1 120 ASIA’S BEST URBAN OASES 104 VIETNAM BUILDS MOMENTUM 112 CLOCK TICKING ON JOKOWI SODA PROVIDES DESIGN FIZZ 86 INDIA CLEANS UP HOUSE 131 MALAYSIA’S COAST WITH THE MOST 70 NO. 164 PROPERTY-REPORT.COM USD10; SGD13; IDR135,000; MYR41; THB330

3

Pullman Residences

6 7

8 9

11

12 13

14

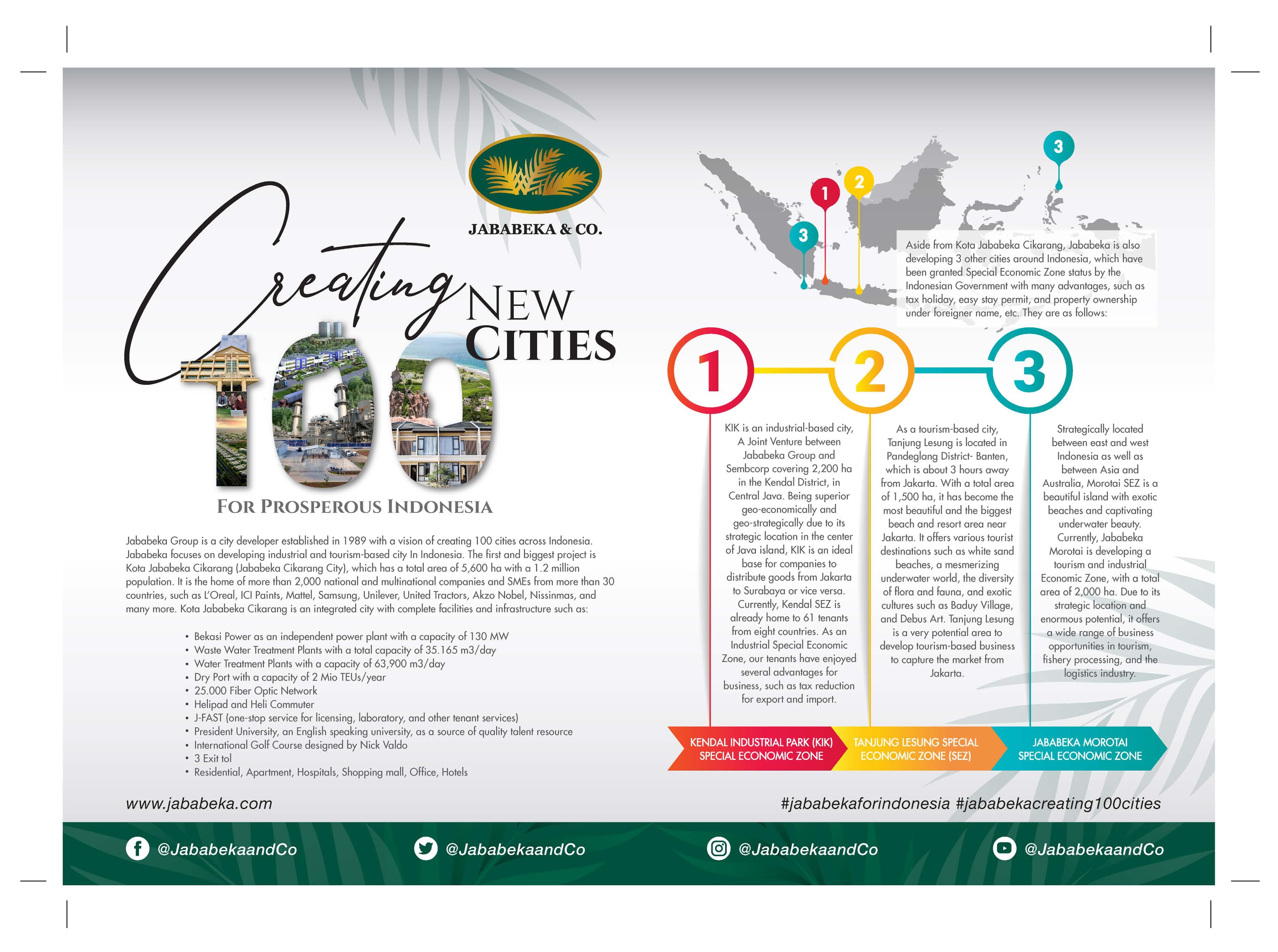

Located in Nam Dinh Province – the cradle of Vietnamese textile industry, Aurora IP is envisioned to become the very first green – clean – sustainable industrial park in Vietnam, explicitly serving for the development of the Vietnamese textile industry.

27 A member of: Master Developer: BY PARKCITY HANOI, VIETNAM THE FIRST AND ONLY DETACHED VILLAS NEXT TO CENTRAL PARK & LAKE. A NEW PROJECT +84 93 679 3338 www.parkcityhanoi.com.vn Call Hotline +84 93 679 3338 or Visit Our Show Gallery ParkCity Hanoi, Le Trong Tan road, Ha Dong district, Hanoi, Vietnam (Monday to Sunday 08.30am – 06.00pm) LAUNCHING SOON. REGISTER NOW.

28

30

35 PT. Mahkota Sentosa Utama high ceiling sun light enter air flow circulation air flow circulation balcony (*Exclusive for Signature Edition) WINNER WINNER

38

FACILITIES

ABOUT THE DEVELOPER

Operating across the Asia Pacific region, Invest Islands is a land brokerage company based in Lombok, Indonesia, with strategic offices in Hong Kong and Perth, Western Australia.

Invest Islands specialises in acquiring premium assets below market value in partnership with local land owners presenting the opportunity to clients to take advantage of the current growth Lombok is now experiencing as well as the safe and legal route into the market tailored to both local and foreign buyers.

43

MANDALIKA 28,3 km 30 Min 17 km 20 Min 29,9 km 30 Min TOROK AIRPORT INVEST ISLANDS 30 mins BALI 90 mins JAKARTA 3 hours SINGAPORE 5 hours HONG KONG SPA FITNESS CLUB CLUB LOUNGE YOGA & MEDITATION INFINITY POOL BEAUTY SALON

LOCATION www.invest-islands.com info@invest-islands.com +62 877-5832-0896

45

Developed by 30 Floors | 231 Exclusive Suites | Infinity Pool | Kids Club Luxurious Phinisi Lobby | On-Demand Housekeeping A View For The Few This iconic beauty will be the benchmark of urban living in Makassar’s skyscraper landscape. 8989 838 (62-411) Marketing Gallery At Ratulangi Point 4th Floor DR. Ratulangi Street No. 2, Ujung Pandang, Makassar - Indonesia www.31sudirmansuites.com

Simplicity, creativity and integrity in design

T: +852 2283 0500

E: general@lead8.com www.lead8.com

Architecture | Interiors | Masterplanning | Branding + Graphics

Beijing Daxing International Airport (Commercial Landside Terminal) Beijing, China

Yorkville - The Ring Chongqing, China

MixC IMAX - Flagship in Shenzhen Bay Shenzhen, China

Timeless City Chengdu, China

Yorkville - The Ring Chongqing, China

MixC IMAX - Flagship in Shenzhen Bay Shenzhen, China

Timeless City Chengdu, China

Timeless City by Lead8 BEST RETAIL ARCHITECTURAL DESIGN (MAINLAND CHINA) HIGHLY COMMENDED MixC Shenzhen Bay by Lead8 BEST RETAIL INTERIOR DESIGN (MAINLAND CHINA) HIGHLY COMMENDED Beijing Daxing International Airport (Commercial Landside Terminal) by Lead8 BEST MIXED USE INTERIOR DESIGN (MAINLAND CHINA) WINNER MixC IMAX Flagship Shenzhen Bay by Lead8 BEST ENTERTAINMENT FACILITY DESIGN (MAINLAND CHINA) WINNER

MixC Shenzhen Bay Shenzhen, China

MixC Shenzhen Bay by Lead8 BEST RETAIL ARCHITECTURAL DESIGN (MAINLAND CHINA) WINNER Yorkville The Ring by Lead8 BEST RETAIL INTERIOR DESIGN (MAINLAND CHINA) WINNER

MixC Shenzhen Bay Shenzhen, China

52 53

54 55

ISSUE 164

Publisher

Jules Kay

Editor Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Senior Editor Richard Allan Aquino

Digital Editor

Gynen Kyra Toriano

Media Relations Manager

Thaddeus Siu

Senior Media Relations Executive

Tanattha Saengmorakot

Media Relations Executive

Piyachanok Raungpaka

Marketing Manager

Marco Dulyachinda

Editorial Contributors

Liam Aran Barnes, Bill Bredesen, Diana Hubbell, Steve Finch, George Styllis, Jonathan Evans

Head of Creative

Ausanee Dejtanasoontorn

Senior Graphic Designer

Poramin Leelasatjarana

Sales Director

Udomluk Suwan

Regional Business Development Manager

Kanittha Srithongsuk

Corporate Partnerships Executive

Priyamani Srimokla (Priya)

Amonlapa Somtaveesilp (Mickey)

Regional Solutions Manager

Orathai Chirapornchai

Business Development Manager, Corporate Sales (Singapore)

Alicia Loh

Solutions Manager (Thailand)

Kritchaorn Rattanapan

Rattanarat Srisangsuk

Solutions Manager (Philippines)

Marylourd Pique

Maria Elena Sta. Maria

Solutions Manager (Vietnam)

Quan Nguyen

Solutions Manager (Indonesia)

Amanda Michelle Wulan Putri

Solutions Manager (Cambodia)

Phumet Puttasimma

Solutions Executive (Malaysia)

Samuel Poon

Solutions Manager (Australia)

Watcharaphon Chaisuk (Jeff)

Solutions Manager (Mainland China, Hong Kong and Macau)

Huiqing Xia (Summer)

Kai Lok

Solutions Manager (Myanmar)

Nyan Zaw Aung (Jordan)

Solutions Manager (India and Sri Lanka)

Monika Singh

Distribution Manager

Rattanaphorn Pongprasert

Editorial Enquiries

duncan@propertyguru.com

Advertising Enquiries

petch@propertyguru.com

Distribution Enquiries

ying@propertyguru.com

PropertyGuru Property Report is published six times a year by

© 2021 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher

KDN PPS 1662/10/2012 (022863)

56

CM MY CY CMY

102

Neighbourhood Watch: Phu Yen

Coastal enclave set for the spotlight as Vietnam begins to focus on post-pandemic growth

104

Destination: Vietnam

With demand for housing continuing to boom—especially near manufacturing hubs— the outlook in Vietnam appears rosy for investors and developers alike

112

Destination: Indonesia

A wide-ranging Omnibus Law, designed to set the agenda for President Jokowi’s second term, has yet to have the desired impact

Considered

Demand

128

Dispatch: China

Beijing’s chronic oversupply of office space presents a crisis, but China’s ingrained work culture suggests demand will catch up

131

Dispatch: India

The country’s notoriously graft-prone real estate sector is growing more transparent thanks to government regulations and the introduction of REIT frameworks

58 59

of place

CONTENTS Issue 164 70 Project Confidential: A sense

Coast Residences

Trends

your resort home even more appealing with fresh furniture pieces 66 Style Take the ox year by the horns with Chinese influenced items 80 Interview: Heart of the sun

is deploying a collaborative, sustainable philosophy as she maps the future of Malaysia’s Sunway Group

Gadgets

that innovate to keep you healthy, productive and creative

Design

What lies beneath

nods to Malaysia’s architectural and cultural heritage are integral to the package at Anantara Desaru

64

Make

Sarena Cheah

68

Products

86

Focus:

resorts

SODA Thailand uncovers the innate character of its projects to create some of the region’s most compelling

120 Special Feature: Urban oases

for resort-style residences with plentiful facilities and multi-functional space is growing in Asia

It’s no coincidence that our resort residences issue is timed at the start of each year. With the old year out of the window, we begin fresh with a positive outlook. What better way to do so than by whetting an appetite for travel and investment by homing in on the thriving resort scene in Southeast Asia?

As you may have noticed, things have changed somewhat. Indeed, it is a moot point as to whether any of us will leave our established bases until later in 2021: if at all. Nevertheless, over a year into the global pandemic, thoughts are turning to a less fraught future. As such, there’s plenty of food for escapist thought in our pages.

