashing to real-world impact.

Closer to home, we go deep on a standout new project in Ho Chi Minh City that’s setting the benchmark for sustainable living in Vietnam. Later in the issue, we offer essential context on how Vietnam is harnessing the power of rooftop solar.

Elsewhere, our market updates from Singapore and the Middle East offer a broader view of how sustainability is shaping investment sentiment, while our neighbourhood guide heads to Bukit Jalil, Kuala Lumpur—a district where urban greenery, lifestyle perks, and major sporting events co-exist in surprisingly harmonious fashion.

There’s no doubt about it: the green revolution in real estate is accelerating. And if you’re not already on board, now might be a good time to hop on.

Duncan Forgan Property Report duncan@propertyguru.com

The GuruSummit returns to Bangkok, Thailand on 11 December 2025.

Rewatch the 2024 edition :

Landco Pacific Corporation’s luxurious beachfront homes offer an irresistible lifestyle possibility, waiting to be realised along the white-sand beaches of Batangas in the Philippines

Property seekers in the Philippines, both domestic and abroad, are becoming increasingly discerning when choosing their homes. With the Philippine economy growing at an impressive 7.6% in 2024—outpacing several Southeast Asian countries— the country shows immense potential to drive housing demand in the years ahead.

A significant contributor to this growth is the rising demand from overseas Filipinos. In 2024, cumulative remittances from Filipinos abroad reached a record-breaking USD38 billion.

Many of these Filipinos are now eager to return home, seeking a luxurious lifestyle after years of hard work overseas. And what better way to retire or repatriate than by living in the serene, picturesque beaches that the Philippines is globally renowned for?

The Philippines boasts some of Asia’s most stunning coastal developments, and Landco Pacific Corporation is at

the forefront of this trend. With over 30 years of expertise in premium leisure developments, Landco has transformed Batangas into a prime destination for those seeking a premium beachfront lifestyle. A subsidiary of Metro Pacific Investments Corporation (MPIC), Landco offers innovative and outstanding lifestyle experiences that revolutionise the way Filipinos live.

Two of Landco’s signature projects, The Residences at Terrazas de Punta Fuego and The Spinnaker, are finalists for Best in Asia titles at the 19th PropertyGuru Asia Property Awards Grand Final. Both developments showcase Batangas, a province renowned for its dynamic economy and natural splendour.

More than just a destination for vacation homes in a robust travel and tourism destination, Batangas is a place to do good business and a jump-off point to explore the country’s island getaways. The Batangas Port is a major maritime gateway comprising an international container terminal and another terminal serving passenger

The Residences at Terrazas de Punta Fuego

ferries, general cargo, and roll-on/ roll-off (Ro-Ro) vessels for inter-island travel.

The Residences at Terrazas de Punta Fuego

A finalist for the Best Waterfront Condo Development (Asia) category, the beachfront development is located in Nasugbu, Batangas—an established tourism zone with pristine, white-sand beaches—this development is only a short drive from Metro Manila, thanks to infrastructure improvements like the Batangas-Quezon Bridge.

Nestled in the exclusive beachfront enclave of Punta Fuego, The Residences is the last call to be part of a marinafront luxury community that has been home to the country’s elite. It’s Landco Pacific’s legacy that began in the 1990s.

The Residences at Terrazas de Punta Fuego fuses a Spanish Mediterranean aesthetic and Asian Tropical design influences to harmonise with its shoreline setting. Awarded Best Waterfront Condo Development at the

12th PropertyGuru Philippines Property Awards, this elegant development offers low-density clusters of one- to three-bedroom units, all spacious, with guaranteed sea views.

With vaulted ceilings, sunlit balconies, and expansive open spaces, The Residences at Terrazas de Punta Fuego creates a sanctuary that feels both timeless and deeply connected to its coastal environment. Residents also enjoy access to over 800 metres of beach exclusive to the community of The Residences at Terrazas de Punta Fuego. The development also features lush landscaping and world-class amenities like a garden courtyard, pool with a function room, spa, sauna, and elegant lounges for reflection or social gatherings.

Showcasing its developer’s commitment to sustainability, The Residences at Terrazas de Punta Fuego is pursuing EDGE Certification, featuring energy- and water-efficient systems, rainwater harvesting, and an eco-friendly double-pipe plumbing network. The development has also preserved existing mature trees, and its design embraces the natural topography of Nasugbu’s coastline.

The Spinnaker

This steadfast commitment to sustainability is also evident in The Spinnaker, Landco’s premium

Located within the 23-hectare, LEEDregistered, master-planned tourism estate Club Laiya, The Spinnaker is also aiming for EDGE Certification with ambitious targets at conserving resources and embodied materials. It is the first condotel to feature a doublepiped waterline system, using nonpotable water for irrigation and toilet flushing. The project also features Electric Vehicle (EV) charging stations and use of recycled materials to minimise its carbon footprint.

Living up to its name, the 22-storey condotel’s landmark design draws inspiration from a yacht’s headsail. The poetic structure gives rise to 247 beachfront units with large cuts, including bi-level two- and threebedroom units from 130 to 315 square meters. The exclusive fourth-floor infinity pool offers panoramic views while the luxurious interiors evoke a laidback Miami vibe, complete with picturesque sunsets.

Awarded Best Condo Architectural Design in the Philippines, The Spinnaker offers a full suite of hotellike amenities—and more. They include a ballroom for events, a sky bar, and even a helipad. As part of its integrated master plan, Club Laiya provides a robust Work from Beach (WFB) setup,

perfect for digital nomads, alongside a slipway for small boats and jet skis for water sports enthusiasts. Residents can also enjoy leisure amenities like Laiya Beach Club, with its infinity pools, beach promenade, and a second-level restaurant overlooking the sea.

The Residences at Terrazas de Punta Fuego and The Spinnaker represent the latest chapter in Batangas’ development, offering an irresistible opportunity to live and invest in one of the Philippines’ most prestigious beachfront communities. These developments show what happens when one blends great design with a deep respect for the earth.

The beachside lifestyle has always been a part of Filipino culture. Now, with developments like The Residences at Terrazas de Punta Fuego and The Spinnaker, that tradition is evolving, embracing sustainability as well as coastal opulence.

For more information about Landco Pacific Corporation, visitlandco.ph or follow www.facebook.com/LandcoPacificCorporation

Both beachfront properties offer a stunning sea view

Let these sustainable, eco-friendly devices power your lifestyle

Even in dim spaces, Garrett Wade’s Kitchen Garden Growhouse looks lush. Under its brass-plated roof, fullspectrum LED grow lights can nourish your herbs yearround—right on your countertop and far from sunshine. With hanging hardware, you can easily suspend this miniature garden above your space.

USD239, garrettwade.com

Offering a three-litre capacity and quiet, remote-controlled operation, the Lomi 3 turns leftovers and organic waste into nutritious fertiliser in as little as three hours. This efficient electric composter comes with a charcoal filter system, warding off unwanted odours and pests.

From USD449, lomi.com

Suri’s electric toothbrush offers a compact, climate-conscious alternative to bulky plastic. With a 40-plus-day battery life, the toothbrush needs only one monthly charge. It can also be used in the shower, thanks to its IPX7 waterproof rating. Eventually, the toothbrush can be sent to Suri for recycling.

From USD95, trysuri.com

The House of Marley’s eco-conscious sound revolution continues with the Stir It Up wireless turntable, crafted from solid bamboo as well as recycled plastic and aluminium, plus environmentally friendly Marley materials called Regrind and Rewind. Bluetooth connectivity aside, it features a built-in pre-amp for plug-and-play simplicity.

USD249.99, thehouseofmarley.com

The Nixon Staple Watch is made from recycled ocean plastics, reinforced with injection-moulded fibre. This minimalist timekeeper also features stainlesssteel pushers and a plush rubber-blend band. Feel free to take it back to the water: It’s resistant down to 100 metres (10ATM).

