1 44 SPARK LIGHTS UP DESIGN 99 FINE LINE IN SAUDI ARABIA 74 ESG LIFTS ASIA REAL ESTATE MELBOURNE’S FORMIDABLE FRUIT 28 KANDAL BURNS BRIGHTLY 62 SENIOR SERVICE IN ASIA 82 USD10; SGD13; IDR135,000; MYR41; THB330 NO. 175 asiapropertyawards.com/newsroom

4

5

BEST SMART BUILDING DEVELOPMENT HIGHLY COMMENDED Prompt88 Health Land by Pattana Property Development Prompt88 Health Land by Pattana Property Development BEST WELLNESS LIFESTYLE DEVELOPMENT WINNER Leasehold 30 Years at 160,000 USD www.prompt88healthland.com Sales contact : +66 (0)2 - 027 - 8888

Prompt 88 is a gathering of specialist doctors, engineers, architects, designers, leading hotel management teams with a new concept of accommodation rather than living in order to live comfortably, healthy and safely.

Prompt 88 have been carefully designed according to Wells certification & Universal Design standard.

Complement this with a range of professional medical and wellness services. The residence can live in or treat as a home-away-from-home, with extra care in the way of health and wellness, by expert. Enjoy life, and health-focused refresh, reboost or retreat to rejuvenate. They can be free to do as they please, when they please.

The place that’s convenient to travel to, with the buzz of city and avoiding the intensity that sometimes surrounds.

* Note prices and conditions according to this document are subject to change without prior notice.

7

8 www.sinarmasland.com Sinar Mas Land @sinarmas_land @sinarmas_land

9

Sinar Mas Land

BEST DEVELOPER (ASIA)

BSD City by Sinar Mas Land

BEST GREEN DEVELOPMENT (INDONESIA)

BSD City by Sinar Mas Land

BEST GREEN DEVELOPMENT

WINNER

Crafting thoughtfullydesigned spaces for the modern local lifestyle.

Kambujaya is a newly established boutique lifestyle and property development firm aspiring to build design oriented and unique living spaces for the Cambodian market.

We were created to meet the growing demands of the Cambodian middle class who are seeking natural greenery, higher quality, and well-designed living solutions that enrich the rhythms of everyday life while building homes that are beautiful, functional, and responsive to their environment.

Our ultimate goal is to enrich the lives of those living in a Kambujaya home because we recognize the influence that beautiful spaces have on people’s mental, physical and emotional wellbeing. It matters to us that our homes are not just a number on a street, but a sanctuary of space. This understanding informs our design philosophy which we apply to every Kambujaya project.

Kambujaya Development Co., Ltd

11

kambujaya.com

Publisher Jules Kay

Publisher Jules Kay

Editor Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Senior Editor

Richard Allan Aquino

Digital Editor Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Bredesen, Diana Hubbell, Steve Finch, George Styllis, Jonathan Evans

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer Poramin Leelasatjarana (Min)

Media Relations & Marketing Services Manager

Nate Dacua

Media Relations & Marketing Services Executive

Piyachanok Raungpaka

Marketing Relations Manager

Tanattha Saengmorakot

Senior Product Lifecycle & Brand Manager

Marco Dulyachinda

Sales Director

Udomluk Suwan

Regional Solutions Manager

Orathai Chirapornchai

Regional Manager of Awards Sponsorship

Kanittha Srithongsuk

Solutions Manager (Australia)

Watcharaphon Chaisuk (Jeff) Solutions Manager (Cambodia)

Phumet Puttasimma (Champ)

Solutions Manager (Greater Niseko)

Nyan Zaw Aung (Jordan)

Solutions Manager (India and Sri Lanka)

Monika Singh Solutions Manager (Indonesia)

Wulan Putri

Senior Account Manager (Indonesia)

Oky Prasetya

Senior Solutions Manager (Mainland China, Hong Kong and Macau)

Huiqing Xia (Summer)

Solutions Manager (Mainland China, Hong Kong and Macau)

Kai Lok

Assistant Manager, Awards (Malaysia and Mainland China)

Samuel Poon Senior Solutions Manager (Philippines)

Marylourd Pique Solutions Manager (Philippines)

Maria Elena Sta. Maria Awards Manager (Singapore)

Alicia Loh Solutions Manager (Thailand)

Kritchaorn Rattanapan

Rattanarat Srisangsuk

Solutions Manager (Vietnam)

Quan Nguyen (Val)

Developer Solution Sales Manager (Vietnam)

Dinh Van Tuan Anh (Kei)

Business Development Executive, Sponsor Partnership Priyamani Srimokla (Priya)

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries petch@propertyguru.com

Distribution Enquiries ying@propertyguru.com

PropertyGuru Property Report is published six times a year by

© 2022 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher

KDN PPS 1662/10/2012 (022863)

14

ISSUE 175

w w w hl b. globa l

CONTENTS

22 Gadgets Get into the swing of the season with great tech gifts

24 Trends

‘Tis time to deck the halls with fine furnishings

26 Style We’ve got you covered with these wintersports essentials

28

Project Confidential: Work bearing fruit

With architectural inspiration from the fig, 380 Melbourne is one of the Australian city’s most multi-faceted private projects

36

Interview: Circle of trust

Vivin Harsanto of JLL Indonesia aims to ensure that her firm remains a reliable partner for clients as they negotiate the post-pandemic world

44

Design Focus: Backwards and forwards

SPARK Architects has established itself as one of Asia’s leading practices by harnessing social imperatives and sustainability with trendsetting design

16

| Issue 175

62

Neighbourhood Watch: Kandal

The home province of Cambodia’s former capital is an economic powerhouse and a rising destination for real estate investment

64

Special feature: New dawn fades

Post-pandemic optimism around Southeast Asia has given way to concerns over inflation, currency depreciation, and rising interest rates

74

Special feature: Property for the people

Players in the real estate industry around Asia are getting serious about investing in environmental, social, and governance (ESG)

82

Special Feature: Growing old gracefully

Ageing societies in Southeast Asia mean that catering to the requirements of mature investors will be a key challenge for developers

96

Dispatch: Rights and rungs

Decriminalisation of gay sex was a landmark decision, but LGBTQ+ couples in Singapore still face major barriers in accessing affordable real estate

99

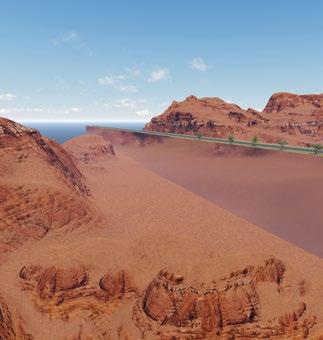

Dispatch: Line in the sand

The fantastical centrepiece of Saudi Arabia’s planned Neom megacity, The Line does not lack ambition or scale

17

Join the region’s most exclusive real estate honours, celebrating 18 years of excellence in 2023 AsiaPropertyAwards.com SHINE BRIGHT LIKE A WINNER

EDITOR’S NOTE

And there we have it: the end of another year.

As 2022 started most of us in Asia were still largely confined to our home countries and chosen bases, with pandemic restrictions making travel a chore as much as a pleasure. Nations around the region have opened over the course of the year, and people are moving freely again.

Indeed, as tourists flock back to Asia’s paradise beaches, pulsing cities and showstopping attractions it can be easy to discount the collective trauma that has just been inflicted upon us.

But post-pandemic Asia is a vastly altered place — both for better and for worse. In the column of positives, one can point to a trend for sustainability that is front of mind for everyone from developers to investors. On the flipside, Asia is destined for a rocky period ahead as the expected global downturn begins to bite.

In this concluding issue of the year, we round up some of the most pressing issues facing the real estate industry as we head towards 2023. These include the growing importance of environmental, social, and governance (ESG) and how markets around Southeast Asia are primed to meet post-pandemic challenges like China’s property slump.

Elsewhere we head to Melbourne for a deep dive on one of Australia’s most exciting new projects, meet with SPARK Architects in Singapore and run the rule over The Line, Saudi Arabia’s fantastical planned linear city in the desert.