In our special feature, we take a look at how the prevailing trend for WFH is providing fertile ground for “urban retreats”, hybrid projects that bridge the gap between city life and resort living. Elsewhere, we home in on some incredible resort designs by SODA Thailand and visit southern Malaysia to get the lowdown on the Anantara Desaru Coast Residences.

The pandemic looms large in our other features. We examine how Vietnam emerged from the wreckage of 2020 as one of the region’s few success stories. Vietnam’s progress contrasts with Indonesia, which is struggling to provide a kickstart to its economic engine.

I hope you enjoy the issue!

Duncan Forgan Property Report duncan@propertyguru.com

60

EDITOR’S NOTE Issue 164

ADVERTORIAL ADVERTORIAL

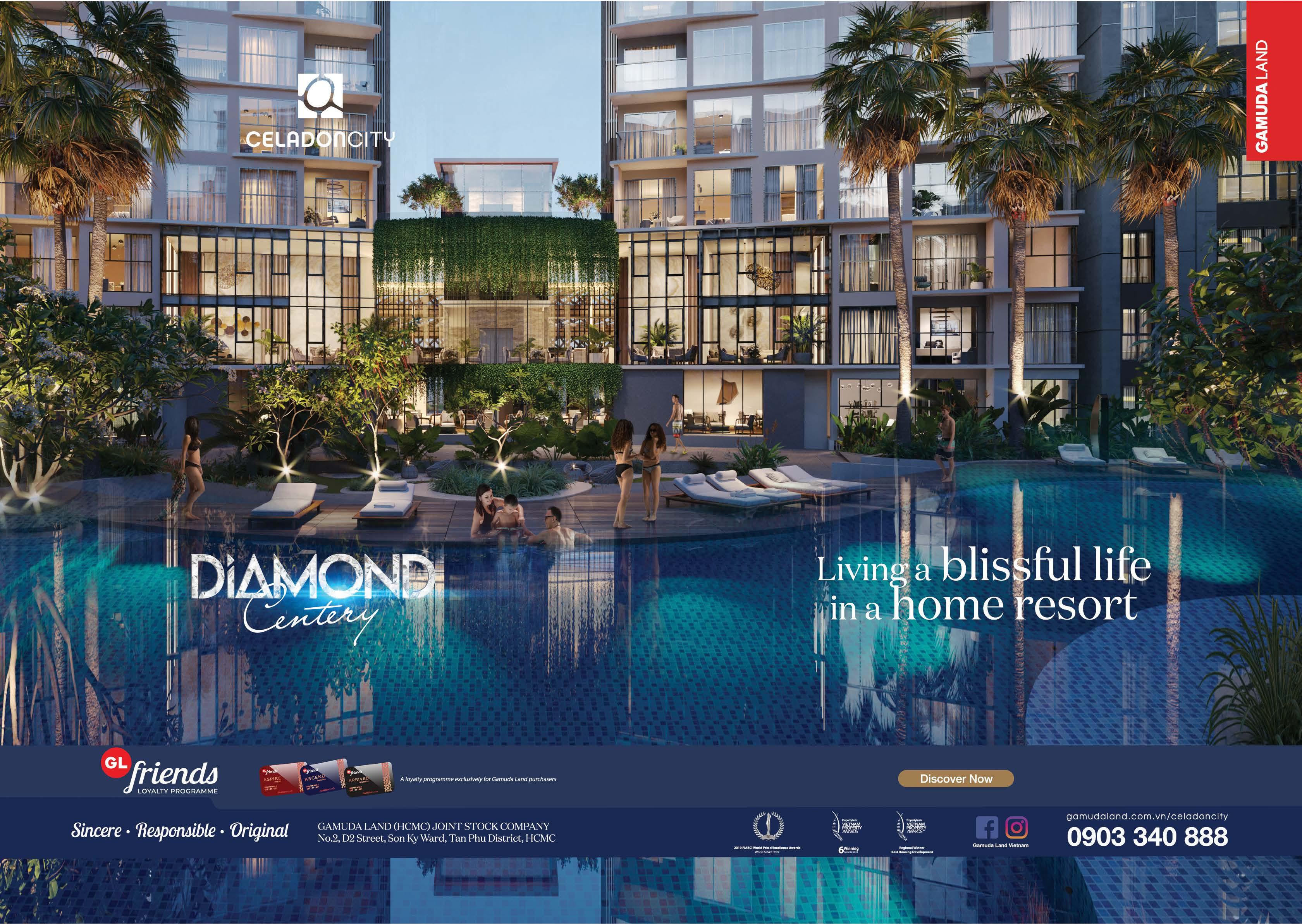

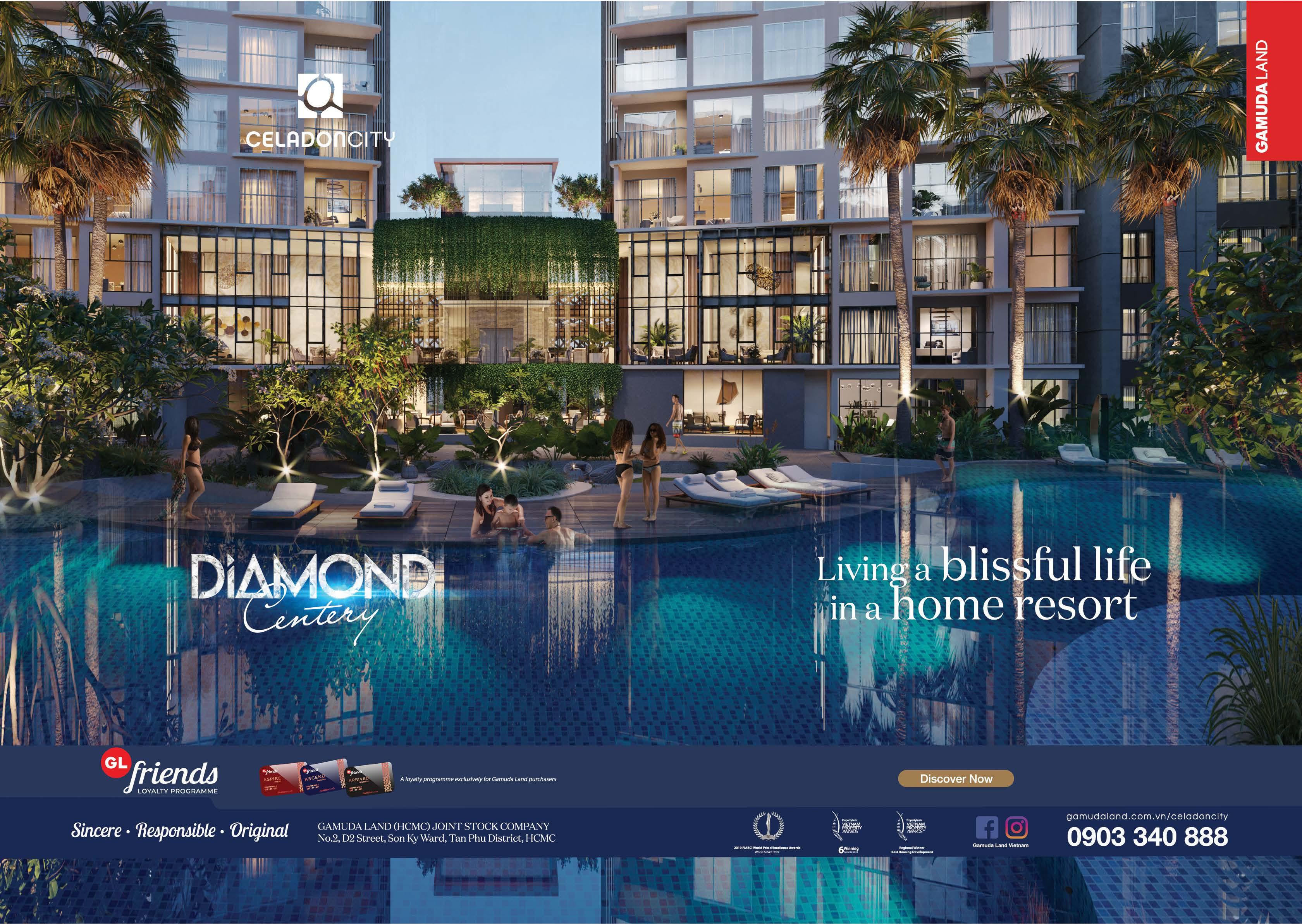

THE GOOD LIFE

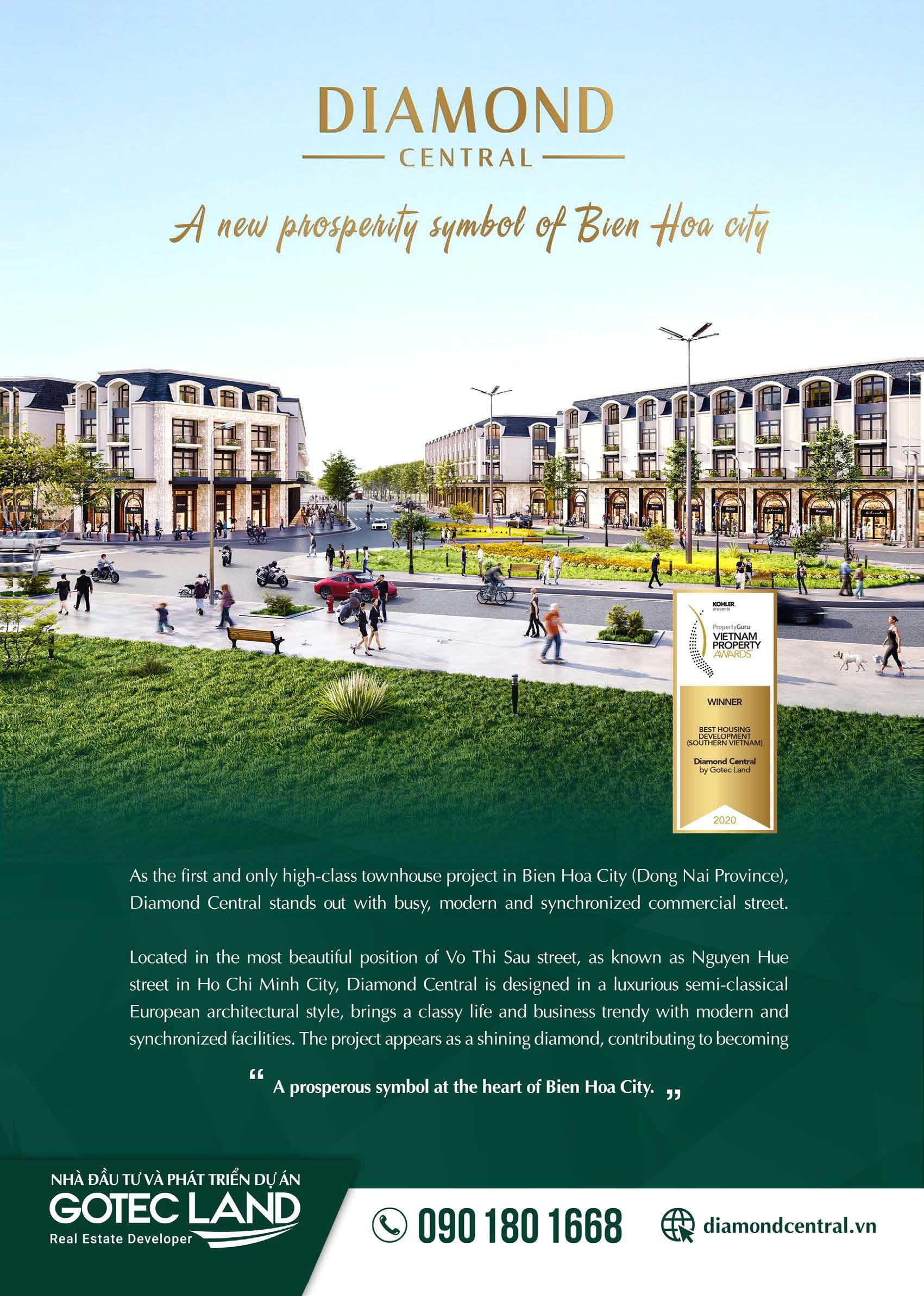

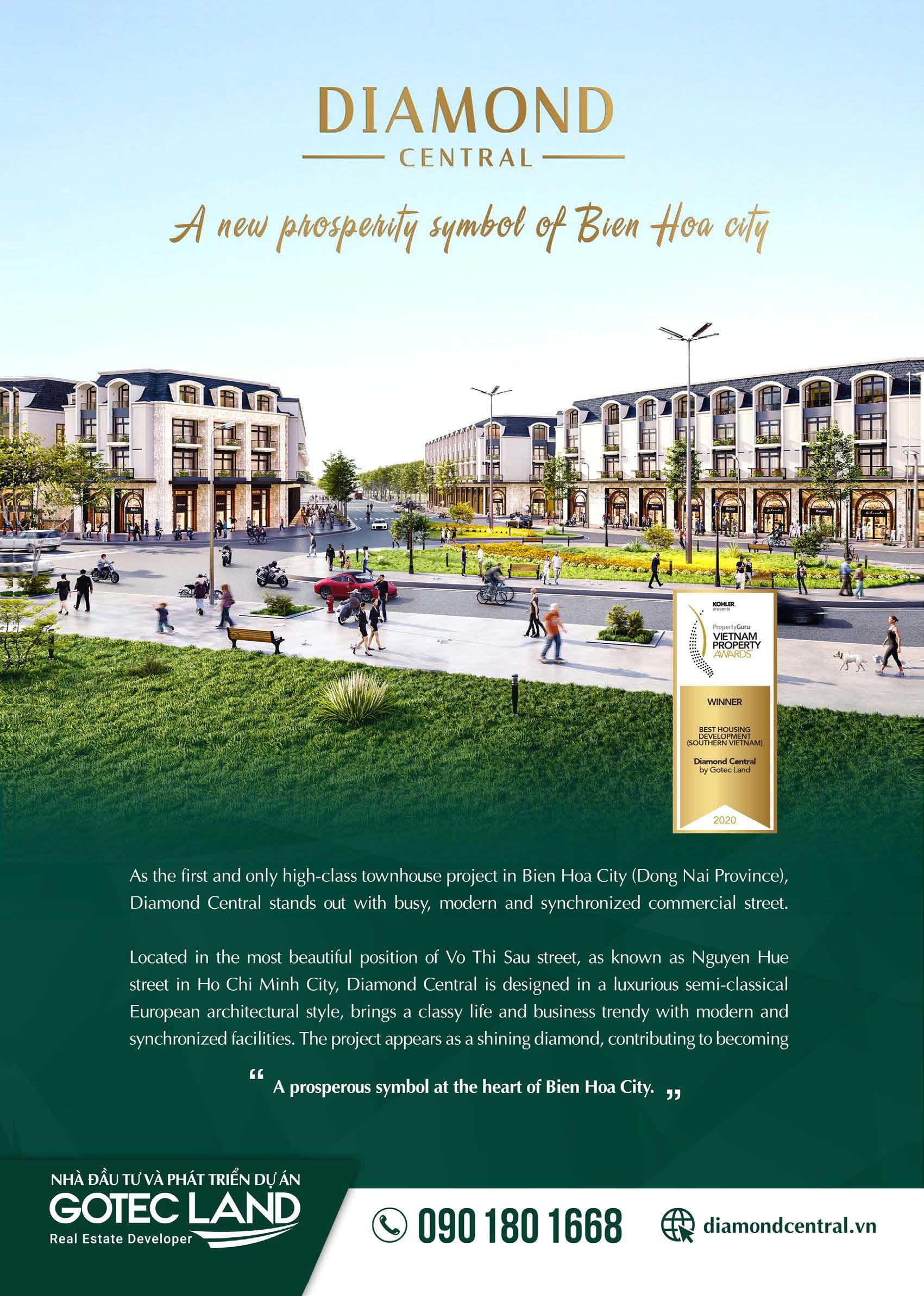

No need to venture out of Ho Chi Minh City for a well-deserved respite – Diamond Centery is the place to call home and resort at the same time

When one thinks of “vacation” or “retirement” in Vietnam, the mind usually wanders off to the nation’s abundance of gorgeous sand and surf – 2,000 miles of coastline to be exact – in such places of renown as Da Nang or Nha Trang. Too often, these are propped up as places to “escape the noise” and “take refuge” from the hustle and bustle of Vietnam’s urban jungles.

But as is the case with the rest of the world, Covid-19 has pushed tourism and holiday home hunting to the backseat. Suddenly people have found themselves confined to the four walls of a city.

Gamuda Land HCMC JSC has upended the notion that living in a city has to be taxing or tedious or that you are better off retiring to a beach town, cut off from all the conveniences of the big city. This year, the Malaysia-based developer launched Diamond Centery, a high-end condo development that evokes a resort in the middle of not just any metropolis but Vietnam’s largest: Ho Chi Minh City.

Diamond Centery is spread over 28,200 sqm of land in Celadon City, a world-class masterplanned township and green urban area currently rising west of central Ho Chi Minh City.

In Diamond Centery, homeowners take a vacation where they live – the development is designed like a beach resort in the city. People relegated to their residences during extraordinary times such as a pandemic need not feel cloistered when they have homes like those in Diamond Centery.

On any given weekend, an entire family can just step outside their door for an instant holiday. Like an oasis in the heart of a busy city, Diamond Centery features an enormous swimming pool – an artificial sea, if one may – ringed by a sand park that further simulates the feel of a resort, coupled with an assortment of relaxing extras such as hydrotherapy beds and ledge loungers. Residents and guests can relax by the sandy shores or bask in diverse water experiences in such amenities as the urban tropical pool, a shallow swimming pathway, wading pool, coastal pool, waterfall pool’s edge, and jacuzzi. These bodies of water are set close to a “below-the-sea” gym and an aquatic yoga centre, suiting all fitness enthusiasts.

Families and friends can schmooze from the rooftop garden down to the pavilion courtyard or watch shows at the outdoor theater, while couples can stroll through the massive landscaped central park. Inside the development, residents can access a clubhouse, a function hall, party house, co-working space, library, games room, gymnasium, and yoga/dance room.

Additionally, Diamond Centery is host to sophisticated, classy amenities befitting successful residents and property seekers of a certain stature. There is the Royal Centery Golf Club, good for a match or two with business partners; the Lifestyle Lounge, a place where one can gab with peers over wine; the Chef’s Choice Kitchen, a hub for gatherings over sumptuous delicacies; and the Escape Spa, the centre for well-deserved treatments after a hard day’s work.

Diamond Centery is set to become a valuable asset for all generations. It has creative playgrounds and wide, open spaces that allow younger residents to roam free and fill their childhood with happy memories. It even has a day care centre, unburdening working parents in the community.

All residents at Diamond Centery have access to Celadon City’s vast tracts of greenery, including the more than 16-hectare eco-park – one of the three largest parks in Ho Chi Minh City – with its trio of artificial lakes. Celadon City is also home to more than five hectares of sports and resort complexes, including Olympic-standard facilities.

Parents at Diamond Centery need not send their children to school outside Celadon City. Within the township one can find good institutions such as Ton That Tung Secondary School, Le Trong Tan High School, Le Thanh Tong High School and High School, Asian International School System, and Mapble Bear International Kindergarten.

As for conveniences, Diamond Centery holds several retail spaces and a grocery store, plus a cafeteria. Residents can also check out the nearby Aeon Mall Tan Phu Celadon; open since 2014, the mall is a pioneer in retail development in Vietnam.