USD150, nixon.com

With furniture that’s kinder to people and the planet, there’s no assembly guilt required

THREAD CAREFULLY

The Citizenry’s Liang wicker chair is an heirloom-quality piece woven from locally sourced rattan in Indonesia. The natural material wraps around a steel frame, lending sculptural form to its function. Produced at a fair-trade facility in Plumbon, it’s a seat you can truly feel good on and about.

From USD799.97, the-citizenry.com

Thuma’s Pillar bookshelf is a modular storage solution made from 100% upcycled wood. With natural grain patterns, the bookshelf features an oilbased finish that deepens its patina over time. Using Japanese joinery principles, this GreenGuard Gold-certified bookshelf can be infinitely reconfigured according to your needs.

USD1,650, thuma.co

Space Copenhagen’s Accent oval lounge table fuses Scandinavian minimalism with artisanal glam. Handcrafted from FSCcertified oak wood with a matte lacquer, the lounge table is part of the Danish architect duo’s contribution to the Mater furniture collection, which includes coffee and dining tables.

EUR2,187.50, materdesign.com

Savvy Rest’s flagship organic sofa, Verona, has cushions filed with Cradle-to-Cradle certified Talalay latex foam. Set on a sustainably sourced maple hardwood frame, the sofa is upholstered in GOTScertified fabrics like hemp and cotton duck. The entire piece is finished with zeroVOC products and natural jute webbing.

From USD3,799, savvyrest.com

Committed to “seed-to-seat” production, furniture maker MasayaCo sources wood only from sustainable forests, reclaiming cow pastures and rehabilitating denuded areas in Nicaragua. One of its most popular products, the Apanas dining table, boasts FSCcertified teak wood, built to last through generations.

From USD1,356, masayacompany.com

These homeware heroes tread lightly on the planet and simplify green-minded living for all

Grow your favourite greens on either end of the Franca stacked planter. Handcrafted from glazed earthenware in New York, the reversible planter features a distinct, cinched waist equipped with a drainage hole. Whichever side you’re using, a matching catch basin can easily fit below it.

From USD62, francanyc.com

DETAILS | Style

With the help of tribal artisans in Chiang Mai, family-run brand Lanna Passa repurposes bamboo fish traps into gorgeous floor lamps. Encased in sustainable bamboo strands, the lamp stands on a rattan wicker base that cradles a bulb. Each piece can be customised to your preferred cable length.

From USD95, lannapassa.com

The Bunny Williams bird feeder invites winged fauna to your garden. With a hexagonal glass-and-steel design finished in black, this rust-resistant feeder can complement most wrought-iron fixtures. Easy to hang with chain or rope, it will have feathered friends dropping by in no time.

From USD77.40, ballarddesigns.com

Nette’s Holy Smoke candle, made from coconut soy wax, is an answered prayer for vegans. Poured into a handmade ceramic vessel, the candle takes you to church with notes of frankincense, cedarwood, and white musk. Also, every purchase of this cleanburning, cruelty-free candle plants a tree.

USD82, nettenyc.com

Vietnamese company EQUO offers a cutlery set made from bagasse, a fibrous byproduct of sugarcane. These forks, spoons, and knives are fully compostable but durable enough to withstand hot food. Chemical-free and grease-resistant, the cutlery renders single-use utensils unnecessary, especially in the era of online takeouts.

THB397, shopequo.com

In Ho Chi Minh City, a housing development embraces biophilic design in its bid for a first-of-its-kind green certification

BY AL GERARD DE LA CRUZ

Even as towers of steel and glass sprout across the nation, Vietnam holds fast to its natural verdure.

The Meadow, an award-winning development by Gamuda Land (Vietnam) in Ho Chi Minh City, paints just such pastoral scenes. The Vietnamese offshoot of the eponymous Malaysian property developer has achieved a rare milestone with this residential project: the first to receive the LOTUS Core & Shell Green Certificate from the Vietnam Green Building Council (VGBC).

The developer, already known for its Celadon City township in Tan Phu district, acquired the project in February 2024 as part of its westward expansion in HCMC. The 50,000-squaremetre site at the commune of Vinh Loc B in Binh Chanh district aligns with rising demand for sustainable, wellnessfocused addresses in Vietnam.

Rigorous feasibility studies and assessments had led business developers at Gamuda Land to unearth a growing sense of biophilia—the innate human tendency to seek connections with nature and other organisms—in the market.

“We wanted The Meadow to embody modern sustainability, not just as a residential product, but as a complete lifestyle experience,” says Chaiwat Julrat, deputy head of the product management unit at Gamuda Land, who worked on the project’s design brief. “It reflects our belief that thoughtful

planning, green design, and human-centric development can enrich lives.”

Kuala Lumpur-based design practice Zone Architect, which Gamuda Land previously tapped for Diamond Centery at Celadon City, delivered a nature-integrated concept for the project.

The master plan took advantage of The Meadow’s waterfront topography. Around 220 landed homes would fan around a central park, set beside the canal to the south. Every dwelling would connect to this park through a patchwork of linear gardens and green lungs, directing pedestrian movement towards the heart of the site.

“Our decision to adopt a biophilic, community-driven design at The Meadow was driven by shifting lifestyle priorities,” explains Quach Thien Kim, marketing manager at Gamuda Land. “Post-pandemic insights revealed that homeowners increasingly value emotional well-being, natural surroundings, and a sense of belonging over purely urban convenience.”

Nearly 80% of the trees planted at The Meadow are native species; existing ones were preserved as much as possible. Over 40 varieties of plants and flowers carpet the central park. The courtyard-style residences house indoor planting areas, increasing the biophilic quotient for homeowners.

This preponderance of greenery has roots in Vietnamese heritage. Planter boxes, positioned at staggered heights on the multi-storey homes, are deliberate callbacks to the terraced rice fields of Sapa.

“Vietnam has transformed from being a nation heavily affected by food shortage to one of the world’s leading producers and exporters of many agricultural products,” notes a spokesperson from Zone Architect.

But ambition augured technical challenges. Gamuda Land submitted The Meadow for LOTUS certification under the newly introduced Home Core & Shell rating system. Confronted with new terrain, the team consulted with sustainable design expert ARDOR Green on the certification process.

The consultancy spotted several hurdles, not least the complexity of certifying multiple standalone units instead of a single, consolidated structure. Among the arcana of LOTUS metrics, The Meadow was required to undergo energy modelling and simulation.

Through strategic fenestrations like skylights, Gamuda Land emphasised passive design at The Meadow, optimising natural illumination and reducing the need for mechanical cooling. High-performance insulation, automated building systems, solar panels, and rainwater harvesters were utilised, taking the burden off the grid and municipal supply.

With support from local authorities, The Meadow obtained its infrastructure construction permit in March 2020 and completed foundational works by late 2023. Set alongside Ring Road 3, The Meadow embodies growth potential in an increasingly accessible area of the metropolis.

“It is one of the very rare ‘clean-and-clear’ landed opportunities in HCMC, and landed properties are very well sought after by the market,” says Le Tran Hong Phuong, deputy manager of the business development unit at Gamuda Land.

Longtime industry player Construction and Building Material JSC (CBM) prevailed in a competitive tender against major contractors for the project, commencing construction in April 2024. At the height of activity, The Meadow mobilised over 500 workers and deployed four tower cranes to accelerate progress.

The dwellings are built with sound, steel-framed systems, and the substructures are engineered to high safety standards. Non-load-bearing exterior walls allow for structural flexibility. Ground floors, raised above road level and coupled with a storm-ready drainage network, mitigate the risk of flooding.

Non-fired building materials and strict waste monitoring helped diminish the project’s carbon footprint. Tellingly, the houses make use of locally sourced vent blocks, creating

At The Meadow, a thoughtfully planned neighbourhood park by the canal binds the built and natural environments together. It leads to what Gamuda Land in Vietnam calls a “biophilic connection” between residents and their surroundings.