Enjoy! Duncan Forgan Property

Report

duncan@propertyguru.com

20

Issue 175

21

SOMETHING MAGICAL

Get into the swing of the season of giving with tech wonders that are high on the Christmas wish list

WE’RE LEVITATING

Created by John Fiorentino of Gravity Blanket fame, the Moon Pod is not your ordinary beanbag. Filled with responsive highdensity beads, this seat gives you the sensation of floating as opposed to sinking. Its dual-shell membrane responds to any body shape and movement.

USD399, moonpod.co

22 DETAILS | Gadgets

PAPER MEMORIES

Give the gift of visuals with a trusted name in photography: Kodak. The company’s Mini Shot 3 Retro wireless instant camera is built with an integrated printer and Bluetooth connectivity, meaning you can print pics directly from your phone.

USD153, shop.kodakphotoprinter.com

GAME ON

No gaming console? No problem. The Backbone converts your phone into one with tactile control buttons and joysticks, complete with a 3.5mm headphone jack. The gizmo plugs into your phone via a USB-C or Lightning port, ideal for both Android and iOS users.

USD100, playbackbone.com

EAR WARMERS

Swap your Apple earphones for the company’s innovative wireless over-ear headphones. The AirPods Max has a universal fit, its knit-mesh headband canopy reducing on-head pressure. And with their acoustically engineered memory foams, the Airpods Max’s ear cushions create an immersive seal for highfidelity sound.

USD549, apple.com

AUTONOMOUS LIVING

Give the gift of cleanliness with Samsung’s Jetbot mop. With two swiftly spinning pads, the robotic mop can navigate all non-carpeted flooring types, including tile, hardwood, vinyl, and laminate. It can also run for almost an hour without refilling its tanks.

USD135, samsung.com

23

OOH FA LA LA

‘Tis the season to deck the halls with furnishings that make your home look its festive best

SHOW PIECE

A good sideboard will show off your fancy dishes and dishware at Christmas dinner, and Mercury Row’s Brumit steps up to the occasion. Featuring flared, angled legs and chic slatted sliding doors, the MDF-and-laminate sideboard offers four drawers to store cutlery and napkins.

USD1,039, wayfair.com

24 DETAILS | Trends

TALL ORDER

Standing 7.5 feet high, National Tree Company’s Feel Real Downswept Douglas Fir commands attention at any highceilinged home this season. It has almost 2,000 polyethylene branch tips, lending it a lifelike look, plus built-in LED bulbs twinkling all-white to multicolour.

From USD593, amazon.com

FAB FOURSOME

Christmas dinner for four? Don’t fret with the Wade Logan Armgart, a midcentury-style dining set with four cushioned chairs and a table in matching wood finishes. The tabletop is made of faux wood with walnut veneer, offering a perfect backdrop to your holiday dinner.

USD765, wayfair.com

CURB APPEAL

Tell the neighbourhood that your home means business this season with Frontgate’s Christmas Cheer cordless wreath on your front door. Tied with a bright red velvet bow in gold lining, the wreath has sprays of Scotch and pistol pine, noble fir, pinecones, and red berries.

From USD69, frontgate.com

COUCH SURFER

Available in a multitude of colours from teal to peony, Swyft’s three-seater Model 04 sofa is great for the holidays. It moonlights as a standard double bed, ideal for friends who come to crash at your place when the Christmas party’s over.

GBP2,295, swyfthome.com

25

ON A HIGH

From the slopes of Niseko to the pistes of Yongpyong, we’ve got you covered with these wintersports essentials

GRACEFUL RUN

If skiing is your thing, Line’s Blade freeride skis offer outstanding torsional stability and enhanced grip with their thin waists and giant shovels. Manufactured with Directional Flex tech, the skis give riders great lift above deep snow and outstanding control at fast speeds.

USD800, lineskis.com

26 DETAILS | Style

ALIEN LOVER

Handcrafted with clean energy in Capita’s ‘Mothership’ manufacturing facility in Austria, the Mega Merc may as well be the spacecraft of snowboards. It shreds through any terrain with an FSC-certified core of ultralight post-consumer recycled plastics, among many other powerful features.

From GBP685, capitasnowboarding.com

OUTER LIMITS

A tough top for alpine temperatures, Mountain Hardwear’s Boundary Ridge jacket features a waterproof, three-layer Gore-Tex shell; helmet-compatible hood; pass pocket on the sleeve; and internal powder skirt. It even comes with the Recco Avalanche Rescue Reflector, alerting emergency responders to your location.

USD474, mountainhardwear.com

HEAD GAME

Put safety first on the slopes with Sweet Protection’s Switcher Mips ski and snowboard helmet. With Mips technology, the helmet reduces rotational forces on the brain. It features 22 vents and great shell construction, plus Impact Shields liners to offer optimum shock absorption.

EUR250, sweetprotection.com

CHROMATIC DREAMS

Smith Optics updates its famed Squad goggles with the Mag system, featuring multiple magnetic contact points and locking mechanisms, as well as two interchangeable ChromaPop lenses. With straps made from recycled nylon materials, the goggles help you see and look good at the highlands.

From USD240, smithoptics.com

27

WORK BEARING FRUIT

With architectural inspiration from the fig, 380 Melbourne is one of the Australian city’s most multi-faceted and pedestrian-friendliest private projects

BY AL GERARD DE LA CRUZ

BY AL GERARD DE LA CRUZ

Across the millennia, the fig has held a fascination for artists, creatives, and storytellers.

When designing 380 Melbourne, Australian design practice Elenberg Fraser recalled D.H. Lawrence’s poetry about the “very secretive fruit.”

The two-tower development, jutting above the heart of Melbourne’s central business district, encloses everything from apartments to Voco hotel rooms and a multitude of amenities, all under one architectural skin.

Interestingly for true blue Melburnians, the project serves as an extension of Timothy Lane, slicing through the site in the grand tradition of the city’s laneways.

“We are interested in the fig because of how it contains thousands of little seeds,” says Matt Chamberlain, associate director at Elenberg Fraser. “We saw this large mixed-use project almost as a shell that contained

a variety of different uses and an extensive building population of all sorts of different people.”

Hiap Hoe was originally set to develop the site in a joint venture with Melbourne-based family business Brady Property Group. The Singaporean developer purchased the site, a former commercial carpark, in 2013 and obtained a planning permit with Elenberg Fraser through town planner Urbis.

In 2016, Hiap Hoe exited the venture, with Elenberg Fraser staying on as architect. Brady Property Group “happily” acquired full ownership of the site, which spans an entire block between Lonsdale and Little Lonsdale Streets, reports Daniel Brady, sales director of Brady Property Group.

“From our proven experience, it is a high-demand location offering an unrivalled lifestyle for residents,” he says.

30

MASSIVE STRUCTURAL MEMBERS AND INTRICATE STEELWORKS WERE INTEGRAL TO THE 714-FOOT-TALL PROJECT. IMAGE CREDIT: ELENBERG FRASER

The commercial carpark that once stood on site proved a hindrance, blocking Timothy Lane from emerging out onto Lonsdale Street. The development eliminates this dead end, allowing pedestrians to continue down the laneway, flanked by open lobbies, F&B establishments, and retail spaces, through the towers’ podium. “In extending Timothy Lane, the development created a new thoroughfare, instilling new life to the neighbourhood,” says Brady.

But the site was unusually long and slender, challenging delivery of building materials to the centre of the project that began construction in 2018. The laneway extension itself challenged the contractors, assembled by the team of Brady Construction, since existing authority services in Timothy Lane impeded excavation.

“At all stages of construction, we notified all the adjoining building owners of our construction program, including any street disruptions or closures, to establish a smooth

relationship with all owners,” reports Brady.

Matching the scale of the streetscape, the podium builds up right to its boundaries with the surrounding narrow streets. With their wider setback, the two towers make for a grand urban gesture seen from many parts of the metropolis. Since many neighbouring buildings are heritage-listed, keeping nearby sites from being built out in the indefinite future, tower occupants are assured of great, unobstructed views, too.

“What I love about this project is that it works well at both an urban scale and a human scale,” says Chamberlain.

The podium was designed as a metaphor for the fig from pre-pollination to maturity. As seen from the laneway, the interior spaces subtly remind onlookers of fig seeds, from the geometries of the chandeliers and lighting installations to the colours of the stones.