Given its affluence of amenities and abundance of lifestyle conveniences, Diamond Centery could only be poised to grow in investment value. Showcasing magnificent architecture and interior design, the 746 units on offer in the project are easy to rent, making for sustainable income streams, and earmarked for high liquidity.

Investors have a choice of 714 standard apartments, 12 duplex units and 20 penthouses, in generous sizes averaging at more than 105 sqm. All units offer open-plan living spaces and fully functional kitchens with ultra-sized balconies that span the entire width of the units. Living rooms and bedrooms are also arranged in a way that they command great views of the Celadon City parks.

Whichever stage property seekers are in life – be they the indolent golden years of retirement or the carefree days of youth – Diamond Centery is ready to meet them. Built like a resort town yet endowed with all the conveniences of a masterplanned city, this development is the place to be for a vacation that never ends.

62 63

LAST RESORT

Make your resort home even more appealing with furniture pieces that look as good inside as they do outside

MAKING WAVES

Spanish architect Patricia Urquiola took inspiration from fishing nets in the Philippines to design Ravel, an outdoor modular set for B&B Italia. The aluminium backrests are interlaced with polyethylene weave in complex diamond shapes—truly a sea change from your ordinary sofa.

€8,356 ($10,280), bebitalia.com

GREAT OUTDOORS

Leaf, an outdoor table by Danish furniture maker Houe, is shaped—aptly— like a leaf and comes with a pre-oiled bamboo top. The triangular form and table construction allow it to easily seat nine.

€749 ($920), houe.com

TEAK IT IN

Designed by Danish furniture maker Henrik Pedersen for Gloster, the Archi chair is made of premium-grade, plantation-grown teak, buffed to bring the timber’s natural oils to the surface, making it resistant to sunlight and precipitation.

From £690 ($940), gloster.com

PLACE IN THE SUN

The all-weather Tressé double daybed by Osier Belle is a gorgeous alternative to the chaise lounge for your pool deck or balcony. Encased in Sunbrella and Agora fabric, the piece comes in customisable dimensions and many Viro wicker options.

$7,760, osierbelle.com.au

OFF THE TABLE

Work leisurely in bed with a lap desk by Sofia + Sam. Unlike other desks, it has a cuddly memory foam cushion and just the right curved shape for your body, plus a wrist rest and slidable mouse pad.

From $43, amazon.com

64 65 DETAILS | Trends

BULL RUN

Take the Year of the Ox by its horns with the help of items with a detectable Chinese influence

BULL NECK

Burberry is going all in on the Year of the Ox with a Chinese New Year collection, including an Italian-made striped jacquard scarf featuring a monogram motif inspired by the zodiac sign. Made of organic wool and mulberry silk.

From HK$2,900 ($374), burberry.com

EATING STREETS

Nike has partnered with Guangzhou artist Jason Deng to launch the Chinese New Year’s most enviable sneakers yet: SB Dunk Low Street Hawker. The watercolourembellished kicks are modelled on regional dishes in China such as yang chun noodles and roast goose.

$110, nike.com

GIN UP

Craft gins from Hong Kong distillery Two Moons make for an authentic Chinese New Year celebration. Their awardwinning signature dry gin is a must-try, which uses a dozen botanicals including Chinese almonds and other sweet nuts.

HK$530 ($68), twomoonsdistillery.com

BELT AND ROAD

Kids can have their own Lunar New Year revelries with four all-new themed Logo playsets, which include Spring Lantern Festival, featuring an illuminated ox lantern, and Story of Nian, recreating the legend of the mythological creature.

From $79.99, lego.com

FOOD WARS

Dig in your favourite Asian dishes with a pair of lightsabre-inspired chopsticks by Chop Sabers. These BPA-free plastic utensils can glow red, green, blue or purple at the touch of a button, faster than you can say, “May the fork be with you.”

From $11, amazon.com

66 67 DETAILS | Style

SAFE PASSAGE

Gear up for the next instalment of the not-yet-Roaring Twenties with products that innovate to keep you healthy, productive, and creative

TAKE PAINS

Theragun now has a mini version. The portable percussive massage gun is a handy tool for soothing your body and relieving muscle aches after a strenuous session exercising at home.

$199.00, theragun.com

FLIP AND SWITCH

Remember when flip phones ruled the mobile world? Take it way back to the 2000s with the Moto Razr 5G, which offers not just a large touchscreen but a foldable one.

$1,399.99, motorola.com

PULL BACK

Invest in the Hydrow Rowing Machine for home workouts. The screen attached to it is a real clincher: it can show you live virtual classes on demand and other visuals to make your workout an immersive experience.

From $1,995, hydrow.com

CHARMING PRINTS

Take 3D printing from the factory to your home with the Creality Ender 3 Pro. Its Meanwell power supply ensures fast heating, good for heavy printing loads, while the magnetic platform sticker allows for easy removal of models from the printing surface.

From $209, creality3dofficial.com

STRAIGHT SHOOTER

With Covid-19 still going strong, be safe with SprayCare, a lightweight wearable that atomises disinfectants from your wrist to clean surfaces (and your hands) on the go. Think Spiderman’s web shooter, only more sanitary.