This innovative, leafy space comprises a communal gardening area and an active play zone, each with distinct but interconnected purposes.

The Community Garden serves as the development’s green living room, as it were. Here, residents gather to tend plants and socialise, cultivating neighbourly relationships in the process. The space is also designed to inculcate eco-consciousness in the next generations of residents, particularly through hands-on activities. A few steps away, the Play Garden promotes an active lifestyle with facilities like a basketball court, playground, and jogging track, built on sculpted landforms.

“We aim for young families, small families to enjoy evenings and weekends, with the park

just within walking distance,” says Mohamad Safiy Zakwan bin Md Baseri, senior manager at Gamuda Parks Design & Research.

Rounding out the project’s intergenerational approach, the development will add a senior centre, a venue for activities ranging from yoga classes to craft workshops. Ramps, handrails, and ample seating will keep the project on par with universal principles.

Gamuda Land’s research identified two demographics driving the design of The Meadow. On one end are young professionals and families seeking healthier, more lifestyleoriented environments. On the other hand, older residents who value walkable communities with a sense of place.

“These insights shaped The Meadow’s low-rise design, abundant greenery, and shared spaces,” says Quach Thien Kim, marketing manager at Gamuda Land, “creating not just homes, but a holistic living experience that supports wellbeing and long-term community building.”

THE MEADOW’S GREEN SPACES CULTIVATE COMMUNITY, WELLNESS, AND EVEN SHARED GARDENING EXPERIENCES

what Gamuda Land calls a highlight of the project: ventilated double-skin façades. The skin wall acts to reduce heat gain, shielding occupants from searing tropical heat and affording them an extra layer of privacy.

For windows and doors, Gamuda Land sourced solar-control glass from industry leaders such as Viglacera and Kibing. Boasting a solar heat gain coefficient below 0.55, a U-value under 4.49, and visible light transmittance of 0.57, the specialised glazing can block 99% of UV radiation and reduce solar heat penetration by 65%, making The Meadow one of HCMC’s most thermally efficient residential developments.

The project officially launched in June 2024. Although Gamuda Land stands ready to provide pre-designed products alongside its interior design partners, the homes themselves come barefaced.

It’s an informed, intentional move. “According to the market survey, most homeowners in Vietnam prefer bare shell so they have full possibility of customising the inner spaces and interior finishes,” says Nguyen Huu Trung Tin, project and construction manager at Gamuda Land.

By mid-2025, 11 units had been completed over 14 months. The remaining homes, which run the gamut from townhouses to villas, are due for completion by year’s end, setting the stage for the final LOTUS certification review. The process requires the project team to correlate the original design with the built reality, with all installed materials and as-built documentation submitted for official approval.

While a brick-and-mortar endeavour, The Meadow could also be seen as a social construct. VGBC’s framework requires the development of buyer guidelines and operational rules to sustain green practices long after completion. The framework also calls for detailed guidance for end users so they can play an active role in upholding the project’s sustainability compliance.

Homeowners are expected to take liberties in environmental stewardship, post-construction. Apart from planned awareness campaigns on 6R (Rethink, Refuse, Reduce, Reuse, Recycle, and Rot), the developer will involve residents in landscape upkeep efforts, including the use of garden waste for mulching. Young residents are also encouraged to take part in community gardening or “green finger” activities with parents and elders.

“If a community starts a gardening club, that helps measure the success of the space,” says Mohamad Safiy Zakwan bin Md Baseri, senior manager at Gamuda Parks Design & Research.

Gamuda Land’s pursuit of LOTUS certification may well be the germ of something new in Vietnam’s green building movement. The Meadow’s shell-only delivery presents not only a blank canvas for well-appointed interiors but also a fertile ground for a renewed relationship with the natural world. Although Vietnam’s industrial might is in full bloom, the country’s romance with Mother Nature is not dead.

Once immersed in the fossil fuel industry, engineer Ashwin Thurairajah now helps Malaysia build greener through a certification system tuned to the tropics

BY AL GERARD DE LA CRUZ

SINCE 2013, GREENRE HAS REGISTERED OVER 1,000 PROJECTS COVERING 500 MILLION SQUARE FEET

With the right incentives and enforcement mechanisms, countries like Malaysia can take the lead in delivering climateconscious, low-carbon growth that benefits both people and the planet

Averting the planet’s climatic collapse requires precise, complex engineering, something Ashwin Thurairajah knows plenty about.

But he didn’t arrive at this quest on a linear path. After decades in the petroleum industry, the seasoned engineer has done a 180, finding purpose in Malaysia’s green building movement.

He leads GreenRE, the homegrown green building certification body established by the Real Estate and Housing Developers’ Association (REHDA) to localise sustainability benchmarks for the built environment.

Since 2013, GreenRE has registered over 1,000 projects covering 500 million square feet, including skyscrapers like Kuala Lumpur’s PNB 118.

Trained in electrical engineering and management at Imperial College London, where he researched photovoltaic technology, Thurairajah cut his teeth on lowcarbon designs compliant with BREEAM and LEED standards. His professional odyssey has since taken him from CHP-powered developments in England to billion-dirham hotel projects in Abu Dhabi and oil fields across the North Sea.

Returning home to Malaysia in 2010, he designed electrical systems for oil and gas giants at Ranhill WorleyParsons, before managing floating platform projects at Aker Solutions.

In 2017, Thurairajah recanted rigs for rainforests to join GreenRE. As executive director, he has worked closely with the government to develop national standards such as MS1525 and MS-2680 and advise on legislation like the Energy Efficiency and Conservation Act (EECA). His input has led to tax incentives in green technology and updates to the Uniform Building By-Laws (UBBL).

The about-face was a natural progression. “My inspiration was simple,” he says. “I could no longer be part of the problem and needed to be a part of the solution.”

In their fourth iteration, GreenRE’s tools have evolved under Thurairajah to include embodied carbon calculators and BIM-integrated assessments, keeping pace with trends like data centre certification, EV readiness, and carbon markets. Critically, GreenRE has seen growing uptake in Johor, Penang, Sabah, and Sarawak.

Expansion should have come yesterday—fewer than 2% of Malaysia’s building stock is green-certified. In 2022, the country emitted around 291 million metric tons of carbon, on par per capita with China and Japan despite their larger populations.

In Malaysia’s race to net-zero emissions by 2050, Thurairajah has engineered a roadmap that’s neither a shortcut nor a box-ticking exercise.

Why is engineering more crucial than ever in green building?

In the face of climate change, we must focus on the cobenefits of environmental sustainability. Fundamentally, it’s about resource efficiency and reducing waste. The journey there will involve mindset shifts, economic reallocation, and technology. Engineering has defined societal progress throughout human history and will continue to play a critical role in handling the environmental challenges ahead.

While international systems offer robust frameworks, they’re often not calibrated for tropical conditions or local market capability. Our rating tools are cost-effective, carbonreduction-centric, and aligned with national legislation and policies such as UBBL, EECA, and the Low Carbon Cities Framework (LCCF). Local tailoring also allows us to engage developers more effectively, helping them focus on what’s most impactful here like energy efficiency, use of sustainable materials, stormwater management, et cetera. We see green building certification as a key lever to nudge the industry’s sustainable aspirations higher.

WITH PROJECTS LIKE SUTERA GARDEN VILLAGE, TANAH SUTERA DEVELOPMENT SDN. BHD. HAS EMERGED AS ONE OF THE ESG CHAMPIONS IN

How does GreenRE address Malaysia’s unique building challenges?

Our criteria integrate both passive and active design strategies suited for Malaysia’s hot, humid climate. We prioritise solar orientation, natural ventilation, daylighting, and thermal insulation, especially roof insulation and effective shading. The overall thermal transfer value and residential envelope transfer value are metrics used to guide effective passive design. On the active side, we focus on high-efficiency HVAC systems, lighting controls, highefficiency vertical transportation, and renewable energy. The goal is to design buildings that minimise cooling loads in the first place and then use efficient systems to manage what’s left. By encouraging early-stage design simulations, we help developers make climate-resilient choices from the outset.