31

32

THE BASE OF THE TOWERS APPEARS AS FLOATING, CANTILEVERED BOXES, FESTOONED WITH LANDSCAPING FROM THE EXTENDED LANEWAY BELOW TO THE PODIUM ROOFTOP ABOVE. IMAGE CREDIT: DYLAN JAMES

Expressed as individual volumes, the podium cantilevers in and out, creating sheltered spaces and allowing pockets of landscaping to poke in between the box-like structures. Higher floors would be facing the street’s tree canopies, for instance. Along the northern stretch of the laneway, a vertical garden spills six storeys down the podium wall, grow lights sustaining them.

“The idea was to represent each program as a single volume and shift them around to break down the delineation between public and private space,” says Chamberlain.

The development of the volumes involved unique structural solutions, including a giant diagonal steel brace to support a large, cantilevered volume from a mega column. Working with the structural engineers of Robert Bird Group, the design team realised the major cantilevers in such a way that the underlying structures are less noticeable. The volumes sport fine detailing around their top and bottom plates, the laneway pedestrians catching themselves reflected on their lustrous stainless steel undersides.

The proportions of the superstructure conformed with the unusually long, slender site. The 218-metre-high tower form is effectively two separate buildings adjoined together, with two vertical lift cores that result in highly efficient floor plates. The shorter South tower partly houses Australia’s first new-build Voco hotel while the rest of its floors and the entirety of the North tower are for residential use.

Working in a series of iterative workshops with Robert Bird, Elenberg Fraser sketched out towers that are longer than they are wide. “What that does structurally is that the broad face can catch a lot of wind load, which sort of wants to tip the building over,” says Chamberlain. “So, we needed to employ connected mega columns, which almost form an extension to the core to give the structure a lot of rigidity in an east-west direction. It’s almost catching a lot of the wind like a sail.”

The slenderness ratio of the towers ultimately benefits their interiors. The shallow perimeter-tocorridor depth maximises daylight penetration into the core.

The façade ripples out in a series of room-wide curved glass bay windows, the modules streaking diagonally across the façade in stacks of eight. These windows protrude up to one metre from the primary façade line, affording occupants

33

WE ARE INTERESTED IN THE FIG BECAUSE OF HOW IT CONTAINS THOUSANDS OF LITTLE SEEDS. WE SAW THIS LARGE MIXED-USE PROJECT ALMOST AS A SHELL THAT CONTAINED A VARIETY OF DIFFERENT USES AND AN EXTENSIVE BUILDING POPULATION OF ALL SORTS OF DIFFERENT PEOPLE

180-degree views and the feeling of stepping beyond the building edge.

Some famous hotel buildings helped inspire the architects to ideate the modularised façade, which is cleverly referenced in the shape of the door handles and other details of the property. “Just the spatial experience of sitting out in that bay window and projecting beyond the façade formed as an inspiration to us to apply modern construction techniques and see what we could do by just using that as a starting point,” says Chamberlain.

“The façade creates a unique spatial experience and helps differentiate this project from a lot of the other apartment projects globally.”

Every curved bay window was designed and engineered to have a different radius than the one above it, ensuring no aperture has a visual connection to neighbouring apartments. With technology imported from Germany, a digital bending machine was used to manufacture the 6,000 curved glass panels in China. The glass supplier also developed a special, low-E coating for the panels, whose dichroic nature allows the façade to shift colours from different angles.

The building’s profile curves accordingly with the bay window system. Brady Construction employed a series of steel edge profiles and reused them up the building as the project progressed. “It’s fairly complex geometry, but achieved in a pretty simple way,” remarks Chamberlain.

With three static tower cranes to expedite the construction, 380 Melbourne was completed in 2021 at a cost of AUD300 million (USD191 million). After pandemicinduced delays, Voco Melbourne Central finally opened within the development in 2022, with general manager Erik Stuebe calling the property “a true original.”

The location is one true selling point. Not only have the units served as city pads for workers in the CBD but also as permanent homes, reports Brady.

With guests, residents, and the public at large to harvest its offerings, the project has truly borne fruit. “Over the last decade we’ve seen a real growth in the number of residents who are moving into the city,” says Chamberlain. “The attraction is just being amongst that vibrant city life.”

34

THE APARTMENT INTERIORS MIRROR THE PROTECTIVE, RESTORATIVE LAYER OF THE FIG SKIN AND THE THOUSANDS OF SEEDS IT HOUSES. IMAGE CREDIT: DYLAN JAMES

SEEDS OF PROGRESS

Consistency is one of 380 Melbourne’s strongest suits. Australian design practice Elenberg Fraser used the fig as a conceptual driver for a lot of the decision-making throughout all the interiors.

“The syconium contains thousands of little seeds within it,” says Matt Chamberlain, associate director at Elenberg Fraser. “We saw that as a neat metaphor for a large mixed-use project of this scale and used the figure as a conceptual driver, particularly through the interior design.”

Throughout all the common areas, the project uses plenty of natural stone products in pinks, reds, purples, and blacks—the colours of the fig. The stones, mostly quarried from India or, in the case of the Terrazzo, imported straight from Italy, can be seen over the indoor flooring, which transitions from one granite to another in coloration.

The apartments themselves are designed to be like a slice of the fruit. The palette is reminiscent of the natural tones of the fig’s skin as well as the fleshy white insides, complementing the engineered oak timber floorboards. Splashes and tones of colour burst out of drawer linings and are artfully concealed within the joinery.

“Even down to the smallest details, like inside the cupboards, we used the colourations of the fig,” says Chamberlain.

35

COMMUNAL AREAS SPREAD OUT IN TEXTURAL REDS AND PINKS, AS IF TO MIMIC THE INSIDES OF THE FIG. IMAGE CREDIT: DYLAN JAMES

36

Circle of trust

Head of the advisory group at JLL Indonesia Vivin Harsanto aims to ensure that her firm remains a reliable partner for clients as they attempt to negotiate the postpandemic world

BY BILL CHARLES

BY BILL CHARLES

37

38

JAKARTA MAY BE SET TO LOSE ITS STATUS AS CAPITAL OF INDONESIA, BUT IT WILL REMAIN THE COUNTRY’S MOST ACTIVE HUB FOR PROPERTY INVESTMENT IN THE FORTHCOMING DECADES

Like many countries post-pandemic, Indonesia is working to pivot economically to a position of stronger growth following the challenges of the past few years.

And in her role as head of the advisory group at JLL Indonesia, Vivin Harsanto oversees research and strategic consulting while advising on property development and investment in both the public and private sectors. Harsanto sees a renewed emphasis on wellness and sustainability, along with technological innovation and recognition of a changing business landscape, as key drivers influencing the country’s real estate markets.

Harsanto, who joined JLL Indonesia in 2008, has 25 years of experience in the real estate industry, working on projects across all segments and in most major cities throughout Indonesia. She is an expert on development strategies, asset optimisation, and investment advisory, in addition to strategies related to the infrastructure sector.

39

The Jakarta government has created the city to be the centre of business and trading in the national, regional, and global economy. It will continue to be a driving force

Looking to the year ahead, Harsanto says about her role: “We will continue to help shape the future of real estate by providing advice to our clients and remain a trusted partner for them in all aspects of their real estate needs, whether that’s their need for valuation planning, marketing, property management, and investments or technology in the property sector.

“We also continuously promote the importance of sustainability, aligning with global and government

initiatives,” she adds. “Above all, we want to ensure that health and wellness post-pandemic will be a priority moving forward.”

Indonesia’s property market has been quite strong after a difficult period, with the economy expected to recover and grow rather quickly post-Covid.

The main drivers of the recovery are a growing population

40

and growing middle class, along with foreign and domestic direct investments and infrastructure developments. Each sector has its current state and character.

Office inquiries across various sectors, apart from active technology companies, have started to pick up since the start of the year. Tenants have cautiously resumed executing their real estate plans, with flight-to-quality, consolidation, and relocation as the central theme driven by cost savings.

Prime shopping malls in strategic locations have enjoyed healthy foot traffic with the easing of social restrictions that allowed them to operate at 100% capacity. F&B and fast-fashion occupiers remain the most active retail segments in 2022.

Meanwhile, the weak demand for condominiums in Jakarta has continued with potential buyers—especially investors—still cautious about buying. On the contrary, the landed housing sector has continued to be active, as can be seen from buyers’ responses to the launches of new products of various types.