From $32, spray.care

68 69 DETAILS | Gadgets

SENSE OF PLACE

Ingenious landscaping and considered nods to Malaysia’s architectural and cultural heritage are integral to the package at Anantara Desaru Coast Residences in Johor

BY AL GERARD DE LA CRUZ

BY AL GERARD DE LA CRUZ

70 71

Malaysia is making Desaru Coast great again. A favourite of holidaymakers from nearby Singapore since the 1980s, the 17-kilometre beach-fringed strip in southeastern Johor has pried the spotlight from the peninsula’s other tourism hubs, with a little nudge from Khazanah Nasional Berhad, Malaysia’s sovereign wealth fund. It is, as former tourism minister Mohamed Nazri Bin Abdul Aziz says, an attraction the government has been “banking on”, with an international ferry terminal due to open in 2021.

Themed Attractions Resorts & Hotels Sdn Bhd (TARH), a unit of Khazanah Nasional Bhd, is transmuting Desaru Coast into a $1.1bn premium integrated destination resort. Garlanding 1,578 hectares (3,900 acres) of the peninsula, the Desaru Coast master development opened to the public in 2016 with a 27-hole golf course designed by South African great Ernie Els and, a year later, an 18-holer designed by Fijian maestro Vijay Singh. The 25-acre

SET BESIDE ANANTARA DESARU COAST RESORT & VILLAS – THE THAI HOSPITALITY BRAND’S FIRST LUXURY HOTEL IN MALAYSIA –ANANTARA DESARU COAST RESIDENCES OFFERS FULLY FURNISHED SEASIDE POOL VILLAS ALONGSIDE A FULL COMPLEMENT OF FIVE-STAR RESORT FACILITIES IN AN ECO-SENSITIVE SETTING. SOME UNITS EVEN FEATURE FLAT ECOROOFS THAT ALLOW LOCAL FLORA TO GROW

Adventure Waterpark, one of the world’s biggest theme parks, followed suit in 2018, as did a 23-acre waterfront retail village.

Big-hitting hospitality brands have washed ashore, too, from Hard Rock Hotel to The Westin and One&Only. Partnering with TARH, Thai development giant Minor International opened the Anantara Coast Resort & Villas in 2019, followed by the adjacent Anantara Desaru Coast Residences last year.

The latter, a boutique collection of 20 seaside pool villas managed and serviced by Anantara, marks Minor International’s first foray into luxury real estate development in Malaysia. “From a development perspective, we are mindful that we are investing in an emerging, up-and-coming location as a first mover,” says Micah Tamthai, vice president of real estate at Minor International. “Whilst there is some work that we need to do to raise more awareness on the destination, Malaysian travellers are also increasingly taking up the opportunity to discover up-and-coming destinations like Desaru Coast.”

Minor International set the $195.6m development into motion as early as 2014 when the company shortlisted WOW Architects to join the project. The Singapore-based design consultancy won the invitation-only bid with its progressive, eco-sensitive masterplan concept for the branded residences. “We feel that the way forward for new resort developments is an eco-awareness principle that must be purposeful and engaging to its guests, residents and locality,” says Wong Chiu Man, managing director at WOW Architects.

The developer instructed the design team to cast Anantara Desaru Coast Residences in the mould of indigenous architecture and craftsmanship. The development has been master-planned as a triumvirate of zones that reference Malaysia’s rich heritage of architectural movements: Colonial Plantation, reflecting late 19th century Malaya; Malay Kampung House, defining vernacular culture; and the Beach, mirroring the geography of the peninsula.

“The team of architects, interior designers, and landscape consultants collaborated to develop a shared vision and a common design language, comprising motifs, colours and a restrained but relevant material palette, to evoke an authentic but modern resort and residential experience that remembers the past but also looks forward to the future,” says Tamthai.

The villas trade on frame-worthy views of the South

72 73

China Sea, although the topographical quirks of the 304,000 square foot site made them labour-intensive goals at first. “The original site was relatively flat, and we had to design a masterplan that allows for ocean views throughout the site,” recounts Wong. “This was achieved through shaping the terrain of the site by raising the ocean-view ‘beach residence villas’ to a higher platform level as well as creating a natural stone and landscaped hotel podium that blends into the topography while maintaining the natural appearance of the landscape.”

Twelve three-bedroom pool villas and eight fourbedroom pool villas, in built-up sizes ranging from 3,100 sq ft to 6,426 sq ft, have since risen onsite. Four of the four-bedroom villas sprawl over a single storey, with master bedrooms that have direct access to beach and pool alike. The four-bedroomers also have four two-storey variants, featuring multi-purpose spaces with vantage points of the ocean.

Expansive, floor-to-ceiling glass facades marry the panoramas of the sea to the interiors and maximise passive lighting and natural ventilation. Living, dining and family spaces spill onto the pool terraces. “The

intent was to create inspiring, open, spacious, and well-ventilated indoor and outdoor spaces which are key features to tropical living,” says Wong.

Malaysia’s own EDC Interiors opted for decorative and furnishing choices that recall fishing nets, weathered wood, and the cerulean blue of the ocean, wresting inspiration from Desaru Coast’s origins as a fishing area. “While contemporary, we wanted the design to also reflect the infusion of local touches,” says Vincent Koh, principal of EDC Interiors. “Inside each villa, we created a tranquil beach hideaway with a timeless aesthetic that pays tribute to local traditions and culture.”

Matte beige stone floors, brown and grey wood, and textured fabric further anchor the interiors in nature. “The elegant, subtle colour palette, materials, and décor allow the panoramic coastal scenery to be the main focal point,” adds Koh.

The landscaping, courtesy of Element Design Studio, was zone-specific, veering between ruggedness and artifice. In the Beach ecology, villas are set in natural shrubland on tree-lined, sandy, sloping terraces that

74 75

THE INTENT WAS TO CREATE INSPIRING, OPEN, SPACIOUS, AND WELL-VENTILATED INDOOR AND OUTDOOR SPACES WHICH ARE KEY FEATURES TO TROPICAL LIVING

ON A CLEAR DAY, THE VILLAS OPEN TO PANORAMIC VIEWS OF THE SOUTH CHINA SEA AND LUSH GREENERIES, FRAMED BY ENORMOUS FLOOR-TO-CEILING SLIDING GLASS PANELS

EACH VILLA HAS AN OPEN-PLAN LAYOUT, WITH GENEROUSLY SIZED DINING AND LIVING SPACES THAT FLOW OUT TO THE PRIVATE INFINITY POOL

IN ADDITION TO THE LAGOON POOL AND OCEAN-FRONTING INFINITY POOL WITHIN THE ADJOINING RESORT, THE VILLAS OFFER A SPACIOUS PRIVATE POOL AND SUNDECK THAT CHAMPION THE USE OF DURABLE MATERIALS AND PROVIDE SCOPE FOR OUTDOOR ENTERTAINING

WELL-VENTILATED EN SUITE BEDROOMS LINK TO THE NATURAL FOLIAGE OUTSIDE VIA EXPANSIVE GLASS FACADES, BLENDING THE VERDANT OUTDOOR LANDSCAPING WITH MODERN, UNCLUTTERED INTERIORS

connote a wild coastal environment. In contrast, the Kampung and Colonial Plantation ecologies are carpeted in more manicured, manmade-looking landscapes.

“Each ecological zone has its distinct landscape characteristics,” says Wong. “To preserve the trees that are growing onsite, we had to set back the beach residence villas to minimise the impact of the zone and at the same time make provisions for beach access while maintaining privacy.”

The design team exercised more lateral thinking with the roofscape. Waterproof reinforced concrete structures with stone gravel toppings enable the roofs of the villas to become substrates for plant life. “The eco flat roof concept was designed to allow local flora to grow and inhabit it over time,” explains Wong. “Over time, guests and residents will be able to enjoy a view of green roofs blending with the natural landscape along the beachfront.”

Cool breezes naturally fan the units, reducing energy loads during the monsoon season. The architects also made their preferences known for low-maintenance, low-impact building materials. With products locally sourced from renewable sources, construction began in July 2017.

“The direction from the client and their team was to build the project sustainably and responsibly,” Wong says. “This required tremendous cooperation between designers, project managers, contractors and suppliers, to bring this vision to life.”

Priced from MYR7.5m, the residences have begun handover since 2020, with some units “reserved by private Malaysian buyers”, reports Tamthai. “As Desaru Coast becomes more developed, the value of land and property will appreciate, which will translate to long-term capital gains for us and our residential owners as a first mover in this pioneering destination.”

Anantara Desaru Coast Residences offers investors a rental programme managed by Anantara Desaru Coast Resort & Villas. End users have full access to the resort’s five-star amenities and services, including Anantara Spa, offering Thai and Malay treatments alike, and Dining By Design, Anantara’s signature private dining experience.

Malaysian, Thai and international fare awaits diners in various restaurants: from alfresco dining by the beach at Sea.Fire.Salt to indoor gastronomy at Turmeric, plus vintages and cigars at Observatory Bar. Butlers are on call 24 hours a day, and private chefs are bookable. Homeowners bask in a lagoon pool and infinity pool as alternatives to the sea; younger ones enjoy the kids and teens’ clubs.

“As a branded residence, our product would be as valuable as a family or multi-generational holiday home as it would an investment property,” says Tamthai. “Should they choose to resell in the future, the branded residence offering places them in a

better position to leverage land and villa capital appreciation.”

Despite the pandemic’s assault on tourism, Minor International will be launching this year more Anantara-branded residential developments, also in symbiosis with adjoining hospitality properties. Avadina Hills by Anantara, 11 Japanese-inspired pool villas, will rise adjacent to the Anantara Layan Phuket Resort in Thailand while Anantara Ubud Bali Villas, 15 pool villas with expansive forest views, will open in Indonesia.

Adds Tamthai: “Covid-19 has underlined our collective desire to escape to destinations like Desaru Coast –those which offer nature and space, where ‘social distancing’ is a given and where the emphasis is placed on wellness and wellbeing.”

76 77

Heart of the Sun

Taking cues from her father, Sunway Group’s visionary founder Jeffrey, Sarena Cheah is deploying a collaborative, sustainable philosophy to elevate one of Malaysia’s biggest developers

BY BILL BREDESEN

BY BILL BREDESEN

79

Consumer preferences in real estate are undergoing a profound shift amidst the global pandemic, according to Sarena Cheah, the managing director of Sunway Group, one of Malaysia’s largest conglomerates.

With work-from-home arrangements increasingly common, an intensified focus on wellbeing and safety, and fast-changing demographics, especially in Malaysia,

real estate developers must adjust their approach if they want to meet the rapidly evolving demands of the new marketplace, she says.

Sunway has a vast range of commercial interests in real estate, construction, tourism, retail, healthcare and education, among other sectors. The company’s innovative master community developments create integrated and

WITH A GROSS DEVELOPMENT VALUE OF MORE THAN MYR30 BILLION OVER 1,800 ACRES OF LAND, SUNWAY ISKANDAR IN JOHOR IS SUNWAY’S LARGEST TOWNSHIP

sustainable cities and communities while embracing a unique “Build-Own-Operate” strategy. Cheah is heavily involved in the company’s property developments.

Her father, Jeffrey Cheah, founded Sunway in 1974 and remains active in its day-to-day operations as the Group’s chairman. The younger Cheah launched her career with Sunway in the late 1990s and witnessed first-hand the formidable challenges wrought by the Asian Financial Crisis in 1997-98.

The company, she says, is fundamentally much stronger today in terms of its balance sheet, employee talent, infrastructure and overall stability. Its top leaders—including Cheah and her father—are also able to leverage their experience, having guided Sunway through previous stretches of economic turbulence to navigate the current cycle.

“The imperative is for us to stick to our core values and organisational purpose, act fast to protect and preserve our people and ecosystems, and do all that’s necessary to ensure financial survival and sustainability,” she says.

The company has also taken steps to expand its footprint internationally, with major projects in China, Singapore and the UK—all locations where Sunway intends to seek more opportunities in the future, says Cheah.

“We view our relationship with our customers not as something that ends at the building or selling of homes. Rather, our care for their health and wellbeing extends throughout their lives,” she says.

“Most importantly, we want to create resilient and thriving communities where everyone can live, learn, work and play in healthy and connected environments.”

How is the pandemic impacting your projects currently under development?

While the lockdowns have affected the progress of some of our ongoing projects, the delays have largely been manageable. We do not anticipate severe financial impact, especially with the passing

80 81

We view our relationship with our customers not as something that ends at the building or selling of homes. Rather, our care for their health and wellbeing extends throughout their lives

in Malaysia of the Temporary Measures for Reducing the Impact of Coronavirus Disease 2019 (COVID-19) Bill.

Exercising prudence, we have delayed some of our launches, aligning them with the current macroeconomic landscape. We have realigned our launches from a gross development value (GDV) of MYR3.5 billion ($863m) to MYR2.2 billion ($542m)—which would still be a record year for us. Most of our launches this year are in Singapore. Our current unbilled sales stand at MYR3.1 billion ($764m) as of June 2020.