We have several, in particular wind-driven rain simulation for high-rise condominiums. Facilitating natural ventilation is a double-edged sword in tropical climates as heavy thunderstorms lead to unwanted water intrusion that can result in slippery walkways and, even worse, damage to lifts and escalators. Simulation can assist in ensuring appropriate roof overhangs, recessed windows, rain screens, et cetera.

Developers who’ve previously used international systems often tell us they appreciate GreenRE’s flexibility, technical support, and cost efficiency. As ESG becomes more central to investment decisions, we’re seeing increased integration of GreenRE certification into sustainability reports and investor disclosure. Several publicly listed developers now highlight their GreenRE certifications as part of their climate strategies.

Greenwashing often stems from good intentions but weak follow-through. Our role is to provide a measurable, third-party verification process that ensures claims are backed by data. Every GreenRE-certified project undergoes technical review, site audits, and performance assessment across key environmental indicators. We also update our criteria regularly to prevent superficial compliance and encourage deeper operational impact. By holding projects accountable through a credible certification framework, we give developers—and their investors—confidence that sustainability targets are being genuinely met.

What are the common pitfalls for developers during the certification process?

For energy efficiency investments, the payback period ranges from two to five years, particularly for measures like efficient HVAC, LED lighting, and energy management systems. One common challenge is the late integration of green strategies, which limits passive design optimisation. Others include incomplete documentation, low design team engagement, and unclear sustainability goals. We always advise developers to engage early—ideally during conceptual design—to maximise benefits and streamline the certification journey.

How do you address the perception that green buildings aren’t profitable?

That perception is changing fast. Green buildings now benefit from lower operating costs, improved asset value, and growing demand from tenants and investors. Banks are increasingly offering green loans and preferential financing rates tied to certification or energy performance.

What’s still missing is scale and coordination. Governmentbacked grants often focus on solar, but broader support is needed for energy retrofits, passive upgrades, and embodied carbon reduction. Clearer taxonomy guidelines, as well as better alignment between certification tools and financing

instruments, will make it easier for developers to access capital.

How strong is the demand for certified properties?

We’ve seen a growing correlation between certification and asset value, particularly in the commercial and mid-tohigh-end residential segments. Certified buildings typically enjoy lower operational costs, better tenant retention, and stronger investor confidence. While comprehensive resale data is still emerging, early indicators suggest GreenREcertified homes and buildings have a market advantage, especially as green features are now linked to energy savings and improved occupant well-being. For institutional buyers and REITs, certification has become a value differentiator.

How do certification challenges differ across real estate segments?

Residential projects often face tighter budgets and limited space for technical systems while commercial and industrial buildings must prioritise operational efficiency. Township certification brings its complexity as it involves larger infrastructure coordination and smart master planning.

MASTER-PLANNED TOWNSHIPS LIKE MEDINI INNOPOLIS, A PROJECT OF ISKANDAR INVESTMENT BERHAD, ATTEMPT TO BALANCE ECONOMIC DEVELOPMENT AND ENVIRONMENTAL ACCOUNTABILITY

How do high-rises, landed properties, and retrofits compare?

High-rise buildings face greater energy demand for cooling and vertical transportation and require robust façade and envelope strategies. Landed properties rely more heavily on passive design such as roof insulation, shading, and crossventilation.

Retrofitted buildings present another layer of challenge: Upgrades must work within existing constraints. Our Existing Non-Residential Building tool is designed to assess and reward performance improvements, benchmarked against fixed metrics for cooling systems and the Building Energy Index (BEI) for overall building performance. New developments have more flexibility in design but must commit from the outset to meet target benchmarks.

What happens to projects that fail to maintain benchmarks?

GreenRE is moving toward a more performance-based approach, especially for existing buildings and energy certification. We’ve introduced a new line of certification, the Energy Certificate, aligned with operational benchmarks through BEI, which require ongoing data reporting.

Renewal of certification is necessary every three years. Buildings that fail to undertake this process will be marked as having an expired certification in our repository. Renewal is necessary to ensure building performance attains desired target efficiencies for energy, water, and waste.

Do you think Asia can meet climate goals in our lifetime?

For a country like Malaysia, net zero does not mean zero carbon. We aim to utilise the vast carbon sink resources at hand by preserving 50% of forest cover across the country to offset emissions. Malaysia is aiming to boost renewable energy adoption, completely phase out coal, and heighten energy efficiency measures. The tools, technologies, and awareness are all improving, but we need stronger political will, data transparency, and institutional alignment to meet our targets. Carbon neutrality in five years may be unrealistic, but significant progress is possible.

For Asia, balancing economic development with environmental accountability remains the biggest challenge. With the right incentives and enforcement mechanisms, countries like Malaysia can take the lead in delivering climate-conscious, low-carbon growth that benefits both people and the planet.

From leafy villages to vertical communities, LiFE Architecture is creating buildings that endure, adapt, and quietly improve everyday existence

BY LIAM ARAN BARNES

Afew years ago, the team at CHT Architects asked a quiet but fundamental question: Was their name still telling the right story?

For two decades, the Melbourne-based studio had built a reputation for thoughtful, context-driven design across housing, commercial spaces, and civic buildings. However, as sustainability and social impact took centre stage—in their priorities and of their clients’—that name started to feel out of step. It no longer captured what their work was becoming.

In 2024, the studio re-emerged as LiFE Architecture. “LiFE now stands for more than just architecture,” says the firm’s director, Mark Spraggon. “It represents our belief that great design can enrich everyday life at every scale—from homes to cities.”

That belief now drives every design decision from the orientation of a building to its response to climate and support for longterm use. Environmental performance isn’t bolted on later. It’s embedded from the outset, part of a deeper aim to create places that are resilient, relevant, and quietly powerful for years to come.

“Certification isn’t the goal,” Spraggon explains. “We focus on buildings that perform naturally, age well, and support both people and the environment.”

That thinking is most visible in some of the studio’s best-known projects. At 101 Cremorne, a commercial tower in Melbourne’s innovation precinct, LiFE was asked to create a tech-enabled workplace

without falling into the usual glass-box clichés.

Instead, they delivered a biophilic, community-oriented environment, complete with green terraces, passive solar design, and even a rooftop moonlight cinema. Inside, timber finishes and filtered daylight create a calm workplace environment that avoids the sterility of typical towers.

“It redefined what a tech precinct building could look and feel like,” Spraggon says.

At the other end of the spectrum is Bloom Seniors Living in Clyde North, a project designed around dignity, comfort, and connection. Here, LiFE traded high-tech systems for a landscape-led model that promotes walkability and thermal comfort through orientation and all-electric design.

The result is a seniors’ community that feels more like a leafy village than a care facility. Shaded walking paths wind between native gardens, with deep verandas that stay cool through summer.

“Joy, dignity, and thermal comfort without overt reliance on mechanical systems,” Spraggon adds.

Housing has always been a through-line in the studio’s portfolio. From individual apartments to entire precincts, the focus remains on homes that hold up—physically and experientially—for the people living in them now and long into the future.

Orientation, daylighting, material longevity, and acoustic privacy are all considered early

MARK SPRAGGON, LIFE ARCHITECTURE DIRECTOR, BELIEVES THAT GREAT DESIGN CAN ENRICH EVERYDAY LIFE AT EVERY SCALE

When we see a place that adapts over time and still feels essential to those who use it, we know it worked

on, with future needs already in view. That might mean a family getting natural light in every bedroom, or an older couple walking into a cool, cross-ventilated home on a 38-degree day.

“Great housing does more than meet code,” says Spraggon. “It quietly improves people’s lives every day.”