As has been the case since the beginning of the pandemic, the need for modern warehouses has stemmed from e-commerce, third-party logistics, and FMCG (fast-moving consumer goods), all of which continue to expand and lease space in greater Jakarta. Last but not least, data centre players remain active in developing facilities, not only on the outskirts of Jakarta, but also within the city centre.

What might the next decade look like in Indonesia’s property market?

We expect the government to focus on infrastructure and public transportation that increase connectivity, including new MRT and LRT lines and toll roads.

Together with the private sector, there will be more initiatives in sustainability and more advanced and innovative efforts to innovate technologically. The office market will see changes in tenant behaviour and priorities such as wellness and sustainability—both supported by technology.

41

PRIME SHOPPING MALLS IN STRATEGIC LOCATIONS IN JAKARTA AND OTHER CITIES HAVE RECOVERED WELL FOLLOWING THE EASING OF PANDEMIC RESTRICTIONS

Retail will be more experiential as merchandise will be easily compared online. Therefore the retail experience and ambiance will be key. Automation in modern warehouses and smart homes will continue to advance. New infrastructure developments will create new public transportation hubs. Non-traditional real estate sectors could also potentially grow. We have seen this in the region, in areas such as urban logistics, data centres, self-storage, life science, and others.

How do you see the luxury segment of the real estate market, which has been hit especially hard by the pandemic, posting a recovery? What will help support that recovery?

Indonesia’s luxury segment has been fairly quiet since 2015-16 with the new regulation on luxury taxes. Some adjustments have been made to those taxes. However, the pandemic has made them less effective, especially in the condominium market.

The luxury segment relies heavily on macroeconomic conditions and confidence levels. As some buyers in this segment see real estate as an investment, buyers are cautious when making purchases. They compare with other investment instruments to see how they could benefit from them. However, some buyers are also end-users. This has less effect on the economy, but more on alternate options,

such as landed houses. We have seen new luxury landed residential units being sold, which means that spending power remains, but only for the right product.

The recovery of this segment mainly relies on the confidence level of potential buyers toward developers—whether it relates to the concept, product, construction progress, and payment terms offered.

What’s the long-term outlook for Jakarta, in your opinion, with the capital expected to move to Borneo?

Certainly, Jakarta will retain its status as Indonesia’s business centre, as with other cities in mature markets. The Jakarta government has created the city to be the centre of business and trading in the national, regional, and global economy. It will continue to be the driving force behind the economy.

How might Indonesia’s attempts to snare the digital nomad market with a new visa impact the property market?

The digital nomad is about millennials and youngsters who combine leisure and work. This new initiative could positively impact the tourism market, especially in Bali. It will expand a new type of demand on top of typical tourists, increasing

42

INDONESIA’S OPENNESS TO DIGITAL NOMADS WILL BENEFIT PRIME REMOTE WORKING LOCATIONS SUCH AS BALI

the number of visitors to Bali. From January to August this year, there were around 3,000 visitors who applied for digital nomad visas, mostly coming from Russia, the US, and the UK.

These millennials and younger generations will drive new demand for leased residential, such as hotels and villas since they could stay for up to six months. Other than that, co-working spaces will be needed to accommodate these new types of visitors, as well as F&B services, such as cafes and restaurants.

What do you think is the importance of the Asia Property Awards as a benchmark for quality in the region?

Since it launched 16 years ago, the PropertyGuru Asia Property Awards series has grown to become the biggest real estate awards program in Asia Pacific. One thing that makes the program successful is its credibility. We believe in being free to enter, offering fair judgment for all, and a transparent process. Being recognised by this award entails a prestigious achievement for the participants.

Through this program, participants also can learn and see ideas and innovations in other countries and ultimately up their own game in the industry.

How is the global economic situation—with generally high inflation and rising interest rates—impacting Indonesia’s property market? What is being done to help support markets?

Indonesia must surmount three challenges that will come with the threat of global recession, which is expected to grip the world in 2023, Investment Minister Bahlil Lahadalia has said. These challenges to the investment sector include political stability, policy consistency, and people’s purchasing power.

Due to rising inflation, Bank Indonesia might increase the benchmark interest further, which could impact the residential market. Buyers could take a longer time in their decision-making process and look for more affordable homes, which consequently might mean a different location or smaller size.

Favourable demographics influence the outlook. Strong consumer spending prospects, thanks to a rapidly growing middle class, will sustain GDP growth. Another critical factor is a projection of a solid expansion of investment.

43

AN EMPHASIS ON INFRASTRUCTURE DEVELOPMENT SUCH AS METRO SYSTEMS IS LIKELY TO EASE TRAFFIC CONGESTION IN JAKARTA

Backwards and forwards

SPARK Architects has established itself as one of Asia’s leading practices by harnessing social imperatives and sustainability with trendsetting design

BY LIAM ARAN BARNES

BY LIAM ARAN BARNES

44

How do you make a new idea? Try combining some old ones “Einstein once said, ‘Combinatory play seems to be the essential component in productive thought’,” says Wenhui Lim, the founding director of SPARK Architects.

Lim is discussing the regeneration of Singapore’s Clarke Quay when she casually quotes the father of modern physics.

SPARK Architects is responsible for the revitalisation of one of the citystate’s most iconic landmarks. And, although she wasn’t part of the team that transformed the dilapidated waterfront district in the early 2000s, Lim believes this mantra shaped the identity of the practice she heads up.

“Creativity is just connecting things,” she says. “This is especially important when considering regeneration projects. Wholesale demolition and new build strategies have been portrayed for too long as symbols of progress.

“But in a resource-constrained world, regeneration and retrofitting are where true innovation and rethinking of the norm can reduce the huge environmental cost of construction.”

The studio traces its beginnings to the Clarke Quay redevelopment. Led and designed by Stephen Pimbley, a disciple of legendary architect Will Alsop, the project for owners CapitaLand included the eye-catching overhaul of shophouse facades, streetscapes, and riverfront dining areas.

Inspired by Einstein’s wisdom, Pimbley mixed historical methods of passive ventilation and cooling with innovative technology. In particular, the combinatory play drew together the ingenious Venturi effect (accelerating air movement over water) with extensive shading and rain protection provided by Ethyl Tetra Fluro Ethylene canopies—the first time the technology had been used in Southeast Asia.

The micro-climate moderation also reduced the ambient temperature by four degrees Celsius, while commercial and entertainment activities soon increased by more than 500%, making it one of the city’s top leisure destinations.

“This changed the international perception of Clarke Quay,” Lim explains. “It became a model for how to cover and ventilate streets in a sustainable way, which has since been reproduced around the world.

45

SPARK ARCHITECTS FOUNDERS STEPHEN PIMBLEY AND WENHUI LIM ARE PASSIONATE ABOUT FUSING INNOVATION WITH AN INSTINCTIVE FLAIR FOR DESIGN

SPARK ARCHITECTS FOUNDERS STEPHEN PIMBLEY AND WENHUI LIM ARE PASSIONATE ABOUT FUSING INNOVATION WITH AN INSTINCTIVE FLAIR FOR DESIGN

“Singapore Tourism even used it as an advertisement for the city. And this is the added value: a thought process that ultimately provided the district with a new identity.”

Nowadays, SPARK is regarded as one of the region’s most dynamic design practices. And with good reason. While designing Clarke Quay, the team won further commissions in Asia, notably China where it enhanced its reputation with the Shanghai Cruise Terminal and Raffles City Beijing. A local studio was soon set up to service the projects.

The firm has continued to expand and now counts more than 100 staff across offices in London, Shanghai, Beijing, and the Lion City. Lim, who partnered with Pimbley shortly after graduating from the National University of Singapore with a degree in architecture, spearheaded SPARK’s inaugural projects in Vietnam and Australia in 2009 and 2013, respectively. She also oversees the firm’s global brand and graphic identity, buoyed by her first love: fine art.

“Technology is of course an important tool for the sophisticated delivery of today’s rule-compliant buildings, but this can easily be studied and learned. The intuitive side of architecture, the ‘art’ if you like, is the fantasy, the magic, and sleight of hand that cannot be taught,” says Lim, explaining she only studied architecture because no art degrees were being offered locally at the time.

“I do believe that having a background in art is the best route into design and architecture as the sensibilities are those best aligned to the social imperative and contribution buildings can make to people and cities.”