Sunway has a vast portfolio. What segments of the business are you personally most interested in?

Yes, Sunway is a conglomerate with many businesses, built organically over the past four decades, guided by our Chairman’s vision. All the businesses operate in synergy with each other and together form an ecosystem for communities to grow and thrive. I like to describe us as a “living community” serving another “living community.”

I currently spend a majority of my time in the property development division, and my vision for this division is not merely to operate as a developer of real estate but as a developer of communities. In this regard, we take a long-term view in all that we do and work to deliver value and a better future for the communities we create and serve.

What is the appeal of the “BuildOwn-Operate” model?

The Build-Own-Operate model is the cornerstone of our Master Community Developer strategy. By continuing to own and operate substantial investment properties in our developments, we become co-investors with our property purchasers, ensuring them that

our interests are aligned and that we have the long-term good of the communities at heart.

Owning substantial parts of a development also allows us the opportunity to continuously help communities in our developments thrive through activities organised by our various businesses. The next step for us is to transform each of our townships into “living labs,” where everyone can come together with us to innovate solutions for our future.

A recent example is our Sunway FutureX Farm in Sunway City Kuala Lumpur. This is the first urban farm innovation hub in Malaysia that we have invested in, in partnership with Sunway Innovation Labs (Sunway iLabs). It has indoor and outdoor farming areas, a research and development centre, training and collaborative spaces as well as a café.

We envision Sunway FutureX Farm as a space where our researchers, government bodies, entrepreneurs and communities can come together to develop next-generation smart-farming solutions so that we can utilise underused urban spaces for agriculture in our townships and developments.

Your townships and integrated developments have helped to transform the landscape in Malaysia. Where do you see innovation coming from in the years ahead?

In the past decade, we invested in digital technology that will drive our efficiency and productivity, including robotic automation, e-procurement and migration to the cloud. We also started integrating technology to ensure better customer outcomes. We will continue to invest in these to remain agile and competitive.

82 83

LOCATED JUST 3.8 KILOMETRES FROM KLCC, SUNWAY VELOCITY TWO IS ONE OF SUNWAY PROPERTY’S LATEST DEVELOPMENTS AND IS SURROUNDED BY AN ARRAY OF URBAN CONVENIENCES FOR THE RESIDENTS TO ENJOY

Our business units are also expanding into virtual products and services. For example, our healthcare unit launched telehealth services, while our retail division launched a digital retail component.

The next leap forward is the adoption of 5G technology. At 100 times faster than 4G’s speed, we can effectively game-change how we operate, transact and perform our daily activities. We have recently teamed up with Celcom Axiata, one of the largest mobile operators in Malaysia, and Huawei, one of the largest telecommunications equipment and smartphone manufacturers in the world. Together, we will testbed and launch nextgeneration urban solutions in Sunway City Kuala Lumpur.

In the pipeline we have enhanced remote education that leverages facial recognition and artificial intelligence, blockchain technology that will be used for transparency and authenticity of academic certificates delivered to university students, driverless buses, and the expansion of telehealth capabilities utilising drone delivery for medicine.

Sustainability is increasingly an important factor in developments. In what ways is Sunway trying to be a leader in this sphere?

We have embraced the UN’s Sustainable Development Goals and adopted its principles wherever we can. All three of our townships— Sunway City Kuala Lumpur, Sunway City Ipoh, and Sunway Iskandar—include up to about 40% green

and blue spaces.

Sunway City Kuala Lumpur is our testbed for new ideas and innovations, where we will first adopt new township solutions before replicating them in our townships and developments. We have incorporated elements like solar panels across public walkways, rainwater harvesting systems, a water treatment plant and waste management systems to make our township more sustainable. We have even co-invested with the government to build public transportation connectivity using electric buses, aligned across our township to provide residents and visitors convenience and connectivity.

Years ago we built a water treatment plant using water from one of the lakes in Sunway City Kuala

Lumpur. The water is treated using a hybrid of ultrafiltration and reverse osmosis processes to meet the quality standards of potable drinking water, and it is supplied to all Sunway’s commercial assets located in the area.

During a water disruption in September that affected 1.2 million consumer accounts, businesses in commercial assets in Sunway City Kuala Lumpur were undisrupted and could operate as usual. All our hotels, restaurants, universities and a mall that included hundreds of tenants were assured of a safe supply of water during that period.

We believe we can do well by doing good—the core tenet of sustainability.

84 85

GREENFIELD RESIDENCE, A SERVICED APARTMENT COMPONENT OF THE BANDAR SUNWAY PROJECT, IS ANOTHER EXAMPLE OF SUNWAY’S PROWESS WHEN IT COMES TO MIXED-USE

What lies beneath

BY DIANA HUBBELL

As high-end resorts and luxury private residences continue to proliferate across Asia-Pacific, designers must work harder than ever to create innovative spaces that stand out from the crowd. Gone are the days when travellers and investors around the region sought out generic signifiers of style. Instead, in this hyper social media-conscious age, eye-popping Instagrammable experiences that create a sense of place are increasingly essential.

Few design firms in Southeast Asia have excelled at crafting these so-called “wow” moments in the way that SODA Thailand has. The trendsetting company has lent its signature head-turning touch to brands such as W Hotels and Sofitel SO, both of which are renowned for properties that make a visual splash. Yet founder Stephen O’Dell views the creation of these aesthetic statements to be less about artifice and more about embracing the surroundings of each specific project.

“For me, design in a big sense is about discovering,” O’Dell says. “You peel away the layers, you chip away like a sculptor in stone and you discover what’s already there. I think this is more from an architecture sense as our hotels in resort locations are in special locations.”

Just as Michelangelo’s chiselled Prisoners appeared to emerge organically from solid rock, O’Dell sees his work as a matter of unearthing the magic that was present in a site all along. This outlook is part of

why no two projects by SODA Thailand are exactly alike. When successfully executed, these designs merge with their surrounding environment as though they always belonged there.

“I like to think that our work is seamlessly rooted to the site. I like it to look as if it’s always been there as if it’s a part of a landscape and not in opposition to it,” O’Dell says. “I often look to contemporary artists like Richard Serra and the way that they’ve taken art out of the gallery and into the landscape. We’re responding to the landscape not just in an artistic way, but in a memorable way.”

Before O’Dell begins designing a project, he spends considerable time investigating the specific site. He examines how the light moves over the landscape over the day, how the waterways flow, and what vegetation flourishes in the climate without excessive use of harmful pesticides and fertilisers.

“Every project has its own set of inspirations and challenges. If there was any overriding philosophy, it’s that we try to respond to a place,” O’Dell says. “When I walk a site, it’s so important to spend as much time as possible on-site from the early morning hours to the evening hours to see what the site has to offer. We look around for these moments.”

At the Hilton Yala, a forthcoming project that O’Dell believes captures his design ethos, a close examination of the site led to some truly jaw-stopping revelations. Guests

86 87

For Stephen O’Dell, the founder of specialist resort design firm SODA Thailand, the secret to memorable work is in letting the innate character of each project shine through

at the resort will be able to gaze upon the charismatic megafauna of Sri Lanka’s Yala National Park at a manmade watering hole.

“Did we create this ‘wow’ moment? No, but we created a bio pond for the elephants to come to drink and we worked with a local naturalist to select the right trees for them,” O’Dell says. “We were creating the stage for crocodiles and wild boar. There’s even a leopard rock and if you’re very lucky, you might even see a leopard. We responded to what we were given.”

Whether it’s the stars in the velvet-black sky over the Maldives or leopards lounging by a pool, these natural elements imbue the manmade designs with a hint of magic. When he comes across such inherently cinematic features, he does his best to use clever architectural design to set them in the spotlight.

“Like a film director or a theatre director, we set the stage for the guest to discover these moments for themselves,” O’Dell says. “We don’t create an object. We create a space and a sense of reception for discovery. The joy of our process is finding these moments ourselves.”

That sense of joy is one that lingers with guests long after their departure. Experiential travel is increasingly what drives both Millennial and Gen-Z consumers around the world. A sense of authenticity, coupled with that crucial element of surprise and delight, is what makes guests long to return.

89

For me, design in a big sense is about discovering. You peel away the layers, you chip away like a sculptor in stone and you discover what’s already there. I think this is more from an architecture sense as our hotels are in special locations

88

SODA THAILAND FOUNDER STEPHEN O’DELL BELIEVES THAT HARNESSING THE INNATE CHARACTER OF A SITE IS KEY TO GREAT RESORT DESIGN

Hilton Yala, Sri Lanka

“The site was man-made in terms of the boundaries, but we had to all but erase the boundaries,” O’Dell says. Instead of relying on artificially imposed distinctions, SODA Thailand looked to the dramatic rock formations and the paths worn by generations of elephants. “We were the architect, interior designer and landscape designer for Hilton. Quite frankly, that’s a dream, because the interior and exterior can flow seamlessly into one another. You can create the entire design environment.” Once completed, the result will be all the more striking for its comprehensive integration into the landscape. “When people arrive, we take them through an opening through these canyon walls. It’s like Jurassic Park.”

90 91

Sofitel SO KL, Malaysia

“[Sofitel SO] is a fun brand and it’s looking to create a little bit of a smile,” says O’Dell. “You look at something and it’s masculine but feminine. There’s a playfulness and it wants you to have that element of surprise.” To capture that playfulness while imbuing the property with a sense of place, SODA Thailand turned to Kuala Lumpur’s multicultural heritage. “We chose to blend Malay culture, Indian culture, Chinese culture, and French culture. So we wanted to express the melting pot of cultures that are there in KL,” he says. Rooms feature subtle nods to the various design aesthetics, including French moulding and Art Deco-inspired touches as well as mini-bars fashioned after Chinese lacquer cabinets and accent throw pillows in vivid hues inspired by Indian spices.

92 93

Anantara Kihavah, Maldives

“Designers can create something out of the blue, but I think a really good designer can peel away the static,” O’Dell says. In this case, SODA Thailand helped draw attention to the stunning Maldivian night sky by building a series of two circular walkways around the resort’s telescope. “There’s an inner circle where the resident astronomer talks to you, and an outer circle where you can just enjoy the stars. From a functional standpoint, it was very elegant,” he says. “You sit around in a circle almost like around a campfire and then you walk across the bridge and see the stars. It’s very powerful, it’s very celestial, it’s very symbolic, and it’s also quite functional.”

94 95

“On the site for this resort, there were epic boulders and hundred-yearold trees,” says O’Dell. While many architects would have viewed these immovable natural landmarks as barriers, he saw them as an opportunity to express the island’s dynamic terrain throughout the resort. As guests enter, their eyes sweep over the landscape. “Our lobby building isn’t just the classic lobby with steps going down to the beach. It’s a journey,” he says. “You arrive and we take people out to a point that looks out over the site, then you take a left and go down a series of cascading steps to courtyards and a pool.”

96 97

W Hotel Phuket, Thailand

MGallery Residences at MontAzure, Phuket, Thailand

When it comes to private residences and luxury condominiums, a view is everything. Since there was no way to offer an ocean vista for every abode here, O’Dell and his colleagues knew that they needed to craft an equally appealing visual panorama for residents. “In this case, we did need to create internal spaces within the site and very articulate landscaping, with pools, water, tree planting, sightlines,” he says. “When it’s done, as you make your way around this site, it’s going to keep changing. There’s going to be this infinite number of views with the mountain or the sea as a backdrop.”

98 99

Novotel Phnom Penh, Cambodia

“Since the hotel is in a vibrant neighbourhood, we wanted to engage the street,” says O’Dell. “We were able to extend the lobby and the dining area out to the street with terraces. I like to think you’re not checking into a hotel, you’re checking into a restaurant and bar.” That melding of interior and exterior extends to the high-ceilinged lobby, which features a living tree that embodies Phnom Penh’s growing eco-awareness. Graphics and original wall art by local artists give each of the rooms a distinctive flair. “We tapped into the local culture. What’s interesting about the design is it’s a very loose fit. It’s very comfortable and it is localised by the artworks and the materials.”