That same rigour extends to the firm’s material and technology choices. Recently, the team has worked more with mass timber, recycled steel, and locally sourced finishes, guided by decisions that prioritise long-term durability, environmental performance, and relevance to the context. Adaptive façades are being trialled to enhance resilience, while digital twin technologies are helping futureproof building maintenance and lifecycle efficiencies.

They often gain more by stripping things back: orienting buildings well, reducing mechanical loads, and letting form do the work. It’s the kind of thinking that delivers more by doing less.

Projects like City of Dreams, an awardwinning vertical community in Malaysia, have demonstrated how LiFE’s passive design strategies can be applied across borders and climates, ranging from temperate to tropical, and from low-rise to high-density.

That philosophy was also put to the test on the Oakwood Premier project in Melbourne, a 40-storey tower combining hotel and residential uses. Working with client and consultant teams across international borders, LiFE delivered a luxury high-rise with genuine environmental performance. Operable windows, thermal zoning, vertical shading, and high-efficiency systems all form part of the mix.

Getting there took persistence. Sustainability was part of the brief from day one but had to hold its ground through rounds of value engineering and high expectations around delivery.

“It’s a reminder that sustainability is possible even in vertical, high-density urban contexts,” says Spraggon.

Outcomes like that depend on early alignment. At LiFE, collaboration is most effective when everyone—clients, consultants, and design teams—shares the same sustainability intent from the outset. It’s an approach that helps avoid friction later and keeps delivery focused.

It’s also helped deliver projects that have been recognised in regional architecture and design awards, affirming the real-world impact of their sustainability-first approach.

Still, Spraggon’s measure of success is less about form or accolades and more about relevance over time.

“When we see a place that adapts over time and still feels essential to those who use it, we know it worked,” he says. “If the building still performs, still matters, and still makes life easier for the people in it, then we’ve done our job.”

That’s what designing for life means: not creating for the moment, but for the rhythms, needs, and quiet evolutions that shape how people live—and how buildings endure.

Set in the heart of Melbourne’s fast-growing innovation precinct, 101 Cremorne reimagines what a commercial tower can be. Its curved form catches the light and deflects the wind, wrapping around biophilic terraces, an urban farm, and a rooftop moonlight cinema. “We wanted to show that a commercial tower could be high-performance and deeply human,” says Spraggon. Passive solar design and recycled materials anchor its sustainable footprint.

In leafy Studley Park, Fellowship offers a low-rise counterpoint to the push for higher density. “We designed it to age well, materially, thermally, and socially,” says Spraggon. Apartments are oriented for light and breeze, with deep balconies that double as shaded outdoor rooms. Locally sourced brickwork and durable cladding reduce embodied carbon, while native landscaping softens the streetscape and supports biodiversity.

Towering above Penang’s coastline, this award-winning high-rise proves that tropical density doesn’t have to mean environmental compromise. Sky gardens spill between levels. Green walls temper the heat. Crossventilation and shaded communal spaces reduce reliance on air-conditioning. “We set out to create a vertical community that still feels grounded,” says Spraggon. Behind the scenes, rainwater harvesting and low-flow systems keep water use in check.

At this all-girls school in Melbourne’s northwest, sustainability is embedded in both the curriculum and the architecture. The new STEAM centre is entirely gas-free, with mixed-mode ventilation, high-performance glazing, and energy-efficient lighting systems. “It’s a learning space that teaches by example,” says Spraggon. Exposed timber and recycled finishes lower impact while creating a warm, tactile environment that fosters focus and creativity.

Luxury high-rise meets environmental rigour at Oakwood Premier in Southbank. The 40-storey tower integrates hotel and residential uses with operable windows, thermal zoning, and high-efficiency building systems. “We had to balance international delivery expectations with local climate goals,” says Spraggon. Vertical shading and passive solar control cut heat gain, while water-saving systems and energy-efficient electrification shrink the building’s operational footprint.

Bloom rethinks aged care through the lens of dignity, walkability, and climate resilience. “It’s a place where older Australians can live well without relying on hard infrastructure,” says Spraggon. Passive solar orientation, allelectric systems, and shaded outdoor paths deliver thermal comfort with minimal emissions. Native planting, watersensitive design, and landscape-led planning make Bloom feel more like a village than a facility.

RLC Residences leads the charge toward a net-zero future with globally certified green homes and bold sustainability commitments

Sustainably designed, constructed, and maintained homes are no longer considered extras in the Philippines. These residential spaces are becoming the standard for property investments.

With forward-looking projects at the leading edge of sustainability, RLC Residences is making good on its promise of a green future for the Philippines.

Hailed the country’s Best Developer for three consecutive years at the PropertyGuru Philippines Property Awards, RLC Residences has a strong sustainability agenda, setting itself apart in an industry that is already embracing Environmental, Social, and Governance (ESG) practices.

RLC Residences recently forged a groundbreaking agreement with the World Bank’s International Finance Corporation (IFC) to develop 1 million square metres of net-zero-carbon,

climate-resilient condominiums by 2031.

This pledge is driven by two pillars: the pursuit of IFC’s coveted EDGE (Excellence in Design for Greater Efficiencies) certification, verifying its green credentials to a global market, and adherence to the Building Resilience Index, also by IFC, validating structural integrity in the face of climate disasters.

RLC Residences has been working towards these goals since 2022. Now, two of the company’s residential towers are already EDGE-certified for sustainability.

“At the end of the day, our goal is to build homes that truly support the way people want to live—comfortable, efficient, and built to last,” says Stephanie Anne Go, Vice President and Head of Business Development and Leasing at RLC Residences. “Working with IFC

has helped us sharpen that focus. It’s not just about hitting sustainability benchmarks, it’s about creating spaces where residents can feel the difference, whether through better airflow, lower utility costs, or just knowing their home is built with care for the long term.”

Only a year after its launch in 2023, Le Pont Residences became the company’s first property to receive EDGE Preliminary Certification from the IFC.

Located in Bridgetowne Estate, a master-planned township bridging Pasig and Quezon City, Le Pont Residences is designed to set industry standards in water conservation and energy efficiency. With natural light and landscaping, Le Pont Residences has efficient fixtures and systems in place that translate to a 28% reduction in energy use and 36% in water consumption.

In the Visayas, Mantawi Residences in Mandaue City, Cebu it has become the first developer to have a condominium development in Cebu with EDGE certification.

Inspired by company founder John L. Gokongwei Jr., who hailed from Cebu, Mantawi Residences honours its roots while meeting IFC’s stringent sustainability metrics. Featuring ecofriendly design solutions, a rainwater harvesting system, and water-efficent fixtures, the project is able to conserve resources by up to 36% and reduce its emissions by substantial margins.

RLC Residences’ sustainable agenda can also be seen in action in Rizal province with the launch of Sierra Valley Gardens’ second phase.

One of the company’s top-selling projects, Sierra Valley Gardens is now 95% sold across its first four buildings, representing a price appreciation of 42%. Today, a fifth building is underway.

The development has captured the attention of sustainability-minded property seekers, especially millennials, with innovative amenities. Its rooftop hydroponics farm, for example, will grow farm-to-table produce for residents

while a rainwater harvesting system will support landscaping; solar energy will power common areas. Sierra Valley Gardens is also EV-ready, with select parking spaces equipped with charging stations, appealing to buyers aiming to reduce their carbon footprint.

RLC Residences’ commitment to the environment also extends to its branded residential portfolio. The Residences at The Westin Manila has made the full switch to 100% renewable energy.

Partnering with ACEN Renewable Energy Solutions (ACEN RES), The Residences at The Westin Manila is the first RLC project under the government’s Green Energy Option Program (GEOP), a voluntary scheme empowering qualified end-users to choose renewable power sources.