Social imperatives are a prominent strand of SPARK’s DNA. In addition to its commitment to promoting retrofitting—the firm supported the

landmark RetroFirst campaign by Architects Journal in 2020—SPARK has been raising awareness of the ‘pandemic of plastic’ witnessed during the pandemic and the use of non-traditional building materials in the future.

For a radical project in India, rehousing a huge slum population in a series of hybrid towers, SPARK tapped up its established network of collection and recycling companies to amass Tetra Pak cartons. These hard-to-recycle drink containers were then fashioned into apartment pods and hoisted onto the towers’ hybrid skeleton.

“The structure uses less concrete and steel, both unsustainable materials, partially replacing them with engineered timber,” Lim says, noting that engineered timber is the way forward referencing French president Emmanuel Macron’s decree that all state-funded buildings be made of at least 50% timber.

Indeed, rather than latching on to the latest whims and buzzphrases, Lim, again showcasing her sprawling cultural influences, sums up SPARK’s philosophy for the future with a quote from an artist who knew a thing or two about setting trends—and transcending them.

“We think a lot about social and environmental sustainability and try to add value to our collective future history, designing buildings and places that are positive, fun, helpful, and designed to improve people’s quality of life,” she says.

“David Bowie once said, ‘style is about the choices you make to create the aspects of life you wish to uphold’. That’s always stuck with me.”

47

Wholesale demolition and new build strategies have been portrayed as symbols of progress. But regeneration and retrofitting are where true innovation can reduce the huge environmental cost of construction

Clarke Quay Singapore

The award-winning redevelopment of Clarke Quay, a historic riverfront district in Singapore, has drawn tourists and locals with its vibrant blend of local culture and world-class lifestyle amenities. The USD90-million upgrade led to an immediate increase in commercial and leisure activities, making it one of the city’s leading landmarks. It has consistently attracted 12 million visitors a year and generated a yield increase five times its original value for client CapitaLand. SPARK’s scope of work included the refurbishment of heritage shophouses, landscaping, wayfinding, new waterfront F&B areas, and the creation of canopies.

49

50

GRiD Singapore

Following the resounding success of Clarke Quay, SPARK set its sights on GRiD, a youthfocused mall and education hub at the heart of Singapore’s Selegie Arts District. Sandwiched between the School of the Arts and time-worn shopping malls, GRiD is a stellar example of retrofitting done right. The project capitalised on its existing relevance to the community, metamorphosising a shoddy street corner into a cultural beacon brimming with high revenuegenerating F&B units. With its post-industrial aesthetic, neon lights, and supersized utilitarian graphics, GRiD deliberately stands out from its neighbours, as an ‘Instagrammable’ gathering point for families, friends, and experience seekers.

51

52

The two striking residential towers sit at the base of Bukit Gambir, a bucolic mountain in the heart of Penang. Inspired by the dramatic surrounding land and seascapes, the composition of the towers is complemented by the extrusion of an elliptical floorplate. Meanwhile, the lushly planted tower garden and podium-level exteriors merge the boundaries between tropical planting and distinctive manmade geometry to generate a distinctive street-level presence with human scale and texture. Upon completion, the 52-storey Western tower became the island’s tallest building.

53

Arte S Penang Malaysia

54

Developer Nusmetro wanted to design an integrated development with spaces for those who want to live, work, and play in the heart of the Malaysian capital. The client also had one major goal: connect the entire structure to the public infrastructure network and densify the city, rather than occupy more of KL’s suburban greenbelt. Unusually, the architectural elements of the facades were inspired by the pattern of the client’s fingerprint, providing the project with its unique identity of human DNA. The three towers rise from the seven-storey podium to a height of 66 floors, featuring 1,600 residential units, a retail area at the ground level, and urban living concept designs including a gymnasium, pools, garden terraces, restaurants, and health facilities.

55

Arte MK Kuala Lumpur, Malaysia

56

Minhang Riverfront Regeneration, Shanghai, China

Another decrepit riverside area, this time in suburban Shanghai, Minhang Riverfront teemed with low-grade industrial warehouses, disused utilities, and overgrown paths. In just two years, SPARK transformed it into an energetic, mixed-use neighbourhood anchored by a playfully designed urban park. As the opening salvo of SPARK’s wider regeneration master plan for the district, the park facilitates improved pedestrian connections and recreational opportunities as well as a more sustainable living environment. From zoning and circulation to furniture and signage, SPARK’s multi-pronged, nature-inspired design exemplifies how civic regeneration need not shy away from bold, playful gestures.

57

58

Guangzhou Shipyard Master Plan

Taking cues from the shipbuilding history of the site, SPARK designed a central plaza featuring a multi-functional digital ‘flying boat’ that forms the image of the development and represents the evolving innovation of the 4k industry. Public space and its ability as a connector, meanwhile, were paramount to the project. The main pedestrian loop connects office workers, residents, and visitors from the central plaza to the facilities at the heritage slipway park, thematic ‘back lane’ food street, and riverfront dry-dock sports hall. The shipyard played a key role in Guangzhou’s industrial history and is primed to perform a new role in the Chinese government’s framework for the Guangzhou, Hong Kong, and Macau Greater Bay Area.

59

THE CAMBODIAN HOME, REIMAGINED

For years, the linkhouse has been a staple of Cambodia’s property sector. Now a boutique developer puts forward a great new vision of the beloved residential typology

Kambujaya Residences, a limited collection of 15 homes located at the eastern outskirts of Phnom Penh City, aimed to revitalise the ubiquitous Cambodian linkhouse typology with a new and modern twist. These homes, the first ever to be developed by Kambujaya, have been consciously designed to incorporate the pillars of the company’s key design philosophy: research-based, nature-integrated, and detail-oriented.

This new development is situated in Chbar Ampov, an up-and-coming district of Phnom Penh, that strikes the fine balance between infrastructural development and preservation of lush native greenery. This residential area boasts a wide array of modern amenities such as community parks, shopping plazas, retail outlets, and a wide selection

of palatable restaurants – all conveniently located within 5 minutes of the project.

The neighbourhood’s invaluable green infrastructure and quiet residential streets provided a perfect backdrop for families seeking solace and tranquillity from the hustle and bustle of the city center. To conserve some of the existing local greenery, the developer went through the tedious process of transplanting some of the site’s original mature mango trees, nursing them, and replanting them back on the site.

Influenced by the area’s lush natural surroundings, the development objective was to create and introduce a new style of living in Cambodia—one that would be symbiotic

60 ADVERTORIAL

ADVERTORIAL

with nature, unique to the local climate, and aesthetically striking. The developer knew the design had to differ and go beyond the usual standard of contemporary linkhouses and crafted a beautiful and functional space that ultimately resonated with its homeowners.

This boutique project was a result of close collaboration among the architects, engineers, and design consultants. Every aspect of the development process, from idea generation to construction oversight, was governed by rigorous analyses based on extensive experience and knowledge to ensure the validity of any rationales. Kambujaya’s hands-on approach, which is quite rare among Cambodian developers, ensured that each detail was constantly covered to maintain efficiency at every step of the way.

Kambujaya believed that constraints can often lead to some of the most innovative and unique design features. Although built within a linkhouse configuration, each Kambujaya home was designed to offer an uncompromising living experience in which residents can reap the benefits of a conventionally detached residential villa.

The three-storey, four-bedroom homes featured large open plan living spaces with ample natural lighting, ventilation, and landscaped greenery throughout. Each movement and

interaction within the home was choreographed to focus on the family-oriented central atrium that was intentionally designed to foster familial bond and a healthy living environment.

Much thought and care were put into the design process, evidenced by a string of niche little design details and features that were meant to be appreciated by the residents over time. The integration of shadow gaps as wall skirting and subtle embedment of handrails underneath a continuous single tile floor arrangement throughout the house were just some examples of the developer’s commitment to raising the bar for quality design and construction standard for Cambodia.

As an inaugural project, Kambujaya Residences perfectly captured Kambujaya’s strength in design and detailorientation as well as their unique approach to boutique development. It also showcased the developer’s ambition to provide better living and lifestyle solutions for the emerging Cambodian middle-class market. Their recognition on the influence that beautiful spaces have on people’s mental, physical and emotional wellbeing contributed to this oneof-a-kind project that put its residents’ experience at the forefront.