100 101

Poetry in motion

BY JONATHAN EVANS

As Vietnam begins to focus on post-pandemic growth, Phu Yen—a relatively little-known coastal enclave with glorious natural attributes — is set for the spotlight

Picturesque Phu Yen province on Vietnam’s south-eastern coast—a place of lagoons, mountains and beaches— is blessed with the kind of geography that lends itself to poetry. Its natural beauty was immortalised in the hit 2015 movie Yellow Flowers on the Green Grass. When you consider the scenic backdrop, which contains the country’s easternmost point, it’s hardly surprising that this former agricultural region is becoming a desirable destination for development both in housing and industry. Infrastructure is on a solid footing; the enchanting 10km coastline of emerging provincial capital Tuy Hoa, with its coconut palms and multi-lane boulevards, is perfectly poised for tourism. Oil-refining projects, meanwhile, should considerably bolster the economy in the coming years. High-end developers are waking up to Phu Yen’s potential. And with enticing leisure options bolstering the area’s appeal, the scene is set for this undiscovered gem to take centre stage. 1 2 3 4 5 6

Alila Bai Om Hideaway Resort

A balmy holiday town in the north of Phu Yen, Song Cau has many beachfront properties. Established luxe contenders in the area include boltholes operated by Anantara and Avani. The 50-hectare, 100-room Alila Bai Om Hideaway Resort, opened in October 2019, sits squarely on the beach’s unspoiled natural landscape and offers gorgeous views across the foliage-strewn promontory and the South China Sea while the area’s many bays and islets are ripe for exploration. Winner of both the Best Resort Development and Best Resort Architectural Design titles at the 2020 PropertyGuru Vietnam Property Awards, it’s another triumph for Kien A Corporation, whose real estate arm principally focuses on future-forward apartment towers in Ho Chi Minh City and hotel properties such as Le Méridien Cam Ranh Bay Resort & Spa.

TNR Grand Palace Phu Yen

This mixed-use mega-complex in central Tuy Hoa, combining 64 shophouse units, a five-floor mall and a five-star, 35-floor hotel, is harmoniously designed to form a hub for business, leisure and retail on the town’s main artery—all within proximity to the airport and the pristine beaches on the coast. The ostentatiously named 12,000sqm project utilises natural finishing materials in an attempt to convey long-standing cultural traditions alongside luxurious contemporary architecture. Deploying smart technology as well as sustainable credentials, TNR Grand Palace is set to become a prestigious address within the fast-emerging province, with recognition coming in the form of the Best Mixed-Use Architectural Design award at the 2020 Vietnam Property Awards.

Mang Lang Church

Bearing a striking resemblance to Hanoi’s St Joseph’s Cathedral, Mang Lang is an imposing Roman Catholic church situated 35km from Tuy Hoa. The gothic-style church was built in 1892 by French missionary Father Joseph Lacassagne. Modern-day Song Cau (then called Ke Cham) was the native village of Andrew of Phu Yen, the “Protomartyr of Vietnam”, an assistant to Jesuit missionaries, who was beheaded in 1644 after refusing to abandon his faith. It became an important shrine when Andrew was declared Patron of the Youth and was later beatified by Pope John Paul II in 2000. It was also here that well-travelled scholar Alexandre de Rhodes wrote his Cathechismus in Octo Dies Divisus in Latin and Vietnamese, which was printed in 1651.

Bob’s Café American

This well-established, unpretentious comfort-food joint run by Pennsylvania native Bob Johnston and his Vietnamese wife Phuong Diep Minh wins regular plaudits for its service and solid culinary offerings including inexpensive pizza, burgers and chicken wings. A sure sign of its reliability is that it’s regularly packed with predominantly local customers, rather than tourists or expatriates—making it something of a curio in a city which otherwise betrays little in the way of western influence. But the real clincher is its location on the quiet backstreet of Nguyen Dinh Chieu, directly beside a leafy park and just two blocks from captivating views of the South China Sea, with the mountains as the backdrop

Noon Concept

Describing itself as “a local indie bar in the heart of [the] city”, Noon Concept is a trendy outlier in a developing conurbation more accustomed to unprepossessing cafés. And with Tuy Hoa revelling in its status as an up-and-coming city, this could be the shape of things to come. The immaculate space focuses customers’ attention on the artful wooden furnishing and minimal décor—an attractive proposition for any passing hipster, with its Instagram-friendly surfaces—but this isn’t just a café. Adjoining the dining area is an in-house store selling a range of branded merchandise, such as recycled bags, toiletries and a travel box, and numerous items to take away from the menu including individually packaged biscuits and cakes. Just for good measure, there’s a large tree growing through the middle of the shopfloor.

Quang Duc Xua

In Phu Yen’s northern Tuy An district, along the well-trodden tourist trail to Mang Lang Church, lies this beautifully carved wooden bungalow which served as the governor’s residence in the early 20th century, though the building dates back to the mid-19th century. Many original fittings remain in its lovingly recreated modern-day incarnation, such as antediluvian rotary telephones and Singer sewing machines. The part-museum, part-shop now holds pottery inspired by the medieval era when artisans created artefacts based on a combination of locally sourced An Dinh clay, O Loan blood clams and Ky Lo firewood. But it’s also a repository for tantalising items created from agarwood, contemporary ceramics and colourful fabrics—all of which make high-quality souvenirs from a trip to this unheralded coastline—while Quang Duc Xua and its café lie enticingly amid landscaped gardens with lily ponds.

102 103

INDUSTRIAL REVOLUTION

Vietnam enters 2021 in rude health due to its impressive response to the pandemic and a booming economy fuelled by FDI. With demand for housing continuing to grow—especially near manufacturing hubs—the outlook seems rosy for investors and developers alike

BY AL GERARD DE LA CRUZ

BY AL GERARD DE LA CRUZ

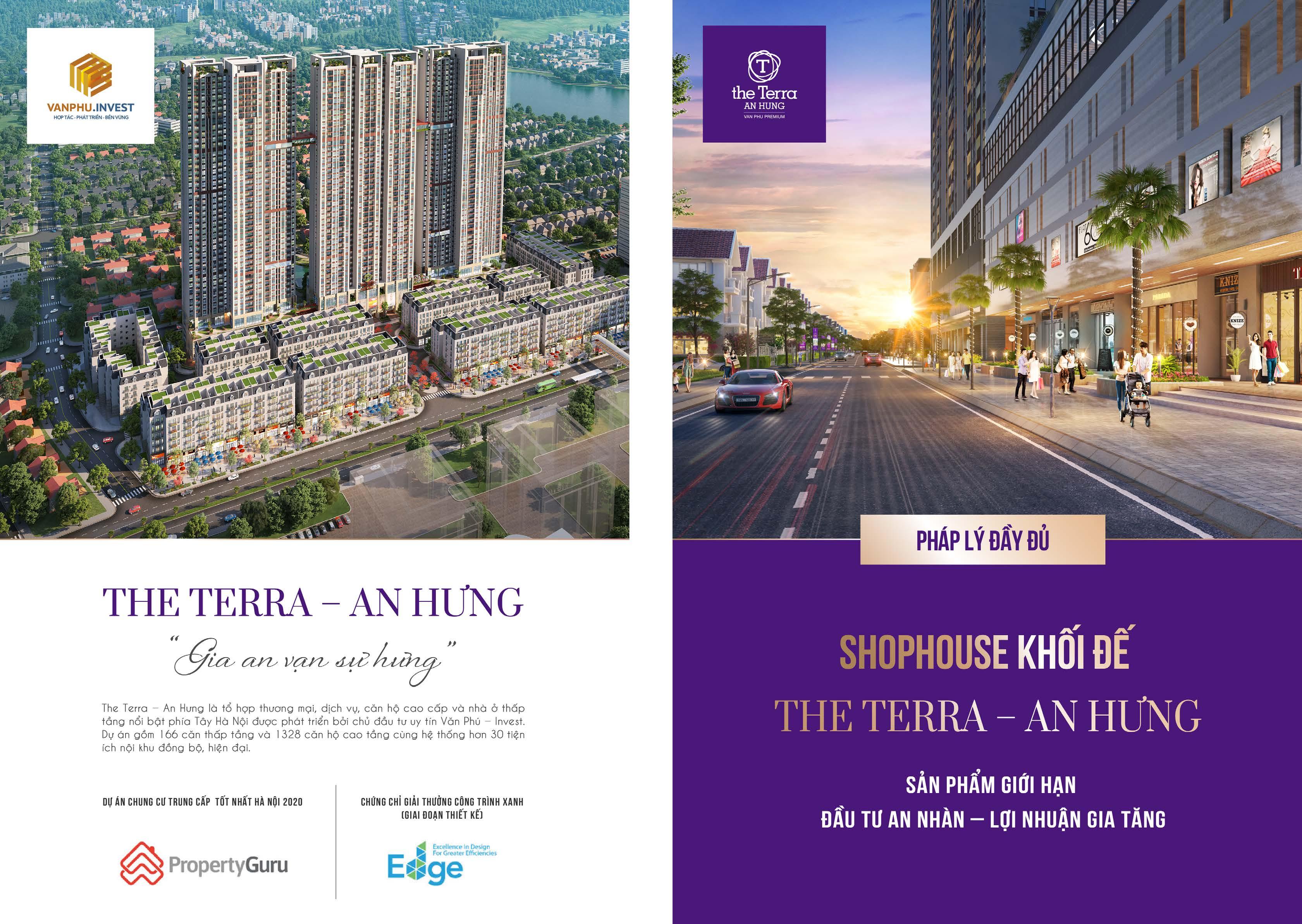

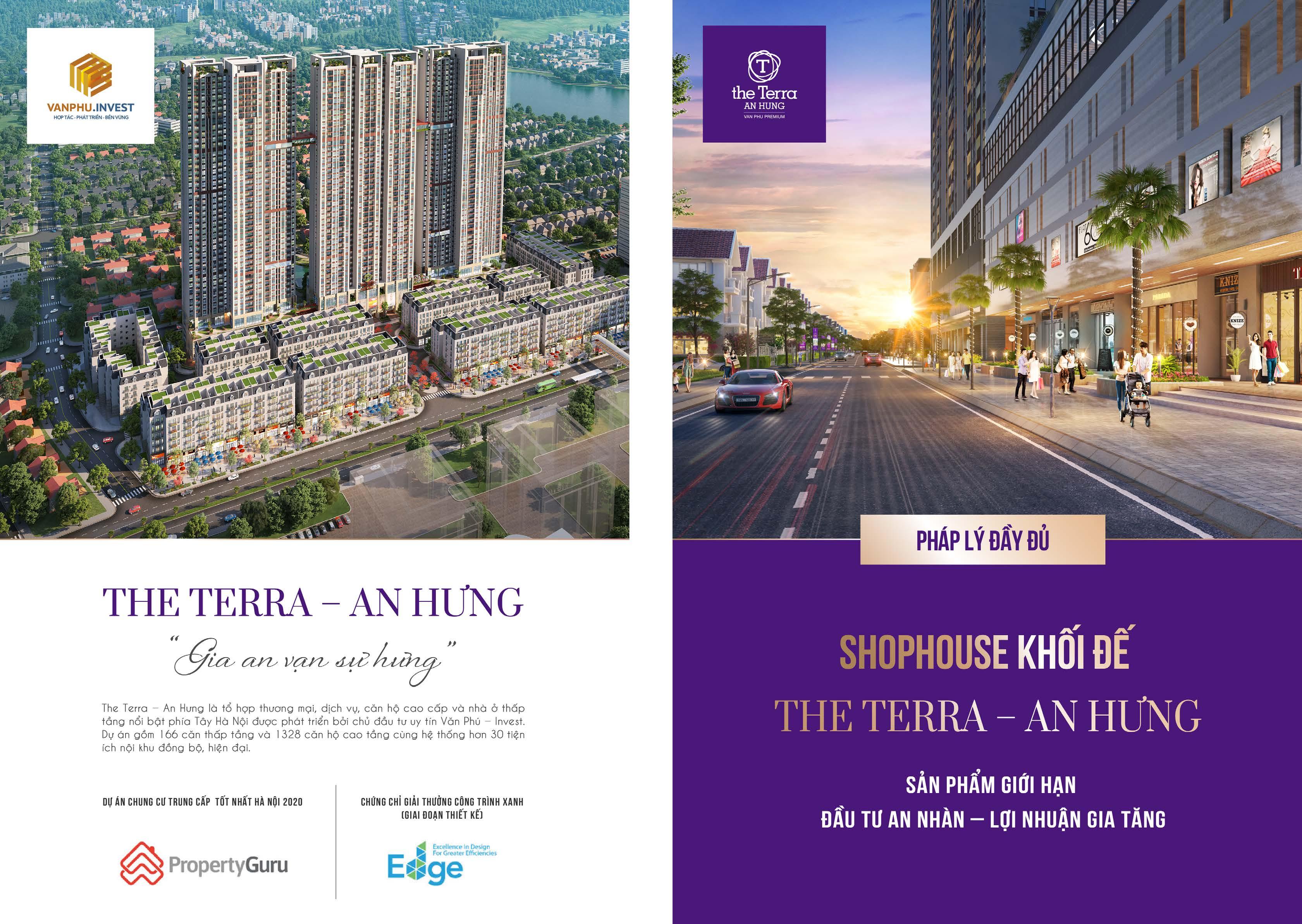

Vietnam has had an impressive year—the pandemic be damned.