As one of the most climate-vulnerable places on earth, the Philippines needs to incorporate resilience into the design and construction of buildings. With solid engineering and planning, RLC Residences’ residential developments are built to withstand these contingencies. Also, by pursuing green certification, RLC Residences addresses climate risk proactively, turning environmental challenges into opportunity and contributing to climate action on a global level.

Ommid Saberi, IFC’s Global Lead for EDGE and Building Resilience Index, says it best: “RLC Residences’ commitment to green and resilient initiatives is commendable and a vital step towards a sustainable future.”

BY JONATHAN EVANS

This affluent Kuala Lumpur suburb appeals to investors drawn to its upscale high-rises and proximity to leading medical and tech institutions

Bukit Jalil City

Driven by development milestones like the National Sports Complex and Pavilion Bukit Jalil, this vast mixed-use project by real estate giant Malton Berhad is positioned near both landmarks, as well as Bukit Jalil Golf & Country Resort. Close to major highways, colleges, and healthcare institutions, the 50-acre site features 1,098 residences and caters to affluent families seeking convenience. It blends extensive retail, 20% green space, and the Hyatt Place hotel with pedestrian zones and smart parking. A central plaza, The Piazza, functions as both a community hub and event space. ESG initiatives include composting, energy efficiency, and a dedicated green lung, Park Green. In 2024, the development earned Best Township Development (Central) at the PropertyGuru Asia Awards Malaysia in partnership with iProperty.

This twin-tower luxury residence by Malton Berhad comprises 709 serviced apartments targeted at expats and highend investors. Completed in 2021, the sleek golden towers house The Park Signature Shops and connect via a covered bridge to both Pavilion Bukit Jalil and the adjacent Recreational Park. Flexible living units feature quality fittings and overlook lush surrounds. Water features, a 50m infinity pool, jacuzzi, yoga deck, gym, and sauna are just a few lifestyle perks by Konzepte + Design Architect and Designstudio MVH. Eco highlights include floor-to-ceiling windows, naturally ventilated parking, and energy-saving lighting. The Park 2 won Best Completed High-Rise Development at the 2024 PropertyGuru Asia Awards Malaysia in partnership with iProperty.

Pavilion BJ is a colossal 80-acre mall— second in the Pavilion brand lineup after Bukit Bintang. It underscores Bukit Jalil’s appeal as a lifestyle enclave. Completed in 2021, the mall launched Southeast Asia’s first Tsutaya Books outlet and Malaysia’s inaugural branch of The Food Merchant, a premium grocer. The standout precinct is Tokyo Town, where sumo wrestler statues welcome shoppers to a maze of Japanesethemed eateries and stores. Pavilion BJ also includes an exhibition hall and events space, having hosted spectacles like the Pokémon Run Malaysia.

Over the past 35 years, Bukit Jalil has become a centre of gravity on Kuala Lumpur’s southern fringe. The suburb shot to prominence with the construction of the National Sports Complex (KL Sports City), which hosted the 1998 Commonwealth Games. Around the same time, the establishment of several medical and tech-learning centres began drawing aspiring doctors and computer scientists to the area. As high-end condominiums rose and infrastructure flourished, the Pavilion Bukit Jalil cemented the neighbourhood’s status as a coveted address. Developers are now racing to meet continued demand from would-be residents.

This lush, centrally located golf course is one of KL’s finest—designed by Australian architect Max Wexler, also behind Sentosa Golf Resort in Singapore. The resort caters to golfers of all levels and doubles as a family-friendly leisure hub. Beyond the 18-hole course are a gym, pool, and multi-sport Clubhouse with courts for tennis, badminton, squash, and more. BJGCR also offers a mini-bowling alley and the Golf House Academy for training. Extra-curriculars range from aerobics and taekwondo to hip-hop dance, belly dancing, and snooker, reflecting the resort’s status as a full-spectrum community space.

Founded in 1993 by tech entrepreneur Datuk Parmjit Singh, APIIT responded to a shortage of IT professionals in Malaysia. Located at Technology Park, Damansara Heights, the institute now enrols 9,000 students and has regional branches in Pakistan, India, and Sri Lanka. Singh also founded the Asia Pacific University of Technology & Innovation. APIIT collaborates with international universities including institutions in the UK and Australia (e.g., Monash, Perth). Programs span four levels: a foundation year, diplomas, degrees, and postgraduate options. Singh remains active in advising national bodies on tech and education policy.

This 80-acre green space (Taman Rekreasi Bukit Jalil), 20 kilometres from downtown, is a jewel of the southern suburbs. Highlights include a playground, fitness trails, reflexology paths, lakes, a heliconia garden, and facilities for people with disabilities. Its most distinctive feature is the International Garden, which showcases landscaped plots themed on countries like Japan (with tea house), the UK (with gazebo), the Netherlands (with windmill), and more unlikely locales such as Iran, Peru, and Canada. Regional gardens from Malaysia, Indonesia, and Thailand— featuring a golden pagoda—complete this multicultural botanical experience.

Foreign levies, regional wars, and buyer fatigue are putting pressure on Singapore’s housing market— though suburban demand and long-term fundamentals offer hope

BY GEORGE STYLLIS

SINGAPORE’S SKYLINE TOWERS OVER SCARCE LAND AND HIGH-STAKES HOUSING DEMAND

It wasn’t long after Donald Trump held up his oversized board of global tariffs in April that the ripple effects were felt in Singapore.

Almost overnight, home views dropped amid concerns that the US president’s 10% levy would slow the city-state’s economy.

“Market sentiment became cautious following Trump’s reciprocal tariffs announcement,” confirms Nai Jia Lee, head of Real Estate Intelligence at PropertyGuru Group.

Though the mood improved in May when Trump announced he would pause the tariffs for 90 days, Singapore’s housing market remains uncertain amid a slowdown since March and ongoing geopolitical tensions.

According to CBRE, 555 new units were launched in March compared to 1,694 in February. At the same time, private new home sales fell 54.4% month-on-month to 729 units.

It was yet another swing in what has been months of fluctuations.

For the first nine months of 2024, the housing market sank to record lows due to government cooling measures, rising mortgage rates, and buyer fatigue after years of high prices.

But the market rebounded in the last quarter. Developer sales jumped threefold to 3,511 units from 1,160 units in the third quarter and exceeded the 3,049 units sold in the first nine months of the year.

The strong start to this year was driven by families and investors flocking to suburban projects for more affordable housing. Tighter loan rules and higher stamp duties implemented since March have made properties in the city centre less attractive.

Meanwhile, borrowing costs have dropped sharply, partly due to the Singapore dollar’s outperformance against

This isn’t a market for gamblers or dreamers. It’s one for strategic thinkers — those who know that value is shifting, fundamentals rule, and market timing, plus patience, is everything

most Asian currencies. The city’s currency is anchored to the Chinese renminbi, which has been kept stable by the People’s Bank of China in the face of China’s trade war with the US.

That allowed buyers to opt for larger homes in the suburbs.

“Unlike before, three- and four-bedroom units are selling quickly at high prices between USD3 million and USD4 million,” adds Nai Jia Lee. “Additionally, the secondary market has fewer listings compared to last year, resulting in higher prices and slower transactions.”

A new trend of flipping homes also contributed to this year’s early rush. With house prices rising year after year in Singapore’s private housing market, sub-sales have become fashionable.

This is when people sell homes bought at new project launches before the units are completed. Last year, about 1,300 such transactions for condos and other private

Singapore’s iconic casino, Marina Bay Sands, is set to begin construction on its fourth tower this summer as part of a USD8-billion upgrade.

The expansion will include a 587-room luxury hotel, a 15,000-seat entertainment arena, fine dining venues, and a new casino.

It comes as regional competition intensifies for a slice of the luxury market, with newer gaming destinations like Vietnam entering the fray.

Construction on the new tower will start in July and is expected to be completed by 2029.

An artist’s impression shows the tower standing separate and slightly taller than the existing three.