61

Kandal catching fire

BY JONATHAN EVANS

The home province of Cambodia’s former capital, Kandal remains an economic powerhouse as well as a rising destination for real estate investment

1 2 3

Borey Arey Ksat

Scheduled for completion in 2023, Borey Arey Ksat (BAK) will be the first integrated development in Leav Aem district to feature contemporary houses, villas, a gym, and pool. It also flaunts a clubhouse, mall, international university, and hospital and its surrounding area will eventually include condos, business quarters, a bank, and schools. The project is a short drive from Arey Ksat ferry port, linking the area to Phnom Penh’s Chroy Changvar peninsula.

The Cambodia–Korea Friendship Bridge, scheduled to commence building next year, will cut driving time and stimulate interest in Arey Ksat, as well as raising land prices.

BAK has already received recognitions at this year’s PropertyGuru Cambodia Property Awards.

Le Urban Eco Park

Upon opening in 2016, Le Urban Eco Park made waves in the field of ecologically minded construction in Cambodia with its innovative giga-project in Kandal Steung district. And it continues to win awards today, scooping the Best Industrial Development prize at this year’s PropertyGuru Cambodia Property Awards. The Singaporean-designed initiative takes the concept of integrated living to a new level by fusing residential, commercial, and business elements. The satellite town counts 120 residences and townhouses, 84 shops, a supermarket, and 15 hectares of industrial park. The community is designed as a self-sustaining exemplar of live-workplay, with energy efficiency, plentiful green space, and natural materials foregrounded in its construction. Eco-initiatives include solar-powered water heating, recycled wastewater, and advanced lighting controls. Onsite factories housing light industrial businesses are major employers in the area.

HOME Chamkar

This alfresco comfort-food restaurant in Sray Chrum Village lies in the Arey Ksat area. It wins great popularity for its impeccable location (notably among passing cyclists, for whom it provides ample bike racks). HOME Chamkar is perched right on the Mekong riverside and lies close to the ferry terminal that effectively connects Kandal province with Phnom Penh. Its relaxing setting is the key USP, and the venue maximises the rustic aura with a front-ofhouse boardwalk where diners soak up refreshing breezes and views of the enticing surrounds, which include many paths lined with mango trees and a lemongrass farm. Phnom Penh’s enervating city buzz may be only a few kilometres upriver, but it feels a world away.

62

Kandal province might not be a name readily familiar to those outside Cambodia. But it is crucial to the national economy. The majority of the largest city Takhmao’s residents commute to Phnom Penh, with road links facilitated by bridges recently constructed across the Mekong. Much of Kandal’s prosperity rests on its proximity to the capital, with agriculture, garment making, and artisan trades—silk weaving, wood carving, handicrafts—all prominent industries. It also houses the former capital of Oudong (see below), a significant city in Cambodian history. Offering quick and easy access to Phnom Penh, Kandal is reasserting its value to contemporary investors.

4 5 6

The River Mall/Center City Ta Khmao

It was predicted by none other than Khmer architect extraordinaire Vann Molyvann that Phnom Penh will continue to grow outwards towards Takhmao because of this area’s flood-resistant qualities. For proof of Molyvann’s prophecy, look no further than the Tonle Bassac riverfront and the imposing complex Center City, which opened in 2016. This integrated development, incorporating residential, commercial, and leisure space, is a joint venture between local developer Tang Kung Group and a Malaysian investor. It encompasses two 27-storey towers, 484 condominium units, a 68-unit commercial wing, two-storey shopping mall, health and fitness centre, swimming pools, and children’s playground. The River Mall, Takhmao’s de facto prime shopping destination, includes dozens of shops, restaurants, and cafés, complementing the “work-live-play” lifestyle.

The Fence Café

Recently, an increasing number of people in Phnom Penh have been turning to longdistance cycling outside the city, touring suburban areas for a change of scene while also getting much-needed fresh air and exercise away from the frenzied development that’s taken over the capital. In Takhmao, The Fence Café is a popular, expertly curated stop for day-trippers on the route of many biking trails. Egg coffee is the signature drink, and collectible, oldschool coffee and tea paraphernalia enliven the interiors. Painted shutters and doors, rattan rugs, and bamboo ceilings all add to the charmingly antiquated atmosphere. The café’s easygoing ambience has made it a go-to destination for pop-up markets, designers creating artwork, and even chess tournaments. A second outlet is located in central Phnom Penh.

Oudong

Cambodia’s capital and royal residence from 1618–1866 was this town, now strewn with relics remaining from the period, and set in Ponhea Lueu district. It’s a beautiful site to visit, with the stupas and temples shadowed by the rural location at the foot of Phnom Oudong (Oudong Mountain). The most enduring architecture dates from the reign of King Ang Duong (1840–60), who built many canals, terraces, bridges, and hand-carved pagodas. The Khmer Rouge gravely damaged Oudong and its religious structures in 1977, but it remains a captivating vision of faded grandeur. The 500-step climb up Phnom Oudong is rewarded by sublime views of the luxuriant countryside, extending as far as Phnom Penh’s Silver Pagoda and Royal Palace.

63

NEW DAWN FADES

Post-pandemic optimism around Southeast Asia has given way to concerns over inflation, currency depreciation, and rising interest rates. Yet 2023 should see most of the region finally surpass pre-pandemic market levels

BY STEVE FINCH

BY STEVE FINCH

66

RISING DEMAND FOR PROPERTY IN BANGKOK IS FUELLED BY A SHARP DROP-OFF IN SUPPLY AS SELLERS WAIT TO LIST

This year was supposed to spell recovery for Southeast Asia’s previously booming real estate markets after the deep freeze of the pandemic. Yet the Ukraine conflict and associated inflationary pressures, along with a deepening Chinese property crisis, have stifled long-awaited rebounds to leave sentiment cautious in many parts of the region ahead of 2023.

In September, house prices in China’s largest cities fell for the 13th straight month, according to central government data. And although a GDP growth of 3.9% beat analysts’ estimates for the third quarter, the figure was still way down on Beijing’s annual target of 5.5% for 2022. A norm-defying third term for Chinese President Xi Jinping indicates a continued focus on security over the economy for Asia’s largest economy. But will the Year of the Rabbit prove more prosperous than that of the Tiger?

Nearby Southeast Asia has remained heavily exposed to China’s real estate regression, producing threats and opportunities which have tied into a challenging global economic climate.

With Chinese property speculators no longer guaranteed returns at home, growing numbers have sought refuge overseas with the ASEAN region a prime destination.

Australia took the number-one spot from Thailand this year in terms of most popular destinations for Chinese buyers, but ASEAN nations remain hugely sought-after.

A key associated problem: city-wide pandemic lockdowns in China have further eroded confidence—and spending—in China’s domestic economy, spurring citizens to seek returns overseas while remaining trapped from doing so in the case of cities including Shanghai earlier this year.

The big question regarding Chinese demand for Southeast Asian property is when will China fully reopen. Some observers believe that it won’t be until the third quarter of 2023. But expect mounting enquiries from speculators in the period leading up to that time.

67

For many developers, realtors, and property sellers, this spells good news amid recent negative global economic pressures.

In Thailand, the prospect of growing numbers of Chinese property investors has come amid a wider debate about foreign land ownership following decades of restrictions. A new regulation introduced by the Thai government in September means foreigners can now buy up to one rai, or 0.16 hectares, if they invest at least 40 million baht (USD1.1 million) in Thai property, securities, or funds over at least three years, a move likely to benefit Chinese buyers as the most dominant overseas contingent. A potential spanner in the works is the fact the opposition Pheu Thai Party, which leads polling ahead of elections due in Thailand next year, opposes the legal change.

Signs of a recovery in Thailand’s residential real estate sector remain similarly confused. Demand has picked up since the first quarter, says Bangkok-based DDProperty. But it is fueled by a sharp drop-off in supply as sellers wait to list and developers stall opening sales as prices continue to slide.

Interest rates could dampen real estate sentiment heading into 2023 as Thailand seeks to control inflation which reached close to 8% in August, its highest rate in 14 years. At the end of September, the Thai central bank raised the base rate for the second straight quarterly meeting by 0.25 points to 1% while leaving open the possibility of further hikes.