The nation’s GDP last year grew 2.8%: one of just a few economies to elude a recession in a virus-plagued world. A beneficiary of the trade war between the US and China, Vietnam has grown its trade surplus so much as to invite accusations of currency manipulation from the former country.

It has taken the pandemic to the bank: luring manufacturers hoping to diversify their supply lines beyond China, and even manufacturing personal protective equipment (PPE) en masse. Industrial parks have mushroomed across the country. So have residential complexes housing their labourers.

As a manufacturing hub, Vietnam is now the most competitive in the world after China, reports Cushman & Wakefield. Pound for pound, Vietnam bests its neighbours in terms of labour costs (25% to 50% lower than China, Indonesia, Malaysia, Philippines, and Thailand) and corporate tax income rates (at 20%, it outstrips the ASEAN average of 21.7%). A signatory to more than a dozen free trade agreements, the country has become the destination du jour for industrialists.

“Vietnam has become an attractive investment destination after the US-China trade war and the pandemic,” says Paul Tonkes, director for logistics and industrial services at Cushman & Wakefield Vietnam.

Last year bookended a decade of success for Vietnam, which only ascended to the status of a middle-income nation in 2010. Industrial leviathans Logos Property and Global Logistic Properties (GLP) last year inked $350m and $1.5bn joint ventures with local developers, securing vast land banks in Bac Ninh, Bac Giang, Quang Ninh and Long An. Today Vietnam has 280 industrial parks in operation, spanning more than 60 cities and provinces and 82,800 hectares of land, with 89 more under construction.

The GDP per capita in industrial hotspots Ho Chi Minh City (HCMC), Hanoi, Long An, Binh Duong, Dong Nai and Hai Phong has leapt from 6% to 14% per annum in the last five years, heightening housing demand from occupiers and investors alike. Large-scale townships by major developers such as Aqua City, Dong Nai Waterfront City, and Vinhomes Imperia have begun sprouting near industrial clusters.

“Those cities are attracting a large number of expatriates in addition to a large local workforce, which leads to high demand for accommodation in the region,” adds Tonkes. “Vietnam’s success lies partly in its potential for residential development associated with industrial zones.”

Granted, the pandemic suspended inflows of expatriates into

Cities are attracting a large number of expatriates in addition to a large local workforce, which leads to high demand for accommodation in the region. Vietnam’s success lies partly in its potential for residential development associated with industrial zones

NO BARRIERS

Free trade agreements (FTAs) could mitigate against retaliation risk from the US, Vietnam’s largest exporting market, which late last year accused the country of intervening in foreign exchange markets to prop up its exports. Vietnam’s trade surplus with the US—which hit a high of $46.4bn in 2019—has alarmed stateside officials. The use of Vietnamese ports as an intermediate transportation point for Chinese-made goods, flouting US tariffs, has not escaped scrutiny from officials, too.

With the twilight of the Donald Trump presidency and global manufacturers reducing dependence on a single market, the Vietnamese government has a lot riding on staying competitive as a manufacturing hub.

“Vietnam’s manufacturing industry and industrial real estate market are vulnerable to trade tensions as long as trade with developed countries remain a key growth driver,” comments Hang Dang, managing director of CBRE Vietnam.

To compete with China and guard against retaliation, expanding relationships with trading partners around the world is key.

“Vietnam should continue to secure free trade agreements and implement attractive investment incentives that lure foreign investors,” says Paul Tonkes, director for logistics and industrial services at Cushman & Wakefield Vietnam. “Improvement in the legal framework and labour quality is also needed to secure the country’s competitiveness.”

LIKE OTHER CITIES AROUND VIETNAM, HANOI’S SKYLINE IS ALTERING DRAMATICALLY AS VIETNAM’S ECONOMY CONTINUES TO PICK UP MOMENTUM

Vietnam last year. Residential sales dwindled accordingly by 50% to 60% in Hanoi and HCMC, in that order, while rents dipped by 40%, according to Cushman & Wakefield, but pricing growth was defiant. Residential prices were up 25% year-on-year in HCMC and up 4% in Hanoi.

Condominiums sell for $1,325 per square metre and $1,966 per sqm on average in Hanoi and HCMC, according to CBRE. From 2017 through the third quarter of 2020, condominium prices in HCMC and Hanoi grew by 10% and 2% per annum.

“The selling price in Vietnam is still attractive compared to markets such as Bangkok and Singapore, which presents potential capital gain once the market matures,” says Hang Dang, managing director of CBRE Vietnam.

Mid-end and affordable condominiums accounted for approximately 87% of new launches in Hanoi in the first nine months of 2020. New launches in these segments sustained a sold rate of up to 42%, close to pre-pandemic levels. In HCMC, newly launched mid-end condos in the city posted a sold rate of 85%, well above 73% and 54% for high-end

106 107

and luxury condos. Mid-end condos also recorded an annual pricing growth of 6%, the highest among segments.

“This implies the market adjustments are oriented towards end users,” adds Hang. Nearly 98% of Vietnamese households still reside in landed houses though, which come in short supply in the land-starved core districts of HCMC and Hanoi. Landed projects tend to proliferate in adjacent areas and provinces plied by infrastructure developments.

Vietnam lavishes 5.7% of its GDP on infrastructure, which is one of the highest spends in Asia. Mass rapid transit lines and ring road systems, in various stages of planning and construction, are poised

to have the “strongest impact” on the residential market, notes Alex Crane, managing director for Cushman & Wakefield Vietnam. The most anticipated of them all, Metro Line No. 1 in HCMC, will connect the CBD to the city’s eastern districts.

“Infrastructure development is one of the major drivers of residential development,” according to Crane. “Fastimproving city infrastructure has resulted in decentralisation, shifting residential projects to the outskirts and suburban areas as well as to accessible second-tier cities and provinces.”

Although industrial development is concentrated in tier-one cities and provinces—Hanoi, Bac Ninh, Hung Yen, Hai Duong and Hai Phong in the north and

HCMC, Dong Nai, Binh Duong and Long An in the south—developers are casting their nets further afield, to tier-two locations where land costs are lower. Residential supply in Vinh Phuc, Thai Nguyen, Bac Giang, Quang Ninh and Ha Nam in the north and Tay Ninh and Ba Ria-Vung Tau in the south has grown by 25% to 40% per annum over the last five years, compared to just 15% to 20% per annum in Hanoi and HCMC.

As of October, industrial parks attracted 10,055 FDI projects with a registered capital of $198bn. The communist nation has steadily cosied towards open borders and market integration: signing the UKVietnam Free Trade Agreement (UKVFTA), EU-Vietnam Free Trade Agreement (EVFTA), and Regional Comprehensive Economic Partnership (RCEP) over the last year alone.

TALKING TECH

From clothing and textiles, Vietnam has made a steady switch to the manufacture of tech and other higher-value goods in recent years. Many manufacturers quickly jumped to the surging demand for personal protective equipment (PPE) in the advent of the pandemic.

In a show of confidence in the market, Apple supplier Pegatron has announced it would plough $1bn into Deep C Industrial Park in Hai Phong.

Tech itself could be the key to making Vietnam an even more competitive reshoring alternative to China. Efforts are now being made to shift Vietnam’s manufacturing base towards Industry 4.0 by way of automation, robotics, and 3D printing.

“Low costs cannot be the only strategy for the long-term sustainability of Vietnam’s manufacturing sector,” says Paul Tonkes, director for logistics and industrial services at Cushman & Wakefield Vietnam.

Foreign investors should invest in developing the local supply chain rather than “passively waiting to reap the benefits,” he adds. The new R&D centres of Samsung in Hanoi and LG in Danang exemplify this point.

As pioneered within e-commerce and during the pandemic, contact-less tech such as drone delivery, solar-powered autonomous barging, and IoT between factory and warehouse stand to reduce Vietnam’s dependence on costly human capital. Investments in agri-technology, agrilogistics and other efficient management systems can also add value to the chain.

“Vietnam’s leap from 2.0 to 4.0 is looking brighter in the coming years,” adds Tonkes.

108 109

CHINA’S LOSS IN ITS ONGOING TRADE WAR WITH THE US HAS BEEN VIETNAM’S GAIN, WITH THE COUNTRY LURING MANUFACTURERS HOPING TO DIVERSIFY THEIR SUPPLY LINES

“Reducing trade barriers with Vietnam will help to speed up the mitigation of supply chains,” says Tonkes.

The Vietnamese economy is poised to grow by 6.8% in 2021, the World Bank projects. At this rate, it could blaze past Malaysia and Singapore as the fourth-largest economy in Southeast Asia. Vietnam’s residential market alone is earmarked for a “strong recovery” in 2021, predicts Hang. Developers have exhibited an eagerness to launch while products with reasonable prices have gained favour with property seekers. This year, CBRE projects 17,500 units in new HCMC launches, up 14% year-on-year, and 25,200 units in Hanoi, up 66%.

With affordable products launched to meet real demand, speculative buying is bound to decrease, according to Cushman & Wakefield. Residential prices may plateau in the short term, but drastic declines are not in the offing.

Industrial park expansion and new investment approvals will generate more demand in the next two years, with class-A logistics supply expected to start scaling by 2022, the consultancy further predicts. A growing tendency by occupiers to become “asset-light” will bode well for the rental of ready-built factories.

“The country has a stable geopolitical situation, managed the Covid-19 crisis well, and wasn’t forced to halt production at any point,” concludes Tonkes. “Vietnam needs to remain attractive by maintaining stable political and macroeconomic conditions and competitive labour costs, and continually improving infrastructure.”

CLEARING THE HURDLES

Incentives for foreign investors, improvements in infrastructure and licencing processes, and legal frameworks in real estate ownerships are expected to be scrutinised in the run-up to the national election in May.

“We can expect a string of new laws to be ratified that will have an impact on the real estate market, whether directly or indirectly,” says Hang Dang, managing director of CBRE Vietnam.

Although some will “remove bottlenecks”, they could also add to development costs, she warns.

While the government has been proactive in improving infrastructure, it will have to accelerate the reduction of logistics and transportation costs for Vietnam to remain

competitive, suggests Paul Tonkes, director for logistics and industrial services at Cushman & Wakefield Vietnam. The government can also do better on widening developers and asset owners’ access to credit, identified by the World Bank in 2019 as the most critical element to improving Vietnam’s economic growth.

Also, the government is enjoined to make land transfer pricing more transparent; it should halt reviews of project prices paid by developers. Instead, the government can use independent evaluators to establish the values of developers’ and investors’ properties, which will then feed into better Land Use Right Certificate (LURC) pricing.

“Those with the most to gain from the election are probably the residential and township developers in the metropolitan area,” says Tonkes.