Paul Town, COO of Marina Bay Sands, says the project isn’t merely an extension but an entirely new experience.

“It’s going to feel more exclusive and more elevated,” he says. Launched in 2010, Marina Bay Sands is one of the world’s most successful casinos, recording USD2 billion in annual earnings in 2024.

However, Singapore faces stiff competition from Asian markets like Cambodia, the Philippines, and Macau, which has offered tax breaks to casino operators.

Town says there was “a bit of a global arms race” around luxury, making the sector “very competitive” for every player.

Roy Ling of FollowTrade says the expansion is a “bold rewrite” of the brand, hinging on attracting high-end spenders.

“Given its track record, the project is likely to be well received, particularly as it taps into a post-pandemic appetite for personalised, experiential luxury. Still, success hinges on more than glitz—execution, economic resilience, and sustained demand from highspending travellers will be key.”

apartments were officially recorded—the highest annual number in more than a decade.

Sales of new private units likely surpassed 3,200 in the first quarter, according to estimates from realtor Huttons Asia— the highest for that period since 2021.

But that momentum dissipated in March, according to Alan Cheong, executive director of research at Savills Singapore.

“Until March the take-up had been 80 to 90 percent for new launches,” he says. “So the market seemed pretty

strong until the number of new launches slowed when Trump announced the tariffs.”

In April, developers sold 663 units, even fewer than the 729 sold in March.

Further fuelling anxiety about the future of the economy and house prices are the wars in the Middle East and the threat that Iran might close the Strait of Hormuz—through which a fifth of the world’s oil flows—in retaliation for further American and Israeli attacks.

Both the Middle East conflict and Trump’s tariffs have the potential to drive up inflation, which has remained low until now.

“The market remains highly volatile due to international events,” adds Cheong. “Elevated tensions in the Middle East could lead to increased inflation and, consequently, higher interest rates. Additionally, we have observed such tensions escalate and de-escalate rapidly, contributing to significant market uncertainty. As most stakeholders prepare for adverse scenarios, it is anticipated that many will proceed with caution, while some may pursue

MIDDLE EAST WARS STOKE CONCERN OVER CONSTRUCTION COSTS

Conflicts in the Middle East are stoking fears that construction costs in Singapore may rise if tensions escalate.

Experts warn the troubles in Gaza, Lebanon, and Iran could push up oil prices and shipping fees, especially if Iran closes the Strait of Hormuz, as it has threatened.

“The market remains highly volatile due to international events. Elevated tensions in the Middle East could lead to increased inflation and, consequently, higher interest rates,” says Nai Jia Lee.

Inflation has remained low in Singapore, with official data showing a 0.6% year-on-year rise in the consumer price index in May—in line with economists’ forecasts.

It was the fifth straight month where the core rate stayed below 1%. But if conflicts worsen, that could change.

Goldman Sachs analysts forecast Brent crude could hit USD110 a barrel if the Strait is blocked, while HSBC sees prices topping USD80.

DBS senior economist Chua Han Teng adds: “Escalating tensions in the Middle East raise concerns about disruptions to global oil supplies, which could further drive up global crude oil prices, consequently increasing Singapore’s energy import prices, as well as electricity and travel-related costs.”

opportunistic purchases or investments as a hedge against inflation.”

This could hit one of the most important customer segments of the housing market, says Roy Ling, CEO of FollowTrade, an investment platform.

Residents who own Housing and Development Board flats and are looking to move into private property—typically a condominium—are “the lifeblood” of the outer and mid areas of Singapore, says Ling.

These buyers, dubbed HDB upgraders, are being squeezed by soaring price-to-income ratios of more than 14 times.

“They are running up against the limits of affordability. The upgrade dream is becoming more financially strained for many young Singaporeans,” he says.

Experts say Singapore still has good market fundamentals: low unsold inventory, low unemployment, and a reliable government. But affordability cannot be allowed to stretch further.

Speaking in April, Prime Minister Lawrence Wong said he would set up a task force to counter the impact of

Trump’s tariffs, which would harm Singapore due to its heavy reliance on exports. The task force would support businesses with tax breaks, households with vouchers, and unemployed workers with a cash allowance.

“Singapore may or may not go into a recession this year, but I do not doubt that our growth will be significantly impacted,” he says.

Nai said there could be some upside with the tariffs—notably that the government may invest more in infrastructure to stimulate the economy and asking prices might become more reasonable amid stiffer competition.

“If the first half of 2025 has taught us anything,” says Ling, “it’s that Singapore’s residential market is in a contemplative, recalibrating phase. This isn’t a market for gamblers or dreamers. It’s one for strategic thinkers— those who know that value is shifting, fundamentals rule, and market timing, plus patience, is everything.”

ITS FIRST STEP

Luxury brand W Residences will launch its first project in Singapore this year with much anticipation.

W Residences Marina View will be one of the most expensive launches of 2024, with two-bedroom units starting at SGD3.6 million (USD2.8 million) and penthouses exceeding SGD10 million.

Scheduled to open in 2028, the development will include 683 rooms and a 350-room W Singapore hotel.

“The project is a timely response to the evolving expectations of luxury buyers in Singapore,” says developer IOI Properties Singapore.

While IOI has previously co-developed properties like Seascape and Cape Royale at Sentosa Cove with Ho Bee Land, this will be its first solo project in the city.

Residents will enjoy services from a dedicated W residential team, home-based spa treatments, and premium pet care.

Savills data shows the branded residences market is expanding rapidly, with over 690 projects completed globally and supply projected to double by 2030. Asia Pacific leads the trend with a 216% increase over the past decade.

“Buyers today seek more than a home—they want a lifestyle that blends prestige, service, and ease. Branded residences meet this demand by combining five-star hospitality with home ownership,” Savills says.

Alan Cheong of Savills told Property Report it was one of the year’s most exciting launches.

“I’m looking forward to this one. I think it will be a really interesting development—the first condominium launched in the core downtown area for several years.”

Gulf nations are shaking off a reputation for overt bling to lead a post-pandemic luxury boom, turning the heads of wealthy investors from around the globe

BY LIAM ARAN BARNES

It’s being marketed as the highest penthouse in the world: a 21,000-square-foot shell on the 107th and 108th floors of the Burj Khalifa. Private elevator. Indoor pool. No interior walls.

The so-called “Sky Palace” hit the market earlier this year for just under USD50 million. Agents say early interest has come from celebrity managers, crypto founder —and Floyd Mayweather.

It’s peak Dubai, the type of showpiece that has earned the emirate a reputation for striking an oftenprecarious balance between glamourous and gaudy. But the Gulf’s real estate surge runs deeper than spectacle. The emirate is leading a post-COVID luxury boom, topping global charts for ultra-prime sales. In Saudi Arabia, Vision 2030 is shifting from render to reality, with giga-projects now visibly underway.

Still, the region’s old pressure points persist. Oil price swings, high interest rates, and regional instability continue to test investor resolve. The Gulf has seen its share of boom-bust cycles. But this one feels different—more policy-led, more demographically grounded. Whether that translates into real resilience or just another reinvention will define the next phase.

Spectacle still sells, but in 2025, Dubai added substance to the show. For the first time, the emirate overtook New York and London in USD10 million-plus home sales, topping Knight Frank’s global ultra-prime rankings.

“This year we have seen Dubai transform into a proven global centre for ultra-prime residential,” says Will McKintosh, regional partner and head of residential MENA at Knight Frank. “The growth is underpinned by genuine end-user demand rather than speculative activity.”

Another recent Knight Frank report noted that prime residential prices rose 19% last year, with demand focused on large waterfront villas, branded residences, and land for bespoke builds. On Palm Jumeirah alone, villa prices climbed more than 20% in 2024.

Branded residences have emerged as the dominant luxury product, with values regularly exceeding AED18,000 (USD 4,901) per square metre. Buyers are prioritising service and liveability, often customising layouts and finishes. McKintosh notes that many are “prepared to pay well above market” for homes operated by prestigious brands, not for resale, but to live in.