“The committee is ready to adjust the size and timing of policy normalisation should the growth and inflation outlook

68

THE PHILIPPINES REAL ESTATE MARKET HAS RANKED AMONG THE MOST BUOYANT IN THE REGION IN 2022 WITH ITS RECOVERY FUELLED BY SOARING DEMAND

shift,” says Piti Disyatat, secretary of the central bank’s Monetary Policy Committee.

Rising base rates have come as an unexpected dampener on real estate markets across the region in 2022, a response designed to contain inflation fueled by the Ukraine conflict and prop up struggling local currencies amid a resurgent US dollar.

Each of ASEAN’s 10 member states has raised rates this year in a bid to tackle inflationary pressure with the Philippines being the most aggressive, increasing the benchmark rate from 2% in May to 4.25% by September. The Philippines real estate market has ranked among the most buoyant in the region in 2022 with CBRE in mid-year confirming a sustained post-pandemic recovery fueled by soaring demand. The jury

is still out on whether rising rates would put a significant brake on the buoyant Manila market going into 2023.

In Malaysia, as in many countries in the region, inflation peaked in August reaching 4.7%. Knock-on price rises on building materials remain the key factor holding back a post-pandemic recovery in Malaysia’s real estate sector, said Zulhkiple Bakar, managing director and principal owner of Perunding ZAB, an engineering and structural design company based in Kuala Lumpur.

“Some developers are down to single-digit profits,” sa says Bakar, citing rising costs for eroding bottom lines in the industry. “The fact that there are still several new launches being held back shows the property market is still recovering.”

69

Like Thailand and Cambodia, Malaysia faces a general election next year, and associated political risks and uncertainty, adds Bakar.

In Vietnam, domestic politics and knock-on effects from the Chinese real estate crisis have contributed to rising uncertainty in a real estate sector accustomed to higherthan-average rates which—as with the rest of the region— have ticked upwards this year.

In October, the detention of a high-profile real estate figure, represented the latest move in an expanding anticorruption drive impacting a growing portfolio of real estate developments, particularly in the main economic hub Ho Chi Minh City.

Some foreign investors in Vietnam’s property sector have had to exit deals—despite months of work and negotiations— after discovering local partners have been implicated in anti-

corruption investigations.

“For companies listed overseas this is an automatic red flag,” says Fred Burke, senior advisor of US law firm Baker McKenzie in Ho Chi Minh City.

Hanoi has attempted to tackle bad debt in the real estate sector in moves that echo restrictions imposed in China last year as large developers including Evergrande Group began to face defaults on debt.

In late October, the National Assembly’s Economic Committee signaled further efforts to clean up the property sector by warning some real estate companies were still suffering from “unhealthy financial positions” with high levels of debt which could cause difficulties in bond payments. Misuse of bond capital was causing a loss of trust among investors it says in a statement. “The government is suddenly realising they do have to tighten things up,” says Burke.

70

VIETNAM HAS BEEN ROCKED BY A STRING OF CORRUPTION SCANDALS THAT HAVE IMPLICATED SOME KEY LOCAL PLAYERS IN THE REAL ESTATE INDUSTRY

Amid such uncertainty, Vietnam is set to record the highest GDP growth in East Asia this year at 7.2%, according to the World Bank. Avoiding a sharp slide in economic growth, as China witnessed in 2022, may depend on whether Hanoi can stem similar property-related pitfalls next year.

Cambodia condo market suffers

Rents for condominiums, in recent years a key growth sector for Cambodia’s emerging property sector, recorded a downturn in the third quarter with China’s real estate problems and wider growth economic slowdown cited as a key brake on investment by CBRE’s Phnom Penh office. Overall market signals were described as mixed by CBRE following a slight improvement in occupancy rates at offices while the hotel and tourism property segment recorded significant growth.

Cambodia was among the first countries in the region to fully open after the pandemic with tourism rebounding as a key economic driver for the local economy. However, the return of international tourists to famous sites including Angkor Wat has coincided with a property crisis in China, which the Cambodian economy has become increasingly reliant upon in recent years. In Phnom Penh, the retail property market has been notably buoyant with the opening of three new malls in the capital: K Mall, 60M Community Mall, and Chip Mong 271 Mega Mall. Aeon Mall has announced plans to open a third venue in the Cambodian capital by the end of the year as the country continued a recent trend of embracing large shopping spaces.

Indonesia sees pre-sales growth stall amid rising rates

Pre-sales of new residential units were expected to slow during the remainder of 2022 resulting in overall annual

71

72

SINGAPORE REMAINS LOCKED IN A NATIONAL DEBATE ABOUT HOW TO TACKLE SPIRALLING HOUSING COSTS AMID ONE OF THE HIGHEST STANDARDS OF LIVING IN THE WORLD

growth of between just zero and 5% in 2022, a significant slowdown compared to 35% recorded the previous year, says Fitch Ratings. Although the ratings agency cited the Eid Islamic holiday as a key dampener on pre-sales during the second quarter, the final weeks of the year were forecast to see an enduring stagnation in pre-sales which drive developer revenues and profits—and fund future projects. Fitch said that Indonesian interest rate hikes were partly the cause for the weakening performance of the sector. In late October, the Indonesian central bank announced a 50-point rise in the base rate to 4.75%, in turn spurring the highest mortgage rates since the pandemic in a bid to bolster the rupiah. Fitch said that about half of all home presales in Indonesia are funded by mortgages, while inflation which hit a seven-year high of nearly 6% in September has caused weakened demand in the property sector. At the end of September, the government ended a sales tax rebate for finished homes which was also expected to dampen demand for new home purchases in the fourth quarter.

Singapore rents soar after new property curbs

Singapore recorded a jump in rents for apartments in September compared to a year earlier after it tightened home loan limits in a bid to curb runaway prices in the market. The measures, designed to increase affordability for home buyers, have resulted in soaring rents. The problem is not expected to improve until the city-state completes 17,000 new private houses aimed at alleviating supply issues, a rise from the 14,000 such units completed in 2022. Rents have increased for 21 consecutive months in Singapore despite strict lockdowns last year amid the global pandemic. Singapore remains locked in a national debate about how best to tackle spiraling housing costs amid one of the highest standards of living in the world. New measures to tackle the high prices and supply problems include a new restriction whereby private homeowners must now wait 15 months before they can move to resold public housing flats, the most affordable units on the local market.

73

Some observers believe that China won’t fully reopen until the third quarter of 2023. But they expect mounting enquiries from speculators in the period leading up to that time

PROPERTY FOR THE PEOPLE

BY LIAM ARAN BARNES

Like many images captured during the pandemic, it could easily have been a scene from a Hollywood apocalypse movie. In the heart of Bangkok, military police clad in fatigues, face masks, and full-length visors guarded the shuttered corrugated metal entrance to a construction workers’ camp. Above them, the sign read: “No entry or exit until further notice.”

The camp was one of a wave of sites sealed off by Thai authorities in June 2021 to curb the spread of Covid-19. Overnight, some 81,000 workers were imprisoned, stranded from the outside world. In 2019, there were more than three million registered migrant workers in the country, mostly from neighbouring Laos, Cambodia, and Myanmar. While as many as 500,000 returned to their home countries at the start of the pandemic, those who remained did not have the right to healthcare or other forms of social safety. Many were—and still are—completely undocumented.

As the initial 30-day quarantine progressed, local media reported that government promises to provide food, water, and basic supplies; cover 50% of salaries; and set up testing sites had fallen short. Workers were left to fend for themselves in crowded and unhygienic close quarters, reliant on charities and donations to survive.

With the pandemic putting a spotlight on corporate practice like never before, players in the real estate industry around Asia are getting serious about investing in ESG

Thai netizens were quick to criticise the government. But the developers and construction companies behind the glitzy high-rises to which workers dedicated their waking hours were also in the firing line for their perceived inactivity. It was a rude awakening for a sector that has invested heavily in marketing corporate social responsibility (CSR) initiatives— and latterly environmental, social, and governance (ESG) schemes.

“I think for the general public the pandemic demonstrated the importance of sustainability and a realisation that the way we have been doing business so far, in terms of profit before everything else, simply cannot continue,” says James Eckford, technical advisor at Baan Dek Foundation, which works with construction companies and developers to help

improve worker camp environments in Thailand. “It’s literally unsustainable.”