110 111

MAJOR CITIES SUCH AS DANANG ARE ATTRACTING DEVELOPERS AND INVESTORS ALIKE DUE TO THEIR GROWING RANGE OF LIFESTYLE AND BUSINESS PERKS

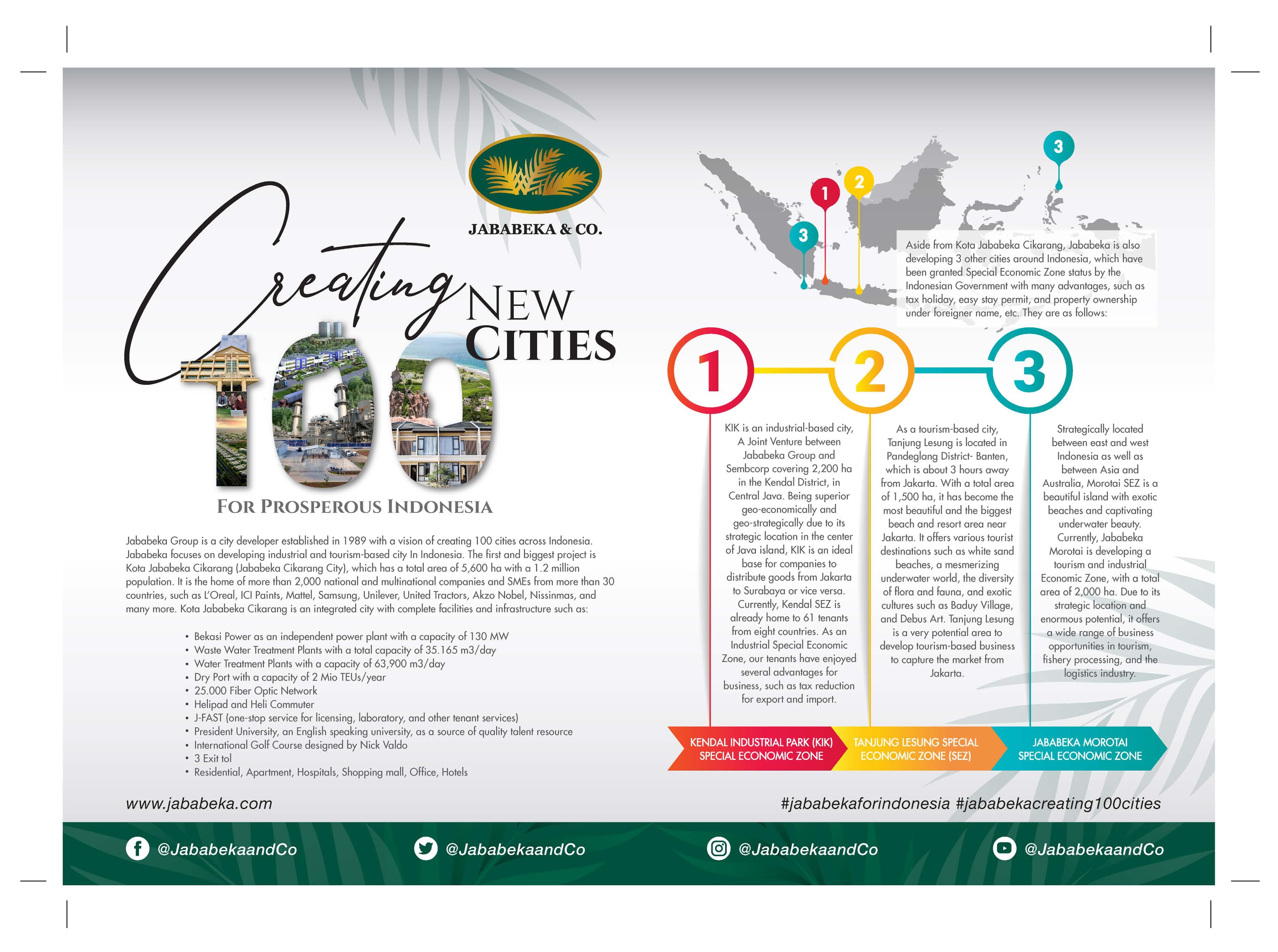

BEAT THE CLOCK

Indonesia President Joko Widodo was counting on his wideranging Omnibus Law to kickstart his nation’s struggling real estate sector. With the pandemic causing chaos, however, the expected lift has yet to arrive

BY GEORGE STYLLIS

BY GEORGE STYLLIS

112 113

As 2019 ended, many Indonesia real estate watchers predicted a revival for the industry. The rollout of government subsidies and tax breaks for buyers would— they mooted—help the property sector shake off its long-term malaise.

But with the arrival of the pandemic dashing those hopes and plunging the country into its worst recession in 22 years, many are wondering whether Joko Widodo has time to turn things around before his second term ends.

President Jokowi, as he is widely known, swept to victory once again in 2019 on the back of pledges to turn Indonesia into an economic powerhouse and revive a lacklustre property sector. At the heart of his vision for the real estate industry is his wide-ranging Omnibus Law, which (along with a slew of other pledges) aims to cut red tape around property transactions, simplify the buying of land and ease restrictions on foreign investment

Many see it as a gamechanger for the economy and real estate markets. It may well be. However, it has so far struggled to get out of the starting blocks—only passing into law in November due to the pandemic and prevarication over

some of the law’s more contentious issues around labour rights.

“The changes introduced by the Omnibus Law to Indonesia’s real estate regime are massive,” law firm Assegaf Hamzah & Partners said recently. “But our view is that nothing in the Omnibus Law can be deemed as settled until the government issues the implementing regulations.”

While the exact date of implementation is still unclear, many are hoping it will be sooner rather than later to help offset the economic damage caused by the pandemic.

BALI BLUES

Bali is not expected to see a recovery in property sales until travel and tourism can return in meaningful numbers. With 60% of GDP deriving from tourism, the island’s economy was one of the hardest hit by the pandemic in Indonesia. Though sales have improved slightly on the back of domestic interest, prices remain at between 30% and 50% below pre-pandemic asking prices. “This is the most severe correction I have seen in Bali in the 25 years I’ve been observing the market,” says Dominique Gallmann, CEO of travel consultancy Exotiq Property. “Will it recover? Of course, it will but I don’t anticipate it going back to prepandemic levels in the next few years.” According to Nikkei Asia, rental rates for luxury villas on the island had been slashed by as much as 85%, as of late November. While the sting is painful, some islandwatchers believe the pause may have longerterm benefits. “Bali might finally use this as an opportunity to move away from cheap mass tourism to a more sustainable cultural tourism, where the goal is not to achieve annual growth rates of more than 10% but to preserve what Bali has to offer the world,” adds Gallmann.

The country reported 765,350 cases and 22,734 deaths as of January 3. The infection rate slowed in the second half of the year and social restrictions were loosened. Nevertheless, the country went into its first recession in 22 years in November as growth fell 3.49% in the third quarter of the year, compared to the same period in 2019.

For the residential property market, the recession capped months of inactivity and years of low growth.

A survey by Bank Indonesia (BI) revealed that the combined sales of small, medium and large houses fell by 43.19% year-onyear in the first three months of the year due to the pandemic. In the same period, the disbursement growth of housing and apartment mortgages nearly halved by 4.34%.

114 115

WIDODO’S OMNIBUS LAW WILL BE A BOON FOR INFRASTRUCTURE DEVELOPMENT WITH A HUGE BUDGET ALLOCATED FOR UPGRADES ON ROAD AND RAIL SYSTEMS

For the condominium market, the pandemic accelerated a years-long trend of slow demand as investors took a waitand-see approach and developers refrained from launching any new projects in the third quarter. At the same time, the apartment market saw occupancy rates plummet as the mainly foreign visitors it relies upon remained in their home countries.

“Residential sales were badly hit after the large-scale social restrictions imposed from April to May 2020 and from then until now,” says Hasan Pamudji, a senior associate director at Knight Frank Indonesia.

In a recent report, real estate services firm JLL said: “Developers are more likely to wait until the wider economic situation improves rather than launching units in a period when sales are likely to be difficult.”

In common with many political leaders around the world, the pandemic has exposed Jokowi. Many observers see the government’s handling of the crisis as a major obstacle to achieving the objectives of his pet policies.

Writing in the East Asia Forum, Liam Gammon, an expert in Asia Pacific Affairs at the Australian National University, argues that the government’s handling of the pandemic was woeful and the high rates of infection expose a level of corruption that should undermine any law designed to create an open, welcoming place to do business. At the same

The ultimate aim (with vaccinations) is to decrease cases to a level where the government can resume activities to something near 100% of what they were before. That will take some time. Therefore, we expect that businesses and social activities won’t start to run normally until 2022

THE RUB OF THE GREEN

With the pandemic forcing many to think about a more sustainable lifestyle in harmony with nature, some believe eco-friendly living will shape Indonesia’s property market in the coming years. “We see a trend towards more eco-friendly developments and requests, such as water collection, solar panels, etc. I believe we will see a surge in boutique concepts and villas with privacy,” says Terje Nielson, director of Seven Stones Indonesia. “I think we will see a change towards more long-stay tourism: more people wanting to live and work from here and continued demand for eco-friendly or nature-based concepts with a high level of selfsustainability.” Also, secondary destinations in Indonesia are poised to capitalise on the trend for remote and flexible working that has been accelerated by the pandemic. “We see a lot of people now wanting to work from home, choosing to make Bali their future home, as well as other areas such as Flores and Lombok,” adds Nielson.

time the passing of the bill was marred by opacity and a lack of consultation, he adds.

“Whatever the merits of the law itself, the process by which it was passed speaks to growing dysfunction in key democratic institutions in Indonesia,” he writes. “With almost all political parties co-opted into the Jokowi government coalition after the 2019 election, the parliament rubber-stamped the bill after a rushed and opaque process that experts say ignored the parliament’s own standing orders.”

Compounding Jokowi’s woes is the desperate state of the real estate market in Indonesia. While the easing of restrictions saw some movement in sales, analysts don’t expect the market to return to pre-pandemic levels for several years unless a successful vaccine programme can be rolled out quickly.

“The government is putting tremendous effort on a vaccine programme that will be implemented in 2021,” says Hendra Hartono, CEO of realtor Leads Property Services Indonesia.

“They expect that around 170 million people in Indonesia will be vaccinated. The ultimate aim is to decrease cases to a level where the government can resume activities to something near 100% of what they were before. That will take some time. Therefore, we expect that businesses and social activities won’t start to run normally until 2022.”

116 117

WITH THE PANDEMIC FORCING HIM ONTO THE BACK FOOT, PRESIDENT JOKOWI HAS STRUGGLED TO BUILD MOMENTUM FOR REFORM IN HIS SECOND, AND FINAL, TERM

It’s a tall order, but if Jokowi can bridge the gap between the pandemic and the Omnibus Law, giving both buyers and developers confidence, some believe the residential market is in for a treat, particularly in the low and mid-tier segments. “Real demand remains intact in the long run as there are plenty of first-time homebuyers who need housing,” adds Pamudji. “Properties below IDR500 million ($35,517) will continue to perform to service this market.”

One key area where the government is expected to see success is infrastructure with the Omnibus Law helping to facilitate an ambitious program of improvements. The government has allocated a budget of IDR413.8 trillion for infrastructure upgrades, up by 47.2% from 2020, after adjustments to account for the pandemic and improving urban connectivity.

In Jabodetabek, the government has launched plans to connect DKI Jakarta and its satellite areas, Bogor, Depok, Tangerang, and Bekasi, to support the industry’s crossregion activities as well as improving the commuting between these areas.

“The president’s focus on infrastructure is expected to positively impact the property sector in 2021,” according to Marine Novita, country manager of property website Rumah. com.

Knight Frank’s Hasan also believes Jokowi’s second-term commitment to developing infrastructure, particularly new toll roads, LRT, MRT, and airports will speed up economic recovery by allowing for “new residential clusters”.

“In the short-term, we will potentially see many residential and industrial townships or clusters being built along and following new infrastructure developments,” he added.

But building the properties is one thing and getting people to buy them is another. Amid rising unemployment, declining consumer spending, and an economy in crisis—all of which could worsen as the global pandemic continues—time will tell whether the Omnibus Law is the silver bullet the country needs.

ROOMS FOR IMPROVEMENT

Indonesia is expected to see 127 new hotel launches in the coming years, with the vast majority to be located in Jakarta and Bali. Leading the wave of new launches will be local brand Harris Hotels with 20 properties around the country, followed by the Swiss-Belhotel International Hotels & Resorts with seven launches. Some of the notable new projects include the Langham Jakarta, a 257-unit hotel with 170 rooms, 30 suites and 57 Langham Residences across 19 floors, while in Bintang, British hospitality giant IHG will open its first two hotels on the island by late 2021—the dual-branded Holiday Inn and Hotel Indigo. Hilton Worldwide will bring one of its main luxury brands to Indonesia upon opening the Waldorf Astoria Jakarta in 2024. Hendra Hartono, CEO of realtor Leads Property Services Indonesia, believes that it will be important for companies to have a rigorous strategy so that “brands find ways of remaining relevant in an increasingly competitive market.” He added: “Hotel rebranding will be a key area widely explored as well as possible renovations, with the underlying theme of cost efficiency still at the forefront.”

118 119

INDONESIA’S PARADISE ISLANDS ARE SEEING DRASTICALLY REDUCED FOOTFALL AS THE GLOBAL PANDEMIC CONTINUES TO STYMIE INTERNATIONAL TRAVEL

URBAN OASES

Last year may be in the rear-view mirror but Covid-19-induced uncertainty will affect Asian real estate markets for the foreseeable future.