That permanence is reflected in the buyer mix. Europeans, Russians, and increasingly Indians dominate high-end deals, while developers are reengaging Chinese investors via structured payment plans and long-term visas.

In particular, the 10-year Golden Visa, along with expanded family and investor residency rules, has become a key draw for wealthy expats and entrepreneurs.

But beyond the ultra-prime market, the picture is less polished. Of the 73,000 units due for delivery in 2025—and 350,000 through 2028—fewer than 4% fall within the AED3,000–5,000 per square

In June 2025, as tensions escalated between Iran and Israel, Dubai’s main index dipped 1.3% and oil prices swung over 2% in a week. It wasn’t a crash, but it was a clear signal that investor sentiment in the Gulf remains sensitive to regional flashpoints.

Still, history suggests that Gulf real estate weathers these shocks well. “Geopolitical volatility is often short-lived, but downside scenarios warrant consideration,” noted UBS’s Chief Investment Office in May 2025. The bigger risk lies in prolonged disruption, particularly to key trade routes like the Strait of Hormuz.

With investor caution rising, Gulf governments are moving to reinforce confidence with stronger financial governance and legal reforms aimed at showing that stability here runs deeper than the headlines.

IN ABU DHABI, APARTMENTS ROSE 4.0%, VILLAS 4.4% YEAR-ONYEAR IN Q1 2025, ACCORDING TO JLL, WITH JUST OVER 1,100 NEW UNITS DELIVERED

foot range. Nearly two-thirds of new stock now targets the AED1,000–2,000 bracket, according to Knight Frank.

Still, volume isn’t closing the gap. Supply trails demand in many areas, and high interest rates are squeezing middleincome buyers. Since 2020, average prices have jumped more than 65%, pushing “affordable” homes out of reach for many.

At the top end, it’s a different story. Prime beachfront stock remains scarce, helping insulate values. Fitch Ratings warns of a potential 10–15% correction by 2026 due to speculative oversupply but expects prime assets to hold steady.

That confidence rests on a maturing regulatory environment. Escrow rules are enforced. Anti-money laundering laws are tighter. Full foreign ownership is allowed in key zones.

“When developers follow RERA requirements, like maintaining separate escrow accounts for each project, investors can see exactly where their money is going,” says John Varghese, managing partner at HLB HAMT.

The new 9% corporate tax and clearer free zone structures have also helped overseas investors model costs more

confidently. But not all corners of the market offer the same clarity.

“There is now a bifurcation,” McKintosh adds. “Prime and ultra-prime are buoyed by global capital and lifestyle-led investment. The mid-market is under real pressure.”

The result is a split market: thriving at the top, squeezed in the middle. For a city that positions itself as a hub for opportunity, that imbalance remains unresolved.

Abu Dhabi, meanwhile, is moving at a steadier pace. Apartment prices rose 4.0%, villas 4.4% year-on-year in Q1 2025, according to JLL, with just over 1,100 new units delivered.

“Abu Dhabi’s residential market is poised for continued growth, driven by sustained investor demand in designated investment zones such as Yas Island and Al Maryah,” JLL notes, with new communities that offer modern design and lifestyle appeal emerging as key demand drivers.

That approach lacks the drama—and global headlines—of Dubai. But for investors chasing stability over spectacle, it’s becoming a quiet contender.

JEDDAH, THE MOST LIBERAL CITY IN SAUDI ARABIA, IS EMERGING AS A FULCRUM FOR REAL ESTATE DEVELOPMENT IN THE KINGDOM

If Dubai dazzles with spectacle, Saudi Arabia is betting on scale. The Kingdom’s residential sector is projected to attract USD1.22 billion in investment in 2025, according to Knight Frank, as its urban population swells by eight million people by 2030—a foundational driver of real estate expansion.

Giga-projects like NEOM, Diriyah Gate, and Qiddiya have moved from render to reality. NEOM’s Sindalah Island opened in late 2024. At Diriyah Gate, the Bujairi Terrace district is now operational, combining cultural landmarks with premium retail and F&B. More than USD2 billion in contracts were awarded there in 2024, including new deals with Indian conglomerates like Tata and Oberoi.

“Despite global headwinds, Saudi’s diversification and scale are attracting serious capital,” says Saud Alsulaimani, country head of KSA at JLL. “Limited prime vacancy, strong tourism momentum—all of that is driving demand in Riyadh and Jeddah.”

The lifestyle shift is real. New districts are prioritising walkability, curated retail, and high-end public space. “A compelling investment landscape,” JLL calls it.

Two years after the 2022 FIFA World Cup, Qatar’s real estate market has cooled but held steady. House prices dropped 6.7% in 2024, while apartment rents fell around 6%, according to the Qatar Central Bank and ValuStrat.

Rather than seeing a post-event slump, Doha has managed a measured transition. Stadium zones have been converted into mixed-use districts, while improved infrastructure continues to support demand across key neighbourhoods.

Occupancy rates have remained above 66%, even outside peak seasons. For neighbouring Gulf markets planning even bigger transformations, Qatar’s example shows how thoughtful planning can smooth the path from the global spotlight to long-term stability.

THE SAUDI MARKET OPENED TO FOREIGN BUYERS IN 2024, AND A 5% REAL ESTATE TRANSFER TAX HAS BEEN INTRODUCED TO FUND INFRASTRUCTURE

Jeddah is emerging as a high-end lifestyle hub, with Red Sea developments drawing interest from returning nationals and regional buyers. Mixed-use, branded, and waterfront assets are all gaining traction.

With over 60% of Saudis under 35, the design brief is changing fast. At the PIF-backed Roshn Group’s first Riyadh project, that meant scrapping gated compounds in favour of open, walkable communities.

“We asked, what happens if you take that wall out and create a living street?” said Oussama Kabbani, Roshn’s chief development officer, in the Financial Times. “To our surprise, it just flew. People were waiting for someone to open the door to a new lifestyle.”

But scrutiny is rising too. With billions on the line, delivery timelines, legal safeguards, and transparency are under the microscope. Vision 2030’s Financial Sector Development Program (FSDP) is pushing governance reform. And the pace is picking up.

The market opened to foreign buyers in 2024. A 5% Real Estate Transfer Tax has been introduced to fund infrastructure. And audit and disclosure standards are tightening.

“Clearer rules and stronger audit practices are making investors feel safer about putting in their money,” says Varghese. “Foreign investors now want proper financial records, clear ownership structures, and strong internal systems. If everything is transparent and meets global norms, they’re more likely to go ahead with a deal.”

While the UAE remains more familiar with international capital, Saudi Arabia is closing the gap fast.

Still, affordability is becoming a tension point. House prices in Riyadh are now 81% higher than in 2020, and apartment prices are up 56%, according to Knight Frank. While the national homeownership rate has hit 63%, it’s just 53.2% in the capital.

The government is stepping in. More than 30,000 homes are now under development by the state’s National Housing Company, with starting prices of around SAR375,000 (USD100,000). Statesubsidised loans are also being deployed as part of the Kingdom’s push to reach 70% home ownership by 2030.

Saudi Arabia and the UAE are chasing the same prize: investor credibility. But their playbooks differ.

Dubai has built its brand. Its challenge now is scale. Can it make the mid-market work while holding the top end steady? Saudi has the money, the momentum, and the mandate. What it needs is proof of concept: liveable communities, reliable delivery, and regulatory trust.

One is refining a mature model. The other is betting big on reinvention.

The ambition is clear. What matters next is execution.

The Gulf has seen its share of boom-bust cycles. But this one feels different. It’s more policy-led, more demographically grounded

Across the Gulf, infrastructure is increasingly driving the real estate story. MEED Projects estimates that over USD3.1 trillion in active projects are underway in the GCC, from highspeed rail to digital infrastructure.