The term ESG was first popularly used in a 2004 report titled “Who Cares Wins”, a joint initiative of financial institutions at the invitation of the United Nations. Almost two decades later, the ESG movement has grown from a corporate social responsibility initiative into a global phenomenon representing more than USD30 trillion in assets under management. In 2019 alone, capital totalling USD17.67 billion flowed into ESG-linked products, an almost 525% increase from 2015, according to US financial services firm Morningstar.

76

(ESG) SCHEMES

Its rapid growth builds on the Socially Responsible Investment (SRI) movement that has been around much longer. But unlike SRI, which is based on ethical and moral criteria and uses mostly negative screens, such as not investing in alcohol, tobacco, or firearms, ESG investing assumes that these factors have financial relevance. It is now, quite literally, big business. But what explains the rise of ESG and what does it mean for the future of real estate?

“There are a few factors leading to this phenomenon,” explains David Fogarty, head of sustainability & ESG consulting services for Southeast Asia at CBRE. “The policy drivers, mandates, and financial incentives from the government and investors motivate and catalyse the implementation of ESG strategies.

“We have also observed that pioneering listed companies are willing to set ESG targets and monitor the implementation through data support. The main benefits are supporting their CSR strategy, corporate branding, and financial incentives such as ESG loans and bonds.”

For many, ESG suggests environmental issues such as climate change and resource scarcity. While these are important elements, the term covers much more, including social issues, labour practices, talent management, product safety, or data security, as well as governance matters like diversity, executive pay, tax management, and business ethics.

Since launching more than a decade ago, Baan Dek Foundation has been revolutionising the way social issues are addressed in Thailand’s real estate sector. Crucially it has worked with innovative construction firms, developers, and humanitarian aid agencies including MQDC, Syntec Construction, and UNICEF Thailand to develop solutions and practical tools to improve communities’ conditions and access to services.

“The social aspect is huge and opaque, and many companies see it as a free-for-all or a pick-and-mix of topics that they think are easy to tackle,” Eckford says. “Good practices emerging are supplier codes of conduct, but the challenge is controlling this

77

A COMMITMENT TO GREEN CONSTRUCTION IS A CENTRAL PLANK OF DEVELOPERS’ ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

and ensuring that there is no social washing happening. This is where civil society and human rights experts can support, not only to ensure that risks are properly identified and vulnerable stakeholders are engaged, but that appropriate mechanisms are in place to ensure accountability.”

Baan Dek Foundation’s experience and the revelations of the pandemic led to the creation in 2021 of the Building Social Impact (BSI) Initiative. The private-sectordriven sustainable social impact initiative for migrant workers and their families features the BSI Framework for Action, a set of 12 actionable recommendations for construction companies. These recommendations aim to improve the living conditions in construction site camps, as well as workers and children’s access to essential public services, such as healthcare, education, and social services. It also includes a training toolkit to guide companies from the operational to the management level.

In less than a year, five major construction companies have already signed on with two large property developers poised to join—in addition to almost 30 smaller-scale firms in Chiang Mai. One of the BSI partners, Magnolia Quality Development (MQDC), is already renowned for its sustainability performance, and recently unveiled the dedicated knowledge-sharing platform Research and Innovation for Sustainability Centre. Other Thai real estate companies with a history of undertaking positive social sustainability initiatives focused on worker and family wellbeing include Areeya

Property, SC Asset, and Pruksa, according to Baan Dek Foundation’s research.

Elsewhere in Asia, Malaysian developer Matrix Concepts Holdings Berhad was recently recognised at the PropertyGuru Asia Property Awards for its ESG efforts. In its 2021 sustainability report, Sustainability Committee chairman Dato’ Haji Mohamad Haslah Bin Mohamad Amin said: “Covid-19 is an excellent example of how poor ESG controls and oversight ultimately resulted in a global pandemic. If anything, the virus outbreak serves as a stark reminder of even more severe consequences should the world continue to relegate sustainability to an afterthought.”

Far from an afterthought, Matrix has placed ESG at the heart of its business in recent years. Major achievements to date include the adoption of the UN’s Sustainable Development Goals, formalising whistleblowing and health and safety policies, as well as the introduction of group-wide sustainability, anti-bribery and corruption policies. With its dedicated committee directly overseen by the board and annual whitepapers, the developer is also trailblazing the governance aspect of ESG in the country’s real estate industry.

“A company with good ESG strategy shall take all the material ESG issues that are important to internal and external stakeholders into account, not only the ‘E’,” says Jackie Cheung, associate director for ESG at Knight Frank Hong Kong. “Governance is the foundation and cornerstone of ESG, which investigates boardroom practice and

78

The pandemic demonstrated the importance of sustainability and a realisation that the way we have been

doing business so far, in terms of profit before everything else, simply cannot continue. It’s literally unsustainable

TAKING CLIMATE CHANGE TO TASK

The Task Force on Climate-Related Financial Disclosures (TCFD) is one of the fast-growing and well-recognised disclosure frameworks that emphasise and quantify governance as a fundamental action.

Created by the Financial Stability Board in 2015, the TCFD was in place to “develop recommendations on the types of information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing a specific set of risks—risks related to climate change.” It is currently supported by more

than 3,500 individual businesses globally and from all industries. In APAC alone, 13 stock exchanges adopt the TCFD, with the earliest adopter being the Singapore Stock Exchange in June 2017.

According to Knight Frank’s Cheung, “the adoption of TCFD is a promising sign that more listed companies are being held accountable for their actions since they have a significant impact on our environment. By being liable, they can have more positive influences on society.” Many countries have also set targets for listed companies to disclose TCFD by 2025 or earlier.

79

THE MISTREATMENT OF CONSTRUCTION WORKERS DURING THE PANDEMIC HAS FORCED DEVELOPERS AROUND ASIA TO ADDRESS CONDITIONS ON PROJECT SITES

behaviour. Governance has the most significant contribution to a firm’s performance out of multiple ESG benchmarks.”

Guocoland is another example of a real estate firm taking major steps to ensure governance is at the heart of its ESG initiatives. Over the years, it has demonstrated its adherence through various accolades. These include the Building and Construction Authority Green Mark Champion award, recognising developers with a strong commitment towards corporate and social responsibility, as well as developing Green Mark buildings at the gold level or higher. The Singapore-based developer is also aligned with comparable reporting frameworks, such as the Task Force on ClimateRelated Financial Disclosures and Global Reporting Initiative standards.

Established industry players such as Guocoland and Matrix may already be embracing internationally recognised standards for ESG, but many are still too reliant on internal reporting, according to Trey Archer, business development director, Asia, for GRESB, which provides validated ESG performance data to financial markets.

“This is a huge mistake. Yes, it’s good to have these documents, but there is no standardisation from one

company to the next,” he says. “They only usually highlight the good areas where companies excel, and there’s no benchmarking. Therefore, GRESB is a powerful tool. It’s a standardised report that all companies follow, revealing both the good and bad, so they can benchmark against industry peers.”

Still, the tide appears to be gradually turning, especially in the aftermath of the pandemic. Developers and construction firms in the region are increasingly adhering to internationally recognised frameworks. Investors, meanwhile, are gaining a greater understanding of supply chains and ever-improving access to ESG assessment criteria and reporting. Yet the next—and arguably most significant—step in embedding ESG into the real estate industry needs to come from the public sector.

“Governments cannot be afraid of appearing as though they are creating more red tape for companies,” Eckford says. “Voluntary measures have long been shown to be ineffective.

“Hard regulation is an absolute must. But this must be combined with support and collaboration as well as punitive measures for lack of action.”

80

IN THAILAND, MAGNOLIA QUALITY DEVELOPMENT CORPORATION (MQDC) IS AMONG THE DEVELOPERS TO HAVE SIGNED ON TO A SOCIAL IMPACT INITIATIVE FOR MIGRANT WORKERS AND THEIR FAMILIES

HOW GRESB WORKS

As investors attempt to monitor and evaluate assetlevel ESG performance, the use of benchmarking tools such as the Global Real Estate Sustainability Benchmark (GRESB) will become increasingly prominent.

GRESB gathers and compares data on the ESG performance of real estate and infrastructure entities. Entities are given a GRESB score that measures their ESG performance in absolute terms, along with a GRESB Rating that ranks them among their peers. Participants also receive a summary analysis of performance, showing strengths and weaknesses across categories such as leadership, policies, risk management, health and safety, greenhouse gas emissions, building certifications, and stakeholder engagement.